INVESTOR PRESENTATION FIRST QUARTER 2019 Exhibit 99.1

Statement Concerning Forward-looking Statements This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Actual results could differ materially from those projected in these forward-looking statements due to a variety of factors, without limitation, fluctuations in interest rates, the availability of suitable qualifying investments, changes in mortgage prepayments, the availability and terms of financing, changes in market conditions as a result of federal corporate and individual tax reform, changes in legislation or regulation affecting the mortgage and banking industries or Fannie Mae, Freddie Mac or Ginnie Mae securities, the availability of new investment capital, the liquidity of secondary markets and credit markets, and other changes in general economic conditions. These and other applicable uncertainties, factors and risks are described more fully in the Company’s filings with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein. Safe Harbor Statement - Private Securities Litigation Reform Act of 1995

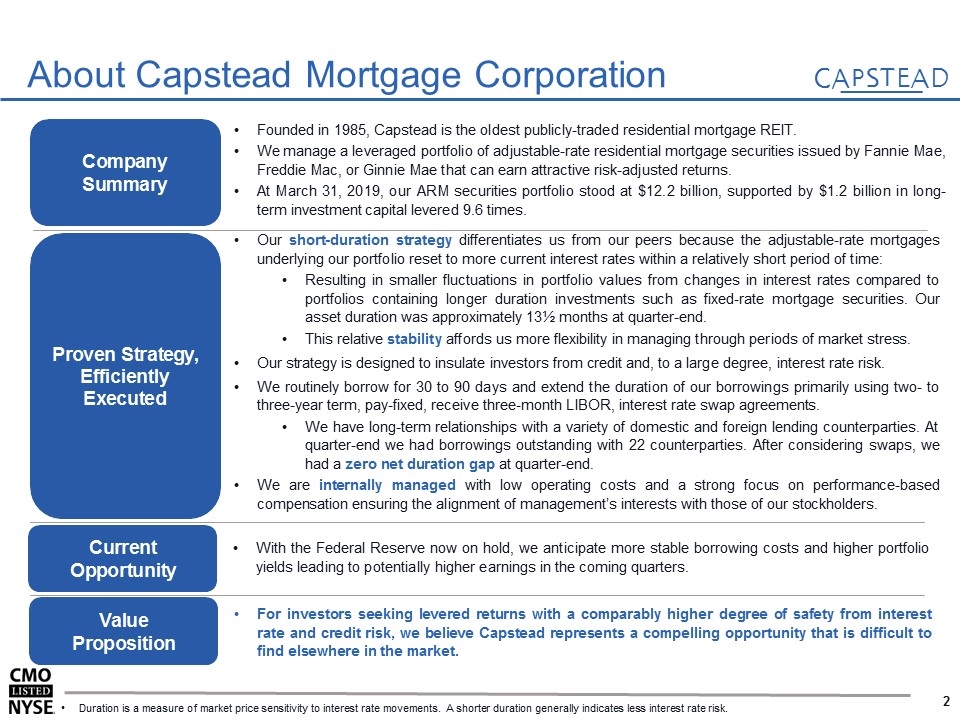

With the Federal Reserve now on hold, we anticipate more stable borrowing costs and higher portfolio yields leading to potentially higher earnings in the coming quarters. Company Summary Proven Strategy, Efficiently Executed Founded in 1985, Capstead is the oldest publicly-traded residential mortgage REIT. We manage a leveraged portfolio of adjustable-rate residential mortgage securities issued by Fannie Mae, Freddie Mac, or Ginnie Mae that can earn attractive risk-adjusted returns. At March 31, 2019, our ARM securities portfolio stood at $12.2 billion, supported by $1.2 billion in long-term investment capital levered 9.6 times. Our short-duration strategy differentiates us from our peers because the adjustable-rate mortgages underlying our portfolio reset to more current interest rates within a relatively short period of time: Resulting in smaller fluctuations in portfolio values from changes in interest rates compared to portfolios containing longer duration investments such as fixed-rate mortgage securities. Our asset duration was approximately 13½ months at quarter-end. This relative stability affords us more flexibility in managing through periods of market stress. Our strategy is designed to insulate investors from credit and, to a large degree, interest rate risk. We routinely borrow for 30 to 90 days and extend the duration of our borrowings primarily using two- to three-year term, pay-fixed, receive three-month LIBOR, interest rate swap agreements. We have long-term relationships with a variety of domestic and foreign lending counterparties. At quarter-end we had borrowings outstanding with 22 counterparties. After considering swaps, we had a zero net duration gap at quarter-end. We are internally managed with low operating costs and a strong focus on performance-based compensation ensuring the alignment of management’s interests with those of our stockholders. For investors seeking levered returns with a comparably higher degree of safety from interest rate and credit risk, we believe Capstead represents a compelling opportunity that is difficult to find elsewhere in the market. Duration is a measure of market price sensitivity to interest rate movements. A shorter duration generally indicates less interest rate risk. Value Proposition About Capstead Mortgage Corporation Current Opportunity

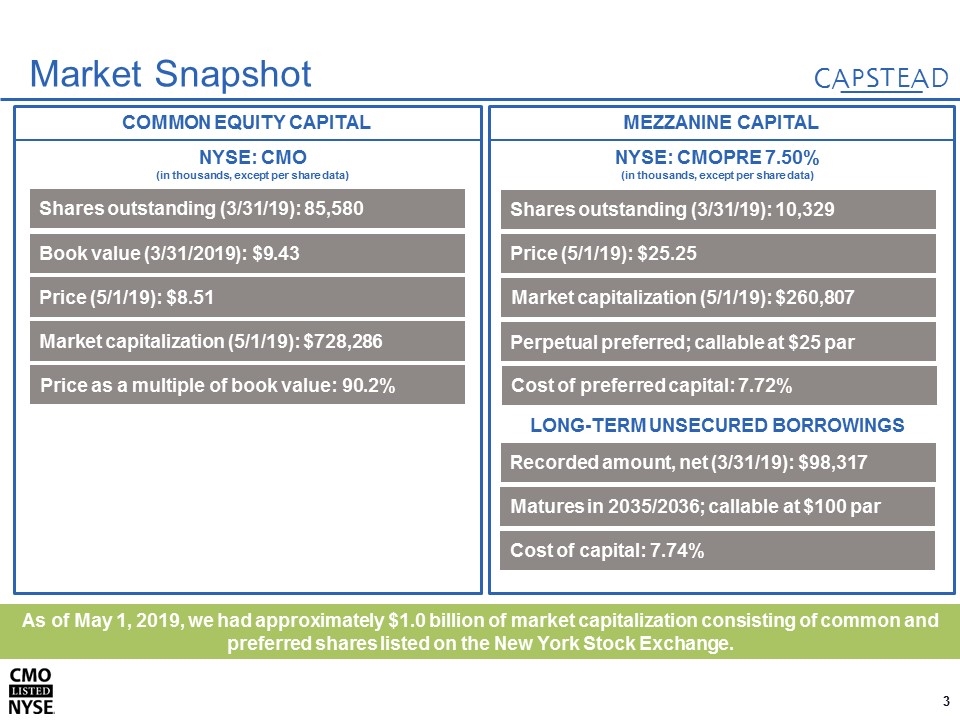

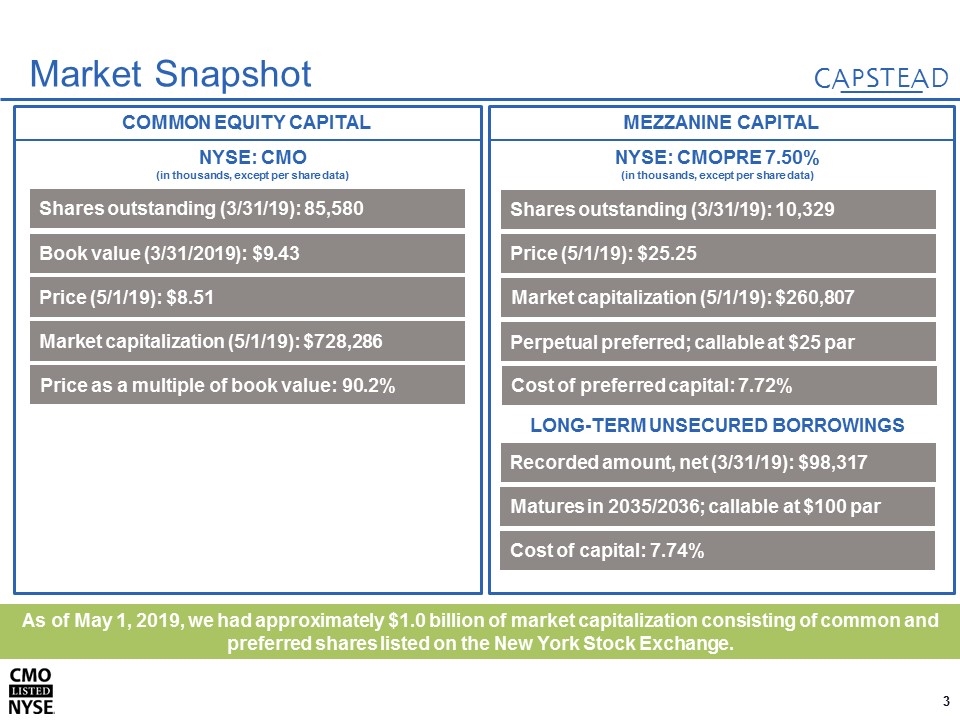

MEZZANINE CAPITAL COMMON EQUITY CAPITAL 50% 16% 84% Market Snapshot As of May 1, 2019, we had approximately $1.0 billion of market capitalization consisting of common and preferred shares listed on the New York Stock Exchange. NYSE: CMOPRE 7.50% (in thousands, except per share data) Shares outstanding (3/31/19): 10,329 Price (5/1/19): $25.25 Perpetual preferred; callable at $25 par Cost of preferred capital: 7.72% Shares outstanding (3/31/19): 85,580 NYSE: CMO (in thousands, except per share data) Book value (3/31/2019): $9.43 Price (5/1/19): $8.51 Market capitalization (5/1/19): $728,286 Price as a multiple of book value: 90.2% LONG-TERM UNSECURED BORROWINGS Recorded amount, net (3/31/19): $98,317 Cost of capital: 7.74% Market capitalization (5/1/19): $260,807 Matures in 2035/2036; callable at $100 par

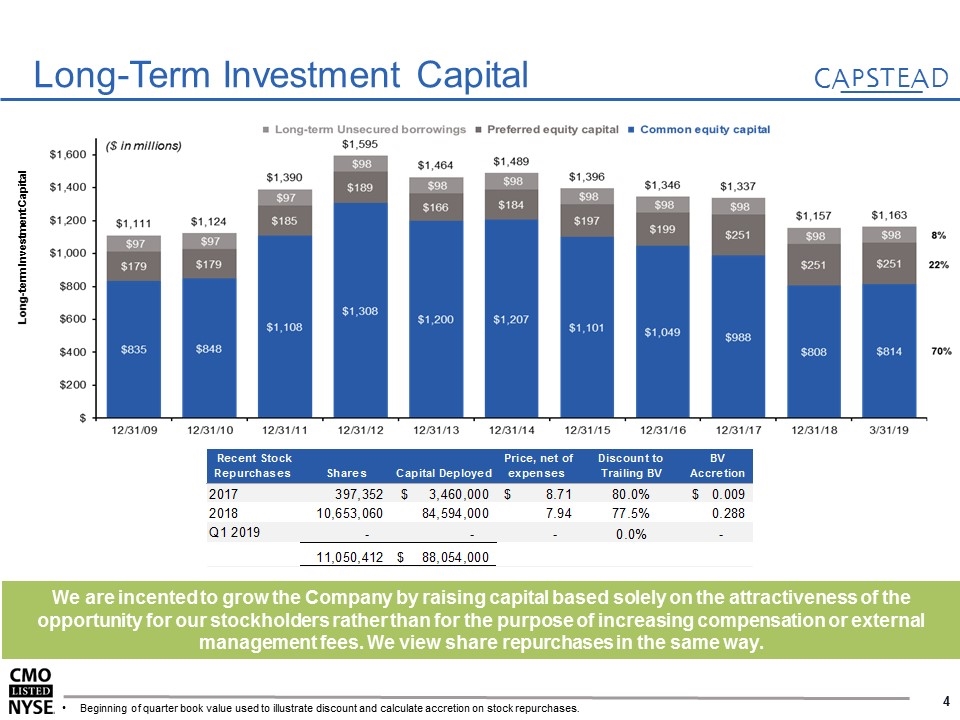

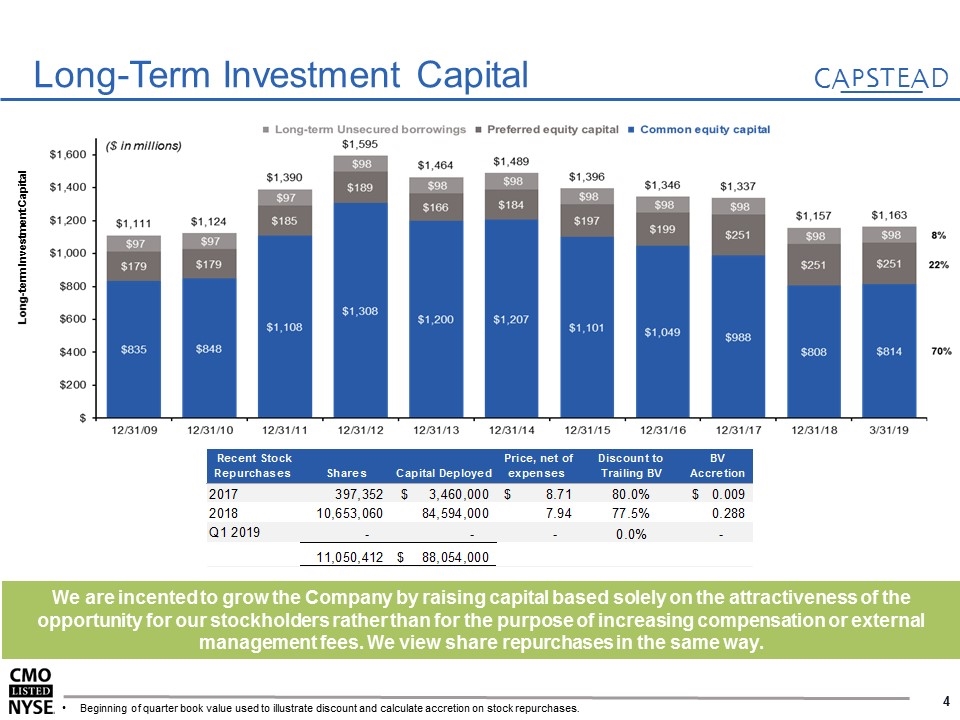

Long-Term Investment Capital We are incented to grow the Company by raising capital based solely on the attractiveness of the opportunity for our stockholders rather than for the purpose of increasing compensation or external management fees. We view share repurchases in the same way. Beginning of quarter book value used to illustrate discount and calculate accretion on stock repurchases. Long-term Investment Capital

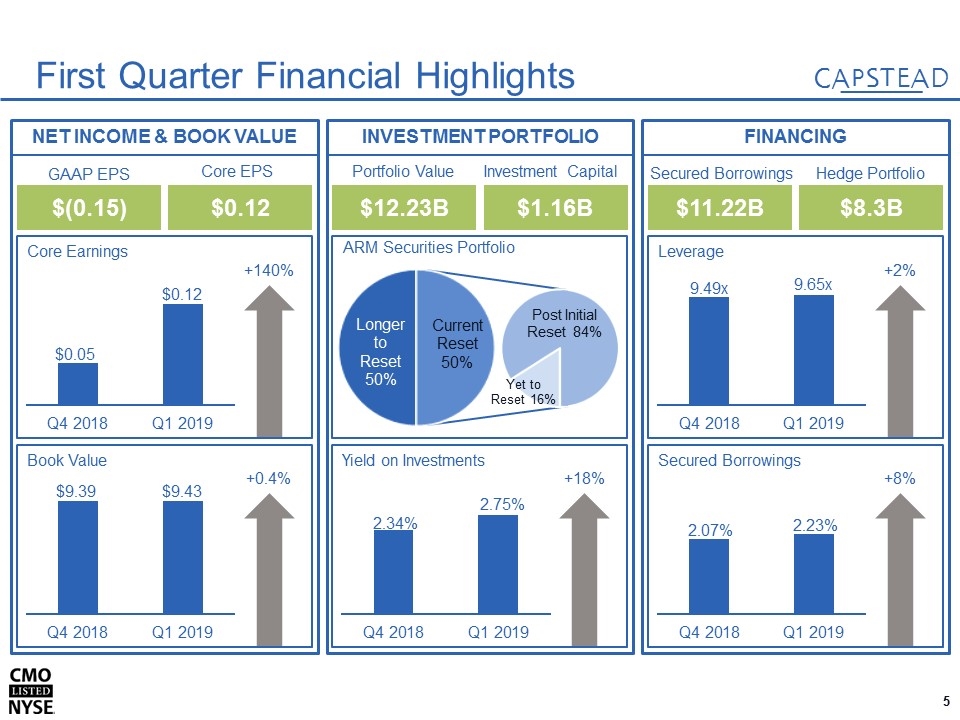

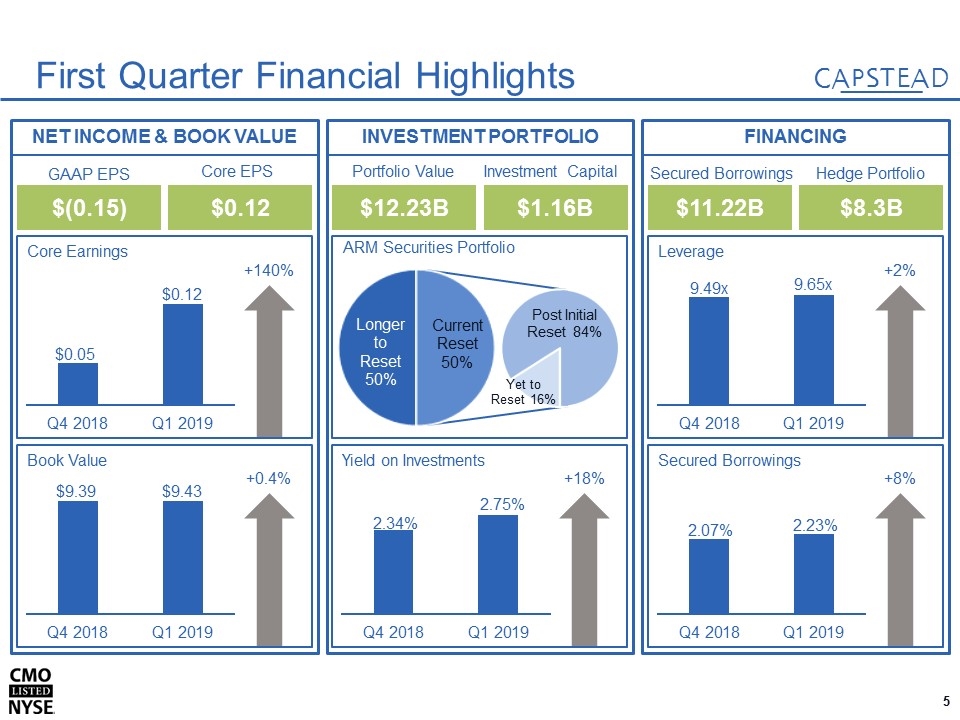

INVESTMENT PORTFOLIO NET INCOME & BOOK VALUE Book Value +0.4% FINANCING $(0.15) $0.12 GAAP EPS Core EPS $12.23B $1.16B Portfolio Value Investment Capital $11.22B $8.3B Secured Borrowings Hedge Portfolio Core Earnings +140% Yield on Investments +18% Secured Borrowings +8% Leverage +2% First Quarter Financial Highlights ARM Securities Portfolio

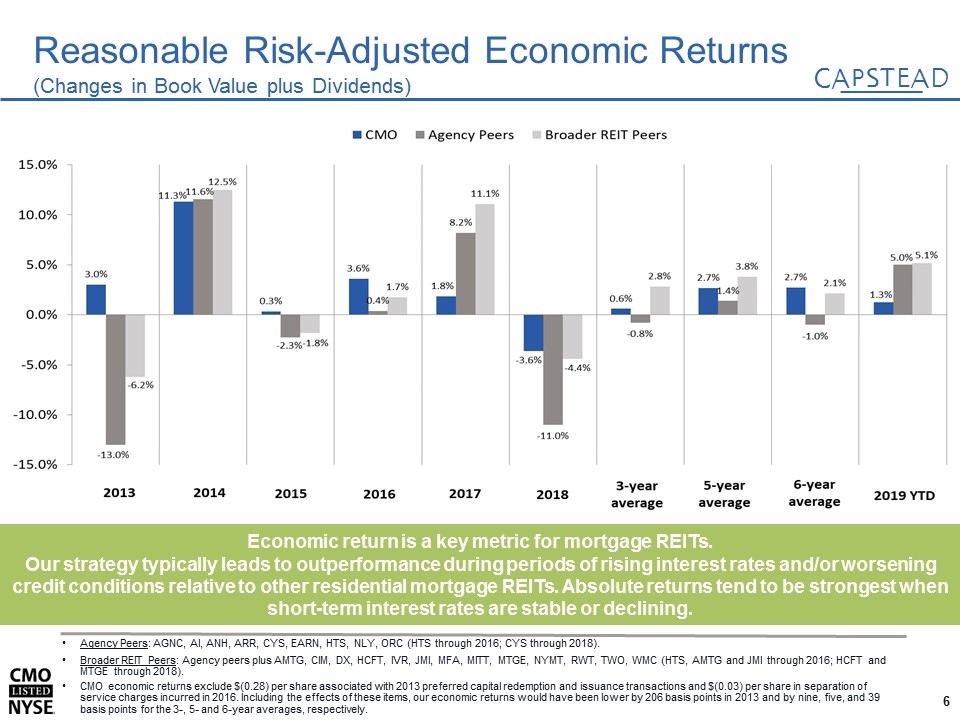

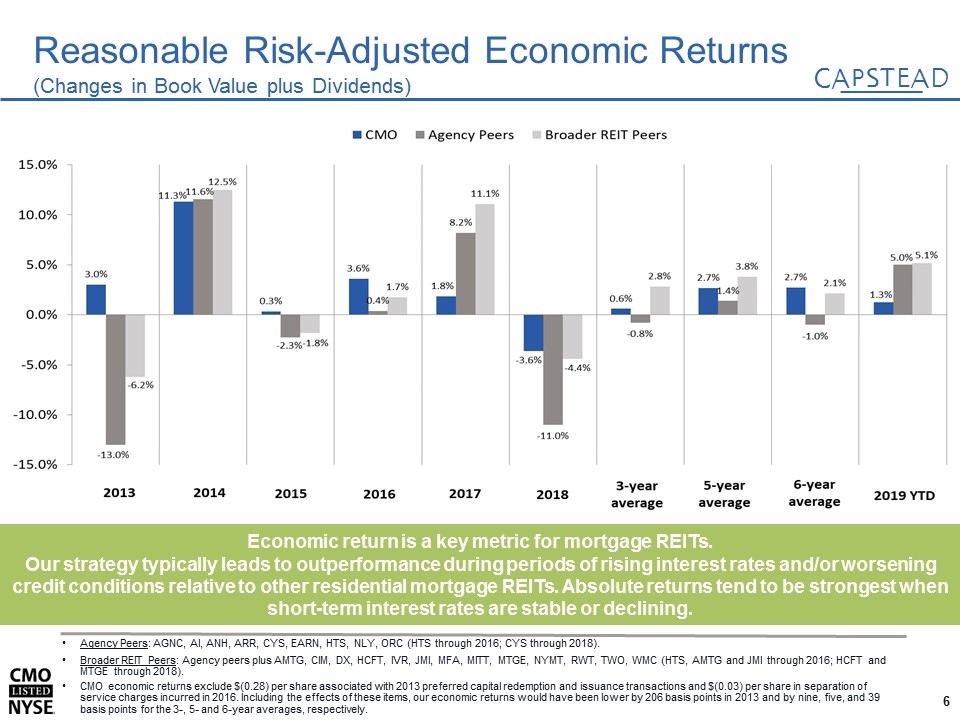

Economic return is a key metric for mortgage REITs. Our strategy typically leads to outperformance during periods of rising interest rates and/or worsening credit conditions relative to other residential mortgage REITs. Absolute returns tend to be strongest when short-term interest rates are stable or declining. Agency Peers: AGNC, AI, ANH, ARR, CYS, EARN, HTS, NLY, ORC (HTS through 2016; CYS through 2018). Broader REIT Peers: Agency peers plus AMTG, CIM, DX, HCFT, IVR, JMI, MFA, MITT, MTGE, NYMT, RWT, TWO, WMC (HTS, AMTG and JMI through 2016; HCFT and MTGE through 2018). CMO economic returns exclude $(0.28) per share associated with 2013 preferred capital redemption and issuance transactions and $(0.03) per share in separation of service charges incurred in 2016. Including the effects of these items, our economic returns would have been lower by 206 basis points in 2013 and by nine, five, and 39 basis points for the 3-, 5- and 6-year averages, respectively. Reasonable Risk-Adjusted Economic Returns (Changes in Book Value plus Dividends)

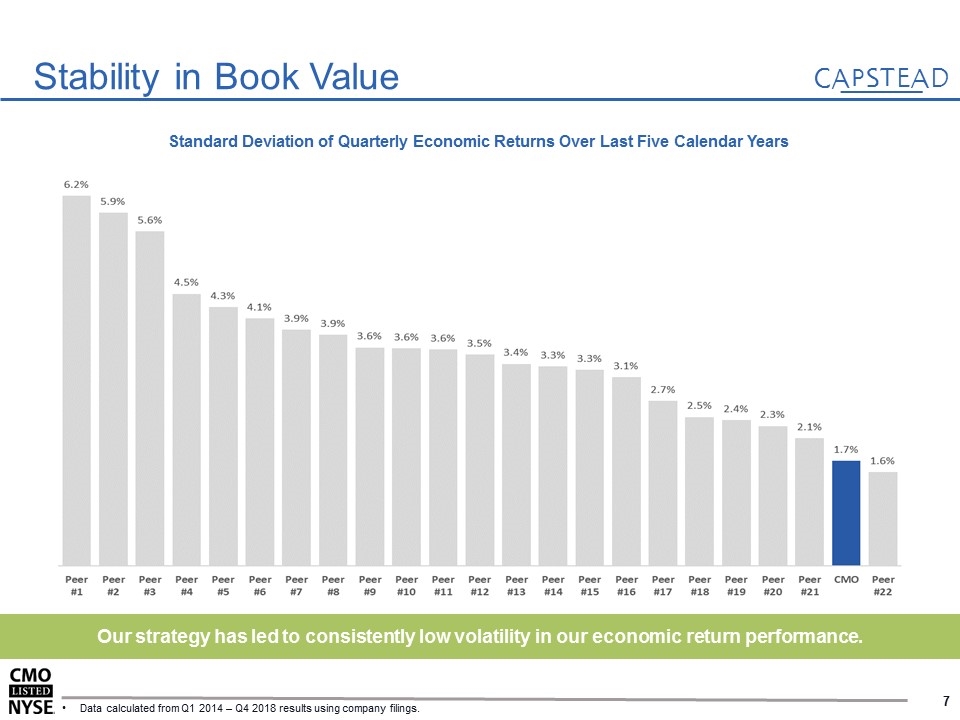

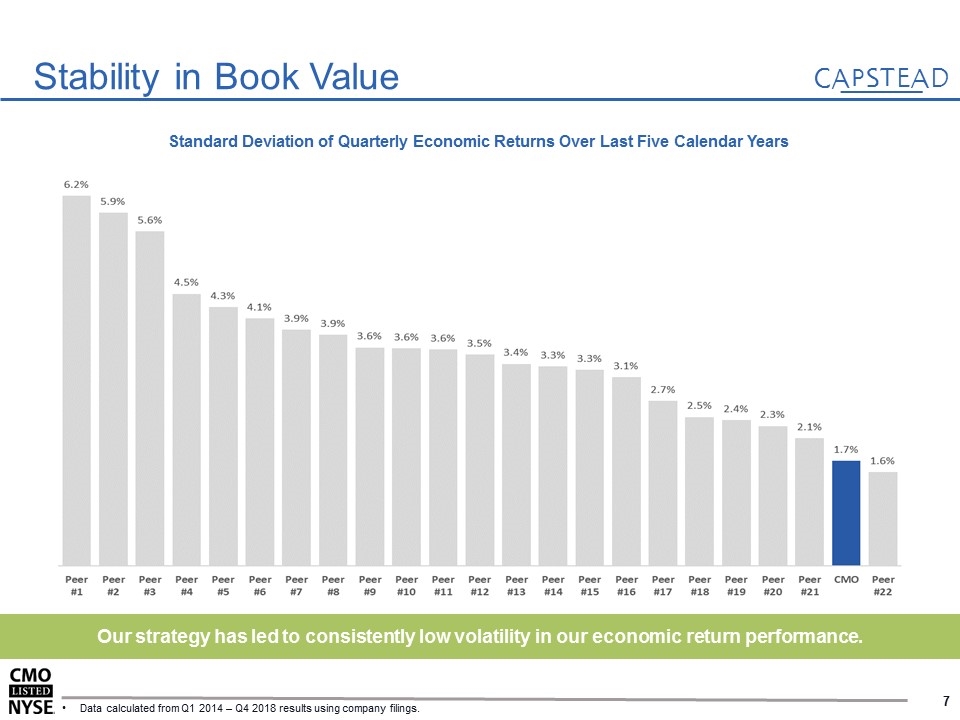

Stability in Book Value Our strategy has led to consistently low volatility in our economic return performance. Data calculated from Q1 2014 – Q4 2018 results using company filings. Standard Deviation of Quarterly Economic Returns Over Last Five Calendar Years

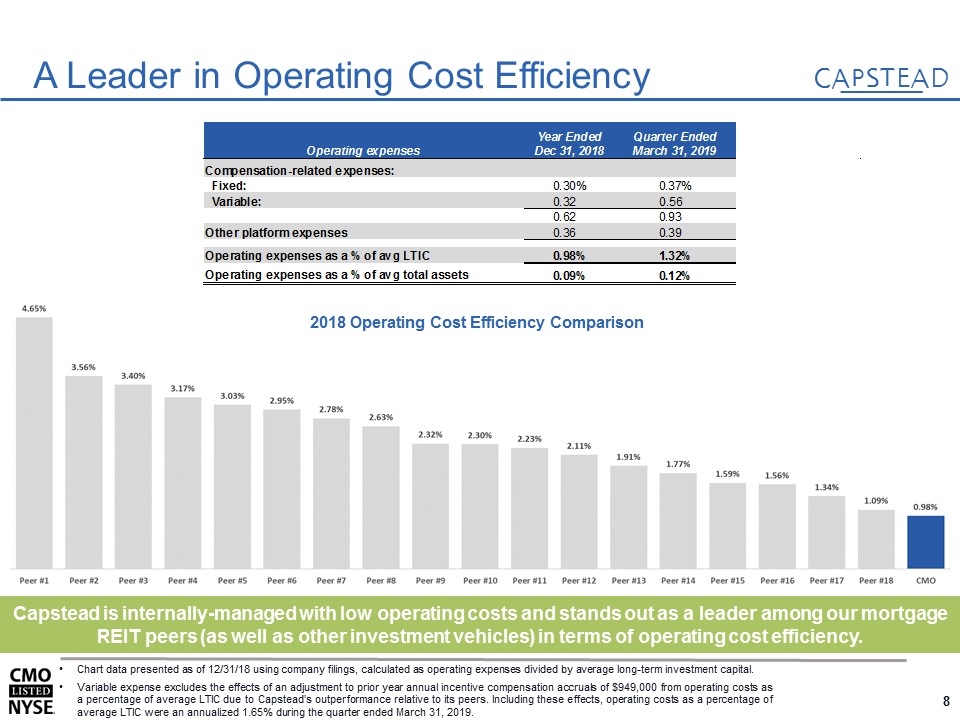

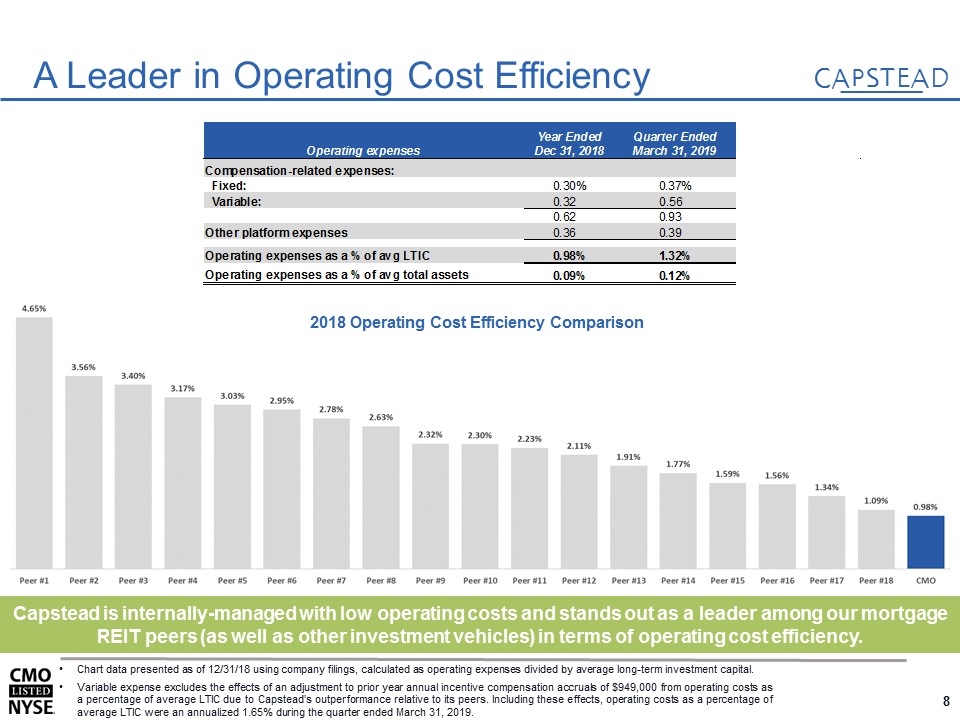

A Leader in Operating Cost Efficiency Capstead is internally-managed with low operating costs and stands out as a leader among our mortgage REIT peers (as well as other investment vehicles) in terms of operating cost efficiency. Chart data presented as of 12/31/18 using company filings, calculated as operating expenses divided by average long-term investment capital. Variable expense excludes the effects of an adjustment to prior year annual incentive compensation accruals of $949,000 from operating costs as a percentage of average LTIC due to Capstead’s outperformance relative to its peers. Including these effects, operating costs as a percentage of average LTIC were an annualized 1.65% during the quarter ended March 31, 2019. 2018 Operating Cost Efficiency Comparison

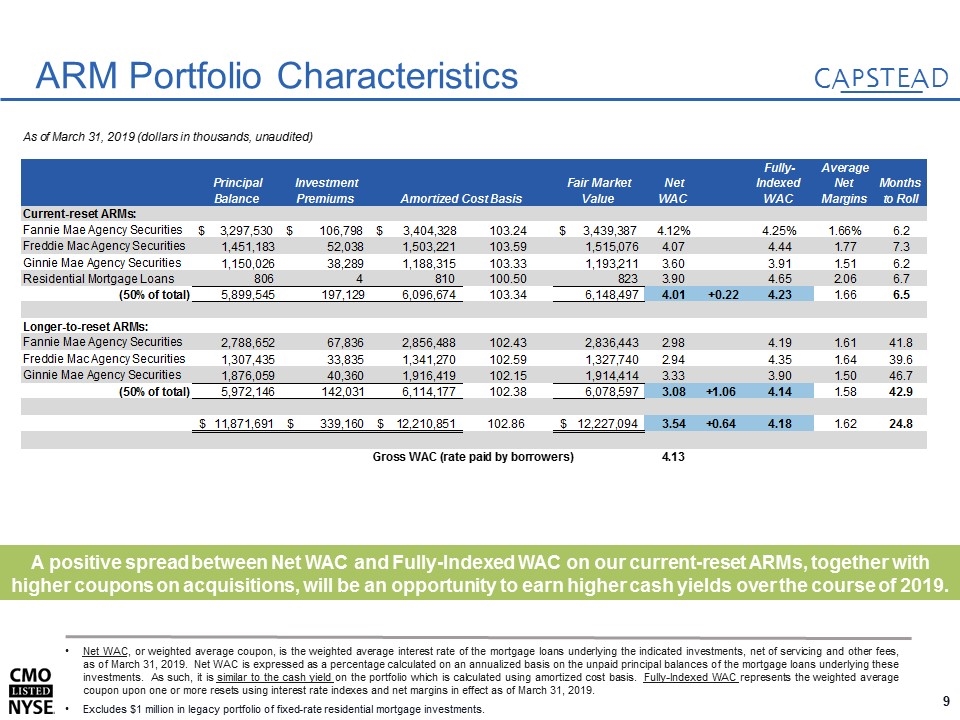

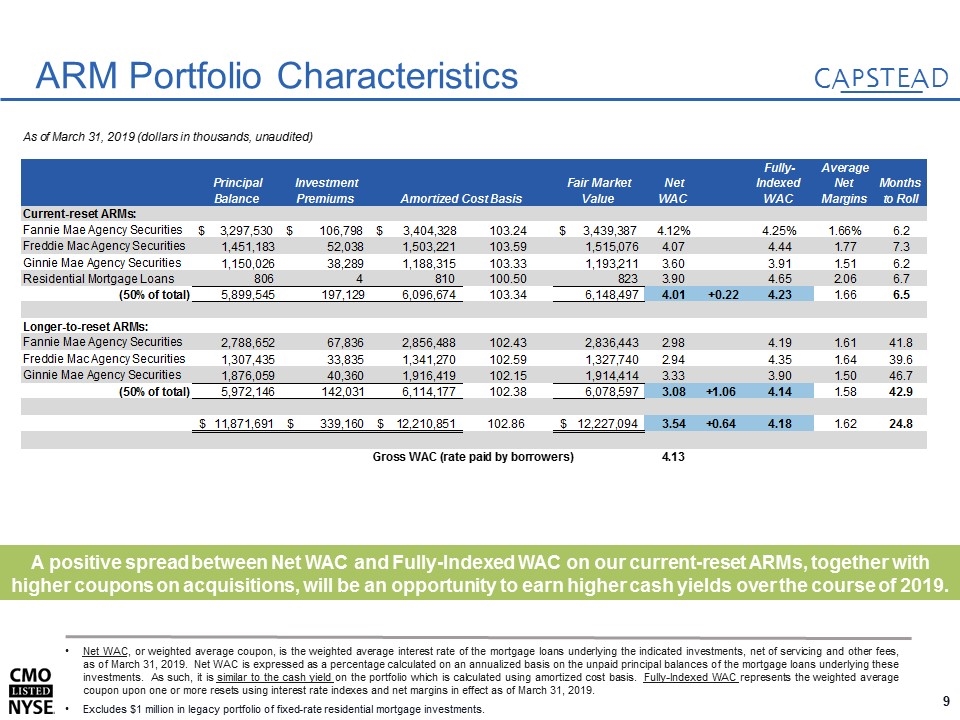

ARM Portfolio Characteristics Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees, as of March 31, 2019. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balances of the mortgage loans underlying these investments. As such, it is similar to the cash yield on the portfolio which is calculated using amortized cost basis. Fully-Indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins in effect as of March 31, 2019. Excludes $1 million in legacy portfolio of fixed-rate residential mortgage investments. A positive spread between Net WAC and Fully-Indexed WAC on our current-reset ARMs, together with higher coupons on acquisitions, will be an opportunity to earn higher cash yields over the course of 2019. As of March 31, 2019 (dollars in thousands, unaudited) Principal Balance Investment Premiums Amortized Cost Basis Fair Market Value Net WAC Fully-Indexed WAC Average Net Margins Months to Roll Current-reset ARMs: Fannie Mae Agency Securities $3,297,530 $,106,798 $3,404,328 103.23872716851703 $3,439,387 4.1200000000000001E-2 4.2500000000000003E-2 1.66E-2 6.2 Freddie Mac Agency Securities 1,451,183 52,038 1,503,221 103.58590198479448 1,515,076 4.07 4.4400000000000004 1.77 7.3 Ginnie Mae Agency Securities 1,150,026 38,289 1,188,315 103.32940298741072 1,193,211 3.6 3.91 1.51 6.2 Residential Mortgage Loans 806 4 810 100.49627791563276 823 3.9 4.6500000000000004 2.06 6.7 (50% of total) 5,899,545 ,197,129 6,096,674 103.34142717785863 6,148,497 4.01 +0.22 4.2300000000000004 1.66 6.5 Longer-to-reset ARMs: Fannie Mae Agency Securities 2,788,652 67,836 2,856,488 102.43257315721002 2,836,443 2.98 4.1900000000000004 1.61 41.8 Freddie Mac Agency Securities 1,307,435 33,835 1,341,270 102.58789155866256 1,327,740 2.94 4.3499999999999996 1.64 39.6 Ginnie Mae Agency Securities 1,876,059 40,360 1,916,419 102.15131826877513 1,914,414 3.33 3.9 1.5 46.7 (50% of total) 5,972,146 ,142,031 6,114,177 102.37822384114521 6,078,597 3.08 +1.06 4.1399999999999997 1.58 42.9 $11,871,691 $,339,160 $12,210,851 102.8568802877366 $12,227,094 3.54 +0.64 4.18 1.62 24.8 Gross WAC (rate paid by borrowers) 4.13

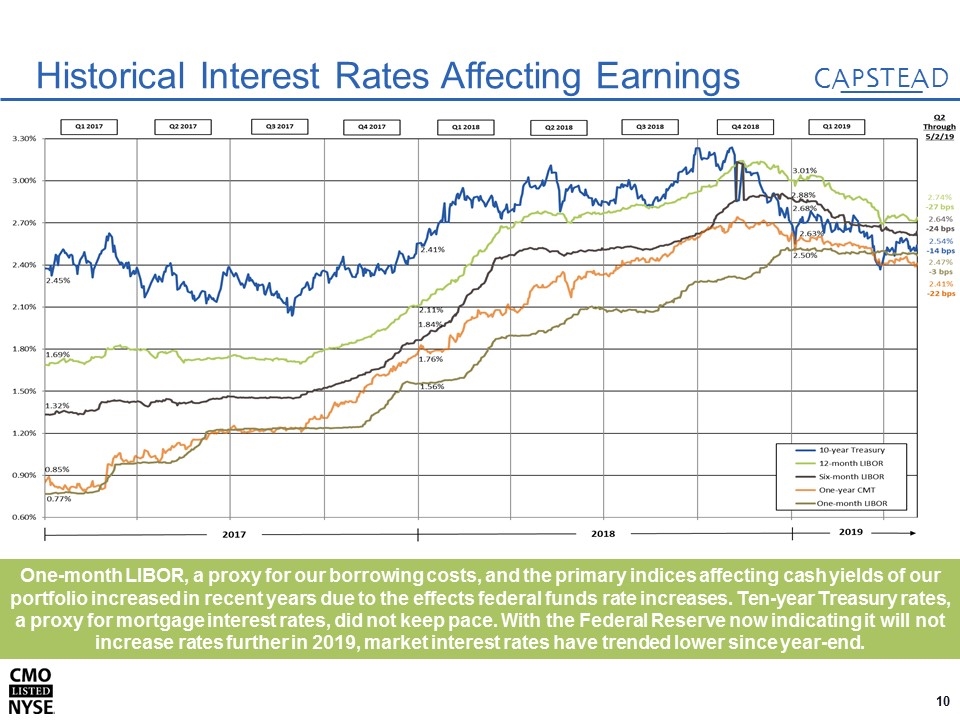

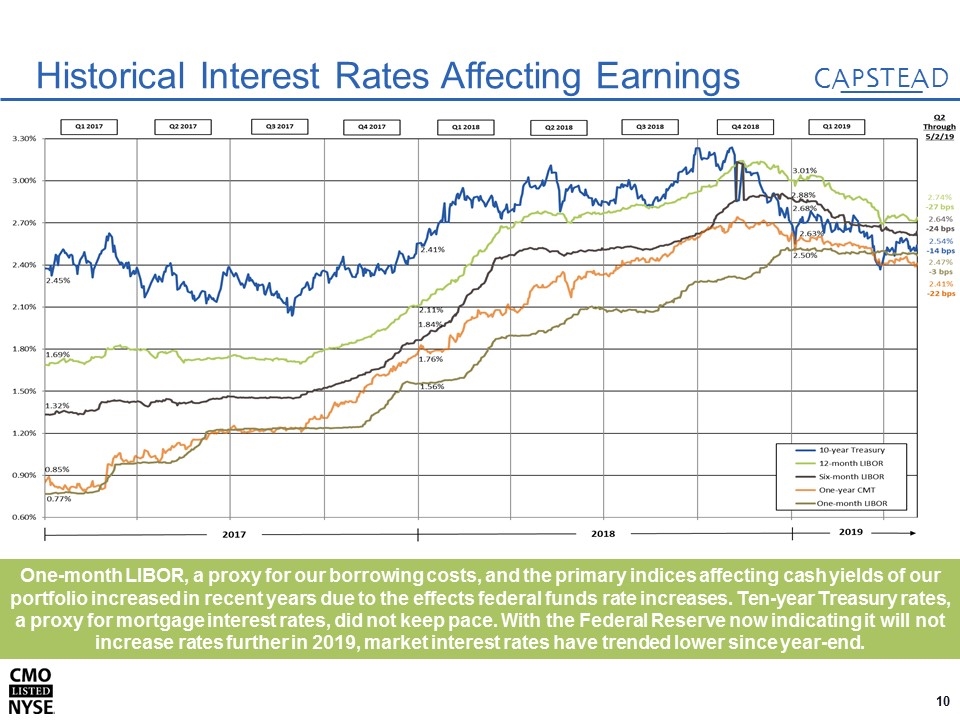

One-month LIBOR, a proxy for our borrowing costs, and the primary indices affecting cash yields of our portfolio increased in recent years due to the effects federal funds rate increases. Ten-year Treasury rates, a proxy for mortgage interest rates, did not keep pace. With the Federal Reserve now indicating it will not increase rates further in 2019, market interest rates have trended lower since year-end. Historical Interest Rates Affecting Earnings

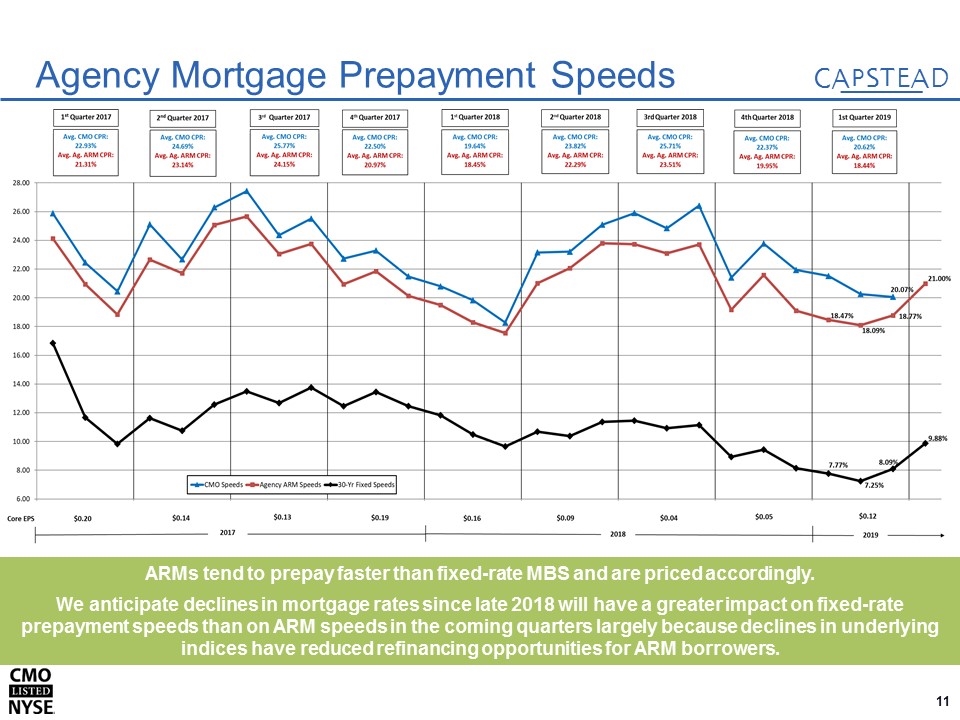

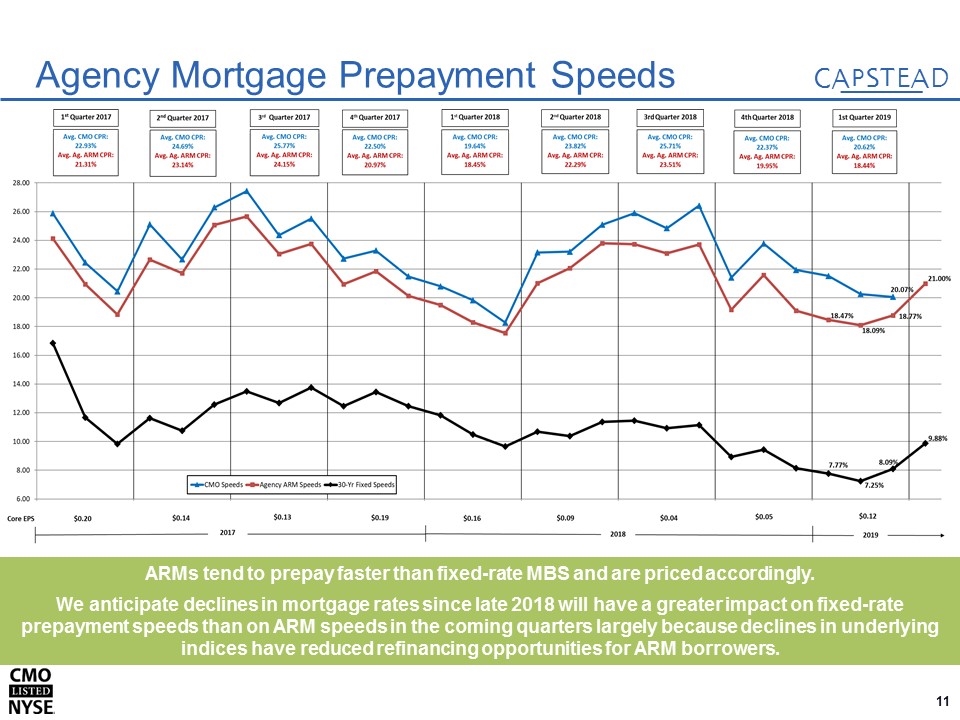

ARMs tend to prepay faster than fixed-rate MBS and are priced accordingly. We anticipate declines in mortgage rates since late 2018 will have a greater impact on fixed-rate prepayment speeds than on ARM speeds in the coming quarters largely because declines in underlying indices have reduced refinancing opportunities for ARM borrowers. Agency Mortgage Prepayment Speeds

APPENDIX

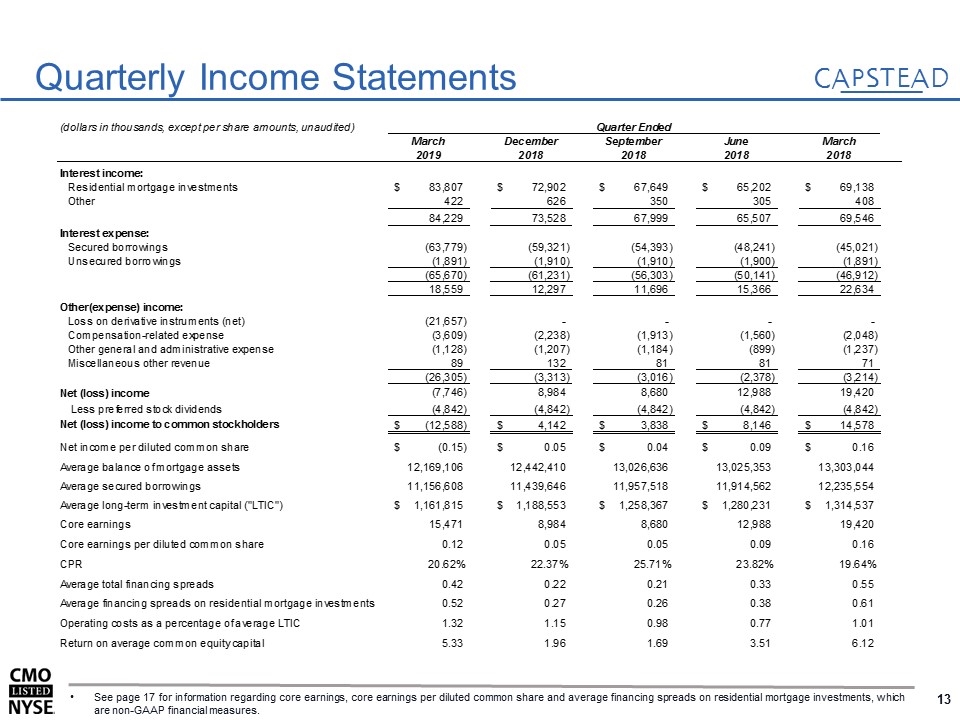

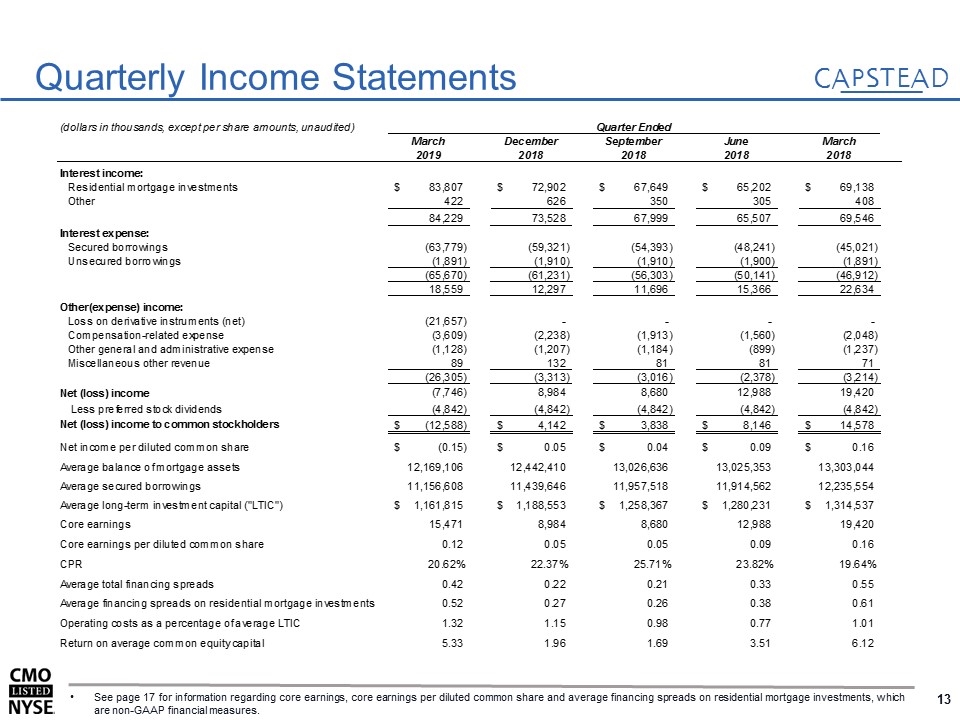

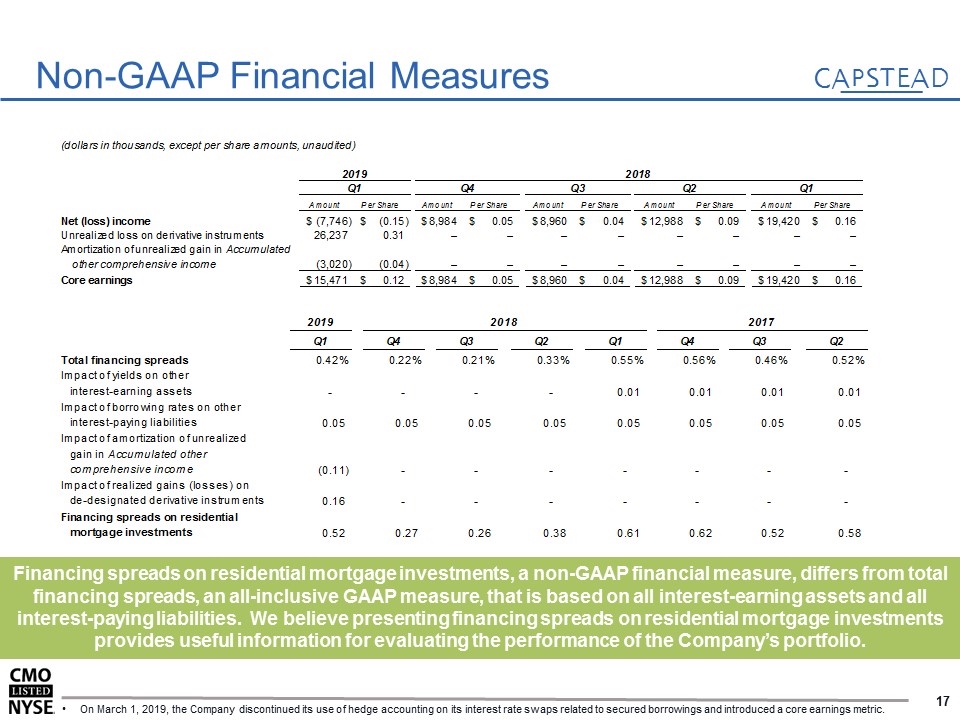

Quarterly Income Statements See page 17 for information regarding core earnings, core earnings per diluted common share and average financing spreads on residential mortgage investments, which are non-GAAP financial measures.

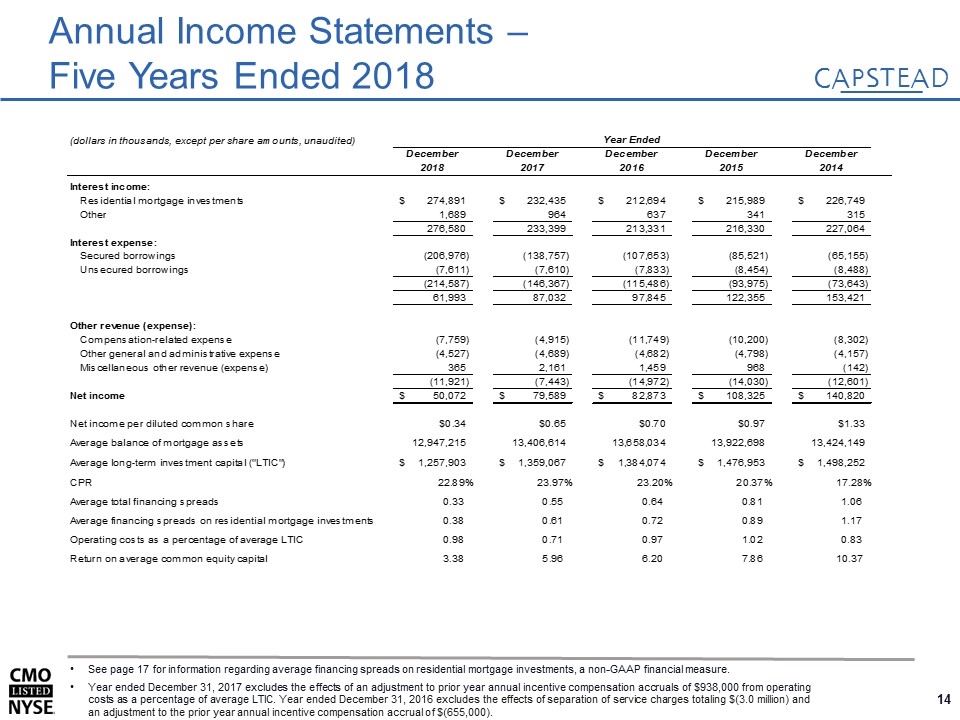

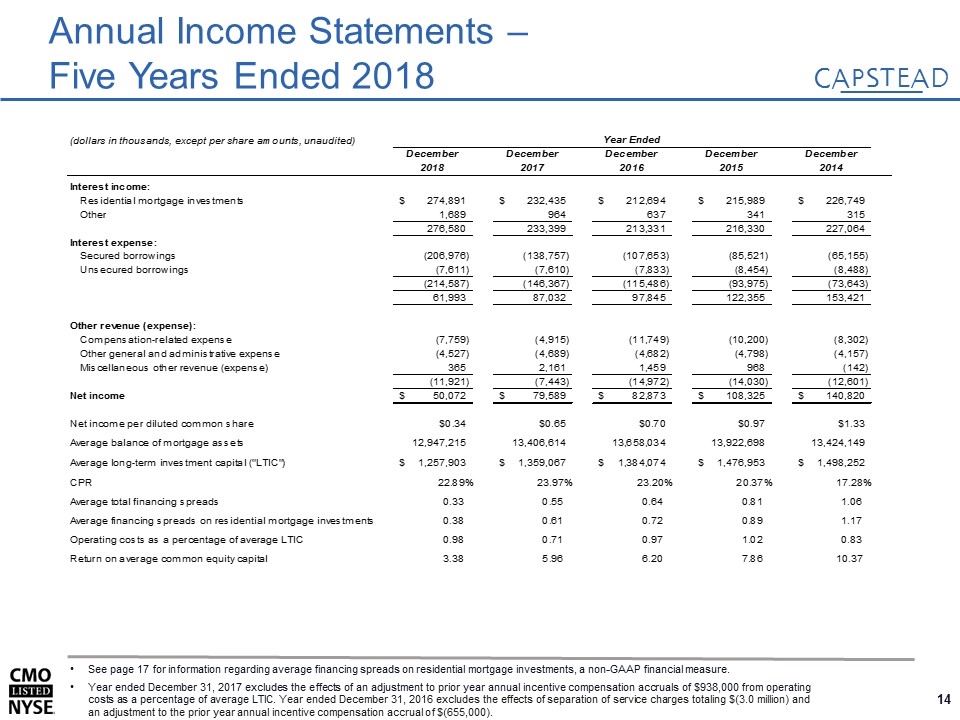

Annual Income Statements – Five Years Ended 2018 See page 17 for information regarding average financing spreads on residential mortgage investments, a non-GAAP financial measure. Year ended December 31, 2017 excludes the effects of an adjustment to prior year annual incentive compensation accruals of $938,000 from operating costs as a percentage of average LTIC. Year ended December 31, 2016 excludes the effects of separation of service charges totaling $(3.0 million) and an adjustment to the prior year annual incentive compensation accrual of $(655,000).

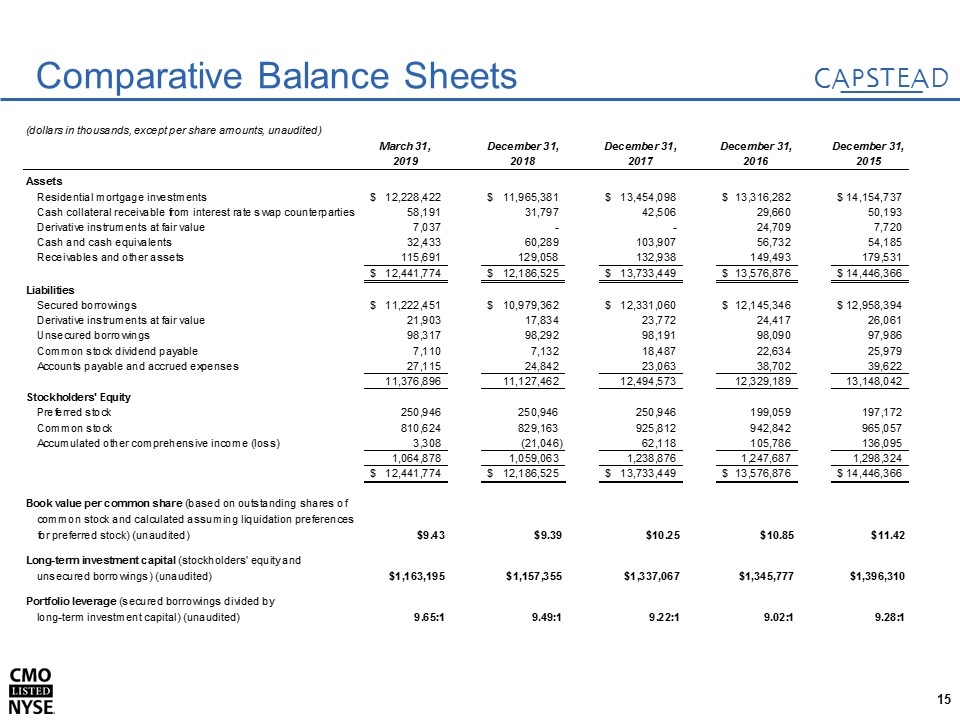

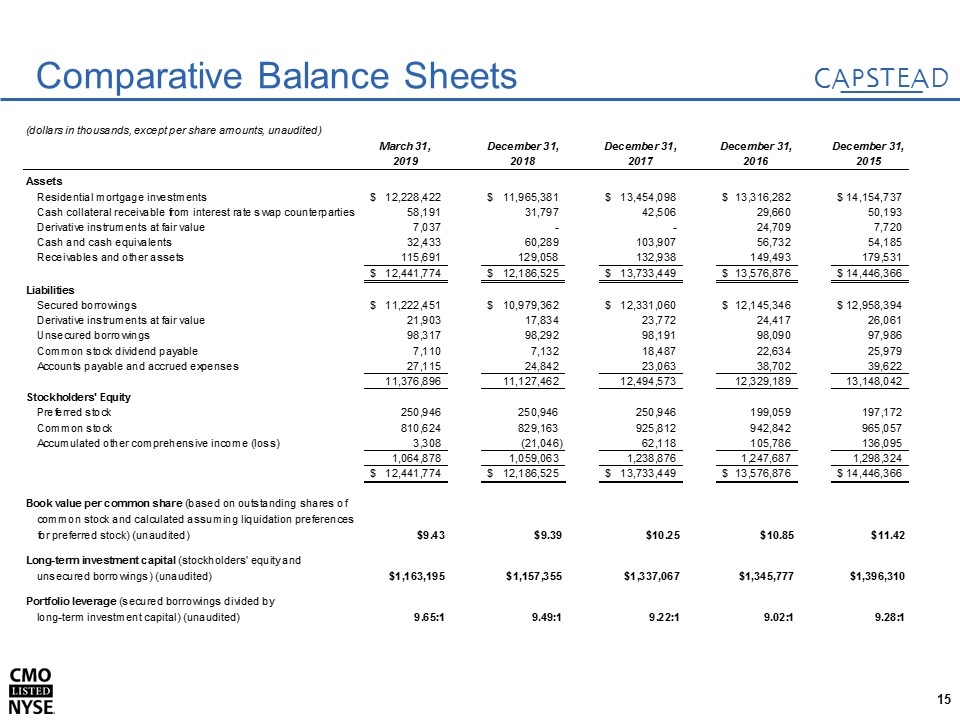

Comparative Balance Sheets

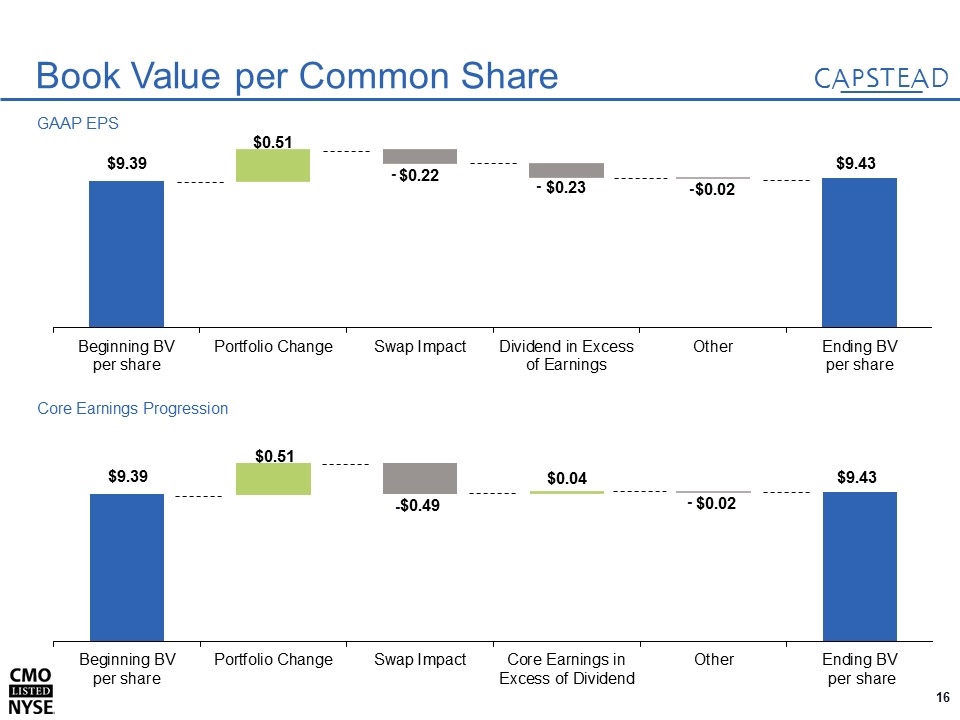

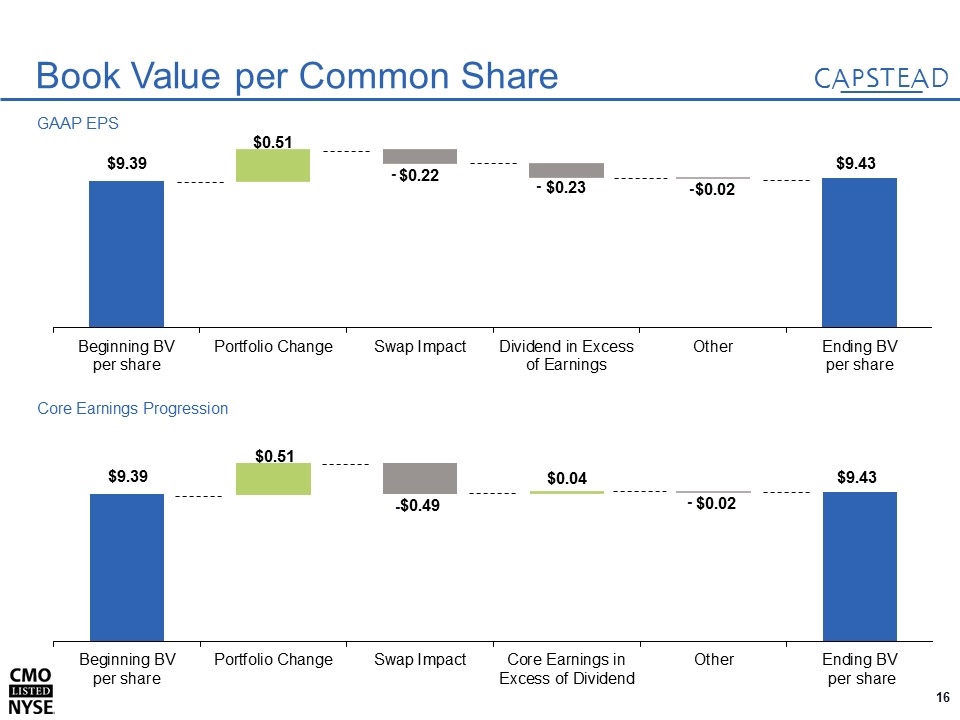

- - - - - Book Value per Common Share GAAP EPS Core Earnings Progression

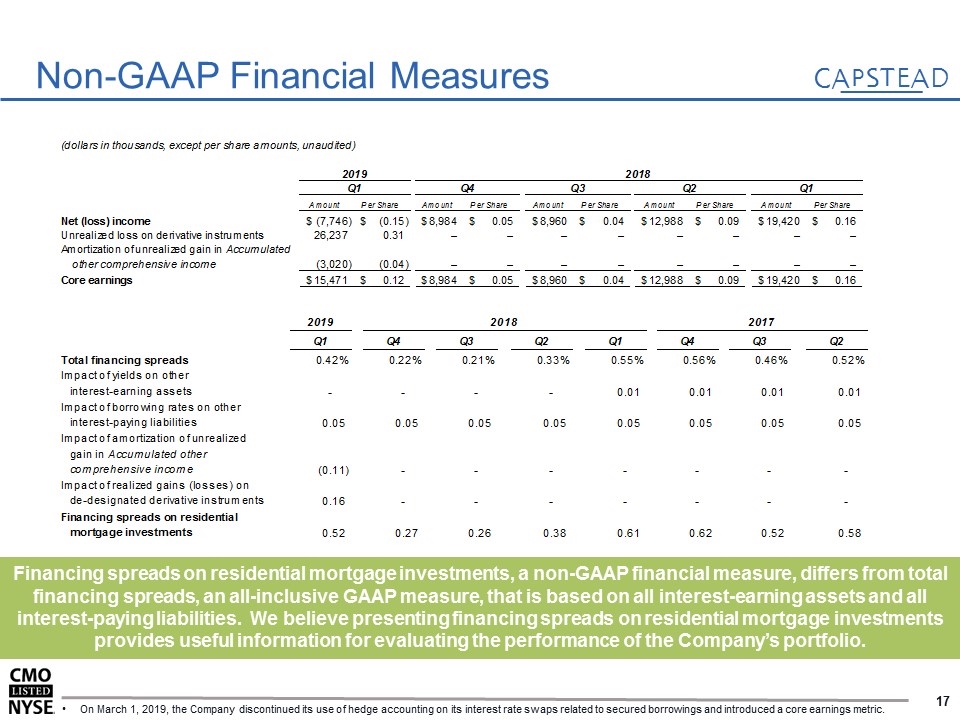

Financing spreads on residential mortgage investments, a non-GAAP financial measure, differs from total financing spreads, an all-inclusive GAAP measure, that is based on all interest-earning assets and all interest-paying liabilities. We believe presenting financing spreads on residential mortgage investments provides useful information for evaluating the performance of the Company’s portfolio. Non-GAAP Financial Measures On March 1, 2019, the Company discontinued its use of hedge accounting on its interest rate swaps related to secured borrowings and introduced a core earnings metric. (dollars in thousands, except per share amounts, unaudited) 2019 2018 Q1 Q4 Q3 Q2 Q1 Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Net (loss) income $-7,746 $-0.15 $8,984 $0.05 $8,960 $0.04 $12,988 $0.09 $19,420 $0.16 Unrealized loss on derivative instruments 26,237 0.31 – – – – – – – – Amortization of unrealized gain in Accumulated other comprehensive income -3,020 -0.04 – – – – – – – – Core earnings $15,471 $0.12 $8,984 $0.05 $8,960 $0.04 $12,988 $0.09 $19,420 $0.16 2019 2018 2017 Q1 Q4 Q3 Q2 Q1 Q4 Q3 Q2 Total financing spreads 4.1843680759816662E-3 2.2000000000000001E-3 2.0827325247523634E-3 3.3E-3 5.4999999999999997E-3 5.5999999999999999E-3 4.5999999999999999E-3 5.1999999999999998E-3 Impact of yields on other interest-earning assets 0 0 0 0 6.8510470922533706E-3 0.01 7.7851161787011181E-3 8.289525854147245E-3 Impact of borrowing rates on other interest-paying liabilities 4.7719269475736403E-2 4.8535987851740237E-2 4.8531162127963406E-2 5.0103123037395503E-2 5.0453757097751684E-2 0.05 5.1329860796100801E-2 5.1876078200261855E-2 Impact of amortization of unrealized gain in Accumulated other comprehensive income -0.10825627510499432 0 0 0 0 0 0 0 Impact of realized gains (losses) on de-designated derivative instruments 0.16418251960289773 0 0 0 0 0 0 0 Financing spreads on residential mortgage investments 0.52413273512802938 0.27 0.25775944687291724 0.382749902129428 0.60706936929591127 0.62 0.52 0.57916802444009596

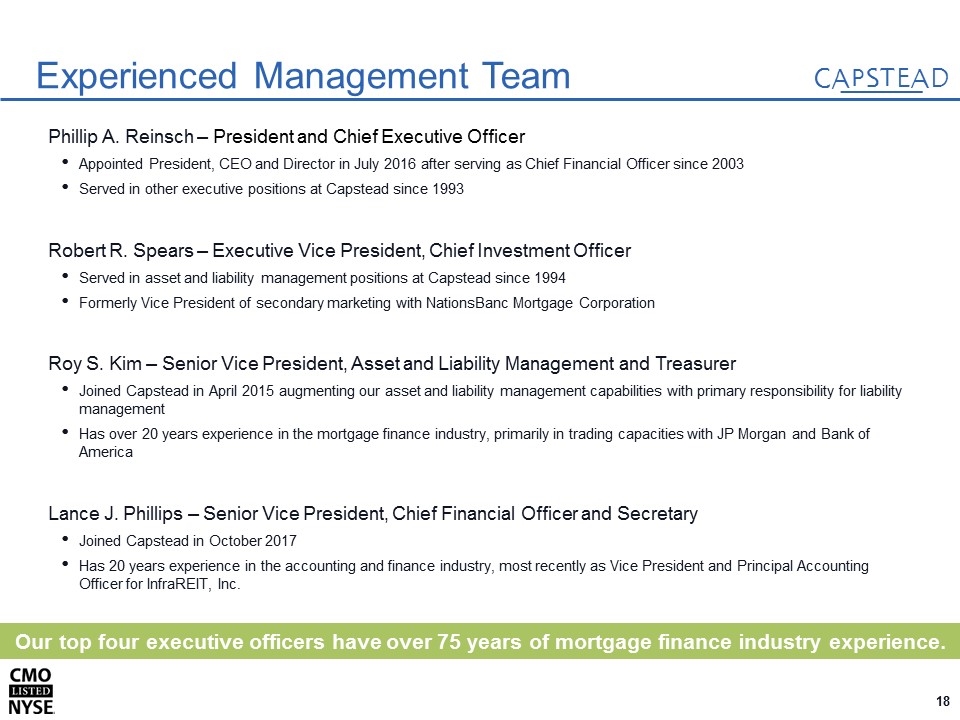

Phillip A. Reinsch – President and Chief Executive Officer Appointed President, CEO and Director in July 2016 after serving as Chief Financial Officer since 2003 Served in other executive positions at Capstead since 1993 Robert R. Spears – Executive Vice President, Chief Investment Officer Served in asset and liability management positions at Capstead since 1994 Formerly Vice President of secondary marketing with NationsBanc Mortgage Corporation Roy S. Kim – Senior Vice President, Asset and Liability Management and Treasurer Joined Capstead in April 2015 augmenting our asset and liability management capabilities with primary responsibility for liability management Has over 20 years experience in the mortgage finance industry, primarily in trading capacities with JP Morgan and Bank of America Lance J. Phillips – Senior Vice President, Chief Financial Officer and Secretary Joined Capstead in October 2017 Has 20 years experience in the accounting and finance industry, most recently as Vice President and Principal Accounting Officer for InfraREIT, Inc. Our top four executive officers have over 75 years of mortgage finance industry experience. Experienced Management Team