UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-02064 |

|

IMPAX FUNDS SERIES TRUST I |

(Exact name of Registrant as specified in charter) |

|

30 Penhallow Street, Suite 100, Portsmouth, NH | | 03801 |

(Address of principal executive offices) | | (Zip code) |

|

Impax Asset Management LLC

30 Penhallow Street, Suite 100, Portsmouth, NH 03801

Attn.: Edward Farrington |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 800-767-1729 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2024 | |

| | | | | | | | |

Form N-CSRS is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSRS in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSRS, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSRS unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Reports to Stockholders

This semi-annual shareholder report contains important information about the Impax Core Bond Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/CB. You can find additional information about the Fund at https://impaxam.com/CB. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXBIX

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $23 | 0.47% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $879,240,523 |

| Total Number of Portfolio Holdings | 488 |

| Portfolio Turnover Rate | 62% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| U.S. Treasury Bonds, 4.625%, 5/15/44 | 5.1% |

| U.S. Treasury Notes, 4.625%, 4/30/29 | 3.8% |

| U.S. Treasury Bonds, 4.625%, 5/15/54 | 3.5% |

| U.S. Treasury Notes, 4.500%, 5/15/27 | 2.8% |

| U.S. Treasury Notes, 4.625%, 5/31/31 | 0.9% |

| International Bank for Reconstruction & Development, 1.625%, 1/15/25 | 0.9% |

| U.S. Treasury Notes, 0.375%, 7/15/27 | 0.6% |

| Kreditanstalt fuer Wiederaufbau, 0.625%, 1/22/26 | 0.6% |

| International Bank for Reconstruction & Development, 0.625%, 4/22/25 | 0.5% |

| Kreditanstalt fuer Wiederaufbau, 4.125%, 7/15/33 | 0.5% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

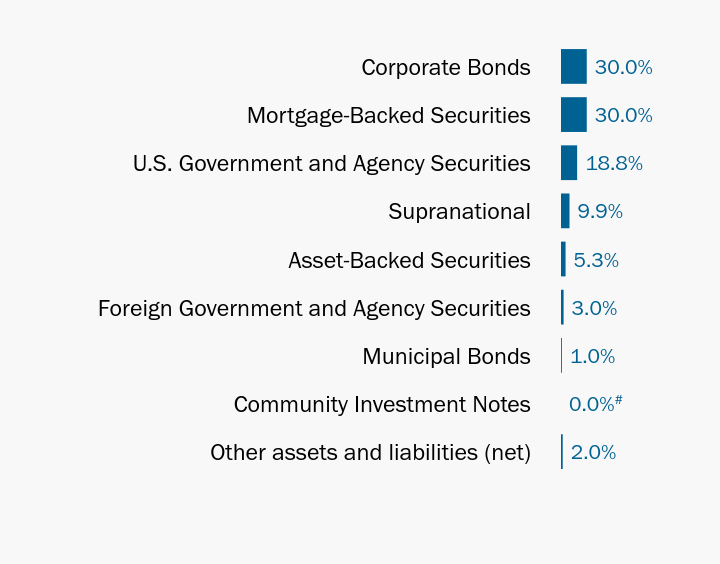

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 2.0% |

| Community Investment Notes | 0.0%Footnote Reference# |

| Municipal Bonds | 1.0% |

| Foreign Government and Agency Securities | 3.0% |

| Asset-Backed Securities | 5.3% |

| Supranational | 9.9% |

| U.S. Government and Agency Securities | 18.8% |

| Mortgage-Backed Securities | 30.0% |

| Corporate Bonds | 30.0% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Footnote# | Less than 0.05%. |

Credit Quality Allocation as of June 30, 2024

| U.S. Government | 19.8% |

| AAA | 12.6% |

| AA+ | 3.6% |

| AA | 0.4% |

| AA- | 1.3% |

| A+ | 0.9% |

| A | 5.3% |

| A- | 5.7% |

| BBB+ | 5.6% |

| BBB | 4.2% |

| BBB- | 2.9% |

| BB+ | 1.7% |

| BB | 1.0% |

| BB- | 0.4% |

| B+ | 0.2% |

| NR | 34.5% |

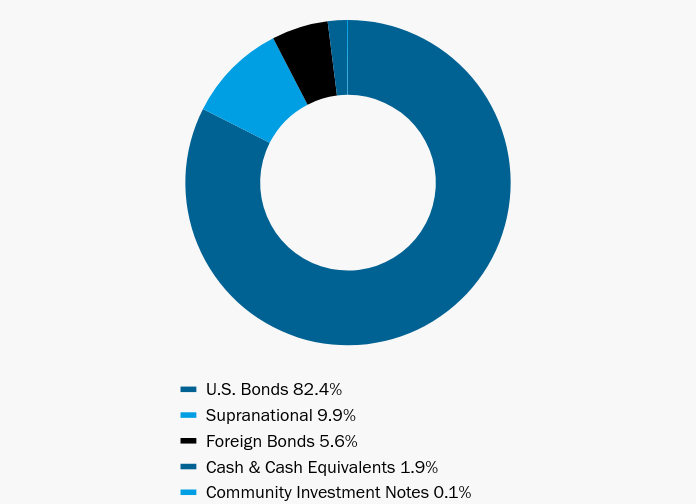

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Bonds | 82.4% |

| Supranational | 9.9% |

| Foreign Bonds | 5.6% |

| Cash & Cash Equivalents | 1.9% |

| Community Investment Notes | 0.1% |

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXBIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/CB

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/CB.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Core Bond Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/CB. You can find additional information about the Fund at https://impaxam.com/CB. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $36 | 0.72% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $879,240,523 |

| Total Number of Portfolio Holdings | 488 |

| Portfolio Turnover Rate | 62% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| U.S. Treasury Bonds, 4.625%, 5/15/44 | 5.1% |

| U.S. Treasury Notes, 4.625%, 4/30/29 | 3.8% |

| U.S. Treasury Bonds, 4.625%, 5/15/54 | 3.5% |

| U.S. Treasury Notes, 4.500%, 5/15/27 | 2.8% |

| U.S. Treasury Notes, 4.625%, 5/31/31 | 0.9% |

| International Bank for Reconstruction & Development, 1.625%, 1/15/25 | 0.9% |

| U.S. Treasury Notes, 0.375%, 7/15/27 | 0.6% |

| Kreditanstalt fuer Wiederaufbau, 0.625%, 1/22/26 | 0.6% |

| International Bank for Reconstruction & Development, 0.625%, 4/22/25 | 0.5% |

| Kreditanstalt fuer Wiederaufbau, 4.125%, 7/15/33 | 0.5% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

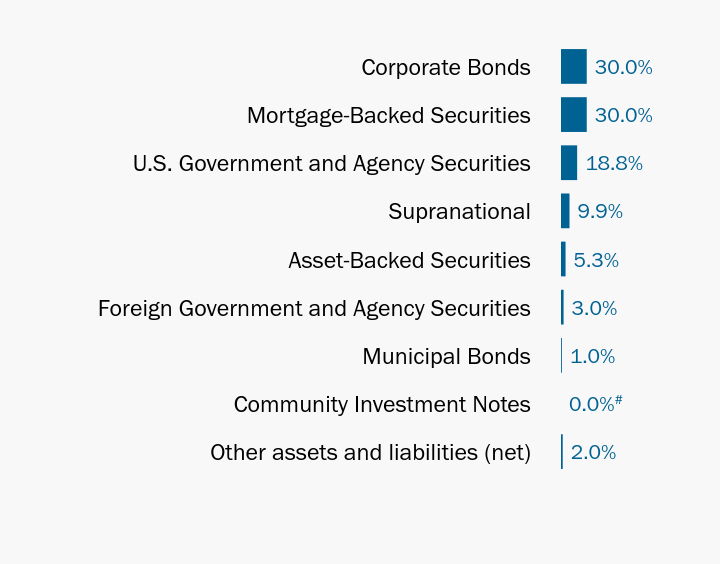

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 2.0% |

| Community Investment Notes | 0.0%Footnote Reference# |

| Municipal Bonds | 1.0% |

| Foreign Government and Agency Securities | 3.0% |

| Asset-Backed Securities | 5.3% |

| Supranational | 9.9% |

| U.S. Government and Agency Securities | 18.8% |

| Mortgage-Backed Securities | 30.0% |

| Corporate Bonds | 30.0% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Footnote# | Less than 0.05%. |

Credit Quality Allocation as of June 30, 2024

| U.S. Government | 19.8% |

| AAA | 12.6% |

| AA+ | 3.6% |

| AA | 0.4% |

| AA- | 1.3% |

| A+ | 0.9% |

| A | 5.3% |

| A- | 5.7% |

| BBB+ | 5.6% |

| BBB | 4.2% |

| BBB- | 2.9% |

| BB+ | 1.7% |

| BB | 1.0% |

| BB- | 0.4% |

| B+ | 0.2% |

| NR | 34.5% |

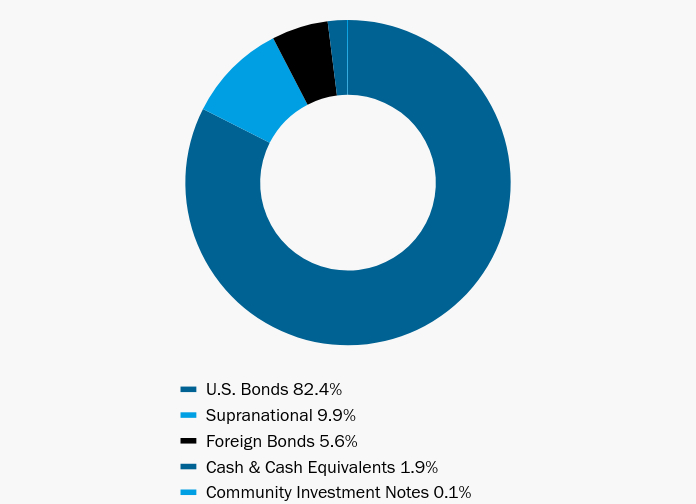

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Bonds | 82.4% |

| Supranational | 9.9% |

| Foreign Bonds | 5.6% |

| Cash & Cash Equivalents | 1.9% |

| Community Investment Notes | 0.1% |

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/CB

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/CB.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Environmental Markets Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GEM. You can find additional information about the Fund at https://impaxam.com/GEM. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax Global Environmental Markets Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $58 | 1.14% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $2,424,706,177 |

| Total Number of Portfolio Holdings | 46 |

| Portfolio Turnover Rate | 13% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 4.8% |

| Waste Management, Inc. | 3.9% |

| Agilent Technologies, Inc. | 3.7% |

| Linde plc | 3.6% |

| Schneider Electric SE | 3.5% |

| Air Liquide SA | 3.4% |

| Republic Services, Inc., A | 3.2% |

| American Water Works Co., Inc. | 3.0% |

| Texas Instruments, Inc. | 3.0% |

| TE Connectivity Ltd. | 2.6% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

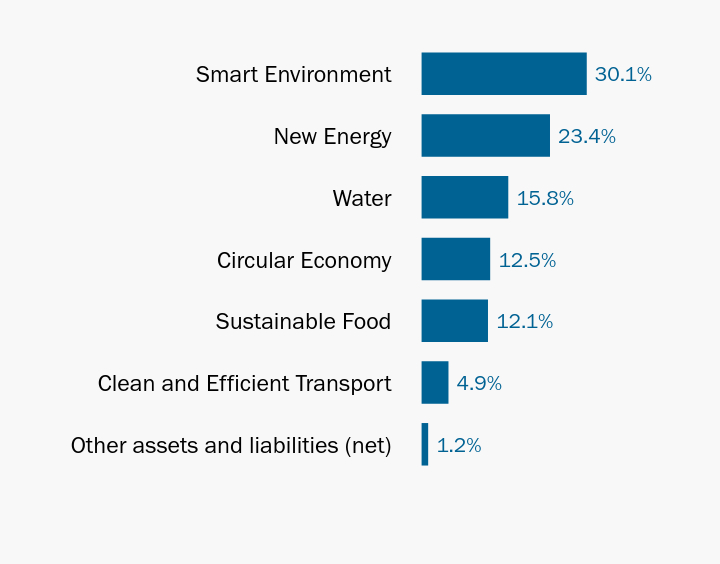

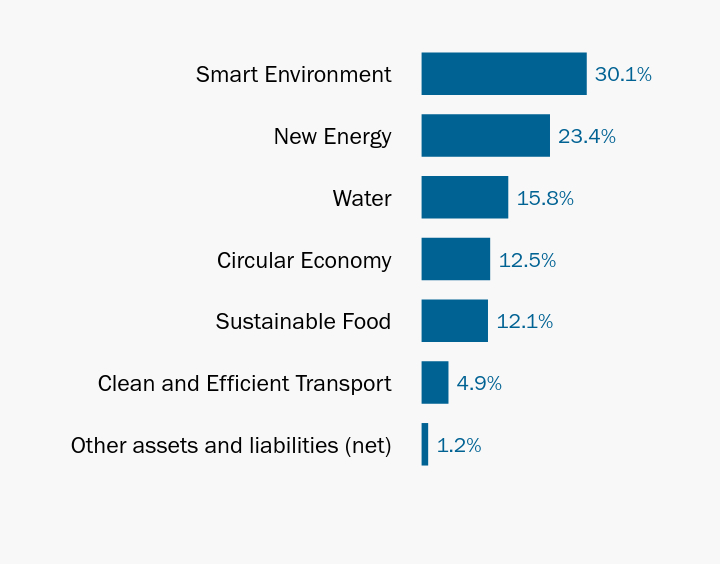

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Clean and Efficient Transport | 4.9% |

| Sustainable Food | 12.1% |

| Circular Economy | 12.5% |

| Water | 15.8% |

| New Energy | 23.4% |

| Smart Environment | 30.1% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

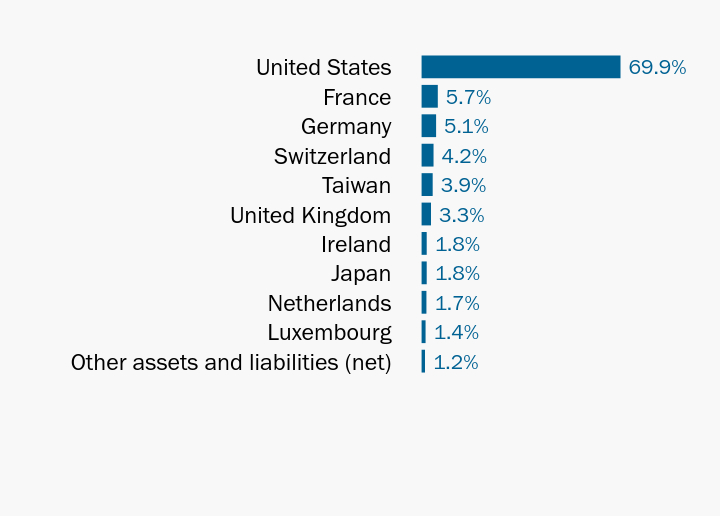

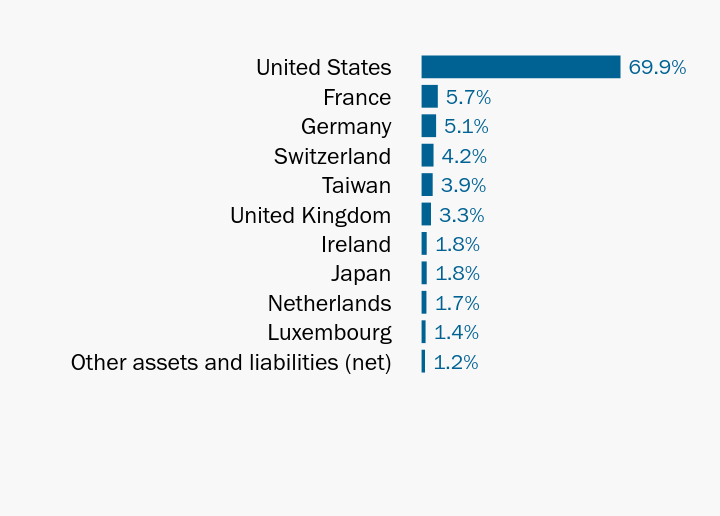

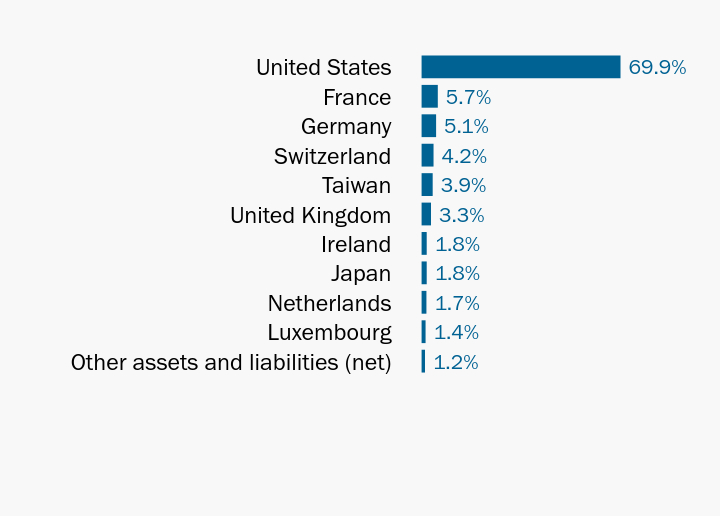

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Luxembourg | 1.4% |

| Netherlands | 1.7% |

| Japan | 1.8% |

| Ireland | 1.8% |

| United Kingdom | 3.3% |

| Taiwan | 3.9% |

| Switzerland | 4.2% |

| Germany | 5.1% |

| France | 5.7% |

| United States | 69.9% |

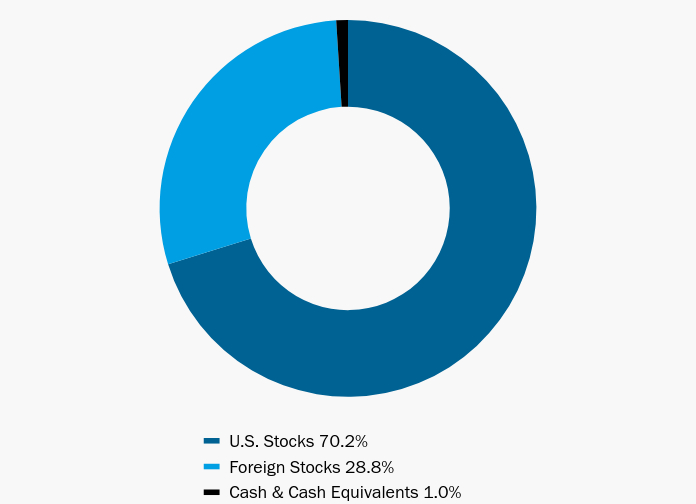

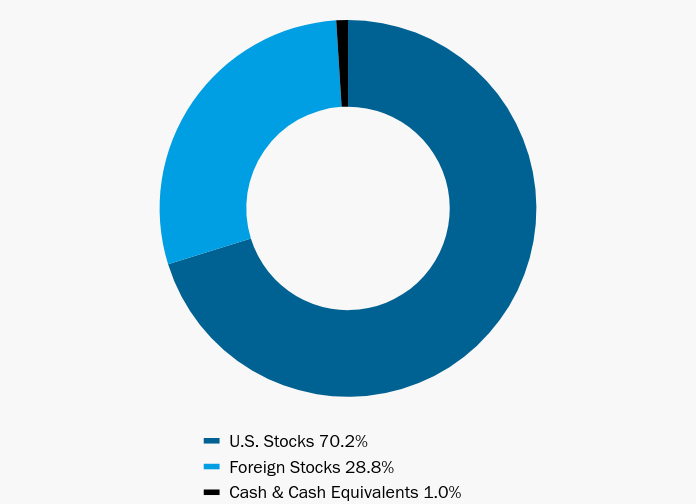

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 70.2% |

| Foreign Stocks | 28.8% |

| Cash & Cash Equivalents | 1.0% |

Impax Global Environmental Markets Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/GEM

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GEM.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Environmental Markets Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GEM. You can find additional information about the Fund at https://impaxam.com/GEM. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PGINX

Impax Global Environmental Markets Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $46 | 0.89% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $2,424,706,177 |

| Total Number of Portfolio Holdings | 46 |

| Portfolio Turnover Rate | 13% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 4.8% |

| Waste Management, Inc. | 3.9% |

| Agilent Technologies, Inc. | 3.7% |

| Linde plc | 3.6% |

| Schneider Electric SE | 3.5% |

| Air Liquide SA | 3.4% |

| Republic Services, Inc., A | 3.2% |

| American Water Works Co., Inc. | 3.0% |

| Texas Instruments, Inc. | 3.0% |

| TE Connectivity Ltd. | 2.6% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

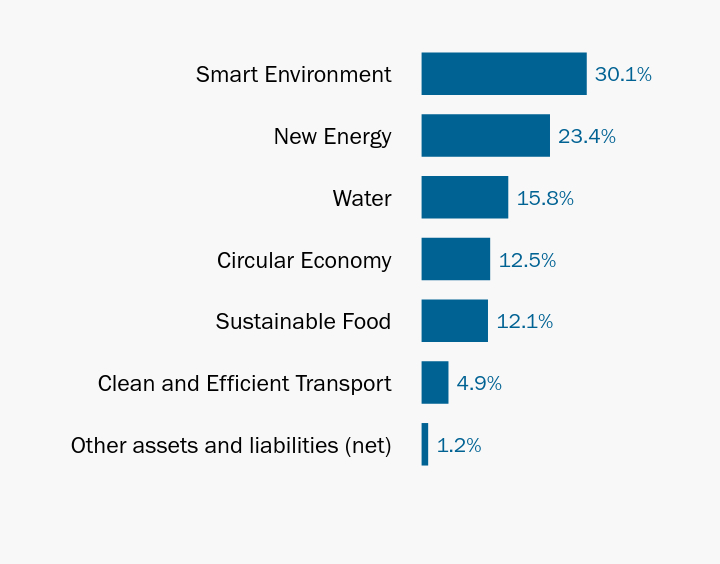

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Clean and Efficient Transport | 4.9% |

| Sustainable Food | 12.1% |

| Circular Economy | 12.5% |

| Water | 15.8% |

| New Energy | 23.4% |

| Smart Environment | 30.1% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Luxembourg | 1.4% |

| Netherlands | 1.7% |

| Japan | 1.8% |

| Ireland | 1.8% |

| United Kingdom | 3.3% |

| Taiwan | 3.9% |

| Switzerland | 4.2% |

| Germany | 5.1% |

| France | 5.7% |

| United States | 69.9% |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 70.2% |

| Foreign Stocks | 28.8% |

| Cash & Cash Equivalents | 1.0% |

Impax Global Environmental Markets Fund

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PGINX

Impax Asset Management

(800) 372-7827

https://impaxam.com/GEM

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GEM.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Environmental Markets Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GEM. You can find additional information about the Fund at https://impaxam.com/GEM. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax Global Environmental Markets Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $58 | 1.14% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $2,424,706,177 |

| Total Number of Portfolio Holdings | 46 |

| Portfolio Turnover Rate | 13% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 4.8% |

| Waste Management, Inc. | 3.9% |

| Agilent Technologies, Inc. | 3.7% |

| Linde plc | 3.6% |

| Schneider Electric SE | 3.5% |

| Air Liquide SA | 3.4% |

| Republic Services, Inc., A | 3.2% |

| American Water Works Co., Inc. | 3.0% |

| Texas Instruments, Inc. | 3.0% |

| TE Connectivity Ltd. | 2.6% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Clean and Efficient Transport | 4.9% |

| Sustainable Food | 12.1% |

| Circular Economy | 12.5% |

| Water | 15.8% |

| New Energy | 23.4% |

| Smart Environment | 30.1% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Luxembourg | 1.4% |

| Netherlands | 1.7% |

| Japan | 1.8% |

| Ireland | 1.8% |

| United Kingdom | 3.3% |

| Taiwan | 3.9% |

| Switzerland | 4.2% |

| Germany | 5.1% |

| France | 5.7% |

| United States | 69.9% |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 70.2% |

| Foreign Stocks | 28.8% |

| Cash & Cash Equivalents | 1.0% |

Impax Global Environmental Markets Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/GEM

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GEM.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Opportunities Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GO. You can find additional information about the Fund at https://impaxam.com/GO. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXGOX

Impax Global Opportunities Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $50 | 0.98% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $127,221,078 |

| Total Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 15% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 5.1% |

| Alcon, Inc. | 4.1% |

| Mastercard, Inc., A | 4.0% |

| Linde plc | 3.7% |

| Schneider Electric SE | 3.5% |

| Thermo Fisher Scientific, Inc. | 3.3% |

| Marsh & McLennan Cos., Inc. | 3.0% |

| Boston Scientific Corp. | 3.0% |

| Cintas Corp. | 3.0% |

| Applied Materials, Inc. | 3.0% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

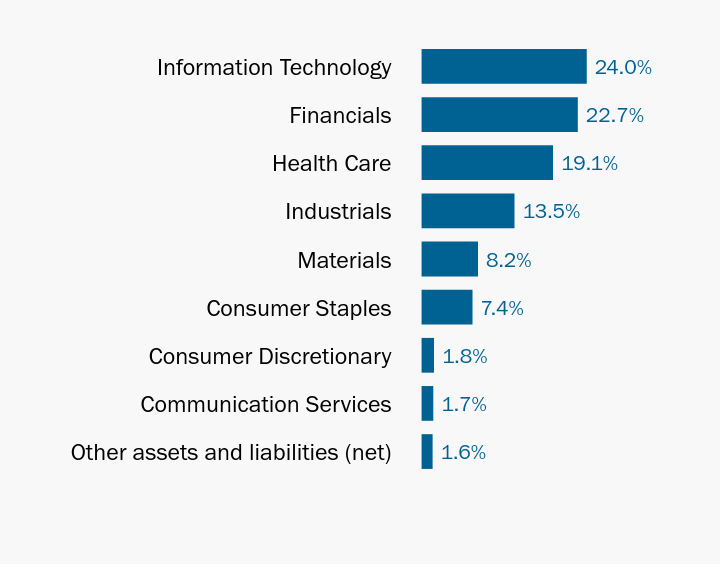

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.6% |

| Communication Services | 1.7% |

| Consumer Discretionary | 1.8% |

| Consumer Staples | 7.4% |

| Materials | 8.2% |

| Industrials | 13.5% |

| Health Care | 19.1% |

| Financials | 22.7% |

| Information Technology | 24.0% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

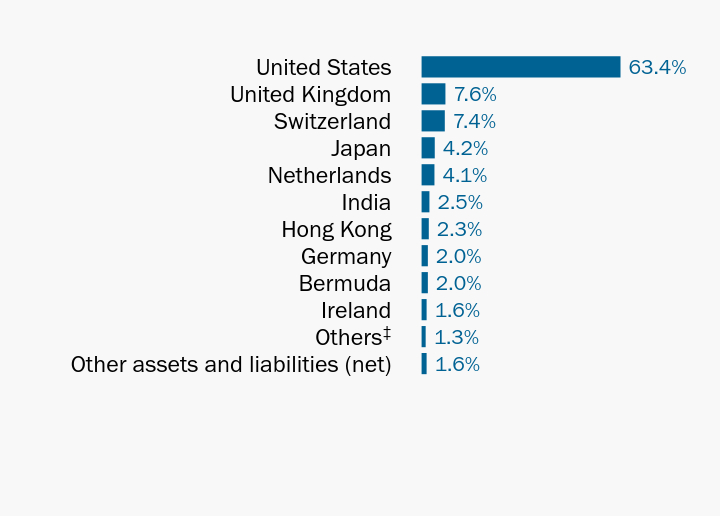

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.6% |

OthersFootnote Reference‡ | 1.3% |

| Ireland | 1.6% |

| Bermuda | 2.0% |

| Germany | 2.0% |

| Hong Kong | 2.3% |

| India | 2.5% |

| Netherlands | 4.1% |

| Japan | 4.2% |

| Switzerland | 7.4% |

| United Kingdom | 7.6% |

| United States | 63.4% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

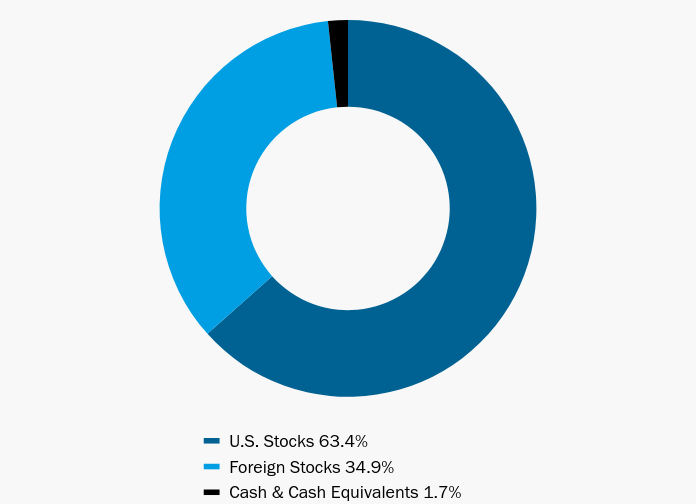

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 63.4% |

| Foreign Stocks | 34.9% |

| Cash & Cash Equivalents | 1.7% |

Impax Global Opportunities Fund

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXGOX

Impax Asset Management

(800) 372-7827

https://impaxam.com/GO

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GO.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Opportunities Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GO. You can find additional information about the Fund at https://impaxam.com/GO. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax Global Opportunities Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $63 | 1.23% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $127,221,078 |

| Total Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 15% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 5.1% |

| Alcon, Inc. | 4.1% |

| Mastercard, Inc., A | 4.0% |

| Linde plc | 3.7% |

| Schneider Electric SE | 3.5% |

| Thermo Fisher Scientific, Inc. | 3.3% |

| Marsh & McLennan Cos., Inc. | 3.0% |

| Boston Scientific Corp. | 3.0% |

| Cintas Corp. | 3.0% |

| Applied Materials, Inc. | 3.0% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.6% |

| Communication Services | 1.7% |

| Consumer Discretionary | 1.8% |

| Consumer Staples | 7.4% |

| Materials | 8.2% |

| Industrials | 13.5% |

| Health Care | 19.1% |

| Financials | 22.7% |

| Information Technology | 24.0% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.6% |

OthersFootnote Reference‡ | 1.3% |

| Ireland | 1.6% |

| Bermuda | 2.0% |

| Germany | 2.0% |

| Hong Kong | 2.3% |

| India | 2.5% |

| Netherlands | 4.1% |

| Japan | 4.2% |

| Switzerland | 7.4% |

| United Kingdom | 7.6% |

| United States | 63.4% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 63.4% |

| Foreign Stocks | 34.9% |

| Cash & Cash Equivalents | 1.7% |

Impax Global Opportunities Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/GO

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GO.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Social Leaders Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GSL. You can find additional information about the Fund at https://impaxam.com/GSL. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | IGSIX

Impax Global Social Leaders Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $50 | 0.98% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $1,709,961 |

| Total Number of Portfolio Holdings | 44 |

| Portfolio Turnover Rate | 18% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| NVIDIA Corp. | 4.9% |

| Intuit, Inc. | 4.2% |

| eBay, Inc. | 3.8% |

| Halma plc | 3.8% |

| Alcon, Inc. | 3.4% |

| MercadoLibre, Inc. | 3.1% |

| IQVIA Holdings, Inc. | 3.0% |

| Legal & General Group plc | 3.0% |

| ServiceNow, Inc. | 3.0% |

| Recruit Holdings Co. Ltd. | 2.8% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

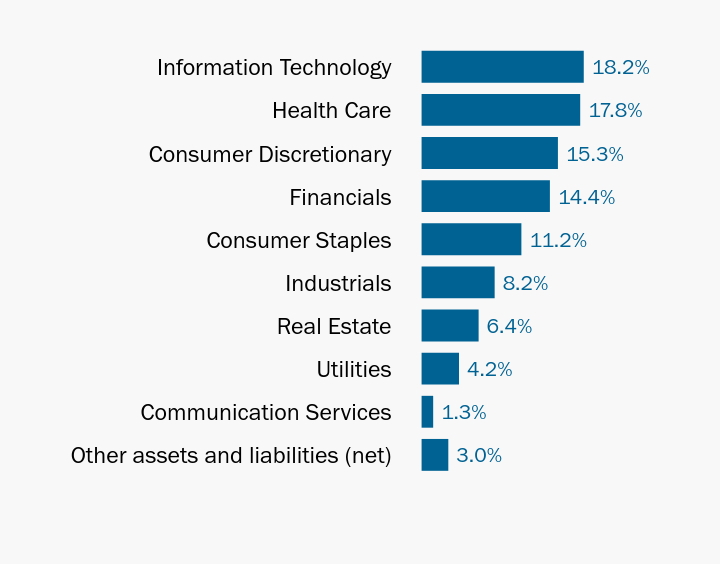

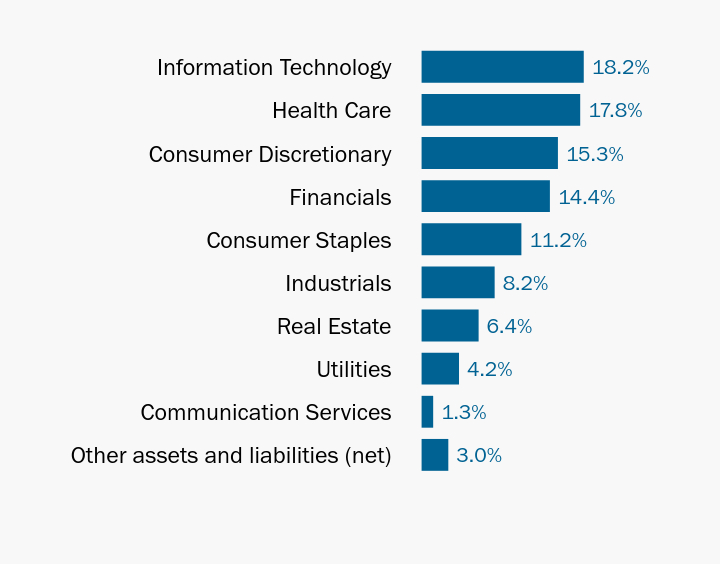

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.0% |

| Communication Services | 1.3% |

| Utilities | 4.2% |

| Real Estate | 6.4% |

| Industrials | 8.2% |

| Consumer Staples | 11.2% |

| Financials | 14.4% |

| Consumer Discretionary | 15.3% |

| Health Care | 17.8% |

| Information Technology | 18.2% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

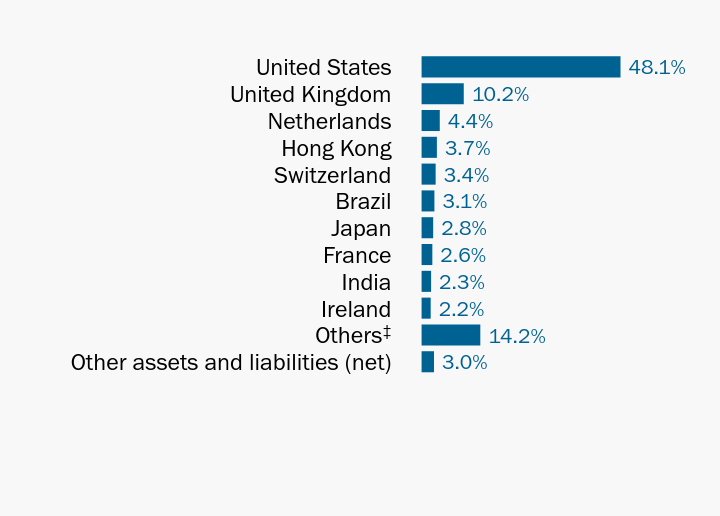

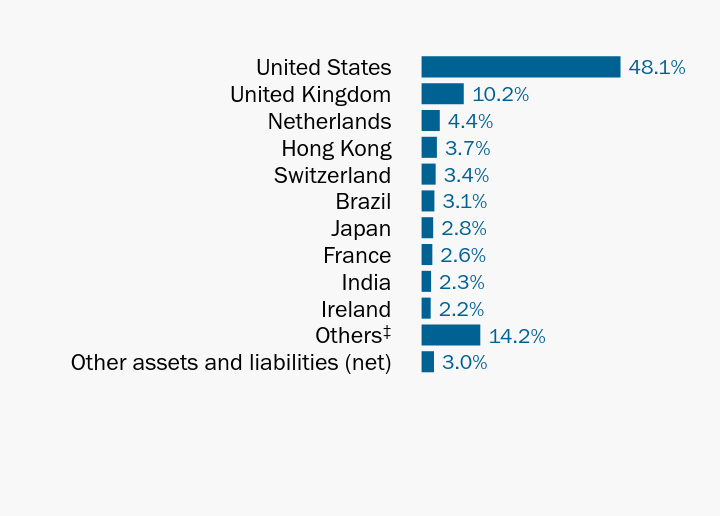

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.0% |

OthersFootnote Reference‡ | 14.2% |

| Ireland | 2.2% |

| India | 2.3% |

| France | 2.6% |

| Japan | 2.8% |

| Brazil | 3.1% |

| Switzerland | 3.4% |

| Hong Kong | 3.7% |

| Netherlands | 4.4% |

| United Kingdom | 10.2% |

| United States | 48.1% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

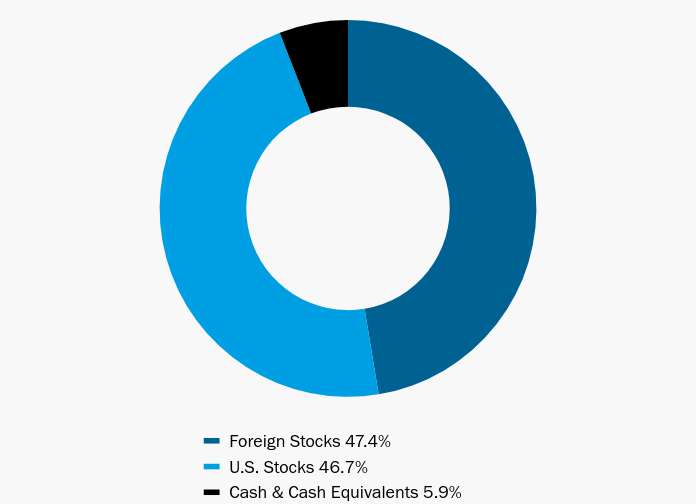

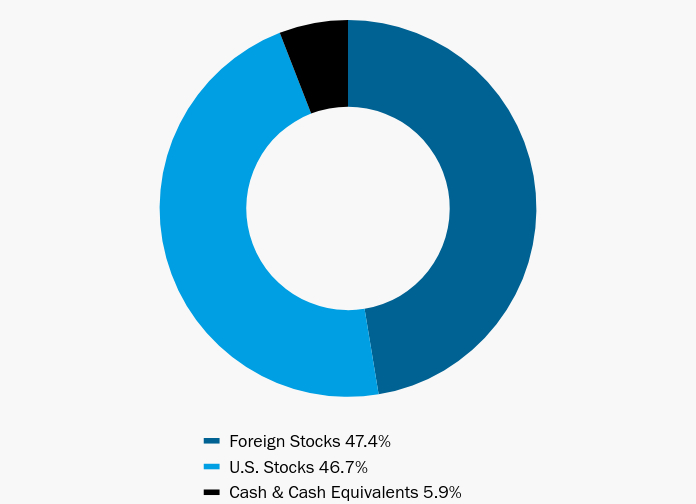

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| Foreign Stocks | 47.4% |

| U.S. Stocks | 46.7% |

| Cash & Cash Equivalents | 5.9% |

Impax Global Social Leaders Fund

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: IGSIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/GSL

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GSL.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Social Leaders Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GSL. You can find additional information about the Fund at https://impaxam.com/GSL. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax Global Social Leaders Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $62 | 1.23% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $1,709,961 |

| Total Number of Portfolio Holdings | 44 |

| Portfolio Turnover Rate | 18% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| NVIDIA Corp. | 4.9% |

| Intuit, Inc. | 4.2% |

| eBay, Inc. | 3.8% |

| Halma plc | 3.8% |

| Alcon, Inc. | 3.4% |

| MercadoLibre, Inc. | 3.1% |

| IQVIA Holdings, Inc. | 3.0% |

| Legal & General Group plc | 3.0% |

| ServiceNow, Inc. | 3.0% |

| Recruit Holdings Co. Ltd. | 2.8% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.0% |

| Communication Services | 1.3% |

| Utilities | 4.2% |

| Real Estate | 6.4% |

| Industrials | 8.2% |

| Consumer Staples | 11.2% |

| Financials | 14.4% |

| Consumer Discretionary | 15.3% |

| Health Care | 17.8% |

| Information Technology | 18.2% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.0% |

OthersFootnote Reference‡ | 14.2% |

| Ireland | 2.2% |

| India | 2.3% |

| France | 2.6% |

| Japan | 2.8% |

| Brazil | 3.1% |

| Switzerland | 3.4% |

| Hong Kong | 3.7% |

| Netherlands | 4.4% |

| United Kingdom | 10.2% |

| United States | 48.1% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| Foreign Stocks | 47.4% |

| U.S. Stocks | 46.7% |

| Cash & Cash Equivalents | 5.9% |

Impax Global Social Leaders Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/GSL

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GSL.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Sustainable Infrastructure Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GSI. You can find additional information about the Fund at https://impaxam.com/GSI. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXDIX

Impax Global Sustainable Infrastructure Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $29 | 0.58% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $91,319,933 |

| Total Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 11% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Waste Management, Inc. | 4.4% |

| SSE plc | 4.3% |

| Elisa OYJ | 4.1% |

| National Grid plc | 3.7% |

| American Water Works Co., Inc. | 3.6% |

| Tele2 AB, B | 3.6% |

| Severn Trent plc | 3.6% |

| Canadian Pacific Kansas City Ltd. | 3.5% |

| Koninklijke KPN NV | 3.4% |

| Northland Power, Inc. | 3.4% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

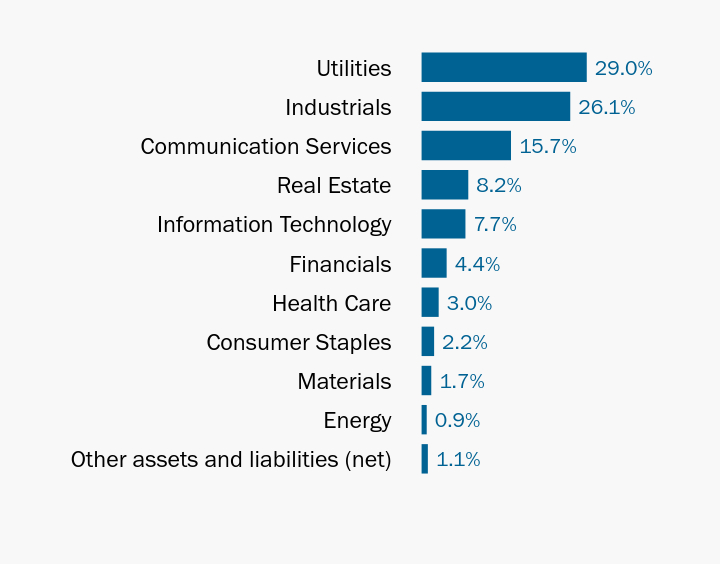

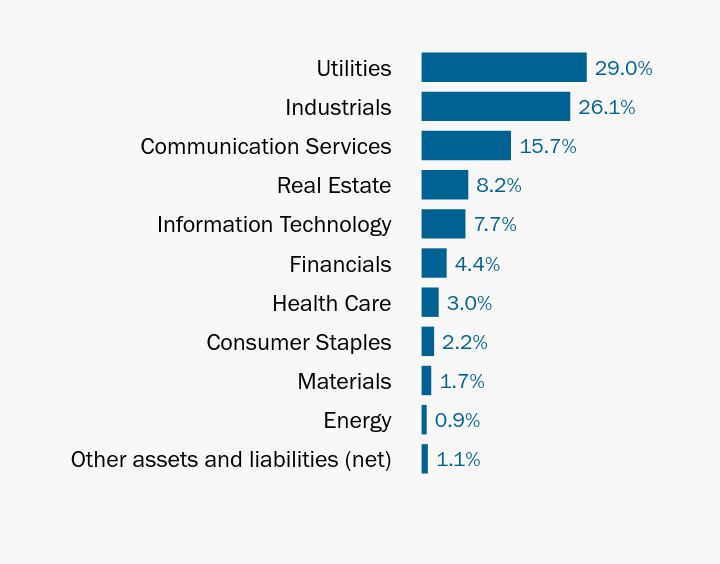

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.1% |

| Energy | 0.9% |

| Materials | 1.7% |

| Consumer Staples | 2.2% |

| Health Care | 3.0% |

| Financials | 4.4% |

| Information Technology | 7.7% |

| Real Estate | 8.2% |

| Communication Services | 15.7% |

| Industrials | 26.1% |

| Utilities | 29.0% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

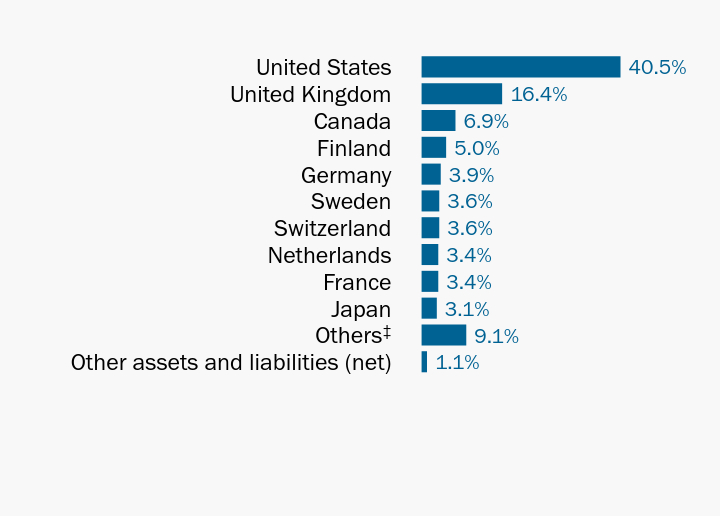

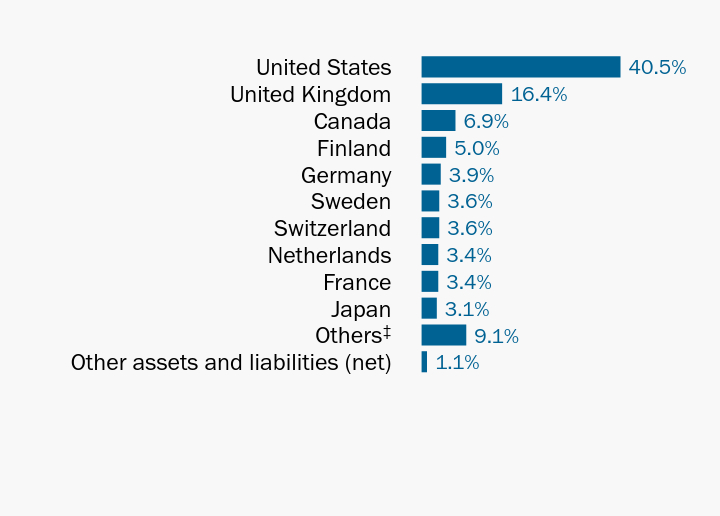

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.1% |

OthersFootnote Reference‡ | 9.1% |

| Japan | 3.1% |

| France | 3.4% |

| Netherlands | 3.4% |

| Switzerland | 3.6% |

| Sweden | 3.6% |

| Germany | 3.9% |

| Finland | 5.0% |

| Canada | 6.9% |

| United Kingdom | 16.4% |

| United States | 40.5% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

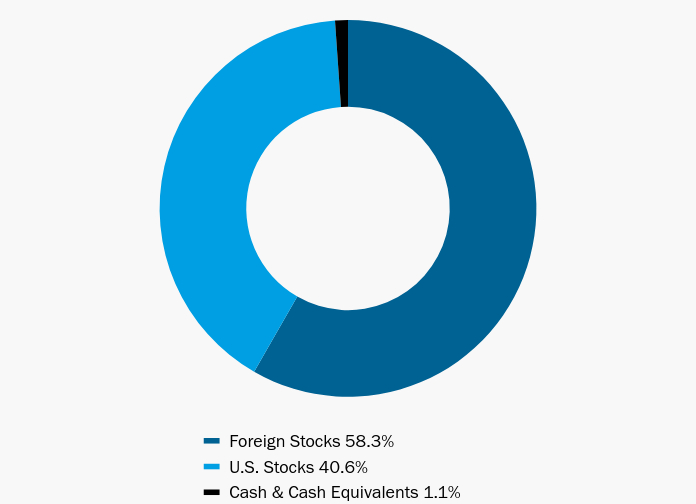

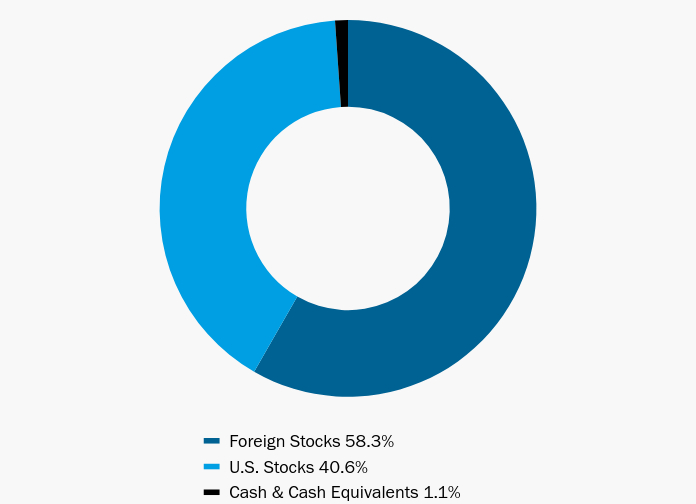

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| Foreign Stocks | 58.3% |

| U.S. Stocks | 40.6% |

| Cash & Cash Equivalents | 1.1% |

Impax Global Sustainable Infrastructure Fund

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXDIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/GSI

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GSI.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Global Sustainable Infrastructure Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/GSI. You can find additional information about the Fund at https://impaxam.com/GSI. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax Global Sustainable Infrastructure Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $42 | 0.83% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $91,319,933 |

| Total Number of Portfolio Holdings | 42 |

| Portfolio Turnover Rate | 11% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Waste Management, Inc. | 4.4% |

| SSE plc | 4.3% |

| Elisa OYJ | 4.1% |

| National Grid plc | 3.7% |

| American Water Works Co., Inc. | 3.6% |

| Tele2 AB, B | 3.6% |

| Severn Trent plc | 3.6% |

| Canadian Pacific Kansas City Ltd. | 3.5% |

| Koninklijke KPN NV | 3.4% |

| Northland Power, Inc. | 3.4% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.1% |

| Energy | 0.9% |

| Materials | 1.7% |

| Consumer Staples | 2.2% |

| Health Care | 3.0% |

| Financials | 4.4% |

| Information Technology | 7.7% |

| Real Estate | 8.2% |

| Communication Services | 15.7% |

| Industrials | 26.1% |

| Utilities | 29.0% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.1% |

OthersFootnote Reference‡ | 9.1% |

| Japan | 3.1% |

| France | 3.4% |

| Netherlands | 3.4% |

| Switzerland | 3.6% |

| Sweden | 3.6% |

| Germany | 3.9% |

| Finland | 5.0% |

| Canada | 6.9% |

| United Kingdom | 16.4% |

| United States | 40.5% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| Foreign Stocks | 58.3% |

| U.S. Stocks | 40.6% |

| Cash & Cash Equivalents | 1.1% |

Impax Global Sustainable Infrastructure Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/GSI

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/GSI.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax High Yield Bond Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/HYB. You can find additional information about the Fund at https://impaxam.com/HYB. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax High Yield Bond Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $46 | 0.93% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $531,742,145 |

| Total Number of Portfolio Holdings | 225 |

| Portfolio Turnover Rate | 28% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.750%, 3/01/30 | 1.5% |

| Darling Ingredients, Inc., 6.000%, 6/15/30 | 1.1% |

| Liberty Mutual Group, Inc., 4.125%, 12/15/51 | 1.1% |

| Avantor Funding, Inc., 4.625%, 7/15/28 | 1.0% |

| Interface, Inc., 5.500%, 12/01/28 | 1.0% |

| Bank of America Corp., 4.300%, 1/28/25 | 1.0% |

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer, 7.000%, 1/15/31 | 0.9% |

| Medline Borrower LP, Refinancing CME Term Loan, 8.094%, 10/23/28 | 0.9% |

| Graphic Packaging International LLC, 3.750%, 2/01/30 | 0.9% |

| Iron Mountain, Inc., 4.875%, 9/15/29 | 0.9% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

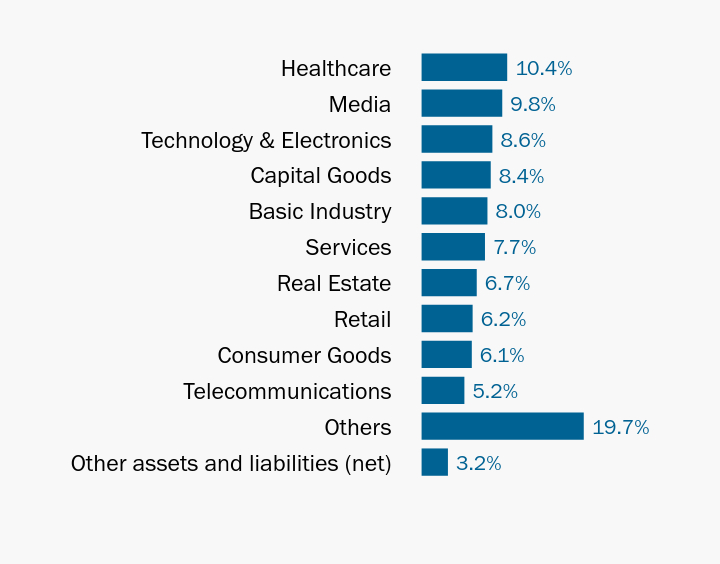

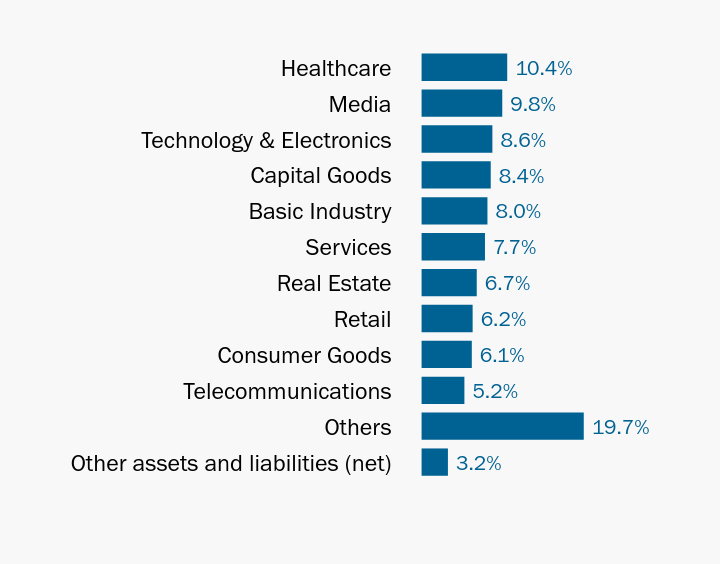

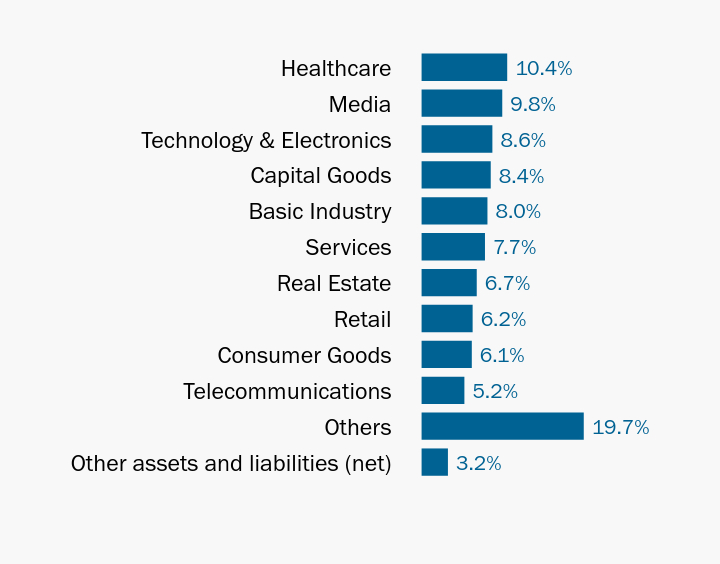

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.2% |

| Others | 19.7% |

| Telecommunications | 5.2% |

| Consumer Goods | 6.1% |

| Retail | 6.2% |

| Real Estate | 6.7% |

| Services | 7.7% |

| Basic Industry | 8.0% |

| Capital Goods | 8.4% |

| Technology & Electronics | 8.6% |

| Media | 9.8% |

| Healthcare | 10.4% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Credit Quality Allocation as of June 30, 2024

| A | 0.6% |

| BBB | 0.2% |

| BBB- | 6.0% |

| BB+ | 16.9% |

| BB | 16.6% |

| BB- | 19.6% |

| B+ | 14.9% |

| B | 9.5% |

| B- | 8.0% |

| CCC+ | 0.3% |

| CCC- | 0.1% |

| NR | 7.3% |

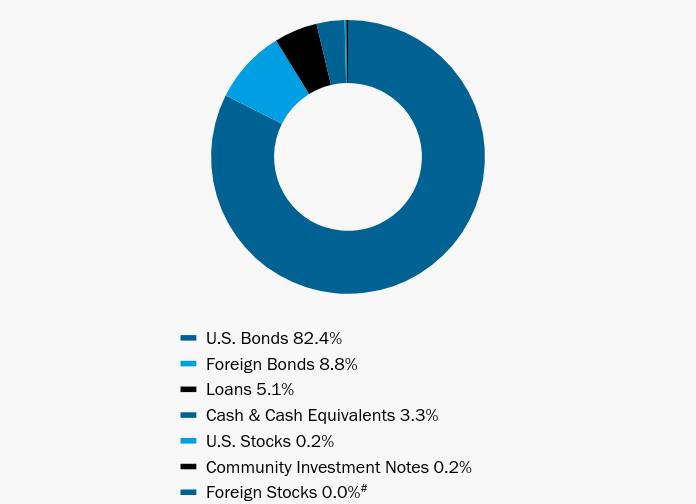

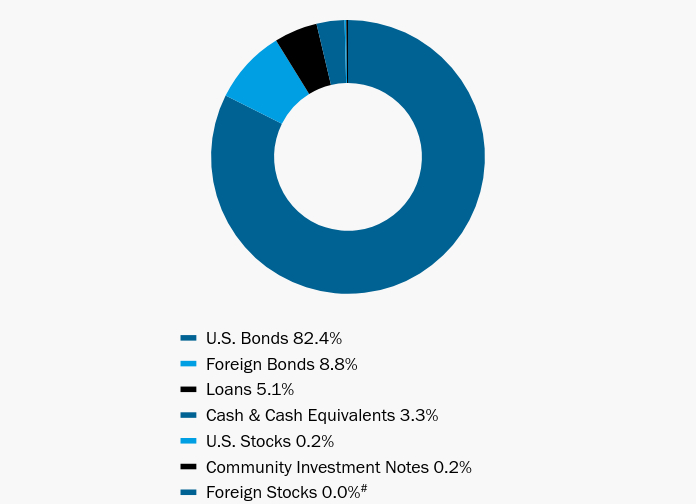

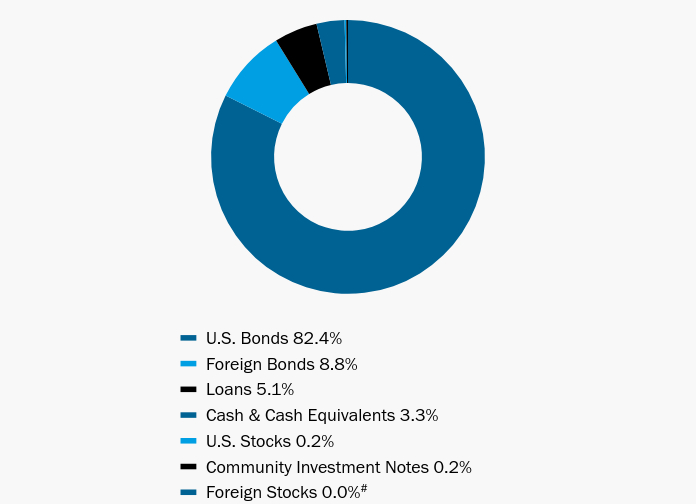

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Bonds | 82.4% |

| Foreign Bonds | 8.8% |

| Loans | 5.1% |

| Cash & Cash Equivalents | 3.3% |

| U.S. Stocks | 0.2% |

| Community Investment Notes | 0.2% |

| Foreign Stocks | 0.0%Footnote Reference# |

| Footnote | Description |

Footnote# | Less than 0.05%. |

Impax High Yield Bond Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/HYB

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/HYB.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax High Yield Bond Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/HYB. You can find additional information about the Fund at https://impaxam.com/HYB. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXHIX

Impax High Yield Bond Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $34 | 0.68% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $531,742,145 |

| Total Number of Portfolio Holdings | 225 |

| Portfolio Turnover Rate | 28% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.750%, 3/01/30 | 1.5% |

| Darling Ingredients, Inc., 6.000%, 6/15/30 | 1.1% |

| Liberty Mutual Group, Inc., 4.125%, 12/15/51 | 1.1% |

| Avantor Funding, Inc., 4.625%, 7/15/28 | 1.0% |

| Interface, Inc., 5.500%, 12/01/28 | 1.0% |

| Bank of America Corp., 4.300%, 1/28/25 | 1.0% |

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer, 7.000%, 1/15/31 | 0.9% |

| Medline Borrower LP, Refinancing CME Term Loan, 8.094%, 10/23/28 | 0.9% |

| Graphic Packaging International LLC, 3.750%, 2/01/30 | 0.9% |

| Iron Mountain, Inc., 4.875%, 9/15/29 | 0.9% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.2% |

| Others | 19.7% |

| Telecommunications | 5.2% |

| Consumer Goods | 6.1% |

| Retail | 6.2% |

| Real Estate | 6.7% |

| Services | 7.7% |

| Basic Industry | 8.0% |

| Capital Goods | 8.4% |

| Technology & Electronics | 8.6% |

| Media | 9.8% |

| Healthcare | 10.4% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Credit Quality Allocation as of June 30, 2024

| A | 0.6% |

| BBB | 0.2% |

| BBB- | 6.0% |

| BB+ | 16.9% |

| BB | 16.6% |

| BB- | 19.6% |

| B+ | 14.9% |

| B | 9.5% |

| B- | 8.0% |

| CCC+ | 0.3% |

| CCC- | 0.1% |

| NR | 7.3% |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Bonds | 82.4% |

| Foreign Bonds | 8.8% |

| Loans | 5.1% |

| Cash & Cash Equivalents | 3.3% |

| U.S. Stocks | 0.2% |

| Community Investment Notes | 0.2% |

| Foreign Stocks | 0.0%Footnote Reference# |

| Footnote | Description |

Footnote# | Less than 0.05%. |

Impax High Yield Bond Fund

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXHIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/HYB

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/HYB.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax High Yield Bond Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/HYB. You can find additional information about the Fund at https://impaxam.com/HYB. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax High Yield Bond Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $46 | 0.93% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $531,742,145 |

| Total Number of Portfolio Holdings | 225 |

| Portfolio Turnover Rate | 28% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| CCO Holdings LLC / CCO Holdings Capital Corp., 4.750%, 3/01/30 | 1.5% |

| Darling Ingredients, Inc., 6.000%, 6/15/30 | 1.1% |

| Liberty Mutual Group, Inc., 4.125%, 12/15/51 | 1.1% |

| Avantor Funding, Inc., 4.625%, 7/15/28 | 1.0% |

| Interface, Inc., 5.500%, 12/01/28 | 1.0% |

| Bank of America Corp., 4.300%, 1/28/25 | 1.0% |

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer, 7.000%, 1/15/31 | 0.9% |

| Medline Borrower LP, Refinancing CME Term Loan, 8.094%, 10/23/28 | 0.9% |

| Graphic Packaging International LLC, 3.750%, 2/01/30 | 0.9% |

| Iron Mountain, Inc., 4.875%, 9/15/29 | 0.9% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.2% |

| Others | 19.7% |

| Telecommunications | 5.2% |

| Consumer Goods | 6.1% |

| Retail | 6.2% |

| Real Estate | 6.7% |

| Services | 7.7% |

| Basic Industry | 8.0% |

| Capital Goods | 8.4% |

| Technology & Electronics | 8.6% |

| Media | 9.8% |

| Healthcare | 10.4% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Credit Quality Allocation as of June 30, 2024

| A | 0.6% |

| BBB | 0.2% |

| BBB- | 6.0% |

| BB+ | 16.9% |

| BB | 16.6% |

| BB- | 19.6% |

| B+ | 14.9% |

| B | 9.5% |

| B- | 8.0% |

| CCC+ | 0.3% |

| CCC- | 0.1% |

| NR | 7.3% |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Bonds | 82.4% |

| Foreign Bonds | 8.8% |

| Loans | 5.1% |

| Cash & Cash Equivalents | 3.3% |

| U.S. Stocks | 0.2% |

| Community Investment Notes | 0.2% |

| Foreign Stocks | 0.0%Footnote Reference# |

| Footnote | Description |

Footnote# | Less than 0.05%. |

Impax High Yield Bond Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/HYB

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/HYB.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax International Sustainable Economy Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/ISE. You can find additional information about the Fund at https://impaxam.com/ISE. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXNIX

Impax International Sustainable Economy Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $23 | 0.45% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $1,194,853,792 |

| Total Number of Portfolio Holdings | 142 |

| Portfolio Turnover Rate | 27% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Novo Nordisk A/S, B | 3.4% |

| ASML Holding NV | 3.0% |

| AstraZeneca plc | 2.7% |

| Novartis AG | 2.7% |

| HSBC Holdings plc | 2.4% |

| Schneider Electric SE | 2.2% |

| CSL Ltd. | 2.0% |

| BNP Paribas SA | 1.9% |

| RELX plc | 1.9% |

| Tokyo Electron Ltd. | 1.9% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

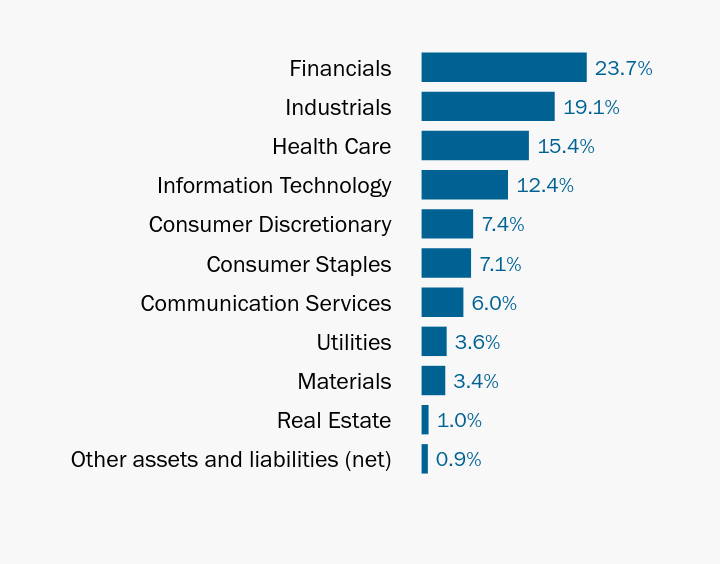

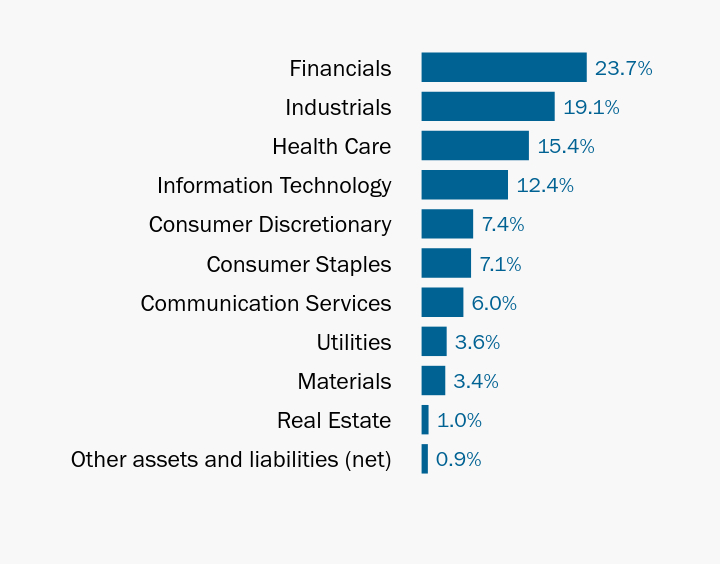

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 0.9% |

| Real Estate | 1.0% |

| Materials | 3.4% |

| Utilities | 3.6% |

| Communication Services | 6.0% |

| Consumer Staples | 7.1% |

| Consumer Discretionary | 7.4% |

| Information Technology | 12.4% |

| Health Care | 15.4% |

| Industrials | 19.1% |

| Financials | 23.7% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

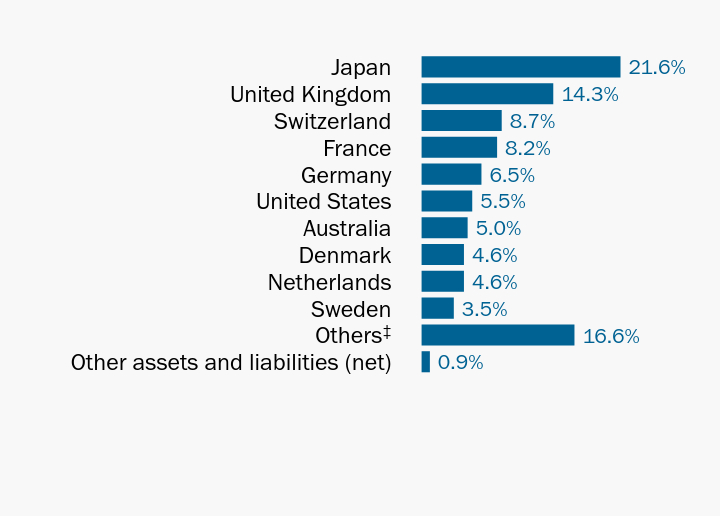

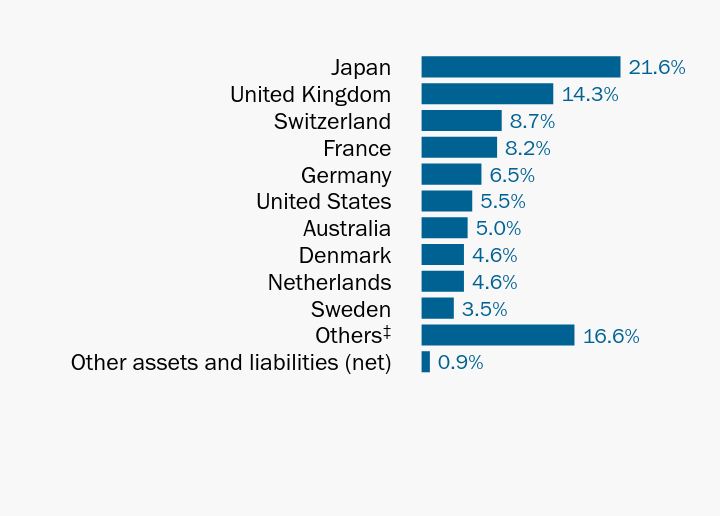

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 0.9% |

OthersFootnote Reference‡ | 16.6% |

| Sweden | 3.5% |

| Netherlands | 4.6% |

| Denmark | 4.6% |

| Australia | 5.0% |

| United States | 5.5% |

| Germany | 6.5% |

| France | 8.2% |

| Switzerland | 8.7% |

| United Kingdom | 14.3% |

| Japan | 21.6% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

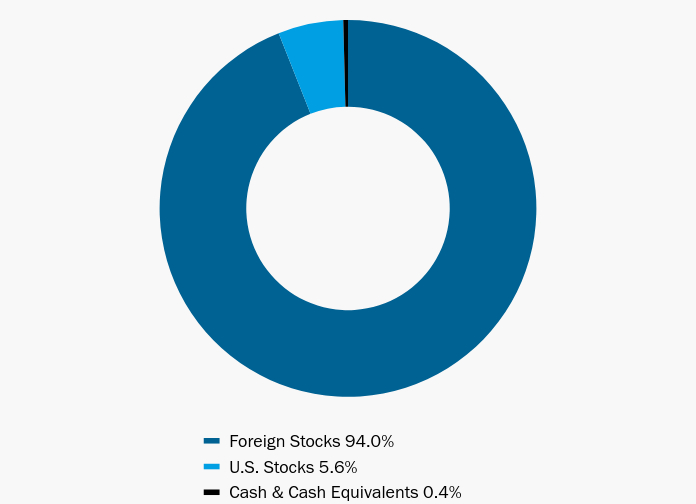

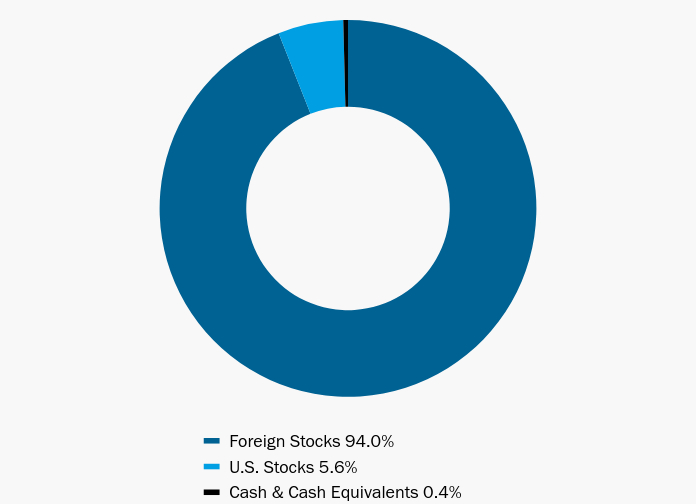

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| Foreign Stocks | 94.0% |

| U.S. Stocks | 5.6% |

| Cash & Cash Equivalents | 0.4% |

Impax International Sustainable Economy Fund

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXNIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/ISE

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/ISE.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax International Sustainable Economy Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/ISE. You can find additional information about the Fund at https://impaxam.com/ISE. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Impax International Sustainable Economy Fund

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $36 | 0.70% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $1,194,853,792 |

| Total Number of Portfolio Holdings | 142 |

| Portfolio Turnover Rate | 27% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Novo Nordisk A/S, B | 3.4% |

| ASML Holding NV | 3.0% |

| AstraZeneca plc | 2.7% |

| Novartis AG | 2.7% |

| HSBC Holdings plc | 2.4% |

| Schneider Electric SE | 2.2% |

| CSL Ltd. | 2.0% |

| BNP Paribas SA | 1.9% |

| RELX plc | 1.9% |

| Tokyo Electron Ltd. | 1.9% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 0.9% |

| Real Estate | 1.0% |

| Materials | 3.4% |

| Utilities | 3.6% |

| Communication Services | 6.0% |

| Consumer Staples | 7.1% |

| Consumer Discretionary | 7.4% |

| Information Technology | 12.4% |

| Health Care | 15.4% |

| Industrials | 19.1% |

| Financials | 23.7% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Geographical Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 0.9% |

OthersFootnote Reference‡ | 16.6% |

| Sweden | 3.5% |

| Netherlands | 4.6% |

| Denmark | 4.6% |

| Australia | 5.0% |

| United States | 5.5% |

| Germany | 6.5% |

| France | 8.2% |

| Switzerland | 8.7% |

| United Kingdom | 14.3% |

| Japan | 21.6% |

| Footnote | Description |

Footnote‡ | Included additional countries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| Foreign Stocks | 94.0% |

| U.S. Stocks | 5.6% |

| Cash & Cash Equivalents | 0.4% |

Impax International Sustainable Economy Fund

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/ISE

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/ISE.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Large Cap Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/LC. You can find additional information about the Fund at https://impaxam.com/LC. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXLIX

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $38 | 0.73% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $1,492,863,028 |

| Total Number of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 17% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 7.9% |

| Alphabet, Inc., A | 5.4% |

| NVIDIA Corp. | 4.7% |

| Apple, Inc. | 3.7% |

| ServiceNow, Inc. | 2.6% |

| Oracle Corp. | 2.6% |

| Merck & Co., Inc. | 2.5% |

| JPMorgan Chase & Co. | 2.4% |

| Walt Disney Co. (The) | 2.2% |

| Procter & Gamble Co. (The) | 2.1% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

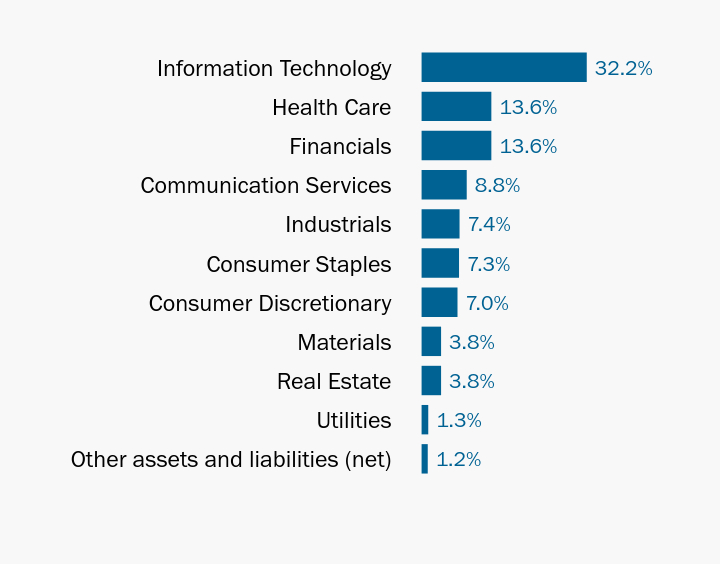

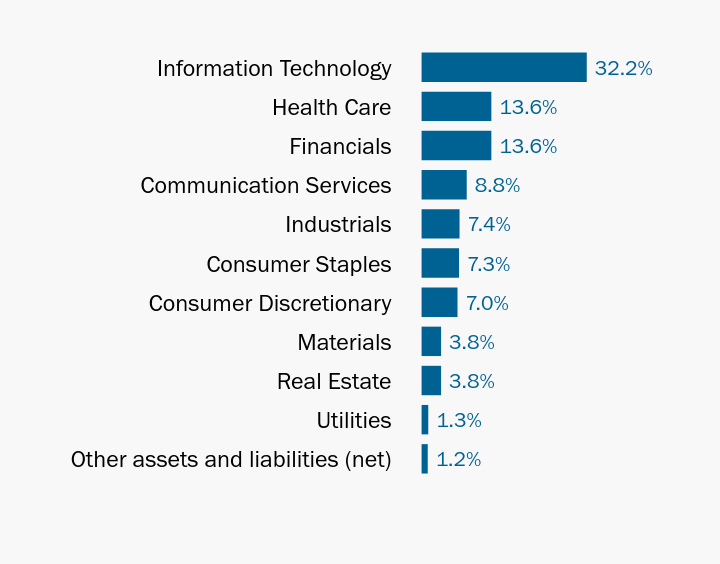

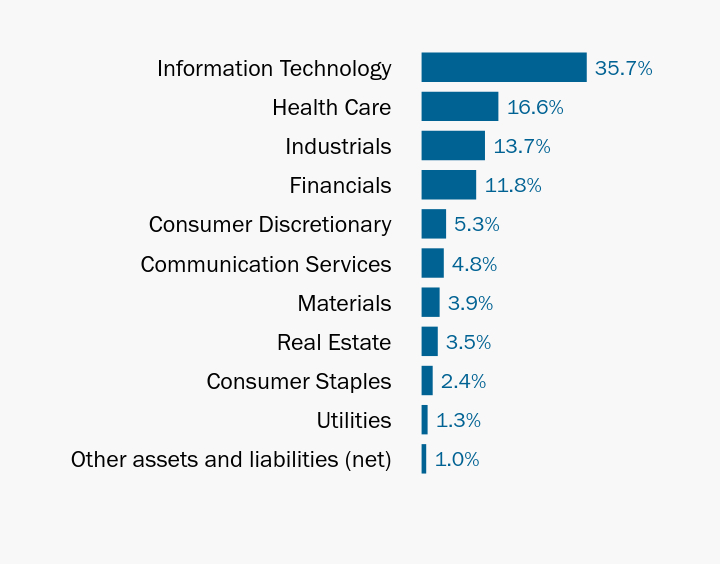

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Utilities | 1.3% |

| Real Estate | 3.8% |

| Materials | 3.8% |

| Consumer Discretionary | 7.0% |

| Consumer Staples | 7.3% |

| Industrials | 7.4% |

| Communication Services | 8.8% |

| Financials | 13.6% |

| Health Care | 13.6% |

| Information Technology | 32.2% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

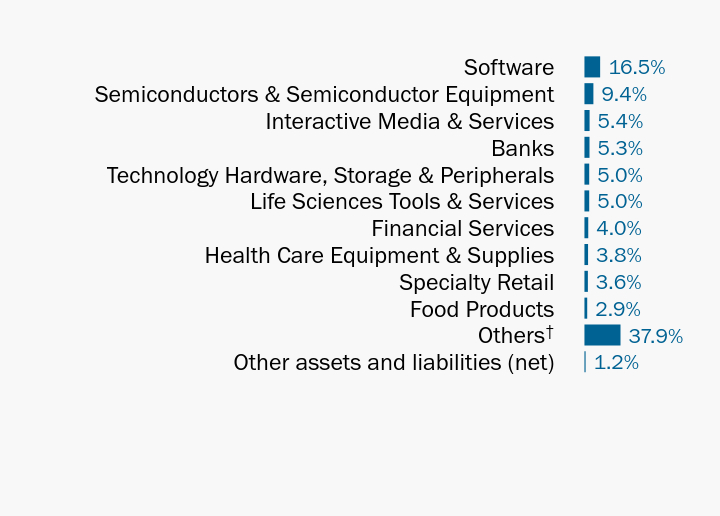

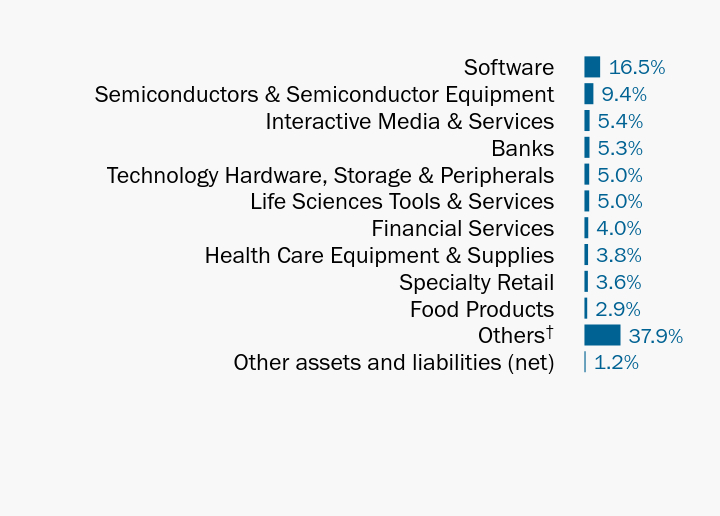

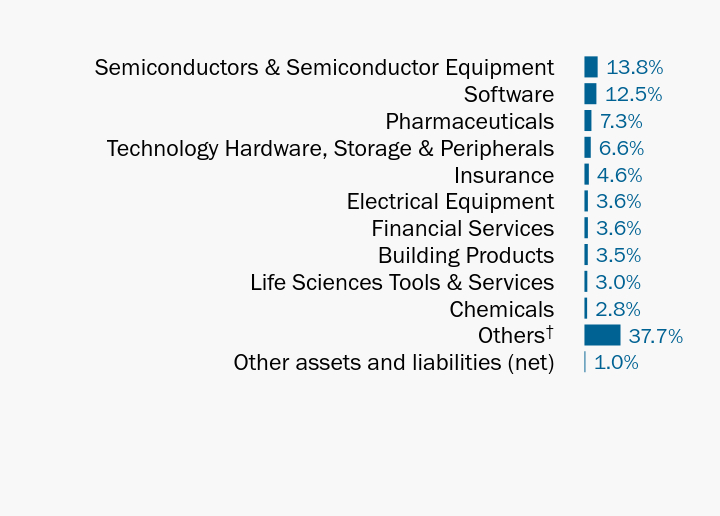

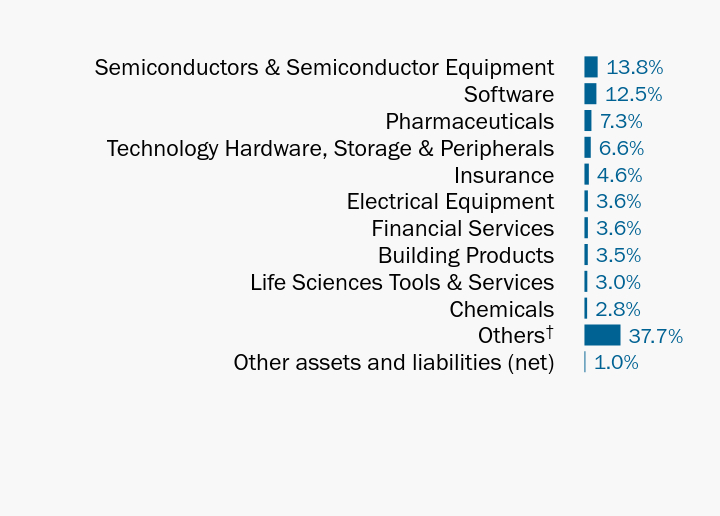

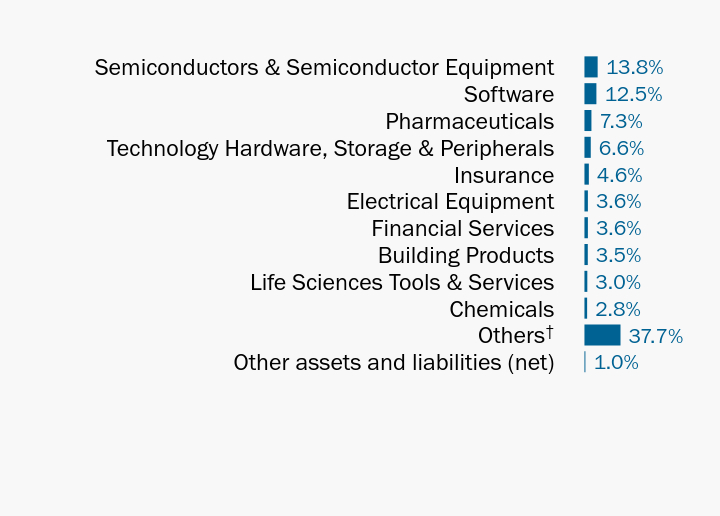

Industry Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

OthersFootnote Reference† | 37.9% |

| Food Products | 2.9% |

| Specialty Retail | 3.6% |

| Health Care Equipment & Supplies | 3.8% |

| Financial Services | 4.0% |

| Life Sciences Tools & Services | 5.0% |

| Technology Hardware, Storage & Peripherals | 5.0% |

| Banks | 5.3% |

| Interactive Media & Services | 5.4% |

| Semiconductors & Semiconductor Equipment | 9.4% |

| Software | 16.5% |

| Footnote | Description |

Footnote† | Included additional industries outside the top 10 listed above. |

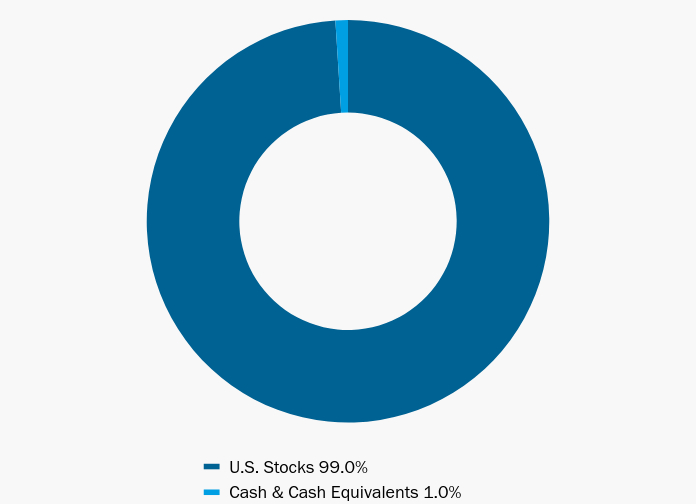

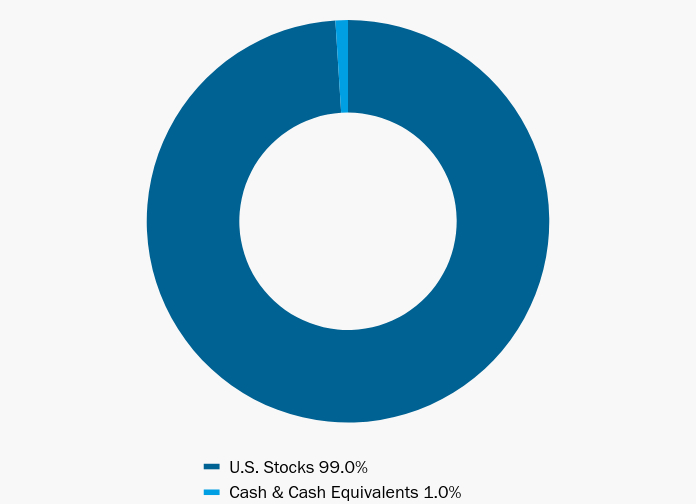

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 97.4% |

| Foreign Stocks | 1.4% |

| Cash & Cash Equivalents | 1.2% |

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXLIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/LC

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/LC.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Large Cap Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/LC. You can find additional information about the Fund at https://impaxam.com/LC. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $51 | 0.98% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $1,492,863,028 |

| Total Number of Portfolio Holdings | 55 |

| Portfolio Turnover Rate | 17% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Microsoft Corp. | 7.9% |

| Alphabet, Inc., A | 5.4% |

| NVIDIA Corp. | 4.7% |

| Apple, Inc. | 3.7% |

| ServiceNow, Inc. | 2.6% |

| Oracle Corp. | 2.6% |

| Merck & Co., Inc. | 2.5% |

| JPMorgan Chase & Co. | 2.4% |

| Walt Disney Co. (The) | 2.2% |

| Procter & Gamble Co. (The) | 2.1% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

| Utilities | 1.3% |

| Real Estate | 3.8% |

| Materials | 3.8% |

| Consumer Discretionary | 7.0% |

| Consumer Staples | 7.3% |

| Industrials | 7.4% |

| Communication Services | 8.8% |

| Financials | 13.6% |

| Health Care | 13.6% |

| Information Technology | 32.2% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Industry Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 1.2% |

OthersFootnote Reference† | 37.9% |

| Food Products | 2.9% |

| Specialty Retail | 3.6% |

| Health Care Equipment & Supplies | 3.8% |

| Financial Services | 4.0% |

| Life Sciences Tools & Services | 5.0% |

| Technology Hardware, Storage & Peripherals | 5.0% |

| Banks | 5.3% |

| Interactive Media & Services | 5.4% |

| Semiconductors & Semiconductor Equipment | 9.4% |

| Software | 16.5% |

| Footnote | Description |

Footnote† | Included additional industries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 97.4% |

| Foreign Stocks | 1.4% |

| Cash & Cash Equivalents | 1.2% |

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/LC

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/LC.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Small Cap Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/SC. You can find additional information about the Fund at https://impaxam.com/SC. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $57 | 1.14% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $667,096,037 |

| Total Number of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 21% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Victory Capital Holdings, Inc., A | 4.8% |

| Ligand Pharmaceuticals, Inc. | 3.6% |

| Onto Innovation, Inc. | 3.5% |

| Brightsphere Investment Group, Inc. | 3.5% |

| US Foods Holding Corp. | 2.6% |

| Voya Financial, Inc. | 2.6% |

| Roivant Sciences Ltd. | 2.5% |

| Element Solutions, Inc. | 2.3% |

| Stericycle, Inc. | 2.2% |

| Arcosa, Inc. | 2.1% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

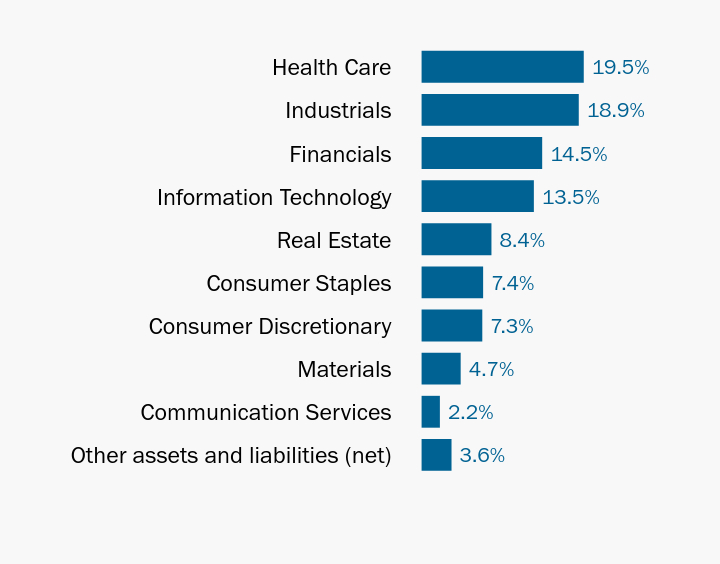

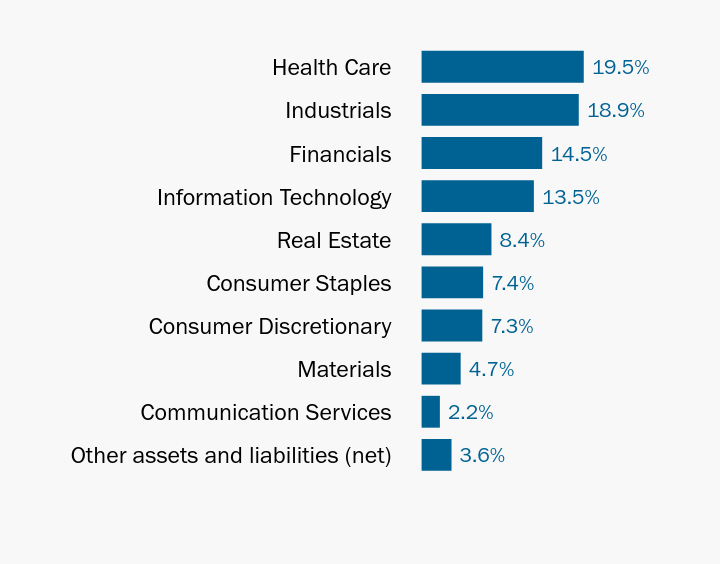

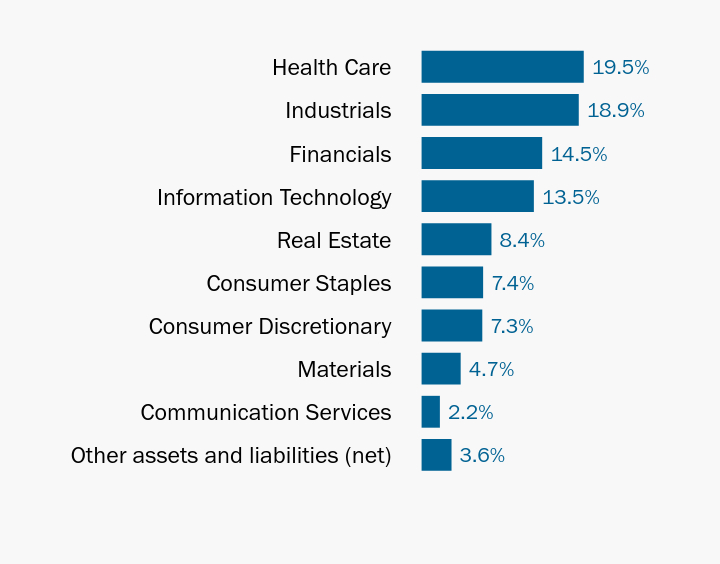

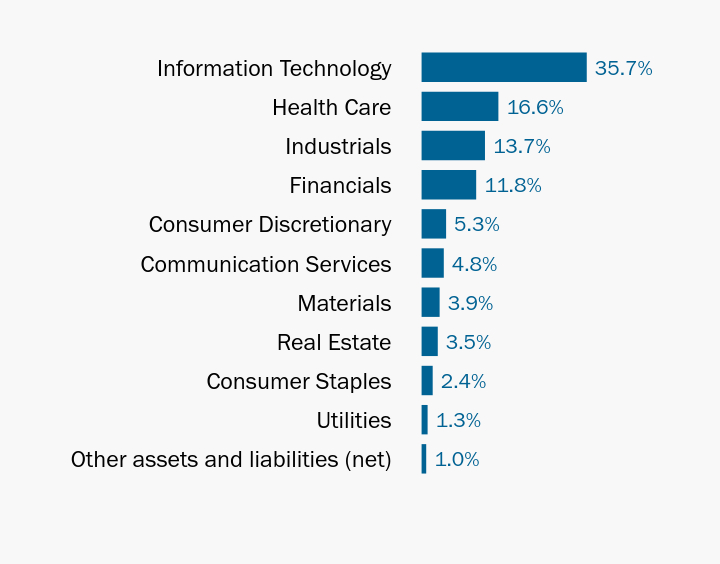

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.6% |

| Communication Services | 2.2% |

| Materials | 4.7% |

| Consumer Discretionary | 7.3% |

| Consumer Staples | 7.4% |

| Real Estate | 8.4% |

| Information Technology | 13.5% |

| Financials | 14.5% |

| Industrials | 18.9% |

| Health Care | 19.5% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

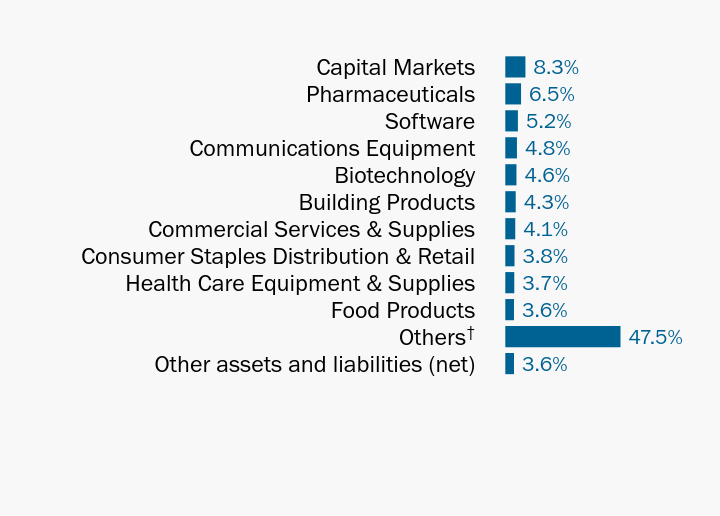

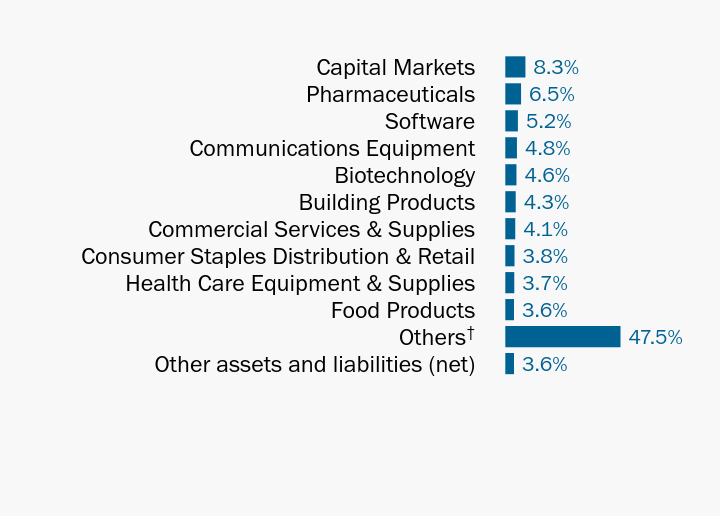

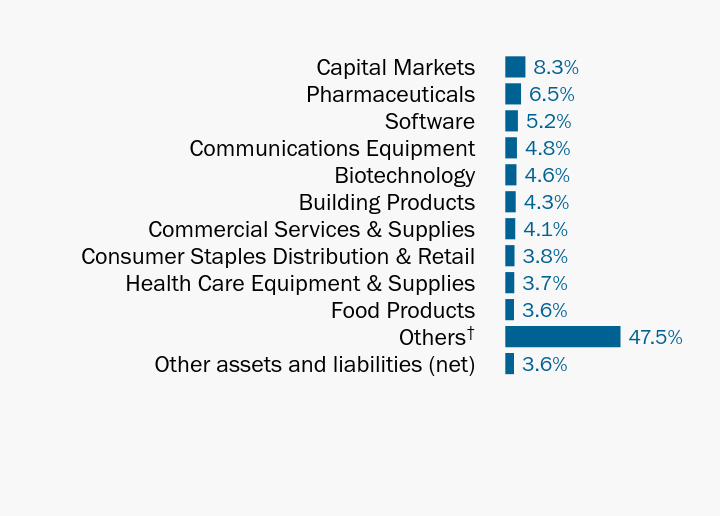

Industry Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.6% |

OthersFootnote Reference† | 47.5% |

| Food Products | 3.6% |

| Health Care Equipment & Supplies | 3.7% |

| Consumer Staples Distribution & Retail | 3.8% |

| Commercial Services & Supplies | 4.1% |

| Building Products | 4.3% |

| Biotechnology | 4.6% |

| Communications Equipment | 4.8% |

| Software | 5.2% |

| Pharmaceuticals | 6.5% |

| Capital Markets | 8.3% |

| Footnote | Description |

Footnote† | Included additional industries outside the top 10 listed above. |

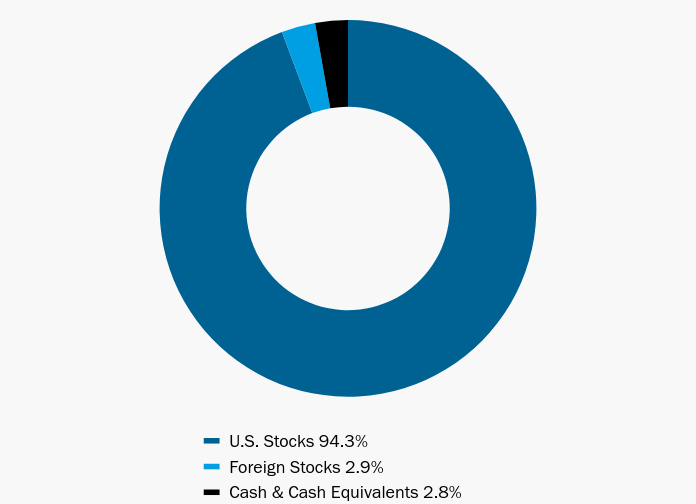

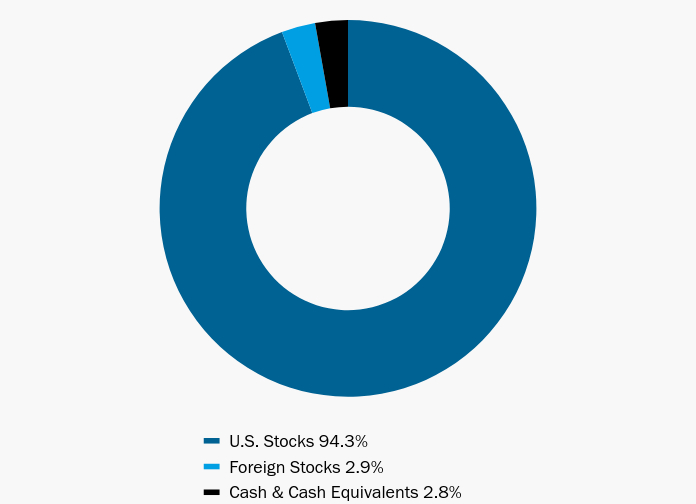

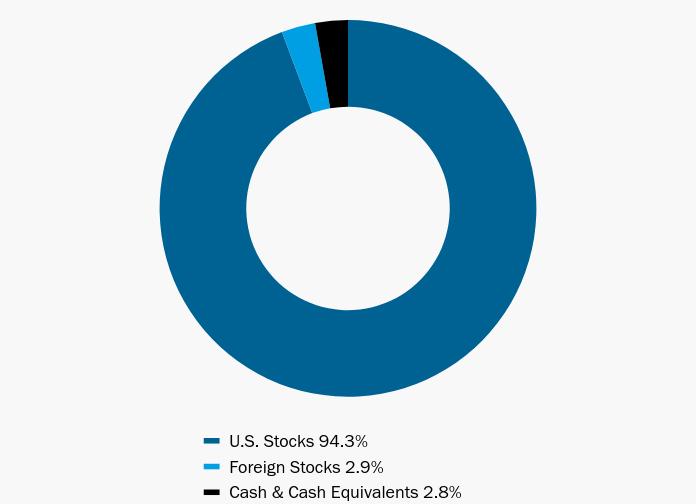

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 94.3% |

| Foreign Stocks | 2.9% |

| Cash & Cash Equivalents | 2.8% |

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/SC

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/SC.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Small Cap Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/SC. You can find additional information about the Fund at https://impaxam.com/SC. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

Institutional Class | PXSIX

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $45 | 0.89% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $667,096,037 |

| Total Number of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 21% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Victory Capital Holdings, Inc., A | 4.8% |

| Ligand Pharmaceuticals, Inc. | 3.6% |

| Onto Innovation, Inc. | 3.5% |

| Brightsphere Investment Group, Inc. | 3.5% |

| US Foods Holding Corp. | 2.6% |

| Voya Financial, Inc. | 2.6% |

| Roivant Sciences Ltd. | 2.5% |

| Element Solutions, Inc. | 2.3% |

| Stericycle, Inc. | 2.2% |

| Arcosa, Inc. | 2.1% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.6% |

| Communication Services | 2.2% |

| Materials | 4.7% |

| Consumer Discretionary | 7.3% |

| Consumer Staples | 7.4% |

| Real Estate | 8.4% |

| Information Technology | 13.5% |

| Financials | 14.5% |

| Industrials | 18.9% |

| Health Care | 19.5% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Industry Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.6% |

OthersFootnote Reference† | 47.5% |

| Food Products | 3.6% |

| Health Care Equipment & Supplies | 3.7% |

| Consumer Staples Distribution & Retail | 3.8% |

| Commercial Services & Supplies | 4.1% |

| Building Products | 4.3% |

| Biotechnology | 4.6% |

| Communications Equipment | 4.8% |

| Software | 5.2% |

| Pharmaceuticals | 6.5% |

| Capital Markets | 8.3% |

| Footnote | Description |

Footnote† | Included additional industries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 94.3% |

| Foreign Stocks | 2.9% |

| Cash & Cash Equivalents | 2.8% |

Semi-annual Shareholder Report

June 30, 2024

Institutional Class: PXSIX

Impax Asset Management

(800) 372-7827

https://impaxam.com/SC

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/SC.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.

This semi-annual shareholder report contains important information about the Impax Small Cap Fund (the "Fund") for the period of January 1, 2024 to June 30, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://impaxam.com/SC. You can find additional information about the Fund at https://impaxam.com/SC. You can also request this information by contacting us at (800) 372-7827.

Semi-annual Shareholder Report

June 30, 2024

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $57 | 1.14% |

Key Fund Statistics as of June 30, 2024

| Net Assets | $667,096,037 |

| Total Number of Portfolio Holdings | 67 |

| Portfolio Turnover Rate | 21% |

Top Ten Holdings as of June 30, 2024Footnote Reference*

| Company | Percent of Net Assets |

| Victory Capital Holdings, Inc., A | 4.8% |

| Ligand Pharmaceuticals, Inc. | 3.6% |

| Onto Innovation, Inc. | 3.5% |

| Brightsphere Investment Group, Inc. | 3.5% |

| US Foods Holding Corp. | 2.6% |

| Voya Financial, Inc. | 2.6% |

| Roivant Sciences Ltd. | 2.5% |

| Element Solutions, Inc. | 2.3% |

| Stericycle, Inc. | 2.2% |

| Arcosa, Inc. | 2.1% |

| Footnote | Description |

Footnote* | Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change. |

Sector Diversification as of June 30, 2024Footnote Reference *

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.6% |

| Communication Services | 2.2% |

| Materials | 4.7% |

| Consumer Discretionary | 7.3% |

| Consumer Staples | 7.4% |

| Real Estate | 8.4% |

| Information Technology | 13.5% |

| Financials | 14.5% |

| Industrials | 18.9% |

| Health Care | 19.5% |

| Footnote | Description |

Footnote * | May include companies representing multiple industries within a single “Sector”. |

Industry Diversification as of June 30, 2024

| Value | Value |

|---|

| Other assets and liabilities (net) | 3.6% |

OthersFootnote Reference† | 47.5% |

| Food Products | 3.6% |

| Health Care Equipment & Supplies | 3.7% |

| Consumer Staples Distribution & Retail | 3.8% |

| Commercial Services & Supplies | 4.1% |

| Building Products | 4.3% |

| Biotechnology | 4.6% |

| Communications Equipment | 4.8% |

| Software | 5.2% |

| Pharmaceuticals | 6.5% |

| Capital Markets | 8.3% |

| Footnote | Description |

Footnote† | Included additional industries outside the top 10 listed above. |

Asset Allocation as of June 30, 2024

| Value | Value |

|---|

| U.S. Stocks | 94.3% |

| Foreign Stocks | 2.9% |

| Cash & Cash Equivalents | 2.8% |

Semi-annual Shareholder Report

June 30, 2024

Impax Asset Management

(800) 372-7827

https://impaxam.com/SC

If you wish to view additional information about the Fund, including but not limited to financial statements or holdings, please visit https://impaxam.com/SC.

For shareholders with multiple accounts at the same address, only one copy of most shareholder documents will be mailed to that address. If you would prefer to receive multiple copies of Fund documents, contact (800) 372-7827.