Exhibit 99.1

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

LABOR READY®

Dependable Temporary Labor.

2003 ANALYST PRESENTATION

September 17, 2003

New York

We Put People to Work.

SAFE HARBOR STATEMENT

Cautionary Note about Forward-Looking Statements

Certain statements made by us in this presentation that are not historical facts or that relate to future plans, events or performances are forward-looking statements within the meaning of the federal securities laws. Our actual results may differ materially from those expressed in any forward-looking statements made by us. Forward-looking statements involve a number of risks of uncertainties including, but not limited to, the risks described in the Company’s most recent 10-K and 10-Q filings. All forward-looking statements are qualified by those risk factors.

[LOGO]

INTRODUCTION TO DIRECTORS

• Robert Sullivan

Chairman

• Mark Beatty

• Tom McChesney

• Gates McKibbin

• Joe Sambataro

• Carl Schafer

• Bill Steele

MANAGEMENT TEAM

• Tim Adams

General Counsel

• Bob Breen

Director, Strategic Planning & Analysis

• Rick Christmas

CIO

• Steve Cooper

CFO

• John Hopkins

Regional VP, Operations/West

• Gary North

Regional VP, Operations/East & U.K.

• Tom Stonich

VP Human Resources

2003 ANALYST PRESENTATION AGENDA

• Overview

• Industry Trends

• Labor Ready Value Proposition

• Company Goals & Strategies

• Key Financial Metrics & Results

[LOGO]

Dependable Temporary Labor.

[GRAPHIC]

Labor Ready has 790 offices in the U.S.,

Canada and U.K.

TRENDS IN TEMPORARY STAFFING

U.S. Help Supply

[CHART]

Cycle Expansions and Contractions: (1) Economic expansion began in November 1982; (2) Economic contraction began in July 1990 and expansion began in March 1991; (3) Economic contraction began in March 2001.

Source: Bureau of Labor Statistics non-seasonally adjusted employment growth for temporary help services (NAICS code 60561320) and total non-farm employment.

[GRAPHIC]

Recent reports on the U.S. economy have been optimistic…

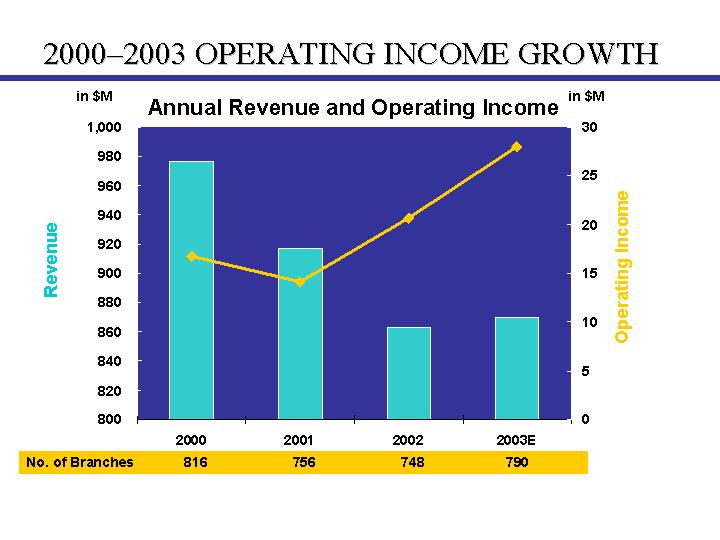

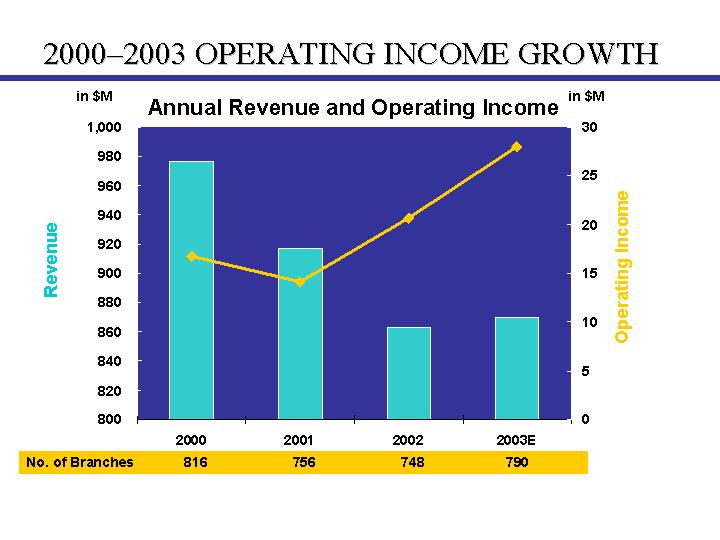

2000—2003 OPERATING INCOME GROWTH

Annual Revenue and Operating Income

[CHART]

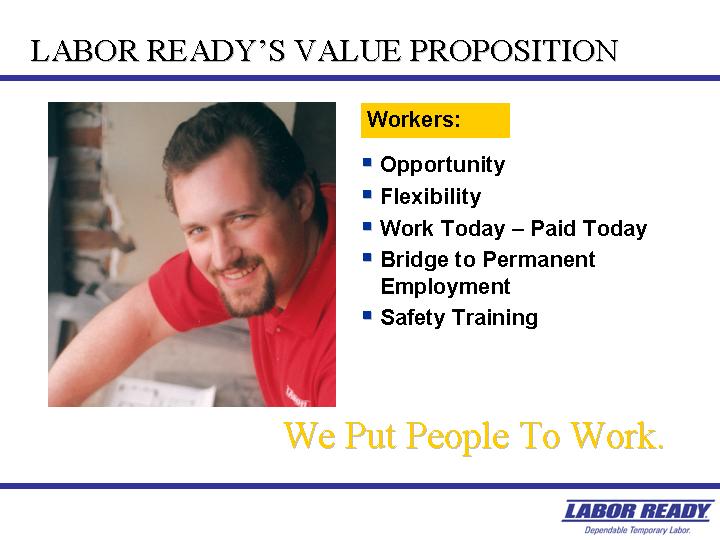

LABOR READY’S VALUE PROPOSITION

[GRAPHIC]

Workers:

• Opportunity

• Flexibility

• Work Today – Paid Today

• Bridge to Permanent Employment

• Safety Training

We Put People To Work.

[LOGO]

[GRAPHIC]

Customer:

• Flexibility

• Eliminates workers’ compensation and payroll tax exposure

• Reduces fixed costs

• Quick fill of employment needs

• Dependable, temporary labor

COMPANY GOALS & STRATEGIES

• Improve branch profitability

• Expand in smaller markets in U.S.

• Expand in U.K.

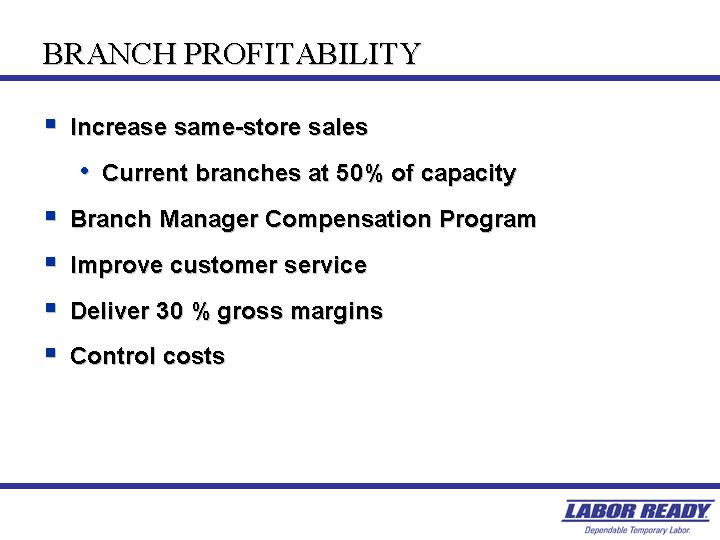

BRANCH PROFITABILITY

• Increase same-store sales

• Current branches at 50% of capacity

• Branch Manager Compensation Program

• Improve customer service

• Deliver 30 % gross margins

• Control costs

SMALLER MARKETS EXPANSION

• Opened 25 new branches in U.S. and Canada in 2003

• Close to 300 markets available

• Smaller market branch model

• Smaller footprint

• Different market criteria

• Zero impact on existing branches

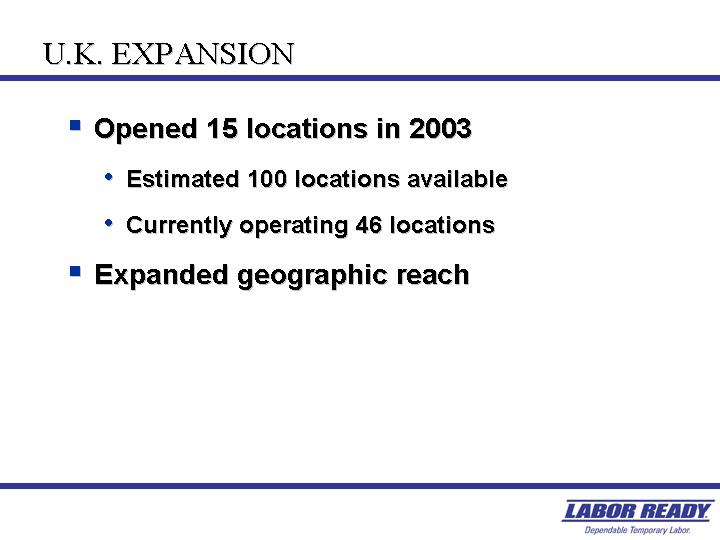

U.K. EXPANSION

• Opened 15 locations in 2003

• Estimated 100 locations available

• Currently operating 46 locations

• Expanded geographic reach

FINANCIAL METRICS & RESULTS

• Sales Trends

• Smaller Market Branch Update

• U.K. Update

• Leverage in Current Operations

• Current Year Estimates

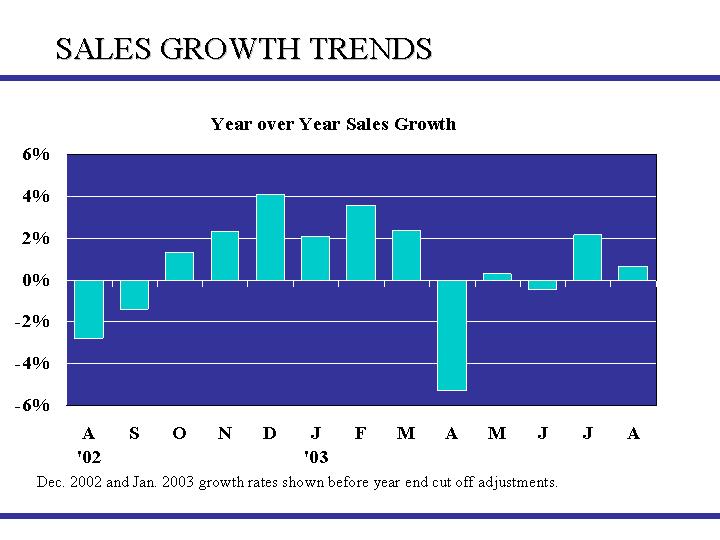

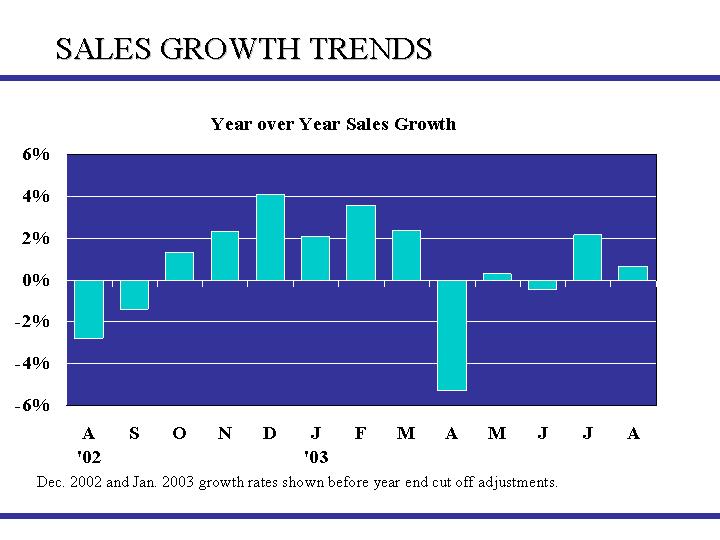

SALES GROWTH TRENDS

Year over Year Sales Growth

[CHART]

Dec. 2002 and Jan. 2003 growth rates shown before year end cut off adjustments.

SALES GROWTH COMPONENTS

Same Store Growth

[CHART]

New Store Growth

[CHART]

REGIONAL RESULTS

[GRAPHIC]

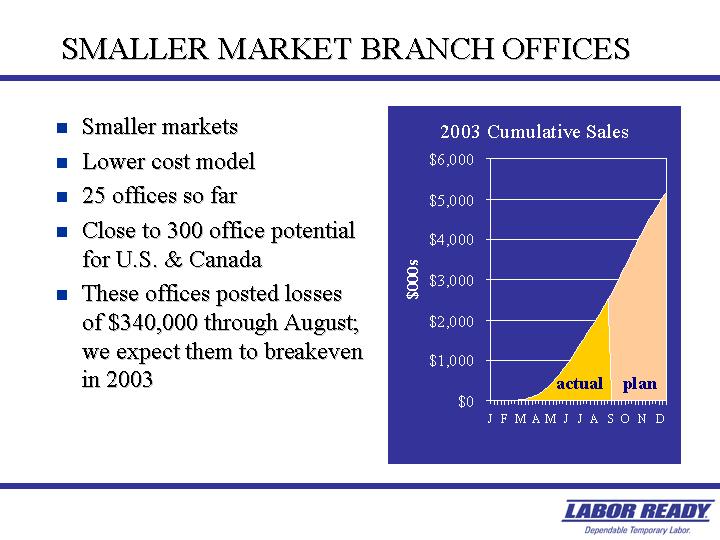

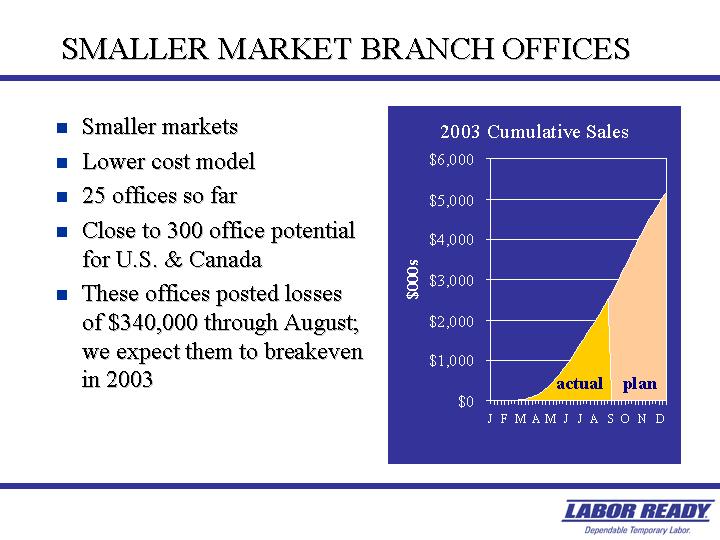

SMALLER MARKET BRANCH OFFICES

• Smaller markets

• Lower cost model

• 25 offices so far

• Close to 300 office potential for U.S. & Canada

• These offices posted losses of $340,000 through August; we expect them to breakeven in 2003

2003 Cumulative Sales

[CHART]

[LOGO]

SMALLER MARKET OFFICE LOCATIONS

[GRAPHIC]

Current Locations

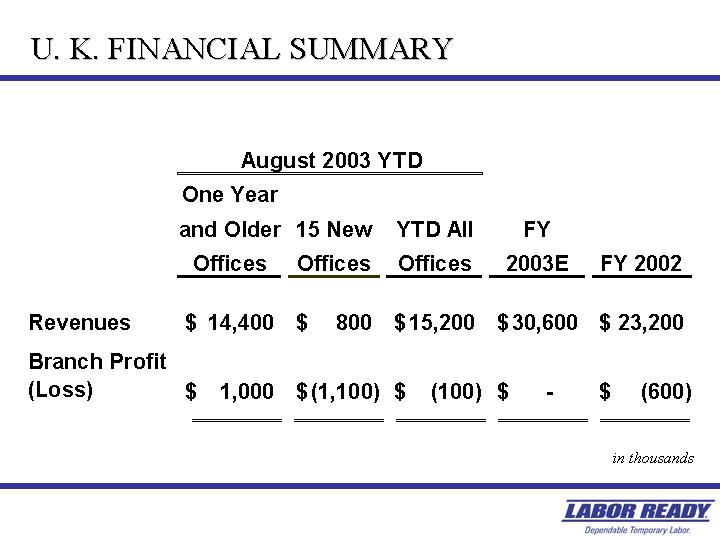

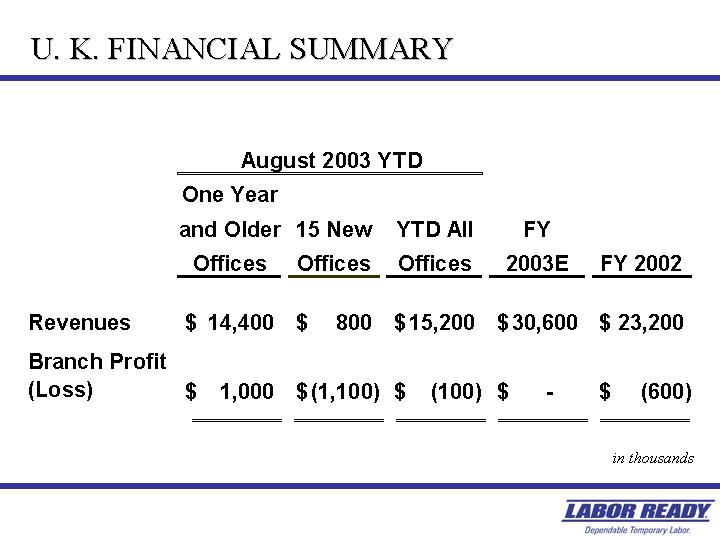

U. K. FINANCIAL SUMMARY

| | August 2003 YTD | | | | | |

| | One Year

and Older

Offices | | 15 New

Offices | | YTD All

Offices | | FY

2003E | | FY 2002 | |

| | | | | | | | | | | |

Revenues | | $ | 14,400 | | $ | 800 | | $ | 15,200 | | $ | 30,600 | | $ | 23,200 | |

| | | | | | | | | | | |

Branch Profit

(Loss) | | $ | 1,000 | | $ | (1,100 | ) | $ | (100 | ) | $ | — | | $ | (600 | ) |

in thousands

Current Locations

[GRAPHIC]

[GRAPHIC]

Q-3 AVG. WEEKLY SALES VOLUMES

[CHART]

[LOGO]

KEY OPERATING METRICS

• Gross margin trends

• SG&A reduction

• Branch Maturation

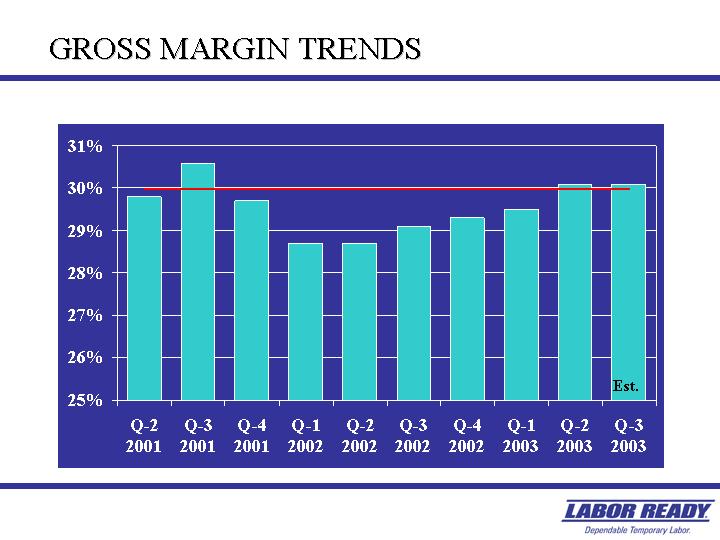

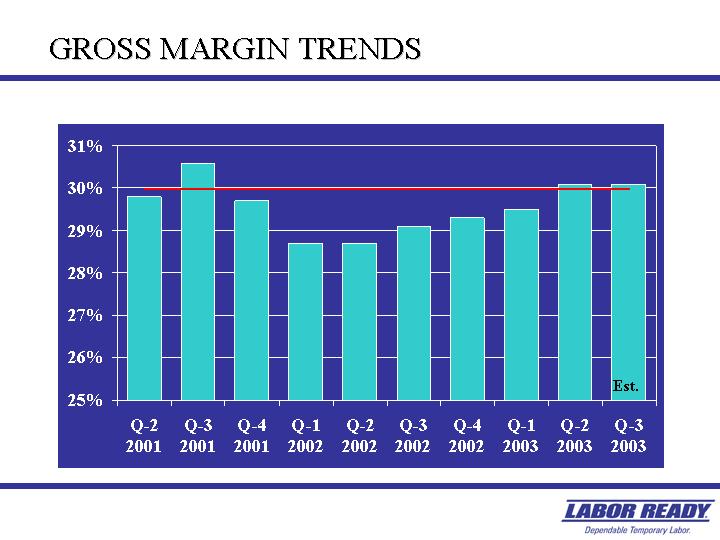

GROSS MARGIN TRENDS

[CHART]

SELLING, GENERAL & ADMIN. COSTS

Trailing four quarters as a percentage of sales

[CHART]

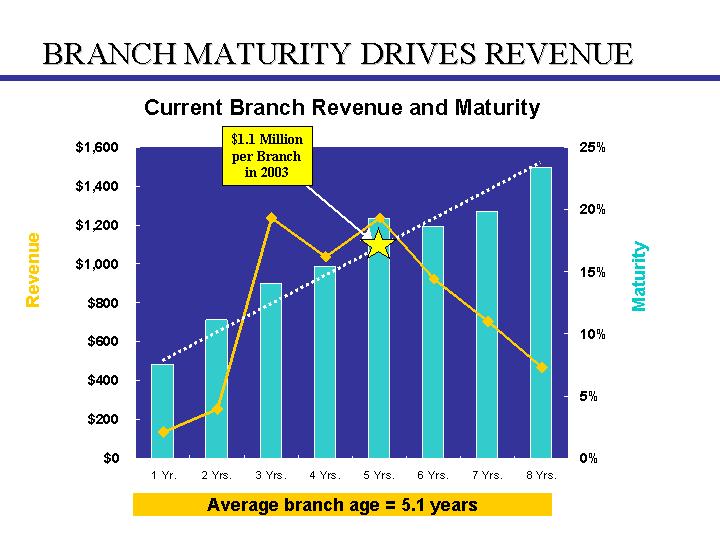

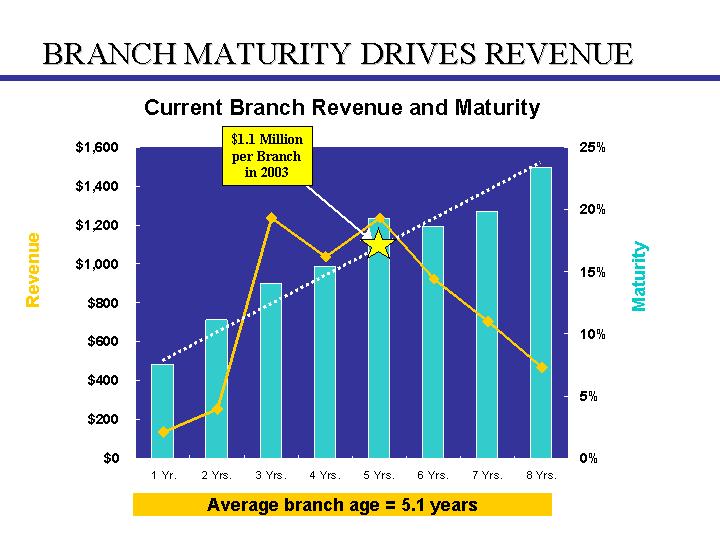

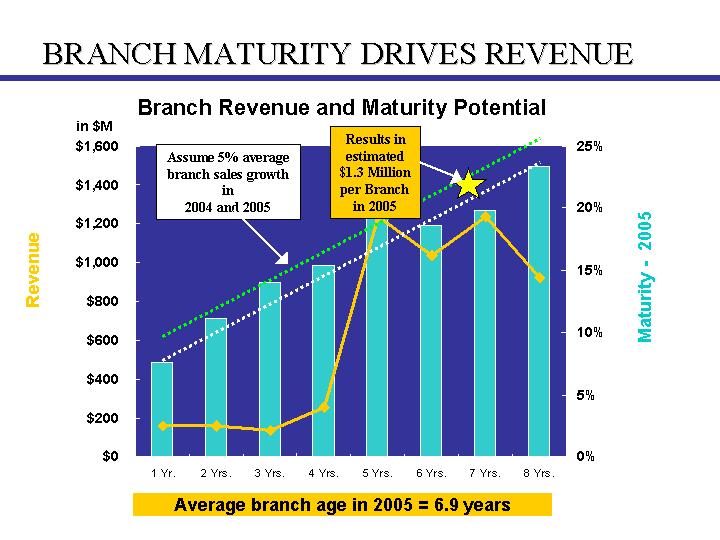

BRANCH MATURITY DRIVES REVENUE

Current Branch Revenue and Maturity

[CHART]

Average branch age = 5.1 years

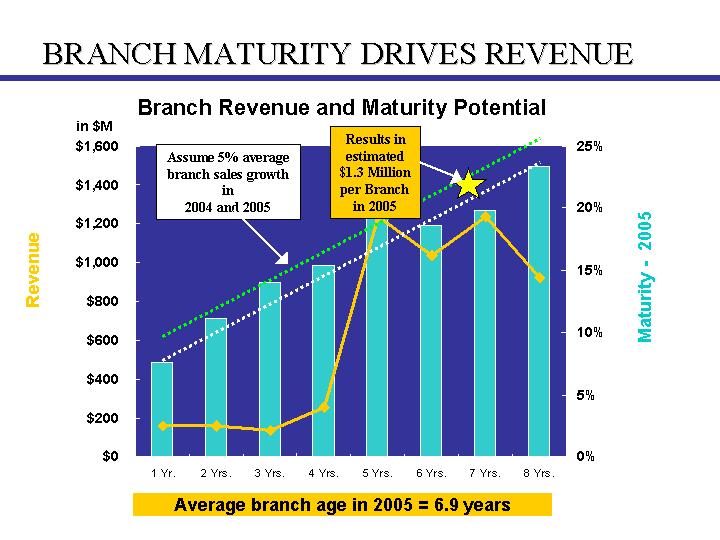

Branch Revenue and Maturity Potential

[CHART]

Average branch age in 2005 = 6.9 years

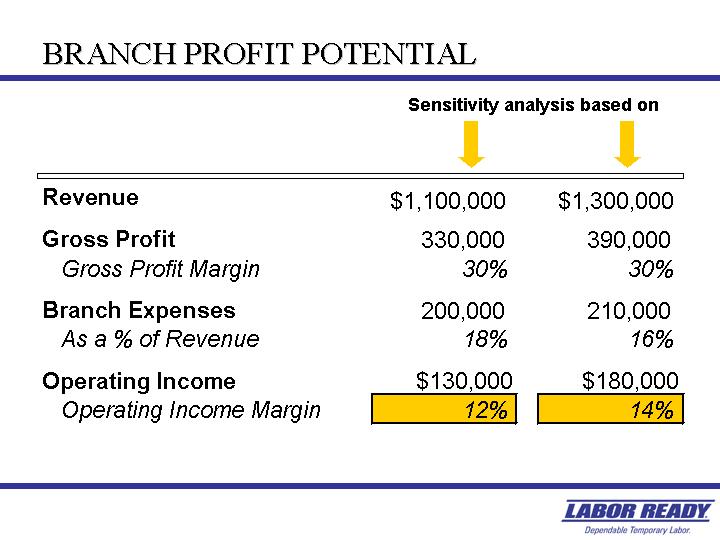

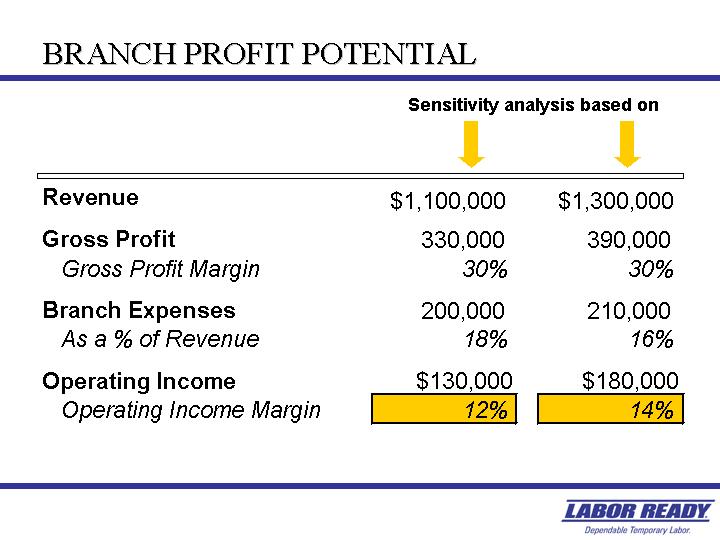

BRANCH PROFIT POTENTIAL

| | Sensitivity analysis based on | |

| | | | | |

Revenue | | $ | 1,100,000 | | $ | 1,300,000 | |

| | | | | | | |

Gross Profit | | 330,000 | | 390,000 | |

Gross Profit Margin | | 30 | % | 30 | % |

| | | | | |

Branch Expenses | | 200,000 | | 210,000 | |

As a% of Revenue | | 18 | % | 16 | % |

| | | | | |

Operating Income | | $ | 130,000 | | $ | 180,000 | |

Operating Income Margin | | 12 | % | 14 | % |

[LOGO]

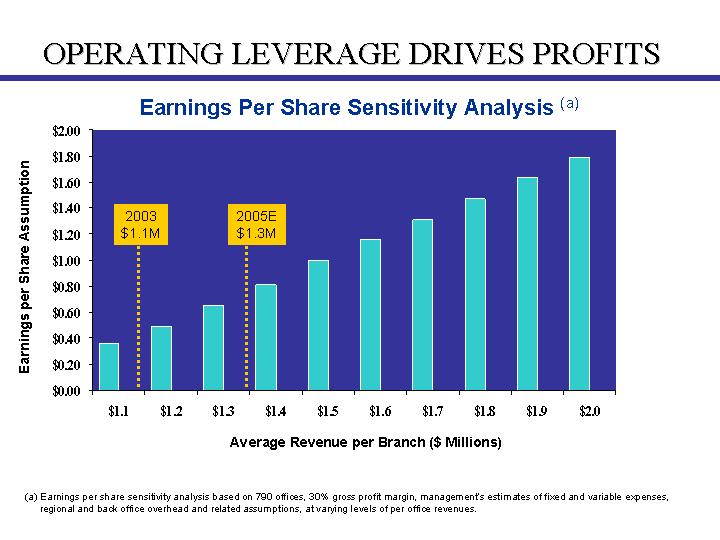

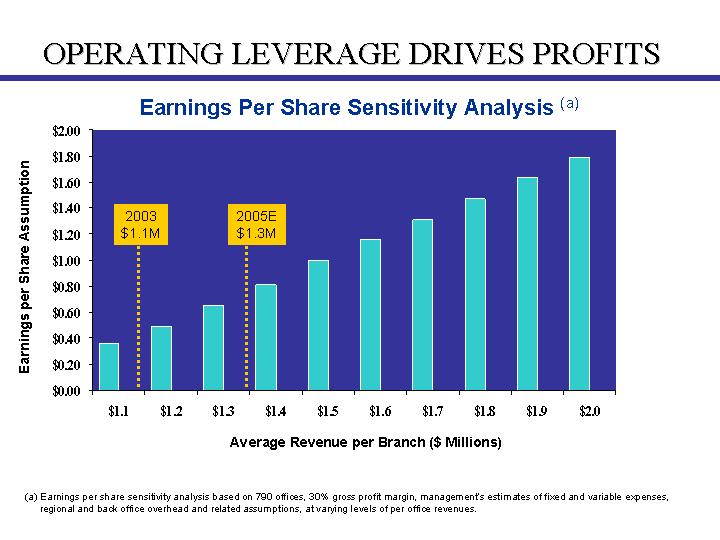

OPERATING LEVERAGE DRIVES PROFITS

Earnings Per Share Sensitivity Analysis (a)

[CHART]

Average Revenue per Branch ($ Millions)

(a) Earnings per share sensitivity analysis based on 790 offices, 30% gross profit margin, management’s estimates of fixed and variable expenses, regional and back office overhead and related assumptions, at varying levels of per office revenues.

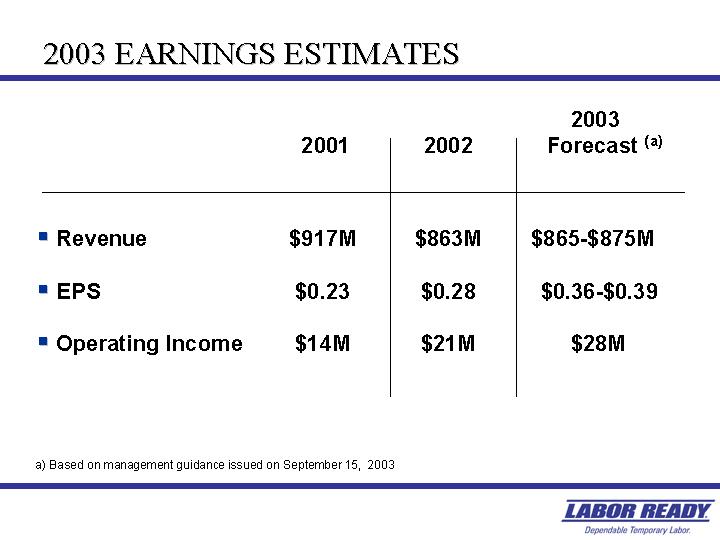

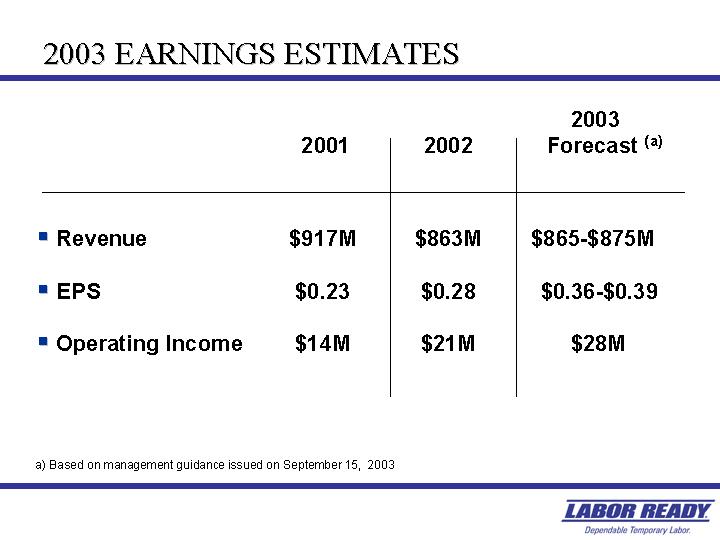

2003 EARNINGS ESTIMATES

| | 2001 | | 2002 | | 2003

Forecast (a) | |

| | | | | | | |

• Revenue | | $ | 917 | M | $ | 863 | M | $865-$875M | |

| | | | | | | |

• EPS | | $ | 0.23 | | $ | 0.28 | | $0.36-$0.39 | |

| | | | | | | |

• Operating Income | | $ | 14 | M | $ | 21 | M | $ | 28 | M |

| | | | | | | | | | |

a) Based on management guidance issued on September 15, 2003

[LOGO]

INVESTMENT HIGHLIGHTS

• Market leader in fragmented industry

• Large and growing markets

• Diverse customer base

• Nearly 600,000 workers

• Scalable and flexible model

• Strong earnings potential

[GRAPHIC]

Labor Ready is poised to realize significant operating leverage

as it benefits from an economic recovery and the maturation of

its branch expansion program executed in the 1990s.