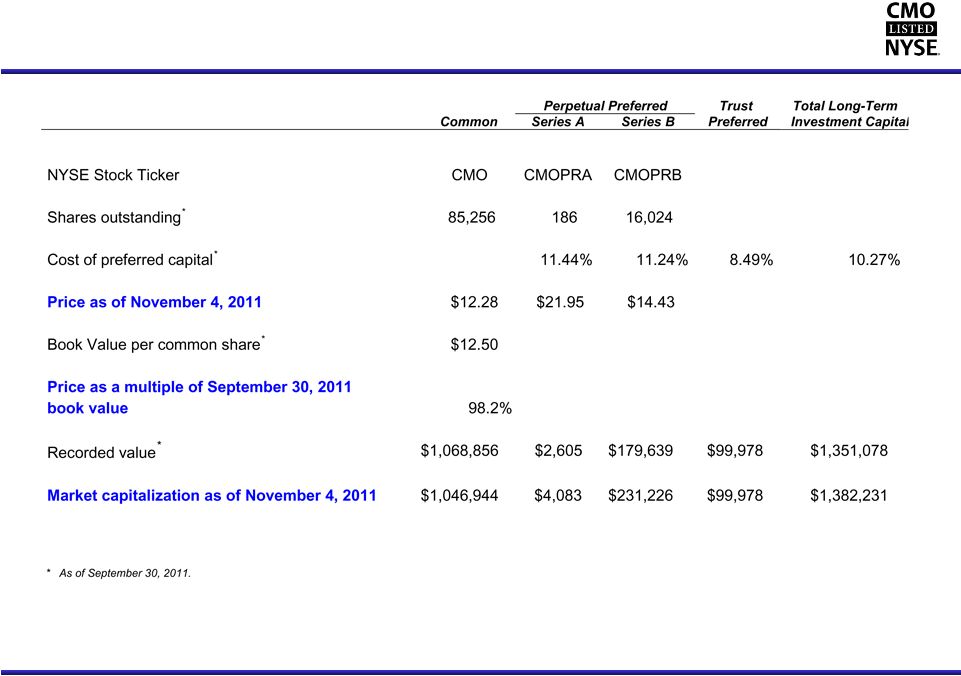

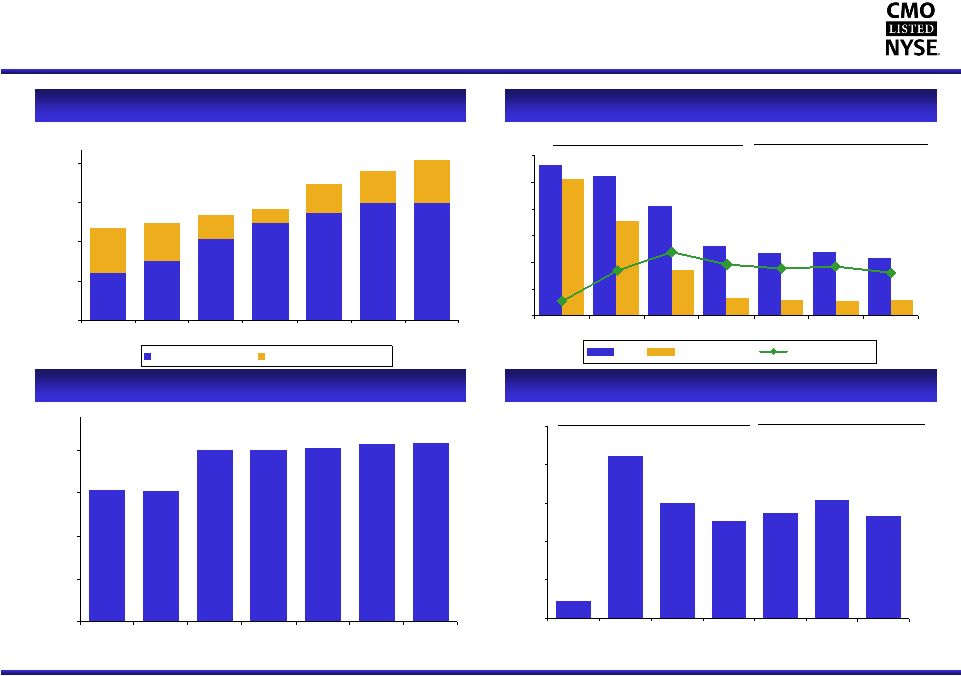

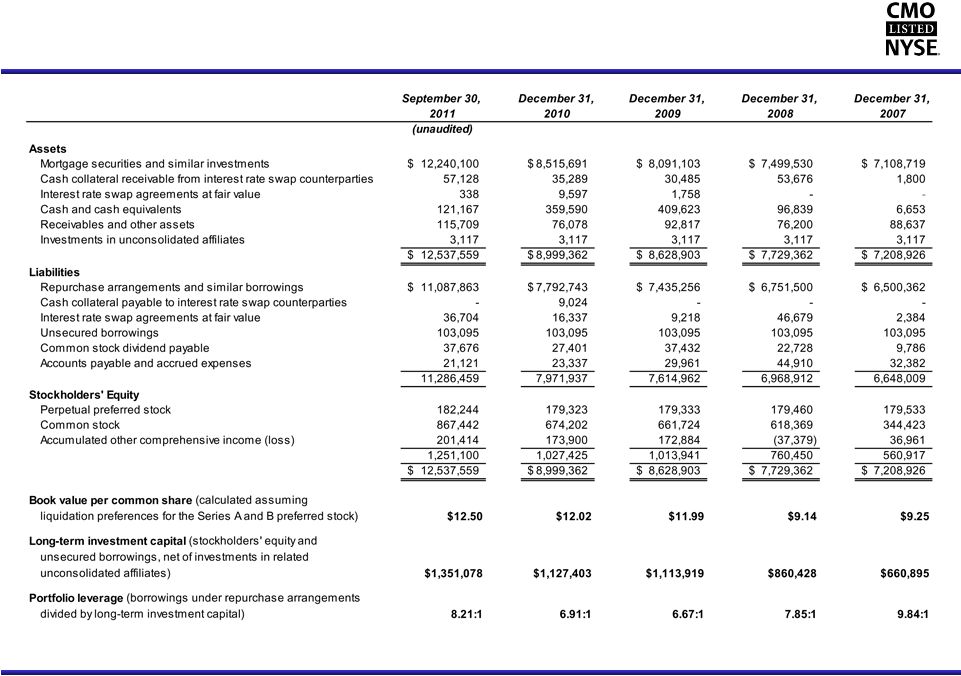

Capstead’s Third Quarter 2011 Highlights • Earnings of $41.0 million or $0.43 per diluted common share. • Our financing spread on mortgage assets* averaged 1.60%, reflecting lower ARM loan coupon interest rate resets and marginally higher mortgage prepayments. • Our book value increased $0.04 to $12.50 per common share. • We raised $54 million in new equity capital using our at-the-market continuous offering program contributing $0.04 to the increase in book value per common share. • Our investment portfolio increased 7% or $816 million to $12.24 billion and our portfolio leverage increased modestly to 8.2 times our long-term investment capital. • Operating expense as a percentage of long-term investment capital averaged 1.16%. • Comments from our October 26, 2011 earnings press release: “Market conditions remain favorable for investing in agency-guaranteed residential ARM securities on a leveraged basis, with attractive risk-adjusted returns achievable in today’s stable financing environment. During the third quarter we increased our portfolio by 7%, deploying $54 million in new equity capital raised under our continuous offering program. Portfolio leverage increased by a more modest 2% to 8.21 times our long-term investment capital. “Mortgage prepayments during the third quarter remained at favorable levels, albeit somewhat higher than what we experienced during the previous quarter. This reflects the factors we articulated in our second quarter earnings release, namely, elevated prepayment rates on newer originations as a result of declining mortgage interest rates, while prepays on more seasoned securities will continue to be suppressed by low housing prices and credit problems being experienced by many of these borrowers. “The fundamental difference between our investment portfolio and those of our peers is our focus on investing solely in ARM securities. At quarter-end these securities were backed by mortgages requiring borrowers to make payments predicated on rates averaging a relatively low 3.60%. Additionally, 73% of our portfolio was invested in ARM securities backed by mortgage loans that will reset in rate in less than eighteen months, typically to a lower interest rate in today’s environment. As a result, most borrowers with mortgage loans underlying securities in our portfolio lack the ability to meaningfully lower their mortgage payments even if they can overcome the other impediments to refinancing mentioned above. For these reasons, we expect prepays to remain largely in check in the fourth quarter.** “With the lackluster performance of the economy and global economic headwinds, we believe the current interest rate environment will likely persist for some time. If this proves to be the case, we anticipate portfolio yields on our current-reset ARM securities will continue trending lower as coupon interest rates on the underlying mortgage loans reset to lower rates. We also expect that borrowing rates will remain relatively low with declining hedging costs providing some offset to declining portfolio yields.” 8 * See page 16 for discussion of use of financing spread on mortgage assets, a non-GAAP financial measure. ** Portfolio runoff averaged 19.3% on an annualized basis during the third quarter (a constant prepayment rate, or CPR of 16.9%). October portfolio runoff declined to 18.7% (a 16.3% CPR), and available November runoff information indicates prepays have declined further. |