Exhibit 99.1

| 1Q2008 RESULTS RELEASE | MAY 7, 2008 |  |

Strong underlying performance (up 9%); net income affected by market conditions

¡ | Strong business performance results in a 9% rise in underlying earnings before tax |

¡ | Operating earnings and net income affected by recent turmoil in world financial markets |

¡ | AEGON reports no significant impairments, reflecting high quality of investment portfolio |

¡ | AEGON confident it will meet 2010 value of new business target despite decline in first quarter |

Chairman’s Statement

AEGON’s Chairman of the Executive Board and CEO Alexander Wynaendts stated:

“AEGON’s businesses continued to demonstrate strong underlying performance, despite the turbulent environment. Retail sales progressed well during the quarter, in particular in the US and the Netherlands. The downturn in financial markets and a weak US dollar resulted in AEGON reporting considerably lower operating earnings and net income for the first quarter. Since the end of the quarter we have seen a reversal of the widening of credit spreads, which would have reduced significantly the negative impact of fair value assets on AEGON’s operating earnings and net income. The quality of our investment portfolio is again demonstrated by the fact that AEGON experienced no material impairments in the first quarter. In addition, our capital position and cash flows remain strong. We also remain confident in our progress toward our 2010 VNB target. Finally, in line with our international growth strategy, we successfully continued our international expansion in Central and Eastern Europe and Turkey.”

PERFORMANCE INDICATORS

| amounts in EUR millions (except per share data) | Notes | 1Q 2008 | 1Q 2007 | % | At constant currency % | |||||||||

| 1 | ||||||||||||||

Underlying earnings before tax | 2 | 658 | 602 | 9 | 22 | |||||||||

Net operating earnings | 267 | 484 | (45 | ) | (38 | ) | ||||||||

Net income | 3 | 153 | 707 | (78 | ) | (75 | ) | |||||||

Net income per share | 0.07 | 0.42 | (83 | ) | (79 | ) | ||||||||

New life sales | 4 | 686 | 826 | (17 | ) | (8 | ) | |||||||

Total deposits | 5 | 8,636 | 12,976 | (33 | ) | (25 | ) | |||||||

Value of new business (VNB) | 186 | 232 | (20 | ) | (12 | ) | ||||||||

Return on equity - underlying earnings | 6 | 13 | % | 11 | % | 18 | ||||||||

For notes see page 28. | ||||||||||||||

Media relations + 31 70 344 8344

Investor relations + 31 70 344 8305 + 1 877 548 9668 – toll free USA only | Media conference call 8:15 am CET

Analyst & Investors call 3:00 pm CET | Website www.aegon.com

Financial supplement AEGON’s Q1 2008 financial supplement is available on www.aegon.com | 2008050701 |

Strategic developments

AEGON has a focused strategy, aimed at creating long-term value for all its stakeholders. The Group’s objectives are to expand its international presence, further strengthen its distribution networks and invest in its growing pension businesses. AEGON took a number of specific steps to meet these objectives:

¡ | AEGON strengthened its position in the developing pension and asset management markets in Central and Eastern Europe (CEE) by signing an agreement to acquire the UNIQA Asset Management Company and the Heller-Saldo 2000 Pension Fund Management Company in Hungary, with a total number of pension fund members of 140,000. Following the acquisition, AEGON Hungary’s pension revenue generating investments will amount to EUR 1.9 billion. |

¡ | As part of its ongoing efforts to expand in rapidly developing markets, AEGON also announced the acquisition of Turkish life and pension company Ankara Emeklilik. Turkey, with its population of 74 million people, has a low life insurance penetration and the private pensions market has significant growth potential. In addition, Ankara Emeklilik has a well-established presence in the Turkish life insurance and private pensions market, with more than 54,000 pension fund members and EUR 35 million in revenue generating investments. Ankara Emeklilik sells through a variety of different channels and has an agreement with Şekerbank to distribute products and services through a nationwide network of 236 branches. |

¡ | In April, AEGON and Industrial Securities, one of China’s leading securities firms, announced the establishment of a new asset management joint venture following final approval from the country’s regulatory authorities. The joint venture will be named AEGON Industrial Fund Management Company. Under the agreement, AEGON will acquire a 49% interest in Industrial Fund Management Company (IFMC), a subsidiary of Industrial Securities. IFMC is a Chinese mutual fund manager with approximately EUR 3 billion in revenue generating investments. Industrial Securities will retain the remaining 51% of IFMC. |

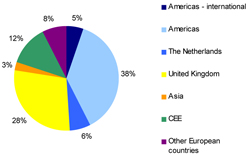

AEGON’s value of new business (VNB) decreased to EUR 186 million. The decline was due primarily to the impact of a weaker US dollar and British pound and a lower contribution from the Group’s life reinsurance and institutional businesses in the Americas. There was a decline in VNB from both Taiwan and the Netherlands, because of a recent change in business mix and the effect of markets on unit-linked sales in Taiwan, while in Spain new business volumes were also lower. AEGON’s operations in CEE again reported strong growth in VNB, helped by the launch of a new mandatory pension fund in Romania at the start of 2008.

Value of new business 1Q 2008

Internal rates of return, meanwhile, improved, rising to 18.4% as the Group continued to focus on writing profitable new business.

Local knowledge. Global power. | Page 2 of 37

Financial highlights

FINANCIAL OVERVIEW

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | At constant currency % | |||||||||

| 1 | ||||||||||||||

Underlying earnings before tax by line of business | ||||||||||||||

Life and protection | 252 | 260 | (3 | ) | 7 | |||||||||

Individual savings and retirement products | 116 | 125 | (7 | ) | 5 | |||||||||

Pensions and asset management | 121 | 132 | (8 | ) | (1 | ) | ||||||||

Institutional products | 108 | 87 | 24 | 41 | ||||||||||

Reinsurance | 43 | 36 | 19 | 34 | ||||||||||

Distribution | 9 | 10 | (10 | ) | (13 | ) | ||||||||

General insurance | 17 | 3 | N.M. | N.M. | ||||||||||

Interest charges and other | (17 | ) | (58 | ) | (71 | ) | (61 | ) | ||||||

Share in net results of associates | 9 | 7 | 29 | 36 | ||||||||||

Underlying earnings before tax | 658 | 602 | 9 | 22 | ||||||||||

Over / (under) performance of fair value items | (316 | ) | 39 | N.M. | N.M. | |||||||||

Operating earnings before tax | 342 | 641 | (47 | ) | (40 | ) | ||||||||

Operating earnings before tax by line of business | ||||||||||||||

Life and protection | 232 | 262 | (11 | ) | (2 | ) | ||||||||

Individual savings and retirement products | (58 | ) | 136 | N.M. | N.M. | |||||||||

Pensions and asset management | 87 | 146 | (40 | ) | (34 | ) | ||||||||

Institutional products | (55 | ) | 100 | N.M. | N.M. | |||||||||

Reinsurance | 31 | 36 | (14 | ) | (3 | ) | ||||||||

Distribution | 9 | 10 | (10 | ) | (13 | ) | ||||||||

General insurance | 17 | 2 | N.M. | N.M. | ||||||||||

Interest charges and other | 70 | (58 | ) | N.M. | N.M. | |||||||||

Share in net results of associates | 9 | 7 | 29 | 36 | ||||||||||

Operating earnings before tax | 342 | 641 | (47 | ) | (40 | ) | ||||||||

Gains/(losses) on investments | (39 | ) | 283 | N.M. | N.M. | |||||||||

Impairment charges | (32 | ) | 7 | N.M. | N.M. | |||||||||

Other income/(charges) | (54 | ) | 15 | N.M. | N.M. | |||||||||

Income before tax | 217 | 946 | (77 | ) | (73 | ) | ||||||||

Income tax | (64 | ) | (239 | ) | (73 | ) | (68 | ) | ||||||

Net income | 153 | 707 | (78 | ) | (75 | ) | ||||||||

Net underlying earnings | 503 | 455 | 11 | 23 | ||||||||||

Net operating earnings | 267 | 484 | (45 | ) | (38 | ) | ||||||||

Underlying earnings geographically | ||||||||||||||

Americas | 478 | 478 | 0 | 14 | ||||||||||

The Netherlands | 113 | 87 | 30 | 30 | ||||||||||

United Kingdom | 45 | 66 | (32 | ) | (23 | ) | ||||||||

Other countries | 39 | 29 | 34 | 37 | ||||||||||

Holding and other | (17 | ) | (58 | ) | (71 | ) | (61 | ) | ||||||

Underlying earnings before tax | 658 | 602 | 9 | 22 | ||||||||||

Operating earnings geographically | ||||||||||||||

Americas | 104 | 505 | (79 | ) | (76 | ) | ||||||||

The Netherlands | 84 | 99 | (15 | ) | (15 | ) | ||||||||

United Kingdom | 45 | 66 | (32 | ) | (23 | ) | ||||||||

Other countries | 39 | 29 | 34 | 37 | ||||||||||

Holding and other | 70 | (58 | ) | N.M. | N.M. | |||||||||

Operating earnings before tax | 342 | 641 | (47 | ) | (40 | ) | ||||||||

Commissions and expenses | 1,416 | 1,515 | (7 | ) | 2 | |||||||||

of which operating expenses | 783 | 795 | (2 | ) | 7 | |||||||||

Local knowledge. Global power. | Page 3 of 37

Operational highlights

Overview

AEGON’s businesses delivered a strong underlying performance in the first quarter of 2008 despite the impact of recent turmoil in world financial markets and weaker currencies in both the United States and the United Kingdom. Underlying earnings, which exclude the effect of market fluctuations on fair value items, were up 9% (or 22% on a constant currency basis). This increase was primarily the result of business growth as well as more favorable investment spreads in the Americas, strong life insurance earnings in CEE, and higher investment income in the Netherlands.

Extremely volatile financial markets, characterized by an unparalleled spike in credit spreads, declining risk free interest rates and lower equity markets had a significant impact on the Group’s operating earnings. Operating earnings include the fair value movements of certain investment classes in the Netherlands and the Americas, as well as a number of products containing financial guarantees. These items considerably underperformed their long-term expected returns. As a result, AEGON’s operating earnings before tax declined to EUR 342 million.

Net income was down to EUR 153 million, a result of lower operating earnings and a decline in realized investment gains. Despite unfavorable market conditions, net impairments totaled just EUR 32 million (3 bps of general account investments) during the quarter. AEGON’s subprime portfolio experienced no impairments this quarter.

Underlying earnings before tax

Underlying earnings before tax increased by 9% (or 22% in constant currencies). Underlying earnings from the Americas, the Netherlands and Other countries all showed strong growth compared with the same period in 2007. In the Americas, earnings benefited from higher spreads and continued underlying growth. In the Netherlands, earnings were positively impacted by higher investment income and the inclusion of a Dutch life insurance company acquired in 2007. The United Kingdom reported a decrease in its underlying earnings, due primarily to the impact of lower financial markets on fund-related fees. Earnings from Other countries were mainly driven by growth of the life insurance business in CEE.

Operating earnings before tax

Operating earnings before tax decreased to EUR 342 million. The weakening of the US dollar and the British pound impacted operating earnings. Operating earnings in the Americas and The Netherlands showed a decline as a result of the impact of financial markets on the performance of fair value items.

The first quarter saw an unprecedented widening in credit spreads. This had a negative impact on the market value of AEGON’s EUR 4.2 billion synthetic CDO (collateralized debt obligation) program and other credit-related financial instruments. Lower interest rates, meanwhile, affected the fair value of guarantees in AEGON’s segregated fund business in Canada, as well as the Group’s total return annuities and its GMWB (guaranteed minimum withdrawal benefits) variable annuity riders. AEGON’s hedge funds portfolio experienced an underperformance, after outperforming expected long-term returns for ten consecutive quarters. As a result of widening credit spreads, AEGON’s operating earnings included a EUR 87 million gain from bonds issued by the Group. These bonds are held in the Group’s accounts at fair value and are hedged using swaps. Movements in the fair value of these swaps usually offset any gains or losses from the bonds themselves.

Net income

Net income was down to EUR 153 million, primarily the result of lower operating earnings and lower realized investment gains in the Americas and the Netherlands. A negative tax impact from intercompany reinsurance transactions largely explains the increase in the effective tax rate.

Commissions and expenses

Commissions and expenses declined 7% in the first quarter. Operating expenses were 2% lower, due to the recent strengthening of the euro. In constant currency, operating expenses increased 7%, due to further investments in the business.

Local knowledge. Global power. | Page 4 of 37

SALES

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | At constant currency % | |||||||||

New life sales | ||||||||||||||

Life single premiums | 2,757 | 3,875 | (29 | ) | (22 | ) | ||||||||

Life recurring premiums annualized | 410 | 438 | (6 | ) | 4 | |||||||||

Total recurring plus 1/10 single | 686 | 826 | (17 | ) | (8 | ) | ||||||||

New premium production accident and health insurance | 166 | 176 | (6 | ) | 7 | |||||||||

New premium production general insurance | 16 | 12 | 33 | 30 | ||||||||||

Gross deposits (on and off balance) by line of business | ||||||||||||||

Fixed annuities | 306 | 193 | 59 | 81 | ||||||||||

Variable annuities | 685 | 683 | 0 | 13 | ||||||||||

Saving deposits | 648 | 569 | 14 | 14 | ||||||||||

Retail mutual funds | 564 | 584 | (3 | ) | 10 | |||||||||

Pensions and asset management | 3,183 | 3,161 | 1 | 14 | ||||||||||

Institutional guaranteed products | 3,249 | 7,786 | (58 | ) | (52 | ) | ||||||||

Reinsurance | 1 | 0 | N.M. | N.M. | ||||||||||

Total gross deposits | 8,636 | 12,976 | (33 | ) | (25 | ) | ||||||||

Net deposits (on and off balance) by line of business | ||||||||||||||

Fixed annuities | (795 | ) | (1,316 | ) | 40 | 31 | ||||||||

Variable annuities | (152 | ) | (175 | ) | 13 | 6 | ||||||||

Saving deposits | (72 | ) | (65 | ) | (11 | ) | (11 | ) | ||||||

Retail mutual funds | 171 | 192 | (11 | ) | 1 | |||||||||

Pensions and asset management | 1,170 | (264 | ) | N.M. | N.M. | |||||||||

Institutional guaranteed products | (1,195 | ) | 1,946 | N.M. | N.M. | |||||||||

Reinsurance | (15 | ) | 0 | N.M. | N.M. | |||||||||

Total net deposits | (888 | ) | 318 | N.M. | N.M. | |||||||||

REVENUE GENERATING INVESTMENTS | ||||||||||||||

| At Mar. 31 2008 | At Dec. 31 2007 | |||||||||||||

Revenue generating investments (total) | 7 | 339,833 | 370,470 | (8 | ) | (3 | ) | |||||||

Investments general account | 125,359 | 132,861 | (6 | ) | ||||||||||

Investments for account of policyholders | 126,273 | 142,384 | (11 | ) | ||||||||||

Off balance sheet investments third parties | 88,201 | 95,225 | (7 | ) | ||||||||||

Sales

Overall new life sales were down to EUR 686 million, due mainly to lower sales of both life reinsurance and bank- and corporate-owned life insurance in the Americas. Retail life sales in the Americas were up 9% and immediate annuity sales in the Netherlands also showed strong growth. New life sales in Asia decreased significantly as a result of the ongoing shift from traditional to unit-linked products and variable annuity deposits, as well as the negative effect from markets on unit-linked sales in Taiwan. Unit-linked sales in CEE were impacted by equity market volatility. In the United Kingdom, declines in sales of individual pensions were offset by increases in group business and higher sales of individual protection and annuity products.

Deposits

In the Americas, Pensions & asset management experienced continued strong growth in deposits. Fixed annuities sales benefited from a steepening of the yield curve. Variable annuity deposits increased primarily as a result of continued strong sales through banks, broker/dealers, fee planners and the inclusion of Merrill Lynch’s life insurance companies. Retail mutual funds continued to experience positive net inflows despite negative market sentiment. The decline in net deposits is mainly a result of the decline in institutional guaranteed products as no deals were possible at acceptable spreads. CEE again showed a solid increase in total gross deposits, as did Asia where a new variable annuity product was launched in Taiwan.

Local knowledge. Global power. | Page 5 of 37

AEGON’s investment portfolio

During the first quarter this year, there was a further deterioration in international credit markets. AEGON’s credit risks are concentrated primarily in the United States. The Group has structured its US investment portfolio defensively to weather a stressed credit environment. As a result, net impairments on investments totaled just EUR 32 million for the Group in the first quarter, evidence of the continued high quality of the Group’s investment portfolio.

Lower financial markets have, however, led to revaluation of credit related assets. Unlike impairments, these revaluations have no impact on the Group’s earnings. Under IFRS, for the ‘available for sale’ investment portfolio, any changes in the fair value are reflected in the revaluation reserve as part of the Group’s shareholders’ equity. Since the beginning of this year, AEGON’s revaluation reserve has declined by EUR 1.5 billion as a consequence of significantly wider credit spreads and lower equity markets, partly offset by lower interest rates.

Revaluations reflect movements in financial markets. Assets are only impaired if AEGON intends to sell at a loss or otherwise does not expect to receive full principal and interest on a particular investment. AEGON is a long-term investor and generally intends to retain large parts of the portfolio until maturity. Moreover, as a result of the Group’s effective asset and liability management, AEGON has ample liquidity in its investment portfolio.

AEGON continues to have limited exposure to the US subprime market. However, the credit risk is concentrated primarily in a certain segment, floating rate subprime assets, with over 85% rated AAA and AA. The value of these securities has been affected by the recent deterioration in the US financial markets. At the end of March, these investments, totaling EUR 1,098 million, showed an unrealized net loss of EUR 334 million. While there is clearly a risk of future impairments in this area, AEGON believes this exposure is of manageable size.

Revenue generating investments

Revenue generating investments totaled EUR 340 billion at the end of March 2008, down 8% from year-end 2007 and down 3% on a constant currency basis. The decline on a constant currency basis was due primarily to lower financial markets during the first quarter.

Capital management

At the end of March, shareholders’ equity totalled EUR 12.6 billion, a decrease of EUR 2.6 billion compared with the end of December 2007. AEGON’s revaluation reserve declined by EUR 1.5 billion. Foreign currency translation effects had an impact of EUR 1.1 billion, primarily due to a decline in the value of the US dollar and UK pound since year-end 2007 (of 7% and 9% respectively). The positive impact of net income (EUR 153 million) was partly offset by paid coupons on perpetuals (EUR 46 million) and the cost of repurchasing AEGON shares to hedge the Group’s 2008 employee stock option program (EUR 73 million).

AEGON applies leverage tolerances to its capital base, which reflects the capital employed in its core activities. This capital base consists of three elements: shareholders’ equity, capital securities and subordinated and senior debt. AEGON aims to ensure that shareholders’ equity accounts for at least 70% of its overall capital base, capital securities8 25% and subordinated and senior debt a maximum of 5%. AEGON manages its economic exposure to currency revaluations in its capital base. AEGON has raised the majority of its perpetual securities denominated in US dollars. These securities are part of Group equity and as a result are carried in the balance sheet at the original EUR/USD exchange rate. At the end of March 2008, shareholders’ equity represented 72% of AEGON’s total capital base. Group equity, which includes other equity instruments (such as perpetual capital securities) and minority interests, represented 93% of total capital8, 9.

Local knowledge. Global power. | Page 6 of 37

In January, AEGON launched a 30-year USD 1.5 billion AXXX innovative capital management transaction. This financing transaction provides the company with flexible solutions that will help manage the Group’s reserves and capital in a cost efficient manner.

The initial size of this transaction is USD 300 million. AEGON will continue to explore further opportunities for securitizations and other innovative capital market transactions as part of an ongoing commitment to manage capital and reserve requirements efficiently and effectively.

Local knowledge. Global power. | Page 7 of 37

Appendix I • Americas • The Netherlands • United Kingdom • Other countries

AMERICAS - EARNINGS

| USD millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Underlying earnings before tax by line of business | |||||||||||

Life | 159 | 153 | 4 | ||||||||

Accident and health | 115 | 116 | (1 | ) | |||||||

Life and protection | 274 | 269 | 2 | ||||||||

Fixed annuities | 95 | 86 | 10 | ||||||||

Variable annuities | 70 | 66 | 6 | ||||||||

Retail mutual funds | 4 | 4 | 0 | ||||||||

Individual savings and retirement products | 169 | 156 | 8 | ||||||||

Pensions and asset management | 45 | 41 | 10 | ||||||||

Institutional guaranteed products | 141 | 94 | 50 | ||||||||

BOLI/COLI | 21 | 21 | 0 | ||||||||

Institutional products | 162 | 115 | 41 | ||||||||

Reinsurance | 65 | 47 | 38 | ||||||||

Share in net results of associates | 1 | (1 | ) | N.M. | |||||||

Underlying earnings before tax | 716 | 627 | 14 | ||||||||

Over / (under) performance of fair value items | (560 | ) | 35 | N.M. | |||||||

Operating earnings before tax | 156 | 662 | (76 | ) | |||||||

Operating earnings before tax by line of business | |||||||||||

Life | 135 | 155 | (13 | ) | |||||||

Accident and health | 109 | 117 | (7 | ) | |||||||

Life and protection | 244 | 272 | (10 | ) | |||||||

Fixed annuities | 8 | 98 | (92 | ) | |||||||

Variable annuities | (103 | ) | 69 | N.M. | |||||||

Retail mutual funds | 4 | 4 | 0 | ||||||||

Individual savings and retirement products | (91 | ) | 171 | N.M. | |||||||

Pensions and asset management | 38 | 42 | (10 | ) | |||||||

Institutional guaranteed products | (99 | ) | 110 | N.M. | |||||||

BOLI/COLI | 17 | 21 | (19 | ) | |||||||

Institutional products | (82 | ) | 131 | N.M. | |||||||

Reinsurance | 46 | 47 | (2 | ) | |||||||

Share in net results of associates | 1 | (1 | ) | N.M. | |||||||

Operating earnings before tax | 156 | 662 | (76 | ) | |||||||

Gains/(losses) on investments | (71 | ) | 174 | N.M. | |||||||

Impairment charges | (21 | ) | 16 | N.M. | |||||||

Income before tax | 64 | 852 | (92 | ) | |||||||

Income tax | (103 | ) | (227 | ) | (55 | ) | |||||

Net income | (39 | ) | 625 | N.M. | |||||||

Net underlying earnings | 522 | 476 | 10 | ||||||||

Net operating earnings | 111 | 500 | (78 | ) | |||||||

Commissions and expenses | 1,169 | 1,192 | (2 | ) | |||||||

of which operating expenses | 547 | 532 | 3 | ||||||||

Local knowledge. Global power. | Page 8 of 37

AMERICAS - SALES

| USD millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

New life sales | |||||||||||

Life single premiums | 241 | 650 | (63 | ) | |||||||

Life recurring premiums annualized | 238 | 248 | (4 | ) | |||||||

Total recurring plus 1/10 single | 262 | 313 | (16 | ) | |||||||

Life | 187 | 172 | 9 | ||||||||

BOLI/COLI | 14 | 60 | (77 | ) | |||||||

Reinsurance | 61 | 81 | (25 | ) | |||||||

Total recurring plus 1/10 single | 262 | 313 | (16 | ) | |||||||

New premium production accident and health insurance | 237 | 219 | 8 | ||||||||

Gross deposits (on and off balance) by line of business | |||||||||||

Fixed annuities | 459 | 253 | 81 | ||||||||

Variable annuities | 974 | 892 | 9 | ||||||||

Retail mutual funds | 773 | 741 | 4 | ||||||||

Pensions and asset management | 4,252 | 3,470 | 23 | ||||||||

Institutional guaranteed products | 4,870 | 10,198 | (52 | ) | |||||||

Reinsurance | 2 | 0 | N.M. | ||||||||

Total gross deposits | 11,330 | 15,554 | (27 | ) | |||||||

Net deposits (on and off balance) by line of business | |||||||||||

Fixed annuities | (1,192 | ) | (1,723 | ) | 31 | ||||||

Variable annuities | (279 | ) | (232 | ) | (20 | ) | |||||

Retail mutual funds | 247 | 245 | 1 | ||||||||

Pensions and asset management | 1,644 | 821 | 100 | ||||||||

Institutional guaranteed products | (1,792 | ) | 2,549 | N.M. | |||||||

Reinsurance | (23 | ) | 0 | N.M. | |||||||

Total net deposits | (1,395 | ) | 1,660 | N.M. | |||||||

REVENUE GENERATING INVESTMENTS | |||||||||||

| At Mar. 31 2008 | At Dec. 31 2007 | ||||||||||

Revenue generating investments (total) | 7 | 317,075 | 325,999 | (3 | ) | ||||||

Investments general account | 132,172 | 134,678 | (2 | ) | |||||||

Investments for account of policyholders | 76,192 | 81,663 | (7 | ) | |||||||

Off balance sheet investments third parties | 108,711 | 109,658 | (1 | ) | |||||||

Local knowledge. Global power. | Page 9 of 37

Americas

¡ | Strong underlying earnings growth of 14% reflects organic growth, the acquisition of Merrill Lynch’s life insurance companies and higher investment spreads |

¡ | Double digit sales growth in both Individual savings & retirement and pensions, and retail life sales up 9% |

¡ | Operating earnings significantly affected by market valuations on fair value items |

¡ | No significant impairments reflecting high quality of investment portfolio |

“AEGON Americas reported solid underlying earnings growth of 14% during the first quarter. For the most part, the basics of our diversified business portfolio continued to perform well in a difficult economic environment,” said Pat Baird, CEO of AEGON Americas. “We believe our investment portfolio and investment oriented products to be well positioned to weather the difficult credit environment. Our operating earnings and net income were negatively affected by widening credit spreads and market valuations being determined primarily by distressed sellers of certain asset classes.”

Overview

AEGON Americas’ underlying performance remained strong and all business lines reported organic growth, with the exception of fixed annuities. Higher investment spreads in the institutional business contributed positively to earnings, as did the inclusion of Merrill Lynch’s life insurance companies. However, Americas faced significant headwinds during the first quarter with unprecedented credit spread widening and growing concerns of an economic slowdown in the United States. These led to mark-to-market valuations impacting the operating earnings.

Retail life sales showed continued growth, with a double-digit increase in deposits in both Individual savings & retirement and pensions. The current financial crisis did however affect production in AEGON Americas’ institutional business.

The investment portfolio continues to weather the current turmoil in terms of impairment charges. Although the subprime portfolio experienced negative revaluations this quarter due to credit spread widening there were no impairments on this portfolio.

Underlying earnings before tax

¡ | Underlying earnings from Life & protection remained relatively flat. Strong organic growth was offset by unfavorable mortality experience. |

¡ | Earnings from Individual savings & retirement increased by 8% thanks to a favorable mortality experience on a closed structured settlement block, as well as additional income from the Merrill Lynch acquisition. |

¡ | Continued organic growth resulted in a 10% increase in underlying earnings from Pensions & asset management activities. |

¡ | Underlying earnings from the Institutional line of business were up 41%. The decrease in short term interest rates during the quarter produced strong positive spreads on institutional guaranteed products, while BOLI/COLI earnings remained flat. |

¡ | Life reinsurance earnings increased 38% on solid growth and positive mortality. |

Operating earnings before tax

Operating earnings before tax declined to USD 156 million, primarily due to the dislocation of financial markets. Increased financial market volatility had a significant negative mark-to-market impact on items carried at fair value.

These fair value items include hedge funds, derivatives, total return annuities and guarantees on variable annuities like GMWB and Canadian segregated funds. Each of these underperformed during the quarter, including hedge funds, which underperformed after ten straight quarters of outperformance. The total underperformance (against long-term expected returns) of fair value items during the quarter was USD 560 million versus an overperformance in the first quarter 2007 of USD 35 million.

¡ | Operating earnings from Life & protection business were negatively impacted by USD 30 million, due primarily to the underperformance of hedge fund investments. |

Local knowledge. Global power. | Page 10 of 37

¡ | Individual savings & retirement business showed an overall underperformance in fair value items of USD 260 million. A drop in the risk free rate in Canada resulted in an underperformance of AEGON Canada’s segregated funds. Low interest rates in the United States, meanwhile, led to declines in the value of AEGON USA’s total return and GMWB products. |

¡ | Earnings from Pensions & asset management activities declined as a result of an underperformance in fair value items totaling USD 7 million. |

¡ | The continued widening of credit spreads caused significant negative mark-to-market on credit derivatives. A large part of the underperformance is related to the synthetic CDO program managed by the Institutional business. While these assets cause substantial short-term operating earnings volatility, AEGON does not expect any cash losses on this program and believes these market adjustments will reverse over time as the transactions under the program mature. Total underperformance of earnings in the Institutional business was USD 244 million. |

¡ | Earnings from life reinsurance were in line with last years’ earnings. Although underlying earnings contributed positive growth of USD 18 million, this was offset by the underperformance of fair value assets and the total return product run off. |

Net income

AEGON Americas reported a net loss for the first quarter of USD 39 million, a reflection of lower operating earnings and the impact of impairment charges and realized investment losses.

Net income was also impacted by an extraordinary tax expense totaling USD 90 million related to an internal reinsurance agreement between US and Irish companies within the AEGON Group. These agreements contain an embedded derivative, valued on a mark-to-market basis. While there is no direct impact on AEGON’s overall pre-tax earnings (since any gain or loss on the embedded derivative is eliminated in consolidation), the tax rate differential between the United States and Ireland does cause fluctuations in tax expenses.

Commissions and expenses

Commissions and expenses decreased 2%. Operating expenses increased 3% driven by increases in employee benefit and acquisition expenses.

Sales and deposits

Retail life production increased 9% primarily as a result of a growth in both sales of high net worth products and in direct marketing activities. This was partly offset by declines in both BOLI/COLI production, as compared to a strong first quarter in 2007, and life reinsurance where clients seek higher retention levels. In total, new life sales in the Americas declined to USD 262 million.

In deposits, double-digit growth in both pensions and Individual savings & retirement line of business were offset by a large decrease in institutional deposits. The result was a decline in total gross deposits of 27%.

Fixed annuity deposits were up 81%, with especially strong sales through the bank channel due in part to a more favorable interest rate environment and rate specials with key accounts. Variable annuity deposits, up 9%, were spurred by the introduction of the new Retirement Income Choice benefit rider. Despite volatile equity markets, sales through the bank, broker /dealer and fee planner channels rose by 17% and 63% respectively. This increase was offset by declines in Canada, and in the direct marketing and agency channels.

Pension deposits continued to show significant growth, up 27%, with particularly strong results from the larger case market.

New spread-based institutional sales declined by 66% in the first quarter on strict pricing discipline through a volatile spread environment.

Local knowledge. Global power. | Page 11 of 37

Value of new business

VNB of USD 118 million was down 20%. Life and Protection VNB increased 66% on higher sales, better returns and lower expenses. However, lower sales volumes in the Institutional and Life reinsurance business led to an overall decline in total VNB. Pensions enjoyed strong sales growth, but reported flat VNB as a result of lower terminal funding sales linked to new retirement plans. The internal rate of return on new business was virtually unchanged at 12.6%.

Please refer to page 27 of this release for further details on AEGON’s VNB.

Revenue generating investments

Total revenue generating investments decreased by 3% in the first quarter to USD 317 billion.

Local knowledge. Global power. | Page 12 of 37

THE NETHERLANDS - EARNINGS

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Underlying earnings before tax by line of business | |||||||||||

Life | 32 | 28 | 14 | ||||||||

Accident and health | 8 | 10 | (20 | ) | |||||||

Life and protection | 40 | 38 | 5 | ||||||||

Saving products | 1 | 5 | (80 | ) | |||||||

Retail mutual funds | 0 | 0 | N.M. | ||||||||

Individual savings and retirement products | 1 | 5 | (80 | ) | |||||||

Pensions and asset management | 51 | 42 | 21 | ||||||||

Distribution | 11 | 8 | 38 | ||||||||

General insurance | 10 | (6 | ) | N.M. | |||||||

Underlying earnings before tax | 113 | 87 | 30 | ||||||||

Over / (under) performance of fair value items | (29 | ) | 12 | N.M. | |||||||

Operating earnings before tax | 84 | 99 | (15 | ) | |||||||

Operating earnings before tax by line of business | |||||||||||

Life | 32 | 28 | 14 | ||||||||

Accident and health | 8 | 10 | (20 | ) | |||||||

Life and protection | 40 | 38 | 5 | ||||||||

Saving products | 1 | 5 | (80 | ) | |||||||

Retail mutual funds | 0 | 0 | N.M. | ||||||||

Individual savings and retirement products | 1 | 5 | (80 | ) | |||||||

Pensions and asset management | 22 | 54 | (59 | ) | |||||||

Distribution | 11 | 8 | 38 | ||||||||

General insurance | 10 | (6 | ) | N.M. | |||||||

Operating earnings before tax | 84 | 99 | (15 | ) | |||||||

Gains/(losses) on investments | (49 | ) | 138 | N.M. | |||||||

Impairment charges | (17 | ) | (5 | ) | N.M. | ||||||

Income before tax | 18 | 232 | (92 | ) | |||||||

Income tax | 1 | (41 | ) | N.M. | |||||||

Net income | 19 | 191 | (90 | ) | |||||||

Net underlying earnings | 92 | 62 | 48 | ||||||||

Net operating earnings | 70 | 74 | (5 | ) | |||||||

Commissions and expenses | 310 | 294 | 5 | ||||||||

of which operating expenses | 219 | 200 | 10 | ||||||||

Local knowledge. Global power. | Page 13 of 37

THE NETHERLANDS - SALES

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

New life sales | |||||||||||

Life single premiums | 445 | 379 | 17 | ||||||||

Life recurring premiums annualized | 26 | 24 | 8 | ||||||||

Total recurring plus 1/10 single | 71 | 62 | 15 | ||||||||

Life | 31 | 24 | 29 | ||||||||

Pensions | 40 | 38 | 5 | ||||||||

Total recurring plus 1/10 single | 71 | 62 | 15 | ||||||||

New premium production accident and health insurance | 6 | 7 | (14 | ) | |||||||

New premium production general insurance | 8 | 7 | 14 | ||||||||

Gross deposits (on and off balance) by line of business | |||||||||||

Saving deposits | 648 | 569 | 14 | ||||||||

Pensions and asset management | 47 | 110 | (57 | ) | |||||||

Total gross deposits | 695 | 679 | 2 | ||||||||

Net deposits (on and off balance) by line of business | |||||||||||

Saving deposits | (72 | ) | (65 | ) | (11 | ) | |||||

Pensions and asset management | 36 | (1,077 | ) | N.M. | |||||||

Total net deposits | (36 | ) | (1,142 | ) | 97 | ||||||

REVENUE GENERATING INVESTMENTS | |||||||||||

| At Mar. 31 2008 | At Dec. 31 2007 | ||||||||||

Revenue generating investments (total) | 7 | 64,965 | 65,643 | (1 | ) | ||||||

Investments general account | 31,460 | 30,813 | 2 | ||||||||

Investments for account of policyholders | 20,649 | 21,354 | (3 | ) | |||||||

Off balance sheet investments third parties | 12,856 | 13,476 | (5 | ) | |||||||

Local knowledge. Global power. | Page 14 of 37

The Netherlands

¡ | Underlying earnings before tax up 30% on higher investment income and the consolidation of a life insurance company |

¡ | Operating earnings significantly affected by market valuations on fair value items |

¡ | New life sales up 15% on strong growth in individual annuities |

“From an operational point of view, the Netherlands showed good progress during the first quarter,” said Jos Streppel, AEGON’s Chief Financial Officer. “Underlying earnings were up and, in most lines of business, sales increased. But financial markets were volatile and inevitably impacted our operating earnings.”

Overview

AEGON The Netherlands reported an increase in underlying earnings before tax of 30% in the first quarter, a result of higher investment income, better claim experience from the general insurance activities and the inclusion of a life insurance company acquired in June 2007. For most lines of business, sales increased, while immediate annuities showed the strongest gains. Operating earnings before tax, however, were lower, primarily driven by a lower valuation of private equity investments.

Underlying earnings before tax

¡ | Earnings for the life business were up 14%, primarily on higher investment income. Despite positive technical results, earnings from Accident & health insurance at EUR 8 million were lower than last year because of an increase in expenses. |

¡ | The individual savings business, meanwhile, reported lower earnings, due to higher guarantee costs. |

¡ | Underlying earnings for Pensions & asset management increased by 21%. Higher investment income and the inclusion of a Dutch life insurance company, contributed positively to earnings, partly offset by lower technical results. |

¡ | Lower expenses and an increase in commission income led to higher earnings from Distribution. |

¡ | General insurance reported a significant improvement in its performance as earnings for the first quarter last year were negatively affected by claims from severe winter storms. |

Operating earnings before tax

Operating earnings before tax decreased by 15%, as a result of a decline in the value of the company’s private equity investments. Changes to the fair value of private equity investments are reflected in the operating earnings of the Pensions & asset management business.

Net income

Net income was significantly down. This decline was the result of a number of different factors including lower operating earnings, a decrease in investment gains on equities, negative movements in the fair value of guarantees (net of hedging), and the impact of impairments on equities. Investment gains were lower following the decision to sell a significant part of the equity portfolio in 2007. The increase in the fair value of guarantees during the first quarter reflected lower equity markets and an increase in the volatility of financial markets. The effective tax rate was low, mainly due to the presence of tax-exempt gains and earnings.

Commissions and expenses

Commissions and expenses rose 5%, largely because of higher operating expenses, which is mainly the result of an increase in employee benefit charges and higher project spending.

Sales and deposits

Total new life sales in the Netherlands grew by 15%, thanks primarily to very strong sales of immediate annuities. Pension sales were also up, a reflection of increased sales in the institutional market and higher sales through the broker channel. Sales of managed assets decreased, however, largely because of intense competition in this segment of the market. Accident and health production was also lower, mainly because of a decline in sales of the ‘WIA’ disability product. General insurance production was up, the result of the inclusion of several large contracts.

Gross deposits of saving products showed an increase in the first quarter, a reflection of recent marketing campaigns and more attractive interest rates. Inflows in the ‘Levensloop’ product remained relatively stable, while overall ‘Levensloop’ assets continued to grow. Total net deposits improved significantly.

Local knowledge. Global power. | Page 15 of 37

Value of new business

As a result of changes to its business mix, the VNB declined. The company’s internal rate of return, meanwhile, reached 10.7%, close to AEGON’s hurdle rate of 11%.

Please refer to page 27 for more detailed information on VNB.

Revenue generating investments

At the end of March 2008, revenue generating investments totaled EUR 65 billion, down fractionally from end-2007 levels. The decrease is a reflection of lower equity markets during the first quarter.

Local knowledge. Global power. | Page 16 of 37

UNITED KINGDOM - EARNINGS

| GBP millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

Operating earnings before tax by line of business | |||||||||||

Life | 8 | 5 | 60 | ||||||||

Accident and health | 0 | 0 | N.M. | ||||||||

Life and protection | 8 | 5 | 60 | ||||||||

Pensions and asset management | 28 | 38 | (26 | ) | |||||||

Distribution | (2 | ) | 1 | N.M. | |||||||

Operating earnings before tax | 34 | 44 | (23 | ) | |||||||

Gains/(losses) on investments | 2 | 1 | 100 | ||||||||

Other income/(charges) | 10 | (41 | ) | 10 | N.M. | ||||||

Income before tax | (5 | ) | 55 | N.M. | |||||||

Income tax attributable to policyholder return | 41 | (7 | ) | N.M. | |||||||

Income before income tax on shareholders return | 36 | 48 | (25 | ) | |||||||

Income tax on shareholders return | (5 | ) | (10 | ) | (50 | ) | |||||

Net income | 31 | 38 | (18 | ) | |||||||

Net underlying earnings | 30 | 37 | (19 | ) | |||||||

Net operating earnings | 30 | 37 | (19 | ) | |||||||

Commissions and expenses | 157 | 144 | 9 | ||||||||

of which operating expenses | 98 | 90 | 9 | ||||||||

Local knowledge. Global power. | Page 17 of 37

UNITED KINGDOM - SALES

| GBP millions | Notes | 1Q 2008 | 1Q 2007 | % | ||||||

New life sales | 11 | |||||||||

Life single premiums | 1,498 | 1,827 | (18 | ) | ||||||

Life recurring premiums annualized | 141 | 114 | 24 | |||||||

Total recurring plus 1/10 single | 291 | 297 | (2 | ) | ||||||

Life | 55 | 48 | 15 | |||||||

Pensions | 236 | 249 | (5 | ) | ||||||

Total recurring plus 1/10 single | 291 | 297 | (2 | ) | ||||||

Gross deposits (on and off balance) by line of business | ||||||||||

Pensions and asset management | 112 | 185 | (39 | ) | ||||||

Total gross deposits | 112 | 185 | (39 | ) | ||||||

Net deposits (on and off balance) by line of business | ||||||||||

Pensions and asset management | (41 | ) | 56 | N.M. | ||||||

Total net deposits | (41 | ) | 56 | N.M. | ||||||

REVENUE GENERATING INVESTMENTS | ||||||||||

| At Mar. 31 2008 | At Dec. 31 2007 | |||||||||

Revenue generating investments (total) | 7 | 50,551 | 53,115 | (5 | ) | |||||

Investments general account | 4,233 | 4,157 | 2 | |||||||

Investments for account of policyholders | 43,611 | 46,095 | (5 | ) | ||||||

Off balance sheet investments third parties | 2,707 | 2,863 | (5 | ) | ||||||

Local knowledge. Global power. | Page 18 of 37

United Kingdom

¡ | Operating earnings decline on lower financial markets |

¡ | Growth in group pension and individual annuities were offset by lower sales of personal pensions and investment bonds |

¡ | Value of new business up 3% in local currency; margins continued to improve |

“Our strategy is bearing fruit,” said Otto Thoresen, CEO of AEGON UK. “We saw steady growth in our annuity, individual protection and corporate pension businesses during the quarter. In addition, we’re making strong progress with our bank distribution partnerships and our efforts to extend the range of products and services we offer. Financial market volatility, however, had an impact on both our earnings and on general market sentiment.”

Overview

Operating earnings before tax declined 23%, due primarily to the impact of lower bond and equity markets on fund-related charges in the pension business. Strong growth in sales of group pensions and individual annuities were offset by declines in personal pensions and investment bonds. The value of new business rose by 3% in local currency, despite lower sales volumes.

Underlying earnings before tax

In the UK underlying earnings equal operating earnings.

Operating earnings before tax

¡ | Earnings from Life & protection operations grew 60% as result of continued growth in the company’s annuity and individual protection businesses, following a successful strategy to expand into higher margin products. |

¡ | Earnings from Pensions & asset management business were 26% lower as a decline in asset values during the quarter led to a fall in income from fund-related charges. |

¡ | Lower sales and the cost of new investments resulted in a decrease in earnings from AEGON UK’s distribution activities. Tax changes on investment products, worsening investor sentiment and concerns over the UK housing market all contributed to the overall decline in sales. |

Net income

Net income decreased by 18% due to lower operating earnings. A higher proportion of earnings was generated by the Life & protection business, which is taxed at a lower rate. The company’s effective tax rate fell to 13.5%, following the UK government’s recent decision to reduce corporation tax.

Commissions and expenses

Total commissions and expenses rose 9%. Operating expenses were higher as a result of recent business growth and an increase in performance-related costs in the company’s asset management business. Higher amortization charges as a result of maturing of the portfolio also led to an increase in expenses.

Sales and deposits

Overall, new life sales were down 2%. Sales of group pensions and annuities showed strong growth, but were offset by a decline in individual pensions and investment bonds.

Sales of individual pensions were lower compared with the record levels seen last year. These record levels were the result of exceptional activity following ‘Pension A-Day’ in May 2006. Meanwhile, recent tax changes and increased financial market volatility led to lower sales of investment bonds, retail mutual funds and managed assets. Currently, AEGON UK has a relatively small share of the on-shore investment bond market. However, this is expected to grow in the coming months, following the launch of a new investment bond product earlier this year. This product offers customers a wide choice of funds, flexible charging and commission structures and the certainty of capital guarantees.

Local knowledge. Global power. | Page 19 of 37

In Q2 2008 AEGON will launch a pension contract called Income for Life. This is a variable annuity style contract, developed for the at-retirement pension market.

Value of new business

VNB increased 3% in local currency as a result of further improvement in margins, despite a decline in sales volumes. Much of the improvement in margins was concentrated in the annuity and individual protection businesses. In the first quarter, the internal rate of return on new business rose to 13.0%.

Please refer to page 27 for more detailed information on VNB.

Revenue generating investments

At the end of March 2008, AEGON UK had a total of GBP 51 billion in revenue generating investments, a decline compared with end-2007 levels due to lower equity and bond markets.

Local knowledge. Global power. | Page 20 of 37

OTHER COUNTRIES - EARNINGS

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

Operating earnings before tax by line of business | |||||||||||

Life | 17 | 8 | 113 | ||||||||

Accident and health | 2 | 1 | 100 | ||||||||

Life and protection | 19 | 9 | 111 | ||||||||

Variable annuities | 1 | 0 | N.M. | ||||||||

Retail mutual funds | 1 | 0 | N.M. | ||||||||

Individual savings and retirement products | 2 | 0 | N.M. | ||||||||

Pensions and asset management | 3 | 4 | (25 | ) | |||||||

General insurance | 7 | 8 | (13 | ) | |||||||

Share in net results of associates | 8 | 8 | 0 | ||||||||

Operating earnings before tax | 39 | 29 | 34 | ||||||||

Gains/(losses) on investments | 0 | 2 | N.M. | ||||||||

Impairment charges | (1 | ) | 0 | N.M. | |||||||

Income before tax | 38 | 31 | 23 | ||||||||

Income tax | (10 | ) | (14 | ) | (29 | ) | |||||

Net income | 28 | 17 | 65 | ||||||||

Net underlying earnings | 27 | 16 | 69 | ||||||||

Net operating earnings | 27 | 16 | 69 | ||||||||

Commissions and expenses | 91 | 79 | 15 | ||||||||

of which operating expenses | 43 | 39 | 10 | ||||||||

Local knowledge. Global power. | Page 21 of 37

OTHER COUNTRIES - SALES

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||

New life sales | 11 | ||||||||

Life single premiums | 172 | 272 | (37 | ) | |||||

Life recurring premiums annualized | 39 | 55 | (29 | ) | |||||

Total recurring plus 1/10 single | 56 | 82 | (32 | ) | |||||

Life | 56 | 82 | (32 | ) | |||||

Total recurring plus 1/10 single | 56 | 82 | (32 | ) | |||||

New premium production accident and health insurance | 2 | 2 | 0 | ||||||

New premium production general insurance | 8 | 5 | 60 | ||||||

Gross deposits (on and off balance) | |||||||||

Variable annuities | 35 | 2 | N.M. | ||||||

Retail mutual funds | 48 | 18 | 167 | ||||||

Pensions and asset management | 151 | 126 | 20 | ||||||

Total gross deposits | 234 | 146 | 60 | ||||||

Net deposits (on and off balance) | |||||||||

Variable annuities | 34 | 1 | N.M. | ||||||

Retail mutual funds | 6 | 6 | 0 | ||||||

Pensions and asset management | 92 | 102 | (10 | ) | |||||

Total net deposits | 132 | 109 | 21 | ||||||

REVENUE GENERATING INVESTMENTS | |||||||||

| At Mar. 31 2008 | At Dec. 31 2007 | ||||||||

Revenue generating investments (total) | 7 | 10,724 | 10,885 | (1 | ) | ||||

Investments general account | 4,878 | 4,801 | 2 | ||||||

Investments for account of policyholders | 2,655 | 2,729 | (3 | ) | |||||

Off balance sheet investments third parties | 3,191 | 3,355 | (5 | ) | |||||

Local knowledge. Global power. | Page 22 of 37

Other countries

¡ | Operating earnings up 34% on strong performance from the life business |

¡ | Pension deposits in CEE show further significant growth |

¡ | Lower equity markets result in overall decline in life sales |

Overview

Other countries reported a 34% increase in operating earnings before tax, primarily the result of strong life earnings. Deposits rose as AEGON’s pension business in CEE continued to show significant growth as well as strong growth of variable annuity deposits in Taiwan. However, declining equity markets during the quarter resulted in a 32% decline in new life sales. Other countries generated almost a quarter of AEGON’s value of new business in the first quarter, a reflection of their continued importance to the Group.

Underlying earnings before tax

In Other countries underlying earnings equal operating earnings.

Operating earnings before tax

¡ | Operating earnings from Life & protection more than doubled to EUR 19 million as a result of strong growth from the in-force book in Poland and a release of EUR 4 million from reserves in Hungary. |

¡ | Operating earnings from Individual savings & retirement products increased to EUR 2 million due to higher fee income from retail mutual funds in Hungary and higher variable annuity sales in Taiwan. |

¡ | Pensions & asset management posted a slight decrease in operating earnings during the quarter as higher contributions from Hungary and Poland were offset by the cost of investments in new pension funds in the Czech Republic, Romania and Slovakia. |

¡ | Operating earnings from General insurance also declined, due primarily to higher claims in Hungary following severe storms in the country last March. |

¡ | Operating earnings from associate companies were unchanged. |

Net income

Other countries reported a 65% increase in net income. The increase was the result of higher operating earnings and lower taxes, partly offset by a decline in gains on investments.

Commissions and expenses

Commissions and expenses increased by 15%. The majority of this increase was due to the cost of investments in new ventures in CEE and the inclusion of a number of newly acquired companies. In addition, a shift to regular premium products in the region led to an increase in commissions.

Sales and deposits

In CEE, new life sales declined to EUR 22 million. Regular premium sales increased 9% as a result of the successful development of broker and agency networks in Slovakia and the Czech Republic. However, this was more than offset by the decline in single premium sales in Poland because of weaker equity markets.

In Asia, new life sales in Taiwan decreased to EUR 13 million as a result of lower equity markets and the ongoing shift from traditional to unit-linked products and variable annuity deposits, which amounted to EUR 35 million. In the coming months, new variable annuity products will be introduced. Unit-linked products accounted for 70% of new life sales for Taiwan in the first quarter. In China, single premium sales increased to EUR 18 million as a result of strong single premium unit-linked sales in the bank channel. Sales increases in China stem primarily from recent efforts to expand AEGON’s distribution network in the country and the introduction of new products. Further progress in this regard has been made with the opening earlier this month of a new branch office in the southern Chinese province of Guangdong.

In Spain, new life sales increased to EUR 18 million as a result of higher recurring premium sales. The partnership with CAM, which is not consolidated in AEGON’s accounts, saw a decrease of 37% in new life sales. CAM is currently in the process of implementing a new sales strategy to grow sales again going forward.

Individual savings & retirement net deposits increased strongly to EUR 40 million primarily as a result of higher variable annuity deposits in Taiwan.

Sales of mortgages in Hungary continued to grow with a total of EUR 35 million provided to homebuyers.

Local knowledge. Global power. | Page 23 of 37

Pension & asset management net deposits decreased 10% to EUR 92 million. Continued strong pension deposits in CEE were partly offset by lower deposits in the asset management business.

General insurance new premium production rose to EUR 8 million as a result of a successful sales campaign for motor insurance in Hungary.

Value of new business

VNB from Other countries decreased 11%, primarily as a result of lower sales volumes. Other countries accounted for 23% of AEGON’s total VNB. In Asia, the decrease in VNB was due largely to a change in product mix and lower production in Taiwan. In CEE, VNB was up 64%, buoyed by the launch of a new mandatory pension fund in Romania, which added EUR 7 million in value of new business. Excluding the new pension fund in Romania, overall VNB from CEE increased 14%. In Spain, VNB decreased mainly due to lower sales from CAM. Asia accounted for 12% of VNB from Other countries, CEE for 55% and France and Spain for the remaining 33%. By 2010, AEGON strives for Other countries’ contribution to VNB to reach between 30% and 35%.

The internal rate of return (IRR) in Asia rose in the first quarter as a result of a shortening in the expected average duration of unit-linked policies. The reduction in IRR in CEE is a reflection of lower rates of return on the Romanian pension business and its significant contribution to overall VNB from the region. In Spain, AEGON’s bank distribution partnerships continued to deliver high rates of return.

Please refer to page 27 for more detailed VNB information.

Revenue generating investments

Revenue generating investments decreased 1% in the first quarter as a result of lower financial markets.

Local knowledge. Global power. | Page 24 of 37

Appendix II - Tables

NET UNDERLYING EARNINGS GEOGRAPHICALLY | |||||||||||

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Americas | 348 | 364 | (4 | ) | |||||||

The Netherlands | 92 | 62 | 48 | ||||||||

United Kingdom | 40 | 55 | (27 | ) | |||||||

Other countries | 27 | 16 | 69 | ||||||||

Holding and other activities | (4 | ) | (42 | ) | 90 | ||||||

Net underlying earnings | 503 | 455 | 11 | ||||||||

OVER / UNDER PERFORMANCE OF FAIR VALUE ITEMS | |||||||||||

| EUR millions | |||||||||||

Operating earnings before tax | 342 | 641 | (47 | ) | |||||||

(Over) / under performance of fair value items - Americas | 374 | (27 | ) | N.M. | |||||||

(Over) / under performance of fair value items - The Netherlands | 29 | (12 | ) | N.M. | |||||||

(Over) / under performance of fair value items - Holding and other activities | (87 | ) | 0 | N.M. | |||||||

Underlying earnings before tax | 658 | 602 | 9 | ||||||||

Net underlying earnings | 503 | 455 | 11 | ||||||||

AMERICAS - OVER / UNDER PERFORMANCE OF FAIR VALUE ITEMS | |||||||||||

| USD millions | |||||||||||

Over / (under) performance of fair value items by line of business | |||||||||||

Life and protection | (30 | ) | 3 | N.M. | |||||||

Individual savings and retirement products | (260 | ) | 15 | N.M. | |||||||

Pensions and asset management | (7 | ) | 2 | N.M. | |||||||

Institutional products | (244 | ) | 15 | N.M. | |||||||

Reinsurance | (19 | ) | 0 | N.M. | |||||||

Total over / (under) performance of fair value items | (560 | ) | 35 | N.M. | |||||||

Total over / (under) performance of fair value items in EUR | (374 | ) | 27 | N.M. | |||||||

NETHERLANDS - OVER / UNDER PERFORMANCE OF FAIR VALUE ITEMS | |||||||||||

| EUR millions | |||||||||||

| Over / (under) performance of fair value items by line of business | |||||||||||

Pensions and asset management | (29 | ) | 12 | N.M. | |||||||

Total over / (under) performance of fair value items | (29 | ) | 12 | N.M. | |||||||

EXPLANATION

Certain assets held by AEGON Americas and AEGON The Netherlands are carried at fair value, and managed on a total return basis, with no offsetting changes in the valuation of related liabilities. These include assets such as hedge funds, private equities, real estate limited partnerships, convertible bonds and structured products. Underlying earnings exclude any over- or underperformance compared to management’s long-term expected return on these assets. Based on current holdings and asset class returns, the long-term expected return on an annual basis is 8-10%, depending on the asset class, including cash income and market value changes. The expected earnings from these assets classes are net of DPAC where applicable.

In addition, certain products offered by AEGON Americas contain guarantees and are reported on a fair value basis, including the segregated funds offered by AEGON Canada and the total return annuity products of AEGON USA. The earnings on these products are impacted by movements in equity markets and risk free interest rates. Short-term developments in the financial markets may therefore cause volatility in earnings. Included in underlying earnings is a long-term expected return on these products and any over- or underperformance compared to management’s expected return is excluded from underlying earnings.

The Holding includes certain issued bonds that are held at fair value through profit or loss. The interest rate risk on these bonds is hedged using swaps. The widening of AEGON’s credit spread resulted in a gain of EUR 87 mln on the fair value movement on these bonds.

Local knowledge. Global power. | Page 25 of 37

SALES

| EUR millions | 1Q 2008 | 1Q 2007 | % | ||||||

New life sales | 686 | 826 | (17 | ) | |||||

Gross deposits (on and off balance) | 8,636 | 12,976 | (33 | ) | |||||

New life sales | |||||||||

Life single premiums | 2,757 | 3,875 | (29 | ) | |||||

Life recurring premiums annualized | 410 | 438 | (6 | ) | |||||

Total recurring plus 1/10 single | 686 | 826 | (17 | ) | |||||

Life | 284 | 308 | (8 | ) | |||||

Pensions | 352 | 410 | (14 | ) | |||||

BOLI/COLI | 9 | 46 | (80 | ) | |||||

Reinsurance | 41 | 62 | (34 | ) | |||||

Total recurring plus 1/10 single | 686 | 826 | (17 | ) | |||||

New premium production accident and health insurance | 166 | 176 | (6 | ) | |||||

New premium production general insurance | 16 | 12 | 33 | ||||||

Gross deposits (on and off balance) | |||||||||

Fixed annuities | 306 | 193 | 59 | ||||||

Variable annuities | 685 | 683 | 0 | ||||||

Saving products | 648 | 569 | 14 | ||||||

Retail mutual funds | 564 | 584 | (3 | ) | |||||

Pensions and asset management | 3,183 | 3,161 | 1 | ||||||

Institutional guaranteed products | 3,249 | 7,786 | (58 | ) | |||||

Reinsurance | 1 | 0 | N.M. | ||||||

Total gross deposits | 8,636 | 12,976 | (33 | ) | |||||

Net deposits (on and off balance) by line of business | |||||||||

Fixed annuities | (795 | ) | (1,316 | ) | 40 | ||||

Variable annuities | (152 | ) | (175 | ) | 13 | ||||

Saving deposits | (72 | ) | (65 | ) | (11 | ) | |||

Retail mutual funds | 171 | 192 | (11 | ) | |||||

Pensions and asset management | 1,170 | (264 | ) | N.M. | |||||

Institutional guaranteed products | (1,195 | ) | 1,946 | N.M. | |||||

Reinsurance | (15 | ) | 0 | N.M. | |||||

Total net deposits | (888 | ) | 318 | N.M. | |||||

| EMPLOYEE NUMBERS | |||||||||

| At Mar. 31 2008 | At Dec. 31 2007 | ||||||||

Number of employees | 30,734 | 30,414 | |||||||

Local knowledge. Global power. | Page 26 of 37

VALUE OF NEW BUSINESS AND IRR

| VNB | VNB | IRR | IRR | ||||||||||

| EUR millions, after tax | Notes | EUR 1Q 2008 | EUR 1Q 2007 | % | % 1Q 2008 | % 1Q 2007 | |||||||

Americas | 79 | 113 | (30 | ) | 12.6 | 12.8 | |||||||

The Netherlands | 12 | 15 | (20 | ) | 10.7 | 13.4 | |||||||

United Kingdom | 53 | 58 | (9 | ) | 13.0 | 12.5 | |||||||

Asia | 5 | 12 | (58 | ) | 17.0 | 13.2 | |||||||

Central and Eastern Europe | 23 | 14 | 64 | 39.0 | 47.7 | ||||||||

Other European Countries | 14 | 21 | (33 | ) | 43.2 | 47.2 | |||||||

Total | 186 | 232 | (20 | ) | 18.4 | 17.9 |

MODELED NEW BUSINESS, APE AND DEPOSITS

| EUR millions | Notes | Premium business APE | Deposit business Deposits | |||||||

| 12 | ||||||||||

Americas | 295 | 335 | 5,997 | 10,807 | ||||||

The Netherlands | 73 | 67 | 0 | 0 | ||||||

United Kingdom | 378 | 446 | 0 | 0 | ||||||

Asia | 17 | 35 | 7 | 0 | ||||||

Central and Eastern Europe | 25 | 27 | 17 | 3 | ||||||

Other European Countries | 59 | 64 | 6 | 4 | ||||||

Total | 847 | 975 | 6,026 | 10,814 | ||||||

VNB/PVNBP SUMMARY

| Premium business | Deposit business | |||||||||||||||||

| VNB | PVNBP | VNB/ PVNBP | VNB/ APE | VNB | PVNBP | VNB/ PVNBP | VNB/ Deposits | |||||||||||

| EUR millions | Notes | 1Q 2008 | % | % | 1Q 2008 | % | % | |||||||||||

| 13 | ||||||||||||||||||

Americas | 49 | 1,438 | 3.4 | 16.5 | 30 | 6,828 | 0.4 | 0.5 | ||||||||||

The Netherlands | 12 | 625 | 1.9 | 16.2 | 0 | 0 | — | — | ||||||||||

United Kingdom | 53 | 2,573 | 2.0 | 13.9 | 0 | 0 | — | — | ||||||||||

Asia | 5 | 99 | 4.6 | 26.6 | 1 | 51 | 1.3 | 10.0 | ||||||||||

Central and Eastern Europe | 12 | 166 | 7.1 | 48.2 | 12 | 400 | 2.9 | 68.6 | ||||||||||

Other European Countries | 14 | 542 | 2.6 | 23.5 | 0 | 6 | 3.1 | 3.1 | ||||||||||

Total | 144 | 5,444 | 2.6 | 16.9 | 42 | 7,284 | 0.6 | 0.7 | ||||||||||

Local knowledge. Global power. | Page 27 of 37

Notes:

1) | 2007 Q1 information has been adjusted to reflect the retrospective application of the change in accounting principles relating to guarantees in the Netherlands and, where applicable, the change in definition of operating earnings to include AEGON’s share in the net results of associates and a new line of business format. These changes were implemented in Q2 2007. |

2) | Certain assets held by AEGON Americas and AEGON The Netherlands are carried at fair value, and managed on a total return basis, with no offsetting changes in the valuation of related liabilities. These include assets such as hedge funds, private equities, real estate limited partnerships and convertible bonds. Underlying earnings exclude any over- or underperformance compared to management’s long-term expected return on these assets. |

In addition, certain products offered by AEGON Americas contain guarantees and are reported on a fair value basis, including the segregated funds offered by AEGON Canada and the total return annuity products of AEGON USA. The earnings on these products are impacted by movements in equity markets and risk free interest rates. Short-term developments in the financial markets may therefore cause volatility in earnings. Included in underlying earnings is a long-term expected return on these products and any over- or underperformance compared to management’s expected return is excluded from underlying earnings.

The Holding includes certain issued bonds that are held at fair value through profit or loss. The interest rate risk on these bonds is hedged using swaps. The widening of AEGON’s credit spread resulted in a gain of EUR 87 million on the fair value movement on these bonds. Underlying earnings exclude this amount.

3) | Net income refers to net income attributable to equity holders of AEGON N.V. |

4) | New life sales is defined as new recurring premiums + 1/10 of single premiums. |

5) | Deposits on and off balance sheet. |

6) | Return on equity is calculated by dividing the net underlying earnings after cost of leverage by the average shareholders’ equity excluding the preferred shares and the revaluation reserve. |

7) | As of 2008, Real estate for own use (both general account and for account of policyholders) has been reclassified from revenue generating investments to other assets. |

8) | Capital securities that are denominated in foreign currencies are, for purposes of calculating the capital base ratio, revalued to the period-end exchange rate. |

9) | All ratios exclude AEGON’s revaluation reserve. |

10) | Included in other non-operating income/(charges) are charges made to policyholders with respect to income tax. |

There is an equal and opposite tax charge which is reported in the line Income tax attributable to policyholder return.

11) | Includes production on investment contracts without a discretionary participation feature of which the proceeds are not recognized as revenues but are directly added to our investment contract liabilities. |

12) | APE = recurring premium + 1/10 single premium. |

13) | PVNBP: Present Value New Business Premium. |

Local knowledge. Global power. | Page 28 of 37

Appendix III - Financial information

CONDENSED CONSOLIDATED BALANCE SHEETS

| EUR millions | At Mar. 31 2008 | At Dec. 31 2007 | % | ||||||||

Investments general account | 125,359 | 132,861 | (6 | ) | |||||||

Investments for account of policyholders | 126,273 | 142,384 | (11 | ) | |||||||

Investments in associates | 470 | 472 | (0 | ) | |||||||

Deferred expenses and rebates | 11,082 | 11,488 | (4 | ) | |||||||

Other assets and receivables | 18,948 | 18,484 | 3 | ||||||||

Cash and cash equivalents | 10,383 | 8,431 | 23 | ||||||||

Total assets | 292,515 | 314,120 | (7 | ) | |||||||

Shareholders’ equity | 12,597 | 15,151 | (17 | ) | |||||||

Other equity instruments | 4,801 | 4,795 | 0 | ||||||||

Minority interest | 15 | 16 | (6 | ) | |||||||

Group equity | 17,413 | 19,962 | (13 | ) | |||||||

Insurance contracts general account | 84,394 | 88,496 | (5 | ) | |||||||

Insurance contracts for account of policyholders | 70,543 | 78,394 | (10 | ) | |||||||

Investment contracts general account | 33,636 | 36,089 | (7 | ) | |||||||

Investment contracts for account of policyholders | 55,875 | 63,756 | (12 | ) | |||||||

Other liabilities | 30,654 | 27,423 | 12 | ||||||||

Total equity and liabilities | 292,515 | 314,120 | (7 | ) | |||||||

CAPITAL BASE | |||||||||||

Group equity | 17,413 | 19,962 | (13 | ) | |||||||

Trust pass-through securities | 137 | 143 | (4 | ) | |||||||

Subordinated borrowings | 34 | 34 | 0 | ||||||||

Senior debt related to insurance activities | 1,313 | 1,255 | 5 | ||||||||

Total capital base | 18,897 | 21,394 | (12 | ) | |||||||

| CONDENSED CONSOLIDATED INCOME STATEMENT | |||||||||||

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Premium income | 6,315 | 7,352 | (14 | ) | |||||||

Investment income | 2,422 | 2,562 | (5 | ) | |||||||

Fee and commission income | 434 | 459 | (5 | ) | |||||||

Other revenues | 1 | 2 | (50 | ) | |||||||

Total revenues | 9,172 | 10,375 | (12 | ) | |||||||

Income from reinsurance ceded | 335 | 438 | (24 | ) | |||||||

Results from financial transactions | (8,900 | ) | 1,479 | N.M. | |||||||

Total income | 607 | 12,292 | (95 | ) | |||||||

Benefits and expenses | 270 | 11,258 | (98 | ) | |||||||

Impairment charges | 34 | (2 | ) | N.M. | |||||||

Interest charges and related fees | 95 | 97 | (2 | ) | |||||||

Total charges | 399 | 11,353 | (96 | ) | |||||||

Share in net results of associates | 9 | 7 | 29 | ||||||||

Income before tax | 217 | 946 | (77 | ) | |||||||

Income tax | (64 | ) | (239 | ) | (73 | ) | |||||

Net income attributable to equity holders of AEGON N.V. | 153 | 707 | (78 | ) | |||||||

Net income per common share | |||||||||||

Basic earnings per share | 0.07 | 0.42 | (83 | ) | |||||||

Dilluted earnings per share | 0.07 | 0.42 | (83 | ) | |||||||

Local knowledge. Global power. | Page 29 of 37

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| EUR millions | At Mar. 31 2008 | At Dec. 31 2007 | ||||

Shareholders’ equity at January 1 | 15,151 | 18,605 | ||||

Net income | 153 | 2,551 | ||||

Movements in foreign currency translations reserve | (1,066 | ) | (1,445 | ) | ||

Movements in revaluation reserves | (1,510 | ) | (2,164 | ) | ||

Total recognized net income for the period | (2,423 | ) | (1,058 | ) | ||

Dividends paid on ordinary shares | 0 | (583 | ) | |||

Preferred dividend | 0 | (85 | ) | |||

Repurchased and sold own shares | (73 | ) | (1,438 | ) | ||

Coupons on perpetuals (net of tax) | (46 | ) | (175 | ) | ||

Other changes | (12 | ) | (115 | ) | ||

Shareholders’ equity at end of period | 12,597 | 15,151 | ||||

CONDENSED CONSOLIDATED CASH FLOW STATEMENTS

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Cash flow from operating activities | 1,615 | 2,711 | (40 | ) | |||||||

Cash flow from investing activities | |||||||||||

Purchase and disposal of intangible assets | (1 | ) | (1 | ) | 0 | ||||||

Purchase and disposal of equipment | (11 | ) | (8 | ) | (38 | ) | |||||

Purchase, disposal and dividends of subsidiaries and associates | (6 | ) | (256 | ) | 98 | ||||||

| (18 | ) | (265 | ) | 93 | |||||||

Cash flow from financing activities | |||||||||||

Issuance and purchase of share capital | (73 | ) | (114 | ) | 36 | ||||||

Issuance, repayment and coupuons of perpetuals | (62 | ) | (55 | ) | (13 | ) | |||||

Issuance, repayment and finance interest on borrowings | 810 | 108 | N.M. | ||||||||

| 675 | (61 | ) | N.M. | ||||||||

Net increase/ (decrease) in cash and cash equivalents | 2,272 | 2,385 | (5 | ) | |||||||

Local knowledge. Global power. | Page 30 of 37

AMOUNTS PER COMMON SHARE

| Notes | 1Q 2008 | 1Q 2007 | % | ||||||||

| 1 | |||||||||||

Net income in EUR | 2 | 0.07 | 0.42 | (83 | ) | ||||||

Net income fully diluted in EUR | 2 | 0.07 | 0.42 | (83 | ) | ||||||

Net income in USD | 0.10 | 0.55 | (82 | ) | |||||||

Net income fully diluted in USD | 0.10 | 0.55 | (82 | ) | |||||||

Net operating earnings in EUR | 2 | 0.15 | 0.28 | (46 | ) | ||||||

Net operating earnings fully diluted in EUR | 2 | 0.15 | 0.28 | (46 | ) | ||||||

Net operating earnings in USD | 0.22 | 0.37 | (41 | ) | |||||||

Net operating earnings fully diluted in USD | 0.22 | 0.37 | (41 | ) | |||||||

| At Mar. 31 2008 | At Dec. 31 2007 | ||||||||||

Shareholders’ equity in EUR | 3 | 7.03 | 8.69 | ||||||||

Shareholders’ equity in USD | 3 | 11.12 | 12.79 | ||||||||

NET INCOME PER COMMON SHARE CALCULATION | |||||||||||

| EUR millions (except per share data) | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Net income | 153 | 707 | (78 | ) | |||||||

Coupons on perpetuals | (46 | ) | (41 | ) | (12 | ) | |||||

Net income attributable to ordinary shareholders | 107 | 666 | (84 | ) | |||||||

Weighted average number of ordinary shares outstanding | 1,499 | 1,581 | (5 | ) | |||||||

Net income per share | 0.07 | 0.42 | (83 | ) | |||||||

Quarterly net income per share | |||||||||||

first quarter | 0.07 | 0.42 | (83 | ) | |||||||

second quarter | 0.34 | ||||||||||

third quarter | 0.31 | ||||||||||

fourth quarter | 0.40 | ||||||||||

Local knowledge. Global power. | Page 31 of 37

SEGMENT REPORTING

| EUR millions | Notes | 1Q 2008 | 1Q 2007 | % | |||||||

| 1 | |||||||||||

Operating earnings before tax geographically | |||||||||||

Americas | 104 | 505 | (79 | ) | |||||||

The Netherlands | 84 | 99 | (15 | ) | |||||||

United Kingdom | 45 | 66 | (32 | ) | |||||||

Other countries | 39 | 29 | 34 | ||||||||

Holding and other activities | 64 | (56 | ) | N.M. | |||||||

Eliminations | 6 | (2 | ) | N.M. | |||||||

Total operating earnings before tax | 342 | 641 | (47 | ) | |||||||

Revenues geographically | |||||||||||

Americas | 3,341 | 4,005 | (17 | ) | |||||||

The Netherlands | 2,368 | 2,218 | 7 | ||||||||

United Kingdom | 2,914 | 3,504 | (17 | ) | |||||||

Other countries | 533 | 631 | (16 | ) | |||||||

Holding and other activities | 60 | 222 | (73 | ) | |||||||

Eliminations | (44 | ) | (205 | ) | 79 | ||||||

Total revenues | 9,172 | 10,375 | (12 | ) | |||||||

Revenues | |||||||||||

Life insurance gross premiums | 5,573 | 6,566 | (15 | ) | |||||||

Accident and health insurance | 569 | 615 | (7 | ) | |||||||

General insurance | 173 | 171 | 1 | ||||||||

Total gross premiums | 6,315 | 7,352 | (14 | ) | |||||||

Investment income | 2,422 | 2,562 | (5 | ) | |||||||

Fee and commission income | 434 | 459 | (5 | ) | |||||||

Other revenues | 1 | 2 | (50 | ) | |||||||

Total revenues | 9,172 | 10,375 | (12 | ) | |||||||

Local knowledge. Global power. | Page 32 of 37

INVESTMENTS GEOGRAPHICALLY

amounts in million EUR (unless otherwise stated)

Americas | United Kingdom GBP | At March 31, 2008 | Americas | The Netherlands | United Kingdom | Other countries | Holdings, other activities & eliminations | Total EUR | |||||||||

| Investments | |||||||||||||||||

| 2,095 | 46 | Shares | 1,325 | 1,921 | 58 | 194 | 91 | 3,589 | |||||||||

| 96,170 | 4,182 | Bonds | 60,821 | 18,287 | 5,255 | 3,977 | 21 | 88,361 | |||||||||

| 19,626 | 5 | Loans | 12,412 | 9,094 | 6 | 611 | 0 | 22,123 | |||||||||

| 13,554 | 0 | Other financial assets | 8,572 | 97 | 0 | 96 | 0 | 8,765 | |||||||||

| 727 | 0 | Investments in real estate | 460 | 2,061 | 0 | 0 | 0 | 2,521 | |||||||||

| 132,172 | 4,233 | Investments general account | 83,590 | 31,460 | 5,319 | 4,878 | 112 | 125,359 | |||||||||