UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | | |

| o | Preliminary Proxy Statement | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under § 240.14a-12 |

SJW Group

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | 5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | 3) | Filing Party: |

| | | |

| | 4) | Date Filed: |

| | | |

Notice of Annual Meeting of Stockholders

March 10, 2020

To Our Stockholders:

Notice is hereby given that the annual meeting of stockholders of SJW Group will be held on Wednesday, April 29, 2020 at 9:00 AM Pacific Time at the principal offices of SJW Group, 110 W. Taylor Street, San Jose, California 95110, for the following purposes, as more fully described in the Proxy Statement accompanying this Notice:

Proposal 1: To elect ten directors to serve on the Board of Directors of SJW Group;

Proposal 2: To approve, on an advisory basis, the compensation of the named executive officers as disclosed in this Proxy Statement;

Proposal 3: To ratify the appointment of KPMG LLP as the independent registered public accounting firm of SJW Group for the fiscal year ending December 31, 2020; and

Proposal 4: To act upon such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

The Board of Directors has set the close of business on Wednesday, March 4, 2020 as the record date for determining the stockholders entitled to notice of, and to vote at the annual meeting and at any adjournment or postponement thereof.

You are cordially invited to attend the meeting in person. You may call our offices at (408) 918-7231 for directions to our principal offices if you wish to attend the meeting in person. Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible. You may vote by telephone, via the Internet or by mailing a completed proxy card. For detailed information regarding voting instructions, please refer to the section entitled "Voting Procedure" on page 2 of the Proxy Statement. You may revoke a previously delivered proxy at any time prior to the meeting. If you attend the meeting and wish to change your proxy vote, you may do so automatically by voting in person at the annual meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON APRIL 29, 2020: A COPY OF THE PROXY STATEMENT, THE FORM OF PROXY, AND THE ANNUAL REPORT FOR THE YEAR ENDED ON DECEMBER 31, 2019 ARE AVAILABLE AT https://www.proxydocs.com/SJW.

Sincerely,

Eric W. Thornburg

President, Chief Executive Officer and

Chairman of the Board

TABLE OF CONTENTS |

| |

Page |

| |

| | |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| | |

| |

| |

| Security Ownership of Certain Beneficial Owners and Management | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

SJW Group

110 W. Taylor Street

San Jose, California 95110

Proxy Statement for the 2020 Annual Meeting of Stockholders

To Be Held on April 29, 2020

The enclosed proxy is solicited on behalf of the Board of Directors of SJW Group, a Delaware corporation ("SJW Group" or the "Corporation"), for use at SJW Group's annual meeting of stockholders to be held on Wednesday, April 29, 2020, at 9:00 AM Pacific Time and at any adjournment or postponement thereof. The annual meeting will be held at the principal offices of the Corporation, 110 W. Taylor Street in San Jose, California 95110.

These proxy solicitation materials are being mailed on or about March 17, 2020 to all stockholders entitled to notice of, and to vote at, the annual meeting of stockholders. SJW Group's 2019 Annual Report, which includes its Form 10-K for the year ended December 31, 2019, accompanies these proxy solicitation materials.

PURPOSE OF MEETING

The Board of Directors has called the annual meeting of stockholders for the following purposes:

| |

| 1. | To elect ten directors to serve on the Board of Directors of SJW Group; |

| |

| 2. | To approve, on an advisory basis, the compensation of the named executive officers as disclosed in this Proxy Statement; |

| |

| 3. | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of SJW Group for the fiscal year ending December 31, 2020; and |

| |

| 4. | To act upon such other business as may properly come before the annual meeting or any adjournment or postponement thereof. |

The Board of Directors asks for your proxy for each of the foregoing proposals, and in the case of Proposal 1, for each of the director nominees.

VOTING RIGHTS AND SOLICITATION

Voting

Only stockholders of record on March 4, 2020, the record date, will be entitled to notice of, and to vote at the annual meeting. As of the close of business on March 4, 2020, there were 28,493,151 shares of common stock issued and outstanding. Each share of common stock is entitled to one vote on each matter presented at the meeting.

Quorum and Votes Required

A majority of the Corporation's voting power of all shares of common stock issued and outstanding and entitled to vote must be present in person or represented by proxy at the annual meeting in order to constitute a quorum. Abstentions and broker non-votes (shares held of record by brokers for which the required voting instructions are not provided by the beneficial owners of those shares) are included in the number of shares present for purposes of determining whether a quorum is present for the transaction of business at the annual meeting. If a broker or other nominee holds shares in its name on behalf of a stockholder who is a beneficial owner of such shares, the broker or nominee is not permitted to vote those shares on Proposal 1 and Proposal 2 in the absence of voting instructions from that stockholder, and therefore broker non-votes will occur if no such instructions are given. The broker or nominee is permitted to vote on Proposal 3 in the absence of voting instructions from the stockholders who are beneficial owners of such shares, therefore the Corporation does not expect any broker non-votes for Proposal 3.

For Proposal 1, each director nominee is elected by a majority of the votes cast with respect to the director, i.e., the number of votes “for” the director exceeds the number of votes “against” the director. Our Amended and Restated Bylaws (the “Bylaws”) provide that any incumbent director who does not receive the required majority votes at the annual meeting will promptly tender his or her resignation to the Board, and the Board, after considering the recommendation of the Nomination & Governance Committee regarding such resignation, shall determine whether to accept or reject the resignation. For a more detailed description of the majority voting process, see "Proposal 1-Election of Directors-General." Abstentions and broker non-votes are not considered votes cast and will not be counted for Proposal 1.

Proposal 2 requires for approval the affirmative vote of a majority of stockholders present in person or represented by proxy at the meeting and entitled to vote. As a result, abstentions will have the same effect as voting against Proposal 2. For Proposal 2, broker non-votes will not be included in the calculation of votes because they are not considered as shares "entitled to vote" on the proposal. In addition, the stockholder vote on executive compensation in Proposal 2 is an advisory vote only, and it is not binding on the Corporation. Although the vote is non-binding, the Board of Directors and the Executive Compensation Committee will consider the outcome of the vote when making future compensation decisions affecting the Corporation’s named executive officers.

Proposal 3 requires for approval the affirmative vote of a majority of stockholders present in person or represented by proxy at the meeting and entitled to vote. As a result, abstentions will have the same effect as voting against Proposal 3. As discussed above, we do not expect broker non-votes in Proposal 3.

Voting Procedure

Stockholders of record may vote via the Internet, by telephone, by mailing a completed proxy card prior to the annual meeting, by delivering a completed proxy card at the annual meeting, or by voting in person at the annual meeting. Instructions for voting via the Internet or by telephone are set forth on the enclosed proxy card. The Internet and telephone voting facilities will close at 11:59 PM Eastern Time on April 28, 2020. If the enclosed form of proxy is properly signed, dated and returned, the shares represented thereby will be voted at the annual meeting in accordance with the instructions specified by the stockholder. If voting instructions are not specified on the proxy, the shares represented by that proxy (if that proxy is not revoked) will be voted at the annual meeting FOR the election of each of the director nominees listed in Proposal 1; FOR the advisory resolution to approve the compensation of the named executive officers as disclosed in this Proxy Statement in Proposal 2; and FOR the ratification of the appointment of KPMG LLP as the independent registered public accounting firm as described in Proposal 3, and as the proxy holder may determine in his or her discretion with respect to any other matter that properly comes before the annual meeting or any adjournment or postponement thereof.

YOUR VOTE IS IMPORTANT. PLEASE SIGN AND RETURN THE ACCOMPANYING PROXY CARD WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON.

You may revoke your proxy at any time before it is actually voted at the meeting by:

| |

| • | Delivering written notice of revocation to the Corporate Secretary at SJW Group, 110 W. Taylor Street, San Jose, California 95110; |

| |

| • | Submitting a later dated proxy; or |

| |

| • | Attending the meeting and voting in person. |

Your attendance at the meeting will not, by itself, constitute a revocation of your proxy.

You may also be represented by another person present at the meeting by executing a form of proxy designating that person to act on your behalf. Shares may only be voted by or on behalf of the record holder of shares as indicated in the stock transfer records of the Corporation. If you are a beneficial owner of shares, but those shares are held of record by another person such as a stock brokerage firm or bank, then you must provide voting instructions to the appropriate record holder so that such person can vote those shares. In the absence of such voting instructions from you, the record holder may not be entitled to vote those shares.

|

|

| We intend to hold our annual meeting in person. However, as part of our precautions regarding the coronavirus or COVID-19, we are considering the possibility that the annual meeting may be held by means of remote communication, including but not limited to, providing a webcast of the annual meeting or holding only a virtual meeting. If we determine it is necessary or appropriate to take any additional steps regarding how we conduct our annual meeting, we will announce the decision to do so in advance, and details on how to participate in our annual meeting will be available at www.sjwgroup.com. As always, we encourage you to vote your shares prior to the annual meeting. |

Proxy Solicitation Costs

The Corporation will bear the entire cost of this solicitation of proxies, including the preparation, assembly, printing, and mailing of this Proxy Statement, the proxy, and any additional solicitation materials that the Corporation may provide to stockholders. Copies of solicitation materials will be provided to brokerage firms, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners. The Corporation will reimburse the brokerage firms, fiduciaries and custodians holding shares in their names for reasonable expenses incurred by them in sending solicitation materials to its beneficial stockholders. The solicitation of proxies will be made by regular or first class mail and may also be made by telephone, telegraph, facsimile, electronic mail or personally by directors, officers and employees of the Corporation who will receive no extra compensation for such services. In addition, the Corporation has retained Georgeson LLC to act as a proxy solicitor in conjunction with the annual meeting. The Corporation has agreed to pay that firm $8,500, plus expenses, for proxy solicitation services.

PROPOSAL 1

ELECTION OF DIRECTORS

General

Ten directors, which will constitute the entire Board of Directors (the "Board") following the annual meeting, are to be elected at the annual meeting to hold office until the next annual meeting or until a successor for such director is elected and qualified, or until the death, resignation or removal of such director. In connection with the closing of the merger with Connecticut Water Service, Inc. ("CTWS") in October 2019, the Board appointed Mary Ann Hanley, Heather Hunt and Carol P. Wallace as directors of the Corporation, and each of them is a nominee for director at the annual meeting. Douglas R. King, current member of the Board, was not nominated for reelection and his term will expire after the annual meeting.

The Corporation's Bylaws provide a majority voting standard for the election of directors in uncontested elections. The election of directors at the annual meeting is uncontested, therefore under the Bylaws, each of the ten nominees set forth in this Proxy Statement will be elected by the majority of the votes cast with respect to such nominee. If an incumbent director does not receive the required majority vote, the director shall promptly tender his or her resignation to the Board. Within 90 days after the annual meeting, the Nominating & Governance Committee will make a recommendation to the Board of Directors as to whether to accept or reject the resignation. The Board will act by taking into account such committee’s recommendation. If the Board does not accept the resignation, the Board is required to publicly disclose its decision and the rationale behind the decision. For more detail about the majority voting standard, see our Bylaws which were filed with the Securities and Exchange Commission (the "SEC").

Unless individual stockholders specify otherwise, each returned proxy will be voted FOR the election of each of the ten nominees whose biographies are provided below, each of whom has been nominated by the existing Board of Directors upon the recommendation of the Nominating & Governance Committee.

Seven of the nominees are current directors of San Jose Water Company, a wholly owned subsidiary ("San Jose Water Company" or "SJWC") and SJW Land Company, another wholly owned subsidiary of the Corporation. SJW Group intends to appoint seven persons elected as directors of the Corporation at the annual meeting to be the directors of SJWC and a certain number as directors to be the directors of SJW Land Company for a concurrent term. It is anticipated that four of the individuals elected as directors of the Corporation at the annual meeting will also be appointed as directors of SJWTX, Inc., a wholly owned subsidiary of the Corporation, for a concurrent term. It is also anticipated that four of the individuals elected as directors of the Corporation at the annual meeting will also be appointed as directors of (i) SJWNE LLC, a wholly owned subsidiary of the Corporation, (ii) CTWS, a wholly owned subsidiary of SJWNE LLC, and (iii) as directors of certain subsidiaries of CTWS, for a concurrent term.

In the unanticipated event that a nominee is unable or declines to serve as a director at the time of the annual meeting, proxies will be voted for any nominee named by the present Board of Directors to fill the vacancy. As of the date of this Proxy Statement, SJW Group is not aware of any nominee who is unable or will decline to serve as a director.

Key Experience, Qualifications, Attributes and Skills of Board Nominees

The following biographies describe the particular experience, qualifications, attributes and skills that led the Board of Directors to conclude that each continuing director and nominee should serve as a director of SJW Group at this time, in light of its business and structure (in addition to any past experience on the Board of Directors of SJW Group and its subsidiaries). No nominee or current director has any family relationship with any other current director, nominee or with any executive officer. Other than Eric W. Thornburg, whose employment relationships with SJW Group and its subsidiaries which are described below, no nominee is or has been employed by SJW Group or its subsidiaries during the past five years.

|

| | | |

| Katharine Armstrong |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Chairman of the Advisory Board of Natural Resources Solutions (“NRS”) since 2017. Ms. Armstrong was the President of NRS from 2008 until 2017 and the President of Katharine Armstrong, Inc. from 2003 until 2014. Ms. Armstrong founded NRS in 2008, an Austin, Texas based company that works in partnership with universities, agencies of state and federal government, stakeholder groups and others to identify and implement positive solutions to environmental challenges created by regulatory mandates. Ms. Armstrong also served as a director of Uranium Energy Corp. from June 2012 until June 2014 and is a former Chairman of the Texas Parks and Wildlife Commission. |

| |

| | | |

Age: 67 | | Committees |

Director Since: 2009 | | l Executive Compensation Committee |

| | | l Nominating & Governance Committee (Chair) |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Ms. Armstrong brings to the Board of Directors contribute to the Board's oversight of the Corporation's operations in a heavily-regulated industry, its management of its water supply, its administration of executive officer compensation programs through the Executive Compensation Committee, and its commitment to community involvement. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Chairman of the Armstrong Center for Energy and the Environment since 2009, a Texas public policy foundation |

| l | Chairman of the Advisory Board and Past President of Natural Resources Solutions, an environmental consulting company based in Austin, Texas |

| l | Former Chairman of the Texas Parks and Wildlife Commission |

| l | Extensive experience in a wide variety of natural resource regulatory policy, including water |

| l | Participated in the formulation of a Land and Water Resources Conservation Plan, a strategic plan mandated by the Texas Legislature |

| l | Past President and current Board member of Texan by Nature, a state-wide conservation initiative founded by Laura Bush, former First Lady of the United States |

| l | Active in the State of Texas where the Corporation conducts business operations through its wholly owned subsidiary, SJWTX, Inc. |

| | |

|

| | | |

| Walter J. Bishop |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Principal in Walter Bishop Consulting, a firm dedicated to utility management, leadership development, and strategic and business planning since 2010. Mr. Bishop was the General Manager and acted as the Chief Executive Officer of the Contra Costa Water District (the "District") from September 1992 until 2010. The District served 600,000 customers in Northern California’s Contra Costa County. From 1983 until 1992, he worked for the East Bay Municipal Utility District in Northern California, including serving as its General Manager. Mr. Bishop has served as a Board Member, Chairman and Officer of numerous water industry organizations dedicated to water supply and utility management. Mr. Bishop is a registered civil engineer in the State of California, and holds a Bachelor of Science in Civil Engineering from Duke University and a Master’s Degree in Public Administration from Pepperdine University. |

| |

| | | |

Age: 68 | | Committees |

Director Since: 2012 | | l Executive Compensation Committee |

| | | l Finance Committee |

| | | l Nominating & Governance Committee |

| | | | l Sustainability Committee (Chair) |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Mr. Bishop brings to the Board of Directors contribute to the Board's oversight of the Corporation's operations in a heavily-regulated industry, its management of its water supply, and its commitment to community involvement. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Extensive experience leading and managing major water utilities in the United States with over one million customers |

| l | Nationally recognized leader and engineer in the water and wastewater industry for over 40 years and received awards from numerous organizations for his commitment to water issues and policy |

| l | Former member of the American Water Works Association's ("AWWA") Board of Directors and Executive Committee and served on the Water Utility Council, International Council and Strategic Planning Committee |

| l | Past Chair of the Water Research Foundation and member of the Board of Trustees for 12 years |

| l | Two-term member of the National Drinking Water Advisory Council which is chartered by Congress to advise the U.S. Environmental Protection Agency on national drinking water policy |

| | |

|

| | | |

| Mary Ann Hanley |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Ms. Hanley has been a director since 2019. Prior to that, she served as a director of CTWS since 1999. She currently serves as Director of the Valencia Society, the endowment fund for St. Francis Hospital and Medical Center, part of Trinity Health New England since 2015 and liaison for government and community alliances at Trinity Health since 1998. Ms. Hanley serves as the Chair of the Board of Oak Hill School since 2010, the largest private non-profit provider of services for people with disabilities in Connecticut. She has been a Director of Goodwin University since 2018 and a member of the Economic and Strategic Development Committee of the University since 2017. From January 1995 to February 1998, she was Legal Counsel to the Governor's Office, State of Connecticut and then Director of the State's Office for Workforce Competitiveness from 1999 to 2010. Ms. Hanley received a Bachelor of Arts from UCONN and a Master's in Public Policy from Trinity College and UCONN School of Law.

|

| |

| | | |

Age: 63 | | Committees |

Director Since: 2019 | | l Audit Committee |

| | | l Nominating & Governance Committee |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Ms. Hanley brings to the Board of Directors contribute to the Board's oversight of the Corporation's governmental relations in New England, legal and risk management, corporate governance, and its commitment to community involvement. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Over 10 years serving in State government both as a consultant and key government official in the offices of two Connecticut Governors |

| l | Over 15 years of direct interaction with the Connecticut General Assembly, executive branch agencies and the state's Congressional delegation |

| l | Negotiated legislative initiatives with members of the Connecticut General Assembly, business leaders and others, including the resolution of a State budget stalemate |

| l | Served as Secretary/Treasurer for over 10 years of CCEDA (Capitol City Economic Development Authority, now CRDA) overseeing a $1B investment in redeveloping downtown Hartford, Connecticut |

| l | Served as Director of the Office for Workforce Competiveness for the Connecticut Employment and Training Commission, the statewide workforce board responsible for recommending policy and planning guidance to the Governor and the legislature on workforce related strategies, investments, and programs |

| | |

|

| | | |

| Heather Hunt |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Ms. Hunt has been a director since 2019. Prior to that, she served as a director of CTWS since 2006. Ms. Hunt currently serves as an Executive Director of the New England States Committee on Electricity since January 2009. From October 2003 through December 2008 she was an attorney and had a regulatory law practice in Connecticut. From 2001 to 2003, Ms. Hunt was Director of State and Local Government Affairs at United Technologies Corporation and before that she was with the Southern Connecticut Gas Company in regulatory and public policy capacities, ultimately serving as Vice President. Ms. Hunt served as a Commissioner of the Maine Public Utility Commission from October 1995 through May 1998 and as a Commissioner of the Connecticut Department of Public Utility Control from October 1993 through July 1995. Ms. Hunt is serving a two-year term on the Living Donor Committee of the United Network for Organ Sharing, the non-profit organization that manages the nation's organ transplant system under contract with the federal government. Ms. Hunt received a Bachelor of Arts in Politics from Fairfield University and a Juris Doctor from Western New England College School of Law. |

| |

| | | |

Age: 54 | | Committees |

Director Since: 2019 | | l Executive Compensation Committee |

| | | l Nominating and Governance Committee

|

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Ms. Hunt brings to the Board of Directors contribute to the Board's oversight of the Corporation's operations in a heavily-regulated industry, legal and risk management, corporate governance, and its commitment to community involvement. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Experience as a utility regulator in Connecticut and Maine overseeing the rates and services of water and other public utilities |

| l | Experience interacting with government officials at the state level |

| l | Served as Vice President for a Connecticut natural gas utility, representing the company's interests before public utility regulators, and managing its government relations activities |

| l | Served as Director of State and Local Government affairs for Connecticut's then-largest employer |

| l | Owned a regulatory law practice and represented private and quasi-public entities in utility-related regulatory matters |

| l | Currently serving as the Executive Director of New England's Regional State Committee ("NESCOE") |

| l | Founder and president of Live On Organ Donation, Inc., a non-profit organization |

| | |

|

| | | |

| Gregory P. Landis |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Counsel to Yarmuth, LLP since April 2016. Mr. Landis served as General Counsel and Senior Vice President of TerraPower, LLC from January 2013 until January 2015 and Senior Advisor from January 2015 until December 2018. Mr. Landis also served as a director of Unwired Planet, Inc. from 2013 to 2015. He was General Counsel and then Senior Legal Advisor of Intellectual Ventures from November 2007 until December 2012. Previously, Mr. Landis served as the General Counsel and Executive Vice President of Vulcan, Inc. from 2005 to 2007, and from 1995 to 2005 was the General Counsel of AT&T Wireless Services, Inc., where he also served as Executive Vice President and Corporate Secretary. From 1985 until 1995, Mr. Landis was a partner at the law firm McCutchen, Doyle, Brown & Enersen. Mr. Landis holds a Juris Doctor, cum laude, from Harvard Law School, and a Bachelor of Arts in Psychology, magna cum laude, from Yale University. |

| |

| | | |

Age: 69 | | Committees |

Director Since: 2016 | | l Audit Committee |

| | | l Executive Compensation Committee |

| | | l Finance Committee |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Mr. Landis brings to the Board of Directors contribute to the Board's oversight of the Corporation's reporting and compliance requirements, corporate governance, and consideration of potential acquisitions and dispositions by the Corporation. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Legal, corporate governance, and mergers and acquisitions experience, including nearly 20 years of experience as chief legal officer for public and private corporations and over 18 years in commercial litigation |

| l | Utility regulatory experience before the California Public Utilities Commission and the Federal Energy Regulatory Commission |

| l | Leadership of government relations functions at public and private companies |

| l | Experience serving on the Board of Directors, chairing the Nomination and Governance Committee and serving on special committees of another publicly traded corporation |

| l | Service on various non-profit boards, including as Board Chair, Finance Committee Chair, and Strategic Planning Co-Chair |

| l | Service on various executive committees, including Compensation and Benefits, Business Ethics, and Recruiting |

| | |

|

| | | |

| Debra C. Man |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Retired as the Assistant General Manager and Chief Operating Officer at the Metropolitan Water District of Southern California (“Metropolitan”) in June 2017. She held such positions since December 2003. Metropolitan is a wholesale water utility that provides water to a six-county service area in which over 19 million people reside. She was responsible for managing the operational business functions of Metropolitan, including operations, engineering, water resource management, budget and regulatory compliance. Ms. Man had been with Metropolitan since 1986. Ms. Man is a registered engineer in California and Hawaii and holds a Bachelor of Science in Civil Engineering from University of Hawaii and a Master’s Degree in Civil Engineering from Stanford University. |

| |

| | | |

Age: 66 | | Committees |

Director Since: 2016 | | l Audit Committee |

| | | l Sustainability Committee |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Ms. Man brings to the Board of Directors contribute to the Board's oversight of the Corporation's operations in a heavily-regulated industry and its management of its water supply. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Experience in managing utility operations and capital investments, including managing an annual budget of over $1.4 billion |

| l | Experience as an executive officer responsible for compliance with federal and state drinking water quality regulations and workforce safety laws |

| l | Experience in negotiating labor contracts |

| l | Experience in maintaining over 100,000 acres of properties for operational use by a utility |

| | |

|

| | | |

| Daniel B. More |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Retired as a Managing Director and Global Head of Utility Mergers & Acquisitions of the Investment Banking Division of Morgan Stanley in 2014. He held such position since 1996. Mr. More has been an investment banker since 1978 and has specialized in the utility sector since 1986. Mr. More currently serves as a Senior Advisor to Guggenheim Securities since November 2015 and as a director of Clearway Energy, Inc. since February 2019. He served as a director of Saeta Yield from February 2015 until July 2018 and served as a director of the New York Independent System Operator from April 2014 until February 2016. Mr. More holds a Bachelor of Arts in Economics from Colby College and a Master of Business Administration in Finance from the Wharton School at the University of Pennsylvania. |

| |

| | | |

Age: 63 | | Committees |

Director Since: 2015 | | l Audit Committee |

| | | l Executive Compensation Committee (Chair) |

| | | | l Finance Committee (Chair) |

| | | | l Sustainability Committee |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Mr. More brings to the Board of Directors contribute to the Board's oversight of the Corporation's financial reporting requirements and consideration of potential acquisitions and dispositions by the Corporation. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Over 30 years of experience in investment banking, including capital raising, privatizations, and mergers and acquisitions with specialization in the utility sector since 1986 |

| l | Experience and knowledge in business strategy, strategic initiatives, corporate governance, and executive recruiting |

| l | Experience and knowledge of utility regulation, cost of capital proceedings and the rate making process |

| | |

|

| | | |

| Eric W. Thornburg |

| |

Position with the Corporation: President, Chief Executive Officer and Chairman of the Board |

| |

| | Business Experience |

| | President and Chief Executive Officer of SJW Group and SJW Land Company and Chief Executive Officer of San Jose Water Company and SJWTX, Inc. since November 6, 2017, and Chairman of the Board of SJW Group, San Jose Water Company, SJW Land Company and SJWTX, Inc. since April 25, 2018. Since October 9, 2019, Mr. Thornburg has served as Chairman of the Board of SJWNE LLC and Connecticut Water Service, Inc. ("CTWS") and all of its subsidiaries. Prior to joining the Corporation, Mr. Thornburg served as President and Chief Executive Officer of CTWS since 2006 and Chairman of the Board of CTWS since 2007. Mr. Thornburg served as President of Missouri-American Water, a subsidiary of American Water Works Corporation from 2000 to 2004. From July 2004 to January 2006, he served as Central Region Vice President-External Affairs for American Water Works Corporation. Mr. Thornburg holds a Bachelor of Arts in Biology and Society from Cornell University and a Master’s Degree in Business Administration from Indiana Wesleyan University. |

| |

| | | |

Age: 59 | | |

Director Since: 2017 | | |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Mr. Thornburg brings to the Board of Directors contribute to the Board's oversight of the Corporation's operations in a heavily-regulated industry, its management of its water supply, and the Corporation's execution of its overall strategy. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Over 30 years of leadership experience in the investor owned water utility profession across ten states and currently serving as the President, Chief Executive Officer, and Chairman of the Corporation with intimate knowledge and experience with our day-to-day operations |

| l | Served as President and Chief Executive Officer of another publicly traded water utility for over eleven years, including ten years as Board Chairman |

| l | Served as President of the National Association of Water Companies ("NAWC") in 2011 and as a Director for over a decade |

| l | Currently serving as a Trustee of the Water Research Foundation |

| | |

|

| | | |

| Robert A. Van Valer |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | President of Roscoe Moss Manufacturing Company, manufacturer of water well casing and screen and water transmission pipe, since 1990. Mr. Van Valer served as Vice President from 1984 until 1990 and previously managed domestic and international water well construction projects since joining Roscoe Moss Manufacturing Company in 1977. Mr. Van Valer has served as a Director Emeritus of the American Ground Water Trust since 2005 and as a Director Emeritus of the Groundwater Resources Association of California since 2017. Mr. Van Valer holds a Bachelor of Science in Finance from the University of Arizona and a Master of International Management from the Thunderbird School of Global Management.

|

| |

| | | |

Age: 70 | | Committees |

Director Since: 2006 | | l Nominating & Governance Committee |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Mr. Van Valer brings to the Board of Directors relate primarily to his substantial experience in the water industry that allows him to contribute to the Board's oversight of the Corporation's operations, through its wholly owned subsidiaries, San Jose Water Company and SJWTX, Inc. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Over 40 years of water industry experience, including water well construction, domestic and foreign, and manufacturing operations and management for water well casing and screen and water transmission pipe |

| l | President since 1990 of Roscoe Moss Manufacturing Company, supplier to municipal, state and federal water projects and investor owned utilities in the western United States |

| l | Participation in several industry non-profit and educational organizations and groundwater associations |

| | |

|

| | | |

| Carol P. Wallace |

| |

Position with the Corporation: Director |

| |

| | Business Experience |

| | Ms. Wallace has been a director since 2019. Prior to that, she served as a director of CTWS since 2003, serving as Chairman since 2017 and as Lead Independent Director from 2012 until 2017. She has 24 years of experience from 1994 until 2018 as the Chief Executive Officer of Cooper-Atkins Corporation and as an employee from 1991, a manufacturer of temperature acquisition instruments prior to its new ownership. Ms. Wallace currently serves as a director of Sandstone Group, LLC since 2012. She served as a Board member of Middlesex Hospital, Middletown, Connecticut from 2013 until February 2018. Ms. Wallace served as a director of Zygo Corporation from 2005 until June 2014. Ms. Wallace received a Bachelor of Arts in Biology from Middlebury College. |

| |

| | | |

Age: 65 | | Committees |

Director Since: 2019 | | l Finance Committee |

| | | | l Sustainability Committee |

| | | | |

| | | | |

| Key Experience, Qualifications, Attributes and Skills |

| The principal experience, qualifications and skills that Ms. Wallace brings to the Board of Directors contribute to the Board's oversight of the Corporation's executive leadership development, strategic planning, and customer and employee relations. In addition to the items listed in the biographical data above, such experience, qualifications and skills may be summarized as follows: |

| l | Served as CEO of Cooper-Atkins Corporation, a technology company that had $50M in annual sales, and had overall responsibility for all financial activity, audit, executive compensation, real estate, governance, management risk assessment, IT and strategic initiatives |

| l | Experience with executing acquisitions |

| l | Familiarity with and knowledge of regulatory activity related to the water industry |

| l | Past Chair of the Connecticut Business & Industry Association |

| l | Experience interacting with government officials at the state level |

| | |

Director Independence

The Board of Directors has affirmatively determined that each of its directors who served during the 2019 fiscal year, current directors and nominees, other than Eric W. Thornburg, the Corporation's President, Chief Executive Officer and Chairman of the Board, is independent within the meaning of the New York Stock Exchange director independence standards, as currently in effect.

In connection with the determination of independence for Robert A. Van Valer, the Board of Directors considered the Corporation's relationship with Roscoe Moss Manufacturing Company ("RMMC"), a supplier of the Corporation and its subsidiaries. Mr. Van Valer is the President and a stockholder of RMMC. RMMC sold Rossum Sand Tester equipment to San Jose Water Company, the Corporation's wholly owned subsidiary, for an aggregate price of approximately $8,191 in 2017, $0 in 2018, and $1,030 in 2019. In addition, RMMC sold conductor casing, well casing and screen for water wells with an aggregate price of approximately $554,093 in 2017, $0 in 2018, and $0 in 2019 to contractors for use in San Jose Water Company's well replacement construction projects. The Board of Directors concluded that the Corporation's relationship with RMMC is not a material relationship and therefore would not impair the independence of Mr. Van Valer in light of the fact that the aggregate sales of RMMC to the Corporation and contractors for use in San Jose Water Company construction projects were less than two

percent of RMMC's gross revenues in 2017, 2018, and 2019 and Mr. Van Valer expects that direct and indirect purchases of products from RMMC will be less than two percent of its revenue in future years.

The Board of Directors has determined that the members of the Audit Committee and the members of the Executive Compensation Committee also meet the additional independence criteria promulgated by the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the New York Stock Exchange for Audit Committee membership and Executive Compensation Committee membership, respectively.

Board Leadership Structure

Board structures vary greatly among U.S. public corporations, and the Board does not believe that any one leadership structure is more effective at creating long-term stockholder value. The Board believes that an effective leadership structure could be achieved either by combining or separating the Chair and Chief Executive Officer positions, so long as the structure encourages the free and open dialogue of competing views and provides for strong checks and balances.

The position of Chairman is currently held by Eric W. Thornburg, President and Chief Executive Officer of SJW Group. The Board also appointed Robert A. Van Valer, an independent director, as the Lead Independent Director of the Board. The Board of Directors believes that combining the Chair and Chief Executive Officer positions and having a Lead Independent Director is the appropriate leadership structure for the Corporation at this time. Combining the Chair and Chief Executive Officer roles fosters clear accountability, effective decision-making, and alignment on corporate strategy and value creation. The Board believes that the Chief Executive Officer is in an optimal position to identify and to lead Board discussions on important matters related to business operations. The Board believes this leadership structure is particularly appropriate for the Corporation at this time given Mr. Thornburg's many years of experience in managing companies in the regulated water utility industry and his familiarity with the challenges and intricacies of the regulatory environment.

As the Lead Independent Director, Mr. Van Valer assumes the following duties and responsibilities:

| |

| i. | advise and consult with the Chair regarding the information provided to directors in connection with Board meetings; |

| |

| ii. | ensure that independent directors have adequate opportunities to meet and discuss issues in executive sessions or at separate meetings without management being present and preside at such executive sessions and meetings; |

| |

| iii. | serve as principal liaison between the independent directors and the Chair; |

| |

| iv. | chair the meetings of the Board when the Chair is not present; and |

| |

| v. | respond directly to stockholders and other stakeholder questions and comments that are directed to the Lead Independent Director or to the independent directors as a group. |

The Board believes that this leadership structure provides strong, unified leadership of the Corporation while maintaining effective and independent oversight of management. Nevertheless, the Board will continue to consider from time to time whether this leadership structure should be maintained or modified.

Board's Role in Risk Oversight

The Corporation has implemented an internal risk assessment process that focuses on the principal risks that have been identified for the Corporation, including risks associated with the Corporation's regulatory environment, business operations and continuity, compliance requirements, its information technology and data storage and retrieval facilities, cyber risk, insurance coverage, liquidity, credit and other financial risks, internal controls over financial reporting, risks related to potential fraudulent activities and any material risks posed by the Corporation's compensation policies. Potential risks are reviewed and discussed by the Board of Directors on a regular basis. The Audit Committee, pursuant to its charter, meets periodically with employees to discuss identified risks and the measures taken to control, manage and mitigate those risks. On the basis of these meetings and discussions, the Chairman of the Audit Committee reports periodically to the full Board. In addition, the Executive Compensation Committee

oversees risk management as it relates to the compensation plans, policies and practices for all employees, including executive officers, particularly whether the compensation programs may create incentives for employees to take excessive or inappropriate risks which could have a material adverse effect on the Corporation. The Nominating & Governance Committee monitors the effectiveness of the corporate governance guidelines and policies and manages risks associated with the independence of the Board of Directors and qualification of directors and nominees for directors.

Board Committees

The Board of Directors has a standing Audit Committee, Executive Compensation Committee, Nominating & Governance Committee, Finance Committee and Sustainability Committee. The Board has the authority to form additional committees, and has done so from time to time, to address matters specifically identified by the Board.

Audit Committee

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee assists the Board of Directors in its oversight of the integrity of the financial reports and other financial information provided by the Corporation to any governmental body or the public, the Corporation's compliance with legal and regulatory requirements, the Corporation's systems of internal controls, the qualifications and independence of the independent accountants, and the quality of the Corporation's accounting and financial reporting processes generally. The Audit Committee also reviews significant accounting policies and the financial results with management and the independent accountants. Mses. Hanley and Man and Messrs. King, Landis, and More are current Audit Committee members, and Mr. King serves as the Chair of the Audit Committee. Mr. King was not nominated for reelection for director and his term will expire after the annual meeting. Accordingly, Mr. King will not serve as a member and the Chair of the Audit Committee after the annual meeting. It is expected that Mr. More will serve as the Chair of the Audit Committee after the annual meeting.

These members are independent as such term is defined pursuant to the Exchange Act and the corporate governance listing standards of the New York Stock Exchange with respect to audit committee members. The Board of Directors has determined that each of Mr. King and Mr. More is an "audit committee financial expert" as defined in SEC rules and all committee members are financially literate. The Audit Committee held eight meetings during fiscal year 2019. The Audit Committee has a written charter which may be found at the Corporation's website at www.sjwgroup.com.

Executive Compensation Committee

The Executive Compensation Committee assists the Board of Directors in its responsibilities with respect to the compensation of the Corporation's executive officers and administers certain employee benefit plans, including the Corporation's Long-Term Incentive Plan, and other incentive plans that may be adopted by the Corporation. The Executive Compensation Committee is authorized to approve the compensation payable to the Corporation's executive officers, approve all perquisites, equity incentive awards and special cash payments made or paid to executive officers, and to approve severance packages with cash and/or equity components for the executive officers. Additionally, the Executive Compensation Committee reviews and recommends to the Board of Directors appropriate director compensation programs.

The Executive Compensation Committee retained Mercer (US), Inc. to serve as the committee's independent compensation consultant and provide advice on executive officer and director compensation for the 2019 fiscal year. The role of such consultant, the nature and scope of the consultant’s assignments and the material elements of the instructions or directions given to the consultant with respect to the performance of its duties are more fully set forth below in the section titled "Compensation Discussion and Analysis."

Mses. Armstrong and Hunt and Messrs. Bishop, Landis, and More are current members of the Executive Compensation Committee, and Mr. More serves as the Chair of the Executive Compensation Committee. Each of these members is independent as such term is defined pursuant to the Exchange Act and the corporate governance listing standards of the New York Stock Exchange with respect to

compensation committee members. The Executive Compensation Committee held seven meetings during fiscal year 2019. The Executive Compensation Committee has a written charter which may be found at the Corporation's website at www.sjwgroup.com.

Nominating & Governance Committee

The Nominating & Governance Committee is charged by the Board of Directors with reviewing and proposing changes to the Corporation's corporate governance policies, developing criteria for evaluating performance of the Board of Directors, determining the requirements and qualifications for members of the Board of Directors and proposing to the Board of Directors nominees for the position of director of the Corporation. Mses. Armstrong, Hanley, and Hunt and Messrs. Bishop, King, and Van Valer are current Nominating & Governance Committee members, and Ms. Armstrong serves as the Chair of the Nominating & Governance Committee. Mr. King was not nominated for reelection for director and his term will expire after the annual meeting. Accordingly, Mr. King will not serve as a member of the Nominating & Governance Committee after the annual meeting. The Board of Directors has determined that all of the members of the Nominating & Governance Committee are independent as defined under the independence standards for nominating committee members in the listing standards for the New York Stock Exchange. The Nominating & Governance Committee held four meetings during fiscal year 2019. The Nominating & Governance Committee has a written charter which may be found at the Corporation's website at www.sjwgroup.com. Upon recommendation of the Nominating & Governance Committee, the Board approved Corporate Governance Policies that set forth additional principles and procedures regarding the functions, responsibilities and other governance matters of the Board and its committees and members. Such Corporate Governance Policies may be found at the Corporation's website at www.sjwgroup.com.

The Board of Directors has approved the "Policies and Procedures of the Nominating & Governance Committee for Nomination for Directors" (as amended, the "Policies and Procedures"). The Policies and Procedures specify director selection criteria for the Nominating & Governance Committee to consider and the procedures for identifying and evaluating director candidates for the Nominating & Governance Committee to follow when executing its duty to recommend director nominees at the annual meeting of stockholders. The Policies and Procedures also specify steps a stockholder must take in order to properly recommend director candidates which the Nominating & Governance Committee will consider. All candidates for director must generally meet the criteria set forth in the Policies and Procedures, a copy of which may be found at the Corporation's website at www.sjwgroup.com.

The criteria addresses the specific qualifications that the Nominating & Governance Committee believes must be met by each nominee prior to recommendation by the committee for a position on the Corporation's Board of Directors. In particular, the criteria addresses the specific qualities or skills that the Nominating & Governance Committee believes are necessary for one or more of the Corporation's directors to possess in order to fill Board, committee chair and other positions, and to provide the best combination of experience and knowledge on the Board and its committees. These criteria include: highest professional and personal ethical standards; absence of any interests that would materially impair his or her ability to exercise judgment or otherwise discharge the fiduciary duties; ability to contribute insight and direction to achieve the Corporation's goals; skills and expertise relative to the entire make-up of the Board; experience in effective oversight and decision-making, including experience on other boards; ability and willingness to serve a full term with consistent attendance; first-hand business experience and achievement in the industry; and independence as determined under the New York Stock Exchange and SEC rules and regulations. The Nominating & Governance Committee and the Board of Directors do take diversity into account when considering potential nominees for directors, such as differences of viewpoint, varied professional or governmental experience, education and advanced degrees, skill set and other individual qualities and attributes that are likely to contribute to board heterogeneity. However, SJW Group does not have a formal or other established policy in which one or more diversity factors have been specifically identified for application as a matter of ordinary course in the director nominee process.

The steps a stockholder must take in order to properly recommend director candidates which the Committee will consider include submission via mail to the attention of the Nominating & Governance

Committee at the address of the Corporate Secretary, SJW Group, 110 W. Taylor Street, San Jose, California 95110, of a completed "Stockholder Recommendation of Candidate for Director" form which can be found at the Corporation's website at www.sjwgroup.com or may be obtained by mailing a request for a copy of the form to the Corporate Secretary of the Corporation at the above address. A completed form must be submitted not earlier than 210 days prior and not later than 120 days prior to the one-year anniversary of the date the Proxy Statement for the preceding annual meeting was mailed to stockholders. In addition to or in lieu of making a director candidate recommendation via the completed recommendation form, stockholders may nominate directly a person for election as a director at the annual meeting by complying with the procedures set out in the Corporation's Bylaws and other applicable federal and state laws governing the election of directors and distribution of proxy statements. Under the Bylaws, a nominating stockholder must provide the Corporation with advance written notice of a proposed nomination no later than 90 days and no earlier than 120 days prior to the one-year anniversary of the preceding year's annual meeting. Such advance notice must include certain information and materials relating to the stockholder and the proposed nominee as prescribed under the Bylaws, including without limitation the name and qualification of the proposed nominee and other information typically required in a proxy statement filed under SEC proxy rules. For more information on the procedure and advance notice requirements for nominating a director, see the Corporation's Bylaws, a copy of which was filed with the SEC.

Finance Committee

The Finance Committee is charged with assisting the Board of Directors in overseeing the Corporation’s strategy and financing. The Finance Committee reviews and makes recommendations to the Board of Directors regarding the Corporation’s long-term growth strategy, public and private financing, any equity repurchase programs, dividend payments and other distributions of equity. The Finance Committee also reviews significant rating agency communications, the Corporation's rating, its debt ratings and business opportunities. The Finance Committee became a standing committee on October 24, 2018. Prior to this date, the Finance Committee was a special committee of the Board. Ms. Wallace and Messrs. Bishop, King, Landis and More are current Finance Committee members, and Mr. More serves as the Chair of the Finance Committee. Mr. King was not nominated for reelection for director and this term will expire after the annual meeting. Accordingly, Mr. King will not serve as a member of the Finance Committee after the annual meeting. The Finance Committee held four meetings during fiscal year 2019. The Finance Committee has a written charter which may be found at the Corporation's website at www.sjwgroup.com.

Sustainability Committee

The Sustainability Committee is charged with providing guidance to the Board of Directors regarding plans, programs, and activities related to the health and safety of employees, customers, business partners, and the public related to the Corporation’s operating subsidiaries. The Sustainability Committee also provides guidance to the Board of Directors on plans, programs, and activities related to environmental stewardship and sustainability, water supply and conservation, water quality, climate change, operational efficiency and the Corporation’s established water supply policies and any water supply projects. The Sustainability Committee became a standing committee on October 24, 2018. Prior to this date, the Sustainability Committee was a special committee named the Water Supply Committee. Mses. Man and Wallace and Messrs. Bishop and More are the current Sustainability Committee members, and Mr. Bishop serves as the Chair of the Sustainability Committee. The Sustainability Committee held four meetings during fiscal year 2019. The Sustainability Committee has a written charter which may be found at the Corporation's website at www.sjwgroup.com.

Evaluation of Board and Committee Performance

Annually, the Board and each of our Audit, Executive Compensation and Nominating & Governance Committees conduct a self-evaluation pursuant to our Corporate Governance Policies or applicable committee charters. In addition, the Nominating & Governance Committee is responsible to report annually to the Board an assessment of the Board’s performance based on such evaluation, which

includes a review of the Board’s overall effectiveness and the areas in which the Board or management believes the Board can make an impact on the Corporation.

Communications with the Board

Communications to the Board of Directors may be submitted by email to boardofdirectors@sjwater.com or by writing to SJW Group, Attention: Corporate Secretary, 110 W. Taylor Street, San Jose, California 95110. The Board of Directors relies upon the Corporate Secretary to forward written questions or comments to named directors or committees or the Lead Independent Director, as appropriate. General comments or inquiries from stockholders are forwarded to the appropriate individual within the Corporation, including the President, as appropriate.

Interested parties may make their concerns known to non-management directors or independent directors on a confidential and anonymous basis either online or by calling the Corporation's toll free hotline, 1-888-883-1499.

Code of Conduct

The Corporation has adopted a Code of Conduct (as amended, the "Code") that applies to the directors, officers and employees of the Corporation. A copy of the Code may be found at the Corporation's website at www.sjwgroup.com. In the event that we make any amendments to or grant any waivers of a provision of the Code that applies to the principal executive officer, principal financial officer, or principal accounting officer that requires disclosure under applicable SEC rules, we intend to disclose such amendment or waiver and the reasons therefore, on our website at www.sjwgroup.com.

Board Meetings

During fiscal year 2019, there were four regular meetings and five special meetings (including one strategic planning meeting) of the Board of Directors of SJW Group. Each director attended or participated in 75 percent or more of the aggregate of: (i) the total number of regular and special meetings of the Board of Directors of SJW Group; and (ii) the total number of meetings held by all committees of the Board on which such director served during the 2019 fiscal year. As the Lead Independent Director, Robert A. Van Valer presides at all executive sessions of non-management directors or independent directors.

Pursuant to the Corporation's Corporate Governance Policies, each member of the Board of Directors is strongly encouraged to attend the annual meetings of stockholders. All members of the Board who were nominated for election at the 2019 annual meeting attended such meeting.

Compensation of Directors

The following table sets forth certain information regarding the compensation of each non-employee member of the Board of Directors of SJW Group for the 2019 fiscal year: |

| | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($) | Change in Pension Value ($)(2) | Total ($) |

| Katharine Armstrong | 111,843 |

| | 78,511 |

| (3 | ) | — |

| | 190,354 |

| |

| Walter J. Bishop | 126,843 |

| | 78,511 |

| (3 | ) | — |

| | 205,354 |

| |

| Mary Ann Hanley (4) | 21,195 |

| | — |

| | — |

| | 21,195 |

| |

| Heather Hunt (4) | 22,695 |

| | — |

| | — |

| | 22,695 |

| |

| Douglas R. King | 118,985 |

| | 78,511 |

| (3 | ) | 63,000 |

| | 260,496 |

| |

| Gregory P. Landis | 111,485 |

| | 78,511 |

| (3 | ) | — |

| | 189,996 |

| |

| Debra C. Man | 101,985 |

| | 78,511 |

| (3 | ) | — |

| | 180,496 |

| |

| Daniel B. More | 138,985 |

| | 78,511 |

| (3 | ) | — |

| | 217,496 |

| |

| Robert A. Van Valer | 103,843 |

| | 78,511 |

| (3 | ) | — |

| | 182,354 |

| |

| Carol P. Wallace (4) | 19,695 |

| | — |

| | — |

| | 19,695 |

| |

| |

| (1) | Consists of the annual retainer and meeting fees for service as a member of the Board of Directors of the Corporation for the 2019 fiscal year and annual retainer and meeting fees for services as board members of San Jose Water Company, SJW Land Company, and SJWTX, Inc. earned prior to October 9, 2019, including amounts deferred under the Corporation’s Deferral Election Program for Non-Employee Board members. The respective dollar amounts of these fees are set forth in the table below. For further information concerning such fees, see the sections below entitled "Director Annual Retainer and Meeting Fees." |

|

| | | | | | | | | |

| Name | 2019 Retainer ($) | 2019 Meeting Fees ($) | Total Annual Service Fees ($) |

| Katharine Armstrong | 72,843 |

| | 39,000 |

| | 111,843 |

| |

| Walter J. Bishop | 72,843 |

| | 54,000 |

| | 126,843 |

| |

| Mary Ann Hanley | 15,195 |

| | 6,000 |

| | 21,195 |

| |

| Heather Hunt | 15,195 |

| | 7,500 |

| | 22,695 |

| |

| Douglas R. King | 76,485 |

| | 42,500 |

| | 118,985 |

| |

| Gregory P. Landis | 61,485 |

| | 50,000 |

| | 111,485 |

| |

| Debra C. Man | 61,485 |

| | 40,500 |

| | 101,985 |

| |

| Daniel B. More | 78,985 |

| | 60,000 |

| | 138,985 |

| |

| Robert A. Van Valer | 75,343 |

| | 28,500 |

| | 103,843 |

| |

| Carol P. Wallace | 15,195 |

| | 4,500 |

| | 19,695 |

| |

| |

| (2) | Represents the increase in the aggregate benefit payable to Mr. King under the Director Pension Plan as a result of the increase in the annual retainer in effect for Mr. King from December 31, 2018 to December 31, 2019. For further information concerning the pension benefit, see the section below entitled “Director Pension Plan.” |

| |

| (3) | Represents the grant-date fair value of the restricted stock unit award for 1,302 shares made to the non-employee director on April 24, 2019. The applicable grant-date fair value of each award was calculated in accordance with FASB ASC Topic 718 and accordingly determined on the basis of the closing selling price per share of SJW Group’s common stock on the award date as appropriately discounted to reflect the lack of dividend equivalent rights. The reported grant-date value does not take into account any estimated forfeitures related to service-vesting conditions. In addition to the restricted stock units, as of December 31, 2019, Messrs. King and Van Valer held deferred stock awards covering 9,294 and 2,705 shares of SJW Group's common stock, respectively, attributable to the director's prior participation in certain deferred compensation programs implemented under the Corporation's Long-Term Incentive Plan. The awards no longer accrue dividend equivalent rights. Their last dividend equivalent right conversion into deferred stock occurred on January 2, 2018 (for the 2017 fiscal year). For further information concerning those programs, see the sections below entitled "Deferral Election Program for Non-Employee Board Members" and "Deferred Restricted Stock Program." |

| |

| (4) | Appointed as a member of the Board of Directors of the Corporation on October 9, 2019. |

Director Annual Retainer and Meeting Fees

Our non-employee Board members receive an annual retainer and meeting fees under the Director Compensation and Expense Reimbursement Policies which were amended and restated on January 1, 2019 and again on October 9, 2019. A copy of the Director Compensation and Expense Reimbursement Policies amended and restated effective January 1, 2019, is attached as Exhibit 10.50 to the Form 10-K filed for the year ended December 31, 2018. A copy of the Director Compensation and Expense Reimbursement Policies amended and restated on October 9, 2019, is attached as Exhibit 10.2 to the Form 8-K filed on October 9, 2019.

The following table sets forth the 2019 annual retainer fees for the non-employee Board members of SJW Group, San Jose Water Company, SJW Land Company, and SJWTX, Inc. under the Director Compensation and Expense Reimbursement Policies as in effect from January 1, 2019 to October 8, 2019 and from October 9, 2019 to December 31, 2019. Beginning on October 9, 2019, the annual retainer for non-employee Board members of SJW Group was increased and the non-employee Board members of San Jose Water Company, SJW Land Company, and SJWTX, Inc., including non-employee Board members of SJW Group serving on such Boards, are no longer entitled to receive annual retainer fees for board services on the boards of those subsidiaries.

|

| | | | | |

| | 2019 Annual Retainer ($) | |

| | January 1 - October 8 | October 9 - December 31 | |

| SJW Group | |

| | |

| Chair | 30,000 |

| 100,000 |

| |

| Other Board Members | 5,000 |

| 66,500 |

| |

| Additional Fee for Lead Independent Director | 10,000 |

| 10,000 |

| |

| Audit Committee Chair | 15,000 |

| 15,000 |

| |

| Executive Compensation Committee Chair | 10,000 |

| 10,000 |

| |

| All other Committee Chairs | 7,500 |

| 7,500 |

| |

| San Jose Water Company | |

| | |

| Chair | 60,000 |

| — |

| |

| Other Board Members | 50,000 |

| — |

| |

| SJW Land Company | |

| | |

| Chair | 10,000 |

| — |

| |

| Other Board Members | 5,000 |

| — |

| |

| SJWTX, Inc. | |

| | |

| Chair | 5,000 |

| — |

| |

| Other Board Members | 5,000 |

| — |

| |

The following table sets forth the 2019 per meeting Board and Committee fees for the non-employee Board members of SJW Group, San Jose Water Company, SJW Land Company, and SJWTX, Inc. effective under the amended and restated Director Compensation and Expense Reimbursement Policies as in effect from January 1, 2019 to October 8, 2019 and from October 9, 2019 to December 31, 2019. Beginning on October 9, 2019, the fees for strategic planning meetings of the SJW Group Board was reduced and non-employee Board members of San Jose Water Company, SJW Land Company, and SJWTX, Inc., including non-employee Board members of SJW Group serving on such Boards, are no longer entitled to receive fees for attendance at the board meetings of those subsidiaries.

|

| | | | | |

| | Per Meeting Fee (1)($) | |

| | January 1 - October 8 | October 9 - December 31 | |

| SJW Group | |

| | |

| Chair and Other Board Members | 1,500 |

| 1,500 |

| |

| Strategic Planning Meeting | 2,500 |

| 1,500 |

| |

| SJW Group Committees | |

| | |

| Chair and other members | 1,500 |

| 1,500 |

| |

| San Jose Water Company | |

| | |

| Chair and Other Board Members | 1,500 |

| — |

| |

| SJW Land Company | |

| | |

| Chair and Other Board Members | 500 |

| — |

| |

| SJWTX, Inc. | |

| | |

| Chair | 2,500 |

| — |

| |

| Other Board Members | 500 |

| — |

| |

The meeting fees are the same for attending Board and Committee meetings held telephonically.

In the event a non-employee director attends an in-person Board or Committee meeting by telephone, he or she will be entitled to receive the applicable per meeting fee for the first meeting

attended by telephone in a calendar year, and half of such meeting fee for each subsequent meeting attended by telephone in the same calendar year.

Non-employee directors may also receive fees determined on a case-by-case basis by SJW Group's Executive Compensation Committee and ratified by the Board of Directors for attending additional meetings other than Board or Committee meetings, such as Board retreats, strategic planning meetings, or other programs organized by SJW Group or its subsidiaries.

Deferral Election Program for Non-Employee Board Members

Pursuant to the Deferral Election Program, each non-employee member of the Corporation's Board of Directors has the opportunity to defer: (i) either 50 percent or 100 percent of his or her annual retainer fees for serving on the Corporation's Board and the Board of one or more subsidiaries; and (ii) 100 percent of his or her fees for attending pre-scheduled meetings of such Boards or any committees of such Boards on which he or she serves. The deferral election is irrevocable and must be made prior to the start of the year for which the fees are to be earned.

The fees which a non-employee Board member elects to defer under such program for the fiscal year are credited to a deferral election account pursuant to one of the following alternatives selected by the Executive Compensation Committee: (i) in a lump sum on the first business day of that calendar year or as soon as administratively practicable thereafter; or (ii) periodically when the fees would otherwise become due and payable during such calendar year in the absence of his or her deferral election for that calendar year in which case the amounts credited shall be fully vested on crediting. In the event of such lump sum credit, the non-employee Board members will vest in the portion of their account attributable to each Board or Board committee on which they serve during a calendar year in a series of 12 equal monthly installments upon their completion of each calendar month of service on that Board or Board committee during such calendar year. For the deferral election accounts established for the 2019 calendar year, the periodic credit alternative was utilized.

The deferral election account will be credited with a fixed rate of interest, compounded semi-annually, set at the start of each calendar year at the lower of (i) the then current 30-year long-term borrowing cost of funds to San Jose Water Company (or the equivalent thereof), as measured as of the start of such calendar year, or (ii) 120 percent of the long-term Applicable Federal Rate determined as of the start of such calendar year and based on semi-annual compounding.

Distribution of the vested balance credited to each Board member's deferral election account will be made or commence on the 30th day following his or her cessation of Board service either in a lump sum or through a series of up to 10 annual installments in accordance with the Board member's payment election.

Mr. More elected to defer all of his 2019 annual retainer fees and pre-scheduled 2019 meeting fees, Mr. King elected to defer all of his 2019 pre-scheduled meeting fees, Ms. Man elected to defer all of her 2019 annual retainer fees, and Mr. Bishop elected to defer 50 percent of his 2019 annual retainer fees.

Deferred Restricted Stock Program

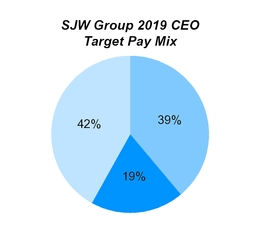

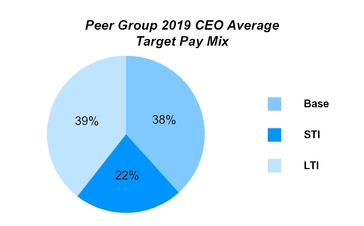

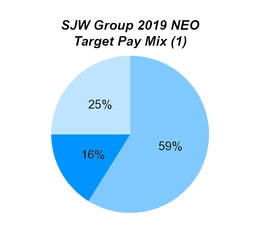

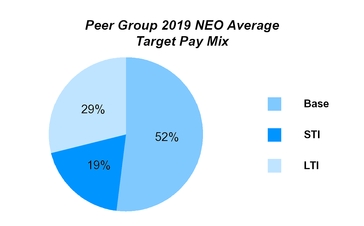

Prior to the 2008 fiscal year, the non-employee directors were able to receive awards of deferred stock, either through the conversion of their deferred Board and Committee fees under the Deferral Election Program into deferred shares of SJW Group common stock or through their participation in the Deferred Restricted Stock Program. Both of those deferred stock programs were implemented under the Corporation's Long-Term Incentive Plan (the "LTIP").