PMC-Sierra Welcome Meeting Microsemi Corporation December 2015 © 2015 Microsemi Corporation. TM Exhibit 99.1

This presentation contains projections or other forward-looking statements regarding future events or the future financial performance of Microsemi Corporation. We wish to caution you that these statements are only predictions and that actual events or results may differ materially. We refer you to all of the documents that the company filed with the Securities and Exchange Commission. Please pay special attention to the Company’s most recent Form 10-K and subsequent Form 10-Qs. These documents contain and identify important factors that could cause the actual results to differ materially from those contained in our projections or forward-looking statements. Disclaimer

Agenda Welcome & Introductions James J. Peterson, Microsemi, Chairman of the Board & CEO Microsemi Company Overview Paul Pickle, Microsemi, President & COO Acquisition Overview/Integration Overiew & Calendar Steven Litchfield, Microsemi, EVP & Chief Strategy Officer Question & Answers Microsemi Team

About Microsemi Corporation (Nasdaq: MSCC) Global provider of semiconductor solutions for applications focused on delivering power, reliability, security and performance. High-value, high end market segments: Communications Defense & Security Aerospace Industrial FY 2015 revenue: $1.25 billion Corporate headquarters in Aliso Viejo, CA

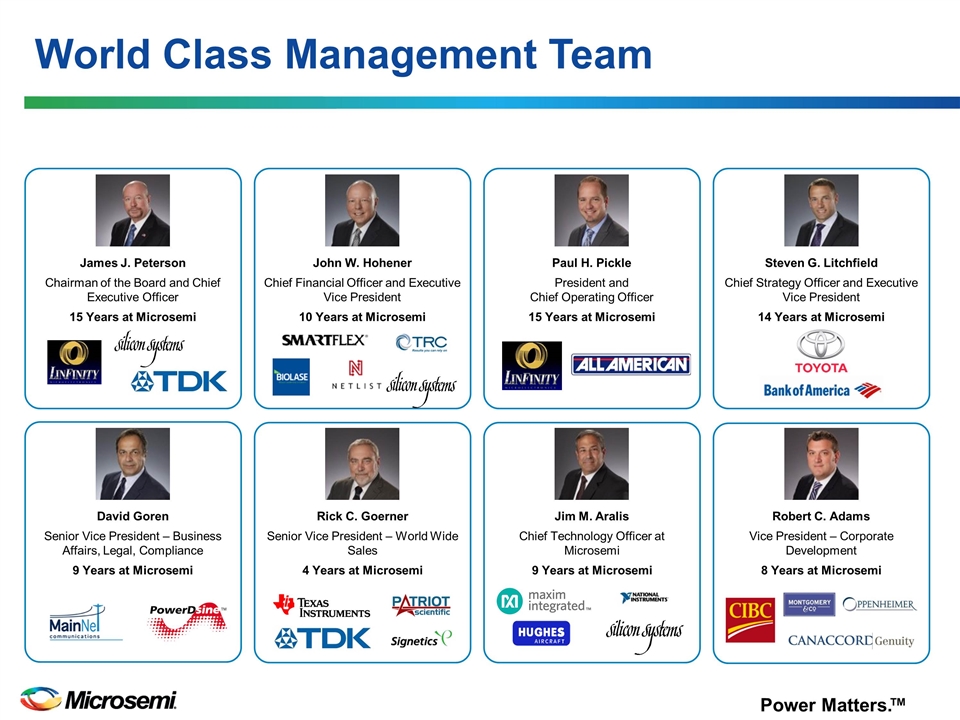

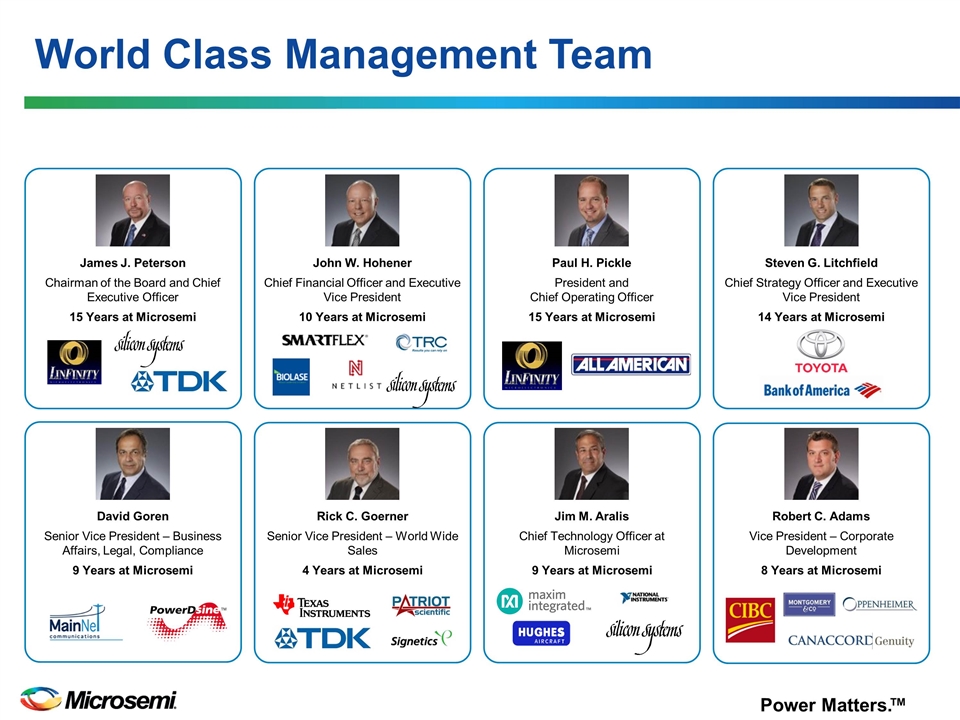

World Class Management Team Steven G. Litchfield Chief Strategy Officer and Executive Vice President 14 Years at Microsemi James J. Peterson Chairman of the Board and Chief Executive Officer 15 Years at Microsemi John W. Hohener Chief Financial Officer and Executive Vice President 10 Years at Microsemi Paul H. Pickle President and Chief Operating Officer 15 Years at Microsemi David Goren Senior Vice President – Business Affairs, Legal, Compliance 9 Years at Microsemi Rick C. Goerner Senior Vice President – World Wide Sales 4 Years at Microsemi Jim M. Aralis Chief Technology Officer at Microsemi 9 Years at Microsemi Robert C. Adams Vice President – Corporate Development 8 Years at Microsemi

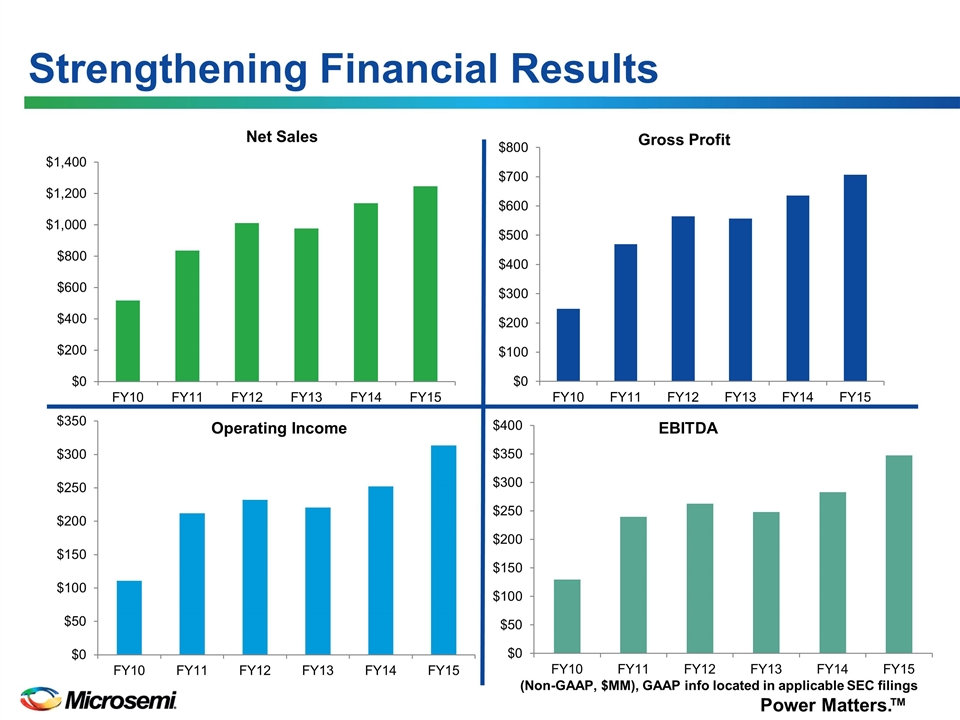

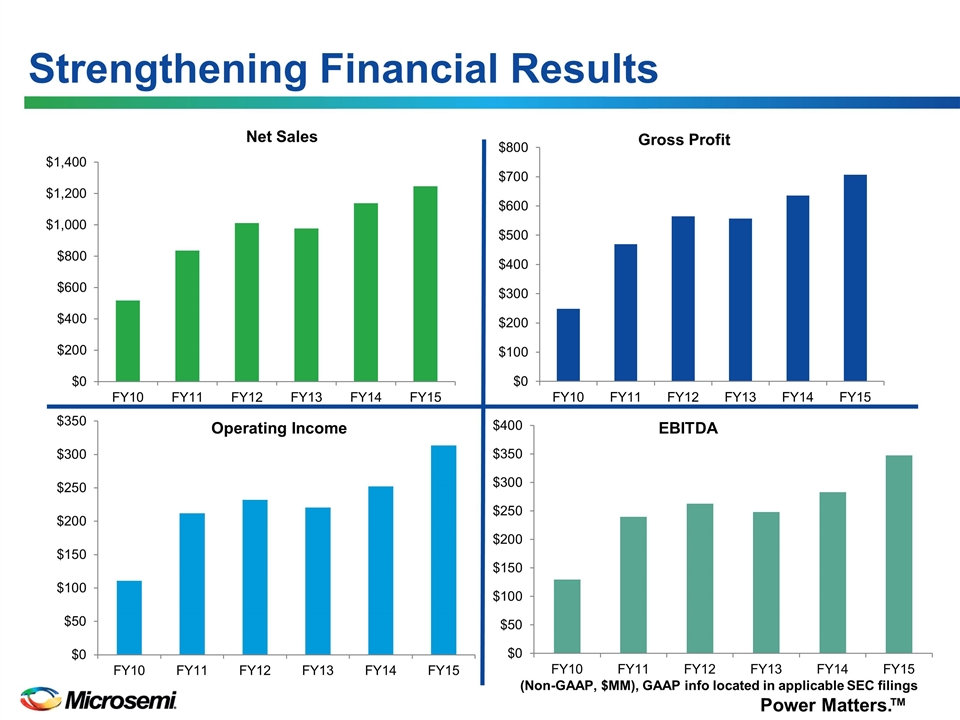

Strengthening Financial Results (Non-GAAP, $MM), GAAP info located in applicable SEC filings Operating Income EBITDA Net Sales Gross Profit

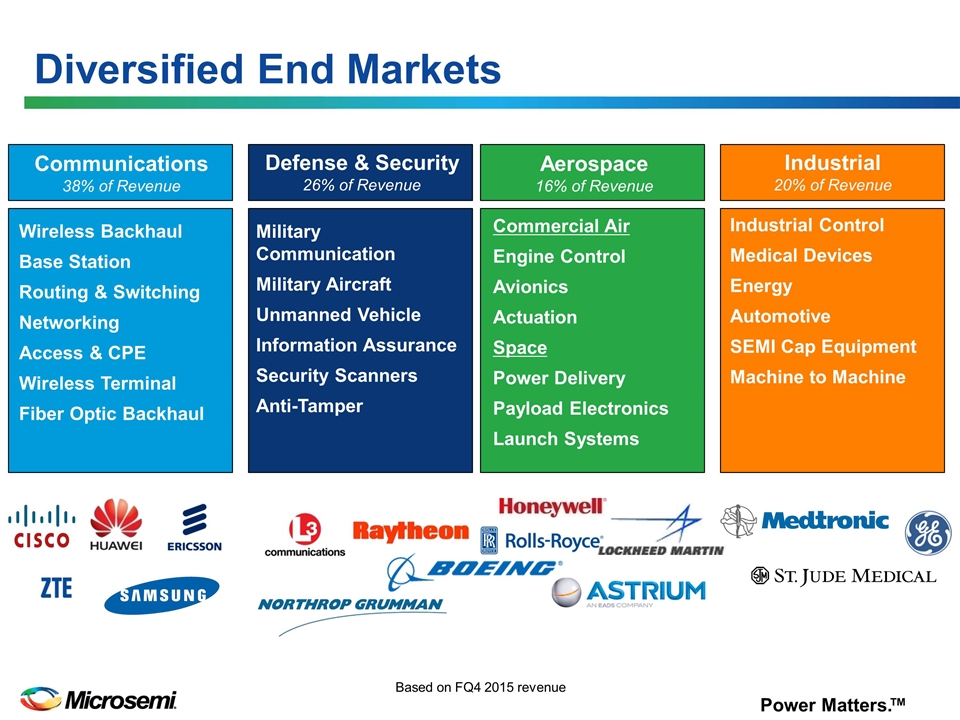

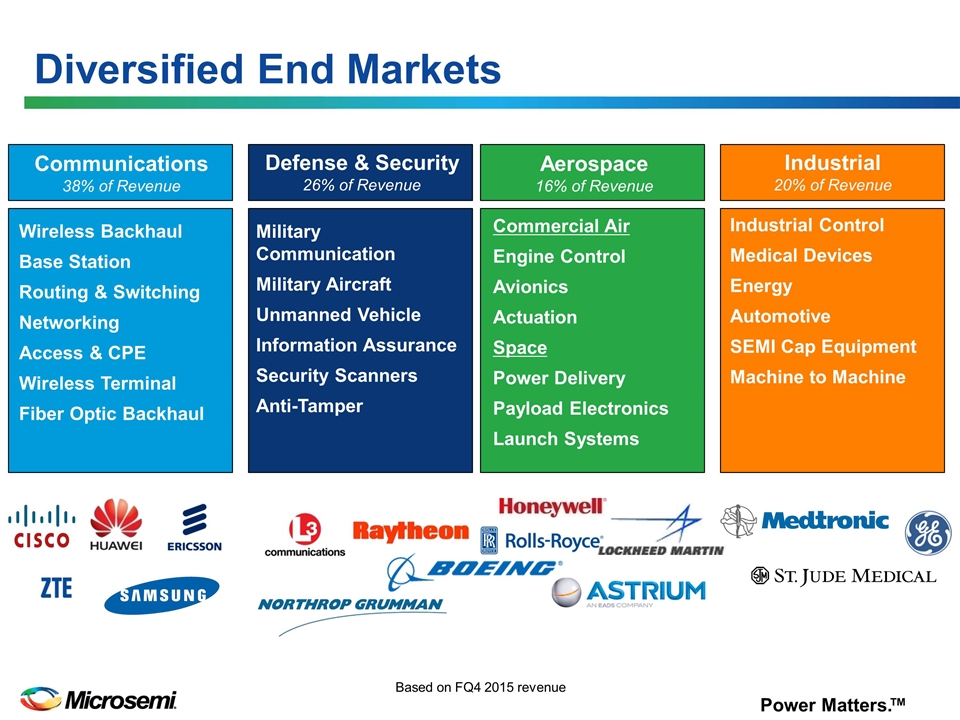

Diversified End Markets Based on FQ4 2015 revenue Wireless Backhaul Base Station Routing & Switching Networking Access & CPE Wireless Terminal Fiber Optic Backhaul Communications 38% of Revenue Defense & Security 26% of Revenue Aerospace 16% of Revenue Industrial 20% of Revenue Military Communication Military Aircraft Unmanned Vehicle Information Assurance Security Scanners Anti-Tamper Commercial Air Engine Control Avionics Actuation Space Power Delivery Payload Electronics Launch Systems Industrial Control Medical Devices Energy Automotive SEMI Cap Equipment Machine to Machine

Microsemi Growth Model Targeted acquisitions to expand Microsemi application footprint Organic growth through innovation and leading-edge products

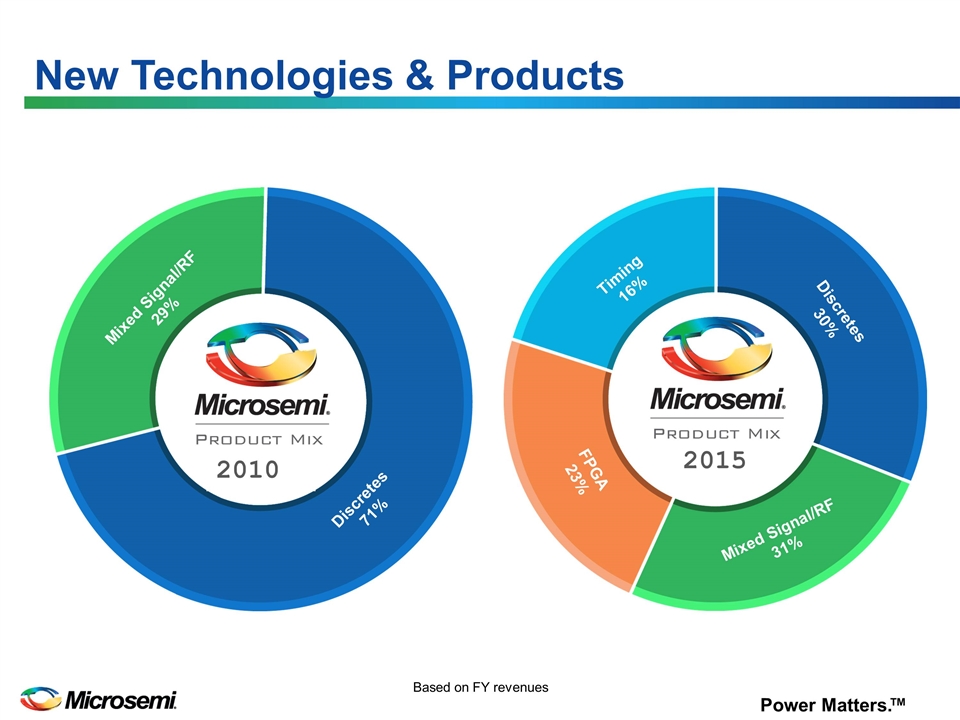

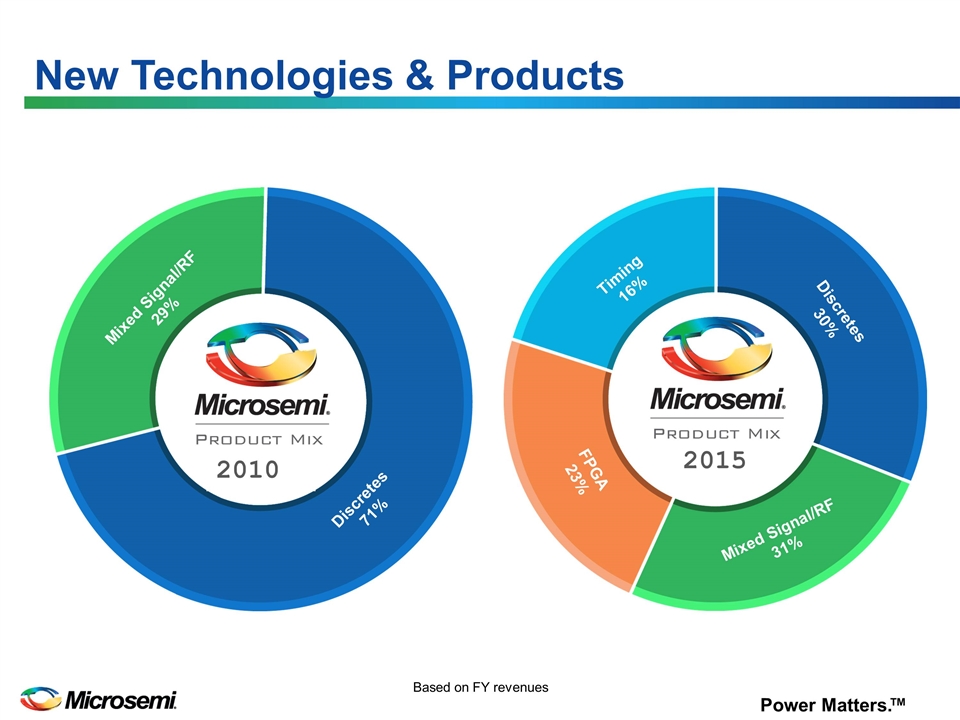

New Technologies & Products Mixed Signal/RF 29% Discretes 71% Timing 16% FPGA 23% Mixed Signal/RF 31% Discretes 30% Based on FY revenues 2015 2010

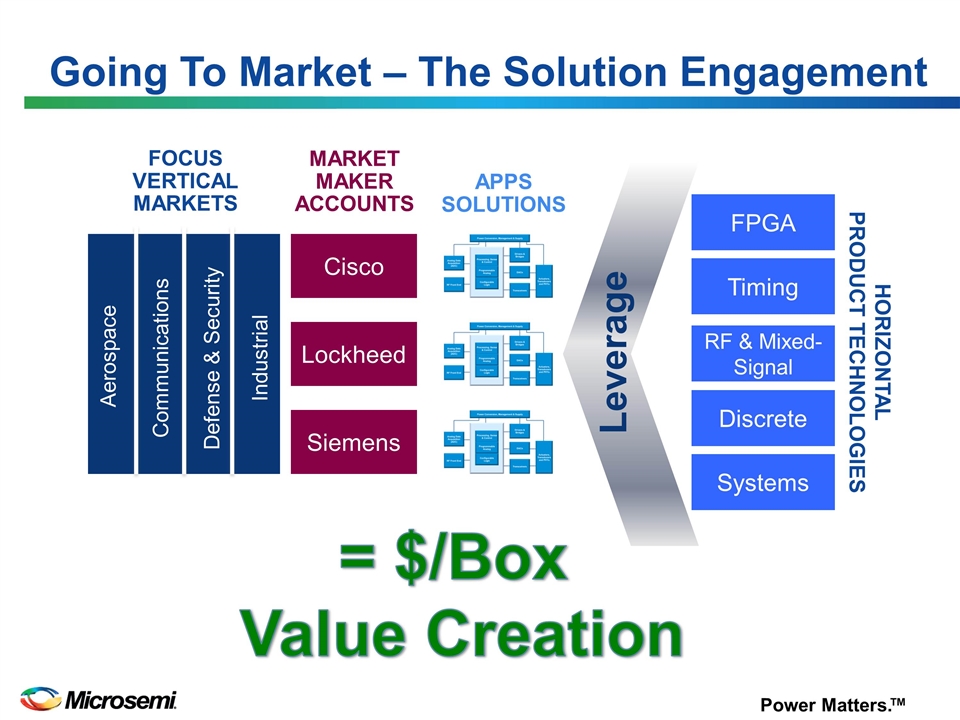

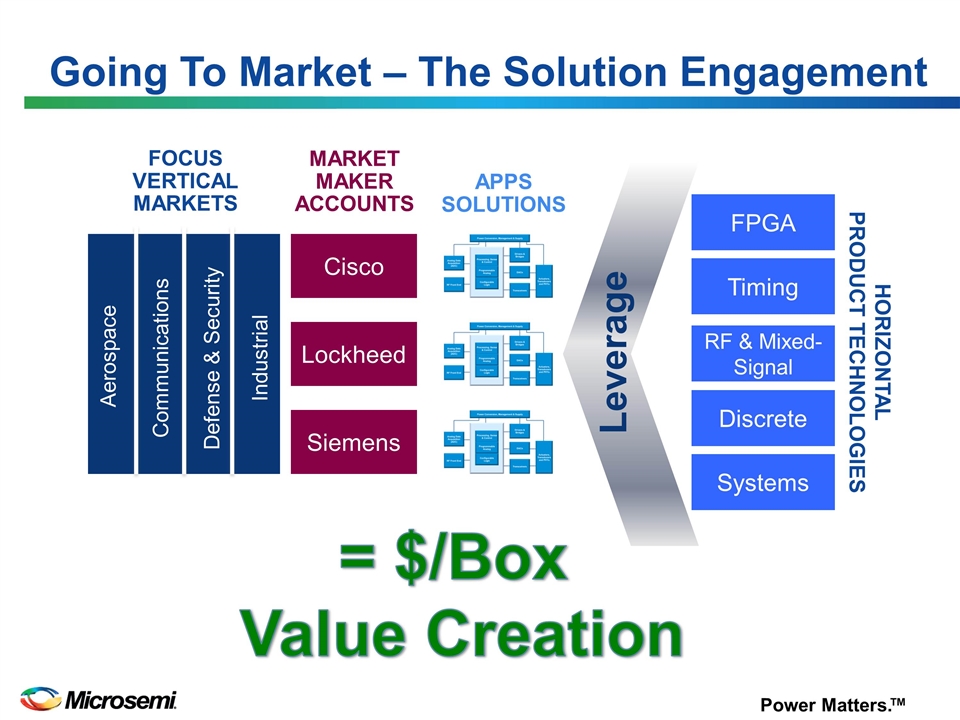

Going To Market – The Solution Engagement FPGA RF & Mixed-Signal Discrete Systems Timing Cisco Lockheed Siemens = $/Box Value Creation Aerospace Communications Industrial Defense & Security Leverage FOCUS VERTICAL MARKETS MARKET MAKER ACCOUNTS APPS SOLUTIONS HORIZONTAL PRODUCT TECHNOLOGIES

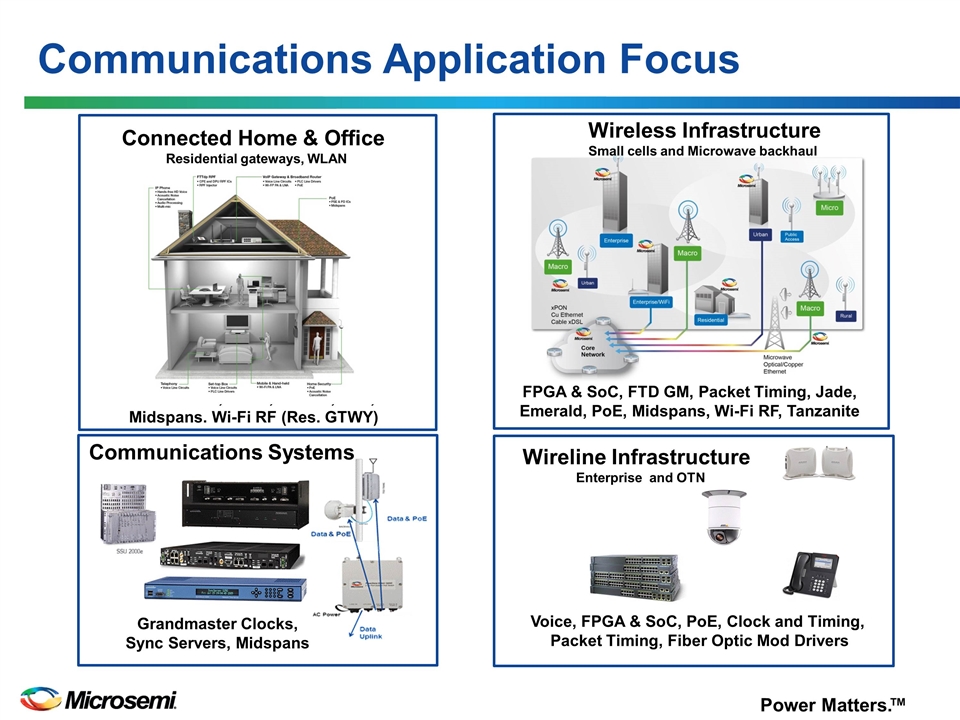

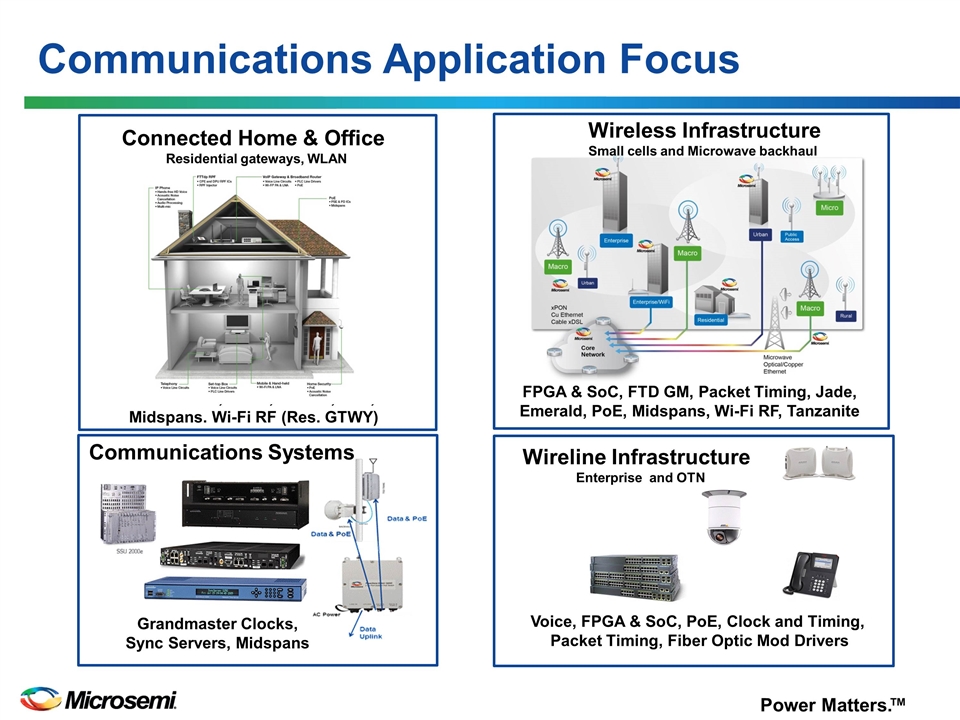

Communications Application Focus Line drivers, Voice, Clocks, PoE, Midspans. Wi-Fi RF (Res. GTWY) Voice, FPGA & SoC, PoE, Clock and Timing, Packet Timing, Fiber Optic Mod Drivers Grandmaster Clocks, Sync Servers, Midspans FPGA & SoC, FTD GM, Packet Timing, Jade, Emerald, PoE, Midspans, Wi-Fi RF, Tanzanite Wireless Infrastructure Small cells and Microwave backhaul Wireline Infrastructure Enterprise and OTN Communications Systems Connected Home & Office Residential gateways, WLAN

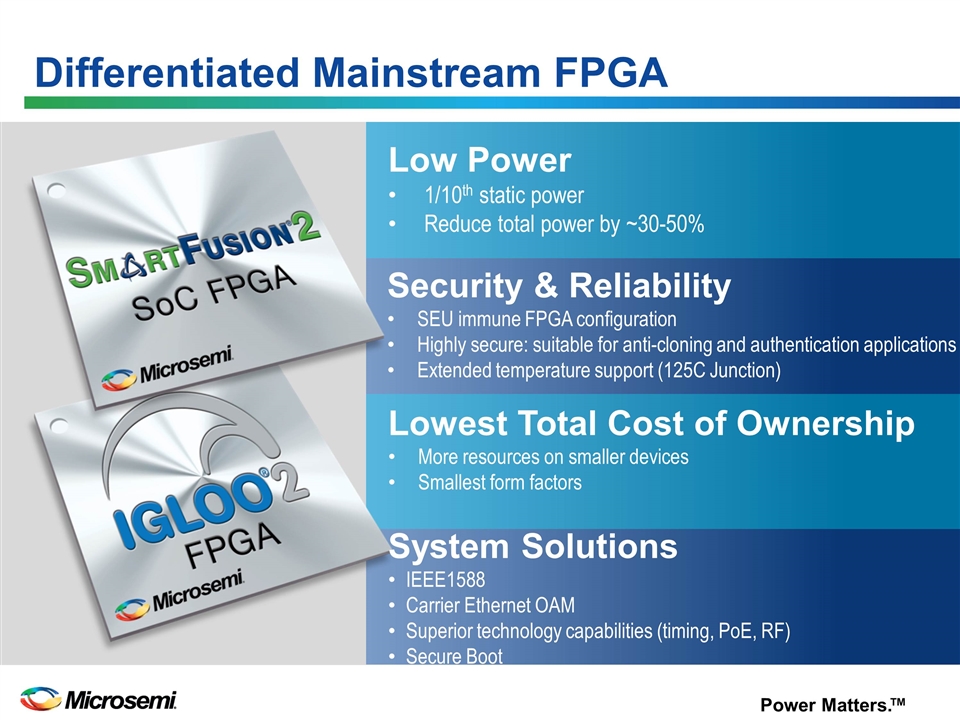

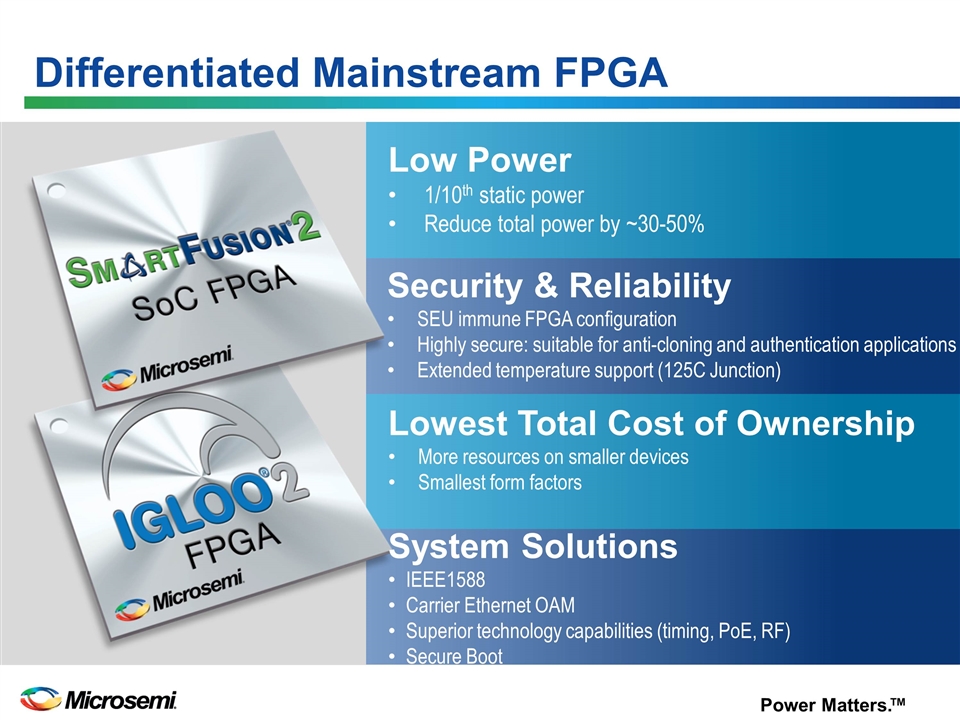

Differentiated Mainstream FPGA Low Power 1/10th static power Reduce total power by ~30-50% Security & Reliability SEU immune FPGA configuration Highly secure: suitable for anti-cloning and authentication applications Extended temperature support (125C Junction) Lowest Total Cost of Ownership More resources on smaller devices Smallest form factors System Solutions IEEE1588 Carrier Ethernet OAM Superior technology capabilities (timing, PoE, RF) Secure Boot

Financials

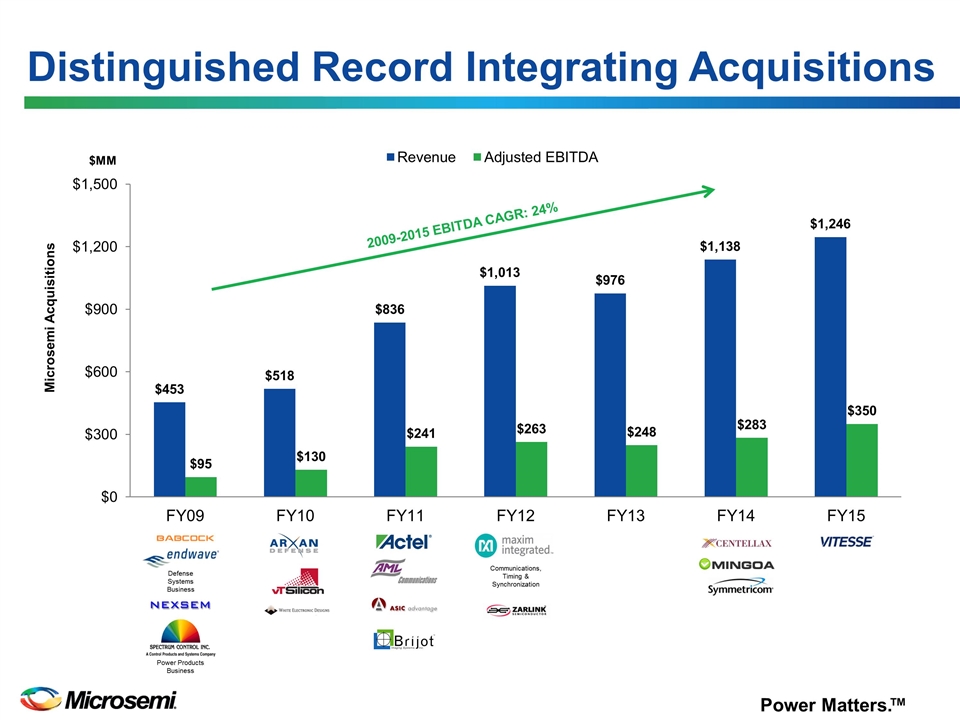

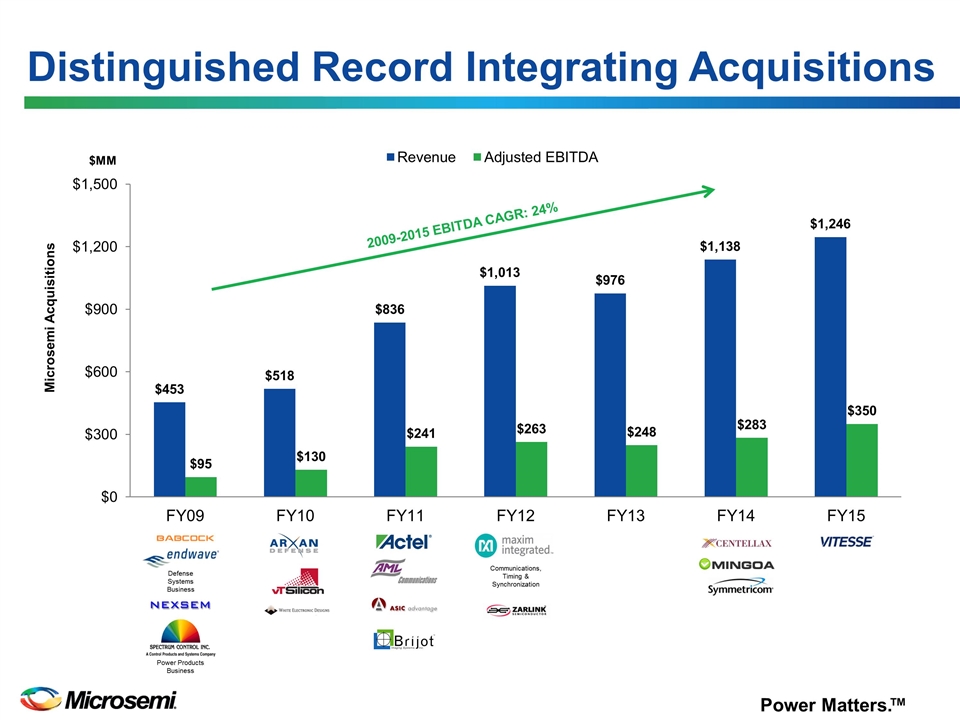

Microsemi Acquisitions Communications, Timing & Synchronization Defense Systems Business Power Products Business $MM 2009-2015 EBITDA CAGR: 24% Distinguished Record Integrating Acquisitions

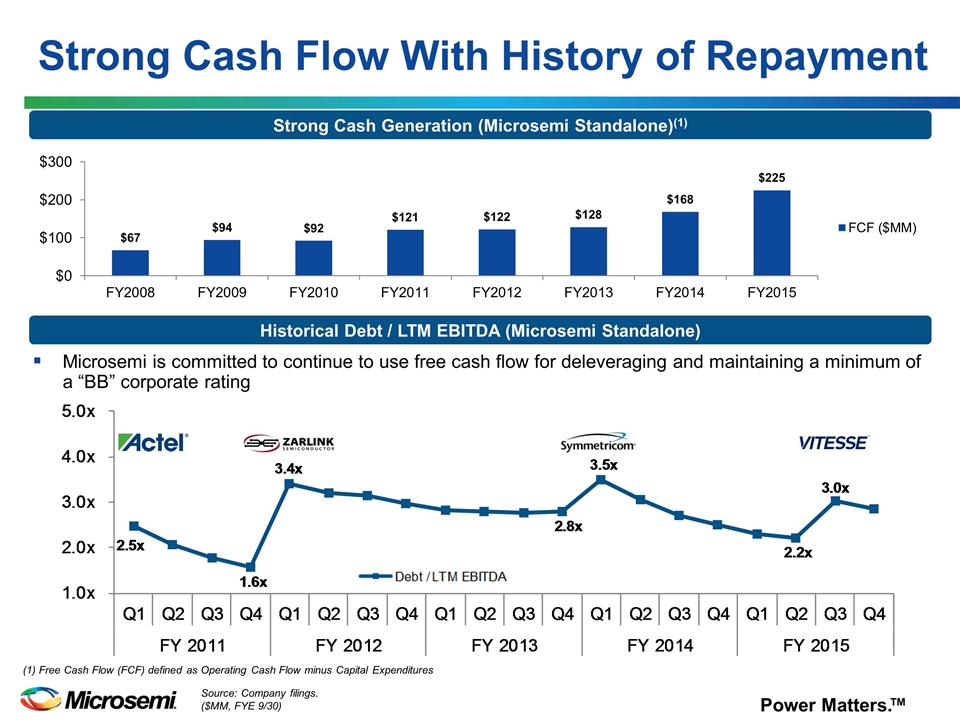

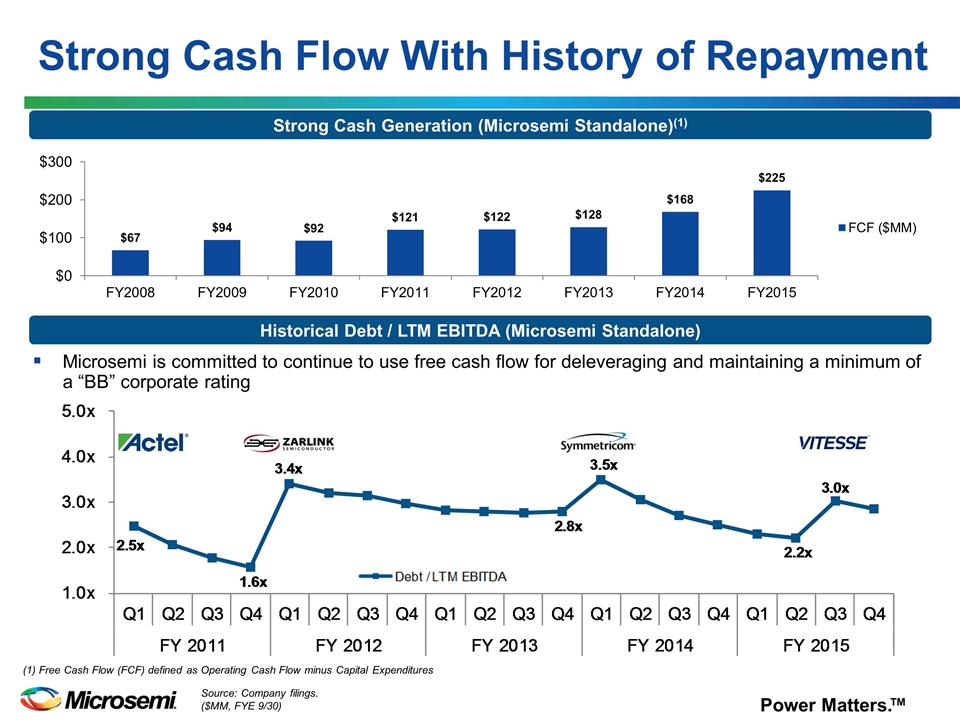

Microsemi is committed to continue to use free cash flow for deleveraging and maintaining a minimum of a “BB” corporate rating Source: Company filings. ($MM, FYE 9/30) Strong Cash Generation (Microsemi Standalone)(1) Historical Debt / LTM EBITDA (Microsemi Standalone) Strong Cash Flow With History of Repayment (1) Free Cash Flow (FCF) defined as Operating Cash Flow minus Capital Expenditures

Transaction Overview & Rationale

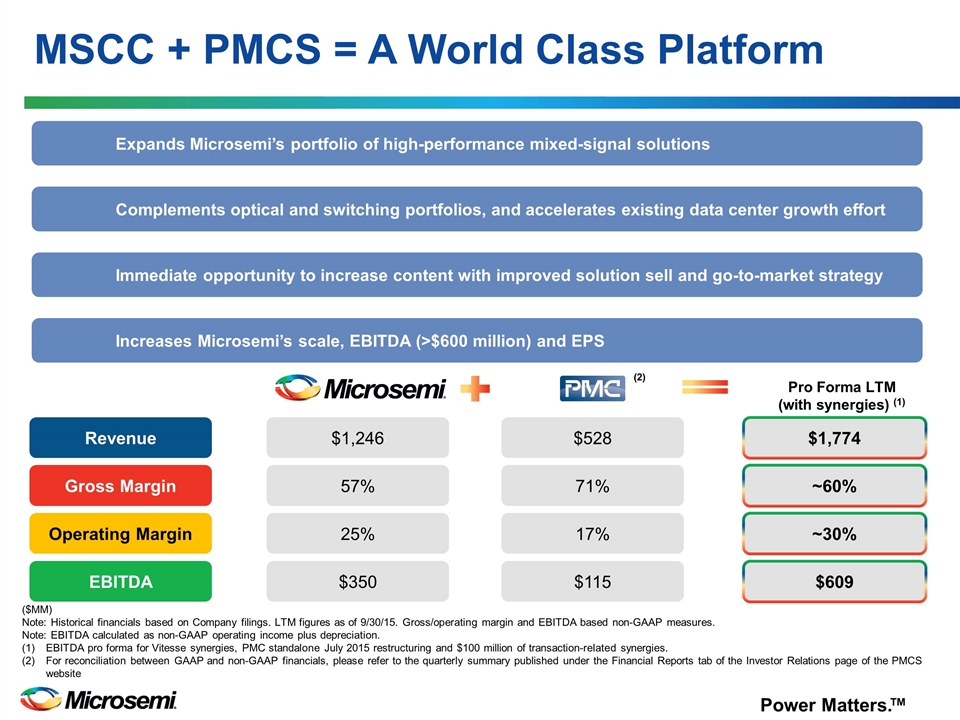

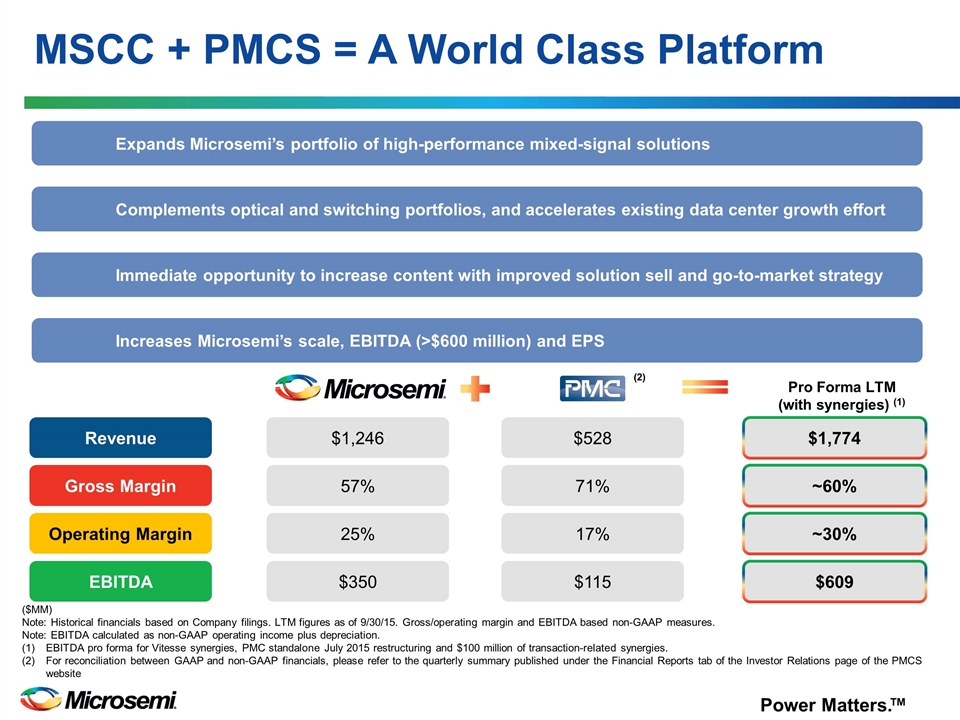

MSCC + PMCS = A World Class Platform Expands Microsemi’s portfolio of high-performance mixed-signal solutions Complements optical and switching portfolios, and accelerates existing data center growth effort Immediate opportunity to increase content with improved solution sell and go-to-market strategy Increases Microsemi’s scale, EBITDA (>$600 million) and EPS Gross Margin Operating Margin EBITDA Revenue Pro Forma LTM (with synergies) (1) $1,246 $528 $1,774 57% 71% ~60% 25% 17% ~30% $350 $115 $609 ($MM) Note: Historical financials based on Company filings. LTM figures as of 9/30/15. Gross/operating margin and EBITDA based non-GAAP measures. Note: EBITDA calculated as non-GAAP operating income plus depreciation. EBITDA pro forma for Vitesse synergies, PMC standalone July 2015 restructuring and $100 million of transaction-related synergies. For reconciliation between GAAP and non-GAAP financials, please refer to the quarterly summary published under the Financial Reports tab of the Investor Relations page of the PMCS website (2)

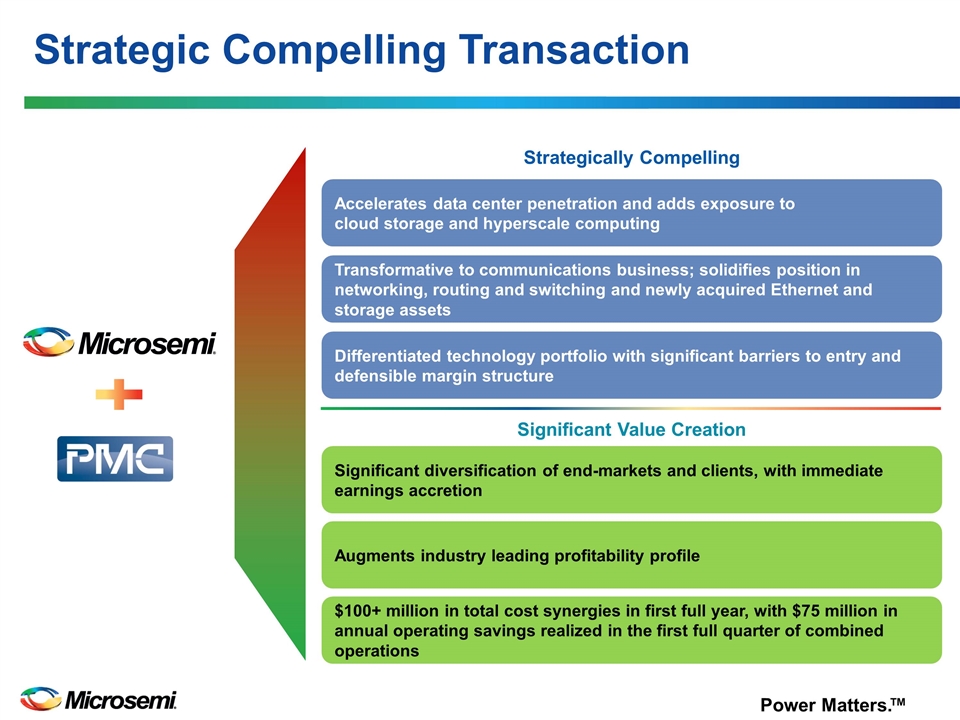

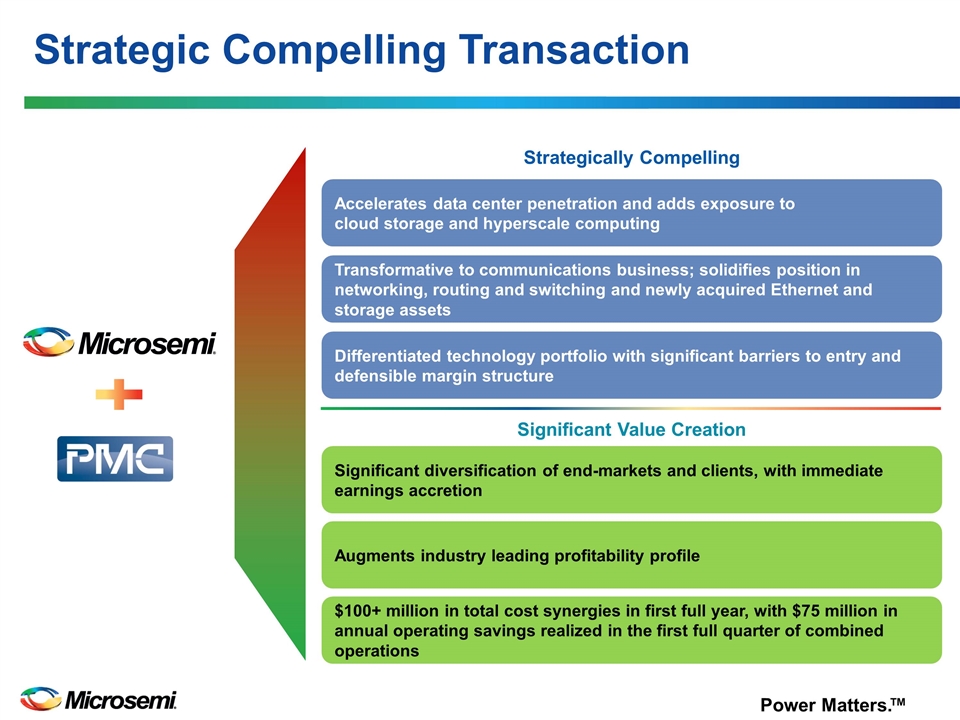

Strategic Compelling Transaction Significant diversification of end-markets and clients, with immediate earnings accretion Augments industry leading profitability profile $100+ million in total cost synergies in first full year, with $75 million in annual operating savings realized in the first full quarter of combined operations Accelerates data center penetration and adds exposure to cloud storage and hyperscale computing Transformative to communications business; solidifies position in networking, routing and switching and newly acquired Ethernet and storage assets Differentiated technology portfolio with significant barriers to entry and defensible margin structure Strategically Compelling Significant Value Creation

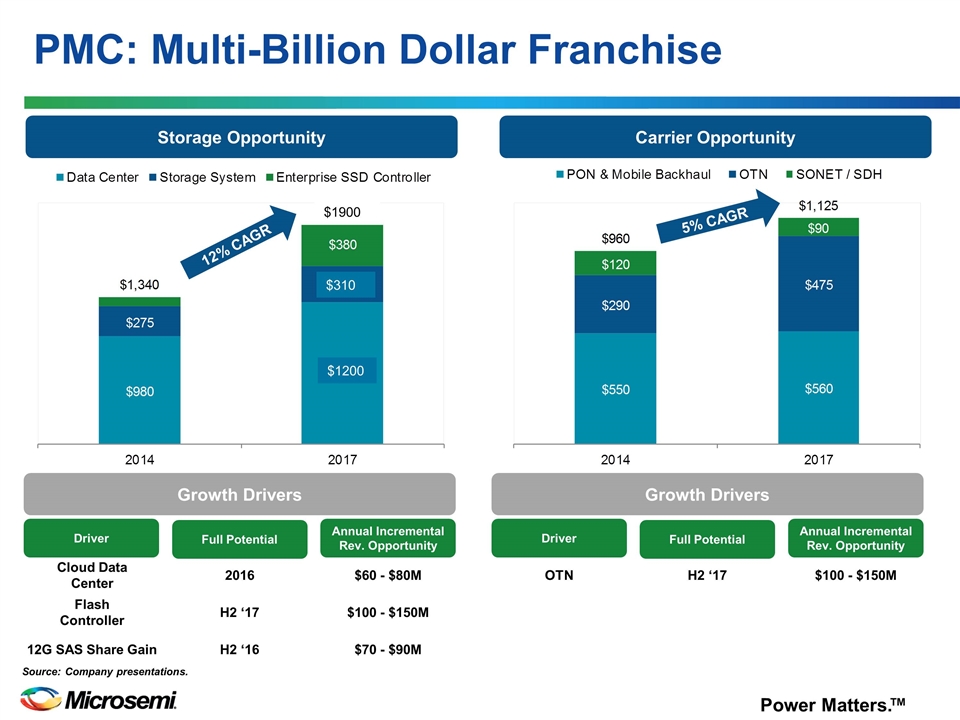

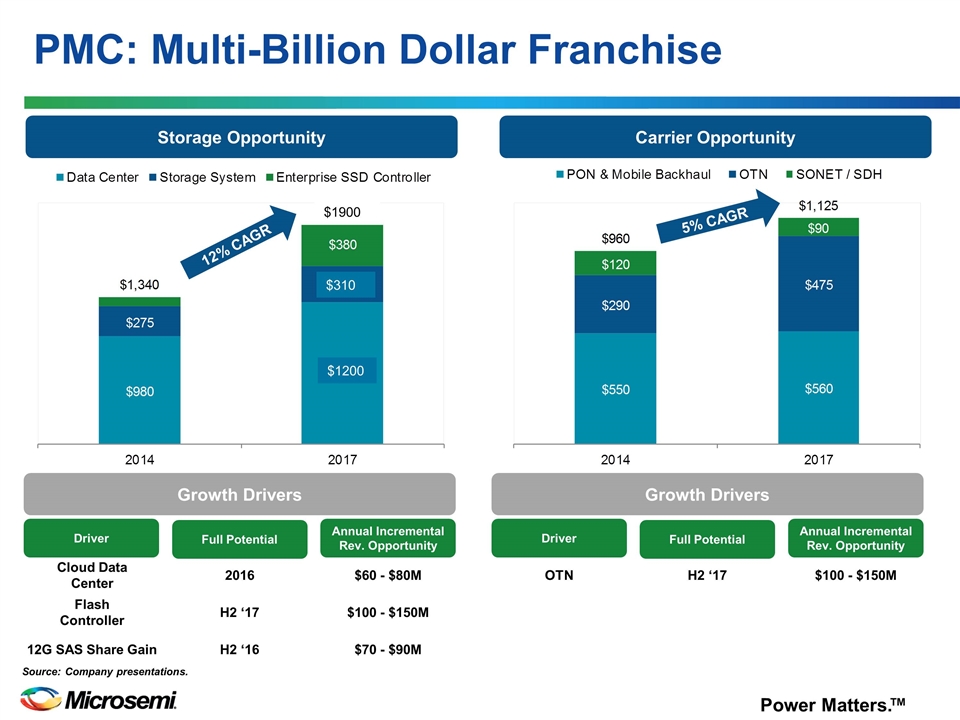

PMC: Multi-Billion Dollar Franchise Storage Opportunity Carrier Opportunity Growth Drivers Growth Drivers Driver Full Potential Annual Incremental Rev. Opportunity Cloud Data Center Flash Controller 12G SAS Share Gain 2016 H2 ‘17 H2 ‘16 $60 - $80M $100 - $150M $70 - $90M Driver Full Potential Annual Incremental Rev. Opportunity OTN H2 ‘17 $100 - $150M 12% CAGR 5% CAGR Source: Company presentations. $1900 $310 $1200

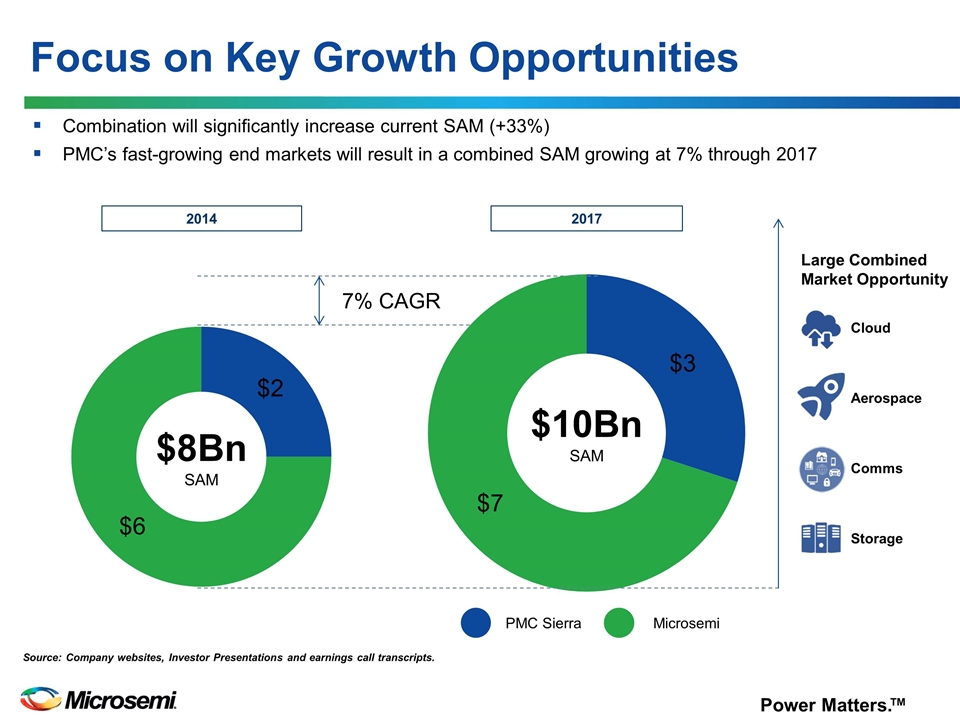

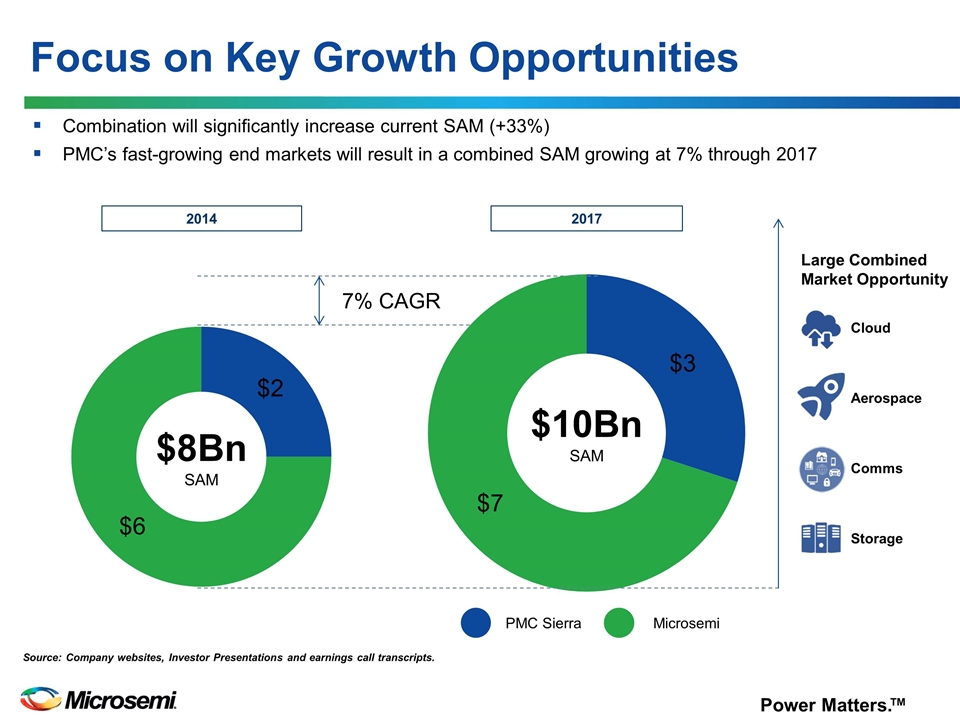

Focus on Key Growth Opportunities Source: Company websites, Investor Presentations and earnings call transcripts. 2014 2017 Combination will significantly increase current SAM (+33%) PMC’s fast-growing end markets will result in a combined SAM growing at 7% through 2017 $8Bn SAM $10Bn SAM 7% CAGR Large Combined Market Opportunity PMC Sierra Microsemi Cloud Storage Comms Aerospace

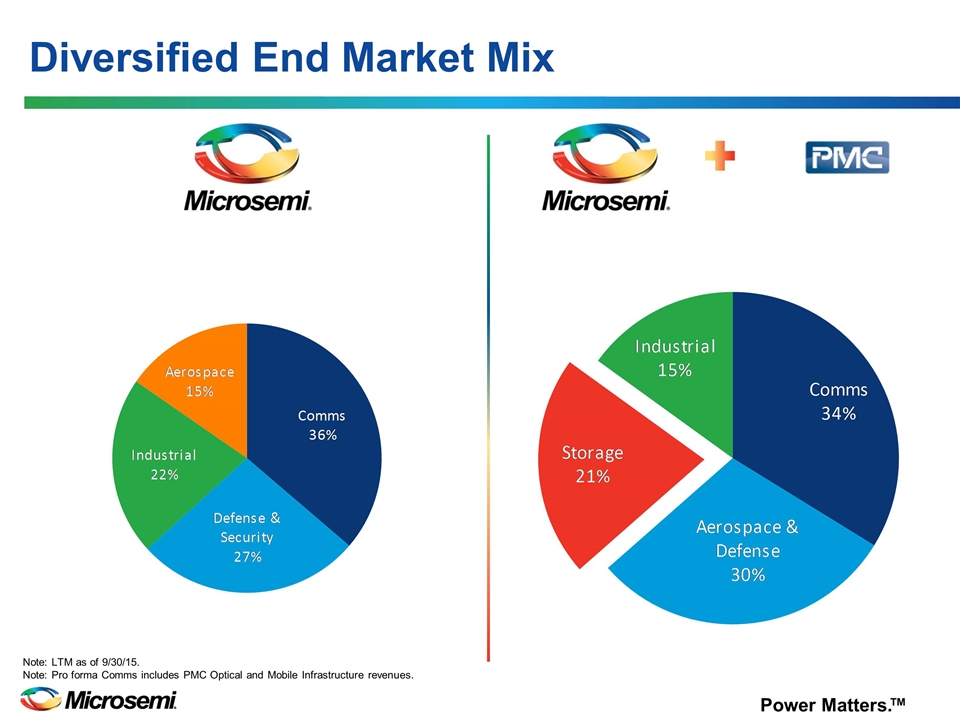

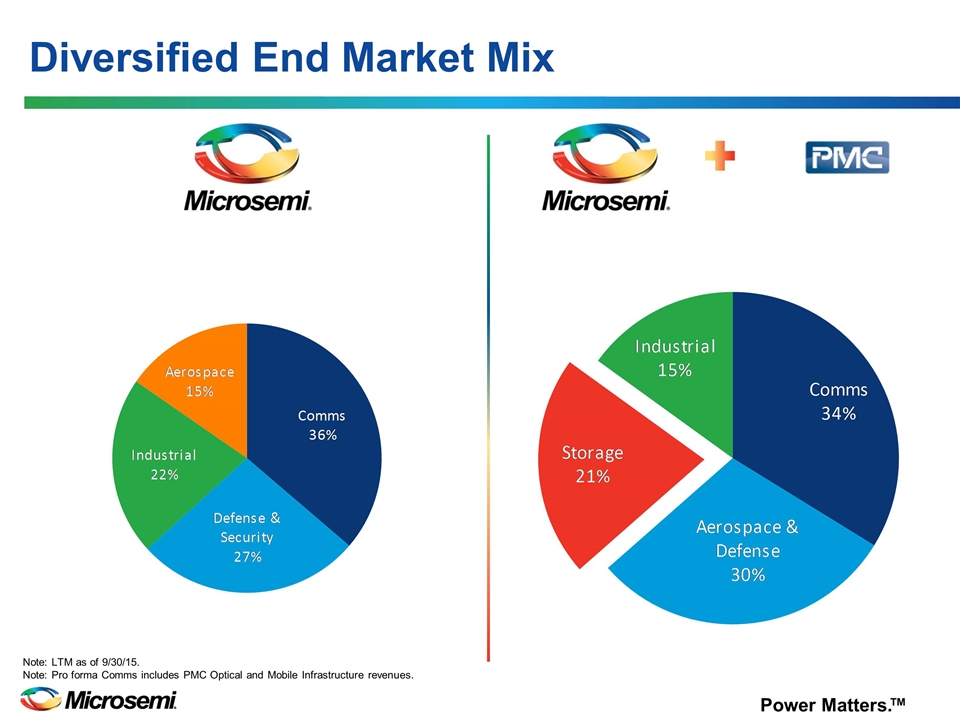

Aerospace Mobile Diversified End Market Mix Defense & Security Aerospace Mobile Industrial Note: LTM as of 9/30/15. Note: Pro forma Comms includes PMC Optical and Mobile Infrastructure revenues.

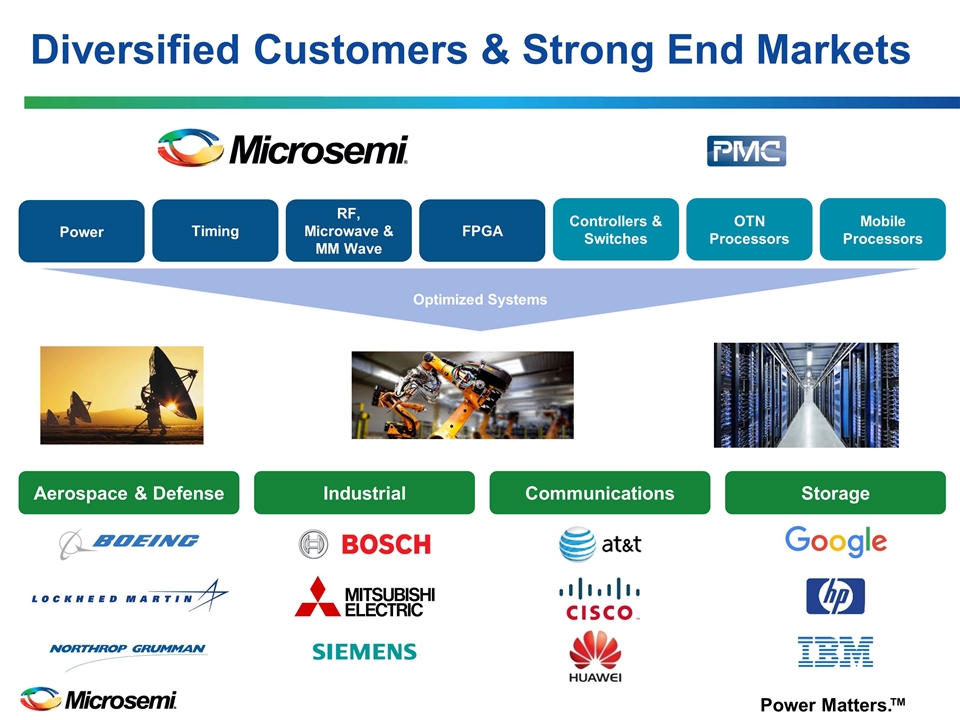

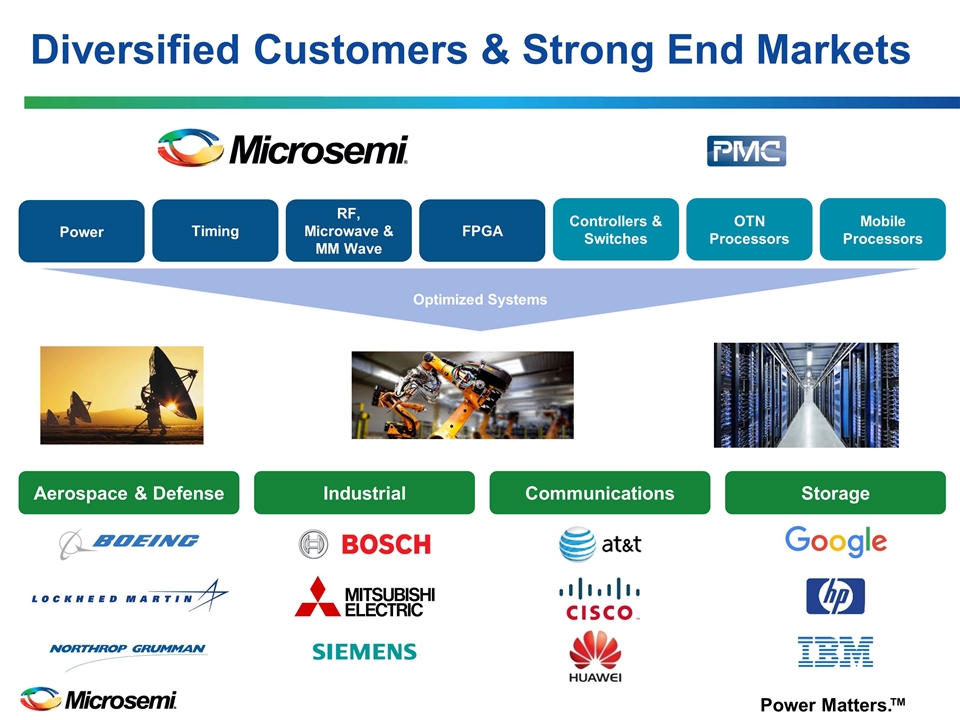

Diversified Customers & Strong End Markets Optimized Systems Power Timing RF, Microwave & MM Wave OTN Processors Mobile Processors Controllers & Switches Aerospace & Defense Storage Industrial FPGA Communications

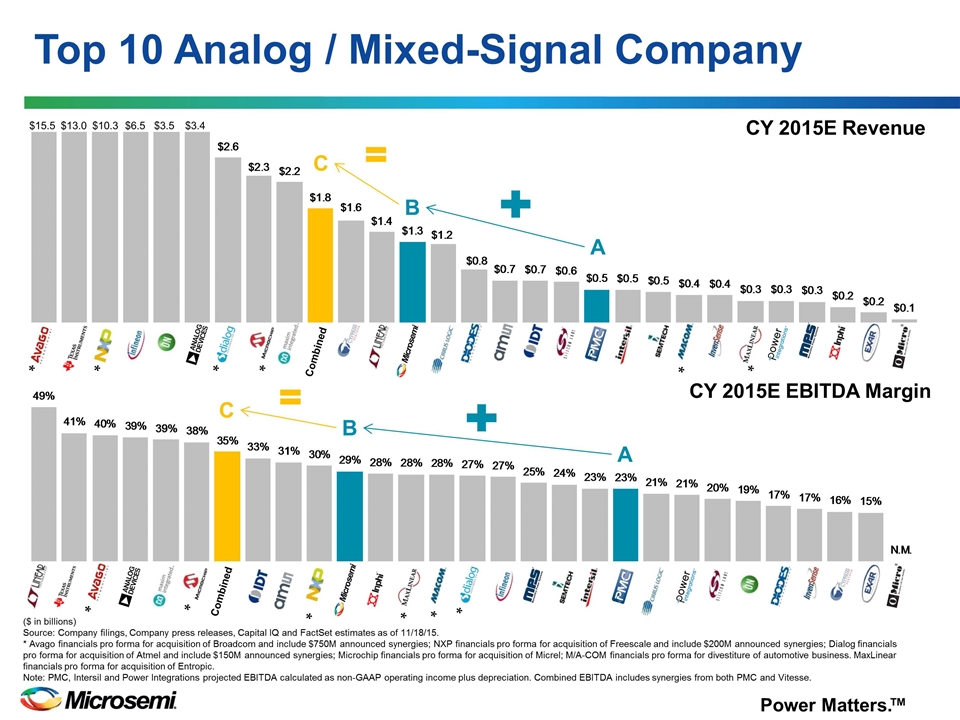

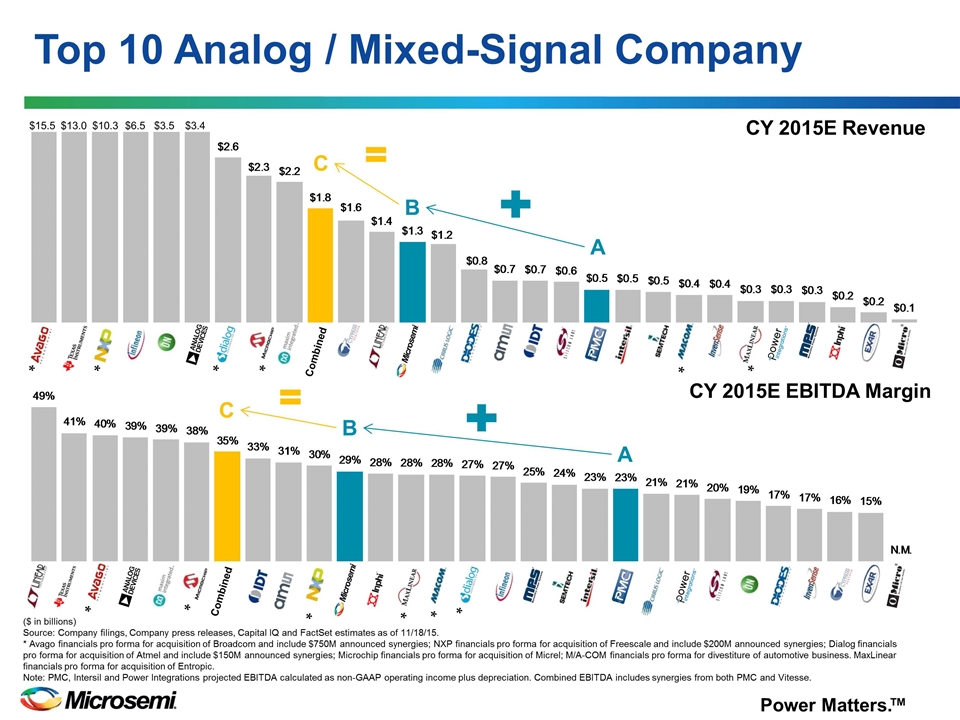

* * * * * * Top 10 Analog / Mixed-Signal Company ($ in billions) Source: Company filings, Company press releases, Capital IQ and FactSet estimates as of 11/18/15. * Avago financials pro forma for acquisition of Broadcom and include $750M announced synergies; NXP financials pro forma for acquisition of Freescale and include $200M announced synergies; Dialog financials pro forma for acquisition of Atmel and include $150M announced synergies; Microchip financials pro forma for acquisition of Micrel; M/A-COM financials pro forma for divestiture of automotive business. MaxLinear financials pro forma for acquisition of Entropic. Note: PMC, Intersil and Power Integrations projected EBITDA calculated as non-GAAP operating income plus depreciation. Combined EBITDA includes synergies from both PMC and Vitesse. $15.5 $13.0 $10.3 Combined $6.5 $3.5 $3.4 CY 2015E Revenue * * Combined * * * * CY 2015E EBITDA Margin A B C A B C

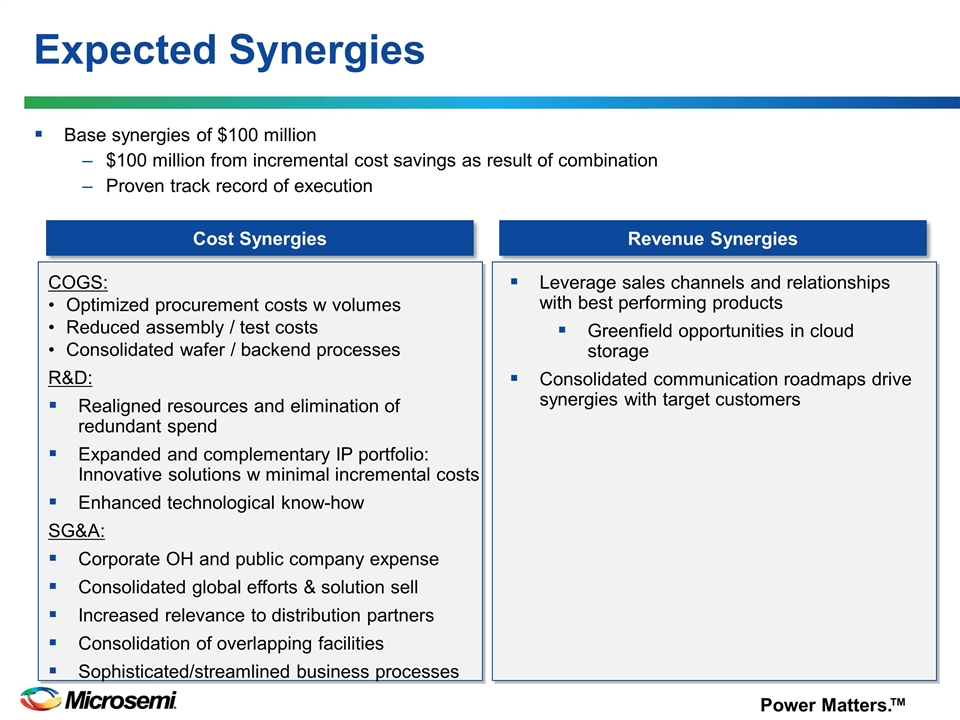

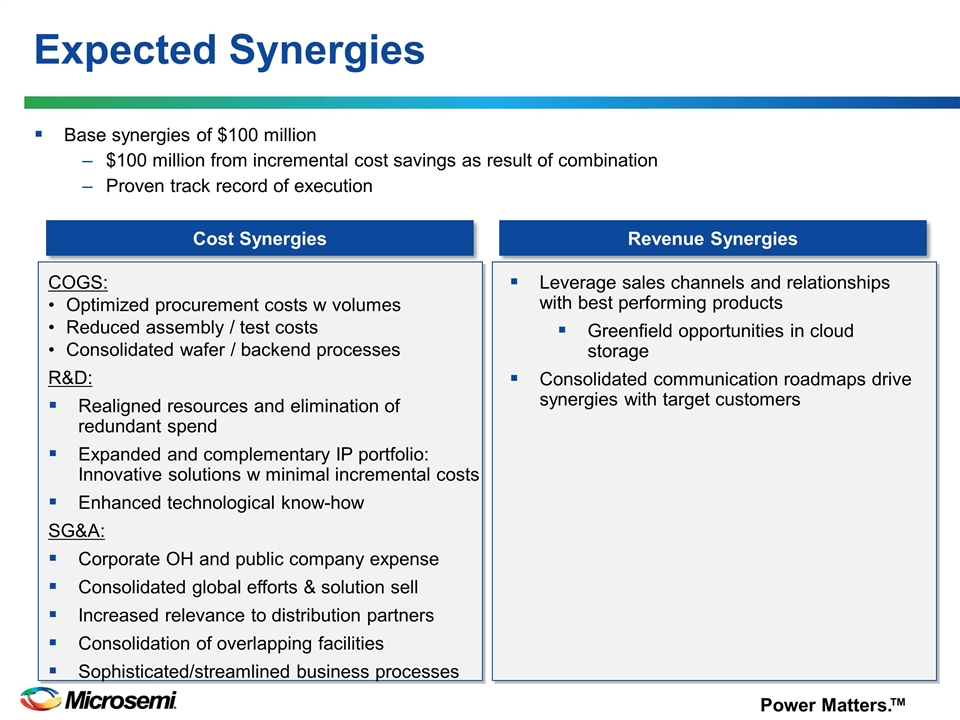

Expected Synergies Base synergies of $100 million $100 million from incremental cost savings as result of combination Proven track record of execution Cost Synergies Revenue Synergies COGS: Optimized procurement costs w volumes Reduced assembly / test costs Consolidated wafer / backend processes R&D: Realigned resources and elimination of redundant spend Expanded and complementary IP portfolio: Innovative solutions w minimal incremental costs Enhanced technological know-how SG&A: Corporate OH and public company expense Consolidated global efforts & solution sell Increased relevance to distribution partners Consolidation of overlapping facilities Sophisticated/streamlined business processes Leverage sales channels and relationships with best performing products Greenfield opportunities in cloud storage Consolidated communication roadmaps drive synergies with target customers

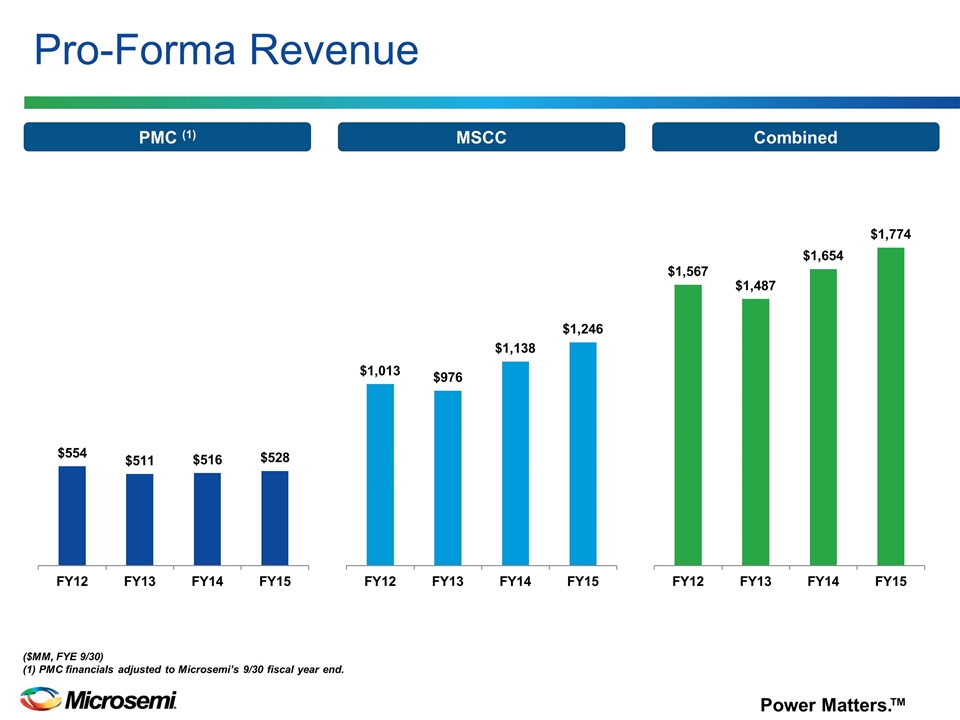

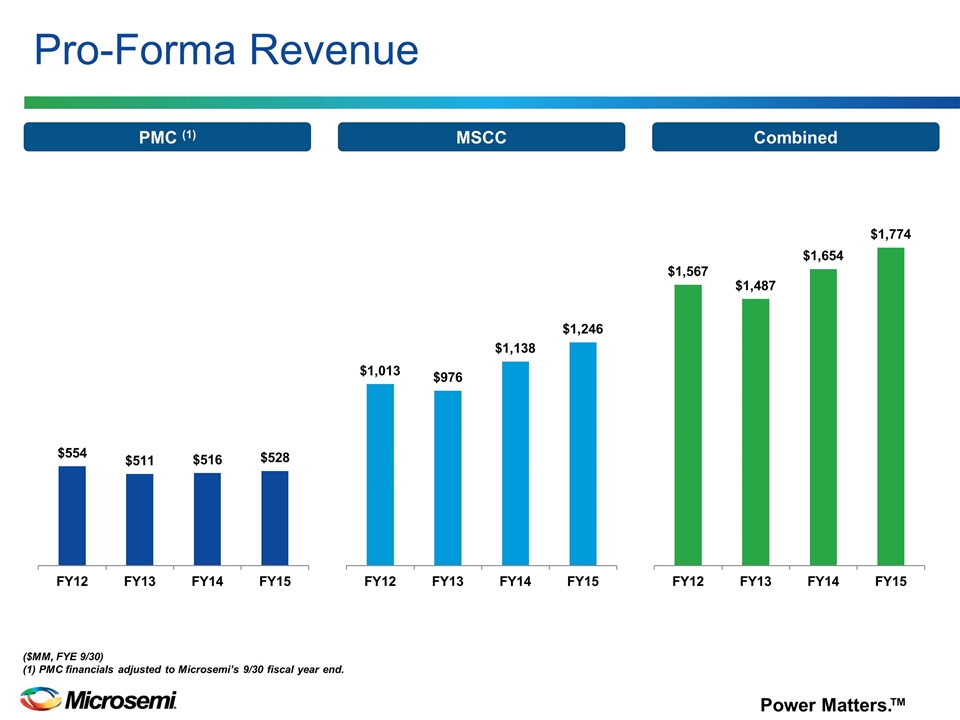

Pro-Forma Revenue ($MM, FYE 9/30) (1) PMC financials adjusted to Microsemi’s 9/30 fiscal year end. PMC (1) MSCC Combined

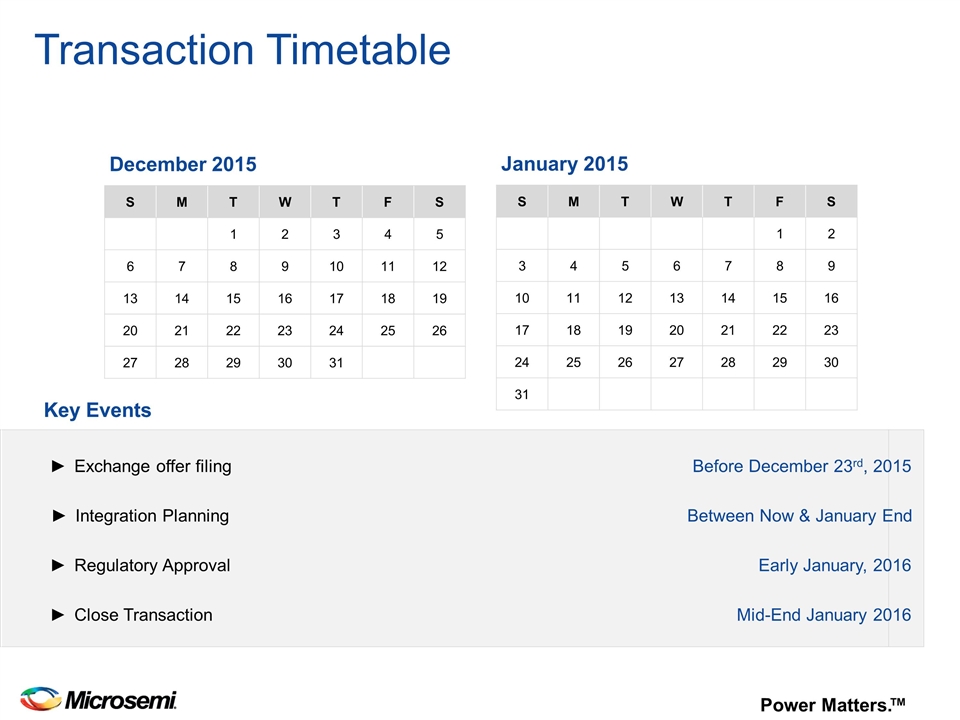

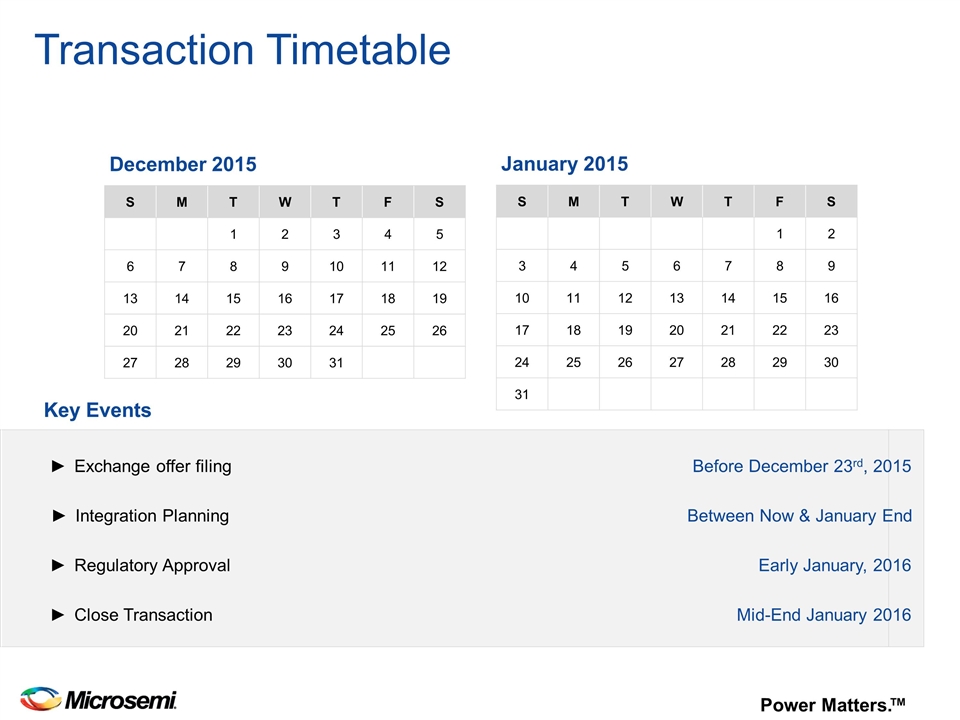

Transaction Timetable Key Events December 2015 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Key Events Exchange offer filing Before December 23rd, 2015 Close Transaction Mid-End January 2016 Regulatory Approval Early January, 2016 Integration Planning Between Now & January End January 2015 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Thank you

This document relates to a pending business combination transaction between Microsemi and PMC. The exchange offer referenced in this document has not yet commenced. This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Microsemi will file a registration statement on Form S-4 related to the transaction with the SEC and may file amendments thereto. Microsemi and a wholly-owned subsidiary of Microsemi will file a tender offer statement on Schedule TO (including a prospectus/offer to exchange, a related letter of transmittal and other exchange offer documents) related to the transaction with the SEC and may file amendments thereto. PMC will file a recommendation statement on Schedule 14D-9 with the SEC and may file amendments thereto. PMC and Microsemi may also file other documents with the SEC regarding the transaction. This document is not a substitute for any registration statement, Schedule TO, Schedule 14D-9 or any other document which PMC or Microsemi may file with the SEC in connection with the transaction. Investors and security holders are urged to read the registration statement, the Schedule TO (including the prospectus/offer to exchange, related letter of transmittal and other exchange offer documents), the recommendation statement on Schedule 14D-9 and the other relevant materials with respect to the transaction carefully and in their entirety when they become available before making any investment decision with respect to the transaction, because they will contain important information about the transaction. Additional Information and Where to Find It © 2012 Microsemi Corporation. CONFIDENTIAL