- WELL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Welltower (WELL) DEF 14ADefinitive proxy

Filed: 8 Apr 22, 7:01am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Under §240.14a-12 |

Welltower Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

| No fee required | |

| Fee paid previously with preliminary materials | |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Kenneth J. Bacon

Chair

April 8 , 2022

| “I would like to extend the deep appreciation of the entire board to Jeff Donahue for his 24 years of service as Lead Independent Director and Chair of the Board.” | ||

| |

Message from

our Chair

Dear Shareholders:

You are cordially invited to attend Welltower’s Annual Meeting of Shareholders, which will be held at 10:00 a.m. Eastern Time on May 23 , 2022, in a virtual format, at www.virtualshareholdermeeting.com/WELL2022. Details regarding access to the meeting and the business to be conducted are provided in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement.

The completion of my first full year as Chair of this seasoned and diverse board coincides with the second anniversary of the onset of the COVID global pandemic. It has been my distinct honor to work alongside my fellow board members and this extraordinarily talented management team as, together, we not only have navigated through the ongoing challenges posed by COVID but are continuously and innovatively reinventing the role that infrastructure can play in the delivery of wellness to seniors. With our industry leading seniors housing portfolio, combined with our nearly 22 million square feet of medical office space and partnerships with leading health systems, we have built the world’s largest health and wellness real estate platform based on the belief that health and wellness can be directly impacted by where seniors live and age.

Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, we hope you will vote as soon as possible. Information about voting methods appears in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. We continue to focus on saving costs and protecting the environment by using the “Notice and Access” method of delivery. Instead of receiving paper copies of our proxy materials in the mail, many shareholders will receive a Notice Regarding the Availability of Proxy Materials, which provides an Internet website address where shareholders can access electronic copies of the proxy materials and vote. This website also has instructions for voting by phone and for requesting paper copies of the proxy materials and proxy card.

In closing, I would like to take this opportunity to extend the deep appreciation of the entire board to Jeff Donahue for his 24 years of service, including serving as Lead Independent Director (May 2019-October 2020) and Chair of the Board (April 2014-May 2019). Jeff has been a valued and steady steward.

On behalf of everyone at Welltower, I thank you for your ongoing interest and investment in Welltower Inc.

Sincerely,

Kenneth J. Bacon

Chair of the Board

Notice of Virtual

Annual Meeting

of Shareholders

| May 23 , 2022 | ||

| 10:00 a.m. Eastern Time | ||

TO THE SHAREHOLDERS OF WELLTOWER INC.:

The Annual Meeting of Shareholders of Welltower Inc. (the “Annual Meeting”) will be held on May 23 , 2022, at 10:00 a.m. Eastern Time in a virtual format, at www.virtualshareholdermeeting.com/WELL2022, for the purpose of considering and acting upon each item described below and transacting any other business that properly comes before the meeting:

| 1. | The election of ten director nominees named in the Proxy Statement accompanying this notice to hold office until the next Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified; |

| 2. | The approval of an amendment to the Certificate of Incorporation of Welltower OP Inc. to remove the provision requiring Welltower Inc. shareholders to approve amendments to the Welltower OP Inc. Certificate of Incorporation and other extraordinary transactions involving Welltower OP Inc.; |

| 3. | The ratification of the appointment of Ernst & Young LLP (“EY”) as Welltower’s independent registered public accounting firm for the year ending December 31, 2022; and |

| 4. | The approval, on an advisory basis, of the compensation of our named executive officers. |

The Board of Directors of Welltower Inc. unanimously recommends that you vote FOR each of the four proposals we will present at the Annual Meeting. Shareholders of record at the close of business on April 4, 2022 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. Information relating to the matters to be considered and voted on at the Annual Meeting appears in the Proxy Statement accompanying this notice.

HOW TO VOTE IN ADVANCE OF THE VIRTUAL ANNUAL MEETING

| BY INTERNET | BY PHONE | BY MAIL |  | |||||

|  |  | ||||||

| Visit www.proxyvote.com | Dial 1-800-690-6903 | Sign, date and return your proxy card or voting instruction form | Scan this QR code to view digital versions of Welltower’s Proxy Statement and 2021 Annual Report | |||||

We have endeavored to provide shareholders attending the Annual Meeting with the same rights and opportunities to participate as they would have at an in-person meeting. You will be able to attend the Annual Meeting online, vote, view the list of registered shareholders, and by visiting www.virtualshareholdermeeting.com/WELL2022. Shareholders of record can access the meeting website using the 16-digit control number included on their proxy card or Notice of Internet Availability of Proxy Materials (the “Notice”). Beneficial owners should review the proxy materials and their voting instruction form or Notice for information on how to vote in advance of, and how to participate in, the Annual Meeting. When accessing our Annual Meeting, please allow ample time for online check-in, which will begin at 9:30 a.m. Eastern Time on May 23 , 2022.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 23 , 2022: The Notice of Internet Availability of Proxy Materials, the Notice of Annual Meeting of Shareholders and Proxy Statement and Welltower’s Annual Report on Form 10-K for the year ended December 31, 2021, are available on the Internet free of charge at www.welltower.com/proxy. | BY ORDER OF THE BOARD OF DIRECTORS

Matthew G. Mcqueen Executive Vice President - General Counsel & Corporate Secretary Toledo, Ohio April 8 , 2022 |

In this Proxy Statement, the terms “Welltower,” “we,” and “our” refer to Welltower Inc. This Proxy Statement includes website addresses and references to additional materials found on those websites. These websites and materials are not incorporated into this Proxy Statement by reference.

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our environmental and social goals, commitments, and strategies. These statements involve risks and uncertainties. Actual results could differ materially from any future results expressed or implied by the forward-looking statements for a variety of reasons, including due to the risks and uncertainties that are discussed in our most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. We assume no obligation to update any forward-looking statements or information, which speak as of their respective dates.

The approximate date on which these materials will be first made available or sent to shareholders is April 8 , 2022.

WELLTOWER • 2022 Proxy Statement 3

This summary highlights our selected business results, executive compensation, ESG and corporate governance information described in more detail in this Proxy Statement. We encourage you to read the entire Proxy Statement before voting.

Welltower Inc. (NYSE: WELL), a real estate investment trust (“REIT”), is an S&P 500 company headquartered in Toledo, Ohio, that is driving the transformation of health care infrastructure. We invest with leading seniors housing operators, post-acute providers and health systems to fund the real estate and infrastructure needed to scale innovative care delivery models and improve people’s wellness and overall health care experience. We own interests in properties concentrated in high-growth markets in the United States, Canada and the United Kingdom, including seniors housing, post-acute communities, and outpatient medical properties. As of December 31, 2021, we owned or invested in over 1,800 properties across our business lines and regions.

2021 was a pivotal year for Welltower, marked by a powerful recovery in our operational performance, the establishment of long-term exclusive partnerships, and the most active year of capital deployment in a decade—all while contending with continued challenges posed by the COVID-19 pandemic.

| 2021 Highlights | ||

| 1,800+ PROPERTIES | $5.7B PRO RATA GROSS INVESTMENTS | |

| BBB+/Baa1 INVESTMENT GRADE BALANCE SHEET | 2.84% DIVIDEND YIELD (as of 12/31/2021) | |

| 37% TOTAL SHAREHOLDER RETURN | ||

2016-2021 Share Price Performance

Portfolio

| • | Increased seniors housing operating (“SHO”) portfolio spot occupancy approximately 510 basis points (“bps”) from the pandemic-low of 72.6%(1) on March 12, 2021. |

| • | Completed $5.7 billion of pro rata gross investments across all segments during 2021, which are expected to create significant shareholder value in the coming years. |

| • | Completed pro rata property dispositions and loan payoffs of $1.4 billion, demonstrating continued strong demand and liquidity for Welltower’s high-quality assets, while improving the quality of our portfolio. |

| • | Formed 19 new and proprietary long-term growth relationships with best-in-class developers and operators which are expected to meaningfully contribute to capital deployment opportunities. |

| (1) | Spot occupancy represents approximate occupancy at our share for 546 properties in operation as of December 31, 2020, including unconsolidated properties and excluding acquisitions, executed dispositions, development conversions and one property closed for redevelopment. |

WELLTOWER • 2022 Proxy Statement 4

| • | During the third quarter, acquired an 85-property seniors housing portfolio owned by Holiday Retirement for $1.58 billion, now operated by Atria Senior Living following its acquisition of the Holiday management company. |

| • | Substantially exited our operating relationship with Genesis Healthcare through a series of mutually beneficial transactions totaling $880 million in value, or $144,000 per bed, achieving an 8.5% unlevered IRR and meaningfully reducing our In-Place NOI(1) exposure to long-term post-acute care. |

Balance Sheet

| • | As of December 31, 2021, we had $347 million of cash and cash equivalents and restricted cash and $3.7 billion of available borrowing capacity under our unsecured revolving credit facility. |

| • | Maintained a favorable leverage position, reporting Net Debt to Adjusted EBITDA of 6.95x(1) as of December 31, 2021. |

| • | Issued $1.75 billion of unsecured notes with a weighted average duration of over nine years and a blended average coupon of 2.57%. |

| • | Closed on an expanded $4.7 billion unsecured credit facility at LIBOR plus 77.5 bps, which represents a five bps improvement in pricing from our previous facility. |

| • | During 2021, efficiently sold 34.9 million shares of common stock under the At-the-Market (“ATM”) program via forward sale agreements, which are expected to generate gross proceeds of approximately $2.8 billion (of which 29.7 million shares have been settled resulting in $2.4 billion of gross proceeds during 2021). |

| • | Moody’s Investors Services and S&P Global Ratings revised their ratings outlook for Welltower to Stable from Negative and affirmed Welltower’s issuer credit ratings as Baa1 and BBB+, respectively. |

Corporate

| • | Finished the year with $127 million of general and administrative expenses, representing approximately 0.23% of Welltower’s enterprise value (lowest ratio among our healthcare REIT peers). |

| • | Paid cash dividends of $2.44 per share with the dividend paid in March 2022 representing Welltower’s 203rd consecutive dividend. |

| • | Appointed John F. Burkart as Executive Vice President – Chief Operating Officer given his experience utilizing a data-driven approach to drive platform efficiencies. |

| • | Added 51 net new employees in 2021 with a focus on Business Insights, Development and Investments, representing a greater than 10% expansion in the Welltower team. |

Diversity

| • | Appointed Dennis G. Lopez and Ade J. Patton, both racially/ethnically diverse, to the Board of Directors. |

| • | Nine of our ten director nominees are women or racially/ethnically diverse. Our independent Chair of the Board is also a racially/ethnically diverse director. |

| • | Four of the five Board committees are chaired by women or racially/ethnically diverse directors. |

COVID-19 Response

| • | Safely reopened communities to admissions, visitation, and in-person tours while maintaining strict adherence to federal, state, local, and/or operator-imposed guidelines. |

| • | Coordinated connections between seniors housing operators and CVS/Omnicare and Walgreens to facilitate distribution of COVID-19 vaccines to Welltower communities and staff and resident education around vaccine efficacy and safety. |

| • | Maintained elevated cleaning and PPE protocols throughout the pandemic. |

Environmental, Social and Governance Leadership Recognition

| • | Elevated by CDP to the highest available band level of Leadership, with an improved score of “A-” for taking coordinated action on climate issues. |

| • | Raised MSCI ESG rating from A to AA. |

| • | Named to the Dow Jones Sustainability North American Index for the sixth consecutive year. |

| • | Listed in the FTSE4Good Index since 2012. |

| (1) | Represents a non-GAAP financial measure. See Appendix A for definitions and reconciliations of non-GAAP financial measures. |

WELLTOWER • 2022 Proxy Statement 5

| • | Recognized by the U.S. Environmental Protection Agency (EPA) and U.S. Department of Energy as an ENERGY STAR Partner of the Year for the third consecutive year and elevated to the level of Sustained Excellence, the EPA’s highest recognition within the ENERGY STAR program. | |

| • | Maintained Gold Level Green Lease Leader status by the Institute for Market Transformation and the U.S. Department of Energy’s Better Buildings Alliance. | |

| • | Named to the Bloomberg Gender-Equality Index for the third consecutive year. | |

| • | Named to the Workplace Health Achievement Index by the American Heart Association for the fourth consecutive year and increased from Bronze to Silver level. | |

| • | Maintained Prime status under the ISS-ESG Corporate rating for the third consecutive year. | |

| • | Named by S&P Global in collaboration with RobecoSAM for the fourth consecutive year in the 2021 edition of The Sustainability Yearbook. | |

| • | Named to the top 20% of Newsweek’s America’s Most Responsible Companies list for the third consecutive year. | |

| • | Named to Sustainalytics 2021 Top-Rated ESG Companies list. | |

| • | Named as one of the top sustainable REITs in Barron’s list of America’s Most Sustainable Companies for the second consecutive year. | |

| • | Honored at the Women’s Forum of New York Breakfast of Champions for the second time for Welltower’s representation of women on its Board of Directors. | |

| • | Opened Sunrise at East 56th, the recipient of all three LEED Silver, WELL Certification at the Silver level, and WELL Health-Safety Rating Seal certifications. |

Executive Compensation Overview

The Compensation Committee oversees Welltower’s compensation practices so that the compensation program is in line with the market, is responsive to shareholder concerns, and considers best compensation practices while ensuring we attract and retain high caliber executive officers and other key employees. The Compensation Committee developed Welltower’s Compensation Principles and Philosophy and Objectives that are described in more detail on pages 36 through 38.

Throughout 2021, we continued our commitment to the success of our employees by maintaining numerous programs designed to attract, develop and retain future leaders. Among other benefits, we offer competitive compensation programs; maternity, caregiver, and wellness leave; technology to help our employees stay engaged while working remotely; and safety protocols and procedures for essential employees who continue to work in the office. We are committed to fostering a diverse and inclusive environment that gives every employee the opportunity to develop and advance, and we believe this starts at the top. This Proxy Statement describes a number of changes to the Board and the Leadership Team that reflect our commitment.

WELLTOWER • 2022 Proxy Statement 6

WELLTOWER’S BOARD OF DIRECTORS

| Name | Age | Primary occupation | Independent | Director since | Committees(1) | |||||

| Kenneth J. Bacon Chair since 2020 | 67 | Co-founder and managing partner of RailField Realty Partners |  | 2016 | • Executive(C) | |||||

| Karen B. DeSalvo | 56 | Chief Health Officer of Google Health |  | 2018 | • Investment • Nom/Gov | |||||

| Jeffrey H. Donahue | 75 | Former President and Chief Executive Officer Enterprise Community Investment, Inc. |  | 1997 | • Compensation(C) • Executive • Investment | |||||

| Philip L. Hawkins | 66 | Executive Chairman of Link Logistics Real Estate |  | 2020 | • Compensation • Investment | |||||

| Dennis G. Lopez | 67 | Chief Executive Officer of QuadReal Property Group Ltd. |  | 2021 | • Compensation • Investment | |||||

| Shankh Mitra | 41 | Chief Executive Officer and Chief Investment Officer of Welltower | 2020 | • Executive | ||||||

| Ade J. Patton | 43 | Executive Vice President and Chief Financial Officer of HBO/HBO Max/Global DTC |  | 2021 | • Audit • Nom/Gov | |||||

| Diana W. Reid | 66 | Former Executive Vice President of The PNC Financial Services Group, Inc. |  | 2020 | • Audit • Executive • Nom/Gov(C) | |||||

| Sergio D. Rivera | 59 | Former Chief Executive Officer of SeaWorld Entertainment, Inc. |  | 2014 | • Audit • Executive • Investment(C) | |||||

| Johnese M. Spisso | 61 | President of UCLA Health, Chief Executive Officer of UCLA Hospital System, and Associate Vice Chancellor of UCLA Health Sciences |  | 2018 | • Compensation • Nom/Gov | |||||

| Kathryn M. Sullivan | 66 | Former Chief Executive Officer of UnitedHealthcare Employer and Individual, Local Markets |  | 2019 | • Audit(C) • Compensation • Executive |

(C) Chair

We believe diversity helps the Board better oversee our management and provide strategic advice. Our Corporate Governance Guidelines provide that the Nominating/Corporate Governance Committee should consider diversity in terms of (i) professional experience, including experience in Welltower’s primary business segments and in areas of possible future expansion; (ii) educational background; and (iii) age, race, gender, sexual orientation, geography, ethnicity, and national origin. The current composition of our Board reflects those efforts and the importance of diversity to the Board.

In addition, we believe that diversity with respect to tenure is important in order to provide for both fresh perspectives and deep experience and knowledge of Welltower. Therefore, we aim to maintain an appropriate balance of tenure across our directors.

Board Diversity

The charts above reflect the total number of the director nominees that are standing for election in 2022.

WELLTOWER • 2022 Proxy Statement 7

CORPORATE GOVERNANCE HIGHLIGHTS

Welltower’s Board is committed to good corporate governance, which promotes the long-term interests of shareholders and strengthens Board and management accountability.

| Board Composition and Independence | Board and Committee Practices | Shareholder Rights | ||

| • All directors except the CEO are independent | • Annual Board and committee evaluations, including one-on-one interviews led by the Chair and interviews by an independent third party every two years | • Single class of stock with equal voting rights | ||

| • Independent Board Chair | • Director orientation and continuing education | • Annual elections for all directors | ||

| • Executive sessions provided for all quarterly Board and committee meetings | • 90% of all director nominees, including all members of the Audit Committee, are financial experts | • Majority voting standard for uncontested elections of directors | ||

| • Mandatory retirement age | • 99% attendance by directors at Board and committee meetings in 2021 | • Proxy access for shareholders | ||

| • Limits on board member service on other public company boards | • Robust stock ownership guidelines |

For more detailed information on Welltower’s corporate governance framework, see the section entitled “Corporate Governance” beginning on page 10.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) LEADERSHIP

Welltower is committed to leadership in our industry and strives to rank among the top S&P 500 companies in ESG practices. Our commitment to helping people live well and age well is supported by our emphasis on sustainability, a core focus on diversity and equality, and good corporate governance. We see our industry-leading progress towards furthering ESG in our organization as not only the right thing to do, but as a way to drive long-term operational efficiency and shareholder value.

We publish information regarding our sustainability, environmental, social, and human capital goals, ESG initiatives, and progress toward our goals in our Environmental, Social and Governance Report, which is available on our website. Some highlights of Welltower’s ESG efforts in 2021 are summarized below:

Environmental

| • | Continued to work towards our goals of a 10% reduction in greenhouse gas (GHG) emissions, energy, and water use by 2025 from our 2018 baseline. | |

| • | Continued foundational operational efficiency upgrades and increased green building certifications and execution of green leases. | |

| • | Increased sustainability data coverage, with more of our seniors housing communities and medical office buildings reporting their energy, water, and waste data and sharing data with Welltower. | |

| • | Through September 30, 2021, used $277.7 million of net proceeds from the December 2019 green bond offering to fund energy efficiency, water conservation, and green building projects. |

WELLTOWER • 2022 Proxy Statement 8

Social

| • | Maintained 1:1 gender parity across the organization and 50% women or racially/ethnically diverse membership on Welltower’s Leadership Team. | |

| • | Relaunched the Welltower Charitable Foundation with a focus on supporting eligible charitable initiatives relating to aging, health care, the environment, education, and the arts through our employee matching program (WELL-Matched), ENG supported donations, and our quarterly donation competitions (Give-WELL). | |

| • | Since early 2016, Welltower and the Welltower Charitable Foundation have provided more than $42 million in cash and in-kind support to programs and communities that align with our philanthropic priorities. | |

| • | Relaunched the Welltower Award through which Welltower has acknowledged and rewarded the hard work and contributions of Welltower employees who support and further our strategic goals based on innovation, leadership, value creation, and customer focus. | |

| • | Expanded our second annual Day of Giving, allowing our employees an opportunity to make an impact for local charitable organizations through global volunteer opportunities conducted during work hours. | |

| • | Honored multiple days and months for diversity and inclusion aligned education and remembrance, including Black History Month, Hispanic Heritage Month, Martin Luther King Jr. Day, Memorial Day, Pride Month, Veterans Day and Women’s History Month. |

Governance

| • | Achieved 80% women and racially/ethnically diverse director leadership on the Board of Directors with 40% of Board committees led by women. | |

| • | Maintained an independent Chair of the Board, who is racially/ethnically diverse. | |

| • | Continued to improve our already high CDP, ISS-ESG, MSCI, Sustainalytics, and Vigeo Eiris scores through enhanced tracking, reporting, and disclosure. | |

| • | Published 9th Annual Environmental, Social and Governance Report in accordance with Global Reporting Initiative (GRI) standards and aligned with Sustainability Accounting Standards Board (SASB) and increased its mapping to the Task Force on Climate-Related Financial Disclosures (TCFD). | |

| • | Conducted efforts to ensure compliance for Welltower, as well as our operators and properties, with municipal energy and water benchmarking and reporting regulations. | |

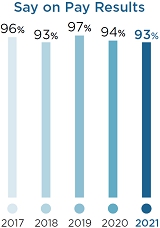

| • | Continued to garner overwhelming shareholder approval (93% and above) for Say-on-Pay proposals regarding our executives’ compensation in each of the past five years. | |

| • | Limited the Board’s ability to waive the director age limit policy under the Corporate Governance Guidelines. |

For additional information

regarding Welltower’s sustainability

program, please visit

www.welltower.com/esg/.

WELLTOWER • 2022 Proxy Statement 9

Welltower’s Board oversees the CEO and other management in the day-to-day operations of Welltower and ensures the best interests of Welltower and its shareholders are being served.

Board Leadership Structure

The Board is responsible for selecting the appropriate Board leadership structure. To do so, the Board periodically reviews its leadership structure to determine whether it continues to best serve Welltower and its shareholders.

At this time, the Board believes the current leadership structure, which separates the Chair and CEO roles, is appropriate. The Board is currently led by an independent Chair, Mr. Bacon, who is Welltower’s first racially/ethnically diverse Chair. This structure allows the CEO to focus his time and energy on operating and managing Welltower and facilitates the Board’s independent oversight of management and Welltower’s overall corporate governance.

WELLTOWER • 2022 Proxy Statement 10

Board Independence and Qualifications

Pursuant to the Corporate Governance Guidelines, the Board undertook a review of director and director nominee independence in March 2022. During this review, the Board considered transactions and relationships between each director and director nominee, or any member of his or her immediate family, and Welltower and its subsidiaries and affiliates. The purpose of this review was to determine whether any relationships or transactions were inconsistent with a determination that a director or director nominee is independent.

The Board has determined that, other than Mr. Mitra, all of the directors are independent under applicable rules of the New York Stock Exchange (“NYSE”). The Board also determined that, other than Mr. Mitra, all of the directors have no material relationship with Welltower (either directly or as a partner, shareholder or officer of an organization that has a relationship with Welltower) and are therefore independent under applicable rules of the NYSE and the independence standards in Welltower’s Corporate Governance Guidelines. Mr. Mitra is not independent because he is the CEO of Welltower.

| 80% of Board Committees are led by women or racially/ethnically diverse directors | ||||

The Board has standing Audit, Compensation, Executive, Investment and Nominating/Corporate Governance Committees. Other than the Compensation Committee, each of these committees is chaired by either a woman or a racially/ethnically diverse director.

The current membership and function of each of the Board committees is described below. Each committee is governed by a written charter that is approved by the Board. The charters are available on Welltower’s website at https://welltower.com/investors/governance/.

| Kenneth J. Bacon | Karen B. DeSalvo | Jeffery H. Donahue | Philip L. Hawkins | Dennis G. Lopez | Shankh Mitra | Ade J. Patton | Diana W. Reid | Sergio D. Rivera | Johnese M. Spisso | Kathryn M. Sullivan | 2021 Meetings | |||||||||||||

| Board |  |  |  |  |  |  |  |  |  |  |  | 6 | ||||||||||||

| Audit(1) |  |  |  |  | 4 | |||||||||||||||||||

| Compensation |  |  |  |  |  | 7 | ||||||||||||||||||

| Executive |  |  |  |  |  |  | 1 | |||||||||||||||||

| Investment |  |  |  |  |  | 6 | ||||||||||||||||||

| Nominating/ Corporate Governance |  |  |  |  | 5 |

| Member |  | Chair |

| (1) | All members of the Audit Committee are financial experts. |

WELLTOWER • 2022 Proxy Statement 11

AUDIT COMMITTEE

MEMBERS: • Ms. Sullivan (Chair) • Mr. Patton • Ms. Reid • Mr. Rivera Meetings in 2021: 4 | The Audit Committee assists the Board in monitoring Welltower’s financial statements; the independent auditor, including its qualifications and independence; the performance of Welltower’s internal auditor and internal audit function; Welltower’s compliance with legal and regulatory requirements; the effectiveness of Welltower’s internal controls over financial reporting and disclosure controls and procedures; Welltower’s major financial risk exposures, risk assessment, and risk management policies; and Welltower’s information technology systems and information security matters. The Board has determined that all members of the Audit Committee have the requisite financial literacy under the rules of the NYSE to serve on the Audit Committee and satisfy the definition of “audit committee financial expert” under applicable rules of the Securities and Exchange Commission (“SEC”). Additionally, the Board determined that all of the members of the Audit Committee are independent under the applicable rules of the NYSE and under the separate independence standards for audit committee members under Rule 10A-3 of the Securities Exchange Act of 1934, as amended. | |

| COMPENSATION COMMITTEE | ||

MEMBERS: • Mr. Donahue (Chair) • Mr. Hawkins • Mr. Lopez • Ms. Spisso • Ms. Sullivan Meetings in 2021: 7 | The Compensation Committee reviews and approves the compensation arrangements for Welltower’s executive officers; reviews and administers Welltower’s stock compensation plans and programs; and reviews and recommends to the Board changes in the Board’s compensation. The Compensation Committee also oversees Welltower’s strategies and policies related to human capital management, including with respect to matters such as diversity and inclusion, workplace environment and culture, and talent development and retention. All of the members of the Compensation Committee are independent under the applicable rules of the NYSE and the SEC and non-employee directors for the purpose of section 16 under the Securities Exchange Act of 1934, as amended. See “Compensation Discussion and Analysis” for additional information regarding the Compensation Committee. | |

| EXECUTIVE COMMITTEE | ||

MEMBERS: • Mr. Bacon (Chair) • Mr. Donahue • Mr. Mitra • Ms. Reid • Mr. Rivera • Ms. Sullivan Meetings in 2021: 1 | The function of the Executive Committee is to exercise all of the powers of the Board (except any powers specifically reserved to the Board) between meetings of the Board. | |

| INVESTMENT COMMITTEE | ||

MEMBERS: • Mr. Rivera (Chair) • Dr. DeSalvo • Mr. Donahue • Mr. Hawkins • Mr. Lopez Meetings in 2021: 6 | The Investment Committee reviews Welltower’s investment guidelines and policies; reviews and approves certain developments, investments, and dispositions; reviews senior management’s development, investment and disposition plans; makes recommendations to the Board regarding investments requiring the Board’s approval; reviews and periodically evaluates the performance of Welltower’s investments; and reviews and makes recommendations to the Board regarding appropriate approval levels of authority granted to the Investment Committee and to senior management. | |

| NOMINATING/CORPORATE GOVERNANCE COMMITTEE | ||

MEMBERS: • Ms. Reid (Chair) • Dr. DeSalvo • Mr. Patton • Ms. Spisso Meetings in 2021: 5 | The Nominating/Corporate Governance Committee engages in succession planning for the Board and key leadership roles on the Board and its committees; identifies potential candidates to fill Board positions; makes recommendations to the Board concerning the size and composition of the Board and its committees; oversees and makes recommendations regarding corporate governance matters, including an annual review of Welltower’s Corporate Governance Guidelines; oversees the annual evaluation of the performance of the Board and its committees; reviews environmental sustainability issues and Welltower’s environmental sustainability practices; and oversees Welltower’s political contributions and policies and practices regarding political contributions. All of the members of the Nominating/Corporate Governance Committee are independent under the applicable rules of the NYSE. | |

WELLTOWER • 2022 Proxy Statement 12

Board Meetings and Attendance

Welltower’s policy is to encourage all directors to attend the annual meeting. All then-serving directors attended last year’s annual meeting of shareholders.

The Board met six times during the year ended December 31, 2021. Each meeting was followed by an executive session of the independent directors.

The Chair presides at all meetings of the shareholders and of the Board and all executive sessions of the independent directors.

In 2021, all incumbent directors attended at least 99% of the aggregate of the meetings of the Board and the committees on which they served.

Governing Documents

The Board has adopted Corporate Governance Guidelines that meet the listing standards adopted by the NYSE and a Code of Business Conduct and Ethics that meets the NYSE’s listing standards and complies with the rules of the SEC. The Corporate Governance Guidelines and Code of Business Conduct and Ethics are available on Welltower’s website at www.welltower.com/investors/governance.

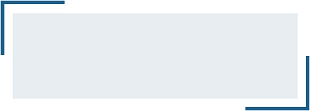

How We Identify Director Nominees

Consider current Board skill sets and needs Check conflicts of interest and references Nominating/Corporate Governance Committee dialogue Ensure Board is strong in core competencies of strategic oversight, corporate governance, shareholder advocacy and leadership and has diversity of expertise and perspectives to meet existing and future business needs All candidates are screened for conflicts of interest and independence Board dialogue and decision Nominating/Corporate Committee dialogue Meet with qualified candidates Consider shortlisted candidates, and after deliberations, recommend candidates for election to the Board Ensure appropriate personal qualities, such as independence of mind, tenacity, and skill set to meet existing or future business needs

When seeking potential directors, the Board generally looks for individuals who have displayed high ethical standards, integrity, and sound business judgment. The Board also believes that a nominee for director should be a current or former senior leader (such as a senior manager, chief operating officer, chief financial officer, or chief executive officer) of a complex organization such as a corporation (including a principal business unit or division of a corporation), university, foundation or governmental entity or otherwise be accustomed to dealing with complex organizational issues. In addition, directors and nominees for director should have the education, experience, intelligence, independence, fairness, reasoning ability, practical wisdom, and vision to exercise sound business judgment; strength of character; and values. We also expect directors and nominees for director to be willing to attend regularly scheduled meetings of the Board and its committees and to contribute a reasonable amount of time to Welltower’s affairs.

WELLTOWER • 2022 Proxy Statement 13

In identifying and evaluating nominees for director, the Nominating/Corporate Governance Committee first looks at the overall size and structure of the Board and the experience, skills, diversity and other qualities already represented. This process helps the committee determine if there are any specific qualities or skills that would complement the Board’s existing strengths. The Nominating/Corporate Governance Committee takes diversity into account in identifying and evaluating nominees for director. We view “diversity” broadly to include (1) professional experience, including experience in Welltower’s primary business segments and in areas of possible future expansion; (2) educational background; and (3) age, race, gender and national origin.

The Nominating/Corporate Governance Committee uses multiple sources for identifying and evaluating nominees for director, including referrals from current directors and management, and may seek input from third-party executive search firms. If the Nominating/Corporate Governance Committee retains one or more search firms, those firms may be asked to identify possible nominees, interview and screen such candidates, and act as a liaison between the Nominating/Corporate Governance Committee and each candidate during the screening and evaluation process.

The Nominating/Corporate Governance Committee will review the résumé and qualifications of each candidate based on the criteria described above and determine whether the candidate would add value to the Board. Once the Nominating/Corporate Governance Committee identifies promising candidates, the Nominating/Corporate Governance Committee will obtain such background and reference checks as it deems necessary, and the Chair of the Nominating/Corporate Governance Committee and the Chair of the Board will interview those individuals. Candidates who are good prospects are invited to meet the other members of the Nominating/Corporate Governance Committee, and if approved, will have an opportunity to meet with the remaining directors and management. At the end of this process, if the Nominating/Corporate Governance Committee determines that the candidate can add value to the Board and the candidate expresses an interest in serving on the Board, the Nominating/Corporate Governance Committee will recommend to the Board that the candidate stand for election by the shareholders or fill a vacancy or newly-created position on the Board.

In determining to nominate Mr. Bacon for re-election, the Nominating/Corporate Governance Committee and the Board carefully evaluated and took into account that Mr. Bacon serves on the boards of Ally Financial Inc., Arbor Realty Trust, and Comcast Corporation. The Nominating/Corporate Governance Committee determined, and the Board concurred, that Mr. Bacon is a valuable, productive, and fully engaged director who should be re-elected to the Board. In reaching this conclusion, the Nominating/Corporate Governance Committee took note of Mr. Bacon’s valuable role on the Board, his ongoing support in the seamless leadership transition to Mr. Mitra and stellar attendance record, and determined that Mr. Bacon’s contributions to Welltower are not compromised by the number of other boards on which he sits.

CANDIDATES SUBMITTED BY SHAREHOLDERS

The Nominating/Corporate Governance Committee will consider qualified Board nominees recommended by shareholders. Nominees for director who are recommended by shareholders will be evaluated in the same manner as any other nominee for director.

Recommendations may be submitted to the Nominating/Corporate Governance Committee in care of the Executive Vice President - General Counsel & Corporate Secretary, Welltower Inc., 4500 Dorr Street, Toledo, Ohio 43615. The Nominating/Corporate Governance Committee must receive recommendations for director nominees to be considered at our 2023 annual meeting by December 9, 2022. Such recommendations must include (1) the name, age, business address and, if known, residence address of the nominee, (2) the principal occupation or employment of the nominee for at least the last five years and a description of the qualifications of the nominee, (3) the class or series and number of shares of Welltower’s stock that are owned beneficially or of record by the nominee, and (4) any other information relating to the nominee that is required to be disclosed in solicitations for proxies for election of directors under Regulation 14A of the U.S. Securities Exchange Act of 1934, as amended, together with a written statement from the nominee that he or she consents to serve, if elected, and includes certain representations, and any questionnaires required to be completed by Welltower directors.

Also, the shareholder making the recommendation should include (1) his or her name and record address, together with the name and address of any other shareholder known to be supporting the nominee, and (2) the class or series and number of shares of Welltower’s stock that are owned beneficially or of record by the shareholder making the recommendation and by any other supporting shareholders.

In addition to the right of shareholders to recommend director nominees to the Nominating/Corporate Governance Committee, the By-Laws permit eligible shareholders to make nominations at a meeting of shareholders of candidates for election to the Board and to have their director nominees included in Welltower’s proxy materials if the shareholder or shareholders comply with specified prior notice requirements.

WELLTOWER • 2022 Proxy Statement 14

The By-Laws require that any such notice relating to a director nominee, whether provided in accordance with the advance notice or the proxy access provisions of the By-Laws, include, in addition to certain other requirements set forth in the By-Laws, all of the information specified in the paragraph above for shareholder recommendations to the Nominating/Corporate Governance Committee for director nominees.

Welltower may require that the proposed nominee furnish other information as Welltower may reasonably request to assist in determining the eligibility of the proposed nominee to serve as a director. At any meeting of shareholders, the Chair of the Board may disregard the purported nomination of any person not made in compliance with these procedures. For additional information regarding the deadlines under the advance notice and proxy access provisions of the By-Laws for our 2023 Annual Meeting of Shareholders, see pages 70-71.

Leadership Team

The Leadership Team—made up of our Named Executive Officers, senior vice presidents, and certain vice presidents—is responsible for developing and executing Welltower’s strategic plan and establishing and achieving the plan’s goals and objectives. Of the eighteen members on the Leadership Team, nine are women and/or racially/ethnically diverse.

To view the biographies of the members of Welltower’s Leadership Team, please visit https://welltower.com/about-us/leadership-team/.

Board Oversight of Risk Management

The Board and the Leadership Team play a vital role in overseeing the management of Welltower’s risks. The Board regularly reviews Welltower’s significant risk exposure, including operational, strategic, financial, legal, environmental sustainability and regulatory risks. The Board and the Audit Committee review the management of financial risk and Welltower’s policies regarding risk assessment and risk management. The Audit Committee reviews and discusses with management the strategies, processes and controls pertaining to the management of Welltower’s information technology operations, including cyber risks and information security. Annually, the Audit Committee receives a cybersecurity update from management, which covers the status of projects to strengthen Welltower’s security systems and improve cyber readiness as well as existing and emerging threat landscapes. The Audit Committee also oversees Welltower’s compliance program with respect to legal and regulatory requirements, including Welltower’s Code of Business Conduct and Ethics and our policies and procedures for monitoring compliance.

The Board and the Compensation Committee review the management of risks relating to Welltower’s compensation plans and arrangements. The Board and the Nominating/Corporate Governance Committee review the management of risks relating to environmental sustainability and Welltower’s corporate governance policies. The Leadership Team is responsible for the identification, assessment and management of risks and has established an Enterprise Risk Management Committee to ensure that appropriate risk identification and mitigation procedures are incorporated into Welltower’s daily activities and decision-making. This Committee is led by the Executive Vice President - General Counsel & Corporate Secretary and includes four additional members of the Leadership Team. Additionally, periodic risk reviews are performed with business unit leaders to assess the likelihood of adverse effects, the potential impact of those risks, risk tolerances and mitigating measures.

The Board meets at regular intervals with the Leadership Team and key members of management who are primarily responsible for risk management to review Welltower’s significant risk exposures. A report detailing risks identified and the results of mitigation efforts is provided to the Board on a regular basis, including the results of risk mitigation testing performed by Internal Audit. To ensure that cybersecurity is an organization-wide effort, Welltower provides annual cybersecurity training for all employees with network access and maintains a security risk insurance policy. We are not aware of any information security breaches within the last three years.

WELLTOWER • 2022 Proxy Statement 15

Annual Board Self-Evaluation

Each year, the Board and the Nominating/Corporate Governance Committee evaluate the effectiveness, size, composition and diversity of the Board as part of the Board and Committee self-evaluation process. These self-evaluations help the Nominating/Corporate Governance Committee assess the effectiveness of our procedures for identifying and evaluating nominees for director. In addition, every two years, the Nominating/Corporate Governance Committee engages an independent third party to conduct the Board and Committee self-evaluation process, which includes one-on-one meetings between the independent third party and each Board member.

Succession Planning

The Board and the Nominating/Corporate Governance Committee are actively engaged in succession planning. The Compensation Committee conducts an annual review of the CEO’s performance and oversees the performance evaluations of the other Named Executive Officers. Annually, the Board discusses succession plans for the CEO and other members of senior management. This succession planning addresses both succession in the ordinary course of business and contingency planning in case of unexpected events. Each of the CEO’s direct reports meets quarterly with the CEO to discuss development plans and opportunities. The Board also consults with the CEO regarding future candidates for senior leadership positions, succession timing for those positions, and development plans for the candidates with the greatest potential. This process facilitates a meaningful discussion regarding all senior leadership positions, ensures continuity of leadership over the long term, and forms the basis on which Welltower makes ongoing leadership assignments.

WELLTOWER • 2022 Proxy Statement 16

Limits on Board Service

We encourage directors to serve on other boards of directors to gain breadth of experience that is useful to the Board. However, directors may not serve on the boards of more than three other public companies. Directors who are chief executive officers of public companies may not serve on the boards of more than one other public company, in addition to Welltower’s Board.

Retirement Policy

While the Board has not established formal term limits, no person may be nominated for election as a director after his or her 75th birthday.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has been an executive officer or employee of Welltower, nor did any of them have any relationships requiring disclosure by Welltower under Item 404 of SEC Regulation S-K. None of Welltower’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity from which an executive officer served as a director of Welltower or member of the Compensation Committee during 2021.

Communications with the Board

Shareholders and other parties interested in communicating with the Board or any specific directors, including the Chair or the independent directors as a group, may do so by writing to: The Board of Directors, Welltower Inc., 4500 Dorr Street, Toledo, Ohio 43615.

The Executive Vice President - General Counsel & Corporate Secretary reviews all such correspondence and regularly forwards to the Board a summary of the correspondence (with copies of the correspondence attached) that, in the opinion of the Executive Vice President - General Counsel & Corporate Secretary, relates to the functions of the Board or its committees or that otherwise require their attention. If a communication received relates to questions, concerns or complaints regarding accounting, internal control over financial reporting or auditing matters, it will be summarized and forwarded to the Chair of the Audit Committee for review. Directors may at any time review a log of all correspondence received by Welltower that is addressed to members of the Board and request copies of such correspondence.

WELLTOWER • 2022 Proxy Statement 17

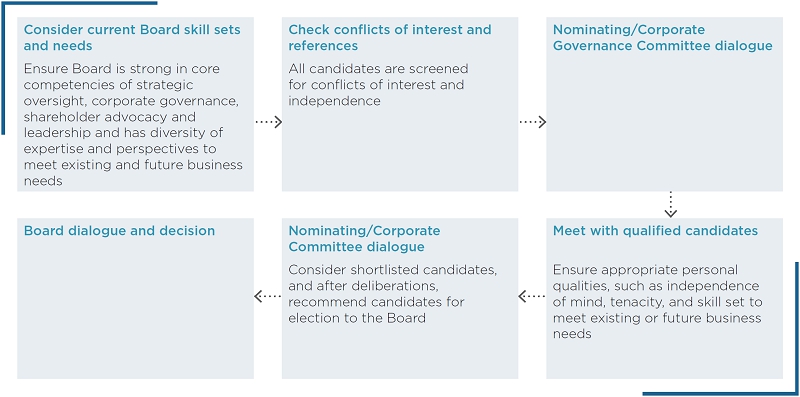

Welltower regularly engages in outreach efforts with shareholders relating to our business, executive compensation program, diversity and inclusion, and environmental, social and governance issues. This outreach program is conducted by a cross-functional team, including members of our Capital Markets, Finance, and Legal teams and the Board. We share the feedback we receive from our shareholders with all members of the Board, which gives directors valuable insight into shareholders’ views about Welltower and informs the Board’s decisions.

Welltower engages with shareholders year-round. The below graphic illustrates key elements of this engagement.

Engage with investors to understand executive compensation and environmental, social and governance priorities Share investor feedback with the Board Review vote results from our most recent annual meeting of shareholders, including the results of the say-on-pay vote, and engage with investors about these results Evaluate proxy season trends, corporate governance best practices, regulatory developments, and our current practices Share investor feedback with the Board Review and gather feedback from investors on any changes made to executive compensation and environmental, social, and governance matters Review end of year results with investors Share investor feedback with the Board

Welltower believes that frequent shareholder engagement is important to understanding varying perspectives on key issues and ensuring we implement best practices. In 2021, members of senior management conducted hundreds of meetings with shareholders, investors and analysts to discuss a number of topics, including financial results; Welltower strategy, objectives and performance; sustainability initiatives; compensation metrics; corporate governance initiatives; and industry trends. As part of our outreach, we engaged with several top shareholders on the topics of our business, executive compensation program, diversity and inclusion efforts, and environmental, social and governance issues. We value shareholder feedback on all topics of governance, and the feedback received is an important component of Board and committee discussions and decisions.

In addition to investor engagement, Welltower’s outreach efforts during 2021 included frequent business update presentations. Management viewed these updates as critical in keeping shareholders apprised of the impact of the COVID-19 pandemic on our business and operator responses to keep residents and staff safe.

For more information about our 2021 shareholder outreach program, see “Compensation Discussion and Analysis-Shareholder Outreach Initiatives” later in this Proxy Statement.

WELLTOWER • 2022 Proxy Statement 18

Proposal 1 – Election of Directors

Welltower’s By-Laws provide that the Board shall have between three and 15 members, with the exact number to be fixed by the Board from time to time. The Board has fixed the number of directors at 11. There are 10 Board nominees recommended for election at the Annual Meeting. The number of directors will automatically be decreased from 11 to 10 if the 10 Board nominees are elected at the Annual Meeting.

The shares represented by your proxy will be voted “for” the election of each of the nominees named below, unless you indicate in the proxy that your vote should be cast “against” any or all of them or that you “abstain.” Each nominee elected as a director will continue in office until the next annual meeting of shareholders and until his or her successor has been duly elected and qualified, or until the earliest of his or her resignation, removal or death. If any nominee declines or is unable to accept such nomination to serve as a director (which the Board does not now expect will happen), the Board reserves the right to substitute another person as a Board nominee, or to reduce the number of Board nominees, as it deems advisable. The proxy solicited hereby will not be voted to elect more than 10 directors.

Except in a contested election, each Board nominee will be elected only if the number of votes cast “for” the nominee’s election exceeds the number of votes cast “against” such nominee’s election. In a contested election (where the number of director nominees exceeds the number of directors to be elected), the vote standard will be a plurality of the votes cast.

Under Welltower’s By-Laws, any incumbent director nominee who receives a greater number of votes “against” his or her election than votes “for” such election will tender his or her resignation for consideration by the Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee will recommend to the Board the action to be taken with respect to such offer of resignation. The Board will act on that recommendation within 90 days from the date of the certification of election results and publicly disclose its decision and the rationale behind it.

THE BOARD OF DIRECTORS OF WELLTOWER UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE 10 NOMINEES. Each nominee receiving more votes “for” his or her election than votes “against” his or her election will be elected. |

WELLTOWER • 2022 Proxy Statement 19

SUMMARY OF BOARD SKILLS AND DIVERSITY

Our directors have an effective mix of backgrounds, diversity, experience, knowledge, and skills. The table below provides a summary of certain collective competencies and attributes of the director nominees. The table does not encompass all of any director’s skills or experience, and the absence of an indicator for a particular item does not mean that the director does not possess that skill or experience. We look to each director to be knowledgeable in all of these areas, and the absence of an indicator for a particular item does not mean a director is unable to contribute to the Board’s decision-making process. Rather, the indicator represents that the item is a core competency that the director brings to the Board.

| Category | Profile / Skills | Kenneth J. Bacon | Karen B. DeSalvo | Philip L. Hawkins | Dennis G. Lopez | Shankh Mitra | Ade J. Patton | Diana W. Reid | Sergio D. Rivera | Johnese M. Spisso | Kathryn M. Sullivan | |||||||||||

| Male | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Female | ● | ● | ● | ● | ||||||||||||||||||

| Asian | ● | |||||||||||||||||||||

| Black or African American | ● | ● | ||||||||||||||||||||

| Hispanic or Latino | ● | ● | ||||||||||||||||||||

| Native Hawaiian or Other Pacific Islander | ||||||||||||||||||||||

| Two or more Races | ||||||||||||||||||||||

| White | ● | ● | ● | ● | ● | |||||||||||||||||

| Banking / Finance / Accounting | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Financial Expert | ● | ● | ● | ● | ● | ● | ● | ● | ● | |||||||||||||

| Health Systems | ● | ● | ● | ● | ||||||||||||||||||

| Large Cap Public Companies | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Operations | ● | ● | ● | ● | ● | |||||||||||||||||

| Outpatient Medical | ● | ● | ● | |||||||||||||||||||

| REITs | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Real Estate | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Seniors Housing | ● | ● | ● | |||||||||||||||||||

| New or Existing Markets | ● | ● | ● | ● | ● | ● | ||||||||||||||||

| Cybersecurity/Information Technology | ● | ● | ● | ● | ||||||||||||||||||

| Enterprise Risk Management | ● | ● | ● | ● | ● | |||||||||||||||||

| Government / Public Policy | ● | ● | ● | |||||||||||||||||||

| Innovation Technology / Data | ● | ● | ● | |||||||||||||||||||

| International | ● | ● | ● | ● | ||||||||||||||||||

| Leadership Development + Succession | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| Retail / Institutional Investor Relations | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Strategy, Marketing, PR, Branding | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||

| Environmental | ● | ● | ● | ● | ● | ||||||||||||||||

| Social | ● | ● | ● | ● | ● | |||||||||||||||||

| Governance | ● | ● | ● | ● | ● | |||||||||||||||||

WELLTOWER • 2022 Proxy Statement 20

| SHANKH MITRA, Chief Executive Officer & Chief Investment Officer | ||

Age 41

Director

Welltower • Executive | EDUCATION: • BA – Engineering, Jadavpur University • MBA – Columbia Business School | |

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Public Storage | ||

KEY SKILLS AND EXPERIENCE: Mr. Mitra has served as Welltower’s Chief Executive Officer since October 2020 and its Chief Investment Officer since August 2018. He served as Welltower’s Vice Chair – Chief Operating Officer and Chief Investment Officer from April 2020 to October 2020. From January 2018 to August 2018, he served as Welltower’s Senior Vice President – Investments and, from January 2016 to January 2018, Mr. Mitra served as Welltower’s Senior Vice President – Finance & Investments. Prior to joining Welltower, Mr. Mitra served as Portfolio Manager, Real Estate Securities at Millennium Management, LLC from July 2013 to October 2015, as a Senior Analyst at Citadel Investment Group from April 2012 to June 2013, and as a Senior Analyst at Fidelity Investments from 2009 to 2012. Among other qualifications, Mr. Mitra has extensive knowledge of and experience in the real estate industry and capital markets. His day-to-day leadership as Chief Executive Officer & Chief Investment Officer provides him with intimate knowledge of Welltower’s business and operations. | ||

| KENNETH J. BACON, Chair & Independent Director |

Age 67

Director

Welltower • Executive | EDUCATION: • BA – Anthropology, Stanford University • MSc – International Relations, London School of Economics • MBA – Finance & Strategy, Harvard Business School | ||

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Ally Financial Inc. (Risk Committee Chair) • Arbor Realty Trust • Comcast Corporation (Governance and Directors Nominating Committee Chair) | FORMER PUBLIC COMPANY DIRECTORSHIPS • Forest City Realty Trust, Inc. | ||

KEY SKILLS AND EXPERIENCE: Mr. Bacon has served as Welltower’s Chair of the Board since October 2020. Mr. Bacon is a co-founder of RailField Realty Partners (a financial advisory and asset management firm) and has served as RailField’s managing partner since 2012. Prior to launching RailField, Mr. Bacon spent 19 years at Fannie Mae, most recently serving as Executive Vice President of the multifamily mortgage business from July 2005 to March 2012. Among other qualifications, Mr. Bacon’s extensive experience in financial services, real estate investment, government affairs and housing make him a valuable asset to the Board. | |||

WELLTOWER • 2022 Proxy Statement 21

| KAREN B. DESALVO, Independent Director | |||

Age 56

Director

Welltower • Investment • Nominating/ | EDUCATION: • BA – Biology and Political Science, Suffolk University • MD – Tulane University School of Medicine • MPH – Tulane University School of Public Health • MSc – Harvard T.H. Chan School of Public Health | ||

FORMER PUBLIC COMPANY DIRECTORSHIPS • Humana Inc. | |||

KEY SKILLS AND EXPERIENCE: Dr. DeSalvo is a physician executive who has served as the Chief Health Officer of Google since December 2019. She is on the Council of the National Academy of Medicine. From 2018-2019, she served as professor of medicine and population health at the University of Texas at Austin Dell Medical School and co-lead of the National Alliance to Impact the Social Determinants of Health with former HHS Secretary Michael O. Leavitt. From 2014 to 2017, she served as Acting Assistant Secretary for Health at the U.S. Department of Health and Human Services and as National Coordinator for Health Information Technology. From 2011 to 2014, she was Health Commissioner for the City of New Orleans. Prior to that she was Vice Dean for Community Affairs and Health Policy at the Tulane University School of Medicine, where she practiced medicine and led the medical school’s community health programs. She was formerly on the Medicare Payment Advisory Commission and the Board of Directors of Humana. Among other qualifications, Dr. DeSalvo’s experience in medical and public health leadership, health care technology, health care delivery and health care policy make her an important addition to the Board. | |||

| PHILIP L. HAWKINS, Independent Director | |||

Age 66

Director

Welltower • Compensation • Investment | EDUCATION: • BA – Hamilton College • MBA – University of Chicago | ||

OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Corporate Office Properties Trust | FORMER PUBLIC COMPANY DIRECTORSHIPS • Prologis, Inc. • DCT Industrial Trust Inc. | ||

KEY SKILLS AND EXPERIENCE: Mr. Hawkins has served as a member of the Board of Trustees of Corporate Office Properties Trust (a real estate investment trust that invests in office buildings) since 2014. He also serves as a board member of the following private companies: Link Logistics Real Estate as the Executive Chairman since January 2020, Washington Prime Group Inc. as the Chairman since February 2022, and Pure Industrial since February 2022. He served as a member of the Board of Directors of Prologis, Inc. from August 2018 to January 2020. From October 2006 to August 2018, he served as Chief Executive Officer, President and a member of the Board of Directors of DCT Industrial Trust Inc. (an industrial REIT that owned, acquired, operated and developed logistics related properties) until it merged into Prologis. From 2002 to 2006, Mr. Hawkins served as President and Chief Operating Officer and a member of the Board of Directors of CarrAmerica Realty Corporation. Earlier in his career at CarrAmerica, he served as Chief Operating Officer for four years and Managing Director of Asset Management for two years. Before that, Mr. Hawkins held a series of senior executive positions in real estate investment, development, leasing and management with LaSalle Partners, Ltd. and served on LaSalle’s Board of Directors. Among other qualifications, Mr. Hawkins’ extensive experience in real estate investment, development and operations in both public and private markets make him an important addition to the Board. | |||

WELLTOWER • 2022 Proxy Statement 22

| DENNIS G. LOPEZ, Independent Director | |||

Age 67

Director

Welltower • Compensation • Investment | EDUCATION: • BA – California State University, Long Beach • MBA – Finance and Accounting, University of California | ||

FORMER PUBLIC COMPANY DIRECTORSHIPS • American Campus Communities, Inc. | |||

KEY SKILLS AND EXPERIENCE: Mr. Lopez has served as the Chief Executive Officer of QuadReal Property Group Ltd. (a global real estate investment, operating and development company) since June 2017. He was Chief Investment Officer of AXA Real Estate Investment Managers (a global real estate investment manager) from 2009 to 2017, and Chief Executive Officer of SUN Real Estate Group (a private equity firm with real estate activities in India and Russia) from 2007 to 2009. Mr. Lopez has had a career of over 30 years in investment banking and real estate investment management, including serving as Global Head of Real Estate at Cambridge Place Investment Management (a London-based hedge fund) for two years and a Managing Director/Head of European Real Estate at JP Morgan in London for seven years. Among other qualifications, Mr. Lopez’s extensive experience in financial investment and services, real estate investment, and international business and investment make him a valuable asset to the Board. | |||

| ADE J. PATTON, Independent Director | ||

Age 43

Director

Welltower • Audit • Nominating/ | EDUCATION: • BA – Government, University of Virginia • MBA – Harvard Business School • JD – Harvard Law School | |

KEY SKILLS AND EXPERIENCE: Mr. Patton has served as Executive Vice President and Chief Financial Officer of HBO/HBO Max/Global DTC at WarnerMedia, LLC since August 2020, and previously served as Chief Financial Officer of Turner Sports and Head of Planning and Development at WM News & Sports from April 2019 to August 2020. Before assuming that role, Mr. Patton served as Senior Vice President – Corporate Finance, M&A and GTO of Turner Broadcasting System, Inc. from February 2017 to April 2019, Senior Portfolio Manager at Millennium Management, LLC (an investment management firm) from January 2015 to February 2017, Senior Research Analyst at Citadel LLC (a multinational hedge fund and financial services company) from June 2009 to March 2014, and Research Analyst at Magnetar Capital LLC (a hedge fund) from June 2007 to June 2009. Among other qualifications, Mr. Patton’s extensive experience in financial and investment management and operations make him a valuable asset to the Board. | ||

| DIANA W. REID, Independent Director | ||

Age 66

Director

Welltower • Audit • Executive • Nominating/ | EDUCATION: • BS – California State University, Chico • MBA – University of Virginia Darden School of Business | |

KEY SKILLS AND EXPERIENCE: Ms. Reid served as Executive Vice President of The PNC Financial Services Group, Inc. (a bank holding company) and the executive in its commercial real estate business from 2007 to 2019. She was Founding Partner of Beekman Advisors from 2003 to 2007, providing owners of privately-held real estate finance companies with strategic advice and sell-side representation. Earlier in her career, she held various roles in bond trading, capital markets, and financial institutions advisory for 19 years at the global investment bank now known as Credit Suisse. Among other qualifications, Ms. Reid’s extensive experience in real estate banking and capital markets make her an important addition to the Board.

| ||

WELLTOWER • 2022 Proxy Statement 23

| SERGIO D. RIVERA, Independent Director | |||

Age 59

Director

Welltower • Audit • Executive • Investment | EDUCATION: • BA – Finance and International Business, Florida International University • MBA – Florida International University | ||

FORMER PUBLIC COMPANY DIRECTORSHIPS • ILG, Inc. • SeaWorld Entertainment, Inc. | |||

KEY SKILLS AND EXPERIENCE: Mr. Rivera served as Chief Executive Officer of SeaWorld Entertainment, Inc. (a leading theme park and entertainment company) from November 2019 to April 2020. He served as President of the Ocean Reef Club (a leading private residential club) from February 2019 to May 2019. Mr. Rivera also served as Chief Executive Officer and President of the Vacation Ownership segment of ILG, Inc. (a hospitality and leisure services company) from 2016 to September 2018. From 1998 to 2016, Mr. Rivera served in a variety of capacities with Starwood Hotels & Resorts Worldwide, Inc., including President of The Americas from 2012 to 2016, and Chief Executive Officer and President of Starwood Vacation Ownership, Inc., formerly a wholly-owned subsidiary of Starwood Hotels & Resorts Worldwide, Inc., from 2007 to 2016. Among other qualifications, Mr. Rivera’s extensive experience in real estate development and investment strategy, corporate finance and accounting, and operating matters relevant to management of complex global businesses with one of the leading hotel and leisure companies in the world provides valuable insight to the Board. | |||

| JOHNESE M. SPISSO, Independent Director | ||

Age 61

Director

Welltower • Compensation • Nominating/ | EDUCATION: • BS – Health Science, Chapman College • MPA – University of San Francisco | |

CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Douglas Emmett, Inc. | ||

KEY SKILLS AND EXPERIENCE: Ms. Spisso has served as the President of UCLA Health (an academic medical center), Chief Executive Officer of the UCLA Hospital System and Associate Vice Chancellor of UCLA Health Sciences since 2016. Before assuming her positions at UCLA, she worked for 22 years at the University of Washington School of Medicine, including serving as Chief Health System Officer and Vice President, Medical Affairs for nine years. Among other qualifications, Ms. Spisso brings to the Board over 30 years of experience in large academic health system management and has demonstrated tremendous strategic and operational leadership during that time.

| ||

| KATHRYN M. SULLIVAN, Independent Director | ||

Age 66

Director

Welltower • Audit (Chair) • Compensation • Executive | EDUCATION: • BA – Accounting, University of Louisiana at Monroe • MBA – Louisiana State University | |

CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Hanger, Inc. | ||

KEY SKILLS AND EXPERIENCE: Ms. Sullivan served as Chief Executive Officer of UnitedHealthcare Employer and Individual, Local Markets (a diversified health care company), which is an operating division of UnitedHealth Group, from March 2015 to 2018. From 2008 to 2015, she served as Chief Executive Officer of UnitedHealthcare, Central Region. Among other qualifications, Ms. Sullivan’s experience in the health care industry, especially with respect to health plan payors, is extremely valuable to the Board.

| ||

WELLTOWER • 2022 Proxy Statement 24

The table below summarizes the compensation paid in 2021 to Welltower’s non-employee directors.

2021 Director Compensation Table

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(12) ($) | Total ($) | |||||||

| Kenneth J. Bacon | 355,500 | (2) | 175,139 | 530,639 | ||||||

| Karen B. DeSalvo | 99,000 | (3) | 175,139 | 274,139 | ||||||

| Jeffrey H. Donahue | 135,500 | (4) | 175,139 | 310,639 | ||||||

| Philip L. Hawkins | 100,000 | (5) | 175,139 | 275,139 | ||||||

| Dennis G. Lopez(1) | 56,896 | (6) | 105,511 | 162,407 | ||||||

| Sharon M. Oster(1) | 49,135 | (7) | 160,066 | 209,201 | ||||||

| Ade J. Patton(1) | 56,896 | (6) | 105,511 | 162,407 | ||||||

| Diana W. Reid | 115,470 | (8) | 175,139 | 290,609 | ||||||

| Sergio D. Rivera | 132,500 | (9) | 175,139 | 307,639 | ||||||

| Johnese M. Spisso | 102,000 | (10) | 175,139 | 277,139 | ||||||

| Kathryn M. Sullivan | 135,500 | (11) | 175,139 | 310,369 | ||||||

| (1) | Ms. Oster decided to not stand for election as a member of the Board at the 2021 Annual Meeting held on May 26, 2021 and therefore retired from the Board on that date. Messrs. Lopez and Patton were nominated to stand for election to the Board on March 30, 2021 and were elected to serve at the 2021 Annual Meeting held on May 26, 2021. |

| (2) | Includes $250,000 additional fee for serving as Chair of the Board and $7,500 additional fee for serving on the Executive Committee. Also includes $3,000 for attending more than four Board meetings. |

| (3) | Includes $3,000 for attending more than four Board meetings and $1,000 for attending more than four Nominating/Corporate Governance Committee meetings. |

| (4) | Includes $25,000 additional fee for serving as Chair of the Compensation Committee and $7,500 additional fee for serving on the Executive Committee. Also, includes $3,000 for attending more than four Board meetings, $3,000 for attending more than four Compensation Committee meetings, and $2,000 for attending more than four Investment Committee meetings. |

| (5) | Includes $3,000 for attending more than four Board meetings and $2,000 for attending more than four Investment Committee meetings. |

| (6) | Each of Mr. Lopez and Mr. Patton earned fees following their election to the Board on May 26, 2021. Mr. Lopez deferred 100% of his fees for 2021 pursuant to the Welltower Inc. 2019 Nonqualified Deferred Compensation Plan. |

| (7) | Fees were paid for Ms. Oster’s services through her retirement on May 26, 2021. |

| (8) | Includes $11,978 additional fee for serving as Chair of the Nominating/Corporate Governance Committee and $4,492 additional fee for serving on the Executive Committee. Also, includes $3,000 for attending more than four Board meetings and $1,000 for attending more than four Nominating/Corporate Governance Committee meetings. |

| (9) | Includes $25,000 additional fee for serving as Chair of the Investment Committee and $7,500 additional fee for serving on the Executive Committee. Also includes $3,000 for attending more than four Board meetings and $2,000 for attending more than four Investment Committee meetings. |

| (10) | Includes $3,000 for attending more than four Board meetings, $3,000 for attending more than four Compensation Committee meetings and $1,000 for attending more than four Nominating/Corporate Governance Committee meetings. |

| (11) | Includes $30,000 additional fee for serving as Chair of the Audit Committee and $7,500 additional fee for serving on the Executive Committee. Also includes $3,000 for attending more than four Board meetings. |

| (12) | Amounts set forth in this column represent the grant date fair value calculated in accordance with FASB ASC Topic 718 for deferred stock units granted to the non-employee directors on February 12, 2021 based on the closing price of $67.51 (other than Mr. Lopez and Mr. Patton) and on May 26, 2021 based on the closing price of $74.99 (other than Ms. Oster). Ms. Oster did not receive a grant on May 26, 2021 in light of her retirement from the Board on such date, and each of Messrs. Lopez and Patton only received a prorated grant on May 26, 2021 upon their appointment to the Board. As of December 31, 2021, (a) each non-employee director (other than Mr. Lopez and Mr. Patton) held an aggregate of 2,572 deferred stock units that had not yet been converted into shares of common stock and (b) Mr. Lopez and Mr. Patton held an aggregate of 1,407 deferred stock units that had not yet been converted into shares of common stock. |

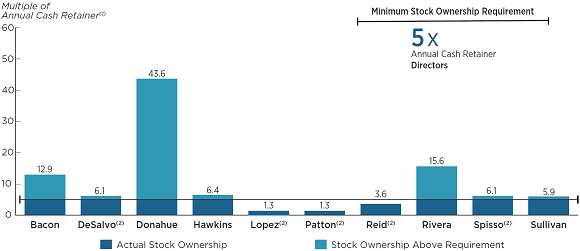

The form and amount of non-employee director compensation is determined by the Board upon the recommendation of the Compensation Committee. Generally, the Board’s policy is to pay its non-employee directors appropriate and competitive compensation to ensure Welltower’s ability to attract and retain highly-qualified directors in a manner consistent with recognized corporate governance best practices. Directors who are also employees do not receive additional compensation for their Board service. The Compensation Committee generally reviews non-employee director compensation on a semi-annual basis, most recently in November 2021, with its independent compensation consultant, which advises the Compensation Committee on the design and amount of compensation for non-employee directors. Any changes to the non-employee director compensation program are then recommended to the full Board for approval. No changes were recommended to the Board.

WELLTOWER • 2022 Proxy Statement 25

The compensation program for non-employee directors for the 2021 calendar year consisted of:

Cash Compensation

| Type of fee | Amount | |

| Annual retainer for all directors | $95,000 yearly | |

| Additional Chair of the Board fee | $250,000 yearly | |

| Additional Committee Chair fees: | ||

| • Audit | $30,000 yearly | |

| • Compensation, Investment | $25,000 yearly | |

| • Nominating/Corporate Governance | $20,000 yearly | |

| Additional fee for non-employee members of the Executive Committee | $7,500 yearly | |