- WELL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Welltower (WELL) 8-KHealth Care Reit to Acquire Sunrise Senior Living

Filed: 22 Aug 12, 12:00am

Sunrise Senior Living Acquisition Overview August 2012 Exhibit 99.2 |

Sunrise Senior Living Acquisition Overview 1 TRANSACTION OVERVIEW TRANSACTION OVERVIEW TIMING TIMING • Health Care REIT to acquire Sunrise Senior Living for $14.50/share • The acquisition positions Health Care REIT among the largest owners of seniors housing worldwide with over 58,000 units in the U.S., Canada and U.K. • The purchase price reflects a real estate value of Sunrise of approximately $1.9 billion Includes approximately $1 billion of assumed debt (1) at an average interest rate of 4.9% • Portfolio includes 20 wholly owned seniors housing properties Located in the U.S.(17) and Canada(3) • Additionally, the Portfolio includes Sunrise’s partnership interests in 105 joint ventures that own seniors housing properties Located in the U.S.(78) and in the U.K.(27) HCN will own on average approximately 28% interest in the 105 joint venture properties • The transaction is expected to close in the first half of 2013 (1) Of the approximate $1 billion in total debt, $397 million of debt associated with the owned properties would be consolidated at close. |

Sunrise Transaction to Meaningfully Advance Strategic Objectives 2 An Opportunity For Health Care REIT to Further Deliver on Strategic Objectives An Opportunity For Health Care REIT to Further Deliver on Strategic Objectives Class-A Properties in High Barrier to Entry Markets Accelerating the Portfolio Transformation $2 Billion Embedded Investment Pipeline Strong NOI Growth and Value Creation Opportunity Enhanced Diversification and Private Pay Component Complementary to Best- in-Class Operator Base |

HCN (6/30/12) Sunrise Pro Forma (1) East & West Coast + Top 31 MSA (2) 76% 96% 78% East & West Coast + Top 31 MSA SH Operating Only (2) 90% 96% 92% Private Pay 74% 97% 77% Monthly RevPOR (SH) (3) $4,764 $7,510 $5,446 Average Age (SH) 13 years 8 years 12 years Accelerating the Portfolio Transformation 3 (1) Pro forma for Sunrise Senior Living transaction assuming a real estate value of $1.9 billion. Pro forma excludes the $925 million of potential investments previously announced on 8/6/12. (2) Represents U.S. investments only. (3) HCN 6/30/12 reported one quarter in arrears. |

Class-A Properties in High Barrier to Entry Markets 4 Core Market Locations (1) • Located in highly affluent markets primarily within top 31 MSAs of respective countries • Approximately 50% of the communities are located in top 5 MSAs • Approximately 85% of the communities are located in top 20 MSAs New York (15), Los Angeles (16), Washington D.C. (7), Boston (7), Chicago (5), San Francisco (4), London (12) Class-A Real Estate (1) • Median age of 8 years • 31 of the communities are less than 5 years old • 90% of the communities are “mansion” prototype • Average RevPOR of $7,510 per month Life Science Hospital Seniors Housing Operating Medical Office Skilled Nursing/Post Acute Seniors Housing Triple-Net Sunrise (1) Data as of July 2012. Sunrise Real Estate Company Core Markets 2 |

Strong NOI Growth and Value Creation Opportunity 5 Strong NOI Growth Opportunity • Property level NOI expected to increase 4% - 5% per year over the long term • Growth captured by Health Care REIT through RIDEA structure Value Creation Opportunity • Re-finance higher priced near-term maturities in both owned and joint venture portfolio • Acquire over $2 billion in joint venture interests • Achieve operational and structural efficiencies 3 |

Embedded Investment Pipeline in Excess of $2 Billion 6 • Real estate pipeline of more than $2 billion to be realized over time by purchasing additional interests from existing Sunrise joint venture partners • In addition to 20 wholly owned properties, acquiring on average 28% interest in 105 joint venture properties 37 properties have purchase options exercisable in 2013 13 properties have purchase options exercisable in 2014 Balance of properties are open-ended or have buy/sell rights that could result in HCN acquiring 100% interest |

Enhanced Diversification and Private Pay Component 7 Note: As of 6/30/2012. Pro forma for Sunrise Senior Living transaction assuming a real estate value of $1.9 billion. Pro forma excludes the $925 million of potential investments previously announced on 8/6/12. Seniors Housing Operating 30% Seniors Housing Triple-Net 25% Skilled Nursing/ Post-Acute 20% Medical Office 18% Hospital 5% Life Science 2% Senior Housing Triple- Net 27% Skilled Nursing/ Post-Acute 22% Senior Housing Operating 22% Medical Office 21% Hospital 6% Life Science 2% Genesis 16.1% Merrill Gardens 7.0% Benchmark 5.4% Brandywine 4.6% Senior Living Communities 3.8% Chartwell 3.1% Senior Star 2.9% Belmont Village 2.4% Brookdale 2.0% Chelsea 1.9% Other 50.9% Genesis 14.4% Sunrise 10.9% Merrill Gardens 6.2% Benchmark 4.8% Brandywine 4.1% Senior Living Communities 3.4% Chartwell 2.8% Senior Star 2.5% Belmont Village 2.1% Brookdale 1.8% Other 47.0% HCN (6/30/12) HCN Pro Forma Including Sunrise |

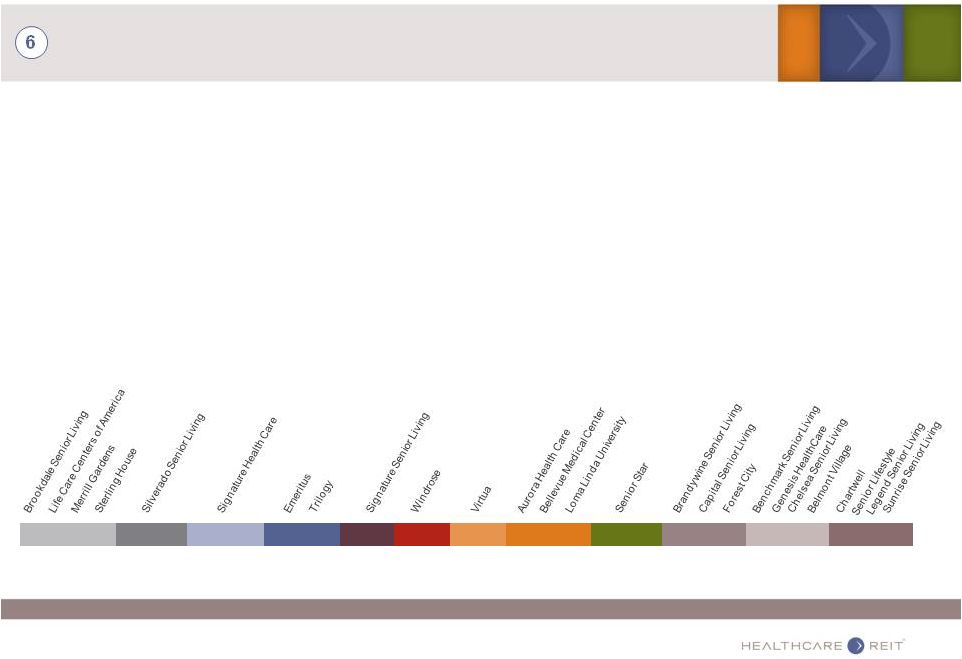

Sunrise Complements Best-in-Class Operator Base 8 2012 ALFA Best of the Best (1) award recipients are HCN operating partners; 10 of 15 award recipients are proprietary HCN relationships 15 of 22 Of our MOB portfolio is affiliated with a health system; 86% of the health systems are investment grade 90% (1) Ranking published in Senior Living Executive May/June 2012 edition. 1995 1998 2001 2002 2005 2006 2007 2008 2009 2010 2011 2012 |

Sunrise Transaction to Meaningfully Advance Strategic Objectives 9 An Opportunity For Health Care REIT to Further Deliver on Strategic Objectives 1 2 3 4 5 6 Complementary to Best- in-Class Operator Base Accelerating the Portfolio Transformation Class-A Properties in High Barrier to Entry Markets Strong NOI Growth and Value Creation Opportunity $2 Billion Embedded Investment Pipeline Enhanced Diversification and Private Pay Component |

Additional Information and Where to Find It In connection with this proposed transaction, a proxy statement will be filed by Sunrise with the United States Securities and Exchange Commission ("SEC"). Investors are urged to carefully read the proxy statement and any other relevant documents filed with the SEC when they become available because they will contain important information. Investors will be able to obtain the proxy statement, and all other relevant documents filed by Sunrise with the SEC free of charge at the SEC's website www.sec.gov. Participants in the Solicitation The respective directors, executive officers and other members of management and employees of Health Care REIT and Sunrise may be deemed to be participants in the solicitation of proxies from the shareholders of Sunrise in favor of the transaction. Information about Health Care REIT and its directors and executive officers, and their ownership of Health Care REIT securities, is set forth in the proxy statement for Health Care REIT's 2012 Annual Meeting of Shareholders, which was filed with the SEC on March 29, 2012. Information about Sunrise and its directors and executive officers, and their ownership of Sunrise securities, is set forth in the proxy statement for the 2012 Annual Meeting of Shareholders of Sunrise, which was filed with the SEC on March 23, 2012. Additional information regarding the interests of the Sunrise directors and executive officers may be obtained by reading the proxy statement when it becomes available. Sunrise Senior Living Acquisition |

This document may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. When the company uses words such as “may”, “will”, “intend”, “should”, “believe”, “expect”, “anticipate”, “project”, “estimate” or similar expressions, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. The company’s expected results may not be achieved, and actual results may differ materially from expectations. This may be a result of various factors, including the satisfaction of closing conditions to the transaction, including, the approval of the transaction by the shareholders of Sunrise and the receipt of regulatory approvals and lender or third-party consents; the completion of the sale of the Sunrise management company to a third party; the respective parties’ performance of their obligations under the transaction agreements; unanticipated difficulties and/or expenditures relating to the transaction; the company’s ability to enter into new joint venture agreements and management contracts; the company’s ability to acquire interests in properties from joint venture partners; the company’s ability to realize operating efficiencies; operator/tenant or joint venture partner bankruptcies or insolvencies; the cooperation of joint venture partners; exposure to potential losses from the actions of the company’s venture partners negative developments in the operating results or financial condition of operators/tenants or managers; risks related to non- compliance with government regulations and new legislation or regulatory developments; the status of capital markets, including availability and cost of capital; changes in financing terms; risks related to international operations; the movement of U.S. and foreign exchange rates; and other factors affecting the execution of the transaction and subsequent performance, including REIT laws and regulations. In addition, the ability of Health Care REIT to achieve the expected property-level NOI growth also will be affected by the effects of competition within the health care and seniors housing industries (in particular the response to the proposed transaction in the marketplace). Additional factors are discussed in the company’s Annual Report on Form 10-K and in its other reports filed from time to time with the Securities and Exchange Commission. The company assumes no obligation to update or revise any forward-looking statements or to update the reasons why actual results could differ from those projected in any forward-looking statements. Forward-Looking Statements and Risk Factors |