Exhibit 10.10

Exhibit 10.10

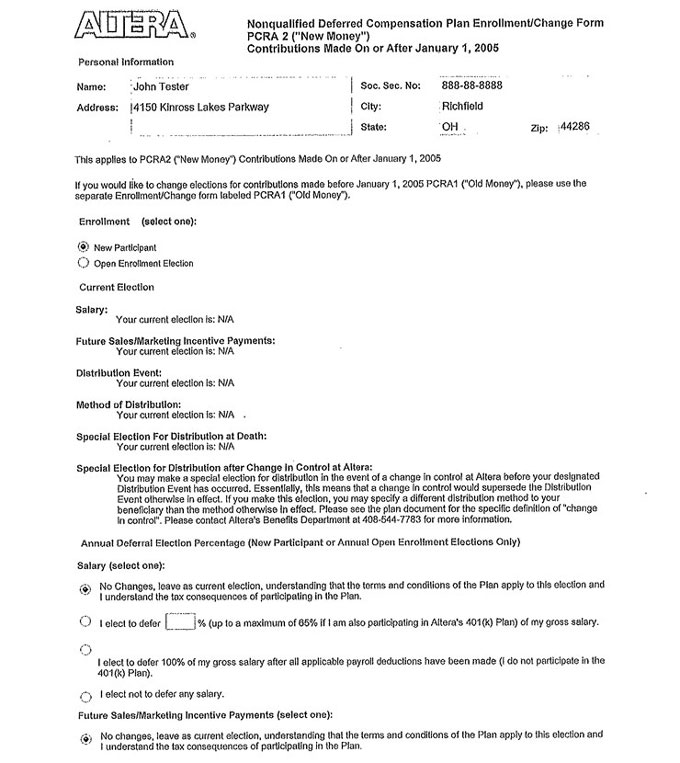

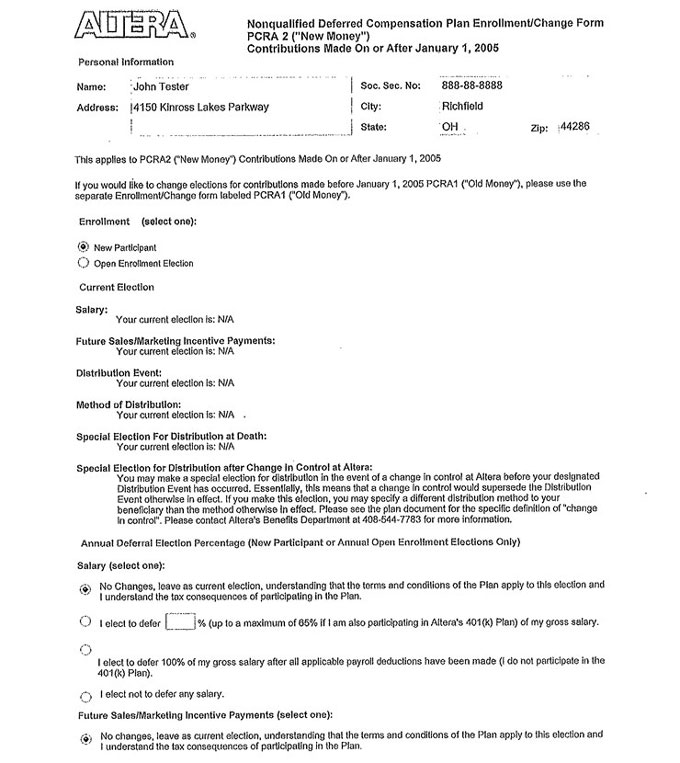

Personal information

Nonqualified Deferred Compensation Plan Enrollment/Change Form

PCRA 2 (“New Money”)

Contributions Made On or After January 1, 2005

Name:

John Tester

Soc. Sec. No: ###-##-####

Address:

4150 Kinross Lakes Parkway

City: Richfield

State: OH zip: 44286

This applies to PCRA2 (“New Money”) Contributions Made On or After January 1, 2005

If you would like to change elections for contributions made before January 1, 2005 PCRA1 (“Old Money”), please use the separate Enrollment/Change form labeled PCRA1 (“Old Money”).

Enrollment (select one):

New Participant

Open Enrollment Election

Current Election

Salary:

Your current election is: N/A

Future Sates/Marketing Incentive Payments: Your current election is: N/A

Distribution Event:

Your current election is: N/A

Method of Distribution:

Your current election is: N/A .

Special Election For Distribution at Death: Your current election is: N/A

Special Election for Distribution after Change in Control at Altera:

You may make a special election for distribution in the event of a change in control at Altera before your designated Distribution Event has occurred. Essentially, this means that a change in control would supersede the Distribution Event otherwise in effect. if you make this election, you may specify a different distribution method to your beneficiary than the method otherwise in effect. Please see the plan document for the specific definition of “change in control”. Please contact Altera’s Benefits Department at 408-544-7783 for more information.

Annual Deferral Election Percentage (New Participant or Annual Open Enrollment Elections Only) Salary (select one):

No Changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan.

I elect to defer % (up to a maximum of 85% if I am also participating in Altera’s 401(k) Plan) of my gross salary.

I elect to defer 100% of my gross salary after all applicable payroll deductions have been made (I do not participate in the 401 (k) Plan).

I elect not to defer any salary.

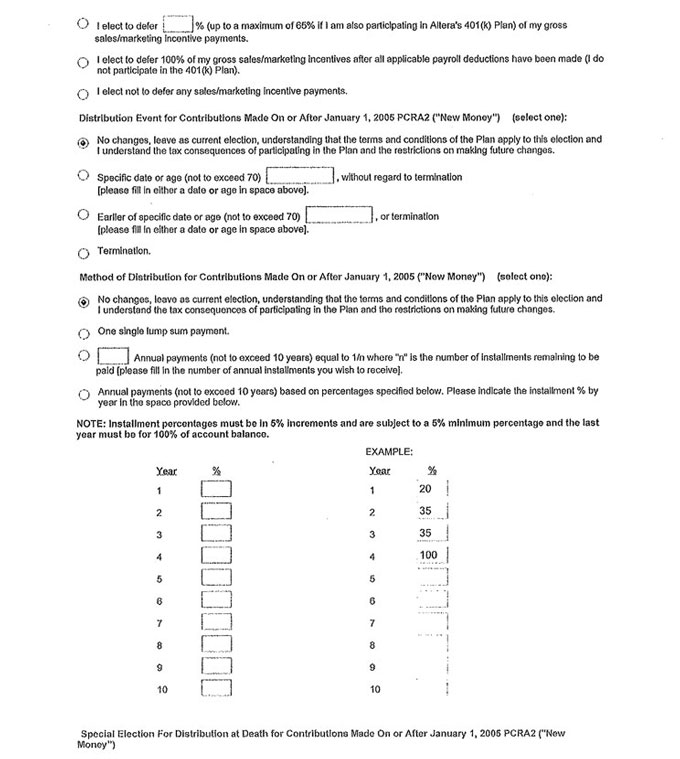

Future Sates/Marketing Incentive Payments (select one):

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan.

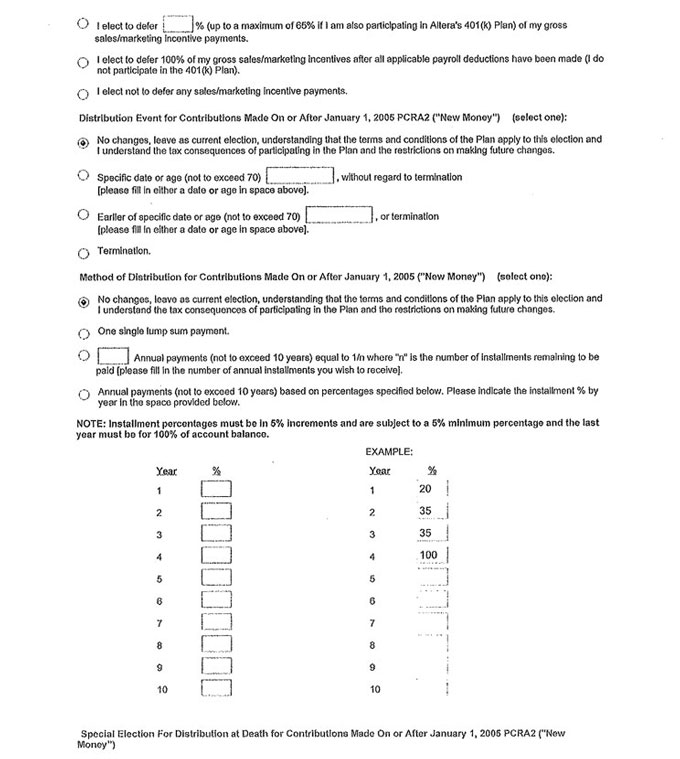

I elect to defer % (up to a maximum of 65% if I am also participating in Altera’s 401(k) Plan) of my gross

sales/marketing incentive payments.

I elect to defer 100% of my gross sales/marketing incentives after all applicable payroll deductions have been made (I do not participate in the 401 (k) PIan).

I elect not to defer any sales/marketing incentive payments.

Distribution Event for Contributions Made On or After January 1, 2005 PCRA2 (“New Money”) (select one):

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan and the restrictions on making future changes.

Specific date or age (not to exceed 70) , without regard to termination

[please fill in either a date or age in space above].

Earlier of specific date or age (not to exceed 70) , or termination

[please fill in either a date or age in space above].

Termination.

Method of Distribution for Contributions Made On or After January 1, 2005 (“New Money”) (select one):

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan and the restrictions on making future changes.

One single lump sum payment.

Annual payments (not to exceed 10 years) equal to 1/n where “n” is the number of installments remaining to be

paid [please fill in the number of annual installments you wish to receive].

Annual payments (not to exceed 10 years) based on percentages specified below. Please indicate the installment % by year in the space provided below.

NOTE: Installment percentages must be in 5% increments and are subject to a 5% minimum percentage and the last year must be for 100% of account balance.

EXAMPLE: year 1 2 3 4 5 6 7 8 9 10 %

year 1 2 3 4 5 6 7 8 9 10 % 20 25 35 100

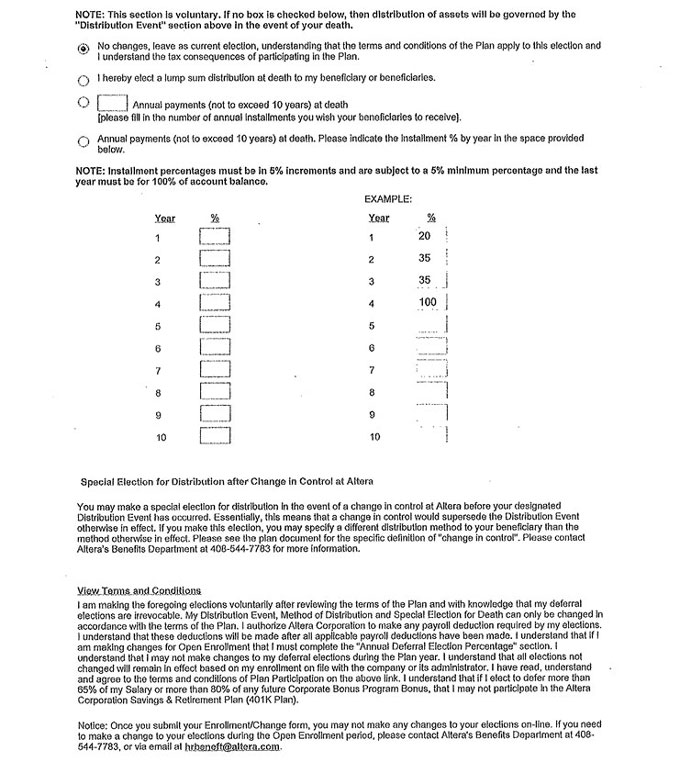

Special Election for Distribution at Death for Contributions Made On or After January 1, 2006 PCRA2 (“New Money”)

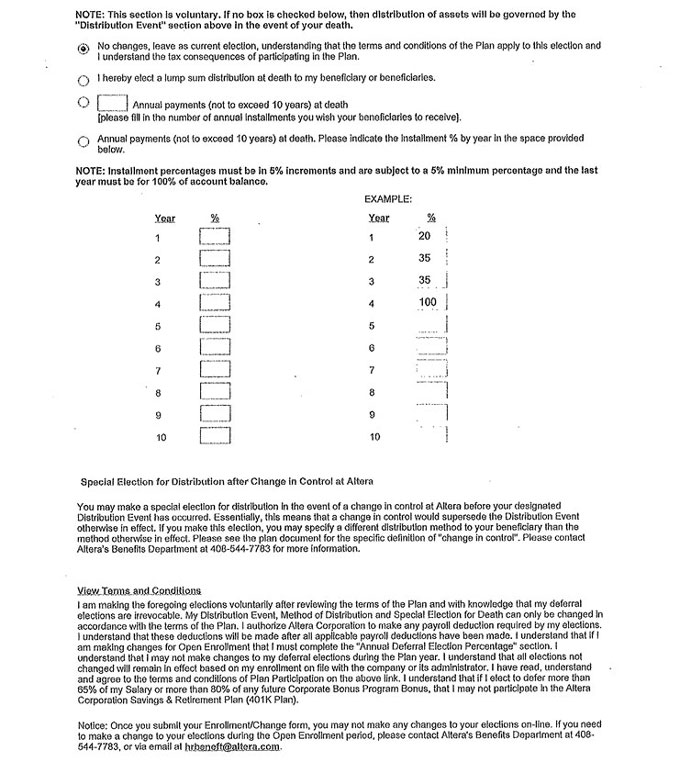

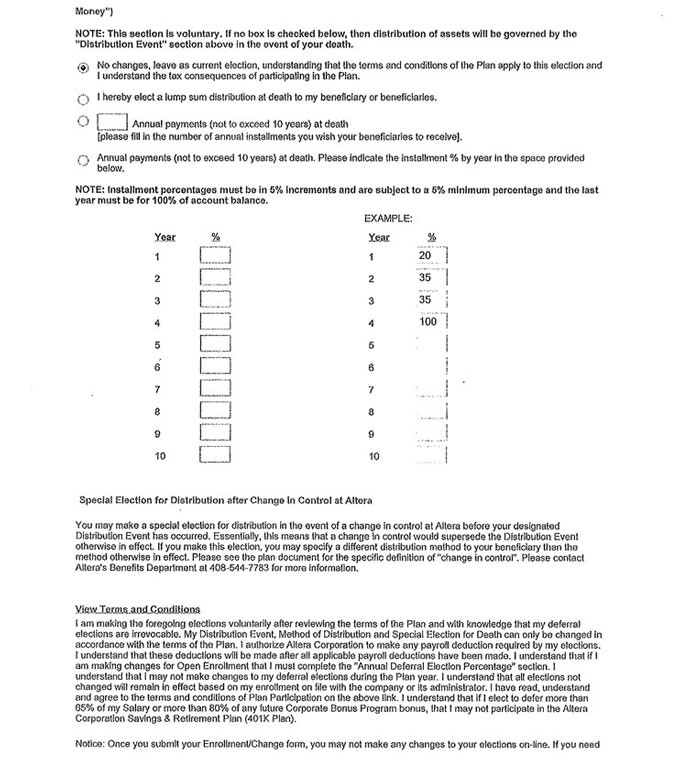

NOTE: This section is voluntary. If no box is checked below, then distribution of assets will be governed by the “Distribution Event” section above in the event of your death.

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan.

I hereby elect a lump sum distribution at death to my beneficiary or beneficiaries.

Annual payments (not to exceed 10 years) at death

[please fill in the number of annual installments you wish your beneficiaries to receive].

Annual payments (not to exceed 10 years) at death. Please indicate the Installment % by year in the space provided below.

NOTE: Installment percentages must be in 5% increments and are subject to a 5% minimum percentage and the last year must be for 100% of account balance.

EXAMPLE:

Year 1 2 3 4 5 6 7 8 9 10

%

Year 1 2 3 4 5 6 7 8 9 10

% 20 35 35 100

Special Election for Distribution after Change in Control at Altera

You may make a special election for distribution in the event of a change in control at Altera before your designated Distribution Event has occurred. Essentially, this means that a change in control would supersede the Distribution Event otherwise in effect. If you make this election, you may specify a different distribution method to your beneficiary than the method otherwise in effect. Please see the plan document for the specific definition of “change in control”. Please contact Altera’s Benefits Department at 408-544-7783 for more information.

View Terms and Conditions

I am making the foregoing elections voluntarily after reviewing the terms of the Plan and with knowledge that my deferral elections are irrevocable. My Distribution Event, Method of Distribution and Special Election for Death can only be changed In accordance with the terms of the Plan. I authorize Altera Corporation to make any payroll deduction required by my elections. I understand that these deductions will be made after all applicable payroll deductions have been made. I understand that if I am making changes for Open Enrollment that I must complete the “Annual Deferral Election Percentage” section. I understand that I may not make changes to my deferral elections during the Plan year. I understand that all elections not changed will remain in effect based on my enrollment on file with the company or its administrator. I have read, understand and agree to the terms and conditions of Plan Participation on the above link. I understand that if I elect to defer more than 65% of my Salary or more than 80% of any future Corporate Bonus Program Bonus, that I may not participate in the Altera Corporation Savings & Retirement Plan (401K Plan).

Notice: Once you submit your Enrollment/Change form, you may not make any changes to your elections on-line. If you need to make a change to your elections during the Open Enrollment period, please contact Altera’s Benefits Department at 408-544-7783, or via email at hrbenefit@altera.com.

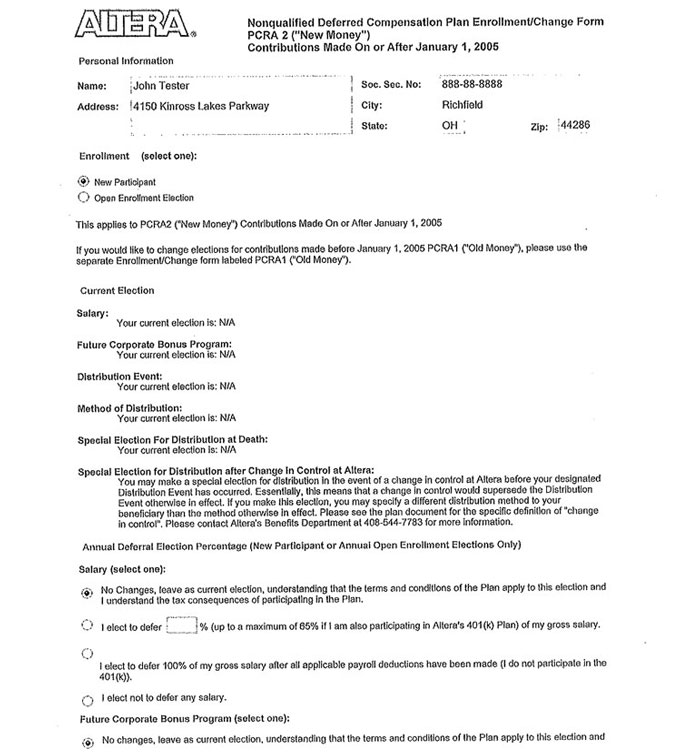

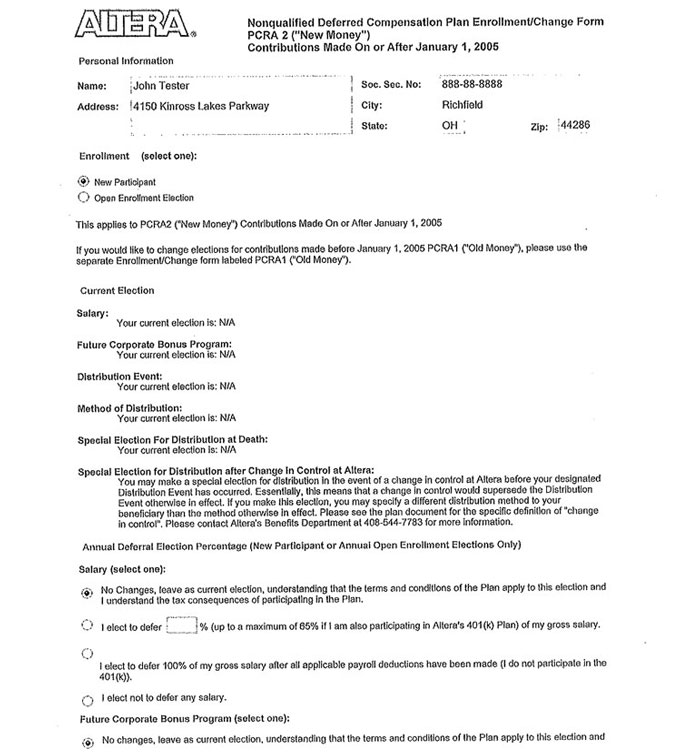

Personal Information

Nonqualified Deferred Compensation Plan Enrollment/Change Form

PCRA 2 (“New Money”)

Contributions Made On or After January 1, 2005

Name: John Tester

Soc.Sec. No: ###-##-####

Address; 4150 Kinross Lakes Parkway

city: Richfield

State: OH ziP: 44286

Enrollment (select one):

New Participant

Open Enrollment Election

This applies to PCRA2 (“New Money”) Contributions Made On or After January 1, 2005

If you would like to change elections for contributions made before January 1, 2005 PCRA1 (“Old Money”), please use the separate Enrollment/Change form labeled PCRA1 (“Old Money”).

Current Election

Salary:

Your current election is: N/A

Future Corporate Bonus Program: Your current election is: N/A

Distribution Event:

Your current election is: N/A

Method of Distribution:

Your current election is: N/A

Special Election For Distribution at Death:

Your current election is: N/A

Special Election for Distribution after Change In Control at Altera:

You may make a special election for distribution in the event of a change in control at Alters before your designated Distribution Event has occurred, Essentially, this means that a change in control would supersede the Distribution Event otherwise in effect. If you make this election, you may specify a different distribution method to your beneficiary than the method otherwise in effect. Please see the plan document for the specific definition of “change in control”. Please contact Altera’s Benefits Department at 408-544-7783 for more information.

Annual Deferral Election Percentage (New Participant or Annual Open Enrollment Elections Only) Salary (select one):

No Changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan.

l elect to defer % (up to a maximum of 65% if I am also participating in Altera’s 401 (k) Plan) of my gross salary.

I elect to defer 100% of my gross salary after all applicable payroll deductions have been made (I do not participate in the 401(k)).

I elect not to defer any salary.

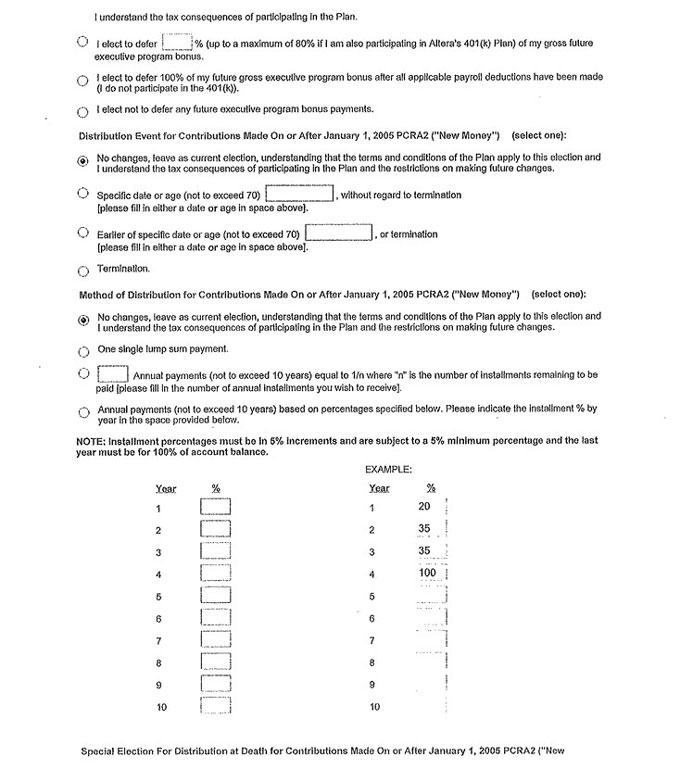

Future Corporate Bonus Program (select one):

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and

I understand the tax consequences of participating In the Plan.

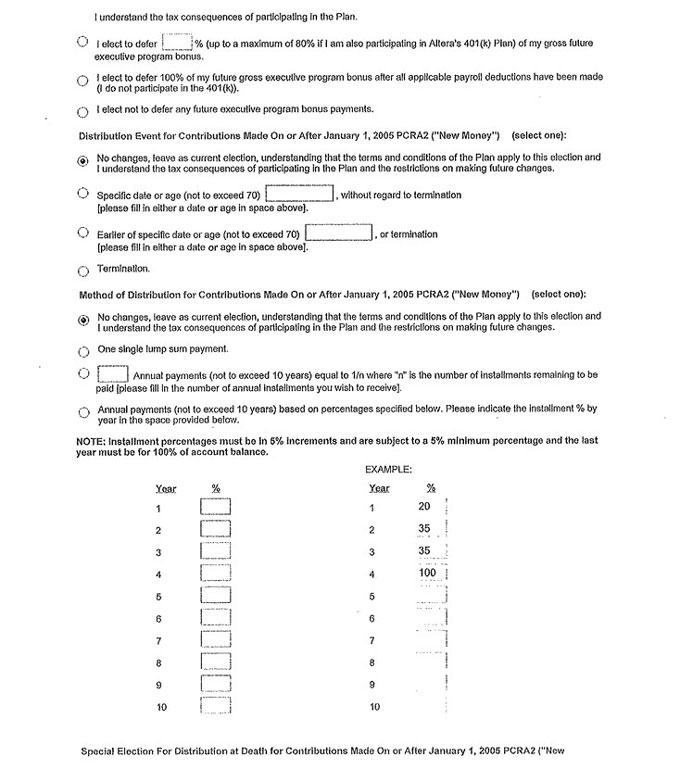

I elect to defer % (up to a maximum of 80% if i am also participating in Altera’s 401 (K) Plan) of my gross future

executive program bonus.

I elect to defer 100% of my future gross executive program bonus after all applicable payroll deductions have been made (I do not participate in the 401 (k)).

I elect not to defer any future executive program bonus payments.

Distribution Event for Contributions Made On or After January 1, 2005 PCRA2 (“New Money”) (select one):

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan and the restrictions on making future changes.

Specific date or age (not to exceed 70), without regard to termination

[please fill in either a date or age in space above].

Earlier of specific date or age (not to exceed 70), or termination

[please fill in either a date or age in space above].

Termination.

Method of Distribution for Contributions Made On or After January 1, 2005 PCRA2 (“New Money”) (select one):

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan and the restrictions on making future changes.

One single lump sum payment.

Annual payments (not to exceed 10 years) equal to 1/n where “n” is the number of installments remaining to be

paid [please fill in the number of annual installments you wish to receive].

Annual payments (not to exceed 10 years) based on percentages specified below. Please indicate the Installment % by year in the space provided below.

NOTE: Installment percentages must be in 5% increments and are subject to a 5% minimum percentage and the last year must be for 100% of account balance.

EXAMPLE:

Year 1 2 3 4 5 6 7 8 9 10

%

Year 1 2 3 4 5 6 7 8 9 10

% 20 35 35 100

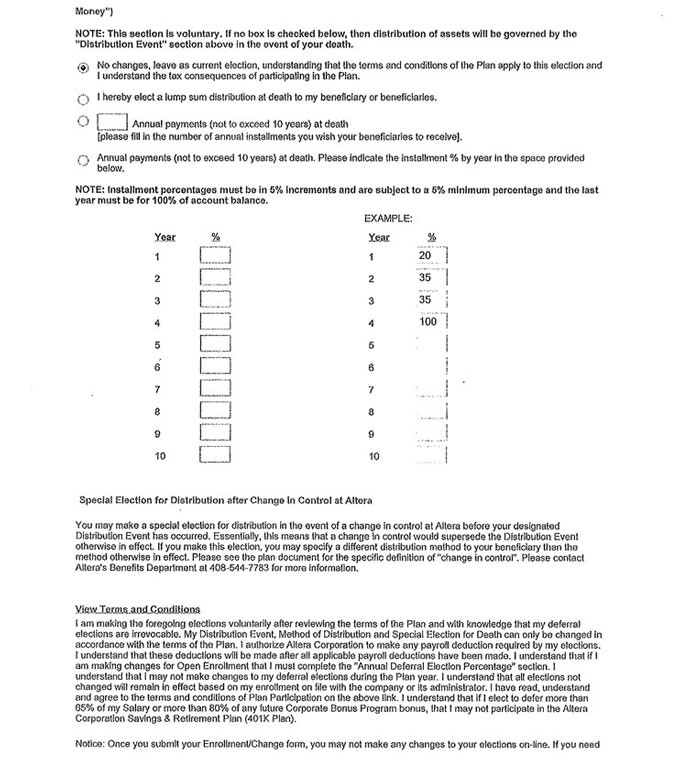

Special Election For Distribution at Death for Contributions Made On or After January 1, 2005 PCRA2 (“New

Money”)

NOTE: This section is voluntary. If no box is checked below, then distribution of assets will be governed by the “Distribution Event” section above in the event of your death.

No changes, leave as current election, understanding that the terms and conditions of the Plan apply to this election and I understand the tax consequences of participating in the Plan.

I hereby elect a lump sum distribution at death to my beneficiary or beneficiaries.

Annual payments (not to exceed 10 years) at death

[please fill in the number of annual installments you wish your beneficiaries to receive].

Annual payments (not to exceed 10 years) at death. Please Indicate the installment % by year in the space provided below.

NOTE: Installment percentages must be in 5% increments and are subject to a 5% minimum percentage and the last year must be for 100% of account balance.

EXAMPLE:

Year 1 2 3 4 5 6 7 8 9 10

%

Year 1 2 3 4 5 6 7 8 9 10

% 20 35 35 100

Special Election for Distribution after Change in Control at Altera

You may make a special election for distribution in the event of a change in control at Altera before your designated Distribution Event has occurred, Essentially, this means that a change in control would supersede the Distribution Event otherwise in effect. If you make this election, you may specify a different distribution method to your beneficiary than the method otherwise in effect. Please see the plan document for the specific definition of “change in control”. Please contact Altera’s Benefits Department at 408-544-7783 for more Information.

View Terms and Conditions

I am making the foregoing elections voluntarily after reviewing the terms of the Plan and with knowledge that my deferral elections are irrevocable. My Distribution Event, Method of Distribution and Special Election for Death can only be changed in accordance with the terms of the Plan. I authorize Altera Corporation to make any payroll deduction required by my elections. I understand that these deductions will be made after all applicable payroll deductions have been made. I understand that if I am making changes for Open Enrollment that I must complete the “Annual Deferral Election Percentage” section. I understand that I may not make changes to my deferral elections during the Plan year, I understand that all elections not changed will remain in effect based on my enrollment on file with the company or Its administrator. I have read, understand and agree to the terms and conditions of Plan Participation on the above link, f understand that if I elect to defer more than 65% of my Salary or more than 80% of any future Corporate Bonus Program bonus, that I may not participate in the Altera Corporation Savings & Retirement Plan (401K Plan).

Notice: Once you submit your Enrollment/Change form, you may not make any changes to your elections on-line. If you need

to make a change to your elections during the Open Enrollment period, please contact Altera’s Benefits Department at 408-544-7783, or via email at hebenefit@altera.com.

I have read this document and agree to the terms

11/26/2008

(Participant Signature) (Date)

Submit