INVESTOR PRESENTATION THIRD QUARTER 2019 Exhibit 99.1

Statement Concerning Forward-looking Statements This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Actual results could differ materially from those projected in these forward-looking statements due to a variety of factors, without limitation, fluctuations in interest rates, the availability of suitable qualifying investments, changes in mortgage prepayments, the availability and terms of financing, changes in market conditions as a result of federal corporate and individual tax reform, changes in legislation or regulation affecting the mortgage and banking industries or Fannie Mae, Freddie Mac or Ginnie Mae securities, the availability of new investment capital, the liquidity of secondary markets and credit markets, and other changes in general economic conditions. These and other applicable uncertainties, factors and risks are described more fully in the Company’s filings with the U.S. Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein. Safe Harbor Statement - Private Securities Litigation Reform Act of 1995

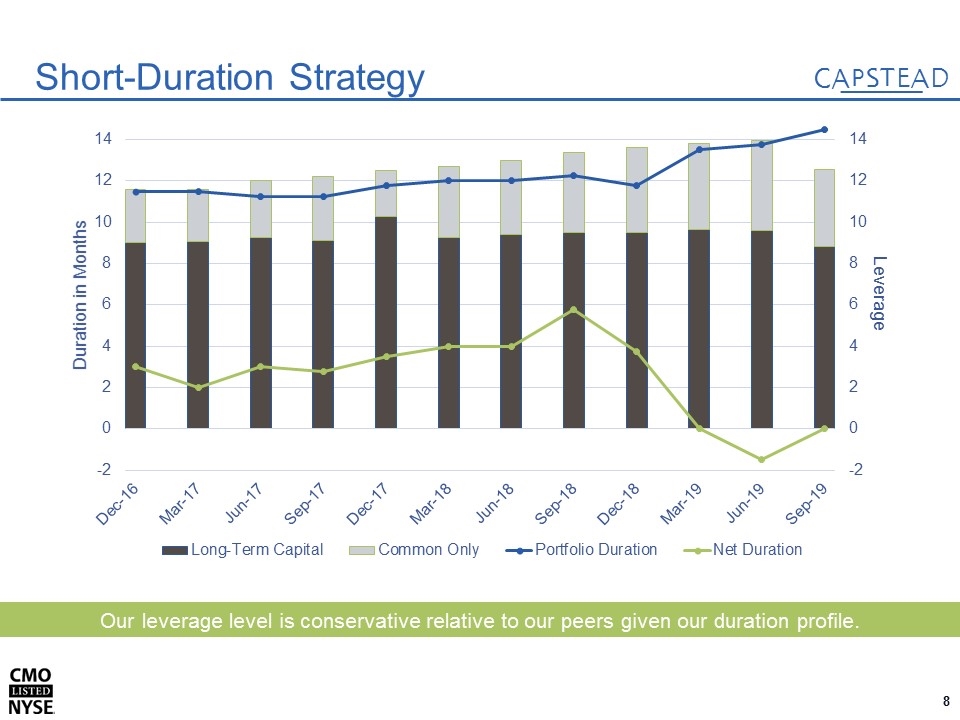

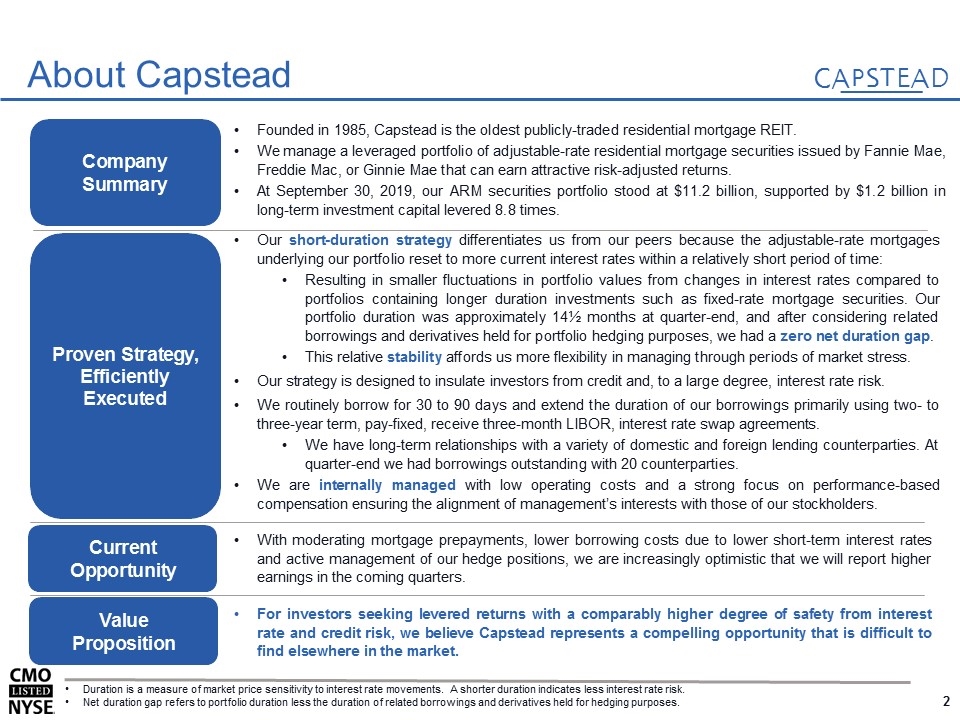

With moderating mortgage prepayments, lower borrowing costs due to lower short-term interest rates and active management of our hedge positions, we are increasingly optimistic that we will report higher earnings in the coming quarters. Company Summary Proven Strategy, Efficiently Executed Founded in 1985, Capstead is the oldest publicly-traded residential mortgage REIT. We manage a leveraged portfolio of adjustable-rate residential mortgage securities issued by Fannie Mae, Freddie Mac, or Ginnie Mae that can earn attractive risk-adjusted returns. At September 30, 2019, our ARM securities portfolio stood at $11.2 billion, supported by $1.2 billion in long-term investment capital levered 8.8 times. Our short-duration strategy differentiates us from our peers because the adjustable-rate mortgages underlying our portfolio reset to more current interest rates within a relatively short period of time: Resulting in smaller fluctuations in portfolio values from changes in interest rates compared to portfolios containing longer duration investments such as fixed-rate mortgage securities. Our portfolio duration was approximately 14½ months at quarter-end, and after considering related borrowings and derivatives held for portfolio hedging purposes, we had a zero net duration gap. This relative stability affords us more flexibility in managing through periods of market stress. Our strategy is designed to insulate investors from credit and, to a large degree, interest rate risk. We routinely borrow for 30 to 90 days and extend the duration of our borrowings primarily using two- to three-year term, pay-fixed, receive three-month LIBOR, interest rate swap agreements. We have long-term relationships with a variety of domestic and foreign lending counterparties. At quarter-end we had borrowings outstanding with 20 counterparties. We are internally managed with low operating costs and a strong focus on performance-based compensation ensuring the alignment of management’s interests with those of our stockholders. For investors seeking levered returns with a comparably higher degree of safety from interest rate and credit risk, we believe Capstead represents a compelling opportunity that is difficult to find elsewhere in the market. Duration is a measure of market price sensitivity to interest rate movements. A shorter duration indicates less interest rate risk. Net duration gap refers to portfolio duration less the duration of related borrowings and derivatives held for hedging purposes. Value Proposition About Capstead Current Opportunity

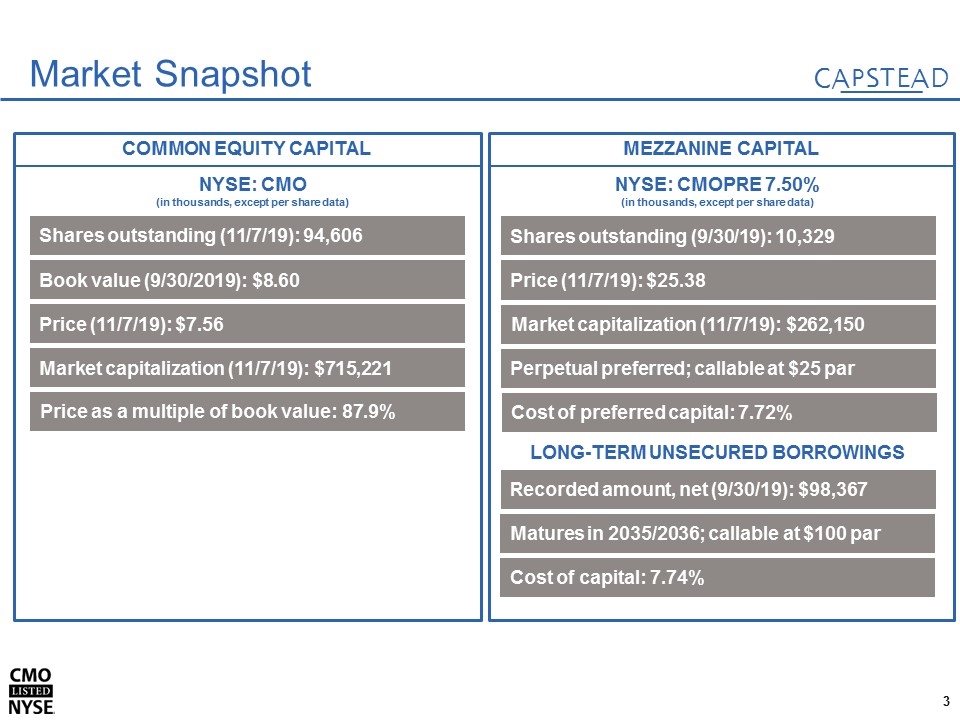

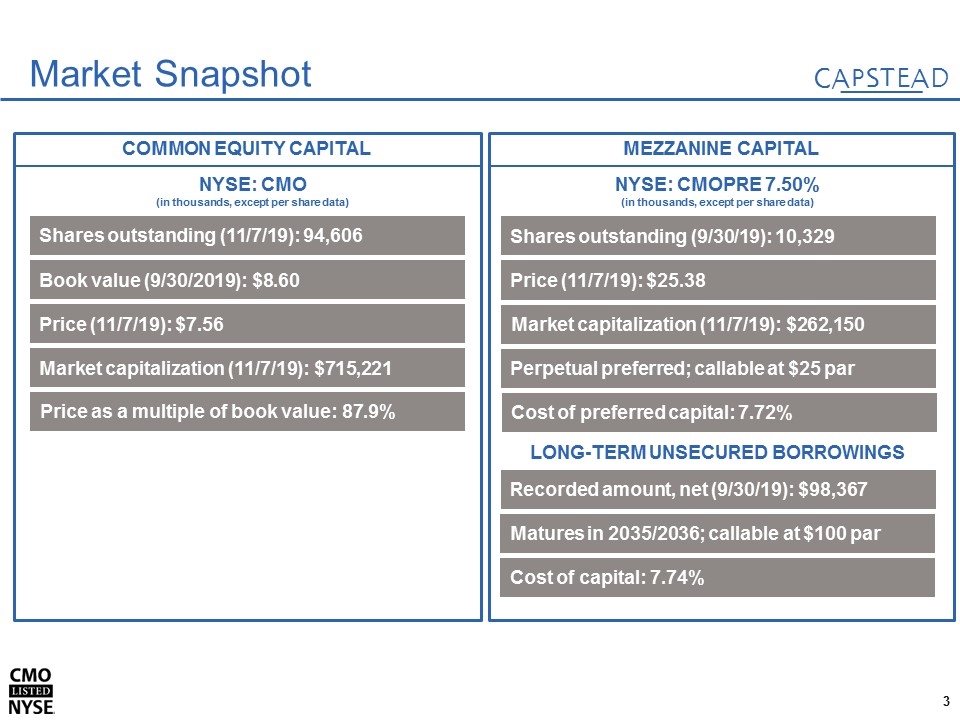

MEZZANINE CAPITAL COMMON EQUITY CAPITAL 50% 16% 84% Market Snapshot NYSE: CMOPRE 7.50% (in thousands, except per share data) Shares outstanding (9/30/19): 10,329 Price (11/7/19): $25.38 Perpetual preferred; callable at $25 par Cost of preferred capital: 7.72% Shares outstanding (11/7/19): 94,606 NYSE: CMO (in thousands, except per share data) Book value (9/30/2019): $8.60 Price (11/7/19): $7.56 Market capitalization (11/7/19): $715,221 Price as a multiple of book value: 87.9% LONG-TERM UNSECURED BORROWINGS Recorded amount, net (9/30/19): $98,367 Cost of capital: 7.74% Market capitalization (11/7/19): $262,150 Matures in 2035/2036; callable at $100 par

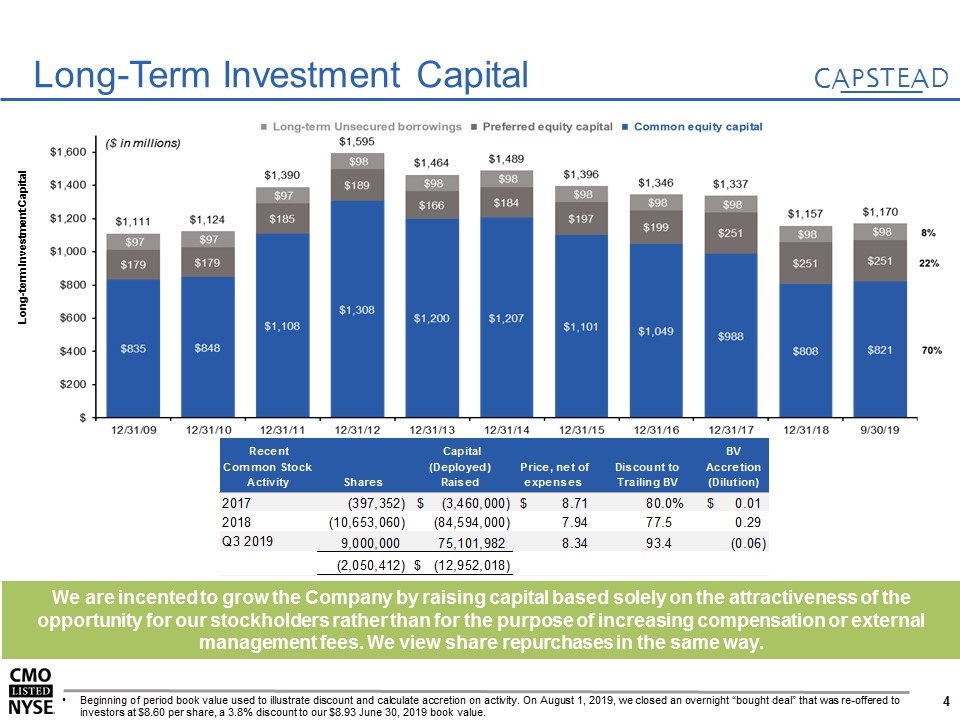

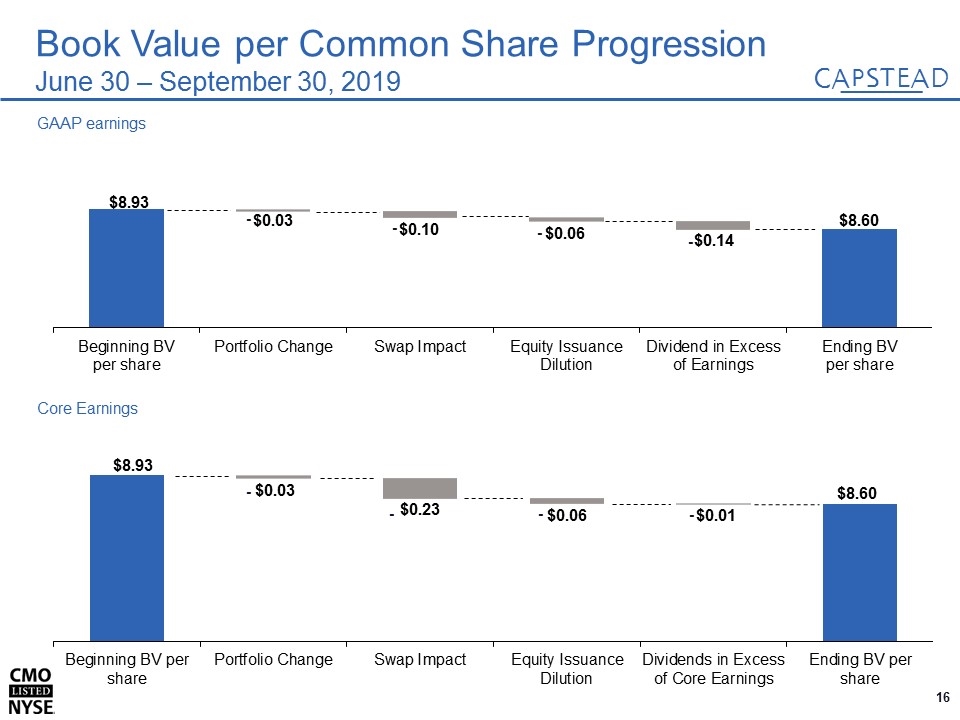

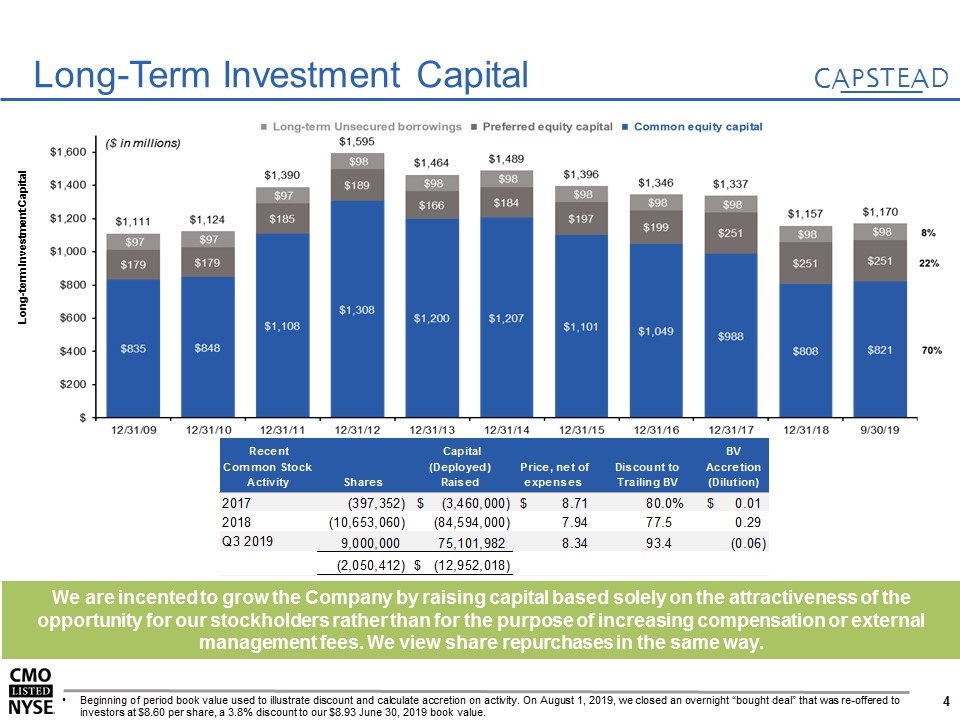

Long-Term Investment Capital We are incented to grow the Company by raising capital based solely on the attractiveness of the opportunity for our stockholders rather than for the purpose of increasing compensation or external management fees. We view share repurchases in the same way. Beginning of period book value used to illustrate discount and calculate accretion on activity. On August 1, 2019, we closed an overnight “bought deal” that was re-offered to investors at $8.60 per share, a 3.8% discount to our $8.93 June 30, 2019 book value. Long-term Investment Capital

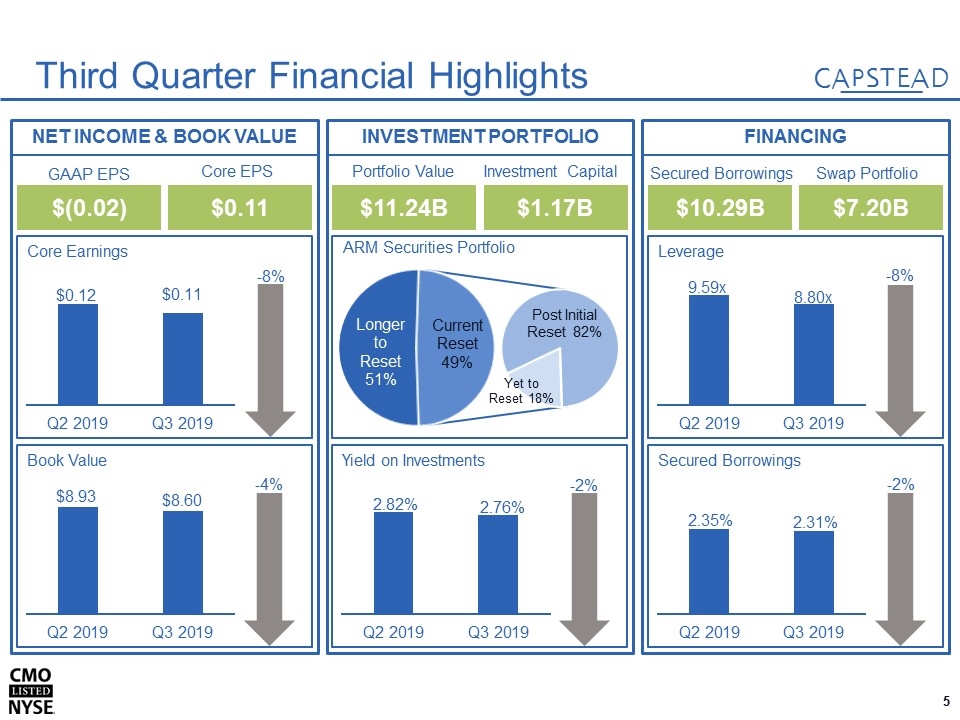

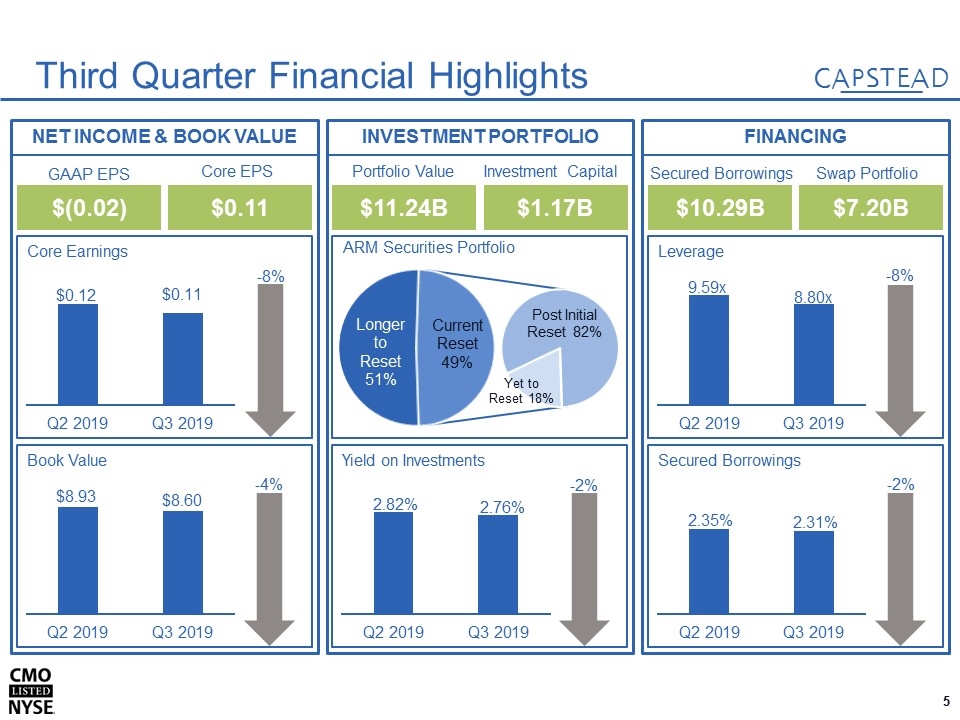

NET INCOME & BOOK VALUE Core Earnings INVESTMENT PORTFOLIO Book Value -4% FINANCING $(0.02) $0.11 GAAP EPS Core EPS $11.24B $1.17B Portfolio Value Investment Capital $10.29B $7.20B Secured Borrowings Swap Portfolio Yield on Investments -2% Secured Borrowings -2% Leverage -8% Third Quarter Financial Highlights ARM Securities Portfolio -8%

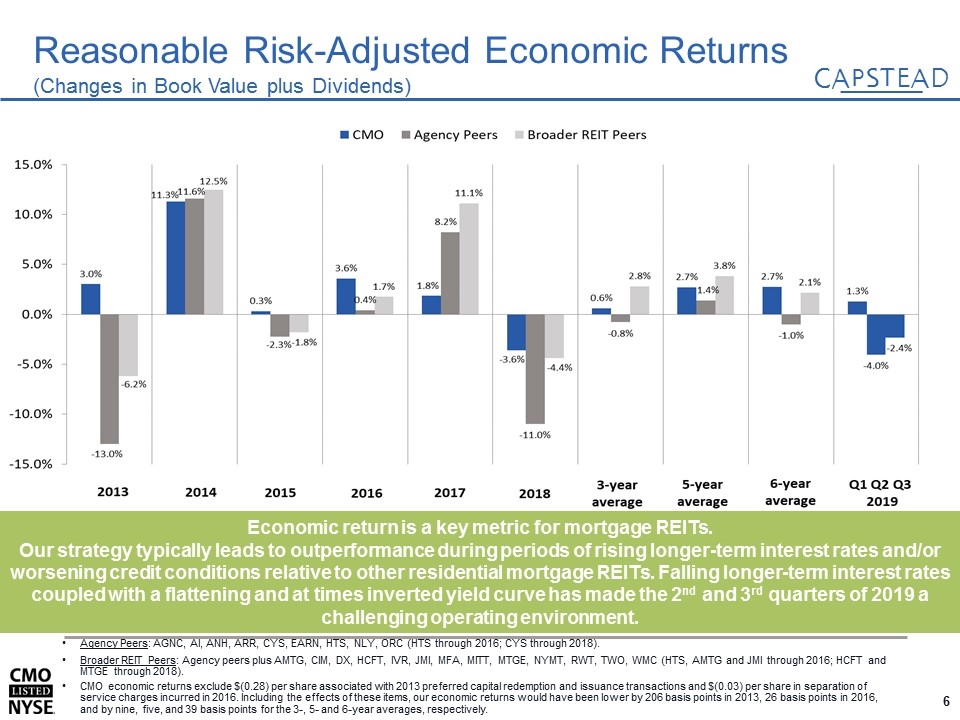

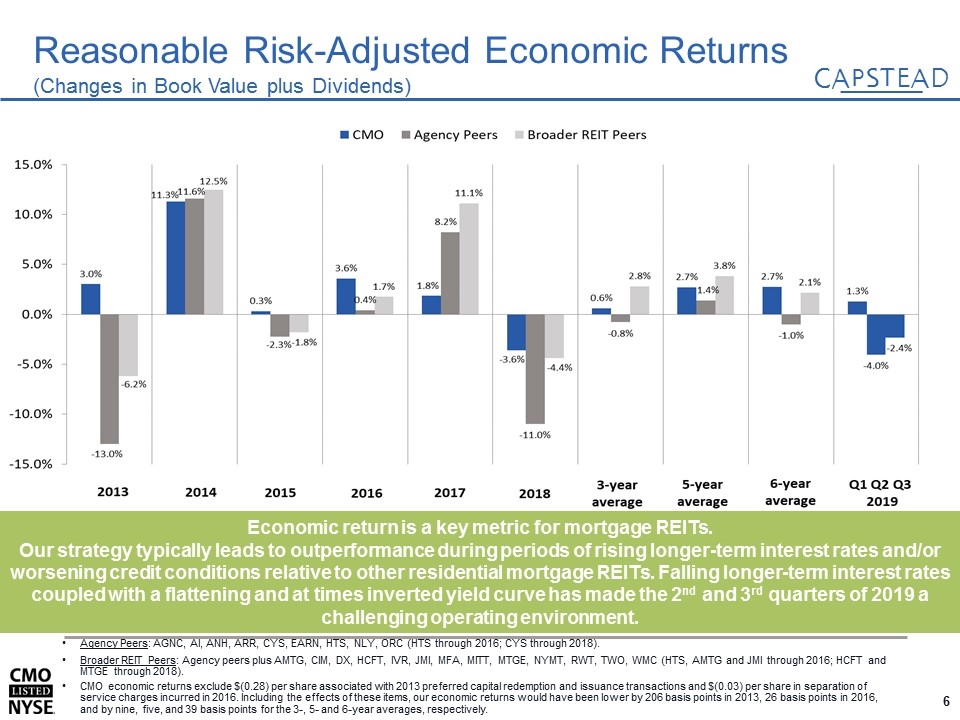

Economic return is a key metric for mortgage REITs. Our strategy typically leads to outperformance during periods of rising longer-term interest rates and/or worsening credit conditions relative to other residential mortgage REITs. Falling longer-term interest rates coupled with a flattening and at times inverted yield curve has made the 2nd and 3rd quarters of 2019 a challenging operating environment. Agency Peers: AGNC, AI, ANH, ARR, CYS, EARN, HTS, NLY, ORC (HTS through 2016; CYS through 2018). Broader REIT Peers: Agency peers plus AMTG, CIM, DX, HCFT, IVR, JMI, MFA, MITT, MTGE, NYMT, RWT, TWO, WMC (HTS, AMTG and JMI through 2016; HCFT and MTGE through 2018). CMO economic returns exclude $(0.28) per share associated with 2013 preferred capital redemption and issuance transactions and $(0.03) per share in separation of service charges incurred in 2016. Including the effects of these items, our economic returns would have been lower by 206 basis points in 2013, 26 basis points in 2016, and by nine, five, and 39 basis points for the 3-, 5- and 6-year averages, respectively. Reasonable Risk-Adjusted Economic Returns (Changes in Book Value plus Dividends)

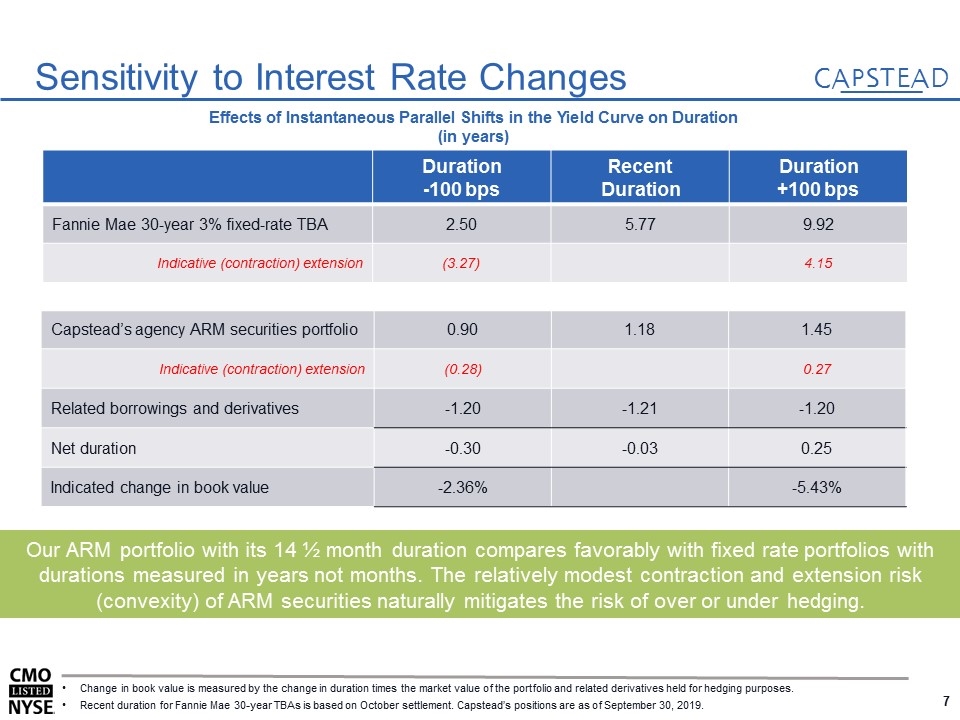

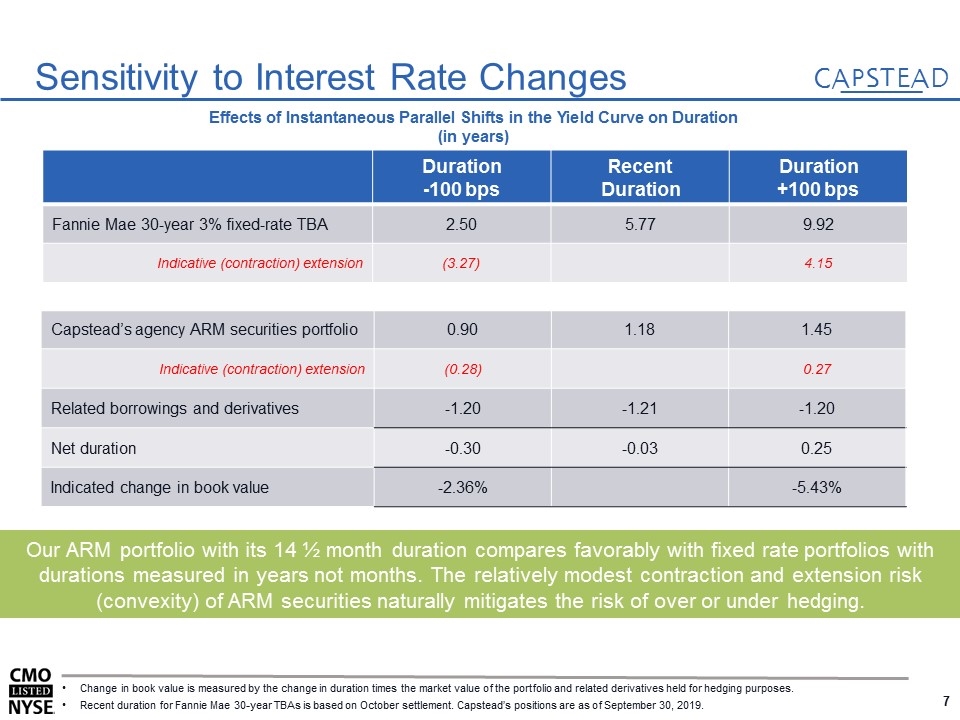

Our ARM portfolio with its 14 ½ month duration compares favorably with fixed rate portfolios with durations measured in years not months. The relatively modest contraction and extension risk (convexity) of ARM securities naturally mitigates the risk of over or under hedging. Sensitivity to Interest Rate Changes Capstead’s agency ARM securities portfolio 0.90 1.18 1.45 Indicative (contraction) extension (0.28) 0.27 Related borrowings and derivatives -1.20 -1.21 -1.20 Net duration -0.30 -0.03 0.25 Indicated change in book value -2.36% -5.43% Effects of Instantaneous Parallel Shifts in the Yield Curve on Duration (in years) Duration -100 bps Recent Duration Duration +100 bps Fannie Mae 30-year 3% fixed-rate TBA 2.50 5.77 9.92 Indicative (contraction) extension (3.27) 4.15 Change in book value is measured by the change in duration times the market value of the portfolio and related derivatives held for hedging purposes. Recent duration for Fannie Mae 30-year TBAs is based on October settlement. Capstead’s positions are as of September 30, 2019.

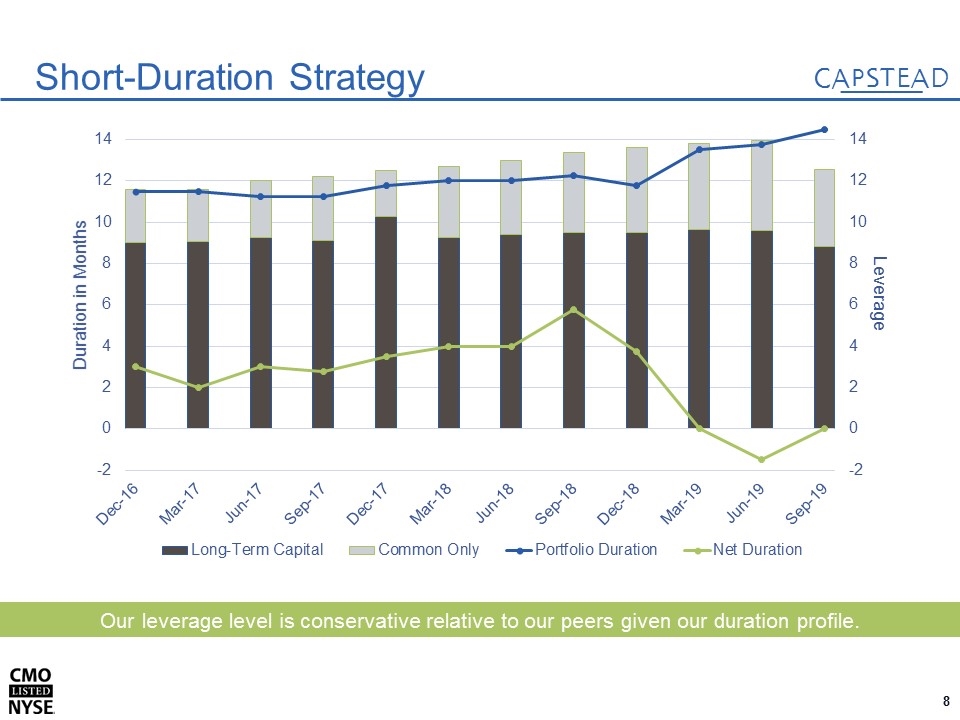

Our leverage level is conservative relative to our peers given our duration profile. Short-Duration Strategy

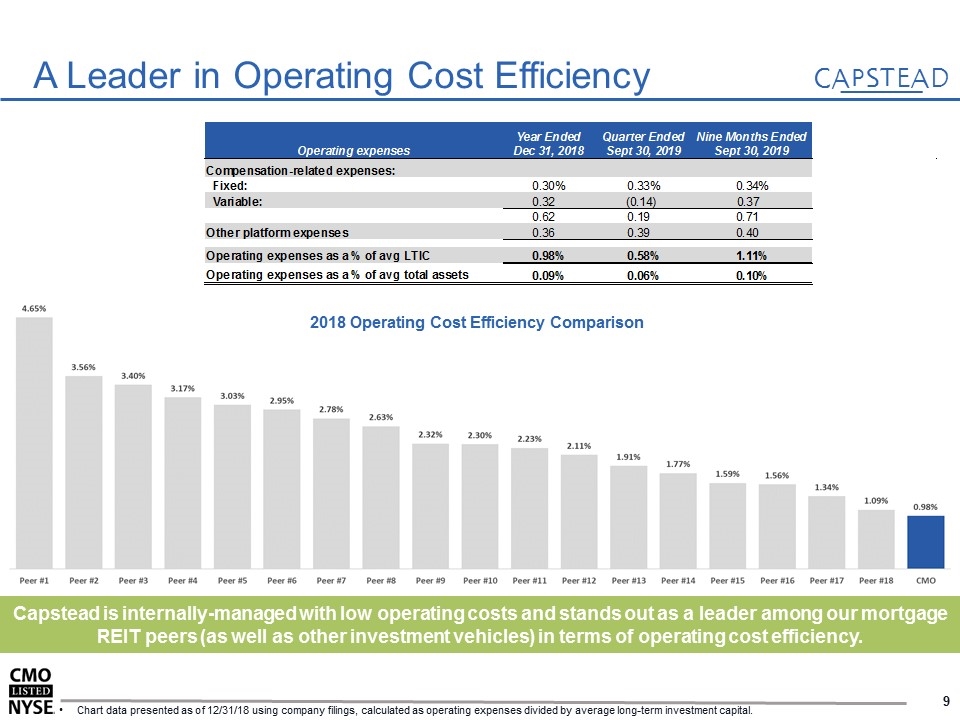

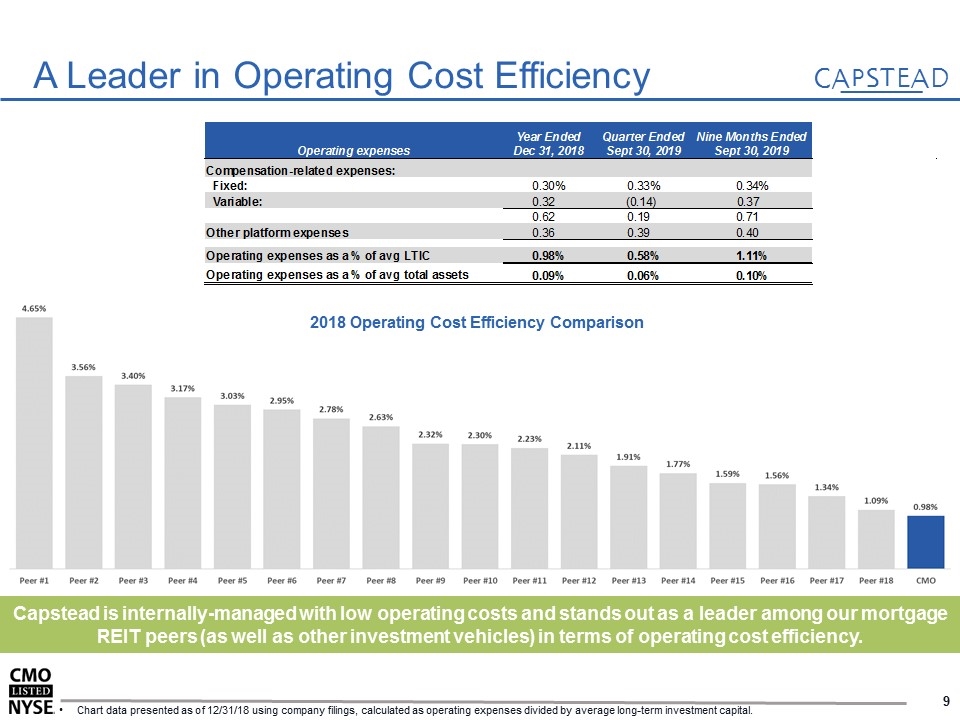

A Leader in Operating Cost Efficiency Capstead is internally-managed with low operating costs and stands out as a leader among our mortgage REIT peers (as well as other investment vehicles) in terms of operating cost efficiency. Chart data presented as of 12/31/18 using company filings, calculated as operating expenses divided by average long-term investment capital. 2018 Operating Cost Efficiency Comparison

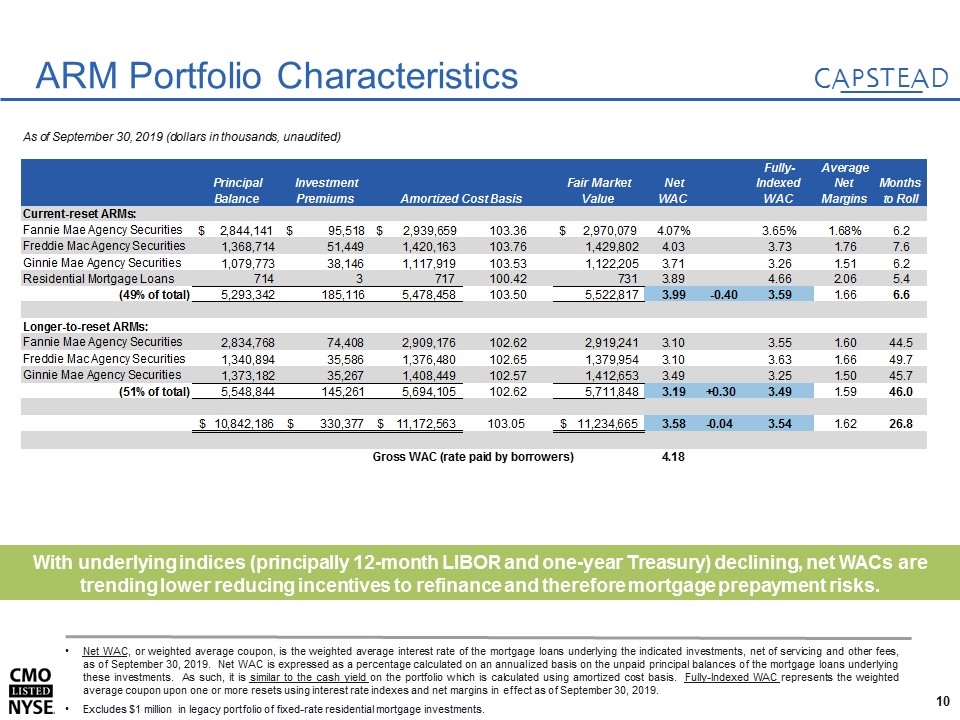

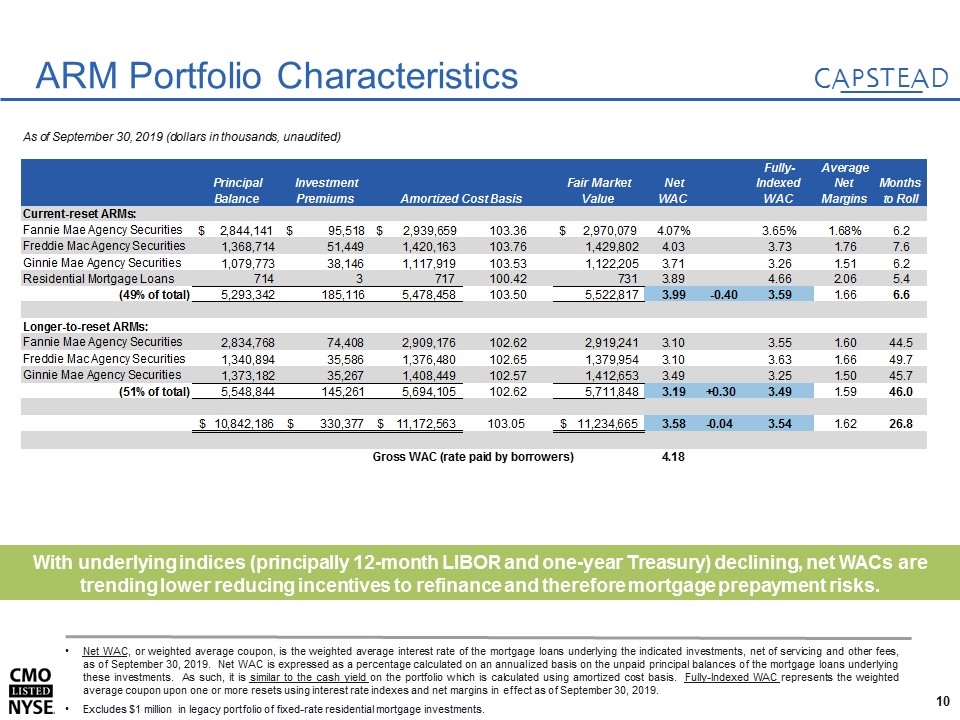

ARM Portfolio Characteristics Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees, as of September 30, 2019. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balances of the mortgage loans underlying these investments. As such, it is similar to the cash yield on the portfolio which is calculated using amortized cost basis. Fully-Indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins in effect as of September 30, 2019. Excludes $1 million in legacy portfolio of fixed-rate residential mortgage investments. With underlying indices (principally 12-month LIBOR and one-year Treasury) declining, net WACs are trending lower reducing incentives to refinance and therefore mortgage prepayment risks. As of September 30, 2019 (dollars in thousands, unaudited) Principal Balance Investment Premiums Amortized Cost Basis Fair Market Value Net WAC Fully-Indexed WAC Average Net Margins Months to Roll Current-reset ARMs: Fannie Mae Agency Securities $2,844,141 $95,518 $2,939,659 103.35841296194528 $2,970,079 4.07E-2 3.6499999999999998E-2 1.6799999999999999E-2 6.2 Freddie Mac Agency Securities 1,368,714 51,449 1,420,163 103.7589299152343 1,429,802 4.03 3.73 1.76 7.6 Ginnie Mae Agency Securities 1,079,773 38,146 1,117,919 103.53277957496623 1,122,205 3.71 3.26 1.51 6.2 Residential Mortgage Loans 714 3 717 100.42016806722688 731 3.89 4.66 2.06 5.4 (49% of total) 5,293,342 ,185,116 5,478,458 103.49714792658401 5,522,817 3.99 -0.40 3.59 1.66 6.6 Longer-to-reset ARMs: Fannie Mae Agency Securities 2,834,768 74,408 2,909,176 102.62483561264979 2,919,241 3.1 3.55 1.6 44.5 Freddie Mac Agency Securities 1,340,894 35,586 1,376,480 102.65390105407289 1,379,954 3.1 3.63 1.66 49.7 Ginnie Mae Agency Securities 1,373,182 35,267 1,408,449 102.56826844511507 1,412,653 3.49 3.25 1.5 45.7 (51% of total) 5,548,844 ,145,261 5,694,105 102.61786058501553 5,711,848 3.19 +0.30 3.49 1.59 46 $10,842,186 $,330,377 $11,172,563 103.04714381398732 $11,234,665 3.58 -0.04 3.54 1.62 26.8 Gross WAC (rate paid by borrowers) 4.18

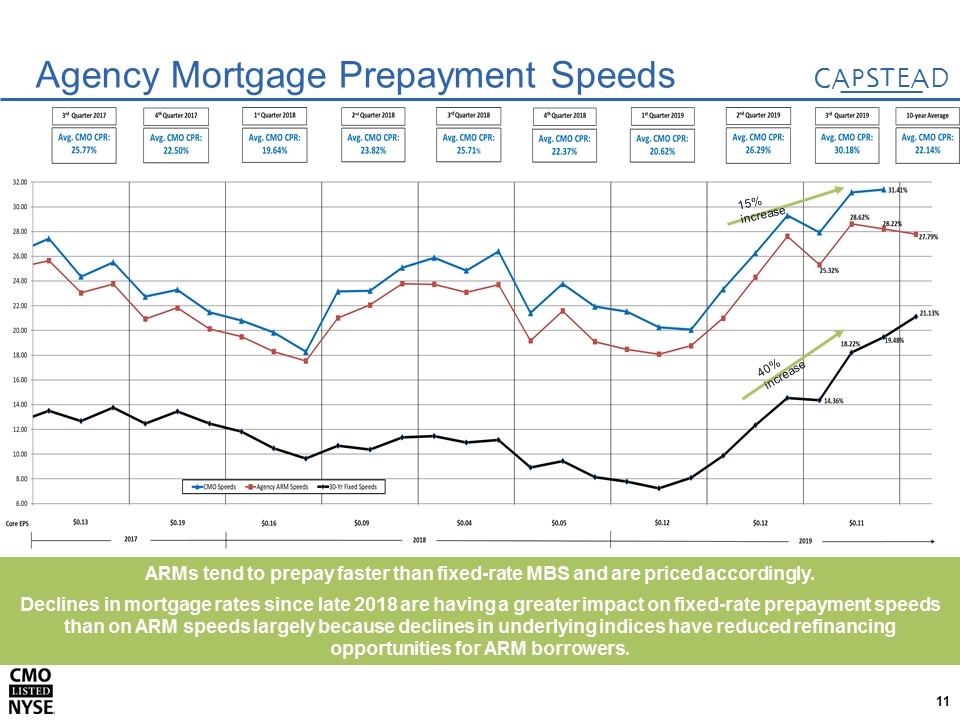

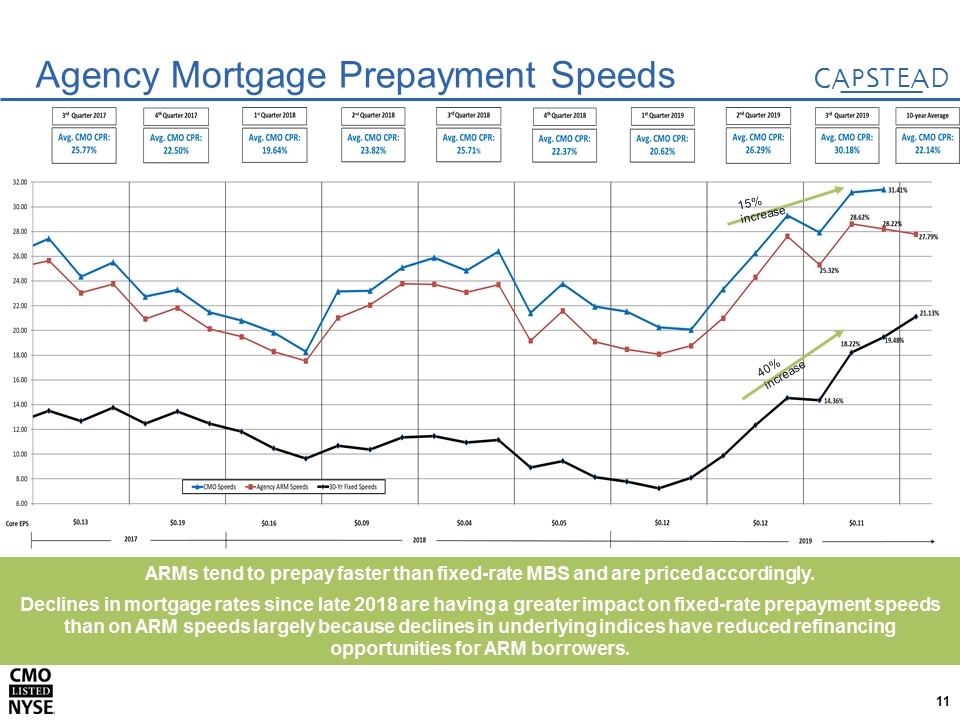

ARMs tend to prepay faster than fixed-rate MBS and are priced accordingly. Declines in mortgage rates since late 2018 are having a greater impact on fixed-rate prepayment speeds than on ARM speeds largely because declines in underlying indices have reduced refinancing opportunities for ARM borrowers. Agency Mortgage Prepayment Speeds 15% increase 40% increase

APPENDIX

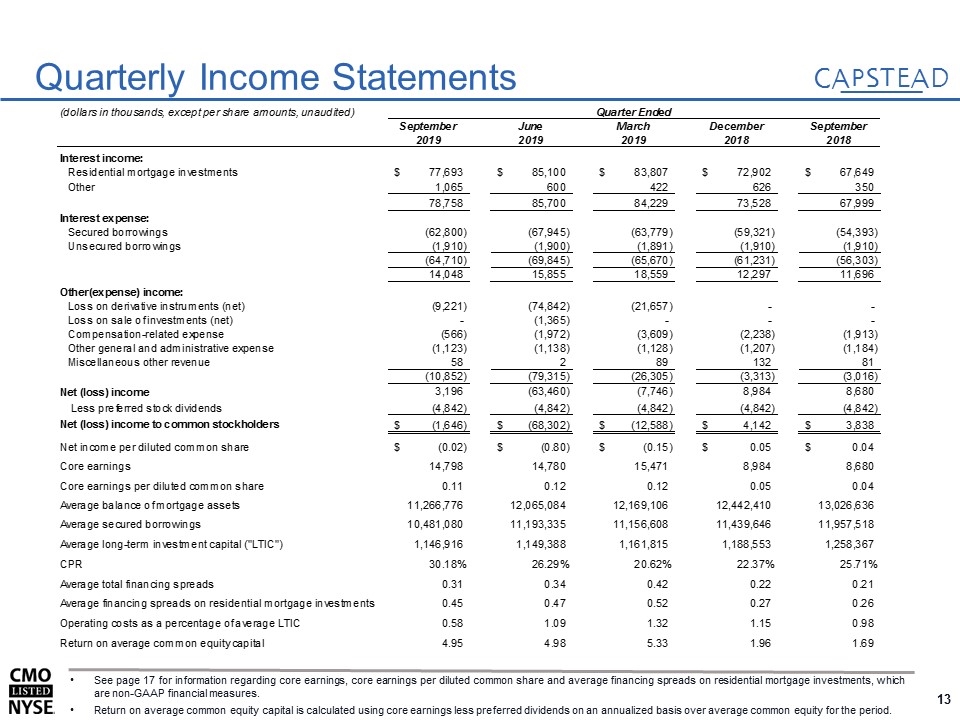

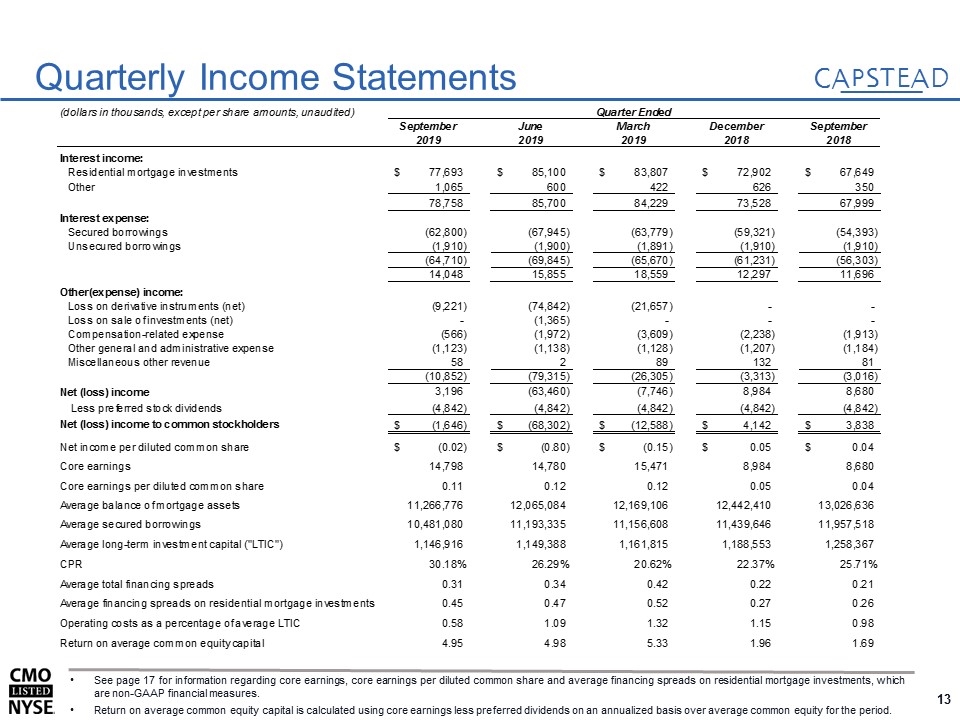

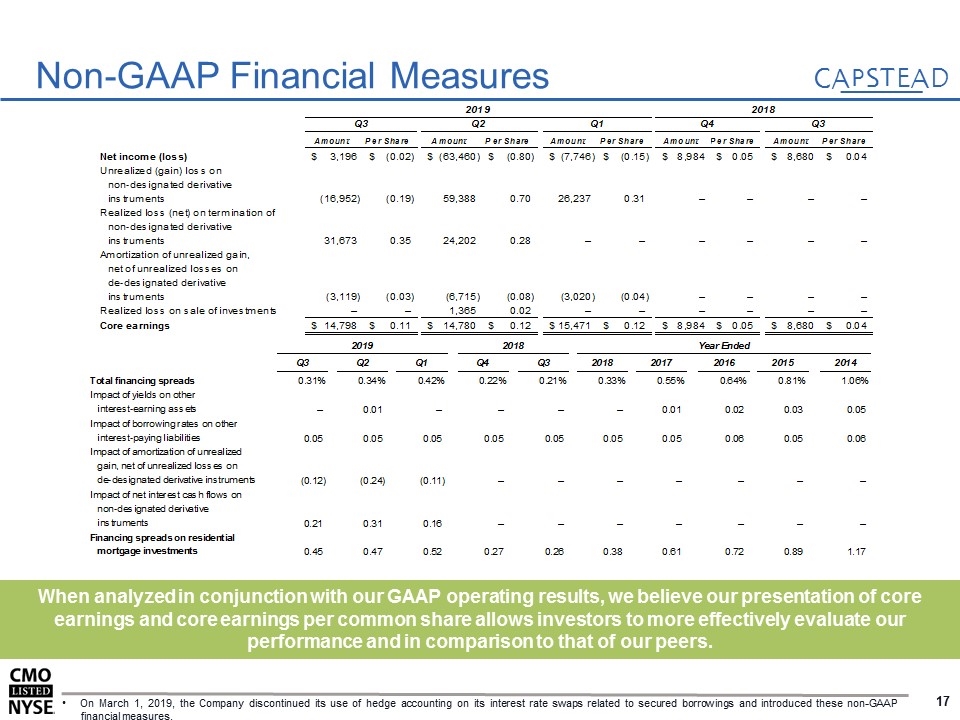

Quarterly Income Statements See page 17 for information regarding core earnings, core earnings per diluted common share and average financing spreads on residential mortgage investments, which are non-GAAP financial measures. Return on average common equity capital is calculated using core earnings less preferred dividends on an annualized basis over average common equity for the period.

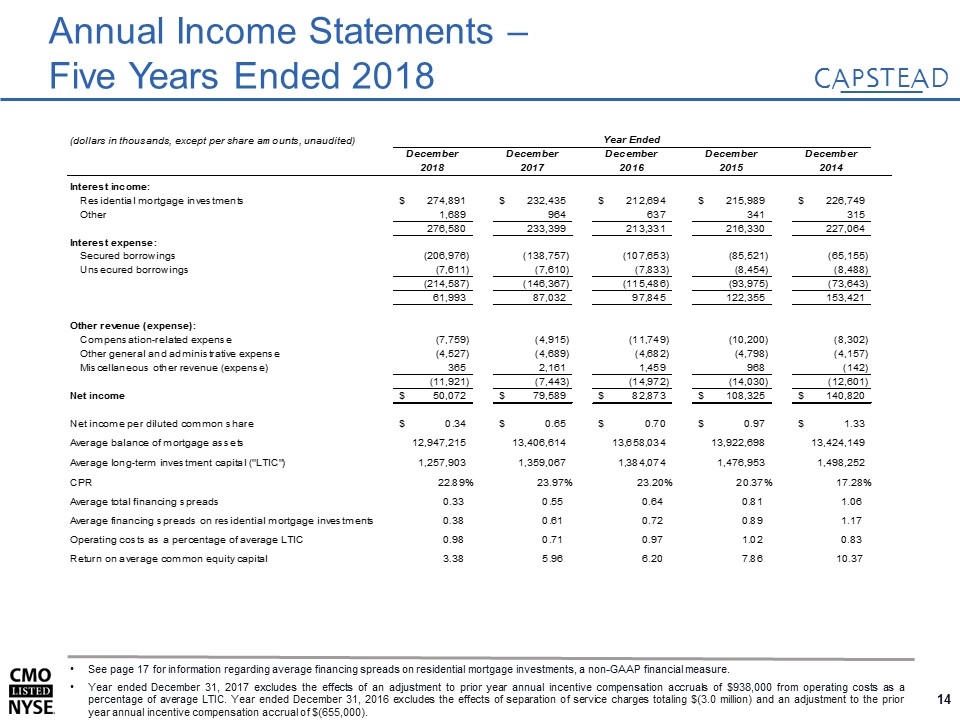

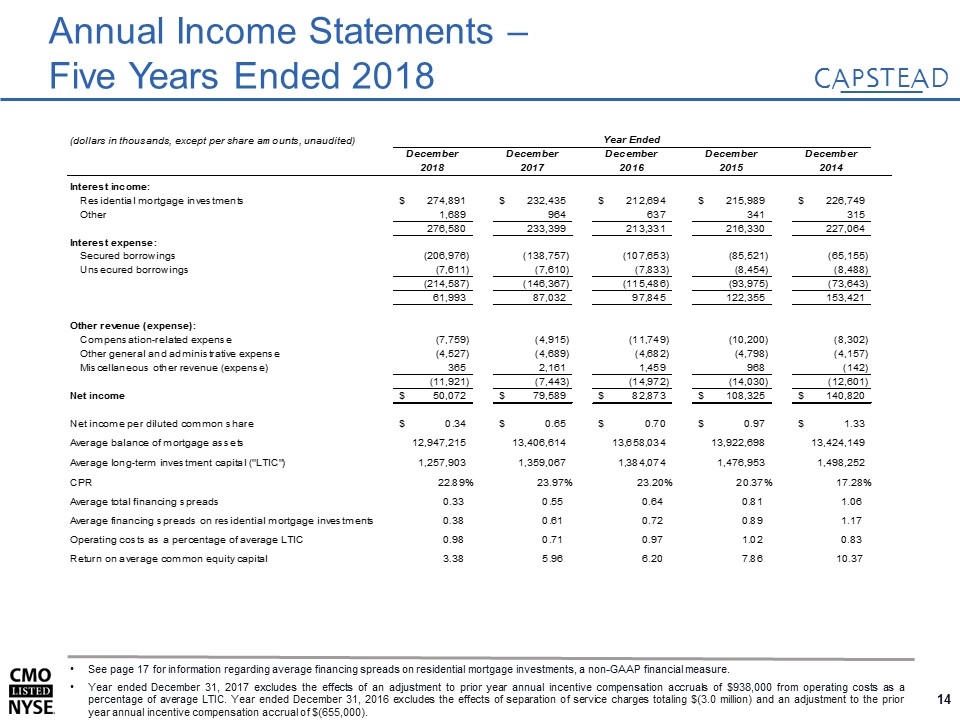

Annual Income Statements – Five Years Ended 2018 See page 17 for information regarding average financing spreads on residential mortgage investments, a non-GAAP financial measure. Year ended December 31, 2017 excludes the effects of an adjustment to prior year annual incentive compensation accruals of $938,000 from operating costs as a percentage of average LTIC. Year ended December 31, 2016 excludes the effects of separation of service charges totaling $(3.0 million) and an adjustment to the prior year annual incentive compensation accrual of $(655,000).

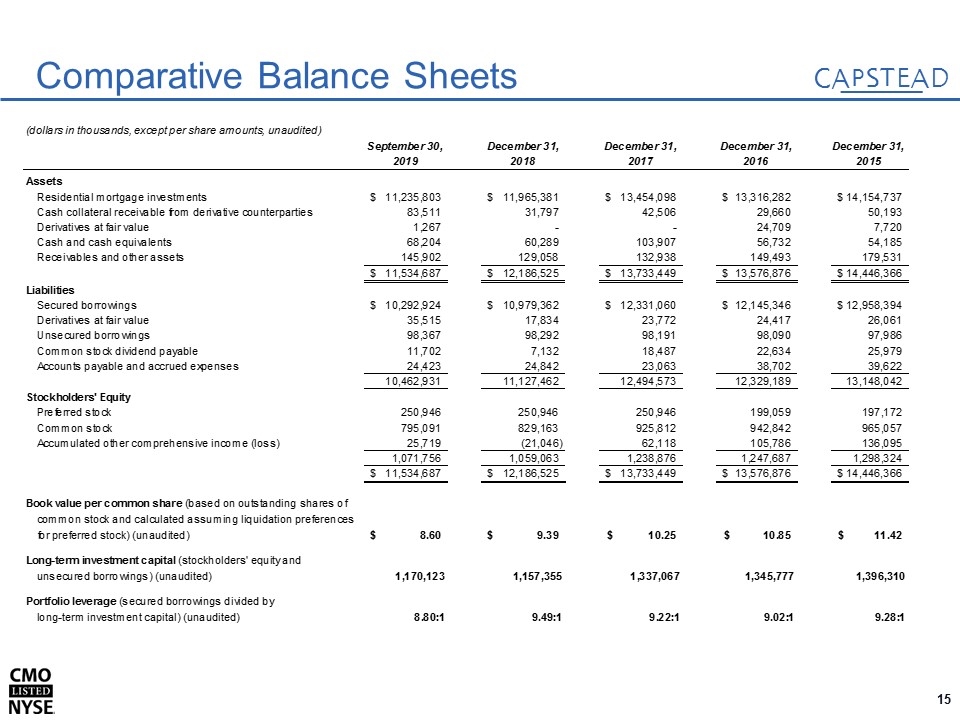

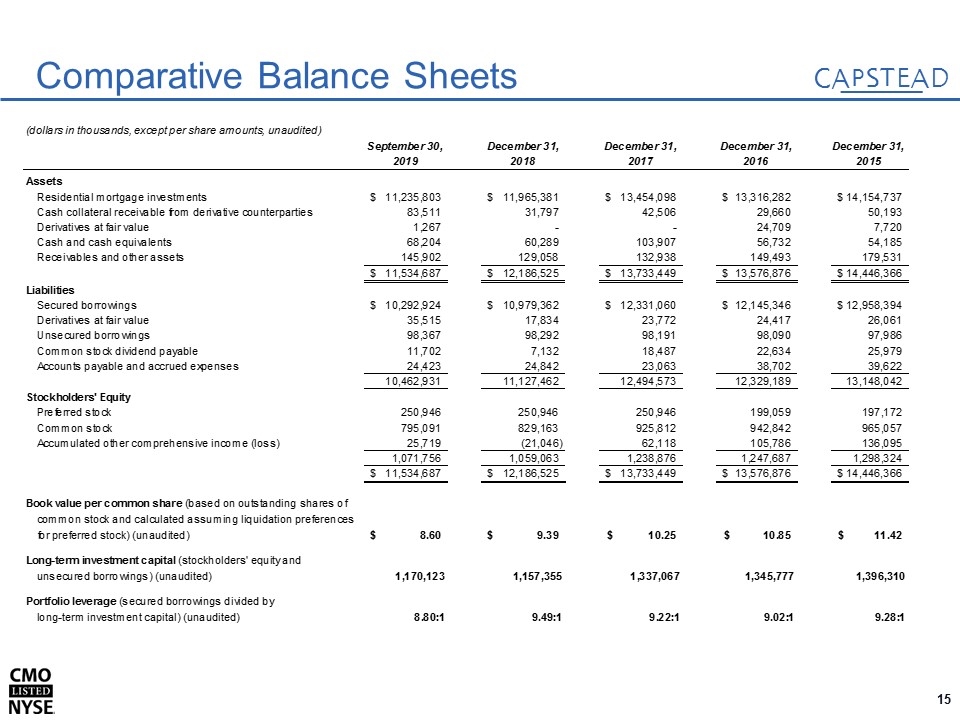

Comparative Balance Sheets

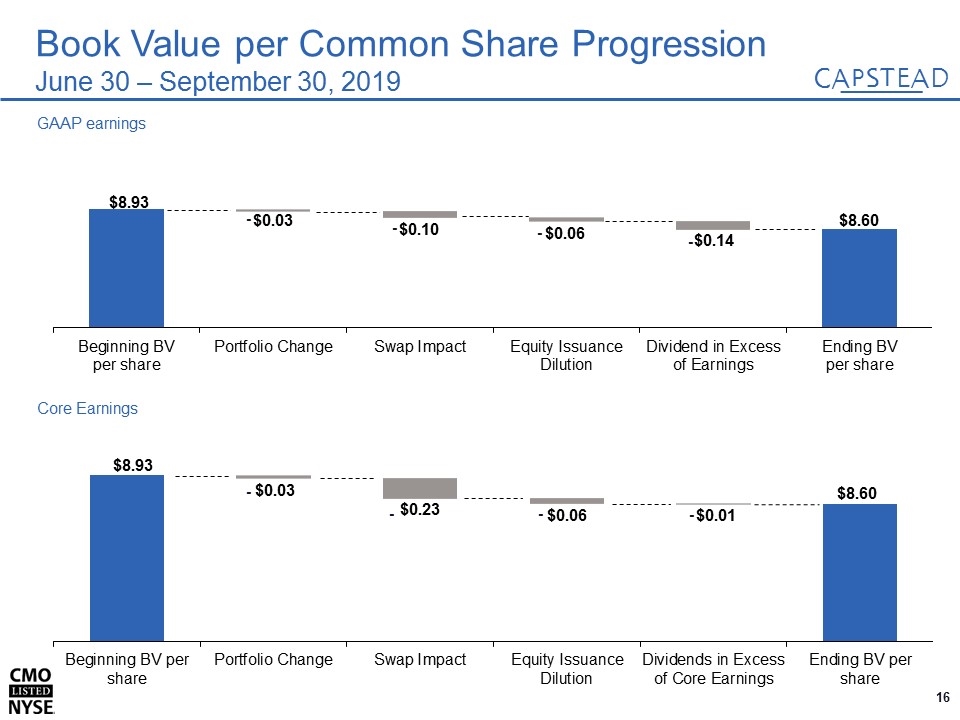

- - - - - - - - Book Value per Common Share Progression June 30 – September 30, 2019 GAAP earnings Core Earnings

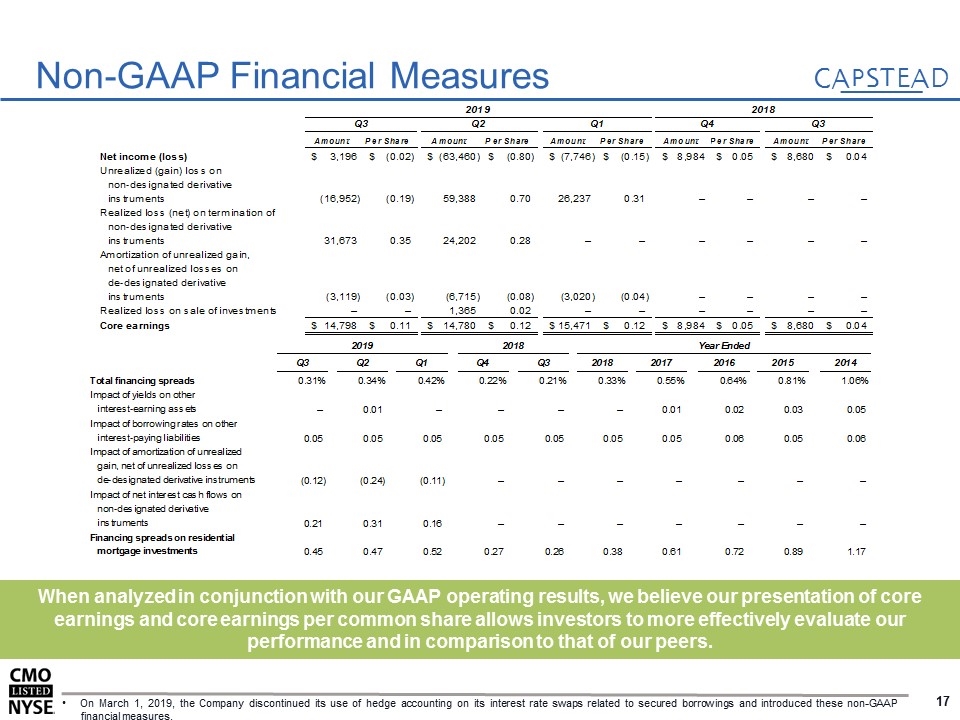

When analyzed in conjunction with our GAAP operating results, we believe our presentation of core earnings and core earnings per common share allows investors to more effectively evaluate our performance and in comparison to that of our peers. Non-GAAP Financial Measures On March 1, 2019, the Company discontinued its use of hedge accounting on its interest rate swaps related to secured borrowings and introduced these non-GAAP financial measures. 2019 2018 Q3 Q2 Q1 Q4 Q3 Amount Per Share Amount Per Share Amount Per Share Amount Per Share Amount Per Share Net income (loss) $3,196 $-0.02 $,-63,460 $-0.8 $-7,746 $-0.15 $8,984 $0.05 $8,680 $0.04 Unrealized (gain) loss on non-designated derivative instruments ,-16,952 -0.19 59,388 0.7 26,237 0.31 – – – – Realized loss (net) on termination of non-designated derivative instruments 31,673 0.35 24,202 0.28000000000000003 – – – – – – Amortization of unrealized gain, net of unrealized losses on de-designated derivative instruments -3,119 -0.03 -6,715 -0.08 -3,020 -0.04 – – – – Realized loss on sale of investments – – 1,365 0.02 – – – – – – Core earnings $14,798 $0.11 $14,780 $0.12 $15,471 $0.12 $8,984 $0.05 $8,680 $0.04 2019 2018 Year Ended Q3 Q2 Q1 Q4 Q3 2018 2017 2016 2015 2014 Total financing spreads 3.0999999999999999E-3 3.3999999999999998E-3 4.1843680759816662E-3 2.2000000000000001E-3 2.0827325247523634E-3 3.3E-3 5.4999999999999997E-3 6.4000000000000003E-3 8.0999999999999996E-3 1.06E-2 Impact of yields on other interest-earning assets – 0.01 – – – – 7.7851161787011181E-3 0.02 0.03 0.05 Impact of borrowing rates on other interest-paying liabilities 4.7719269475736403E-2 4.7719269475736403E-2 4.7719269475736403E-2 4.8535987851740237E-2 4.8531162127963406E-2 0.05 5.1329860796100801E-2 0.06 5.1329860796100801E-2 0.06 Impact of amortization of unrealized gain, net of unrealized losses on de-designated derivative instruments -0.12 -0.24 -0.10825627510499432 – – – – – – – Impact of net interest cash flows on non-designated derivative instruments 0.21 0.31 0.16418251960289773 – – – – – – – Financing spreads on residential mortgage investments 0.45 0.47 0.52413273512802938 0.27 0.25775944687291724 0.38 0.61 0.72 0.89 1.17

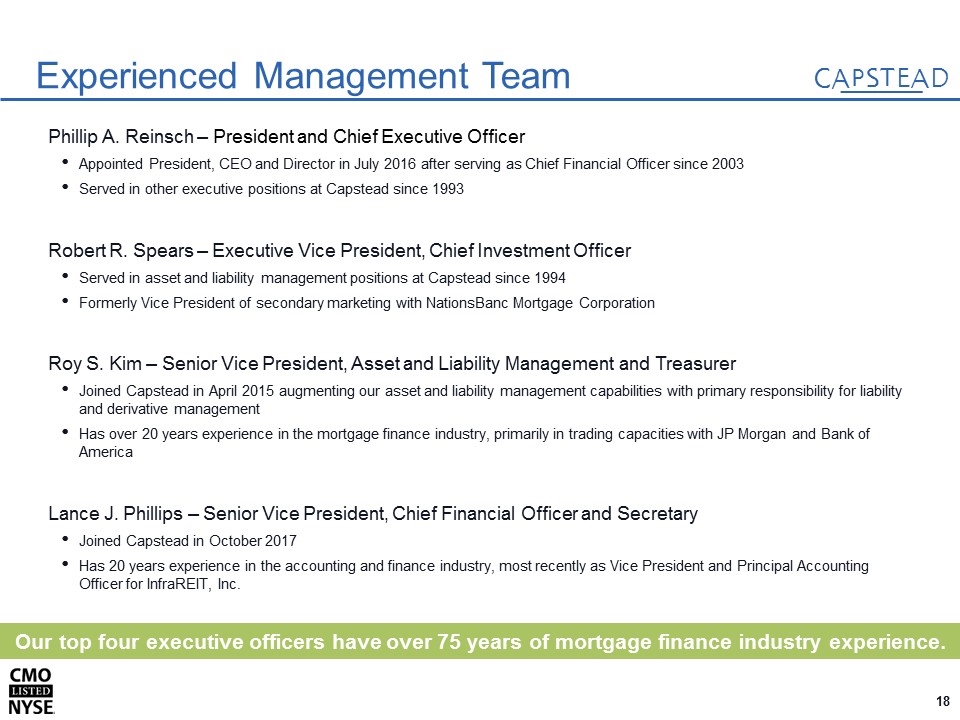

Phillip A. Reinsch – President and Chief Executive Officer Appointed President, CEO and Director in July 2016 after serving as Chief Financial Officer since 2003 Served in other executive positions at Capstead since 1993 Robert R. Spears – Executive Vice President, Chief Investment Officer Served in asset and liability management positions at Capstead since 1994 Formerly Vice President of secondary marketing with NationsBanc Mortgage Corporation Roy S. Kim – Senior Vice President, Asset and Liability Management and Treasurer Joined Capstead in April 2015 augmenting our asset and liability management capabilities with primary responsibility for liability and derivative management Has over 20 years experience in the mortgage finance industry, primarily in trading capacities with JP Morgan and Bank of America Lance J. Phillips – Senior Vice President, Chief Financial Officer and Secretary Joined Capstead in October 2017 Has 20 years experience in the accounting and finance industry, most recently as Vice President and Principal Accounting Officer for InfraREIT, Inc. Our top four executive officers have over 75 years of mortgage finance industry experience. Experienced Management Team