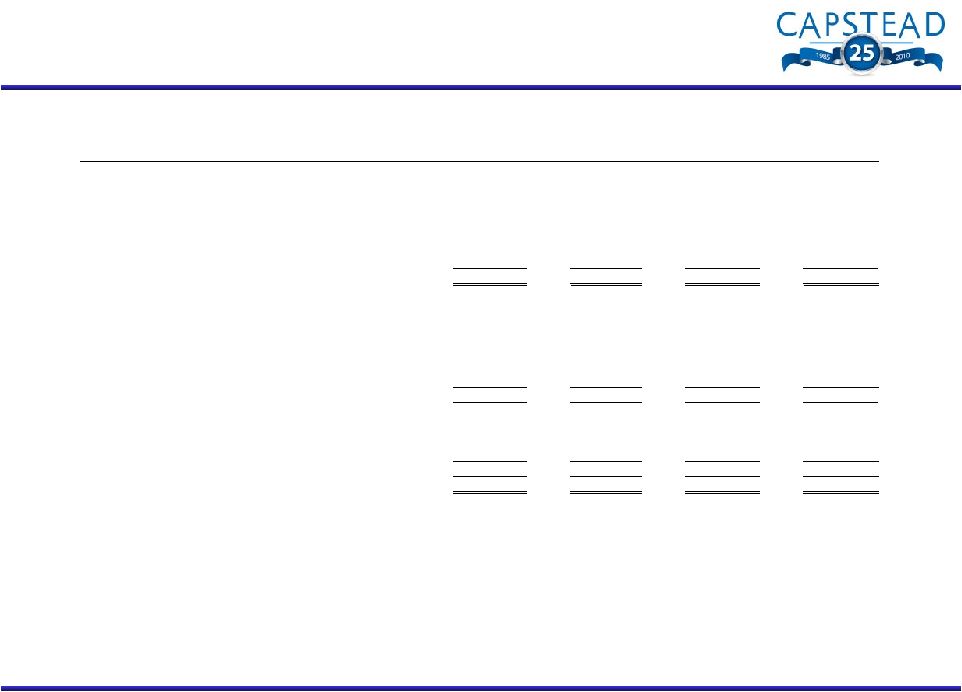

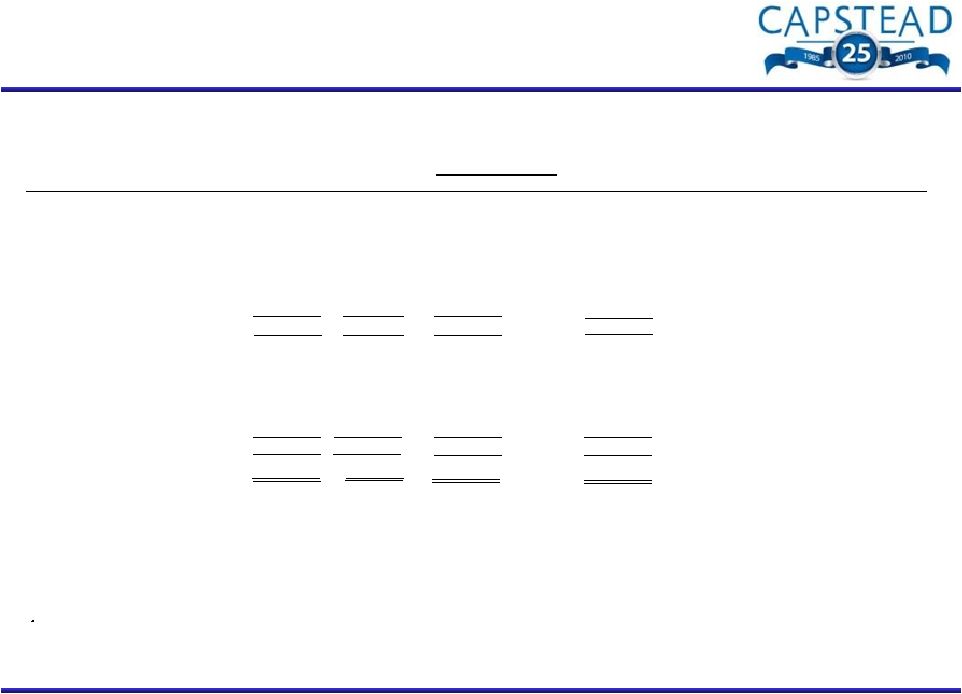

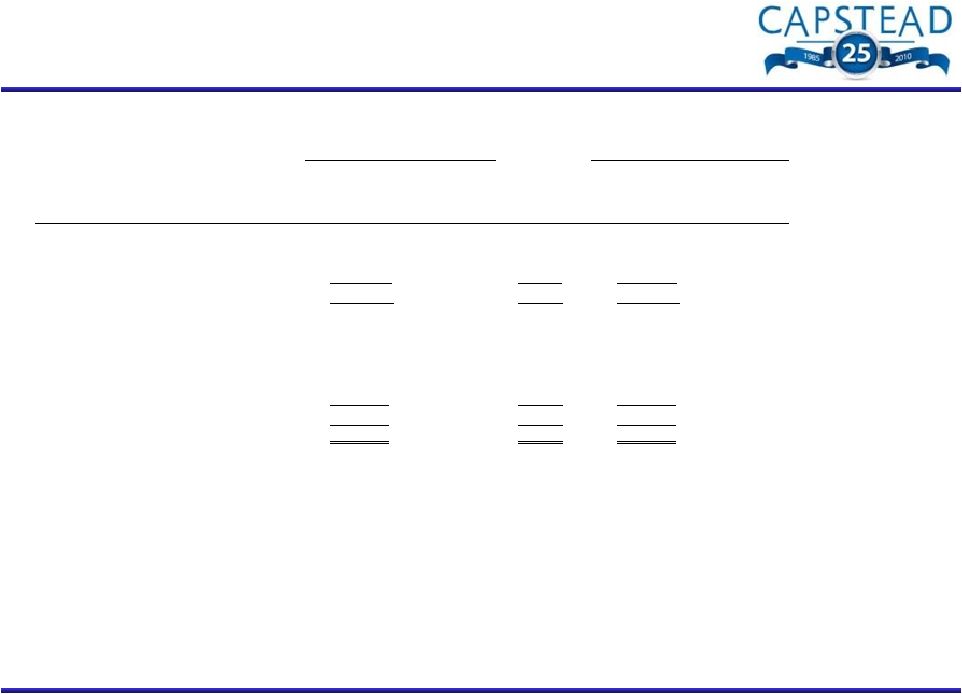

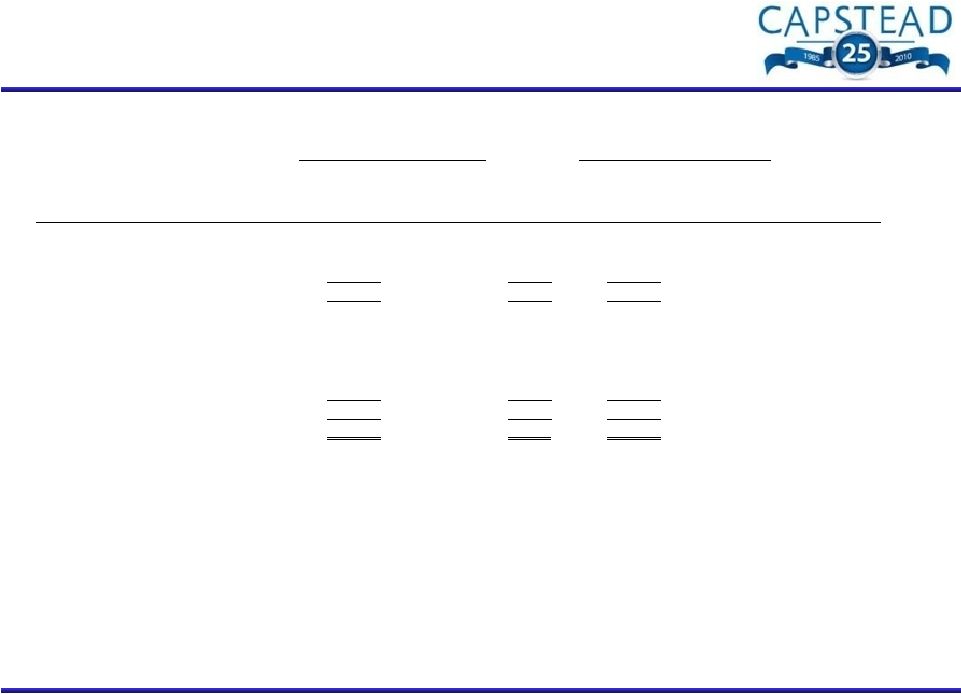

Comparative Balance Sheet (dollars in thousands, except per share amounts) 11 December 31, December 31, December 31, December 31, Assets Mortgage securities and similar investments 8,515,691 $ 8,091,103 $ 7,499,530 $ 7,108,719 $ Cash collateral receivable from interest rate swap counterparties 35,289 30,485 53,676 1,800 Interest rate swap agreements at fair value 9,597 1,758 Cash and cash equivalents 359,590 409,623 96,839 6,653 Receivables and other assets 76,078 92,817 76,200 88,637 Investments in unconsolidated affiliates 3,117 3,117 3,117 3,117 8,999,362 $ 8,628,903 $ 7,729,362 $ 7,208,926 $ Liabilities Repurchase arrangements and similar borrowings 7,792,743 $ 7,435,256 $ 6,751,500 $ 6,500,362 $ Cash collateral payable to interest rate swap counterparties 9,024 Interest rate swap agreements at fair value 16,337 9,218 46,679 2,384 Unsecured borrowings 103,095 103,095 103,095 103,095 Common stock dividend payable 27,401 37,432 22,728 9,786 Accounts payable and accrued expenses 23,337 29,961 44,910 32,382 7,971,937 7,614,962 6,968,912 6,648,009 Stockholders' Equity Perpetual preferred stock 179,323 179,333 179,460 179,533 Common stock 674,202 661,724 618,369 344,423 Accumulated other comprehensive income (loss) 173,900 172,884 (37,379) 36,961 1,027,425 1,013,941 760,450 560,917 8,999,362 $ 8,628,903 $ 7,729,362 $ 7,208,926 $ Book value per common share liquidation preferences for the Series A and B preferred stock) $12.02 $11.99 $9.14 $9.25 Long-term investment capital unsecured borrowings, net of investments in related unconsolidated affiliates) $1,127,403 $1,113,919 $860,428 $660,895 Portfolio leverage divided by long-term investment capital) 6.91:1 6.67:1 7.85:1 9.84:1 2010 2009 2008 2007 (calculated assuming (stockholders’ equity and (borrowings under repurchase arrangements - - - - - |