UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

PMC-Sierra, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| | (set forth the amount on which the filing fee is calculated and state how it was determined): |

4) Proposed maximum aggregate value of transaction: ________________________________________________________________________________________________________________

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| 1) Amount Previously Paid: | | |

| | |

| 2) Form, Schedule or Registration Statement No.: | | |

PMC-SIERRA, INC.

1380 Bordeaux Drive

Sunnyvale, California 94089

(408) 239-8000

Notice of Annual Meeting of Stockholders

| | |

DATE AND TIME | | May 1, 2013 at 9:00 a.m. |

PLACE | | PMC-Sierra, Inc. 1380 Bordeaux Drive Sunnyvale, California 94089 |

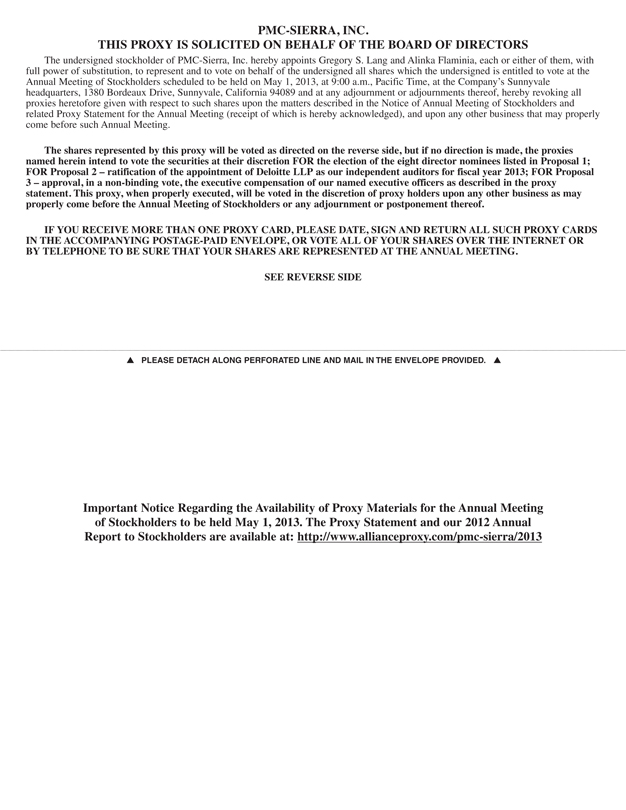

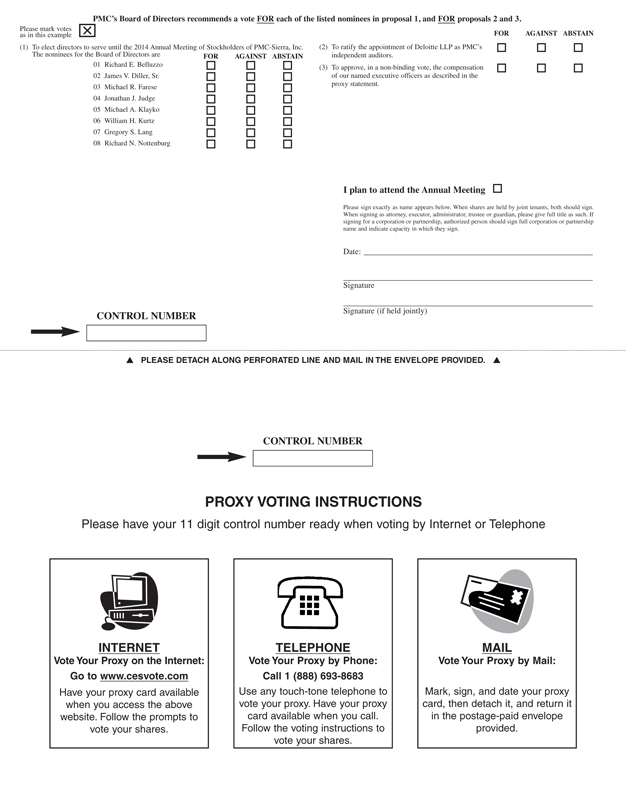

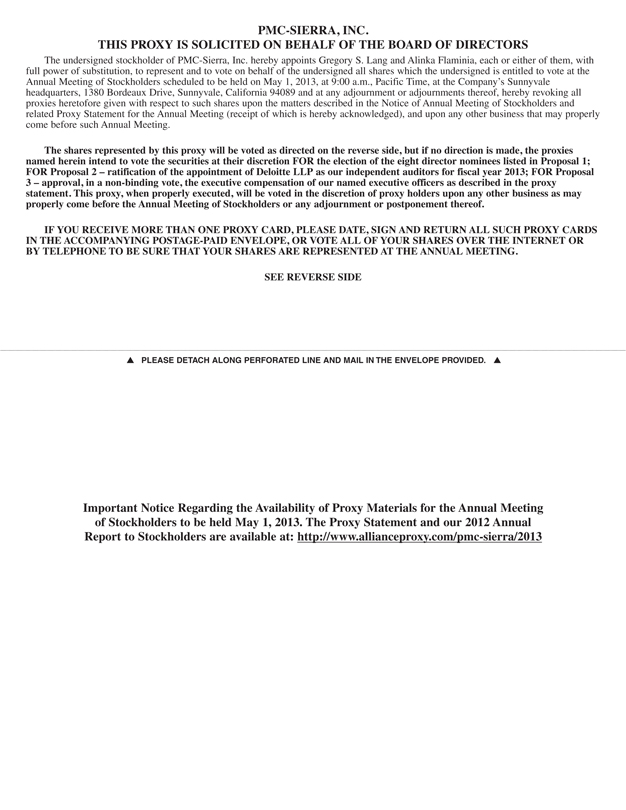

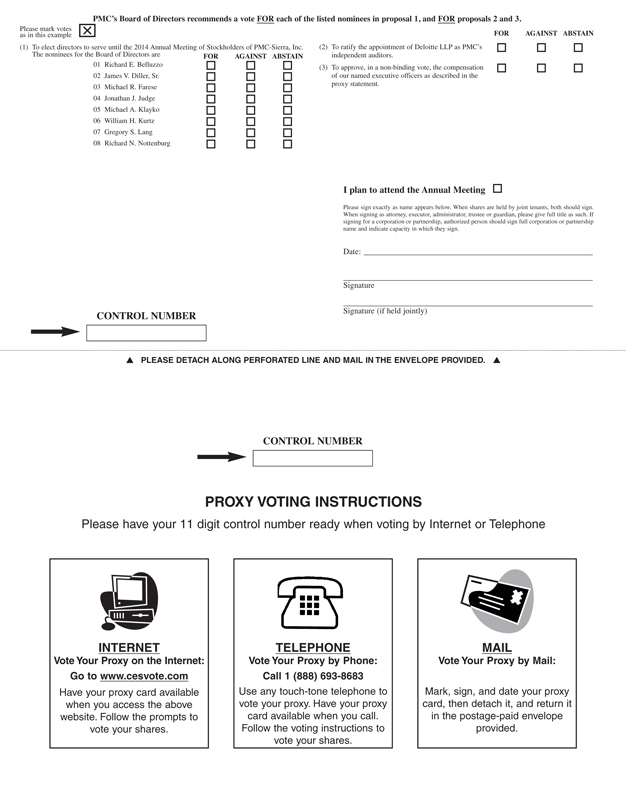

ITEMS OF BUSINESS | | (1) To elect eight directors to serve until the 2014 Annual Meeting of Stockholders of PMC-Sierra, Inc. (“PMC” or the “Company”) or until their successors are duly elected and qualified. The nominees for the Board of Directors are Richard E. Belluzzo, James V. Diller, Sr., Michael R. Farese, Jonathan J. Judge, Michael A. Klayko, William H. Kurtz, Gregory S. Lang, and Richard N. Nottenburg; |

| | (2) To ratify the appointment of Deloitte LLP as PMC’s independent auditors; |

| | (3) An advisory vote on the compensation of our named executive officers as described in the proxy statement; |

| | (4) To consider such other business as may properly come before the 2013 Annual Meeting of Stockholders (the “Annual Meeting”). |

RECORD DATE | | You are entitled to vote if you were a stockholder at the close of business on March 6, 2013. |

ANNUAL MEETING ADMISSION | | All PMC stockholders are cordially invited to attend the Annual Meeting in person. The Annual Meeting will begin promptly at 9:00 a.m. |

VOTING BY PROXY | | Your vote is important. Whether or not you plan to attend the meeting, please vote as soon as possible. You may vote in person, by mailing a completed proxy card, by telephone or over the Internet, except that stockholders who receive the proxy materials over the Internet will not receive a proxy card in the mail, unless specifically requested. For specific voting instructions, please refer to the instructions provided with your proxy card or the voting instructions you receive in the notice of Internet availability of proxy materials or by e-mail, and in this proxy statement. |

|

|

Vice President, General Counsel, Corporate Secretary |

This proxy statement and form of proxy are being distributed and made available on or about March 15, 2013.

PMC-SIERRA, INC.

1380 Bordeaux Drive

Sunnyvale, California 94089

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

Notice of Internet availability of this proxy statement, the accompanying proxy card or the voting instructions you received by e-mail and the Annual Report to Stockholders of PMC-Sierra, Inc. (“PMC”, the “Company” “us” or “we”) are being provided to you on or about March 15, 2013. The Board of Directors (the “Board”) of PMC is soliciting your proxy to vote your shares at the 2013 Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournment or postponement thereof. This proxy statement provides you with information on these matters to assist you in voting your shares.

Questions and Answers About the Proxy Materials and the Annual Meeting

| Q: | Why am I receiving these materials? |

| A: | PMC’s Board is making these proxy materials available to you over the Internet or providing paper copies of these proxy materials to you by mail in connection with PMC’s Annual Meeting, which will take place on May 1, 2013. Stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement. |

| Q: | What information is contained in these materials? |

| A: | The information included in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of directors and our most highly paid executive officers, and certain other required information. If you received a paper copy of these materials by mail, PMC’s Annual Report on Form 10-K for the fiscal year ended December 29, 2012, a proxy card and a return envelope are also enclosed. |

| Q: | Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials? |

| A: | Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are continuing to furnish proxy materials to our stockholders primarily over the Internet. As a result, we are mailing to many of our stockholders a notice about the Internet availability of the proxy materials instead of mailing a paper copy of the proxy materials. All stockholders receiving the notice will have the ability to access the proxy materials over the Internet and request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the notice. |

| Q: | Why didn’t I receive a notice in the mail regarding the Internet availability of the proxy materials? |

| A: | Paper copies of the proxy materials are being mailed to those stockholders who have previously requested to receive paper copies or who are living outside of the United States. |

We are providing notice of Internet availability of the proxy materials by e-mail to those stockholders who have previously elected electronic delivery of the proxy materials. Those stockholders should have received an e-mail containing a link to the website where those materials are available and a link to the proxy voting website.

1

| Q: | How can I access the proxy materials over the Internet? |

| A: | Your notice regarding Internet availability of the proxy materials, proxy card or voting instruction card will contain instructions on how to: |

| | • | | view our proxy materials for the Annual Meeting on the Internet; and |

| | • | | instruct us to send our future proxy materials to you electronically by e-mail. |

Your notice of Internet availability of proxy materials, proxy card or voting instruction card will contain instructions on how you may request to access proxy materials electronically. Choosing to access your future proxy materials electronically will help us conserve natural resources and reduce the costs of printing and distributing our proxy materials. If you choose to access future proxy materials electronically, you will receive an e-mail with instructions containing a link to the website where those materials are available and a link to the proxy voting website. Your election to access proxy materials by e-mail will remain in effect until you terminate it.

| Q: | How may I obtain a paper copy of the proxy materials? |

| A: | Stockholders receiving notice of Internet availability of the proxy materials, whether in paper or by e-mail, will find instructions about how to obtain a paper copy of the proxy materials as part of that notice. Stockholders who do not receive a notice or an e-mail will receive a paper copy of the proxy materials by mail. |

| Q: | What proposals will be voted on at the Annual Meeting? |

| A: | There are three proposals scheduled to be voted on at the Annual Meeting: |

| | • | | the election of directors; |

| | • | | the ratification of the appointment of Deloitte LLP as PMC’s independent auditors; and |

| | • | | the approval, in a non-binding vote, of the compensation of our named executive officers as described in this proxy statement. |

| Q: | What is the Board’s voting recommendation? |

| A: | PMC’s Board recommends that you vote your shares “FOR” each of the nominees to the Board, “FOR” the ratification of the appointment of Deloitte LLP as PMC’s independent auditors, and “FOR” the approval of our executive compensation as described herein (the “Say-on-Pay Vote”). |

| Q: | Which of my shares can be voted? |

| A: | You can vote all shares you owned as of the close of business on March 6, 2013 (the “Record Date”). These shares include shares that are: (1) held directly in your name as the stockholder of record, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee. |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

| A: | Most stockholders of PMC hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. If you hold your shares as a beneficial owner, it is critical that you cast your vote if you want it to count. In the past, if you held your shares as a beneficial owner and you did not indicate how you wanted your shares voted in the election of directors, your bank or broker was allowed to vote your shares on your behalf in the election of directors as they felt appropriate. However, your stockbroker, bank or other nominee may no longer vote your shares in non-routine matters, including the election of directors, unless they have your voting instructions, so it is very important that you indicate your voting instructions to the institution holding your shares. |

2

Shares Directly Held—Stockholder of Record

If your shares are registered directly in your name with PMC’s transfer agent, American Stock Transfer & Trust Company, you are considered the stockholder of record of those shares. As the stockholder of record, you have the right to grant your voting proxy directly to PMC or to vote in person at the Annual Meeting.

Shares Indirectly Held—Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered the stockholder of record with respect to those shares. We urge you to direct your broker on how to vote your shares. Beneficial owners may attend the Annual Meeting but may not vote in person unless you obtain a signed proxy from the stockholder of record giving you the right to vote the shares in person at the Annual Meeting. Your broker or nominee should provide you with a voting instruction card for you to use in directing the broker or nominee regarding how to vote your shares. If you did not receive a voting instruction card, please contact the institution holding your shares.

| Q: | How can I vote my shares in person at the Annual Meeting? |

| A: | Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, ballots will be available at the meeting. Please bring proof of identification. |

Even if you plan to attend the Annual Meeting, PMC recommends that you also submit your proxy as described below so that your vote will be counted if you later decide not to or are otherwise unable to attend the Annual Meeting. Shares held in street name may be voted in person by you only if you obtain a signed proxy from the stockholder of record giving you the right to vote the shares.

| Q: | How can I vote my shares without attending the Annual Meeting? |

| A: | You may vote your shares by granting a proxy for those shares you hold directly as the stockholder of record by returning the enclosed proxy card or following the instructions provided or, for shares held in street name, by submitting voting instructions to your broker or nominee using the voting instruction card provided by your broker or nominee. You may also vote by telephone or over the Internet by following either the instructions included on your proxy card or the voting instructions you receive by e-mail or in the notice of Internet availability of proxy materials. If you received a paper copy of these proxy materials and you choose to vote by telephone or over the Internet, do not complete and mail your proxy card. |

| A: | You may change your proxy instructions at any time prior to the closing of the vote at the Annual Meeting. For shares held directly in your name, you may accomplish this by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) or by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold in street name, you may accomplish this by submitting new voting instructions to your broker or nominee before the deadline noted on the voting instruction card you received. |

| A: | Votes will be counted by the Inspector of Elections, who will separately count “FOR” and “AGAINST” votes and abstentions with respect to the election of directors and, with respect to any proposals other than the election of directors, “FOR” and “AGAINST” votes, abstentions and broker non-votes. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a |

3

| | particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares because the matter is not considered a routine matter. For all proposals, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” it will have no effect on the outcome of the election of directors, but for all other proposals it has the same effect as a vote “AGAINST.” If you sign your proxy card with no further instructions, your shares will be voted in accordance with the recommendations of the Board. Your bank or broker is not permitted to vote your uninstructed shares on a discretionary basis on non-routine matters which include the following Proposals in this proxy statement: the election of directors (Proposal No. 1); and the approval of the non-binding Say-on-Pay Vote (Proposal No. 3). Thus, if you hold your shares in street name and do not instruct your bank or broker how to vote in non-routine matters, no votes will be cast on your behalf on these proposals. Your bank or broker will, however, continue to have discretion to vote any uninstructed shares on the ratification of the appointment of Deloitte LLP as PMC’s independent auditors (Proposal No. 2). Please ensure that you complete the voting instruction card sent by your bank or broker. |

| Q: | What is the voting requirement to approve each of the proposals? |

| A: | Under our bylaws, directors must be elected by a majority of votes cast in uncontested elections. Therefore, each nominee for director receiving more votes “FOR” than votes “AGAINST” shall be elected as a director. Shares not present and shares that “ABSTAIN” will have no effect on the election of directors. All other proposals require the affirmative “FOR” vote of a majority of those shares present and entitled to vote. If you are a beneficial owner and do not provide the stockholder of record with voting instructions, your shares may constitute broker non-votes, as described below in “What is the quorum requirement for the Annual Meeting?” In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote with respect to a proposal on which the broker has expressly not voted. |

| Q: | What does it mean if I receive more than one notice or e-mail about Internet availability of the proxy materials or more than one paper copy of the proxy or voting instruction card? |

| A: | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive in the mail and vote over the Internet the shares represented for each notice or e-mail you receive. |

| Q: | Where can I find the voting results of the Annual Meeting? |

| A: | PMC will announce preliminary voting results at the Annual Meeting and publish the final results in a Current Report on Form 8-K once they are certified following the Annual Meeting. |

| Q: | What happens if additional proposals are presented at the Annual Meeting? |

| A: | Other than the proposals described in this proxy statement, PMC does not expect any matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the persons named as proxy holders, Gregory S. Lang and Alinka Flaminia, will have the discretion to vote your shares on additional matters properly presented for a vote at the Annual Meeting. Mr. Lang is PMC’s President and Chief Executive Officer and Ms. Flaminia is PMC’s Vice President, General Counsel and Corporate Secretary. If for any unforeseen reason any of PMC’s nominees is not available as a candidate for director, the person named as proxy holder will vote your proxy for such other candidate or candidates as may be nominated by the Board. |

| Q: | What class of shares is entitled to be voted? |

| A: | Each share of PMC’s common stock outstanding as of the close of business on the Record Date is entitled to one vote at the Annual Meeting. On the Record Date, PMC had approximately 203,209,819 shares of common stock issued and outstanding. |

4

| Q: | Is cumulative voting permitted for the election of directors? |

| A. | No. At our 2011 annual meeting, stockholders voted to amend PMC’s Restated Certificate of Incorporation to eliminate cumulative voting in the election of directors. |

| Q: | What is the quorum requirement for the Annual Meeting? |

| A: | The quorum requirement for holding the Annual Meeting and transacting business is a majority of the outstanding shares entitled to be voted as of the Record Date. The shares may be present in person or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the Annual Meeting. None of the proposals, other than the ratification of the appointment of Deloitte LLP as PMC’s independent auditors, is considered a routine matter. |

| Q: | Who will count the vote? |

| A: | A representative of Alliance Advisors, LLC will be present at the Annual Meeting and will tabulate the votes and act as the Inspector of Elections. |

| Q: | Is my vote confidential? |

| A: | Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within PMC or to third parties except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, or (3) to facilitate a successful proxy solicitation by the Board. If a stockholder makes written comments on his or her proxy card, these will be forwarded to PMC’s management. |

| Q: | Another member of my household is also a PMC stockholder and we share the same address. Why did we only receive one copy of the proxy materials? |

| A: | In an effort to further reduce printing costs and postage fees, we have adopted a practice approved by the SEC called “householding.” Under this practice, stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our proxy materials, unless one or more of these stockholders notifies us that he or she wishes to continue receiving individual copies. Stockholders who participate in householding will continue to receive separate proxy cards. If you share an address with another stockholder and received only one set of proxy materials and would like to request a separate copy of these materials, please: (1) mail your request to PMC-Sierra, Inc., 1380 Bordeaux Drive, Sunnyvale, California, 94089, Attn: Investor Relations; (2) send an e-mail toinvestor.relations@pmcs.com; or (3) call our Investor Relations department at 1-408-988-8276. Similarly, you may also contact us if you received multiple copies of the proxy materials and would prefer to receive a single copy in the future. |

| Q: | Who bears the cost of soliciting votes for the Annual Meeting? |

| A: | PMC pays the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by PMC’s directors, officers, and employees, who will not receive any additional compensation for such solicitation activities. PMC has retained the services of Alliance Advisors, LLC to aid in the solicitation of proxies from banks, brokers, nominees and intermediaries. The fee paid to Alliance Advisors, LLC for its solicitation services will not exceed $8,000. In addition, PMC may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. |

5

| Q: | May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors? |

| A: | You may submit proposals or nominate directors for consideration at future annual meetings of stockholders. |

Any stockholder who wants to make a proposal that is to be included in PMC’s proxy statement for an annual meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) must deliver written notice to PMC’s corporate secretary at our principal place of business at least 120 days before the one-year anniversary of the mailing date of the prior year’s proxy materials (in the case of the 2014 annual meeting, this date is November 15, 2013). If the date of next year’s annual meeting is more than thirty days after the one-year anniversary of this year’s Annual Meeting, then the deadline will be changed. In addition, under our bylaws, stockholder proposals to be considered at our 2014 annual meeting that are submitted outside of Rule 14a-8 under the Exchange Act, including director nominations, must be submitted not later than January 1, 2014 and not earlier than December 2, 2013; provided however, that if PMC’s 2014 annual meeting of stockholders is called for a date that is not within twenty-five days before or after the anniversary of the Annual Meeting, then to be considered timely, stockholder proposals and director nominations must be received by our corporate secretary at our principal executive offices not later than the close of business on the tenth day following the day on which notice of PMC’s 2014 annual meeting of stockholders was mailed or publicly disclosed, whichever occurs first. Any such notice must contain the information specified in PMC’s bylaws regarding the matters proposed to be brought before the annual meeting and the stockholder proposing such matters. All proposals will also need to comply with the SEC’s regulations regarding the inclusion of stockholder proposals in PMC-sponsored proxy materials.

The proxy solicited by our Board for the 2013 annual meeting of stockholders will confer discretionary authority to vote on (i) any nominee or proposal presented by a stockholder at the meeting for which PMC has not been properly provided with notice between December 2, 2013 and January 1, 2014, and (ii) any proposal made in accordance with our bylaw provisions, if the 2014 proxy statement briefly describes the nature of the matter and how management’s proxy holders intend to vote on it, provided that the stockholder does not comply with the requirements of Rule 14a-4(c)(2) under the Exchange Act.

The full text of the Company’s relevant bylaw provisions as in effect from time to time may be obtained by writing to PMC’s corporate secretary.

6

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the eight nominees of the Board named below. Each nominee has consented to his nomination, and PMC does not expect that any nominee will be unable to serve as a director. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board to fill the vacancy. The term of office of each person elected as a director will continue until the next annual meeting of stockholders or until such director’s successor has been elected. The table below sets forth information about each nominee as of the Record Date.

Our bylaws provide for a majority voting standard for the election of directors in uncontested director elections, such as that being conducted at this Annual Meeting. Under this standard, a director nominee will be elected only if the number of votes cast “FOR” the nominee exceeds the number of votes cast “AGAINST” that nominee. In the case of contested elections (a situation in which the number of nominees exceeds the number of directors to be elected), the plurality vote standard would apply.

Recommendation

PMC’s Board of Directors recommends a vote FOR the nominees listed below:

| | | | | | |

Name of Nominee | | Age | | Principal Occupation | | Director

Since |

Richard E. Belluzzo | | 59 | | Senior Strategic Advisor, Gores Group | | 2003 |

James V. Diller, Sr. | | 77 | | Vice Chairman of the Board, PMC; Interim President and Chief Executive Officer, Intersil Corporation | | 1983 |

Michael R. Farese, Ph.D. | | 66 | | Sr. Vice President, Global Engineering, Entropic Communications | | 2006 |

Jonathan J. Judge | | 59 | | Chairman of the Board, PMC | | 2004 |

Michael A. Klayko | | 58 | | Chief Executive Officer, MKA Capital | | 2011 |

William H. Kurtz | | 55 | | Chief Financial Officer & Chief Commercial Officer, Bloom Energy | | 2003 |

Gregory S. Lang | | 49 | | President and Chief Executive Officer, PMC | | 2008 |

Richard N. Nottenburg, Ph.D. | | 59 | | Investor and Business Consultant | | 2011 |

Richard E. Belluzzo

Mr. Belluzzo has been a director of PMC since June 2003. He currently serves as a Senior Strategic Advisor for the Gores Group, a private equity firm. From April 2011 until August 2012, Mr. Belluzzo served as the Executive Chairman of Quantum Corporation, a computer storage solutions company. From September 2001 until April 2011, Mr. Belluzzo served as Quantum Corporation’s Chief Executive Officer. From September 1999 to May 2002, Mr. Belluzzo held senior management positions with Microsoft Corporation, most recently as President and Chief Operating Officer. From January 1998 to September 1999, Mr. Belluzzo was Chief Executive Officer of Silicon Graphics, Inc. From 1975 to January 1998, Mr. Belluzzo was with Hewlett-Packard Company, where Executive Vice President of the printer business was his latest position held. Mr. Belluzzo serves as Chairman of the Board of JDS Uniphase Corporation, an optical telecommunications equipment maker, and is a director of Infoblox Inc., an automated network control solutions provider.

The Board determined that Mr. Belluzzo’s background and experience as a Chief Executive Officer of a large public company, as well as his deep knowledge of the technology industry, allow him to contribute significantly to the Board and its strategic direction. Mr. Belluzzo’s financial acumen enhances the Audit Committee and his experience in the boardroom as a CEO and director contribute greatly to the Nominating and Corporate Governance Committee.

7

James V. Diller, Sr.

Mr. Diller, a founder of PMC, was PMC’s Chief Executive Officer from 1983 to July 1997 and President from 1983 to July 1993. Mr. Diller has been a director of PMC since its formation in 1983. Mr. Diller was Chairman of PMC’s Board from July 1993 until February 2000, when he became Vice Chairman. Since December, 2012, Mr. Diller has served as Interim President and Chief Executive Officer of Intersil Corporation, an analog semiconductor company. He is also a director of Intersil Corporation, and is Chairman of the Board of Avago Technologies Limited, an analog semiconductor company.

Mr. Diller has over 50 years of experience in the semiconductor industry, and has held positions ranging from development engineer and product line manager, to Chief Executive Officer, including at PMC. The Board determined that Mr. Diller’s long history with PMC, as well as his breadth of experience and on-going, active involvement in the semiconductor industry, continue to make him a valuable asset to the Board. For these reasons, the Board has excepted Mr. Diller this year from the Board’s general policy not to renominate a director for re-election at an annual stockholder meeting after that director’s 75th birthday.

Michael R. Farese, Ph.D.

Dr. Farese has been a director of PMC since May 2006. Dr. Farese joined Entropic Communications, a fabless semiconductor company that provides silicon and software solutions to enable connected home networking and entertainment, as Senior Vice President, Engineering and Operations in June of 2010 and is presently its Senior Vice President of Global Engineering. From September 2007 until May 2010, Dr. Farese served as the President and Chief Executive Officer of BitWave Semiconductor, Inc., a fabless semiconductor company and innovator of radio frequency integrated circuits. Dr. Farese served as the Senior Vice President of Engineering for Palm, Inc. from September 2005 until September 2007. From March 2002 to June 2005, Dr. Farese was the Chief Executive Officer and President of WJ Communications, Inc. He was Chief Executive Officer and President of Tropian, Inc. from October 1999 to March 2002 and prior to that held senior management positions at Motorola, Ericsson and Nokia Mobile Phones. Dr. Farese also held management positions at AT&T and Bell Laboratories. Dr. Farese serves on the board of directors of QuickLogic Corporation, a fabless semiconductor company.

The Board has determined that Dr. Farese’s extensive experience and knowledge in wireless communication products and systems allows him to significantly contribute to the strategic vision of the Company. His background as a seasoned Chief Executive Officer for technology companies also provides him with experience and knowledge in compensation and governance matters to enhance his contributions to the Compensation Committee and Nominating and Governance Committee.

Jonathan J. Judge

Mr. Judge has been a director of PMC since April 2004 and has served as Chairman of the Board since August 2011. Mr. Judge served as Chief Executive Officer of First Data Corporation, a global leader in electronic commerce and payment processing from August 2010 until he retired in January 2013. From October 2004 through July 2010, Mr. Judge served as the President and Chief Executive Officer of Paychex, Inc., a provider of payroll and human resource services. Mr. Judge served as President and Chief Executive Officer of Crystal Decisions, Inc. from October 2002 until the merger of Crystal Decisions with Business Objects S.A. in December 2003. From 1976 until October 2002, Mr. Judge was employed by International Business Machines Corporation (“IBM”), where he held senior management positions, the latest being General Manager of IBM’s personal computing division. Mr. Judge was also a member of IBM’s Worldwide Management Committee from 1999 until 2002.

In addition to his experience as a Chief Executive Officer and public board service, Mr. Judge’s semiconductor experience includes 25 years with IBM. The Board determined that Mr. Judge’s business and

8

management acumen and long-term focus on executive development and compensation make him a valuable asset to chair the Board and the Compensation Committee.

Michael A. Klayko

Mr. Klayko has been a director of PMC since August 2011. Since January 2013, Mr. Klayko is Chief Executive Officer of MKA Capital, an investment company focusing on technology investments. From January 2005 until January 14, 2013, Mr. Klayko served as Chief Executive Officer of Brocade Communications Systems, Inc., a comprehensive network solutions provider (“Brocade”). Previously, Mr. Klayko was Vice President of Worldwide Sales at Brocade and also served as the Vice President of Marketing and Support and Vice President of OEM Sales. Additionally, Mr. Klayko has held management positions at Rhapsody Networks, McDATA, EMC, HP and IBM.

The Board has determined that Mr. Klayko’s more than 30 years of experience in the storage, computer and telecommunications industry makes him a valuable asset to the Board and his experience with compensation from the perspectives of each executive, management, sales and as a director further contributes to the Compensation Committee.

William H. Kurtz

Mr. Kurtz has been a director of PMC since April 2003. Mr. Kurtz joined Bloom Energy, a developer of fuel cell systems for on-site power generation, as its Chief Financial Officer in March 2008 and was also appointed its Chief Commercial Officer as of September 2010. Prior to joining Bloom Energy, Mr. Kurtz served as the Executive Vice President and Chief Financial Officer of Novellus Systems, Inc., a global semiconductor equipment company, from September 2005 to March 2008. From March 2004 until August 2005, Mr. Kurtz was Senior Vice President and Chief Financial Officer of Engenio Information Technologies, Inc. From July 2001 to February 2004, Mr. Kurtz was Chief Operating Officer and Chief Financial Officer of 3PARdata, Inc. From August 1998 to June 2001, Mr. Kurtz was Executive Vice President and Chief Financial Officer of Scient Corporation. From July 1983 to August 1998, Mr. Kurtz served in various capacities at AT&T, Inc. (“AT&T”), including Vice President of Cost Management and Chief Financial Officer of AT&T’s Business Markets Division. Prior to joining AT&T, he worked at Price Waterhouse, now PricewaterhouseCoopers LLP. Mr. Kurtz is a certified public accountant. He also served as a director of Redback Networks, Inc., a broadband networking equipment company, from October 1999 to January 2007.

The Board determined that Mr. Kurtz’s financial expertise, exemplified by his qualifications as a certified public accountant, his background and experience in a number of companies as Chief Financial Officer, and his broad experience in semiconductors and new technology development make him a valuable asset to the Board and to serve as the designated financial expert and chair of the Audit Committee.

Gregory S. Lang

Mr. Lang has been a director of PMC and its President and Chief Executive Officer since May 2008. Prior to his appointment, Mr. Lang was President and Chief Executive Officer and served as a director of Integrated Device Technology, Inc. (“IDT”), a developer of mixed signal semiconductor solutions. Mr. Lang joined IDT as its President in October 2001 and became Chief Executive Officer in January 2003. From September 1996 to October 2001, Mr. Lang was Vice President and General Manager, Platform Networking Group, at Intel Corporation (“Intel”). Mr. Lang previously held various other management positions during his 15-year tenure at Intel. Mr. Lang is also a member of the board of directors of Intersil Corporation, an analog semiconductor company and serves on the board of directors of the Semiconductor Industry Association, a trade association representing the U.S. semiconductor industry.

The Board determined that the breadth of Mr. Lang’s experience within the semiconductor industry and, specifically, his position as PMC’s President and Chief Executive Officer provides him insight into the

9

Company’s current operations, challenges, risks, and growth which is valuable to the Board in performing its oversight responsibilities and in making strategic decisions.

Richard N. Nottenburg, Ph.D.

Dr. Nottenburg has been a director of PMC since August 2011. Dr. Nottenburg is an investor in early stage technology companies and a business consultant. He is currently a member of the board of directors of Aeroflex Holding Corporation and Verint Systems Inc. From June 2008 until October 2010, Dr. Nottenburg served as President, Chief Executive Officer, and a director of Sonus Networks, Inc., a leader in IP communications infrastructure. Previously, he was Executive Vice President and Chief Strategy Officer for Motorola, Inc., a leading provider of mission-critical communication products and services for enterprise and government customers. Prior to joining Motorola, Dr. Nottenburg was Vice President and General Manager of Vitesse Semiconductor Corporation after its merger with Multilink Technology Corporation in 2003. From 1995 until 2003, he served as President and Chief Executive Officer of Multilink, a company that he co-founded.

The Board has determined that Dr. Nottenburg’s extensive experience in communication networks as well as authoring more than fifty publications and presentations and holding eight U.S. patents make him a valuable asset to the Board and the Audit Committee.

Recommendation

PMC’s Board of Directors recommends a vote FOR each of the nominees to the Board of Directors to serve until the 2014 annual meeting of stockholders or until his successor is duly elected or appointed.

Vote Required

Each nominee for director receiving more votes “FOR” than “AGAINST” shall be elected as a director. If you do not wish your shares to be voted with respect to a nominee, you may “ABSTAIN,” in which case your shares will have no effect on the election of that nominee.

10

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee has retained Deloitte LLP as PMC’s independent auditors to audit its consolidated financial statements for fiscal 2013. During fiscal 2012, Deloitte LLP served as PMC’s independent auditors and also provided tax services. Although PMC is not required to seek stockholder ratification of this appointment, the Board believes it is good corporate governance to do so. If the appointment is not ratified, the Audit Committee will investigate the reasons and reconsider the appointment. A representative of Deloitte LLP is expected to attend the Annual Meeting and will be given an opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Fees Incurred by PMC for Deloitte LLP

The following table shows the fees paid or accrued by PMC for audit and other services provided by Deloitte LLP for fiscal 2012 and 2011. Audit fees increased from fiscal 2011 to fiscal 2012 primarily due to additional work performed in relation to the conversion of PMC’s global enterprise resource planning system and the write-down of goodwill and intangibles arising from the acquisitions of Wintegra, Inc. and Passave, Inc. Fees paid by PMC for tax services increased on a year-over-year basis due to incurring fees related to transfer pricing and tax planning matters.

| | | | | | | | |

| | | 2012 | | | 2011 | |

Audit Fees(1) | | $ | 1,295,150 | | | $ | 929,155 | |

Audit-Related Fees(2) | | | — | | | | — | |

Tax Fees(3) | | | 461,712 | | | | 429,564 | |

All Other Fees(4) | | | — | | | | — | |

| | | | | | | | |

Total | | $ | 1,756,862 | | | $ | 1,358,719 | |

| | | | | | | | |

| (1) | Audit fees billed by Deloitte LLP for examination of PMC’s annual financial statements, the audit of internal control over financial reporting in 2012 and 2011, and the review of those financial statements included in PMC’s quarterly reports on Form 10-Q and annual reports on Form 10-K. |

| (2) | Audit-related fees consisted of professional services billed by Deloitte LLP in connection with consultations on financial accounting and reporting matters. The Company paid no fees in this category for fiscal 2012 and 2011. |

| (3) | Corporate tax compliance and advisory services billed by Deloitte LLP. |

| (4) | Fees for products and services other than the services reported above. For fiscal 2012 and 2011 the Company paid no fees in this category. |

Audit Committee Pre-Approval Policy

The Audit Committee must approve all audit-related and permitted non-audit services to be performed by PMC’s independent auditors prior to the commencement of such services. The Audit Committee approves such services by Deloitte LLP on the basis that the services are compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. Deloitte LLP presents an audit plan and fee proposal to the Audit Committee at mid-year for review. The approved plan and fees determine the scope of their fiscal year services. Any audit or non-audit services outside that scope (whether service or amount) is separately approved by the Audit Committee. All of the services described in the fee table above were approved pursuant to the Audit Committee’s pre-approval policy.

Recommendation

PMC’s Board of Directors recommends a vote FOR the ratification of the appointment of Deloitte LLP as PMC’s independent auditors for the 2013 fiscal year.

Vote Required

The affirmative vote of a majority of the votes cast is required to confirm the appointment of Deloitte LLP as PMC’s independent auditors for the 2013 fiscal year.

11

PROPOSAL NO. 3

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION

Section 14A of the Exchange Act and Rule 14a-21(a) thereunder requires us to provide our stockholders with a nonbinding advisory vote on the compensation of our named executive officers as described in this proxy statement (commonly referred to as a “Say-on-Pay” vote).

The Board and PMC’s executive team value the opinions of our stockholders. At the 2012 annual meeting of our stockholders, more than 99% of the votes cast on the Say-on-Pay vote proposal were voted in favor of our executive compensation program for our named executive officers. In addition, in 2011 the Board recommended that Say-on-Pay votes be held on an annual basis and approximately 92% of the votes cast on this Say-on-Pay frequency vote proposal at the 2011 annual meeting of our stockholders were voted in favor of holding Say-on-Pay votes every year. As a result, the Board has implemented a policy to conduct an annual advisory vote on the compensation of our named executive officers.

As noted in the Compensation Discussion and Analysis included in this proxy statement, our executive compensation program uses compensation elements including base salary, semi-annual performance-based cash bonuses, a variety of equity incentives including performance-based restricted stock unit awards for our CEO in 2012, retirement benefits, health and other similar personal benefits to achieve the goals of:

| | • | | directly and substantially linking rewards to measurable corporate performance; |

| | • | | permitting sufficient flexibility to enable us to continue to attract, motivate and retain executive officers in a highly cyclical business environment and to support us in achieving our strategic business objectives; |

| | • | | motivating our executive officers in all stages of the cyclical economy of the semiconductor industry; |

| | • | | minimizing dilution by providing a mix of equity incentives within guidelines approved by the Compensation Committee; |

| | • | | providing competitive compensation with the opportunity for above-market pay tied to above-target performance; and |

| | • | | ensuring that our executive compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on PMC. |

The Board believes that our executive compensation program directly and substantially links rewards to measurable corporate performance. The process for determining compensation packages for our executive officers requires that the Compensation Committee, based on rigorous analysis and the advice of carefully selected outside advisors, use judgment and experience to carefully determine the optimal components and amounts of compensation for each executive officer.

For a more detailed discussion of PMC’s compensation philosophy, objectives and practices for fiscal 2012, we strongly encourage stockholders to review this proxy statement, and in particular the information contained in the “Executive Compensation” section of this proxy statement (beginning at page 27), including the Compensation Discussion and Analysis and the tabular and related narrative disclosures.

Recommendation

PMC’s Board of Directors recommends a vote FOR the following advisory resolution:

RESOLVED, that the stockholders approve the compensation of PMC’s named executive officers as described in the proxy statement in the “Executive Compensation” section, including the “Compensation Discussion and Analysis” and the tabular and narrative disclosures therein, each as required by Item 402 of SEC Regulation S-K.

Vote Required

Because the vote is advisory, it will not be binding upon the Board. However, the Board and the Compensation Committee will consider the outcome of the vote when making future decisions about PMC’s executive compensation policies and practices.

12

BOARD STRUCTURE

| | | | | | |

Name of Director | | Audit Committee | | Compensation Committee | | Nominating and

Corporate Governance

Committee |

Non-Employee Directors: | | | | | | |

Richard E. Belluzzo | | Member | | | | Member |

James V. Diller, Sr.(2) | | | | | | |

Michael R. Farese | | | | Member | | Chair |

Jonathan J. Judge(1) | | | | Chair | | |

Michael A. Klayko | | | | Member | | |

William H. Kurtz | | Chair | | | | |

Richard N. Nottenburg | | Member | | | | |

Employee Director: | | | | | | |

Gregory S. Lang | | | | | | |

Number of Meetings in Fiscal 2012 | | 8 | | 5 | | 2 |

Board Leadership Structure

PMC currently has eight directors. Since 2008, PMC has separated the positions of Chief Executive Officer and Chairman of the Board. Mr. Judge has served as PMC’s non-executive Chairman since August 12, 2011. Under the current structure, having a non-executive Chairman provides for an effective channel for the Board to express its views on management, and allows the Chief Executive Officer to focus more on the operation of the Company.

Board’s Role in Risk Oversight

The Board’s risk oversight function is primarily administered through board committees. Generally, the board committee with subject matter expertise in a particular area is responsible for overseeing the management of risk in that area. For example, the Audit Committee oversees the management of financial, accounting and internal control risks, the Compensation Committee oversees the management of risks in the Company’s compensation programs, and the Nominating and Corporate Governance Committee oversees compliance with the Company’s governance policies. In addition, the Audit Committee conducts an annual risk assessment and also oversees the management of risks related to the Company’s business objectives, including intellectual property, IT infrastructure, and business redundancy functions.

To assist the Audit Committee in its risk management oversight function, PMC’s Internal Audit reports directly to the Audit Committee. The Audit Committee reviews with Internal Audit and management the categories of risk that PMC faces, including the likelihood of occurrence and the potential impact of such risks and mitigating measures. The Audit Committee receives regular reports on the status of the Company’s cash reserves, and the Audit Committee periodically reviews the Company’s Investment Policy and PMC’s investments of cash to ensure adherence to the Investment Policy. The Compensation Committee works with management on the design and evaluation of compensation programs. The Compensation Committee takes a conservative approach to this design to minimize risk to the Company, including consideration as to whether PMC’s compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company.

Management reports directly to the Nominating and Corporate Governance Committee regarding compliance with Company policies, including the Company’s Code of Business Conduct and Ethics.

13

In carrying out their risk oversight duties, the board committees review management’s implementation of risk policies and procedures, and reviews reports from management, independent auditors, Internal Audit, legal counsel, regulators and outside experts, as appropriate, regarding risks the Company may face.

The Board and its committees are committed to ensuring effective risk management oversight and work with management to ensure that effective risk management strategies are incorporated into PMC’s culture and day-to-day business operations.

Board Independence

The NASDAQ listing standards require that a majority of the members of a listed company’s board of directors must qualify as “independent” as affirmatively determined by its board of directors. Our Board annually reviews information relating to the members of our Board to ensure that a majority of our Board is independent under the NASDAQ rules and SEC rules. After such review, our Board has determined that all of the director nominees, except Messrs. Lang and Diller, satisfy the definition of independent director as established in the NASDAQ Stock Market listing standards. The Board has determined that each of the members of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee satisfies the definition of independent director as established in the NASDAQ listing standards.

Meetings

During the 2012 fiscal year, the Board held eleven meetings. Each of our directors attended at least 75% of all Board and applicable committee meetings. The Chairman and each director serving as the chairperson of a Board committee are required to attend the annual meeting of stockholders by phone or in person unless prevented by circumstances beyond his control. All directors attended the 2012 annual meeting of stockholders.

Lead Independent Director

While the Company has a non-executive and independent Chairman, the Board has determined that the following duties of a Lead Independent Director are fully assumed by the Chairman:

| | • | | authority to call meetings of the independent directors; |

| | • | | lead meetings of the independent directors in which the Chairman does not participate; |

| | • | | act as a liaison between the independent directors and the Chairman; |

| | • | | review agendas for board meetings in consultation with the Chairman and President and Chief Executive Officer; |

| | • | | receive communications from stockholders in accordance with the procedures specified in this proxy statement for communications with the Board; |

| | • | | be available for consultation with stockholders to the extent determined by the independent directors; and |

| | • | | retain legal or other advisors as deemed necessary and appropriate. |

The Board has discretion to name a Lead Independent Director as it may deem appropriate in the future.

Audit Committee

The Audit Committee consisted of Messrs. Belluzzo, Judge and Kurtz from the start of fiscal 2012 until February 8, 2012. Effective February 9, 2012, the Audit Committee consists of Mr. Belluzzo, Dr. Nottenburg and Mr. Kurtz who, for all of fiscal 2012 served as the Chair of the Audit Committee and its designated “audit

14

committee financial expert” in accordance with SEC rules. The Audit Committee held eight meetings during 2012. As constituted in fiscal 2012 and as presently constituted, the Board has determined that all of the Audit Committee members were/are financially literate in accordance with SEC rules. The Audit Committee oversees Internal Audit and appoints and oversees the independent auditors. The Audit Committee approves the independent auditors’ fees and pre-approves any audit and non-audit services to be provided by the independent auditors. The Audit Committee also monitors the independence of the auditors.

The Audit Committee meets with PMC’s independent auditors, internal auditors and senior management to review the general scope of PMC’s accounting, financial reporting, annual audit and internal audit programs, matters relating to internal control systems and results of the annual audit. The Audit Committee regularly meets with the independent auditors without management present and meets at least once a year with only management present. The Internal Audit Director also meets regularly and privately with the Audit Committee Chair.

The Audit Committee has authority to review and approve any proposed transactions between PMC and its officers and directors, or their affiliates. The Audit Committee also constitutes PMC’s Qualified Legal Compliance Committee and reviews any reports from PMC’s legal counsel of material violations of laws. A copy of the Audit Committee charter is available at:http:// pmcs.com/charter/audit.

Compensation Committee

From the start of fiscal 2012 until February 8, 2012, the Compensation Committee consisted of Dr. Farese and Mr. Judge. Effective February 9, 2012, the Compensation Committee consists of Dr. Farese, Mr. Klayko and Mr. Judge, who continues to serve as Chair. Mr. Judge served as Chair of the Compensation Committee for all of fiscal 2012. The Compensation Committee held five meetings in 2012. The Compensation Committee reviews and approves PMC’s compensation policies, plans and programs, including the compensation of and employment agreements with its executive officers and annually evaluates compensation of members of the Board. The Compensation Committee may delegate its responsibilities to subcommittees when appropriate. The Compensation Committee serves as the plan administrator of PMC’s equity plans and oversees administration of its benefit programs. A copy of the Compensation Committee charter is available at:http:// pmcs.com/charter/compensation.

In fiscal 2012, the Compensation Committee continued to engage, Compensia, Inc., a national compensation consulting firm (“Compensia”), to advise the Compensation Committee with regard to executive and director compensation. Compensia did not provide any other services to the Company in fiscal 2012. Compensia maintains an internal policy that is specifically designed to prevent any conflicts of interest. In addition, the Compensation Committee has assessed the independence of Compensia taking into account, among other factors, the factors set forth in Exchange Act Rule 10C-1 and the NASDAQ listing standards, and concluded that no conflict of interest exists that would prevent Compensia from independently representing the Compensation Committee.

Nominating and Corporate Governance Committee

From the start of fiscal 2012 until February 8, 2012, the Nominating and Corporate Governance Committee (the “NCGC”) consisted of Dr. Farese and Mr. Marshall. Mr. Belluzzo was appointed to the NCGC on February 9, 2012 at which time Mr. Marshall was named its Chair. Upon Mr. Marshall’s retirement from the Board on May 10, 2012, Dr. Farese was appointed Chair of the NCGC and Mr. Belluzzo remained as the other director serving the committee. The NCGC held two meetings in 2012. The NCGC determines criteria for board and committee membership. The NCGC makes recommendations to the entire Board as to the size and composition of the Board and its committees, reviews and approves, if appropriate, conflicts of interest of directors and officers, and monitors PMC’s corporate governance. The NCGC supervises an annual assessment by the Board of its performance. The NCGC informally evaluates the performance of individual directors as part of the annual nomination process. A copy of the NCGC charter is available at:http:// pmcs.com/charter/nominatingcorpgovernance.

15

Consideration of Director Nominees

The NCGC selects nominees for annual election by the stockholders by first evaluating the Board which would result from re-electing directors willing to continue serving on the Board. If the NCGC wants to consider additional candidates, the directors and senior management suggest potential nominees. From time to time PMC engages third party search firms to identify, screen and assist in recruiting potential nominees based on criteria provided by PMC. The NCGC, other Board members and senior management then meet with each candidate so that the NCGC has broad input in evaluating each candidate. The NCGC also confirms the candidate’s independence under SEC and NASDAQ rules. This consideration of director nominees may also occur between annual meetings if the NCGC determines that PMC would benefit from additional directors.

The NCGC believes that, in addition to factors such as the candidate’s integrity, judgment and reputation, PMC’s Board benefits from directors who share many of the following qualities or skills:

| | • | | independence from management; |

| | • | | extensive business and industry experience, particularly in the technology sector; |

| | • | | experience as an executive officer of a publicly traded corporation; |

| | • | | experience as a director of a publicly traded corporation; |

| | • | | knowledge about the industries in which PMC’s end user customers participate, or the markets which those customers serve; |

| | • | | diversity of experience (including race/ethnicity, age, skills and experience); |

| | • | | absence of conflicts of interest; and |

| | • | | available time for service as a PMC director in light of the candidate’s other business and professional commitments. |

The NCGC has no specific, minimum qualifications that it believes must be met for a position on PMC’s Board other than the financial expertise of potential Audit Committee members and whether at least one Audit Committee member qualifies as an “audit committee financial expert.” The NCGC does not have a formal policy with respect to diversity, but PMC’s Corporate Governance Guidelines expressly provide that the NCGC consider Board candidates and/or nominees who represent a mix of backgrounds, diversity of race/ethnicity, gender, age, skills and experience that enhance the quality of the Board’s deliberations and decisions.

The NCGC will consider director candidates recommended by stockholders. To recommend a candidate, stockholders should submit to PMC’s Chief Executive Officer an analysis of the candidate’s independence and the factors listed above, and a description of any relationship between the stockholder and candidate. Submissions will be provided to the NCGC for consideration. The Committee applies the same standards in evaluating candidates submitted by stockholders as it does in evaluating candidates submitted by other sources.

On January 10, 2013, PMC entered into a letter agreement (the “Agreement”) with Relational Investors LLC (“Relational”), a stockholder beneficially owning more than 5% of PMC’s common stock. Under the Agreement, PMC has agreed to appoint Kirt Karros or Ralph Whitworth to PMC’s Board and the Compensation Committee of the Board if requested by Relational between August 1, 2013 and 30 days prior to the expiration of the notice period specified in the Company’s advance notice bylaw related to nominations of directors at the Company’s 2014 Annual Meeting of Stockholders. Should Mr. Karros or Mr. Whitworth join PMC’s Board, PMC agrees to re-nominate him at PMC’s 2014 Annual Meeting of Stockholders for a one-year term. PMC’s obligations to appoint and re-nominate Mr. Karros or Mr. Whitworth if requested by Relational are conditioned upon Relational continuing to hold at least 9 million shares of PMC common stock.

Please see “Policies and Procedures with Respect to Related Party Transactions” beginning on page 55.

16

Corporate Governance

PMC has adopted Corporate Governance Guidelines (the “Governance Guidelines”) that outline, among other matters, the role and functions of the Board, Board composition, compensation and administration. These Guidelines may be updated from time to time and have been revised since the last annual meeting of stockholders. The Governance Guidelines are available, along with other important corporate governance materials, on our website athttp:// pmcs.com/governanceguidelines.

The Governance Guidelines provide, among other things, that:

| | • | | the Board will exercise its business judgment to direct management in the best interests of stockholders of PMC. The Board may also consider the interests of the Company’s employees, customers, suppliers and creditors; |

| | • | | a majority of the directors must qualify as independent directors under all applicable regulations, including SEC and NASDAQ rules; |

| | • | | should the Chief Executive Officer also the serve as Chairman of the Board, and otherwise as it considers appropriate, the Board shall appoint a Lead Independent Director from among the independent directors; |

| | • | | at least four times annually, the independent directors will meet in private session without the Chief Executive Officer or other members of management present; |

| | • | | the Board performs an annual effectiveness self-evaluation of the Board and its committees; |

| | • | | directors and executive officers are required to attain and maintain a minimum equity ownership interest in the Company; |

| | • | | directors who are engaged in full-time employment as an executive of a publicly traded company should not serve on the boards of more than four publicly traded companies, including PMC’s Board; |

| | • | | a director shall notify the NCGC of any principal job change and submit a resignation from the Board for consideration by the NCGC. The NCGC will make a recommendation to the Board as to whether that director shall be nominated for re-election at the next annual meeting or, in exceptional circumstances, whether the director’s resignation should be accepted; |

| | • | | the Board does not believe it should limit the number of terms for which an individual may serve as a director; |

| | • | | as a general policy, a director will not be nominated for re-election at the annual meeting following the director’s 75th birthday; and |

| | • | | if a director does not receive the vote required for re-election at any annual meeting at which he or she is nominated for re-election, such director will thereafter tender his or her irrevocable resignation from the Board to the NCGC. The NCGC will make a recommendation to the Board regarding whether the director’s resignation should be accepted. |

Because the operation of the Board is a dynamic process, the Board regularly reviews changing legal and regulatory requirements, evolving best practices and other developments. The Board may modify the Governance Guidelines from time to time, as appropriate.

Communications with the Board

Any stockholder who desires to contact our Chairman or other members of our Board may do so by writing to: Board of Directors, c/o Corporate Secretary, PMC-Sierra, Inc., 1380 Bordeaux Drive, Sunnyvale, California 94089 or corporate.secretary@pmcs.com. Communications received in writing are reviewed internally by management and then distributed to the Chairman or other members of the Board as appropriate.

17

Code of Business Conduct and Ethics

PMC has adopted a Code of Business Conduct and Ethics that applies to our directors and all of our employees, including our President and Chief Executive Officer, our Chief Financial Officer, and our principal accounting officer. The Code of Business Conduct and Ethics is available on our website athttp:// pmcs.com/code-of-ethics.

18

EXECUTIVE OFFICERS

The following information about our executive officers is as of March 6, 2013.

| | | | | | |

Name of Officer | | Age | | | Position |

Gregory S. Lang | | | 49 | | | President and Chief Executive Officer |

Ra’ed O. Elmurib | | | 53 | | | Vice President, Corporate Development and General Manager of the Microprocessors Products Division |

Alinka Flaminia | | | 51 | | | Vice President, General Counsel and Corporate Secretary |

Steven J. Geiser | | | 44 | | | Vice President, Finance and Chief Financial Officer |

Colin C. Harris | | | 55 | | | Vice President, Chief Operating Officer, General Manager of the Communications Business Unit |

Travis Karr | | | 40 | | | Vice President, General Manager of the Enterprise Storage Division |

O. Daryn Lau | | | 48 | | | Vice President, New Business Initiatives |

Robert M. Liszt | | | 56 | | | Vice President, Worldwide Sales |

Mr. Lang has been a director of PMC and its President and Chief Executive Officer since May 2008. Prior to his appointment, Mr. Lang was President and Chief Executive Officer, and served as a director, of IDT. Mr. Lang joined IDT as its President in October 2001 and became Chief Executive Officer in January 2003. At IDT he led the organization and the transformation of the company’s culture, financial structure, core competencies and product direction resulting in increased profits and revenue. From September 1996 to October 2001, Mr. Lang was Vice President and General Manager, Platform Networking Group, at Intel where he built Intel’s client-side wired and wireless networking businesses. Mr. Lang previously held various other management positions during his 15-year tenure at Intel. Mr. Lang is a member of the board of directors of Intersil Corporation, an analog semiconductor company.

Mr. Elmurib has served as Vice President, Corporate Development and General Manager of the Microprocessor Products Division since January 2010 and as Vice President, General Manager of the Microprocessor Products Division since December 2006. Mr. Elmurib previously served as the Vice President, Corporate Development managing corporate business development and strategic investments, partnerships and acquisitions and, as Director of Sales for Asia Pacific and the Western U.S., oversaw the sales activities and managed the direct and channel sales force. Mr. Elmurib joined PMC in 2000 as a Regional Sales Manager for the South West region. Prior to joining PMC, Mr. Elmurib was the President of Unitec Sales, a manufacturer representative organization, and held various sales management positions at STMicroelectronics N.V.

Ms. Flaminia has served as Vice President and General Counsel since January 2007 and was appointed Corporate Secretary in February 2007. Ms. Flaminia was Senior Counsel at Xilinx, Inc. from March 2001 through 2006 where she provided legal services to the finance and corporate services, sales, marketing and human resources organizations worldwide which included providing legal counsel in the areas of: corporate and securities law; corporate governance; commercial transactions and tax; mergers and acquisitions; intellectual property licensing; sales and distribution contracts; antitrust and unfair trade practices; employment law; compensation and benefits; and litigation. Previously, Ms. Flaminia was employed by McAfee, Inc. (formerly known as Network Associates, Inc.) from December 1999 to March 2001 and was a Director of Legal Affairs in her last position held. From October 1990 to November 1999, Ms. Flaminia was in private practice.

Mr. Geiser has served as Vice President, Finance and Chief Financial Officer since November 19, 2012. Mr. Geiser was Chief Financial Officer at Trilliant Networks, Inc. from October 2011 to March 2012. From September 2006 to October 2009, he was Chief Financial Officer at RMI Corporation where played a pivotal role in the successful sale of the company to Netlogic Microsystems, Inc., a company later acquired by Broadcom. Mr. Geiser was the initial Chief Financial Officer at Spansion, Inc. from its formation in July 2003 through February 2006. He was responsible for the direction of all financial activities, including the successful completion of one of the largest technology IPOs in 2005. From May 1994 to July 2003, Mr. Geiser held various financial positions at Advanced Micro Devices, Inc. including Vice President of Finance for the memory division

19

and domestic financial controller for the company’s final manufacturing operations in Southeast Asia. Before pursuing an advanced degree in finance, he was a controls systems engineer for Sundstrand Aerospace Corporation.

Mr. Harris, a founder of PMC, has served as Vice President, Chief Operating Officer since April 2007. Commencing in January 2013, Mr. Harris also assumed the role of General Manager of the Communications Business Unit. Previously, Mr. Harris served as Vice President of Worldwide Operations at PMC from July 2004 to April 2007 and Vice President of IC Technology from May 1997 to July 2004. In 1992, he became PMC’s Director of Operations and subsequently Director of Quality Assurance.

Mr. Karr has served as Vice President and General Manager of the Enterprise Storage Division since August 2010. Mr. Karr joined the Communication Products Division in August 2008 and served as its Vice President and General Manager from January 2009 until August 2010. Prior to his role in the Communication Products Division, Mr. Karr served as the Vice President of Marketing of the Enterprise Storage Division from 2006 until August 2008. Mr. Karr joined PMC in 1996. Earlier positions held include Director of Product Marketing from 2003 to 2006 for storage products and, prior to 2003, Marketing Manager for communications products.

Mr. Lau has served as Vice President, New Business Initiatives since January 2013. From August 2010 until January 2013 he served as Vice President, General Manager of the Communication Products Division. Prior to that appointment he was Vice President of Corporate Strategy and Technology Office since September 2008. Mr. Lau held increasingly senior positions at Applied Micro Circuits Corporation (“AMCC”) from May 2004 to August 2008, including serving as Senior Vice President, Corporate Strategy Office and CTO Office from October 2007 to August 2008, where he was responsible for running AMCC’s semiconductor business, including the architecture group, strategic and product marketing, engineering development and customer support. From May 2004, when IDT acquired ZettaCom, a supplier of high-performance network semiconductor solutions co-founded by Mr. Lau, until April 2005, Mr. Lau served as Vice President and General Manager of the Serial Switching Division of IDT. After co-founding ZettaCom in October 1999, Mr. Lau served as its President and Chief Executive Officer until the acquisition by IDT. Prior to that, Mr. Lau held various technical leadership and management roles at Cisco Systems from 1993 to September 1999.

Mr. Liszt has served as Vice President of Worldwide Sales since March 2006. He was Vice President, Global Sales at Agere Systems, Inc. (now known as LSI Logic Corporation) from November 2005 to February 2006 and Vice President, North American Sales from May 2002 until November 2005 where he provided sales leadership and account strategies for a diverse group of sales professionals, field application engineers and sales operations teams. He was also responsible for establishing hybrid sales channels which included global distribution representatives and direct sales organizations targeting market leading OEM’s. He was Vice President Components Division at NEC Electronics Corporation from January 2001 until May 2002, Vice President, North American Sales from June 1999 to January 2001 and Vice President of Geographic Sales from September 1998 to May 1999. From 1982 to 1998, he held sales management positions with Hitachi America Semiconductor (“Hitachi”) where he focused on developing and executing on sales strategies that would promote multiple Hitachi product sales into global accounts including semiconductors, display systems and disk drives.

20

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information concerning:

| | • | | beneficial ownership of PMC’s common stock by all persons known to PMC to be the beneficial owners of 5% or more of PMC’s common stock; |

| | • | | beneficial ownership of PMC’s common stock by all directors, nominees and named executive officers; and |

| | • | | beneficial ownership of PMC’s common stock by all directors and executive officers as a group. |

Under the rules of the SEC, “beneficial ownership” includes any shares as to which the individual has the sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days, through the exercise of any stock option or other right. Unless otherwise indicated, each person or entity has sole investment and voting power, or shares such powers with his or her spouse, with respect to the shares set forth in the following table. Unless otherwise noted, the information below is as of March 1, 2013. This information is not indicative of beneficial ownership for any other purpose. As of March 1, 2013, there are no arrangements known to PMC, including any pledge by any person of securities of PMC, the operation of which may at a subsequent date result in a change of control of the Company. Unless otherwise indicated, the address of each of the individuals named below is c/o PMC-Sierra, Inc., 1380 Bordeaux Drive, Sunnyvale, California 94089.

| | | | | | | | |

Name | | Number of

Shares | | | Approximate

Percentage

Ownership | |

Greater than 5% Shareholders | | | | | | | | |

Cadian Capital Management, LLC(1) | | | 22,788,900 | | | | 11.34 | % |

T. Rowe Price Associates, Inc.(2) | | | 20,986,650 | | | | 10.40 | % |

Relational Investors, LLC(3) | | | 17,847,255 | | | | 8.88 | % |

FMR LLC(4) | | | 16,298,722 | | | | 8.11 | % |

Fisher Investments(5) | | | 11,657,215 | | | | 5.80 | % |

The Vanguard Group, Inc.(6) | | | 11,007,247 | | | | 5.47 | % |

Morgan Stanley(7) | | | 10,139,912 | | | | 5.00 | % |

Directors | | | | | | | | |

Richard E. Belluzzo(8) | | | 322,002 | | | | * | |

James V. Diller, Sr.(9) | | | 1,388,467 | | | | * | |

Michael R. Farese(10) | | | 202,002 | | | | * | |

Jonathan J. Judge(11) | | | 289,774 | | | | * | |

Michael A. Klayko(12) | | | 94,259 | | | | * | |

William H. Kurtz(13) | | | 332,002 | | | | * | |

Gregory S. Lang(14) | | | 2,442,336 | | | | 1.22 | % |

Richard N. Nottenburg(15) | | | 87,723 | | | | * | |

Named Executive Officers | | | | | | | | |

Michael W. Zellner(16) | | | 625,169 | | | | * | |

Steven J. Geiser | | | — | | | | * | |

Colin C. Harris(17) | | | 1,289,891 | | | | * | |

Travis Karr(18) | | | 288,858 | | | | * | |

Robert M. Liszt(19) | | | 511,531 | | | | * | |

Executive Officers | | | | | | | | |

Ra’ed Elmurib(20) | | | 371,753 | | | | * | |

Alinka Flaminia(21) | | | 411,282 | | | | * | |

O. Daryn Lau(22) | | | 394,656 | | | | * | |

All directors and executive officers as a group (16) persons)(23) | | | 9,055,549 | | | | 4.51 | % |

21

| (1) | Based solely on information reported by Cadian Capital Management, LLC on Schedule 13G/A filed with the SEC on January 16, 2013, Cadian Capital Management, LLC has shared voting and dispositive power with respect to all reported shares. The address of Cadian Capital Management, LLC is 535 Madison Avenue, 36th Floor, New York, NY 10022. |

| (2) | Based solely on information reported by T. Rowe Price Associates, Inc. (“Price Associates”) on a Schedule 13G/A filed with the SEC on February 11, 2013, Price Associates has sole voting power over 2,158,000 shares. For purposes of the reporting requirements of the Exchange Act, Price Associates is deemed to be a beneficial owner of such securities; however, Price Associates expressly disclaims that it is, in fact, the beneficial owner of such securities. The address of Price Associates is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (3) | Based solely on information reported by Relational Investors, LLC on Schedule 13D/A filed with the SEC on January 11, 2013, each of Relational Investors, LLC Ralph V. Whitworth and David H. Batchelder has shared voting and shared dispositive power with respect to all reported shares. The address of Relational Investors, LLC is 12400 High Bluff Drive, Suite 600, San Diego, CA 92130. |