- CMCL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Caledonia Mining (CMCL) 6-KCurrent report (foreign)

Filed: 16 Dec 24, 5:11pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Of the Securities Exchange Act of 1934

For the month of December 2024

Commission File Number: 001-38164

CALEDONIA MINING CORPORATION PLC

(Translation of registrant's name into English)

B006 Millais House

Castle Quay

St Helier

Jersey JE2 3EF

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

INCORPORATION BY REFERENCE

The information contained in the section "Information Contained in this Report on Form 6-K" shall be deemed to be incorporated by reference in the Registration Statement on Form F-3 of Caledonia Mining Corporation Plc (File No. 333-281436) of the Company, as amended or supplemented, to the extent not superseded by documents or reports subsequently filed.

Exhibits 99.1, 99.2 and 99.3 included with this report are expressly incorporated by reference into this report and are hereby incorporated by reference as exhibits to the Registration Statement on Form F-3 of Caledonia Mining Corporation Plc (File No. 333-281436), as amended or supplemented.

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

New S-K 1300 Technical Report Study for the Bilboes Gold Project

Caledonia Mining Corporation Plc (Caledonia) announces the publication of a new Technical Report Summary (TRS) titled “Bilboes Gold Project Technical Report Summary” on the Bilboes Gold Project, Zimbabwe (Bilboes or the Project), prepared by DRA Projects (Pty) Ltd (DRA) in accordance with Subpart 1300 and Item 601(b)(96) of Regulation S-K, as adopted by the United States Securities and Exchange Commission (S-K 1300), with an effective date of May 30, 2024. The results of the TRS are summarized below.

Report Purpose

Caledonia mandated DRA to complete the TRS to report an Initial Assessment (IA) on the Bilboes Gold Project, Zimbabwe. The purpose of the TRS is to report mineral resources in accordance with S-K 1300, to present the results of an IA for the implementation of open pit mining to recover the gold mineralization and to propose additional work required for feasibility level studies.

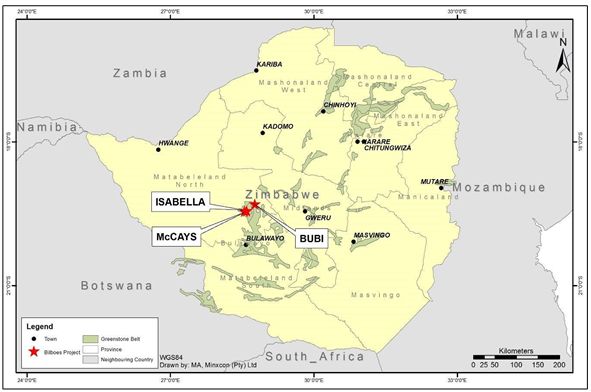

Project Location

The Bilboes properties are located in the Matabeleland North Province of Zimbabwe. The Isabella-McCays properties are situated approximately 80 km north of Bulawayo while Bubi is situated approximately 100 km north of Bulawayo. Bubi is 32 km due north-east of Isabella.

Bilboes have rights to three groups of claims covering an area of 2,731.6 ha that consist of four open-pit mining properties in Matabeleland North Province of Zimbabwe. These open pits are referred to as Isabela North; Isabela South; McCays and Bubi in the figure below.

History

Initial exploration allowed the estimation of a small oxide Resource and an open-pit; heap-leach mine was commissioned in 1989. Some 95,877 oz of was produced since 2003. Subsequent exploration extended Isabella and new discoveries were made at Bubi and McCays, which has yielded production of 9,136 kg of gold (293,729 oz) to December 2023. All mining has been from open pit oxide ore utilizing the heap leach extraction processing method.

Pilot Plant Test Work

The pilot plant test work was conducted over a period of six months from April 2018 to September 2018, utilizing 20 t of the Isabella McCays ore and 15 t of Bubi ore. The Isabella McCays ores gold recoveries ranged from 85.9% to 91.0% and the mass pulls ranged from 3.8% to 6.0% with a weighted average of 88.4% recovery and 5.0% mass pull. The Bubi ore recoveries ranged from 85.9% to 88.8% and mass pulls ranged from 7.8% to 15.2% with averages of 87.5% recovery and 10.0% mass pull.

Mineral Resource Estimate

The TRS declared a mineral resource estimate (MRE) in terms of S-K 1300, which is summarized in the table below using a cut-off grade of 0.9 g/t Au and constrained inside a Lerchs-Grossman (LG) optimized pit shell using US$ 2,400 per ounce gold price.

Mineral Resource based on a 0.9g/t Au Cut-Off Grade

| Mineral Resources (0.9 g/t Au) Reference Point : In Situ | |||||

| Property | Classification | Tonnes (Mt) | Au (g/t) | Metal (kg) | Ounces (koz) |

| Isabella South (ISBS) | Measured | 1.325 | 2.34 | 3,104 | 100 |

| Indicated | 5.211 | 2.17 | 11,299 | 363 | |

| Total Measured and Indicated | 6.537 | 2.20 | 14,403 | 463 | |

| Inferred | 1.335 | 1.80 | 2,404 | 77 | |

| Isabella North (ISBN) | Measured | 2.589 | 2.68 | 6,939 | 223 |

| Indicated | 4.430 | 2.31 | 10,246 | 329 | |

| Total Measured and Indicated | 7.019 | 2.45 | 17,186 | 553 | |

| Inferred | 1.613 | 2.18 | 3,520 | 113 | |

| Bubi | Measured | 1.288 | 1.95 | 2,518 | 81 |

| Indicated | 14.006 | 2.19 | 30,708 | 987 | |

| Total Measured and Indicated | 15.294 | 2.17 | 33,225 | 1,068 | |

| Inferred | 5.116 | 1.8 | 9,208 | 296 | |

| McCays | Measured | 0.925 | 3.05 | 2,821 | 91 |

| Indicated | 3.874 | 2.37 | 9,193 | 296 | |

| Total Measured and Indicated | 4.799 | 2.50 | 12,014 | 386 | |

| Inferred | 1.054 | 2.16 | 2,274 | 73 | |

| Totals (ISBS +ISBN+ Bubi + McCays) | Total Measured | 6.128 | 2.51 | 15,382 | 495 |

| Total Indicated | 27.522 | 2.26 | 61,446 | 1,976 | |

| Total Measured and Indicated | 33.650 | 2.30 | 76,828 | 2,470 | |

| Total Inferred | 9.118 | 1.99 | 17,406 | 560 | |

S-K 1300 definitions observed for classification of mineral resources.

Mineral resources are reported in-situ.

Resources are constrained by a Lerchs-Grossman (LG) optimized pit shell using Whittle software.

Mineral resources are not mineral reserves and have no demonstrated economic viability. The estimate of mineral resources may be materially affected by mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, and governmental factors (Modifying Factors).

An IA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the IA will be realized.

Numbers may not add due to rounding.

The MRE has been depleted to reflect mining up to 31 December 2023

Effective Date of resource estimate is 31 December 2023.

Mineral Reserve

The TRS did not declare mineral reserves.

Mining Methods

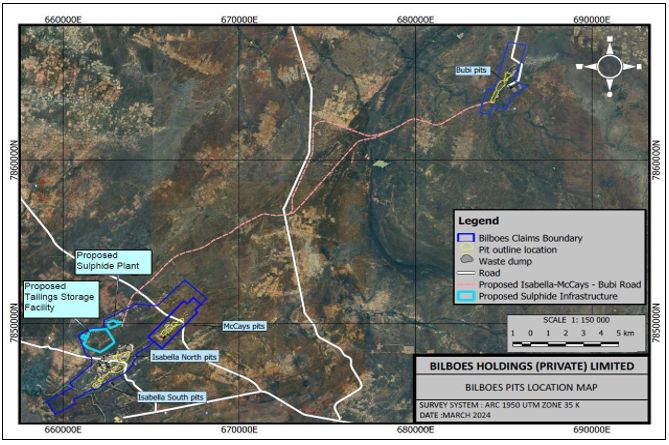

The Bilboes Gold Project consists of four mining areas containing between one to three pits each. These areas are labelled as McCays, Isabella South, Isabella North and Bubi in the figure below.

Block Plan Showing Bilboes Pits and Process Plant Location

Based on the analysis of the engineering geological aspects of the investigated deposits which included rock mass characterization, hydrogeology, intact rock properties and structural geology, a geotechnical model comprising design parameters was developed. Using these design parameters; kinematic, empirical and limit equilibrium analysis was conducted to determine the optimal slope configuration for the various deposits.

Based on the analysis conducted, it is understood that the capacity of the slopes should be affected by the following:

| · | Completely weathered slopes should be a maximum of 3 m in height, and it is recommended that the material is pushed back from the crest, |

| · | For the transitional rock (highly to moderately weathered), by a combination of rock mass strength and adverse structural orientation. Inter-ramp heights of 60 m are achievable with inter-ramp angles between 45°and 50°, |

| · | For the unweathered rock slopes adverse structural orientation should determine the slope angle which is achievable. Inter-ramp heights of 90 m are achievable with inter-ramp angles of between 50° and 55°, depending on the wall direction. |

In the IA the previous Base Case was revalidated with Phase 1 being a 240 ktpm gold processing plant treating run of mine (RoM) material from Isabella and McCays (after a short ramp-up period) before being upgraded for a Phase 2 to treat RoM material from the Bubi pit at 180 ktpm.

The inputs to the whittle optimization include revenue related financial parameters, geotechnical parameters, various waste mining costs and the process plant throughput.

Dilution of 4% and mining losses of 5% loss were assumed.

The life of mine (LoM) schedule considers the blending requirement that a maximum of 50% of feed to plant be sourced from Isabella North and the remainder from Isabella South (preferred blend) or McCays. Irregular waste production profiles were smoothed to ensure the production profile is practically implementable.

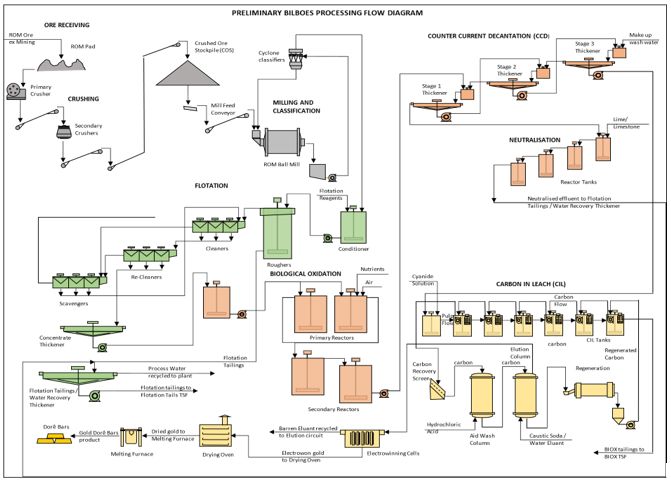

Recovery Methods

Plant feed will be derived from two main mining areas, namely Isabella McCays and Bubi, with production throughput to be phased over LoM as described in each scenario.

Operations in the process plant can essentially be divided into the following sections:

| · | Comminution (plant feed size reduction by crushing and milling to facilitate liberation of the mineral particles for subsequent downstream concentration), |

| · | Flotation (concentration of sulfides and gold into a small concentrate mass), |

| · | Biological oxidation (BIOX®) (destruction of the sulfides in the concentrate using oxidizing bacteria to expose the gold particles for downstream recovery), |

| · | Carbon in leach (cyanidation leach of the BIOX® residue and recovery of the solubilized gold onto activated carbon), |

| · | Carbon treatment, |

| · | Electrowinning and smelting, |

| · | Tailings handling. |

The unit operations will be appliable to all three scenarios described in the IA report. Further detail covering the test work and processing route can be found in the historical feasibility study reports. A simplified schematic flow diagram is presented below.

Simplified Process Flow Diagram Tailings Storage Facility

SLR Consulting (Africa) (Pty) Ltd (SLR) were engaged to optimize the tailings storage facility (TSF) as a follow on to investigate a new concept design and associated costing based on a phased paddock approach for base case. The objectives were to minimize initial capital outlay and delay further expenditure according to a three-phase build programme that aligned with the LoM production schedule.

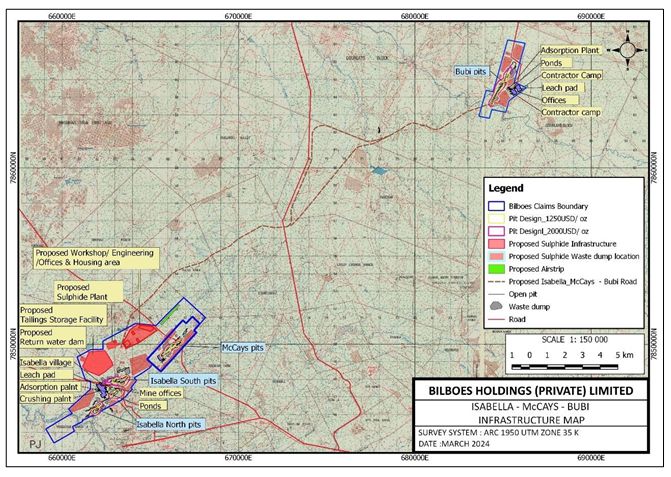

Project Infrastructure

The overall site plan below includes major facilities of the Project including the Isabella North and South, McCays and Bubi open pit mines, gold processing plan, TSF, waste stockpiles, demarcated areas for mine buildings and accommodation facilities, main power line internal mine roads and access public roads.

Grid power will be supplied from the Zimbabwe National Grid by constructing a 70 km 132 kV

Lynx line from Shangani Substation. To feed the line, a line bay will be constructed at Shangani. A mine substation will be constructed at Isabella.

The estimate received is for a 132kV substation, equipped with a 50 MVA 132/33 kV step-down transformer. Raw water will be provided from open pit dewatering and the wellfield boreholes located across the mine license area.

Overall Site Plan

Social and Community Related Requirements and Plans

An Environmental and Social Management Plan has been developed which contains the environmental, social and safety management and monitoring commitments that Bilboes will implement to manage the negative impacts and enhance the positive impacts identified in the Environmental Impact Assessment study. This will include:

| · | A Livelihoods Restoration Plan (LRP), |

| · | Several Corporate Social Responsibility (CSR) programmes, |

| · | Develop a fair and transparent labor, working conditions and recruitment policy, |

| · | A local procurement policy will be developed and implemented, |

| · | Develop a Stakeholder Engagement Plan, |

| · | Addressing the social or community impacts. |

Capital Costs

DRA has developed and costed two distinct project phases:

| · | Phase 1: Processing 240 ktpm of milled plant feed from the Isabella McCays mining area, scheduled for years 1 to 6, |

| · | Phase 2: Processing 180 ktpm of milled plant feed from the Bubi mining area, scheduled for years 6 to 10. |

The estimate assumes that the project will be executed on an Engineering, Procurement, and Construction Management basis.

The mining costs are a combination of site establishment and pre-development during the production ramp up which consists of the first nine months of production.

The capital estimate is summarized in the table below.

Capital Summary per Project Phase

| Description | Grand Total | Sub Total Phase 1 (Million US$) | Sub Total Phase 2 (Million US$) |

| (Million US$) | |||

| Mining | 25.54 | 25.54 | 0.00 |

| Process and Infrastructure | 311.82 | 267.63 | 44.19 |

| Indirect Costs | 31.79 | 29.57 | 2.21 |

| Contingency | 33.82 | 29.49 | 4.33 |

| Total Project Costs | 402.97 | 352.24 | 50.73 |

Operating Costs

The operating cost estimate has been completed from a zero base and presented in United States Dollar (US$). Costs associated with labor, materials and consumables have been included in this estimate.

Mining Contractor Costing

The average mining cost based on pricing received is US$ 2.65 /t including the plant feed transport cost from all mining areas process plant. The cost breakdown is shown in the table below.

Mining Contractor OPEX

| Area | Cost per Total Tonne Mined (Ore and Waste) (US$) |

| G&A | 0.29 |

| Drill and Blast | 0.45 |

| Load and Haul Incl. Rehandle and Services | 1.91 |

| Total | 2.65 |

| Diesel Cost | 1.52 (October 2023) |

Process Plant Operating Cost

Operating costs have been estimated and based on the production profile for LoM. Steady state costs are presented for Phase 1 and Phase 2 in the table below. Main drivers in costs include reagents and power which collectively account for more than 70% of total plant operating costs.

Plant OPEX

| Description | Unit | Phase 1: 240 ktpm IM | Phase 2: 180 ktpm Bubi |

| Variable | US$ m/a | 37.93 | 53.33 |

| Fixed | US$ m/a | 12.31 | 17.17 |

| Overview | |||

| RoM | t/a | 2,880,000 | 2,160,000 |

| Total variable | US$ m/a | 37.93 | 53.33 |

| Total fixed | US$ m/a | 12.31 | 17.17 |

| Total | US$ m/a | 50.24 | 70.49 |

| Unit cost | US$/t RoM | 17.44 | 32.64 |

General and Administration Cost

The general and administration cost (G&A) cost includes administrative personnel, general office supplies, safety and training, travel (both on site and off site), independent contractors, insurance, permits, fuel levies, security, camp power, camp costs, ICT, relocation, and recruitment.

Total G&A costs amount to US$ 4,912,650 per annum in phases 1 and 2.

Total Operating Costs Summary

The Bilboes total operating costs have been estimated and based on the production profile over LoM.

LoM Operating Cost Summary

| Description | Cost (US$ m) | Unit cost (US$ / t RoM) |

| Mining | 596.13 | 25.54 |

| Process Plant | 564.31 | 24.18 |

| G&A | 47.17 | 2.02 |

| Total | 1,207.61 | 51.74 |

Market Studies

The Gold Trade Act empowers the Minister responsible for Finance to issue a Gold Dealers License which entitles entities to export and sell gold from Zimbabwe to customers of their choice. Prior to 1 June 2021, only Fidelity Gold Refinery (Private) Limited (FGR) had the Gold Dealership License and therefore all gold bullion was sold to FGR. With effect from 1 August 2021, all gold producers can directly sell any incremental production to customers of their choice using FGR’s license to export. Caledonia’s Blanket Mine is currently selling 75% of its gold to a customer of its choice outside Zimbabwe by exporting the gold using FGR’s license.

Sales proceeds from the exported gold are received directly into Blanket's bank account in Zimbabwe. As all Bilboes production is considered incremental, Bilboes will be able to sell its gold directly to customers of its choice or to continue selling to FGR.

Bilboes is confident that it will be able to export and sell its gold production on similar terms as those currently in place between FGR and Blanket.

Economic Outcomes

The financial model has been prepared on a 100% equity project basis and does not consider alternative financing scenarios. A discount rate of 10% has been applied in the analysis. The outcomes are presented on a pre-tax and post-tax basis.

A static metal price of US$ 1,884/oz has been applied, based on a three-year trailing average price up to April 2024. All-in sustaining costs have been reported as per the World Gold Council guideline dated November 2018 and are exclusive of project capital, depreciation, and amortization costs. Capital payback is exclusive of the construction period and referenced to the start of first production.

Project Economics Summary

| Description | Units | Values |

| Financial Outcomes (Post-tax, Constant Model Terms) | ||

| NPV @ 10% | US$ m | 308.73 |

| IRR | % | 33.99 |

| Peak Cash Funding | US$ m | 309.18 |

| AISC | US$/oz | 967.90 |

| Payback (UNDISCOUNTED) - From Production Start | years | 1.9 |

A data table analysis has been conducted to specifically illustrate the influence of changes in gold pricing and discount rates on the project's economic outcomes and is presented (bold) in the table below that indicates the current base case scenario. The NPV and payback period (undiscounted, from production start) are presented on a post-tax basis.

Data Table Analysis

| Discount Rate (%) | ||||||

| Gold Price (USD/oz) | 15% | 12.5% | 10% | 7.5% | 5% | Payback Period (Post-tax), years |

| NPV (Post-tax), USD M | ||||||

| 1,500 | 31 | 59 | 94 | 137 | 191 | 3.6 years |

| 1,700 | 116 | 157 | 206 | 267 | 342 | 2.5 years |

| 1,884 | 194 | 246 | 309 | 385 | 480 | 1.9 years |

| 2,000 | 243 | 302 | 373 | 460 | 567 | 1.8 years |

| 2,200 | 327 | 398 | 484 | 588 | 717 | 1.6 years |

| 2,400 | 411 | 494 | 594 | 717 | 867 | 1.5 years |

| 2,600 | 495 | 590 | 705 | 845 | 1016 | 1.3 years |

Conclusions of DRA as the Qualified Person

Mineral Resource Estimate

| · | The data collected during the exploration, drilling and sampling programmes, including surveying, drill hole logging, sampling, geochemical analysis, and data quality assurance, was collected in a professional manner and in accordance with appropriate industry standards by suitably qualified and experienced personnel. |

| · | The geological modelling and mineral resource estimate were undertaken utilizing recognized deposit and industry strategies/methodologies for the type of deposit of the Bilboes mine. |

| · | The mineral resource is constrained in an optimized pit shell. This together with the assumptions relating to mining, processing, infrastructure, and market factors supports the “reasonable prospects for eventual economic extraction”. |

| · | Based on an assessment including data quality and integrity, data spacing, confidence in the grade interpolation, confidence in the geological interpretation and confidence in the estimate DRA believes the mineral resource estimate is robust. |

Mining Engineering

| · | Both the modelling and the grade interpolation have been conducted in an unbiased manner and the resulting grade and tonnage estimates should be reliable within the context of the classification applied. |

| · | The open pit modelling is based on suitably supported assumptions and parameters and completed utilizing appropriate industry standards suitable for the Bilboes Project. |

| · | The economic modelling is supported by technical studies in mining, processing, infrastructure, environmental, social, and marketing. Based on the inputs from these disciplines, the financial model demonstrates an economically viable mine. The economic analysis is based on a gold price of US$ 1,884/oz. |

| · | The sensitivity analyses demonstrates that the profitability of the project is most sensitive to revenue related factors such as gold price and recovery. |

Recommendations of DRA as the Qualified Person

| · | Based on the study work completed it shows an attractive economic outcome. It is recommended that the Bilboes Project enters into a feasibility study phase. This is estimated by DRA to cost $ 1,429,000. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CALEDONIA MINING CORPORATION PLC | |

| (Registrant) | |

| Date: December 16, 2024 | /s/ JOHN MARK LEARMONTH |

| John Mark Learmonth | |

| CEO and Director | |

EXHIBIT INDEX

Exhibit | Description | |

| 99.2 | ||

| Consent of Craig Harvey |