SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-CSRS/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 002-96924

AMANA MUTUAL FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

1300 N. State Street

Bellingham, Washington 98225-4730

(Address of Principal Executive Offices, including ZIP Code)

Jane K. Carten

1300 N. State Street

Bellingham, Washington 98225-4730

(Name and Address of Agent for Service)

Registrant's Telephone Number – (360) 734-9900

Date of fiscal year end: May 31, 2022

Date of reporting period: November 30, 2021

Item 1. Semi-Annual Report

Performance Summary

As of November 30, 2021

| | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annual Returns (before any taxes paid by shareowners) | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Expense Ratio1 | |

| | | | | | |

Amana Income Fund Investor Shares (AMANX) | | | 17.36% | | | | 14.98% | | | | 13.74% | | | | 12.11% | | | | 9.36% | | | | 1.04% | |

| | | | | | |

Amana Income Fund Institutional Shares (AMINX) | | | 17.60% | | | | 15.22% | | | | 13.99% | | | | n/a | | | | n/a | | | | 0.80% | |

| | | | | | | |

Amana Growth Fund Investor Shares (AMAGX) | | | 34.21% | | | | 27.51% | | | | 24.73% | | | | 17.30% | | | | 12.58% | | | | 0.95% | |

| | | | | | |

Amana Growth Fund Institutional Shares (AMIGX) | | | 34.55% | | | | 27.82% | | | | 25.03% | | | | n/a | | | | n/a | | | | 0.70% | |

| | | | | | | |

Amana Developing World Fund Investor Shares (AMDWX) | | | 13.37% | | | | 13.83% | | | | 9.07% | | | | 3.16% | | | | n/a | | | | 1.20% | |

| | | | | | |

Amana Developing World Fund Institutional Shares (AMIDX) | | | 13.56% | | | | 14.04% | | | | 9.23% | | | | n/a | | | | n/a | | | | 0.97% | |

| | | | | | | |

Amana Participation Fund Investor Shares (AMAPX) | | | 0.73% | | | | 4.19% | | | | 2.92% | | | | n/a | | | | n/a | | | | 0.82% | |

| | | | | | |

Amana Participation Fund Institutional Shares (AMIPX) | | | 0.88% | | | | 4.43% | | | | 3.13% | | | | n/a | | | | n/a | | | | 0.58% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

As of December 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | | |

| Average Annual Returns (before any taxes paid by shareowners) | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Expense Ratio1 | |

| | | | | | |

Amana Income Fund Investor Shares (AMANX) | | | 22.51% | | | | 20.48% | | | | 15.06% | | | | 12.77% | | | | 9.87% | | | | 1.04% | |

| | | | | | |

Amana Income Fund Institutional Shares (AMINX) | | | 22.79% | | | | 20.73% | | | | 15.32% | | | | n/a | | | | n/a | | | | 0.80% | |

| | | | | | | |

Amana Growth Fund Investor Shares (AMAGX) | | | 31.53% | | | | 32.48% | | | | 25.17% | | | | 17.76% | | | | 12.81% | | | | 0.95% | |

| | | | | | |

Amana Growth Fund Institutional Shares (AMIGX) | | | 31.82% | | | | 32.80% | | | | 25.47% | | | | n/a | | | | n/a | | | | 0.70% | |

| | | | | | | |

Amana Developing World Fund Investor Shares (AMDWX) | | | 7.31% | | | | 15.59% | | | | 9.62% | | | | 3.54% | | | | n/a | | | | 1.20% | |

| | | | | | |

Amana Developing World Fund Institutional Shares (AMIDX) | | | 7.52% | | | | 15.78% | | | | 9.82% | | | | n/a | | | | n/a | | | | 0.97% | |

| | | | | | | |

Amana Participation Fund Investor Shares (AMAPX) | | | 0.49% | | | | 4.11% | | | | 2.94% | | | | n/a | | | | n/a | | | | 0.82% | |

| | | | | | |

Amana Participation Fund Institutional Shares (AMIPX) | | | 0.64% | | | | 4.36% | | | | 3.16% | | | | n/a | | | | n/a | | | | 0.58% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Performance data quoted in this report represents past performance, is before any taxes payable by shareowners, and is no guarantee of future results. Current performance may be higher or lower than that stated herein. Performance current to the most recent month-end is available by calling toll-free 1-888-732-6262 or visiting www.amanafunds.com. Average annual total returns are historical and include change in share value as well as reinvestment of dividends and capital gains, if any. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The Amana Funds limit the securities they purchase to those consistent with Islamic principles, which limits opportunities and may affect performance.

Institutional Shares of the Amana Income, Growth, and Developing World Funds began operations September 25, 2013.

The Amana Participation Fund began operations September 28, 2015.

A note about risk: Please see the Notes to Financial Statements beginning on page 35 for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see the Funds’ prospectus or each Fund’s summary prospectus.

| 1 | By regulation, expense ratios shown in this table are as stated in the Funds’ most recent prospectus which is dated September 24, 2021, and incorporates results for the fiscal year ended May 31, 2021. Ratios presented for Amana Growth have been restated to reflect a reduction in the Advisory and Administrative Services fee, which became effective on December 1, 2020. Ratios presented in this table differ from the expense ratios shown elsewhere in this report as they represent different fiscal periods. Also by regulation, this page shows performance as of the most recent calendar quarter-end in addition to performance through the Funds’ most recent fiscal period. |

Please consider an investment’s objectives, risks, charges, and expenses carefully before investing. To obtain a free prospectus or summary prospectus that contains this and other important information on the Amana Funds, please call toll-free 1-888-732-6262 or visit www.amanafunds.com. Please read the prospectus or summary prospectus carefully before investing.

| | | | | | |

|

| | | |

| 2 | | | | Semi-Annual Report | | November 30, 2021 |

| | |

| Fellow Shareowners: | | January 10, 2022 |

Investors shrugged off doubt and the securities markets again appreciated during the six months ended November 30, 2021, though in a more subdued manner than the outsized gains of 2020 and early 2021. Total return for the S&P 500 Index was 9.38% and the broader Dow Jones Islamic Market World Index returned 8.22%. Developing markets faltered, with the MSCI Emerging Markets Index falling -9.78%. Islamic fixed-income markets were more subdued, with the FTSE Sukuk Index gaining 0.66%.

The Amana Fund portfolios performed respectably compared to these indices. Amana Growth Investor Shares gained 16.56%, Amana Income Investor Shares gained 4.55%, while Amana Developing World Investor Shares fell -0.95%, and Amana Participation Investor Shares fell -0.07% for the six months ended November 30, 2021. As expected, lower expenses allowed the Institutional Shares of each Fund to post slightly better returns: Amana Developing World -0.87%, Amana Growth 16.70%, Amana Income 4.67%, and Amana Participation 0.05%. Nearly half of Amana’s shareowner assets – 48.8% – are now in Institutional shares.

The Amana Funds’ investment philosophy follows Islamic principles, which preclude most investments in banking and finance. We favor companies with good sustainability factors, low debt levels, and strong balance sheets. In volatile and troubled times, these solid principles have repeatedly proven their value.

Rose-Tinted Glasses in Developed Markets

With the S&P 500 Index returning 28.71% for the 12-months ended December 31, 2021, while the Dow Jones Islamic Market World Index returned 20.02%, developed markets seemed to defy logic. Supply chain disruptions, a new variant of the coronavirus, inflation spiking, and significant environmental catastrophes seem at odds with such an ebullient result. We caution that such outsized returns are not likely to repeat, especially as the Federal Reserve pulls the various levers at its command including ending stimulus programs and signaling rate increases.

Amana Income Fund – 35 Years of Solid Investing

On June 23, 1986, Amana Income Fund began operations, with both Dr. Yaqub Mirza and Mr. Nicholas Kaiser as founding members of the Board of Trustees. From inception to November 30, 2021 – more than 35 years – the Income Fund’s Investor Shares provided an average annual return of 9.21% (after expenses). Few investment vehicles have such a long-term record of success.

Amana Participation Fund Assets Increase

The Amana Participation Fund’s primary objective is capital preservation, and it has a secondary objective of current income, both consistent with Islamic principles. After more than five years of successful operation under the dedicated and capable portfolio management of Mr. Patrick Drum, we are pleased to note that investors have embraced its goal of lower volatility compared to equity markets. Assets of the Fund exceeded $218 million as of November 30, 2021, representing a 55% increase year-over-year.

Strong Performance and Sustainability Rankings

As experienced investors, we know that gains or losses over a short interval tell an incomplete story compared to performance evaluated over a lengthier time span, even during times of unprecedented, repeated positive returns. That’s why the long-term performance recognition that Amana has received is so important to our shareowners.

For the past three years as of November 30, Amana Growth and Developing World Funds were rated 4 Stars by Morningstar for above average, risk-adjusted performance. Please refer to “Morningstar Ratings” on pages 6 and 7 for more details.

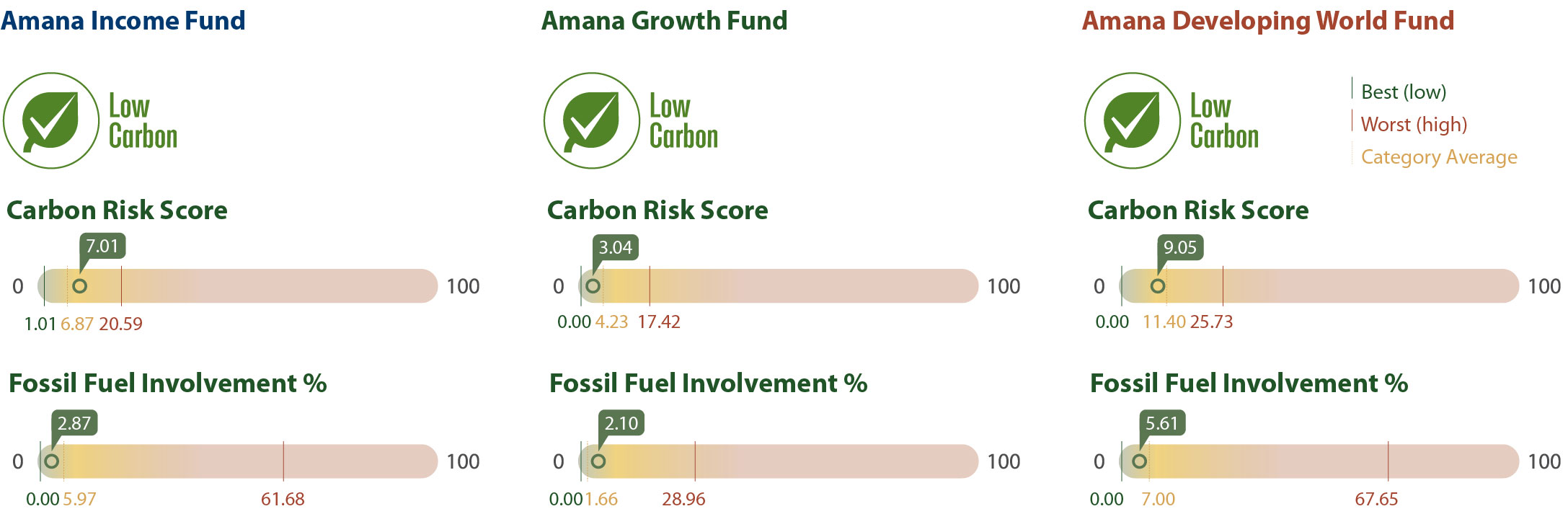

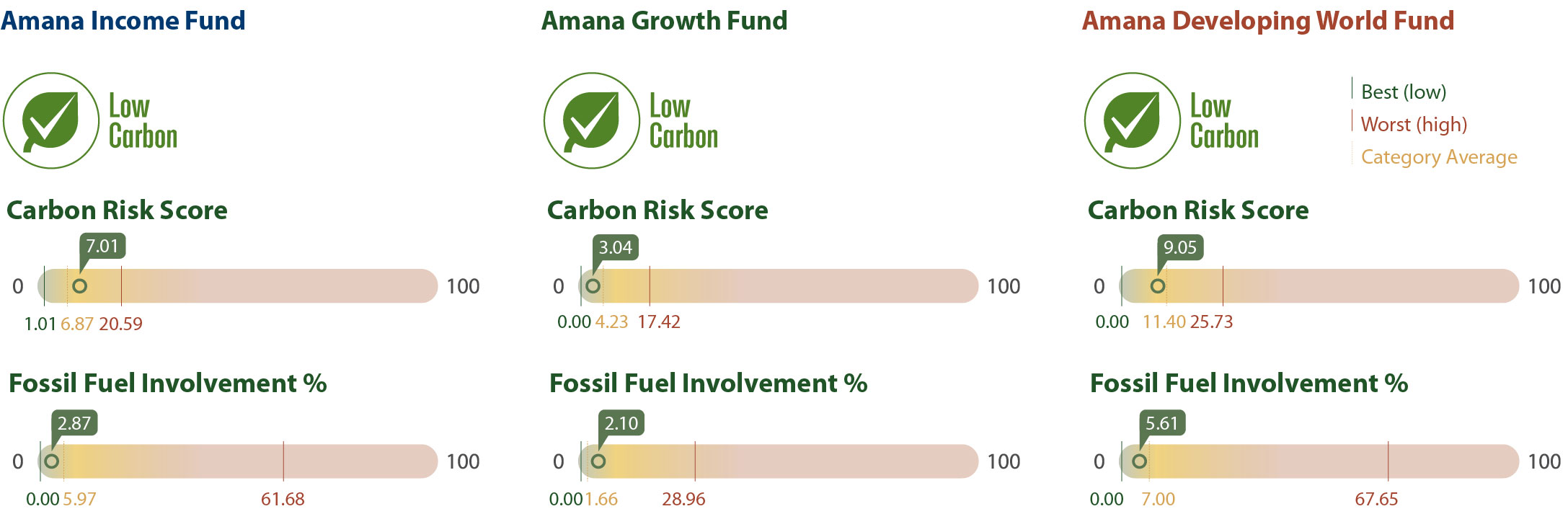

Morningstar continued to award “Low Carbon” designations to Amana Income, Growth, Developing World as of September 30, 2021, which identifies them as “low-carbon” funds within the global universe (see page 7).

Amana Growth and Amana Developing World also earned “High” (5-Globe) Sustainability Ratings from Morningstar as of October 31, 2021 (see page 6).

| | | | | | |

|

| | | |

| Semi-Annual Report | | November 30, 2021 | | | | 3 |

Lower Expense Ratios

For the fiscal period ended November 30, 2021, we are pleased to note reductions in annualized expense ratios of all Amana Funds and share classes. For the Institutional Share class of Amana Participation Fund the expense ratio was 0.53%, for Amana Growth it was 0.65%, for Amana Income it was 0.77%, and for Amana Developing World it was 0.90%. Investor Shares expense ratios for each Fund also decreased. See page 42 for more details.

These lower expense ratios result both from greater assets to spread Fund costs, and Saturna Capital again reducing Advisory and Administrative Services fee rates for the Amana equity funds.

Going Forward

At year end market observers offer their expectations for the coming year. We have little insight into inflation and interest rates in 2022. The removal of fiscal and monetary stimulus implies tightening conditions in 2022. Regardless, we feel confident about growth, with one caveat. While the Delta and Omicron variants have pushed US COVID infections to record highs, the milder illness from Omicron, as well as its transmissibility, imply a short spike. Infections are soaring, but experience elsewhere indicates the surge could quickly fade. The bigger risk is a disruption of Chinese economic activity. China has employed a zero-tolerance COVID strategy. The transmissibility of Omicron, travel during Chinese New Year, hosting the Winter Olympics, and weak protection from domestic vaccines mean that China may lock down wide swaths of its territory. That would affect global economic activity, inflation expectations, and the interest rate outlook in the short term. Longer term we may see an acceleration in de-globalization, affecting investment, margins, and profitability.

We continue to place emphasis on seeking companies with robust balance sheets and competitive advantages to sustain operations even through stormy seas. We cannot control the weather, but we can plot a less risky course and pick solid vessels.

Strong Management Matters

Amana Mutual Funds embody basic principles of sound finance: good governance, transparency, fairness, and risk sharing. The Trustees are active governors, taking seriously their responsibilities to shareowners. Saturna staff work globally, based in offices in Bellingham (Washington), Henderson (Nevada), and Kuala Lumpur (Malaysia) to better serve you.

As a group, the five Amana Trustees are solidly committed to investing in Amana Mutual Funds. Including their affiliated accounts, they currently have over $38 million invested in the four mutual funds of the Trust. Both Dr. Mirza and Mr. Kaiser remain among the Trust’s largest individual shareowners.

For more information, please visit www.amanafunds.com or call 1-888/73-AMANA. We thank you for investing with us.

Respectfully,

(photo omitted)

Nicholas Kaiser,

President

(photo omitted)

M. Yaqub Mirza,

Independent Board Chairman

| | | | | | |

|

| | | |

| 4 | | | | Semi-Annual Report | | November 30, 2021 |

| | | | | | |

| | | |

| Portfolio Managers | | | | | | |

| | | |

(photo omitted) | | Scott Klimo CFA Portfolio Manager Amana Growth Fund Deputy Portfolio Manager Amana Income Fund Amana Developing World Fund | | (photo omitted) | | Bryce Fegley MS, CFA, CIPM® Deputy Portfolio Manager Amana Income Fund |

| | | |

(photo omitted) | | Monem Salam MBA Portfolio Manager Amana Income Fund Amana Developing World Fund Deputy Portfolio Manager Amana Growth Fund | | (photo omitted) | | Christopher E. Paul MBA, CFA Deputy Portfolio Manager Amana Growth Fund |

| | | |

(photo omitted) | | Patrick Drum MBA, CFA, CFP® Portfolio Manager Amana Participation Fund | | (photo omitted) | | Elizabeth Alm CFA Deputy Portfolio Manager Amana Participation Fund |

| | | |

| | | | (photo omitted) | | Levi Stewart Zurbrugg MBA, CPA® Deputy Portfolio Manager Amana Developing World Fund |

| | | | | | |

|

| | | |

| Semi-Annual Report | | November 30, 2021 | | | | 5 |

| | | | | | | | | | | | | | |

| Morningstar Ratings (as of November 30, 2021) | | | | | | | | | | | | | | |

| | | | | | | |

Morningstar™ RatingsA | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | 15 Year | | Overall | | Sustainability

Rating™ B |

| | |

Amana Income Fund – “Large Blend” Category | | |

| | | | | | | |

Investor Shares (AMANX) | | n/a | | êê | | êê | | êê | | n/a | | êê | |  |

| | | | | | | |

% Rank in Category | | 94 | | 86 | | 84 | | 92 | | 62 | | n/a | | 30 |

| | | | | | | |

Institutional Shares (AMINX) | | n/a | | êê | | êê | | ¶¶ | | n/a | | êê | |  |

| | | | | | | |

% Rank in Category | | 94 | | 84 | | 82 | | 90 | | 58 | | n/a | | 30 |

| | | | | | | |

Number of Funds in Category | | 1,370 | | 1,247 | | 1,104 | | 810 | | 594 | | 1,247 | | 3,350 |

| |

Amana Growth Fund – “Large Growth” Category | | |

| | | | | | | |

Investor Shares (AMAGX) | | n/a | | êêêê | | êêêê | | êêê | | n/a | | êêêê | |  |

| | | | | | | |

% Rank in Category | | 4 | | 28 | | 24 | | 54 | | 36 | | n/a | | 2 |

| | | | | | | |

Institutional Shares (AMIGX) | | n/a | | êêêê | | êêêê | | ¶¶¶ | | n/a | | êêêê | |  |

| | | | | | | |

% Rank in Category | | 4 | | 26 | | 20 | | 49 | | 33 | | n/a | | 2 |

| | | | | | | |

Number of Funds in Category | | 1,232 | | 1,117 | | 1,016 | | 764 | | 560 | | 1,117 | | 1,557 |

| |

Amana Developing World Fund – “Diversified Emerging Markets” Category | | |

| | | | | | | |

Investor Shares (AMDWX) | | n/a | | êêêê | | êêêê | | êêê | | n/a | | êêê | |  |

| | | | | | | |

% Rank in Category | | 18 | | 21 | | 49 | | 89 | | n/a | | n/a | | 9 |

| | | | | | | |

Institutional Shares (AMIDX) | | n/a | | êêêê | | êêêê | | ¶¶¶ | | n/a | | êêê | |  |

| | | | | | | |

% Rank in Category | | 18 | | 19 | | 44 | | 87 | | n/a | | n/a | | 9 |

| | | | | | | |

Number of Funds in Category | | 791 | | 720 | | 613 | | 340 | | 160 | | 720 | | 1,781 |

| |

Amana Participation Fund – “Emerging Markets Bond” Category | | |

| | | | | | | |

Investor Shares (AMAPX) | | n/a | | êêê | | êêê | | n/a | | n/a | | êêê | | n/a |

| | | | | | | |

% Rank in Category | | 18 | | 73 | | 85 | | n/a | | n/a | | n/a | | n/a |

| | | | | | | |

Institutional Shares (AMIPX) | | n/a | | êêê ê | | êêê | | n/a | | n/a | | êêê | | n/a |

| | | | | | | |

% Rank in Category | | 16 | | 66 | | 79 | | n/a | | n/a | | n/a | | n/a |

| | | | | | | |

Number of Funds in Category | | 277 | | 258 | | 218 | | 75 | | 37 | | 258 | | n/a |

The Morningstar Sustainability Rating and the Morningstar Portfolio Sustainability Score are not based on fund performance and are not equivalent to the Morningstar Rating (“Star Rating”).

© 2021 Morningstar®. All rights reserved. Morningstar, Inc. is an independent fund performance monitor. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

| A | Morningstar Ratings™ (“Star Ratings”) are as of November 30, 2021 and December 31, 2021. The Morningstar Rating™ for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance (not including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. |

| B | Morningstar Sustainability Ratings are as of October 31, 2021. The Morningstar Sustainability Rating™ is intended to measure how well the issuing companies of the securities within a fund’s portfolio are managing their environmental, social, and governance (“ESG”) risks and opportunities relative to the fund’s Morningstar category peers. The Morningstar Sustainability Rating calculation is a two-step process. First, each fund with at least 50% of assets covered by a company-level ESG score from Sustainalytics receives a Morningstar Portfolio Sustainability Score™. The Morningstar Portfolio Sustainability Score is an asset-weighted average of normalized company-level ESG scores with deductions made for controversial incidents by the issuing companies, such as environmental accidents, fraud, or discriminatory behavior. The Morningstar Sustainability Rating is then assigned to all scored funds within Morningstar Categories in which at least ten (10) funds receive a Portfolio Sustainability Score and is determined by each fund’s rank within the following distribution: High (highest 10%), Above Average (next 22.5%), Average (next 35%), Below Average (next 22.5%), and Low (lowest 10%). The Morningstar Sustainability Rating is depicted by globe icons where High equals 5 globes and Low equals 1 globe. A Sustainability Rating is assigned to any fund that has more than half of its underlying assets rated by Sustainalytics and is within a Morningstar Category with at least 10 scored funds; therefore, the rating is not limited to funds with explicit sustainable or responsible investment mandates. Morningstar updates its Sustainability Ratings monthly. Portfolios receive a Morningstar Portfolio Sustainability Score and Sustainability Rating one month and six business days after their reported as-of date based on the most recent portfolio. As part of the evaluation process, Morningstar uses Sustainalytics’ ESG scores from the same month as the portfolio as-of date. |

The Fund’s portfolios are actively managed and subject to change, which may result in a different Morningstar Sustainability Score and Rating each month.

The Funds were rated on the following percentages of Assets Under Management:

| | | | |

| Amana Income Fund | | | 100% | |

| Amana Growth Fund | | | 100% | |

| Amana Developing World Fund | | | 100% | |

As of October 31, 2021, the Amana Participation Fund had not received a Sustainability Rating.

% Rank in Category is the fund’s percentile rank for the specified time period relative to all funds that have the same Morningstar category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. Percentile ranks within categories are most useful in those categories that have a large number of funds.

The Amana Mutual Funds offer two share classes – Investor Shares and Institutional Shares, each of which has different expense structures.

| | | | | | |

|

| | | |

| 6 | | | | Semi-Annual Report | | November 30, 2021 |

| | | | | | | | | | | | |

| Morningstar Ratings (as of December 31, 2021) | | | | | | | | | | | | |

| | | | | | |

Morningstar™ RatingsA | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | 15 Year | | Overall |

| | | | | | | |

Amana Income Fund – “Large Blend” Category | | | | | | | | | | | | |

| | | | | | |

Investor Shares (AMANX) | | n/a | | êê | | êê | | êê | | n/a | | êê |

| | | | | | |

% Rank in Category | | 86 | | 87 | | 81 | | 91 | | 55 | | n/a |

| | | | | | |

Institutional Shares (AMINX) | | n/a | | êê | | êêê | | ¶¶ | | n/a | | êêê |

| | | | | | |

% Rank in Category | | 84 | | 85 | | 77 | | 90 | | 51 | | n/a |

| | | | | | |

Number of Funds in Category | | 1,382 | | 1,244 | | 1,109 | | 822 | | 610 | | 1,244 |

| | | | | | |

Amana Growth Fund – “Large Growth” Category | | | | | | | | | | | | |

| | | | | | |

Investor Shares (AMAGX) | | n/a | | êêêê | | êêêê | | êêê | | n/a | | êêêê |

| | | | | | |

% Rank in Category | | 5 | | 24 | | 21 | | 51 | | 33 | | n/a |

| | | | | | |

Institutional Shares (AMIGX) | | n/a | | êêêê | | êêêê | | ¶¶¶ | | n/a | | êêêê |

| | | | | | |

% Rank in Category | | 4 | | 22 | | 18 | | 45 | | 31 | | n/a |

| | | | | | |

Number of Funds in Category | | 1,237 | | 1,116 | | 1,012 | | 768 | | 559 | | 1,116 |

| | | | | | |

Amana Developing World Fund – “Diversified Emerging Markets” Category | | | | | | | | | | | | |

| | | | | | |

Investor Shares (AMDWX) | | n/a | | êêêê | | êêêê | | êêê | | n/a | | êêêê |

| | | | | | |

% Rank in Category | | 20 | | 21 | | 48 | | 91 | | n/a | | n/a |

| | | | | | |

Institutional Shares (AMIDX) | | n/a | | êêêê | | êêêê | | ¶¶¶ | | n/a | | êêêê |

| | | | | | |

% Rank in Category | | 20 | | 21 | | 44 | | 90 | | n/a | | n/a |

| | | | | | |

Number of Funds in Category | | 791 | | 720 | | 615 | | 342 | | 159 | | 720 |

| | | | | | |

Amana Participation Fund – “Emerging Markets Bond” Category | | | | | | | | | | | | |

| | | | | | |

Investor Shares (AMAPX) | | n/a | | êêê | | êêê | | n/a | | n/a | | êêê |

| | | | | | |

% Rank in Category | | 17 | | 77 | | 82 | | n/a | | n/a | | n/a |

| | | | | | |

Institutional Shares (AMIPX) | | n/a | | êêê | | êêê | | n/a | | n/a | | êêê |

| | | | | | |

% Rank in Category | | 14 | | 71 | | 74 | | n/a | | n/a | | n/a |

| | | | | | |

Number of Funds in Category | | 276 | | 262 | | 219 | | 76 | | 37 | | 262 |

Morningstar Carbon Metrics (as of September 30, 2021)

Morningstar carbon metrics are asset-weighted portfolio calculations based on their Sustainalytics subsidiary’s carbon-risk research. Based on two of these metrics – Carbon Risk Score and Fossil Fund Involvement % – funds may receive the Low Carbon designation, which allows investors to easily identify low-carbon funds within the global universe.

The portfolio Carbon Risk Score is a number between 0 and 100 (a lower score is better). A portfolio’s Carbon Risk Score is the asset-weighted sum of the carbon risk scores of its holdings, averaged over the trailing 12 months. The carbon risk of a company is Sustainalytics’ evaluation of the degree to which a firm’s activities and products are aligned with the transition to a low-carbon economy. The assessment includes carbon intensity, fossil fuel involvement, stranded assets exposure, mitigation strategies, and green product solutions.

Fossil Fuel Involvement % is the portfolio’s asset-weighted percentage exposure to fossil fuels, averaged over the trailing 12 months. Companies with fossil fuel involvement are defined as those in the following subindustries: Thermal Coal Extraction, Thermal Coal Power Generation, Oil & Gas Production, Oil & Gas Power Generation, and Oil & Gas Products & Services.

To receive the Low Carbon designation a fund must have a Carbon Risk Score below 10 and a Fossil Fuel Involvement % of less than 7% of assets. For these metrics to be calculated, at least 67% of a portfolio’s assets must be covered by Sustainalytics company carbon-risk research. All Morningstar carbon metrics are calculated quarterly.

Amana Income Fund was rated on 94%, Amana Growth Fund was rated on 94%, and Amana Developing World Fund was rated on 74% of assets under management.

| | | | | | |

|

| | | |

| Semi-Annual Report | | November 30, 2021 | | | | 7 |

| | |

| Amana Income Fund: Performance Summary | | |

| | | | | | | | | | | | | | | | |

Average Annual Returns (as of November 30, 2021) | |

| | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Expense Ratio | |

| | | | |

Investor Shares (AMANX) | | | 17.36% | | | | 13.74% | | | | 12.11% | | | | 1.04% | |

| | | | |

Institutional Shares (AMINX)2 | | | 17.60% | | | | 13.99% | | | | n/a | | | | 0.80% | |

| | | | |

S&P 500 Index | | | 27.92% | | | | 17.89% | | | | 16.15% | | | | n/a | |

Growth of $10,000

| | |

| | Comparison of any mutual fund to a market index must be made bearing in mind that the index is unmanaged and expense-free. Conversely, the Fund will (1) be actively managed; (2) have an objective other than mirroring the index, such as limiting risk; (3) bear transaction and other operational costs; (4) stand ready to buy and sell its securities to shareowners on a daily basis; and (5) provide a wide range of services. The graph compares $10,000 invested in Investor Shares of the Fund on November 30, 2011, to an identical amount invested in the S&P 500 Index, a broad-based stock market index. The graph shows that an investment in Investor Shares of the Fund would have risen to $31,378 versus $44,726 in the Index. Investor Shares are used in this chart because they represent the larger share class in terms of assets and have a longer track record. Please note that investors cannot invest directly in the Index. |

Past performance does not guarantee future results. The “Growth of $10,000” graph and “Average Annual Returns” performance table assume the reinvestment of dividends and capital gains. They do not reflect the deduction of taxes that a shareowner might pay on fund distributions or the redemption of fund shares.

| 2 | Institutional shares of the Amana Income Fund began operations September 25, 2013. |

Fund Objective

The objectives of the Income Fund are current income and preservation of capital, consistent with Islamic principles; current income is its primary objective.

| | | | |

Top 10 Holdings | | | | |

| |

| % of Total Net Assets | |

| |

Eli Lilly | | | 8.7% | |

| |

Microsoft | | | 8.3% | |

| |

Rockwell Automation | | | 6.3% | |

| |

Taiwan Semiconductor ADR | | | 6.1% | |

| |

Illinois Tool Works | | | 4.4% | |

| |

Pfizer | | | 3.9% | |

| |

PPG Industries | | | 3.7% | |

| |

Carlisle | | | 3.5% | |

| |

Honeywell International | | | 3.3% | |

| |

Genuine Parts | | | 3.1% | |

| | | | | | | | | | | | |

Portfolio Diversification | | | | | | | | | | | | |

| | | |

| % of Total Net Assets | | | | | | | | | |

| | | |

Large Pharma | | | 21.1% | | | ∎ | | | | |  | |

Infrastructure Software | | | 8.3% | | | ∎ | | |

Household Products | | | 6.3% | | | ∎ | | |

Measurement Instruments | | | 6.3% | | | ∎ | | |

Semiconductor Manufacturing | | | 6.1% | | | ∎ | | |

Specialty Chemicals | | | 5.8% | | | ∎ | | |

Semiconductor Devices | | | 5.8% | | | ∎ | | |

Basic & Diversified Chemicals | | | 4.6% | | | ∎ | | |

Industrial Machinery | | | 4.4% | | | ∎ | | |

Non Wood Building Materials | | | 3.5% | | | ∎ | | |

Commercial & Residential Building Equipment & Systems | | | 3.3% | | | ∎ | | |

Automotive Retailers | | | 3.1% | | | ∎ | | |

Rail Freight | | | 3.1% | | | ∎ | | |

Industries < 3.0% | | | 12.8% | | | ∎ | | |

| | | |

Other Assets (net of liabilities) | | | 5.5% | | | ∎ | | | | | | |

| | | | | | |

|

| | | |

| 8 | | | | Semi-Annual Report | | November 30, 2021 |

| | |

| Amana Income Fund: Schedule of Investments | | As of November 30, 2021 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Common Stocks – 94.5% | | | | Number of Shares | | | Cost | | | Market Value | | | Percentage of Assets | |

| | | | | | |

| | | Consumer Discretionary | | | | | | | | | | | | | | |

| | | | | | | |

| | | Automotive Retailers | | | | | | | | | | | | | | |

| | | | | | | |

| | | Genuine Parts | | | | | 382,000 | | | | $15,016,749 | | | | $48,796,680 | | | | 3.1% | |

| | | | | | | |

| | | Home Improvement | | | | | | | | | | | | | | |

| | | | | | | |

| | | Stanley Black & Decker | | | | | 71,950 | | | | 4,850,611 | | | | 12,573,982 | | | | 0.8% | |

| | | | | | | |

| | | | | | | | | | | 19,867,360 | | | | 61,370,662 | | | | 3.9% | |

| | | | | | |

| | | Consumer Staples | | | | | | | | | | | | | | |

| | | | | | | |

| | | Household Products | | | | | | | | | | | | | | |

| | | | | | | |

| | | Colgate-Palmolive | | | | | 415,400 | | | | 15,151,572 | | | | 31,163,308 | | | | 2.0% | |

| | | | | | | |

| | | Kimberly-Clark | | | | | 230,000 | | | | 13,960,736 | | | | 29,971,300 | | | | 1.9% | |

| | | | | | | |

| | | Procter & Gamble | | | | | 123,000 | | | | 14,086,035 | | | | 17,783,340 | | | | 1.1% | |

| | | | | | | |

| | | Unilever ADR | | | | | 420,000 | | | | 14,236,893 | | | | 21,357,000 | | | | 1.3% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 57,435,236 | | | | 100,274,948 | | | | 6.3% | |

| | | | | | | |

| | | Packaged Food | | | | | | | | | | | | | | |

| | | | | | | |

| | | McCormick & Co | | | | | 559,288 | | | | 13,161,835 | | | | 47,998,096 | | | | 3.0% | |

| | | | | | | |

| | | | | | | | | | | 70,597,071 | | | | 148,273,044 | | | | 9.3% | |

| | | | | | |

| | | Health Care | | | | | | | | | | | | | | |

| | | | | | | |

| | | Large Pharma | | | | | | | | | | | | | | |

| | | | | | | |

| | | AbbVie | | | | | 350,000 | | | | 9,148,094 | | | | 40,348,000 | | | | 2.5% | |

| | | | | | | |

| | | Bristol-Myers Squibb | | | | | 650,000 | | | | 15,185,381 | | | | 34,859,500 | | | | 2.2% | |

| | | | | | | |

| | | Eli Lilly | | | | | 560,000 | | | | 20,261,156 | | | | 138,902,400 | | | | 8.7% | |

| | | | | | | |

| | | GlaxoSmithKline ADR | | | | | 500,000 | | | | 18,048,789 | | | | 20,560,000 | | | | 1.3% | |

| | | | | | | |

| | | Johnson & Johnson | | | | | 110,000 | | | | 7,893,250 | | | | 17,152,300 | | | | 1.1% | |

| | | | | | | |

| | | Novartis ADR | | | | | 275,400 | | | | 14,323,946 | | | | 21,949,380 | | | | 1.4% | |

| | | | | | | |

| | | Pfizer | | | | | 1,150,000 | | | | 19,768,443 | | | | 61,789,500 | | | | 3.9% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 104,629,059 | | | | 335,561,080 | | | | 21.1% | |

| | | | | | | |

| | | Medical Devices | | | | | | | | | | | | | | |

| | | | | | | |

| | | Abbott Laboratories | | | | | 350,000 | | | | 8,392,885 | | | | 44,019,500 | | | | 2.7% | |

| | | | | | | |

| | | | | | | | | | | 113,021,944 | | | | 379,580,580 | | | | 23.8% | |

| | | | | | |

| | | Industrials | | | | | | | | | | | | | | |

| | | | | | | |

| | | Commercial & Residential Building Equipment &

Systems | | | | | | | | | | | | | | |

| | | | | | | |

| | | Honeywell International | | | | | 260,000 | | | | 10,768,521 | | | | 52,582,400 | | | | 3.3% | |

| | | | | | | |

| | | Flow Control Equipment | | | | | | | | | | | | | | |

| | | | | | | |

| | | Parker Hannifin | | | | | 40,000 | | | | 1,586,972 | | | | 12,082,400 | | | | 0.7% | |

| | | | | | | |

| | | Industrial Distribution & Rental | | | | | | | | | | | | | | |

| | | | | | | |

| | | W.W. Grainger | | | | | 80,000 | | | | 7,590,798 | | | | 38,512,800 | | | | 2.4% | |

| | | | | | | |

| | | Industrial Machinery | | | | | | | | | | | | | | |

| | | | | | | |

| | | Illinois Tool Works | | | | | 300,000 | | | | 14,672,460 | | | | 69,645,000 | | | | 4.4% | |

Continued on next page.

| | | | | | | | |

|

| | | | |

| The accompanying notes are an integral part of these financial statements. | | Semi-Annual Report | | November 30, 2021 | | | | 9 |

| | |

| Amana Income Fund: Schedule of Investments | | As of November 30, 2021 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Common Stocks – 94.5% | | | | Number of Shares | | | Cost | | | Market Value | | | Percentage of Assets | |

| | | | | | |

| | | Industrials (continued) | | | | | | | | | | | | | | |

| | | | | | | |

| | | Measurement Instruments | | | | | | | | | | | | | | |

| | | | | | | |

| | | Rockwell Automation | | | | | 300,000 | | | | $13,657,124 | | | | $100,860,000 | | | | 6.3% | |

| | | | | | | |

| | | Rail Freight | | | | | | | | | | | | | | |

| | | | | | | |

| | | Canadian National Railway | | | | | 384,000 | | | | 8,600,818 | | | | 48,602,880 | | | | 3.1% | |

| | | | | | | |

| | | | | | | | | | | 56,876,693 | | | | 322,285,480 | | | | 20.2% | |

| | | | | | |

| | | Materials | | | | | | | | | | | | | | |

| | | | | | | |

| | | Basic & Diversified Chemicals | | | | | | | | | | | | | | |

| | | | | | | |

| | | Air Products & Chemicals | | | | | 110,000 | | | | 6,424,723 | | | | 31,618,400 | | | | 2.0% | |

| | | | | | | |

| | | Linde | | | | | 130,000 | | | | 8,531,142 | | | | 41,358,200 | | | | 2.6% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 14,955,865 | | | | 72,976,600 | | | | 4.6% | |

| | | | | | | |

| | | Non Wood Building Materials | | | | | | | | | | | | | | |

| | | | | | | |

| | | Carlisle | | | | | 244,000 | | | | 7,222,997 | | | | 54,948,800 | | | | 3.5% | |

| | | | | | | |

| | | Specialty Chemicals | | | | | | | | | | | | | | |

| | | | | | | |

| | | 3M | | | | | 200,000 | | | | 13,704,248 | | | | 34,008,000 | | | | 2.1% | |

| | | | | | | |

| | | PPG Industries | | | | | 379,000 | | | | 12,758,054 | | | | 58,430,430 | | | | 3.7% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 26,462,302 | | | | 92,438,430 | | | | 5.8% | |

| | | | | | | |

| | | | | | | | | | | 48,641,164 | | | | 220,363,830 | | | | 13.9% | |

| | | | | | |

| | | Technology | | | | | | | | | | | | | | |

| | | | | | | |

| | | Communications Equipment | | | | | | | | | | | | | | |

| | | | | | | |

| | | Cisco Systems | | | | | 572,000 | | | | 26,072,500 | | | | 31,368,480 | | | | 2.0% | |

| | | | | | | |

| | | Consumer Electronics | | | | | | | | | | | | | | |

| | | | | | | |

| | | Nintendo | | | | | 45,000 | | | | 23,496,951 | | | | 19,756,663 | | | | 1.2% | |

| | | | | | | |

| | | Infrastructure Software | | | | | | | | | | | | | | |

| | | | | | | |

| | | Microsoft | | | | | 400,000 | | | | 7,953,170 | | | | 132,236,000 | | | | 8.3% | |

| | | | | | | |

| | | Semiconductor Devices | | | | | | | | | | | | | | |

| | | | | | | |

| | | Intel | | | | | 900,000 | | | | 19,537,540 | | | | 44,280,000 | | | | 2.8% | |

| | | | | | | |

| | | Texas Instruments | | | | | 250,000 | | | | 38,489,292 | | | | 48,092,500 | | | | 3.0% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 58,026,832 | | | | 92,372,500 | | | | 5.8% | |

| | | | | | | |

| | | Semiconductor Manufacturing | | | | | | | | | | | | | | |

| | | | | | | |

| | | Taiwan Semiconductor ADR | | | | | 824,500 | | | | 8,249,619 | | | | 96,590,175 | | | | 6.1% | |

| | | | | | | |

| | | | | | | | | | | 123,799,072 | | | | 372,323,818 | | | | 23.4% | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Total investments | | | | | | | | | $432,803,304 | | | | $1,504,197,414 | | | | 94.5% | |

| | | | | | |

| | Other assets (net of liabilities) | | | | | | | | | | | | | 88,361,958 | | | | 5.5% | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Total net assets | | | | | | | | | | | | | $1,592,559,372 | | | | 100.0% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

ADR: American Depositary Receipt

| | | | | | | | |

|

| | | | |

| 10 | | | | Semi-Annual Report | | November 30, 2021 | | The accompanying notes are an integral part of these financial statements. |

Amana Income Fund

Statement of Assets and Liabilities

| | | | |

| As of November 30, 2021 | |

| | |

| | | | |

| |

Assets | | | | |

| |

Investments in securities, at value

(Cost $432,803,304) | | | $1,504,197,414 | |

| |

Cash | | | 85,454,861 | |

| |

Dividends receivable | | | 3,917,794 | |

| |

Receivable for Fund shares sold | | | 1,011,816 | |

| |

Prepaid expenses | | | 12,754 | |

| | | | |

| |

Total assets | | | 1,594,594,639 | |

| | | | |

| |

Liabilities | | | | |

| |

Accrued advisory fees | | | 996,722 | |

| |

Payable for Fund shares redeemed | | | 701,192 | |

| |

Accrued 12b-1 distribution fees | | | 168,670 | |

| |

Accrued retirement plan custody fee | | | 49,737 | |

| |

Accrued audit expenses | | | 45,040 | |

| |

Accrued other operating expenses | | | 39,680 | |

| |

Accrued Chief Compliance Officer expenses | | | 17,870 | |

| |

Accrued trustee expenses | | | 16,356 | |

| | | | |

| |

Total liabilities | | | 2,035,267 | |

| | | | |

| |

Net Assets | | | $1,592,559,372 | |

| | |

| | | | |

| | |

Analysis of Net Assets | | | | |

| |

Paid-in capital (unlimited shares authorized, without par value) | | | $408,967,048 | |

| |

Total distributable earnings | | | 1,183,592,324 | |

| | | | |

| |

Net assets applicable to Fund shares outstanding | | | $1,592,559,372 | |

| | |

| | | | |

| | |

Net asset value per Investor Share | | | AMANX | |

| |

Net assets, at value | | | $799,768,243 | |

| |

Shares outstanding | | | 12,433,675 | |

| | | | |

| |

Net asset value, offering and redemption price per share | | | $64.32 | |

| | |

| | | | |

| | |

Net asset value per Institutional Share | | | AMINX | |

| |

Net assets, at value | | | $792,791,129 | |

| |

Shares outstanding | | | 12,407,735 | |

| | | | |

| |

Net asset value, offering and redemption price per share | | | $63.89 | |

Statement of Operations

| | | | |

| Period ended November 30, 2021 | |

| | |

| | | | |

| |

Investment income | | | | |

| |

Dividend Income

(net of foreign tax of $260,764) | | | $14,805,675 | |

| |

Miscellaneous income | | | 4,586 | |

| | | | |

| |

Total investment income | | | 14,810,261 | |

| | | | |

| |

Expenses | | | | |

| |

Investment advisory fees | | | 5,896,710 | |

| |

12b-1 distribution fees | | | 1,031,011 | |

| |

Custodian fees | | | 33,620 | |

| |

Filing and registration fees | | | 31,956 | |

| |

Retirement plan custodial fees | | | | |

| |

Investor Shares | | | 49 | |

| |

Institutional Shares | | | 30,009 | |

| |

Printing and postage fees | | | 27,882 | |

| |

Audit fees | | | 15,574 | |

| |

Other operating expenses | | | 14,563 | |

| |

Trustee fees | | | 14,038 | |

| |

Chief Compliance Officer expenses | | | 13,246 | |

| |

Legal fees | | | 11,663 | |

| | | | |

| |

Total gross expenses | | | 7,120,321 | |

| | | | |

| |

Less custodian fee credits | | | (33,620 | ) |

| | | | |

| |

Net expenses | | | 7,086,701 | |

| | | | |

| |

Net investment income | | | $7,723,560 | |

| | |

| | | | |

| | |

| | | | |

| |

Net realized gain from investments and foreign currency | | | $37,283,844 | A |

Net increase in unrealized appreciation on investments | | | 25,960,923 | |

| | | | |

| |

Net gain on investments | | | $63,244,767 | |

| | |

| | | | |

| | |

Net increase in net assets resulting from operations | | | $70,968,327 | |

| | |

| | | | |

| A | Includes $11,817,477 in net realized gains from redemptions in-kind. |

| | | | | | | | |

|

| | | | |

| The accompanying notes are an integral part of these financial statements. | | Semi-Annual Report | | November 30, 2021 | | | | 11 |

Amana Income Fund

| | | | | | | | |

Statements of Changes in Net Assets | | | Period ended November 30, 2021 | | | | Year ended May 31, 2021 | |

| | | |

Increase in net assets from operations | | | | | | | | |

| | |

From operations | | | | | | | | |

| | |

Net investment income | | | $7,723,560 | | | | $15,901,444 | |

| | |

Net realized gain on investment | | | 37,283,844 | | | | 109,441,618 | |

| | |

Net increase in unrealized appreciation | | | 25,960,923 | | | | 251,602,142 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 70,968,327 | | | | 376,945,204 | |

| | | | | | | | |

| | |

Distributions to shareowners from | | | | | | | | |

| | |

Net dividend and distribution to shareholders - Investor Shares | | | - | | | | (48,715,136 | ) |

| | |

Net dividend and distribution to shareholders - Institutional Shares | | | - | | | | (42,660,760 | ) |

| | | | | | | | |

| | |

Total distributions | | | - | | | | (91,375,896 | ) |

| | | | | | | | |

| | |

Capital share transactions | | | | | | | | |

| | |

Proceeds from the sale of shares | | | | | | | | |

| | |

Investor Shares | | | 30,619,206 | | | | 67,430,743 | |

| | |

Institutional Shares | | | 118,184,764 | | | | 200,977,427 | |

| | |

Value of shares issued in reinvestment of dividends and distributions | | | | | | | | |

| | |

Investor Shares | | | - | | | | 47,457,602 | |

| | |

Institutional Shares | | | - | | | | 41,065,802 | |

| | |

Cost of shares redeemed | | | | | | | | |

| | |

Investor Shares | | | (110,201,010 | ) | | | (169,718,357 | ) |

| | |

Institutional Shares | | | (62,146,068 | ) | | | (196,452,487 | ) |

| | | | | | | | |

| | |

Total capital share transactions | | | (23,543,108 | ) | | | (9,239,270 | ) |

| | | | | | | | |

| | |

Total increase in net assets | | | $47,425,219 | | | | $276,330,038 | |

| | | |

| | | | | | | | |

| | | |

Net assets | | | | | | | | |

| | |

Beginning of period | | | 1,545,134,153 | | | | 1,268,804,115 | |

| | |

End of period | | | $1,592,559,372 | | | | $1,545,134,153 | |

| | | |

Shares of the Fund sold and redeemed | | | | | | | | |

| | |

Investor Shares (AMANX) | | | | | | | | |

| | |

Number of shares sold | | | 484,883 | | | | 1,197,311 | |

| | |

Number of shares issued in reinvestment of dividends and distributions | | | - | | | | 840,652 | |

| | |

Number of shares redeemed | | | (1,728,658 | ) | | | (3,062,129 | ) |

| | | | | | | | |

| | |

Net decrease in number of shares outstanding | | | (1,243,775 | ) | | | (1,024,166 | ) |

| | | | | | | | |

| | |

Institutional Shares (AMINX) | | | | | | | | |

| | |

Number of shares sold | | | 1,871,634 | | | | 3,575,035 | |

| | |

Number of shares issued in reinvestment of dividends and distributions | | | - | | | | 732,160 | |

| | |

Number of shares redeemed | | | (992,842 | ) | | | (3,503,470 | ) |

| | | | | | | | |

| | |

Net increase in number of shares outstanding | | | 878,792 | | | | 803,725 | |

| | | |

| | | | | | | | |

| | | | | | | | |

|

| | | | |

| 12 | | | | Semi-Annual Report | | November 30, 2021 | | The accompanying notes are an integral part of these financial statements. |

Amana Income Fund: Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Investor Shares (AMANX) | | | Period ended | | | | | | | | Year ended May 31, | | | | | |

| | | | | | |

Selected data per share of outstanding capital stock throughout each period: | | | Nov. 30, 2021 | | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018 | | | | 2017 | |

| | | | | | | |

Net asset value at beginning of period | | | $61.52 | | | | $50.03 | | | | $48.32 | | | | $48.91 | | | | $48.03 | | | | $44.35 | |

| | | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeA | | | 0.27 | | | | 0.58 | | | | 0.67 | | | | 0.61 | | | | 0.58 | | | | 0.59 | |

| | | | | | |

Net gains on securities (both realized & unrealized) | | | 2.53 | | | | 14.53 | | | | 5.17 | | | | 1.80 | | | | 3.28 | | | | 4.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 2.80 | | | | 15.11 | | | | 5.84 | | | | 2.41 | | | | 3.86 | | | | 5.49 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Dividends (from net investment income) | | | - | | | | (0.56 | ) | | | (0.66 | ) | | | (0.62 | ) | | | (0.57 | ) | | | (0.58 | ) |

| | | | | | |

Distributions (from capital gains) | | | - | | | | (3.06 | ) | | | (3.47 | ) | | | (2.38 | ) | | | (2.41 | ) | | | (1.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total distributions | | | - | | | | (3.62 | ) | | | (4.13 | ) | | | (3.00 | ) | | | (2.98 | ) | | | (1.81 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value at end of period | | | $64.32 | | | | $61.52 | | | | $50.03 | | | | $48.32 | | | | $48.91 | | | | $48.03 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total ReturnB | | | 4.55% | | | | 30.87% | | | | 11.77% | | | | 5.35% | | | | 7.82% | | | | 12.67% | |

| | | | | | | |

Ratios / supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets ($000), end of year | | | $799,768 | | | | $841,439 | | | | $735,565 | | | | $805,610 | | | | $882,571 | | | | $956,977 | |

| | | | | | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Before custodian fee creditsC | | | 1.02% | | | | 1.04% | | | | 1.06% | | | | 1.11% | | | | 1.13% | | | | 1.13% | |

| | | | | | |

After custodian fee creditsC | | | 1.01% | | | | 1.04% | | | | 1.06% | | | | 1.10% | | | | 1.12% | | | | 1.12% | |

| | | | | | |

Ratio of net investment income after custodian fee credits to average net assetsC | | | 0.86% | | | | 1.03% | | | | 1.31% | | | | 1.22% | | | | 1.14% | | | | 1.29% | |

| | | | | | |

Portfolio turnover rateB | | | 3% | | | | 5% | | | | 0% | | | | 1% | | | | 1% | | | | 1% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Institutional Shares (AMINX) | | | Period ended | | | | | | | | Year ended May 31, | | | | | |

| | | | | | |

Selected data per share of outstanding capital stock throughout each period: | | | Nov. 30, 2021 | | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018 | | | | 2017 | |

| | | | | | | |

Net asset value at beginning of period | | | $61.04 | | | | $49.72 | | | | $48.12 | | | | $48.72 | | | | $47.90 | | | | $44.30 | |

| | | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeA | | | 0.35 | | | | 0.71 | | | | 0.78 | | | | 0.74 | | | | 0.70 | | | | 0.70 | |

| | | | | | |

Net gains on securities (both realized & unrealized) | | | 2.50 | | | | 14.42 | | | | 5.13 | | | | 1.79 | | | | 3.26 | | | | 4.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 2.85 | | | | 15.13 | | | | 5.91 | | | | 2.53 | | | | 3.96 | | | | 5.60 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Less distributions | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Dividends (from net investment income) | | | - | | | | (0.75 | ) | | | (0.84 | ) | | | (0.75 | ) | | | (0.73 | ) | | | (0.77 | ) |

| | | | | | |

Distributions (from capital gains) | | | - | | | | (3.06 | ) | | | (3.47 | ) | | | (2.38 | ) | | | (2.41 | ) | | | (1.23 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total distributions | | | - | | | | (3.81 | ) | | | (4.31 | ) | | | (3.13 | ) | | | (3.14 | ) | | | (2.00 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value at end of period | | | $63.89 | | | | $61.04 | | | | $49.72 | | | | $48.12 | | | | $48.72 | | | | $47.90 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total ReturnB | | | 4.67% | | | | 31.14% | | | | 11.96% | | | | 5.63% | | | | 8.05% | | | | 12.96% | |

| | | | | | | |

Ratios / supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets ($000), end of period | | | $792,791 | | | | $703,695 | | | | $533,239 | | | | $472,724 | | | | $451,651 | | | | $372,621 | |

| | | | | | |

Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Before custodian fee creditsC | | | 0.77% | | | | 0.80% | | | | 0.83% | | | | 0.87% | | | | 0.89% | | | | 0.89% | |

| | | | | | |

After custodian fee creditsC | | | 0.77% | | | | 0.79% | | | | 0.82% | | | | 0.86% | | | | 0.88% | | | | 0.89% | |

| | | | | | |

Ratio of net investment income after custodian fee credits to average net assetsC | | | 1.10% | | | | 1.27% | | | | 1.55% | | | | 1.47% | | | | 1.39% | | | | 1.52% | |

| | | | | | |

Portfolio turnover rateB | | | 3% | | | | 5% | | | | 0% | | | | 1% | | | | 1% | | | | 1% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| A | Calculated using average shares outstanding |

| B | Not annualized for periods of less than one year |

| C | Annualized for periods of less than one year |

| | | | | | | | |

|

| | | | |

| The accompanying notes are an integral part of these financial statements. | | Semi-Annual Report | | November 30, 2021 | | | | 13 |

| | |

| Amana Growth Fund: Performance Summary | | |

| | | | | | | | | | | | | | | | |

Average Annual Returns (as of November 30, 2021) | | | | | | | | | | | | | | | | |

| | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | Expense Ratio1 | |

| | | | |

Investor Shares (AMAGX) | | | 34.21 | | | | 27.51 | | | | 17.30 | | | | 1.03% | |

| | | | |

Institutional Shares (AMIGX)2 | | | 34.55 | | | | 27.82 | | | | n/a | | | | 0.79% | |

| | | | |

S&P 500 Index | | | 27.92 | | | | 20.36 | | | | 16.15 | | | | n/a | |

Growth of $10,000

| | |

| | Comparison of any mutual fund to a market index must be made bearing in mind that the index is unmanaged and expense-free. Conversely, the Fund will (1) be actively managed; (2) have an objective other than mirroring the index, such as limiting risk; (3) bear transaction and other operational costs; (4) stand ready to buy and sell its securities to shareowners on a daily basis; and (5) provide a wide range of services. The graph compares $10,000 invested in Investor Shares of the Fund on November 30, 2011, to an identical amount invested in the S&P 500 Index, a broad-based stock market index. The graph shows that an investment in Investor Shares of the Fund would have risen to $49,298 versus $44,726 in the Index. Investor Shares are used in this chart because they represent the larger share class in terms of assets and have a longer track record. Please note that investors cannot invest directly in the Index. |

Past performance does not guarantee future results. The “Growth of $10,000” graph and “Average Annual Returns” performance table assume the reinvestment of dividends and capital gains. They do not reflect the deduction of taxes that a shareowner might pay on fund distributions or the redemption of fund shares.

| 1 | Expense ratios shown in this table have been restated to reflect a reduction in the Advisory and Administrative Services fee, which became effective on December 1, 2020. Ratios presented in this table differ from the expense ratios shown elsewhere in this report as they represent older fiscal periods. |

| 2 | Institutional shares of the Amana Growth Fund began operations September 25, 2013. |

Fund Objective

The objective of the Growth Fund is long-term capital growth, consistent with Islamic principles.

| | | | |

Top 10 Holdings | | | | |

| |

| % of Total Net Assets | |

| |

Apple | | | 9.2% | |

| |

Intuit | | | 8.1% | |

| |

Adobe | | | 7.4% | |

| |

ASML Holding | | | 6.7% | |

| |

Estee Lauder, Class A | | | 4.2% | |

| |

Qualcomm | | | 4.0% | |

| |

Taiwan Semiconductor ADR | | | 4.0% | |

| |

Agilent Technologies | | | 3.8% | |

| |

Trimble | | | 3.6% | |

| |

Church & Dwight | | | 3.0% | |

| | | | | | | | | | | | |

Portfolio Diversification | | | | | | | | | | | | |

| | | | |

| | | % of Total Net Assets | | | | | | | | | |

| | | |

Application Software | | | 16.1% | | | ∎ | | | | |  | |

Communications Equipment | | | 12.0% | | | ∎ | | |

Semiconductor Manufacturing | | | 10.7% | | | ∎ | | |

Household Products | | | 7.9% | | | ∎ | | |

Large Pharma | | | 7.0% | | | ∎ | | |

Semiconductor Devices | | | 6.5% | | | ∎ | | |

Measurement Instruments | | | 6.3% | | | ∎ | | |

Life Science Equipment | | | 3.8% | | | ∎ | | |

Rail Freight | | | 3.8% | | | ∎ | | |

Other industries < 3% | | | 20.6% | | | ∎ | | |

Other Assets (net of liabilities) | | | 5.3% | | | ∎ | | |

| | | | | | |

|

| | | |

| 14 | | | | Semi-Annual Report | | November 30, 2021 |

| | |

| Amana Growth Fund: Schedule of Investments | | As of November 30, 2021 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Common Stocks – 94.7% | | | | Number of Shares | | | Cost | | | Market Value | | | Percentage of Assets | |

| | | | | | |

| | | Communications | | | | | | | | | | | | | | |

| | | | | | | |

| | | Internet Media | | | | | | | | | | | | | | |

| | | | | | | |

| | | Alphabet, Class A1 | | | | | 12,500 | | | | $27,109,896 | | | | $35,474,375 | | | | 1.0% | |

| | | | | | | |

| | | | | | | | | | | 27,109,896 | | | | 35,474,375 | | | | 1.0% | |

| | | | | | |

| | | Consumer Discretionary | | | | | | | | | | | | | | |

| | | | | | | |

| | | Apparel, Footwear & Accessory Design | | | | | | | | | | | | | | |

| | | | | | | |

| | | Nike, Class B | | | | | 100,000 | | | | 9,504,490 | | | | 16,924,000 | | | | 0.5% | |

| | | | | | | |

| | | Home Products Stores | | | | | | | | | | | | | | |

| | | | | | | |

| | | Lowe’s | | | | | 400,000 | | | | 8,620,300 | | | | 97,836,000 | | | | 2.7% | |

| | | | | | | |

| | | Specialty Apparel Stores | | | | | | | | | | | | | | |

| | | | | | | |

| | | TJX Companies | | | | | 1,150,000 | | | | 12,679,185 | | | | 79,810,000 | | | | 2.2% | |

| | | | | | | |

| | | | | | | | | | | 30,803,975 | | | | 194,570,000 | | | | 5.4% | |

| | | | | | |

| | | Consumer Staples | | | | | | | | | | | | | | |

| | | | | | | |

| | | Beverages | | | | | | | | | | | | | | |

| | | | | | | |

| | | PepsiCo | | | | | 100,200 | | | | 6,443,626 | | | | 16,009,956 | | | | 0.4% | |

| | | | | | | |

| | | Household Products | | | | | | | | | | | | | | |

| | | | | | | |

| | | Church & Dwight | | | | | 1,200,000 | | | | 21,472,365 | | | | 107,256,000 | | | | 3.0% | |

| | | | | | | |

| | | Clorox | | | | | 152,500 | | | | 8,592,445 | | | | 24,834,625 | | | | 0.7% | |

| | | | | | | |

| | | Estee Lauder, Class A | | | | | 458,594 | | | | 16,624,230 | | | | 152,285,309 | | | | 4.2% | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 46,689,040 | | | | 284,375,934 | | | | 7.9% | |

| | | | | | | |

| | | | | | | | | | | 53,132,666 | | | | 300,385,890 | | | | 8.3% | |

| | | | | | |

| | | Health Care | | | | | | | | | | | | | | |

| | | | | | | |

| | | Biotech | | | | | | | | | | | | | | |

| | | | | | | |

| | | Amgen | | | | | 355,000 | | | | 18,341,782 | | | | 70,602,400 | | | | 2.0% | |

| | | | | | | |

| | | Large Pharma | | | | | | | | | | | | | | |

| | | | | | | |

| | | Eli Lilly | | | | | 350,000 | | | | 12,007,975 | | | | 86,814,000 | | | | 2.4% | |

| | | | | | | |

| | | Johnson & Johnson | | | | | 380,000 | | | | 23,150,478 | | | | 59,253,400 | | | | 1.6% | |

| | | | | | | |

| | | Novo Nordisk ADR | | | | | 1,002,195 | | | | 7,665,243 | | | | 107,064,492 | | | | 3.0% | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 42,823,696 | | | | 253,131,892 | | | | 7.0% | |

| | | | | | | |

| | | Life Science Equipment | | | | | | | | | | | | | | |

| | | | | | | |

| | | Agilent Technologies | | | | | 900,000 | | | | 16,302,137 | | | | 135,810,000 | | | | 3.8% | |

| | | | | | | |

| | | Medical Devices | | | | | | | | | | | | | | |

| | | | | | | |

| | | Stryker | | | | | 300,000 | | | | 15,657,168 | | | | 70,989,000 | | | | 1.9% | |

| | | | | | | |

| | | | | | | | | | | 93,124,783 | | | | 530,533,292 | | | | 14.7% | |

| | | | | | |

| | | Industrials | | | | | | | | | | | | | | |

| | | | | | | |

| | | Building Sub Contractors | | | | | | | | | | | | | | |

| | | | | | | |

| | | EMCOR Group | | | | | 89,650 | | | | 1,352,555 | | | | 10,698,831 | | | | 0.3% | |

| | | | |

| | | Commercial & Residential Building Equipment & Systems | | | | | | | |

| | | | | | | |

| | | Johnson Controls International | | | | | 1,044,000 | | | | 48,905,901 | | | | 78,049,440 | | | | 2.2% | |

| | | | | | | |

| | | Industrial Distribution & Rental | | | | | | | | | | | | | | |

| | | | | | | |

| | | Fastenal | | | | | 633,000 | | | | 7,613,244 | | | | 37,454,610 | | | | 1.0% | |

Continued on next page.

| | | | | | | | |

|

| | | | |

| The accompanying notes are an integral part of these financial statements. | | Semi-Annual Report | | November 30, 2021 | | | | 15 |

| | |

| Amana Growth Fund: Schedule of Investments | | As of November 30, 2021 |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | Common Stocks – 94.7% | | | | Number of Shares | | | Cost | | | Market Value | | | Percentage of Assets | |

| | | | | | |

| | | Industrials (continued) | | | | | | | | | | | | | | |

| | | | | | | |

| | | Measurement Instruments | | | | | | | | | | | | | | |

| | | | | | | |

| | | Keysight Technologies1 | | | | | 500,000 | | | | $8,390,911 | | | | $97,240,000 | | | | 2.7% | |

| | | | | | | |

| | | Trimble1 | | | | | 1,500,000 | | | | 15,966,794 | | | | 128,805,000 | | | | 3.6% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 24,357,705 | | | | 226,045,000 | | | | 6.3% | |

| | | | | | | |

| | | Metalworking Machinery | | | | | | | | | | | | | | |

| | | | | | | |

| | | Lincoln Electric Holdings | | | | | 307,000 | | | | 6,707,264 | | | | 41,432,720 | | | | 1.1% | |

| | | | | | | |

| | | Rail Freight | | | | | | | | | | | | | | |

| | | | | | | |

| | | Norfolk Southern | | | | | 250,000 | | | | 14,370,513 | | | | 66,317,500 | | | | 1.8% | |

| | | | | | | |

| | | Union Pacific | | | | | 300,000 | | | | 16,986,610 | | | | 70,692,000 | | | | 2.0% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 31,357,123 | | | | 137,009,500 | | | | 3.8% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | 120,293,792 | | | | 530,690,101 | | | | 14.7% | |

| | | | | | |

| | | Materials | | | | | | | | | | | | | | |

| | | | | | | |

| | | Precious Metal Mining | | | | | | | | | | | | | | |

| | | | | | | |

| | | Newmont | | | | | 750,000 | | | | 42,354,995 | | | | 41,190,000 | | | | 1.1% | |

| | | | | | | |

| | | | | | | | | | | 42,354,995 | | | | 41,190,000 | | | | 1.1% | |

| | | | | | |

| | | Technology | | | | | | | | | | | | | | |

| | | | | | | |

| | | Application Software | | | | | | | | | | | | | | |

| | | | | | | |

| | | Adobe1 | | | | | 400,000 | | | | 12,795,020 | | | | 267,940,000 | | | | 7.4% | |

| | | | | | | |

| | | Intuit | | | | | 450,000 | | | | 15,564,740 | | | | 293,535,000 | | | | 8.1% | |

| | | | | | | |

| | | SAP ADR | | | | | 170,400 | | | | 11,199,301 | | | | 21,886,176 | | | | 0.6% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 39,559,061 | | | | 583,361,176 | | | | 16.1% | |

| | | | | | | |

| | | Communications Equipment | | | | | | | | | | | | | | |

| | | | | | | |

| | | Apple | | | | | 2,016,000 | | | | 1,526,905 | | | | 333,244,800 | | | | 9.2% | |

| | | | | | | |

| | | Cisco Systems | | | | | 1,500,000 | | | | 26,759,130 | | | | 82,260,000 | | | | 2.3% | |

| | | | | | | |

| | | Motorola Solutions | | | | | 70,000 | | | | 17,581,669 | | | | 17,722,600 | | | | 0.5% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 45,867,704 | | | | 433,227,400 | | | | 12.0% | |

| | | | | | | |

| | | Information Services | | | | | | | | | | | | | | |

| | | | | | | |

| | | Gartner1 | | | | | 179,900 | | | | 6,185,085 | | | | 56,173,775 | | | | 1.5% | |

| | | | | | | |

| | | Infrastructure Software | | | | | | | | | | | | | | |

| | | | | | | |

| | | Microsoft | | | | | 120,000 | | | | 30,150,399 | | | | 39,670,800 | | | | 1.1% | |

| | | | | | | |

| | | Oracle | | | | | 650,000 | | | | 12,885,855 | | | | 58,981,000 | | | | 1.6% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 43,036,254 | | | | 98,651,800 | | | | 2.7% | |

| | | | | | | |

| | | Semiconductor Devices | | | | | | | | | | | | | | |

| | | | | | | |

| | | Qualcomm | | | | | 800,000 | | | | 30,482,851 | | | | 144,448,000 | | | | 4.0% | |

| | | | | | | |

| | | Xilinx | | | | | 391,200 | | | | 8,547,213 | | | | 89,369,640 | | | | 2.5% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 39,030,064 | | | | 233,817,640 | | | | 6.5% | |

| | | | | | | |

| | | Semiconductor Manufacturing | | | | | | | | | | | | | | |

| | | | | | | |

| | | ASML Holding | | | | | 308,000 | | | | 10,937,644 | | | | 243,785,080 | | | | 6.7% | |

| | | | | | | |

| | | Taiwan Semiconductor ADR | | | | | 1,222,471 | | | | 12,765,781 | | | | 143,212,478 | | | | 4.0% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | 23,703,425 | | | | 386,997,558 | | | | 10.7% | |

| | | | | | | |

| | | | | | | | | | | 197,381,593 | | | | 1,792,229,349 | | | | 49.5% | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Total investments | | | | | | | | | $564,201,700 | | | | $3,425,073,007 | | | | 94.7% | |

| | | | | | |

| | Other assets (net of liabilities) | | | | | | | | | | | | | 191,694,602 | | | | 5.3% | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Total net assets | | | | | | | | | | | | | $3,616,767,609 | | | | 100.0% | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| ADR: | American Depositary Receipt |

| | | | | | | | |

|

| | | | |

| 16 | | | | Semi-Annual Report | | November 30, 2021 | | The accompanying notes are an integral part of these financial statements. |

Amana Growth Fund

Statement of Assets and Liabilities

| | | | |

| As of November 30, 2021 | |

| | |

| | | | |

| |

Assets | | | | |

| |

Investments in securities, at value

(Cost $564,201,700) | | | $3,425,073,007 | |

| |

Cash | | | 180,254,436 | |

| |

Receivable for Fund shares sold | | | 11,870,855 | |

| |

Dividends receivable | | | 3,537,649 | |

| |

Prepaid expenses | | | 41,722 | |

| | | | |

| |

Total assets | | | 3,620,777,669 | |

| | | | |

| |

Liabilities | | | | |

| |

Accrued advisory fees | | | 1,861,918 | |

| |

Payable for Fund shares redeemed | | | 1,538,725 | |

| |

Accrued 12b-1 distribution fees | | | 406,137 | |

| |

Accrued audit expenses | | | 74,168 | |

| |

Accrued retirement plan custody fee | | | 72,066 | |

| |

Accrued other liabilities | | | 34,147 | |

| |

Accrued trustee expenses | | | 12,577 | |

| |

Accrued Chief Compliance Officer expenses | | | 10,322 | |

| | | | |

| |

Total liabilities | | | 4,010,060 | |

| | | | |

| |

Net Assets | | | $3,616,767,609 | |

| | |

| | | | |

| | |

Analysis of Net Assets | | | | |

| |

Paid-in capital (unlimited shares authorized, without par value) | | | $687,961,794 | |

| |

Total distributable earnings | | | 2,928,805,815 | |

| | | | |

| |

Net assets applicable to Fund shares outstanding | | | $3,616,767,609 | |

| | |

| | | | |

| | |

Net asset value per Investor Share | | | AMAGX | |

| |

Net assets, at value | | | $1,966,436,196 | |

| |

Shares outstanding | | | 27,579,190 | |

| | | | |

| |

Net asset value, offering and redemption price per share | | | $71.30 | |

| | |

| | | | |

| | |

Net asset value per Institutional Share | | | AMIGX | |

| |

Net assets, at value | | | $1,650,331,413 | |

| |

Shares outstanding | | | 22,995,828 | |

| | | | |

| |

Net asset value, offering and redemption price per share | | | $71.77 | |

| | |

| | | | |

Statement of Operations

| | | | |

| Period ended November 30, 2021 | |

| | |

| | | | |

| |

Investment income | | | | |

| |

Dividend income

(net of foreign taxes of ($437,402)) | | | $15,652,230 | |

| |

Miscellaneous income | | | 11,532 | |

| | | | |

| |

Total investment income | | | 15,663,762 | |

| | | | |

| |

Expenses | | | | |

| |

Investment advisory fees | | | 10,691,861 | |

| |

12b-1 distribution fees | | | 2,343,525 | |

| |

Custodian fees | | | 68,925 | |

| |

ReFlow fees | | | 51,057 | |

| |

Filing and registration fees | | | 46,861 | |

| |

Printing and postage fees | | | 43,162 | |

| |

Retirement plan custodial fees | | | | |

| |

Investor Shares | | | 53 | |

| |

Institutional Shares | | | 42,092 | |

| |

Chief Compliance Officer expenses | | | 31,056 | |

| |

Audit fees | | | 28,688 | |

| |

Other operating expenses | | | 27,439 | |

| |

Legal fees | | | 25,938 | |

| |

Trustee fees | | | 20,055 | |

| | | | |

| |

Total gross expenses | | | 13,420,712 | |

| | | | |

| |

Less custodian fee credits | | | (68,925 | ) |

| | | | |

| |

Net expenses | | | 13,351,787 | |

| | | | |

| |

Net investment income | | | $2,311,975 | |

| | |

| | | | |

| | |

| | | | |

| |

Net realized gain from investments | | | $10,118,216 | A |

| |

Net increase in unrealized appreciation on investments | | | 494,301,211 | |

| | | | |

| |

Net gain on investments | | | $504,419,427 | |

| | |

| | | | |

| | |

Net increase in net assets resulting from operations | | | $506,731,402 | |

| A | Includes $10,579,904 in net realized gains from redemptions in-kind. |

| | | | | | | | |

|

| | | | |

| The accompanying notes are an integral part of these financial statements. | | Semi-Annual Report | | November 30, 2021 | | | | 17 |

Amana Growth Fund

| | | | | | | | |

Statements of Changes in Net Assets | | | Period ended November 30, 2021 | | | | Year ended May 31, 2021 | |

| | | |

Increase in net assets from operations | | | | | | | | |

| | |

From operations | | | | | | | | |

| | |

Net investment income | | | $2,311,975 | | | | $7,604,359 | |

| | |

Net realized gain on investment | | | 10,118,216 | | | | 60,016,976 | |

| | |

Net increase in unrealized appreciation | | | 494,301,211 | | | | 836,595,291 | |

| | | | | | | | |

| | |

Net increase in net assets | | | 506,731,402 | | | | 904,216,626 | |

| | | | | | | | |

| | |

Distributions to shareowners from | | | | | | | | |

| | |

Net dividend and distribution to shareholders - Investor Shares | | | - | | | | (83,742,944 | ) |

| | |

Net dividend and distribution to shareholders - Institutional Shares | | | - | | | | (62,577,629 | ) |

| | | | | | | | |

| | |

Total distributions | | | - | | | | (146,320,573 | ) |

| | | | | | | | |

| | |

Capital share transactions | | | | | | | | |

| | |

Proceeds from the sale of shares | | | | | | | | |

| | |

Investor Shares | | | 143,084,024 | | | | 216,554,355 | |

| | |

Institutional Shares | | | 249,685,159 | | | | 311,702,332 | |

| | |

Value of shares issued in reinvestment of dividends and distributions | | | | | | | | |

| | |

Investor Shares | | | - | | | | 81,477,919 | |

| | |

Institutional Shares | | | - | | | | 60,033,078 | |

| | |

Cost of shares redeemed | | | | | | | | |

| | |

Investor Shares | | | (196,049,645 | ) | | | (310,903,221 | ) |

| | |

Institutional Shares | | | (113,124,892 | ) | | | (252,942,615 | ) |

| | | | | | | | |

| | |

Total capital share transactions | | | 83,594,646 | | | | 105,921,848 | |

| | | | | | | | |

| | |

Total increase in net assets | | | $590,326,048 | | | | $863,817,901 | |

| | | |

| | | | | | | | |

| | | |

Net assets | | | | | | | | |

| | |

Beginning of period | | | 3,026,441,561 | | | | 2,162,623,660 | |

| | |

End of period | | | $3,616,767,609 | | | | $3,026,441,561 | |

| | | |

Shares of the Fund sold and redeemed | | | | | | | | |

| | |

Investor Shares (AMAGX) | | | | | | | | |

| | |

Number of shares sold | | | 2,120,321 | | | | 3,991,294 | |

| | |

Number of shares issued in reinvestment of dividends and distributions | | | - | | | | 1,461,225 | |

| | |

Number of shares redeemed | | | (2,909,499 | ) | | | (5,800,622 | ) |

| | | | | | | | |

| | |

Net decrease in number of shares outstanding | | | (789,178 | ) | | | (348,103 | ) |

| | | | | | | | |

| | |

Institutional Shares (AMIGX) | | | | | | | | |

| | |

Number of shares sold | | | 3,673,253 | | | | 5,639,756 | |

| | |

Number of shares issued in reinvestment of dividends and distributions | | | - | | | | 1,072,020 | |

| | |

Number of shares redeemed | | | (1,671,534 | ) | | | (4,556,803 | ) |

| | | | | | | | |

| | |

Net increase in number of shares outstanding | | | 2,001,719 | | | | 2,154,973 | |

| | | |

| | | | | | | | |

| | | | | | | | |

|

| | | | |

| 18 | | | | Semi-Annual Report | | November 30, 2021 | | The accompanying notes are an integral part of these financial statements. |

Amana Growth Fund: Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | |

Investor Shares (AMAGX) | | | Period ended | | | | | | | | Year ended May 31, | | | | | |

| | | | | | |

Selected data per share of outstanding capital stock throughout each period: | | | Nov. 30, 2021 | | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018 | | | | 2017 | |

| | | | | | | |

Net asset value at beginning of period | | | $61.17 | | | | $45.39 | | | | $39.31 | | | | $36.24 | | | | $34.42 | | | | $33.05 | |

| | | | | | |

Income from investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeA | | | 0.01 | | | | 0.10 | | | | 0.15 | | | | 0.13 | | | | 0.16 | | | | 0.17 | |

| | | | | | |

Net gains on securities (both realized and unrealized) | | | 10.12 | | | | 18.74 | | | | 7.33 | | | | 4.14 | | | | 5.47 | | | | 5.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total from investment operations | | | 10.13 | | | | 18.84 | | | | 7.48 | | | | 4.27 | | | | 5.63 | | | | 5.47 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |