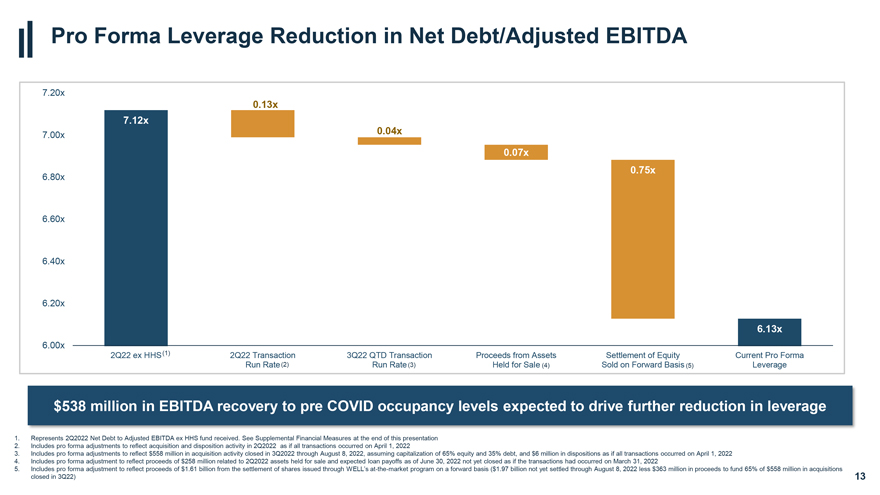

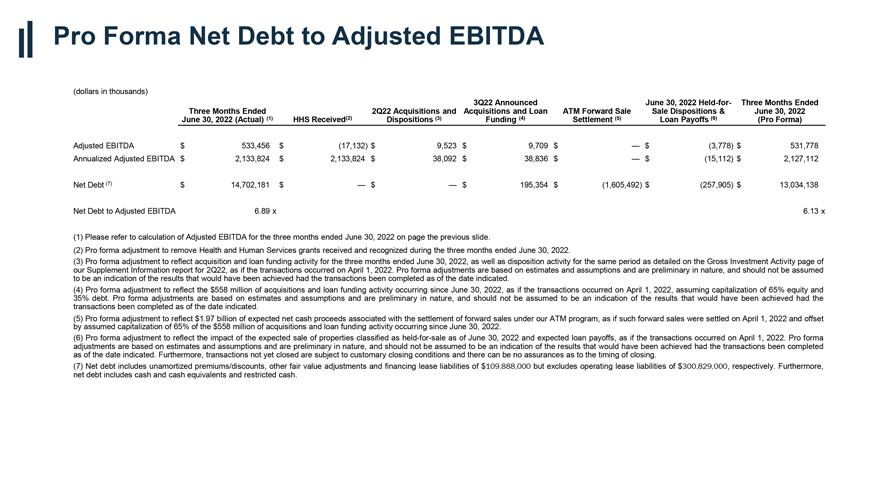

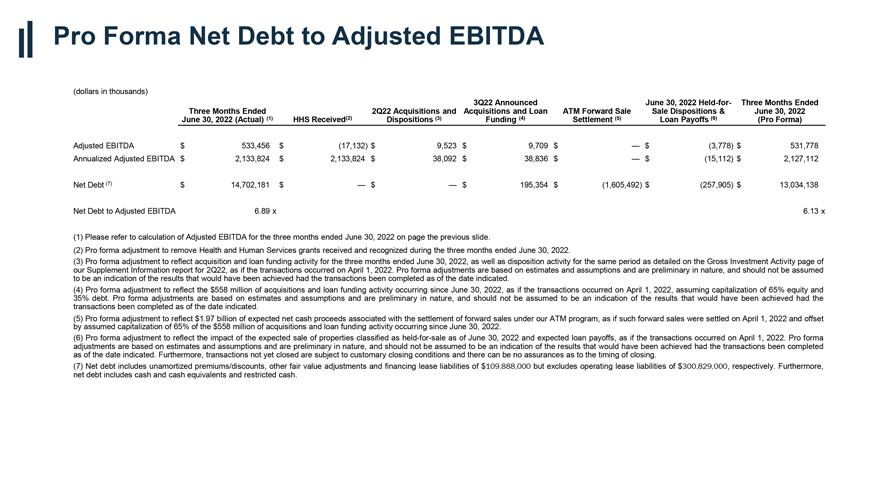

Pro Forma Net Debt to Adjusted EBITDA (dollars in thousands) 3Q22 Announced June 30, 2022 Held-for- Three Months Ended Three Months Ended 2Q22 Acquisitions and Acquisitions and Loan ATM Forward Sale Sale Dispositions & June 30, 2022 June 30, 2022 (Actual) (1) HHS Received(2) Dispositions (3) Funding (4) Settlement (5) Loan Payoffs (6) (Pro Forma) Adjusted EBITDA $ 533,456 $ (17,132) $ 9,523 $ 9,709 $ — $ (3,778) $ 531,778 Annualized Adjusted EBITDA $ 2,133,824 $ 2,133,824 $ 38,092 $ 38,836 $ — $ (15,112) $ 2,127,112 Net Debt (7) $ 14,702,181 $ — $ — $ 195,354 $ (1,605,492) $ (257,905) $ 13,034,138 Net Debt to Adjusted EBITDA 6.89 x 6.13 x (1) Please refer to calculation of Adjusted EBITDA for the three months ended June 30, 2022 on page the previous slide. (2) Pro forma adjustment to remove Health and Human Services grants received and recognized during the three months ended June 30, 2022. (3) Pro forma adjustment to reflect acquisition and loan funding activity for the three months ended June 30, 2022, as well as disposition activity for the same period as detailed on the Gross Investment Activity page of our Supplement Information report for 2Q22, as if the transactions occurred on April 1, 2022. Pro forma adjustments are based on estimates and assumptions and are preliminary in nature, and should not be assumed to be an indication of the results that would have been achieved had the transactions been completed as of the date indicated. (4) Pro forma adjustment to reflect the $558 million of acquisitions and loan funding activity occurring since June 30, 2022, as if the transactions occurred on April 1, 2022, assuming capitalization of 65% equity and 35% debt. Pro forma adjustments are based on estimates and assumptions and are preliminary in nature, and should not be assumed to be an indication of the results that would have been achieved had the transactions been completed as of the date indicated. (5) Pro forma adjustment to reflect $1.97 billion of expected net cash proceeds associated with the settlement of forward sales under our ATM program, as if such forward sales were settled on April 1, 2022 and offset by assumed capitalization of 65% of the $558 million of acquisitions and loan funding activity occurring since June 30, 2022. (6) Pro forma adjustment to reflect the impact of the expected sale of properties classified as held-for-sale as of June 30, 2022 and expected loan payoffs, as if the transactions occurred on April 1, 2022. Pro forma adjustments are based on estimates and assumptions and are preliminary in nature, and should not be assumed to be an indication of the results that would have been achieved had the transactions been completed as of the date indicated. Furthermore, transactions not yet closed are subject to customary closing conditions and there can be no assurances as to the timing of closing. (7) Net debt includes unamortized premiums/discounts, other fair value adjustments and financing lease liabilities of $109,888,000 but excludes operating lease liabilities of $300,829,000, respectively. Furthermore, net debt includes cash and cash equivalents and restricted cash.