- CMO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Capstead Mortgage (CMO) 425Business combination disclosure

Filed: 26 Jul 21, 7:55am

Exhibit 99.2

Franklin BSP Realty Trust formed through merger of Benefit Street Partners Realty Trust, Inc. and Capstead Mortgage Corporation July 26, 2021

Important Information ADDITIONAL INFORMATION ABOUT THE MERGER: In connection with the proposed merger, Benefit Street Partners Realty Trust (“BSPRT”) intends to file a registration statement on Form S - 4 with the SEC that will include a proxy statement of Capstead Mortgage Corporation (“CMO”) and will also co nstitute a prospectus of BSPRT. This communication is not a substitute for the registration statement, the proxy statement/prospectus or any other documents that wil l be made available to the stockholders of CMO. In connection with the proposed merger, BSPRT and CMO also plan to file relevant materials with the SEC. STOCKHOLDERS OF CMO ARE UR GED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE RELEVANT PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WIL L CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. A definitive proxy statement/prospectus will be sent to CMO’s stockh old ers. Investors may obtain a copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BSPRT and CMO fr ee of charge at the SEC’s website, www.sec.gov. Copies of the documents filed by BSPRT with the SEC will be available free of charge on BSPRT’s website at http: //w ww.bsprealtytrust.com or by contacting BSPRT’s Investor Services at (844) 785 - 4393, as they become available. Copies of the documents filed by CMO with the SEC will be available free of charge on CMO’s website at http://www.capstead.com or by contacting CMO’s Investor Relations at (214) 874 - 2339. PARTICIPANTS IN SOLICITATION RELATING TO THE MERGER: BSPRT and CMO and their respective directors and executive officers and other members of management and employees, may be deemed to be participants in the solicitation of proxies from CMO stockholders in respect of the propos ed merger among BSPRT, CMO and their respective subsidiaries. Information about the directors and executive officers of CMO is available in the proxy statement fo r i ts 2021 annual meeting of stockholders, which was filed with the SEC on April 1, 2021. Information about directors and executive officers of BSPRT is available in the proxy st ate ment for its 2021 annual meeting of stockholders, which was filed with the SEC on April 8, 2021. Other information regarding the participants in the proxy solicitation and a d esc ription of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC re gar ding the proposed merger when they become available. Stockholders of CMO should read the proxy statement/prospectus carefully when it becomes available before making a ny voting or investment decisions. Investors may obtain free copies of these documents from BSPRT or CMO using the sources indicated above. NO OFFER OR SOLICITATION: This communication and the information contained herein does not constitute an offer to sell or the solicitation of an offer to buy or sell any securities or a solicitation of a proxy or of any vote or approval, nor shall there be any sale of securities in any jurisdic tio n in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be ma de except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This communication may be deemed to be solicitation mat eri al in respect of the proposed merger. Disclaimer on Forward - Looking Statements: This communication contains statements that constitute forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements can genera lly be identified as forward - looking because they include words such as “believes,” “anticipates,” “expects,” “would,” “could,” or words of similar meaning. These statements are based on the companies’ current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from tho se described in the forward - looking statements; neither BSPRT or Capstead can give any assurance that their expectations will be attained. Factors that could cause actual results to differ materially f rom BSPRT’s or CMO’s expectations include those set forth in the section entitled “Risk Factors” in BSPRT’s and CMO’s most recent Annual Reports o n F orm 10 - K, as amended, and Quarterly Reports on Form 10 - Q filed with the SEC, and other reports filed by BSPRT and CMO with the SEC, copies of which are available on the SEC’s website, www.sec.gov . Forward - looking statements are not guarantees of performance or results and speak only as of the date such statements are made. Except as req uir ed by law, neither BSPRT nor CMO undertakes any obligation to update or revise any forward - looking statement in this communication, whether to reflect new information, futu re events, changes in assumptions or circumstances or otherwise. 2

Transaction Highlights 3 Premium Valuation ▪ $7.30 per share estimated total consideration, representing 115.75% of CMO’s diluted book value per share as of June 30, 2021 and a 20.0% premium to CMO’s market price as of July 23, 2021 ▪ Includes cash consideration of $ 0.99 per CMO diluted common share calculated as of June 30, 2021 Compelling Business Combination ▪ Would create the 4 th largest publicly - traded commercial mortgage REIT with nearly $2 billion in pro forma equity; new capital is additive to an existing and seasoned book of commercial mortgages focused on multifamily ▪ At closing, BSPRT shares will be listed and publicly - traded on the NYSE under the ticker “FBRT” Structural Features to Support Stock Price ▪ $100 million post - closing share repurchase commitment, including $35 million funded by Franklin ▪ BSPRT stockholders subject to 6 - month lock up period after closing (1) 1 2 3 4 5 Improved Balance Sheet and Earnings Profile ▪ Reduces estimated leverage, with BSPRT current leverage of 2.4x (v. CMO leverage of 6.8x) ▪ Strong distributable earnings in excess of a 10 % ROE ▪ Expected to pay substantially all earnings in the form of dividends Benefit S t r e e t P A R T N E RS R ealty T r u s t Note: Financial data estimated as of June 30, 2021 (1) Stockholder lock up period applies to all but 6% of shares The combination of Benefit Street Partners Realty Trust, Inc. (“BSPRT”) and Capstead Mortgage Corporation (“CMO”) would create one of the largest publicly traded commercial mortgage real estate investment trusts (“REIT”) and is anticipated to generate significant long - term value for all stockholders Similarly Performing Commercial Mortgage REITs Trade Above Book Value World Class Sponsorship with Leading Global Asset Management Platforms, Benefit Street Partners and Franklin Templeton 6

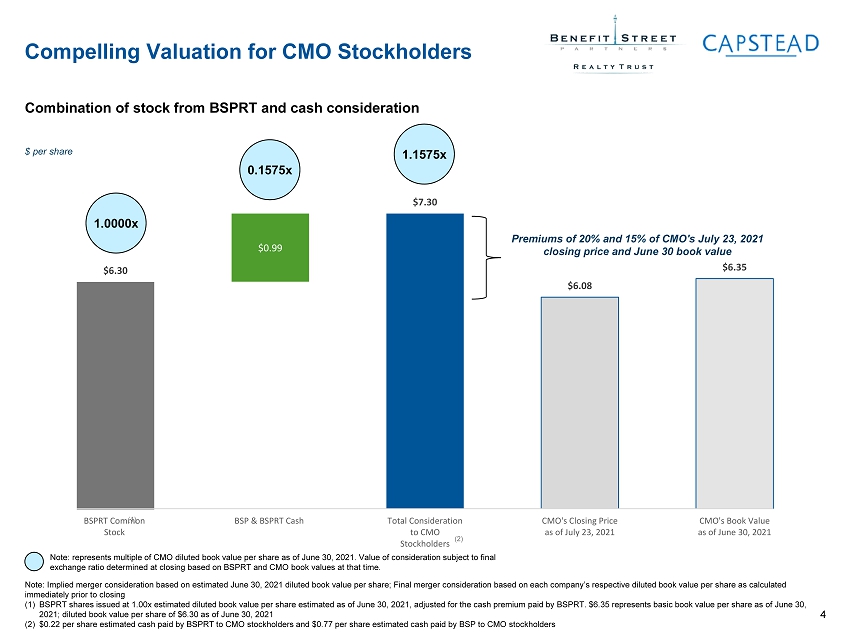

$0.99 $6.30 $7.30 $6.08 $6.35 BSPRT Common Stock BSP & BSPRT Cash Total Consideration to CMO Stockholders CMO's Closing Price as of July 23, 2021 CMO's Book Value as of June 30, 2021 Compelling Valuation for CMO Stockholders $ per share 1.0000x 0.1575x 1.1575x Note: represents multiple of CMO diluted book value per share as of June 30, 2021 . Value of consideration subject to final exchange ratio determined at closing based on BSPRT and CMO book values at that time. Combination of stock from BSPRT and cash consideration Premiums of 20% and 15% of CMO's July 23, 2021 closing price and June 30 book value 4 Note: Implied merger consideration based on estimated June 30, 2021 diluted book value per share; Final merger consideration based on each company’s respective diluted book value per share as calculated immediately prior to closing (1) BSPRT shares issued at 1.00x estimated diluted book value per share estimated as of June 30, 2021, adjusted for the cash premium paid by BSPRT. $6.35 represents basic book value per share as of June 30, 2021; diluted book value per share of $6.30 as of June 30, 2021 (2) $0.22 per share estimated cash paid by BSPRT to CMO stockholders and $0.77 per share estimated cash paid by BSP to CMO stockholders (1) (2)

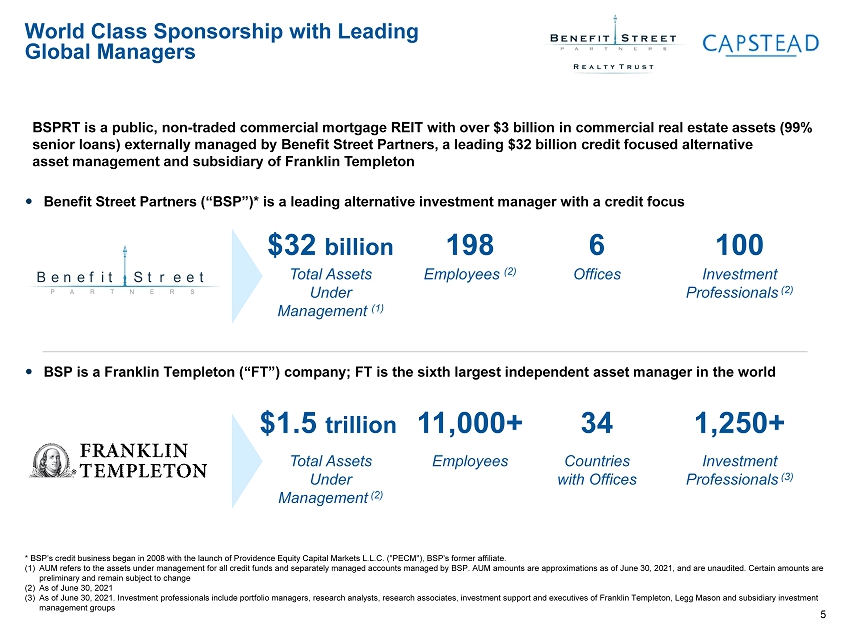

World Class Sponsorship with Leading Global Managers Benefit Street Partners (“BSP”)* is a leading alternative investment manager with a credit focus * BSP’s credit business began in 2008 with the launch of Providence Equity Capital Markets L.L.C. ("PECM"), BSP's former affi lia te. (1) AUM refers to the assets under management for all credit funds and separately managed accounts managed by BSP. AUM amounts ar e a pproximations as of June 30, 2021, and are unaudited. Certain amounts are preliminary and remain subject to change (2) As of June 30, 2021 (3) As of June 30, 2021 . Investment professionals include portfolio managers, research analysts, research associates, investment support and executi ves of Franklin Templeton, Legg Mason and subsidiary investment management groups 100 Investment Professionals (2) $ 32 billion Total Assets Under Management (1) 198 Employees (2) 6 Offices BSP is a Franklin Templeton (“FT”) company; FT is the sixth largest independent asset manager in the world Total Assets Under Management (2) 1,250+ Investment Professionals (3) 11,0 00+ Employees 34 Countries with Offices Benefit S t r e e t P A R T N E RS R ealty T r u s t $ 1.5 trillion 5 BSPRT is a public, non - traded commercial mortgage REIT with over $3 billion in commercial real estate assets (99% senior loans) externally managed by Benefit Street Partners, a leading $32 billion credit focused alternative asset management and subsidiary of Franklin Templeton

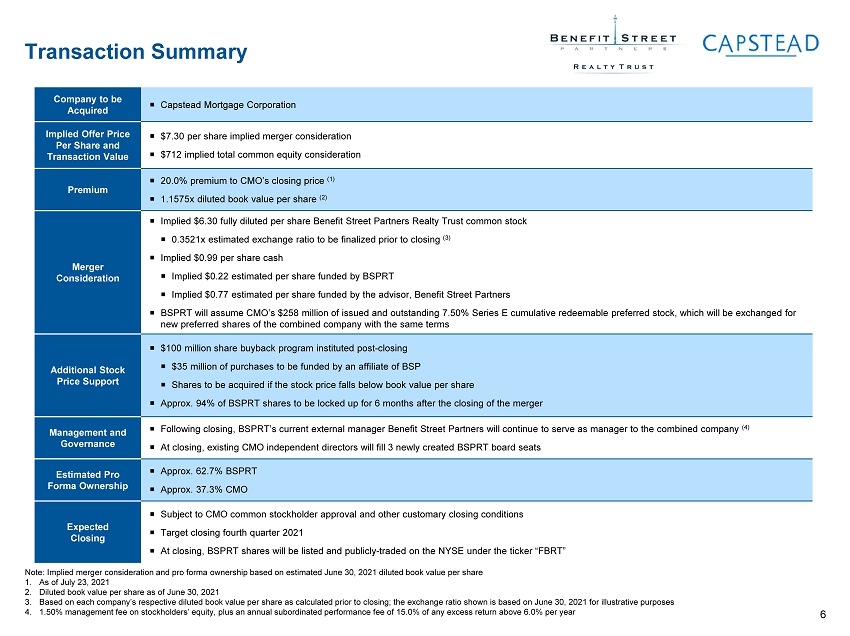

Transaction Summary Company to be Acquired Capstead Mortgage Corporation Implied Offer Price Per Share and Transaction Value $7.30 per share implied merger consideration $712 implied total common equity consideration Premium 20.0 % premium to CMO’s closing price (1) 1.1575x diluted book value per share (2) Merger Consideration Implied $6.30 fully diluted per share Benefit Street Partners Realty Trust common stock 0.3521x estimated exchange ratio to be finalized prior to closing ( 3) Implied $0.99 per share cash Implied $0.22 estimated per share funded by BSPRT Implied $0.77 estimated per share funded by the advisor, Benefit Street Partners BSPRT will assume CMO’s $258 million of issued and outstanding 7.50% Series E cumulative redeemable preferred stock, which wi ll be exchanged for new preferred shares of the combined company with the same terms Additional Stock Price Support $100 million share buyback program instituted post - closing $35 million of purchases to be funded by an affiliate of BSP Shares to be acquired if the stock price falls below book value per share Approx. 94% of BSPRT shares to be locked up for 6 months after the closing of the merger Management and Governance Following closing , BSPRT’s current external manager Benefit Street Partners will continue to serve as manager to the combined company (4) At closing, existing CMO independent directors will fill 3 newly created BSPRT board seats Estimated Pro Forma Ownership Approx. 62.7% BSPRT Approx. 37.3% CMO Expected Closing Subject to CMO common stockholder approval and other customary closing conditions Target closing fourth quarter 2021 At closing, BSPRT shares will be listed and publicly - traded on the NYSE under the ticker “FBRT ” Note: Implied merger consideration and pro forma ownership based on estimated June 30, 2021 diluted book value per share 1. As of July 23, 2021 2. Diluted book value per share as of June 30, 2021 3. Based on each company’s respective diluted book value per share as calculated prior to closing; the exchange ratio shown is based on June 30, 2021 for illustrative purposes 4. 1.50 % management fee on stockholders’ equity, plus an annual subordinated performance fee of 15.0% of any excess return above 6.0 % p er year 6

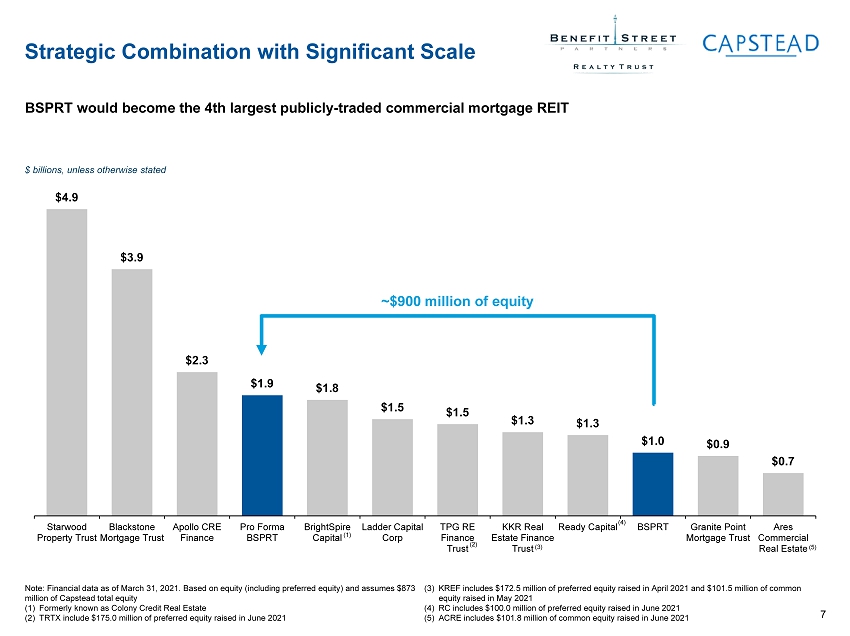

$4.9 $3.9 $2.3 $1.9 $1.8 $1.5 $1.5 $1.3 $1.3 $1.0 $0.9 $0.7 Starwood Property Trust Blackstone Mortgage Trust Apollo CRE Finance Pro Forma BSPRT BrightSpire Capital Ladder Capital Corp TPG RE Finance Trust KKR Real Estate Finance Trust Ready Capital BSPRT Granite Point Mortgage Trust Ares Commercial Real Estate Strategic Combination with Significant Scale 7 Note: Financial data as of March 31, 2021. Based on equity (including preferred equity) and assumes $873 million of Capstead total equity (1) Formerly known as Colony Credit Real Estate (2) TRTX include $175.0 million of preferred equity raised in June 2021 (3) KREF includes $172.5 million of preferred equity raised in April 2021 and $101.5 million of common equity raised in May 2021 (4) RC includes $100.0 million of preferred equity raised in June 2021 (5) ACRE includes $101.8 million of common equity raised in June 2021 BSPRT would become the 4th largest publicly - traded commercial mortgage REIT ~$900 million of equity $ billions, unless otherwise stated (1) (2) (3) (4) (5)

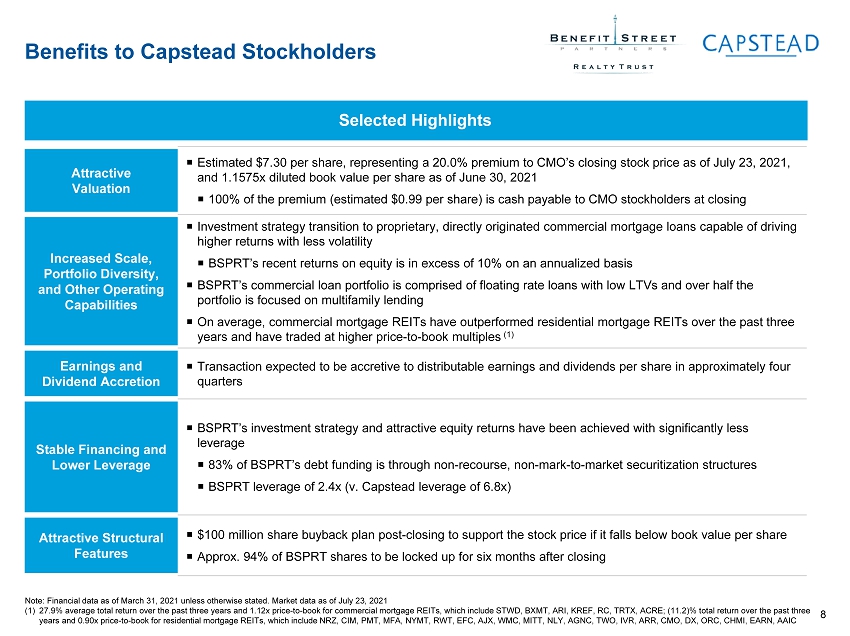

Benefits to Capstead Stockholders Selected Highlights Attractive Valuation Estimated $7.30 per share, representing a 20.0% premium to CMO’s closing stock price as of July 23, 2021, and 1.1575x diluted book value per share as of June 30, 2021 100% of the premium (estimated $0.99 per share) is cash payable to CMO stockholders at closing Increased Scale, Portfolio Diversity, and Other Operating Capabilities Investment strategy transition to proprietary, directly originated commercial mortgage loans capable of driving higher returns with less volatility BSPRT’s recent returns on equity is in excess of 10% on an annualized basis BSPRT’s commercial loan portfolio is comprised of floating rate loans with low LTVs and over half the portfolio is focused on multifamily lending On average, commercial mortgage REITs have outperformed residential mortgage REITs over the past three years and have traded at higher price - to - book multiples (1) Earnings and Dividend A ccretion Transaction expected to be accretive to distributable earnings and dividends per share in approximately four quarters Stable Financing and Lower Leverage BSPRT’s investment strategy and attractive equity returns have been achieved with significantly less leverage 83% of BSPRT’s debt funding is through non - recourse, non - mark - to - market securitization structures BSPRT leverage of 2.4x (v. Capstead leverage of 6.8x ) Attractive Structural Features $100 million share buyback plan post - closing to support the stock price if it falls below book value per share Approx. 94% of BSPRT shares to be locked up for six months after closing 8 Note: Financial data as of March 31, 2021 unless otherwise stated. Market data as of July 23, 2021 (1) 27.9% average total return over the past three years and 1.12x price - to - book for commercial mortgage REITs, which include STWD, BXMT, ARI, KREF, RC, TRTX, ACRE; (11.2)% total return over the past three years and 0.90x price - to - book for residential mortgage REITs, which include NRZ, CIM, PMT, MFA, NYMT, RWT, EFC, AJX, WMC, MITT, NLY, AGNC, TWO, IVR, ARR, CMO, DX, ORC, CHMI, EARN, AAIC

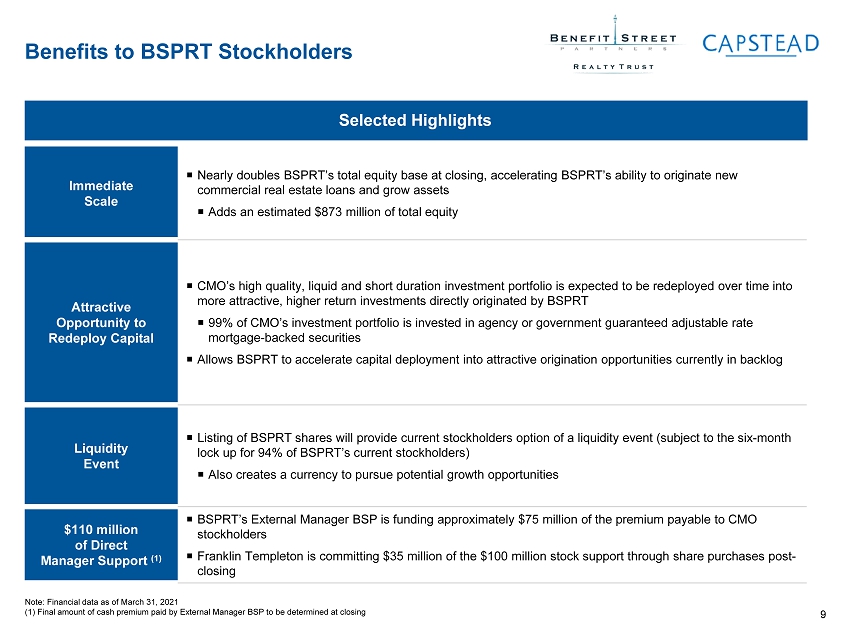

Benefits to BSPRT Stockholders Selected Highlights Immediate Scale Nearly doubles BSPRT’s total equity base at closing, accelerating BSPRT’s ability to originate new commercial real estate loans and grow assets Adds an estimated $873 million of total equity Attractive Opportunity to Redeploy Capital CMO’s high quality, liquid and short duration investment portfolio is expected to be redeployed over time into more attractive, higher return investments directly originated by BSPRT 99% of CMO’s investment portfolio is invested in agency or government guaranteed adjustable rate mortgage - backed securities Allows BSPRT to accelerate capital deployment into attractive origination opportunities currently in backlog Liquidity Event Listing of BSPRT shares will provide current stockholders option of a liquidity event (subject to the six - month lock up for 94% of BSPRT’s current stockholders) Also creates a currency to pursue potential growth opportunities $110 million of Direct Manager Support (1) BSPRT’s External Manager BSP is funding approximately $75 million of the premium payable to CMO stockholders Franklin Templeton is committing $35 million of the $100 million stock support through share purchases post - closing 9 Note: Financial data as of March 31, 2021 (1) Final amount of cash premium paid by External Manager BSP to be determined at closing

BSPRT – Overview and Investment Strategy

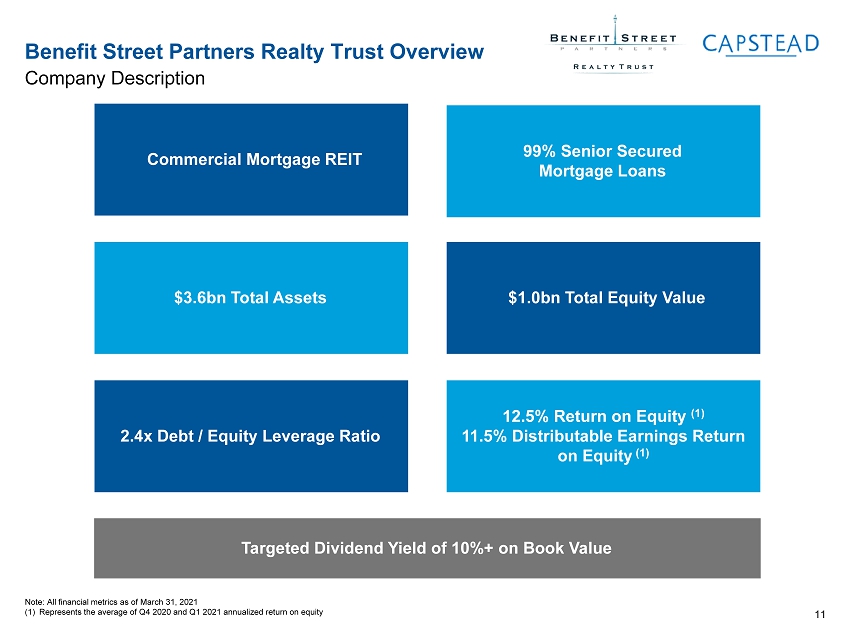

Benefit Street Partners Realty Trust Overview $3.6bn Total Assets 2.4x Debt / Equity Leverage Ratio 12.5% Return on Equity (1) 11.5% Distributable Earnings Return on Equity (1) $1.0bn Total Equity Value Targeted Dividend Yield of 10%+ on Book Value Note: All financial metrics as of March 31, 2021 (1) Represents the average of Q4 2020 and Q1 2021 annualized return on equity Commercial Mortgage REIT 99% Senior Secured Mortgage Loans Company Description 11

Benefit Street Partners Realty Trust Overview Key Differentiators Strong Team/Sponsorship Diversified Portfolio of Senior, Floating Rate Loans Differentiated Strategy is Intended to Produce Best Risk/Reward Attractive NIM Spread & Leverage Conservative and Flexible Balance Sheet 1 2 3 4 5 12 Credit Focused Culture 6

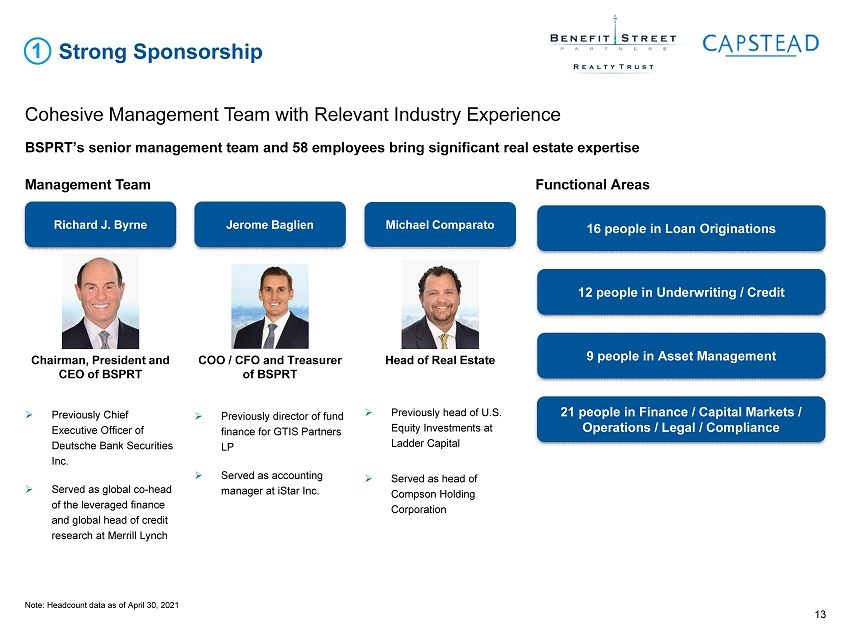

Strong Sponsorship Cohesive Management Team with Relevant Industry Experience BSPRT’s senior management team and 58 employees bring significant real estate expertise Jerome Baglien Michael Comparato Richard J. Byrne Chairman, President and CEO of BSPRT » Previously Chief Executive Officer of Deutsche Bank Securities Inc. » Served as global co - head of the leveraged finance and global head of credit research at Merrill Lynch Head of Real Estate » Previously head of U.S. Equity Investments at Ladder Capital » Served as head of Compson Holding Corporation COO / CFO and Treasurer of BSPRT » Previously director of fund finance for GTIS Partners LP » Served as accounting manager at iStar Inc. 16 people in Loan Originations 9 people in Asset Management 21 people in Finance / Capital Markets / Operations / Legal / Compliance Management Team Functional Areas 12 people in Underwriting / Credit Note: Headcount data as of April 30 , 2021 13 1

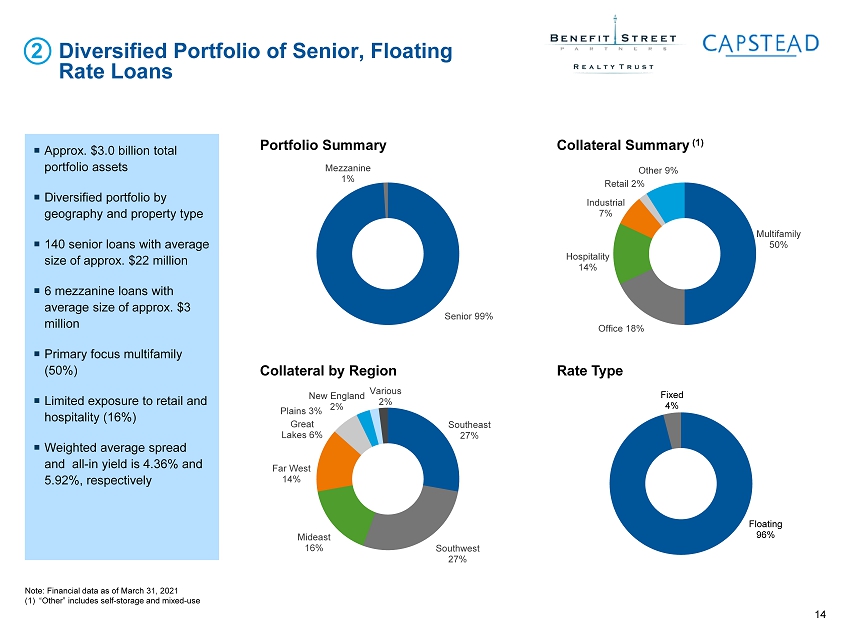

Diversified Portfolio of Senior, Floating Rate Loans Portfolio Summary Collateral by Region Collateral Summary (1) Approx. $3.0 billion total portfolio assets Diversified portfolio by geography and property type 140 senior loans with average size of approx. $22 million 6 mezzanine loans with average size of approx. $3 million Primary focus multifamily (50%) Limited exposure to retail and hospitality (16%) Weighted average spread and all - in yield is 4.36% and 5.92%, respectively Note: Financial data as of March 31, 2021 (1) “Other” includes self - storage and mixed - use Rate Type Floating 96% Fixed 4% Multifamily 50% Office 18% Hospitality 14% Industrial 7% Retail 2% Other 9% Senior 99% Mezzanine 1% Southeast 27% Southwest 27% Mideast 16% Far West 14% Great Lakes 6% Plains 3% New England 2% Various 2% 14 2

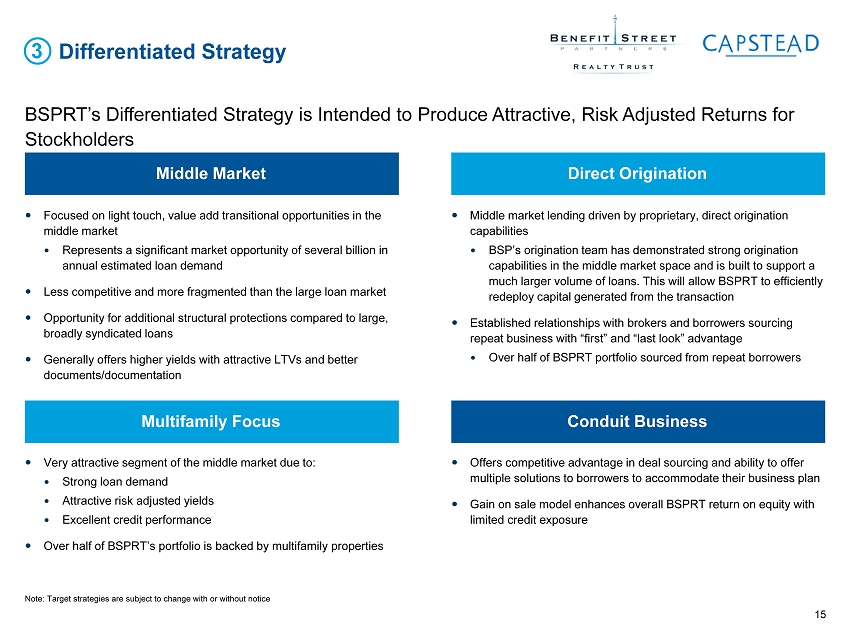

Differentiated Strategy Focused on light touch, value add transitional opportunities in the middle market Represents a significant market opportunity of several billion in annual estimated loan demand Less competitive and more fragmented than the large loan market Opportunity for additional structural protections compared to large, broadly syndicated loans Generally offers higher yields with attractive LTVs and better documents/documentation Note: Target strategies are subject to change with or without notice 15 3 BSPRT’s Differentiated Strategy is Intended to Produce Attractive, Risk Adjusted Returns for Stockholders Middle Market Direct Origination Middle market lending driven by proprietary , direct origination capabilities BSP’s origination team has demonstrated strong origination capabilities in the middle market space and is built to support a much larger volume of loans. This will allow BSPRT to efficiently redeploy capital generated from the transaction Established relationships with brokers and borrowers sourcing repeat business with “first” and “last look” advantage Over half of BSPRT portfolio sourced from repeat borrowers Conduit Business Multifamily Focus Very attractive segment of the middle market due to: Strong loan demand Attractive risk adjusted yields Excellent credit performance Over half of BSPRT’s portfolio is backed by multifamily properties Offers competitive advantage in deal sourcing and ability to offer multiple solutions to borrowers to accommodate their business plan Gain on sale model enhances overall BSPRT return on equity with limited credit exposure

Attractive NIM Spread and Leverage BSPRT has generated the highest NIM spread despite low mezzanine exposure Note: TTM period as of March 31, 2021. Peers include select public commercial mortgage REITs with total equity greater than $ 500 million (1) Net debt divided by equity TTM NIM Spread Net Leverage (1) 2.7% 2.9% 0.6% 2.2% 2.5% 2.6% 2.7% 3.0% 3.1% 3.4% 3.4% 3.6% 0.0% 1.0% 2.0% 3.0% 4.0% Mean Median Peer 9 Peer 8 Peer 7 Peer 6 Peer 5 Peer 4 Peer 3 Peer 2 Peer 1 BSPRT 2.6x 2.6x 1.7x 2.0x 2.1x 2.3x 2.5x 2.7x 2.8x 3.0x 3.4x 3.8x 0.0x 1.0x 2.0x 3.0x 4.0x Mean Median Peer 9 Peer 2 Peer 5 BSPRT Peer 1 Peer 3 Peer 4 Peer 6 Peer 8 Peer 7 16 4

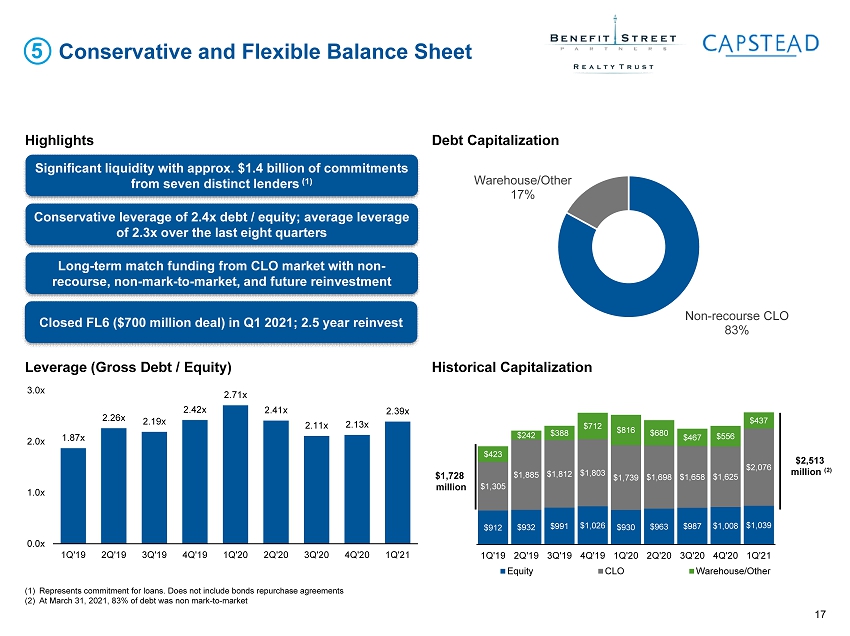

Conservative and Flexible Balance Sheet 5 (1) Represents commitment for loans. Does not include bonds repurchase agreements (2) At March 31, 2021, 83% of debt was non mark - to - market Highlights Debt Capitalization Leverage (Gross Debt / Equity) Historical Capitalization Conservative leverage of 2.4x debt / equity; average leverage of 2.3x over the last eight quarters Significant liquidity with approx. $1.4 billion of commitments from seven distinct lenders (1) Long - term match funding from CLO market with non - recourse, non - mark - to - market, and future reinvestment Closed FL6 ($700 million deal) in Q1 2021; 2.5 year reinvest Non - recourse CLO 83% Warehouse/Other 17% 1.87x 2.26x 2.19x 2.42x 2.71x 2.41x 2.11x 2.13x 2.39x 0.0x 1.0x 2.0x 3.0x 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 $912 $932 $991 $1,026 $930 $963 $987 $1,008 $1,039 $1,305 $1,885 $1,812 $1,803 $1,739 $1,698 $1,658 $1,625 $2,076 $423 $242 $388 $712 $816 $680 $467 $556 $437 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21 Equity CLO Warehouse/Other $2,513 million (2) $1,728 million 17

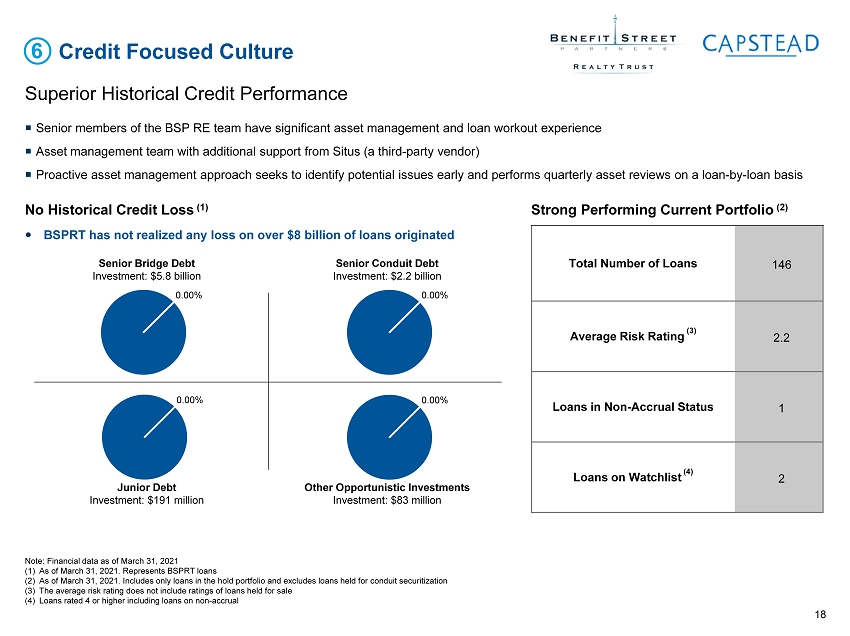

Credit Focused Culture Senior members of the BSP RE team have significant asset management and loan workout experience Asset management team with additional support from Situs (a third - party vendor) Proactive asset management approach seeks to identify potential issues early and performs quarterly asset reviews on a loan - by - l oan basis Note: Financial data as of March 31 , 2021 (1) As of March 31 , 2021. Represents BSPRT loans (2) As of March 31, 2021. Includes only loans in the hold portfolio and excludes loans held for conduit securitization (3) The average risk rating does not include ratings of loans held for sale (4) Loans rated 4 or higher including loans on non - accrual 0.00% 0.00% Senior Conduit Debt Investment: $ 2.2 billion 0.00% Other Opportunistic Investments Investment: $83 million 0.00% Total Number of Loans 146 Average Risk Rating (3) 2.2 Loans in Non - Accrual Status 1 Loans on Watchlist (4) 2 No Historical Credit Loss ( 1 ) Strong Performing Current Portfolio ( 2 ) BSPRT has not realized any loss on over $8 billion of loans originated Senior Bridge Debt Investment: $ 5.8 billion Junior Debt Investment: $ 191 million 18 6 Superior Historical Credit Performance

Key Take Aways and Investment Highlights 58 person real estate team with strong deal sourcing and underwriting capabilities supported by BSP’s leading credit expertise Conservative capital structure with focus on longer tenor, non - mark - to - market and non - recourse CLO debt; approximately 83% of debt capitalization is comprised of CLO debt Demonstrated track record of growth while generating attractive returns; distributable earnings return on equity (1) of 12.6% in Q4 2020 and 10.4% in Q1 2021 Differentiated middle market focus provides significant competitive advantage; average loan size of approx. $22 million and net interest margin of 3.6% Existing large scale, highly diversified portfolio with demonstrated resiliency through the recent downturn; average multifamily holdings over past 6 quarters is over 50% Large and compelling real estate lending market opportunity; over $2.1 trillion of real estate debt maturities over the next five years 19 (1) Please see "Non - GAAP Financial Information" in Appendix A for a description of distributable earnings return on equity and a reconciliation of distributable earnings return on equity to BSPRT's GAAP financial results

Appendix

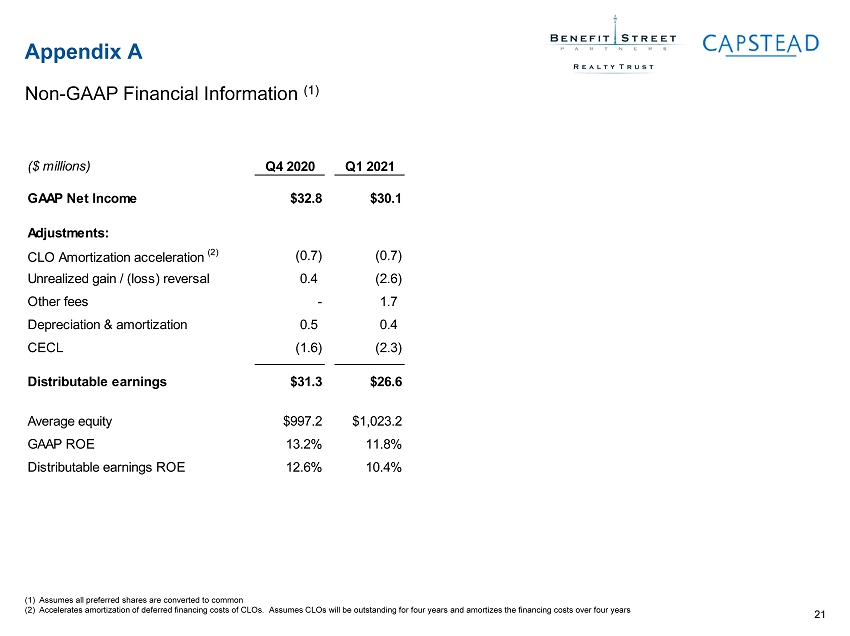

Appendix A 21 Non - GAAP Financial Information (1) (1) Assumes all preferred shares are converted to common (2) Accelerates amortization of deferred financing costs of CLOs . Assumes CLOs will be outstanding for four years and amortizes the financing costs over four years ($ millions) Q4 2020 Q1 2021 GAAP Net Income $32.8 $30.1 Adjustments: CLO Amortization acceleration (2) (0.7) (0.7) Unrealized gain / (loss) reversal 0.4 (2.6) Other fees - 1.7 Depreciation & amortization 0.5 0.4 CECL (1.6) (2.3) Distributable earnings $31.3 $26.6 Average equity $997.2 $1,023.2 GAAP ROE 13.2% 11.8% Distributable earnings ROE 12.6% 10.4%