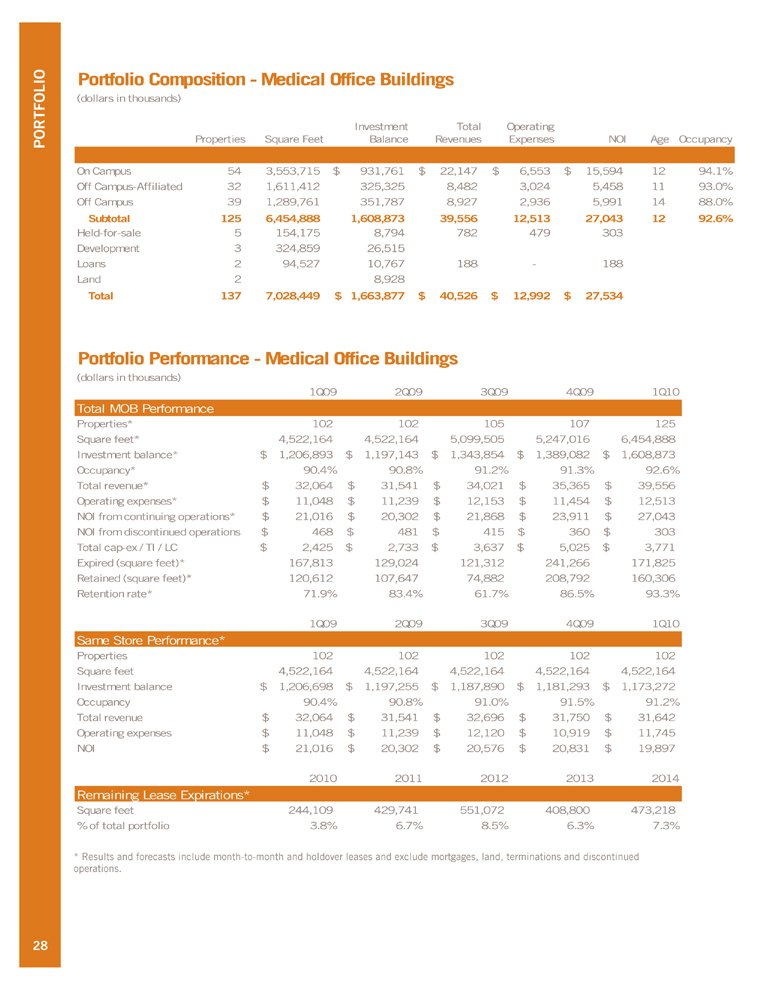

| PORTFOLIO Portfolio Composition — Medical Office Buildings (dollars in thousands) Investment Total Operating Properties Square Feet Balance Revenues Expenses NOI Age Occupancy On Campus 54 3,553,715 $931,761 $22,147 $6,553 $15,594 12 94.1% Off Campus-Affiliated 32 1,611,412 325,325 8,482 3,024 5,458 11 93.0% Off Campus 39 1,289,761 351,787 8,927 2,936 5,991 14 88.0% Subtotal 125 6,454,888 1,608,873 39,556 12,513 27,043 12 92.6% Held-for-sale 5 154,175 8,794 782 479 303 Development 3 324,859 26,515 Loans 2 94,527 10,767 188 - 188 Land 2 8,928 Total 137 7,028,449 $1,663,877 $40,526 $12,992 $27,534 Portfolio Performance — Medical Office Buildings (dollars in thousands) 1Q09 2Q09 3Q09 4Q09 1Q10 Total MOB Performance Properties* 102 102 105 107 125 Square feet* 4,522,164 4,522,164 5,099,505 5,247,016 6,454,888 Investment balance* $1,206,893 $1,197,143 $1,343,854 $1,389,082 $1,608,873 Occupancy* 90.4% 90.8% 91.2% 91.3% 92.6% Total revenue* $32,064 $31,541 $34,021 $35,365 $39,556 Operating expenses* $11,048 $11,239 $12,153 $11,454 $12,513 NOI from continuing operations* $21,016 $ 20,302 $21,868 $23,911 $27,043 NOI from discontinued operations $468 $481 $415 $360 $303 Total cap-ex / TI / LC $2,425 $2,733 $3,637 $5,025 $3,771 Expired (square feet)* 167,813 129,024 121,312 241,266 171,825 Retained (square feet)* 120,612 107,647 74,882 208,792 160,306 Retention rate* 71.9% 83.4% 61.7% 86.5% 93.3% 1Q09 2Q09 3Q09 4Q09 1Q10 Same Store Performance* Properties 102 102 102 102 102 Square feet 4,522,164 4,522,164 4,522,164 4,522,164 4,522,164 Investment balance $1,206,698 $1,197,255 $1,187,890 $1,181,293 $1,173,272 Occupancy 90.4% 90.8% 91.0% 91.5% 91.2% Total revenue $32,064 $31,541 $32,696 $31,750 $31,642 Operating expenses $11,048 $11,239 $12,120 $10,919 $11,745 NOI $21,016 $20,302 $20,576 $20,831 $ 19,897 2010 2011 2012 2013 2014 Remaining Lease Expirations* Square feet 244,109 429,741 551,072 408,800 473,218% of total portfolio 3.8% 6.7% 8.5% 6.3% 7.3% * Results and forecasts include month-to-month and holdover leases and exclude mortgages, land, terminations and discontinued operations. 28 |