SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to ‘240.14a-11(c) or ‘240.14a-12 |

PMC-Sierra, Inc.

(Name of Registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

PMC-SIERRA, INC.

3975 Freedom Circle

Santa Clara, California 95054

(408) 239-8000

Notice of Annual Meeting of Stockholders

| | |

| TIME | | June 1, 2006 at 9:00 a.m. |

| |

| PLACE | | Hyatt Regency Santa Clara 5101 Great America Parkway Santa Clara, California 95054 |

| |

| ITEMS OF BUSINESS | | (1) To elect directors to serve until PMC’s 2007 Annual Meeting of Stockholders. The nominees for the Board of Directors are Robert Bailey, Richard Belluzzo, James Diller, Sr., Michael Farese, Jonathan Judge, William Kurtz and Frank Marshall. (2) To ratify the appointment of Deloitte & Touche LLP as PMC’s independent auditors. (3) To consider such other business as may properly come before the annual meeting. |

| |

| RECORD DATE | | You are entitled to vote if you were a stockholder at the close of business on April 3, 2006. |

| |

| ANNUAL MEETING ADMISSION | | All PMC stockholders are cordially invited to attend the annual meeting in person. The annual meeting will begin promptly at 9:00 a.m. |

| |

| VOTING BY PROXY | | Please submit a proxy as soon as possible so that your shares can be voted at the annual meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions on the proxy card. |

|

| /s/ Robert Bailey |

| President and Chief Executive Officer |

This proxy statement and accompanying proxy card are being distributed on or about April 28, 2006.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

PMC currently has six directors. Prior to the annual meeting, the board intends to increase the number of directors to seven, and to appoint Michael Farese as a PMC director. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the seven nominees of the Board named below. If for any reason Dr. Farese does not join the board, PMC will reduce the board size to six directors and propose election of the other six individuals. If any nominee is unable or declines to serve as a director at the time of the annual meeting, the proxies will be voted for any nominee designated by the present Board to fill the vacancy. PMC does not expect that any nominee will be unable to or will decline to serve as a director. The term of office of each person elected as a director will continue until the next annual meeting of stockholders or until the director’s successor has been elected. The table below sets forth information about each nominee as of April 28, 2006.

Recommendation

PMC’s Board of Directors recommends a vote FOR the nominees listed below:

| | | | | | |

Name of Nominee | | Age | | Principal Occupation | | Director

Since |

Robert Bailey | | 48 | | President and Chief Executive Officer, PMC | | 1996 |

Richard Belluzzo | | 52 | | Chief Executive Officer, Quantum Corporation | | 2003 |

James Diller, Sr. | | 70 | | Retired | | 1983 |

Michael Farese | | 59 | | Senior Vice President of Engineering, Palm, Inc. | | — |

Jonathan Judge | | 52 | | Chief Executive Officer, Paychex, Inc | | 2004 |

William Kurtz | | 49 | | Executive Vice President and Chief Financial Officer of Novellus Systems, Inc. | | 2003 |

Frank Marshall | | 59 | | Private Investor and Management Consultant | | 1996 |

Robert Bailey

Mr. Bailey has been a director of PMC since October 1996. Mr. Bailey has been PMC’s President and Chief Executive Officer since July 1997. He has been Chairman of the Board of Directors since May 2005 and also served as Chairman from February 2000 until February 2003. Mr. Bailey has served as President, Chief Executive Officer and director of PMC-Sierra, Ltd., PMC’s Canadian operating subsidiary (“LTD”) since December 1993. Mr. Bailey was employed by AT&T-Microelectronics (now known as Agere Systems) from August 1989 to November 1993, where he served as Vice President and General Manager, and by Texas Instruments in management from June 1979 to August 1989.

Richard Belluzzo

Mr. Belluzzo has been a director of PMC since June 2003. He has been Chief Executive Officer of Quantum Corporation, a computer storage solutions company, since September 2002. From September 1999 to May 2002, Mr. Belluzzo held senior management positions with Microsoft Corp., most recently President and Chief Operating Officer. From January 1998 to September 1999, Mr. Belluzzo was Chief Executive Officer of Silicon Graphics Inc. From 1975 to January 1998, Mr. Belluzzo was with Hewlett-Packard Co., most recently as Executive Vice President of the printer business. Mr. Belluzo is also a director of Quantum Corporation and JDS Uniphase, an optical telecommunications equipment maker.

James Diller, Sr.

Mr. Diller, a founder of PMC, was PMC’s Chief Executive Officer from 1983 to July 1997 and President from 1983 to July 1993. Mr. Diller has been a director of PMC since its formation in 1983. Mr. Diller was Chairman of PMC’s Board of Directors from July 1993 until February 2000, when he became Vice Chairman. He is also a director of Intersil Corporation, an analog semiconductor company, and Chairman of the Board of Directors of Summit Microelectronics, an analog power management company.

Michael Farese

Dr. Farese is the Senior Vice President of Engineering for Palm, Inc., a maker of hand-held devices. He was Chief Executive Officer and President of WJ Communications from March 2002 to June 2005. He was Chief Executive Officer and President of Tropian, Inc. from October 1999 to March 2002.

Jonathan Judge

Mr. Judge has been a director since April 2004. Since October 2004, Mr. Judge has been the President and Chief Executive Officer of Paychex, Inc., a provider of payroll and human resource services. Mr. Judge served as President and Chief Executive Officer of Crystal Decisions, Inc. from October 2002 until the merger of Crystal Decisions with Business Objects S.A. in December 2003. From 1976 until October 2002, Mr. Judge was employed by International Business Machines Corporation, where he held senior management positions, most recently as General Manager of IBM’s personal computing division. Mr. Judge was also a member of IBM’s Worldwide Management Committee from 1999 until 2002. Mr. Judge is also a director of Paychex, Inc.

William Kurtz

Mr. Kurtz has been a director of PMC since April 2003. He became the Executive Vice President and Chief Financial Officer of Novellus Systems, Inc., a semiconductor equipment company, in September 2005. From March 2004 until August 2005, Mr. Kurtz was Senior Vice President and Chief Financial Officer of Engenio Information Technologies, Inc. From July 2001 to February 2004, Mr. Kurtz was Chief Operating Officer and Chief Financial Officer of 3PARdata, Inc. From August 1998 to June 2001, Mr. Kurtz was Executive Vice President and Chief Financial Officer of Scient Corporation. From July 1983 to August 1998, Mr. Kurtz served in various capacities at AT&T, including Vice President of Cost Management and Chief Financial Officer of AT&T’s Business Markets Division. Prior to joining AT&T, he worked at Price Waterhouse, now PricewaterhouseCoopers LLP. Mr. Kurtz is a certified public accountant. He is also a director of Redback Networks, Inc., a broadband networking equipment company.

Frank Marshall

Mr. Marshall has been a director of PMC since April 1996. Mr. Marshall is a private investor in, and management consultant to, early stage high technology companies. Mr. Marshall served as interim Chief Executive Officer of Covad Communications Group from November 2000 until July 2001. From July 1995 to October 1997, Mr. Marshall was Vice President and General Manager, Core Products Business Unit of Cisco Systems, Inc. From April 1992 to July 1995, Mr. Marshall was Vice President of Engineering for Cisco Systems, Inc. He is also a director of Juniper Networks Inc., a network equipment company.

Vote Required

The seven nominees for director receiving the highest number of affirmative votes of shares shall be elected as directors. Votes withheld from any director are counted for purposes of determining the presence or absence of a quorum, but have no other legal effect under Delaware law.

-2-

BOARD STRUCTURE

Board Independence

The Board has determined that all of the nominees, except Mr. Bailey, satisfy the definition of independent director as established in Nasdaq listing standards. The Board has determined that each of the members of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee satisfies the definition of independent director as established in Nasdaq listing standards.

Meetings

During the 2005 fiscal year, the Board held six meetings. Each of our directors attended at least 75% of all board and applicable committee meetings. Directors are encouraged to attend annual meetings of PMC stockholders. Five directors attended the last annual meeting of stockholders.

Lead Independent Director

Mr. Marshall has been the Board’s Lead Independent Director since May 2005. The Lead Independent Director has the following responsibilities:

| | • | | authority to call meetings of the independent directors |

| | • | | lead meetings of the independent directors in which the Chairman does not participate |

| | • | | act as a liaison between the independent directors and the Chairman |

| | • | | review agendas for Board meetings in consultation with the Chairman |

| | • | | receive communications from stockholders in accordance with the procedures specified in this Proxy Statement for communications with the Board |

| | • | | be available for consultation with stockholders to the extent determined by the independent directors |

The Board believes that these responsibilities are substantially equal to the functions performed by an independent Chairman of the Board.

Audit Committee

The Audit Committee consists of Mr. Belluzzo, Mr. Judge and Mr. Kurtz (Chair) and held eight meetings in fiscal 2005. The Board has determined that Mr. Kurtz is qualified as an “audit committee financial expert.” The Audit Committee appoints, compensates and oversees the independent auditors. The Audit Committee approves the independent auditors’ fees and pre-approves any audit and non-audit services to be provided by the independent auditors. The Audit Committee also monitors the independence of the auditors.

The Audit Committee meets independently with PMC’s independent auditors and senior management to review the general scope of PMC’s accounting, financial reporting, annual audit and internal audit programs, matters relating to internal control systems and results of the annual audit.

The Audit Committee has authority to review and approve any proposed transactions between PMC and its officers and directors, or their affiliates. The Audit Committee also constitutes PMC’s Qualified Legal Compliance Committee to review any reports from PMC’s counsel of material violations of laws. The Audit Committee Charter was filed with PMC’s 2004 proxy statement.

-3-

Compensation Committee

The Compensation Committee in fiscal 2005 consisted of Mr. Diller and Mr. Judge, held six formal meetings and met several times informally. The Compensation Committee reviews and approves PMC’s compensation policies, plans and programs, including the compensation of and employment agreements with its executive officers. The Committee also acts as administrator of PMC’s equity incentive plans and benefit programs. The Compensation Committee Charter was filed with PMC’s 2004 proxy statement.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Mr. Diller and Mr. Marshall. The Committee held three meetings in fiscal 2005. The Nominating and Corporate Governance Committee makes recommendations to the entire Board as to the size and composition of the Board and its committees. The Committee determines criteria for Board and committee membership, evaluates director compensation, reviews conflicts of interest and monitors PMC’s corporate governance. The Committee supervises an annual Board assessment of the Board’s own performance. The Committee informally evaluates the performance of individual directors as part of the annual nomination process. The Nominating and Corporate Governance Committee Charter was filed with PMC’s 2004 proxy statement.

Other Committees

The Board has authorized a committee, consisting of Mr. Bailey and any other director, to administer any non-equity benefit plan of PMC or any PMC subsidiary, and to grant stock options to purchase up to 25,000 shares of PMC’s common stock to individuals not subject to Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”). The Board has authorized a committee, consisting of Mr. Bailey and any two directors, to approve capital expenditures.

Consideration of Director Nominees

The Nominating and Corporate Governance Committee selects nominees for annual election by the stockholders by first evaluating the Board which would result from re-electing directors willing to continue serving on the Board. If the Committee requires additional candidates, the directors and senior management suggest potential nominees. PMC has also paid third party search firms to identify, screen and assist in recruiting potential nominees based on criteria provided by PMC. The Committee, other Board members and senior management then meet with candidates so the Committee has broad input in evaluating the candidate. The Committee also confirms the candidate’s independence under SEC and Nasdaq rules. This process may also occur between annual meetings if the Committee determines that PMC would benefit from additional directors.

The Committee believes that in addition to factors such as the candidate’s integrity, judgment and reputation, PMC’s Board benefits from directors who share the following qualities or skills.

| | • | | Independence from management (not applicable to PMC’s CEO). |

| | • | | Extensive business and industry experience, particularly in the technology sector. |

| | • | | Experience as an executive officer of a publicly traded corporation. |

| | • | | Experience as a director of a publicly traded corporation. |

-4-

| | • | | Knowledge about the industries in which PMC’s end user customers participate, or the markets which those customers serve. |

| | • | | Absence of potential conflicts of interest. |

| | • | | Available time for service as a PMC director in light of the candidate’s other business and professional commitments. |

The Committee has no specific, minimum qualifications that it believes must be met for a position on PMC’s Board, other than the financial expertise of potential Audit Committee members, and whether at least one Audit Committee member qualifies as an “audit committee financial expert.”

The Committee will consider, through the process described above, director candidates recommended by stockholders. To recommend a candidate, stockholders should submit to PMC’s CEO, who will provide it to the Committee, an analysis of the candidate’s independence and the factors listed above, and a description of any relationship between the stockholder and candidate. To be considered for the 2007 annual meeting, suggestions meeting these criteria must be received before December 29, 2006.

Communications with the Board

Any stockholder who desires to contact our Lead Independent Director or the other members of our Board may do so by writing to: Board of Directors, c/o Corporate Secretary, PMC-Sierra, Inc., 3975 Freedom Circle, Santa Clara, California 95054. Communications received in writing are reviewed internally by management and then distributed to the Lead Independent Director or the other members of the Board as appropriate.

Code of Business Conduct and Ethics

PMC has adopted a Code of Business Conduct and Ethics that applies to all of our employees, including our Chief Executive Officer, our Chief Financial Officer and our principal accounting officers. PMC undertakes to provide any person, without charge, a copy of the Code of Business Conduct and Ethics upon written request to PMC’s Corporate Secretary.

-5-

DIRECTOR COMPENSATION

PMC’s non-employee directors receive the following compensation. Directors employed by PMC (currently only Mr. Bailey) do not receive any compensation for their Board activities.

| | | | | | |

Compensation Item | | | | | |

Annual Director Compensation | | | | $ | 25,000 | (1)(2) |

Per meeting payment | | | | $ | 1,000 | |

Initial Stock Option | | | | | 40,000 | shares (3) |

Annual Stock Option | | | | | 40,000 | shares(4) |

Annual Compensation for Audit Committee Chair | | | | $ | 15,000 | (1) |

Annual Compensation for Lead Independent Director or Independent Board Chair | | | | $ | 15,000 | (1) |

Annual Compensation for each committee member except Audit Committee Chair | | | | $ | 3,000 | (1) |

| (1) | Directors may elect annually not to receive the cash payment and instead to receive a fully vested option, exercisable at fair market value on the date of grant, to purchase a number of shares equal to three times the cash payment, divided by the per share market value on the date of grant. |

| (2) | PMC’s Compensation Committee in 2005 engaged an independent consultant to review director compensation and based on that review recommended an increase in the annual cash payment from the $20,000 paid in 2005 to $25,000. The proposed increase will be effective beginning with the 2006 Annual Stockholder Meeting. |

| (3) | Directors receive a stock option to purchase 40,000 shares upon joining the Board. This stock option vests 1/24 per month over two years, and has an exercise price equal to the fair market value of the stock on the date of grant. |

| (4) | Other than in the calendar year a director is first appointed to the Board, upon reelection to the Board at each annual meeting, each Board member receives four stock options for 10,000 shares – one on reelection and then one every 90 days thereafter. These stock options have an exercise price equal to the fair market value of the stock on the date of grant. The options are unvested on their grant date and vest evenly every month until they are fully vested two years after the Board member’s reelection to the Board. |

PMC has agreed to indemnify each director and officer against certain claims and expenses for which the director might be held liable in connection with past or future services to PMC and its subsidiaries. PMC maintains insurance policies insuring its officers and directors against such liabilities.

-6-

EXECUTIVE OFFICERS

The following information about our executive officers is as of April 28, 2006.

| | | | | | |

Name of Officer | | Age | | Position | | |

Robert Bailey | | 48 | | President, Chief Executive Officer and Director | | |

Colin Harris | | 48 | | Vice President, Worldwide Operations | | |

Alan Krock | | 45 | | Vice President, Chief Financial Officer | | |

Robert M. Liszt | | 49 | | Vice President, Worldwide Sales | | |

Ben D. Naskar | | 51 | | Vice President and General Manager | | |

Mark Stibitz | | 47 | | Vice President and General Manager | | |

Mr. Bailey has served as PMC’s President and Chief Executive Officer since July 1997. He has been Chairman of the Board of Directors since May 2005 and was also Chairman from February 2000 until February 2003. Mr. Bailey has been a director of PMC since October 1996. Mr. Bailey has served as President, Chief Executive Officer and director of PMC-Sierra, Ltd., PMC’s Canadian operating subsidiary (“LTD”) since December 1993. Mr. Bailey was employed by AT&T-Microelectronics (now known as Agere Systems) from August 1989 to November 1993, where he served as Vice President and General Manager, and by Texas Instruments in management from June 1979 to August 1989.

Mr. Harris has served as Vice President of Worldwide Operations at PMC since July 2004. Mr. Harris was PMC’s Vice President of IC Technology from June 2001 to July 2003. In 1992, he became PMC’s director of Operations and subsequently director of Quality Assurance. Before joining PMC in 1989 as Operations Manager, Mr. Harris was employed by Mitel Semiconductor.

Mr. Krock has served as PMC’s Vice President and Chief Financial Officer since November 2002. He was Vice President and Chief Financial Officer of Integrated Device Technology, Inc. from January 1998 until November 2002, a Vice President from July 1997 until January 1998 and its Corporate Controller from February 1996 to July 1997. Previously Mr. Krock held management positions at Rohm Corporation and Price Waterhouse, now PricewaterhouseCoopers LLP. He currently serves as a Director of Netlogic Microsystems, Inc., a fabless semiconductor company.

Mr. Liszt became PMC’s Vice President of Worldwide Sales in March 2006. He was Agere Systems’ Vice President, Global Sales from November 2005 to February 2006 and Vice President, North American Sales from May 2002 until November 2005. He was NEC Electronics’ Vice President Components Division in 2001, Vice President, North American Sales from June 1999 to January 2001 and Associate Vice President of Geographic Sales from September 1998 to May 1999. From 1982 to 1998, he held sales management positions with Hitachi America Semiconductor.

Mr. Naskar has served as Vice President and General Manager of PMC’s Communications Products Division since September 2005. Mr. Naskar was employed by Magfusion Inc. from May 2002 to August 2005, most recently as President and CEO. Mr. Naskar was previously Managing Director and Vice President, Asia Pacific, for Analog Devices, Group Director in the Communications Division of National Semiconductor, and worked as a senior manager for Advanced Micro Devices, Inc.

Mr. Stibitz has served as Vice President and General Manager of PMC’s Enterprise and Storage Division since December 2001. He was a Vice President and General Manager at Agere Systems (formerly Lucent Technologies Microelectronics Group) from September 1996 to December 2001. Prior to that, Mr. Stibitz was the ASIC Product Line Director at AT&T Microelectronics and a member of AT&T Bell technical staff for fifteen years.

-7-

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of December 31, 2005, concerning:

| | • | | beneficial ownership of PMC’s common stock by all persons known to PMC to be the beneficial owners of 5% or more of PMC’s common stock; |

| | • | | beneficial ownership of PMC’s common stock by all directors, nominees and Named Executive Officers; and |

| | • | | beneficial ownership of PMC’s common stock by all directors and executive officers as a group. |

Under the rules of the Securities and Exchange Commission, “beneficial ownership” includes any shares as to which the individual has the sole or shared voting power or investment power and also any shares which the individual has the right to acquire as of March 1, 2006 (60 days after December 31, 2005), through the exercise of any stock option or other right. Unless otherwise indicated, each person or entity has sole investment and voting power, or shares such powers with his or her spouse, with respect to the shares set forth in the following table. This information is not indicative of beneficial ownership for any other purpose. Unless otherwise indicated, the address of each of the individuals named below is c/o PMC-Sierra, Inc., 3975 Freedom Circle, Santa Clara, California 95054.

| | | | |

Name | | Number of Shares | | Approximate

Percentage

Ownership |

FMR Corp.(1) | | 27,467,754 | | 14.9% |

AXA Financial, Inc(2) | | 18,990,558 | | 10.3% |

T. Rowe Price Associates, Inc.(3) | | 12,350,221 | | 6.7% |

Massachusetts Financial Services Company(4) | | 9,581,903 | | 5.2% |

Robert Bailey(5) | | 3,910,599 | | 2.1% |

James Diller, Sr.(6) | | 2,990,155 | | 1.6% |

Steffen Perna(7) | | 1,085,308 | | * |

Frank Marshall (8) | | 448,594 | | * |

Alan Krock (9) | | 386,275 | | * |

Colin Harris (10) | | 362,805 | | * |

Thomas Sun (11) | | 237,411 | | * |

Tom Brigiotta(12) | | 135,835 | | * |

William Kurtz(13) | | 91,302 | | * |

Richard Belluzzo(14) | | 81,927 | | * |

Jonathan Judge(15) | | 44,939 | | * |

| | |

All directors and executive officers as a group (13 persons)(16) | | 11,833,587 | | 6.1% |

| (1) | Based solely on information reported by FMR Corp. (“FMR”) on a Schedule 13G filed with the SEC on February 14, 2006. FMR has sole investment power with respect to all of such shares, sole voting authority with respect to 898,063 shares, shared voting power over none of the shares and shared investment power over none of the shares. The address of FMR is 82 Devonshire Street, Boston, Massachusetts 02109. Includes 26,972,228 shares beneficially owned by Fidelity Management & Research Company, an affiliate of FMR. |

| (2) | Based solely on information reported by AXA Assurances I.A.R.D. Mutuelle on a Schedule 13G filed with the SEC on February 10, 2006. AXA has sole investment power with respect to all such shares, sole voting authority with respect to 17,031,871 shares, shared voting power over none of the shares and shared investment power over none of the shares. The address of AXA is 26, rue Drouot, 75009 Paris, France. |

-8-

| (3) | Based solely on information reported by T. Rowe Price Associates, Inc. (“T. Rowe Price”) on a Schedule 13G filed with the SEC on February 14, 2006. T. Rowe Price has sole investment power with respect to all of such shares, sole voting authority with respect to 1,824,399 shares, shared voting power over none of the shares and shared investment power over none of the shares. The address of T. Rowe Price is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (4) | Based solely on information reported by Massachusetts Financial Services Company (“MFS”) on a Schedule 13G filed with the SEC on February 14, 2006. MFS has sole investment power with respect to all of such shares, sole voting authority with respect to 9,423,123 shares, shared voting power over none of the shares and shared investment power over none of the shares. The address of MFS is 500 Boylston Street, Boston, MA 02116. |

| (5) | Includes 10,401 shares held jointly by Robert L. Bailey and Merry L. Bailey. Includes 2,808,904 shares subject to options exercisable within 60 days after December 31, 2005, 1,708 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005 and 7,780 shares held by Mr. Bailey’s two children. Includes 1,081,806 shares issuable upon redemption of LTD Special Shares. |

| (6) | Includes 639,072 shares held jointly by James Diller and June P. Diller, Trustees of the James Diller and June P. Diller Trust UA 07/20/77, includes 1,065,779 shares subject to options exercisable within 60 days after December 31, 2005, 642,652, shares held by the James Diller Annuity Trust (GRAT) and 642,652 shares held by his wife’s separate annuity trust, the June Diller Annuity Trust (GRAT). Voting and investment control of the shares held by the James Diller and June P. Diller Trust UA 07/20/77 is held by James Diller and June Diller. Voting and investment control of the shares held by the James Diller Annuity Trust (GRAT) is held by James Diller. Voting and investment control of the shares held by the June Diller Annuity Trust (GRAT) is held by James Diller. |

| (7) | Includes 1,070,678 shares subject to options exercisable within 60 days after December 31, 2005 and 1,766 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005. |

| (8) | Includes 286,302 shares subject to options exercisable within 60 days after December 31, 2005. Includes 123,328 shares held by Timark, L.P. Mr. Marshall is a General Partner of Timark, L.P. and disclaims beneficial ownership except to the extent of his pecuniary interest therein. Mr. Marshall has voting and investment control over the shares held by Timark, L.P. |

| (9) | Includes 383,332 shares subject to options exercisable within 60 days after December 31, 2005 and 1,969 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005. |

| (10) | Includes 334,311 shares subject to options exercisable within 60 days after December 31, 2005 and 1,850 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005. Includes 20,412 shares issuable upon redemption of LTD Special Shares held by Mr. Harris’ spouse and three children. |

| (11) | Includes 214,221 shares subject to options exercisable within 60 days after December 31, 2005 and 1,915 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005. |

| (12) | Includes 133,333 shares subject to options exercisable within 60 days after December 31, 2005 and 1,315 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005. |

| (13) | Includes 91,302 shares subject to options exercisable within 60 days after December 31, 2005. |

| (14) | Includes 81,927 shares subject to options exercisable within 60 days after December 31, 2005. |

| (15) | Includes 44,939 shares subject to options exercisable within 60 days after December 31, 2005. |

| (16) | Includes 8,292,448 shares subject to options exercisable within 60 days after December 31, 2005 and 11,781 shares issuable pursuant to PMC’s 1991 Employee Stock Purchase Plan within 60 days after December 31, 2005 held by the current executive officers and directors listed above and two executive officers not listed above. Includes 1,298,690 shares issuable upon redemption of LTD Special Shares held by two executive officers listed above and one executive officer not listed above. See notes (5) through (15) above. |

-9-

EXECUTIVE COMPENSATION AND OTHER MATTERS

The following table provides fiscal 2005 compensation information for the Chief Executive Officer and the four other executive officers of PMC who, based on their salary and bonus compensation, were the most highly compensated in fiscal year 2005, and one former executive officer of PMC (the “Named Executive Officers”).

Summary Compensation Table

| | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation | | Long-Term

Compensation (1) | | All Other Compensation |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Stock Options (#)(2) | | Life

Insurance

Premiums

($) | | Retirement

Account

Contributions

($) | | Relocation

Expenses

($) | | | Other($) |

Robert Bailey | | 2005 | | 400,000 | | 168,750 | | 600,000 | | 757 | | — | | — | | | — |

President and Chief Executive Officer | | 2004 | | 350,000 | | 118,000 | | 605,112(3) | | 666 | | — | | — | | | — |

| | 2003 | | 350,000 | | — | | 1,630,000(4) | | 666 | | — | | — | | | — |

| | | | | | | | |

Alan Krock | | 2005 | | 237,557 | | 81,230 | | 200,000 | | 456 | | 7,685 | | 92 | | | — |

Vice President and Chief Financial Officer | | 2004 | | 225,000 | | 48,566 | | 202,556(5) | | 455 | | 7,134 | | 43,069 | (6) | | — |

| | 2003 | | 225,000 | | — | | 400,000 | | 532 | | 6,762 | | 204,466 | (7) | | — |

| | | | | | | | |

Thomas Brigiotta(8) | | 2005 | | 257,635 | | 41,500 | | 40,000 | | 526 | | 5,250 | | 109,732 | | | — |

Vice President, Worldwide Sales | | 2004 | | 68,308 | | — | | 400,000 | | 179 | | 601 | | 57,815 | | | — |

| | | | | | | | | | | | | | | | | — |

| | | | | | | | |

Colin Harris | | 2005 | | 225,797 | | 52,621 | | 250,000(9) | | 395 | | 7,685 | | — | | | — |

Vice President, Worldwide Operations | | 2004 | | 188,777 | | 29,628 | | 150,000(10) | | 352 | | 7,134 | | — | | | — |

| | 2003 | | 180,253 | | — | | 275,000(4) | | 389 | | 6,686 | | — | | | — |

| | | | | | | | |

Thomas Sun(11) | | 2005 | | 227,921 | | 43,261 | | 200,000 | | 61 | | 7,685 | | 29,551 | | | — |

Vice President, Asia Pacific | | 2004 | | 177,223 | | 30,934 | | 77,556(5) | | 80 | | 7,134 | | 24,896 | | | — |

| | 2003 | | 156,014 | | — | | 249,000(4) | | 338 | | 6,686 | | 22,010 | | | — |

| | | | | | | | |

Steffen Perna(12) | | 2005 | | 247,557 | | 21,356 | | 200,000 | | 784 | | — | | — | | | — |

Vice President and General Manager | | 2004 | | 232,982 | | 40,703 | | 252,556(5) | | 124 | | — | | 32,264 | | | — |

| | 2003 | | 188,000 | | 60,000 | | 600,000(4) | | 249 | | — | | — | | | — |

| (1) | PMC made no restricted stock awards during the periods presented. |

| (2) | All options granted in fiscal year 2005, other than as described in the other footnotes, were options granted on April 18, 2005 at an exercise price of $7.87 per share, which vest 1/4 one year from the date of grant and 1/48 monthly thereafter. |

| (3) | Includes a fully vested option to purchase 5,112 shares of common stock at an exercise price of $0.01 per share, which had an aggregate fair market value of $102,905 on the grant date of December 29, 2003. |

| (4) | Options granted in fiscal year 2003 replaced options cancelled in fiscal year 2002. |

| (5) | Includes a fully vested option to purchase 2,556 shares of common stock at an exercise price of $0.01 per share, which had an aggregate fair market value of $51,452 on the grant date of December 29, 2003. |

| (6) | Mr. Krock’s relocation expenses included an income tax gross-up of $43,069 in fiscal year 2004. |

| (7) | Relocation expenses incurred in 2002 but paid in 2003. |

| (8) | Mr. Brigiotta became an executive officer in September 2004 and ceased to be an executive officer in October 2005. |

| (9) | Includes options for: 62,500 shares granted on April 18, 2005 at an exercise price of $ 7.87 per share, 62,500 shares granted on July 18, 2005 at an exercise price of $10.14 per share, 62,500 shares granted on October 18, 2005 at an exercise price of $ 7.83 per share and 62,500 shares granted on January 18, 2006 at an exercise price of $9.29 per share, all of which vest 1/4 on April 18, 2006 and 1/48 monthly thereafter. |

| (10) | Includes option for 50,000 shares granted on October 20, 2004 at an exercise price of $9.00 per share, which vests 1/4 one year from the date of grant and 1/48 monthly thereafter. |

| (11) | Mr. Sun ceased to be an executive officer on February 2, 2006. |

| (12) | Mr. Perna ceased to be an executive officer on April 3, 2006. |

No Named Executive Officer had tax planning or other reimbursable personal expenses, other than relocation expenses, in excess of $50,000.

The Company provides the Named Executive Officers with no perquisites or personal benefits during or after the officer’s employment, except as disclosed in this proxy statement.

-10-

Option Grants In Last Fiscal Year

The following table sets forth each stock option grant made during fiscal year 2005 to each of the Named Executive Officers. Under the terms of PMC’s 1994 Incentive Stock Plan, the Board of Directors retains discretion, subject to plan limits, to modify the terms of outstanding options and to reprice the options.

| | | | | | | | | | | | |

| | | Number of

Securities

Underlying

Options Granted(1) | | % of Total

Options

Granted to

Employees in Fiscal Year(2) | | Exercise or

Base Price ($/Sh) | | Expiration Date | | Potential Realizable Value at

Assumed Annual Rates of Stock Price

Appreciation for Option Term(3) |

Name | | | | | | 5%($) | | 10%($) |

Robert Bailey | | 600,000 | | 7.89% | | 7.87 | | 04/18/2015 | | 2,969,640 | | 7,525,652 |

Alan Krock | | 200,000 | | 2.63% | | 7.87 | | 04/18/2015 | | 989,880 | | 2,508,551 |

Thomas Brigiotta | | 40,000 | | 0.53% | | 7.87 | | 04/18/2015 | | 197,976 | | 501,710 |

Colin Harris(4) | | 62,500 | | 0.82% | | 7.87 | | 04/18/2015 | | 309,338 | | 783,922 |

| | 62,500 | | 0.82% | | 10.14 | | 07/18/2015 | | 398,562 | | 1,010,034 |

| | 62,500 | | 0.82% | | 7.83 | | 10/18/2015 | | 307,765 | | 779,938 |

| | 62,500 | | 0.82% | | 9.29 | | 01/18/2006 | | 365,152 | | 925,367 |

Thomas Sun | | 200,000 | | 2.63% | | 7.87 | | 04/18/2015 | | 989,880 | | 2,508,551 |

Steffen Perna | | 200,000 | | 2.63% | | 7.87 | | 04/18/2015 | | 989,880 | | 2,508,551 |

| (1) | The options granted vest as to 1/4th of the shares on 04/18/2006; thereafter, 1/48 of the total granted vest on the 18th day of each month. |

| (2) | PMC granted options to purchase 7,603,677 shares of Common Stock to employees in fiscal 2005. |

| (3) | The 5% and 10% assumed annualized rates of compound stock price appreciation are mandated by rules of the Securities and Exchange Commission and do not represent PMC’s estimate or projection by PMC of future Common Stock prices. |

| (4) | Mr. Harris was granted an option for 250,000 shares on April 18, 2005 and elected to receive it in four quarterly installments. |

Aggregated Option Exercises In Last Fiscal Year And

Fiscal Year-End Option Values

The following table shows aggregate exercises of options to purchase PMC’s common stock in fiscal 2005 by the Named Executive Officers.

| | | | | | | | | | | | | |

| | | Shares

Acquired on Exercise(1) | | Value Realized(2) | | Number of Securities Underlying

Unexercised Options at Fiscal

Year-End (#)(3) | | Value of Unexercised

In-The-Money Options at

Fiscal Year-End($)(4) |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Robert Bailey | | 103,861 | | $ | 432,061 | | 2,757,966 | | 982,034 | | 1,919,013 | | 672,380 |

Alan Krock | | 128,838 | | $ | 658,214 | | 366,666 | | 308,334 | | 468,331 | | 304,419 |

Thomas Brigiotta | | 1,187 | | $ | 1,533 | | 116,666 | | 323,334 | | — | | — |

Colin Harris | | 83,610 | | $ | 338,141 | | 329,520 | | 226,980 | | 336,049 | | 7,151 |

Thomas Sun | | 3,628 | | $ | 17,488 | | 206,439 | | 258,361 | | 202,997 | | 102,715 |

Steffen Perna | | 145,423 | | $ | 659,731 | | 1,051,930 | | 340,626 | | 939,267 | | 247,502 |

| (1) | Includes shares purchased pursuant to PMC’s Employee Stock Purchase Plan. |

| (2) | Market value of underlying securities at exercise date, minus the exercise price. |

| (3) | Does not include outstanding LTD Special Shares redeemable for shares of common stock of PMC. Includes options that are not “in-the-money” at year-end (the exercise price equals or exceeds $ 7.71, the closing market price for a share of PMC common stock on December 31, 2005, the last trading day of fiscal year 2005). |

| (4) | Market value underlying securities at year-end, minus the exercise price. |

-11-

Ten-Year Option Repricings

| | | | | | | | | | |

Name | | Date | | Number of Securities Underlying Options Repriced(1) | | Exercise Price at Time of Repricing($) | | New Exercise Price(2) | | Length of Original

Option Term

Remaining at Date

of Repricing |

Robert Bailey President and Chief Executive Officer | | 9/26/2002 | | 480,000

400,000

750,000 | | 52.375

19.87

18.26 | | 5.95

5.95

5.95 | | 6 years, 8 months

8 years

8 years, 8 months |

| | | | | |

Gregory Aasen(3) Chief Operating Officer and Chief Technical Officer | | 9/26/2002 | | 300,000

225,000

300,000 | | 52.375

19.87

18.26 | | 5.95

5.95

5.95 | | 6 years, 8 months

8 years

8 years, 8 months |

| | | | | |

Colin Harris Vice President, Worldwide Operations | | 9/26/2002 | | 80,000

50,000

65,000

80,000 | | 52.375

19.87

18.26

15.9844 | | 5.95

5.95

5.95

5.95 | | 6 years, 8 months

8 years

8 years, 8 months

5 years, 9 months |

| | | | | |

Haresh Patel(3) Vice President of Worldwide Sales | | 9/26/2002 | | 100,000

100,000

300,000 | | 52.375

19.87

18.26 | | 5.95

5.95

5.95 | | 6 years, 8 months

8 years

8 years, 8 months |

| | | | | |

Steffen Perna(3) Vice President and General Manager | | 9/26/2002 | | 150,000

100,000

350,000 | | 52.375

19.87

18.26 | | 5.95

5.95

5.95 | | 6 years, 8 months

8 years

8 years, 8 months |

| | | | | |

Thomas Riordan(3) Vice President and General Manager | | 9/26/2002 | | 150,000

225,000 | | 19.87

18.26 | | 5.95

5.95 | | 8 years

8 years, 8 months |

| | | | | |

Mark Stibitz Vice President and General Manager | | 9/26/2002 | | 425,000 | | 18.26 | | 5.95 | | 8 years, 8 months |

| | | | | |

Tom Sun(3) Vice President, Asia Pacific | | 9/26/2002 | | 24,000

75,000

150,000 | | 52.375

19.87

18.26 | | 5.95

5.95

5.95 | | 6 years, 8 months

8 years

8 years, 8 months |

| | (1) | The market price of PMC common stock on the date of cancellation, on September 26, 2002, was $4.13 per share. |

| | (2) | The exercise price of the new options equaled the market price of the underlying PMC common stock at the time of repricing. |

| | (3) | Former executive officer. |

-12-

Employment Agreements

PMC’s executive officers each have the following agreement with PMC. If no change of control is reasonably expected within the next 60 days or has occurred in the past two years, then if the officer is terminated without cause, the officer receives only his base salary and accrued vacation through the date of termination.

If an officer is terminated without cause or constructively terminated as defined in the employment agreements, and a change of control is reasonably expected to occur within 60 days of the termination or has occurred within the past two years, then the officers are entitled to the following benefits:

| | (1) | their base salary through the date of termination; plus |

| | (2) | a lump-sum payment equal to four percent of their current base salary for each full month they were employed with PMC, provided that the total payment shall not exceed two times their current base salary; plus |

| | (3) | a lump-sum payment equal to two percent of their prior year’s bonus for each full month they were employed with PMC; plus |

| | (4) | all accrued vacation through the date of termination. |

For example, if a change of control had occurred on December 31, 2005, and Mr. Bailey had been terminated at that date, then in addition to his base salary through his termination date Mr. Bailey would have been eligible for a lump sum payment equal to (2 x $450,000) + (144 months x 2% x $168,750) = $1,386,000.

The officers are required to execute consulting agreements with PMC that would require them to provide service to PMC during each calendar quarter and maintain the confidentiality of PMC’s trade secrets. While they serve as consultants to PMC, their stock options continue to vest and remain exercisable until 30 days after all their options have vested.

Mr. Bailey and Mr. Krock each has the right to receive the payments and benefits under (1) and (4) above, and to become a consultant on these terms, if on the first anniversary of a change of control he is still employed by PMC or its successor.

“Cause” means (i) gross dereliction of duties which continues after at least two notices, each 30 days apart, from the Chief Executive Officer (or in the case of the Chief Executive Officer, from a director designated by a majority of the Board), specifying in reasonable detail the tasks which must be accomplished and a timeline for their accomplishment to avoid termination for cause; (ii) willful and gross misconduct which injures PMC; (iii) willful and material violation of laws applicable to PMC; or (iv) embezzlement or theft of PMC property.

“Change of control” means the occurrence of any of the following events:

| | (1) | any “person” or “group” as such terms are defined under Sections 13 and 14 of the Exchange Act (other than PMC, a subsidiary of PMC, or a PMC employee benefit plan) is or becomes the “beneficial owner” (as defined in Exchange Act Rule 13d-3), directly or indirectly, of PMC securities representing 50% or more of the combined voting power of PMC’s then outstanding securities; |

| | (2) | the closing of (a) the sale of all or substantially all of the assets of PMC if the holders of PMC securities representing all voting power for the election of directors before the transaction hold less than a majority of the total voting power for the election of directors of all entities which acquire such assets, or (b) the merger of PMC with or into another corporation if the holders of PMC securities representing all voting power for the election of directors before the transaction hold less than a majority of the total voting power for the election of directors of the surviving entity; |

-13-

| | (3) | the issuance of securities which would give a person or group beneficial ownership of PMC securities representing 50% or more of all voting power for the election of directors; or |

| | (4) | a change in the Board such that the incumbent directors and nominees of the incumbent directors are no longer a majority of the total number of directors. |

“Constructive termination” means (i) a material reduction in the executive’s base salary, target bonus or benefits; (ii) a material reduction in title, authority, status, obligations or responsibilities; or (iii) the requirement that executive relocate more than 100 miles from the current PMC headquarters.

Compensation Committee Interlocks and Insider Participation

Mr. Diller served as PMC’s Chief Executive Officer from 1983 to 1997. It has been greater than 5 years since Mr. Diller ceased to be an employee of the company.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires PMC’s executive officers and directors, and persons who own more than 10% of PMC’s common stock, to file reports regarding ownership of, and transactions in, PMC’s securities with the Securities and Exchange Commission and to provide PMC with copies of those filings. Based solely on its review of the copies of such forms received by PMC, or written representations from certain reporting persons, PMC believes that during fiscal year 2005, each of the reporting persons complied with all applicable Section 16(a) filing requirements.

-14-

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

This report summarizes the principles and other factors considered by the Compensation Committee in determining executive compensation.

Compensation Philosophy. Under the Committee’s supervision, PMC has implemented compensation policies, plans and programs to achieve the following objectives:

| | • | | attract, retain and motivate talented executive officers; |

| | • | | provide them with cash bonus opportunities linked to achievement of business objectives and individual performance goals; and |

| | • | | align the financial interests of executive officers with those of stockholders by providing executive officers with an equity stake in PMC. |

Elements of Compensation. Executive officer compensation consists of a base salary, quarterly bonuses and stock options. Potential cash bonuses depend on achieving corporate objectives and enhancing stockholder value. Stock option grants depend on personal and corporate performance and the retention value of the officer’s unvested options. Each fiscal year management engages a compensation consultant to analyze each officer’s compensation and to provide peer company data in comparison with each PMC officer’s compensation. Based on this analysis, the CEO prepares and submits to the Committee an annual plan for base salary and bonuses for PMC’s executive officers for Committee review and approval. In 2006 the Committee also engaged another compensation consultant to review the analysis provided by management’s consultant and to advise the Committee.

The Committee considers the total earned or potentially available compensation of each executive officer in establishing each element of the officer’s compensation. The Committee considers each individual’s bonus potential as a percentage of salary. Actual bonuses depend on corporate and individual performance as discussed below.

The compensation consultant provides, and the Committee reviews, industry compensation benchmarks relative to companies in the semiconductor industry that have revenues comparable to PMC’s revenues or that compete with PMC for executive talent irrespective of revenue level.

There are currently no elements of executive compensation other than those outlined in this proxy statement. The Committee regularly considers other compensation elements, such as restricted stock or stock appreciation rights, in determining its approach to compensating our executives.

Cash Compensation. PMC generally sets base salaries below amounts paid to senior managers with comparable qualifications, experience and responsibilities at comparable companies in order to emphasize quarterly and longer-term incentive compensation. Base salaries are determined in light of industry and peer group surveys, compensation for the executives as a group, individual position and responsibilities, the individual’s total compensation in the prior year and PMC’s plan for the current fiscal year. In fiscal 2005, PMC increased executive officer salaries by an average of 13% to reflect peer compensation data and improved operating results.

Each executive officer is also eligible to receive a cash bonus as a participant in a Company-wide bonus pool. Currently, all of our employees, including executives, are only eligible for cash bonuses when operating income on a non-GAAP basis exceeds 10% of revenue. The aggregate bonus pool is also capped when operating income on a non-GAAP basis equals 20% of revenue. After each quarter which meets these criteria, the CEO presents the Committee with a proposed allocation of the bonus pool, first between executives and non-executives as two groups, and also with a specific proposed amount for each executive officer based on that individual’s achievement of subjective and objective goals.

-15-

Stock Options. During each fiscal year, the Committee considers whether to grant executive officers long-term equity incentives such as stock options. The Committee believes stock option grants encourage the achievement of superior results over time and align employee and stockholder interests. The Committee reviews PMC’s historic annual option grants as a percentage of PMC’s outstanding shares, historic actual option exercises relative to outstanding shares, and the total number and proportion of shares subject to outstanding options relative to peer companies. The Committee reviews, for each executive officer, peer company data for officers in comparable positions, covering the individual’s aggregate equity position relative to shares outstanding and the size of each individual’s proposed annual option grant (normalized for differences in shares outstanding).

During fiscal 2005, PMC granted to executive officers other than the CEO options to purchase: 852,500 shares exercisable at $ 7.87 per share; 300,000 shares exercisable at $ 8.42 per share; 62,500 shares exercisable at $ 10.14 per share; 62,500 shares exercisable at $ 7.83 per share and 62,500 shares exercisable at $9.29 per share. All options vest over four years.

Chief Executive Officer Compensation. The Committee determines the CEO’s total cash compensation based on similar competitive compensation data as that used for other executive officers, the Committee’s assessment of his past performance and the Committee’s expectations as to his future contributions to PMC. In fiscal 2005, PMC increased the CEO’s base salary by $50,000. He received a cash bonus for 2005 quarters in which PMC generated pre-tax profits on the same basis as other executives. During fiscal 2005, PMC granted its CEO an option to purchase 600,000 shares exercisable at $ 7.87 per share.

This report of the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 (the “Securities Act”), or the Exchange Act, except to the extent that PMC specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

|

| James Diller, Sr. |

| Jonathan Judge |

-16-

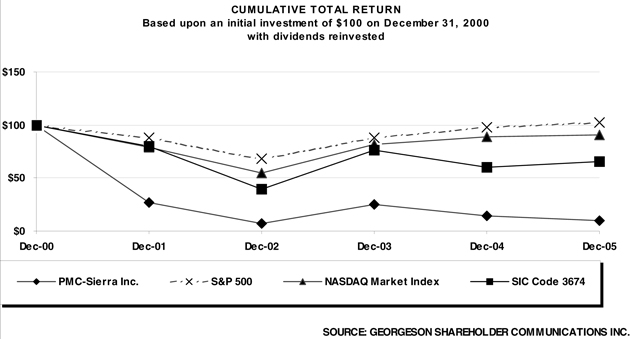

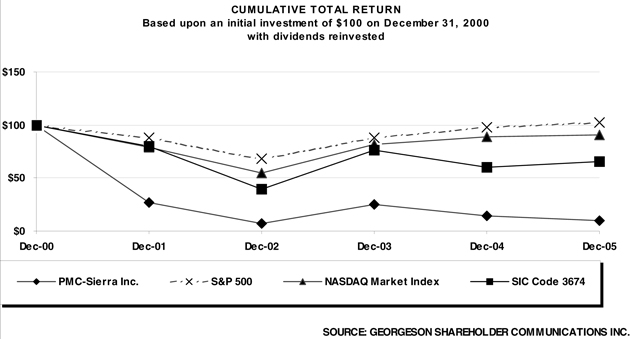

STOCK PRICE PERFORMANCE GRAPH

The following graph shows a comparison of cumulative total stockholder returns for PMC, the Nasdaq National Market, the line-of-business index for semiconductors and related devices (SIC code 3674) furnished by Georgeson Shareholder Communications Inc., and the S&P 500 Index. The graph assumes the investment of $100 on December 31, 2000. The performance shown is not necessarily indicative of future performance.

Comparison of 5-Year Cumulative Total Return*

Among PMC-Sierra, Inc.,

S&P 500 Index and SIC Code Index

| * | The total return on each of these investments assumes the reinvestment of dividends, although cash dividends have never been paid on PMC’s common stock. |

-17-

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed PMC’s audited consolidated financial statements and discussed them with management. The Audit Committee has discussed with Deloitte & Touche LLP, PMC’s independent auditors during the 2005 fiscal year, the matters required to be discussed by Statement on Auditing Standards No. 61.

The Audit Committee received from Deloitte & Touche LLP the written disclosures required by Independence Standards Board Standard No. 1 and discussed with them their independence.

Based on this review, the Audit Committee recommended to the Board that PMC’s audited consolidated financial statements be included in PMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

This report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or the Exchange Act, except to the extent that PMC specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

|

| Audit Committee Members: |

Richard Belluzzo |

| Jonathan Judge |

| William Kurtz, Chair |

-18-

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has retained Deloitte & Touche LLP as PMC’s independent auditors to audit its consolidated financial statements for fiscal 2006. During fiscal 2005, Deloitte & Touche LLP served as PMC’s independent auditors and also provided certain tax and other audit-related services. Although PMC is not required to seek stockholder ratification of this appointment, the Board believes it to be good corporate governance to do so. If the appointment is not ratified, the Audit Committee will investigate the reasons and reconsider the appointment. Representatives of Deloitte & Touche LLP are expected to attend the annual meeting, where they will be available to respond to questions.

Fees Incurred by PMC for Deloitte & Touche LLP

The following table shows the fees paid or accrued by PMC for audit and other services provided by Deloitte & Touche LLP for fiscal years 2005 and 2004.

| | | | | | |

| | | 2005 | | 2004 |

Audit Fees (1) | | $ | 579,328 | | $ | 466,538 |

Audit-Related Fees (2) | | | 118,856 | | | 8,067 |

Tax Fees (3) | | | 632,860 | | | 849,303 |

All Other Fees | | | — | | | — |

Total | | $ | 1,331,044 | | $ | 1,323,908 |

| | | | | | |

| (1) | Audit fees billed by Deloitte & Touche LLP for review of PMC’s annual financial statements, the audit of management’s assessment of internal control over financial reporting, the audit of internal control over financial reporting and the review of those financial statements included in PMC’s quarterly reports on Form 10-Q and annual report on Form 10-K. |

| (2) | Audit-related fees consisted of professional services in connection with PMC’s preparation for a convertible debt offering in 2005 and consultations concerning financial accounting and reporting. |

| (3) | Fiscal 2005 tax fees included $456,858 for tax compliance and $ 176,002 for tax consulting and planning. Fiscal 2004 tax fees included $527,285 for compliance and $ 322,018 for tax consulting and planning. |

The Audit Committee must approve all audit related and permitted non-audit services to be performed by PMC’s independent auditors prior to the commencement of such services. The Audit Committee concluded that the provision of such services by Deloitte & Touche LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

Recommendation

PMC’s Board of Directors recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as PMC’s independent auditors.

Vote Required

The affirmative vote of a majority of the votes cast is required to confirm the appointment of Deloitte & Touche LLP as independent auditors of PMC for the 2006 fiscal year.

-19-

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | Why am I receiving these materials? |

| A: | PMC’s Board of Directors is providing these proxy materials to you in connection with PMC’s annual meeting of stockholders, which will take place on June 1, 2006. Stockholders are invited to attend the annual meeting and are requested to vote on the proposals described in this proxy statement. |

| Q: | What information is contained in these materials? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of directors and our most highly paid officers, and certain other required information. PMC’s 2006 Annual Report on Form 10-K, Proxy Card and return envelope are also enclosed. |

| Q: | What proposals will be voted on at the annual meeting? |

| A: | There are two proposals scheduled to be voted on at the annual meeting: |

| | • | | the election of directors |

| | • | | the ratification of the appointment of Deloitte & Touche as PMC’s independent auditors |

| Q: | What is the Board’s voting recommendation? |

| A: | PMC’s Board recommends that you vote your shares “FOR” each of the nominees to the Board and “FOR” the ratification of the appointment of Deloitte & Touche as PMC’s independent auditors. |

| Q: | Which of my shares can be voted? |

| A: | You can vote all shares you owned as of the close of business on April 3, 2006 (the “Record Date”). These shares include shares that are: (1) held directly in your name as the stockholder of record, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee. |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Most stockholders of PMC hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

Stockholder of Record

If your shares are registered directly in your name with PMC’s transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record of those shares. As the stockholder of record, you have the right to grant your voting proxy directly to PMC or to vote in person at the annual meeting. PMC has enclosed a proxy card for you to use.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the annual meeting. Your broker or nominee has enclosed a voting instruction card for you to use in directing the broker or nominee regarding how to vote your shares.

| Q: | How can I vote my shares in person at the annual meeting? |

| A: | Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to do so, please bring the enclosed proxy card or proof of identification. |

Even if you plan to attend the annual meeting, PMC recommends that you also submit your proxy as described below so that your vote will be counted if you later decide not to attend the annual meeting. Shares held in street name may be voted in person by you only if you obtain a signed proxy from the record holder giving you the right to vote the shares.

C-1

| Q: | How can I vote my shares without attending the annual meeting? |

| A: | Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the annual meeting. You may vote by granting a proxy for those shares you hold directly as the stockholder of record or, for shares held in street name, by submitting voting instructions to your broker or nominee using the voting instruction card provided by your broker or nominee. |

| A: | You may change your proxy instructions at any time prior to the vote at the annual meeting. For shares held directly in your name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or by attending the annual meeting and voting in person. Attendance at the annual meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares held beneficially by you, you may accomplish this by submitting new voting instructions to your broker or nominee. |

| A: | In the election of directors, you may vote “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees. For the other proposals, you may vote “FOR”, “AGAINST” or “ABSTAIN”. If you “ABSTAIN”, it has the same effect as a vote “AGAINST”. If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted in accordance with the recommendations of the Board. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | The seven nominees receiving the highest number of affirmative votes of the shares present or represented and entitled to vote shall be elected as directors. All other proposals require the affirmative “FOR” vote of a majority of those shares present and entitled to vote. If you are a beneficial owner and do not provide the stockholder of record with voting instructions, your shares may constitute broker non-votes, as described below in “What is the quorum requirement for the annual meeting?” In tabulating the voting result for any particular proposal, shares which constitute broker non-votes are not considered entitled to vote. |

| Q: | What does it mean if I receive more than one proxy or voting instruction card? |

| A: | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

| Q: | Where can I find the voting results of the annual meeting? |

| A: | PMC will announce preliminary voting results at the annual meeting and publish final results in PMC’s quarterly report on Form 10-Q for the second quarter of fiscal year 2006. |

| Q: | What happens if additional proposals are presented at the annual meeting? |

| A: | Other than the proposals described in this proxy statement, PMC does not expect any matters to be presented for a vote at the annual meeting. If you grant a proxy, the persons named as proxy holders, Robert Bailey, PMC’s President and Chief Executive officer, Alan Krock, PMC’s Vice President and Chief Financial Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the annual meeting. If for any unforeseen reason any of PMC’s nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board. |

| Q: | What class of shares is entitled to be voted? |

| A: | Each share of PMC’s common stock outstanding as of the close of business on April 3, 2006, the Record Date, is entitled to one vote at the annual meeting. In addition, since cumulative voting applies to PMC’s common stock in the election of directors, if any stockholder at the meeting and prior to the voting gives notice of the stockholder’s intention to cumulate votes for the election of directors, then the stockholder, or the stockholder’s proxy, may cumulate such stockholder’s votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of shares held by such stockholder, or distribute the stockholder’s votes on the same principle among as many candidates as the stockholder may select, provided that votes cannot be cast for more than seven nominees. On the Record Date, PMC had approximately 186,123,162 shares of common stock issued and outstanding. |

C-2

| Q: | What is the quorum requirement for the annual meeting? |

| A: | The quorum requirement for holding the annual meeting and transacting business is a majority of the outstanding shares entitled to be voted as of the Record Date. The shares may be present in person or represented by proxy at the annual meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the annual meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares. |

| Q: | Who will count the vote? |

| A: | A representative of Georgeson Shareholder Communications Inc. will tabulate the votes and act as the Inspector of Elections. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within PMC or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by the Board. Occasionally, stockholders provide written comments on their proxy card which are then forwarded to PMC’s management. |

| Q: | Who will bear the cost of soliciting votes for the annual meeting? |

| A: | PMC will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by PMC’s directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. PMC has retained the services of Georgeson Shareholder Communications Inc. to aid in the solicitation of proxies from banks, brokers, nominees and intermediaries. PMC estimates that it will pay Georgeson Shareholder Communications Inc. a fee of $10,000 for its services. In addition, PMC may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. |

| Q: | May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors? |

| A: | You may submit proposals or nominate directors for consideration at future annual stockholder meetings. |

Any stockholder who wants to make a proposal or director nomination that is to be included in PMC’s proxy statement for that annual meeting must deliver written notice to PMC’s corporate secretary at least 120 days before the one-year anniversary of the mailing date of the prior year’s proxy materials (in the case of the 2007 Annual Meeting, this date is December 29, 2006. Any stockholder who wants to make a proposal or director nomination that is not to be included in PMC’s proxy statement for that annual meeting, must deliver written notice to PMC’s corporate secretary at least 45 days before the one-year anniversary of the mailing date of the prior year’s proxy materials (in the case of the 2007 annual meeting this date is March 14, 2007). This notice must contain the information specified in PMC’s bylaws regarding the matters proposed to be brought before the annual meeting and the stockholder proposing such matters. Such proposals will also need to comply with the U.S. Securities and Exchange Commission’s regulations regarding the inclusion of stockholder proposals in PMC-sponsored proxy materials. If the date of next year’s annual meeting is more than 30 days after the one-year anniversary of this year’s annual meeting, then the deadline will be changed.

C-3

TO VOTE BY MAIL, PLEASE DETACH PROXY CARD HERE

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

PMC-SIERRA, INC.

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 1, 2006

The undersigned Stockholder of PMC-SIERRA, INC. (the “Company”) acknowledges receipt of the Notice of

Annual Meeting of Stockholders and the Proxy Statement each dated April 28, 2006, and the undersigned

revokes all prior proxies and appoints each of Robert Bailey and Alan Krock, proxies and attorneys-in-fact,

each with full power to each of substitution, on behalf and in the name of the undersigned to represent the

undersigned and to vote all shares of Common Stock of the Company which the undersigned would be

entitled to vote at the Annual Meeting of Stockholders to be held at Hyatt Regency Santa Clara, 5101 Great

America Parkway, Santa Clara, California 95054, on June 1, 2006, at 9:00 a.m. local time, and at any

adjournment thereof, and instructs said proxies to vote as directed on the reverse side.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned

stockholder. If no direction is made, this proxy will be voted for all of the nominees of director in Item

1 and for Item 2. Whether or not direction is made, this proxy, when properly executed, will be voted

in the discretion of the proxy holders upon such other business as may properly come before the

Annual Meeting of Stockholders or any adjournment or postponement thereof. The proxy holders

reserve the right to cumulate votes and cast such votes in favor of the election of some or all of the

applicable director nominees in their sole discretion.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned

stockholder. If no direction is made, this proxy will be voted for the proposals.

(Important - To be signed and dated on reverse side)

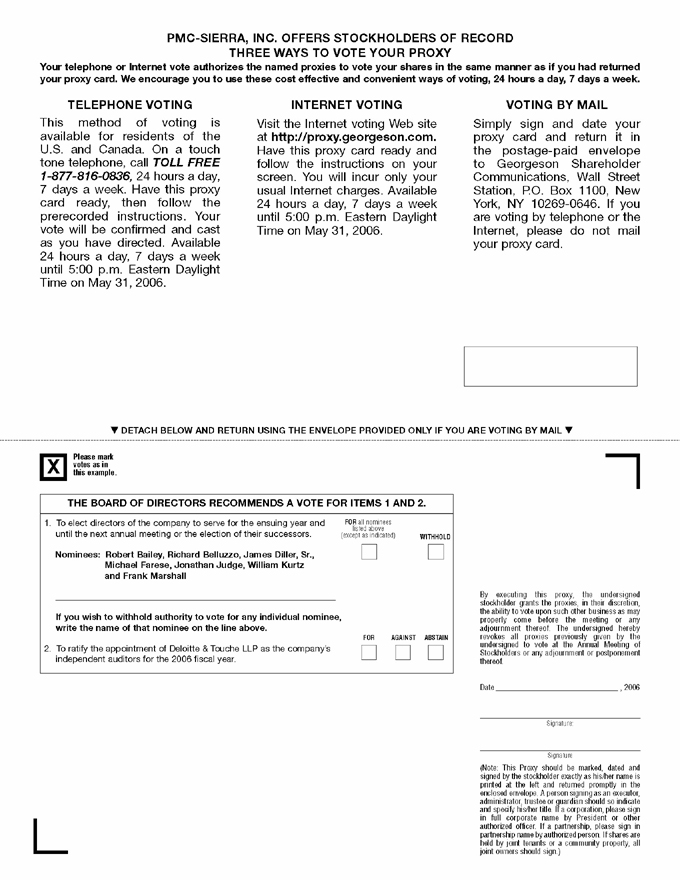

PMC-SIERRA, INC. OFFERS STOCKHOLDERS OF RECORD

THREE WAYS TO VOTE YOUR PROXY

Your telephone or Internet vote authorizes the named proxies to vote your shares in the same manner as if you had returned

your proxy card. We encourage you to use these cost effective and convenient ways of voting, 24 hours a day, 7 days a week.

TELEPHONE VOTING

This method of voting is

available for residents of the

U.S. and Canada. On a touch

tone telephone, call TOLL FREE

1-877-816-0836, 24 hours a day,

7 days a week. Have this proxy

card ready, then follow the

prerecorded instructions. Your

vote will be confirmed and cast

as you have directed. Available

24 hours a day, 7 days a week

until 5:00 p.m. Eastern Daylight

Time on May 31, 2006.

INTERNET VOTING

Visit the Internet voting Web site

at http://proxy.georgeson.com.

Have this proxy card ready and

follow the instructions on your

screen. You will incur only your

usual Internet charges. Available

24 hours a day, 7 days a week

until 5:00 p.m. Eastern Daylight

Time on May 31, 2006.

VOTING BY MAIL

Simply sign and date your

proxy card and return it in

the postage-paid envelope

to Georgeson Shareholder

Communications, Wall Street

Station, P.O. Box 1100, New

York, NY 10269-0646. If you

are voting by telephone or the

Internet, please do not mail

your proxy card.

DETACH BELOW AND RETURN USING THE ENVELOPE PROVIDED ONLY IF YOU ARE VOTING BY MAIL

Please mark

votes as in

this example.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ITEMS 1 AND 2.

1. To elect directors of the company to serve for the ensuing year and

until the next annual meeting or the election of their successors.

Nominees: Robert Bailey, Richard Belluzzo, James Diller, Sr.,

Michael Farese, Jonathan Judge, William Kurtz

and Frank Marshall

FOR all nominees listed above (except as indicated) WITHHOLD

If you wish to withhold authority to vote for any individual nominee,

write the name of that nominee on the line above.

2. To ratify the appointment of Deloitte & Touche LLP as the company’s

independent auditors for the 2006 fiscal year.

FOR AGAINST ABSTAIN

By executing this proxy, the undersigned

stockholder grants the proxies, in their discretion,

the ability to vote upon such other business as may

properly come before the meeting or any

adjournment thereof. The undersigned hereby

revokes all proxies previously given by the

undersigned to vote at the Annual Meeting of

Stockholders or any adjournment or postponement

thereof.

Date , 2006

Signature:

Signature

(Note: This Proxy should be marked, dated and

signed by the stockholder exactly as his/her name is

printed at the left and returned promptly in the

enclosed envelope. A person signing as an executor,

administrator, trustee or guardian should so indicate

and specify his/her title. If a corporation, please sign

in full corporate name by President or other

authorized officer. If a partnership, please sign in

partnership name by authorized person. If shares are

held by joint tenants or a community property, all

joint owners should sign.)