- WELL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Welltower (WELL) 8-KWelltower Reports Second Quarter 2018 Results

Filed: 27 Jul 18, 6:07am

| Table of Contents | |

Overview | |

| (dollars in thousands, at Welltower pro rata ownership) | |||||||||||

| Portfolio Composition | Beds/Unit Mix | ||||||||||

| Average Age | Properties | Total | Independent Living | Assisted Living | Memory Care | Long-Term/ Post-Acute Care | |||||

| Seniors housing triple-net | 14 | 404 | 35,238 | 7,766 | 20,481 | 6,509 | 482 | ||||

| Long-term/post-acute care | 19 | 180 | 21,489 | 40 | 1,016 | 127 | 20,306 | ||||

| Seniors housing operating | 17 | 518 | 62,557 | 28,527 | 21,879 | 11,723 | 428 | ||||

| Square Feet | |||||||||||

| Outpatient medical | 13 | 251 | 16,330,593 | ||||||||

| Land parcels | 14 | ||||||||||

| Total | 16 | 1,367 | |||||||||

| NOI Performance | Same Store(1) | In-Place Portfolio(2) | ||||||||||||||||

| Properties | 2Q17 NOI | 2Q18 NOI | % Change | Properties | Annualized In-Place NOI | % of Total | ||||||||||||

Seniors housing triple-net(3) | 305 | $ | 100,615 | 103,783 | 3.1 | % | 375 | $ | 530,360 | 26.7 | % | |||||||

Long-term/post-acute care(3) | 147 | 49,143 | 50,277 | 2.3 | % | 156 | 208,868 | 10.5 | % | |||||||||

| Seniors housing operating | 435 | 207,304 | 207,601 | 0.1 | % | 491 | 907,492 | 45.7 | % | |||||||||

| Outpatient medical | 231 | 79,638 | 81,232 | 2.0 | % | 244 | 339,900 | 17.1 | % | |||||||||

| Total | 1,118 | $ | 436,700 | 442,893 | 1.4 | % | 1,266 | $ | 1,986,620 | 100.0 | % | |||||||

| Portfolio Performance | Facility Revenue Mix | |||||||||||

Stable Portfolio(4) | Occupancy | EBITDAR Coverage(5) | EBITDARM Coverage(5) | Private Pay | Medicaid | Medicare | Other Government(6) | |||||

| Seniors housing triple-net | 86.2 | % | 1.07 | 1.23 | 93.3 | % | 3.2 | % | 0.5 | % | 3.0 | % |

| Long-term/post-acute care | 82.7 | % | 1.44 | 1.77 | 31.3 | % | 33.0 | % | 35.7 | % | 0.0 | % |

| Seniors housing operating | 87.6 | % | n/a | n/a | 98.1 | % | 0.1 | % | 0.4 | % | 1.4 | % |

| Outpatient medical | 93.6 | % | n/a | n/a | 98.8 | % | 0.0 | % | 0.0 | % | 1.2 | % |

| Total | 1.17 | 1.38 | 94.6 | % | 1.9 | % | 2.0 | % | 1.5 | % | ||

| Property Acquisitions/Joint Ventures Detail | ||||||||||

| Operator | Units | Location | MSA | |||||||

| Seniors Housing Operating | ||||||||||

| Kisco Senior Living | 176 | 300 Kildaire Woods Drive | Cary | North Carolina | US | Raleigh | ||||

| Sunrise Senior Living | 340 | 3701 International Drive | Montgomery | Maryland | US | Washington D.C. | ||||

| Total | 516 | |||||||||

| Notes: | ||||||||||

| (1) See page 24 for reconciliation. | ||||||||||

| (2) Excludes land parcels, loans, developments and investments held for sale. See page 22 for reconciliation. | ||||||||||

| (3) Same store NOI for these property types represents rent cash receipts excluding the impact of expansions. | ||||||||||

| (4) Data as of June 30, 2018 for seniors housing operating and outpatient medical and March 31, 2018 for remaining asset types. | ||||||||||

| (5) Represents trailing twelve month coverage metrics. | ||||||||||

| (6) Represents various federal and local reimbursement programs in the United Kingdom and Canada. | ||||||||||

| Investment | |

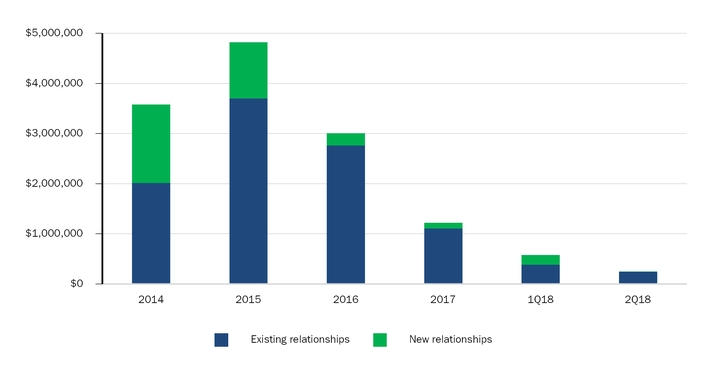

| Gross Investments | ||||||||||||||||||||||||||||

| 2014 | 2015 | 2016 | 2017 | 1Q18 | 2Q18 | 14-18 Quarterly Average | ||||||||||||||||||||||

| Existing relationships | $ | 2,018,581 | $ | 3,707,612 | $ | 2,768,874 | $ | 1,113,787 | $ | 389,949 | $ | 251,218 | $ | 640,658 | ||||||||||||||

| New relationships | 1,561,250 | 1,112,520 | 238,167 | 110,367 | 188,034 | — | 199,904 | |||||||||||||||||||||

| Total | $ | 3,579,831 | $ | 4,820,132 | $ | 3,007,041 | $ | 1,224,154 | $ | 577,983 | $ | 251,218 | $ | 840,562 | ||||||||||||||

| % Existing | 56 | % | 77 | % | 92 | % | 91 | % | 67 | % | 100 | % | 76 | % | ||||||||||||||

| Detail of Acquisitions/JVs | ||||||||||||||||||||||||||||

| 2014 | 2015 | 2016 | 2017 | 1Q18 | 2Q18 | 14-18 Total | ||||||||||||||||||||||

| Count | 41 | 44 | 22 | 18 | 5 | 2 | 139 | |||||||||||||||||||||

| Total | $ | 2,981,276 | $ | 3,765,912 | $ | 2,287,973 | $ | 742,020 | $ | 475,786 | $ | 171,600 | $ | 11,071,953 | ||||||||||||||

| Low | 3,500 | 6,080 | 10,618 | 7,310 | 4,950 | 75,600 | 3,500 | |||||||||||||||||||||

| Median | 31,150 | 33,513 | 27,402 | 24,025 | 42,789 | 85,800 | 30,625 | |||||||||||||||||||||

| High | 880,157 | 437,472 | 1,150,000 | 149,400 | 217,000 | 96,000 | 1,150,000 | |||||||||||||||||||||

| Investment Timing | ||||||||||||||||||||||||

| Acquisitions/ Joint Ventures | Yield | Loan Advances(1) | Yield | Construction Conversions | Yield | Dispositions | Yield | |||||||||||||||||

| April | $ | 75,600 | 6.3 | % | $ | 1,708 | 7.8 | % | $ | 62,230 | 6.4 | % | $ | — | 0.0 | % | ||||||||

| May | 96,000 | 7.0 | % | 1,832 | 7.9 | % | — | 0.0 | % | 55,038 | 10.8 | % | ||||||||||||

| June | — | 0.0 | % | 1,497 | 7.9 | % | 26,888 | 8.2 | % | 11,723 | 10.0 | % | ||||||||||||

| Total | $ | 171,600 | 6.7 | % | $ | 5,037 | 7.9 | % | $ | 89,118 | 7.0 | % | $ | 66,761 | 10.6 | % | ||||||||

| Notes: | ||||||||||||||||||||||||

| (1) Includes advances for non-real estate loans and excludes advances for development loans. | ||||||||||||||||||||||||

| Investment | |

| (dollars in thousands, except per bed / unit / square foot, at Welltower pro rata ownership) | ||||||||||||

| Gross Investment Activity | ||||||||||||

| Second Quarter 2018 | ||||||||||||

| Properties | Beds / Units / Square Feet | Pro Rata Amount | Investment Per Bed / Unit / SqFt | Yield | ||||||||

Acquisitions / Joint ventures(1) | ||||||||||||

| Seniors housing operating | 2 | 516 | units | $ | 171,600 | 332,558 | 6.7 | % | ||||

Development(2) | ||||||||||||

| Development projects: | ||||||||||||

| Seniors housing triple-net | 8 | 799 | units | $ | 24,610 | |||||||

| Long-term/post-acute care | 1 | 120 | beds | 3,405 | ||||||||

| Seniors housing operating | 8 | 1,102 | units | 21,304 | ||||||||

| Outpatient medical | 2 | 245,455 | sf | 21,073 | ||||||||

| Total development projects | 19 | $ | 70,392 | |||||||||

| Expansion projects: | ||||||||||||

| Seniors housing triple-net | 2 | 81 | units | $ | 2,338 | |||||||

| Seniors housing operating | 1 | 48 | units | 1,851 | ||||||||

| Total expansion projects | 3 | $ | 4,189 | |||||||||

| Total development | 22 | $ | 74,581 | 7.8 | % | |||||||

Loan advances(3) | 5,037 | 7.9 | % | |||||||||

| Gross investments | $ | 251,218 | 7.0 | % | ||||||||

Dispositions(4) | ||||||||||||

| Seniors housing triple-net | 1 | 172 | units | $ | 18,038 | 104,872 | 11.0 | % | ||||

| Long-term/post-acute care | 2 | 230 | beds | 37,000 | 160,870 | 10.7 | % | |||||

| Real property dispositions | 3 | $ | 55,038 | 10.8 | % | |||||||

| Loan payoffs | 11,723 | 10.0 | % | |||||||||

| Total dispositions | 3 | $ | 66,761 | 10.6 | % | |||||||

| Net investments | $ | 184,457 | ||||||||||

| Notes: | ||||||||||||

| (1) Amounts represent purchase price excluding accounting adjustments pursuant to U.S. GAAP for all consolidated and unconsolidated property acquisitions. Yield represents annualized contractual or projected cash rent/NOI to be generated divided by investment amount, excluding land parcels. | ||||||||||||

| (2) Amounts represent cash funded and capitalized interest for all developments/expansions including construction in progress, loans and in-substance real estate. Yield represents projected annualized cash rent/NOI to be generated upon conversion/stabilization divided by commitment amount. | ||||||||||||

| (3) Amounts represent cash funded to operators for real estate and non-real estate loans, excluding development loans. Yield represents annualized contractual interest divided by investment amount. | ||||||||||||

| (4) Amounts represent proceeds received for loan payoffs and consolidated and unconsolidated property sales. Yield represents annualized cash rent/interest/NOI that was being generated pre-disposition divided by proceeds. | ||||||||||||

| Investment | |

| (dollars in thousands, except per bed / unit / square foot, at Welltower pro rata ownership) | ||||||||||||

| Gross Investment Activity | ||||||||||||

| Year-To-Date 2018 | ||||||||||||

| Properties | Beds / Units / Square Feet | Pro Rata Amount | Investment Per Bed / Unit / SqFt | Yield | ||||||||

Acquisitions / Joint ventures(1) | ||||||||||||

| Seniors housing operating | 11 | 2,898 | units | $ | 599,647 | 206,918 | 6.7 | % | ||||

| Outpatient medical | 3 | 140,734 | sf | 47,739 | 339 | 6.0 | % | |||||

| Total acquisitions | 14 | $ | 647,386 | 6.7 | % | |||||||

Development(2) | ||||||||||||

| Development projects: | ||||||||||||

| Seniors housing triple-net | 9 | 882 | units | $ | 37,813 | |||||||

| Long-term/post-acute care | 1 | 120 | beds | 8,150 | ||||||||

| Seniors housing operating | 8 | 1,102 | units | 39,628 | ||||||||

| Outpatient medical | 5 | 430,270 | sf | 37,587 | ||||||||

| Total development projects | 23 | $ | 123,178 | |||||||||

| Expansion projects: | ||||||||||||

| Seniors housing triple-net | 2 | 81 | units | $ | 8,993 | |||||||

| Seniors housing operating | 1 | 48 | units | 1,851 | ||||||||

| Total expansion projects | 3 | $ | 10,844 | |||||||||

| Total development | 26 | $ | 134,022 | 7.9 | % | |||||||

Loan advances(3) | 47,883 | 6.1 | % | |||||||||

| Gross investments | $ | 829,291 | 6.8 | % | ||||||||

Dispositions(4) | ||||||||||||

| Seniors housing triple-net | 26 | 2,625 | units | $ | 452,841 | 172,511 | 7.2 | % | ||||

| Long-term/post-acute care | 4 | 410 | beds | 61,985 | 151,183 | 11.7 | % | |||||

| Seniors housing operating | 2 | 250 | units | 6,908 | 27,632 | 6.5 | % | |||||

| Outpatient medical | 18 | 1,441,588 | sf | 428,727 | 297 | 6.0 | % | |||||

| Real property dispositions | 50 | $ | 950,461 | 6.9 | % | |||||||

| Loan payoffs | 103,796 | 7.5 | % | |||||||||

| Total dispositions | 50 | $ | 1,054,257 | 7.0 | % | |||||||

| Net investments | $ | (224,966 | ) | |||||||||

| Notes: | ||||||||||||

| (1) Amounts represent purchase price excluding accounting adjustments pursuant to U.S. GAAP for all consolidated and unconsolidated property acquisitions. Yield represents annualized contractual or projected cash rent/NOI to be generated divided by investment amount, excluding land parcels. | ||||||||||||

| (2) Amounts represent cash funded and capitalized interest for all developments/expansions including construction in progress, loans and in-substance real estate. Yield represents projected annualized cash rent/NOI to be generated upon conversion/stabilization divided by commitment amount. | ||||||||||||

| (3) Amounts represent cash funded to operators for real estate and non-real estate loans, excluding development loans. Yield represents annualized contractual interest divided by investment amount. | ||||||||||||

| (4) Amounts represent proceeds received for loan payoffs and consolidated and unconsolidated property sales. Yield represents annualized cash rent/interest/NOI that was being generated pre-disposition divided by proceeds. | ||||||||||||

| Portfolio | |

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||||||

In-Place NOI Diversification(1) | ||||||||||||||||||||||||

| By Partner: | Total Properties | Seniors Housing Triple-net | Long-Term/ Post-Acute Care | Seniors Housing Operating | Outpatient Medical | Total | % of Total | |||||||||||||||||

| Sunrise Senior Living North America | 124 | $ | — | $ | — | $ | 263,708 | $ | — | $ | 263,708 | 13.3 | % | |||||||||||

| Sunrise Senior Living United Kingdom | 44 | — | — | 77,300 | — | 77,300 | 3.9 | % | ||||||||||||||||

| Brookdale Senior Living | 145 | 131,684 | — | 13,356 | — | 145,040 | 7.3 | % | ||||||||||||||||

| Revera | 98 | — | — | 115,799 | — | 115,799 | 5.8 | % | ||||||||||||||||

| Genesis HealthCare | 95 | — | 103,616 | — | — | 103,616 | 5.2 | % | ||||||||||||||||

| Benchmark Senior Living | 37 | — | — | 79,371 | — | 79,371 | 4.0 | % | ||||||||||||||||

| Brandywine Living | 27 | 74,357 | — | — | — | 74,357 | 3.7 | % | ||||||||||||||||

| Senior Resource Group | 24 | — | — | 71,201 | — | 71,201 | 3.6 | % | ||||||||||||||||

| Belmont Village | 19 | — | — | 64,720 | — | 64,720 | 3.3 | % | ||||||||||||||||

| Avery | 52 | 58,760 | — | 1,119 | — | 59,879 | 3.0 | % | ||||||||||||||||

| Sagora Senior Living | 30 | 20,972 | — | 33,869 | — | 54,841 | 2.8 | % | ||||||||||||||||

| Remaining | 571 | 244,587 | 105,252 | 187,049 | 339,900 | 876,788 | 44.1 | % | ||||||||||||||||

| Total | 1,266 | $ | 530,360 | $ | 208,868 | $ | 907,492 | $ | 339,900 | $ | 1,986,620 | 100.0 | % | |||||||||||

| By Country: | ||||||||||||||||||||||||

| United States | 1,005 | $ | 446,724 | $ | 202,115 | $ | 661,157 | $ | 318,943 | $ | 1,628,939 | 82.0 | % | |||||||||||

| United Kingdom | 110 | 80,180 | — | 78,285 | 20,957 | 179,422 | 9.0 | % | ||||||||||||||||

| Canada | 151 | 3,456 | 6,753 | 168,050 | — | 178,259 | 9.0 | % | ||||||||||||||||

| Total | 1,266 | $ | 530,360 | $ | 208,868 | $ | 907,492 | $ | 339,900 | $ | 1,986,620 | 100.0 | % | |||||||||||

| By MSA: | ||||||||||||||||||||||||

| New York | 62 | $ | 71,367 | $ | 13,196 | $ | 54,155 | $ | 8,580 | $ | 147,298 | 7.4 | % | |||||||||||

| Los Angeles | 64 | 2,723 | — | 102,780 | 25,614 | 131,117 | 6.6 | % | ||||||||||||||||

| Greater London | 50 | 35,616 | — | 52,660 | 20,957 | 109,233 | 5.5 | % | ||||||||||||||||

| Philadelphia | 37 | 20,368 | 28,840 | 9,229 | 22,350 | 80,787 | 4.1 | % | ||||||||||||||||

| Dallas | 51 | 17,379 | 3,758 | 23,951 | 28,688 | 73,776 | 3.7 | % | ||||||||||||||||

| Boston | 36 | 1,757 | 1,411 | 64,349 | 1,172 | 68,689 | 3.5 | % | ||||||||||||||||

| Seattle | 28 | 16,173 | — | 19,480 | 14,033 | 49,686 | 2.5 | % | ||||||||||||||||

| San Francisco | 17 | 12,326 | — | 35,156 | — | 47,482 | 2.4 | % | ||||||||||||||||

| Washington D.C. | 20 | 7,819 | 5,822 | 32,139 | — | 45,780 | 2.3 | % | ||||||||||||||||

| Toronto | 25 | — | — | 41,960 | — | 41,960 | 2.1 | % | ||||||||||||||||

| Houston | 26 | 4,174 | — | 12,510 | 24,838 | 41,522 | 2.1 | % | ||||||||||||||||

| Chicago | 22 | 11,711 | 1,449 | 22,496 | 2,139 | 37,795 | 1.9 | % | ||||||||||||||||

| San Diego | 13 | — | 2,825 | 24,833 | 1,500 | 29,158 | 1.5 | % | ||||||||||||||||

| Kansas City | 24 | 7,906 | 5,451 | 9,064 | 6,698 | 29,119 | 1.5 | % | ||||||||||||||||

| Minneapolis | 19 | 12,582 | — | 3,409 | 13,087 | 29,078 | 1.5 | % | ||||||||||||||||

| Miami | 23 | — | — | 10,704 | 17,458 | 28,162 | 1.4 | % | ||||||||||||||||

| Montréal | 19 | — | — | 28,134 | — | 28,134 | 1.4 | % | ||||||||||||||||

| Indianapolis | 16 | 8,133 | 9,542 | — | 9,999 | 27,674 | 1.4 | % | ||||||||||||||||

| Atlanta | 17 | 2,278 | — | 6,707 | 17,042 | 26,027 | 1.3 | % | ||||||||||||||||

| Raleigh | 11 | 16,920 | — | 7,066 | — | 23,986 | 1.2 | % | ||||||||||||||||

| Remaining | 686 | 281,128 | 136,574 | 346,710 | 125,745 | 890,157 | 44.8 | % | ||||||||||||||||

| Total | 1,266 | $ | 530,360 | $ | 208,868 | $ | 907,492 | $ | 339,900 | $ | 1,986,620 | 100.0 | % | |||||||||||

| Notes: | ||||||||||||||||||||||||

| (1) Represents current quarter annualized in-place NOI. See page 22 for reconciliation. | ||||||||||||||||||||||||

| Portfolio | |

| Portfolio | |

| Triple-Net Payment Coverage Stratification | |||||||||||||||||||

EBITDARM Coverage(1) | EBITDAR Coverage(1) | ||||||||||||||||||

| % of In-Place NOI | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | |||||||||

| <0.85x | 0.2 | % | 0.0 | % | 0.0 | % | 3 | 1 | 0.3 | % | 0.0 | % | 0.3 | % | 7 | 2 | |||

| 0.85x - 0.95x | 0.0 | % | 0.0 | % | 0.0 | % | — | — | 2.9 | % | 0.1 | % | 3.0 | % | 8 | 5 | |||

| 0.95x - 1.05x | 2.2 | % | 0.0 | % | 2.2 | % | 8 | 3 | 3.1 | % | 0.9 | % | 4.0 | % | 12 | 6 | |||

| 1.05x - 1.15x | 0.9 | % | 0.1 | % | 1.0 | % | 9 | 3 | 13.0 | % | 0.7 | % | 13.7 | % | 9 | 8 | |||

| 1.15x - 1.25x | 13.4 | % | 0.0 | % | 13.4 | % | 9 | 9 | 0.6 | % | 0.0 | % | 0.6 | % | 9 | 2 | |||

| 1.25x - 1.35x | 3.0 | % | 1.6 | % | 4.6 | % | 11 | 6 | 2.6 | % | 5.2 | % | 7.8 | % | 16 | 6 | |||

| >1.35x | 3.9 | % | 7.4 | % | 11.3 | % | 14 | 14 | 1.1 | % | 2.2 | % | 3.3 | % | 10 | 7 | |||

| Total | 23.6 | % | 9.1 | % | 32.7 | % | 11 | 36 | 23.6 | % | 9.1 | % | 32.7 | % | 11 | 36 | |||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||

Revenue and Lease Maturity(2) | |||||||||||||||||||||||||||

| Rental Income | |||||||||||||||||||||||||||

| Year | Seniors Housing Triple-net | Long-Term / Post-Acute Care | Outpatient Medical | Interest Income | Seniors Housing Operating | Total Revenues | % of Total | ||||||||||||||||||||

| 2018 | $ | 173,812 | $ | — | $ | 10,914 | $ | 5,293 | $ | — | $ | 190,019 | 4.5 | % | |||||||||||||

| 2019 | — | — | 28,367 | 10,059 | — | 38,426 | 0.9 | % | |||||||||||||||||||

| 2020 | — | — | 32,512 | 7,024 | — | 39,536 | 0.9 | % | |||||||||||||||||||

| 2021 | 3,203 | 1,291 | 40,067 | 1,813 | — | 46,374 | 1.1 | % | |||||||||||||||||||

| 2022 | 2,370 | 1,219 | 41,706 | 21,100 | — | 66,395 | 1.6 | % | |||||||||||||||||||

| 2023 | — | — | 29,847 | 1,660 | — | 31,507 | 0.7 | % | |||||||||||||||||||

| 2024 | 10,842 | — | 32,213 | 858 | — | 43,913 | 1.0 | % | |||||||||||||||||||

| 2025 | 64,033 | — | 19,485 | 2,874 | — | 86,392 | 2.0 | % | |||||||||||||||||||

| 2026 | 64,617 | 34,613 | 29,410 | 701 | — | 129,341 | 3.1 | % | |||||||||||||||||||

| 2027 | 31,693 | 2,343 | 9,778 | 588 | — | 44,402 | 1.1 | % | |||||||||||||||||||

| 2028 | 13,441 | 36,543 | 15,135 | 1,118 | — | 66,237 | 1.6 | % | |||||||||||||||||||

| Thereafter | 192,181 | 143,380 | 95,194 | 2,490 | 2,999,410 | 3,432,655 | 81.4 | % | |||||||||||||||||||

| $ | 556,192 | $ | 219,389 | $ | 384,628 | $ | 55,578 | $ | 2,999,410 | $ | 4,215,197 | 100.0 | % | ||||||||||||||

| Weighted Avg Maturity Years | 10 | 13 | 7 | 4 | n/a | 9 | |||||||||||||||||||||

| Notes: | |||||||||||||||||||||||||||

| (1) Represents trailing twelve month coverage metrics as of March 31, 2018 for stable portfolio only. Agreements included represent 88% of total seniors housing triple-net and long-term/post-acute care In-Place NOI. See page 22 for a reconciliation. Agreements with mixed units use the predominant type based on investment balance. | |||||||||||||||||||||||||||

| (2) Excludes all land parcels, developments and investments held for sale. Rental income represents annualized base rent for effective lease agreements. The amounts are derived from the current contracted monthly base rent including straight-line for leases with fixed escalators or annual cash rent for leases with contingent escalators, net of collectability reserves, if applicable. Rental income does not include common area maintenance charges or the amortization of above/below market lease intangibles. Interest income represents contractual rate of interest for loans, net of collectability reserves if applicable. Seniors Housing Operating revenue represents current quarter resident fee and service income annualized and adjusted for timing adjustments for current quarter acquisitions. | |||||||||||||||||||||||||||

| (3) Total weighted average revenue maturity includes rental/interest income and excludes seniors housing operating revenues which have no fixed maturities. | |||||||||||||||||||||||||||

| Portfolio | |

| Quality Indicators | ||||||||

| Long-Term/Post-Acute Care | US Portfolio(1,3) | Industry Benchmarks(2) | ||||||

| Property age | 19 | 39 | ||||||

| Quality mix (revenues) | 67.0 | % | 46.0 | % | ||||

| EBITDARM per bed | 22,201 | DNA | ||||||

| Seniors Housing Operating | US Portfolio(3,5,6) | Industry Benchmarks(4) | ||||||

| Property age | 16 | 21 | ||||||

| 5 year total population growth | 3.9 | % | 3.5 | % | ||||

| 5 year 75+ population growth | 14.4 | % | 12.2 | % | ||||

| Housing value | $ | 536,727 | $ | 209,770 | ||||

| Household income | $ | 92,172 | $ | 61,045 | ||||

| REVPOR | $ | 7,151 | $ | 4,707 | ||||

| SS REVPOR growth | 3.5 | % | 2.6 | % | ||||

| SSNOI per unit | $ | 23,724 | $ | 17,827 | ||||

| SSNOI growth | 0.0 | % | DNA | |||||

UK Portfolio(3,5,6) | Industry Benchmarks(7) | |||||||

| Property age | 10 | 21 | ||||||

| Units per property | 79 | 41 | ||||||

| 5 year total population growth | 3.8 | % | 3.3 | % | ||||

| 5 year 75+ population growth | 18.6 | % | 8.9 | % | ||||

| Housing value | £ | 475,423 | £ | 289,612 | ||||

| REVPOR | £ | 6,463 | £ | 3,720 | ||||

| SS REVPOR growth | 2.9 | % | 3.3 | % | ||||

| SSNOI per unit | £ | 18,917 | £ | 9,544 | ||||

| SSNOI growth | 0.3 | % | DNA | |||||

Canadian Portfolio(3,5,6) | Industry Benchmarks(8) | |||||||

| 5 year total population growth | 5.2 | % | 5.0 | % | ||||

| 5 year 75+ population growth | 17.4 | % | DNA | |||||

| Housing value | C$ | 840,120 | C$ | 692,675 | ||||

| Household income | C$ | 107,818 | C$ | 95,952 | ||||

| REVPOR | C$ | 3,602 | C$ | 2,320 | ||||

| SS REVPOR growth | 2.1 | % | 2.4 | % | ||||

| SSNOI per unit | C$ | 15,349 | DNA | |||||

| SSNOI growth | 0.8 | % | DNA | |||||

| Portfolio | |

3-Mile Ring(1) | |||||||||||||||||||||||||||||||||||

| Welltower | Welltower | ||||||||||||||||||||||||||||||||||

| MSA | Prop. / Units | Annualized IPNOI(2) | % of US SHO Portfolio | Prop. / Units Under Construction(3) | Prop. / Units Potentially Impacted | IPNOI Potentially Impacted(4) | 5 Year Total Pop. Growth(5) | 5 Year 75+ Pop. Growth(5) | Avg. Pop. Density(6) | Household Income(7) | Housing Value(7) | Est. Net Annual Inventory Growth(8) | Est. Annual Job Growth(9) | ||||||||||||||||||||||

| Los Angeles | 37 / 4,253 | $ | 102,780 | 15.5 | % | 3 / 362 | 5 / 928 | $ | 3,996 | 3.4 | % | 13.2 | % | 6,879 | $ | 91,581 | $ | 822,309 | 0.4 | % | 1.3 | % | |||||||||||||

| Boston | 32 / 2,410 | 64,349 | 9.7 | % | 1 / 96 | 1 / 98 | 2,095 | 3.5 | % | 10.3 | % | 3,013 | 104,603 | 542,019 | 3.5 | % | 1.6 | % | |||||||||||||||||

| New York | 16 / 1,216 | 54,155 | 8.2 | % | 5 / 607 | 4 / 263 | 11,327 | 0.7 | % | 7.0 | % | 5,537 | 107,728 | 509,927 | 5.9 | % | 1.2 | % | |||||||||||||||||

| San Francisco | 12 / 1,320 | 35,156 | 5.3 | % | 1 / 125 | 1 / 79 | 4,441 | 4.8 | % | 15.6 | % | 7,469 | 113,115 | 1,039,627 | (0.2 | )% | 1.8 | % | |||||||||||||||||

| Washington D.C. | 12 / 1,292 | 32,139 | 4.9 | % | 2 / 254 | 5 / 435 | 3,818 | 4.1 | % | 15.8 | % | 5,325 | 121,306 | 687,066 | 4.1 | % | 0.7 | % | |||||||||||||||||

| San Diego | 10 / 1,309 | 24,833 | 3.8 | % | — | — | — | 4.3 | % | 17.9 | % | 4,874 | 90,961 | 710,656 | 0.8 | % | 2.2 | % | |||||||||||||||||

| Dallas | 13 / 1,839 | 23,951 | 3.6 | % | 1 / 180 | 1 / 215 | 779 | 7.5 | % | 26.0 | % | 3,327 | 76,833 | 267,926 | 3.9 | % | 3.4 | % | |||||||||||||||||

| Chicago | 14 / 1,654 | 22,496 | 3.4 | % | 1 / 102 | 1 / 120 | 689 | 0.3 | % | 14.1 | % | 3,385 | 87,163 | 322,786 | 3.6 | % | 0.8 | % | |||||||||||||||||

| Seattle | 10 / 1,094 | 19,480 | 2.9 | % | — | — | — | 5.8 | % | 19.0 | % | 5,047 | 88,637 | 498,176 | (0.7 | )% | 3.3 | % | |||||||||||||||||

| San Jose | 6 / 735 | 15,144 | 2.3 | % | — | — | — | 5.3 | % | 14.5 | % | 6,353 | 114,915 | 1,102,564 | (1.1 | )% | 3.2 | % | |||||||||||||||||

| Houston | 8 / 947 | 12,510 | 1.9 | % | 3 / 541 | 2 / 263 | 5,285 | 8.3 | % | 29.1 | % | 3,545 | 89,706 | 447,885 | 2.8 | % | 2.6 | % | |||||||||||||||||

| New Haven | 5 / 524 | 10,842 | 1.6 | % | — | — | — | -0.3 | % | 5.0 | % | 2,290 | 70,037 | 228,944 | (0.1 | )% | 0.6 | % | |||||||||||||||||

| Miami | 2 / 849 | 10,704 | 1.6 | % | — | — | — | 6.4 | % | 18.8 | % | 4,289 | 72,813 | 303,340 | 0.4 | % | 0.9 | % | |||||||||||||||||

| Norwalk | 3 / 305 | 9,532 | 1.4 | % | 2 / 252 | 2 / 215 | 5,885 | 1.9 | % | 11.5 | % | 1,076 | 120,293 | 471,980 | 17.7 | % | 0.3 | % | |||||||||||||||||

| Philadelphia | 5 / 374 | 9,229 | 1.4 | % | 3 / 337 | 2 / 139 | 3,941 | 0.9 | % | 4.7 | % | 1,912 | 98,394 | 377,865 | 2.9 | % | 1.4 | % | |||||||||||||||||

| Phoenix | 7 / 768 | 9,197 | 1.4 | % | 1 / 100 | 1 / 144 | 1,186 | 6.6 | % | 17.1 | % | 3,428 | 70,000 | 313,354 | 8.7 | % | 3.1 | % | |||||||||||||||||

| Santa Maria, CA | 2 / 605 | 9,176 | 1.4 | % | — | — | — | 4.2 | % | 8.2 | % | 2,818 | 84,181 | 645,136 | N/A | 1.8 | % | ||||||||||||||||||

| Kansas City | 6 / 784 | 9,064 | 1.4 | % | 1 / 156 | 1 / 90 | 277 | 3.1 | % | 14.1 | % | 2,355 | 80,978 | 273,005 | 5.3 | % | 1.5 | % | |||||||||||||||||

| Charlottesville, VA | 1 / 302 | 8,864 | 1.3 | % | — | — | — | 3.5 | % | 7.9 | % | 2,091 | 48,712 | 314,516 | N/A | 3.1 | % | ||||||||||||||||||

| San Antonio | 3 / 725 | 7,525 | 1.1 | % | — | — | — | 9.1 | % | 26.1 | % | 2,730 | 59,635 | 208,173 | (0.2 | )% | 2.2 | % | |||||||||||||||||

| Tampa | 3 / 905 | 7,217 | 1.1 | % | 1 / 120 | 1 / 327 | 424 | 9.7 | % | 20.0 | % | 1,433 | 74,199 | 247,128 | 2.4 | % | 2.3 | % | |||||||||||||||||

| Providence | 2 / 250 | 7,076 | 1.1 | % | — | — | — | 2.8 | % | 13.7 | % | 969 | 99,807 | 390,053 | (0.6 | )% | 1.3 | % | |||||||||||||||||

| Raleigh | 2 / 250 | 7,066 | 1.1 | % | 2 / 471 | 2 / 250 | 6,632 | 6.5 | % | 24.6 | % | 3,064 | 83,708 | 276,844 | 11.2 | % | 3.0 | % | |||||||||||||||||

| Manchester, NH | 2 / 168 | 6,993 | 1.1 | % | — | — | — | 1.1 | % | 8.4 | % | 1,916 | 76,194 | 251,002 | N/A | 1.1 | % | ||||||||||||||||||

| Atlanta | 6 / 610 | 6,707 | 1.0 | % | 4 / 687 | 4 / 443 | 4,360 | 6.7 | % | 26.7 | % | 3,593 | 85,419 | 424,644 | 8.1 | % | 1.7 | % | |||||||||||||||||

| Total - Top 25 | 219 / 25,488 | $ | 526,185 | 79.6 | % | 31 / 4,390 | 33 / 4,009 | $ | 55,135 | 4.0 | % | 15.0 | % | 4,463 | $ | 95,148 | $ | 588,046 | 2.7 | % | 1.7 | % | |||||||||||||

| All Other US SHO Markets | 76 / 8,966 | 134,972 | 20.4 | % | 10 / 1,329 | 12 / 1,554 | 11,001 | 3.7 | % | 12.8 | % | 2,535 | 81,037 | 344,736 | |||||||||||||||||||||

| Total US SHO | 295 / 34,454 | $ | 661,157 | 100.0 | % | 41 / 5,719 | 45 / 5,563 | $ | 66,136 | 3.9 | % | 14.4 | % | 3,973 | $ | 92,172 | $ | 536,727 | |||||||||||||||||

| % of Total IPNOI | 3.3 | % | |||||||||||||||||||||||||||||||||

| US National Average | 3.5 | % | 12.2 | % | 93 | $ | 61,045 | $ | 209,770 | 2.9 | % | 1.6 | % | ||||||||||||||||||||||

| Notes: | |||||||||||||||||||||||||||||||||||

| (1) Based on historical drawing patterns in our portfolio, a 3-mile ring is appropriate for most urban markets, which accounts for the vast majority of our portfolio. A 5-mile ring is appropriate for most suburban markets. A larger ring is appropriate for rural markets. Each market is unique due to population density, town lines, geographic barriers, and roads/infrastructure. In the interest of simplicity, we have applied a 3-mile competitive ring to all of our properties given the preponderance of urban locations. We have also included a sensitivity with a 5-mile ring. | |||||||||||||||||||||||||||||||||||

| (2) Represents annualized IPNOI. See pages 5 and 22 for a reconciliation. | |||||||||||||||||||||||||||||||||||

| (3) Construction data provided by NIC, reflects competitive seniors housing properties within 3 miles of Welltower SHO properties for US markets. | |||||||||||||||||||||||||||||||||||

| (4) Reflects annualized IPNOI for Welltower SHO properties within 3 miles of new construction for the component of our project that potentially competes with the project under construction. | |||||||||||||||||||||||||||||||||||

| (5) Total population and 75+ population growth data represents simple averages of Claritas estimates for 2018-2023. | |||||||||||||||||||||||||||||||||||

| (6) Average population density data represents average population per square mile within a 3-mile ring based on 2018 Claritas estimates. | |||||||||||||||||||||||||||||||||||

| (7) Household income and household value data are medians weighted by IPNOI. | |||||||||||||||||||||||||||||||||||

| (8) NIC MAP Data and Analysis Service, 2Q18. Net inventory growth is calculated at the MSA level based on historical deletions from inventory and a 5-6 quarter construction period to reflect our urban locations. Total - Top 25 Net Inventory Growth weighted by IPNOI. | |||||||||||||||||||||||||||||||||||

| (9) Annual job growth data represents MSA level growth from May 2017-May 2018 per Bureau of Labor Statistics. | |||||||||||||||||||||||||||||||||||

| (10) Weighted by IPNOI. | |||||||||||||||||||||||||||||||||||

| (11) Reflects net inventory growth for NIC Top 99 Markets. | |||||||||||||||||||||||||||||||||||

| Portfolio | |

5-Mile Ring(1) | |||||||||||||||||||||||||||||||||||

| Welltower | Welltower | ||||||||||||||||||||||||||||||||||

| MSA | Prop. / Units | Annualized IPNOI(2) | % of US SHO Portfolio | Prop. / Units Under Construction(3) | Prop. / Units Potentially Impacted | IPNOI Potentially Impacted(4) | 5 Year Total Pop. Growth(5) | 5 Year 75+ Pop. Growth(5) | Avg. Pop. Density(6) | Household Income(7) | Housing Value(7) | Est. Net Annual Inventory Growth(8) | Est. Annual Job Growth(9) | ||||||||||||||||||||||

| Los Angeles | 37 / 4,253 | $ | 102,780 | 15.5 | % | 3 / 362 | 10 / 1,491 | $ | 9,294 | 3.4 | % | 13.4 | % | 6,667 | $ | 85,785 | $ | 760,136 | 0.4 | % | 1.3 | % | |||||||||||||

| Boston | 32 / 2,410 | 64,349 | 9.7 | % | 4 / 306 | 4 / 299 | 3,585 | 3.6 | % | 10.8 | % | 2,844 | 102,941 | 527,330 | 3.5 | % | 1.6 | % | |||||||||||||||||

| New York | 16 / 1,216 | 54,155 | 8.2 | % | 9 / 1,167 | 7 / 483 | 27,207 | 0.9 | % | 7.3 | % | 5,135 | 104,287 | 480,809 | 5.9 | % | 1.2 | % | |||||||||||||||||

| San Francisco | 12 / 1,320 | 35,156 | 5.3 | % | 1 / 125 | 1 / 79 | 4,441 | 4.9 | % | 15.3 | % | 6,380 | 109,958 | 969,890 | (0.2 | )% | 1.8 | % | |||||||||||||||||

| Washington D.C. | 12 / 1,292 | 32,139 | 4.9 | % | 5 / 582 | 9 / 1,019 | 8,216 | 4.6 | % | 16.7 | % | 5,259 | 118,213 | 659,796 | 4.1 | % | 0.7 | % | |||||||||||||||||

| San Diego | 10 / 1,309 | 24,833 | 3.8 | % | 1 / 200 | 2 / 249 | 1,752 | 4.7 | % | 17.0 | % | 4,400 | 87,898 | 661,269 | 0.8 | % | 2.2 | % | |||||||||||||||||

| Dallas | 13 / 1,839 | 23,951 | 3.6 | % | 3 / 417 | 2 / 293 | 1,823 | 7.3 | % | 24.8 | % | 3,154 | 71,721 | 258,667 | 3.9 | % | 3.4 | % | |||||||||||||||||

| Chicago | 14 / 1,654 | 22,496 | 3.4 | % | 5 / 581 | 3 / 358 | 6,359 | 0.1 | % | 14.7 | % | 3,148 | 89,138 | 332,368 | 3.6 | % | 0.8 | % | |||||||||||||||||

| Seattle | 10 / 1,094 | 19,480 | 2.9 | % | — | — | — | 6.0 | % | 20.9 | % | 4,765 | 86,025 | 497,100 | (0.7 | )% | 3.3 | % | |||||||||||||||||

| San Jose | 6 / 735 | 15,144 | 2.3 | % | — | — | — | 5.2 | % | 14.8 | % | 5,456 | 113,979 | 1,094,375 | (1.1 | )% | 3.2 | % | |||||||||||||||||

| Houston | 8 / 947 | 12,510 | 1.9 | % | 3 / 541 | 3 / 366 | 5,285 | 8.5 | % | 31.8 | % | 3,592 | 81,354 | 309,730 | 2.8 | % | 2.6 | % | |||||||||||||||||

| New Haven | 5 / 524 | 10,842 | 1.6 | % | 1 / 160 | 1 / 103 | 776 | 0.0 | % | 5.3 | % | 2,398 | 69,098 | 244,440 | (0.1 | )% | 0.6 | % | |||||||||||||||||

| Miami | 2 / 849 | 10,704 | 1.6 | % | — | — | — | 6.4 | % | 14.4 | % | 4,270 | 64,937 | 278,536 | 0.4 | % | 0.9 | % | |||||||||||||||||

| Norwalk | 3 / 305 | 9,532 | 1.4 | % | 3 / 392 | 2 / 215 | 6,384 | 1.5 | % | 10.5 | % | 1,311 | 89,072 | 455,132 | 17.7 | % | 0.3 | % | |||||||||||||||||

| Philadelphia | 5 / 374 | 9,229 | 1.4 | % | 4 / 437 | 2 / 139 | 3,941 | 0.9 | % | 5.4 | % | 2,154 | 91,155 | 343,625 | 2.9 | % | 1.4 | % | |||||||||||||||||

| Phoenix | 7 / 768 | 9,197 | 1.4 | % | 10 / 1,734 | 6 / 721 | 6,178 | 6.8 | % | 18.2 | % | 3,154 | 68,925 | 292,107 | 8.7 | % | 3.1 | % | |||||||||||||||||

| Santa Maria, CA | 2 / 605 | 9,176 | 1.4 | % | — | — | — | 4.8 | % | 9.2 | % | 1,666 | 78,859 | 677,092 | N/A | 1.8 | % | ||||||||||||||||||

| Kansas City | 6 / 784 | 9,064 | 1.4 | % | 2 / 228 | 3 / 451 | 2,230 | 3.3 | % | 14.2 | % | 2,218 | 76,163 | 239,142 | 5.3 | % | 1.5 | % | |||||||||||||||||

| Charlottesville, VA | 1 / 302 | 8,864 | 1.3 | % | — | — | — | 5.2 | % | 11.5 | % | 1,474 | 61,696 | 323,077 | N/A | 3.1 | % | ||||||||||||||||||

| San Antonio | 3 / 725 | 7,525 | 1.1 | % | — | — | — | 8.8 | % | 25.8 | % | 2,557 | 60,774 | 198,014 | (0.2 | )% | 2.2 | % | |||||||||||||||||

| Tampa | 3 / 905 | 7,217 | 1.1 | % | 1 / 120 | 1 / 327 | 424 | 9.7 | % | 17.3 | % | 1,414 | 60,418 | 214,566 | 2.4 | % | 2.3 | % | |||||||||||||||||

| Providence | 2 / 250 | 7,076 | 1.1 | % | — | — | — | 2.3 | % | 12.2 | % | 1,204 | 100,344 | 380,686 | (0.6 | )% | 1.3 | % | |||||||||||||||||

| Raleigh | 2 / 250 | 7,066 | 1.1 | % | 2 / 471 | 2 / 250 | 6,632 | 7.9 | % | 31.2 | % | 2,558 | 91,285 | 333,406 | 11.2 | % | 3.0 | % | |||||||||||||||||

| Manchester, NH | 2 / 168 | 6,993 | 1.1 | % | — | — | — | 1.2 | % | 10.2 | % | 1,534 | 75,667 | 259,725 | N/A | 1.1 | % | ||||||||||||||||||

| Atlanta | 6 / 610 | 6,707 | 1.0 | % | 6 / 995 | 5 / 535 | 5,292 | 6.7 | % | 27.9 | % | 3,322 | 82,386 | 381,747 | 8.1 | % | 1.7 | % | |||||||||||||||||

| Total - Top 25 | 219 / 25,488 | $ | 526,185 | 79.6 | % | 63 / 8,818 | 63 / 7,378 | $ | 99,819 | 4.1 | % | 15.3 | % | 4,200 | $ | 91,486 | $ | 557,148 | 2.7 | % | 1.7 | % | |||||||||||||

| All Other US SHO Markets | 76 / 8,966 | 134,972 | 20.4 | % | 26 / 3,454 | 25 / 2,606 | 25,588 | 3.7 | % | 13.5 | % | 2,337 | 76,380 | 321,872 | |||||||||||||||||||||

| Total US SHO | 295 / 34,454 | $ | 661,157 | 100.0 | % | 89 / 12,272 | 88 / 9,984 | $ | 125,407 | 4.0 | % | 14.9 | % | 3,726 | $ | 88,300 | $ | 507,523 | |||||||||||||||||

| % of Total IPNOI | 6.3 | % | |||||||||||||||||||||||||||||||||

| US National Average | 3.5 | % | 12.2 | % | 93 | $ | 61,045 | $ | 209,770 | 2.9 | % | 1.6 | % | ||||||||||||||||||||||

| Notes: | |||||||||||||||||||||||||||||||||||

| (1) Based on historical drawing patterns in our portfolio, a 3-mile ring is appropriate for most urban markets, which accounts for the vast majority of our portfolio. A 5-mile ring is appropriate for most suburban markets. A larger ring is appropriate for rural markets. Each market is unique due to population density, town lines, geographic barriers, and roads/infrastructure. For this table, we have applied a 5-mile competitive ring to all of our properties. We have also included a sensitivity with a 3-mile ring. | |||||||||||||||||||||||||||||||||||

| (2) Represents annualized IPNOI. See pages 5 and 22 for a reconciliation. | |||||||||||||||||||||||||||||||||||

| (3) Construction data provided by NIC, reflects competitive seniors housing properties within 5 miles of Welltower SHO properties for US markets. | |||||||||||||||||||||||||||||||||||

| (4) Reflects annualized IPNOI for Welltower SHO properties within 5 miles of new construction for the component of our project that potentially competes with the project under construction. | |||||||||||||||||||||||||||||||||||

| (5) Total population and 75+ population growth data represents simple averages of Claritas estimates for 2018-2023. | |||||||||||||||||||||||||||||||||||

| (6) Average population density data represents average population per square mile within a 5-mile ring based on 2018 Claritas estimates. | |||||||||||||||||||||||||||||||||||

| (7) Household income and household value data are medians weighted by IPNOI. | |||||||||||||||||||||||||||||||||||

| (8) NIC MAP Data and Analysis Service, 2Q18. Net inventory growth is calculated at the MSA level based on historical deletions from inventory and a 5-6 quarter construction period to reflect our urban locations. Total - Top 25 Net Inventory Growth weighted by IPNOI. | |||||||||||||||||||||||||||||||||||

| (9) Annual job growth data represents MSA level growth from May 2017-May 2018 per Bureau of Labor Statistics. | |||||||||||||||||||||||||||||||||||

| (10) Weighted by IPNOI. | |||||||||||||||||||||||||||||||||||

| (11) Reflects net inventory growth for NIC Top 99 Markets. | |||||||||||||||||||||||||||||||||||

| Portfolio | |

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||

Seniors Housing Operating(1) | |||||||||||||||||||||

| Total Performance | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | ||||||||||||||||

| Properties | 466 | 481 | 484 | 496 | 499 | ||||||||||||||||

| Beds/Units | 54,391 | 57,103 | 57,303 | 60,007 | 60,811 | ||||||||||||||||

| Total occupancy | 87.9 | % | 87.7 | % | 87.3 | % | 86.4 | % | 86.0 | % | |||||||||||

| Total revenues | $ | 633,851 | $ | 655,955 | $ | 672,725 | $ | 678,938 | $ | 706,452 | |||||||||||

| Operating expenses | $ | 425,229 | $ | 441,185 | $ | 455,629 | $ | 462,817 | $ | 477,299 | |||||||||||

| NOI | $ | 208,622 | $ | 214,770 | $ | 217,096 | $ | 216,121 | $ | 229,153 | |||||||||||

| NOI margin | 32.9 | % | 32.7 | % | 32.3 | % | 31.8 | % | 32.4 | % | |||||||||||

| Recurring cap-ex | $ | 9,028 | $ | 9,051 | $ | 16,793 | $ | 12,199 | $ | 9,775 | |||||||||||

| Other cap-ex | $ | 23,574 | $ | 39,010 | $ | 58,719 | $ | 18,323 | $ | 35,624 | |||||||||||

Same Store Performance(2) | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | ||||||||||||||||

| Properties | 435 | 435 | 435 | 435 | 435 | ||||||||||||||||

| Occupancy | 89.0 | % | 89.0 | % | 88.8 | % | 88.0 | % | 87.9 | % | |||||||||||

| Same store revenues | $ | 616,013 | $ | 624,737 | $ | 625,984 | $ | 624,443 | $ | 630,872 | |||||||||||

| Compensation | 252,009 | 256,952 | 261,500 | 263,892 | 264,136 | ||||||||||||||||

| Utilities | 20,930 | 23,220 | 22,386 | 24,263 | 20,940 | ||||||||||||||||

| Food | 22,709 | 22,943 | 23,200 | 22,146 | 22,501 | ||||||||||||||||

| Repairs and maintenance | 13,888 | 14,275 | 15,468 | 14,908 | 15,063 | ||||||||||||||||

| Property taxes | 19,417 | 18,954 | 17,046 | 19,108 | 18,959 | ||||||||||||||||

| All other | 79,756 | 79,132 | 80,778 | 77,623 | 81,672 | ||||||||||||||||

| Same store operating expenses | 408,709 | 415,476 | 420,378 | 421,940 | 423,271 | ||||||||||||||||

| Same store NOI | $ | 207,304 | $ | 209,261 | $ | 205,606 | $ | 202,503 | $ | 207,601 | |||||||||||

| Year over year growth rate | 0.1 | % | |||||||||||||||||||

| Partners | Properties | Beds / Units | Welltower Ownership % | Core Markets | 2Q18 NOI | % of Total | ||||||||||||

| Sunrise Senior Living | 172 | 14,634 | 97.6 | % | Southern California | $ | 36,251 | 15.8 | % | |||||||||

| Revera | 98 | 12,156 | 75.0 | % | Boston | 16,011 | 7.0 | % | ||||||||||

| Benchmark Senior Living | 37 | 3,087 | 95.0 | % | Northern California | 15,805 | 6.9 | % | ||||||||||

| Senior Resource Group | 24 | 4,496 | 67.1 | % | New York / New Jersey | 13,434 | 5.9 | % | ||||||||||

| Belmont Village | 19 | 2,791 | 95.0 | % | Greater London | 12,914 | 5.6 | % | ||||||||||

| Silverado Senior Living | 27 | 2,482 | 95.7 | % | Toronto | 10,433 | 4.6 | % | ||||||||||

| Chartwell Retirement Residences | 40 | 7,898 | 52.4 | % | Washington D.C. | 9,451 | 4.1 | % | ||||||||||

| Sagora Senior Living | 14 | 2,697 | 89.2 | % | Montréal | 7,043 | 3.1 | % | ||||||||||

| Merrill Gardens | 11 | 1,454 | 80.0 | % | Seattle | 4,862 | 2.1 | % | ||||||||||

| Senior Star Living | 11 | 2,064 | 90.0 | % | Ottawa | 4,575 | 2.0 | % | ||||||||||

| Discovery Senior Living | 6 | 1,930 | 53.6 | % | Vancouver | 2,862 | 1.2 | % | ||||||||||

| Brookdale Senior Living | 13 | 1,787 | 80.0 | % | Birmingham, UK | 1,067 | 0.5 | % | ||||||||||

| Cogir | 6 | 1,466 | 95.0 | % | Manchester, UK | 1,055 | 0.5 | % | ||||||||||

| Northbridge | 6 | 506 | 95.0 | % | Core Markets | 135,763 | 59.2 | % | ||||||||||

| EPOCH Senior Living | 3 | 230 | 95.0 | % | All Other | 93,390 | 40.8 | % | ||||||||||

| Oakmont Senior Living | 2 | 145 | 100.0 | % | Total | $ | 229,153 | 100.0 | % | |||||||||

| Kisco | 1 | 176 | 90.0 | % | ||||||||||||||

| Avery | 5 | 445 | 87.5 | % | ||||||||||||||

| Signature Senior Lifestyle | 4 | 367 | 87.5 | % | ||||||||||||||

| Total | 499 | 60,811 | ||||||||||||||||

| Notes: | ||||||||||||||||||

| (1) Excludes land and properties classified as held for sale. | ||||||||||||||||||

| (2) See page 24 for reconciliation. | ||||||||||||||||||

| Portfolio | |

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

| Outpatient Medical | ||||||||||||||||||||

Core Performance(1) | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | |||||||||||||||

| Properties | 239 | 240 | 246 | 249 | 249 | |||||||||||||||

| Square feet | 15,733,848 | 15,775,193 | 16,145,070 | 16,285,804 | 16,286,006 | |||||||||||||||

Occupancy(2) | 94.0 | % | 94.1 | % | 93.8 | % | 94.0 | % | 93.6 | % | ||||||||||

| Total revenues | $ | 121,842 | 124,706 | 125,139 | 126,368 | $ | 126,236 | |||||||||||||

| Operating expenses | $ | 39,081 | 40,978 | 39,743 | 40,937 | $ | 39,475 | |||||||||||||

| NOI | $ | 82,761 | $ | 83,728 | $ | 85,396 | $ | 85,431 | $ | 86,761 | ||||||||||

| NOI margin | 67.9 | % | 67.1 | % | 68.2 | % | 67.6 | % | 68.7 | % | ||||||||||

Revenues per square foot(2) | $ | 33.31 | $ | 34.08 | $ | 33.59 | $ | 33.69 | $ | 33.56 | ||||||||||

NOI per square foot(2) | $ | 22.62 | $ | 22.88 | $ | 22.92 | $ | 22.77 | $ | 23.06 | ||||||||||

| Recurring cap-ex | $ | 5,344 | $ | 7,831 | $ | 5,272 | $ | 5,759 | $ | 5,878 | ||||||||||

| Other cap-ex | $ | 4,120 | $ | 4,432 | $ | 7,097 | $ | 5,239 | $ | 7,165 | ||||||||||

Same Store Performance(1, 3) | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | |||||||||||||||

| Properties | 231 | 231 | 231 | 231 | 231 | |||||||||||||||

| Occupancy | 94.1 | % | 94.1 | % | 93.7 | % | 93.8 | % | 93.4 | % | ||||||||||

| Same store revenues | $ | 117,746 | $ | 119,685 | $ | 118,932 | $ | 119,867 | $ | 118,638 | ||||||||||

| Same store operating expenses | 38,108 | 39,710 | 38,339 | 38,895 | 37,406 | |||||||||||||||

| Same store NOI | $ | 79,638 | $ | 79,975 | $ | 80,593 | $ | 80,972 | $ | 81,232 | ||||||||||

| Year over year growth rate | 2.0 | % | ||||||||||||||||||

Portfolio Diversification by Tenant(2, 4) | Rental Income | % of Total | Quality Indicators(2) | |||||||

| Tenet Health | $ | 32,422 | 8.4 | % | Health system affiliated properties as % of NOI | 95.1 | % | |||

| Kelsey-Seybold | 21,631 | 5.6 | % | Health system affiliated tenants as % of rental income | 65.5 | % | ||||

| Virtua | 15,708 | 4.1 | % | Retention (trailing twelve months) | 76.2 | % | ||||

| Florida Medical Clinic | 11,526 | 3.0 | % | In-house managed properties as % of square feet(5) | 99.4 | % | ||||

| Texas Health Resources | 11,370 | 3.0 | % | Average remaining lease term | 6.7 | |||||

| Remaining Portfolio | 291,971 | 75.9 | % | Average building size (square feet) | 65,406 | |||||

| Total | $ | 384,628 | 100.0 | % | Average age (years) | 13 | ||||

Expirations(2) | 2018 | 2019 | 2020 | 2021 | 2022 | Thereafter | ||||||||||||

| Occupied square feet | 464,739 | 1,163,533 | 1,341,407 | 1,580,328 | 1,723,388 | 8,567,398 | ||||||||||||

| % of occupied square feet | 3.1 | % | 7.8 | % | 9.0 | % | 10.6 | % | 11.6 | % | 57.7 | % | ||||||

| Notes: | ||||||||||||||||||

| (1) Includes consolidated rental properties, mortgages, unconsolidated properties and development properties, and excludes land parcels and properties sold or classified as held for sale. | ||||||||||||||||||

| (2) Results and forecast include month-to-month and holdover leases, consolidated rental properties and unconsolidated properties, and excludes land parcels and properties sold or classified as held for sale. Per square foot amounts are annualized. | ||||||||||||||||||

| (3) Includes 231 same store properties representing 15,156,050 square feet. See page 24 for reconciliation. | ||||||||||||||||||

| (4) Rental income represents annualized base rent for effective lease agreements. The amounts are derived from the current contracted monthly base rent including straight-line for leases with fixed escalators or annual cash rent for leases with contingent escalators, net of collectability reserves, if applicable. Rental income does not include common area maintenance charges or the amortization of above/below market lease intangibles. Excludes land parcels and all assets held for sale. | ||||||||||||||||||

| (5) Includes only multi-tenant properties. | ||||||||||||||||||

| Portfolio | |

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

Development Summary(1) | ||||||||||||||||||||

| Unit Mix | ||||||||||||||||||||

| Facility | Total | Independent Living | Assisted Living | Memory Care | Long-term/Post-acute Care | Commitment Amount | Balance at 6/30/18 | Estimated Conversion | ||||||||||||

| Seniors Housing Triple-Net | ||||||||||||||||||||

| Reigate, UK | 87 | — | 63 | 24 | — | $ | 27,677 | $ | 19,875 | 3Q18 | ||||||||||

| El Dorado, CA | 80 | — | 57 | 23 | — | 28,000 | 3,637 | 4Q18 | ||||||||||||

| Kingswood, UK | 73 | — | 46 | 27 | — | 11,425 | 3,623 | 1Q19 | ||||||||||||

| Apex, NC | 152 | 98 | 30 | 24 | — | 30,883 | — | 3Q19 | ||||||||||||

| Westerville, OH | 90 | — | 63 | 17 | 10 | 22,800 | 5,647 | 3Q19 | ||||||||||||

| StoryPoint, KY | 162 | 162 | — | — | — | 34,600 | 4,210 | 1Q20 | ||||||||||||

| Droitwich, UK | 70 | — | 45 | 25 | — | 16,714 | 4,721 | 1Q20 | ||||||||||||

| Edenbridge, UK | 85 | — | 51 | 34 | — | 21,011 | 5,071 | 3Q20 | ||||||||||||

| Subtotal | 799 | 260 | 355 | 174 | 10 | $ | 193,110 | $ | 46,784 | |||||||||||

| Long-Term/Post-Acute Care | ||||||||||||||||||||

| Exton, PA | 120 | — | — | — | 120 | $ | 34,175 | $ | 26,710 | 3Q18 | ||||||||||

| Seniors Housing Operating | ||||||||||||||||||||

| Bushey, UK | 95 | — | 71 | 24 | — | $ | 40,333 | $ | 35,639 | 3Q18 | ||||||||||

| Toronto, ON | 332 | 332 | — | — | — | 33,795 | 20,788 | 2Q19 | ||||||||||||

| Scarborough, ON | 172 | 141 | — | 31 | — | 24,501 | 2,330 | 4Q19 | ||||||||||||

| Shrewsbury, NJ | 81 | — | 52 | 29 | — | 11,696 | 2,426 | 4Q19 | ||||||||||||

| Wilton, CT | 90 | — | 59 | 31 | — | 13,974 | 3,725 | 1Q20 | ||||||||||||

| New York, NY | 151 | — | 69 | 82 | — | 141,666 | 77,476 | 1Q20 | ||||||||||||

| Wandsworth, UK | 98 | — | 78 | 20 | — | 58,347 | 25,877 | 1Q20 | ||||||||||||

| Fairfield, CT | 83 | — | 54 | 29 | — | 12,648 | 3,281 | 4Q20 | ||||||||||||

| Subtotal | 1,102 | 473 | 383 | 246 | — | $ | 336,960 | $ | 171,542 | |||||||||||

| Outpatient Medical | ||||||||||||||||||||

| Rentable Square Ft | Preleased % | Health System Affiliation | Commitment Amount | Balance at 6/30/18 | Estimated Conversion | |||||||||||||||

| Brooklyn, NY | 140,955 | 100 | % | Yes | $ | 105,177 | $ | 52,438 | 3Q19 | |||||||||||

| Mission Viejo, CA | 104,500 | 100 | % | Yes | 71,372 | 14,625 | 3Q19 | |||||||||||||

| Subtotal | 245,455 | $ | 176,549 | $ | 67,063 | |||||||||||||||

| Total Development Projects | $ | 740,794 | $ | 312,099 | ||||||||||||||||

| Notes: | ||||||||||||||||||||

| (1) Includes development projects (construction in progress, development loans and in-substance real estate) and excludes expansion projects. Commitment amount represents current balances plus unfunded commitments to complete development. | ||||||||||||||||||||

| Portfolio | |

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||||

Development Funding Projections(1) | ||||||||||||||||||||||

| Projected Future Funding | ||||||||||||||||||||||

| Projects | Beds / Units / Square Feet | Projected Yields(2) | 2018 Funding | Funding Thereafter | Total Unfunded Commitments | Committed Balances | ||||||||||||||||

| Seniors housing triple-net | 8 | 799 | 7.5 | % | $ | 67,521 | $ | 78,805 | $ | 146,326 | $ | 193,110 | ||||||||||

| Long-term/post-acute care | 1 | 120 | 8.0 | % | 7,465 | — | 7,465 | 34,175 | ||||||||||||||

| Seniors housing operating | 8 | 1,102 | 8.1 | % | 36,501 | 128,917 | 165,418 | 336,960 | ||||||||||||||

| Outpatient medical | 2 | 245,455 | 6.8 | % | 50,982 | 58,504 | 109,486 | 176,549 | ||||||||||||||

| Total | 19 | 8.0 | % | $ | 162,469 | $ | 266,226 | $ | 428,695 | $ | 740,794 | |||||||||||

Development Project Conversion Estimates(1) | ||||||||||||||

| Quarterly Conversions | Annual Conversions | |||||||||||||

| Amount | Projected Yields(2) | Amount | Projected Yields(2) | |||||||||||

| 1Q18 actual | $ | 136,762 | 9.3 | % | 2018 estimate | $ | 356,065 | 8.2 | % | |||||

| 2Q18 actual | 89,118 | 7.0 | % | 2019 estimate | 311,649 | 7.3 | % | |||||||

| 3Q18 estimate | 102,185 | 8.5 | % | 2020 estimate | 298,960 | 7.9 | % | |||||||

| 4Q18 estimate | 28,000 | 6.1 | % | Total | $ | 966,674 | 7.8 | % | ||||||

| 1Q19 estimate | 11,425 | 8.0 | % | |||||||||||

| 2Q19 estimate | 33,795 | 7.6 | % | |||||||||||

| 3Q19 estimate | 230,232 | 7.0 | % | |||||||||||

| 4Q19 estimate | 36,197 | 8.3 | % | |||||||||||

| 1Q20 estimate | 265,301 | 7.8 | % | |||||||||||

| 3Q20 estimate | 21,011 | 8.0 | % | |||||||||||

| 4Q20 estimate | 12,648 | 9.7 | % | |||||||||||

| $ | 966,674 | 7.8 | % | |||||||||||

| Unstabilized Properties | ||||||||||||||||

| 3/31/2018 Properties | Stabilizations | Construction Conversions | Acquisitions/ Dispositions | 6/30/2018 Properties | Beds / Units | |||||||||||

| Seniors housing triple-net | 27 | (4 | ) | 1 | (1 | ) | 23 | 2,675 | ||||||||

| Long-term/post-acute care | 12 | (3 | ) | — | — | 9 | 1,266 | |||||||||

| Seniors housing operating | 24 | (4 | ) | — | 1 | 21 | 2,383 | |||||||||

| Total | 63 | (11 | ) | 1 | — | 53 | 6,324 | |||||||||

| Occupancy | 3/31/2018 Properties | Stabilizations | Construction Conversions | Acquisitions/ Dispositions | Progressions | 6/30/2018 Properties | |||||||||||

| 0% - 50% | 23 | — | 1 | — | (7 | ) | 17 | ||||||||||

| 50% - 70% | 20 | (3 | ) | — | — | 4 | 21 | ||||||||||

| 70% + | 20 | (8 | ) | — | — | 3 | 15 | ||||||||||

| Total | 63 | (11 | ) | 1 | — | — | 53 | ||||||||||

| Occupancy | 6/30/2018 Properties | Months In Operation | Revenues | % of Total Revenues(3) | Gross Investment Balance | % of Total Gross Investment | |||||||||||

| 0% - 50% | 17 | 5 | $ | 38,296 | 0.9 | % | $ | 404,362 | 1.3 | % | |||||||

| 50% - 70% | 21 | 19 | 53,272 | 1.3 | % | 426,177 | 1.4 | % | |||||||||

| 70% + | 15 | 24 | 50,570 | 1.2 | % | 465,438 | 1.5 | % | |||||||||

| Total | 53 | 16 | $ | 142,138 | 3.4 | % | $ | 1,295,977 | 4.2 | % | |||||||

| Notes: | |||||||||||||||||

| (1) Includes development projects (construction in progress, development loans, and in-substance real estate) and excludes expansion projects. | |||||||||||||||||

| (2) Actual yields may vary. | |||||||||||||||||

| (3) Includes revenues annualized from amounts presented on page 7. | |||||||||||||||||

| Financial | |

| (dollars in thousands at Welltower pro rata ownership) | ||||||||

| Components of NAV | ||||||||

| Stabilized NOI | Pro rata beds/units/square feet | |||||||

Seniors housing operating(1) | $ | 907,492 | 47,536 | units | ||||

| Seniors housing triple-net | 530,360 | 31,165 | units | |||||

| Long-term/post-acute care | 208,868 | 15,690 | beds | |||||

| Outpatient medical | 339,900 | 15,041,891 | square feet | |||||

Total in-place NOI(2) | 1,986,620 | |||||||

Incremental stabilized NOI(3) | 29,742 | |||||||

| Total stabilized NOI | $ | 2,016,362 | ||||||

| Obligations | ||||||||

| Lines of credit | $ | 540,000 | ||||||

Senior unsecured notes(4) | 8,461,754 | |||||||

Secured debt(4) | 2,632,937 | |||||||

| Capital lease obligations | 71,302 | |||||||

| Total Debt | $ | 11,705,993 | ||||||

| Add (Subtract): | ||||||||

Other liabilities (assets), net(5) | $ | 400,216 | ||||||

| Cash and cash equivalents and restricted cash | (272,383 | ) | ||||||

| Preferred stock | 718,498 | |||||||

| Net Obligations | $ | 12,552,324 | ||||||

| Other Assets | ||||||||

| Land parcels | $ | 50,549 | Effective Interest Rate(7) | |||||

Real estate loans receivable(6) | 431,144 | 8.0% | ||||||

| Non real estate loans receivable | 286,891 | 8.8% | ||||||

Other investments(8) | 49,734 | |||||||

Investments held for sale(9) | 708,561 | |||||||

Development properties:(10) | ||||||||

| Current balance | $ | 315,466 | ||||||

| Unfunded commitments | 439,728 | |||||||

| Committed balances | $ | 755,194 | ||||||

| Projected yield | 8.0 | % | ||||||

| Projected NOI | $ | 60,416 | ||||||

| Common Shares Outstanding | 372,030 | |||||||

| Notes: | ||||||||

| (1) Includes $14,271,000 attributable to our proportional share of income from unconsolidated management company investments. | ||||||||

| (2) See page 22 for reconciliation. | ||||||||

| (3) Represents incremental NOI from seniors housing operating lease-up properties that have been open for less than two years. | ||||||||

| (4) Amounts represent principal amounts due and do not include unamortized premiums/discounts, deferred loan expenses or other fair value adjustments as reflected on the balance sheet. Includes $1.3 billion of foreign secured debt. | ||||||||

| (5) Includes liabilities / (assets) that impact cash or NOI and excludes non-real estate loans and non-cash items such as follows: | ||||||||

| Unearned revenues | $ | 203,121 | ||||||

| Below/(above) market lease intangibles, net | 38,697 | |||||||

| Deferred taxes, net | (14,185 | ) | ||||||

| Available-for-sale equity investments | (21,903 | ) | ||||||

| In place lease intangibles, net | (52,048 | ) | ||||||

| Other non-cash liabilities / (assets), net | 3,772 | |||||||

| Total non-cash liabilities/(assets), net | $ | 157,454 | ||||||

| (6) Represents $499,516,000 of real estate loans excluding development loans and net of $68,372,000 of allowance for loan losses. | ||||||||

| (7) Average cash-pay interest rates are 8.0% and 6.1% for real estate and non real estate loans, respectively. Rates exclude non-accrual/interest-free loans. | ||||||||

| (8) Represents fair value estimate of unconsolidated equity investments including Genesis HealthCare stock and a management company investment not reflected in NOI. | ||||||||

| (9) Represents expected proceeds from assets held for sale. | ||||||||

| (10) See pages 13-14. Also includes expansion projects. | ||||||||

| Financial | |

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

Net Operating Income(1) | ||||||||||||||||||||

| 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | ||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Seniors housing triple-net | ||||||||||||||||||||

| Rental income | $ | 145,575 | $ | 148,492 | $ | 145,824 | $ | 143,923 | $ | 137,864 | ||||||||||

| Interest income | 7,989 | 8,083 | 7,144 | 7,087 | 7,428 | |||||||||||||||

| Other income | 2,177 | 1,240 | 936 | 312 | 12,959 | |||||||||||||||

| Total revenues | 155,741 | 157,815 | 153,904 | 151,322 | 158,251 | |||||||||||||||

| Long-term/post-acute care | ||||||||||||||||||||

| Rental income | 74,648 | 74,441 | 74,422 | 63,284 | 61,598 | |||||||||||||||

| Interest income | 12,912 | 12,105 | 4,831 | 7,463 | 5,819 | |||||||||||||||

| Other income | 365 | 1,948 | (900 | ) | 1,064 | 236 | ||||||||||||||

| Total revenues | 87,925 | 88,494 | 78,353 | 71,811 | 67,653 | |||||||||||||||

| Seniors housing operating | ||||||||||||||||||||

| Resident fees and service | 660,591 | 682,589 | 699,545 | 704,930 | 731,580 | |||||||||||||||

| Interest income | — | — | — | 85 | 172 | |||||||||||||||

| Other income | 1,030 | 1,432 | 1,118 | 1,143 | 1,554 | |||||||||||||||

| Total revenues | 661,621 | 684,021 | 700,663 | 706,158 | 733,306 | |||||||||||||||

| Outpatient medical | ||||||||||||||||||||

| Rental income | 128,848 | 131,792 | 131,950 | 126,785 | 126,044 | |||||||||||||||

| Interest income | — | — | — | 12 | 43 | |||||||||||||||

| Other income | 707 | 495 | 461 | 182 | 195 | |||||||||||||||

| Total revenues | 129,555 | 132,287 | 132,411 | 126,979 | 126,282 | |||||||||||||||

| Corporate and land | ||||||||||||||||||||

| Rental income | 54 | 84 | 26 | 86 | 62 | |||||||||||||||

| Other income | 150 | 651 | 322 | 307 | 439 | |||||||||||||||

| Total revenues | 204 | 735 | 348 | 393 | 501 | |||||||||||||||

| Total | ||||||||||||||||||||

| Rental income | 349,125 | 354,809 | 352,222 | 334,078 | 325,568 | |||||||||||||||

| Resident fees and service | 660,591 | 682,589 | 699,545 | 704,930 | 731,580 | |||||||||||||||

| Interest income | 20,901 | 20,188 | 11,975 | 14,647 | 13,462 | |||||||||||||||

| Other income | 4,429 | 5,766 | 1,937 | 3,008 | 15,383 | |||||||||||||||

| Total revenues | $ | 1,035,046 | $ | 1,063,352 | $ | 1,065,679 | $ | 1,056,663 | $ | 1,085,993 | ||||||||||

| Property operating expenses: | ||||||||||||||||||||

| Seniors housing triple-net | $ | — | $ | — | $ | — | $ | 17 | $ | 9 | ||||||||||

| Long-term/post-acute care | — | — | — | — | 124 | |||||||||||||||

| Seniors housing operating | 446,219 | 462,531 | 477,430 | 484,636 | 498,277 | |||||||||||||||

| Outpatient medical | 39,388 | 41,347 | 40,057 | 41,010 | 39,533 | |||||||||||||||

| Corporate and land | 178 | 95 | 60 | 163 | 126 | |||||||||||||||

| Total property operating expenses | $ | 485,785 | $ | 503,973 | $ | 517,547 | $ | 525,826 | $ | 538,069 | ||||||||||

| Net operating income: | ||||||||||||||||||||

| Seniors housing triple-net | $ | 155,741 | $ | 157,815 | $ | 153,904 | $ | 151,305 | $ | 158,242 | ||||||||||

| Long-term/post-acute care | 87,925 | 88,494 | 78,353 | 71,811 | 67,529 | |||||||||||||||

| Seniors housing operating | 215,402 | 221,490 | 223,233 | 221,522 | 235,029 | |||||||||||||||

| Outpatient medical | 90,167 | 90,940 | 92,354 | 85,969 | 86,749 | |||||||||||||||

| Corporate and land | 26 | 640 | 288 | 230 | 375 | |||||||||||||||

| Net operating income | $ | 549,261 | $ | 559,379 | $ | 548,132 | $ | 530,837 | $ | 547,924 | ||||||||||

| Notes: | ||||||||||||||||||||

| (1) Please see discussion of Supplemental Reporting Measures on page 21. Includes amounts from investments sold or held for sale. See pages 11-12 for more information. | ||||||||||||||||||||

| Financial | |

| (dollars in thousands) | ||||||||

Leverage and EBITDA Reconciliations(1) | ||||||||

| Twelve Months Ended | Three Months Ended | |||||||

| 6/30/2018 | 6/30/2018 | |||||||

| Net income (loss) | $ | 620,384 | $ | 167,273 | ||||

| Interest expense | 493,986 | 121,416 | ||||||

| Income tax expense (benefit) | 31,761 | 3,841 | ||||||

| Depreciation and amortization | 933,072 | 236,275 | ||||||

| EBITDA | $ | 2,079,203 | $ | 528,805 | ||||

| Loss (income) from unconsolidated entities | 57,221 | (1,249 | ) | |||||

Stock-based compensation(2) | 26,158 | 5,167 | ||||||

| Loss (gain) on extinguishment of debt, net | 12,377 | 299 | ||||||

| Impairment of assets | 132,638 | 4,632 | ||||||

| Loss (gain) on real estate dispositions, net | (406,942 | ) | (10,755 | ) | ||||

| Provision for loan losses | 62,966 | — | ||||||

| Loss (gain) on derivatives and financial instruments, net | (14,309 | ) | (7,460 | ) | ||||

| Additional other income | (10,805 | ) | (10,805 | ) | ||||

Other expenses(2) | 171,243 | 10,058 | ||||||

| Total adjustments | 30,547 | (10,113 | ) | |||||

| Adjusted EBITDA | $ | 2,109,750 | $ | 518,692 | ||||

| 0 | ||||||||

| Interest Coverage Ratios | ||||||||

| Interest expense | $ | 493,986 | $ | 121,416 | ||||

| Capitalized interest | 10,437 | 2,100 | ||||||

| Non-cash interest expense | (11,628 | ) | (1,716 | ) | ||||

| Total interest | $ | 492,795 | $ | 121,800 | ||||

| EBITDA | $ | 2,079,203 | $ | 528,805 | ||||

| Interest coverage ratio | 4.22 | x | 4.34 | x | ||||

| Adjusted EBITDA | $ | 2,109,750 | $ | 518,692 | ||||

| Adjusted Interest coverage ratio | 4.28 | x | 4.26 | x | ||||

| 0 | ||||||||

| Fixed Charge Coverage Ratios | ||||||||

| Total interest | $ | 492,795 | $ | 121,800 | ||||

| Secured debt principal amortization | 60,258 | 14,139 | ||||||

| Preferred dividends | 46,704 | 11,676 | ||||||

| Total fixed charges | $ | 599,757 | $ | 147,615 | ||||

| EBITDA | $ | 2,079,203 | $ | 528,805 | ||||

| Fixed charge coverage ratio | 3.47 | x | 3.58 | x | ||||

| Adjusted EBITDA | $ | 2,109,750 | $ | 518,692 | ||||

| Adjusted Fixed charge coverage ratio | 3.52 | x | 3.51 | x | ||||

| 0 | ||||||||

| Net Debt to EBITDA Ratios | ||||||||

| Total debt | $ | 11,435,559 | ||||||

Less: cash and cash equivalents(3) | (215,120 | ) | ||||||

| Net debt | $ | 11,220,439 | ||||||

| EBITDA Annualized | 2,115,220 | |||||||

| Net debt to EBITDA ratio | 5.30 | x | ||||||

| Adjusted EBITDA Annualized | $ | 2,074,768 | ||||||

| Net debt to Adjusted EBITDA ratio | 5.41 | x | ||||||

| 0 | ||||||||

| Notes: | ||||||||

| (1) Please see discussion of Supplemental Reporting Measures on page 21. | ||||||||

| (2) Certain severance-related costs are included in stock-based compensation and excluded from other expenses. | ||||||||

| (3) Includes IRC Section 1031 deposits, if any. | ||||||||

| Financial | |

| (amounts in thousands except share price) | |||||||

| Leverage and Current Capitalization | |||||||

| % of Total | |||||||

| Book Capitalization | |||||||

| Lines of credit | $ | 540,000 | 2.0 | % | |||

Long-term debt obligations(1) | 10,895,559 | 41.3 | % | ||||

Cash and cash equivalents(2) | (215,120 | ) | (0.8 | )% | |||

| Net debt to consolidated book capitalization | 11,220,439 | 42.5 | % | ||||

Total equity(3) | 15,198,644 | 57.5 | % | ||||

| Consolidated book capitalization | $ | 26,419,083 | 100.0 | % | |||

Joint venture debt, net(4) | 170,859 | ||||||

| Total book capitalization | $ | 26,589,942 | |||||

| Undepreciated Book Capitalization | |||||||

| Lines of credit | $ | 540,000 | 1.7 | % | |||

Long-term debt obligations(1) | 10,895,559 | 34.6 | % | ||||

Cash and cash equivalents(2) | (215,120 | ) | (0.7 | )% | |||

| Net debt to consolidated undepreciated book capitalization | $ | 11,220,439 | 35.6 | % | |||

| Accumulated depreciation and amortization | 5,113,928 | 16.2 | % | ||||

Total equity(3) | 15,198,644 | 48.2 | % | ||||

| Consolidated undepreciated book capitalization | $ | 31,533,011 | 100.0 | % | |||

Joint venture debt, net(4) | 170,859 | ||||||

| Total undepreciated book capitalization | $ | 31,703,870 | |||||

| Enterprise Value | |||||||

| Lines of credit | $ | 540,000 | 1.5 | % | |||

Long-term debt obligations(1) | 10,895,559 | 30.2 | % | ||||

Cash and cash equivalents(2) | (215,120 | ) | (0.6 | )% | |||

| Net debt to consolidated enterprise value | $ | 11,220,439 | 31.1 | % | |||

| Common shares outstanding | 372,030 | ||||||

| Period end share price | 62.69 | ||||||

| Common equity market capitalization | $ | 23,322,561 | 64.5 | % | |||

Noncontrolling interests(3) | 856,721 | 2.4 | % | ||||

| Preferred stock | 718,498 | 2.0 | % | ||||

| Consolidated enterprise value | $ | 36,118,219 | 100.0 | % | |||

Joint venture debt, net(4) | 170,859 | ||||||

| Total enterprise value | $ | 36,289,078 | |||||

| Secured Debt as % of Total Assets | |||||||

Secured debt(1) | $ | 2,450,483 | 8.9 | % | |||

| Total assets | $ | 27,618,982 | |||||

| Total Debt as % of Total Assets | |||||||

Total debt(1) | $ | 11,435,559 | 41.4 | % | |||

| Total assets | $ | 27,618,982 | |||||

| Unsecured Debt as % of Unencumbered Assets | |||||||

Unsecured debt(1) | $ | 8,913,774 | 34.4 | % | |||

| Unencumbered assets | $ | 25,916,082 | |||||

| Notes: | |||||||

| (1) Amounts include unamortized premiums/discounts and other fair value adjustments as reflected on our balance sheet. | |||||||

| (2) Inclusive of IRC Section 1031 deposits, if any. | |||||||

| (3) Includes all noncontrolling interests (redeemable and permanent) as reflected on our balance sheet. | |||||||

| (4) Net of Welltower's share of unconsolidated debt and minority partners' share of Welltower consolidated debt. | |||||||

| Financial | |

| (dollars in thousands) | |||||||||||||||||||||||||||||

Debt Maturities and Principal Payments(1) | |||||||||||||||||||||||||||||

| Year | Lines of Credit(2) | Senior Unsecured Notes(3,4,5) | Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt(6) | % of Total | Wtd. Avg. Interest Rate | |||||||||||||||||||||

| 2018 | $ | — | $ | — | $ | 197,438 | $ | 20,084 | $ | (20,798 | ) | $ | 196,724 | 1.7 | % | 4.2 | % | ||||||||||||

| 2019 | — | 600,000 | 476,109 | 56,712 | (87,144 | ) | 1,045,677 | 9.0 | % | 4.1 | % | ||||||||||||||||||

| 2020 | — | 685,810 | 138,533 | 54,240 | (32,691 | ) | 845,892 | 7.3 | % | 5.0 | % | ||||||||||||||||||

| 2021 | 540,000 | 1,140,259 | 340,621 | 25,378 | (116,073 | ) | 1,930,185 | 16.6 | % | 3.0 | % | ||||||||||||||||||

| 2022 | — | 600,000 | 224,330 | 12,652 | (30,579 | ) | 806,403 | 6.9 | % | 4.9 | % | ||||||||||||||||||

| 2023 | — | 500,000 | 290,628 | 18,812 | (104,272 | ) | 705,168 | 6.1 | % | 4.0 | % | ||||||||||||||||||

| 2024 | — | 400,000 | 287,602 | 36,095 | (81,237 | ) | 642,460 | 5.5 | % | 4.4 | % | ||||||||||||||||||

| 2025 | — | 1,250,000 | 126,540 | 371,744 | (31,178 | ) | 1,717,106 | 14.8 | % | 3.9 | % | ||||||||||||||||||

| 2026 | — | 700,000 | 38,853 | 15,717 | (9,233 | ) | 745,337 | 6.4 | % | 4.2 | % | ||||||||||||||||||

| 2027 | — | — | 136,189 | 60,171 | (34,623 | ) | 161,737 | 1.4 | % | 3.6 | % | ||||||||||||||||||

| Thereafter | — | 2,585,685 | 205,235 | 78,390 | (31,308 | ) | 2,838,002 | 24.3 | % | 4.8 | % | ||||||||||||||||||

| Totals | $ | 540,000 | $ | 8,461,754 | $ | 2,462,078 | $ | 749,995 | $ | (579,136 | ) | $ | 11,634,691 | 100.0 | % | ||||||||||||||

Weighted Avg Interest Rate(7) | 3.0 | % | 4.5 | % | 3.8 | % | 3.8 | % | 3.6 | % | 4.2 | % | |||||||||||||||||

| Weighted Avg Maturity Years | 2.9 | 7.7 | 5.5 | 9.0 | 5.4 | 7.2 | |||||||||||||||||||||||

| % Floating Rate Debt | 100.0 | % | 8.2 | % | 34.8 | % | 13.5 | % | 54.3 | % | 16.2 | % | |||||||||||||||||

Debt by Local Currency(1) | |||||||||||||||||||||||||||||

| Lines of Credit | Senior Unsecured Notes | Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt | Investment Hedges(8) | |||||||||||||||||||||||

| United States | $ | 540,000 | $ | 6,657,500 | $ | 1,138,999 | $ | 547,861 | $ | (278,357 | ) | $ | 8,606,003 | $ | — | ||||||||||||||

| United Kingdom | — | 1,385,685 | 177,737 | — | (44,434 | ) | 1,518,988 | 1,176,698 | |||||||||||||||||||||

| Canada | — | 418,569 | 1,145,342 | 202,134 | (256,345 | ) | 1,509,700 | 437,595 | |||||||||||||||||||||

| Totals | $ | 540,000 | $ | 8,461,754 | $ | 2,462,078 | $ | 749,995 | $ | (579,136 | ) | $ | 11,634,691 | $ | 1,614,293 | ||||||||||||||

| Glossary | |

| Supplemental Reporting Measures | |

| Supplemental Reporting Measures | |

| (dollars in thousands) | |||||||||||||||||||||||

| Non-GAAP Reconciliations | |||||||||||||||||||||||

| NOI Reconciliation | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | ||||||||||||||||||

| Net income (loss) | $ | 203,441 | $ | 89,299 | $ | (89,743 | ) | $ | 453,555 | $ | 167,273 | ||||||||||||

| Loss (gain) on real estate dispositions, net | (42,155 | ) | (1,622 | ) | (56,381 | ) | (338,184 | ) | (10,755 | ) | |||||||||||||

| Loss (income) from unconsolidated entities | 3,978 | (3,408 | ) | 59,449 | 2,429 | (1,249 | ) | ||||||||||||||||

| Income tax expense (benefit) | (8,448 | ) | 669 | 25,663 | 1,588 | 3,841 | |||||||||||||||||

| Other expenses | 6,339 | 99,595 | 60,167 | 3,712 | 10,058 | ||||||||||||||||||

| Impairment of assets | 13,631 | — | 99,821 | 28,185 | 4,632 | ||||||||||||||||||

| Provision for loan losses | — | — | 62,966 | — | — | ||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | 5,515 | — | 371 | 11,707 | 299 | ||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | 736 | 324 | — | (7,173 | ) | (7,460 | ) | ||||||||||||||||

| General and administrative expenses | 32,632 | 29,913 | 28,365 | 33,705 | 32,831 | ||||||||||||||||||

| Depreciation and amortization | 224,847 | 230,138 | 238,458 | 228,201 | 236,275 | ||||||||||||||||||

| Interest expense | 116,231 | 122,578 | 127,217 | 122,775 | 121,416 | ||||||||||||||||||

| Consolidated net operating income | $ | 556,747 | $ | 567,486 | $ | 556,353 | $ | 540,500 | $ | 557,161 | |||||||||||||

NOI attributable to unconsolidated investments(1) | 21,873 | 22,431 | 21,539 | 21,620 | 21,725 | ||||||||||||||||||

NOI attributable to noncontrolling interests(2) | (29,359 | ) | (30,538 | ) | (29,760 | ) | (31,283 | ) | (30,962 | ) | |||||||||||||

Pro rata net operating income (NOI)(3) | $ | 549,261 | $ | 559,379 | $ | 548,132 | $ | 530,837 | $ | 547,924 | |||||||||||||

| In-Place NOI Reconciliation | ||||||||||||||||||||||||

| At Welltower pro rata ownership | Seniors Housing Triple-net | Long-Term /Post-Acute Care | Seniors Housing Operating | Outpatient Medical | Corporate & Land | Total | ||||||||||||||||||

| Revenues | $ | 158,251 | $ | 67,653 | $ | 733,306 | $ | 126,282 | $ | 501 | $ | 1,085,993 | ||||||||||||

| Property operating expenses | (9 | ) | (124 | ) | (498,277 | ) | (39,533 | ) | (126 | ) | (538,069 | ) | ||||||||||||

NOI(3) | 158,242 | 67,529 | 235,029 | 86,749 | 375 | 547,924 | ||||||||||||||||||

| Adjust: | ||||||||||||||||||||||||

| Interest income | (7,428 | ) | (5,819 | ) | (172 | ) | (43 | ) | — | (13,462 | ) | |||||||||||||

| Other income | (12,959 | ) | (236 | ) | (1,554 | ) | (195 | ) | (439 | ) | (15,383 | ) | ||||||||||||

| Sold / held for sale | (3,001 | ) | (5,160 | ) | (5,702 | ) | 12 | — | (13,851 | ) | ||||||||||||||

| Developments / land | — | (7 | ) | 205 | — | 64 | 262 | |||||||||||||||||

Non In-Place NOI(4) | (2,054 | ) | (4,090 | ) | (2,221 | ) | (2,037 | ) | — | (10,402 | ) | |||||||||||||

Timing adjustments(5) | (210 | ) | — | 1,288 | 489 | — | 1,567 | |||||||||||||||||

| Total adjustments | (25,652 | ) | (15,312 | ) | (8,156 | ) | (1,774 | ) | (375 | ) | (51,269 | ) | ||||||||||||

| In-Place NOI | 132,590 | 52,217 | 226,873 | 84,975 | — | 496,655 | ||||||||||||||||||

| Annualized In-Place NOI | $ | 530,360 | $ | 208,868 | $ | 907,492 | $ | 339,900 | $ | — | $ | 1,986,620 | ||||||||||||

| Notes: | ||||||||||||||||||||||||

| (1) Represents Welltower's interests in joint ventures where Welltower is the minority partner. | ||||||||||||||||||||||||

| (2) Represents minority partners' interests in joint ventures where Welltower is the majority partner. | ||||||||||||||||||||||||

| (3) Represents Welltower's pro rata share of NOI. See page 16 for more information. | ||||||||||||||||||||||||

| (4) Primarily represents non-cash NOI. | ||||||||||||||||||||||||

| (5) Represents timing adjustments for current quarter acquisitions, construction conversions and segment transitions. Excludes recently announced Brookdale transaction. | ||||||||||||||||||||||||

| Supplemental Reporting Measures | |

| (dollars in thousands, except REVPOR and SSNOI/unit) | ||||||||||||||||

| SHO REVPOR Reconciliation | United States | United Kingdom | Canada | Total | ||||||||||||

Consolidated SHO revenues(1) | $ | 568,965 | $ | 80,621 | $ | 115,581 | $ | 765,167 | ||||||||

Unconsolidated SHO revenues attributable to Welltower(2) | 22,585 | — | 20,123 | 42,708 | ||||||||||||

SHO revenues attributable to noncontrolling interests(3) | (42,481 | ) | (6,281 | ) | (25,807 | ) | (74,569 | ) | ||||||||

Pro rata SHO revenues(4) | 549,069 | 74,340 | 109,897 | 733,306 | ||||||||||||

| SHO interest and other income | (1,396 | ) | (30 | ) | (300 | ) | (1,726 | ) | ||||||||

| SHO revenues attributable to held for sale properties | (25,509 | ) | (1,172 | ) | — | (26,681 | ) | |||||||||

Adjustment for standardized currency rate(5) | — | (563 | ) | 3,573 | 3,010 | |||||||||||

| SHO local revenues | 522,164 | 72,575 | 113,170 | 707,909 | ||||||||||||

| Average occupied units/month | 24,407 | 2,780 | 13,128 | 40,315 | ||||||||||||

| REVPOR/month in USD | $ | 7,151 | $ | 8,725 | $ | 2,881 | $ | 5,869 | ||||||||

REVPOR/month in local currency(5) | £ | 6,463 | C$ | 3,602 | ||||||||||||

| Reconciliations of SHO SS REVPOR Growth, SSNOI Growth and SSNOI/Unit | |||||||||||||||||||||||||||||||

| United States | United Kingdom | Canada | Total | ||||||||||||||||||||||||||||

| 2Q17 | 2Q18 | 2Q17 | 2Q18 | 2Q17 | 2Q18 | 2Q17 | 2Q18 | ||||||||||||||||||||||||

| SHO SS REVPOR Growth | |||||||||||||||||||||||||||||||

Consolidated SHO revenues(1) | $ | 503,984 | $ | 568,965 | $ | 70,042 | $ | 80,621 | $ | 104,063 | $ | 115,581 | $ | 678,089 | $ | 765,167 | |||||||||||||||

Unconsolidated SHO revenues attributable to WELL(2) | 22,397 | 22,585 | — | — | 19,338 | 20,123 | 41,735 | 42,708 | |||||||||||||||||||||||

SHO revenues attributable to noncontrolling interests(3) | (29,552 | ) | (42,481 | ) | (4,107 | ) | (6,281 | ) | (24,544 | ) | (25,807 | ) | (58,203 | ) | (74,569 | ) | |||||||||||||||

SHO pro rata revenues(4) | 496,829 | 549,069 | 65,935 | 74,340 | 98,857 | 109,897 | 661,621 | 733,306 | |||||||||||||||||||||||

| Non-cash revenues on same store properties | (119 | ) | (110 | ) | (19 | ) | (22 | ) | — | — | (138 | ) | (132 | ) | |||||||||||||||||

| Revenues attributable to non-same store properties | (52,003 | ) | (75,718 | ) | (16,192 | ) | (19,369 | ) | (2,561 | ) | (9,343 | ) | (70,756 | ) | (104,430 | ) | |||||||||||||||

Currency and ownership adjustments(5) | 4,532 | — | 2,765 | (436 | ) | 7,301 | 3,278 | 14,598 | 2,842 | ||||||||||||||||||||||

SH-NNN to SHO conversions (6) | 11,834 | — | — | — | — | — | 11,834 | — | |||||||||||||||||||||||

Other normalizing adjustments(7) | — | — | (1,146 | ) | (716 | ) | — | — | (1,146 | ) | (716 | ) | |||||||||||||||||||

SHO SS revenues(8) | 461,073 | 473,241 | 51,343 | 53,797 | 103,597 | 103,832 | 616,013 | 630,870 | |||||||||||||||||||||||

Avg. occupied units/month(9) | 22,069 | 21,884 | 2,066 | 2,104 | 11,893 | 11,668 | 36,028 | 35,656 | |||||||||||||||||||||||

SHO SS REVPOR(10) | $ | 6,983 | $ | 7,228 | $ | 8,307 | $ | 8,546 | $ | 2,912 | $ | 2,974 | $ | 5,715 | $ | 5,914 | |||||||||||||||

| SS REVPOR YOY growth | — | % | 3.5 | % | — | % | 2.9 | % | — | % | 2.1 | % | — | 3.5 | % | ||||||||||||||||

| SHO SSNOI Growth | |||||||||||||||||||||||||||||||

Consolidated SHO NOI(1) | $ | 159,148 | $ | 175,125 | $ | 20,174 | $ | 20,295 | $ | 39,656 | $ | 44,085 | $ | 218,978 | $ | 239,505 | |||||||||||||||

Unconsolidated SHO NOI attributable to WELL(2) | 9,006 | 8,245 | — | — | 7,396 | 7,996 | 16,402 | 16,241 | |||||||||||||||||||||||

SHO NOI attributable to noncontrolling interests(3) | (10,208 | ) | (9,950 | ) | (236 | ) | (923 | ) | (9,534 | ) | (9,844 | ) | (19,978 | ) | (20,717 | ) | |||||||||||||||

SHO pro rata NOI(4) | 157,946 | 173,420 | 19,938 | 19,372 | 37,518 | 42,237 | 215,402 | 235,029 | |||||||||||||||||||||||

| Non-cash NOI on same store properties | 503 | (587 | ) | (19 | ) | (22 | ) | — | 1 | 484 | (608 | ) | |||||||||||||||||||

| NOI attributable to non-same store properties | (14,395 | ) | (21,350 | ) | (3,945 | ) | (3,050 | ) | (768 | ) | (3,655 | ) | (19,108 | ) | (28,055 | ) | |||||||||||||||

Currency and ownership adjustments(5) | 1,279 | — | 887 | (116 | ) | 2,788 | 1,261 | 4,954 | 1,145 | ||||||||||||||||||||||

SH-NNN to SHO conversions(6) | 6,902 | — | — | — | — | — | 6,902 | — | |||||||||||||||||||||||

Other normalizing adjustments(7) | (184 | ) | 510 | (1,146 | ) | (420 | ) | — | — | (1,330 | ) | 90 | |||||||||||||||||||

SHO pro rata SSNOI(8) | $ | 152,051 | $ | 151,993 | $ | 15,715 | $ | 15,764 | $ | 39,538 | $ | 39,844 | $ | 207,304 | $ | 207,601 | |||||||||||||||

| SHO SSNOI growth | 0.0 | % | 0.3 | % | 0.8 | % | 0.1 | % | |||||||||||||||||||||||

| SHO SSNOI/Unit | |||||||||||||||||||||||||||||||

Trailing four quarters' SSNOI(4) | $ | 600,229 | $ | 64,227 | $ | 160,515 | $ | 824,971 | |||||||||||||||||||||||

Average units in service(11) | 25,300 | 2,515 | 13,072 | 40,887 | |||||||||||||||||||||||||||