SECOND QUARTER REPORT

MANAGEMENT DISCUSSION & ANALYSIS OF FINANCIAL STATEMENTS

For The Six Months Ended

June 30, 2013

Date of Report – September 5, 2013

S A M E X M I N I N G C O R P.

SAMEX MINING CORP. 2001 Kirby drive, Suite 1107 Houston, TX 77019 | TEL: 713.956.5200 (x102) FAX: 713.513.5322 EMAIL: 2samex@samex.com | WEB: www.samex.com TRADING SYMBOLS: SXG - TSX Venture Exch. SMXMF - OTCQB |

S A M E X M I N I N G C O R P.

SECOND QUARTER 2013 Drilling At El Gringo Project - Los Zorros Property, Chile Exploration and Evaluation Asset Costs - $1,754,207 Mineral Interest Administration and Investigation Costs - $121,516 |

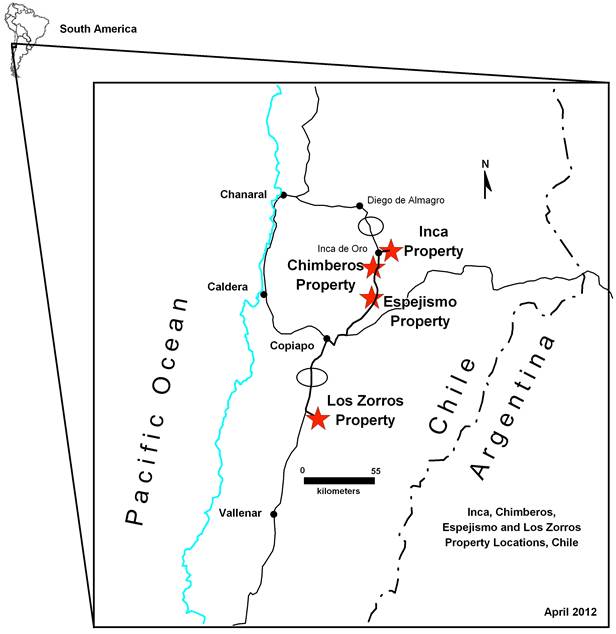

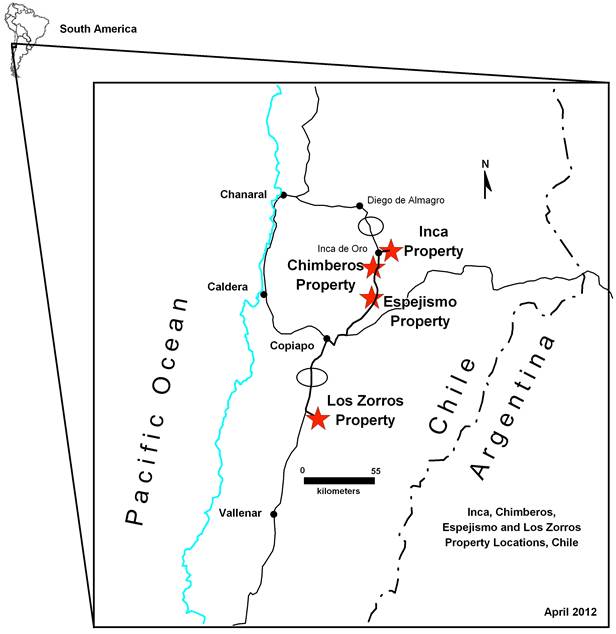

SAMEX MINERAL EXPLORATION PROPERTIES IN CHILE

| LOS ZORROS PROPERTY - Copper, Gold, Silver Prospects |

| CHIMBEROS PROPERTY - Copper, Gold, Silver Prospects |

| INCA PROPERTY - Copper, Gold, Molybdenum Prospects |

| ESPEJISMO PROPERTY - Gold Prospects |

Website -www.samex.com

SAMEX trades in Canada on the TSX Venture Exchange - symbol:SXG

SAMEX is quoted in the United States on the OTCQB - symbol:SMXMF

MANAGEMENT DISCUSSION

DATE: September 5, 2013

SAMEX Mining Corp. is a junior resource company engaged in the acquisition and exploration of mineral properties in South America, particularly in the country of Chile. The Company focuses its exploration activities on the search for deposits of precious and base metals. In Chile, the Company holds an interest in the Los Zorros district copper-gold-silver prospects, the Chimberos copper-gold-silver prospects, the Inca copper-gold-molybdenum prospects, and the Espejismo gold prospects. See the section in this report titled “Mineral Property Summaries” for individual property details.

We are an exploration stage company and have no mineral producing properties at this time. All of our properties are exploration projects, and we receive no revenues from production. All work presently planned by us is directed at defining mineralization and increasing our understanding of the characteristics and economics of that mineralization. There is no assurance that a commercially viable ore deposit exists in any of our properties until further exploration work is conducted and a comprehensive evaluation based upon unit cost, grade, recoveries and other factors conclude economic feasibility.

The Company carries out all normal procedures to obtain title and makes a conscientious search of mining records to confirm that the Company has satisfactory title to the properties it has acquired by staking, purchase or option, and/or that satisfactory title is held by the optionor/owner of properties the Company may acquire pursuant to an option agreement, and/or that satisfactory title is held by the owner of properties in which the Company has earned a percentage interest in the property pursuant to a joint venture or other type of agreement. However, the possibility exists that title to one or more of the concessions held by the Company, or an optionor/owner, or the owner of properties in which the Company has earned a percentage interest, might be defective for various reasons. The Company will take all reasonable steps to perfect title to any particular concession(s) found to be in question.

SAMEX is a reporting issuer in British Columbia and Alberta and trades in Canada on the TSX Venture Exchange under the symbolSXG. News releases can be viewed on the Company’s website at www.samex.com or at www.sedar.com. The Company is also quoted in the United States on the OTCQB under the symbolSMXMF.

This discussion contains forward-looking statements, the accuracy of which involves risks and uncertainties and our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including, but not limited to, those risk factors described elsewhere in this report. See note “Forward Looking Statements” at end of this report.

OVERVIEW OF RESULTS FOR THE SIX MONTHS ENDED JUNE 30, 2013

The following section contains a summary of our operating results for the six months ended June 30, 2013, which is qualified by detailed descriptions that follow elsewhere in this document. This section also contains a number of ‘forward looking statements’ which, although intended to be accurate, may be affected by a number of risks and uncertainties that may cause them to be materially different from actual outcomes. See “Forward Looking Statements” at the end of this report.

As a junior exploration company, our operations are significantly affected by a number of external factors, particularly those that affect the price of the commodities we explore for or those that affect the market for our securities. During 2012 and into 2013, the global economy was still experiencing the after-shocks of the 2008-2009 financial crisis and ensuing recession, as well as the impact of measures taken to counteract its effects. In response to the crises, many governments engaged in broad economic stimulus activities and expansionist monetary policies, resulting in large fiscal deficits and unprecedented levels of government debt and slow or negative growth and persistent high levels of unemployment. These and other factors gave rise to mounting concern over the possibility of sovereign debt default and a systemic financial failure in the Euro-zone resulting in broader financial contagion. In addition, new concerns began to develop over the appearance of asset bubbles, and a general slowdown in China and other developing economies. Although the United States and certain other countries began to show signs of moderate growth during 2012, and the Euro-zone successfully avoided or contained its most serious financial threats, these concerns and the underlying financial conditions that gave rise to them, persisted throughout 2012 and into 2013, although in a more muted form.

In light of, and likely in response to these and other factors, the price of gold, which rose to over $1,900/oz. during 2011, before dropping back to $1,700 range, continued to rise somewhat during 2012, although with considerable volatility. The price of silver, which rose to over $48 in 2011, ending the year around $30, rose slightly during 2012, although, again, with considerable volatility. Although, the market for shares of junior precious metal explorers also improved briefly with the increase in precious metal prices, the market for the shares of junior exploration companies declined significantly in 2012, making it much more difficult for companies to raise capital for exploration. Prior to the second quarter of 2013 this did not have a direct effect on the Company since we had sufficient funds to cover our general operations and exploration programs, however, it significantly impacts our future operations since we are dependent upon our ability to access capital markets in order to fund our general operations and exploration programs. In April 2013, gold and silver experienced a dramatic price drop over a two week period that resulted in a negative outlook for junior exploration companies such as ours that will make it difficult for us to raise equity capital in the immediate short term and possibly longer should the market for precious and other metals continue to remain volatile. Therefore additional capital may not be available on terms acceptable to us or at all.

During the second quarter, "Exploration And Evaluation Assets" costs totaled $1,754,207and "Mineral Interests Administration And Investigation" expenses totaled $121,516 for the three months ended June 30, 2013.

Los Zorros Property, Chile - During the second quarter of 2013, the Company continued exploration in the El Gringo area of the Los Zorros Property. Exploration during the second quarter included bulldozer work to construct drill access roads and drill pads and approximately 2,949 meters of core drilling in nine drill holes. For further information concerning the El Gringo area please see www.samex.com for News Release No. 2-13 dated January 31, 2013, "Samex Prepares Drilling Program At El Gringo Copper And Gold Prospect - Los Zorros, Chile"; and News Release No. 3-13 dated February 27, 2013, "Samex Expands El Gringo Drill Program And Provides Chimberos Update"; News Release No. 5-13 dated March 27, 2013, "SAMEX Reports Encouraging Preliminary Results At El Gringo And Further Expands Drill Program"; and News Release No.6-13 dated May 30, 2013, "Samex Makes Multiple Copper-Gold-Silver Intercepts & Further Defines Target At El Gringo". Drill holes and assays subsequent to the May 30th news release did not encounter any significant mineralization. As reported by the Company in News Release No. 7-13 dated August 21, 2013, subsequent to the second quarter of 2013, the Company consulted with several geological advisors and determined that the most recently received drill assays did not improve from the results announced on May 30, 2013. Irrespective of these efforts, the Company no longer has the capacity to continue independent exploration at its El Gringo Project and management has made the decision to halt exploration and explore strategic alternatives.

The Los Zorros Property in Chile covers a district of about 80 square kilometers with numerous scattered small mines and prospects where there was sporadic attempts at small-scale production for copper, gold and silver in the past. The exploration objective at Los Zorros is to explore for copper, gold and silver beneath the widespread mineral occurrences in this district of historic small mining activity. Of particular significance, all acquisition payments have now been made on our extensive accumulated land holdings at Los Zorros. For further property details, see "Los Zorros Property" in the "Mineral Property Summaries" section of this MD&A report or see news releases concerning the Los Zorros Property at www.samex.com.

INCA Property - Buy-out Of NSR Royalty Completed During Second Quarter - Pursuant to a royalty purchase contract dated August 20, 2012, the Company has completed the buy-out of the 1% NSR royalty on the Providencia Mine concessions (which comprise a portion of the INCA Property) for the Chilean peso equivalent of US$50,000 by making 10 monthly payments as follows: US$5,000 on August 31, 2012 (paid); US$5,000 on October 4, 2012 (paid); US$5,000 on November 4, 2012 (paid); US$5,000 on December 4, 2012 (paid); US$5,000 on January 4, 2013 (paid); US$5,000 on February 4, 2013 (paid); US$5,000 on March 4, 2013 (paid); US$5,000 on April 4, 2013 (paid); US$5,000 on May 4, 2013 (paid); and US$5,000 on June 4, 2013 (paid).

Bolivian Properties Written Off and Wind-up Of Bolivian Subsidiaries - Subsequent to the end of the 2012 fiscal year, we decided to abandon and write-off our Bolivian properties (Santa Isabel, Eskapa, El Desierto) and to close our remaining Bolivian operations. Back in the year 2009, we had decided to temporarily suspend exploration activities in Bolivia and put the Bolivian properties on “care and maintenance” status due to what we viewed as a deteriorating political climate for resource companies. This conclusion was re-enforced by a number of events such as the nationalization of Bolivia’s natural gas resources, a moratorium on the grant of new mineral exploration licenses, and a national referendum that resulted in constitutional changes and requirements that all mining projects be conducted only in partnership with the state mining company – on economically unfavorable terms. Since that time, due to the inactivity on the Bolivian properties, each subsequent year we have written down the property interest for the Eskapa, El Desierto and Santa Isabel properties to a nominal value of $1,000 each. Subsequent to the year ended December 31, 2012, we decided to abandon our Bolivian operations and let the Bolivian properties lapse by not paying the annual patents. As a result of this decision, all of the Bolivian exploration and evaluation assets (total of $3,802) related to the Eskapa, El Desierto and Santa Isabel properties were written-off at December 31, 2012. Subsequent to the second quarter we are completing the process of winding up and closing our Bolivian subsidiaries (Samex S.A., Emibol S.A. and Bolivex S.A.) and the disposition of the related subsidiaries (South American Mining & Exploration Corp. and Samex International Ltd.), leaving us with Minera Samex Chile S.A. as our sole remaining subsidiary.

Sale of Gold and Silver Bullion Holdings - During the first quarter of 2013, the Company sold all of its gold and silver bullion holdings and we do not currently hold any gold and silver bullion.

Geologic Consulting Agreement with Toro Taylor - Our subsidiary Minera Samex Chile S.A. (“Samex Chile”) entered into an agreement dated January 16, 2013 with Toro Taylor Y Compañia Limitada (“ETT”), a company owned or controlled by our Chief Geologist, Juan Carlos Toro Taylor. Under the terms of the Agreement, ETT agreed to conduct certain exploration activities on the Company’s Chilean projects including in particular at least 1,200 meters of drilling. Samex Chile is required to pay compensation of US$40,000 per month to cover the cost of ETT consultants (including the sum of US$14,000 per month payable as compensation for Juan Carlos Toro Taylor) plus expenses and an administrative fee of 10% of exploration and travel expenses, excluding ETT consultant compensation. The term of the agreement was originally for three (3) months expiring April 17, 2013, however, the parties amended the agreement to extend the term for a further two months.

Trends and Financing - Over the past several years, we have experienced a number of important external changes in the market place that had an affect on our overall performance. In the latter part of 2008, we found ourselves in the middle of a global economic crisis, with its actual or threatened bank failures, major international liquidity issues, and a general slowdown leading to a global recession. Shortly thereafter, commodity prices, particularly the price of copper, began a serious decline, eventually falling to a five year low, along with the price of gold and silver. Along with this, the share prices of most public companies including in particular junior resource stocks such as ours, fell to new lows, which greatly reduced our ability to raise capital. Although precious metal prices rebounded to trade at new highs, with considerable volatility, the market for the shares of junior explorers, after a brief improvement early in 2011, has significantly declined, making our ability to access capital to fund mineral exploration projects considerably more difficult. Also, although the global economy has now largely recovered from the primary effects of the global financial crisis, many countries - particularly the US and Euro-zone countries - are still experiencing slow growth, high unemployment and other economic stresses, which in turn may continue to depress general investor sentiment and their levels of risk tolerance, and thus the market for junior explorers. We anticipate that, due to prevailing global economic imbalances and other continuing economic conditions, gold and silver prices will be volatileand could rapidly reach much higher levels in response to economic shocks or other triggering events, should they occur. While such events could indirectly result in higher share prices for junior gold and silver explorers, we cannot accurately predict the timing of such events or their actual effect on our ability to raise capital.

Accounts Payable and Accrued Liabilities - At June 30, 2013, our subsidiary, Minera Samex Chile S.A. had incurred significant accounts payable and accrued liabilities related to exploration during the second quarter involving bulldozer work, assaying and drilling at the El Gringo area of the Los Zorros Property, and also including $137,859 of accrued payroll liabilities for employees in Chile.

Plans and Projections – Based on current assets at the date of this report, we require additional capital in order for the Company to continue general operations and exploration programs. As reported by the Company in News Release No. 7-13 dated August 21, 2013, subsequent to the second quarter of 2013, the Company consulted with several geological advisors and determined that the most recently received drill assays from El Gringo did not improve from the results announced on May 30, 2013. Irrespective of these efforts, the Company no longer has the capacity to continue independent exploration at its El Gringo Project and management has made the decision to halt exploration and explore strategic alternatives.

SAMEX has entered into discussions with multiple parties to identify and evaluate strategic alternatives. Strategic alternatives may include, but are not limited to: joint venturing or selling existing land concessions, optioning properties in other jurisdictions, or transitioning the company to a different segment of the mining industry. The Company cautions that while it is in the process of evaluating strategic alternatives, there are no assurances or guarantees that the pursuit of a strategic alternative will be successful. See “Liquidity and Capital Resources” and “Anticipated Capital Requirements”. See note “Forward Looking Statements” at the end of this report.

ANALYSIS OF FINANCIAL STATEMENTS

International Financial Reporting Standards - The consolidated financial statements of the Company for the six months ended June 30, 2013 are reported under International Financial Reporting Standards ("IFRS"). Our consolidated financial statements have been prepared in Canadian dollars and in accordance with IFRS which differ in significant respects from accounting principles generally accepted in Canadian GAAP and from accounting principles generally accepted in the United States ("U.S. GAAP"). As such, this discussion of our financial condition and results of operations is based on the results prepared in accordance with IFRS.

During the year ended December 31, 2012, management concluded that the functional currency of Minera Samex Chile S.A. is the Chilean Peso and not the Canadian dollar as it was previously designated to be, and accounted for this accordingly in its annual consolidated financial statements for the year ended December 31, 2012. In consideration of the effects of the difference in foreign exchange translation to reflect the Chilean Peso being identified as the functional currency of Minera Samex Chile S.A. and so that the amounts reported in the interim consolidated financial statements are comparable, the interim consolidated statements of comprehensive loss, shareholders' equity and cash flows for the three/six month period ended June 30, 2012 have been restated to reflect the Chilean peso as the functional currency of Minera Samex Chile S.A. See Note 9 "Restatement" to the interim consolidated financial statements for the six months ended June 30, 2013.

The following discussion of our operating results explains material changes in our consolidated results of operations for the three/six months ended June 30, 2013. The discussion should be read in conjunction with the Company's interim consolidated financial statements for the six months ended June 30, 2013 and the related notes included in this report. Management’s discussion and analysis of our operating results in this section is qualified in its entirety by, and should be read in conjunction with, the interim consolidated financial statements and notes thereto and also in conjunction with the Company's audited annual consolidated financial statements for the year ended December 31, 2012. This discussion contains forward-looking statements, the accuracy of which involves risks and uncertainties and our actual results could differ materially from those anticipated in the forward-looking statements for many reasons, including, but not limited to, those risk factors described elsewhere in this report.

Overview - Our business is exploration for minerals. We do not have any properties that are in production. We have no earnings and, therefore, finance these exploration activities by the sale of our equity securities or through joint ventures with other mineral exploration companies. The key determinants of our operating results include the following:

| a) | our ability to identify and acquire quality mineral exploration properties on favorable terms; |

| b) | the cost of our exploration activities; |

| c) | our ability to finance our exploration activities and general operations; |

| d) | our ability to identify and exploit commercial deposits of mineralization; and |

| e) | the write-down and abandonment of mineral properties as exploration results provide further information relating to the underlying value of such properties. |

These determinates are affected by a number of factors, most of which are largely out of our control, including the following:

| a) | the competitive demand for quality mineral exploration properties; |

| b) | political and regulatory climate in countries where properties of interest are located; |

| c) | regulatory and other costs associated with maintaining our operations as a public company; |

| d) | the costs associated with exploration activities; and |

| e) | the cost of acquiring and maintaining our mineral properties. |

Our primary capital and liquidity requirements relate to our ability to secure funds, principally through the sale of our securities, to raise sufficient capital to maintain our operations and fund our efforts to acquire mineral properties with attractive exploration targets and conduct successful exploration programs on them. We anticipate this requirement will continue until such time as we have either discovered sufficient mineralization on one or more properties with sufficient grade, tonnage and type to support the commencement of sustained profitable mining operations and are thereafter able to place such property or properties into commercial production or until we have obtained sufficient positive exploration results on one or more of our properties to enable us to successfully negotiate a joint venture with a mining company with greater financial resources than us or some other suitable arrangement sufficient to fund our operations.

Our success in raising equity capital is dependent upon factors which are largely out of our control including:

| a) | market prices for gold, silver, copper and other metals and minerals; |

| b) | the market for our securities; and |

| c) | the results from our exploration activities. |

Significant factors affecting our operations over the past several years include the instability in the global financial situation and the related volatility in the demand for, and in the prices of precious and base metals. During 2012, lingering effects of the 2008-2009 financial crisis and government responses to it - including high levels of government debt, adoption of expansionist monetary policies, Eurozone instability, and a growing sovereign debt crisis - contributed to a significant increase in the demand for, and in the price of, gold and silver (although with considerable volatility). However, in April 2013, gold and silver experienced a dramatic price drop over a two week period that resulted in a negative outlook for junior exploration companies such as ours that will make it difficult for us to raise equity capital in the immediate short term and possibly longer should the market for precious and other metals continue to remain volatile. We anticipate that, due to prevailing global economic imbalances and other continuing economic conditions, gold and silver prices will be volatileand could rapidly reach much higher levels in response to economic shocks or other triggering events, should they occur. While such events could indirectly result in higher share prices for junior gold and silver explorers, we cannot accurately predict the timing of such events or their actual effect on our ability to raise capital. Metal prices cannot be predicted with accuracy and our plans will be largely dependent upon the timing and outcome of metal markets, particularly the price of gold, silver and copper which is entirely outside of our control. We also anticipate that our operating results would be significantly affected by the results of our exploration activities on our existing properties. See note titled “Forward Looking Statements” at the end of this report.

Currency Risk - Currency exchange rate fluctuations could adversely affect our operations. The parent Company's functional currency is the Canadian Dollar and the functional currency of the Company's subsidiary, Minera Samex Chile S.A., is the Chilean Peso. We have obligations and commitments in Canadian Dollars, Chilean Pesos and United States Dollars. Fluctuations in foreign currency exchange rates may affect our results of operations and the value of our foreign assets, which in turn may adversely affect reported financial figures and the comparability of period-to-period results of operations.

Accounting Policies - We have adopted a number of accounting policies and made a number of assumptions and estimates in preparing our financial reporting, which are described in Note 2 to our consolidated financial statements for the year ended December 31, 2012. We have prepared the interim consolidated financial statements for the six months ended June 30, 2013 using the same accounting policies and critical accounting estimates we applied in our audited annual consolidated financial statements for the year ended December 31, 2012. These policies, assumptions and estimates significantly affect how our historical financial performance is reported and also your ability to assess our future financial results. In addition, there are a number of factors which may indicate our historical financial results, but will not be predictive of anticipated future results. You should carefully review the following disclosure, together with the attached consolidated financial statements and the notes thereto, and also in conjunction with the Company's audited annual consolidated financial statements for the year ended December 31, 2012.

Going Concern Assumptions - Our consolidated financial statements have been prepared on the assumption that we will continue as a going concern, meaning that we will continue in operation for the foreseeable future and will be able to realize assets and discharge our liabilities in the ordinary course of operations. We do not have any mineral properties in production, and have not yet generated any revenues and have a history of losses. Our continuation as a going concern is uncertain and dependent on our ability to discover commercial mineral deposits on our properties and place them into profitable commercial production and our ability to sustain our operations until such time. However, based on current assets at the date of this report, we require additional capital in order for the Company to continue general operations and exploration programs. The Company no longer has the capacity to continue independent exploration and management has made the decision to halt exploration and explore strategic alternatives. SAMEX has entered into discussions with multiple parties to identify and evaluate strategic alternatives. Strategic alternatives may include, but are not limited to: joint venturing or selling existing land concessions, optioning properties in other jurisdictions, or transitioning the company to a different segment of the mining industry. The Company cautions that while it is in the process of evaluating strategic alternatives, there are no assurances or guarantees that the pursuit of a strategic alternative will be successful. See note “Forward Looking Statements” at the end of this report.

Selected Annual Information & Summary of Quarterly Results

| Selected Annual Information (reported under IFRS) | Year Ended December 31, 2012 | Year Ended December 31, 2011* | Year Ended December 31, 2010 |

| | | | |

| Revenue | $ | - | $ | - | $ | - |

| Loss from operations | 1,866,307 | 4,142,106 | 1,163,026 |

| Net loss for the year | 1,446,975 | 3,708,873 | 1,091,350 |

| Comprehensive loss for the year | 761,555 | 4,852,872 | 1,330,323 |

| Net loss per share | (0.02) | (0.03) | (0.01) |

| Total assets | 21,772,354 | 22,397,380 | 19,116,519 |

| Long-term liabilities | - | - | - |

* See Note 13 "Restatement" to audited annual consolidated financial statements for the year ended December 31, 2012.

Quarterly Results | Jun 30, 2013 | Mar 31, 2013 | Dec 31, 2012 | Sep 30, 2012 | Jun 30, 2012* | Mar 31, 2012* | Dec 31, 2011 | Sep 30, 2011 |

| Revenue $ | - | - | - | - | - | - | - | - |

| Net (earnings) loss $ | 560,159 | 1,734,114 | 713,688 | 117,482 | 690,998 | (109,368) | 856,284 | (74,635) |

| Comprehensive (earnings) loss $ | 915,578 | 1,365,193 | 28,268 | 117,482 | 231,913 | (530,786) | 2,000,283 | (74,635) |

| Net (earnings) loss /share $ | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | (0.01) | 0.01 | (0.01) |

* See Note 9 "Restatement" to interim consolidated financial statements for the six months ended June 30, 2013.

The loss for the second quarter ended June 30, 2011 includes a stock-based compensation expense of $2,494,291 in relation to stock options granted to consultants, employees, directors and officers on 1,950,000 shares at $1.50 per share. The loss for the fourth quarter ended December 31, 2011 includes year-end adjustments. In some quarters, losses from operations are offset by gains in the fair value of gold and silver bullion held by the Company. The loss for the second quarter ended June 30, 2012 includes a loss of $301,240 in the fair value of the gold and silver bullion holdings. The loss for the third quarter ended September 30, 2012 was offset by a gain of $310,945 in the fair value of the Company's gold and silver bullion holdings. The loss for the fourth quarter ended December 31, 2012 includes an impairment of exploration and evaluation assets totaling $215,450, and a loss of $84,665 on the changes in fair value of the gold and silver bullion holdings. The loss for the first quarter ended March 31, 2013 includes severance totaling $1,341,734 paid to employees and a consultant of the Company that were terminated pursuant to the change in management effected January 15, 2013 and also includes a stock-based compensation expense of $87,126 in relation to stock options granted to three new directors on 750,000 shares at $0.14 per share. The loss for the second quarter ended June 30, 2013 includes $137,859 of accrued payroll liabilities for employees in Chile.

Operating Results

Los Zorros Property - During the second quarter of 2013, the Company continued exploration in the El Gringo area of the Los Zorros Property. Exploration during the second quarter included bulldozer work to construct drill access roads and drill pads and approximately 2,949 meters of core drilling in nine drill holes.

For the three months ended June 30, 2013, "Exploration And Evaluation Assets" costs totaled $1,754,207and "Mineral Interests Administration And Investigation" expenses totaled $121,516. Our assets categorized in the Consolidated Statements Of Financial Position as “Exploration And Evaluation Assets" were $20,567,314 at June 30, 2013 ($18,139,082 at December 31, 2012).

Current Assets at June 30, 2013 totaled $153,072 ($3,531,045 at December 31, 2012). The Company's Total Assets were $20,810,116 at June 30, 2013 ($21,772,354 at December 31, 2012). At June 30, 2013, our subsidiary, Minera Samex Chile S.A. had incurred significant accounts payable and accrued liabilities related to exploration during the second quarter involving bulldozer work, assaying and drilling at the El Gringo area of the Los Zorros Property, and also including $137,859 of accrued payroll liabilities for employees in Chile.

The following comments relate to categories in the interim consolidated financial statements for the six months ended June 30, 2012:

Statements of Financial Position

“Gold and Silver Bullion” - During the first quarter of 2013 the Company sold all of its gold and silver bullion holdings for proceeds of $651,753. The Company recognized a gain of $9,063 in fair value of its gold and silver bullion for the three months ended March 31, 2013. We do not currently hold any gold and silver bullion.

"Accounts Payable and Accrued Liabilities" - related to our subsidiary, Minera Samex Chile S.A. which incurred significant accounts payable and accrued liabilities related to exploration during the second quarter involving bulldozer work, assaying and drilling at the El Gringo area of the Los Zorros Property, and also including $137,859 of accrued payroll liabilities for employees in Chile.

Consolidated Statements of Comprehensive Loss

"Consulting Fees" - includes director's fees totaling US$15,000 paid to three directors for serving in their capacity as directors from April 1 to June 30, 2013; also includes consultant fees of US$30,000 in aggregate paid to consultants serving as assistants to the Interim Chief Executive Officer of the Company; also includes consultant fees of $45,372 in aggregate paid to consultants, Larry McLean, Interim CFO, and Brenda McLean, Interim Corporate Secretary.

“Mineral Interests Administration and Investigation Costs” - are expensed as incurred and are not capitalized to exploration and evaluation assets and include operating costs related to the Company’s activities that are not allocated to one of the Company’s specific mineral properties, and generative exploration or investigating and evaluating mineral properties not acquired by the Company.

“Office and Miscellaneous” - includes rent and utilities for the Canadian corporate office, book-keeping/accounting, office supplies, telephone, postage, courier, etc.

“Professional Fees” – includes legal fees for corporate counsel in Canada and South America. Also includes US$78,429 paid to Sasco Partners, LP, an investment fund controlled by Sasan Sadeghpour, our Interim Chief Executive Officer, Chairman and director, as reimbursement of legal fees incurred by Sasco during and prior to negotiation of the settlement agreement dated September 10, 2012, but not covered by the agreement.

"Salaries and Benefits" - $137,859 for three month period ended June 30, 2013 is accrued payroll liabilities for employees in Chile. The amount for the six month period ended June 30, 2013 includes severance totaling $1,341,734 that was paid during the first quarter of 2013 to employees and a consultant of the Company that were terminated pursuant to the change in management effected January 15, 2013.

"Other Comprehensive (Earnings) Loss" - "Translation (Gain) Loss" - $355,419 related to foreign exchange translation.

Note 4. Exploration and Evaluation Assets

"Geology mapping, surveys - stock-based compensation" - during the second quarter, the Company granted a stock option to a geologic consultant working on the Los Zorros Property on 300,000 shares at $0.16 per share with a fair value on the grant date of $39,933.

Liquidity and Capital Resources - We are an exploration company and do not have any mineral properties in production and, therefore, did not generate any revenue from operations during the three months ended June 30, 2013. During the three months ended June 30, 2013 we realized a loss from operations of $560,159, a comprehensive loss of $915,578, and a loss of $0.01 per share (for the three months ended June 30, 2012 we realized a loss from operations of $389,758, a comprehensive loss of $231,913, and a loss of $0.01 per share). Losses are a reflection of our ongoing expenditures on our mineral property exploration and evaluation assets which are all currently in the exploration stage. Since we have no source of operating revenues, no lines of credit and no current sources of external liquidity, our ability to continue as a going concern is dependent upon our ability to raise additional financing in the future to meet our working capital and on-going cash requirements. Based on current assets at the date of this report, we require additional capital in order for the Company to continue general operations and exploration programs. The Company no longer has the capacity to continue independent exploration and management has made the decision to halt exploration and explore strategic alternatives. SAMEX has entered into discussions with multiple parties to identify and evaluate strategic alternatives. Strategic alternatives may include, but are not limited to: joint venturing or selling existing land concessions, optioning properties in other jurisdictions, or transitioning the company to a different segment of the mining industry. The Company cautions that while it is in the process of evaluating strategic alternatives, there are no assurances or guarantees that the pursuit of a strategic alternative will be successful. See “Anticipated Capital Requirements”. See note “Forward Looking Statements” at the end of this report.

Financing - In the past, we have relied in large part on our ability to raise capital from the sale of our securities to fund the acquisition and exploration of our mineral properties. 2010/2011 saw a significant increase in the demand for, and in the price of, gold and silver, and an improved market and price for shares of companies focused on precious metals. These trends during 2010/2011 improved our ability to raise capital at higher prices, on more favourable terms, and in greater amounts than in previous years. During fiscal 2010 we raised a total of $10,162,060 from two private placement at a price of $0.30 per unit and at $0.50 per unit and from the exercise of warrants as follows: during the first quarter ended March 31, 2010, the Company received proceeds of $177,000 from the exercise of warrants for the purchase of 885,000 shares at $0.20 per share. During the second quarter ended June 30, 2010 the Company received proceeds of $10,000 from the exercise of warrants for the purchase of 50,000 shares at $0.20 per share. During the third quarter ended September 30, 2010, the Company completed a private placement of 3,647,334 units at a price of $0.30 per unit for gross proceeds of $1,094,200 and received proceeds of $20,000 from the exercise of warrants for the purchase of 100,000 shares at $0.20 per share. During the fourth quarter ended December 31, 2010, the Company completed a private placement of 17,583,720 units at a price of $0.50 per unit for proceeds of $8,791,860 and received proceeds of $69,000 from the exercise of warrants for the purchase of 345,000 shares at $0.20 per share.

During fiscal 2011, we raised proceeds of $4,675,500 from the exercise of warrants and proceeds of $60,000 from the exercise of stock options as follows: during the first quarter ended March 31, 2011, the Company received proceeds of $1,784,550 from the exercise of warrants for the purchase of 195,000 shares at $0.20 per share, 500,000 shares at $0.30 per share, 750,000 shares at $0.70 per share, and 1,372,500 shares at $0.78 per share. During the second quarter ended June 30, 2011 the Company received proceeds of $2,800,950 from the exercise of warrants and $20,000 from the exercise of an option. During the third quarter ended September 30, 2011, the Company received proceeds of $90,000 from the exercise of warrants for 200,000 shares at $0.20 per share and 50,000 shares at $1.00 per share, and proceeds of $40,000 from the exercise of a stock option to acquire 200,000 shares at $0.20 per share.

During the year ended December 31, 2012 we received proceeds of $5,000 from the exercise of a warrant for the purchase of 25,000 shares at $0.20 per share. We did not raise any funding during the six months ended June 30, 2013.

Use Of Proceeds - In 2010 we completed a private placement in the third quarter and in regulatory filings disclosed that the intended use of the proceeds of $1,094,200 would be $800,000 for expenditures/exploration on our mineral properties and $294,200 for general working capital. This intended use of proceeds was more than satisfied as exploration/mineral interests costs totaled $1,523,911 for the 2010 fiscal year. During the fourth quarter of 2010 we completed a private placement and in regulatory filings disclosed that the intended use of the proceeds of $8,791,860 would be $5,000,000 for expenditures/exploration on our mineral properties and $3,791,860 for general working capital. This intended use of proceeds was satisfied by our exploration/mineral interests costs/expenses as follows:

For the year ended December 31, 2011, our exploration and evaluation assets costs totaled $3,345,249 and mineral interests administration and investigation expenses totaled $287,369. For the year ended December 31, 2012, exploration and evaluation assets costs totaled $5,244,231and mineral interests administration and investigation expenses totaled $387,787. During the three months ended March 31, 2013 our exploration and evaluation assets costs totaled $712,227 and mineral interests administration and investigation expenses totaled $114,665. During the three months ended June 30, 2013 our exploration and evaluation assets costs totaled $1,754,207 and mineral interests administration and investigation expenses totaled $121,516 .

Anticipated Capital Requirements - Based on current assets at the date of this report, we require additional capital in order for the Company to continue general operations and exploration programs. The Company no longer has the capacity to continue independent exploration and management has made the decision to halt exploration and explore strategic alternatives. SAMEX has entered into discussions with multiple parties to identify and evaluate strategic alternatives. Strategic alternatives may include, but are not limited to: joint venturing or selling existing land concessions, optioning properties in other jurisdictions, or transitioning the company to a different segment of the mining industry. The Company cautions that while it is in the process of evaluating strategic alternatives, there are no assurances or guarantees that the pursuit of a strategic alternative will be successful.

Our anticipated cash requirements for the year are primarily comprised of the anticipated costs of conducting exploration programs, our administrative overhead and any obligations listed under the “Table of Contractual Obligations” (see below) and other operating expenses in the normal course of business. See note titled “Forward Looking Statements” at end of this report.

Table of Contractual Obligations - The following table summarizes our contractual obligations at June 30, 2013 and the effect these obligations are expected to have on our liquidity and cash flows in future periods.

| Contractual Obligations | Payment Due By Period |

| | Total | Less than a year | 1-3 Years | 4-5 Years | After 5 Years |

Long-term Debt Obligations | NIL | | | | |

Capital (Finances) Lease Obligations | NIL | | | | |

Operating Lease Obligations | NIL | | | | |

Purchase Obligations Equipment | NIL | | | | |

Other Long-term Liabilities | NIL | | | | |

Total Contractual Obligations and Commitments | NIL | | | | |

Research and Development, patents and licenses, etc. - We are a mineral exploration company and we do not carry on any research and development activities.

Trend Information - We anticipate that the price of gold, silver, and copper will continue to be volatile over the next year due in large part to prevailing global economic imbalances and other continuing economic conditions. Metal prices cannot be predicted with accuracy and our plans will be largely dependent upon the timing and outcome of metal markets, particularly the price of gold, silver and copper which is entirely outside of our control. See note titled “Forward Looking Statements” at the end of this report.

The prices of precious metals and base metals fluctuate widely and are affected by numerous factors beyond our control, including expectations with respect to the rate of inflation, relative strength of the U.S. dollar, Chilean Peso and of other currencies as against the Canadian Dollar, interest rates, and global or regional political or economic crisis. The demand for and supply of precious metals and base metals may affect precious metals and base metals prices but not necessarily in the same manner as supply and demand affect the prices of other commodities. If metal prices are weak, it is more difficult to raise financing for exploration projects. There is no assurance our attempts to attract capital will be successful. Failure to attract sufficient capital may significantly affect our ability to conduct our planned exploration activities. Conversely, when metal prices are strong, competition for possible mineral properties increases as does the corresponding prices for such prospective acquisitions and the cost of drilling and other resources required to conduct exploration activities.

We have followed the policy of, at year end, writing down to nominal value any of our mineral properties on which we have not conducted any significant exploration or acquisition activities during that fiscal year and do not plan to conduct exploration activities within the current year, regardless of our long term view of the prospects of the particular property. Since our future exploration activities are dependent upon a number of uncertainties including our ability to raise the necessary capital (which is in turn affected by external factors such the prices of precious and base metals), we may be required, by application of this accounting policy, to write down other properties now shown as an asset in our consolidated financial statements to nominal value, even though we may intend to conduct future exploration activities on them after the current fiscal period.

Off Balance Sheet Arrangements - At June 30, 2013, we did not have any material off-balance sheet arrangements out of the ordinary course of business.

Disclosure Controls and Procedures - The Chief Executive Officer and Chief Financial Officer of the Company evaluated the effectiveness of the Company’s disclosure controls and procedures as of December 31, 2012 and concluded that as of such date, the Company’s disclosure controls and procedures were adequate and effective to ensure that material information relating to the Company and its consolidated subsidiaries would be made known to them by others within those entities. During the period covered by this report, there were no significant changes in the Company’s internal controls or in other factors that materially adversely affected, or are reasonably likely to materially adversely affect, the Company’s internal control over financial reporting.

Directors And Officers Of The Company During The Three Months Ended June 30, 2013 - Sasan Sadeghpour - Director, Chairman, and Interim Chief Executive Officer; James Pappas - Director; Travis Cocke - Director; Patrick M. Cahill - Director. Interim Officers: Sasan Sadeghpour - Interim Chief Executive Officer; Brenda McLean - Interim Corporate Secretary; Larry McLean - Interim Chief Financial Officer

Audit Committee & Compensation Committee - The Audit Committee is governed by the Company’s Audit Committee Charter. The Audit Committee’s primary function is to review the annual audited financial statements with the Company’s auditor prior to presentation to the Board. The audit committee also reviews the Company’s interim un-audited quarterly financial statements prior to finalization and publication.

The Company's Audit Committee, is composed of Sasan Sadeghpour, Director, Chairman, and Interim Chief Executive Officer, who is not independent, and independent directors, James Pappas, Travis Cocke, and Patrick M. Cahill. Sasan Sadeghpour has been a director of the Company since September 10, 2012 and James Pappas, Travis Cocke, and Patrick M. Cahill were appointed to the Board on January 15, 2013. All four of the Audit Committee members are “financially literate”: Sasan Sadeghpour has financial experience and is the President and Chief Investment Officer of Sasco Investments, LP and has managed hedge fund Sasco Partners, LP since its inception in January 2004; James Pappas is an investment manager and general partner of entities whose principal business is investing in securities. Mr. Pappas received a Bachelor of Business Administration, and a Masters in Finance from Texas A&M University; Travis Cocke has experience as an investment portfolio manager and is managing member for several private investment partnerships with interest in real estate and public equities. Mr. Cocke received a BBA in Finance from Texas A&M University; Patrick M. Cahill, CPA, has experience as a Controller and Chief Financial Officer and is currently an independent consultant assisting companies on financial and operational projects. Mr. Cahill is a graduate of The McCombs School of Business at The University of Texas.

The Compensation Committee's primary function is to assist and advise the Board of Directors with respect to any and all matters relating to the compensation of the executive officers of the Company or other such persons as the Board may request from time to time. The Company's Compensation Committee is composed of independent directors, James Pappas, Travis Cocke, and Patrick M. Cahill.

Related Party Transactions - During the three months ended June 30, 2013, three directors were each paid US$5,000 for serving in their capacity as directors of the Company for the second quarter from April 1 to June 30, 2013. Sasan Sadeghpour, director, Chairman and Interim Chief Executive Officer declined this quarterly director's fee. During the three months ended June 30, 2013, consultant fees totaling $45,372 were paid to consultants, Larry McLean, Interim CFO, and Brenda McLean, Interim Corporate Secretary, in their capacity as interim officers of the Company.

During the three months ended June 30, 2013, the Company paid the sum of US $78,429 to Sasco Partners, LP, an investment fund controlled by Sasan Sadeghpour, our Interim Chief Executive Officer, Chairman and director, as reimbursement of legal fees incurred by Sasco during and prior to negotiation of the settlement agreement dated September 10, 2012, but not covered by the agreement.

Employees – During the three months ended June 30, 2013, we had 19 employees, all of which were in Chile and involved in activities related to our mineral exploration properties in Chile (27 employees during the second quarter of 2012).

Investor Relations – Investor relations during the second quarter of 2013 were handled by Sasan Sadeghpour, Director, Chairman, and Interim Chief Executive Officer of the Company.

Stock Options -Under the Company’s “rolling” Stock Option Plan approved by shareholders and accepted by the TSX Venture Exchange, the Company may reserve up to 10% of its issued and outstanding shares for issuance (less any shares already issued under existing stock options).

During the three months ended June 30, 2013, on April 3, 2013 the Company granted an stock option to a geologic consultant working on the Los Zorros Property on 300,000 shares at $0.16 per share with a fair value on the grant date of $39,933. During the three months ended June 30, 2013 options were cancelled/expired/forfeited on 20,000 shares at $0.85; 50,000 at $0.20; 30,000 at $0.35; and 25,000 at $1.50. There were 10,895,000 outstanding stock options at June 30, 2013.

Subsequent to the second quarter, options were cancelled/expired/forfeited on 90,000 shares at $0.20; 110,000 shares at $0.35; and 200,000 shares at $1.50. At the date of this report, September 5, 2013, options were outstanding to acquire 10,495,000 common shares as shown in the table below. The outstanding options consist of an aggregate of 3,100,000 shares for directors/interim officers; 1,250,000 shares for employees and consultants; and 6,145,000 shares for former directors and a former employee.

| Optionee | Date of Option | # of Shares | Price | Expiry Date |

| James Pappas | March 1, 2013 | 250,000 | $0.14 | March 1, 2018 |

| Travis Cocke | March 1, 2013 | 250,000 | $0.14 | March 1, 2018 |

| Patrick Cahill | March 1, 2013 | 250,000 | $0.14 | March 1, 2018 |

| Juan Carlos Toro Taylor | April 3, 2013 | 300,000 | $0.16 | April 3, 2018 |

Larry McLean | April 20, 2005 May 2, 2006 February 23, 2007 September 4, 2009 May 2, 2011 | 350,000 300,000 250,000 625,000 75,000 | $0.40 $0.85 $0.84 $0.20 $1.50 | April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 |

| Brenda McLean | April 20, 2005 May 2, 2006 February 23, 2007 September 4, 2009 May 2, 2011 | 175,000 150,000 75,000 250,000 100,000 | $0.40 $0.85 $0.84 $0.20 $1.50 | April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 |

| Francisco Vergara | May 2, 2006 September 4, 2009 September 16, 2010 May 2, 2011 | 50,000 150,000 100,000 100,000 | $0.85 $0.20 $0.35 $1.50 | May 2, 2016 September 4, 2019 September 16, 2015 May 2, 2021 |

| Manuel Avalos | May 2, 2006 September 4, 2009 September 16, 2010 May 2, 2011 | 100,000 150,000 150,000 100,000 | $0.85 $0.20 $0.35 $1.50 | May 2, 2016 September 4, 2019 September 16, 2015 May 2, 2021 |

| Jorge Humphreys | May 2, 2006 | 20,000 | $0.85 | May 2, 2016 |

| Jorge Espinoza | May 2, 2006 | 30,000 | $0.85 | May 2, 2016 |

Jeffrey Dahl | April 20, 2005 May 2, 2006 February 23, 2007 September 4, 2009 May 2, 2011 | 350,000 300,000 270,000 625,000 75,000 | $0.40 $0.85 $0.84 $0.20 $1.50 | April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 |

Peter Dahl | April 20, 2005 May 2, 2006 February 23, 2007 September 4, 2009 | 350,000 150,000 150,000 400,000 | $0.40 $0.85 $0.84 $0.20 | April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 |

Robert Kell | April 20, 2005 May 2, 2006 February 23, 2007 September 4, 2009 May 2, 2011 | 350,000 300,000 275,000 625,000 75,000 | $0.40 $0.85 $0.84 $0.20 $1.50 | April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 |

| Allen Leschert | April 20, 2005 May 2, 2006 February 23, 2007 September 4, 2009 May 2, 2011 | 350,000 150,000 150,000 200,000 75,000 | $0.40 $0.85 $0.84 $0.20 $1.50 | April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 April 7, 2015 |

| Malcolm Fraser | January 6, 2011 May 2, 2011 | 200,000 225,000 | $0.70 $1.50 | April 7, 2015 April 7, 2015 |

| Philip Southam | April 20, 2005 May 2, 2006 September 4, 2009 September 16, 2010 May 2, 2011 | 30,000 70,000 150,000 150,000 100,000 | $0.40 $0.85 $0.20 $0.35 $1.50 | August 5, 2014 August 5, 2014 August 5, 2014 August 5, 2014 August 5, 2014 |

| TOTAL OPTIONS | | 10,495,000 | | |

Warrants - During the three months ended June 30, 2013, no warrants were issued or exercised and no warrants expired. There were 22,031,888 warrants outstanding at June 30, 2013.

No Securities Were Issued During The Three Months Ended June 30, 2013

| Outstanding shares at December 31, 2012 -126,733,719 |

| Outstanding shares at June 30, 2013 -126,733,719 |

| Outstanding shares at the date of this report - September 5, 2013 -126,733,719 |

MINERAL PROPERTY SUMMARIES

LOS ZORROS PROPERTY, Chile

The Los Zorros Property in the Atacama region of northern Chile is located approximately 60 kilometers south of the city of Copiapo, Chile. The property is accessed by vehicle by driving approximately 60 kilometers south of the city of Copiapo on the paved, four-lane Pan American Highway (Highway 5) then traveling 5.5 kilometers east on a government maintained dirt road to the western boundary of the property and a further 4 kilometers to the Company’s exploration camp.

The Los Zorros property covers a district of about 80 square kilometers with numerous scattered small mines and prospects where there was sporadic attempts at small-scale production for copper, gold and silver in the past. The exploration objective at Los Zorros is to explore for copper, gold and silver beneath the widespread mineral occurrences in this district of historic small mining activity. The Los Zorros property is a very large, district-sized land holding, only a portion of which has been systematically explored by SAMEX to date. The Company has 100% interest in 67 mineral concessions (approx. 8,690 hectares) acquired by staking, purchase at government auction, purchase agreement, and by two purchase option contracts. Of particular significance, all acquisition payments have been made on these extensive accumulated land holdings at Los Zorros.

Many kilometers of access roads, bulldozer trenches, and a total of 29,434.45 meters of drilling in 65 core drill holes have been completed during various exploration programs conducted by SAMEX between 2004 and 2012 (see details/results in news releases concerning the Los Zorros Property on the SAMEX website at www.samex.com). During 2012, exploration work at Los Zorros included bulldozer work to construct access roads, drill pads and trenches and a total of 11,844 meters of drilling was completed in 21 core drill holes. We also further expanded the Los Zorros camp facilities to accommodate the additional geologists and support workers involved in the exploration and drilling activities.

During 2013 exploration work continued in the El Gringo area of the Los Zorros Property (see www.samex.com for News Release No. 2-13 dated January 31, 2013, "Samex Prepares Drilling Program At El Gringo Copper And Gold Prospect - Los Zorros, Chile" and News Release No. 3-13 dated February 27, 2013, "Samex Expands El Gringo Drill Program And Provides Chimberos Update" and News Release No. 5-13 dated March 27, 2013, "SAMEX Reports Encouraging Preliminary Results At El Gringo And Further Expands Drill Program" and News Release No.6-13 dated May 30, 2013, "Samex Makes Multiple Copper-Gold-Silver Intercepts & Further Defines Target At El Gringo"). Drill holes and assays subsequent to the May 30th news release did not encounter any significant mineralization. As reported by the Company in News Release No. 7-13 dated August 21, 2013, subsequent to the second quarter of 2013, the Company consulted with several geological advisors and determined that the most recently received drill assays did not improve from the results announced on May 30, 2013. Irrespective of these efforts, the Company no longer has the capacity to continue independent exploration at its El Gringo Project and management has made the decision to halt exploration and explore strategic alternatives.

Aravena Option Dropped - Costs Written Off at December 31, 2012 - Under a Unilateral Option Contract dated June 28, 2011 between Cristian Marcelo Aravena Caullan and our subsidiary Minera Samex Chile S. A. ("the Aravena Option"), the Company had an option to acquire 100% interest in additional mineral concessions covering approximately 2,900 hectare adjacent to the Los Zorros property by paying the 2011/2012 patents (paid) and by making option payments totaling the Chilean Peso-equivalent of US$245,345 as follows: US$60,000 upon signing the Option (paid); U.S. $95,345 due January 31, 2012 (paid); and US$90,000 by January 31, 2013. However, subsequent to the year ended December 31, 2012, the Company decided not to exercise the Aravena Option and advised the owner that it would not be making the final option payment of US$90,000 due January 31, 2013. This resulted in an impairment of the Aravena Option costs that had previously been capitalized to the Los Zorros Property and consequently option payment costs and patents costs totaling $201,407 were written off at December 31, 2012.

Los Zorros Property Mineral Interests - The Company’s Chilean subsidiary, Minera Samex Chile, S.A, has 100% interest in 67 exploitation mining concessions (approx. 8,690 hectares) acquired by staking, purchase at government auction, purchase agreement, and by two purchase option contracts. The Company holds a 100% interest in the acquired concessions subject to the terms described below in the Purchase and Sale Agreement with Compania Contractual Minera Ojos del Salado, the Purchase Option Contract with Comercial Sali Hochschild S.A., the Purchase Option Contract with Compania Minera San Estaban Primera S.A., and subject to the Finder’s Fee, Bonus and Royalty described below:

Purchase and Sale Agreement dated January 29, 2003 between our subsidiary, Minera Samex Chile S.A. and Compania Contractual Minera Ojos del Salado - We entered into a purchase agreement dated January 29, 2003, with the vendor, Compania Contractual Minera Ojos del Salado, to acquire approximately 1,429 hectares of mineral concessions covering old goldmines and gold showings in the Los Zorros district for US$50,000 cash (which has been paid). Because of the vendor’s interest in copper, under the purchase agreement, the vendor retained a back-in right to earn an interest in the property in the event that we discover a copper deposit containing not less than two million tonnes of contained equivalent copper on or within a half kilometer of the property. The vendor can elect to exercise the back-in right to earn a 30% interest by reimbursing us three times the expenditures incurred, and up to 51% interest by expending 100% of all further costs necessary to complete a bankable feasibility study on the property. Thereafter, the parties would negotiate a joint venture to carry out development and mining of the property.

Purchase Option Contract dated November 6, 2003, between our subsidiary, Minera Samex Chile S.A. and Compañia Minera y Comercial Sali Hochschild S.A. – In October 2006 we completed the acquisition of mineral concessions covering a 209-hectare-portion of the Los Zorros property (covers portions of the Milagro and Lora areas of the Los Zorros property). Under the Option, SAMEX acquired the concessions by making option payments totaling US$230,000 as follows: US$30,000 upon signing of the Option Agreement (paid); US$50,000 by October 31, 2004 (paid); US$50,000 by October 31, 2005; (paid); US$100,000 by October 31, 2006 (paid). Pursuant to the exercise of the Hochschild option and the related Purchase Contract dated October 27, 2006, SAMEX holds 100% interest in the concessions subject to a Net Smelter Return Royalty of 2% on gold and silver, 1.5% on copper, and 1.5% on other payable minerals, if the US$ price per pound of the mineral is less than US$1 or 2% if the US$ price per pound of the mineral is US$1 or greater. SAMEX has an option to buyout the Royalty at any time for US$1,800,000. Pursuant to the option/purchase agreement, if the concessions were not in production by December 31, 2007, advance royalty payments of US$100,000 per year were required for five years (by February 29, 2008 (paid), by March 1, 2009 (paid), by March 1, 2010 (paid), by March 1, 2011 (paid), and by March 1, 2012 (paid) to a maximum of US$500,000 (paid). The advance royalty payments are recoverable from future royalty payments.

Purchase Option Contract dated June 29, 2005 between our subsidiary, Minera Samex Chile S.A. and Compañia Minera San Estaban Primera S.A. – In December 2006 we completed the acquisition of mineral concessions covering a 95-hectare-portion of the Los Zorros property by making option payments totaling US$200,000 over 18 months as follows: US$75,000 upon signing the Option Agreement (paid); US$25,000 by December 20, 2005 (paid); US$50,000 by March 20, 2006 (paid); and US$50,000 by December 20, 2006 (paid). SAMEX now holds 100% interest in the concessions subject to a Net Smelter Return Royalty of 1.5% on copper, gold, silver, and other payable minerals. SAMEX has an option to buyout the Royalty at any time for US$1,000,000.

Finder’s Fee, Bonus and Royalty - Pursuant to a Consulting Agreement dated September 25, 2002 between SAMEX and Geosupply Servicios de Geologia & Mineria & Sondajes de Diamantina, the concessions in the Los Zorros district are subject to the following finder’s fee, bonus and royalty:

| a) | A finder’s fee of US$10,000 payable within 90 days of commencement of a drilling program on the concessions (which has been paid); |

| b) | A bonus of US$150,000 payable within one year from the date of Commencement of Commercial Production on the concessions; and |

| c) | Net Smelter Return royalty equal to 0.25% of Net Smelter Returns. |

Annual Patent Payments On the Company's Landholdings - In order keep a mining concession valid and in effect, it is necessary to pay an annual license fee (patent). The patent payments must be made in advance during the month of March of each year. Patent fee are calculated based upon the value of the Chilean Monthly Tax Unit (“M.T.U.”) which varies from month to month. In the case of an exploitation concession the annual patent fee is calculated as one-tenth (1/10th) of the Monthly Tax Unit per hectare (for example, in March 2013 the M.T.U. was 40,085 x 1/10th = 4,008.5 Chilean Pesos per hectare which, at the Observed US$/Peso exchange rate of 472 at April 29, 2013 equated to approximately US$8.50 per hectare for exploitation concessions). In the case of an exploration concession the annual patent fee is calculated as one-fiftieth (1/50th) of the Monthly Tax Unit per hectare (for example, in March 2013 the M.T.U. was 40,085 x 1/50th = 801.7 Chilean Pesos per hectare which, at the Observed US$/Peso exchange rate of 472 at April 29, 2013 equated to approximately US$1.70 per hectare for exploration concessions). Should the holder of the concession fail to pay the fee within the designated period, judicial procedures to publicly auction the concession may be instituted.

Sampling, analytical procedures, controls at Los Zorros - Geochemical analyses on samples were performed by ALS Minerals, an independent, internationally recognized and ISO certified laboratory complying with the international standards ISO 9001:2000 and ISO 17025:1999. In preparing drill core samples for analysis, the core is cut or split in half, with one half kept for reference and re-analysis if necessary, while the other half is bagged and sealed as a sample for analysis. To provide quality control, pre-packaged, sealed, certified standard (include low and medium grade copper-gold pulps) and blank pulps are included for analysis by inserted them as samples in random order at approximately 1 per every 30 samples. To ensure chain of custody, the bagged samples for analysis are picked up by an agent of ALS Minerals and transported directly to the ALS Minerals laboratory at Antofagasta or at Coquimbo, Chile.

The Los Zorros Property is without a known body of commercial ore and our activities to date have been exploratory in nature.

CHIMBEROS PROPERTY, Chile

The Chimberos Property is a silver-gold-copper prospect located about 75 kilometers north of the city of Copiapo and situated in the historic Chimberos mining district which was one of Chile’s largest silver producing areas. The property is accessed by vehicle by driving north from Copiapo on a paved, two-lane highway (Highway C-17) to the property which is adjacent to the highway. Part of the property covers much of the core of a complex fissure fault zone which controlled the enriched silver mineralization that was mined in the Buena Esperanza mines at Chimberos. The exploration objective at Chimberos is to explore for copper, gold and silver beneath this historic mining district.

During the fourth quarter of 2012, we completed blasting and bulldozer work to construct access roads and drill pads in preparation for a drilling program at Chimberos. In November, the Company commenced drilling, and by year-end, 2,073 meters of drilling had been completed in six core drill holes. See www.samex.com for News Release N0. 9-12 dated November 5, 2012 "Samex Begins Drilling At Chimberos Silver-Gold-Copper Project, Chile and News Release No. 3-13 dated February 27, 2013, "Samex Expands El Gringo Drill Program And Provides Chimberos Update". Due to the change in geologic personnel in January 2013, a portion of the core drilled by the prior geologic team had not yet been logged, sampled and assayed by the time of this report.

Chimberos Property Mineral Interests - The Company’s Chilean subsidiary, Minera Samex Chile, S.A, has 100% interest in 36 exploitation mining concessions (approx. 2,828 hectares) acquired by staking and purchasing concessions at government auction.

Annual Patent Payments On the Company's Landholdings - In order keep a mining concession valid and in effect, it is necessary to pay an annual license fee (patent). The patent payments must be made in advance during the month of March of each year. Patent fee are calculated based upon the value of the Chilean Monthly Tax Unit (“M.T.U.”) which varies from month to month. In the case of an exploitation concession the annual patent fee is calculated as one-tenth (1/10th) of the Monthly Tax Unit per hectare (for example, in March 2013 the M.T.U. was 40,085 x 1/10th = 4,008.5 Chilean Pesos per hectare which, at the Observed US$/Peso exchange rate of 472 at April 29, 2013 equated to approximately US$8.50 per hectare for exploitation concessions). In the case of an exploration concession the annual patent fee is calculated as one-fiftieth (1/50th) of the Monthly Tax Unit per hectare (for example, in March 2013 the M.T.U. was 40,085 x 1/50th = 801.7 Chilean Pesos per hectare which, at the Observed US$/Peso exchange rate of 472 at April 29, 2013 equated to approximately US$1.70 per hectare for exploration concessions). Should the holder of the concession fail to pay the fee within the designated period, judicial procedures to publicly auction the concession may be instituted.

Sampling, analytical procedures, controls at Chimberos - Geochemical analyses on samples were performed by ALS Minerals, an independent, internationally recognized and ISO certified laboratory complying with the international standards ISO 9001:2000 and ISO 17025:1999. In preparing drill core samples for analysis, the core is cut or split in half, with one half kept for reference and re-analysis if necessary, while the other half is bagged and sealed as a sample for analysis. To provide quality control, pre-packaged, sealed, certified standard (include low and medium grade copper-gold pulps) and blank pulps are included for analysis by inserted them as samples in random order at approximately 1 per every 30 samples. To ensure chain of custody, the bagged samples for analysis are picked up by an agent of ALS Minerals and transported directly to the ALS Minerals laboratory at Antofagasta or at Coquimbo, Chile.

The Chimberos Property is without a known body of commercial ore and our activities to date have been exploratory in nature.

INCA PROPERTY, Chile

The INCA property in the Atacama region of Chile is located approximately 90 kilometers north of the city of Copiapo, Chile and 6.0 kilometers east of the paved highway that connects Copiapo to Diego Del Amargo and the El Salvador Mine. The property is accessed by vehicle by driving north from Copiapo on paved, two-lane highway (Highway C-17) to the village of Inca de Oro. The INCA property and the Company’s exploration camp are located about 6 kilometers east of the village of Inca de Oro along a government maintained gravel road leading to the San Pedro de Cachiyuyo district. The INCA property is favorably situated from a logistical perspective, being close to important transportation routes, power lines and general mining infrastructure.

Historically, the INCA project area has been the center of small mining activity primarily for production of oxide-copper and some secondary enriched copper sulfide ores. This area hosts variably sized breccia pipes with outcropping, or historically mined copper, molybdenum and gold mineralization and the exploration objective has been to explore this area for copper, gold, silver and molybdenum.

During 2006 we completed the construction and equipping of a camp and exploration office at the INCA project and compiled extensive maps of the project area. We also conducted more than 30 line-kilometers of IP geophysical survey over six survey lines. In 2007 we conducted additional geophysical surveys and a program of bulldozer trenching, sampling and assaying was completed. Blasting and bulldozer work was conducted to prepare access roads and drill pads for a Phase I core drilling program. The core-drilling program completed 10,309 meters of drilling in 35 holes. From the results of the Phase I exploration, it became apparent that, although some of the results (particularly in the area around the Providencia mine) were very promising, the first phase of exploration did not discover the presence of a wide-spread, near-surface porphyry copper deposit that we had hoped for. We concluded that, although the possibility still existed to find a large scale copper deposit at INCA, considerable more exploration work and expenditures would be required to do so, which exceeded our available resources at that time. Since that time we have been seeking to arrange a joint venture or sale of all or a portion of our INCA copper, gold, molybdenum property.

Of importance, during 2009 we completed the final option payment under the “Araya Option” to acquire the Providencia Mine concessions situated within the greater INCA project area. These concessions cover one of the stronger mineralized areas identified during phase I exploration at the INCA project including the Providencia copper breccia pipe, a swarm of sheeted veins, and other tourmalinized/silicified breccia bodies and pipes.

During 2011 we expanded our land holdings at the INCA property by purchasing 20 hectares of mineral concessions pursuant to the "Rojas Option" for consideration of the Chilean Peso-equivalent of US$300,000 (paid). With the staking of additional concessions during 2011 and 2012, our landholdings at the INCA project consist of 61 concessions (approx. 8,994 hectares) including the 45-hectare Providencia Mine concessions that we acquired in 2009 pursuant to the “Araya Option” and the 20 hectares of concessions we purchased during 2011 pursuant the Rojas Option. With these acquisitions, SAMEX holds prospective and strategic concessions within the INCA project area. See news releases concerning the INCA Property on the SAMEX website at www.samex.com.

Expenditures on the INCA property during 2012 included costs for staking, surveying, constructing monuments for concessions, annual patent payments, maintaining and staffing the INCA camp/core storage facilities, and monthly payments related to the US$50,000 buy out of the 1% NSR on the Providencia Mine concessions which comprise a portion of the INCA property. We are continuing our efforts to arrange a joint venture or sale of all or a portion of our INCA copper, gold, molybdenum property.

INCA Property Mineral Interests - The Company’s Chilean subsidiary, Minera Samex Chile S.A. has 100% interest in 61 exploitation mining concessions (approx. 8,994 hectares) acquired by staking, purchase at government auction, and by the Araya Option, the Rojas Option/Purchase, and the Viscacha I Purchase as described below:

Araya Option – Pursuant to a Unilateral Option Purchase Contract dated April 4, 2006 with Malvina del Carmen Araya Santander the Company acquired 100% interest in 45 hectares of mineral interests (the Providencia Mine concessions situated within the greater INCA project area) for consideration of option payments totaling the Chilean Peso-equivalent of US$300,000 (paid).Buy-out of NSR Royalty Completed - A 1% NSR royalty was originally retained by the vendor, however pursuant to a royalty purchase contract dated August 20, 2012 the Company bought out the 1% NSR royalty on the Providencia Mine concessions (which comprise a portion of the INCA Property) for the Chilean peso equivalent of US$50,000 by making 10 payments as follows: US$5,000 on August 31, 2012 (paid); US$5,000 on October 4, 2012 (paid); US$5,000 on November 4, 2012 (paid); US$5,000 on December 4, 2012 (paid); US$5,000 on January 4, 2013 (paid); US$5,000 on February 4, 2013 (paid); US$5,000 on March 4, 2013 (paid); US$5,000 on April 4, 2013 (paid); US$5,000 on May 4, 2013 (paid); and US$5,000 on June 4, 2013 (paid).

Rojas Option/Purchase - The Company acquired 100% interest in 20 hectares of mineral concessions within the greater INCA project area for consideration of payments totaling U.S. $300,000 (paid). No royalty is payable on these concessions.

Vizcacha I Purchase – The Company purchased the Vizcacha I mineral concession covering a 3-hectare-portion of the INCA project for a total consideration of US$32,938 (17,000,000 Chilean Pesos). No royalty is payable on this concession.

Annual Patent Payments On the Company's Landholdings - In order keep a mining concession valid and in effect, it is necessary to pay an annual license fee (patent). The patent payments must be made in advance during the month of March of each year. Patent fee are calculated based upon the value of the Chilean Monthly Tax Unit (“M.T.U.”) which varies from month to month. In the case of an exploitation concession the annual patent fee is calculated as one-tenth (1/10th) of the Monthly Tax Unit per hectare (for example, in March 2013 the M.T.U. was 40,085 x 1/10th = 4,008.5 Chilean Pesos per hectare which, at the Observed US$/Peso exchange rate of 472 at April 29, 2013 equated to approximately US$8.50 per hectare for exploitation concessions). In the case of an exploration concession the annual patent fee is calculated as one-fiftieth (1/50th) of the Monthly Tax Unit per hectare (for example, in March 2013 the M.T.U. was 40,085 x 1/50th = 801.7 Chilean Pesos per hectare which, at the Observed US$/Peso exchange rate of 472 at April 29, 2013 equated to approximately US$1.70 per hectare for exploration concessions). Should the holder of the concession fail to pay the fee within the designated period, judicial procedures to publicly auction the concession may be instituted.