Information as of March 31, 2017 Investor Presentation Exhibit 99.1

and individual income tax reform, federal government fiscal challenges and Federal Reserve monetary policy, including policy regarding its holdings of Agency and U.S. Treasury Securities; deterioration in credit quality and ratings of existing or future issuances of Fannie Mae, Freddie Mac or Ginnie Mae securities; changes in legislation or regulation affecting Fannie Mae, Freddie Mac, Ginnie Mae and similar federal government agencies and related guarantees; changes in legislation or regulation affecting exemptions for mortgage REITs from regulation under the Investment Company Act of 1940; other changes in legislation or regulation affecting the mortgage and banking industries; and increases in costs and other general competitive factors. Safe Harbor Statement - Private Securities Litigation Reform Act of 1995 Statement Concerning Forward-looking Statements This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Forward-looking statements are based largely on the expectations of management and are subject to a number of risks and uncertainties including, but not limited to, the following: In addition to the above considerations, actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein. changes in general economic conditions; fluctuations in interest rates and levels of mortgage prepayments; the effectiveness of risk management strategies; the impact of differing levels of leverage employed; liquidity of secondary markets and credit markets; the availability of financing at reasonable levels and terms to support investing on a leveraged basis; the availability of new investment capital; the availability of suitable qualifying investments from both an investment return and regulatory perspective; changes in market conditions as a result of federal corporate and individual income tax reform, federal government fiscal 2

Company Summary Proven Strategy of Efficiently Managing a Leveraged Portfolio of Short-Duration Agency-Guaranteed ARM Securities Experienced Management Team Aligned with Stockholders Overview of Capstead Mortgage Corporation Founded in 1985, Capstead is the oldest publicly-traded residential mortgage REIT. Our sole focus is on managing a leveraged portfolio of short-duration* agency-guaranteed (i.e. Fannie Mae, Freddie Mac and Ginnie Mae) residential ARM securities that is appropriately hedged and can earn attractive risk-adjusted returns over the long term, with little, if any, credit risk. At March 31, 2017, our agency-guaranteed ARM securities portfolio stood at $13.41 billion, supported by $1.36 billion in long-term investment capital levered 9.04 times. Our short-duration strategy differentiates us from our peers because the adjustable-rate mortgages underlying our portfolio reset to more current interest rates within a relatively short period of time: allowing us to benefit from future recoveries in financing spreads that typically contract during periods of rising interest rates, and resulting in smaller fluctuations in portfolio values from changes in interest rates compared to portfolios containing a significant amount of longer-duration ARM or fixed-rate mortgage securities. By virtue of being internally-managed and with our sole focus on agency-guaranteed securities, we are arguably the most efficient mortgage REIT in the industry. Our top three executive officers have a combined 75 years of mortgage finance industry experience. We are internally-managed with low operating costs and a strong focus on performance-based compensation. This structure greatly enhances the alignment of management interests with those of our stockholders. 3 This singular and straightforward investment strategy, together with our use of cash flow hedge accounting, allows for easily understood transparent financial reporting, with limited use of non-GAAP financial measures. Additional transparency is evident by virtue of our internally-managed structure – our compensation-related decisions and costs are fully disclosed and subject to annual say-on-pay approvals. We make every effort to provide additional analysis in our earnings reports, SEC filings and analyst presentations that tells our story in a complete and straightforward fashion. Straightforward Investment Strategy and Transparent Reporting * Duration is a measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

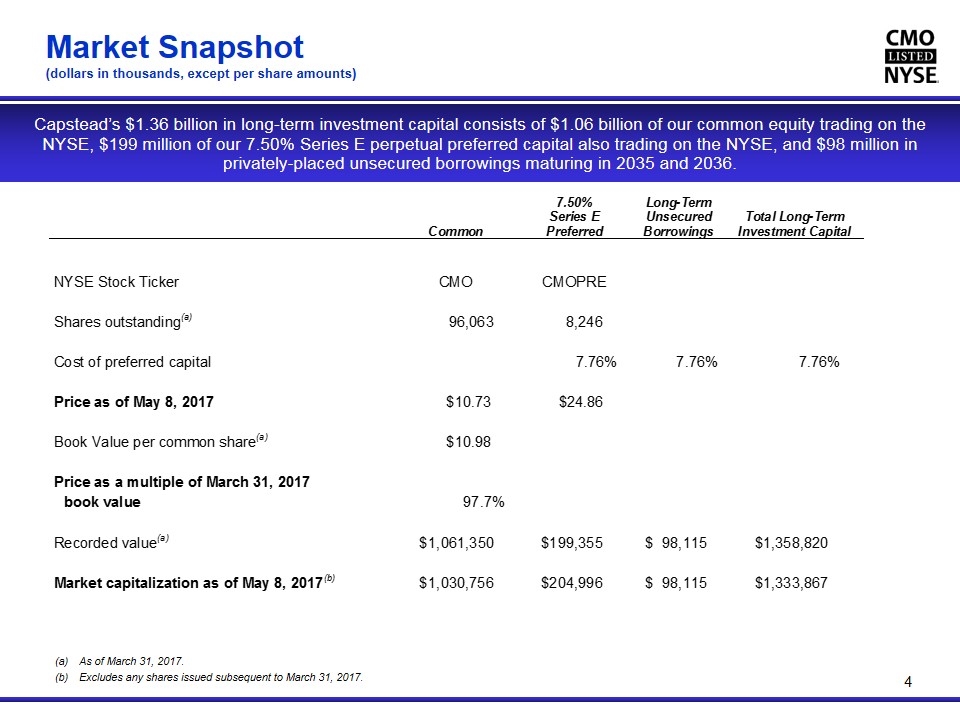

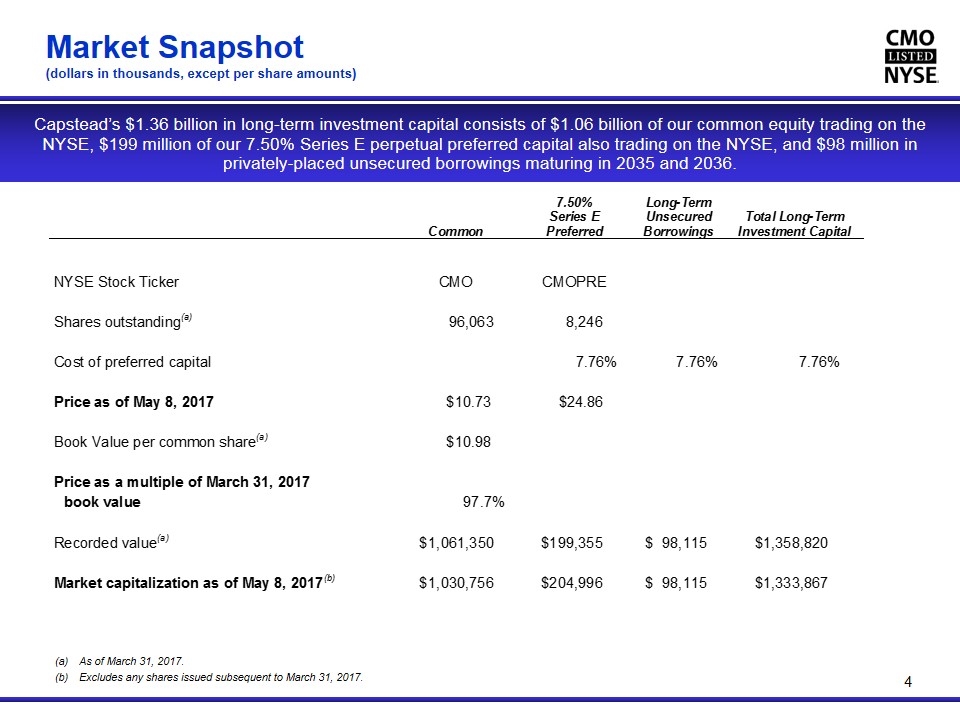

Market Snapshot (dollars in thousands, except per share amounts) 4 As of March 31, 2017. Excludes any shares issued subsequent to March 31, 2017. Capstead’s $1.36 billion in long-term investment capital consists of $1.06 billion of our common equity trading on the NYSE, $199 million of our 7.50% Series E perpetual preferred capital also trading on the NYSE, and $98 million in privately-placed unsecured borrowings maturing in 2035 and 2036.

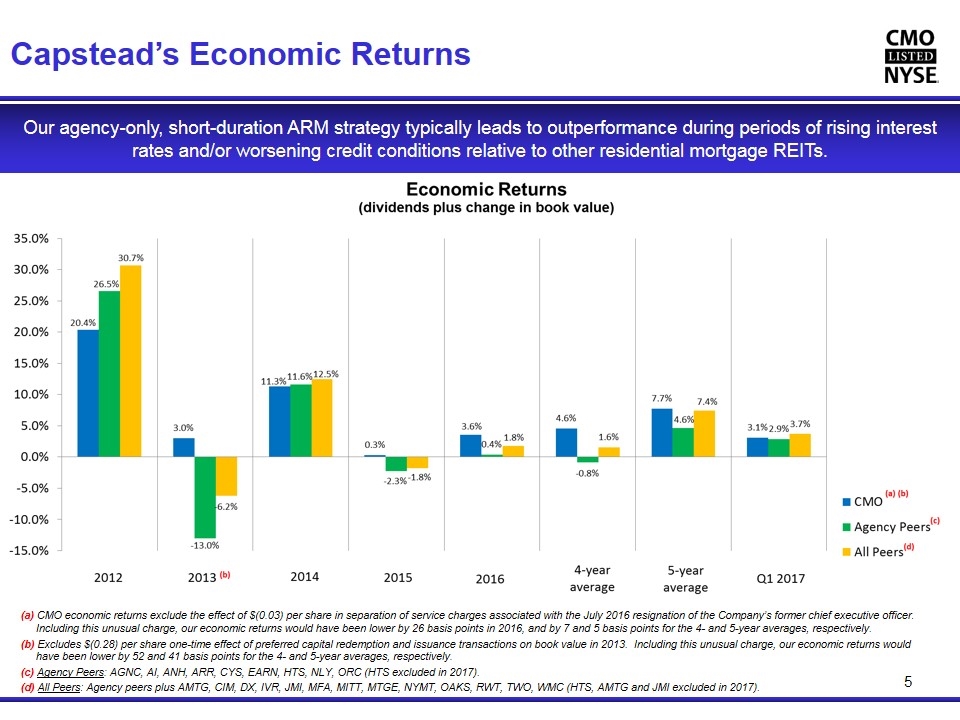

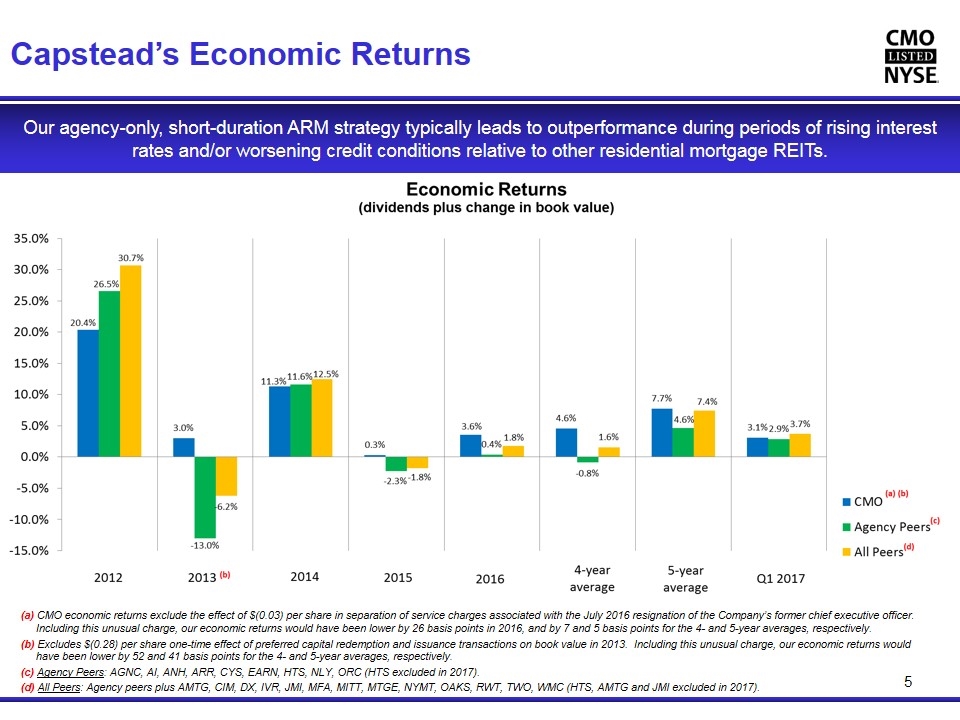

Capstead’s Economic Returns Our agency-only, short-duration ARM strategy typically leads to outperformance during periods of rising interest rates and/or worsening credit conditions relative to other residential mortgage REITs. 5 (a) CMO economic returns exclude the effect of $(0.03) per share in separation of service charges associated with the July 2016 resignation of the Company’s former chief executive officer. Including this unusual charge, our economic returns would have been lower by 26 basis points in 2016, and by 7 and 5 basis points for the 4- and 5-year averages, respectively. (b) Excludes $(0.28) per share one-time effect of preferred capital redemption and issuance transactions on book value in 2013. Including this unusual charge, our economic returns would have been lower by 52 and 41 basis points for the 4- and 5-year averages, respectively. (c) Agency Peers: AGNC, AI, ANH, ARR, CYS, EARN, HTS, NLY, ORC (HTS excluded in 2017). (d) All Peers: Agency peers plus AMTG, CIM, DX, IVR, JMI, MFA, MITT, MTGE, NYMT, OAKS, RWT, TWO, WMC (HTS, AMTG and JMI excluded in 2017).

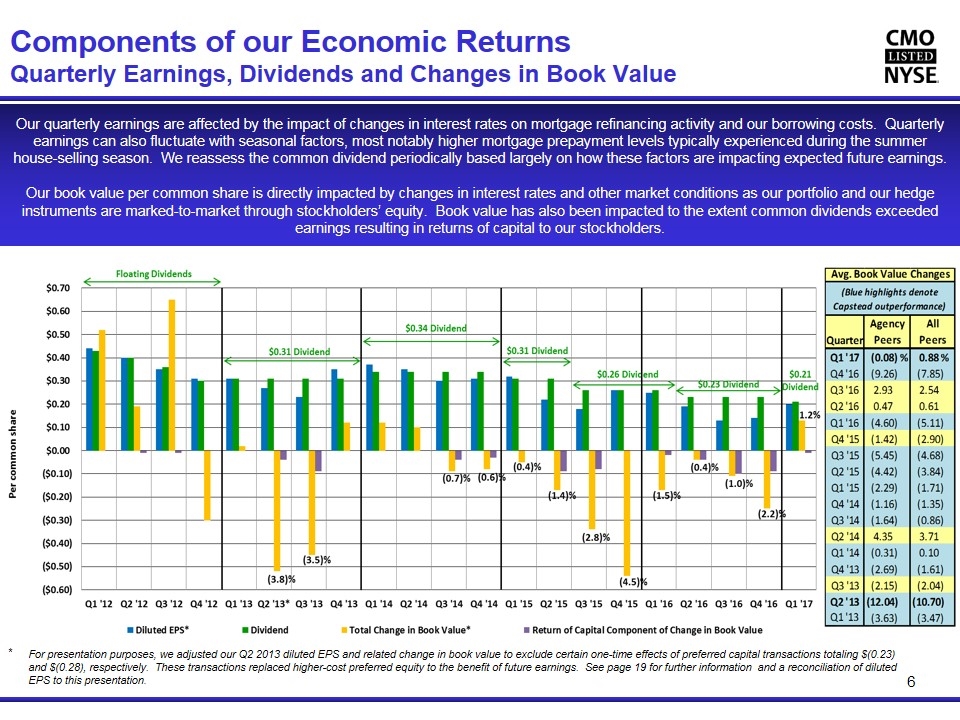

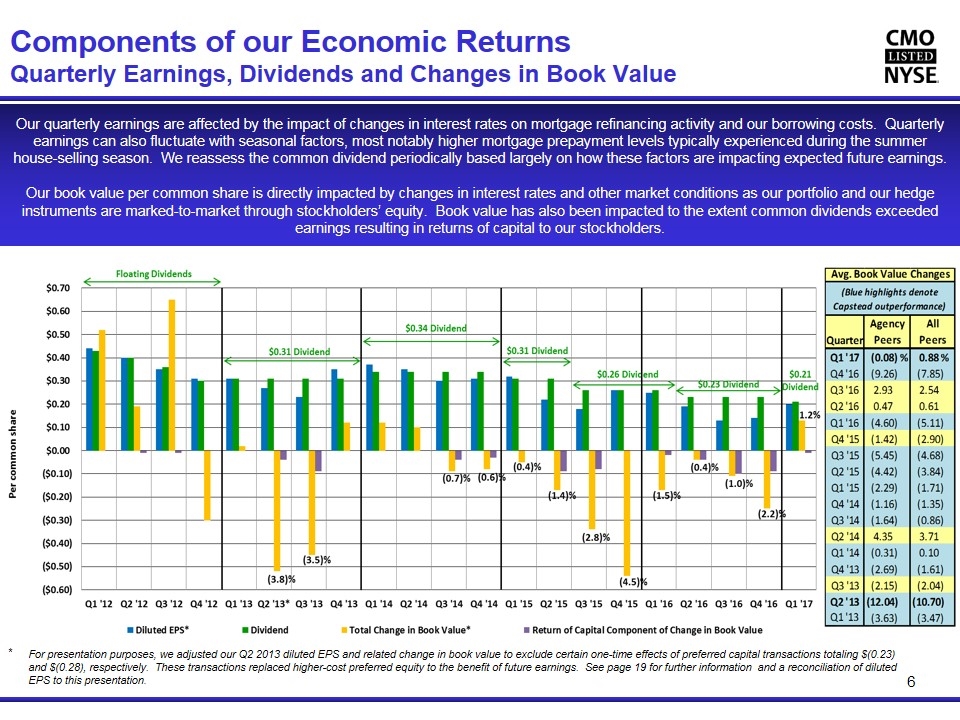

Components of our Economic Returns Quarterly Earnings, Dividends and Changes in Book Value 6 Our quarterly earnings are affected by the impact of changes in interest rates on mortgage refinancing activity and our borrowing costs. Quarterly earnings can also fluctuate with seasonal factors, most notably higher mortgage prepayment levels typically experienced during the summer house-selling season. We reassess the common dividend periodically based largely on how these factors are impacting expected future earnings. Our book value per common share is directly impacted by changes in interest rates and other market conditions as our portfolio and our hedge instruments are marked-to-market through stockholders’ equity. Book value has also been impacted to the extent common dividends exceeded earnings resulting in returns of capital to our stockholders. For presentation purposes, we adjusted our Q2 2013 diluted EPS and related change in book value to exclude certain one-time effects of preferred capital transactions totaling $(0.23) and $(0.28), respectively. These transactions replaced higher-cost preferred equity to the benefit of future earnings. See page 19 for further information and a reconciliation of diluted EPS to this presentation.

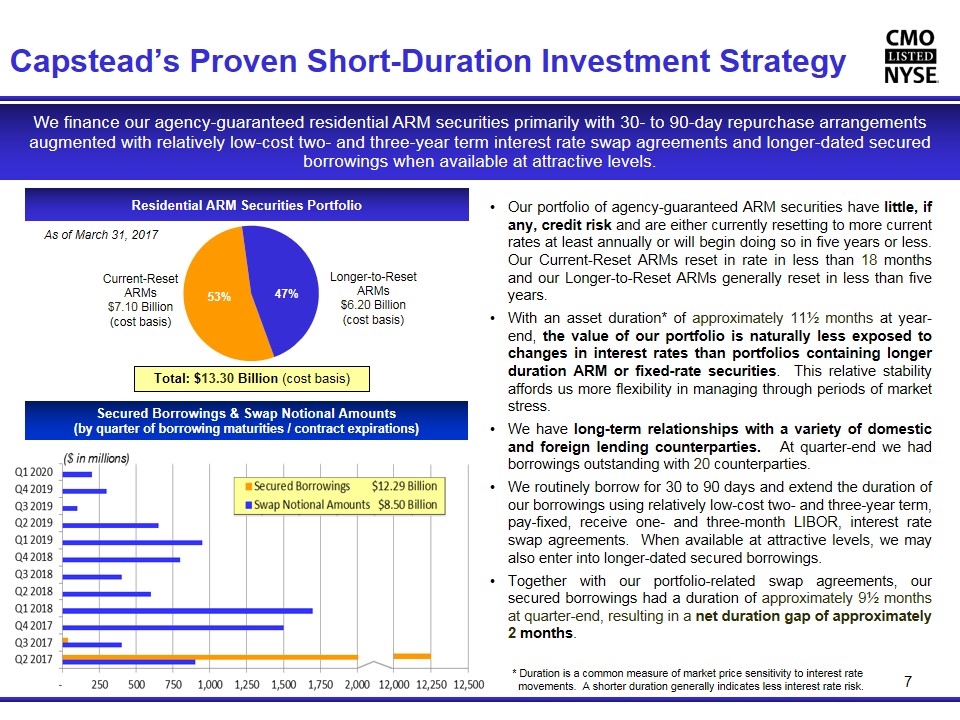

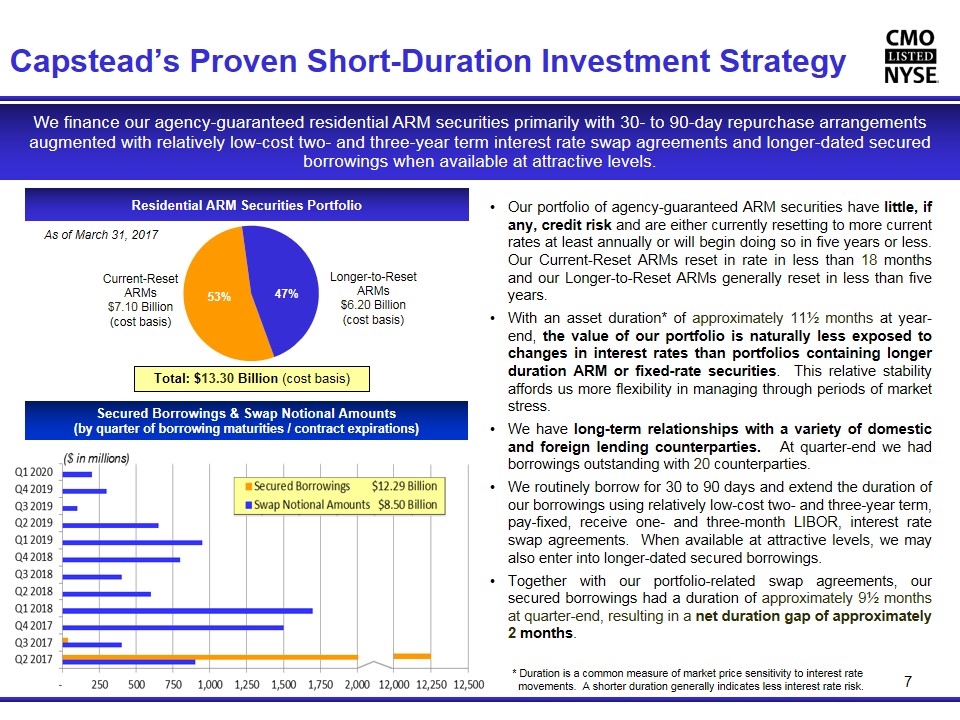

Capstead’s Proven Short-Duration Investment Strategy 7 As of March 31, 2017 We finance our agency-guaranteed residential ARM securities primarily with 30- to 90-day repurchase arrangements augmented with relatively low-cost two- and three-year term interest rate swap agreements and longer-dated secured borrowings when available at attractive levels. Residential ARM Securities Portfolio Secured Borrowings & Swap Notional Amounts (by quarter of borrowing maturities / contract expirations) Total: $13.30 Billion (cost basis) Our portfolio of agency-guaranteed ARM securities have little, if any, credit risk and are either currently resetting to more current rates at least annually or will begin doing so in five years or less. Our Current-Reset ARMs reset in rate in less than 18 months and our Longer-to-Reset ARMs generally reset in less than five years. With an asset duration* of approximately 11½ months at year-end, the value of our portfolio is naturally less exposed to changes in interest rates than portfolios containing longer duration ARM or fixed-rate securities. This relative stability affords us more flexibility in managing through periods of market stress. We have long-term relationships with a variety of domestic and foreign lending counterparties. At quarter-end we had borrowings outstanding with 20 counterparties. We routinely borrow for 30 to 90 days and extend the duration of our borrowings using relatively low-cost two- and three-year term, pay-fixed, receive one- and three-month LIBOR, interest rate swap agreements. When available at attractive levels, we may also enter into longer-dated secured borrowings. Together with our portfolio-related swap agreements, our secured borrowings had a duration of approximately 9½ months at quarter-end, resulting in a net duration gap of approximately 2 months. Longer-to-Reset ARMs $6.20 Billion (cost basis) Current-Reset ARMs $7.10 Billion (cost basis) * Duration is a common measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk.

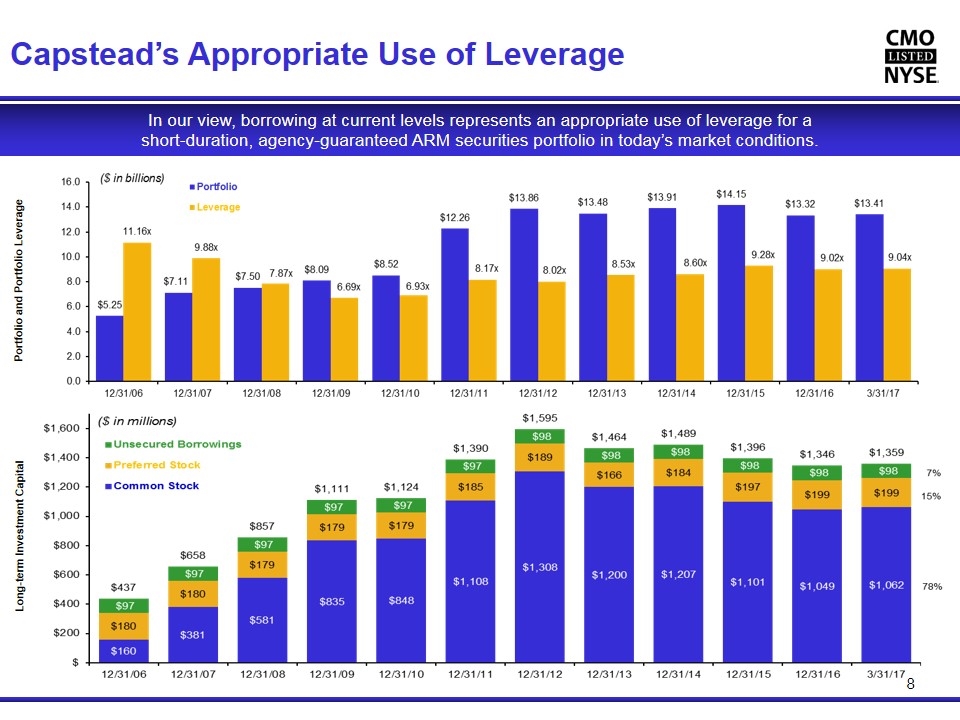

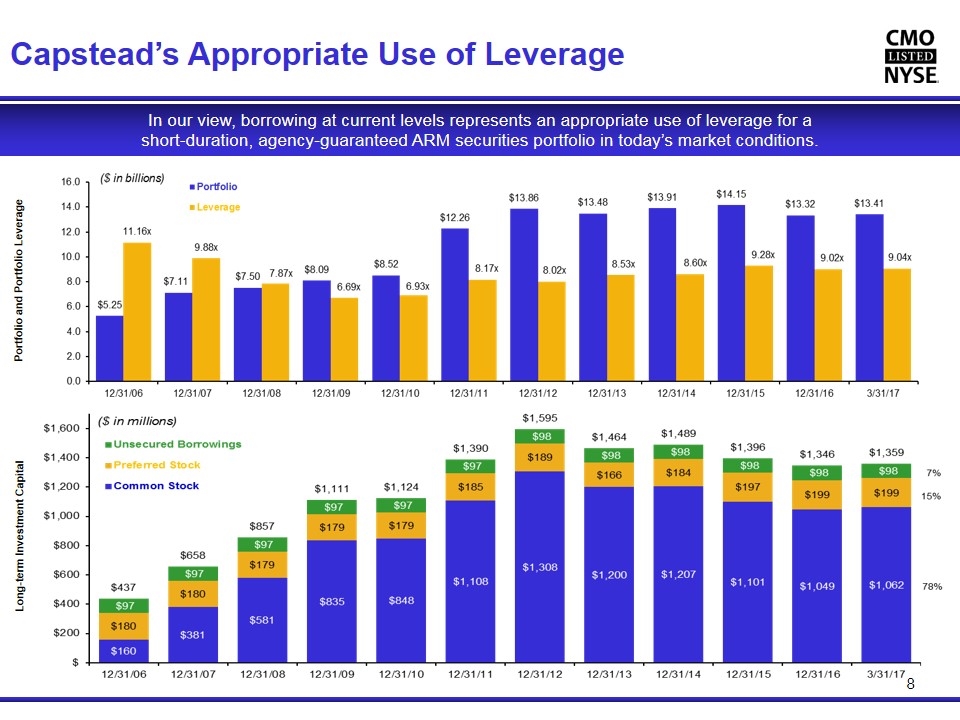

Capstead’s Appropriate Use of Leverage 8 Portfolio and Portfolio Leverage In our view, borrowing at current levels represents an appropriate use of leverage for a short-duration, agency-guaranteed ARM securities portfolio in today’s market conditions. Long-term Investment Capital

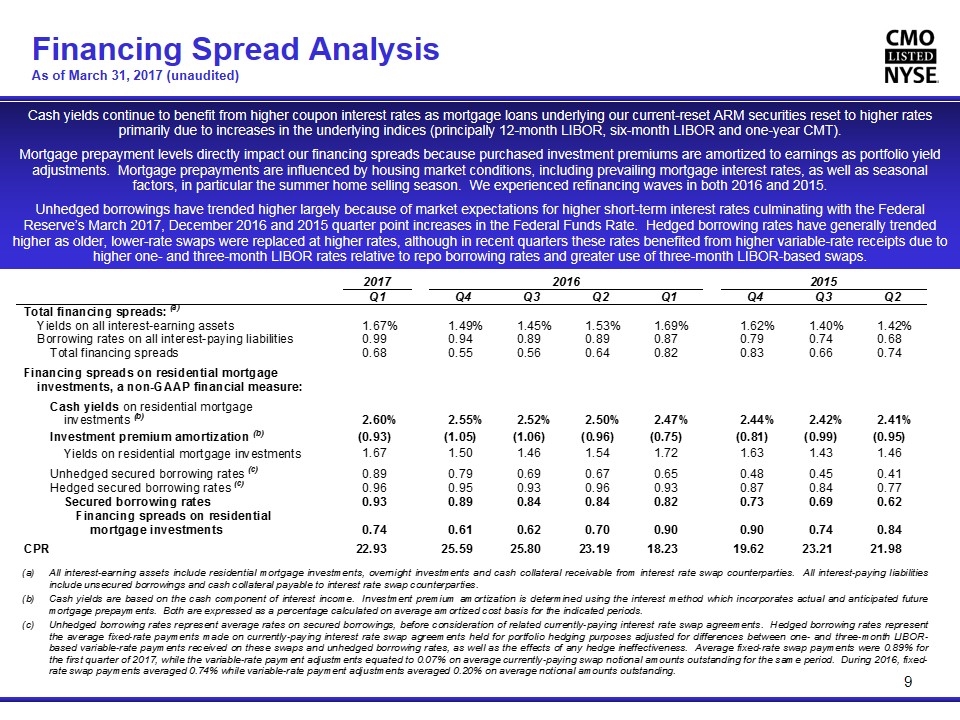

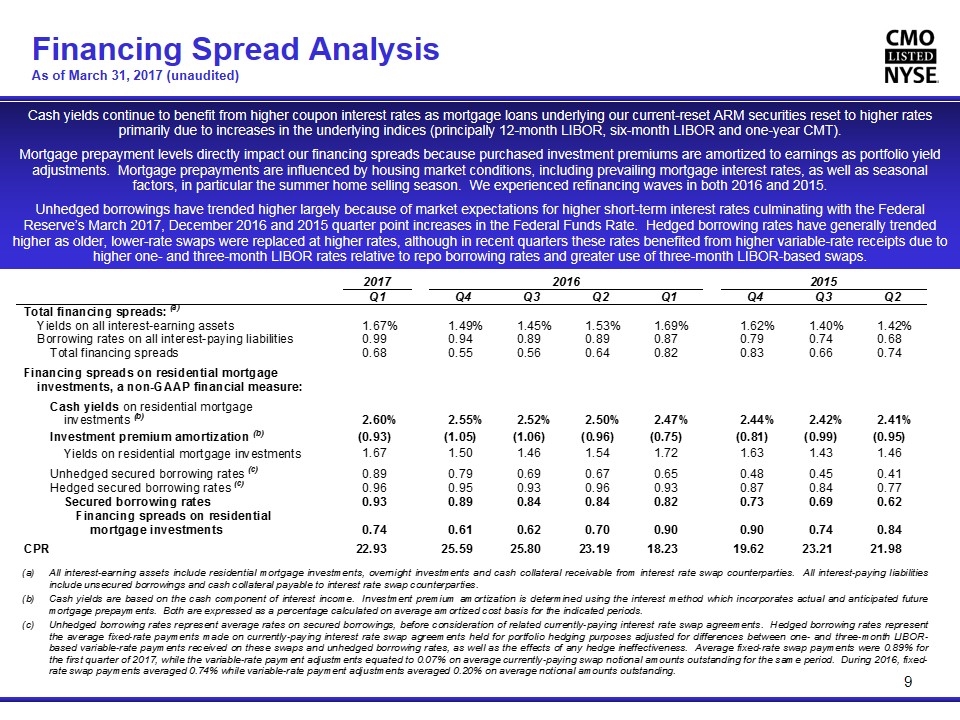

Financing Spread Analysis As of March 31, 2017 (unaudited) 9 Cash yields continue to benefit from higher coupon interest rates as mortgage loans underlying our current-reset ARM securities reset to higher rates primarily due to increases in the underlying indices (principally 12-month LIBOR, six-month LIBOR and one-year CMT). Mortgage prepayment levels directly impact our financing spreads because purchased investment premiums are amortized to earnings as portfolio yield adjustments. Mortgage prepayments are influenced by housing market conditions, including prevailing mortgage interest rates, as well as seasonal factors, in particular the summer home selling season. We experienced refinancing waves in both 2016 and 2015. Unhedged borrowings have trended higher largely because of market expectations for higher short-term interest rates culminating with the Federal Reserve’s March 2017, December 2016 and 2015 quarter point increases in the Federal Funds Rate. Hedged borrowing rates have generally trended higher as older, lower-rate swaps were replaced at higher rates, although in recent quarters these rates benefited from higher variable-rate receipts due to higher one- and three-month LIBOR rates relative to repo borrowing rates and greater use of three-month LIBOR-based swaps.

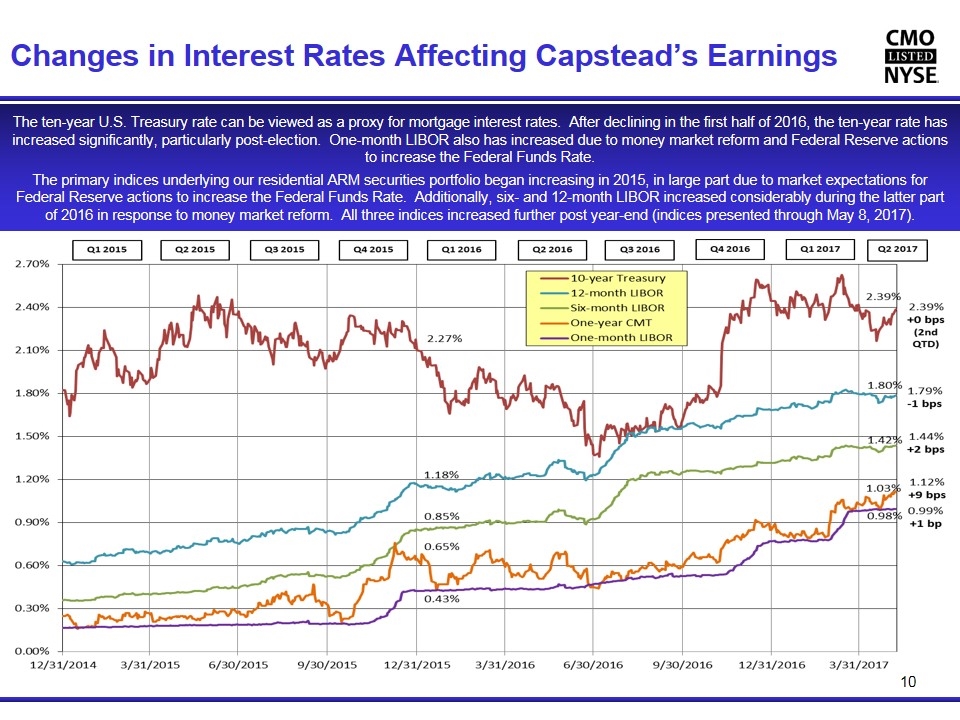

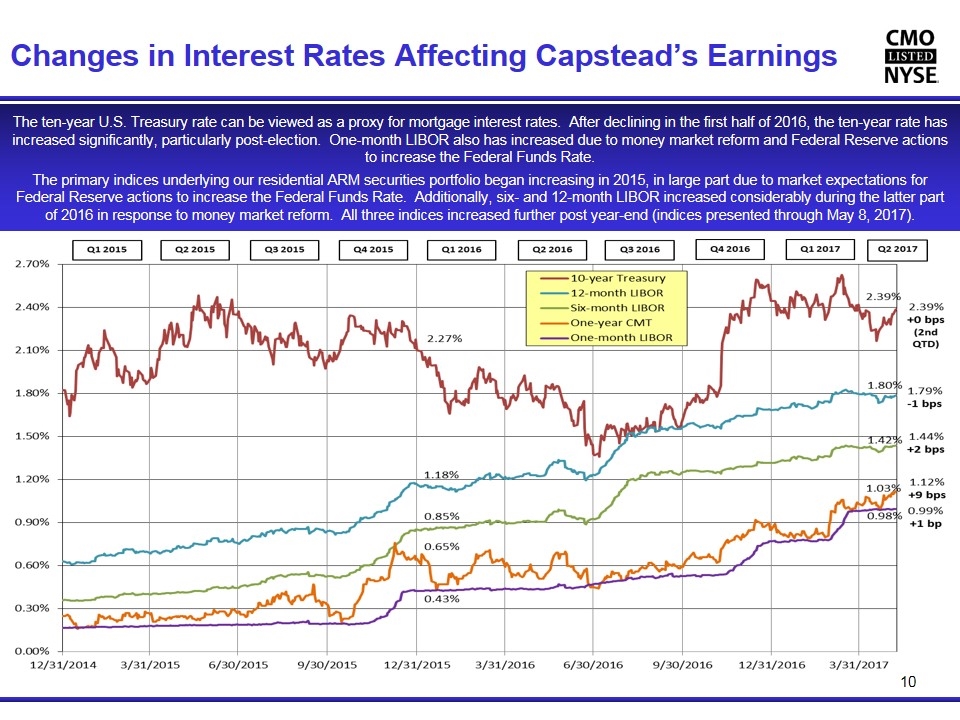

Changes in Interest Rates Affecting Capstead’s Earnings The ten-year U.S. Treasury rate can be viewed as a proxy for mortgage interest rates. After declining in the first half of 2016, the ten-year rate has increased significantly, particularly post-election. One-month LIBOR also has increased due to money market reform and Federal Reserve actions to increase the Federal Funds Rate. The primary indices underlying our residential ARM securities portfolio began increasing in 2015, in large part due to market expectations for Federal Reserve actions to increase the Federal Funds Rate. Additionally, six- and 12-month LIBOR increased considerably during the latter part of 2016 in response to money market reform. All three indices increased further post year-end (indices presented through May 8, 2017). 10

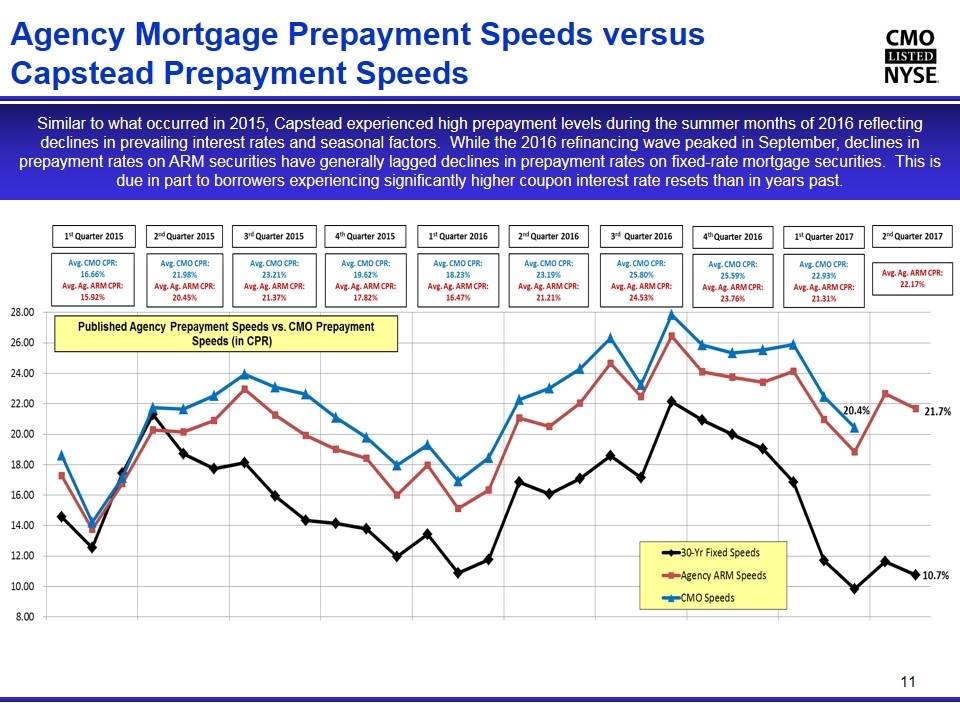

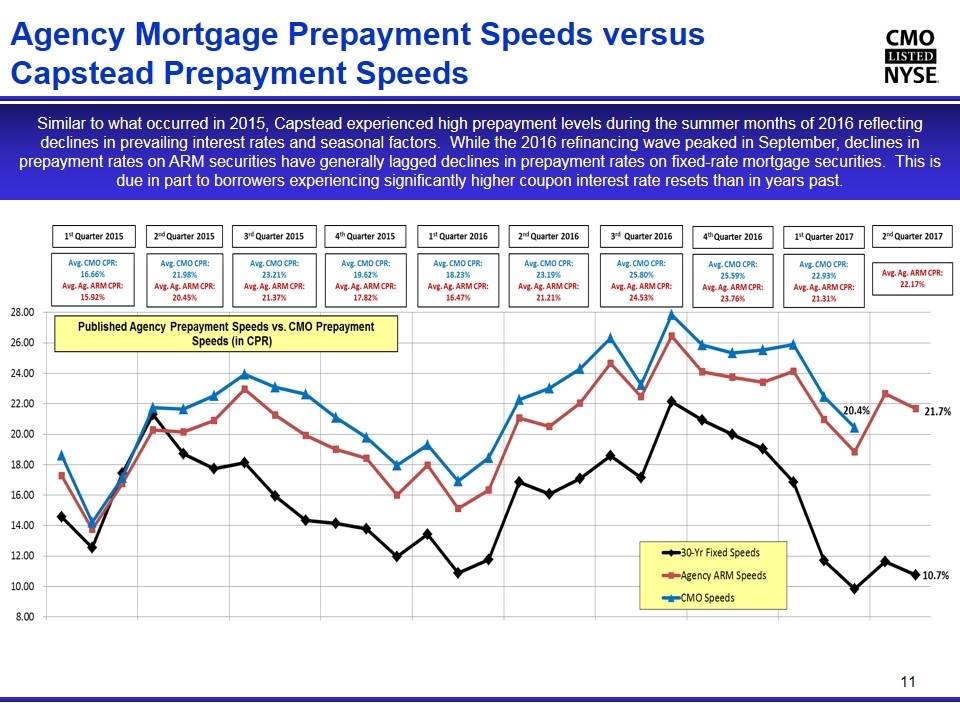

Agency Mortgage Prepayment Speeds versus Capstead Prepayment Speeds Similar to what occurred in 2015, Capstead experienced high prepayment levels during the summer months of 2016 reflecting declines in prevailing interest rates and seasonal factors. While the 2016 refinancing wave peaked in September, declines in prepayment rates on ARM securities have generally lagged declines in prepayment rates on fixed-rate mortgage securities. This is due in part to borrowers experiencing significantly higher coupon interest rate resets than in years past. 11

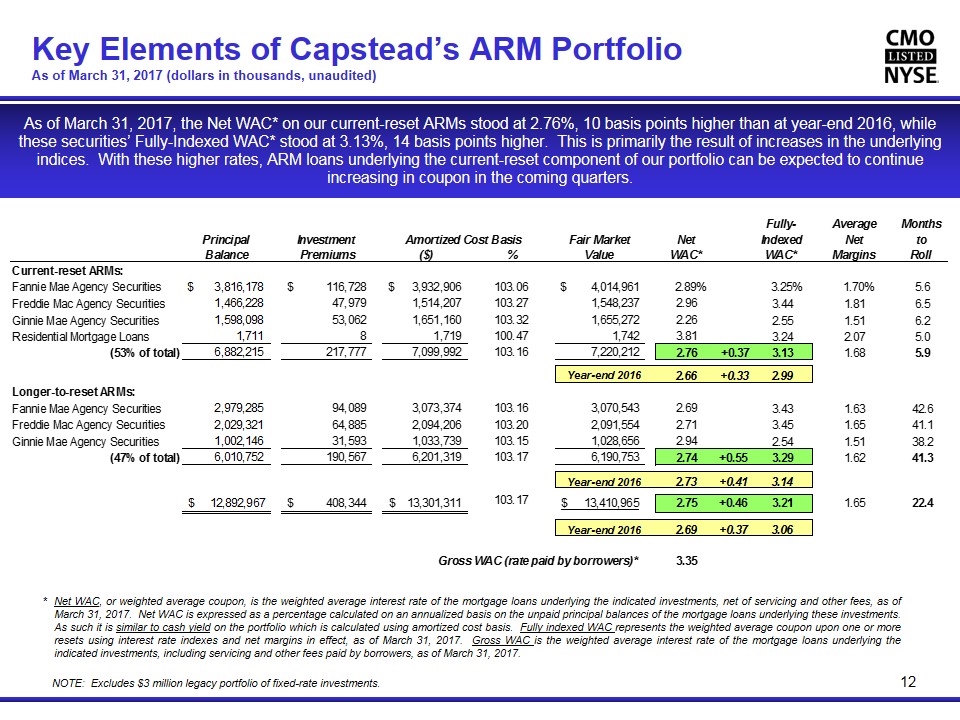

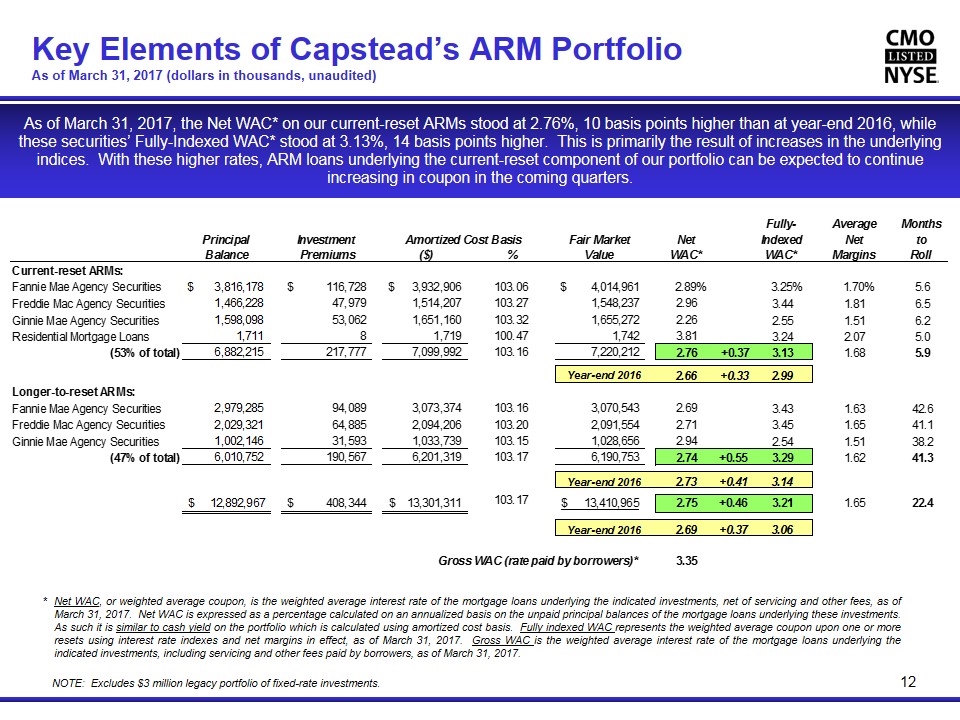

*Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees, as of March 31, 2017. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balances of the mortgage loans underlying these investments. As such it is similar to cash yield on the portfolio which is calculated using amortized cost basis. Fully indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins in effect, as of March 31, 2017. Gross WAC is the weighted average interest rate of the mortgage loans underlying the indicated investments, including servicing and other fees paid by borrowers, as of March 31, 2017. Key Elements of Capstead’s ARM Portfolio As of March 31, 2017 (dollars in thousands, unaudited) 12 NOTE: Excludes $3 million legacy portfolio of fixed-rate investments. As of March 31, 2017, the Net WAC* on our current-reset ARMs stood at 2.76%, 10 basis points higher than at year-end 2016, while these securities’ Fully-Indexed WAC* stood at 3.13%, 14 basis points higher. This is primarily the result of increases in the underlying indices. With these higher rates, ARM loans underlying the current-reset component of our portfolio can be expected to continue increasing in coupon in the coming quarters. Fully- Average Months Principal Investment Amortized Cost Basis Fair Market Net Indexed Net to Balance Premiums ($) % Value WAC* WAC* Margins Roll Current-reset ARMs: Fannie Mae Agency Securities $3,816,178 $,116,728 $3,932,906 103.05876717490641 $4,014,961 2.89% 3.25% 1.70% 5.6 Freddie Mac Agency Securities 1,466,228 47,979 1,514,207 103.27227416199935 1,548,237 2.96 3.44 1.81 6.5 Ginnie Mae Agency Securities 1,598,098 53,062 1,651,160 103.32032203281652 1,655,272 2.2599999999999998 2.5499999999999998 1.51 6.2 Residential Mortgage Loans 1,711 8 1,719 100.46756282875511 1,742 3.81 3.24 2.0699999999999998 5 (53% of total) 6,882,215 ,217,777 7,099,992 103.16434461870196 7,220,212 2.76 +0.37 3.13 1.68 5.9 Year-end 2016 2.66 +0.33 2.99 Longer-to-reset ARMs: Fannie Mae Agency Securities 2,979,285 94,089 3,073,374 103.15810672694958 3,070,543 2.69 3.43 1.63 42.6 Freddie Mac Agency Securities 2,029,321 64,885 2,094,206 103.19737488549126 2,091,554 2.71 3.45 1.65 41.1 Ginnie Mae Agency Securities 1,002,146 31,593 1,033,739 103.15253466061831 1,028,656 2.94 2.54 1.51 38.200000000000003 (47% of total) 6,010,752 ,190,567 6,201,319 103.17043524670457 6,190,753 2.74 +0.55 3.29 1.62 41.3 Year-end 2016 2.73 +0.41 3.14 $12,892,967 $,408,344 $13,301,311 103.16718409346738 $13,410,965 2.75 +0.46 3.21 1.65 22.4 Year-end 2016 2.69 +0.37 3.06 Gross WAC (rate paid by borrowers)* 3.35

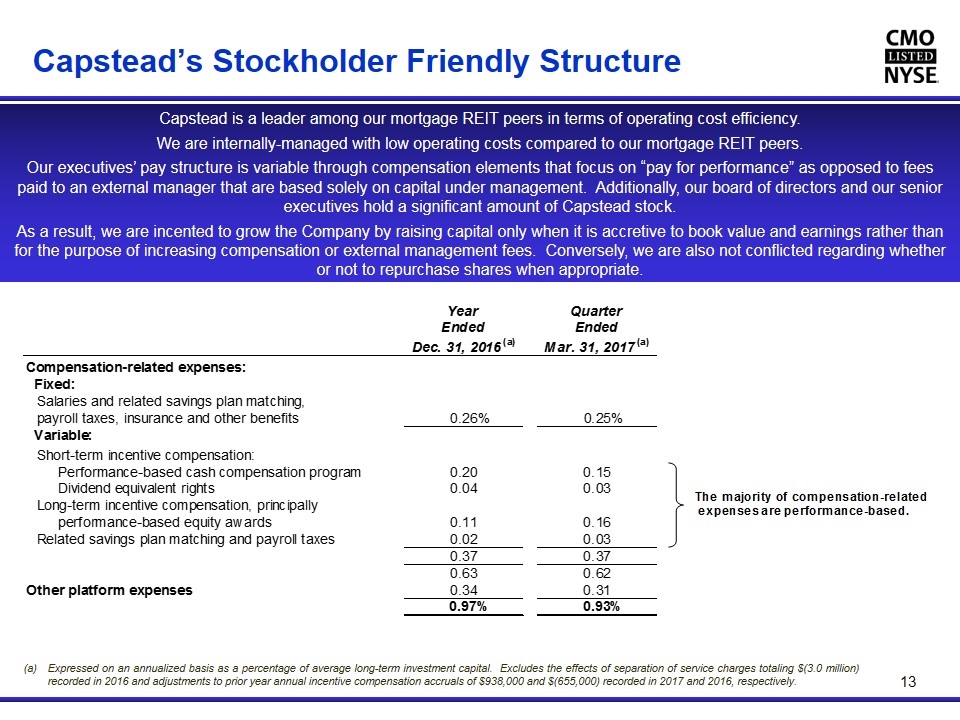

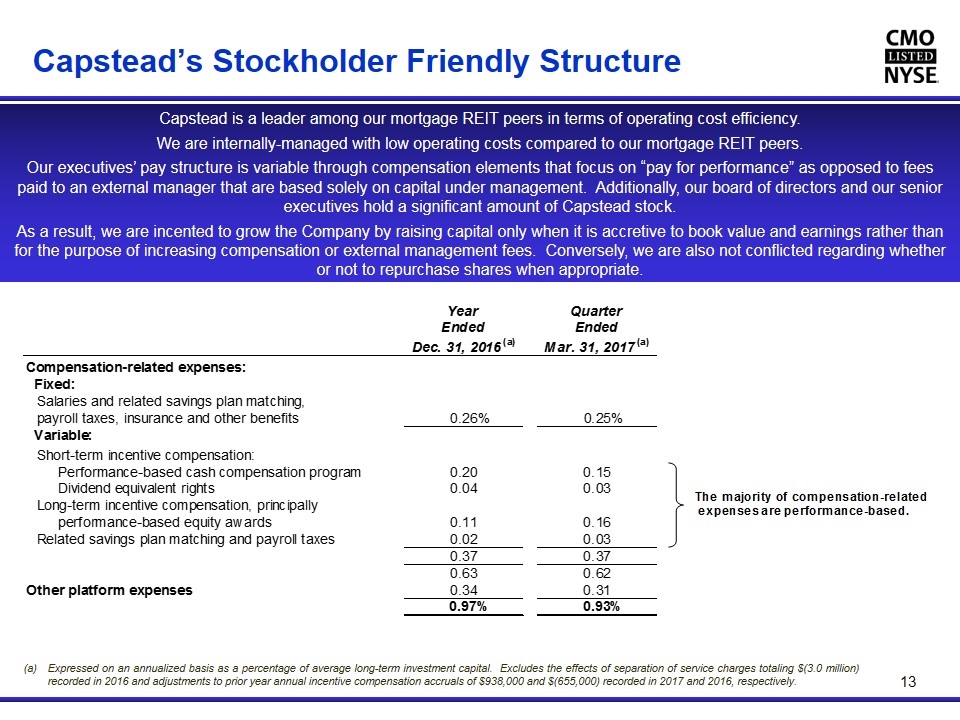

Capstead’s Stockholder Friendly Structure 13 Expressed on an annualized basis as a percentage of average long-term investment capital. Excludes the effects of separation of service charges totaling $(3.0 million) recorded in 2016 and adjustments to prior year annual incentive compensation accruals of $938,000 and $(655,000) recorded in 2017 and 2016, respectively. Capstead is a leader among our mortgage REIT peers in terms of operating cost efficiency. We are internally-managed with low operating costs compared to our mortgage REIT peers. Our executives’ pay structure is variable through compensation elements that focus on “pay for performance” as opposed to fees paid to an external manager that are based solely on capital under management. Additionally, our board of directors and our senior executives hold a significant amount of Capstead stock. As a result, we are incented to grow the Company by raising capital only when it is accretive to book value and earnings rather than for the purpose of increasing compensation or external management fees. Conversely, we are also not conflicted regarding whether or not to repurchase shares when appropriate.

Appendix 14

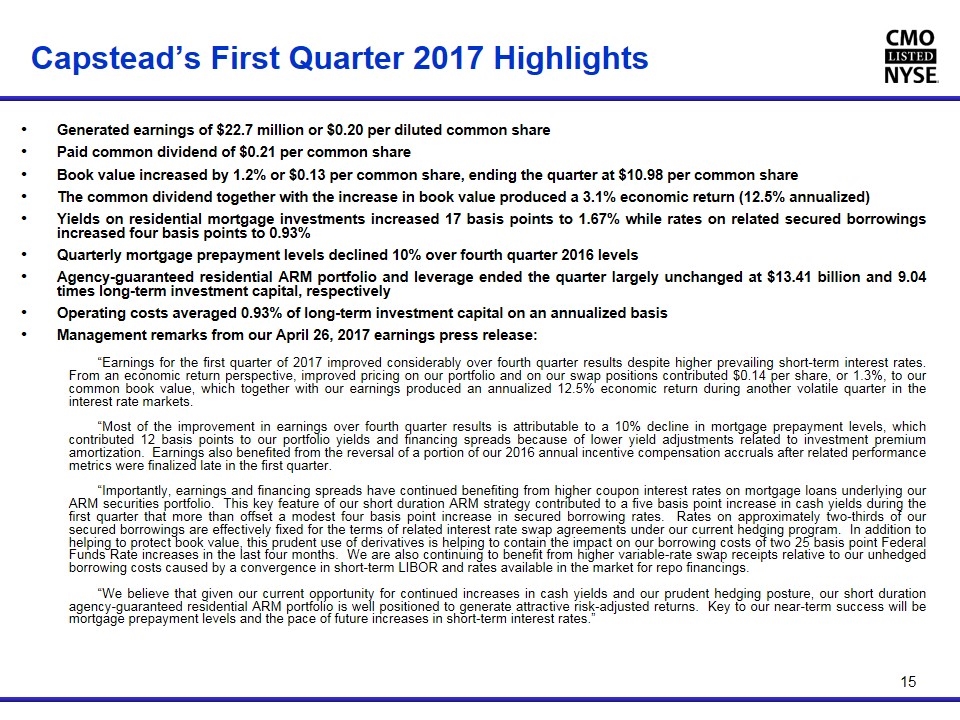

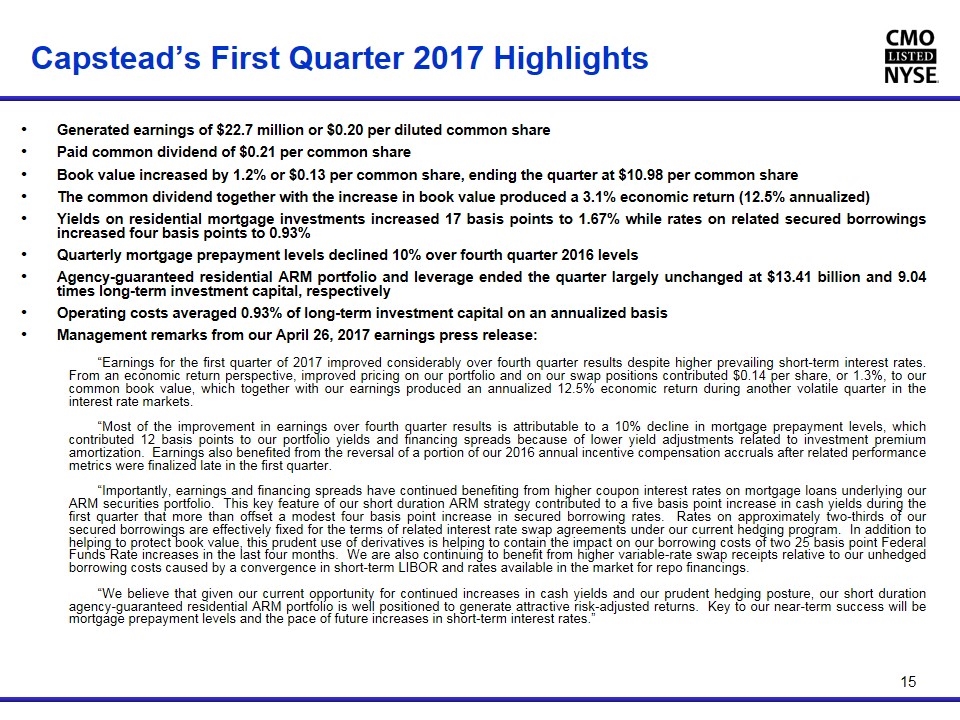

Capstead’s First Quarter 2017 Highlights Generated earnings of $22.7 million or $0.20 per diluted common share Paid common dividend of $0.21 per common share Book value increased by 1.2% or $0.13 per common share, ending the quarter at $10.98 per common share The common dividend together with the increase in book value produced a 3.1% economic return (12.5% annualized) Yields on residential mortgage investments increased 17 basis points to 1.67% while rates on related secured borrowings increased four basis points to 0.93% Quarterly mortgage prepayment levels declined 10% over fourth quarter 2016 levels Agency-guaranteed residential ARM portfolio and leverage ended the quarter largely unchanged at $13.41 billion and 9.04 times long-term investment capital, respectively Operating costs averaged 0.93% of long-term investment capital on an annualized basis Management remarks from our April 26, 2017 earnings press release: “Earnings for the first quarter of 2017 improved considerably over fourth quarter results despite higher prevailing short-term interest rates. From an economic return perspective, improved pricing on our portfolio and on our swap positions contributed $0.14 per share, or 1.3%, to our common book value, which together with our earnings produced an annualized 12.5% economic return during another volatile quarter in the interest rate markets. “Most of the improvement in earnings over fourth quarter results is attributable to a 10% decline in mortgage prepayment levels, which contributed 12 basis points to our portfolio yields and financing spreads because of lower yield adjustments related to investment premium amortization. Earnings also benefited from the reversal of a portion of our 2016 annual incentive compensation accruals after related performance metrics were finalized late in the first quarter. “Importantly, earnings and financing spreads have continued benefiting from higher coupon interest rates on mortgage loans underlying our ARM securities portfolio. This key feature of our short duration ARM strategy contributed to a five basis point increase in cash yields during the first quarter that more than offset a modest four basis point increase in secured borrowing rates. Rates on approximately two-thirds of our secured borrowings are effectively fixed for the terms of related interest rate swap agreements under our current hedging program. In addition to helping to protect book value, this prudent use of derivatives is helping to contain the impact on our borrowing costs of two 25 basis point Federal Funds Rate increases in the last four months. We are also continuing to benefit from higher variable-rate swap receipts relative to our unhedged borrowing costs caused by a convergence in short-term LIBOR and rates available in the market for repo financings. “We believe that given our current opportunity for continued increases in cash yields and our prudent hedging posture, our short duration agency-guaranteed residential ARM portfolio is well positioned to generate attractive risk-adjusted returns. Key to our near-term success will be mortgage prepayment levels and the pace of future increases in short-term interest rates.” 15

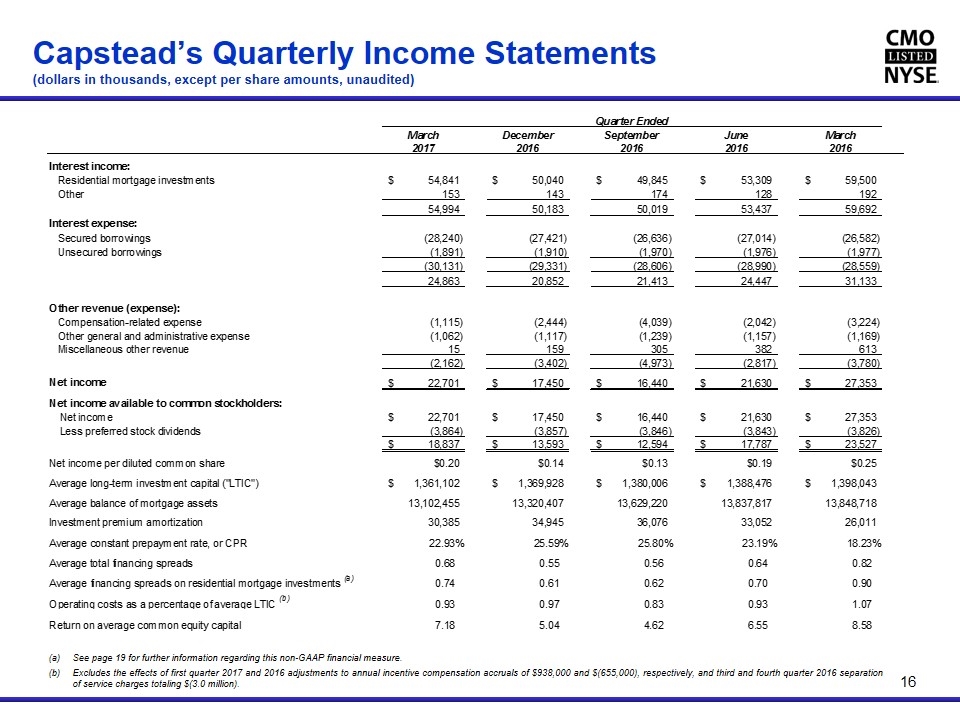

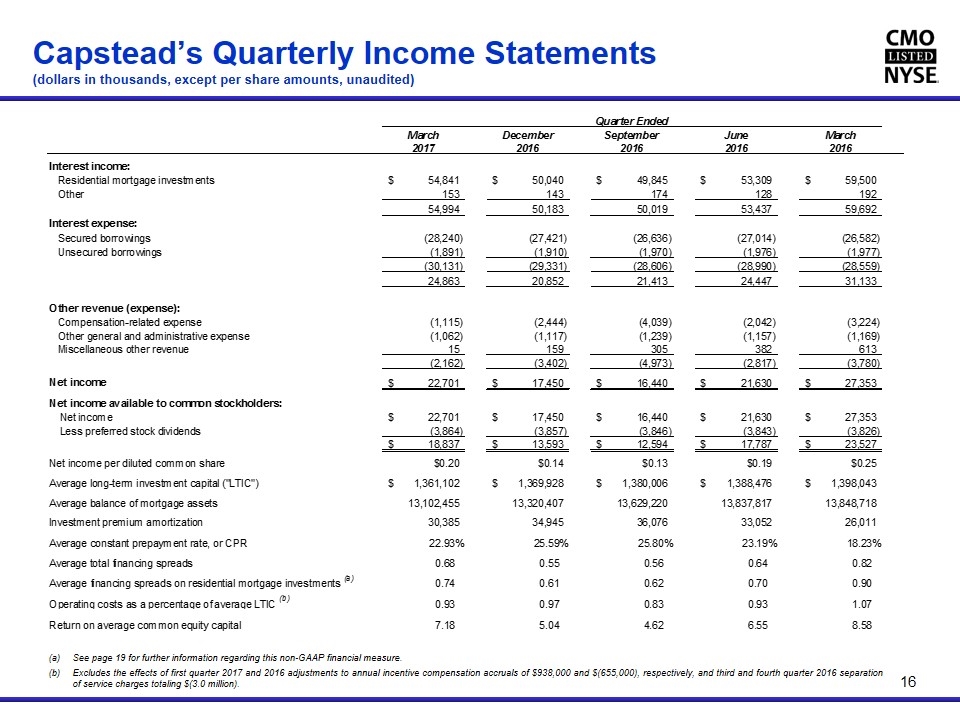

Capstead’s Quarterly Income Statements (dollars in thousands, except per share amounts, unaudited) 16 See page 19 for further information regarding this non-GAAP financial measure. Excludes the effects of first quarter 2017 and 2016 adjustments to annual incentive compensation accruals of $938,000 and $(655,000), respectively, and third and fourth quarter 2016 separation of service charges totaling $(3.0 million).

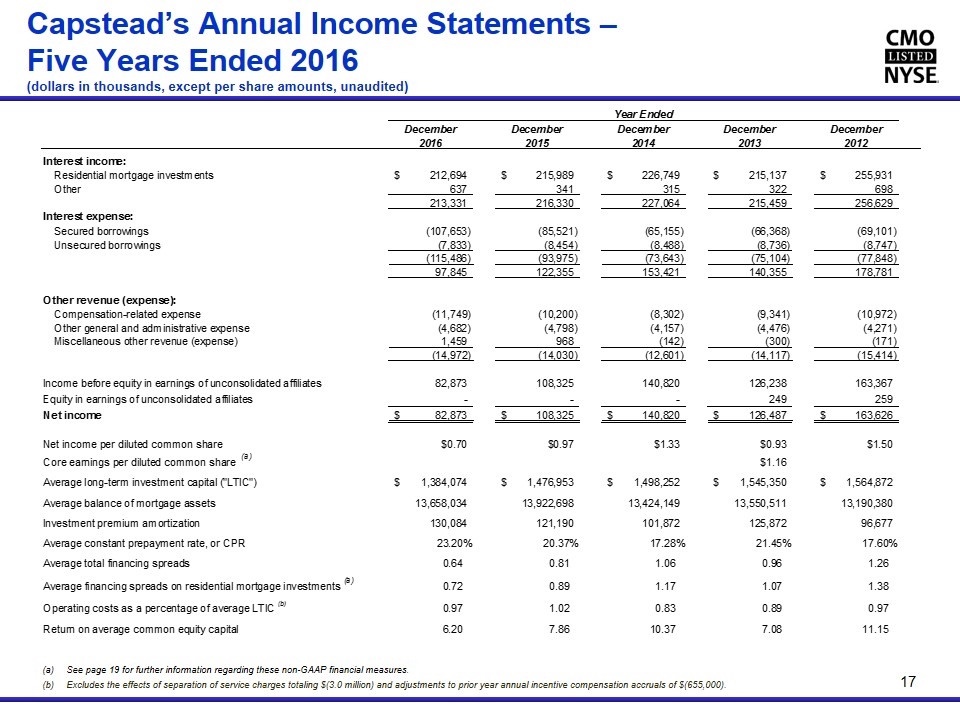

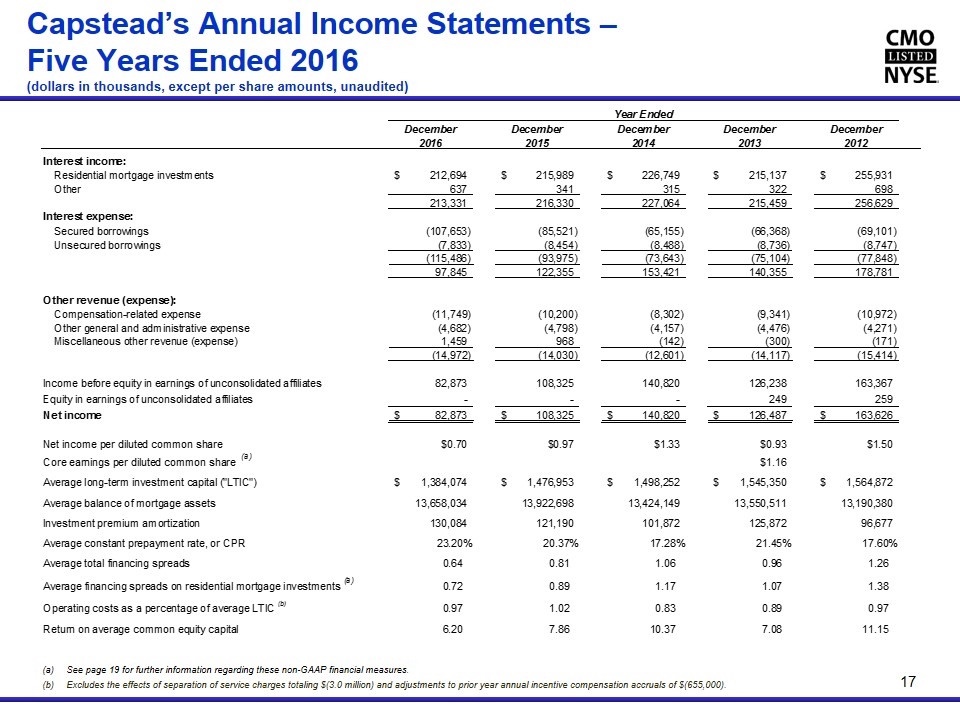

Capstead’s Annual Income Statements – Five Years Ended 2016 (dollars in thousands, except per share amounts, unaudited) 17 See page 19 for further information regarding these non-GAAP financial measures. Excludes the effects of separation of service charges totaling $(3.0 million) and adjustments to prior year annual incentive compensation accruals of $(655,000).

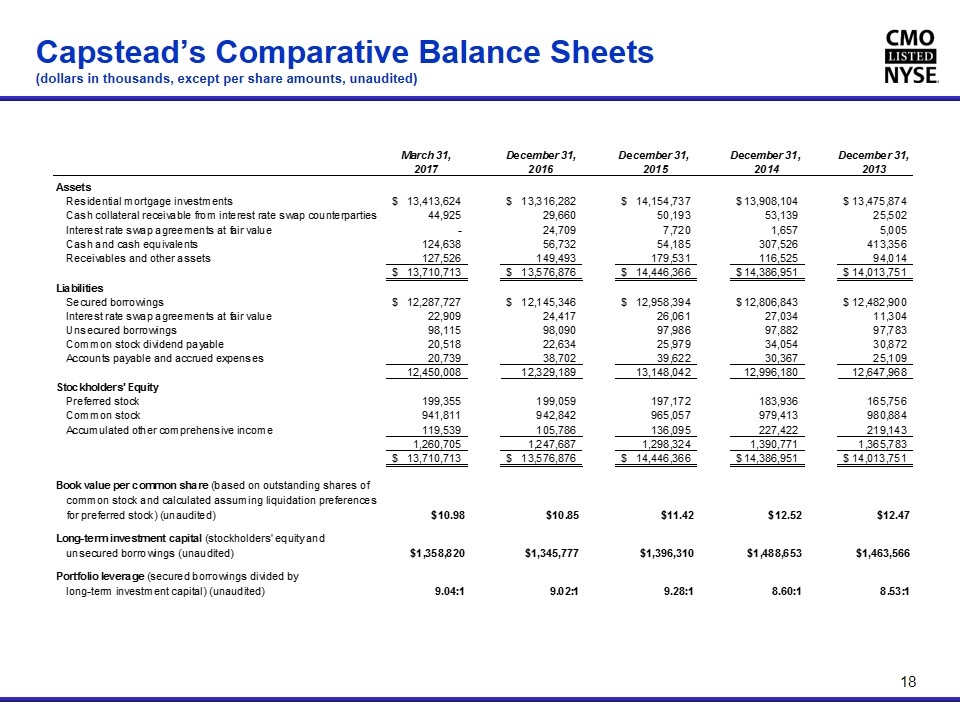

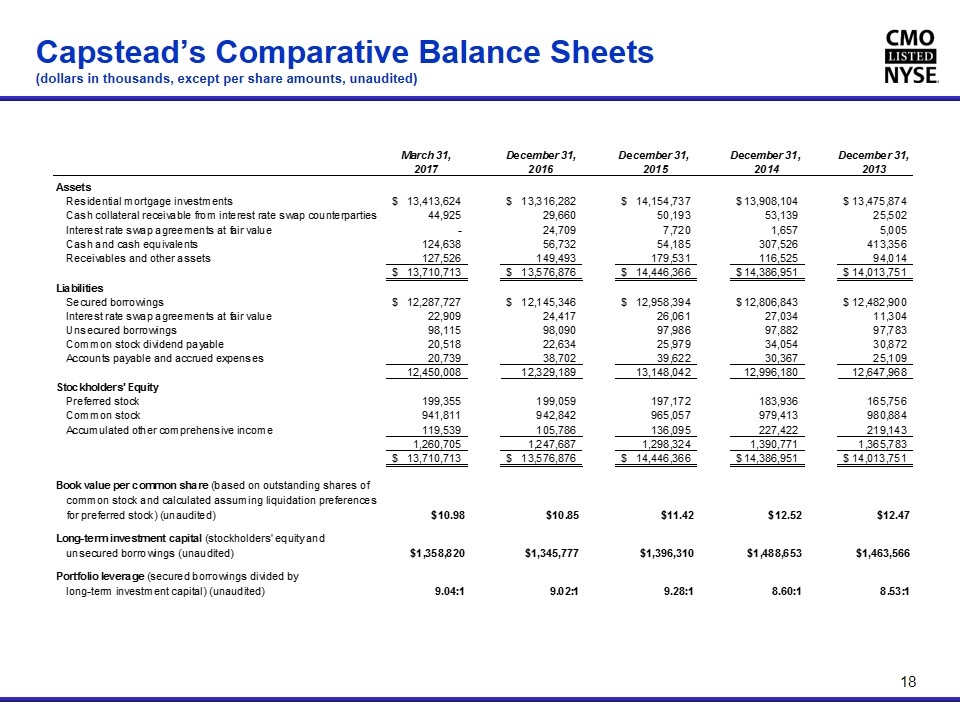

Capstead’s Comparative Balance Sheets (dollars in thousands, except per share amounts, unaudited) 18

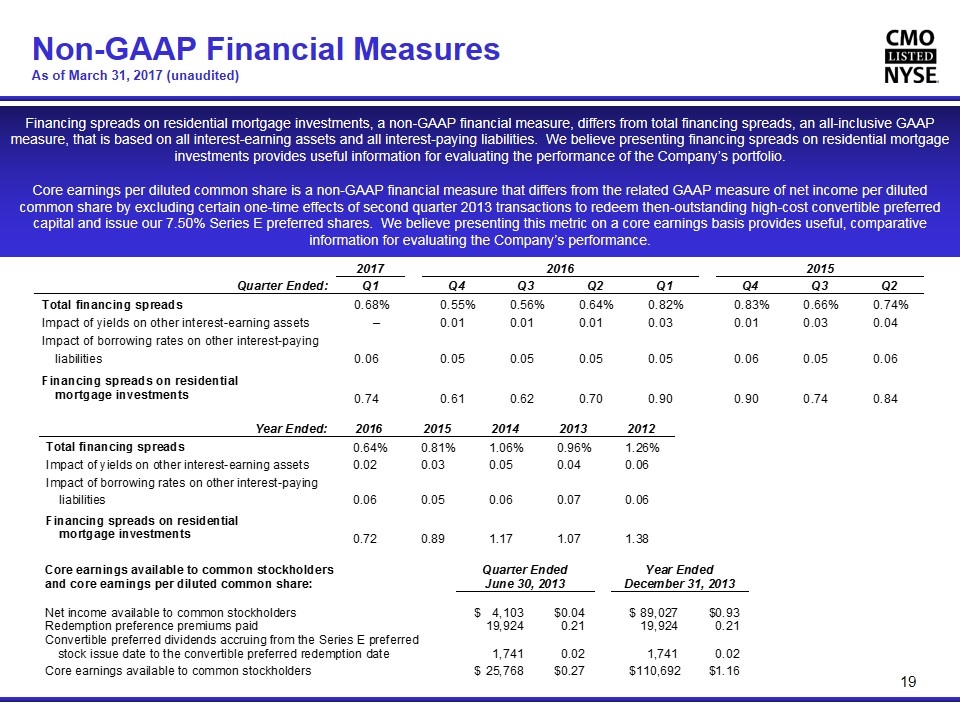

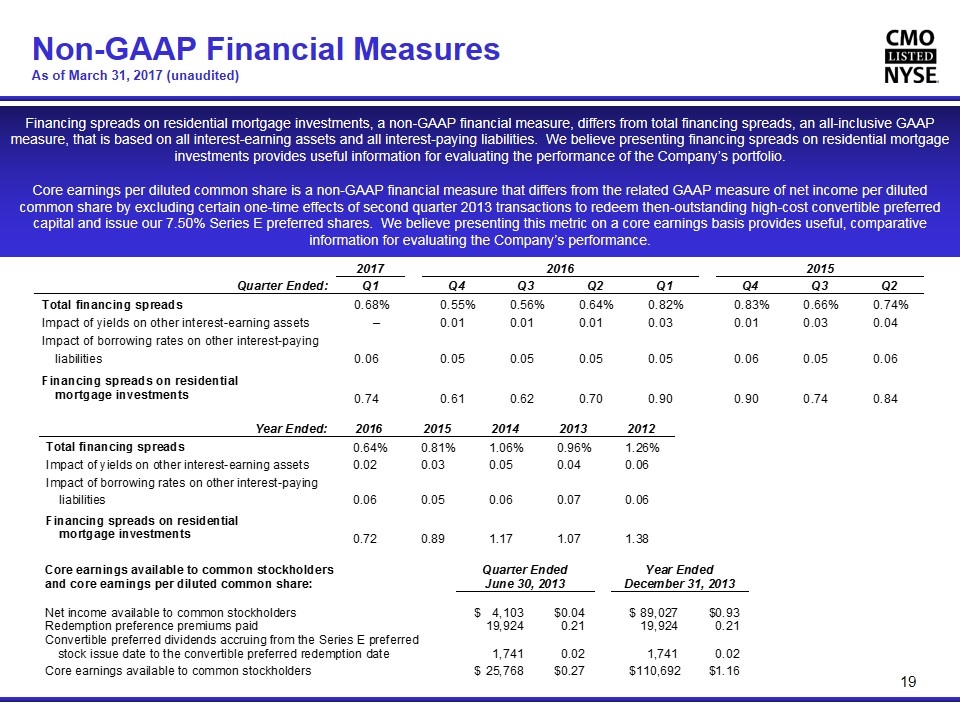

Non-GAAP Financial Measures As of March 31, 2017 (unaudited) 19 Financing spreads on residential mortgage investments, a non-GAAP financial measure, differs from total financing spreads, an all-inclusive GAAP measure, that is based on all interest-earning assets and all interest-paying liabilities. We believe presenting financing spreads on residential mortgage investments provides useful information for evaluating the performance of the Company’s portfolio. Core earnings per diluted common share is a non-GAAP financial measure that differs from the related GAAP measure of net income per diluted common share by excluding certain one-time effects of second quarter 2013 transactions to redeem then-outstanding high-cost convertible preferred capital and issue our 7.50% Series E preferred shares. We believe presenting this metric on a core earnings basis provides useful, comparative information for evaluating the Company’s performance. Core earnings available to common stockholders Quarter EndedYear Endedand core earnings per diluted common share:June 30, 2013December 31, 2013Net income available to common stockholders$4,103$0.04$89,027$0.93Redemption preference premiums paid19,9240.2119,9240.21Convertible preferred dividends accruing from the Series E preferredstock issue date to the convertible preferred redemption date1,7410.021,7410.02Core earnings available to common stockholders$25,768$0.27$110,692$1.16

Experienced Management Team 20 Our top three executive officers have a combined 75 years of mortgage finance industry experience. Phillip A. Reinsch – President and Chief Executive Officer, Director, Chief Financial Officer* and Secretary Appointed President, CEO and Director in July 2016 Served as CFO since 2003, and has served in other executive positions at Capstead since 1993 Formerly employed by Ernst & Young LLP focusing on mortgage banking and asset securitization A CPA and member of the NAREIT Mortgage REIT Council, the FEI Dallas Chapter Real Estate Steering Committee and the NACD * Will relinquish CFO title once this open position is filled Robert R. Spears – Executive Vice President, Chief Investment Officer Has served in asset and liability management positions at Capstead since 1994 Formerly Vice President of secondary marketing with NationsBanc Mortgage Corporation Roy S. Kim – Senior Vice President, Asset and Liability Management and Treasurer Joined Capstead in April 2015 augmenting our asset and liability management capabilities with primary responsibility for liability management Has over 20 years experience in the mortgage finance industry, primarily in trading capacities with JP Morgan and Bank of America