UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

x Pre-Effective Amendment No. 1 | | o Post-Effective Amendment No. |

(Check appropriate box or boxes)

Exact Name of Registrant as Specified in Charter: Securian Funds Trust | | Area Code and Telephone Number: 651-665-3500 |

Address of Principal Executive Offices: (Number, Street, City, State, Zip Code) 400 Robert Street North, St. Paul, Minnesota 55101-2098 | |

Name and Address of Agent for Service: David M. Dimitri

400 Robert Street North

St. Paul, MN 55101-2098

With a copy to: Michael J. Radmer, Esq.

Dorsey & Whitney LLP

50 South Sixth Street

Minneapolis, MN 55402 | | Approximate Date of Proposed Public Offering:

As soon as practicable after the effective date of the Registration Statement. |

(Number and Street) (City) (State) (Zip Code) | | |

Calculation of Registration Fee under the Securities Act of 1933:

Title of Securities Being

Registered | | Amount Being

Registered | | Proposed Maximum

Offering Price per

Unit | | Proposed Maximum

Aggregate Offering

Price | | Amount of

Registration Fee | |

Shares of SFT Core Bond Fund of Securian Funds Trust | | | | | | | | No filing fee is due because of reliance on Section 24(f) of the Investment Company Act of 1940 | |

It is proposed that this filing will become effective as soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

SECURIAN FUNDS TRUST

SFT Mortgage Securities Fund

400 Robert Street North

St. Paul, MN 55101

Dear Minnesota Life Insurance Company or Securian Life Insurance Company Variable Contract Owner:

The Board of Trustees of the SFT Mortgage Securities Fund (the "Acquired Fund"), a series of the Securian Funds Trust (the "Trust"), is pleased to submit a proposal to reorganize the Acquired Fund into the SFT Core Bond Fund (the "Acquiring Fund"), which is another series of the Trust.

As the owner of a variable annuity or variable life insurance contract issued by Minnesota Life Insurance Company or Securian Life Insurance Company, your contract is funded by shares of the Acquired Fund. Accordingly, we ask that you indicate whether you approve or disapprove of the proposed reorganization by submitting instructions on how to vote your beneficial shares by mail or by attending the shareholder meeting.

The proposed reorganization is being recommended primarily because there has been decreasing demand for the Acquired Fund within the variable annuity and variable life insurance products in which the Acquired Fund is offered. The decreasing demand has caused the Acquired Fund to lose assets and shrink in size over recent years. If the loss of assets continues, the Acquired Fund's fixed expenses will be spread over a smaller asset base, which may result in expenses increasing as a percentage of assets. The proposed reorganization is also expected to result in lower fees for Acquired Fund shareholders. The fees of the Acquiring Fund are lower than the fees of the Acquired Fund, and the proposed reorganization is expected to result in a larger fund that spreads fixed costs over a larger asset base.

THE BOARD OF TRUSTEES OF THE TRUST BELIEVES THAT THE TRANSACTION IS IN THE BEST INTERESTS OF THE ACQUIRED FUND AND ITS SHAREHOLDERS, AND UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR APPROVAL.

The Board considered various factors in reviewing the proposed reorganization on behalf of the Acquired Fund's shareholders, including, but not limited to, the following:

• The expectation that the proposed reorganization will reduce overall expenses for Acquired Fund shareholders;

• The superior long-term investment performance of the Acquiring Fund, although past performance is no guarantee of future results; and

• The expectation that the proposed reorganization will have no federal income tax consequences for Contract Owners.

If the proposal is approved, the Acquiring Fund will acquire all of the assets and assume all of the liabilities of the Acquired Fund in exchange for newly issued shares of the Acquiring Fund. These Acquiring Fund shares in turn will be distributed proportionately to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund. To accomplish the proposed reorganization, the Board of Trustees of the Acquired Fund submits for your approval an Agreement and Plan of Reorganization with respect to the Acquired Fund.

The shareholder meeting to consider the proposal will take place at 9:00 a.m., Central Time, on November 29, 2018, and the transaction, if approved, is expected to close shortly thereafter.

Whether or not you plan to attend the meeting, please review the enclosed voting instruction form. You may submit your instructions on voting the shares that fund your contract by mail. Following this letter is a Q&A summarizing the reorganization and information on how to vote your shares. Please read the entire proxy statement/prospectus carefully before you vote.

Thank you for your prompt attention to this important matter.

Sincerely,

David Kuplic

President

Securian Funds Trust

October 18, 2018

SECURIAN FUNDS TRUST

PROXY STATEMENT/PROSPECTUS Q&A

THE FOLLOWING IS A BRIEF OVERVIEW OF THE CHANGES BEING RECOMMENDED FOR THE SFT MORTGAGE SECURITIES FUND. WE ENCOURAGE YOU TO READ THE FULL TEXT OF THE ENCLOSED PROXY STATEMENT/PROSPECTUS.

Q: Why is the reorganization being proposed?

The reorganization is being proposed primarily because the SFT Mortgage Securities Fund (the "Acquired Fund") has experienced decreasing demand in recent years and the loss of assets could trigger an increase in fees and expenses as a percentage of assets. The proposed reorganization will result in lower fees and expenses for Acquired Fund shareholders. The Board has determined that the reorganization is in the best interests of the Acquired Fund's shareholders and recommends that you vote FOR the reorganization.

Q: Will my fees and expenses increase as a result of the reorganization?

No. The management fees paid by the Acquiring Fund (0.40%) are equal to the management fees paid by the Acquired Fund (0.40%). The total annual fund operating expenses for the Acquiring Fund Class 1 Shares (0.50%) and Class 2 Shares (0.75%) are lower than those of the Acquired Fund's Class 1 Shares (0.73%) and Class 2 Shares (0.98%).

Q: Who is paying the costs of the shareholder meeting and this proxy solicitation?

The total cost associated with the reorganization is estimated to be $160,000. The total cost represents fees and expenses associated with, but not limited to, printing and mailing this proxy solicitation and other communications to Contract Owners; accounting, tax, legal, and custodial expenses; and other transaction expenses. Costs related to the reorganization and proxy solicitation will be allocated 80% (or approximately $128,000) to the Acquired Fund, with the remaining 20% (or approximately $32,000) being allocated to Securian Asset Management, Inc., the Fund's investment manager ("Manager"). The operating expenses for the Acquiring Fund are lower (approximately 23 basis points) than the Acquired Fund; as such, the Acquired Fund shareholders are expected to materially benefit from the reorganization. The Manager is also expected to benefit due to greater economies of scale, operational efficiencies and overhead reduction as a result of managing one less fund.

Q: Will I incur taxes as a result of the reorganization?

No. For federal income tax purposes, the reorganization is not expected to be a taxable event for Contract Owners. Please see the Certain Tax Consequences discussion in the enclosed proxy statement/prospectus for additional information.

Q: If approved, when will the reorganization happen?

If shareholders approve the reorganization, it will take place shortly after the shareholder meeting on November 29, 2018.

Q: Is there anything I need to do to convert my shares?

No. Upon shareholder approval of the reorganization, the Acquired Fund Class 1 and Class 2 Shares, respectively, that serve as a funding vehicle for benefits under your variable annuity or variable life insurance contract automatically will be exchanged for the corresponding Class 1 and Class 2 Shares of the Acquiring Fund. The total value of the Acquiring Fund shares that a shareholder receives in the reorganization will be the same as the total value of the Acquired Fund shares held by the shareholder immediately before the reorganization. For example, Class 1 Shares of the Acquired Fund will be exchanged for an equivalent value of Class 1 Shares of the Acquiring Fund, and Class 2 Shares of the Acquired Fund will be exchanged for an equivalent value of Class 2 Shares of the Acquiring Fund.

Q: What happens to the Acquired Fund's portfolio?

Overall, approximately 50% of the Acquired Fund's portfolio will be sold to complete the reorganization. The Manager currently anticipates approximately 80% of the mortgage-backed securities held in the Acquired Fund will be sold and mortgage-backed securities currently account for approximately 62% of the assets in the Acquired Fund. The Manager also anticipates only a de minimis portion (i.e. 5% or less) of the Acquired Fund's remaining securities will be sold to complete the reorganization. The cost to realign the portfolio is estimated to be less than $10,000, or less than 1 basis point for the Acquired Fund.

Q: How does the Board recommend that I vote?

After careful consideration, the Board recommends that you vote FOR the reorganization.

Q: How and when do I vote?

You can vote in one of two ways:

- By mail with the enclosed voting instruction form

- In person at the shareholder meeting

Please vote as soon as possible by following the instructions on the voting instruction form.

Q: Whom should I call if I have questions?

If you have questions about any of the proposals described in the proxy statement or about voting procedures, please call toll free at 1-800-995-3850.

SECURIAN FUNDS TRUST

400 Robert Street North

St. Paul, MN 55101

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD November 29, 2018

SFT Mortgage Securities Fund

A special meeting of the shareholders of the SFT Mortgage Securities Fund (the "Acquired Fund") will be held at 9:00 a.m., Central Time on November 29, 2018, at the offices of Minnesota Life Insurance Company, 400 Robert Street North, St. Paul, Minnesota. At the meeting, shareholders of the Acquired Fund will consider the following proposals:

–To approve an Agreement and Plan of Reorganization (the "Plan") between the Acquired Fund and the SFT Core Bond Fund (the "Acquiring Fund"), both series of the Securian Funds Trust. Under the Plan, the Acquiring Fund would acquire all of the assets and assume all of the liabilities of the Acquired Fund in exchange for shares of the Acquiring Fund, which would be distributed proportionately to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund, and the assumption of the Acquired Fund's liabilities; and

–Such other business as may properly come before the meeting, or any adjournment of the meeting.

The Acquired Fund issues and sells shares to certain accounts of Minnesota Life Insurance Company ("Minnesota Life") and Securian Life Insurance Company ("Securian Life"). The separate accounts hold shares of mutual funds, including the Acquired Fund, which serve as a funding vehicle for benefits under variable annuity and variable life insurance contracts ("Contracts") issued by Minnesota Life and Securian Life. As the owners of the assets held in the separate accounts, Minnesota Life and Securian Life are the shareholders of the Acquired Fund and are entitled to vote the shares of the Acquired Fund. However, Minnesota Life and Securian Life will vote outstanding shares of the Acquired Fund in accordance with instructions given by the owners of the Contracts for which the Fund serves as a funding vehicle. This Notice is being delivered to Contract Owners whose Contracts were funded by shares of the Acquired Fund on the record date, so that they may instruct Minnesota Life and Securian Life how to vote the shares of the Acquired Fund underlying their contracts.

Shareholders of record at the close of business on October 1, 2018 are entitled to vote at the meeting.

By Order of the Board of Trustees

Michael J. Radmer

Secretary

October 18, 2018

YOU CAN VOTE QUICKLY AND EASILY.

PLEASE FOLLOW THE INSTRUCTIONS ON THE ENCLOSED VOTING INSTRUCTION FORM.

PROXY STATEMENT/PROSPECTUS — OCTOBER 18, 2018

| Acquired Fund | | Acquiring Fund | |

SFT Mortgage Securities Fund

("Mortgage Securities Fund") | | | SFT Core Bond Fund

("Core Bond Fund") | | |

This proxy statement/prospectus describes a proposed Agreement and Plan of Reorganization (the "Plan") pursuant to which the outstanding shares of the Mortgage Securities Fund, which serves as a funding vehicle for your variable annuity or variable life insurance contract, would be exchanged for shares of the Core Bond Fund. Both the Acquiring Fund and the Acquired Fund (each a "Fund" and together the "Funds") are series of the Securian Funds Trust (the "Trust"). The address of the Funds is 400 Robert Street North, St. Paul, MN 55101. The phone number of the Funds is 1-800-995-3850.

THE BOARD OF TRUSTEES OF THE TRUST UNANIMOUSLY RECOMMENDS APPROVAL OF THE PLAN.

These securities are not deposits or obligations of, or guaranteed by, any bank or an affiliate of any bank, nor are they insured by the Federal Deposit Insurance Corporation (FDIC), or any other agency of the United States, or any bank or an affiliate of any bank; and are subject to investment risks including possible loss of value.

As with all mutual funds, the Securities and Exchange Commission (the "SEC") has not approved or disapproved these securities or passed on the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Each of the Funds is subject to the information requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 (the "1940 Act") and files reports, proxy materials, and other information with the SEC. These reports, proxy materials, and other information can be inspected and copied at the Public Reference Room maintained by the SEC. In addition, copies of these documents may be viewed online or downloaded from the SEC's website at https://www.sec.gov.

You should retain this proxy statement/prospectus for future reference. It sets forth concisely the information about the Acquiring Fund that a prospective investor should know before investing. Additional information is set forth in the Statement of Additional Information, dated the same date as this proxy statement/prospectus, relating to this proxy statement/prospectus.

This proxy statement/prospectus was first mailed to Contract Owners on or about October 18, 2018.

WHERE TO GET MORE INFORMATION

The following documents (SEC file nos. 002-96990 and 811-04279) have been filed with the SEC and are incorporated by reference into this proxy statement/prospectus:

• The Statement of Additional Information, dated the same date as this proxy statement/prospectus, relating to the Reorganization, which includes the Statement of Additional Information for the Acquiring Fund;

• the unaudited financial statements of the Acquiring Fund and the Acquired Fund included in the Semi-Annual Report to Shareholders of Securian Funds Trust, for the six-month period ended June 30, 2018;

• the prospectus of Securian Funds Trust, which includes the Acquiring Fund and the Acquired Fund, dated May 1, 2018, as supplemented to date;

• the Statement of Additional Information for Securian Funds Trust, which includes the Acquiring Fund and the Acquired Fund, dated May 1, 2018, as supplemented to date; and

• the reports of the Independent Registered Public Accounting Firm and the audited financial statements of the Acquiring Fund and the Acquiring Fund included in the Annual Report to Shareholders of Securian Funds Trust, for the year ended December 31, 2017.

For a free copy of any of the documents listed above and/or to ask questions about this combined proxy statement/prospectus, please call toll-free 1-800-995-3850 or write to Securian Funds Trust, 400 Robert Street North, St. Paul, MN 55101.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

2

ABOUT THE ACQUIRED AND ACQUIRING FUNDS

The Acquired Fund issues and sells shares to separate accounts of Minnesota Life Insurance Company ("Minnesota Life") and Securian Life Insurance Company ("Securian Life"). These separate accounts hold shares of mutual funds, including the Acquired Fund, which serve as funding vehicles for benefits under variable annuity or variable life insurance contracts issued by Minnesota Life and Securian Life (the "Contracts"). Each separate account has subaccounts that invest in the Acquired Fund and certain other mutual funds. Owners of the Contracts ("Contract Owners") allocate the value of their Contracts among these subaccounts. As the owners of the assets held in the separate accounts, Minnesota Life and Securian Life are the shareholders of the Acquired Fund and are entitled to vote the shares of the Acquired Fund. However, Minnesota Life and Securian Life will vote outstanding shares of the Acquired Fund in accordance with instructions given by the Contract Owners who are eligible to vote at the meeting, and will vote shares as to which they have received no instructions for or against the proposal in the same proportion as the shares for which they receive instructions.

The Funds are open-end management investment companies. If the Plan is approved, the shares of the Acquiring Fund will be distributed proportionately by the Acquired Fund to the holders of its shares in complete liquidation of the Acquired Fund. Each Acquired Fund shareholder would become the owner of Acquiring Fund shares having a total net asset value equal to the total net asset value of that shareholder's holdings in the Acquired Fund.

The following information summarizes the proposed reorganization of the Acquired Fund into the Acquiring Fund (the "Reorganization").

HOW THE REORGANIZATION WILL WORK

The Acquired Fund will transfer all of its assets to the Acquiring Fund. The Acquiring Fund will assume all of the Acquired Fund's liabilities.

The Acquiring Fund will issue shares of beneficial interest to the Acquired Fund in an amount equal to the value of the assets that it receives from the Acquired Fund, less the liabilities it assumes. These shares will be distributed to the Acquired Fund's shareholders (the separate accounts) in proportion to their holdings in the Acquired Fund. Specifically, shareholders of Class 1 and Class 2 Shares, respectively, of the Acquired Fund will receive shares of the corresponding class of the Acquiring Fund that are equal in value to their shares in the Acquired Fund immediately before the Reorganization.

You will not pay any sales charge in connection with this distribution of shares. If you already have an Acquiring Fund account, shares distributed in the Reorganization will be added to that account.

FUND INVESTMENT OBJECTIVES

The investment objective of the Acquired Fund is to seek a high level of current income consistent with prudent investment risk and the investment objective of the Acquiring Fund is to seek as high a level of a long-term total rate of return as is consistent with prudent investment risk. The Acquiring Fund also seeks preservation of capital as a secondary objective.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

3

TABLE OF CONTENTS

SECTION A — PROPOSAL | | | 5 | | |

PROPOSAL: Approve or Reject the Agreement and Plan of Reorganization | | | 5 | | |

SUMMARY | | | 5 | | |

How the Reorganization Will Work | | | 5 | | |

Comparison of the Acquired Fund and the Acquiring Fund | | | 5 | | |

General Information | | | 5 | | |

Comparison of Investment Objectives | | | 6 | | |

Comparison of Investment Strategies | | | 6 | | |

Analysis of Investment Policies | | | 9 | | |

Principal Risk Factors | | | 9 | | |

Fees & Expenses | | | 13 | | |

Performance | | | 14 | | |

THE REORGANIZATION | | | 16 | | |

Terms of the Reorganization | | | 16 | | |

Conditions to Closing the Reorganization | | | 16 | | |

Termination of the Plan | | | 16 | | |

Certain Tax Consequences | | | 17 | | |

Reasons for the Proposed Reorganization and Board Deliberations | | | 17 | | |

Board's Determinations | | | 18 | | |

Recommendation and Vote Required | | | 18 | | |

SECTION B — Proxy Voting and Shareholder Meeting Information | | | 19 | | |

SECTION C — Capitalization, Ownership of Fund Shares and Other Fund Information | | | 20 | | |

Financial Highlights | | | 22 | | |

EXHIBIT A — AGREEMENT AND PLAN OF REORGANIZATION | | | A-1 | | |

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

4

SECTION A — PROPOSAL

PROPOSAL: APPROVE OR REJECT THE AGREEMENT AND PLAN OF REORGANIZATION

SUMMARY

This proxy statement/prospectus is being used by the Acquired Fund to solicit voting instructions for the proposal to approve the Plan providing for the Reorganization of the Acquired Fund into the Acquiring Fund. A form of the Plan is included as Exhibit A.

The following is a summary. More complete information appears later in this proxy statement/prospectus. You should read the entire proxy statement/prospectus, exhibits and accompanying materials because they contain details that are not in this summary.

HOW THE REORGANIZATION WILL WORK

The SFT Mortgage Securities Fund (the "Acquired Fund") will transfer all of its assets to the SFT Core Bond Fund (the "Acquiring Fund"). The Acquiring Fund will assume all of the Acquired Fund's liabilities.

The Acquiring Fund will issue shares of beneficial interest in an amount equal to the value of the assets that it receives from the Acquired Fund, less the liabilities it assumes. These shares will be distributed to the Acquired Fund's shareholders (the separate accounts) in proportion to their holdings in the Acquired Fund. Specifically, shareholders of Class 1 and Class 2 Shares, respectively, of the Acquired Fund will receive shares of the corresponding class of the Acquiring Fund that are equal in value to their shares in the Acquired Fund immediately before the Reorganization. As such, the value of your interest in the subaccount investing in the Acquiring Fund received in connection with the Reorganization will equal the value of your interest in the subaccounts that were invested in the Acquired Fund immediately before the Reorganization.

As part of the Reorganization, systematic transactions (such as the dollar-cost average program) currently set up for your Acquired Fund accounts will be transferred to your new Acquiring Fund account. If you do not want your systematic transactions to continue, please contact your financial representative to make changes.

Neither the Acquired Fund, nor the Contract Owners whose contract values are allocated to subaccounts investing in the Acquired Fund, will pay any sales charge in connection with the Reorganization.

After the Reorganization has been completed, contract values that were allocated to subaccounts investing in the Acquired Fund will be allocated to subaccounts investing in the Acquiring Fund. The Acquired Fund will be terminated.

COMPARISON OF THE ACQUIRED FUND AND THE ACQUIRING FUND

The information below and on the following pages outline similarities and differences between the Acquired Fund and Acquiring Fund.

GENERAL INFORMATION

The Acquired Fund and the Acquiring Fund:

• Are outstanding series of an open-end management investment company organized as a Delaware statutory trust.

• Have Securian Asset Management, Inc. (the "Manager"), formerly Advantus Capital Management, Inc., as their investment adviser.

• Have Thomas Houghton as the primary portfolio manager. Mr. Houghton will remain as the portfolio manager for the Acquiring Fund after the reorganization.

• Have the same policies for buying and selling shares and the same exchange rights.

• Have the same distribution policies.

• Are available only to Contract Owners who allocate contract value to a subaccount that invests in the Funds.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

5

COMPARISON OF INVESTMENT OBJECTIVES

Acquired Fund | | Acquiring Fund | |

The investment objective of the Acquired Fund is to seek a high level of current income consistent with prudent investment risk. | | The investment objective of the Acquiring Fund is to seek as high a level of a long-term total rate of return as is consistent with prudent investment risk. The Acquiring Fund also seeks preservation of capital as a secondary objective. | |

COMPARISON OF INVESTMENT STRATEGIES

As provided in more detail below, the principal investment strategies of the Acquired Fund and the Acquiring Fund are similar.

Acquired Fund | | Acquiring Fund | |

Under normal circumstances, the Acquired Fund invests at least 80% of its net assets (including any borrowings for investment purposes) in mortgage-related securities. The Acquired Fund invests a major portion of its assets in investment-grade securities representing interests in pools of mortgage loans. In selecting securities, the Acquired Fund's investment adviser considers factors such as, but not limited to, security pricing, prepayment risk, liquidity, credit quality and the type of loan and collateral underlying the security, as well as trends in economic conditions, interest rates and the mortgage markets. The Acquired Fund may also engage in frequent or short-term trading of securities.

The Acquired Fund may invest in government or government-related mortgage loan pools or private mortgage loan pools. In government or government-related mortgage loan pools, the U.S. government, or certain agencies, guarantee to mortgage pool security holders the payment of principal and interest.

The Acquired Fund may also invest in private mortgage loan pools sponsored by commercial banks, insurance companies, mortgage bankers and other private financial institutions. Mortgage pools created by these non-governmental entities offer a higher rate of interest than government or government related securities. Unlike government agency sponsored mortgage loan pools, payment of interest and payment to investors is not guaranteed.

The Acquired Fund may also invest in non-government securities, which may include but are not limited to securities issued by non-government entities secured by obligations of residential mortgage borrowers. Non-government securities also may include asset-backed securities (which may include but are not limited to interests in auto, rail cars, shipping containers, credit cards, manufactured housing and/or other consumer loans), commercial mortgage-backed securities (which represent interests in commercial mortgage loans and receivables) and corporate debt issued by REITs and other issuers. The Acquired Fund may also invest in securities whose disposition is restricted under the federal securities laws but which have been determined by Securian Asset Management, Inc. (Securian AM), formerly Advantus Capital Management, Inc., to be liquid under liquidity guidelines adopted by the Trust's Board of Trustees. Examples of restricted securities could include certain asset-backed and mortgage-backed securities. | | The Acquiring Fund invests primarily in a variety of investment-grade debt securities. It is the Acquiring Fund's policy to invest, under normal circumstances, at least 80% of the value of its net assets (including any borrowings for investment purposes) in bonds (for this purpose, "bonds" includes any debt security). These debt securities include, among other things, investment-grade corporate and mortgage-backed securities, debt securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities (including the Government National Mortgage Association, the Federal National Mortgage Association, and the Federal Home Loan Mortgage Association), investment-grade asset-backed securities and other debt obligations of U.S. banks or savings and loan associations. The Acquiring Fund may invest in investment-grade debt securities issued by domestic companies in a variety of industries. The Acquiring Fund may also invest in securities whose disposition is restricted under the federal securities laws but which have been determined by Securian Asset Management, Inc. (Securian AM), formerly Advantus Capital Management, Inc., to be liquid under liquidity guidelines adopted by the Trust's Board of Trustees. Examples may include certain bonds that are only available to institutional buyers.

The Acquiring Fund may also invest in non-government securities, which may include but are not limited to securities issued by non-government entities secured by obligations of residential mortgage borrowers. Non-government securities also may include asset-backed securities (which may include but are not limited to interests in auto, rail cars, shipping containers, credit card, manufactured housing and/or other consumer loans) and commercial mortgage-backed securities (which represent interests in commercial mortgage loans and receivables). Investments by the Acquiring Fund may be long-term, intermediate-term or short-term debt securities.

In selecting securities, the Acquiring Fund's investment adviser considers factors such as, but not limited to, security pricing, industry outlook, current and anticipated interest rates and other market and economic conditions, general levels of debt prices and issuer operations. The Acquiring Fund may also engage in frequent or short-term trading of securities. | |

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

6

The principal investment strategies for the Funds are set forth below.

SFT Mortgage Securities Fund (Acquired Fund)

Under normal circumstances, the Acquired Fund invests at least 80% of its net assets (including any borrowings for investment purposes) in mortgage-related securities. The 80% investment policy is not fundamental, which means it may be changed without the vote of a majority of the Acquired Fund's outstanding shares, but the shareholders will be notified in writing at least 60 days prior to any change of this policy. The Acquired Fund invests a major portion of its assets in high and investment-grade securities representing interests in pools of mortgage loans. In addition, the Acquired Fund may invest in a variety of other mortgage-related securities including collateralized mortgage obligations (CMOs) and stripped mortgage-backed securities.

In selecting mortgage-related securities, the Manager considers a variety of factors, including, but not limited to, security pricing, prepayment risk, credit quality, liquidity, the collateral securing the underlying loan (i.e., residential versus commercial real estate) and the type of underlying mortgage loan (i.e., a 30-year fully-amortized loan versus a 15-year fully-amortized loan). The Manager also considers current and expected trends in economic conditions, interest rates and the mortgage market, and selects securities which, in its judgment, are likely to perform well in those circumstances. An additional consideration in selecting securities is the ability to obtain a readily available market price for a particular security. The Manager may choose not to buy a security or to hold a lesser amount of a security if a market price for such security is not readily available. The Manager may still buy or hold a security for which a market price is not readily available, but such securities must then be valued at fair value in accordance with valuation policies and procedures approved by the Trust's Board of Trustees. In addition, accurate market prices may not be readily available in volatile markets, which would also necessitate fair valuation by the Manager.

The market for mortgage-related securities is generally liquid, but individual mortgage-related securities purchased by the Acquired Fund may be subject to the risk of reduced liquidity due to changes in quality ratings or changes in general market conditions, which adversely affect particular mortgage-related securities or the broader mortgage securities market as a whole. In addition, the Acquired Fund may also invest without limit in securities whose disposition is restricted under the federal securities laws but which have been determined by the Manager to be liquid under liquidity guidelines adopted by the Trust's Board of Trustees. Investments in restricted securities present greater risks inasmuch as such securities may only be resold subject to statutory or regulatory restrictions, or if the Acquired Fund bears the costs of registering such securities. The Acquired Fund may, therefore, be unable to dispose of such securities as quickly as, or at prices as favorable as those for, comparable but unrestricted securities. As of December 31, 2017, the Acquired Fund had 11.7% of its net assets invested in restricted securities deemed liquid pursuant to the liquidity guidelines. The Manager continuously monitors the liquidity of portfolio securities and may determine that, because of a reduction in liquidity subsequent to purchase, securities, which originally were determined to be liquid, have become illiquid.

Interests in pools of mortgage loans provide the security holder the right to receive, out of the underlying mortgage loans, periodic interest payments at a fixed rate and a full principal payment at a designated maturity or call date. Scheduled principal, interest and other payments on the underlying mortgage loans received by the sponsoring or guarantor entity are then distributed or "passed through" to security holders net of any service fees retained by the sponsor or guarantor. Additional payments passed through to security holders could arise from the prepayment of principal resulting from the sale of residential property, the refinancing of underlying mortgages, or the foreclosure of residential property. In "pass through" mortgage loan pools, payments to security holders will depend on whether mortgagors make payments to the pooling entity on the underlying mortgage loans.

The Acquired Fund may invest in government or government-related mortgage loan pools or private mortgage loan pools. In government or government-related mortgage loan pools, the U.S. government, or certain agencies, guarantee to mortgage pool security holders the payment of principal and interest. The principal government or government-related guarantors of mortgage-related securities are the Government National Mortgage Association (GNMA), the Federal National Mortgage Association (FNMA) and the Federal Home Loan Mortgage Corporation (FHLMC). GNMA securities are supported by the U.S. Treasury. Securities issued or guaranteed by U.S. government-related organizations, such as FNMA and FHLMC, are not backed by the full faith and credit of the U.S. government and no assurance can be given that the U.S. government will provide financial support. Therefore, U.S. government-related organizations may not be able to meet their payment obligations in the future. In September of 2008, the Federal Housing Finance Agency was appointed as conservator of FNMA and FHLMC. As part of this appointment,

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

7

the U.S. Treasury agreed to provide additional capital to FNMA and FHLMC but no assurances can be given that the Treasury will agree to do this in the future should the need for additional capital arise.

The Acquired Fund may also invest in private mortgage loan pools sponsored by commercial banks, insurance companies, mortgage bankers and other private financial institutions. Mortgage pools created by these non-governmental entities offer a higher rate of interest than government or government related securities. Unlike government agency sponsored mortgage loan pools, payment of interest and payment to investors is not guaranteed.

The Acquired Fund may also invest a portion of its assets in asset-backed securities and in corporate debt issued by real estate investment trusts (REITs) and other issuers. Asset-backed securities usually represent interests in pools of consumer and other loans (which may include but are not limited to trade, manufactured housing, credit card or automobile receivables). The credit quality of most asset-backed securities depends primarily on the credit quality of the assets underlying such securities, how well the entity issuing the security is insulated from the credit risk of the originator or any other affiliated entities, the quality of the servicing of the receivables, and the amount and quality of any credit support provided to the securities. The rate of principal payment on asset-backed securities may depend on the rate of principal payments received on the underlying assets, which in turn may be affected by a variety of economic and other factors. A REIT is a corporation or trust that invests in fee or leasehold ownership of real estate, mortgages or shares issued by other REITs, and that receives favorable tax treatment provided it meets certain conditions.

SFT Core Bond Fund (Acquiring Fund):

It is the Acquiring Fund's policy to invest, under normal circumstances, at least 80% of the value of its net assets (including any borrowings for investment purposes) in bonds (for this purpose, "bonds" includes any debt security). The 80% investment policy is not fundamental, which means it may be changed without the vote of a majority of the Acquiring Fund's outstanding shares, but the shareholders will be notified in writing at least 60 days prior to any change of this policy. The Acquiring Fund invests primarily in a variety of investment-grade securities, which include:

• Investment-grade corporate debt obligations and mortgage-backed securities

• Debt securities issued or guaranteed by the U.S. government or any of its agencies or instrumentalities (including U.S. Treasury bills, notes and bonds, and U.S. Treasury inflation-protection securities)

• Investment-grade mortgage-backed securities issued by governmental agencies and financial institutions

• Investment-grade asset-backed securities

• Debt obligations of U.S. banks, savings and loan associations and savings banks.

The Acquiring Fund will invest a portion of its assets in investment-grade debt obligations issued by domestic companies in a variety of industries. The Acquiring Fund may invest in long-term debt securities (i.e., maturities of more than 10 years), intermediate debt securities (i.e., maturities from 3 to 10 years) and short-term debt securities (i.e., maturities of less than 3 years).

In selecting corporate debt securities and their maturities, the Manager seeks to maximize total return by engaging in a risk/return analysis that focuses on various factors such as industry outlook, current and anticipated market and economic conditions, general levels of debt prices and issuer operations. An additional consideration in selecting securities is the ability to obtain a readily available market price for a particular security. The Manager may choose not to buy a security or to hold a lesser amount of a security if a market price for such security is not readily available. The Manager may still buy or hold a security for which a market price is not readily available, but such securities must then be valued at fair value in accordance with valuation policies and procedures approved by the Trust's Board of Trustees. In addition, accurate market prices may not be readily available in volatile markets, which would also necessitate fair valuation by the Manager.

The Acquiring Fund may also invest a portion of its assets in asset-backed securities. Asset-backed securities represent interest in pools of consumer and other loans (which may include but are not limited to manufactured housing, credit card, trade or automobile loans). Investors in asset-backed securities are entitled to receive payments of principal and interest received by the pool entity from the underlying consumer loans net of any costs and expenses incurred by the entity.

The market for bonds and other debt securities is generally liquid, but individual debt securities purchased by the Acquiring Fund may be subject to the risk of reduced liquidity due to changes in quality ratings or changes in

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

8

general market conditions, which adversely affect particular debt securities or the broader bond market as a whole. In addition, the Acquiring Fund may invest without limit in securities whose disposition is restricted under the federal securities laws but which have been determined by the Manager to be liquid under liquidity guidelines adopted by the Trust's Board of Trustees. Investments in restricted securities present greater risks inasmuch as such securities may only be resold subject to statutory or regulatory restrictions, or if the Acquiring Fund bears the costs of registering such securities. The Acquiring Fund may, therefore, be unable to dispose of such securities as quickly as, or at prices as favorable as those for, comparable but unrestricted securities. As of December 31, 2017, the Acquiring Fund had 20.8% of its net assets invested in restricted securities deemed liquid pursuant to the liquidity guidelines. The Manager continuously monitors the liquidity of portfolio securities and may determine that, because of a reduction in liquidity subsequent to purchase, securities, which originally were determined to be liquid, have become illiquid.

The Fund may also engage in frequent or short-term trading of securities.

ANALYSIS OF INVESTMENT POLICIES

The investment objectives of the Funds are generally different. The Acquired Fund seeks a high level of current income consistent with prudent investment risk while the Acquiring Fund seeks as high a level of long-term rate of return as is consistent with prudent investment risk. The Acquiring Fund also seeks preservation of capital as a secondary objective. The Funds have similar investment strategies to achieve their investment objectives in that they both invest a large portion of their assets in investment-grade debt securities.

The Acquired Fund normally invests 80% of its assets in mortgage related securities while the Acquiring Fund normally invests 80% of its assets in bonds and mortgage-backed securities. Both Funds also invest in government and non-government securities and may also invest in securities whose disposition is restricted under the federal securities laws. The Acquired Fund generally holds a higher concentration of securities issued or guaranteed by the U.S. government or its agencies or instrumentalities (e.g., securities issued by Ginnie Mae, Fannie Mae, or Freddie Mac) than the Acquiring Fund. Both the Acquired and Acquiring Fund may invest up to 10% of their assets in debt securities that are rated below investment-grade (i.e., below BBB- or Baa3 by S&P or Moody's, respectively); however, historically, neither Fund has invested in securities that are rated below investment-grade and the Acquiring Fund has no present intention to do so.

If shareholders of the Acquired Fund approve the Reorganization, they will be subject to the investment objectives and principal investment strategies of the Acquiring Fund.

PRINCIPAL RISK FACTORS

The principal risks of investing in the Funds are shown in the table below.

An investment in the Acquired Fund involves similar principal risks as an investment in the Acquiring Fund. However, as previously described, the Acquired Fund invests significantly in mortgage-related assets, and thus, is subject to concentration risk as a principal risk. The Acquired Fund also presents government securities and REIT risk as principal risks, which are not present in the Acquiring Fund. All of the other principal risks are applicable to both Funds, as illustrated below.

Principal Risks | | Acquired Fund | | Acquiring Fund | |

| Active Management Risk: The investment adviser's judgment about the attractiveness, value, or potential appreciation of the Fund's investments may prove to be incorrect. If the securities selected and strategies employed by the Fund fail to produce the intended results, the Fund could underperform other funds with similar objectives and investment strategies. | | Yes | | Yes | |

| Concentration Risk: The Fund's performance may be more susceptible to a single economic, regulatory or technological occurrence than an investment portfolio that does not concentrate its investments in a single industry. The Fund is subject to concentration risk if the Fund invests more than 25% of its total assets in a particular industry. The Mortgage Securities Fund concentrates its investments in a single industry. | | Yes | | No | |

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

9

Principal Risks | | Acquired Fund | | Acquiring Fund | |

| Credit Risk: The Fund may lose some or all of its investment, including both principal and interest, because an issuer of a debt security, an asset-backed or mortgage-backed security (or an underlying obligor) or other fixed income obligation will not make payments on the security or obligation when due, as well as the risk that the credit quality of a security may be lowered, resulting in a lower price, greater volatility and reduced liquidity for such security. | | Yes | | Yes | |

| Extension Risk: Rising interest rates could cause property owners to prepay their mortgages more slowly than expected, resulting in slower than anticipated prepayments of mortgage-backed securities. This risk is greater for residential mortgage-backed securities. | | Yes | | Yes | |

| Government Securities Risk: A Fund may invest in securities issued or guaranteed by the U.S. government or its agencies and instrumentalities (such as securities issued by Ginnie Mae, Fannie Mae, or Freddie Mac). U.S. government securities are subject to market risk, interest rate risk, and credit risk. Securities such as those issued or guaranteed by Ginnie Mae or the U.S. Treasury, that are backed by the full faith and credit of the United States, are guaranteed only as to the timely payment of interest and principal when held to maturity, and the market prices for such securities will fluctuate. Notwithstanding that these securities are backed by the full faith and credit of the United States, circumstances could arise that would prevent the payment of interest or principal. This would result in losses to the Fund. Securities issued or guaranteed by U.S. government-related organizations, such as Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. government and no assurance can be given that the U.S. government will provide financial support. Therefore, U.S. government-related organizations may not have the funds to meet their payment obligations in the future. U.S. government securities include zero coupon securities, which tend to be subject to greater market risk and interest rate risk than interest-paying securities of similar maturities. | | Yes | | No | |

| Income Risk: The Fund may experience a decline in its income due to falling interest rates, earnings declines or income decline within a security. | | Yes | | Yes | |

| Interest Rate Risk: The value of a mortgage-backed security, debt security or fixed income obligation may decline due to an increase in market interest rates. Long-term debt securities, mortgage-backed securities and fixed income obligations are generally more sensitive to interest rate changes. Interest rates in the U.S. and certain other countries are at, or near, historic lows, which may increase the Fund's exposure to risks associated with rising rates. The negative impact on a mortgage-backed security, debt security or fixed income obligation from resulting rate increases could be swift and significant, including falling market values and reduced liquidity. Substantial redemptions from the Fund and other fixed income funds may worsen the impact. Other types of securities also may be adversely affected from an increase in interest rates. In addition, interest rates may decline further resulting in lower yields, which make the Fund less attractive to investors who are seeking higher rates of returns. Also, a lower yield may not be sufficient to cover the expenses of the Fund. | | Yes | | Yes | |

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

10

Principal Risks | | Acquired Fund | | Acquiring Fund | |

| Liquidity Risk: The Fund's ability to sell particular securities at an advantageous price or in a timely manner may be impaired due to low trading volume, lack of a market maker, or legal restrictions. The recent increase in capital requirements and potential for increased regulation may negatively impact market liquidity going forward. In the event certain securities experience low trading volumes, the prices of such securities may display abrupt or erratic movements. In addition, it may be more difficult for the Fund to buy and sell significant amounts of such securities without an unfavorable impact on prevailing market prices. As a result, these securities may be difficult to sell at a favorable price at the time when the investment adviser believes it is desirable to do so. Investment in securities that are less actively traded (or over time experience decreased trading volume) may restrict the Fund's ability to take advantage of other market opportunities. | | Yes | | Yes | |

| Mortgage-Related and Other Asset-Backed Securities Risk: Mortgage-related and other asset-backed securities represent interests in "pools" of mortgages or other assets such as consumer loans or receivables held in trust and often involve risks that are different from or possibly more acute than risks associated with other types of debt instruments. Generally, rising interest rates tend to extend the duration of fixed rate mortgage-related securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, if a Fund holds mortgage-related securities, it may exhibit additional volatility since individual mortgage holders are less likely to exercise prepayment options, thereby putting additional downward pressure on the value of these securities and potentially causing the Fund to lose money. This is known as extension risk. Mortgage-backed securities can be highly sensitive to rising interest rates, such that even small movements can cause an investing Fund to lose value. Mortgage-backed securities, and in particular those not backed by a government guarantee, are subject to credit risk. In addition, adjustable and fixed rate mortgage-related securities are subject to prepayment risk. When interest rates decline, borrowers may pay off their mortgages sooner than expected. This can reduce the returns of a Fund because the Fund may have to reinvest that money at the lower prevailing interest rates. A Fund's investments in other asset-backed securities are subject to risks similar to those associated with mortgage-related securities, as well as additional risks associated with the nature of the assets and the servicing of those assets. Payment of principal and interest on asset-backed securities may be largely dependent upon the cash flows generated by the assets backing the securities, and asset-backed securities may not have the benefit of any security interest in the related assets. | | Yes | | Yes | |

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

11

Principal Risks | | Acquired Fund | | Acquiring Fund | |

Non-Government Securities Risk: Payments on a non-government security may not be made when due, or the value of such security may decline, because the security is not issued or guaranteed as to principal or interest by the U.S. government or by agencies or authorities controlled or supervised by and acting as instrumentalities of the U.S. government. These securities may include but are not limited to securities issued by non-government entities, which can include instruments secured by obligations of residential mortgage borrowers. Non-agency securities also may include asset-backed securities (which represent interests in auto, consumer and/or credit card loans) and commercial mortgage-backed securities (which represent interests in commercial mortgage loans).

Non-agency securities can present valuation and liquidity issues and be subject to precipitous downgrades (or even default) during time periods characterized by recessionary market pressures such as falling home prices, rising unemployment, bank failures and/or other negative market stresses. The risk of non-payment by the issuer of any non-agency security increases when markets are stressed. | | Yes | | Yes | |

| Prepayment Risk: Falling interest rates may cause prepayments of mortgage-related securities to occur more quickly than expected. This occurs because, as interest rates fall, more property owners refinance the mortgages underlying these securities. The Fund must reinvest the prepayments at a time when interest rates on new mortgage investments are falling, reducing the income of the Fund. In addition, when interest rates fall, prices on mortgage-related securities may not rise as much as for other types of comparable debt securities because investors may anticipate an increase in mortgage prepayments. | | Yes | | Yes | |

| REIT Risk: The value of the Fund's investment in securities issued by REITs may be adversely affected by changes in the value of the underlying property or by the loss of the REIT's favorable tax status or changes in laws and/or rules related to REIT tax status. | | Yes | | No | |

| Restricted Securities Risk: In connection with investments in securities whose disposition is restricted under federal securities laws, certain securities may only be resold subject to statutory or regulatory restrictions, or the Fund may bear the costs of registering such securities. The Fund may, therefore, be unable to dispose of such securities as quickly as, or at prices as favorable as those for, comparable but unrestricted securities. | | Yes | | Yes | |

| Short Term Trading Risk: A Fund may trade securities frequently and hold securities in its portfolio for one year or less. Frequent purchases and sales of securities will increase the Fund's transaction costs. Factors that can lead to short-term trading include market volatility, a significant positive or negative development concerning a security, an attempt to maintain a Fund's market capitalization target, and the need to sell a security to meet redemption activity. | | Yes | | Yes | |

Depending upon its assessment of changing market conditions, the Manager, at any time, may change the Fund's emphasis on particular investments or asset classes, which may change the risks associated with the Fund. The fact that a risk is not identified as a principal risk for a particular Fund does not mean that the Fund may not be subject to that risk. The Statement of Additional Information for the Acquiring Fund, which is incorporated by reference in this proxy statement/prospectus, contains additional information on the Acquiring Fund's permitted investments and investment restrictions.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

12

FEES & EXPENSES

The following table describes the fees and expenses that you may pay if you buy and hold Class 1 or Class 2 Shares of the Funds. The table also shows estimated pro forma expenses of the Acquiring Fund assuming the proposed Reorganization had been effective during the most recent fiscal year. The Funds are offered only as investment options for certain Contracts. The table does not reflect charges assessed in connection with the variable life insurance policies or variable annuity contracts, or qualified plans, that invest in the Funds. If these charges were included, the expenses shown in the table below would be higher. Please refer to your Contract prospectus for a description of those fees and expenses. The fees and expenses below exclude the costs of the Reorganization. See "Reasons for the Proposed Reorganization and Board Deliberations" for additional information concerning the allocation of the costs of the Reorganization.

TABLE A-1

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

The following table is based on fund assets as of June 30, 2018.

| | | SFT Mortgage Securities

Fund

(Acquired Fund) | | SFT Core Bond Fund

(Acquiring Fund) | | SFT Core Bond Fund —

Pro Forma with

Acquired Fund | |

Class 1 Shares | |

Management Fees | | | 0.40 | % | | | 0.40 | % | | | 0.40 | % | |

Distribution (12b-1) Fees | | | — | | | | — | | | | — | | |

Other Expenses | | | 0.31 | % | | | 0.10 | % | | | 0.09 | % | |

Acquired Fund Fees and Expenses | | | 0.02 | % | | | — | | | | 0.02 | % | |

Total Annual Fund Operating Expenses | | | 0.73 | % | | | 0.50 | % | | | 0.51 | % | |

Class 2 Shares | |

Management Fees | | | 0.40 | % | | | 0.40 | % | | | 0.40 | % | |

Distribution (12b-1) Fees | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | |

Other Expenses | | | 0.31 | % | | | 0.10 | % | | | 0.09 | % | |

Acquired Fund Fees and Expenses | | | 0.02 | % | | | — | | | | 0.02 | % | |

Total Annual Fund Operating Expenses | | | 0.98 | % | | | 0.75 | % | | | 0.76 | % | |

Example: This example is intended to help you compare the cost of investing in the Funds with the cost of investing in other Funds.

For each Fund, the example assumes an investment of $10,000 in the Fund for the time periods indicated and then a redemption of all shares at the end of those periods. The example also assumes that the investment has a 5% return each year and that the Fund's operating expenses remain the same. The example does not reflect the other fees and expenses related to a variable life insurance policy, variable annuity contract or qualified plan that invests in the Fund. If these other fees and expenses were included, the expenses shown in the example below would be higher. This example also shows pro forma expenses of the Acquiring Fund assuming the proposed Reorganization

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

13

had been in effect for the periods shown. Although actual costs may be higher or lower, based on these assumptions, costs would be:

Fund | | 1 year | | 3 years | | 5 years | | 10 years | |

SFT Mortgage Securities Fund — Class 1 Shares

(Acquired Fund) | | $ | 75 | | | $ | 233 | | | $ | 406 | | | $ | 906 | | |

SFT Mortgage Securities Fund — Class 2 Shares

(Acquired Fund) | | $ | 100 | | | $ | 312 | | | $ | 542 | | | $ | 1,201 | | |

SFT Core Bond Fund — Class 1 Shares

(Acquiring Fund) | | $ | 51 | | | $ | 160 | | | $ | 280 | | | $ | 628 | | |

SFT Core Bond Fund — Class 2 Shares

(Acquiring Fund) | | $ | 77 | | | $ | 240 | | | $ | 417 | | | $ | 930 | | |

SFT Core Bond Fund — Class 1 Shares —

Pro Forma with Acquired Fund | | $ | 52 | | | $ | 164 | | | $ | 285 | | | $ | 640 | | |

SFT Core Bond Fund — Class 2 Shares —

Pro Forma with Acquired Fund | | $ | 78 | | | $ | 243 | | | $ | 422 | | | $ | 942 | | |

Portfolio Turnover

A Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. For the six-month period ended June 30, 2018, the Acquired Fund's portfolio turnover rate was 71.2% of the average value of its portfolio, and the Acquiring Fund's portfolio turnover rate was 100.0% of the average value of its portfolio.

PERFORMANCE

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in the Fund's performance from year to year and how the Fund's average annual returns over time compare to the return of a broad based index. The chart and table do not reflect the charges and other expenses associated with the variable life insurance policies and variable annuity contracts, or qualified plans, which invest in the Fund. If such charges and expenses were included, the returns shown below would be lower. The past performance of the Fund does not necessarily indicate how the Fund will perform in the future.

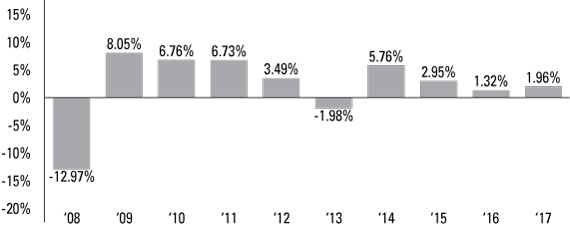

SFT Mortgage Securities Fund (Acquired Fund)

Performance Bar Chart and Table

Calendar Year Total Returns for Class 2 Shares (a)

Best Quarter

3Q '09 | 4.10%

Worst Quarter

4Q '08 | -7.38%

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

14

(a) The performance shown in the bar chart above is for Class 2 Shares and reflects a 0.25% 12b-1 distribution fee that is not charged to Class 1 Shares. The returns for Class 1 Shares would be substantially similar to the returns shown in the bar chart, but for the 12b-1 fee associated with Class 2 Shares.

Average Annual Total Return

(for periods ending December 31, 2017)

| | | 1 Year | | 5 Years | | 10 Years | | Inception | |

Mortgage Securities Fund — Class 1

(inception 2/11/08) | | | 2.22 | % | | | 2.23 | % | | | — | | | | 2.24 | % | |

Mortgage Securities Fund — Class 2 | | | 1.96 | % | | | 1.97 | % | | | 2.03 | % | | | — | | |

Bloomberg Barclays U.S. Mortgage-

Backed Securities Index (reflects no

deduction for fees, expenses or taxes) | | | 2.47 | % | | | 2.04 | % | | | 3.84 | % | | | — | | |

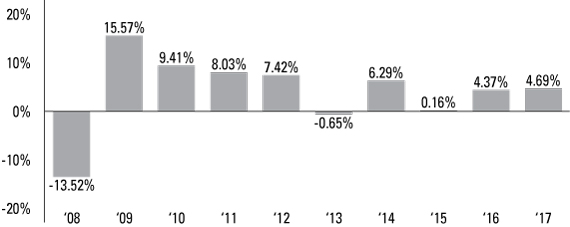

SFT Core Bond Fund (Acquiring Fund)

Performance Bar Chart and Table

Calendar Year Total Returns for Class 2 Shares (a)

Best Quarter

3Q '09 | 7.19%

Worst Quarter

4Q '08 | -7.02%

(a) The performance shown in the bar chart above is for Class 2 Shares and reflects a 0.25% 12b-1 distribution fee that is not charged to Class 1 Shares. The returns for Class 1 Shares would be substantially similar to the returns shown in the bar chart, but for the 12b-1 fee associated with Class 2 Shares.

Average Annual Total Return

(for periods ending December 31, 2017)

| | | 1 Year | | 5 Years | | 10 Years | | Inception | |

Core Bond Fund — Class 1

(inception 2/11/08) | | | 4.95 | % | | | 3.19 | % | | | — | | | | 4.18 | % | |

Core Bond Fund — Class 2 | | | 4.69 | % | | | 2.93 | % | | | 3.90 | % | | | — | | |

Bloomberg Barclays U.S. Aggregate

Bond Index (reflects no deduction for

fees, expenses or taxes) | | | 3.54 | % | | | 2.10 | % | | | 4.01 | % | | | — | | |

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

15

THE REORGANIZATION

TERMS OF THE REORGANIZATION

The Board has approved the Plan, a copy of which is attached as Exhibit A. The Plan provides for the Reorganization on the following terms:

The Reorganization is scheduled to occur on the first day that the New York Stock Exchange is open for business following shareholder approval and receipt of any necessary regulatory approvals, but may occur on any later date agreed to by the Funds.

The Acquired Fund will transfer all of its assets to the Acquiring Fund and, in exchange, the Acquiring Fund will assume the Acquired Fund's liabilities. Overall, approximately 50% of the Acquired Fund's portfolio will be sold to complete the reorganization. The Manager currently anticipates approximately 80% of the mortgage-backed securities held in the Acquired Fund will be sold and mortgage-backed securities currently account for approximately 62% of the assets in the Acquired Fund. The Manager also anticipates only a de minimis portion (i.e. 5% or less) of the Acquired Fund's remaining securities will be sold to complete the reorganization. The cost to realign the portfolio is estimated to be less than $10,000, or less than 1 basis point for the Acquired Fund.

The Acquiring Fund will issue shares to the Acquired Fund in an amount equal to the value of the assets that it receives from the Acquired Fund, less the liabilities assumed by the Acquiring Fund in the transaction. These shares will immediately be distributed by the Acquired Fund to its shareholders (the separate accounts) in proportion to their holdings in the Acquired Fund. Specifically, shareholders of Class 1 and Class 2 Shares, respectively, of the Acquired Fund will receive shares of the corresponding class of the Acquiring Fund that are equal in value to their shares in the Acquired Fund immediately before the Reorganization. As a result, shareholders (the separate accounts) of the Acquired Fund will become shareholders of the Acquiring Fund. Contract values that were allocated to subaccounts invested in the Acquired Fund will be allocated to subaccounts investing in the Acquiring Fund.

Neither the Acquired Fund nor any Contract Owners whose contract values are allocated to subaccounts investing in the Acquired Fund will pay any sales charge in connection with the Reorganization.

The net asset value of the Acquired Fund and the Acquiring Fund will be computed as of 3:00 p.m. Central Time, on the closing date. After the Reorganization, the Acquired Fund will be terminated.

CONDITIONS TO CLOSING THE REORGANIZATION

The completion of the Reorganization is subject to certain conditions described in the Plan, including:

• The Funds will have received any approvals, consents, or exemptions from the SEC or any regulatory body necessary to carry out the Reorganization.

• An effective registration statement on Form N-14 will be on file with the SEC.

• The Contract Owners of the Acquired Fund who are eligible to provide voting instructions for the meeting will have approved the Plan.

• The Trust, on behalf of the Acquired Fund and Acquiring Fund, will receive an opinion of Eversheds Sutherland (US) LLP that a Contract Owner that has Contract value allocated to a subaccount that holds interests in the Acquiring Fund or Acquired Fund will not recognize any gain or loss as a result of the Reorganization.

TERMINATION OF THE PLAN

The Plan and the transaction contemplated by it may be terminated and abandoned by resolutions of the Board of Trustees of the Acquired Fund or the Acquiring Fund at any time prior to closing. In the event of a termination, there will be no liability for damages on the part of either the Acquired Fund or the Acquiring Fund, or the trustees, officers, or shareholders of the Acquired Fund or the Acquiring Fund.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

16

CERTAIN TAX CONSEQUENCES

Provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Internal Revenue Code of 1986, as amended (the "Code") or annuity contracts under Section 72 of the Code, the Reorganization will not be a taxable event for federal income tax purposes for Contract Owners who have a portion of their Contract allocated to a Fund. Contract Owners should consult their own tax advisors and the prospectus or other information provided by the insurance company regarding their Contracts as to the specific consequences to them of the Reorganization in light of their own unique circumstances, including the applicability and effect of any possible state, local, non-U.S. and other tax consequences of the Reorganization.

As a condition to the closing of the Reorganization, the Funds will receive an opinion from Eversheds Sutherland (US) LLP to the effect that a Contract Owner that has Contract value allocated to a subaccount that holds interests in the Acquiring Fund or Acquired Fund will not recognize any gain or loss as a result of the Reorganization. The opinion will be based in part on certain representations made by the Trust and Securian. Contract Owners should be aware that the opinion will not be binding on the Internal Revenue Service.

REASONS FOR THE PROPOSED REORGANIZATION AND BOARD DELIBERATIONS

The Board believes that the proposed Reorganization will be advantageous to shareholders of the Acquired Fund based on its consideration of the following matters:

Terms and Conditions of the Reorganization. The Board considered the terms and conditions of the Reorganization as described in the previous paragraphs.

Tax Consequences. The Board considered the tax consequences of the Reorganization for Contract Owners, as set forth in the section "Certain Tax Consequences," above.

Current and Future Asset Growth. The Board considered the current, and likely future, decrease in demand for the Acquired Fund's investment objectives and investment strategies within the variable annuity and variable life insurance products. The decreasing demand has caused the Acquired Fund to lose assets and shrink in size over recent years. The Acquired Fund has experienced a reduction in total net assets from $98.2MM as of December 31, 2014 to $83.9MM as of June 30, 2018. If the loss of assets continues, the Acquired Fund's fixed expenses will be spread over a smaller asset base which may result in fund expenses increasing as a percentage of assets.

Expense Ratios. The Board considered the relative expenses of the Funds. The total annual fund operating expense ratio for the Acquiring Fund was lower than the total annual fund operating expense ratio for the Acquired Fund as of the end of the most recent fiscal year. The total annual fund operating expenses for the Acquiring Fund are 0.50% for Class 1 Shares and 0.75% for Class 2 Shares. The total annual fund operating expenses for the Acquired Fund are 0.70% for Class 1 Shares and 0.95% Class 2 Shares.

The management fees paid by the Acquiring Fund (0.40%) are equal to the management fees paid by the Acquired Fund (0.40%). The Acquiring Fund includes a charge of 0.09% for Other Expenses in both Class 1 and Class 2 Shares while the Acquired Fund includes a charge of 0.28% for Other Expenses in both Class 1 and Class 2 Shares. The Funds have the same Distribution (12b-1) Fee schedule; both charge 0.25% for Class 2 Shares but do not include a Distribution (12b-1) Fee for Class 1 Shares. The Board considered that, in sum, shareholders of the Acquired Fund may expect to incur lower overall expenses following the Reorganization.

The Board also considered the possibility that the Reorganization will result in higher aggregate net assets and the opportunity for net cash inflows, or reduced outflows. These factors may reduce the risk that if net assets of the Acquired Fund fail to grow, or even diminish, the Acquired Fund's total expense ratios could rise from current levels as fixed expenses become a larger percentage of net assets.

Economies of Scale. The Board considered the advantage of combining Funds. The Board believes that the combined Fund should have a better opportunity to take advantage of economies of scale and better prospects for growth than either Fund standing alone. For example, a larger fund should have an enhanced ability to effect portfolio transactions on more favorable terms and should have greater investment flexibility. Furthermore, as indicated above, fixed expenses, such as audit expenses and accounting expenses that are charged on a per fund basis may be reduced as a percentage of Fund net asset values.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

17

Costs. The Board notes that the fees and expenses associated with the reorganization will be allocated to the Acquired Fund and the Manager. The fees and expenses include, but are not limited to, costs such as printing and mailing this proxy solicitation and other communications to Contract Owners; accounting, tax, legal, and custodial expenses; and other transaction expenses. 80% of the fees and expenses will be allocated to the Acquired Fund, and 20% of the fees and expenses will be allocated to the Manager. The cost to realign the portfolio is estimated to be less than $10,000, or less than 1 basis point for the Acquired Fund. The total cost associated with the reorganization is estimated to be $160,000.

Dilution. The Board considered the fact that the Reorganization will not dilute the interests of the current Contract Owners with contract values allocated to subaccounts investing in the Acquired Fund because it will be effected on the basis of the relative net asset value per share of the Acquired Fund and the Acquiring Fund, respectively. Thus, subaccounts holding shares of the Acquired Fund will receive shares of the Acquiring Fund equal in value to their shares in the Acquired Fund.

Performance and Other Factors. The Board considered the relative performance records of the Funds since their inception in 2008. The Board noted that the Acquiring Fund has experienced superior performance compared to the Acquired Fund and is generally considered a higher rated fund by industry standards. The Board was cognizant of the fact that an Acquiring Fund's past performance is no guarantee of its future results.

Potential Effects on the Manager. The Board considered the potential benefits from the Reorganization that could be realized by the Manager. The Board recognized that the potential benefits to the Manager consist principally of economies of scale and the potential elimination of expenses incurred in duplicative efforts to administer separate funds. The Board noted, however, that shareholders of the Acquired Fund will benefit from the decrease in total operating expense ratios resulting from the proposed Reorganization.

Each Trustee carefully considered the factors described above and evaluated the merits of the Reorganization in accordance with his or her own experience and business judgment. Although each Trustee independently formed his or her own judgment on the proposed Reorganization, the Board accepted the Manager's analysis that the current, and future, demand for the Acquired Fund is decreasing. The Board recognized that the investment objectives and investment strategies employed by the Funds are different.

In addition, the Board noted that the total operating expense ratio of the Acquiring Fund is expected to be lower than the total operating expense ratio of the Acquired Fund. The Board also accepted the Manager's analysis that the shareholders of the Acquiring Fund would not be harmed by the Reorganization.

BOARD'S DETERMINATIONS

After considering the factors described above and other relevant information at an in-person meeting held on July 26, 2018, the Board of Trustees of the Acquired Fund, including a majority of the independent Trustees, found that participation in the Reorganization is in the best interests of the Acquired Fund and that the interests of shareholders in the Acquired Fund and existing Contract Owners with contract values allocated to subaccounts investing in the Acquired Fund would not be diluted as a result of the Reorganization.

The Board of Trustees of the Acquiring Fund approved the Plan at the meeting held on July 26, 2018. Among other factors, the Board members considered the terms of the Plan, the provisions intended to avoid the dilution of Contract Owners' interests, and the anticipated tax consequences of the Reorganization. The Board found that participation in the Reorganization is in the best interests of the Acquiring Fund and that the interests of shareholders in the Acquiring Fund and existing Contract Owners with contract values allocated to subaccounts investing in the Acquiring Fund will not be diluted as a result of the Reorganization.

RECOMMENDATION AND VOTE REQUIRED

The Board recommends that Contract Owners who are entitled to vote at the meeting approve the proposed Plan. Approval of the Plan requires the affirmative vote, in person or by proxy, of a majority of the voting power of the outstanding shares of the Acquired Fund as of the record date, October 1, 2018. At the record date, the Acquired Fund had 43,214,607 shares outstanding. Shareholders of the Acquired Fund are entitled to one vote for each full share held and are entitled to fractional votes for fractional shares. If the Plan is not approved by the shareholders of the Acquired Fund, the Board will consider what further action should be taken.

If shareholder approval is obtained, the Reorganization is scheduled to be effective on or about December 3, 2018.

Securian Funds Trust t Proxy Statement/Prospectus t October 18, 2018

18

SECTION B — PROXY VOTING AND SHAREHOLDER MEETING INFORMATION

A special meeting of shareholders of the Acquired Fund will be held as specified in the Notice of Special Meeting that accompanies this proxy statement/prospectus. At the meeting, shareholders (the separate accounts and certain funds managed by Securian Asset Management, Inc. ("Manager") will vote their shares of the Acquired Fund. You have the right to instruct Minnesota Life Insurance Company and Securian Life Insurance Company (together, "Securian") on how to vote the shares of the Acquired Fund held under your Contract. Unless you plan to attend the Meeting and vote in person, your voting instructions must be received by mail no later than 9:00 a.m. Central Time on November 29, 2018, the day of the Meeting.