Exhibit 99.1

Proven

Investment

Strategy

+

Experienced

Management

Capstead invests in a conservatively leveraged

portfolio of residential adjustable-rate

mortgage (“ARM”) securities issued and

guaranteed by Fannie Mae, Freddie Mac or

Ginnie Mae. These agency-guaranteed

mortgage securities are considered to have

limited, if any, credit risk, particularly in light

of federal government support for Fannie Mae

and Freddie Mac.

Our investment strategy is designed to

produce attractive risk-adjusted returns over

the long term, while reducing, but not

eliminating, sensitivity to changes in interest

rates. This strategy differentiates us from our

peers because ARM securities reset to more

current interest rates within a relatively short

period of time allowing for:

The recovery of financing spreads

diminished during periods of rising

interest rates, and

Smaller fluctuations in portfolio values,

and therefore book value, caused by

changes in interest rates compared with

portfolios that contain a significant

amount of fixed-rate mortgage securities.

From a credit risk perspective, the credit

quality of agency-guaranteed mortgage

securities helps ensure that fluctuations in

value due to credit risk should be limited

and financing at reasonable rates and terms

should remain available under stressed

market conditions.

1 | C a p s t e a d M o r t g a g e C o r p o r a t i o n

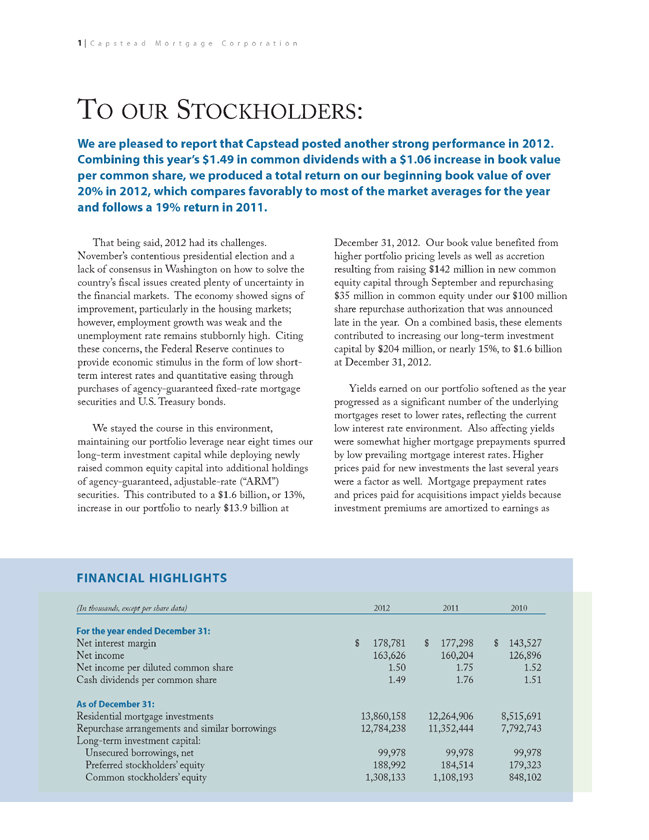

TO OUR STOCkHOLDeRS:

We are pleased to report that Capstead posted another strong performance in 2012.

Combining this year’s $1.49 in common dividends with a $1.06 increase in book value

per common share, we produced a total return on our beginning book value of over

20% in 2012, which compares favorably to most of the market averages for the year

and follows a 19% return in 2011.

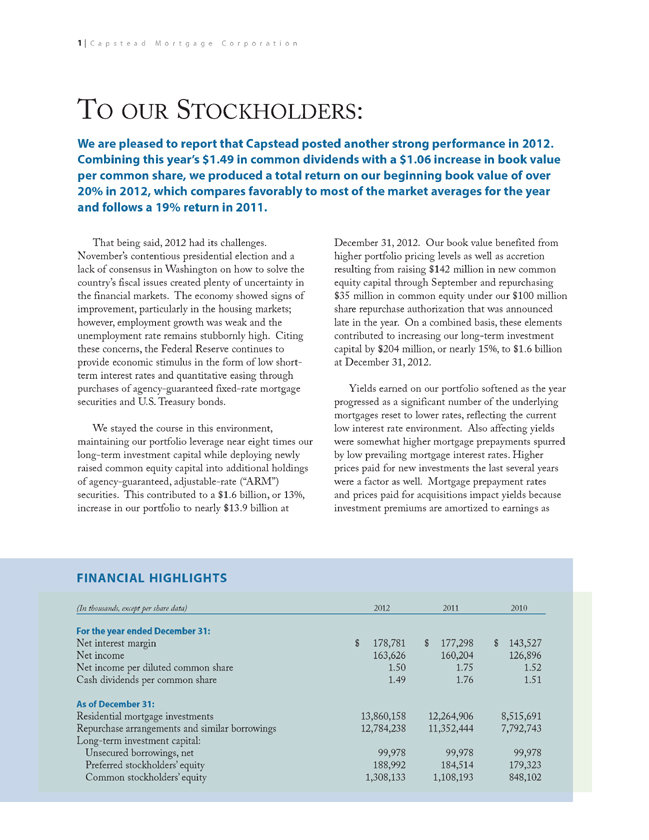

(In thousands, except per share data) 2012 2011 2010

For the year ended December 31:

Net interest margin $ 178,781 $ 177,298 $ 143,527

Net income 163,626 160,204 126,896

Net income per diluted common share 1.50 1.75 1.52

Cash dividends per common share 1.49 1.76 1.51

As of December 31:

Residential mortgage investments 13,860,158 12,264,906 8,515,691

Repurchase arrangements and similar borrowings 12,784,238 11,352,444 7,792,743

Long-term investment capital:

Unsecured borrowings, net 99,978 99,978 99,978

Preferred stockholders’ equity 188,992 184,514 179,323

Common stockholders’ equity 1,308,133 1,108,193 848,102

FINANCIAL HIGHLIGHTS

That being said, 2012 had its challenges.

November’s contentious presidential election and a

lack of consensus in Washington on how to solve the

country’s fiscal issues created plenty of uncertainty in

the financial markets. The economy showed signs of

improvement, particularly in the housing markets;

however, employment growth was weak and the

unemployment rate remains stubbornly high. Citing

these concerns, the Federal Reserve continues to

provide economic stimulus in the form of low shortterm

interest rates and quantitative easing through

purchases of agency-guaranteed fixed-rate mortgage

securities and U.S.Treasury bonds.

We stayed the course in this environment,

maintaining our portfolio leverage near eight times our

long-term investment capital while deploying newly

raised common equity capital into additional holdings

of agency-guaranteed, adjustable-rate (“ARM”)

securities. This contributed to a $1.6 billion, or 13%,

increase in our portfolio to nearly $13.9 billion at

December 31, 2012. Our book value benefited from

higher portfolio pricing levels as well as accretion

resulting from raising $142 million in new common

equity capital through September and repurchasing

$35 million in common equity under our $100 million

share repurchase authorization that was announced

late in the year. On a combined basis, these elements

contributed to increasing our long-term investment

capital by $204 million, or nearly 15%, to $1.6 billion

at December 31, 2012.

Yields earned on our portfolio softened as the year

progressed as a significant number of the underlying

mortgages reset to lower rates, reflecting the current

low interest rate environment. Also affecting yields

were somewhat higher mortgage prepayments spurred

by low prevailing mortgage interest rates.Higher

prices paid for new investments the last several years

were a factor as well. Mortgage prepayment rates

and prices paid for acquisitions impact yields because

investment premiums are amortized to earnings as

2 | C a p s t e a d M o r t g a g e C o r p o r a t i o n

yield adjustments over the life of the portfolio.

Meanwhile, our overall borrowing rates were flat year

over year, as higher market rates for short-term

borrowings offset benefits of lower hedging costs as

older, higher-rate interest rate swap agreements were

replaced at more favorable rates. We reported net

income of $164 million for 2012, up from $160 million

in 2011, while net income per diluted common share

declined 14% year over year to $1.50. This reflects

a 19% increase in average diluted common shares

outstanding resulting from raising $374 million in

new common equity capital over the past two years.

Looking forward, we believe many of the factors

leading to declining yields and higher short-term

borrowing rates during 2012 have largely run their

course. Further declines in weighted average coupons

should be muted given that an increasing number of

mortgage loans underlying our portfolio are at or near

fully indexed levels. Prevailing mortgage rates are off

the lows seen last fall, contributing to expectations that

refinancing activity may decline as 2013 progresses.

Furthering our optimism is our exclusive focus on

ARM securities, over half of which were originated

prior to 2008. Most of the mortgage loans underlying

these securities carry coupon interest rates at or below

current fixed mortgage rates, diminishing the economic

advantage, if any, of refinancing. Additionally, for

many of these homeowners, refinancing continues to be

hampered by low housing prices and credit problems.

As a result, we anticipate that mortgage prepayment

rates will remain manageable in 2013. As for our

borrowing costs, we are seeing lower market rates for

short-term borrowings than rates that were common

late in 2012. Additionally, we will benefit from lower

hedging costs as older and higher-rate interest rate

swap agreements expiring during 2013 are replaced at

significantly lower rates. Considering these positive

developments, we are expecting relatively stable

quarterly results in 2013.

We believe our focus on investing in a portfolio

of agency-guaranteed ARM securities is a prudent

investment strategy that can produce attractive riskadjusted

returns over the long term while reducing,

but not eliminating, sensitivity to changes in interest

rates. By focusing solely on agency-guaranteed ARM

securities we have differentiated Capstead from our

mortgage ReIT peers, many of which invest in fixedrate

and/or private label residential mortgage securities.

Coupon interest rates on mortgage loans underlying

ARM securities reset to more current interest rates

within a relatively short period of time. This allows

for a recovery of financing spreads diminished during

periods of rising interest rates and better insulates

our book value from changes in the interest rate

environment because resulting fluctuations in the value

of ARM securities are typically smaller compared to

fixed-rate mortgage securities. From a credit risk

perspective, agency-guaranteed securities are considered

to have limited, if any, credit risk, in light of federal

government support for Fannie Mae and Freddie Mac.

This support has largely alleviated concerns regarding

the ability of these government-sponsored enterprises

to fulfill their guarantee obligations.

We finance our investment portfolio using leverage provided by a variety of lending counterparties consisting primarily of large commercial

banking institutions based all over the world. These borrowings typically mature within 30 to 90 days.

$5.76

billion

$8.10

billion

PortfolioComposition

58% Current-Reset ARMs

42% Longer-to-Reset ARMs

We believe our focus on

investing in a portfolio of

agency-guaranteed ARM

securities is a prudent

investment strategy that

can produce attractive riskadjusted

returns over the long

term while reducing, but not

eliminating, sensitivity to

changes in interest rates.

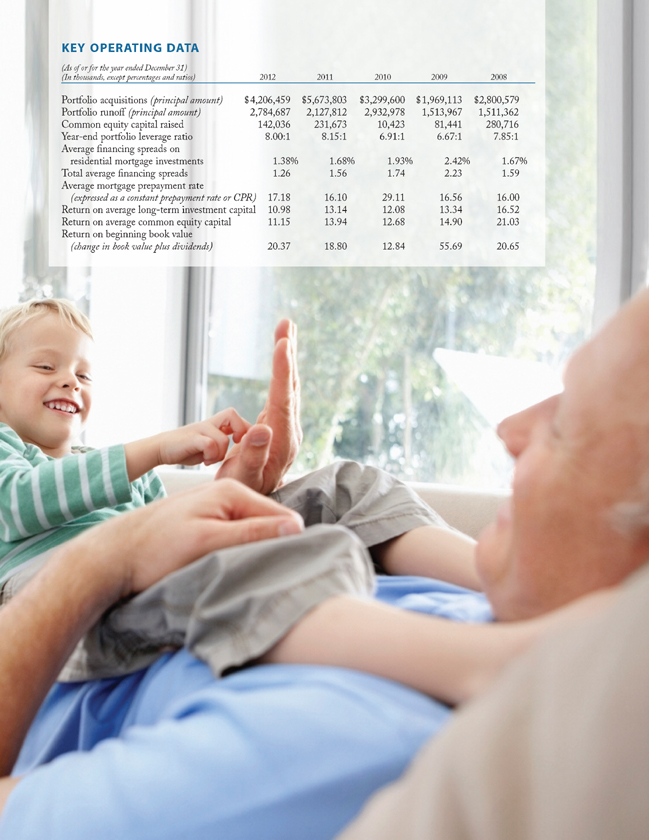

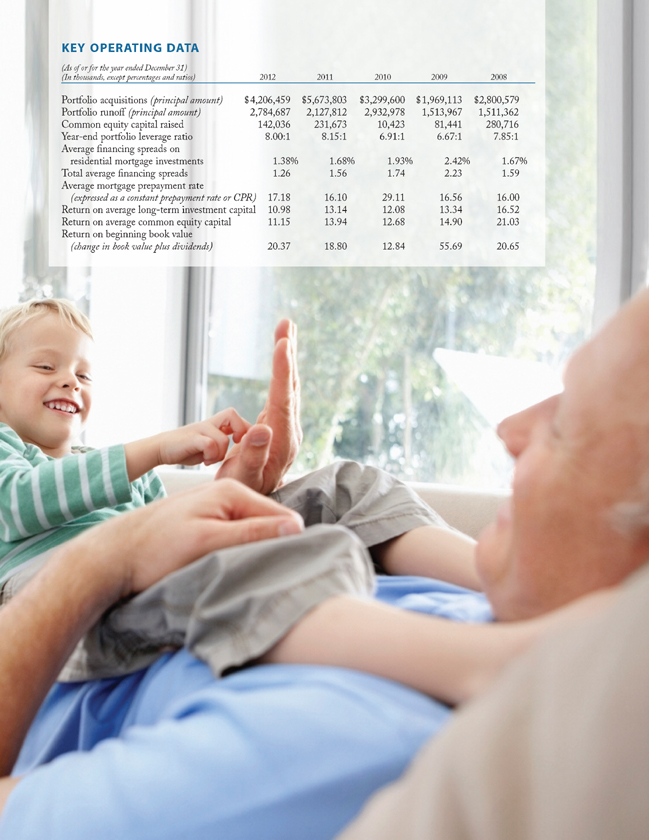

(As of or for the year ended December 31)

(In thousands, except percentages and ratios) 2012 2011 2010 2009 2008

Portfolio acquisitions (principal amount) $4,206,459 $5,673,803 $3,299,600 $1,969,113 $2,800,579

Portfolio runoff (principal amount) 2,784,687 2,127,812 2,932,978 1,513,967 1,511,362

Common equity capital raised 142,036 231,673 10,423 81,441 280,716

Year-end portfolio leverage ratio 8.00:1 8.15:1 6.91:1 6.67:1 7.85:1

Average Nnancing spreads on

residential mortgage investments 1.38% 1.68% 1.93% 2.42% 1.67%

Total average Nnancing spreads 1.26 1.56 1.74 2.23 1.59

Average mortgage prepayment rate

(expressed as a constant prepayment rate or CPR) 17.18 16.10 29.11 16.56 16.00

Return on average long-term investment capital 10.98 13.14 12.08 13.34 16.52

Return on average common equity capital 11.15 13.94 12.68 14.90 21.03

Return on beginning book value

(change in book value plus dividends) 20.37 18.80 12.84 55.69 20.65

KEY OPERATING DATA

Another differentiating factor between us and

most other mortgage ReITs is that we are internally

managed, meaning all of our investing activities are

performed by Capstead employees, not by an external

advisor. Additionally, approximately two-thirds of

our employee compensation expense for 2012 was

performance-based, with a significant amount of this

compensation awarded in shares of Capstead stock.

We believe this internally managed structure not only

avoids concerns regarding conflicts of interest unique

to externally managed companies, it also provides a

higher level of transparency regarding how we have

aligned the financial interests of our employees with

those of our stockholders through our compensation

practices. This strong alignment of interests through

the use of performance-based compensation practices

is reflected in an 11% year over year decrease in our

employee compensation costs for 2012.

Our future returns are predicated on our ability

to continue to produce attractive dividends while

preserving book value, both of which can fluctuate with

changes in market conditions. These returns may be

augmented by accretive capital raises when we can

invest new capital at attractive prices, as well as

opportunistic share repurchases should our shares trade

at a significant discount to book value and attractivelypriced

investments are not available. We believe that

by staying focused on our investment strategy of

managing a conservatively levered portfolio of agencyguaranteed

ARM securities, we are providing our

stockholders the opportunity to continue to prosper

over time.

On behalf of our board of directors and all of our

employees, thank you for your continued support

and investment.

Sincerely,

Andrew F. Jacobs

President and CeO

February 28, 2013

5 | C a p s t e a d M o r t g a g e C o r p o r a t i o n

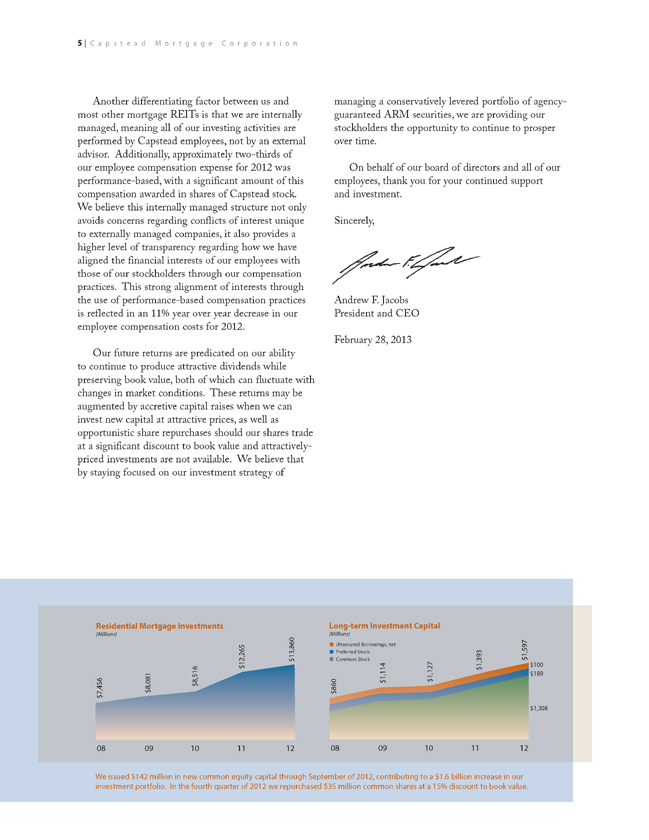

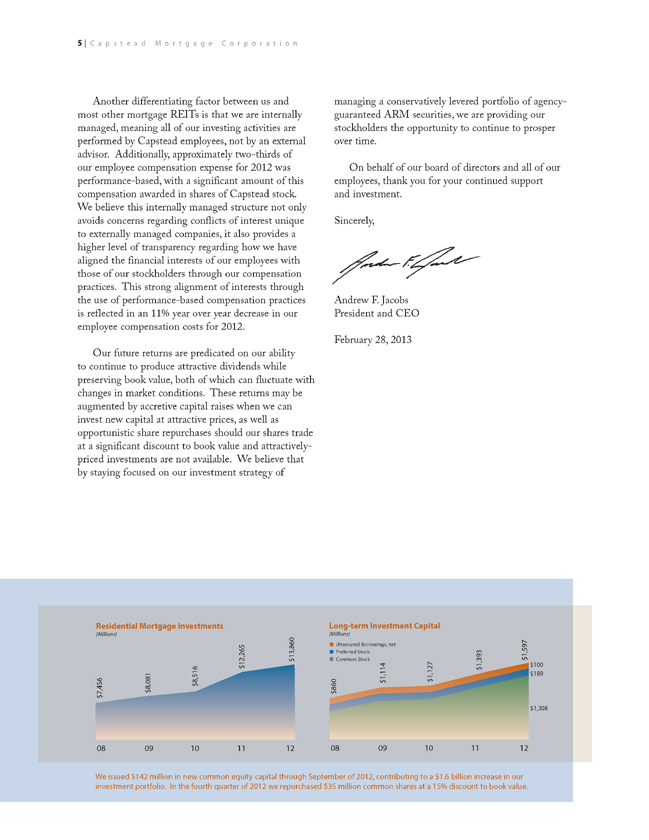

Residential Mortgage Investments

(Millions)

08 09 10 11 12

$7,456

$8,081

$8,516

$12,265

$13,860

We issued $142 million in new common equity capital through September of 2012, contributing to a $1.6 billion increase in our

investment portfolio. In the fourth quarter of 2012 we repurchased $35 million common shares at a 15% discount to book value.

Long-term Investment Capital

(Millions)

08 09 10 11 12

$1,597

$1,393

$1,127

$860

$1,114

Unsecured Borrowings, net

Preferred Stock

Common Stock

$1,308

$189

$100

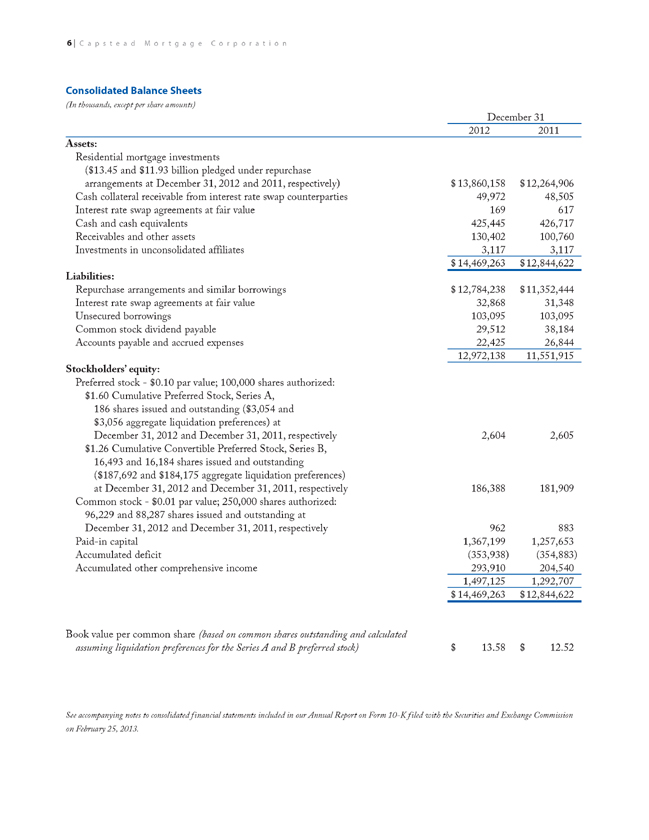

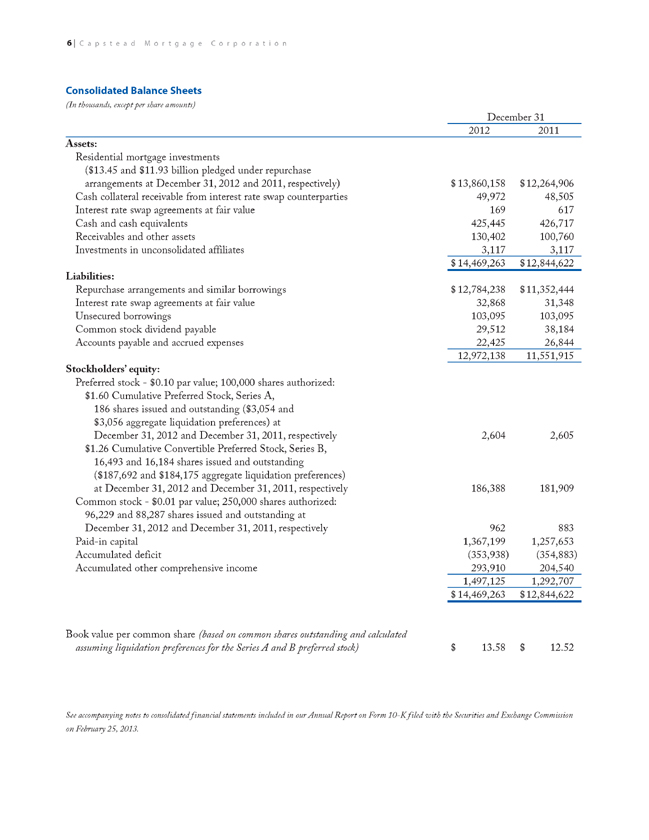

Consolidated Balance Sheets

(In thousands, except per share amounts)

December 31

2012 2011

Assets:

Residential mortgage investments

($13.45 and $11.93 billion pledged under repurchase

arrangements at December 31, 2012 and 2011, respectively) $ 13,860,158 $12,264,906

Cash collateral receivable from interest rate swap counterparties 49,972 48,505

Interest rate swap agreements at fair value 169 617

Cash and cash equivalents 425,445 426,717

Receivables and other assets 130,402 100,760

Investments in unconsolidated affiliates 3,117 3,117

$ 14,469,263 $12,844,622

Liabilities:

Repurchase arrangements and similar borrowings $ 12,784,238 $11,352,444

Interest rate swap agreements at fair value 32,868 31,348

Unsecured borrowings 103,095 103,095

Common stock dividend payable 29,512 38,184

Accounts payable and accrued expenses 22,425 26,844

12,972,138 11,551,915

Stockholders’ equity:

Preferred stock - $0.10 par value; 100,000 shares authorized:

$1.60 Cumulative Preferred Stock, Series A,

186 shares issued and outstanding ($3,054 and

$3,056 aggregate liquidation preferences) at

December 31, 2012 and December 31, 2011, respectively 2,604 2,605

$1.26 Cumulative Convertible Preferred Stock, Series B,

16,493 and 16,184 shares issued and outstanding

($187,692 and $184,175 aggregate liquidation preferences)

at December 31, 2012 and December 31, 2011, respectively 186,388 181,909

Common stock - $0.01 par value; 250,000 shares authorized:

96,229 and 88,287 shares issued and outstanding at

December 31, 2012 and December 31, 2011, respectively 962 883

Paid-in capital 1,367,199 1,257,653

Accumulated deficit (353,938) (354,883)

Accumulated other comprehensive income 293,910 204,540

1,497,125 1,292,707

$ 14,469,263 $12,844,622

Book value per common share (based on common shares outstanding and calculated

assuming liquidation preferences for the Series A and B preferred stock) $ 13.58 $ 12.52

See accompanying notes to consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission

on February 25, 2013.

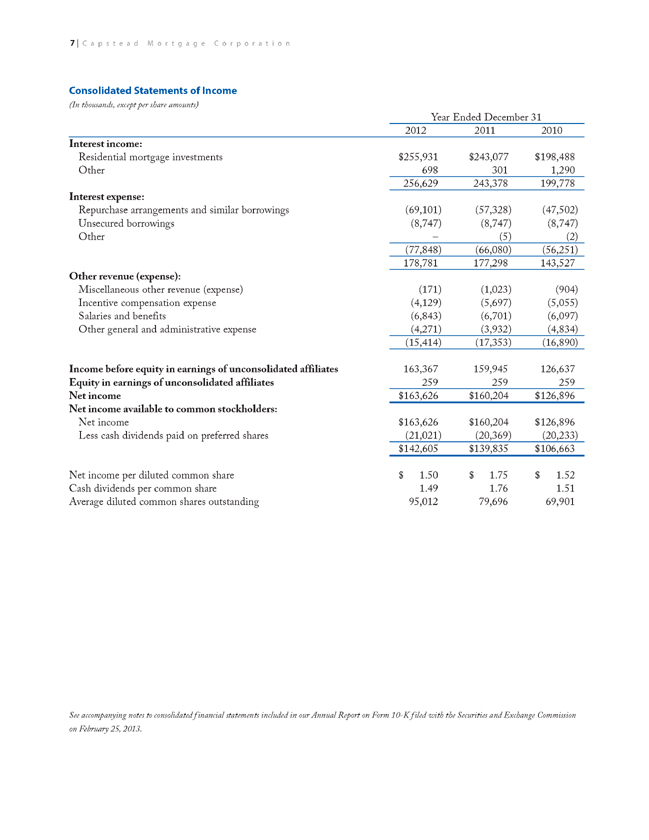

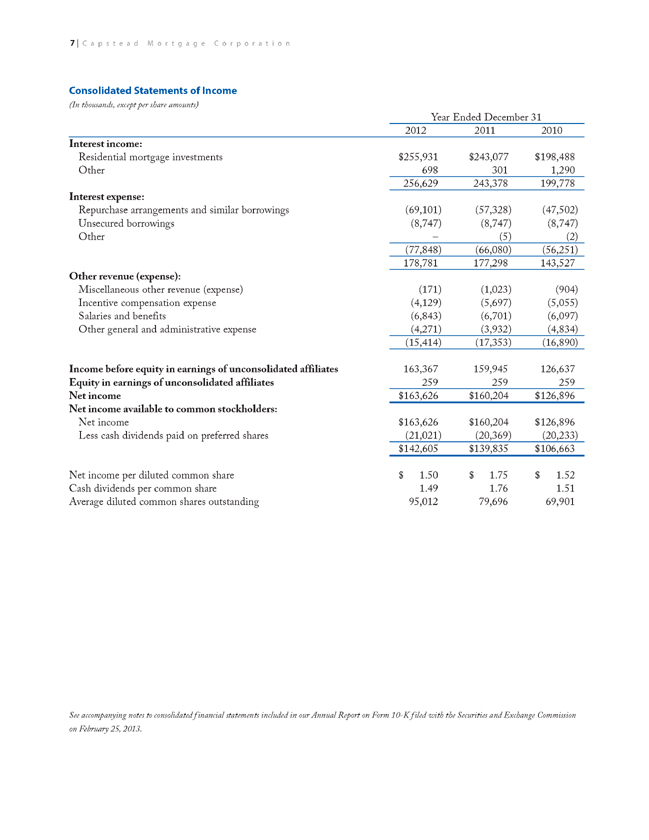

Consolidated Statements of Income

(In thousands, except per share amounts)

Year ended December 31

2012 2011 2010

Interest income:

Residential mortgage investments $255,931 $243,077 $198,488

Other 698 301 1,290

256,629 243,378 199,778

Interest expense:

Repurchase arrangements and similar borrowings (69,101) (57,328) (47,502)

Unsecured borrowings (8,747) (8,747) (8,747)

Other – (5) (2)

(77,848) (66,080) (56,251)

178,781 177,298 143,527

Other revenue (expense):

Miscellaneous other revenue (expense) (171) (1,023) (904)

Incentive compensation expense (4,129) (5,697) (5,055)

Salaries and benefits (6,843) (6,701) (6,097)

Other general and administrative expense (4,271) (3,932) (4,834)

(15,414) (17,353) (16,890)

Income before equity in earnings of unconsolidated affiliates 163,367 159,945 126,637

Equity in earnings of unconsolidated affiliates 259 259 259

Net income $163,626 $160,204 $126,896

Net income available to common stockholders:

Net income $163,626 $160,204 $126,896

Less cash dividends paid on preferred shares (21,021) (20,369) (20,233)

$142,605 $139,835 $106,663

Net income per diluted common share $ 1.50 $ 1.75 $ 1.52

Cash dividends per common share 1.49 1.76 1.51

Average diluted common shares outstanding 95,012 79,696 69,901

See accompanying notes to consolidated financial statements included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission

on February 25, 2013.

8 | C a p s t e a d M o r t g a g e C o r p o r a t i o n

Directors

Jack Bernard

executive Director,

Renewable Funding, LLC

Jack Biegler

Private Investments

Chairman of the Board

Michelle P. Goolsby

Partner,Greenmont Capital Partners II

Andrew F. Jacobs

President and Chief executive Officer

Gary keiser

Private Investments

Paul M. Low

Private Investments

Chairman emeritus

Christopher W.Mahowald

Managing Partner,

RSF Partners

Michael G. O’Neil

Private Investments

Mark S.Whiting

Chief executive Officer,

Drawbridge Realty Trust, LLC

Officers

President and CEO

Andrew F. Jacobs

President and Chief executive Officer

Executive Vice Presidents

Phillip A. Reinsch

Chief Financial Officer and Secretary

Robert R. Spears, Jr.

Director of Residential Mortgage

Investments

Senior Vice Presidents

Michael W. Brown

Asset and Liability Management

and Treasurer

D. Christopher Sieber

Financial Accounting and Reporting

Vice Presidents

Diane F.Wilson

Financial Accounting and Reporting

Richard A.Wolf

Asset and Liability Management

Capstead’s management team, left to right:

Andrew F. Jacobs, Robert R. Spears, Jr.,Michael W. Brown and Phillip A. Reinsch

Transfer Agent and Registrar

Inquiries concerning dividend payments, lost certiNcates,

change of address and account information should be

directed to:

Wells Fargo Shareowner Services

Post Office Box 64854

St. Paul,Minnesota 55164-0854

(800) 468-9716

www.wellsfargo.com/shareownerservices

Preferred Share Conversions

Holders of the Series A and Series B preferred shares may

convert into common shares at any time.

Holders of the Series A and Series B preferred shares are

advised to carefully consider whether or not it is

economically advantageous to convert into common

shares, considering the conversion ratio as well as the

prevailing market prices and dividends of both the

common and preferred shares.

If conversion is requested after one or more preferred

record dates and on or before the record date for payment

of quarterly dividends on the common shares, the

preferred holder requesting conversion must return to us

all preferred share dividends declared and paid for the

corresponding quarter.

Available Information

We make available on our website at www.capstead.com,

free of charge, our annual report on Form 10-k, quarterly

reports on Form 10-Q, current reports on Form 8-k,

investor presentations, quarterly fact sheets, press releases,

charters for the committees of the board of directors,

our Board of Director’s Guidelines, Code of Business

Conduct and ethics, Financial Code of Professional

Conduct and other company information, including

amendments to such documents and waivers, if any, to

the codes. Such information is also furnished upon

written request to:

Capstead Mortgage Corporation

Attention: Stockholder Relations

8401 North Central expressway

Suite 800

Dallas,Texas 75225-4404

Annual Meeting

Our annual meeting of stockholders will be held at

9:00 a.m. Central Time onWednesday, April 24, 2013 at:

8401 North Central expressway

Suite 220

Dallas,Texas 75225-4404

Corporate Shareholder Information

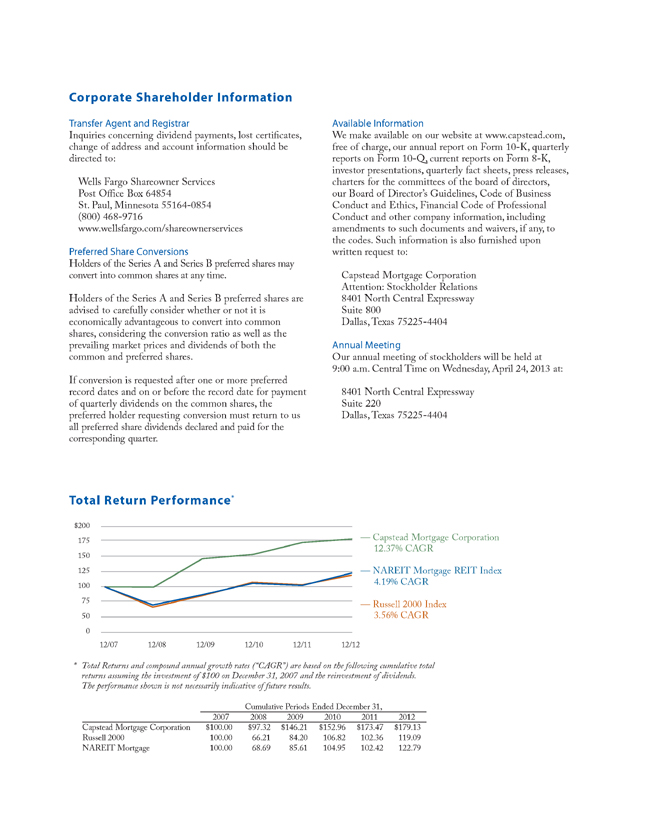

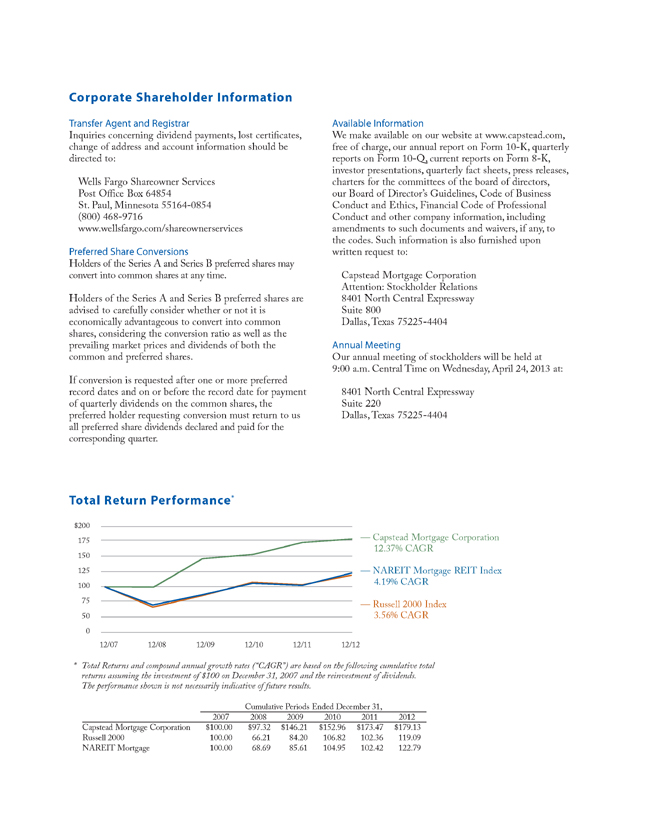

Total Return Performance*

Cumulative Periods ended December 31,

2007 2008 2009 2010 2011 2012

Capstead Mortgage Corporation $100.00 $97.32 $146.21 $152.96 $173.47 $179.13

Russell 2000 100.00 66.21 84.20 106.82 102.36 119.09

NAReIT Mortgage 100.00 68.69 85.61 104.95 102.42 122.79

$200

175

150

125

100

75

50

0

12/07 12/08 12/09 12/10 12/11 12/12

— Capstead Mortgage Corporation

12.37% CAGR

— NAReIT Mortgage ReIT Index

4.19% CAGR

— Russell 2000 Index

3.56% CAGR

* Total Returns and compound annual growth rates (“CAGR”) are based on the following cumulative total

returns assuming the investment of $100 on December 31, 2007 and the reinvestment of dividends.

The performance shown is not necessarily indicative of future results.

8401 North Central Expressway

Suite 800

Dallas, TX 75225-4404

(800) 358-2323

www.capstead.com

FORWARD-LOOkING STATeMeNTS

This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may

contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar

meaning. Forward-looking statements are based largely on the expectations of our management and are subject to a number of risks and uncertainties

including, but not limited to, the following:

changes in general economic conditions;

fluctuations in interest rates and levels of mortgage prepayments;

the effectiveness of risk management strategies;

the impact of differing levels of leverage employed;

liquidity of secondary markets and credit markets;

the availability of financing at reasonable levels and terms to support investing on a leveraged basis;

the availability of new investment capital;

the availability of suitable qualifying investments from both an investment return and regulatory perspective;

changes in legislation or regulation affecting exemptions for mortgage ReITs from regulation under the Investment Company Act of 1940;

changes in legislation or regulation affecting FannieMae, FreddieMac,GinnieMae and similar federal government agencies and related guarantees;

deterioration in credit quality and ratings of existing or future issuances of agency-guaranteed mortgage securities; and

increases in costs and other general competitive factors.

In addition to the above considerations, our actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be

significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks,

uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances

discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forwardlooking

statements speak only as of the date the statement is made and we undertake no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any

forward-looking statements included herein.

CAP1AR2013