UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4279

Securian Funds Trust

(Exact name of registrant as specified in charter)

400 Robert Street North

St. Paul, Minnesota 55101-2098

(Address of principal executive offices) (Zip code)

Thomas P. Trier, Esq.

400 Robert Street North

St. Paul, Minnesota 55101-2098

(Name and address of agent for service)

Registrant's telephone number, including area code:

(651) 665-3500

Date of fiscal year end: December 31, 2023

Date of reporting period: June 30, 2023

ITEM 1. REPORT TO STOCKHOLDERS.

Filed herewith.

Offered in Minnesota Life

Insurance Company and

Securian Life Insurance

Company variable products

Semi-Annual report

June 30, 2023

SFT Balanced Stabilization Fund

SFT Core Bond Fund

SFT Delaware IvySM Growth Fund

SFT Delaware IvySM Small Cap Growth Fund

SFT Equity Stabilization Fund

SFT Government Money Market Fund

SFT Index 400 Mid-Cap Fund

SFT Index 500 Fund

SFT International Bond Fund

SFT Real Estate Securities Fund

SFT T. Rowe Price Value Fund

SFT Wellington Core Equity Fund

TABLE OF CONTENTS

| | | Page No. | |

Fund Reviews | |

SFT Balanced Stabilization Fund | | | 1 | | |

| SFT Core Bond Fund | | | 2 | | |

SFT Delaware IvySM Growth Fund | | | 3 | | |

SFT Delaware IvySM Small Cap Growth Fund | | | 4 | | |

SFT Equity Stabilization Fund | | | 5 | | |

SFT Government Money Market Fund | | | 6 | | |

SFT Index 400 Mid-Cap Fund | | | 7 | | |

| SFT Index 500 Fund | | | 8 | | |

SFT International Bond Fund | | | 9 | | |

SFT Real Estate Securities Fund | | | 11 | | |

SFT T. Rowe Price Value Fund | | | 12 | | |

SFT Wellington Core Equity Fund | | | 13 | | |

Investments In Securities | |

SFT Balanced Stabilization Fund | | | 14 | | |

| SFT Core Bond Fund | | | 21 | | |

SFT Delaware IvySM Growth Fund | | | 35 | | |

SFT Delaware IvySM Small Cap Growth Fund | | | 37 | | |

SFT Equity Stabilization Fund | | | 39 | | |

SFT Government Money Market Fund | | | 41 | | |

SFT Index 400 Mid-Cap Fund | | | 42 | | |

| SFT Index 500 Fund | | | 49 | | |

SFT International Bond Fund | | | 56 | | |

SFT Real Estate Securities Fund | | | 60 | | |

SFT T. Rowe Price Value Fund | | | 61 | | |

SFT Wellington Core Equity Fund | | | 64 | | |

Financial Statements | |

Statements of Assets and Liabilities | | | 66 | | |

Statements of Operations | | | 68 | | |

Statements of Changes in Net Assets | | | 70 | | |

Financial Highlights | | | 75 | | |

Notes to Financial Statements | | | 87 | | |

Fund Expense Examples | | | 104 | | |

Proxy Voting and Quarterly Holdings Information | | | 105 | | |

Statement Regarding Basis for Approval of Advisory Contracts | | | 106 | | |

Statement Regarding Liquidity Risk Management Program | | | 109 | | |

Trustees and Executive Officers | | | 110 | | |

SFT Balanced Stabilization Fund

Fund Objective

The SFT Balanced Stabilization Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500® Index and 40 percent U.S. Aggregate Bond Index (collectively, the Blended Benchmark Index).

The Fund invests primarily in Class 1 shares of the SFT Index 500 Fund for equity exposure, in a basket of fixed income securities issued for fixed income exposure and certain derivative instruments. The Fund is subject to risks associated with such investments as described in detail in the Fund's prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

Performance Update

For the six-month period ended June 30, 2023, the Fund had a net return of 9.26 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor**. The Blended Benchmark Index returned 10.81 percent over the same period.

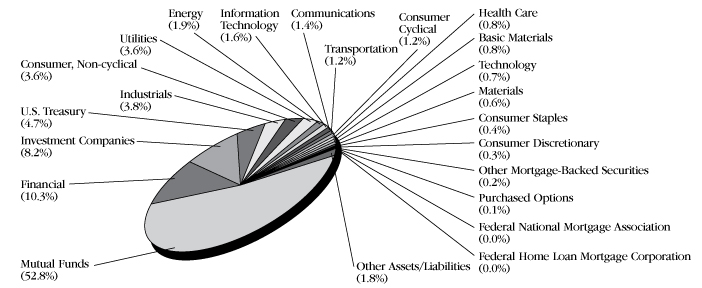

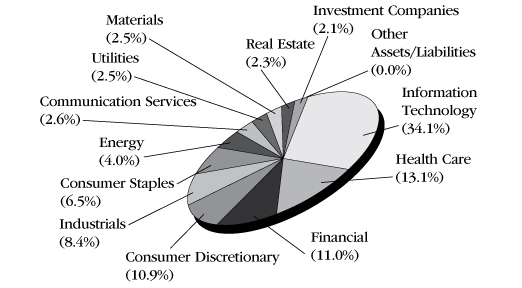

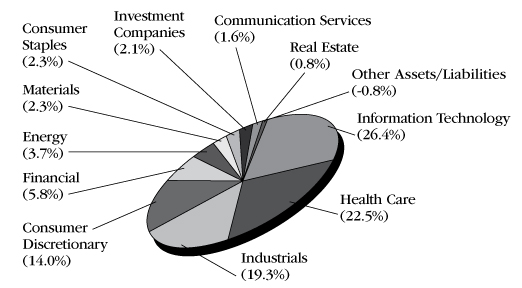

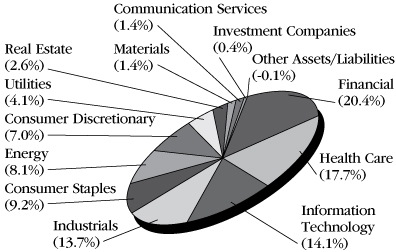

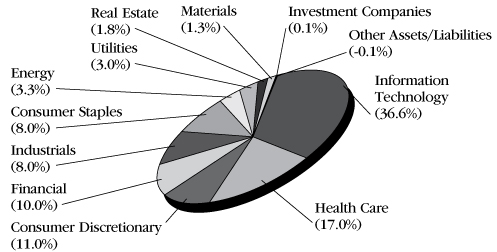

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

** Securian Asset Management, Inc. (Securian AM) and the Securian Funds Trust, on behalf of the SFT Balanced Stabilization Fund (the Fund), have entered into an Expense Limitation Agreement, dated May 1, 2013, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2021. The Expense Limitation Agreement was terminated on May 1, 2021. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund.

The Blended Benchmark Index is comprised of 60 percent of the S&P 500® Index and 40 percent of the Bloomberg U.S. Aggregate Bond Index. The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall. The Bloomberg U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

1

SFT Core Bond Fund

Fund Objective

The SFT Core Bond Fund seeks as high a level of long-term total return as is consistent with prudent investment risk. Preservation of capital is a secondary objective. The investment adviser for the Fund is Securian Asset Management, Inc. Metropolitan West Asset Management, LLC serves as investment sub-adviser to the Fund. The Fund invests in long-term, fixed income, high quality debt instruments. The risks incurred by investing in debt instruments include, but are not limited to, reinvestment of prepaid debt obligations at lower rates of return, and the inability to reinvest at higher interest rates when debt obligations are prepaid more slowly than expected. In addition, the net asset value of the Fund may fluctuate in response to changes in interest rates and is not guaranteed.

Performance Update

The Fund's performance for the six-month period ended June 30, 2023, for each class of shares offered was as follows:

Class 1 | | 2.20 percent* | |

Class 2 | | 2.07 percent* | |

The Fund's benchmark, the Bloomberg U.S. Aggregate Bond Index, returned 2.09 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged benchmark composite representing average market-weighted performance of U.S. Treasury and agency securities, investment-grade corporate bonds and mortgage-backed securities with maturities greater than one year.

2

SFT Delaware IvySM Growth Fund

Fund Objective

The SFT Delaware IvySM Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by large capitalization companies. The investment adviser for the Fund is Securian Asset Management, Inc. Delaware Investments Fund Advisers serves as investment sub-adviser to the Fund. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for large cap stocks or in the equity markets generally.

Performance Update

For the six month period ended June 30, 2023, the Fund generated a total net return of 27.29 percent*. The Fund's benchmark the Russell 1000 Growth Index which returned 29.02 percent over the same period.

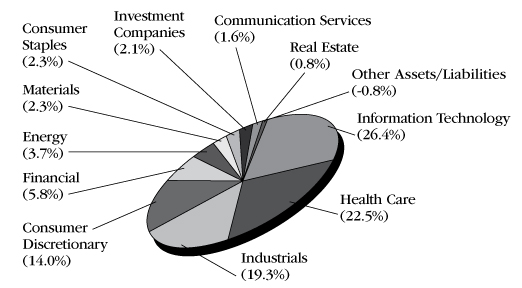

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

'Ivy' is the registered service mark of Ivy Distributors, Inc., an affiliate of the Delaware Investments Fund Advisers, the Fund's investment sub-adviser.

3

SFT Delaware IvySM Small Cap Growth Fund

Fund Objective

The SFT Delaware IvySM Small Cap Growth Fund seeks to provide growth of capital. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks issued by small capitalization companies. The investment adviser for the Fund is Securian Asset Management, Inc. Delaware Investments Fund Advisers serves as investment sub-adviser to the Fund. The risks incurred by investing in the Fund include, but are not limited to, the risk of declines in the market for small cap stocks or in the equity markets generally.

Performance Update

For the six month period ended June 30, 2023, the Fund generated a total net return of 12.06 percent*. The Fund's benchmark the Russell 2000 Growth Index which returned 13.55 percent over the same period.

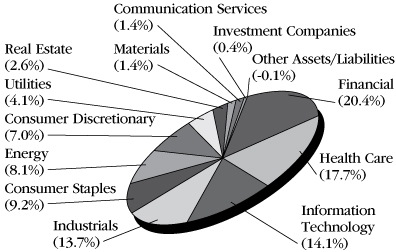

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Russell 2000 Growth Index is an unmanaged index of those Russell 2000 Index growth companies with higher price-to-book ratios and higher forecasted growth values. The index is broad-based, comprised of 2,000 of the smallest U.S.-domiciled company common stocks based on total market capitalization.

'Ivy' is the registered service mark of Ivy Distributors, Inc., an affiliate of the Delaware Investments Fund Advisers, the Fund's investment sub-adviser.

4

SFT Equity Stabilization Fund

Fund Objective

The SFT Equity Stabilization Fund seeks to maximize risk-adjusted total return relative to its blended benchmark index comprised of 60 percent S&P 500® Low Volatility Index, 20 percent S&P 500® BMI International Developed Low Volatility Index and 20 percent Bloomberg U.S. 3-Month Treasury Bellwether Index (collectively, the Blended Benchmark Index).

The Fund invests at least 80% of its assets in equity securities. Equity securities include those that are equity based, such as ETFs that invest primarily in U.S. and foreign equity securities. The Fund is subject to risks associated with such investments as described in detail in the Fund's prospectus. The net asset value of the Fund will fluctuate and is not guaranteed. It is possible to lose money by investing in the Fund. There is no assurance that efforts to manage Fund volatility will achieve the desired results.

Performance Update

For the six-month period ended June 30, 2023, the Fund had a net return of 3.97 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor**. The Blended Benchmark Index, returned 1.12 percent for the same period.

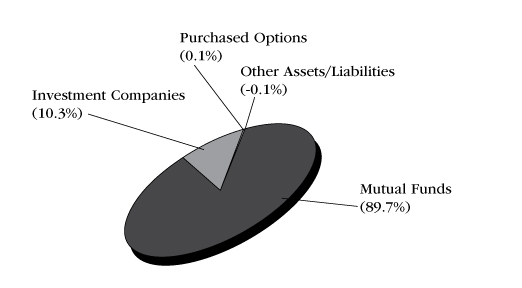

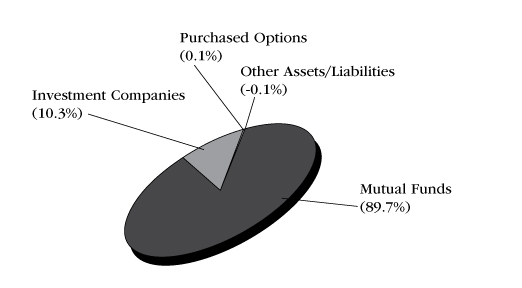

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

**Securian Asset Management, Inc. (Securian AM) and the Securian Funds Trust, on behalf of the SFT Equity Stabilization Fund (the Fund), have entered into an Expense Limitation Agreement, dated November 18, 2015, which limits the operating expenses of the Fund, excluding certain expenses (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with the generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.80% of the Fund's average daily net assets through April 30, 2021. The Expense Limitation Agreement was terminated on May 1, 2021. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement. The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund.

The Blended Benchmark Index is comprised of 60 percent of the S&P 500® Low Volatility Index, 20 percent S&P 500® BMI International Developed Low Volatility Index and 20 percent Bloomberg U.S. 3-MonthTreasury Bellwether Index. The S&P 500® Low Volatility Index measures performance of the 100 least volatile stocks in the S&P 500®. The S&P 500® BMI International Developed Low Volatility Index measures the performance of the 200 least volatile stocks in the S&P Developed Market large/midcap universe. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights. The Bloomberg U.S. 3-Month Treasury Bellwether Index tracks the market for the on-the-run 3-month Treasury bill issued by the U.S. government.

5

SFT Government Money Market Fund

Fund Objective

The SFT Government Money Market Fund seeks maximum current income to the extent consistent with liquidity and the preservation of capital. The Fund invests at least 99.5% of its total assets in cash, government securities, and/or repurchase agreements that are collateralized fully (i.e., collateralized by cash or government securities).

Investment in the Fund is neither insured nor guaranteed by the U.S. Government, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. It is possible to lose money by investing in the Fund.

Performance Update

For the six-month period ended June 30, 2023, the Fund had a net return of 2.03 percent*. This return reflects the waiver, reimbursement or payment of certain of the Fund's expenses by its investment advisor and principal underwriter**. The Fund's benchmark, the Bloomberg U.S. Treasury Bill 1-3 Month Index, returned 2.35 percent for the same period.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Investment in the Fund is neither insured nor guaranteed by the U.S. Government or any other agency, and there can be no assurance that the Fund will be able to maintain a stable net asset value of $1.00 per share. Shares upon redemption may be worth more or less than their original cost.

Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The Bloomberg U.S. Treasury Bill 1-3 Month Index is a market value-weighted index of investment-grade fixed-rate public obligations of the U.S. Treasury with maturities of three months, excluding zero coupons.

** Effective May 1, 2012, the Board of Trustees of Securian Funds Trust approved a Restated Net Investment Income Maintenance Agreement among Securian Funds Trust (on behalf of SFT Government Money Market Fund), Securian Asset Management, Inc. (Securian AM) and Securian Financial Services, Inc. (Securian Financial). A similar agreement was previously approved by the Board of Directors of Advantus Series Fund, Inc., the Trust's predecessor, effective October 29, 2009. Under such Agreement, Securian AM agrees to waive, reimburse or pay SFT Government Money Market Fund expenses so that the Fund's daily net investment income does not fall below zero. Securian Financial may also waive its Rule 12b-1 fees. Securian AM and Securian Financial each has the option under the Agreement to recover the full amount waived, reimbursed or paid (the "Expense Waiver") on any day on which the Fund's net investment income exceeds zero. On any day, however, the Expense Waiver does not constitute an obligation of the Fund unless Securian AM or Securian Financial has expressly exercised its right to recover a specified portion of the Expense Waiver on that day, in which case such specified portion is then due and payable by the Fund. In addition, the right of Securian AM and/or Securian Financial to recover the Expense Waiver is subject to the following limitations: (1) if a repayment of the Expense Waiver by the Fund would cause the Fund's net investment income to fall below zero, such repayment is deferred until a date when repayment would not cause the Fund's net investment income to fall below zero; (2) the right to recover any portion of the Expense Waiver expires three years after the effective date of that portion of the Expense Waiver; and (3) any repayment of the Expense Waiver by the Fund cannot cause the Fund's expense ratio to exceed 1.25%. If Securian AM and Securian Financial exercise their rights to be paid such waived amounts, the Fund's future yield will be negatively affected for an indefinite period. The Agreement is effective through April 30, 2024, and shall continue in effect thereafter, provided such continuance is specifically approved by Securian AM, Securian Financial, and a majority of the Trust's independent Trustees.

Effective November 1, 2017, Securian AM and Securian Funds Trust, on behalf of the SFT Government Money Market Fund, entered into an Expense Limitation Agreement which limits the operating expenses of the Fund, excluding certain expenses, (such as interest expense, acquired fund fees, cash overdraft fees, taxes, brokerage commissions, other expenditures which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Fund's business), to 0.70% of the Fund's average daily net assets through April 30, 2024.

The Expense Limitation Agreement renews annually for a full year each year thereafter unless terminated by Securian AM upon at least 30 day's notice prior to the end of the contract term. The Fund is authorized to reimburse Securian AM for management fees previously waived and/or for the cost of expenses previously paid by Securian AM pursuant to this agreement, provided that such reimbursement will not cause the Fund to exceed any limits in effect at the time of such reimbursement.

The Fund's ability to reimburse Securian AM in this manner only applies to fees waived or reimbursements made by Securian AM within the three fiscal years prior to the date of such reimbursement. To the extent that the Fund makes such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fees and Expenses of the Fund in the Fund's prospectus.

6

SFT Index 400 Mid-Cap Fund

Fund Objective

The SFT Index 400 Mid-Cap Fund seeks to provide investment results generally corresponding to the aggregate price and dividend performance of publicly traded common stocks that comprise the Standard & Poor's MidCap 400® Index (S&P MidCap 400). The Fund is designed to provide an economical and convenient means of maintaining a diversified portfolio in this equity security area as part of an overall investment strategy. The risks incurred by investing in the Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P MidCap 400, and the risk of declines in the market for mid-cap stocks or in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2023, for each class of shares offered was as follows:

Class 1 | | 8.57 percent* | |

Class 2 | | 8.44 percent* | |

The Fund's benchmark, the S&P MidCap 400, returned 8.84 percent for the same period.

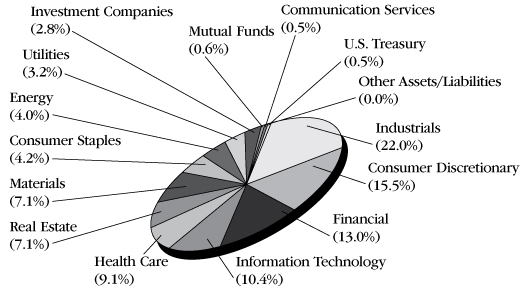

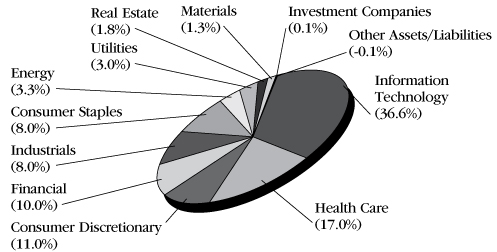

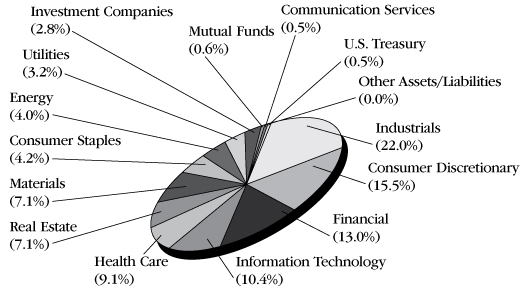

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

S&P MidCap 400® provides investors with a benchmark for mid-sized companies. The index which is distinct from the large-cap S&P 500®, is designed to measure the performance of 400 mid-sized companies, reflecting the distinctive risk and return characteristics of this market segment.

"Standard & Poor's®", "S&P®", "Standard & Poor's MidCap 400" and "S&P MidCap 400" are trademarks of the S&P Global, Inc. and have been licensed for use by the SFT Index 400 Mid-Cap Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

7

SFT Index 500 Fund

Fund Objective

The SFT Index 500 Fund seeks investment results that correspond generally to the price and yield performance of the common stocks included in the Standard and Poor's 500® Index (S&P 500). The Fund is designed to provide an economical and convenient means of maintaining a broad position in the equity market as part of an overall investment strategy. The risks incurred by investing in the Fund include, but are not limited to, the risk that the Fund may not be able to replicate the performance of the S&P 500, and the risk of declines in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2023, for each class of shares was as follows:

Class 1 | | 16.78 percent* | |

Class 2 | | 16.63 percent* | |

The Fund's benchmark, the S&P 500, returned 16.89 percent for the same period.

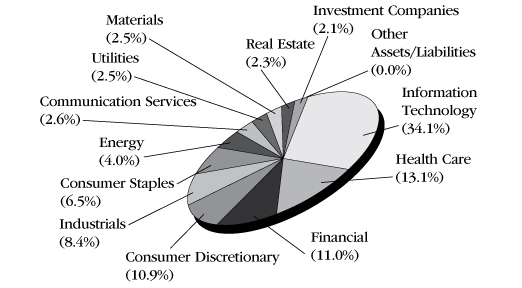

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower. The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

"Standard & Poor's®", "S&P®", "Standard & Poor's 500" and "S&P 500" are trademarks of the S&P Global, Inc. and have been licensed for use by SFT Index 500 Fund. The Fund is not sponsored, endorsed, sold or promoted by Standard & Poor's and Standard & Poor's makes no representation regarding the advisability of investing in the Fund.

8

SFT International Bond Fund

Fund Objective

The SFT International Bond Fund seeks to maximize current income consistent with protection of principal. The Fund pursues its objective by investing primarily in debt securities issued by issuers located anywhere in the world. The investment adviser for the Fund is Securian Asset Management, Inc. Brandywine Global Investment Management, LLC serves as investment sub-adviser to the Fund. Investment risks associated with international investing in addition to other risks include currency fluctuations, political and economic instability, and differences in accounting standards when investing in foreign markets.

Performance Update

The Fund's performance for the six-month period ended June 30, 2023, for each class of shares offered was as follows:

Class 1 | | 3.92 percent* | |

Class 2 | | 3.82 percent* | |

The Fund's benchmark, the FTSE World Government Bond Index, returned 1.66 percent for the same period.

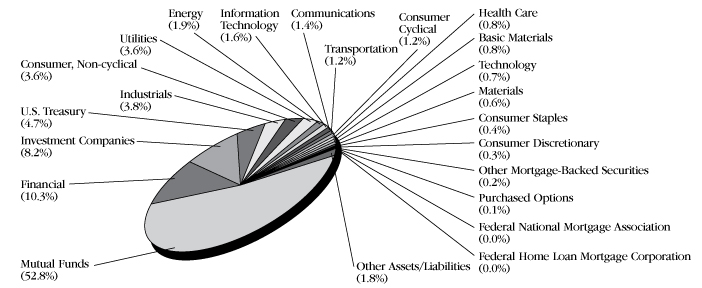

Sector Diversification (shown as a percentage of net assets)

Currency Diversification (shown as a percentage of net assets)

African | | | 0.42 | % | |

South African Rand | | | 0.42 | % | |

Americas | | | 96.94 | % | |

U.S. Dollar | | | 94.23 | % | |

Brazilian Real | | | 1.41 | % | |

Colombian Peso | | | 1.10 | % | |

Mexican Peso | | | 0.46 | % | |

Canadian Dollar** | | | -0.26 | % | |

Asia Pacific | | | 3.53 | % | |

Japanese Yen | | | 1.41 | % | |

Australian Dollar | | | 0.98 | % | |

South Korean Won | | | 0.90 | % | |

Indian Rupee | | | 0.45 | % | |

New Zealand Dollar | | | 0.28 | % | |

Thailand Baht | | | 0.15 | % | |

Malaysian Ringgit** | | | 0.00 | % | |

Chinese Yaun Renminbi** | | | -0.64 | % | |

Europe | | | -0.89 | % | |

Norwegian Krone | | | 1.38 | % | |

Russian Ruble | | | 0.20 | % | |

Polish Zloty | | | 0.00 | % | |

British Pound** | | | -0.12 | % | |

Euro** | | | -2.35 | % | |

**A negative figure reflects net "short" exposure, designed to benefit if the value of the associated currency decreases. Conversely, the Fund's value would potentially decline if the value of the associated currency increases.

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

Effective June 1, 2023, Securian Asset Management, Inc. ("Securian AM") and Securian Funds Trust (the "Trust"), on behalf of the SFT International Bond Fund (the "Fund"), entered into an Expense Limitation Agreement (the "Agreement") for the period dated June 1, 2023 through May 1, 2025. The Agreement limits the operating expenses of the Class 2 shares of the Fund to 0.99% of the average daily net assets of Class 2 shares. The Agreement may be continued annually upon the affirmative vote of the majority of the trustees of the Trust who are not "interested persons" of the Trust or any party to the Agreement, as such term is defined in the Investment Company

9

Act of 1940, as amended, and may be terminated by Securian AM at any time after May 1, 2024, upon sixty (60) days' prior written notice. To the extent Securian AM absorbs other expenses to satisfy this limit on operating expenses, it may seek repayment of a portion or all of such amounts at any time within three (3) fiscal years after the fiscal year in which such amounts were absorbed, provided that such reimbursement will not cause the Class 2 shares to exceed the operating expense limit. Should the Fund make any such reimbursements to Securian AM, the amount of the reimbursements will be reflected in the financial statements in the Fund's shareholder reports and in Other Expenses under Fess and Expenses of the Fund.

The FTSE World Government Bond Index is a market capitalization weighted index consisting of the government bond markets from over twenty countries. Country eligibility is determined based upon market capitalization and investability criteria. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of U.S. $25 million. Government securities typically exclude floating or variable rate bonds, U.S./Canadian savings bonds and private placements. Each bond must have a minimum rating of BBB-/Baa3 by S&P or Moody's.

10

SFT Real Estate Securities Fund

Fund Objective

The SFT Real Estate Securities Fund seeks above-average income and long-term growth of capital. The Fund intends to pursue its objective by investing primarily in equity securities of companies in the real estate industry. The investment adviser for the Fund is Securian Asset Management, Inc. Cohen & Steers Capital Management, Inc. serves as investment sub-adviser to the Fund. Investment risks associated with investing in the Fund, in addition to other risks, include rental income fluctuations, depreciation, property tax value changes, and differences in real estate market value.

Performance Update

The Fund's performance for the six-month period ended June 30, 2023, for each class of shares offered was as follows:

Class 1 | | 5.83 percent* | |

Class 2 | | 5.70 percent* | |

The Fund's benchmarks, the FSTE NAREIT All Equity REITs Index (effective August 1, 2022), returned 2.97% and the FTSE NAREIT Equity REITs Index (effective prior to August 1, 2022), returned 5.37 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The FTSE NAREIT All Equity REITs Index contains all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria.

FTSE NAREIT Equity REITs Index contains all tax qualified REITs except timber and infrastructure REITs.

11

SFT T. Rowe Price Value Fund

Fund Objective

The SFT T. Rowe Price Value Fund seeks to provide long-term capital appreciation by investing in common stocks believed to be undervalued. Income is a secondary objective. The Fund pursues its objective by taking a value approach to investment selection. Holdings consist primarily of large cap stocks, but may also include stocks of mid-cap and small-cap companies. The investment adviser for the Fund is Securian Asset Management, Inc. T. Rowe Price Associates, Inc. serves as investment sub-adviser to the Fund. The Fund's value approach to investing carries the risk that the market will not recognize a security's intrinsic value for a long time or that a stock judged to be undervalued may actually be appropriately priced at a low level.

Performance Update

For the six-month period ended June 30, 2023, the Fund had a net return of 4.02 percent*. The Fund's benchmark, the Russell 1000 Value Index, returned 5.12 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

12

SFT Wellington Core Equity Fund

Fund Objective

The SFT Wellington Core Equity Fund seeks long-term capital appreciation. The Fund pursues its objective by investing primarily in a diversified portfolio of common stocks. The investment adviser for the Fund is Securian Asset Management, Inc. Wellington Management Company LLP serves as investment sub-adviser to the Fund. Risks associated with investing in the Fund include, but are not limited to, issuer-specific market volatility and risk of declines in the equity markets generally.

Performance Update

The Fund's performance for the six-month period ended June 30, 2023, for each class of shares offered was as follows:

Class 1 | | 12.57 percent* | |

Class 2 | | 12.43 percent* | |

The Fund's benchmark, the Standard & Poor's 500® Index, returned 16.89 percent for the same period.

Sector Diversification (shown as a percentage of net assets)

* The results shown are past performance and are not an indication of future performance. Current performance may be lower or higher. The investment returns and principal value of an investment will fluctuate so that shares upon redemption may be worth more or less than their original cost. Performance figures of the Fund do not reflect charges pursuant to the terms of the variable life insurance policies and variable annuity contracts funded by separate accounts that invest in the Fund's shares. When such charges are deducted, actual investment performance in a variable policy or contract will be lower.

The S&P 500® Index is a broad, unmanaged index of 500 common stocks which are representative of the U.S. stock market overall.

13

SFT Balanced Stabilization Fund

Investments in Securities

(Percentages of each investment category relate to total net assets)

| | | Principal | | Value(a) | |

Long-Term Debt Securities (37.1%) | |

Government Obligations (4.7%) | |

U.S. Government Agencies and Obligations (4.7%) | |

Federal Home Loan Mortgage Corporation (0.0%) | |

3.000%, 09/01/43 | | $ | 49,733 | | | $ | 44,814 | | |

3.500%, 10/01/44 | | | 52,007 | | | | 48,459 | | |

3.500%, 11/01/44 | | | 50,556 | | | | 47,107 | | |

3.500%, 12/01/44 | | | 55,015 | | | | 51,263 | | |

| | | | | | 191,643 | | |

Federal National Mortgage Association (0.0%) | |

3.000%, 04/01/43 | | | 76,872 | | | | 69,327 | | |

3.000%, 05/01/43 | | | 25,561 | | | | 23,053 | | |

3.000%, 06/01/43 | | | 113,988 | | | | 102,795 | | |

3.500%, 08/01/42 | | | 51,075 | | | | 48,060 | | |

3.500%, 02/01/43 | | | 66,976 | | | | 63,456 | | |

| | | | | | 306,691 | | |

U.S. Treasury (4.7%) | |

U.S. Treasury Bond

4.000%, 11/15/42 | | | 5,530,000 | | | | 5,485,933 | | |

4.000%, 11/15/52 | | | 1,200,000 | | | | 1,230,750 | | |

U.S. Treasury Note

1.000%, 12/15/24 | | | 15,500,000 | | | | 14,586,953 | | |

3.875%, 12/31/27 | | | 9,350,000 | | | | 9,215,594 | | |

| | | | | | 30,519,230 | | |

Total government obligations

(cost: $31,997,167) | | | | | 31,017,564 | | |

Other Mortgage-Backed Securities (0.2%) | |

Commercial Mortgage-Backed Securities (0.2%) | |

Bank, Series 2019-BNK18,

Class A4,

3.584%, 05/15/62 | | | 1,500,000 | | | | 1,303,310 | | |

Total other mortgage-backed securities

(cost: $1,542,982) | | | | | 1,303,310 | | |

Corporate Obligations (32.2%) | |

Basic Materials (0.8%) | |

Chemicals (0.4%) | |

Celanese U.S. Holdings LLC,

6.330%, 07/15/29 | | | 1,500,000 | | | | 1,489,316 | | |

Nutrien Ltd.,

3.000%, 04/01/25 (b) | | | 1,000,000 | | | | 951,183 | | |

| | | | | | 2,440,499 | | |

Mining (0.4%) | |

Anglo American Capital PLC,

2.625%, 09/10/30 (b) (c) | | | 2,000,000 | | | | 1,645,900 | | |

FMG Resources August

2006 Pty. Ltd.,

6.125%, 04/15/32 (b) (c) | | | 1,000,000 | | | | 950,000 | | |

| | | | | | 2,595,900 | | |

Communications (1.4%) | |

Cable/Satellite TV (0.3%) | |

Comcast Corp.

2.887%, 11/01/51 | | | 1,319,000 | | | | 883,793 | | |

| | | Principal | | Value(a) | |

2.937%, 11/01/56 | | $ | 327,000 | | | $ | 212,700 | | |

4.200%, 08/15/34 (d) | | | 500,000 | | | | 464,749 | | |

| | | | | | 1,561,242 | | |

Diversified Telecommunication Services (0.5%) | |

AT&T, Inc.

2.550%, 12/01/33 | | | 943,000 | | | | 736,796 | | |

3.550%, 09/15/55 | | | 1,405,000 | | | | 980,027 | | |

3.800%, 12/01/57 | | | 75,000 | | | | 54,280 | | |

4.500%, 05/15/35 | | | 1,000,000 | | | | 916,246 | | |

Verizon Communications,

Inc., 2.987%, 10/30/56 | | | 1,194,000 | | | | 754,197 | | |

| | | | | | 3,441,546 | | |

Media (0.4%) | |

Charter Communications

Operating LLC/Charter

Communications

Operating Capital,

3.750%, 02/15/28 | | | 1,500,000 | | | | 1,374,697 | | |

Paramount Global,

4.000%, 01/15/26 | | | 250,000 | | | | 238,171 | | |

Walt Disney Co.,

4.950%, 10/15/45 | | | 1,000,000 | | | | 960,274 | | |

| | | | | | 2,573,142 | | |

Telecommunication (0.2%) | |

Crown Castle Towers LLC,

3.663%, 05/15/45 (c) | | | 1,000,000 | | | | 946,698 | | |

Vodafone Group PLC,

4.125%, 05/30/25 (b) | | | 500,000 | | | | 487,372 | | |

| | | | | | 1,434,070 | | |

Wireless Telecommunication Services (0.0%) | |

Rogers Communications,

Inc., 4.100%, 10/01/23 (b) | | | 250,000 | | | | 248,526 | | |

Consumer Cyclical (1.2%) | |

Consumer Staples Distribution & Retail (0.3%) | |

Kroger Co.

4.450%, 02/01/47 | | | 1,000,000 | | | | 863,531 | | |

5.150%, 08/01/43 | | | 1,100,000 | | | | 1,010,327 | | |

| | | | | | 1,873,858 | | |

Entertainment (0.2%) | |

Warnermedia Holdings,

Inc., 5.141%, 03/15/52 | | | 1,400,000 | | | | 1,133,979 | | |

Home Furnishings (0.1%) | |

Harman International

Industries, Inc.,

4.150%, 05/15/25 | | | 1,000,000 | | | | 969,487 | | |

Retail (0.6%) | |

AutoZone, Inc.,

3.250%, 04/15/25 | | | 1,000,000 | | | | 956,889 | | |

Lowe's Cos., Inc.,

5.625%, 04/15/53 | | | 2,250,000 | | | | 2,244,300 | | |

Target Corp.,

3.500%, 07/01/24 (d) | | | 750,000 | | | | 736,456 | | |

| | | | | | 3,937,645 | | |

See accompanying notes to financial statements.

14

SFT Balanced Stabilization Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Consumer Discretionary (0.3%) | |

Broadline Retail (0.3%) | |

Amazon.com, Inc.

3.875%, 08/22/37 | | $ | 1,000,000 | | | $ | 910,776 | | |

4.050%, 08/22/47 | | | 1,000,000 | | | | 895,447 | | |

| | | | | | 1,806,223 | | |

Consumer Staples (0.4%) | |

Consumer Products — Miscellaneous (0.1%) | |

SC Johnson & Son, Inc.,

3.350%, 09/30/24 (c) | | | 750,000 | | | | 726,583 | | |

Household Products (0.1%) | |

Kimberly-Clark Corp.,

3.900%, 05/04/47 | | | 1,000,000 | | | | 848,493 | | |

Personal Care (0.2%) | |

Estee Lauder Cos., Inc.,

4.150%, 03/15/47 | | | 1,000,000 | | | | 870,760 | | |

Consumer, Non-cyclical (3.6%) | |

Agricultural Operations (0.4%) | |

Cargill, Inc.

3.125%, 05/25/51 (c) | | | 1,000,000 | | | | 720,033 | | |

4.375%, 04/22/52 (c) | | | 2,150,000 | | | | 1,925,794 | | |

| | | | | | 2,645,827 | | |

Beverages (0.4%) | |

Anheuser-Busch InBev

Worldwide, Inc.,

4.375%, 04/15/38 | | | 1,000,000 | | | | 923,511 | | |

Constellation Brands, Inc.,

5.250%, 11/15/48 | | | 2,050,000 | | | | 1,969,205 | | |

| | | | | | 2,892,716 | | |

Biotechnology (0.6%) | |

Amgen, Inc.,

4.050%, 08/18/29 | | | 2,000,000 | | | | 1,894,178 | | |

Bio-Rad Laboratories, Inc.,

3.700%, 03/15/32 | | | 2,000,000 | | | | 1,750,726 | | |

| | | | | | 3,644,904 | | |

Commercial Service — Finance (0.0%) | |

Moody's Corp.,

4.875%, 02/15/24 | | | 150,000 | | | | 149,423 | | |

Commercial Services (0.3%) | |

Ashtead Capital, Inc.,

5.500%, 08/11/32 (c) | | | 2,000,000 | | | | 1,927,222 | | |

Diagnostic Equipment (0.3%) | |

Abbott Laboratories

3.875%, 09/15/25 | | | 750,000 | | | | 732,994 | | |

4.750%, 11/30/36 | | | 1,000,000 | | | | 1,000,303 | | |

4.750%, 04/15/43 | | | 250,000 | | | | 243,904 | | |

| | | | | | 1,977,201 | | |

Drugstore Chains (0.0%) | |

CVS Pass-Through Trust,

6.943%, 01/10/30 | | | 116,945 | | | | 118,970 | | |

| | | Principal | | Value(a) | |

Food (0.3%) | |

Mars, Inc.,

3.950%, 04/01/49 (c) | | $ | 1,000,000 | | | $ | 838,441 | | |

Tyson Foods, Inc.,

5.150%, 08/15/44 | | | 1,000,000 | | | | 902,156 | | |

| | | | | | 1,740,597 | | |

Food Products (0.1%) | |

General Mills, Inc.,

3.000%, 02/01/51 | | | 1,002,000 | | | | 706,482 | | |

Pharmaceuticals (1.2%) | |

AbbVie, Inc.

3.600%, 05/14/25 | | | 1,000,000 | | | | 966,762 | | |

3.800%, 03/15/25 | | | 670,000 | | | | 650,617 | | |

4.400%, 11/06/42 | | | 1,000,000 | | | | 892,645 | | |

4.450%, 05/14/46 | | | 1,000,000 | | | | 875,009 | | |

Becton Dickinson & Co.,

4.298%, 08/22/32 | | | 2,000,000 | | | | 1,895,234 | | |

Bristol-Myers Squibb Co.

3.250%, 11/01/23 | | | 500,000 | | | | 496,262 | | |

3.875%, 08/15/25 | | | 229,000 | | | | 221,704 | | |

Novartis Capital Corp.,

3.400%, 05/06/24 (d) | | | 500,000 | | | | 491,541 | | |

Takeda Pharmaceutical Co.

Ltd., 5.000%, 11/26/28 (b) | | | 1,000,000 | | | | 991,064 | | |

| | | | | | 7,480,838 | | |

Energy (1.9%) | |

Oil & Gas (1.1%) | |

Baker Hughes Holdings LLC/

Baker Hughes

Co-Obligor, Inc.,

3.337%, 12/15/27 | | | 1,000,000 | | | | 922,712 | | |

BP Capital Markets

America, Inc.,

4.234%, 11/06/28 | | | 1,000,000 | | | | 967,724 | | |

Chevron USA, Inc.,

3.900%, 11/15/24 | | | 1,000,000 | | | | 981,425 | | |

Coterra Energy, Inc.,

3.900%, 05/15/27 | | | 1,000,000 | | | | 941,448 | | |

Marathon Petroleum Corp.,

3.625%, 09/15/24 | | | 750,000 | | | | 730,036 | | |

Phillips 66,

4.650%, 11/15/34 | | | 1,000,000 | | | | 943,528 | | |

TotalEnergies Capital

International SA,

3.750%, 04/10/24 (b) | | | 750,000 | | | | 738,868 | | |

Valero Energy Corp.,

4.350%, 06/01/28 | | | 1,000,000 | | | | 952,317 | | |

| | | | | | 7,178,058 | | |

Pipelines (0.8%) | |

Energy Transfer LP

4.250%, 04/01/24 | | | 1,000,000 | | | | 983,879 | | |

4.900%, 03/15/35 | | | 1,000,000 | | | | 906,521 | | |

Enterprise Products

Operating LLC,

Series J, 5.750%,

03/01/35 | | | 250,000 | | | | 247,612 | | |

See accompanying notes to financial statements.

15

SFT Balanced Stabilization Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Kinder Morgan, Inc.,

5.300%, 12/01/34 | | $ | 750,000 | | | $ | 716,034 | | |

MPLX LP,

4.950%, 09/01/32 | | | 2,000,000 | | | | 1,912,782 | | |

Williams Cos., Inc.,

3.750%, 06/15/27 | | | 500,000 | | | | 470,656 | | |

| | | | | | 5,237,484 | | |

Financial (10.3%) | |

Banks (6.0%) | |

Associated Banc-Corp.,

4.250%, 01/15/25 | | | 750,000 | | | | 704,258 | | |

Bank of America Corp.

Series L, 3.950%, 04/21/25 | | | 1,000,000 | | | | 968,894 | | |

Series L, 4.183%, 11/25/27 | | | 1,000,000 | | | | 950,401 | | |

4.244%, 04/24/38 (3-Month

USD TERM SOFR +

2.076%) (e) | | | 1,000,000 | | | | 873,600 | | |

4.948%, 07/22/28

(SOFRRATE + 2.040%) (e) | | | 1,500,000 | | | | 1,470,886 | | |

Bank of New York

Mellon Corp.

3.442%, 02/07/28

(3-Month USD TERM

SOFR + 1.331%) (e) | | | 1,000,000 | | | | 941,098 | | |

5.834%, 10/25/33

(SOFRRATE + 2.074%) (e) | | | 1,000,000 | | | | 1,038,258 | | |

Capital One Financial Corp.

4.250%, 04/30/25 | | | 1,500,000 | | | | 1,447,467 | | |

5.468%, 02/01/29

(SOFRRATE + 2.080%) (e) | | | 1,500,000 | | | | 1,434,532 | | |

Citigroup, Inc.

3.300%, 04/27/25 | | | 750,000 | | | | 721,359 | | |

3.980%, 03/20/30 (3-Month

USD TERM SOFR +

1.600%) (e) | | | 1,000,000 | | | | 924,016 | | |

4.650%, 07/23/48 | | | 1,250,000 | | | | 1,121,687 | | |

4.750%, 05/18/46 (f) | | | 1,200,000 | | | | 1,014,262 | | |

Comerica Bank,

5.332%, 08/25/33

(SOFRRATE + 2.610%) (e) | | | 2,000,000 | | | | 1,623,902 | | |

Discover Bank,

4.250%, 03/13/26 | | | 500,000 | | | | 471,177 | | |

Fifth Third Bank NA,

3.950%, 07/28/25 | | | 1,000,000 | | | | 932,393 | | |

First Republic Bank

4.375%, 08/01/46, FDIC | | | 575,000 | | | | 2,875 | | |

4.625%, 02/13/47, FDIC | | | 1,379,000 | | | | 6,895 | | |

Goldman Sachs Group, Inc.

3.850%, 01/26/27 | | | 1,000,000 | | | | 949,665 | | |

4.482%, 08/23/28

(SOFRRATE + 1.725%) (e) | | | 2,000,000 | | | | 1,930,174 | | |

5.150%, 05/22/45 (f) | | | 1,000,000 | | | | 934,074 | | |

JPMorgan Chase & Co.

3.125%, 01/23/25 | | | 1,000,000 | | | | 967,306 | | |

3.328%, 04/22/52

(SOFRRATE + 1.580%) (e) | | | 2,000,000 | | | | 1,456,504 | | |

KeyBank NA,

4.390%, 12/14/27 | | | 3,000,000 | | | | 2,634,267 | | |

M&T Bank Corp.,

4.553%, 08/16/28

(SOFRRATE + 1.780%) (e) | | | 3,000,000 | | | | 2,783,376 | | |

| | | Principal | | Value(a) | |

Morgan Stanley

2.802%, 01/25/52

(SOFRRATE + 1.430%) (e) | | $ | 2,000,000 | | | $ | 1,308,102 | | |

6.342%, 10/18/33

(SOFRRATE + 2.560%) (e) | | | 1,000,000 | | | | 1,058,095 | | |

PNC Bank NA

3.800%, 07/25/23 | | | 250,000 | | | | 249,660 | | |

4.050%, 07/26/28 | | | 1,000,000 | | | | 921,073 | | |

Synchrony Bank,

5.400%, 08/22/25 | | | 1,000,000 | | | | 956,831 | | |

Truist Financial Corp.,

6.123%, 10/28/33

(SOFRRATE + 2.300%) (e) | | | 2,000,000 | | | | 2,034,146 | | |

U.S. Bancorp,

5.850%, 10/21/33

(SOFRRATE + 2.090%) (e) | | | 1,000,000 | | | | 1,001,815 | | |

Wells Fargo & Co.

3.068%, 04/30/41

(SOFRRATE + 2.530%) (e) | | | 1,600,000 | | | | 1,175,280 | | |

4.750%, 12/07/46 (f) | | | 2,300,000 | | | | 1,934,905 | | |

| | | | | | 38,943,233 | | |

Finance (0.9%) | |

Allied World Assurance Co.

Holdings Ltd.,

4.350%, 10/29/25 (b) | | | 1,290,000 | | | | 1,230,683 | | |

Intercontinental

Exchange, Inc.,

4.350%, 06/15/29 | | | 3,000,000 | | | | 2,932,524 | | |

Jefferies Group LLC/

Jefferies Group Capital

Finance, Inc.,

2.625%, 10/15/31 | | | 2,000,000 | | | | 1,548,802 | | |

| | | | | | 5,712,009 | | |

Financial Services (0.8%) | |

American Express Co.

3.300%, 05/03/27 | | | 1,000,000 | | | | 932,199 | | |

4.050%, 12/03/42 (f) | | | 2,000,000 | | | | 1,737,498 | | |

CME Group, Inc.,

3.000%, 03/15/25 | | | 1,000,000 | | | | 961,043 | | |

Discover Financial Services,

3.750%, 03/04/25 | | | 1,000,000 | | | | 951,200 | | |

Eaton Vance Corp.,

3.500%, 04/06/27 | | | 1,000,000 | | | | 926,941 | | |

| | | | | | 5,508,881 | | |

Insurance (1.0%) | |

American Financial

Group, Inc.,

4.500%, 06/15/47 | | | 1,000,000 | | | | 810,052 | | |

Assured Guaranty

U.S. Holdings, Inc.,

5.000%, 07/01/24 | | | 330,000 | | | | 325,667 | | |

Marsh & McLennan

Cos., Inc.,

4.350%, 01/30/47 | | | 1,000,000 | | | | 848,174 | | |

Metropolitan Life Global

Funding I,

1.550%, 01/07/31 (c) | | | 3,000,000 | | | | 2,328,738 | | |

See accompanying notes to financial statements.

16

SFT Balanced Stabilization Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Principal Life Global

Funding II,

1.500%, 08/27/30 (c) | | $ | 3,000,000 | | | $ | 2,300,499 | | |

| | | | | | 6,613,130 | | |

Property / Casualty Insurance (0.2%) | |

Arch Capital Finance LLC,

4.011%, 12/15/26 (d) | | | 1,000,000 | | | | 955,265 | | |

Real Estate Investment Trust — Diversified (0.1%) | |

Kite Realty Group Trust,

4.000%, 03/15/25 (d) | | | 1,000,000 | | | | 938,953 | | |

Real Estate Investment Trust — Health Care (0.6%) | |

Healthcare Realty

Holdings LP

3.750%, 07/01/27 | | | 1,000,000 | | | | 918,589 | | |

3.875%, 05/01/25 | | | 1,000,000 | | | | 953,168 | | |

Physicians Realty LP,

4.300%, 03/15/27 | | | 1,000,000 | | | | 941,397 | | |

Welltower OP LLC,

4.125%, 03/15/29 | | | 1,500,000 | | | | 1,377,588 | | |

| | | | | | 4,190,742 | | |

Real Estate Investment Trust — Office Property (0.1%) | |

Alexandria Real Estate

Equities, Inc.,

4.500%, 07/30/29 | | | 500,000 | | | | 471,050 | | |

Real Estate Investment Trust — Shopping Centers (0.0%) | |

Retail Opportunity

Investments

Partnership LP,

5.000%, 12/15/23 | | | 250,000 | | | | 246,294 | | |

Real Estate Investment Trust — Single Tenant (0.1%) | |

Office Properties

Income Trust,

4.500%, 02/01/25 | | | 750,000 | | | | 646,875 | | |

Specialized REITs (0.5%) | |

American Tower Corp.,

3.375%, 10/15/26 | | | 1,000,000 | | | | 932,523 | | |

Crown Castle, Inc.,

4.750%, 05/15/47 | | | 1,000,000 | | | | 866,262 | | |

Essex Portfolio LP,

3.500%, 04/01/25 | | | 1,000,000 | | | | 957,416 | | |

Goodman U.S. Finance

Four LLC,

4.500%, 10/15/37 (c) | | | 500,000 | | | | 415,895 | | |

| | | | | | 3,172,096 | | |

Health Care (0.8%) | |

Health Care Providers & Services (0.4%) | |

Aetna, Inc.,

3.875%, 08/15/47 | | | 1,000,000 | | | | 778,088 | | |

Elevance Health, Inc.,

4.375%, 12/01/47 | | | 1,000,000 | | | | 867,471 | | |

Laboratory Corp. of

America Holdings,

4.000%, 11/01/23 | | | 250,000 | | | | 248,426 | | |

UnitedHealth Group, Inc.,

3.750%, 07/15/25 (d) | | | 1,000,000 | | | | 973,344 | | |

| | | | | | 2,867,329 | | |

| | | Principal | | Value(a) | |

Pharmaceuticals (0.4%) | |

Cardinal Health, Inc.,

3.750%, 09/15/25 | | $ | 1,000,000 | | | $ | 962,634 | | |

Mead Johnson

Nutrition Co.,

5.900%, 11/01/39 | | | 1,000,000 | | | | 1,044,990 | | |

Mylan, Inc.,

4.200%, 11/29/23 | | | 500,000 | | | | 496,603 | | |

| | | | | | 2,504,227 | | |

Industrials (3.8%) | |

Aerospace & Defense (0.7%) | |

General Dynamics Corp.,

3.500%, 05/15/25 | | | 1,000,000 | | | | 970,651 | | |

L3Harris Technologies, Inc.,

3.832%, 04/27/25 | | | 1,000,000 | | | | 969,684 | | |

Raytheon

Technologies Corp.

3.700%, 12/15/23 | | | 500,000 | | | | 495,216 | | |

4.050%, 05/04/47 | | | 1,000,000 | | | | 847,245 | | |

4.125%, 11/16/28 | | | 1,500,000 | | | | 1,441,985 | | |

| | | | | | 4,724,781 | | |

Air Freight & Logistics (0.1%) | |

FedEx Corp.,

4.400%, 01/15/47 | | | 1,000,000 | | | | 842,101 | | |

Building Products (0.4%) | |

CRH America Finance, Inc.,

4.400%, 05/09/47 (c) | | | 1,000,000 | | | | 835,585 | | |

Mohawk Industries, Inc.,

3.625%, 05/15/30 | | | 2,000,000 | | | | 1,793,964 | | |

| | | | | | 2,629,549 | | |

Containers & Packaging (0.3%) | |

Amcor Finance USA, Inc.,

4.500%, 05/15/28 | | | 1,000,000 | | | | 949,713 | | |

Sealed Air Corp.,

6.875%, 07/15/33 (c) | | | 1,000,000 | | | | 1,037,500 | | |

| | | | | | 1,987,213 | | |

Electrical Equipment (0.9%) | |

Flex Ltd.

4.750%, 06/15/25 (b) | | | 1,000,000 | | | | 973,936 | | |

4.875%, 06/15/29 (b) | | | 1,000,000 | | | | 952,611 | | |

General Motors

Financial Co., Inc.,

5.000%, 04/09/27 | | | 2,000,000 | | | | 1,942,636 | | |

Jabil, Inc.,

3.600%, 01/15/30 | | | 2,000,000 | | | | 1,781,396 | | |

| | | | | | 5,650,579 | | |

Environmental Control (0.2%) | |

Republic Services, Inc.,

3.950%, 05/15/28 | | | 1,000,000 | | | | 957,363 | | |

Industrial Conglomerates (0.1%) | |

3M Co.,

3.625%, 10/15/47 | | | 1,000,000 | | | | 760,870 | | |

Machinery (0.3%) | |

Caterpillar, Inc.,

3.250%, 04/09/50 | | | 2,300,000 | | | | 1,806,857 | | |

See accompanying notes to financial statements.

17

SFT Balanced Stabilization Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Miscellaneous Manufacturing (0.3%) | |

Carlisle Cos., Inc.,

3.750%, 12/01/27 | | $ | 1,000,000 | | | $ | 945,117 | | |

Textron, Inc.

3.875%, 03/01/25 | | | 750,000 | | | | 728,212 | | |

4.300%, 03/01/24 | | | 500,000 | | | | 494,710 | | |

| | | | | | 2,168,039 | | |

Transportation (0.2%) | |

Burlington Northern

Santa Fe LLC,

3.750%, 04/01/24 | | | 350,000 | | | | 345,879 | | |

Canadian Pacific

Railway Co.,

4.300%, 05/15/43 (b) | | | 250,000 | | | | 215,743 | | |

Penske Truck Leasing Co.

LP/PTL Finance Corp.,

3.900%, 02/01/24 (c) | | | 1,000,000 | | | | 985,370 | | |

| | | | | | 1,546,992 | | |

Trucking & Leasing (0.3%) | |

GATX Corp.

3.250%, 03/30/25 | | | 1,000,000 | | | | 949,633 | | |

4.550%, 11/07/28 | | | 1,000,000 | | | | 954,010 | | |

| | | | | | 1,903,643 | | |

Information Technology (1.6%) | |

Communications Equipment (0.2%) | |

QUALCOMM, Inc.,

4.650%, 05/20/35 | | | 1,000,000 | | | | 988,389 | | |

Computers (0.7%) | |

Apple, Inc.,

4.375%, 05/13/45 (d) | | | 1,000,000 | | | | 944,880 | | |

Dell International

LLC/EMC Corp.,

6.200%, 07/15/30 | | | 2,000,000 | | | | 2,067,208 | | |

Leidos, Inc.,

4.375%, 05/15/30 | | | 2,000,000 | | | | 1,832,500 | | |

| | | | | | 4,844,588 | | |

Interactive Media & Services (0.1%) | |

eBay, Inc.,

3.450%, 08/01/24 | | | 750,000 | | | | 733,705 | | |

IT Services (0.3%) | |

Global Payments, Inc.

4.800%, 04/01/26 | | | 750,000 | | | | 729,223 | | |

5.300%, 08/15/29 | | | 1,500,000 | | | | 1,452,354 | | |

| | | | | | 2,181,577 | | |

Software (0.3%) | |

Fiserv, Inc.,

3.850%, 06/01/25 | | | 1,000,000 | | | | 969,258 | | |

Oracle Corp.,

3.800%, 11/15/37 | | | 1,000,000 | | | | 815,052 | | |

| | | | | | 1,784,310 | | |

Materials (0.6%) | |

Chemicals (0.5%) | |

Mosaic Co.,

5.450%, 11/15/33 | | | 200,000 | | | | 194,450 | | |

| | | Principal | | Value(a) | |

Sherwin-Williams Co.,

3.950%, 01/15/26 | | $ | 1,000,000 | | | $ | 967,682 | | |

Yara International ASA

3.148%, 06/04/30 (b) (c) | | | 1,000,000 | | | | 832,995 | | |

4.750%, 06/01/28 (b) (c) | | | 1,000,000 | | | | 944,143 | | |

| | | | | | 2,939,270 | | |

Construction Materials (0.1%) | |

Vulcan Materials Co.,

4.500%, 06/15/47 | | | 1,000,000 | | | | 863,253 | | |

Technology (0.7%) | |

Semiconductor Equipment (0.5%) | |

Broadcom, Inc.,

3.419%, 04/15/33 (c) | | | 2,000,000 | | | | 1,667,686 | | |

Micron Technology, Inc.,

2.703%, 04/15/32 | | | 2,000,000 | | | | 1,566,682 | | |

| | | | | | 3,234,368 | | |

Software (0.2%) | |

VMware, Inc.,

1.400%, 08/15/26 | | | 1,800,000 | | | | 1,587,242 | | |

Transportation (1.2%) | |

Passenger Airlines (0.7%) | |

Air Canada Pass

Through Trust,

Series 2015-2A, Class A,

4.125%, 06/15/29 (b) (c) | | | 733,993 | | | | 647,749 | | |

American Airlines Pass

Through Trust,

Series 2015-2, Class A,

4.000%, 03/22/29 | | | 668,404 | | | | 589,867 | | |

British Airways Pass

Through Trust,

Series 2013-1, Class A,

4.625%, 12/20/25 (c) | | | 302,253 | | | | 298,114 | | |

Delta Air Lines, Inc./

SkyMiles IP Ltd.,

4.750%, 10/20/28 (c) | | | 2,000,000 | | | | 1,940,472 | | |

United Airlines Pass

Through Trust

Series 2013-1, Class A,

4.300%, 02/15/27 | | | 144,545 | | | | 138,894 | | |

Series 2018-1, Class AA,

3.500%, 09/01/31 | | | 953,746 | | | | 852,184 | | |

| | | | | | 4,467,280 | | |

Transport — Rail (0.5%) | |

Norfolk Southern Corp.,

3.850%, 01/15/24 | | | 500,000 | | | | 492,914 | | |

Union Pacific Corp.

3.750%, 03/15/24 | | | 500,000 | | | | 495,311 | | |

5.375%, 06/01/33 | | | 2,500,000 | | | | 2,531,062 | | |

| | | | | | 3,519,287 | | |

Utilities (3.6%) | |

Electric Utilities (2.5%) | |

Alabama Power Co.,

3.125%, 07/15/51 | | | 2,000,000 | | | | 1,369,984 | | |

Ameren Illinois Co.,

3.700%, 12/01/47 | | | 1,000,000 | | | | 796,272 | | |

See accompanying notes to financial statements.

18

SFT Balanced Stabilization Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

Arizona Public Service Co.,

4.350%, 11/15/45 | | $ | 1,000,000 | | | $ | 798,950 | | |

CenterPoint Energy Houston

Electric LLC, Series AJ,

4.850%, 10/01/52 | | | 3,150,000 | | | | 2,981,639 | | |

Duke Energy Corp.,

4.500%, 08/15/32 | | | 1,000,000 | | | | 940,034 | | |

Duke Energy Florida LLC,

5.950%, 11/15/52 | | | 1,000,000 | | | | 1,090,657 | | |

Duke Energy Progress LLC,

3.600%, 09/15/47 | | | 1,000,000 | | | | 764,653 | | |

Entergy Texas, Inc.,

3.450%, 12/01/27 | | | 3,000,000 | | | | 2,739,849 | | |

Northern States Power Co.,

3.750%, 12/01/47 | | | 1,000,000 | | | | 756,521 | | |

Oglethorpe Power Corp.,

4.250%, 04/01/46 | | | 800,000 | | | | 594,157 | | |

Oklahoma Gas &

Electric Co.,

4.150%, 04/01/47 | | | 1,000,000 | | | | 810,321 | | |

Wisconsin Power &

Light Co.,

3.950%, 09/01/32 | | | 3,000,000 | | | | 2,739,858 | | |

| | | | | | 16,382,895 | | |

Electric — Integrated (0.1%) | |

Berkshire Hathaway

Energy Co.,

3.750%, 11/15/23 | | | 250,000 | | | | 248,121 | | |

Gas Utilities (0.7%) | |

National Fuel Gas Co.

4.750%, 09/01/28 | | | 1,000,000 | | | | 945,922 | | |

5.200%, 07/15/25 | | | 1,000,000 | | | | 978,703 | | |

ONEOK, Inc.

4.000%, 07/13/27 | | | 500,000 | | | | 467,470 | | |

4.350%, 03/15/29 | | | 1,500,000 | | | | 1,395,115 | | |

Washington Gas Light Co.,

Series K,

3.796%, 09/15/46 | | | 1,000,000 | | | | 763,455 | | |

| | | | | | 4,550,665 | | |

Multi-Utilities (0.1%) | |

Atmos Energy Corp.,

4.125%, 03/15/49 | | | 750,000 | | | | 630,036 | | |

Eastern Energy Gas

Holdings LLC,

3.550%, 11/01/23 | | | 250,000 | | | | 247,499 | | |

| | | | | | 877,535 | | |

| | | Shares/

Principal | | Value(a) | |

Water Utilities (0.2%) | |

American Water

Capital Corp.,

3.750%, 09/01/47 | | $ | 1,000,000 | | | $ | 788,524 | | |

Aquarion Co.,

4.000%, 08/15/24 (c) | | | 500,000 | | | | 489,303 | | |

| | | | | | 1,277,827 | | |

Total corporate obligations

(cost: $224,531,778) | | | | | 210,390,058 | | |

Total long-term debt securities

(cost: $258,071,927) | | | | | 242,710,932 | | |

Mutual Funds (52.8%) | |

Investment Companies (52.8%) | |

iShares Core S&P 500 ETF | | | 105,440 | | | | 46,995,662 | | |

SFT Index 500 Fund (g) | | | 14,224,618 | | | | 274,114,718 | | |

SPDR S&P 500 ETF Trust (d) | | | 36,170 | | | | 16,033,438 | | |

Vanguard S&P 500 ETF | | | 20,175 | | | | 8,216,874 | | |

Total mutual funds

(cost: $168,921,296) | | | | | 345,360,692 | | |

Short-Term Securities (8.2%) | |

Investment Companies (8.2%) | |

State Street Institutional

U.S. Government Money

Market Fund, current

rate 5.030% | | | 53,843,636 | | | | 53,843,636 | | |

Total short-term securities

(cost: $53,843,636) | | | | | 53,843,636 | | |

Total investments excluding

purchased options (98.1%)

(cost: $480,836,859) | | | | | 641,915,260 | | |

Total purchased options

outstanding (0.1%)

(cost: $653,966) | | | | | 614,600 | | |

Total investments in securities

(cost: $481,490,825) (h) | | | | | 642,529,860 | | |

Cash and other assets in excess

of liabilities (1.8%) | | | | | 11,942,254 | | |

Total net assets (100.0%) | | | | $ | 654,472,114 | | |

Investments in Securities Legend

(a) Securities are valued in accordance with procedures described in Note 2 of the notes to financial statements.

(b) Foreign security: the Fund held 1.8% of net assets in foreign securities at June 30, 2023.

(c) Security sold within terms of a private placement memorandum exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended, and may be sold only to dealers in that program.

(d) Fully or partially pledged as initial margin deposits on open futures contracts.

(e) Variable rate security.

(f) Pursuant to the Fund's Liquidity Risk Management Program, this security has been determined to be illiquid by the Fund's Liquidity Risk Management Program Administrator.

(g) Affiliated security.

See accompanying notes to financial statements.

19

SFT Balanced Stabilization Fund

Investments in Securities – continued

(h) At June 30, 2023, the cost of investments for federal income tax purposes was $486,217,169. The aggregate unrealized appreciation and depreciation of investments based on this cost were:

Gross unrealized appreciation | | $ | 181,115,253 | | |

Gross unrealized depreciation | | | (20,062,460 | ) | |

Net unrealized appreciation | | $ | 161,052,793 | | |

Holdings of Open Futures Contracts

On June 30, 2023, securities with an aggregate market value of $19,478,482 have been pledged to cover margin requirements for the following open futures contracts:

Description | | Expiration

Date | | Number of

Contracts | | Position

Type | | Notional

Amount | | Market

Value | | Unrealized

Appreciation/

(Depreciation)(a) | |

S&P 500 E-Mini Index Future | | September 2023 | | | 567 | | | Long | | $ | 122,408,235 | | | $ | 127,241,887 | | | $ | 4,833,652 | | |

Call Options Purchased:

The Fund had the following call options purchased open at June 30, 2023:

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Value(a) | |

CBOE Volatility Index | | $ | 21 | | | July 2023 | | | 10,150 | | | $ | 1,015,000 | | | $ | 446,600 | | |

Put Options Purchased:

The Fund had the following put options purchased open at June 30, 2023:

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Value(a) | |

S&P 500 Index | | $ | 4,315 | | | July 2023 | | | 100 | | | $ | 10,000 | | | $ | 168,000 | | |

Call Options Written:

The Fund had the following call options written open at June 30, 2023:

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Value(a) | |

CBOE Volatility Index | | $ | 40 | | | July 2023 | | | 10,150 | | | $ | 1,015,000 | | | $ | (71,050 | ) | |

Put Options Written:

The Fund had the following put options written open at June 30, 2023:

Description | | Exercise

Price | | Expiration

Date | | Number of

Contracts | | Notional

Amount | | Value(a) | |

S&P 500 Index | | $ | 3,865 | | | July 2023 | | | 100 | | | $ | 10,000 | | | $ | (22,500 | ) | |

See accompanying notes to financial statements.

20

SFT Core Bond Fund

Investments in Securities

(Percentages of each investment category relate to total net assets)

| | | Principal | | Value(a) | |

Long-Term Debt Securities (108.3%) | |

Government Obligations (60.6%) | |

Other Government Obligations (0.8%) | |

Provincial or Local Government

Obligations (0.8%) | |

Douglas County Public

Utility District No. 1

Wells Hydroelectric

Project Revenue,

Series A, 5.450%,

09/01/40 | | $ | 1,185,000 | | | $ | 1,232,092 | | |

Municipal Electric

Authority of Georgia,

6.655%, 04/01/57 | | | 685,000 | | | | 785,531 | | |

New York City Transitional

Finance Authority Future

Tax Secured Revenue,

5.508%, 08/01/37 | | | 620,000 | | | | 646,040 | | |

Ohio Water Development

Authority, Series A2,

4.817%, 12/01/30 | | | 250,000 | | | | 249,587 | | |

Texas A&M University,

Series D, 4.000%,

05/15/31 | | | 325,000 | | | | 313,638 | | |

| | | | | | 3,226,888 | | |

U.S. Government Agencies and

Obligations (59.8%) | |

Export-Import Bank of the United

States (0.0%) | |

Export-Import Bank of the

U.S., 2.578%, 12/10/25 | | | 26,188 | | | | 25,038 | | |

Federal Home Loan Bank (2.2%) | |

Federal Home Loan Banks | |

5.300%, 05/22/24 | | | 4,870,000 | | | | 4,854,435 | | |

5.370%, 05/21/24 | | | 4,900,000 | | | | 4,887,069 | | |

| | | | | | 9,741,504 | | |

Federal Home Loan Mortgage Corporation (7.5%) | |

2.000%, 11/01/51 | | | 5,099,605 | | | | 4,163,227 | | |

2.000%, 12/01/51 | | | 3,750,187 | | | | 3,068,204 | | |

2.500%, 04/01/28 | | | 49,960 | | | | 46,246 | | |

2.500%, 01/01/52 | | | 1,853,609 | | | | 1,574,225 | | |

2.500%, 03/01/52 | | | 7,721,404 | | | | 6,557,433 | | |

3.000%, 08/01/42 | | | 264,621 | | | | 238,304 | | |

3.000%, 12/01/42 | | | 101,202 | | | | 91,173 | | |

3.000%, 01/01/43 | | | 143,446 | | | | 130,888 | | |

3.000%, 02/01/43 | | | 348,793 | | | | 320,233 | | |

3.000%, 04/01/43 | | | 501,704 | | | | 451,881 | | |

3.000%, 10/25/46 | | | 44,042 | | | | 39,725 | | |

3.000%, 02/01/52 | | | 3,512,448 | | | | 3,097,330 | | |

3.500%, 10/01/25 | | | 29,785 | | | | 29,211 | | |

3.500%, 05/01/32 | | | 71,977 | | | | 68,963 | | |

3.500%, 03/01/42 | | | 358,539 | | | | 341,490 | | |

3.500%, 08/01/42 | | | 304,217 | | | | 289,751 | | |

3.500%, 05/25/45 | | | 178,680 | | | | 158,927 | | |

4.000%, 09/01/40 | | | 312,026 | | | | 302,490 | | |

4.000%, 11/01/40 | | | 554,646 | | | | 537,520 | | |

4.000%, 02/01/41 | | | 126,633 | | | | 122,736 | | |

4.000%, 03/01/41 | | | 135,546 | | | | 131,375 | | |

| | | Principal | | Value(a) | |

4.000%, 08/01/52 | | $ | 5,264,270 | | | $ | 4,942,441 | | |

4.000%, 11/01/52 | | | 3,676,437 | | | | 3,452,927 | | |

4.500%, 09/01/40 | | | 41,418 | | | | 40,920 | | |

4.500%, 01/01/41 | | | 210,351 | | | | 203,472 | | |

4.500%, 02/01/41 | | | 123,388 | | | | 119,352 | | |

4.500%, 03/01/41 | | | 260,849 | | | | 259,416 | | |

4.500%, 04/01/41 | | | 221,510 | | | | 219,940 | | |

5.000%, 05/01/29 | | | 9,536 | | | | 9,431 | | |

5.000%, 04/01/35 | | | 38,042 | | | | 38,506 | | |

5.000%, 08/01/35 | | | 21,992 | | | | 21,865 | | |

5.000%, 11/01/35 | | | 38,745 | | | | 39,202 | | |

5.000%, 11/01/39 | | | 224,192 | | | | 225,155 | | |

5.000%, 04/01/40 | | | 73,870 | | | | 74,735 | | |

5.000%, 08/01/40 | | | 46,490 | | | | 46,908 | | |

5.500%, 11/01/23 | | | 3,358 | | | | 3,360 | | |

5.500%, 05/01/34 | | | 307,354 | | | | 316,478 | | |

5.500%, 10/01/34 | | | 80,916 | | | | 83,307 | | |

5.500%, 07/01/35 | | | 129,265 | | | | 132,664 | | |

5.500%, 10/01/35 | | | 133,124 | | | | 130,583 | | |

5.500%, 12/01/38 | | | 61,004 | | | | 62,669 | | |

6.000%, 11/01/33 | | | 135,964 | | | | 140,536 | | |

6.100%, 10/25/29

(1-Month USD LIBOR +

0.950%) (b) | | | 312,498 | | | | 303,116 | | |

6.250%, 12/15/23 | | | 1,072 | | | | 1,068 | | |

6.500%, 09/01/32 | | | 14,620 | | | | 15,261 | | |

6.500%, 11/01/32 | | | 13,010 | | | | 14,215 | | |

6.500%, 06/01/36 | | | 86,703 | | | | 86,932 | | |

7.000%, 12/01/37 | | | 23,235 | | | | 24,434 | | |

| | | | | | 32,770,225 | | |

Federal National Mortgage Association (28.1%) | |

2.000%, 11/01/51 | | | 10,000,419 | | | | 8,165,747 | | |

2.000%, 07/13/53,

TBA (c) | | | 5,100,000 | | | | 4,156,500 | | |

2.000%, 08/14/53,

TBA (c) | | | 11,325,000 | | | | 9,231,645 | | |

2.500%, 03/01/27 | | | 69,734 | | | | 65,630 | | |

2.500%, 11/01/27 | | | 117,948 | | | | 111,452 | | |

2.500%, 03/01/28 | | | 91,986 | | | | 86,544 | | |

2.500%, 07/01/28 | | | 123,362 | | | | 116,078 | | |

2.500%, 12/01/51 | | | 2,566,045 | | | | 2,194,856 | | |

2.500%, 03/01/52 | | | 2,683,972 | | | | 2,276,622 | | |

2.500%, 04/01/52 | | | 4,468,494 | | | | 3,799,395 | | |

2.500%, 07/13/53,

TBA (c) | | | 24,375,000 | | | | 20,661,621 | | |

3.000%, 11/01/27 | | | 53,891 | | | | 51,990 | | |

3.000%, 09/01/42 | | | 69,764 | | | | 62,806 | | |

3.000%, 01/01/46 | | | 62,859 | | | | 56,319 | | |

3.000%, 04/01/52 | | | 5,858,068 | | | | 5,156,240 | | |

3.000%, 06/01/52 | | | 480,562 | | | | 425,053 | | |

3.000%, 07/13/53,

TBA (c) | | | 11,075,000 | | | | 9,744,270 | | |

3.000%, 08/14/53,

TBA (c) | | | 9,675,000 | | | | 8,521,181 | | |

3.500%, 11/01/25 | | | 36,070 | | | | 35,375 | | |

3.500%, 01/01/26 | | | 44,012 | | | | 43,165 | | |

3.500%, 12/01/32 | | | 72,240 | | | | 68,856 | | |

3.500%, 11/01/40 | | | 247,358 | | | | 227,774 | | |

3.500%, 01/01/41 | | | 272,460 | | | | 253,270 | | |

3.500%, 02/01/41 | | | 324,838 | | | | 303,400 | | |

3.500%, 04/01/41 | | | 171,996 | | | | 158,666 | | |

See accompanying notes to financial statements.

21

SFT Core Bond Fund

Investments in Securities – continued

| | | Principal | | Value(a) | |

3.500%, 11/01/41 | | $ | 934,101 | | | $ | 863,818 | | |

3.500%, 12/01/41 | | | 188,184 | | | | 175,769 | | |

3.500%, 05/01/42 | | | 96,175 | | | | 88,757 | | |

3.500%, 01/01/43 | | | 221,899 | | | | 208,198 | | |

3.500%, 02/01/43 | | | 267,906 | | | | 253,824 | | |

3.500%, 05/01/43 | | | 859,246 | | | | 803,804 | | |

3.500%, 08/14/53,

TBA (c) | | | 3,600,000 | | | | 3,283,453 | | |

4.000%, 12/01/40 | | | 37,142 | | | | 36,045 | | |

4.000%, 04/01/41 | | | 544,515 | | | | 518,192 | | |

4.000%, 09/01/41 | | | 141,655 | | | | 137,453 | | |

4.000%, 11/01/41 | | | 86,861 | | | | 84,166 | | |

4.000%, 06/01/42 | | | 250,439 | | | | 241,163 | | |

4.000%, 09/01/43 | | | 155,175 | | | | 148,757 | | |

4.000%, 07/13/53,

TBA (c) | | | 3,050,000 | | | | 2,861,758 | | |

4.500%, 04/01/25 | | | 4,635 | | | | 4,590 | | |

4.500%, 05/25/34 | | | 537,000 | | | | 523,602 | | |

4.500%, 05/01/35 | | | 82,730 | | | | 82,831 | | |

4.500%, 07/01/35 | | | 211,765 | | | | 205,358 | | |

4.500%, 09/01/37 | | | 73,709 | | | | 71,481 | | |

4.500%, 06/01/39 | | | 79,419 | | | | 78,811 | | |

4.500%, 04/01/41 | | | 660,529 | | | | 655,438 | | |

4.500%, 07/01/41 | | | 445,957 | | | | 440,060 | | |

4.500%, 07/01/47 | | | 188,578 | | | | 185,443 | | |

4.500%, 08/01/52 | | | 5,939,500 | | | | 5,709,494 | | |

4.500%, 07/13/53,

TBA (c) | | | 4,225,000 | | | | 4,061,281 | | |

5.000%, 07/01/23 | | | 14 | | | | 14 | | |

5.000%, 11/01/33 | | | 89,348 | | | | 90,427 | | |

5.000%, 03/01/34 | | | 71,138 | | | | 72,123 | | |

5.000%, 05/01/34 | | | 14,644 | | | | 14,549 | | |

5.000%, 12/01/34 | | | 83,480 | | | | 84,486 | | |

5.000%, 07/01/35 | | | 76,773 | | | | 77,393 | | |

5.000%, 08/01/35 | | | 32,714 | | | | 33,149 | | |

5.000%, 03/01/38 | | | 32,050 | | | | 32,338 | | |

5.000%, 04/01/38 | | | 65,407 | | | | 66,104 | | |

5.000%, 06/01/39 | | | 56,690 | | | | 57,293 | | |

5.000%, 12/01/39 | | | 202,070 | | | | 204,212 | | |

5.000%, 06/01/40 | | | 25,924 | | | | 26,160 | | |

5.000%, 04/01/41 | | | 203,384 | | | | 204,446 | | |

5.000%, 07/13/53,

TBA (c) | | | 15,000,000 | | | | 14,700,000 | | |

5.500%, 08/01/23 | | | 52 | | | | 52 | | |

5.500%, 02/01/24 | | | 1,753 | | | | 1,751 | | |

5.500%, 04/01/33 | | | 314,109 | | | | 320,607 | | |

5.500%, 05/01/33 | | | 4,212 | | | | 4,290 | | |

5.500%, 12/01/33 | | | 32,057 | | | | 32,718 | | |

5.500%, 01/01/34 | | | 60,790 | | | | 61,913 | | |

5.500%, 02/01/34 | | | 70,325 | | | | 72,411 | | |

5.500%, 03/01/34 | | | 108,526 | | | | 110,302 | | |

5.500%, 04/01/34 | | | 53,178 | | | | 54,261 | | |

5.500%, 05/01/34 | | | 1,772 | | | | 1,826 | | |

5.500%, 09/01/34 | | | 76,924 | | | | 79,301 | | |

5.500%, 10/01/34 | | | 23,220 | | | | 23,937 | | |

5.500%, 01/01/35 | | | 40,010 | | | | 40,527 | | |

5.500%, 02/01/35 | | | 125,841 | | | | 129,021 | | |

5.500%, 04/01/35 | | | 94,396 | | | | 96,464 | | |

5.500%, 06/01/35 | | | 6,516 | | | | 6,634 | | |

5.500%, 08/01/35 | | | 62,120 | | | | 63,260 | | |

5.500%, 10/01/35 | | | 128,717 | | | | 130,992 | | |

5.500%, 11/01/35 | | | 28,334 | | | | 28,866 | | |

5.500%, 09/01/36 | | | 56,569 | | | | 57,560 | | |

5.500%, 12/01/39 | | | 33,932 | | | | 35,257 | | |

| | | Principal | | Value(a) | |

5.500%, 07/13/53,

TBA (c) | | $ | 6,375,000 | | | $ | 6,346,113 | | |