QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

THE MIDDLEBY CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

N/A | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notes:

THE MIDDLEBY CORPORATION

1400 Toastmaster Drive

Elgin, Illinois 60120

November 21, 2003

Notice of Special Stockholders Meeting:

You are hereby notified that a Special Meeting of Stockholders of The Middleby Corporation (the "Company") will be held at the Company's offices located at 1400 Toastmaster Drive, Elgin, Illinois 60120 at 10:30 a.m., local time, on Monday, December 15, 2003, for the following purposes:

- 1.

- To consider and act on a proposal to approve certain amendments to the Management Incentive Plan; and

- 2.

- To consider and act on a proposal to approve certain amendments to the 1998 Stock Incentive Plan.

The Board of Directors has fixed the close of business on November 12, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at the Special Meeting.

You are urged to attend the Special Meeting in person. Whether or not you expect to be present in person at the Special Meeting, please vote, sign and date the enclosed proxy and return it in the envelope provided.

By Order of the Board of Directors

DAVID B. BAKER

Secretary

THE MIDDLEBY CORPORATION

1400 Toastmaster Drive

Elgin, Illinois 60120

SPECIAL MEETING OF STOCKHOLDERS

DECEMBER 15, 2003

PROXY STATEMENT

GENERAL

This Proxy Statement and the accompanying proxy are furnished to stockholders of The Middleby Corporation (the "Company") in connection with the solicitation of proxies by the Company's Board of Directors for use at a Special Meeting of Stockholders (the "Meeting") to be held at the Company's facility located at 1400 Toastmaster Drive, Elgin, Illinois 60120, at 10:30 a.m., local time, on Monday, December 15, 2003, for the purposes set forth in the accompanying Notice of Meeting. The Proxy Statement and the form of proxy included herewith is being mailed to stockholders on or about November 21, 2003.

Stockholders of record at the close of business on November 12, 2003 are entitled to notice of and to vote at the Meeting. On such date there were outstanding 9,207,875 shares of common stock, par value $0.01 per share, of the Company ("Common Stock"). The presence, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding and entitled to vote at the Meeting is necessary to constitute a quorum. In deciding all questions, each holder of Common Stock will be entitled to one vote, in person or by proxy, for each share held on the record date.

Votes cast by proxy or in person at the Meeting will be tabulated by the election inspectors appointed for the Meeting, who will determine whether or not a quorum is present. The election inspectors will treat abstentions as shares that are present and entitled to vote but as not voted for purposes of determining the approval of any matter submitted to the stockholders for a vote. Abstentions will have the same effect as negative votes. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter.

Properly executed proxies will be voted in the manner directed by the stockholders. If no direction is made, such proxies will be votedFOR approval of the amendments to the Management Incentive Plan described below under the caption "Approval of Amendments to the Management Incentive Plan" andFOR approval of the amendments to the 1998 Stock Incentive Plan described below under the caption "Approval of Amendments to the 1998 Stock Incentive Plan".

Any proxy may be revoked by the stockholder at any time prior to the voting thereof by notice in writing to the Secretary of the Company, either prior to the Meeting (at the above Elgin address) or at the Meeting if the stockholder attends in person. A later dated proxy will revoke a prior dated proxy. As of the date of this Proxy Statement, the Board of Directors knows of no other business which will be presented for consideration at the Meeting. If other proper matters are presented at the Meeting, however, it is the intention of the proxy holders named in the enclosed form of proxy to take such actions as shall be in accordance with their best judgment.

1

The information contained in this Proxy Statement relating to the security holdings of directors and officers of the Company and their transactions with the Company is based upon information received from each individual as of March 28, 2003 and updated as of November 12, 2003.

The Compensation Committee, at its meetings in October and November, 2003, approved certain changes to the compensation packages for William F. Whitman, Jr., Chairman of the Board of Directors of the Company, and Selim A. Bassoul, President and Chief Executive Officer of the Company. Certain of these changes to the compensation packages cannot be implemented without approval by the Company's stockholders as described below under the captions "Approval of Amendments to Management Incentive Plan" and "Approval of Amendments to 1998 Stock Incentive Plan". The Board of Directors believes that it is important to provide management with compensation packages that will retain and provide incentives to key executive officers and senior managers. Approval of the proposals described below will provide the Company with the flexibility needed to achieve this goal.

PROPOSAL NO. 1

APPROVAL OF AMENDMENTS TO MANAGEMENT INCENTIVE PLAN

The Compensation Committee has adopted certain amendments to The Middleby Corporation Management Incentive Plan that (i) increase the maximum bonus that can be paid to any eligible employee for any particular year to $2,400,000; (ii) permit the Compensation Committee to pay a pro rata bonus under the Management Incentive Plan to an otherwise eligible employee who was involuntarily terminated by the Company during the fiscal year, provided that such employee was not terminated for cause and further provided that the pre-established performance goals approved by the Compensation Committee are attained; and (iii) permit the Compensation Committee to pay pro rata bonuses, based on attainment of prorated performance goals, prior to the end of the fiscal year. The Management Incentive Plan, which was originally approved by the stockholders in 2001, is intended to be a performance-based compensation program, the compensation payable under which is not subject to the $1,000,000 limitation on deductible compensation set forth in Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code").

Under the Management Incentive Plan, as originally adopted and approved by the stockholders in 2001, executive officers of the Company and other key employees selected by the Compensation Committee who have been employed by the Company for at least six months are eligible to receive incentive compensation under the Management Incentive Plan, provided that they are employed by the Company on the last day of the fiscal year. Payments under the Management Incentive Plan for any fiscal year are based on attainment of pre-established performance goals approved by the Compensation Committee relating to the Company's adjusted earnings before interest, income taxes, depreciation and amortization ("EBITDA") for such fiscal year. The maximum amount that can be paid for any fiscal year to any covered employee under the Management Incentive Plan is $1,822,000. Payments under the Management Incentive Plan are made in cash after completion of the year end audit, generally on or about March 1 following the fiscal year end. William F. Whitman, Jr., Selim A. Bassoul, David B. Baker, Timothy J. FitzGerald and certain other senior managers of the Company participated in the Management Incentive Plan in fiscal 2002.

If the stockholders approve the amendments to the Management Incentive Plan, the following will occur: (i) the maximum bonus payable to an eligible employee will increase from $1,822,000 to $2,400,000; (ii) the Compensation Committee will have the flexibility to pay pro rata bonuses to employees who

2

would otherwise be eligible, but who are not employed on the last day of the fiscal year, provided that the pre-established performance goals approved by the Compensation Committee are attained; and (iii) the Compensation Committee will have the flexibility to pay pro rata bonuses based on a period shorter than a full fiscal year, subject to attainment of prorated pre-established performance goals.

Vote Required for Approval; Board Recommendation

The affirmative vote of a majority of outstanding shares voted by holders of Common Stock at the Meeting at which a quorum is present is necessary to approve this proposal. If the proposal is not approved, the changes to the Management Incentive Plan will not be implemented.

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE IN FAVOR OF APPROVAL OF THE AMENDMENTS TO THE MANAGEMENT INCENTIVE PLAN.

PROPOSAL NO. 2

APPROVAL OF AMENDMENTS TO THE 1998 STOCK INCENTIVE PLAN

The Board of Directors has adopted, subject to stockholder approval, amendments to the 1998 Stock Incentive Plan that (i) increase the number of shares available for grants by an additional 400,000 shares to an aggregate of 1,500,000 shares of Common Stock, and (ii) increase the number of shares with respect to which grants may be made to Messrs. Bassoul and Whitman in 2003 to 325,000 and 170,000, respectively.

The 1998 Stock Incentive Plan as originally adopted provided that grants could be made for an aggregate of 550,000 shares of Common Stock. It was amended, pursuant to stockholder approval in May 2002, to provide for an aggregate of 850,000 shares of Common Stock and further amended, pursuant to stockholder approval in May 2003, to provide for an aggregate of 1,100,000 shares of Common Stock. The 1998 Stock Incentive Plan as originally adopted provided that grants could not be made to any executive officer for more than 100,000 shares in any fiscal year. Pursuant to stockholder approval in 2002, the limitation was increased with respect to Mr. Bassoul to 200,000 shares for 2002. As a result of option grants and exercises, only an aggregate of 121,063 shares are available for future grants under the 1998 Stock Incentive Plan at November 12, 2003, and only 0 and 5,000 shares, respectively, are available in 2003 for grants to each of Messrs. Bassoul and Whitman.

The following will occur if stockholders approve the proposed amendments to the 1998 Stock Incentive Plan: (i) the aggregate number of shares of Common Stock available for grants under the 1998 Stock Incentive Plan will increase from 1,100,000 to 1,500,000 and (ii) the 2003 annual limit on grants to Messrs. Bassoul and Whitman will be increased to 325,000 and 170,000, respectively.

At November 12, 2003, an aggregate of 569,000 shares were covered by unexercised options under the 1998 Stock Incentive Plan; and to the extent that any of these options should expire or be forfeited, shares covered by such options may be re-granted under the 1998 Stock Incentive Plan.

On November 12, 2003, the last reported sale price of Common Stock on the Nasdaq National Market was $28.77 per share.

3

Description of the 1998 Stock Incentive Plan

The 1998 Stock Incentive Plan permits the granting of any or all of the following: (1) stock options, including incentive stock options, (2) stock appreciation rights ("SARs"), in tandem with stock options or free-standing, (3) restricted stock, and (4) performance stock.

The Board of Directors of the Company administers the 1998 Stock Incentive Plan. The Board has the authority to make grants and to determine their terms; provided, however, that the selection of eligible employees for participation and decisions concerning the timing, pricing and amount of a grant is made solely by a committee consisting of two or more directors. Under the provisions of the 1998 Stock Incentive Plan, the Board has the authority to interpret the provisions of the 1998 Stock Incentive Plan, to adopt any rules, procedures and forms necessary for the operation and administration of the 1998 Stock Incentive Plan, and to determine all questions relating to the eligibility and other rights of all persons under the 1998 Stock Incentive Plan. All employees of the Company and its subsidiaries and affiliates are eligible to be participants.

The number of shares of Common Stock available for grants under the 1998 Stock Incentive Plan is subject to adjustment if there is a merger, consolidation, stock dividend, split-up, combination, or exchange of shares, recapitalization or change in capitalization with respect to the shares of Common Stock. The shares of stock deliverable under the 1998 Stock Incentive Plan may consist in whole or in part of unissued shares or reacquired shares. If a grant expires or is canceled, any shares which were not issued or fully vested under the grant at the time of expiration or cancellation will again be available for grants.

Options may be either "Incentive Stock Options", as defined in Section 422 of the Code, or options not intended to be so qualified ("Non-qualified Options"). The Board may grant more than one option to a participant during the life of the 1998 Stock Incentive Plan, and such option may be in addition to an option or options previously granted. However, the aggregate fair market value of stock with respect to which Incentive Stock Options are exercisable for the first time by such individual during any calendar year (under all stock option plans of the Company and its subsidiaries) may not exceed $100,000. Incentive Stock Options shall be exercisable at no less than 100% of the fair market value of the shares on the date of grant, subject to anti-dilution provisions. However, if any Incentive Stock Option is granted to an individual who owns more than 10% of the total combined voting power of all classes of stock of the Company, actually or constructively under Section 424 of the Code, such option shall be exercisable at 110% of the fair market value of the stock subject to the option. Non-qualified Options may be granted at less than 100% of the fair market value of shares on the date of grant.

To comply with Section 162(m) of the Code with respect to future grants of options, the 1998 Stock Incentive Plan (i) limits the number of shares to which options may be granted to each executive officer whose compensation is required to be reported in the Company's annual proxy statement (an "Executive Officer") to 100,000 during any fiscal year during which such person serves as an Executive Officer (except that in fiscal year 2002, pursuant to stockholder approval, Mr. Bassoul received a one-time grant of options for 200,000 shares); and (ii) provides that certain required decisions concerning grants under the 1998 Stock Incentive Plan will be made by a committee of "outside directors" appointed by the Board of Directors. Section 162(m) of the Code limits the deductible compensation paid to Executive Officers of publicly held corporations to $1,000,000. Any taxable compensation which is recognized by an Executive Officer upon (i) the exercise of a nonstatutory option or (ii) a disqualifying disposition of stock acquired under an incentive stock option, is subject to the limit. However, the limit will not apply if the options are granted under a stockholder-approved plan document which specifies the maximum number of option shares that can be granted to an Executive Officer during the corporation's tax year,

4

provided that each grant is determined by a directors' committee which is comprised solely of "outside directors".

Options granted pursuant to the 1998 Stock Incentive Plan will generally be transferable only by will or by laws governing descent and distribution, and during the lifetime of an optionee, will be exercisable only by the optionee. However, subject to the approval of the Board, the 1998 Stock Incentive Plan provides that an option may be transferable, as permitted under the Securities Exchange Act of 1934 (the "Exchange Act"), as long as such transfers are made to one or more of the following: family members, including children of the optionee, the spouse of the optionee, or grandchildren of the optionee, trusts for such family members or charities ("Transferees"), and provided that such transfer is a bona fide gift and, accordingly, the optionee receives no consideration for the transfer, and that the options transferred continue to be subject to the same terms and conditions that were applicable to the options immediately prior to the transfer. In the event of such a transfer, the Transferee may not subsequently transfer such option. However, the designation of a beneficiary will not constitute a transfer.

No option will be exercisable following three months after termination of employment with the Company (or such shorter or longer period as the option may provide) unless such termination of employment occurs by reason of disability or death. In the event of the disability or death of an optionee while an employee of the Company or any subsidiary of the Company, the options or unexercisable portions thereof, to the extent exercisable on the date of disability or death, shall be exercisable at any time for a period not to exceed the expiration of one year from the date of disability or death (or such shorter period as the option may provide). In no event, however, shall an option be exercisable after the expiration of ten years from the date such option was granted (five years in the case of Incentive Stock Options granted to an optionee owning more than 10% of the voting power of stock of the Company as contemplated by Section 425 (d) of the Code), or beyond the term for which it was granted.

Payment for shares of Common Stock purchased upon exercise of an option granted under the 1998 Stock Incentive Plan shall be made in full at the time of such exercise, whether in cash, shares of Common Stock (valued at fair market value), or, except as prohibited by law, by a note payable to the Company, or in a combination of cash, notes and shares of stock. Under this provision, "pyramiding" of the shares may be allowed. In pyramiding, an optionee requests the Company to apply the shares received upon exercise of a portion of an option to satisfy the purchase price for additional portions of the option. The effect of pyramiding is to allow an optionee to deliver a relatively small number of shares in satisfaction of the purchase price of even the largest option. The technique yields an optionee no more than the appreciation or "spread" inherent in the exercise of the option.

A SAR may be granted free-standing or in tandem with new options. However, a SAR which is issued in tandem with an Incentive Stock Option will be subject to the following: (i) it will expire no later than at the expiration of the Incentive Stock Option; (ii) payment under the SAR will not exceed 100% of the difference between the exercise price of the option and the fair market value of stock on the date the SAR is exercised; (iii) it will be transferable only when the option is transferable, and under the same conditions; (iv) it will be exercisable only when the option is exercisable; and (v) it may only be exercised when the fair market value of the Company's stock exceeds the exercise price of the option. Payment by the Company upon exercise of a SAR will be in cash, stock, or any combination thereof as the Board shall determine.

The 1998 Stock Incentive Plan provides that each grant of restricted stock shall include a description of the restrictions applicable to the grant and the conditions on which the restrictions may be removed. Each grant will also provide whether the recipient must pay any amount in connection with the grant and, if so, the amount and terms of that payment. Such amount shall not exceed 10% of the fair market value

5

of the restricted stock at the time the grant is made, and may be for such lesser amount as shall be determined by the Board of Directors.

The 1998 Stock Incentive Plan provides that each grant of performance stock shall include a description of any applicable provisions relating to the performance period and performance criteria. Performance stock awards offer certain employees the potential for substantial financial incentives (in addition to potential appreciation in the value of Common Stock) based on continued service and the achievement of long-term Company performance goals, but in a manner that also places such employees at risk in the event of poor Company performance. The Company offers the opportunity to purchase a specified number of Company shares at market price to selected employees pursuant to a performance award structure. The amount of shares to be granted will be at the discretion of the 1998 Stock Incentive Plan committee.

Except as prohibited by law, the purchase of shares under the structure is fully financed by full-recourse interest-bearing loans provided by the Company. Purchasing employees are also eligible to receive a deferred cash incentive award at the end of a 5-year incentive period. Two-thirds of the incentive award will be based on Company performance criteria during the performance period. The remaining one-third of the incentive award are be based on the participant's continued service with the Company until the end of the performance period. The maximum incentive award (based on achievement of certain target performance goals) is equal to the amount of the loan plus accrued interest through the date of the award payment. The portion of the incentive award attributable to Company performance criteria varies based on the degree of achievement of the performance requirement. Currently, the initial award performance criteria are be based on the Company's earnings per share. The Company reserves the right to alter the structure of any performance stock award under the 1998 Stock Incentive Plan.

If there is a merger, consolidation, stock dividend, split-up, combination or exchange of shares, recapitalization or change in capitalization with respect to the shares of Common Stock, or any other corporate action with respect to the shares of Common Stock which, in the opinion of the Board, adversely affects the relative value of a grant, the number of shares and the exercise price (in the case of an option) of any grant which is outstanding at the time of that event will be adjusted by the Board to the extent necessary to remedy the adverse effect on the grant's value.

6

New Plan Benefits

1998 Stock Incentive Plan

One share of Common Stock underlies each option granted under the 1998 Stock Incentive Plan. The following table provides information, to the extent determinable, regarding the number of options that will be granted to each of the following under the 1998 Stock Incentive Plan if the amendments to the 1998 Stock Incentive Plan are approved by the Company's stockholders:

| Name and Position | Number of Options | |

|---|---|---|

| Selim A. Bassoul President, Chief Executive Officer and Director | 225,000 | |

William F. Whitman, Jr. Chairman of the Board | 75,000 | |

David B. Baker Vice President, Chief Administrative Officer and Secretary | 10,000 | |

Timothy J. FitzGerald Vice President and Chief Financial Officer | 35,000 | |

All current executive officers as a group | 345,000 | |

All current directors who are not executive officers as a group | None | |

Each associate of any such directors or executive officers | None | |

Each other person who received or is to receive 5 percent of such options | None | |

All current employees who are not executive officers as a group | 85,500 |

Federal Income Tax Consequences of the 1998 Stock Incentive Plan

With respect to Non-qualified Options, the difference between the option price and the fair market value of the stock on the date the option is exercised will be taxable as ordinary income to the optionee and will be deductible by the Company as compensation on such date. Gain or loss on the subsequent sale of such stock will be eligible for capital gain or loss treatment by the optionee and will have no federal income tax consequences to the Company.

An exchange of Common Stock in payment of the option price in the case of a Non-qualified Option is considered a tax-free exchange by the optionee to the extent of a like number of new shares, with the new shares retaining the basis and holding period of the old shares. The fair market value of any additional shares transferred to the optionee (representing the excess of the fair market value of all of the new shares over the fair market value of all of the old shares) will constitute ordinary income to the optionee and be deductible by the Company. This amount then becomes the optionee's basis in such shares.

With respect to Incentive Stock Options, if the optionee does not make a disqualifying disposition of stock acquired on exercise of such option, no income for federal income tax purposes will result to such optionee upon the granting or exercise of the option (except that the amount by which the fair market value of the stock at time of exercise exceeds the option price will be a tax preference item under the expanded alternative minimum tax), and in the event of any sale thereafter any amount realized in excess of cost will be taxed as long-term capital gain and any loss sustained will be long-term capital loss. In

7

such case, the Company will not be entitled to a deduction for federal income tax purposes in connection with the issuance or exercise of the option. A disqualifying disposition will occur if the optionee makes a disposition of such shares within two years from the date of the granting of the option or within one year after the transfer of such shares. If a disqualifying disposition is made, the difference between the option price and the lesser of (i) the fair market value of the stock at the time the option is exercised or (ii) the amount realized upon disposition of the stock will be treated as ordinary income to the optionee at the time of disposition and will be allowed as a deduction to the Company.

An exchange of Common Stock in payment of the option price in the case of an Incentive Stock Option, if the exchange is not a disqualifying disposition of the stock exchanged, is considered to be tax-free. Under proposed regulations, a number of shares received upon exercise equal to the number of shares exchanged will have a basis equal to the basis of the shares exchanged and the remaining shares received will have a zero basis.

An exchange of statutory option stock to acquire other stock on exercise of an Incentive Stock Option is a taxable recognition transaction with respect to the stock disposed of if the minimum statutory holding period for such statutory option stock has not been met. Statutory option stock includes stock acquired through exercise of an Incentive Stock Option, a restricted stock option or an option granted under an employee stock purchase plan. If there is such a premature disposition, ordinary income is attributed to the optionee (and will be deductible by the Company) to the extent of the optionee's "bargain" purchase on acquisition of the surrendered stock, and the post-acquisition appreciation in value of such stock is taxed to optionee as a short-term gain if held for less than the applicable holding period for long-term capital gains, and long-term capital gain if held for such applicable holding period, and will not be deductible by the Company.

A portion of the excess of the amount deductible by the Company over the value of options when issued may be subject to the alternative minimum tax imposed on corporations. With respect to SARs, the fair market value of shares issued and the amount of cash paid by the Company upon exercise of such rights will be taxable as ordinary income to the holder of the rights and will be deductible by the Company, in each case on the date of exercise. Gain or loss on the subsequent sale of such shares will be eligible for capital gain or loss treatment by the recipient and will have no federal income tax consequences to the Company.

With respect to grants of restricted stock, shares may be granted to an employee without recognition of income by the employee as long as the shares are not transferable and remain subject to a substantial risk of forfeiture. Upon the lapse of any restrictions on the transferability of the shares or the lapse of the conditions creating the risk of forfeiture, the employee is required to recognize ordinary income to the extent of the excess of the fair market value of the shares, determined at the time of the lapse of the applicable restrictions, over the price, if any, paid for the shares. The employee may, alternatively, elect to recognize income at the date of the award, in the amount of the then difference between the value of unrestricted shares and the price, if any, paid by the employee for the restricted shares. The Company is allowed a deduction in an amount equal to the income recognized by the employee in the year such income is recognized. Unless the election referred to above is made, dividends received during the continuation of restrictions on shares will be taxable to the employee as ordinary income for the periods in which such dividends are received, and such dividends will be deductible by the Company as compensation, Dividends received after such election has been made or after the restrictions cease to apply will be taxed as dividends to the employee and will not be deductible by the Company.

The tax consequences with respect to grants of performance stock will depend upon the structure of such awards.

8

The described tax consequences are based on current laws, regulations and interpretations thereof, all of which are subject to change. In addition, the discussion is limited to federal income taxes and does not attempt to describe state and local tax effects which may accrue to participants or the Company.

Vote Required for Approval; Board Recommendation

The affirmative vote of a majority of outstanding shares voted by holders of Common Stock at the Meeting at which a quorum is present is necessary to approve this proposal. If the proposal is not approved, the changes to the 1998 Stock Incentive Plan will not be implemented.

THE BOARD UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE IN FAVOR OF APPROVAL OF THE AMENDMENTS TO THE 1998 STOCK INCENTIVE PLAN.

HOLDINGS OF STOCKHOLDERS, DIRECTORS, AND EXECUTIVE OFFICERS

The following table sets forth, as of November 12, 2003, the name, address and holdings of each person known by the Company to be the beneficial owner of more than five percent of Common Stock, and the amount of Common Stock beneficially owned by each of the directors and executive officers of the Company and by all directors and executive officers of the Company as a group. The address of directors and executive officers is c/o The Middleby Corporation, 1400 Toastmaster Drive, Elgin, Illinois 60120.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent Of Class | |||

|---|---|---|---|---|---|

| Directors and Executive Officers | |||||

| William F. Whitman, Jr. | 2,023,774 shares(1) | 22.0 | % | ||

| Robert R. Henry | 835,500 shares(2)(3)(4)(5) | 9.1 | % | ||

| W. Fifield Whitman III | 549,446 shares(6)(7) | 6.0 | % | ||

| Laura B. Whitman | 459,625 shares(3)(4)(5)(7) | 5.0 | % | ||

| Selim A. Bassoul | 362,530 shares(8) | 3.9 | % | ||

| A. Don Lummus | 128,700 shares | 1.4 | % | ||

| David P. Riley | 67,130 shares(5)(9) | (10 | ) | ||

| Robert L. Yohe | 56,000 shares(3) | (10 | ) | ||

| Timothy J. FitzGerald | 36,510 shares(11) | (10 | ) | ||

| Sabin C. Streeter | 35,000 shares(5) | (10 | ) | ||

| David B. Baker | 34,333 shares(12) | (10 | ) | ||

| John R Miller III | 32,000 shares(4)(5) | (10 | ) | ||

| Philip G. Putnam | 24,000 shares(3)(4)(5) | (10 | ) | ||

| All directors and executive officers of the Company | 4,644,548 shares(1)-(9) & (11)-(12) | 50.3 | % | ||

Other 5% Owners | |||||

Dimensional Fund Advisors, Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | 683,244 shares(13) | 7.4 | % | ||

Corbyn Investment Management, Inc. Suite 108 2330 W. Joppa Road Lutherville, MD 21093 | 566,200 shares(14) | 6.1 | % |

9

NOTES:

- 1.

- Does not include 718,500 shares owned by the trusts described in Note 2 below, as to which Mr. Whitman disclaims beneficial ownership. Includes 255,300 shares owned by Mr. Whitman's spouse. Also included are 45,000 vested shares of Common Stock deemed issued upon exercise of stock options granted in October 2003.

- 2.

- Includes 718,500 shares of Common Stock held by Mr. Henry as trustee under trusts as follows: (a) 437,250 shares for the benefit of Mr. Whitman's two adult children, W. Fifield Whitman III and Laura B. Whitman (218,625 shares owned by a trust for the benefit of Laura B. Whitman and 218,625 shares owned by a trust for the benefit of W. Fifield Whitman III — See Note 7 below), and (b) 281,250 shares for the benefit of Mr. Whitman's spouse. Mr. Henry disclaims beneficial ownership of these shares.

- 3.

- Includes 15,000 vested shares of Common Stock deemed issued upon exercise of stock options granted in February 1996.

- 4.

- Includes 3,000 vested shares of Common Stock deemed issued upon exercise of stock options granted in May 2000.

- 5.

- Includes 3,000 vested shares of Common Stock deemed issued upon exercise of stock options granted in March 2003.

- 6.

- Includes 7,500 vested shares of Common Stock deemed issued upon exercise of stock options granted in May 2003.

- 7.

- Does not include 218,625 shares owned by Mr. Henry as trustee for the benefit of Laura B. Whitman or 218,625 shares owned by Mr. Henry as trustee for the benefit of W. Fifield Whitman III described in Note 2 above.

- 8.

- Includes 50,000 vested shares of Common Stock deemed issued upon exercise of stock options.

- 9.

- Includes 43,268 shares of Common Stock owned by trusts for the benefit of Mr. Riley's two adult children, for which Mr. Riley and his wife serve as trustees. Mr. Riley disclaims beneficial ownership of these shares.

- 10.

- Represents less than 1% of all common shares outstanding.

- 11.

- Mr. FitzGerald, age 35, is the Vice President and Chief Financial Officer of the Company. His holdings include 6,750 vested shares of Common Stock deemed issued upon exercise of stock options.

- 12.

- Mr. Baker, age 46, is the Vice President, Chief Administrative Officer and Secretary of the Company. His holdings include 5,000 vested shares of Common Stock deemed issued upon exercise of stock options.

- 13.

- Information taken from Amended Schedule 13G, filed February 12, 2003, which states that the information is as of December 31, 2002 and shows sole voting power as to 683,244 shares and sole power of disposition as to 683,244 shares. The Amended Schedule 13G states that all securities reported on the schedule are owned by advisory clients of Dimensional Fund Advisors, Inc. and that Dimensional Fund Advisors, Inc. disclaims beneficial ownership of all such securities.

- 14.

- Information taken from Amended Schedule 13G, filed January 9, 2003, which states that the information is as of December 31, 2002 and shows sole voting power as to 566,200 shares and sole power of disposition as to 566,200 shares. The Amended Schedule 13G states that the filer is a group consisting of a registered investment adviser and a registered investment company.

10

The following table sets forth information concerning the annual and long-term compensation for services to the Company in all capacities for the fiscal years ending December 28, 2002 (the "2002 fiscal year"), December 29, 2001 (the "2001 fiscal year"), and December 30, 2000 (the "2000 fiscal year"), received by those persons who were, during the 2002 fiscal year, (i) the chief executive officer and (ii) the most highly compensated executive officers of the Company whose total annual salary and bonus in the 2002 fiscal year exceeded $100,000.

SUMMARY COMPENSATION TABLE

| | | | | | Long-Term Compensation Awards | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Annual Compensation | | | |||||||||||||

| | Other Annual Compensation ($)(2) | Securities Underlying Options/ SARs(#)(3) | All Other Compensation ($)(4) | |||||||||||||

| Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($)(1) | |||||||||||||

| William F. Whitman, Jr. Chairman of the Board | 2002 2001 2000 | $ $ $ | 440,487 451,545 359,815 | $ $ $ | 1,185,000 825,000 684,960 | $ $ $ | 70,000 67,000 67,000 | 100,000 — — | $ $ $ | 16,151 16,847 12,423 | ||||||

Selim A. Bassoul President and Chief Executive Officer | 2002 2001 2000 | $ $ $ | 319,600 279,722 270,020 | $ $ $ | 1,185,000 825,000 920,000 | $ $ $ | 465,853 9,000 153,397 | 200,000 — — | $ $ $ | 8,071 8,251 176,514 | ||||||

David B. Baker Vice President, Chief Financial Officer and Secretary(5) | 2002 2001 2000 | $ $ $ | 134,429 124,042 116,316 | $ $ $ | 230,230 69,300 240,000 | — — — | 10,000 — 10,000 | $ $ $ | 8,634 9,000 6,447 | |||||||

NOTES:

- 1.

- Amounts in 2001 and 2002 include any amounts paid pursuant to the Company's Management Incentive Plan, described elsewhere in this Proxy Statement.

- 2.

- Amounts in 2002, 2001 and 2000 for Mr. Whitman represent director's fee for services to the Company and its subsidiaries. Mr. Bassoul's 2002 amount includes director's fee for services to the Company and its subsidiaries and the forgiveness of a debt plus interest upon reaching certain operating performance goals, his 2001 amount includes director's fees for services to the Company and its subsidiaries, and his 2000 amount includes the forgiveness of a debt plus interest upon reaching certain operating performance goals. Details of debt forgiveness transactions for Mr. Bassoul are described elsewhere in this Proxy Statement under "Employment Agreements".

- 3.

- Amounts represent options to purchase shares of Common Stock awarded under the Company's 1998 Stock Incentive Plan.

- 4.

- All Other Compensation consists of (a) the Company's Profit Sharing Contributions, (b) 401(k) Company Matching Contributions; (c) insurance premiums paid by the Company on a group term life insurance policy; and (d) relocation benefits paid. Individual amounts are as follows (amounts shown are for each of 2002, 2001 and 2000, respectively):

- (a)

- Messrs. Whitman, Bassoul, and Baker, received Profit Sharing Contributions of $5,863, $6,487 and $6,245.

- (b)

- 401(k) Company Matching Contributions for Mr. Whitman were $2,824, $2,830 and $0; for Mr. Bassoul were $1,833, $1,200 and $0; and for Mr. Baker were $2,399, $2,289 and $0.

- (c)

- Life insurance premiums paid by the Company for Mr. Whitman were $7,464, $7,530 and $6,178; for Mr. Bassoul were $375, $564 and $216; and for Mr. Baker were $372, $224 and $202.

11

- (d)

- Relocation expenses paid to Mr. Bassoul totaled $170,053 for the 2000 fiscal year.

- 5.

- Mr. Baker was Chief Financial Officer of the Company until May 16, 2003, at which time he became Chief Administrative Officer of the Company.

Employment Agreements

WILLIAM F. WHITMAN, JR. The Company and Middleby Marshall Inc. ("MM"), the Company's principal subsidiary, entered into an employment agreement with Mr. Whitman dated as of March 10, 1978, as amended and restated January 1, 1995, as amended as of January 1, 1998, as amended as of January 1, 2001, as amended as of April 16, 2002, and as amended as of January 2, 2003. The employment agreement, as amended, provides, among other things, for Mr. Whitman to serve as Chairman of the Board of Directors of the Company and Chairman of the Board of MM for a term ending December 31, 2006 and for a specified minimum amount of annual compensation. Such compensation was $600,000 effective January 1, 2003. In addition, the employment agreement provides that Mr. Whitman shall be entitled to certain retirement benefits in the event of Mr. Whitman's termination of employment for any reason, including death or disability, such payments to commence on the first day of the month following the date of such termination of employment. The Company has established, and transferred assets to, a grantor trust for satisfying the retirement benefit obligation under this employment agreement. Each monthly installment of retirement benefits shall be in an amount (subject to CPI adjustments) equal to one- twelfth (1/12) of 75% of Mr. Whitman's total compensation in effect during the last year of his employment with the Company. Retirement benefits will be paid to Mr. Whitman for his life, or if he dies before age 75, such benefits will be paid to his spouse until he would have attained age 75. In addition, the employment agreement provides that Mr. Whitman is eligible to participate in the Company's Management Incentive Plan, described elsewhere in this Proxy Statement.

The employment agreement gives both parties the right to terminate in the event of a breach (willful breach, if the Company is terminating) of the obligations of the other party under the agreement, with certain payments to Mr. Whitman in certain events. The agreement may also be terminated by the Company at any time without cause upon 90 days notice, such termination to be effective in two years, but in such event Mr. Whitman would be entitled to salary and bonus for such two-year period. After termination for any reason except breach by the Company or MM, the Company and MM may elect to pay Mr. Whitman his base salary for an additional year, in which event Mr. Whitman may not compete with the Company or MM for such period of time. Moreover, the agreement extends to Mr. Whitman the right to terminate his employment at any time during a two-year period following a change in control of the Company, and upon such termination Mr. Whitman is entitled to receive as severance pay an amount equal to two years of his base salary, all accrued but unpaid salary, and all retirement benefits under the agreement.

In addition, the Company maintains for the continued benefit of Mr. Whitman and his spouse all health and medical plans and programs which the Company maintains for its senior executives and their families. Mr. Whitman and his spouse are entitled to such health and medical benefits for life.

SELIM A. BASSOUL. The Company and MM entered into an employment agreement with Mr. Bassoul dated as of May 16, 2002 and as amended as of July 3, 2003. The employment agreement provides, among other things, for Mr. Bassoul to serve as President and Chief Executive Officer of the Company and of MM for a term ending December 31, 2006. Under the agreement, effective July 1, 2002, Mr. Bassoul receives an annual base salary of $360,000. Mr. Bassoul's annual base salary will be $400,000 effective January 1, 2004. The employment agreement further provides that Mr. Bassoul is eligible to participate in the Company's Management Incentive Plan, described elsewhere in this Proxy Statement. In addition, Mr. Bassoul was granted stock options with respect to 200,000 shares of Common Stock under the 1998 Stock Incentive Plan, plus options for an additional 50,000 shares if the

12

Company met its 2002 goal based on its earnings before interest, taxes, depreciation and amortization ("EBITDA"). Those stock options were approved at the 2002 annual meeting of the stockholders of the Company. The Company met its 2002 EBITDA goal.

The employment agreement gives both parties the right to terminate at any time. Under the employment agreement as amended, if the Company and MM terminate the agreement without cause or Mr. Bassoul's employment is terminated within the six-month period following a change in control, Mr. Bassoul will be entitled to payments for a period of 24 months following his termination date in an amount equal to his annual monthly salary in effect on such date. In addition, the Compensation Committee has approved the following additional changes to Mr. Bassoul's compensation package, which are to be reflected in amendments to his employment agreement: (i) the payment, in the event of involuntary termination of his employment for reasons other than cause (as defined in his employment agreement), of a pro rata bonus for the year in which the termination occurs, provided that the pre-approved performance goals for such year are attained (subject to stockholder approval as described in Proposal No. 1 above); (ii) an increase in the severance payable to Mr. Bassoul upon involuntary termination of his employment by the Company for reasons other than cause or upon his voluntary termination within six months of a change in control (as defined in his employment agreement) from two times his base salary to two times his base salary plus two times his bonus, provided, however, that such increase shall not be payable to the extent that all payments to Mr. Bassoul described in Section 280G(b)(2) of the Code, including such increase, constitute a parachute payment; and (iii) immediate vesting of his lifetime entitlement to health benefits for himself and his otherwise eligible dependents, rather than vesting at age 51 as now set forth in Mr. Bassoul's employment agreement.

In addition, Mr. Bassoul participates in two separate, special executive compensation plans. On November 8, 1999, the Company loaned Mr. Bassoul the sum of $434,250, which was repayable with interest of 6.08% as of February 28, 2003 and established in conjunction with 100,000 shares of Common Stock purchased at the market price by the Company on behalf of Mr. Bassoul. In accordance with a special incentive agreement with Mr. Bassoul, the loan and the related interest was to be forgiven by the Company if certain targets of earnings before taxes ("EBT") for fiscal years 2000, 2001 and 2002 were achieved. As of December 28, 2002, the entire loan had been forgiven as the financial targets established by the special incentive agreement had been achieved. One-third of the principal loan amount had been forgiven in fiscal year 2000 and the remaining two-thirds was forgiven in fiscal year 2002.

In March 2001, the Company loaned Mr. Bassoul the sum of $300,000 to pay for the purchase of 50,000 shares of Common Stock. The loan bears interest at the rate of 6.00% per annum. The Company agreed to forgive the indebtedness in increments over a three-year period if the Company reaches stated levels of EBT per share for fiscal years 2001, 2002 and 2003. The Company did not achieve the stated EBT level for fiscal year 2001, and, accordingly, no debt forgiveness occurred with respect to that time period. The Company did achieve its EBT level for fiscal year 2002. Therefore, as of December 28, 2002, one-third of the principal loan amount had been forgiven, and there was an outstanding principal loan balance of $200,000 plus interest as of November 12, 2003. If Mr. Bassoul voluntarily leaves the Company, the unforgiven portion of the loan becomes due.

DAVID B. BAKER. In June 2002, the Company and Mr. Baker entered into a two-year severance agreement which provides that in the event of Mr. Baker's involuntary termination of employment with the Company other than for cause, or in the event Mr. Baker voluntarily leaves the Company within six months after a change in control, Mr. Baker is entitled to severance pay equal to one year's base salary plus one year's continued health and medical benefits.

TIMOTHY J. FITZGERALD. In June 2002, the Company and Mr. FitzGerald entered into a two-year severance agreement which provides that in the event of Mr. FitzGerald's involuntary termination of

13

employment with the Company other than for cause, or in the event Mr. FitzGerald voluntarily leaves the Company within six months after a change in control, Mr. FitzGerald is entitled to severance pay equal to one year's base salary plus one year's continued health and medical benefits.

Tax Qualified Retirement Plans

The Company maintains two tax-qualified 401(k) plans for employees: (1) The Middleby Corporation Profit Sharing and Savings Plan and (2) The Middleby Corporation Union 401k Plan.

The Middleby Corporation Profit Sharing and Savings Plan is for employees and the employees of affiliated employers who are not union employees, non-resident aliens or leased employees. Each eligible employee becomes a participant upon employment. This plan provides for an annual discretionary profit sharing contribution by the Company and affiliated companies. The profit sharing contribution is allocated to individual accounts of participants in proportion to their compensation and is integrated with the applicable Social Security taxable wage base. A participant's profit sharing account begins vesting after 2 years of service with the Company and affiliated employers and is fully vested after 5 years of service. A participant whose employment terminates for reasons other than death, total disability or retirement on or after attaining age 65 is entitled only to the vested portion of his account. The Plan also permits participants to contribute to their own accounts on a pre-tax basis by means of compensation deferral elections. The portion of a participant's account that is attributable to compensation deferral contributions is always 100% vested. The Plan also permits the Company and affiliated employers to make matching contributions under the Savings Plan that are allocated to participants as a uniform percentage of their compensation deferral contributions for the same year. The portion of a participant's account that is attributable to matching contributions is subject to the same vesting rules that apply to that participant's profit sharing account. During the fiscal year ended December 28, 2002, the Company made Profit Sharing contributions of $600,000 and matching contributions of $421,301 to this plan. Aggregate contributions to executive officers in such fiscal year totaled an estimated $24,645.

The Middleby Corporation Union 401k Plan, adopted on July 1, 2002, is for the benefit of union employees working for the Middleby Cooking Systems Group in Elgin, Illinois. Each eligible employee becomes a participant upon employment. This Plan provides for an annual employer contribution to each union member of $500 on July, 1, 2002, $500 on January 1, 2003, $1,000 on January 1, 2004, $1,500 on January 1, 2005, $1,500 on January 1, 2006 and $1,500 on January 1, 2007. Employer contributions to participant's 401k accounts begin vesting after 2 years of service with the Company and affiliated employers and is fully vested after 5 years of service. A participant whose employment terminates for reasons other than death, total disability or retirement on or after attaining age 65 is entitled only to the vested portion of his account. The Plan also permits participants to contribute to their own accounts on a pre-tax basis by means of compensation deferral elections. The portion of a participant's account that is attributable to deferral reduction contributions is always 100% vested. The Plan also permits the Company to make matching contributions under the Union 401k Plan that are allocated to participants as a uniform percentage of their deferral reduction contributions for the same year. The portion of a participant's account that is attributable to matching contributions is subject to the same vesting rules that apply to that participant's employer contribution account. All union participants who were employed by the Middleby Corporation on or before April 30, 1997 are fully vested in all Company contributions to their individual 401k accounts. During the fiscal year ended December 28, 2002, the Company made employer contributions of $82,500 and matching contributions of $52,882 to this plan. There were not any contributions under this plan to executive officers of the Company.

14

Management Incentive Plan

The Management Incentive Plan is described in Proposal No. 1 above.

Stock Option Grants

The following table sets forth certain information concerning individual grants of stock options made during the fiscal year ended December 28, 2002 to the named executive officers of the Company receiving such grants under the Company's 1998 Stock Incentive Plan.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| | Individual Grants | | | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options/SARs Granted (#) | Percent Of Total Options/SARs Granted to Employees in Fiscal Year | | | Potential Realizable Value At Assumed Annual Rates of Stock Price Appreciation for Option Term | |||||||||

| | Exercise or Base Price Per Share ($/Sh) | | ||||||||||||

| | Expiration Date | |||||||||||||

| Name | 5% ($) | 10% ($) | ||||||||||||

| William F. Whitman, Jr. | 100,000 | (1) | 26 | % | $ | 5.90 | (2) | 02/26/12 | $ | 961,048 | $ | 1,530,308 | ||

| Selim A. Bassoul | 200,000 | (1) | 53 | % | $ | 5.90 | (2) | 02/26/12 | $ | 1,922,096 | $ | 3,060,616 | ||

| David B. Baker | 10,000 | (1) | 3 | % | $ | 5.90 | (2) | 02/26/12 | $ | 96,105 | $ | 153,031 | ||

NOTES:

- (1)

- This option grant is exercisable each year in 20% increments beginning February 26, 2003 through February 26, 2007 and expires on February 26, 2012.

- (2)

- The exercise price was based upon the closing price of the Company shares on February 26, 2002.

Option Exercises and Fiscal Year-End Values

The following table sets forth certain information concerning the exercise of stock options during the fiscal year ended December 28, 2002 by each of the named executive officers and the fiscal year-end value of unexercised options under the 1998 Stock Incentive Plan and the 1989 Stock Incentive Plan. Options awarded under these plans become exercisable in accordance with the terms of the grant.

15

Aggregated Option/SAR Exercises in Last Fiscal Year

and FY-End Option/SAR Values

| Name | Shares Acquired on Exercise (#) | Value Realized ($) | Number of Securities Underlying Unexercised Options/SARs At FY-End(#) Exercisable/ Unexercisable | Value of Unexercised In-the-Money Options/SARs at FY-End($) Exercisable/ Unexercisable(1) | |||

|---|---|---|---|---|---|---|---|

| William F. Whitman, Jr. | 0 | N/A | 70,000/130,000 | $738,500/$1,371,500 | |||

| Selim A. Bassoul | 0 | N/A | 33,750/200,000 | $356,063/$2,110,000 | |||

| David B. Baker | 0 | N/A | 7,375/15,625 | $77,806/$164,843 |

- (1)

- Values based on the Company's 2002 fiscal year end closing common stock share price of $10.55.

Equity Compensation Plan Information

The following table provides information as of December 28, 2002 with respect to shares of Common Stock that may be issued under the Company's existing equity compensation plans, including the 1998 Stock Incentive Plan and the 1989 Stock Incentive Plan. The table does not include information regarding options granted during fiscal year 2003.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance (c) | |||

|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 558,125 | $ | 6.06 | 91,563 | ||

| Equity compensation plans not approved by security holders | 81,000 | $ | 7.111 | N/A | ||

| Total | 639,125 | $ | 6.1932 | 91,563 | ||

Summary of Equity Compensation Plans Not Approved by Stockholders

As of December 28, 2002, the Company had made two separate option grants to directors which were not approved by stockholders: a 1996 grant and a 2000 grant. The Company believes that it is important to develop compensation and incentive packages that will attract and retain qualified members to serve on the Board of Directors, while linking their performance to increasing shareholder value. The Company believes that periodically granting stock options to board members is an effective means to achieving this goal. Board members received option grants to purchase 15,000 shares of Common Stock in 1996 and 3,000 shares of Common Stock in 2000. Such options were tied to the level of effectiveness of the Board of Directors in direct relation to creating shareholder value in the applicable year. Under each grant, the options were granted at the current market value, the options vested immediately with a term of no longer than 10 years.

16

Stock Price Performance Graph

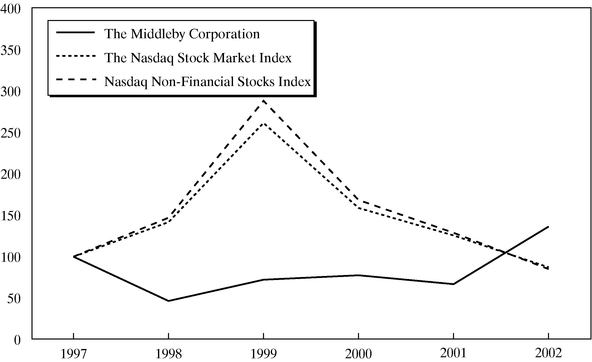

The graph below compares five-year cumulative total return for a stockholder investing $100 in the Company on December 31, 1997 with the Nasdaq Stock Market Index and the Index of Nasdaq Non-Financial Stocks over the same period, assuming reinvestment of dividends. The Company does not believe it is feasible to provide a comparison against a group of peer companies, as there is an insufficient number of other similar publicly traded companies. The following graph shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 (the "Securities Act") or the Exchange Act, except to the extent the Company specifically incorporates the information contained therein by reference, and shall not otherwise be deemed filed under such Acts.

| | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| The Middleby Corporation | 100 | 46.35 | 71.96 | 76.82 | 66.58 | 135.72 | ||||||

| The Nasdaq Stock Market Index | 100 | 140.99 | 261.48 | 157.78 | 125.17 | 86.54 | ||||||

| Nasdaq Non-Financial Stocks Index | 100 | 146.75 | 287.70 | 168.05 | 128.51 | 84.02 |

Report of the Compensation Committee and Board of Directors

This Report of the Compensation Committee and Board of Directors shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act or under the Exchange Act except to the extent the Company specifically incorporates the information contained herein by reference, and shall not otherwise be deemed filed under such Acts.

Report of Compensation Committee as of April 17, 2003

The Compensation Committee reviews and approves recommendations concerning the compensation of the Chairman as well as the President and Chief Executive Officer of the Company. The full Board of

17

Directors reviews the Company's operating profit target levels and the bonus component of the compensation of executive officers and senior managers of the Company, other than the Chairman and the President and Chief Executive Officer. The basic strategy of the Compensation Committee is to have a significant portion of executive compensation at risk, where payment of bonuses is tied to performance and creating shareholder value.

William F. Whitman, Jr., Chairman of the Board, is employed by the Company pursuant to an employment agreement, which is summarized elsewhere in this Proxy Statement. The current levels of base salary for Mr. Whitman has been determined on the basis of the value contributed by Mr. Whitman to the longstanding operations of the Company and MM. Mr. Whitman's 2002 bonus was based upon achieving strategic initiatives, fulfilling cost containment goals, and fulfilling certain earnings before interest, taxes, depreciation and amortization ("EBITDA") goals.

Selim A. Bassoul, President and Chief Executive Officer, is employed by the Company pursuant to an employment agreement, which is summarized elsewhere in this Proxy Statement. Mr. Bassoul's 2002 compensation for the fiscal year ended December 28, 2002 was based upon his performance as President and Chief Executive Officer of the Company, including his contributions to achieving strategic initiatives, fulfilling cost containment goals, and fulfilling certain EBITDA goals.

The compensation of other executive officers and senior managers of the Company are set at levels to be competitive with amounts paid to executive officers and senior managers with comparable qualifications, experience and responsibilities at other businesses of similar type or with similar market capitalization. Such individuals receive a salary and also participate in the annual Management Incentive Plan. The Management Incentive Plan provides for payment of bonuses determined as a percentage of such participant's base salary depending on the achievement of certain levels of EBITDA. Target levels are set annually to be in line with the Company's annual budget, and are presented by the President and Chief Executive Officer to the Board of Directors for review and approval.

The Compensation Committee believes that awards under the Company's incentive plans link the financial interests of management with those of the stockholders. Grants during any fiscal year, including the fiscal year ended December 28, 2002, are based on an individual's long-term contribution to the operations of the Company and MM.

Update to Report of Compensation Committee, as of November 21, 2003

The Compensation Committee also believes that extraordinary performance and contribution to the operations of the Company deserve extraordinary compensation. For this reason and in light of recent contributions to the Company's success, the Compensation Committee, in a series of meetings held in October and November 2003, approved changes to the compensation packages for Messrs. Bassoul and Whitman, and other executive officers and senior managers, as explained below.

Selim A. Bassoul

In light of the extraordinary contributions made by Mr. Bassoul to the success of the Company, the Compensation Committee has approved the following changes to Mr. Bassoul's compensation package. Effective January 1, 2004, Mr. Bassoul's base salary (and base bonus) will be increased from $360,000 to $400,000. In addition, the Company will reimburse Mr. Bassoul for legal and/or consulting expenses incurred by him for his personal financial, tax and estate planning.

18

Subject to stockholder approval of an amendment to the Management Incentive Plan to permit payment of pro rata bonuses based on attainment of prorated performance goals, prior to the end of the fiscal year, the Compensation Committee intends to accelerate the payment of approximately 90% of Mr. Bassoul's projected bonus for 2003 to late December 2003, rather than in 2004 as is normally the case. Payment of the bonus would be subject to the attainment of the pre-approved performance goals for 2003, prorated to the date of payment.

During its deliberations, the Compensation Committee noted that certain of the stock options previously granted to Mr. Bassoul (and Mr. Whitman) under the 1998 Stock Incentive Plan as incentive stock options (ISOs) were non-statutory options (NSOs) (because the amount of options that vested in certain years exceeded the maximum amount that could vest and still qualify as ISOs). In the case of NSOs, unlike ISOs, a taxable event occurs at the time of exercise and the spread between the exercise price and the fair market value of the stock at the time of exercise is ordinary income to the employee and deductible expense to the Company. In consideration of the tax consequences to the Company and to Messrs. Bassoul and Whitman of the stock options held by Messrs. Bassoul and Whitman, and in light of the Company's excellent financial results in 2003 to date, the Compensation Committee, in its subjective judgment, determined that it was appropriate to provide to Mr. Bassoul (and Mr. Whitman, see discussion below) additional compensation.

In this regard, the Compensation Committee approved the following additional benefits for Mr. Bassoul: (i) a cash bonus (which bonus will not be a performance-based bonus excluded from the $1,000,000 cap on deductibility of compensation as set forth in Section 162(m) of the Code) in the amount of $125,000; and (ii) an option to purchase 125,000 shares of Company Common Stock. The option granted pursuant to (ii) above was granted on October 23, 2003, with an exercise price of $18.47, the closing market price on the grant date, and is 100% vested at grant. This grant is subject to approval of the stockholders of (x) an increase in the aggregate number of shares of Company Common Stock under the 1998 Stock Incentive Plan, and (y) an increase in the annual limit on the number of shares that can be granted to Mr. Bassoul.

In addition to these option grants, the Compensation Committee also granted the following options to Mr. Bassoul. First, it granted to Mr. Bassoul an option to purchase 50,000 shares of Company Common Stock, which option was originally scheduled to be granted to Mr. Bassoul in 2004. This option was granted on October 23, 2003, with an exercise price of $18.47, the closing market price on the grant date, and is 100% vested at grant. Second, it granted (subject to stockholder approval as described in Proposal No. 2) to Mr. Bassoul an option to purchase 100,000 shares of Company Common Stock, which option shall vest on October 23, 2008, provided that if, at any time prior to such date, the 20-day average trading price of the Company's Common Stock equals or exceeds $36, $37, $38, $39 and $40, such option will vest, as of such time, in 20,000, 40,000, 60,000, 80,000 and 100,000 shares, respectively. This option was also granted on October 23, 2003, with an exercise price of $18.47, the closing market price on the grant date.

The Compensation Committee also approved the following additional changes to Mr. Bassoul's compensation package, which are to be reflected in amendments to his employment agreement: (i) the payment, in the event of involuntary termination of employment for reasons other than cause (as defined in his employment agreement), of a pro rata bonus for the year in which the termination occurs, provided that the pre-approved performance goals for such year are attained (subject to stockholder approval as described in Proposal No. 1); (ii) an increase in the severance payable to Mr. Bassoul upon involuntary termination of his employment by the Company for reasons other than cause or upon his voluntary termination within six months of a change in control (as defined in his employment agreement) from two times his base salary to two times his base salary plus two times his bonus, provided, however, that such

19

increase shall not be payable to the extent that all payments to Mr. Bassoul described in Section 280G(b)(2) of the Code, including such increase, constitute a parachute payment; and (iii) immediate vesting of his lifetime entitlement to health benefits for himself and his otherwise eligible dependents, rather than vesting at age 51 as now set forth in Mr. Bassoul's employment agreement.

William F. Whitman, Jr.

The Compensation Committee has approved the following corresponding changes to Mr. Whitman's compensation package. Subject to stockholder approval of the amendments to the Management Incentive Plan, the Compensation Committee intends to accelerate the payment of approximately 90% of Mr. Whitman's projected bonus for 2003 to late December 2003, rather than in 2004 as is normally the case. Payment of the bonus would be subject to the attainment of the pre-approved performance goals for 2003, prorated to the date of payment, in the same manner as discussed above for Mr. Bassoul.

As stated above in the discussion of the changes to Mr. Bassoul's compensation, in light of the financial success of the Company in 2003 to date, and the tax consequences to the Company and Mr. Whitman of the NSOs, the Compensation Committee, in its subjective judgment, has approved additional benefits for Mr. Whitman corresponding to those described above for Mr. Bassoul: (i) a cash bonus in the amount of $430,000; and (ii) an option to purchase 120,000 shares of Company Common Stock. The option granted pursuant to (ii) above was granted on October 23, 2003, with an exercise price of $18.47, the closing market price on the grant date, and 100% vested at grant. The option to purchase 45,000 of the said 120,000 shares was granted without the need for any amendment to the 1998 Stock Incentive Plan, and the option to purchase the remaining 75,000 shares is subject to approval by the Company's stockholders of certain amendments to the 1998 Stock Incentive Plan, which are described above under Proposal No. 2.

Although the Compensation Committee did not approve any further changes to Mr. Whitman's base compensation, by virtue of Mr. Bassoul's increase in base salary, the base bonus payable to Mr. Whitman will also increase to $400,000.

Other

In addition to the changes to the compensation packages specific to Messrs. Bassoul and Whitman, the Compensation Committee has approved the following changes that apply, except as specifically noted, to all executive officers and certain senior managers.

All currently outstanding grants of options will be amended to eliminate the excess parachute payment (as defined in Section 280G of the Code) limitation on acceleration of vesting in the event of a change in control. In addition, the form of option agreement utilized for all future option grants will be amended to eliminate this limitation.

A grant of options for an aggregate of 130,500 shares of Company Common Stock (subject to stockholder approval of changes to the 1998 Stock Incentive Plan described in Proposal No. 2) was made to a group of 15 executive officers (other than Messrs. Bassoul and Whitman) and senior managers. These options, which have five year terms, were granted on October 23, 2003, at an exercise price of $18.47, the closing market price on the grant date, and were 100% vested at grant.

Subject to stockholder approval of the amendment of the Management Incentive Plan, the Management Incentive Plan will provide that, upon involuntary termination of employment during the fiscal year for reasons other than cause, an eligible employee, with a written employment agreement, will be entitled to

20

receive a pro rata bonus for the year of termination, provided that the pre-approved performance goals for such year are attained. This change corresponds with the change to Mr. Bassoul's employment agreement described above.

Any employee who receives payments in the event of a change in control of the Company that are excess parachute payments within the meaning of Section 280G of the Code, will receive a cash payment in an amount equal to the sum of (i) the excise tax payable with respect to such excess parachute payments, and (ii) any additional income tax payable by such person on account of the payment made pursuant to this gross-up.

It is the Compensation Committee's intent that (i) the extraordinary cash bonuses to Messrs. Bassoul and Whitman in the amounts of $125,000 and $430,000, respectively, and (ii) any gross-up payments made on account of the parachute payment rules in Section 280G of the Code, will be excluded in determining the Company's adjusted EBITDA for purposes of determining bonuses under the Management Incentive Plan in the relevant year.

The Compensation Committee: Robert L. Yohe, Chairman, Robert R. Henry, and John R. Miller III | ||

Other Directors: William F. Whitman, Jr., Selim A. Bassoul, A. Don Lummus, Philip G. Putnam, David P. Riley, Sabin C. Streeter, Laura B. Whitman, and W. Fifield Whitman III |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of Robert R. Henry, John R. Miller III, and Robert L. Yohe, all of whom are independent directors of the Company and are not officers of the Company. William F. Whitman, Jr., Chairman of the Board, and Selim A. Bassoul, President and Chief Executive Officer of the Company, participate with the full board in reviewing and approving certain components of compensation of other executive officers and senior managers. Recommendations concerning the compensation of Messrs. Whitman and Bassoul, however, are subject to the review and approval of the Compensation Committee.

Directors' Compensation

Each director of the Company receives an annual fee of $20,000, and each director who is not an officer of the Company receives an additional fee of $1,000 for each meeting of the Board of Directors or committee thereof that he or she attends and $500 for each telephonic meeting that he or she participates in. Each director who serves as a committee chair receives an additional annual fee of $5,000. The Company has made certain one-time stock option grants to non-management directors, as described elsewhere in this Proxy Statement under the captions "Holdings of Stockholders, Directors and Executive Officers" and "Equity Compensation Plan Information".

Directors' Retirement Plan

The Company maintains an unfunded retirement plan for non-employee directors. The plan provides for an annual benefit upon retirement from the Board of Directors at age 70, equal to 100% of the director's last annual retainer, payable on a quarterly basis for a number of years equal to the director's years of service, up to a maximum of 10 years.

21

Cost of Solicitation

All expenses incurred in the solicitation of proxies will be borne by the Company. In addition to the use of the mails, proxies may be solicited on behalf of the Company by directors, officers and employees of the Company or by telephone or telecopy. The Company will reimburse brokers and others holding Common Stock as nominees for their expenses in sending proxy material to the beneficial owners of such Common Stock and obtaining their proxies.

Proposals of Security Holders

Proposals of stockholders intended to be presented at the 2004 Annual Meeting of Stockholders under SEC Rule 14a-8 must be received by the Secretary of the Company at the Company's principal executive offices for inclusion in the Company's Proxy Statement and form of proxy relating to the 2004 Annual Meeting no later than December 19, 2003.

Notice of stockholder matters intended to be submitted at the next annual meeting outside the processes of Rule 14a-8 will be considered untimely if not received by the Company by March 3, 2004.

By order of the Board of Directors. | ||

DAVID B. BAKER Secretary | ||

Dated: November 21, 2003 |

22

THE MIDDLEBY CORPORATION

1998 STOCK INCENTIVE PLAN

This document contains the provisions of The Middleby Corporation 1998 Stock Incentive Plan, as adopted effective as of February 19, 1998 (the "Effective Date"). The purpose of this Plan is to provide a means to attract and retain employees of experience and ability and to furnish additional incentives to them.

1.1. "Board" means the Company's Board of Directors.

1.2. "Code" means the Internal Revenue Code of 1986, as amended.

1.3. "Company" means The Middleby Corporation, a Delaware corporation.

1.4. "Eligible Employee" means any employee of an Employer.

1.5. "Employer" means the Company or any affiliate or subsidiary of the Company.

1.6. "Fair Market Value" means, as of any date, the closing price of Stock on the national stock exchange or automated quotation system on which the Stock is then listed or, if there was no trading in Stock on that date, the closing price of Stock on such exchange or automated quotation system on the next preceding date on which there was trading in Stock.

1.7. "Grant" means any award of Options, Stock Appreciation Rights, Restricted Stock or Performance Stock (or any combination thereof) made under this Plan to an Eligible Employee.

1.8. "Option" means any stock option granted under this Plan.

1.9. "Performance Stock" means Stock issued pursuant to Article VII of this Plan.

1.10. "Plan" means The Middleby Corporation 1998 Stock Incentive Plan, as set out in this document and as subsequently amended.

1.11. "Recipient" means an Eligible Employee to whom a Grant has been made.