Strategic Review Update: Middleby to Separate Food Processing Business into Standalone Public Company Exhibit 99.3

Forward-Looking Statements This presentation contains "forward-looking statements" subject to the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other factors, which could cause the Company's actual results, performance or outcomes to differ materially from those expressed or implied in the forward-looking statements. The following are some of the important factors that could cause The Middleby Corporation’s (the “Company”) actual results, performance or outcomes to differ materially from those discussed in the forward-looking statements: changing market conditions; volatility in earnings resulting from goodwill impairment losses, which may occur irregularly and in varying amounts; variability in financing costs and interest rates; quarterly variations in operating results; dependence on key customers; risks associated with the Company's foreign operations, including international exposure, political risks affecting international sales, market acceptance and demand for the Company's products and the Company's ability to manage the risk associated with the exposure to foreign currency exchange rate fluctuations; the Company's ability to protect its trademarks, copyrights and other intellectual property; changing market conditions, including inflation; the impact of competitive products and pricing; the impact of announced management and organizational changes; the state of the residential construction, housing and home improvement markets; the state of the credit markets, including mortgages, home equity loans and consumer credit; intense competition in the Company's business segments including the impact of both new and established global competitors; unfavorable tax law changes and tax authority rulings; cybersecurity attacks and other breaches in security; the continued ability to realize profitable growth through the sourcing and completion of strategic acquisitions; the timely development and market acceptance of the Company's products; the availability and cost of raw materials; the possibility that the proposed spin-off of the Company’s Food Processing business (“FP” or “FP business”) will not be consummated within the anticipated time period or at all, including as the result of regulatory, market or other factors, including the possibility that various closing conditions for the spin-off may not be satisfied; the potential disruption to our business in connection with the proposed spin-off; the potential that the FP business and the Company do not realize all of the expected benefits of the spin-off; that the spin-off may be more difficult, time consuming or costly than expected; the failure of the spin-off to qualify for the expected tax treatment; the duration and outcome of the Company’s ongoing strategic review (“Strategic Review”) with respect to its Residential Kitchen business; potential adverse effects of the Strategic Review or announcement of the proposed FP spin-off or, in each case, results thereof, including on the market price of the Company's common stock, the ability of the Company to develop and maintain relationships with personnel, customers, suppliers and others with whom it does business or the Company's business, financial condition, results of operations and financial performance; risks related to diversion of the Company’s management's attention from its ongoing business operations due to the Strategic Review and the proposed FP spin-off; and other risks detailed in the Company’s SEC filings. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. The forward-looking statements included in this presentation are made only as of the date hereof and, except as required by federal securities laws and rules and regulations of the SEC, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Use of Non-GAAP Financial Information This presentation contains information about the Company’s and FP’s financial results which are not presented in accordance with GAAP. Specifically, Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA represents net income before depreciation and amortization (including asset impairments), interest expense, income tax (expense) benefit, other income (expense), net, equity income (loss), net of tax, restructuring and other special items. In addition, Adjusted EBITDA margin, which is Adjusted EBITDA as a percent of revenue, is also a non-GAAP financial measure. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures prepared in accordance with GAAP, and the financial results prepared in accordance with GAAP. Also, Middleby RemainCo represents an aggregation of the Company’s Commercial Foodservice Equipment Group and Residential Kitchen Equipment Group reportable operating segments, which is also a non-GAAP financial measure. In addition, the non-GAAP financial measures included in this presentation do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. The Company believes Adjusted EBITDA and Adjusted EBITDA margin are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating performance for business planning purposes. The Company believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that it uses internally for purposes of assessing its core operating performance. Reconciliations of these non-GAAP financial measures are available on the “Investors” section of the Company's website.

Strategic Rationale for a Separation of Food Processing Enables each entity to have a unique, optimized capital structure and capital allocation policy in-line with individual business models and strategic / operational priorities Enhances strategic and financial impact of M&A across each business entity ü Provides greater exposure to and deeper understanding of each entity’s standalone growth story, business strategies, and performance, aligned with respective macroeconomic trends ü Next chapter of growth for highly successful but inherently different businesses that will benefit from a renewed focus on individual core strategies, driving a full valuation in line with best-in-class peers for each entity ü ü As Part of a Comprehensive Assessment of its Portfolio, Middleby’s Board of Directors Has Decided to Spin-off the Company’s Food Processing Business

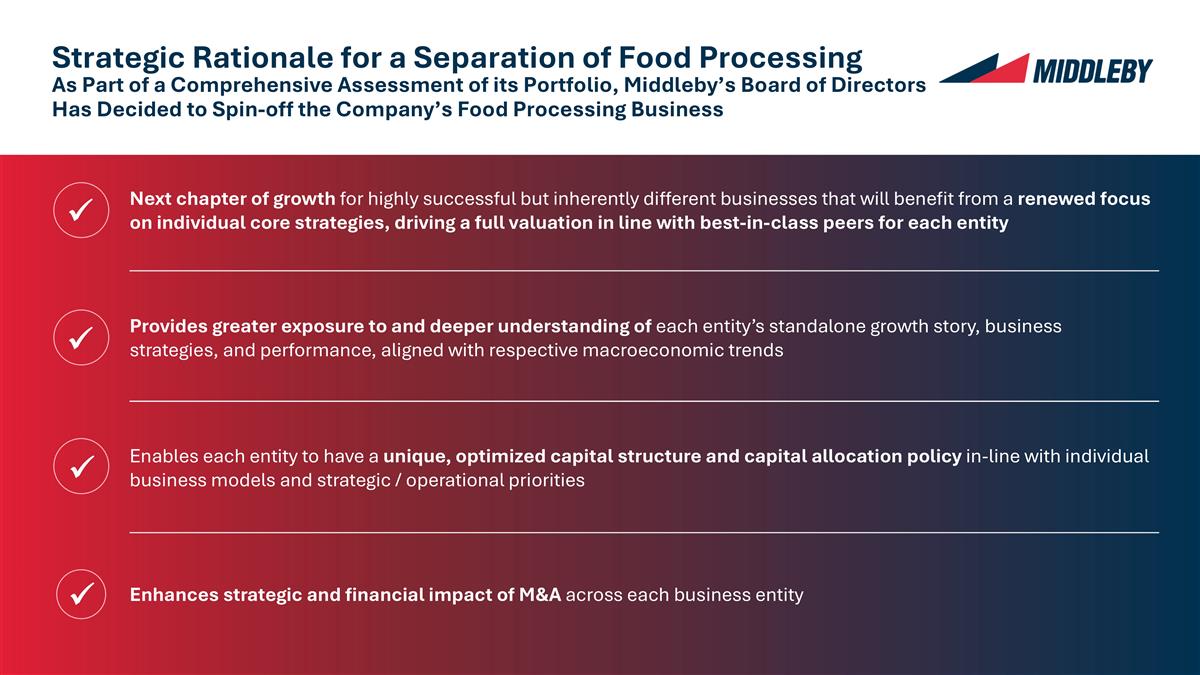

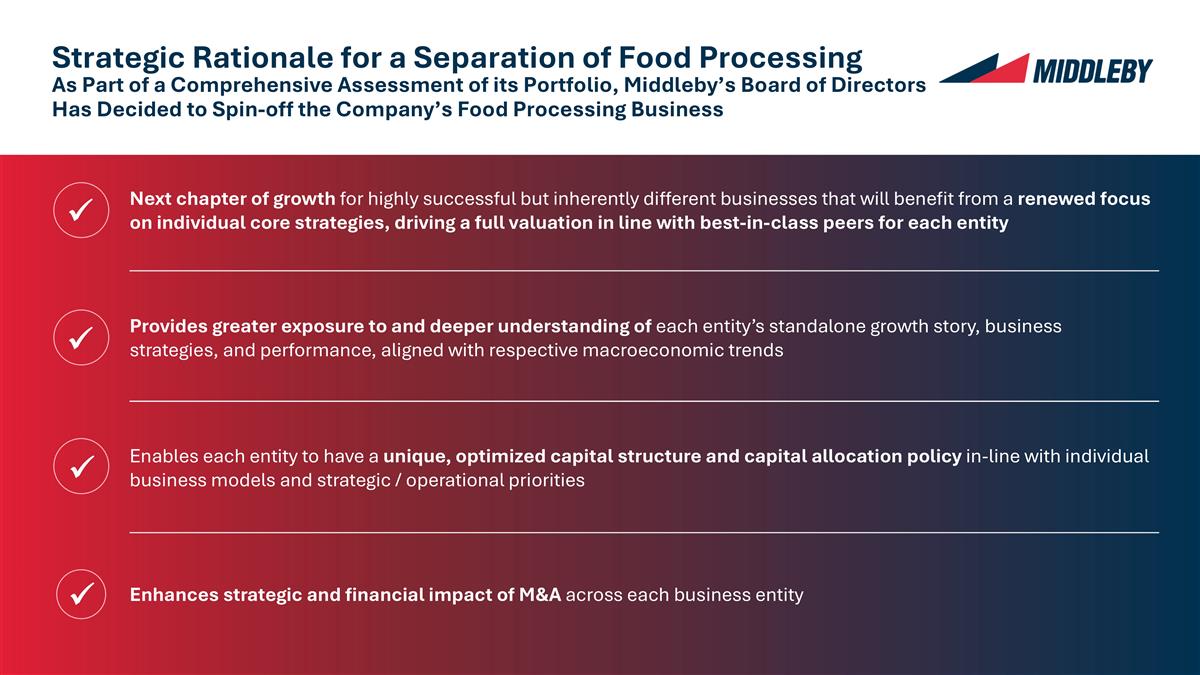

$0.7bn 2024A Revenue $0.2bn1 2024A Adj. EBITDA ~26%1 Adj. EBITDA Margin $3.1bn 2024A Revenue $0.7bn1 2024A Adj. EBITDA ~23%1 Adj. EBITDA Margin Fast growing and focused food processing market leader with a best-in-class financial profile Business will benefit from its own capital structure, investor base and acquisition currency Strong M&A pipeline and actionable organic initiatives support a significant growth opportunity and ability to quickly scale Founded on Middleby’s culture, Food Processing can realize its long-term strategic vision with independence to fuel visible growth Market-leading brands in kitchen equipment across Commercial and Residential end-markets in both food and beverage Positioned to accelerate sales growth, capitalizing on next generation product innovation and differentiated go-to-market investments Top-tier margins and cash generation combined with further opportunities to scale in the market Significant upside in volumes and margin at Residential Kitchen through market recovery and realization of strategic investments With distinct identities, market leading companies are well positioned to accelerate growth Separation Enables Focused and Capability-Aligned Companies with Best-in-Class Financial Profiles 1 As reported in 2024A earnings release and excludes any allocation of corporate costs. REMAINCO

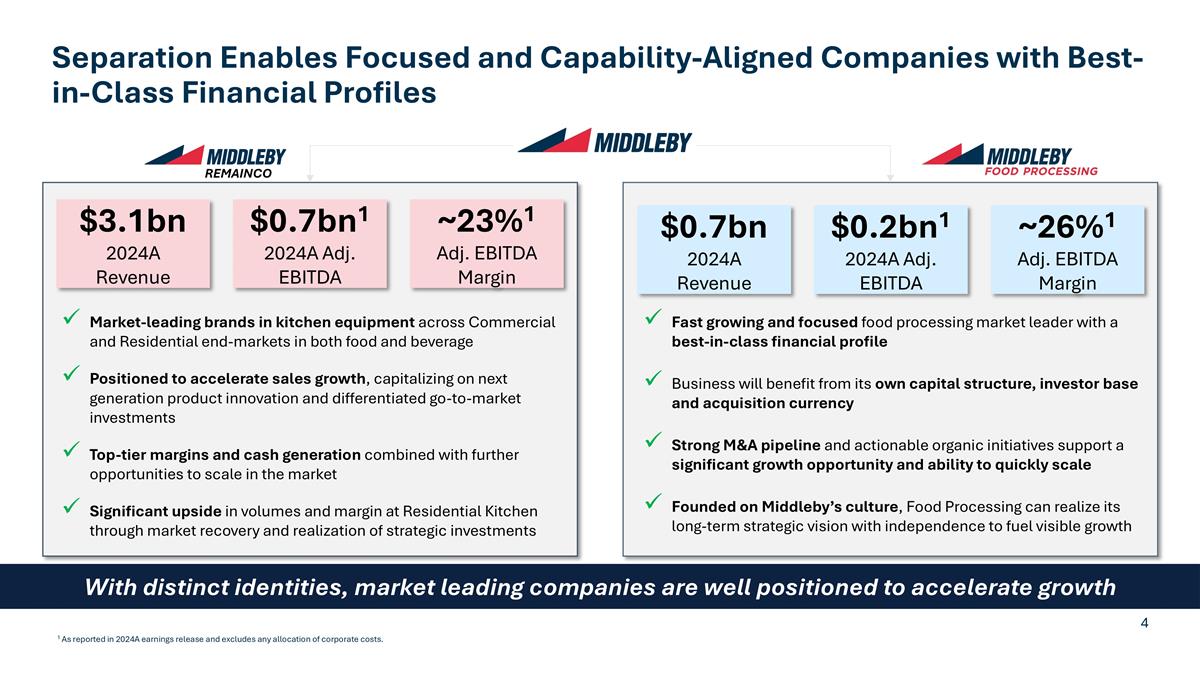

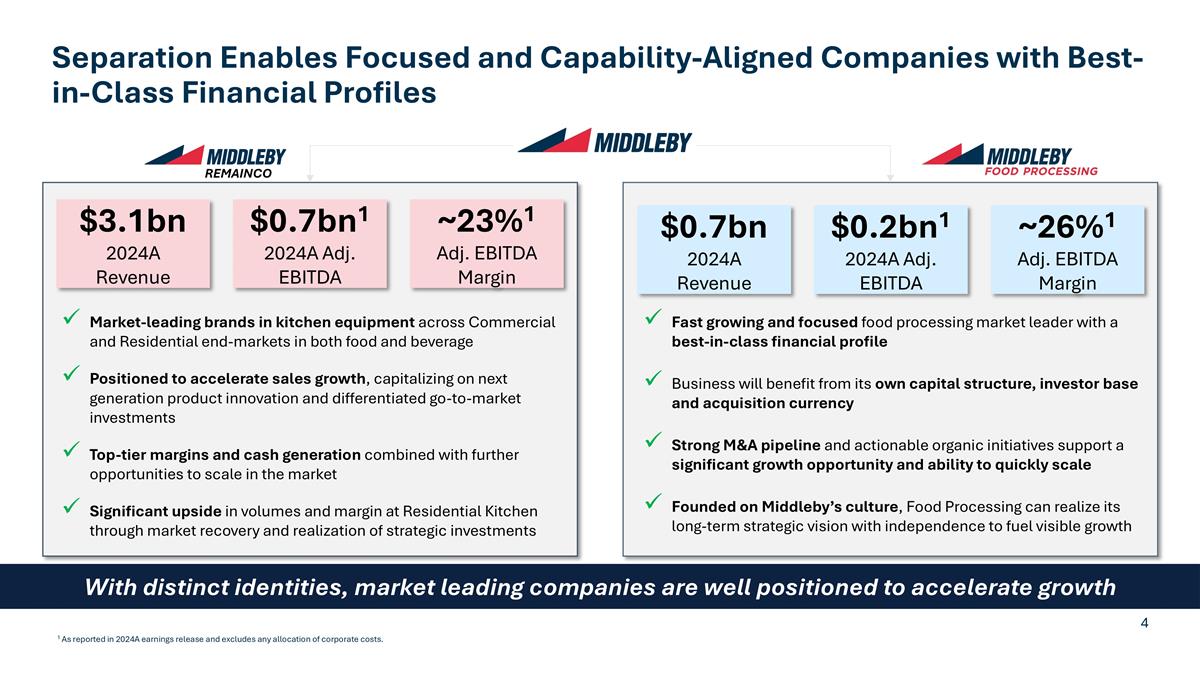

…Trusted by Key Blue Chip Customers Middleby Food Processing Competitive Advantages Portfolio of Industry Leading Food Processing Brands… 1 As reported in 2024A earnings release and excludes any allocation of corporate costs. Creating a Standalone Leader in the Protein, Baking, and Snack Industries Best-in-Class, end-to-end solutions for industrial protein, bakery, and snack processors 1 Track record of long-term organic and acquisition driven sales growth 2 Industry leading Adj. EBITDA margins at ~26%1 3 Innovative automation technologies are in demand across highly attractive end-markets 4 TAM expansion opportunities into adjacent food applications such as snack, poultry, and pet food 5

Middleby Food Processing Customer-Focused Innovation Leader with Long-term Industry Tailwinds We Develop Innovative, Industry-leading Processing Equipment Designed to . . . ACCELERATE PROCESSING IMPROVE THROUGHPUT INCREASE YIELDS RAISE PROFITABILITY MAXIMIZE SANITATION SAFER DESIGN, EASIER CLEANING MAINTAIN CONSISTENCY HIGHER QUALITY PRACTICE SUSTAINABILITY TAKE ENVIRONMENTAL RESPONSIBILITY ü EXPAND CAPACITY MORE PRODUCTION, LESS PEOPLE REDUCE COSTS OPERATING AND CAPITAL

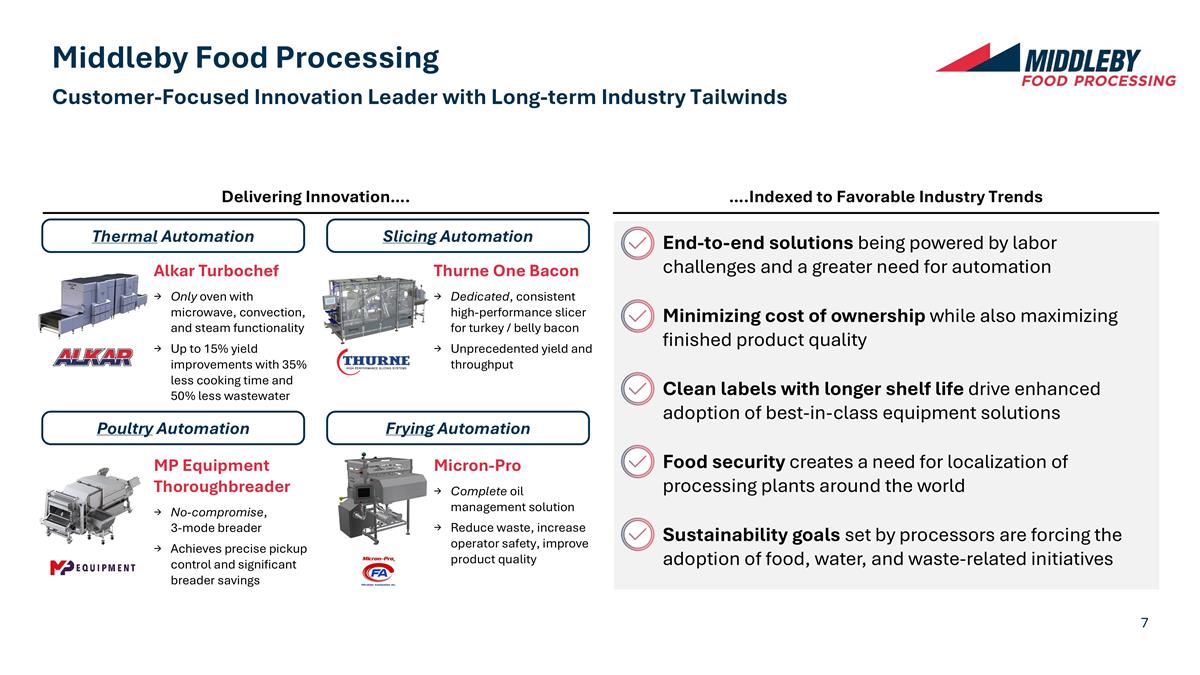

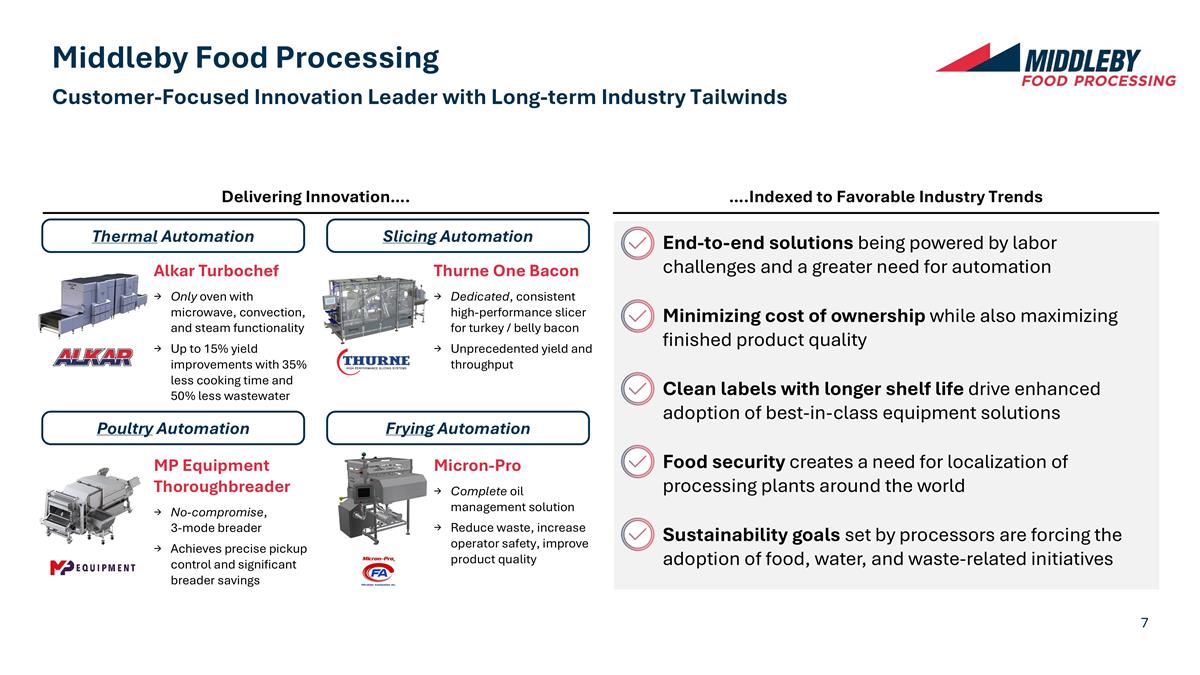

Middleby Food Processing Delivering Innovation…. ….Indexed to Favorable Industry Trends End-to-end solutions being powered by labor challenges and a greater need for automation Minimizing cost of ownership while also maximizing finished product quality Clean labels with longer shelf life drive enhanced adoption of best-in-class equipment solutions Food security creates a need for localization of processing plants around the world Sustainability goals set by processors are forcing the adoption of food, water, and waste-related initiatives Customer-Focused Innovation Leader with Long-term Industry Tailwinds Poultry Automation Thermal Automation Frying Automation Slicing Automation Micron-Pro Complete oil management solution Reduce waste, increase operator safety, improve product quality Thurne One Bacon Dedicated, consistent high-performance slicer for turkey / belly bacon Unprecedented yield and throughput MP Equipment Thoroughbreader No-compromise, 3-mode breader Achieves precise pickup control and significant breader savings Alkar Turbochef Only oven with microwave, convection, and steam functionality Up to 15% yield improvements with 35% less cooking time and 50% less wastewater

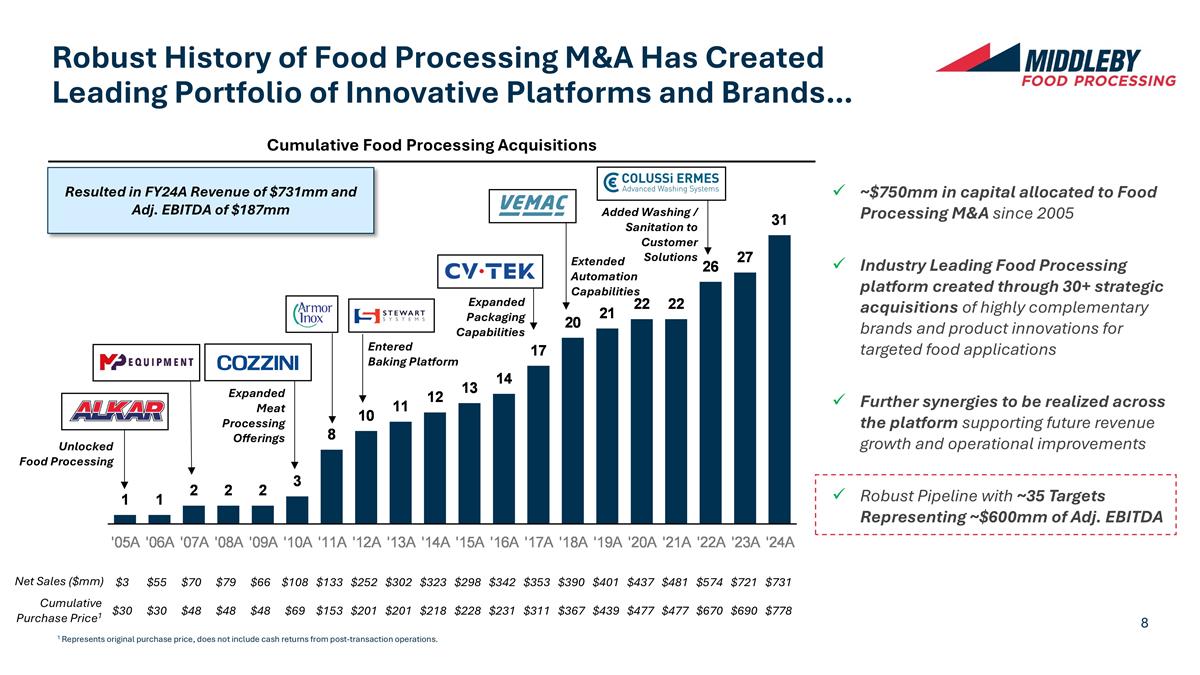

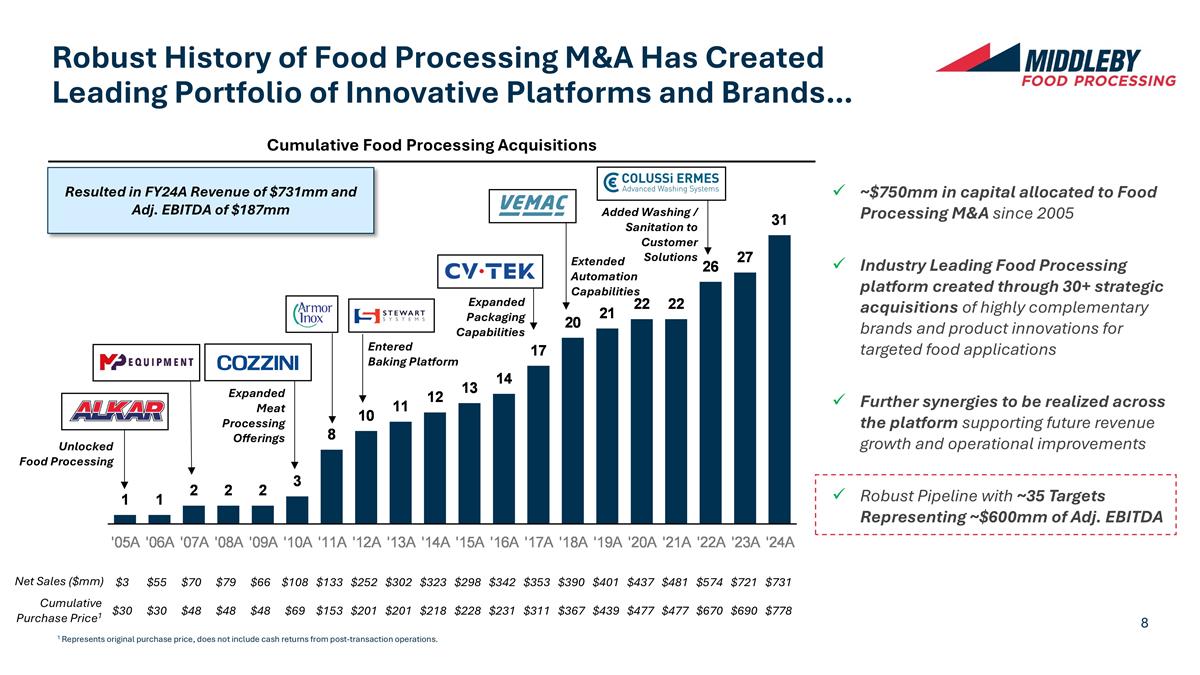

Robust History of Food Processing M&A Has Created Leading Portfolio of Innovative Platforms and Brands… Expanded Meat Processing Offerings $3 $55 $70 $79 $66 $108 $133 $252 $302 $323 $298 $342 $353 $390 $401 $437 $481 $574 $721 $731 Net Sales ($mm) ~$750mm in capital allocated to Food Processing M&A since 2005 Industry Leading Food Processing platform created through 30+ strategic acquisitions of highly complementary brands and product innovations for targeted food applications Further synergies to be realized across the platform supporting future revenue growth and operational improvements Robust Pipeline with ~35 Targets Representing ~$600mm of Adj. EBITDA Resulted in FY24A Revenue of $731mm and Adj. EBITDA of $187mm Unlocked Food Processing Cumulative Food Processing Acquisitions Cumulative Purchase Price1 $30 $30 $48 $48 $48 $69 $153 $201 $201 $218 $228 $231 $311 $367 $439 $477 $477 $670 $690 $778 Entered Baking Platform Expanded Packaging Capabilities Extended Automation Capabilities 1 Represents original purchase price, does not include cash returns from post-transaction operations. Added Washing / Sanitation to Customer Solutions

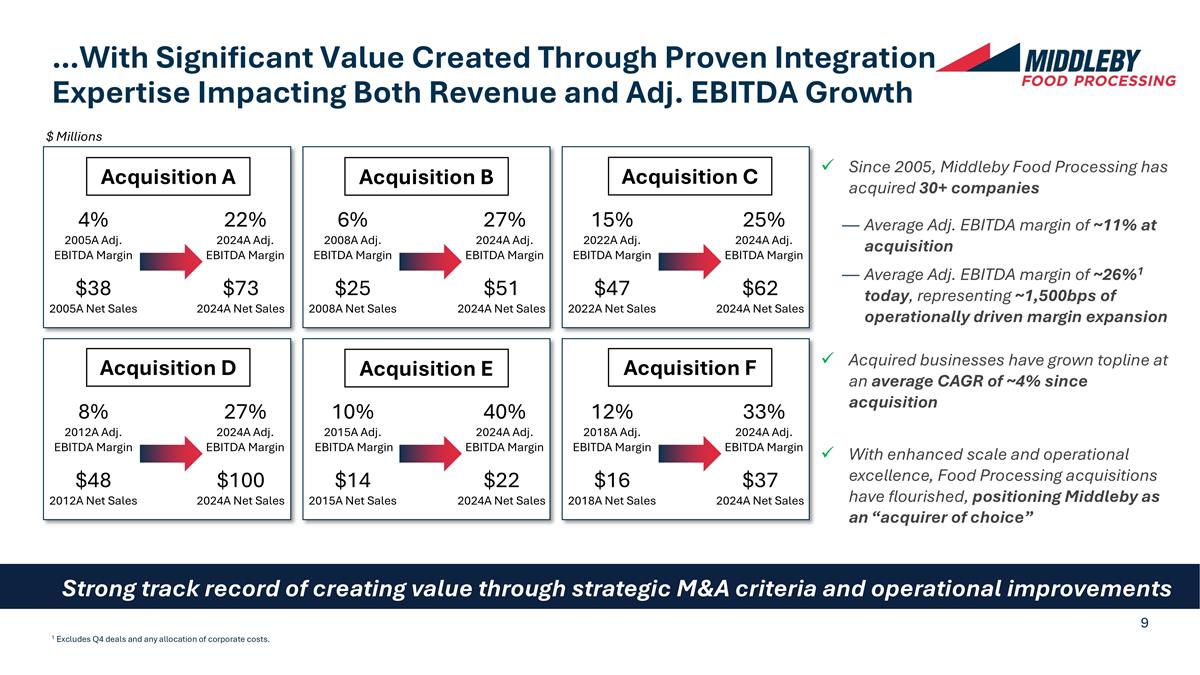

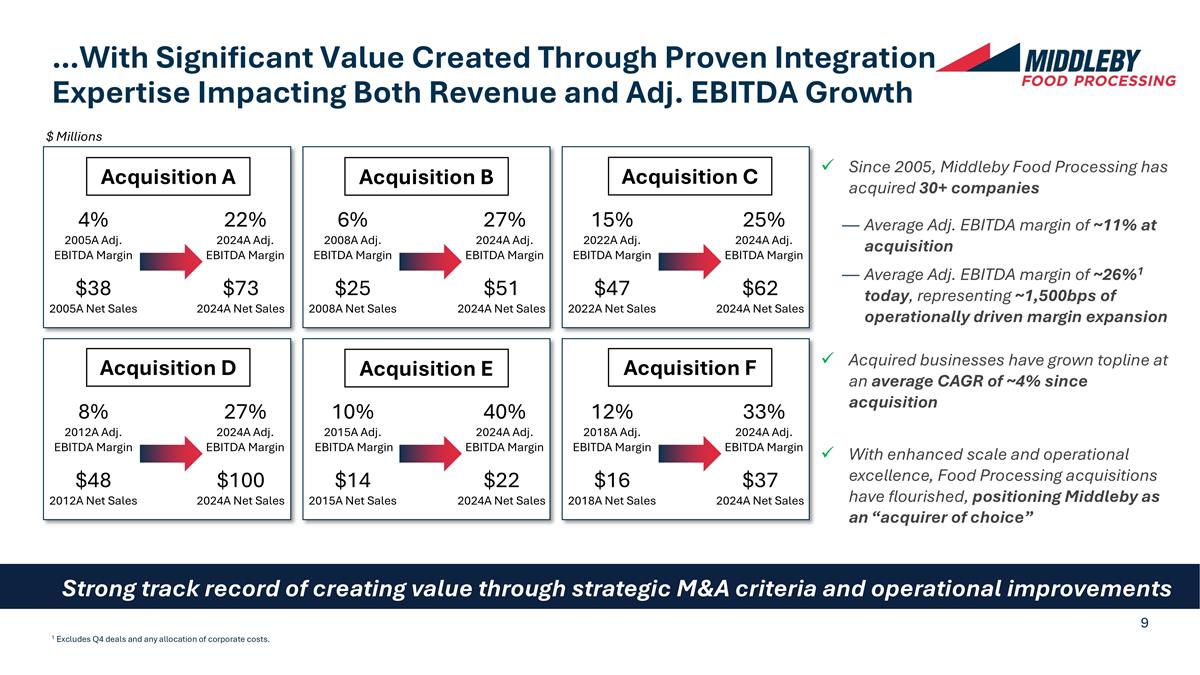

…With Significant Value Created Through Proven Integration Expertise Impacting Both Revenue and Adj. EBITDA Growth Strong track record of creating value through strategic M&A criteria and operational improvements 4% 2005A Adj. EBITDA Margin 22% 2024A Adj. EBITDA Margin $38 2005A Net Sales $73 2024A Net Sales 10% 2015A Adj. EBITDA Margin 40% 2024A Adj. EBITDA Margin $14 2015A Net Sales $22 2024A Net Sales Since 2005, Middleby Food Processing has acquired 30+ companies Average Adj. EBITDA margin of ~11% at acquisition Average Adj. EBITDA margin of ~26%1 today, representing ~1,500bps of operationally driven margin expansion Acquired businesses have grown topline at an average CAGR of ~4% since acquisition With enhanced scale and operational excellence, Food Processing acquisitions have flourished, positioning Middleby as an “acquirer of choice” 6% 2008A Adj. EBITDA Margin 27% 2024A Adj. EBITDA Margin $25 2008A Net Sales $51 2024A Net Sales 15% 2022A Adj. EBITDA Margin 25% 2024A Adj. EBITDA Margin $47 2022A Net Sales $62 2024A Net Sales 8% 2012A Adj. EBITDA Margin 27% 2024A Adj. EBITDA Margin $48 2012A Net Sales $100 2024A Net Sales 12% 2018A Adj. EBITDA Margin 33% 2024A Adj. EBITDA Margin $16 2018A Net Sales $37 2024A Net Sales 1 Excludes Q4 deals and any allocation of corporate costs. Acquisition A Acquisition B Acquisition C Acquisition D Acquisition E Acquisition F $ Millions

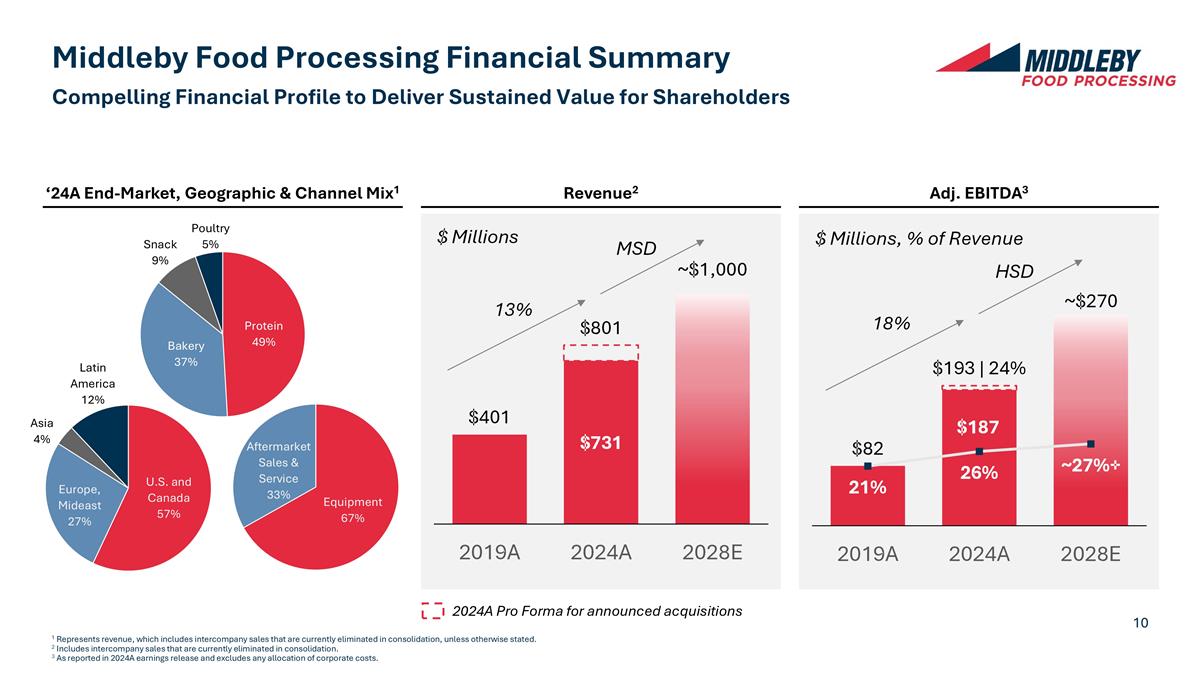

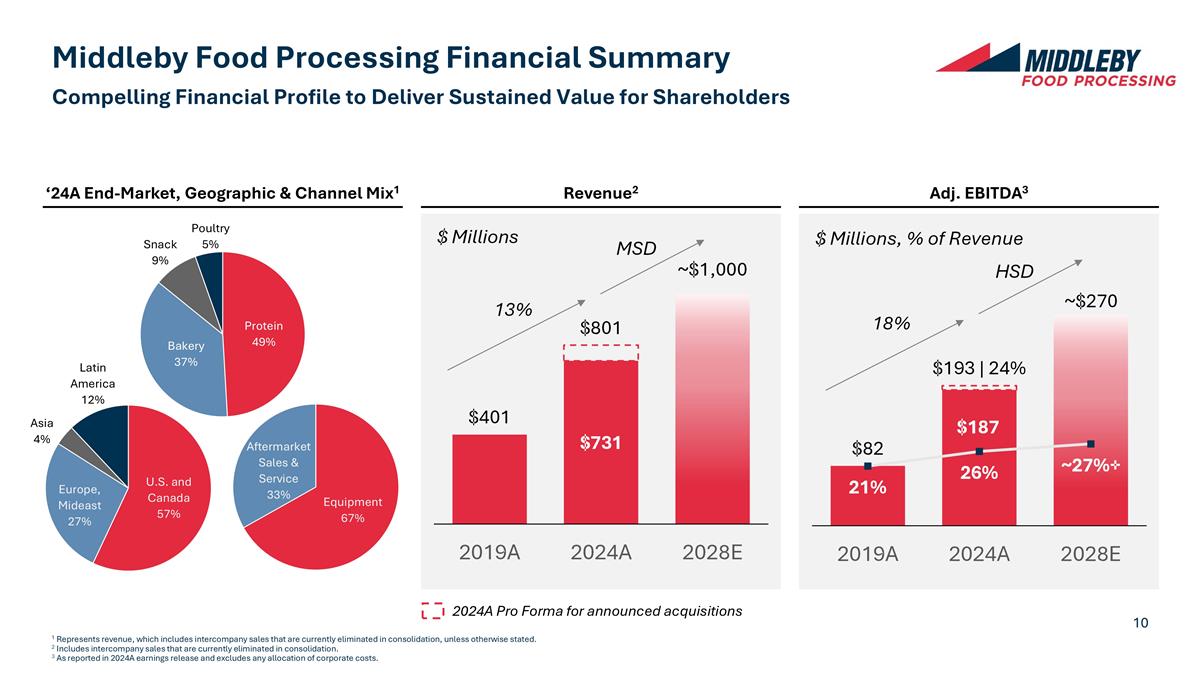

Middleby Food Processing Financial Summary Compelling Financial Profile to Deliver Sustained Value for Shareholders 1 Represents revenue, which includes intercompany sales that are currently eliminated in consolidation, unless otherwise stated. 2 Includes intercompany sales that are currently eliminated in consolidation. 3 As reported in 2024A earnings release and excludes any allocation of corporate costs. ‘24A End-Market, Geographic & Channel Mix1 Revenue2 Adj. EBITDA3 2024A Pro Forma for announced acquisitions

Middleby RemainCo Competitive Advantages Portfolio of Industry Leading Commercial and Residential Brands… 1 As reported in 2024A earnings release and excludes any allocation of corporate costs. Most innovative portfolio of cooking and beverage solutions Synergistic technologies across commercial and residential platforms with a shared commitment to innovation Strong Adj. EBITDA margin of ~23%1 driven by product innovation providing customers transformational labor, safety, & quality gains Accelerating growth into new, attractive markets such as ice and beverage Proven M&A playbook assembling “best-in-class” brand and product offerings, creating industry-leading market position Leading Kitchen Equipment Business Significant upside in volumes and margin at Residential Kitchen through market recovery and realization of strategic investments …Trusted by Key Blue Chip Customers 1 2 3 4 5 6 Beverage / Ice Residential Kitchen Commercial Foodservice

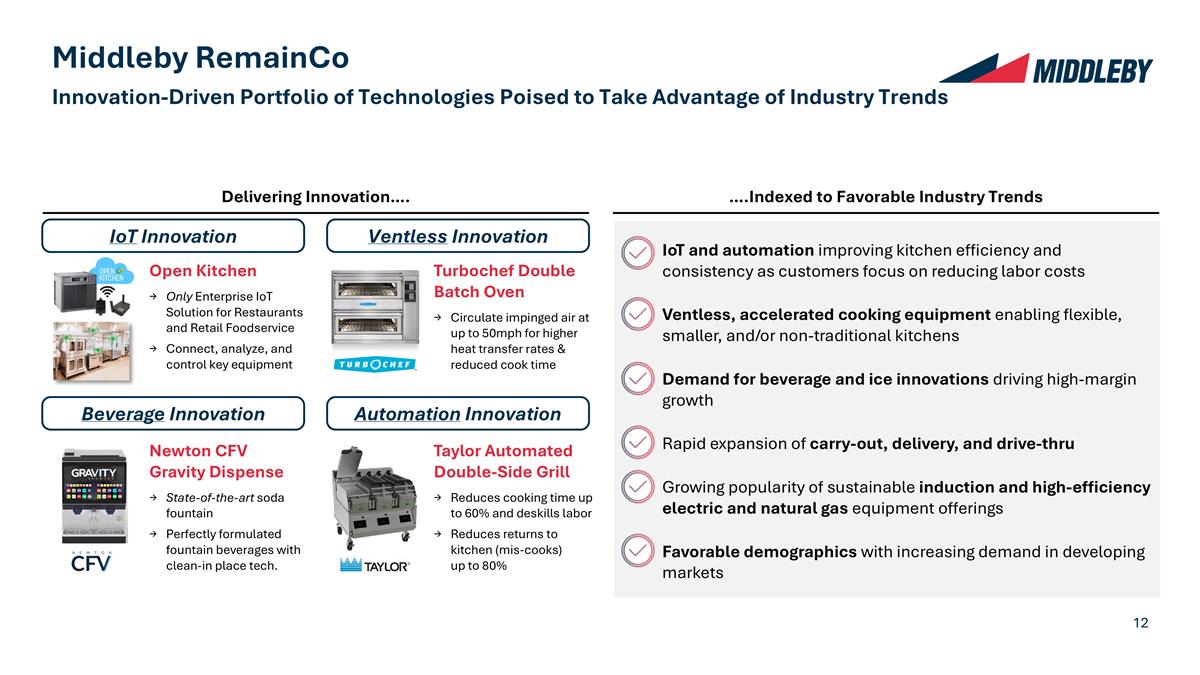

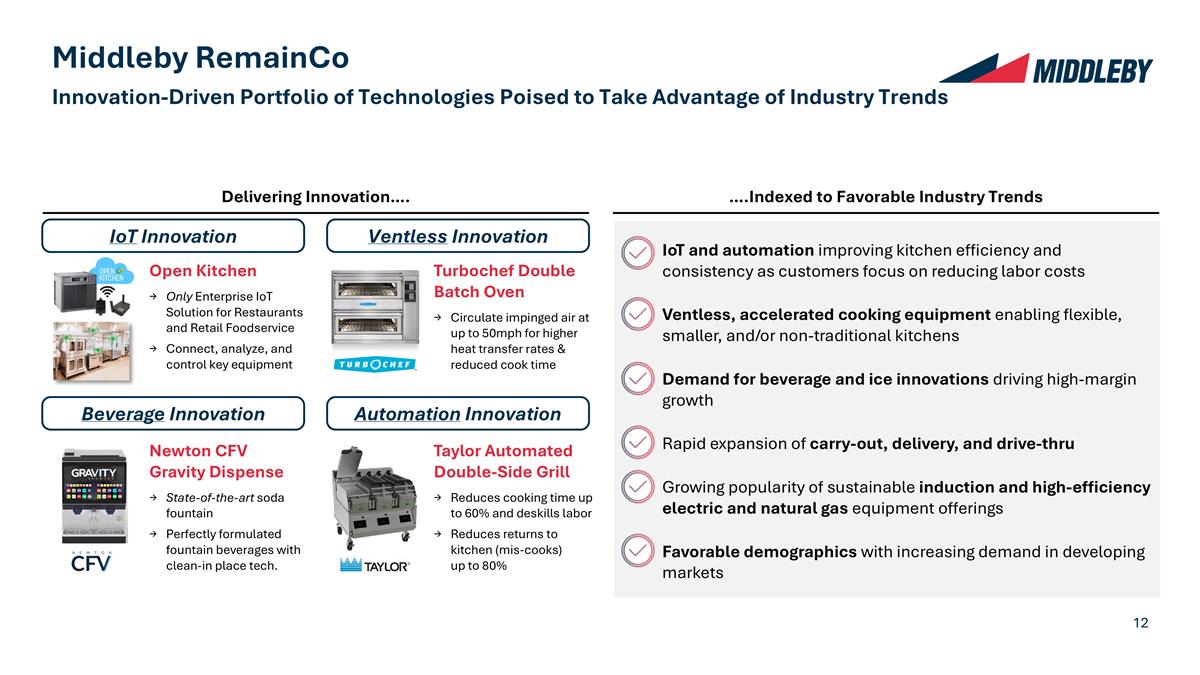

Middleby RemainCo Delivering Innovation…. ….Indexed to Favorable Industry Trends IoT and automation improving kitchen efficiency and consistency as customers focus on reducing labor costs Ventless, accelerated cooking equipment enabling flexible, smaller, and/or non-traditional kitchens Demand for beverage and ice innovations driving high-margin growth Rapid expansion of carry-out, delivery, and drive-thru Growing popularity of sustainable induction and high-efficiency electric and natural gas equipment offerings Favorable demographics with increasing demand in developing markets Innovation-Driven Portfolio of Technologies Poised to Take Advantage of Industry Trends Beverage Innovation Automation Innovation IoT Innovation Open Kitchen Only Enterprise IoT Solution for Restaurants and Retail Foodservice Connect, analyze, and control key equipment Newton CFV Gravity Dispense State-of-the-art soda fountain Perfectly formulated fountain beverages with clean-in place tech. Taylor Automated Double-Side Grill Reduces cooking time up to 60% and deskills labor Reduces returns to kitchen (mis-cooks) up to 80% Ventless Innovation Turbochef Double Batch Oven Circulate impinged air at up to 50mph for higher heat transfer rates & reduced cook time

Strategic Investments Driving Future Growth… Middleby RemainCo Transforming our Go-To-Market to Drive Growth and Customer Experience Substantial investments have been made to accelerate growth Middleby has made substantial investments in selling tools and capabilities focused on end-user engagement, greater brand awareness, and launches of new product innovations, all leading to a growing pipeline of sales opportunities 8 Innovation centers1 demonstrating our leading product innovations Award winning culinary teams supporting customers with hands-on experiential learning Industry leading digital sales, marketing, and education to engage end-users and channel partners, including launch of the “Middleby app”, “Middleby Learn”, and “Middleby University” Designer Services Teams capturing mindshare of consultants, designers, and specifiers Key account teams fostering deep relationships with dealers and foodservice operators Middleby Advantage after-sale service and support …And Improving the Experience for Our Customers 1 Includes centers expected to be completed by the end of 2025.

Middleby RemainCo Recent Entry Into Fast-Growing Ice & Beverage Category Provides Meaningful Growth Opportunities Automated coffee and espresso Ice production and storage Liquor and beer dispense solutions Brewing and distilling Canning and bottling Nitro and cold brew Soda, tea, milk, and water dispense automation Blending and smoothies Shakes and desserts Patented flow control technology Recently Established Ice and Beverage Platform Well Positioned for Growth Trends… ~$750mm 2024A Revenue ~25% Adj. EBITDA Margin ….Across Growing Portfolio of Category-Leading Brands Early-stage ice & beverage platform with cutting-edge technology targeting large addressable market

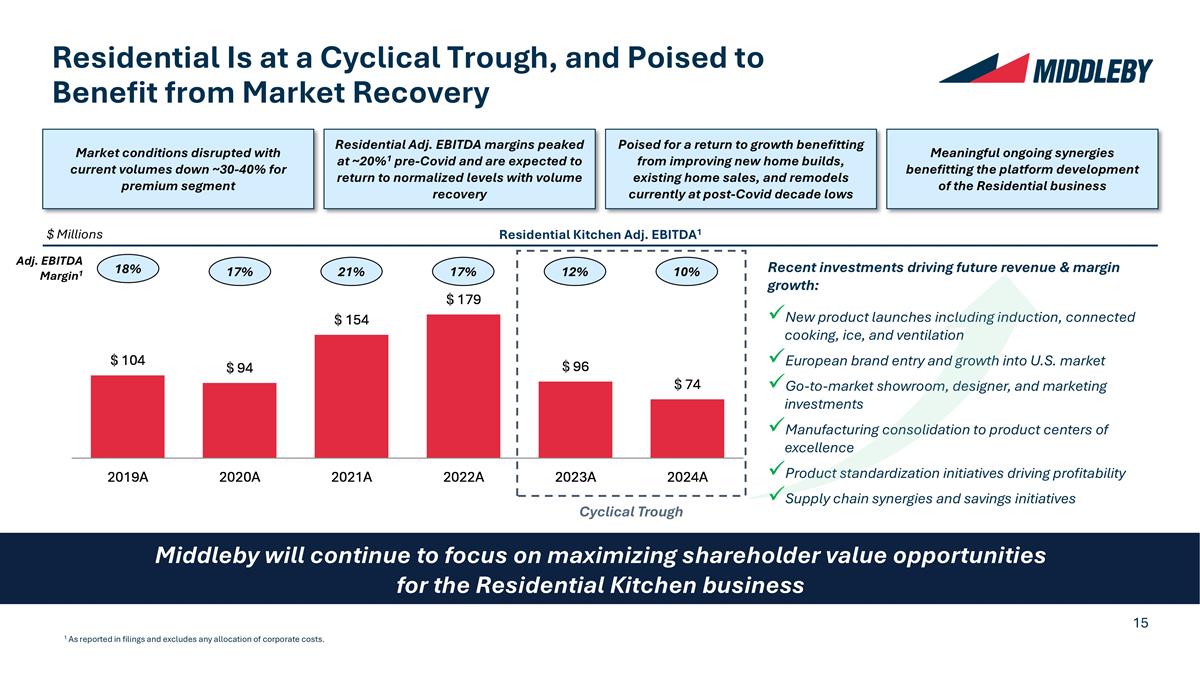

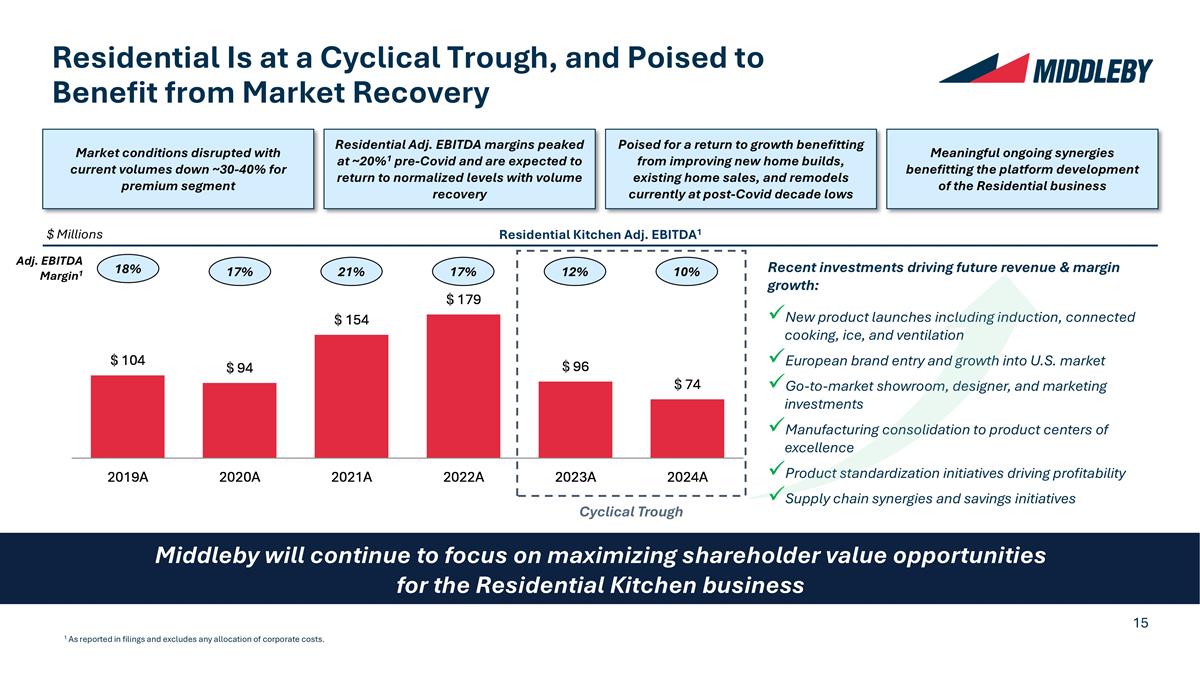

Residential Is at a Cyclical Trough, and Poised to Benefit from Market Recovery Residential Kitchen Adj. EBITDA1 18% 21% 17% 17% 12% 10% Cyclical Trough 1 As reported in filings and excludes any allocation of corporate costs. Adj. EBITDA Margin1 Middleby will continue to focus on maximizing shareholder value opportunities for the Residential Kitchen business Market conditions disrupted with current volumes down ~30-40% for premium segment Residential Adj. EBITDA margins peaked at ~20%1 pre-Covid and are expected to return to normalized levels with volume recovery Poised for a return to growth benefitting from improving new home builds, existing home sales, and remodels currently at post-Covid decade lows Meaningful ongoing synergies benefitting the platform development of the Residential business Recent investments driving future revenue & margin growth: New product launches including induction, connected cooking, ice, and ventilation European brand entry and growth into U.S. market Go-to-market showroom, designer, and marketing investments Manufacturing consolidation to product centers of excellence Product standardization initiatives driving profitability Supply chain synergies and savings initiatives $ Millions

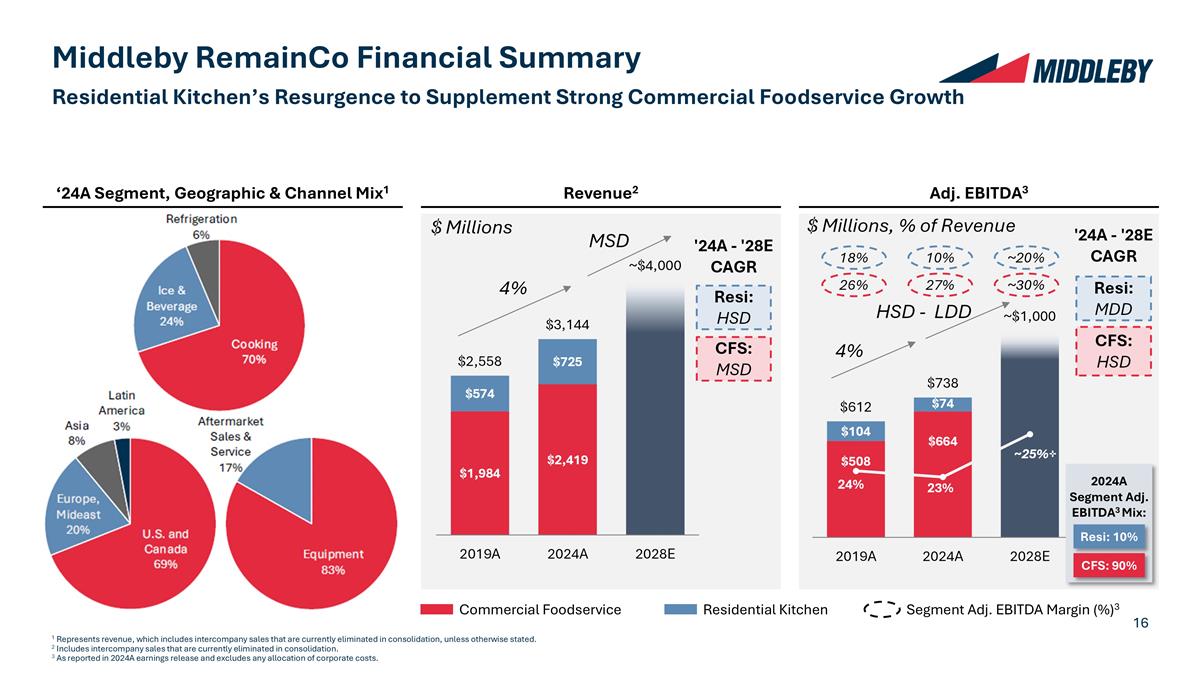

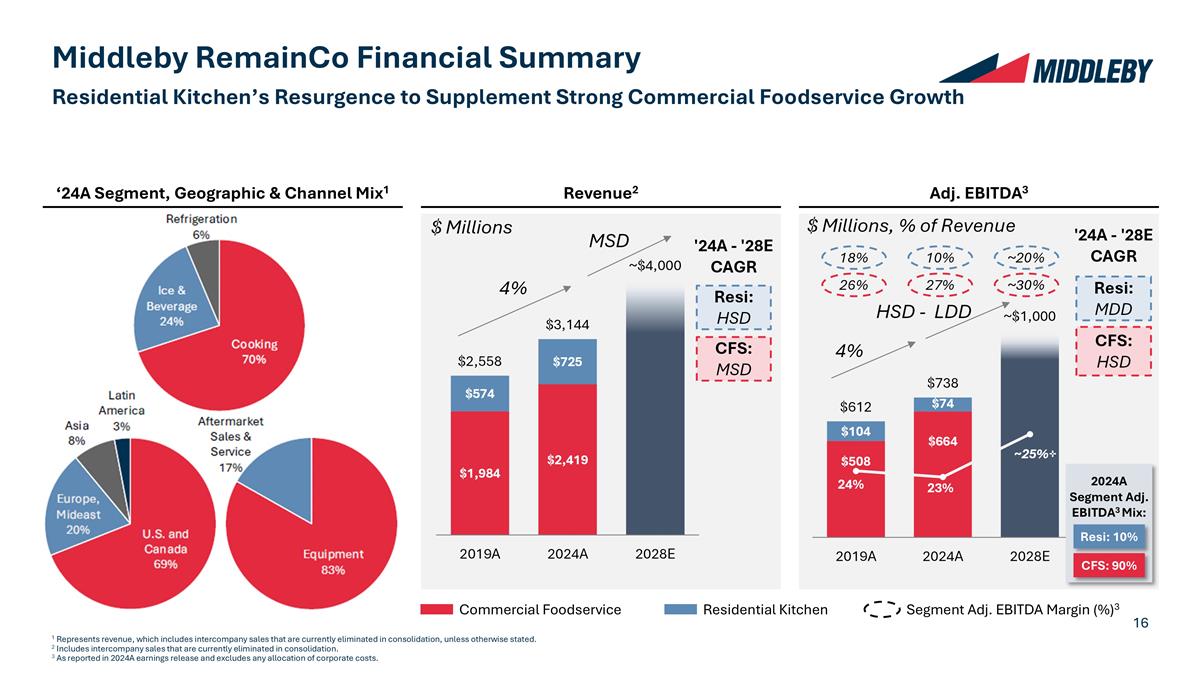

Middleby RemainCo Financial Summary Residential Kitchen’s Resurgence to Supplement Strong Commercial Foodservice Growth Revenue2 Adj. EBITDA3 ‘24A Segment, Geographic & Channel Mix1 Commercial Foodservice Residential Kitchen Segment Adj. EBITDA Margin (%)3 2024A Segment Adj. EBITDA3 Mix: 1 Represents revenue, which includes intercompany sales that are currently eliminated in consolidation, unless otherwise stated. 2 Includes intercompany sales that are currently eliminated in consolidation. 3 As reported in 2024A earnings release and excludes any allocation of corporate costs. Resi: 10% CFS: 90%

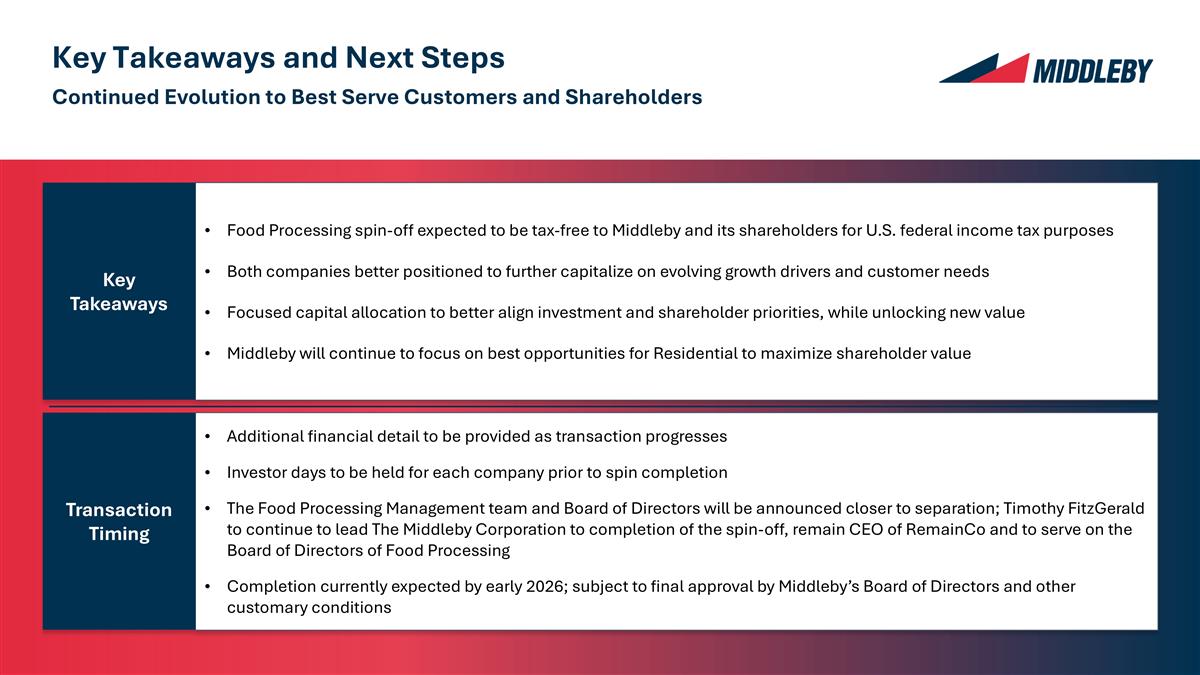

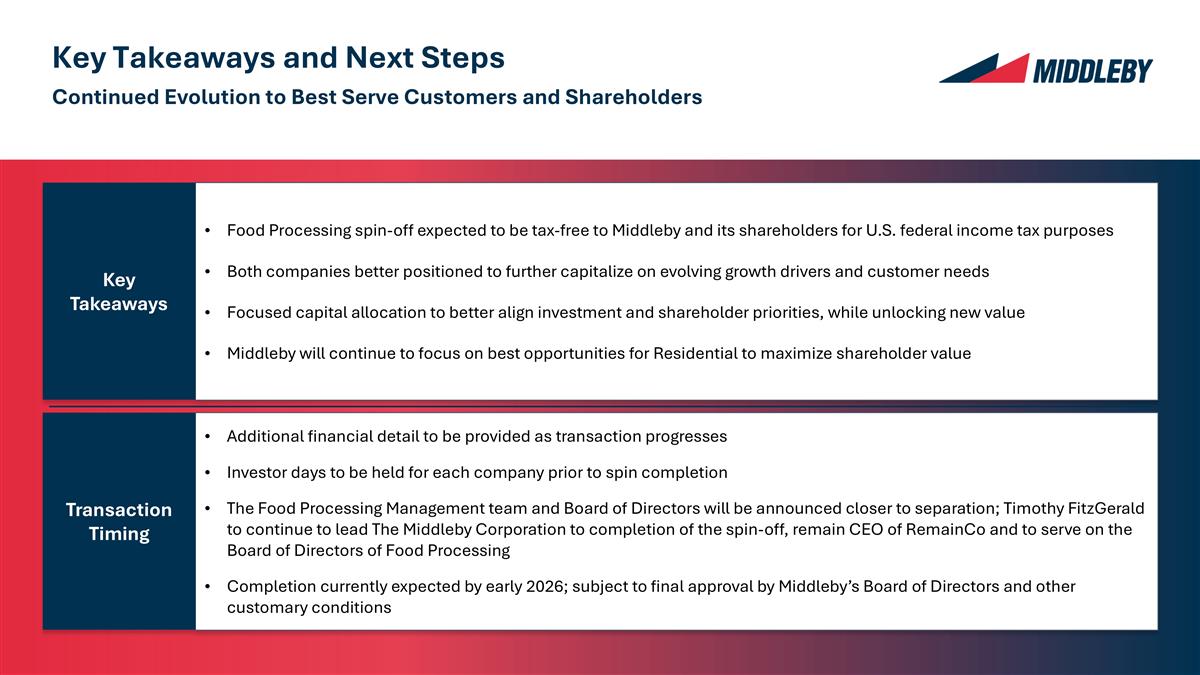

Key Takeaways and Next Steps Continued Evolution to Best Serve Customers and Shareholders Food Processing spin-off expected to be tax-free to Middleby and its shareholders for U.S. federal income tax purposes Both companies better positioned to further capitalize on evolving growth drivers and customer needs Focused capital allocation to better align investment and shareholder priorities, while unlocking new value Middleby will continue to focus on best opportunities for Residential to maximize shareholder value Key Takeaways Additional financial detail to be provided as transaction progresses Investor days to be held for each company prior to spin completion The Food Processing Management team and Board of Directors will be announced closer to separation; Timothy FitzGerald to continue to lead The Middleby Corporation to completion of the spin-off, remain CEO of RemainCo and to serve on the Board of Directors of Food Processing Completion currently expected by early 2026; subject to final approval by Middleby’s Board of Directors and other customary conditions Transaction Timing