UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM6-K

Report of Foreign Private Issuer

Pursuant to Rule13a-16 or15d-16 under the

Securities Exchange Act of 1934

For the month of February, 2018

Commission File Number1-8910

NIPPON TELEGRAPH AND TELEPHONE CORPORATION

(Translation of registrant’s name into English)

OTEMACHI FIRST SQUARE, EAST TOWER

5-1, OTEMACHI1-CHOME

CHIYODA-KU, TOKYO100-8116 JAPAN

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form20-F or Form40-F.

Form 20-F ☒ Form40-F ☐

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form6-K in paper as permitted by RegulationS-T Rule 101(b)(7):

ANNOUNCEMENT OF FINANCIAL RESULTS FOR THE THREE AND NINE MONTHS ENDED DECEMBER 31, 2017

On February 9, 2018, the registrant filed with the Tokyo Stock Exchange information as to the registrant’s financial condition and results of operations at and for the three and nine months ended December 31, 2017. Attached hereto is a copy of the press release and supplementary data relating thereto, both dated February 9, 2018, pertaining to such financial condition and results of operations, as well as forecasts for the registrant’s operations for the fiscal year ending March 31, 2018. The consolidated financial information of the registrant and that of its subsidiary NTT DOCOMO, INC., included in the press release and the supplementary data relating thereto, were prepared on the basis of accounting principles generally accepted in the United States. Thenon-consolidated financial information of the registrant and that of each of the registrant’s three wholly-owned subsidiaries, Nippon Telegraph and Telephone East Corporation, Nippon Telegraph and Telephone West Corporation and NTT Communications Corporation, as well as the consolidated financial information of its subsidiary NTT DATA CORPORATION, included in the press release and the supplementary data relating thereto, were prepared on the basis of accounting principles generally accepted in Japan. The consolidated financial information of the registrant’s subsidiary Dimension Data Holdings plc, included in the supplementary data related to the press release, was prepared on the basis of International Financial Reporting Standards (“IFRS”). The financial information for the three and nine months ended December 31, 2017 in the press release is unaudited.

The earnings projections of the registrant and its subsidiaries included in the press release contain forward-looking statements. The registrant desires to qualify for the “safe-harbor” provisions of the Private Securities Litigation Reform Act of 1995, and consequently is hereby filing cautionary statements identifying important factors that could cause the registrant’s actual results to differ materially from those set forth in the attachment.

The registrant’s forward-looking statements are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of the registrant in light of information currently available to it regarding the registrant and its subsidiaries and affiliates, the economy and the telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of the registrant and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from any future results that may be derived from the forward-looking statements, as well as other risks included in the registrant’s most recent Annual Report on Form20-F and other filings and submissions with the United States Securities and Exchange Commission.

No assurance can be given that the registrant’s actual results will not vary significantly from any expectation of future results that may be derived from the forward-looking statements included herein.

The information on any website referenced herein or in the attached material is not incorporated by reference herein or therein.

The attached material is a translation of the Japanese original. The Japanese original is authoritative.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

NIPPON TELEGRAPH AND TELEPHONE CORPORATION |

| |

| By | | /s/ Takashi Ameshima |

| | Name: | | Takashi Ameshima |

| | Title: | | Vice President |

| | | | Investor Relations Office |

Date: February 9, 2018

| | | | |

Financial Results Release | |

| February 9, 2018

[U.S. GAAP |

] |

For the Nine Months Ended December 31, 2017 | |

| | | | |

Name of registrant | | : | | Nippon Telegraph and Telephone Corporation (“NTT”) /

URL http://www.ntt.co.jp/ir/ |

Code No. | | : | | 9432 |

Stock exchanges on which the Company’s shares are listed | | : | | Tokyo |

Representative | | : | | Hiroo Unoura, President and Chief Executive Officer |

Contact | | : | | Takashi Ameshima, Head of IR, Finance and Accounting Department /

TEL+81-3-6838-5481 |

Scheduled filing date of quarterly securities report | | : | | February 13, 2018 |

Scheduled date of dividend payments | | : | | – |

Supplemental material on quarterly results | | : | | Yes |

Presentation on quarterly results | | : | | Yes (for institutional investors and analysts) |

| 1. | Consolidated Financial Results for the Nine Months Ended December 31, 2017 (April 1, 2017 – December 31, 2017) |

Amounts are rounded to the nearest million yen.

(1) Consolidated Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Operating Revenues | | | Operating Income | | | Income before

Income Taxes | | | Net Income

Attributable to NTT | |

Nine months ended December 31, 2017 | | | 8,722,036 | | | | 4.3 | % | | | 1,319,553 | | | | 0.1 | % | | | 1,441,310 | | | | 10.3 | % | | | 736,590 | | | | 10.1 | % |

Nine months ended December 31, 2016 | | | 8,360,497 | | | | (1.6 | )% | | | 1,318,554 | | | | 17.0 | % | | | 1,307,197 | | | | 16.6 | % | | | 668,728 | | | | 10.7 | % |

| | | | | | |

| Notes: | | 1. | | Comprehensive income (loss) attributable to NTT: | | For the nine months ended December 31, 2017: 811,781 million yen 38.0% |

| | | | | | For the nine months ended December 31, 2016: 588,306 million yen 12.3% |

| | 2. | | Percentages above represent changes from the corresponding period of the previous fiscal year. |

| | | | | | | | |

| | | Basic Earnings

per Share

Attributable to NTT | | | Diluted Earnings

per Share

Attributable to NTT | |

Nine months ended December 31, 2017 | | | 367.98 | (yen) | | | — | (yen) |

Nine months ended December 31, 2016 | | | 325.64 | (yen) | | | — | (yen) |

(2) Consolidated Financial Position

| | | | | | | | | | | | | | | | | | | | |

| | | (Millions of yen, except per share amounts) | |

| | | Total Assets | | | Total Equity | | | NTT Shareholders’

Equity | | | Equity Ratio

(Ratio of NTT

Shareholders’ Equity

to Total Assets) | | | NTT

Shareholders’

Equity per Share | |

December 31, 2017 | | | 21,528,070 | | | | 11,993,834 | | | | 9,376,545 | | | | 43.6 | % | | | 4,736.86 | (yen) |

March 31, 2017 | | | 21,250,325 | | | | 11,507,756 | | | | 9,052,479 | | | | 42.6 | % | | | 4,491.73 | (yen) |

| | | | | | | | | | | | | | | | | | | | |

| | | Annual Dividends | |

| | End of the

first quarter | | | End of the

second quarter | | | End of the

third quarter | | | Year-end | | | Total | |

Year Ended March 31, 2017 | | | — | | | | 60.00 | (yen) | | | — | | | | 60.00 | (yen) | | | 120.00 | (yen) |

Year Ending March 31, 2018 | | | — | | | | 75.00 | (yen) | | | — | | | | — | | | | — | |

Year Ending March 31, 2018 (Forecasts) | | | — | | | | — | | | | — | | | | 75.00 | (yen) | | | 150.00 | (yen) |

Note: Change in dividend forecasts during the nine months ended December 31, 2017: None

| 3. | Consolidated Financial Results Forecasts for the Fiscal Year Ending March 31, 2018 (April 1, 2017 – March 31, 2018) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Millions of yen, except per share amount) | |

| | | Operating Revenues | | | Operating Income | | | Income before

Income Taxes | | | Net Income

Attributable to NTT | | | Basic Earnings per Share

Attributable to NTT | |

Year Ending March 31, 2018 | | | 11,750,000 | | | | 3.2 | % | | | 1,590,000 | | | | 3.3 | % | | | 1,695,000 | | | | 10.9 | % | | | 880,000 | | | | 10.0 | % | | | 440.00 | (yen) |

| | | | |

| Notes: | | 1. | | Percentages above represent changes from the previous fiscal year. |

| | 2. | | Change in consolidated financial results forecasts for the fiscal year ending March 31, 2018 during the nine months ended December 31, 2017: None |

– 1 –

*Notes:

| | | | | | | | |

| (1) | | Change in significant consolidated subsidiaries during the nine months ended December 31, 2017 that resulted in changes in the scope of consolidation: None |

| |

| (2) | | Adoption of accounting which is simplified or exceptional for quarterly consolidated financial statements: None |

| |

| (3) | | Change of accounting policy |

| | |

| | i. | | Change due to revision of accounting standards and other regulations: Yes |

| | |

| | ii. | | Other change: Yes |

| | | | (For further details, please see “Summary Information (notes)” on page 3.) |

| |

| (4) | | Number of shares outstanding (common stock) |

| | |

| | i. | | Number of shares outstanding (including treasury stock): |

| | | |

| | | | | | December 31, 2017 : 2,096,394,470 shares |

| | | |

| | | | | | March 31, 2017 : 2,096,394,470 shares |

| | |

| | ii. | | Number of shares of treasury stock: |

| | | |

| | | | | | December 31, 2017 : 116,908,131 shares |

| | | |

| | | | | | March 31, 2017 : 81,026,959 shares |

| | |

| | iii. | | Weighted average number of shares outstanding: |

| | | |

| | | | | | For the nine months ended December 31, 2017 : 2,001,718,206 shares |

| | | |

| | | | | | For the nine months ended December 31, 2016 : 2,053,571,790 shares |

| * | This financial results release is not subject to the quarterly review. |

| * | Explanation of earnings forecasts and other notes: |

Forward-looking statements in this earnings release, such as forecasts of results of operations, are based on the information currently available to NTT and certain assumptions that we regard as reasonable and therefore actual results may differ materially from those contained in or suggested by any forward-looking statements. With regard to the assumptions and other related matters concerning forecasts for the fiscal year ending March 31, 2018, please refer to page 10.

On Friday, February 9, 2018, NTT will hold a presentation on its financial results for institutional investors and analysts. Shortly thereafter, NTT plans to post on its website explanatory details, along with the materials used at the presentation.

– 2 –

1. Summary Information (notes)

| (1) | Change in significant consolidated subsidiaries during the nine months ended December 31, 2017, that resulted in changes in the scope of consolidation: None |

| (2) | Adoption of accounting which is simplified or exceptional for quarterly consolidated financial statements: None |

| (3) | Change of accounting policy: Yes |

Balance Sheet Classification of Deferred Taxes

On November 20, 2015, the FASB issuedASU2015-17 “Balance sheet classification of deferred taxes” which requires that all deferred tax liabilities and assets be classified as noncurrent on the balance sheet.

Effective April 1, 2017, NTT Group adopted this ASU prospectively and prior periods were not retrospectively adjusted.

Simplifying the Test for Goodwill Impairment

On January 26, 2017, the FASB issued ASU2017-04 “Simplifying the Test for Goodwill Impairment,” which replaces thetwo-step goodwill impairment test with theone-step goodwill impairment test. The amendments in this update require that an entity should perform its annual, or interim, goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount and an entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value.

The adoption of ASU2017-04 would be permitted for goodwill impairment tests with measurement dates after January 1, 2017. NTT Group adopted this ASU for goodwill impairment test with measurement date on July 1, 2017.

Change in Fiscal Year End of Certain Subsidiaries

As of April 1, 2017, certain of NTT’s consolidated subsidiaries changed their fiscal year ends from December 31 or January 31 to March 31, thereby eliminating a three-month ortwo-month lag between their fiscal year ends and NTT’s fiscal year end in NTT’s quarterly consolidated financial statements. The elimination of this lag was applied as a change in accounting policy. NTT did not make any retrospective adjustments to its financial statements as these changes did not have a material impact on the consolidated financial statements for the nine months ended December 31, 2016 or the year ended March 31, 2017. As a result of this change, NTT’s retained earnings have increased by ¥964 million, and its accumulated other comprehensive income (loss) and noncontrolling interests have decreased by ¥3,351 million and ¥2,012 million, respectively, as of the beginning of the current fiscal year.

– 3 –

2. CONSOLIDATED FINANCIAL STATEMENTS

(1) Consolidated Balance Sheets

| | | | | | | | | | | | |

| | | Millions of yen | |

| | | March 31,

2017 | | | December 31,

2017 | | | Increase

(Decrease) | |

ASSETS | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | |

Cash and cash equivalents | | ¥ | 925,213 | | | ¥ | 766,581 | | | ¥ | (158,632 | ) |

Short-term investments | | | 63,844 | | | | 44,094 | | | | (19,750 | ) |

Notes and accounts receivable, trade | | | 2,699,708 | | | | 2,849,652 | | | | 149,944 | |

Allowance for doubtful accounts | | | (48,626 | ) | | | (52,835 | ) | | | (4,209 | ) |

Accounts receivable, other | | | 505,145 | | | | 658,418 | | | | 153,273 | |

Inventories | | | 365,379 | | | | 459,442 | | | | 94,063 | |

Prepaid expenses and other current assets | | | 573,170 | | | | 623,302 | | | | 50,132 | |

Deferred income taxes | | | 228,590 | | | | — | | | | (228,590 | ) |

| | | | | | | | | | | | |

Total current assets | | | 5,312,423 | | | | 5,348,654 | | | | 36,231 | |

| | | | | | | | | | | | |

Property, plant and equipment: | | | | | | | | | | | | |

Telecommunications equipment | | | 11,046,115 | | | | 10,991,048 | | | | (55,067 | ) |

Telecommunications service lines | | | 16,064,732 | | | | 14,144,223 | | | | (1,920,509 | ) |

Buildings and structures | | | 6,147,869 | | | | 6,236,623 | | | | 88,754 | |

Machinery, vessels and tools | | | 2,032,389 | | | | 2,118,915 | | | | 86,526 | |

Land | | | 1,292,685 | | | | 1,306,405 | | | | 13,720 | |

Construction in progress | | | 421,819 | | | | 475,577 | | | | 53,758 | |

| | | | | | | | | | | | |

| | | 37,005,609 | | | | 35,272,791 | | | | (1,732,818 | ) |

Accumulated depreciation | | | (27,286,588 | ) | | | (25,565,588 | ) | | | 1,721,000 | |

| | | | | | | | | | | | |

Net property, plant and equipment | | | 9,719,021 | | | | 9,707,203 | | | | (11,818 | ) |

| | | | | | | | | | | | |

| | | |

Investments and other assets: | | | | | | | | | | | | |

Investments in affiliated companies | | | 484,596 | | | | 507,216 | | | | 22,620 | |

Marketable securities and other investments | | | 495,290 | | | | 552,254 | | | | 56,964 | |

Goodwill | | | 1,314,645 | | | | 1,355,737 | | | | 41,092 | |

Software | | | 1,209,485 | | | | 1,197,194 | | | | (12,291 | ) |

Other intangible assets | | | 453,918 | | | | 412,118 | | | | (41,800 | ) |

Other assets | | | 1,492,076 | | | | 1,558,670 | | | | 66,594 | |

Deferred income taxes | | | 768,871 | | | | 889,024 | | | | 120,153 | |

| | | | | | | | | | | | |

Total investments and other assets | | | 6,218,881 | | | | 6,472,213 | | | | 253,332 | |

| | | | | | | | | | | | |

Total assets | | ¥ | 21,250,325 | | | ¥ | 21,528,070 | | | ¥ | 277,745 | |

| | | | | | | | | | | | |

– 4 –

| | | | | | | | | | | | |

| | | Millions of yen | |

| | | March 31,

2017 | | | December 31,

2017 | | | Increase

(Decrease) | |

LIABILITIES AND EQUITY | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | |

Short-term borrowings | | ¥ | 227,207 | | | ¥ | 377,194 | | | ¥ | 149,987 | |

Current portion of long-term debt | | | 681,904 | | | | 587,451 | | | | (94,453 | ) |

Accounts payable, trade | | | 1,612,996 | | | | 1,365,246 | | | | (247,750 | ) |

Current portion of obligations under capital leases | | | 14,430 | | | | 13,011 | | | | (1,419 | ) |

Accrued payroll | | | 443,308 | | | | 402,755 | | | | (40,553 | ) |

Accrued taxes on income | | | 239,755 | | | | 163,304 | | | | (76,451 | ) |

Accrued consumption tax | | | 75,083 | | | | 99,517 | | | | 24,434 | |

Advances received | | | 324,342 | | | | 389,937 | | | | 65,595 | |

Other | | | 512,368 | | | | 516,082 | | | | 3,714 | |

| | | | | | | | | | | | |

Total current liabilities | | | 4,131,393 | | | | 3,914,497 | | | | (216,896 | ) |

| | | | | | | | | | | | |

Long-term liabilities: | | | | | | | | | | | | |

Long-term debt (excluding current portion) | | | 3,168,478 | | | | 3,154,018 | | | | (14,460 | ) |

Obligations under capital leases (excluding current portion) | | | 25,568 | | | | 23,680 | | | | (1,888 | ) |

Liability for employees’ retirement benefits | | | 1,599,381 | | | | 1,645,420 | | | | 46,039 | |

Accrued liabilities for point programs | | | 103,047 | | | | 102,115 | | | | (932 | ) |

Deferred income taxes | | | 166,751 | | | | 137,675 | | | | (29,076 | ) |

Other | | | 497,132 | | | | 504,835 | | | | 7,703 | |

| | | | | | | | | | | | |

Total long-term liabilities | | | 5,560,357 | | | | 5,567,743 | | | | 7,386 | |

| | | | | | | | | | | | |

Redeemable noncontrolling interests | | | 50,819 | | | | 51,996 | | | | 1,177 | |

| | | | | | | | | | | | |

Equity: | | | | | | | | | | | | |

NTT shareholders’ equity | | | | | | | | | | | | |

Common stock, no par value | | | 937,950 | | | | 937,950 | | | | — | |

Additionalpaid-in capital | | | 2,862,035 | | | | 2,841,567 | | | | (20,468 | ) |

Retained earnings | | | 5,626,155 | | | | 6,092,304 | | | | 466,149 | |

Accumulated other comprehensive income (loss) | | | 1,562 | | | | 73,402 | | | | 71,840 | |

Treasury stock, at cost | | | (375,223 | ) | | | (568,678 | ) | | | (193,455 | ) |

| | | | | | | | | | | | |

Total NTT shareholders’ equity | | | 9,052,479 | | | | 9,376,545 | | | | 324,066 | |

| | | | | | | | | | | | |

Noncontrolling interests | | | 2,455,277 | | | | 2,617,289 | | | | 162,012 | |

| | | | | | | | | | | | |

Total equity | | | 11,507,756 | | | | 11,993,834 | | | | 486,078 | |

| | | | | | | | | | | | |

Total liabilities and equity | | ¥ | 21,250,325 | | | ¥ | 21,528,070 | | | ¥ | 277,745 | |

| | | | | | | | | | | | |

– 5 –

(2) Consolidated Statements of Income and Consolidated Statements of Comprehensive Income

NINE-MONTH PERIOD ENDED DECEMBER 31

Consolidated Statements of Income

| | | | | | | | | | | | |

| | | Millions of yen | |

| | | 2016 | | | 2017 | | | Increase

(Decrease) | |

Operating revenues: | | | | | | | | | | | | |

Fixed voice related services | | ¥ | 919,161 | | | ¥ | 858,886 | | | ¥ | (60,275 | ) |

Mobile voice related services | | | 651,378 | | | | 706,412 | | | | 55,034 | |

IP / packet communications services | | | 2,842,376 | | | | 2,860,996 | | | | 18,620 | |

Sale of telecommunications equipment | | | 650,100 | | | | 641,991 | | | | (8,109 | ) |

System integration | | | 2,123,736 | | | | 2,479,868 | | | | 356,132 | |

Other | | | 1,173,746 | | | | 1,173,883 | | | | 137 | |

| | | | | | | | | | | | |

| | | 8,360,497 | | | | 8,722,036 | | | | 361,539 | |

| | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | |

Cost of services (excluding items shown separately below) | | | 1,751,417 | | | | 1,700,865 | | | | (50,552 | ) |

Cost of equipment sold (excluding items shown separately below) | | | 654,772 | | | | 675,388 | | | | 20,616 | |

Cost of system integration (excluding items shown separately below) | | | 1,496,570 | | | | 1,774,817 | | | | 278,247 | |

Depreciation and amortization | | | 1,082,890 | | | | 995,564 | | | | (87,326 | ) |

Impairment losses | | | | | | | | | | | | |

Goodwill | | | 53,294 | | | | 18,864 | | | | (34,430 | ) |

Metal cables | | | — | | | | 124,800 | | | | 124,800 | |

Other | | | 12,698 | | | | 744 | | | | (11,954 | ) |

Selling, general and administrative expenses | | | 1,990,302 | | | | 2,111,441 | | | | 121,139 | |

| | | | | | | | | | | | |

| | | 7,041,943 | | | | 7,402,483 | | | | 360,540 | |

| | | | | | | | | | | | |

Operating income | | | 1,318,554 | | | | 1,319,553 | | | | 999 | |

| | | | | | | | | | | | |

Other income (expenses): | | | | | | | | | | | | |

Interest and amortization of bond discounts and issue costs | | | (28,168 | ) | | | (25,276 | ) | | | 2,892 | |

Interest income | | | 13,176 | | | | 14,093 | | | | 917 | |

Income from arbitration award | | | — | | | | 147,646 | | | | 147,646 | |

Other, net | | | 3,635 | | | | (14,706 | ) | | | (18,341 | ) |

| | | | | | | | | | | | |

| | | (11,357 | ) | | | 121,757 | | | | 133,114 | |

| | | | | | | | | | | | |

Income before income taxes and equity in earnings (losses) of affiliated companies | | | 1,307,197 | | | | 1,441,310 | | | | 134,113 | |

| | | | | | | | | | | | |

Income tax expense (benefit): | | | | | | | | | | | | |

Current | | | 369,479 | | | | 421,822 | | | | 52,343 | |

Deferred | | | 55,362 | | | | 35,763 | | | | (19,599 | ) |

| | | | | | | | | | | | |

| | | 424,841 | | | | 457,585 | | | | 32,744 | |

| | | | | | | | | | | | |

Income before equity in earnings (losses) of affiliated companies | | | 882,356 | | | | 983,725 | | | | 101,369 | |

| | | | | | | | | | | | |

Equity in earnings (losses) of affiliated companies | | | 14,247 | | | | 12,050 | | | | (2,197 | ) |

| | | | | | | | | | | | |

Net income | | | 896,603 | | | | 995,775 | | | | 99,172 | |

| | | | | | | | | | | | |

Less – Net income attributable to noncontrolling interests | | | 227,875 | | | | 259,185 | | | | 31,310 | |

| | | | | | | | | | | | |

Net income attributable to NTT | | ¥ | 668,728 | | | ¥ | 736,590 | | | ¥ | 67,862 | |

| | | | | | | | | | | | |

| | | |

Per share of common stock: | | | | | | | | | | | | |

Weighted average number of shares outstanding (Shares) | | | 2,053,571,790 | | | | 2,001,718,206 | | | | | |

Net income attributable to NTT (Yen) | | ¥ | 325.64 | | | ¥ | 367.98 | | | | | |

| | | | | | | | | | | | |

– 6 –

Consolidated Statements of Comprehensive Income

| | | | | | | | | | | | |

| | | Millions of yen | |

| | | 2016 | | | 2017 | | | Increase

(Decrease) | |

Net income | | ¥ | 896,603 | | | ¥ | 995,775 | | | ¥ | 99,172 | |

Other comprehensive income (loss), net of tax: | | | | | | | | | | | | |

Unrealized gain (loss) on securities | | | 1,117 | | | | 42,466 | | | | 41,349 | |

Unrealized gain (loss) on derivative instruments | | | (2,415 | ) | | | 737 | | | | 3,152 | |

Foreign currency translation adjustments | | | (97,527 | ) | | | 61,778 | | | | 159,305 | |

Pension liability adjustments | | | 8,173 | | | | 5,670 | | | | (2,503 | ) |

| | | | | | | | | | | | |

Total other comprehensive income (loss) | | | (90,652 | ) | | | 110,651 | | | | 201,303 | |

| | | | | | | | | | | | |

Total comprehensive income (loss) | | | 805,951 | | | | 1,106,426 | | | | 300,475 | |

| | | | | | | | | | | | |

Less – Comprehensive income attributable to noncontrolling interests | | | 217,645 | | | | 294,645 | | | | 77,000 | |

| | | | | | | | | | | | |

Total comprehensive income (loss) attributable to NTT | | ¥ | 588,306 | | | ¥ | 811,781 | | | ¥ | 223,475 | |

| | | | | | | | | | | | |

– 7 –

(3) Going Concern Assumption

None

(4) NTT Shareholders’ Equity

1. Dividends

Cash dividends paid during the nine months ended December 31, 2017 were as follows:

| | |

Resolution | | The shareholders’ meeting held on June 27, 2017 |

Class of shares | | Common stock |

Source of dividends | | Retained earnings |

Total cash dividends paid | | ¥120,922 million |

Cash dividends per share | | ¥60 |

Record date | | March 31, 2017 |

Date of payment | | June 28, 2017 |

| | |

Resolution | | The Board of Directors’ meeting on November 10, 2017 |

Class of shares | | Common stock |

Source of dividends | | Retained earnings |

Total cash dividends declared | | ¥150,484 million |

Cash dividends per share | | ¥75 |

Record date | | September 30, 2017 |

Date of payment | | December 11, 2017 |

2. Treasury stock

On December 12, 2016, the Board of Directors resolved that NTT may acquire up to 33 million shares of its outstanding common stock for an amount in total not exceeding ¥150 billion from December 13, 2016 through June 30, 2017. Based on this resolution, NTT repurchased 21,693,800 shares of its common stock for a total purchase price of ¥106,763 million between December 2016 and March 2017. NTT also repurchased 8,893,400 shares of its common stock for a total purchase price of ¥43,235 million in April 2017 and concluded the repurchase of its common stock authorized by Board of Directors’ resolution.

On September 25, 2017, the Board of Directors resolved that NTT may acquire up to 30 million shares of its outstanding common stock for an amount in total not exceeding ¥150 billion from September 26, 2017 through March 31, 2018. NTT repurchased 26,946,400 shares of its common stock for a total purchase price of ¥150,000 million between October 2017 and December 2017, and concluded the repurchase of its common stock authorized by Board of Directors’ resolution.

– 8 –

(5) Subsequent Events

NTT DOCOMO’s repurchase of its common stock

On October 26, 2017, the Board of Directors of NTT DOCOMO resolved that NTT DOCOMO may acquire up to 120 million shares of its outstanding common stock for an amount in total not exceeding ¥300,000 million from October 27, 2017 through March 31, 2018.

On December 11, 2017, the Board of Directors of NTT DOCOMO resolved that NTT DOCOMO may acquire up to 93,248,787 shares of its outstanding common stock by way of tender offer at an amount in total not exceeding ¥250,000 million from December 12, 2017 through January 15, 2018. Based on this resolution, NTT DOCOMO repurchased 75,678,037 shares of its common stock at ¥202,893 million on February 6, 2018, 74,599,000 shares of which NTT sold back to NTT DOCOMO at ¥200,000 million. Due to NTT DOCOMO’s repurchase transactions, NTT’s ownership interest in NTT DOCOMO decreased from 66.7% to 66.0%. NTT expects to recognize the difference between the consideration paid to thenon-controlling interest holders and the decrease in the carrying value of suchnon-controlling interests resulting from this transaction as an adjustment to “Additionalpaid-in capital” in the consolidated balance sheet as of March 31, 2018.

The Board of Directors of NTT DOCOMO also resolved that NTT DOCOMO may acquire up to 44,321,963 shares of its outstanding common stock*by way of repurchases on Tokyo Stock Exchange for an amount in total not exceeding ¥97,107 million*from the next business day following the expiration of the tender offer through March 31, 2018. NTT DOCOMO did not make repurchase by way of repurchases on the market in January 2018.

| | * | The number of shares remaining after subtracting the number of shares acquired by way of tender offer from the maximum limit of 120 million shares and the amount remaining after subtracting the total amount used to repurchase the shares acquired by way of tender offer from the maximum limit of ¥300,000 million. |

– 9 –

[Note]

The forward-looking statements and projected figures concerning the future performance of NTT and its subsidiaries and affiliates contained or referred to herein are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of NTT in light of information currently available to it regarding NTT and its subsidiaries and affiliates, the economy and telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of NTT and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from the forecasts contained or referred to herein, as well as other risks included in NTT’s most recent Annual Report on Form20-F and other filings and submissions with the United States Securities and Exchange Commission.

– 10 –

Financial Results for the Nine Months Ended December 31, 2017 February 9, 2018

|

|

The forward-looking statements and projected figures concerning the future performance of NTT and its subsidiaries and affiliates contained or referred to herein are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of NTT in light of information currently available to it regarding NTT and its subsidiaries and affiliates, the economy and telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of NTT and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from the forecasts contained or referred to herein, as well as other risks included in NTT’s most recent Annual Report on Form20-F and other filings and submissions with the United States Securities and Exchange Commission.

* “E” in this material represents that the figure is a plan or projection for operation.

** “FY” in this material indicates the fiscal year ending March 31 of the succeeding year.

*** “3Q” in this material represents the9-month period beginning on April 1 and ending on December 31.

Financial Results for the Nine Months Ended December 31, 2017 1 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

Table of Contents

Highlights

Contributing Factors by Segment Topics (Reference) Major B2B2X Initiatives (Reference) NTT R&D Forum 2018 (Reference) Mobile World Congress 2018 – A Group Exhibition On Display Appendix

Financial Results for the Nine Months Ended December 31, 2017 2 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

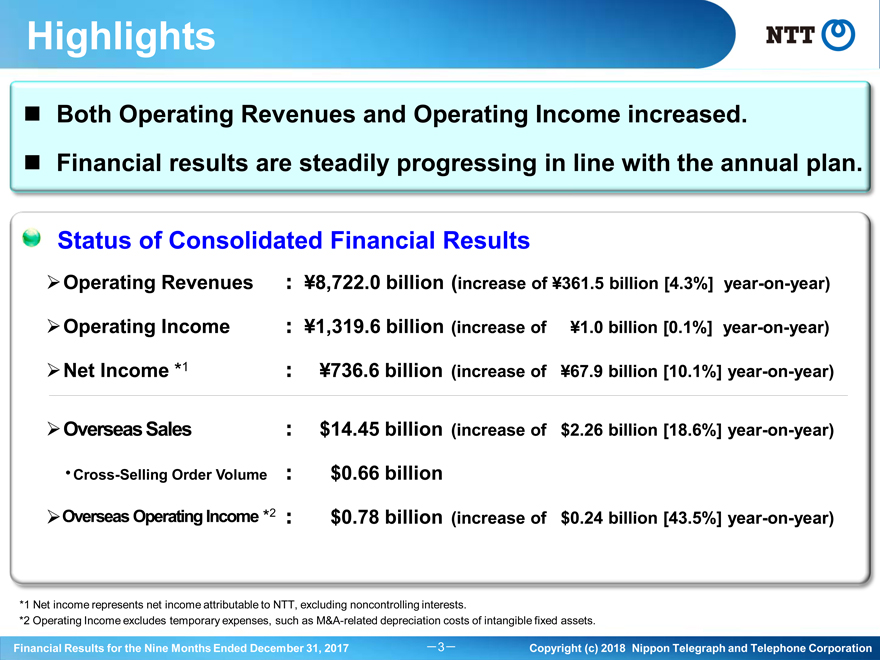

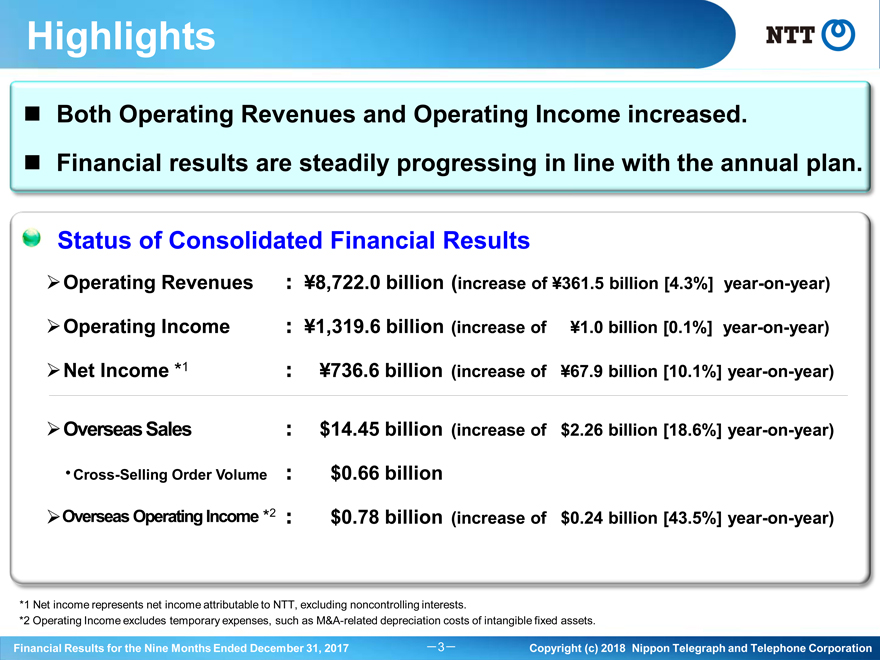

Highlights

Both Operating Revenues and Operating Income increased.

Financial results are steadily progressing in line with the annual plan.

Status of Consolidated Financial Results

Operating Revenues Ą8,722.0 billion (increase of Ą361.5 billion [4.3%]year-on-year)

Operating Income Ą1,319.6 billion (increase of Ą1.0 billion [0.1%]year-on-year) Net Income *1 Ą736.6 billion (increase of Ą67.9 billion [10.1%]year-on-year)

Overseas Sales $14.45 billion (increase of $2.26 billion [18.6%]year-on-year)

$0.66 billion

Overseas Operating Income *2 $0.78 billion (increase of $0.24 billion [43.5%]year-on-year)

*1 Net income represents net income attributable to NTT, excluding noncontrolling interests.

*2 Operating Income excludes temporary expenses, such asM&A-related depreciation costs of intangible fixed assets.

Financial Results for the Nine Months Ended December 31, 2017 3 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

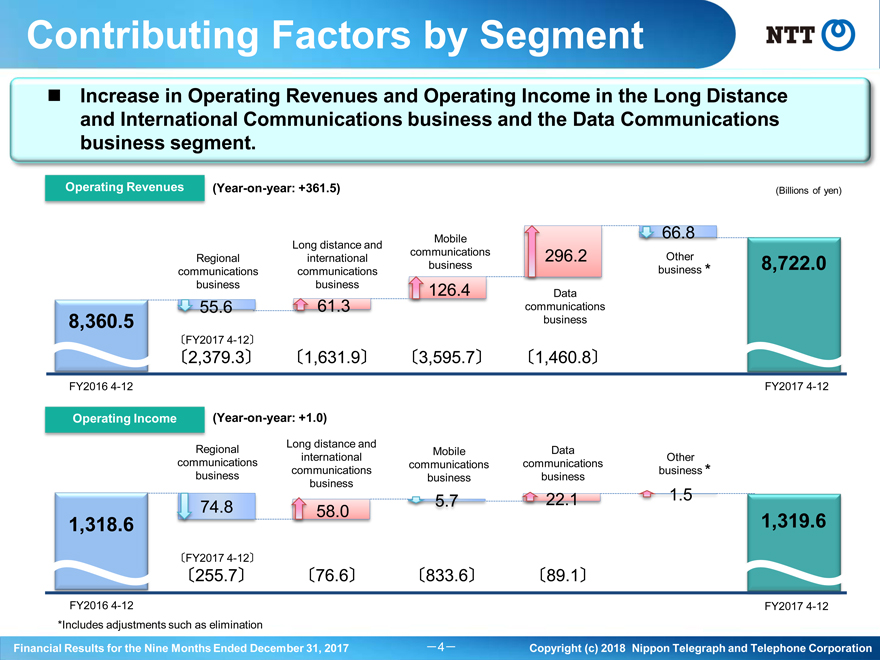

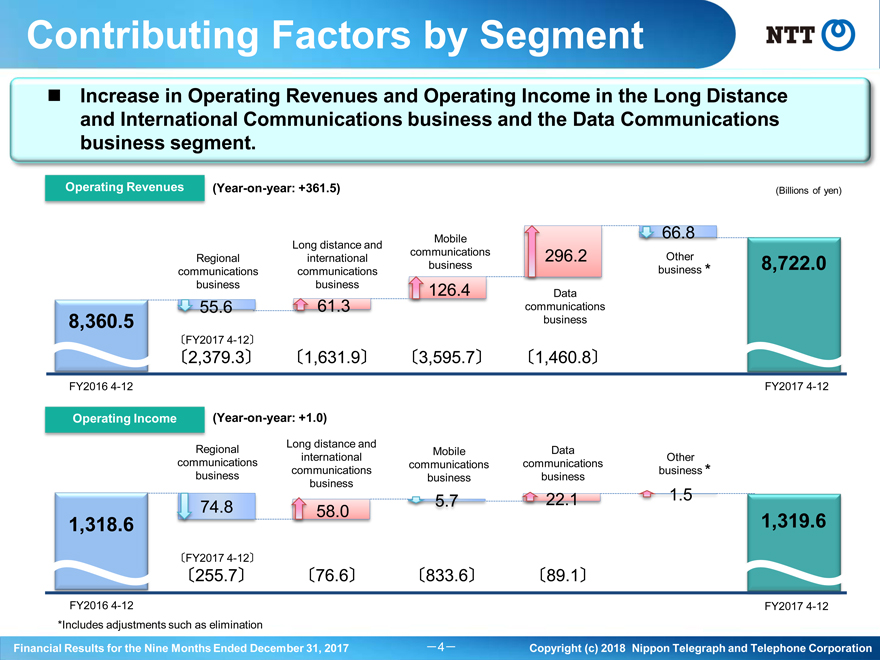

Contributing Factors by Segment

Increase in Operating Revenues and Operating Income in the Long Distance and International Communications business and the Data Communications business segment.

Operating Revenues(Year-on-year: +361.5) (Billions of yen)

Mobile 66.8 Long distance and communications 296.2 Other Regional international business business * 8,722.0 communications communications business business 126.4 Data 55.6 61.3 communications 8,360.5 business

FY20174-12

2,379.3 1,631.9 3,595.7 1,460.8

FY20164-12 FY20174-12

Operating Income(Year-on-year: +1.0)

Regional Long distance and

Mobile Data communications international Other communications communications business communications business * business business business

5.7 22.1 1.5 74.8 58.0

1,318.6 1,319.6

FY20174-12

255.7 76.6 833.6 89.1

FY20164-12 FY20174-12 *Includes adjustments such as elimination

Financial Results for the Nine Months Ended December 31, 2017 4 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

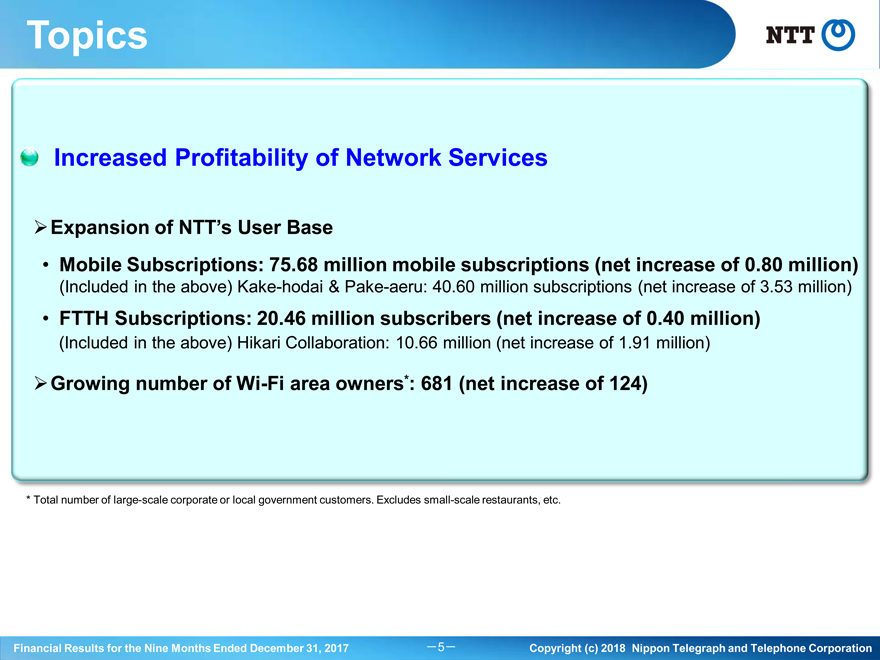

Topics

Increased Profitability of Network Services

Expansion of NTT’s User Base

• Mobile Subscriptions: 75.68 million mobile subscriptions (net increase of 0.80 million)

(Included in the above) Kake-hodai & Pake-aeru: 40.60 million subscriptions (net increase of 3.53 million)

• FTTH Subscriptions: 20.46 million subscribers (net increase of 0.40 million)

(Included in the above) Hikari Collaboration: 10.66 million (net increase of 1.91 million)

Growing number ofWi-Fi area owners*: 681 (net increase of 124)

* Total number of large-scale corporate or local government customers. Excludes small-scale restaurants, etc.

Financial Results for the Nine Months Ended December 31, 2017 5 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

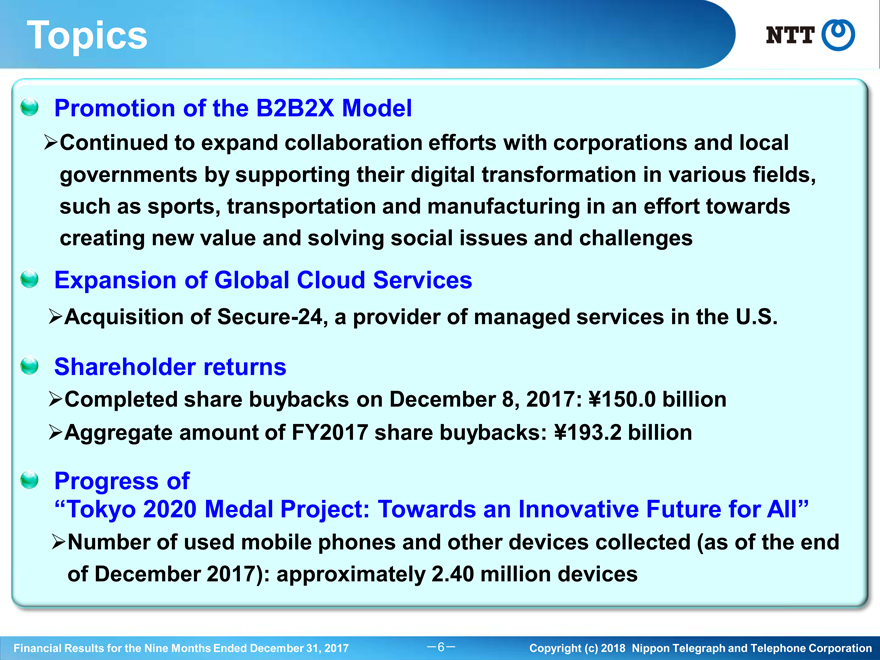

Topics

Promotion of the B2B2X Model

Continued to expand collaboration efforts with corporations and local governments by supporting their digital transformation in various fields, such as sports, transportation and manufacturing in an effort towards creating new value and solving social issues and challenges

Expansion of Global Cloud Services

Acquisition ofSecure-24, a provider of managed services in the U.S.

Shareholder returns

Completed share buybacks on December 8, 2017: Ą150.0 billion Aggregate amount of FY2017 share buybacks: Ą193.2 billion

Progress of

“Tokyo 2020 Medal Project: Towards an Innovative Future for All”

Number of used mobile phones and other devices collected (as of the end of December 2017): approximately 2.40 million devices

Financial Results for the Nine Months Ended December 31, 2017 6 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

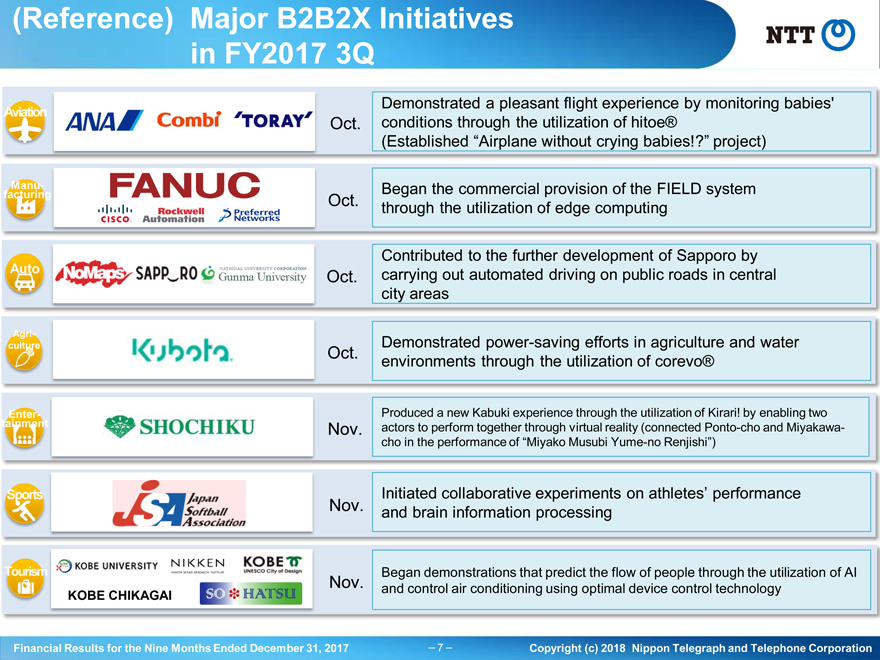

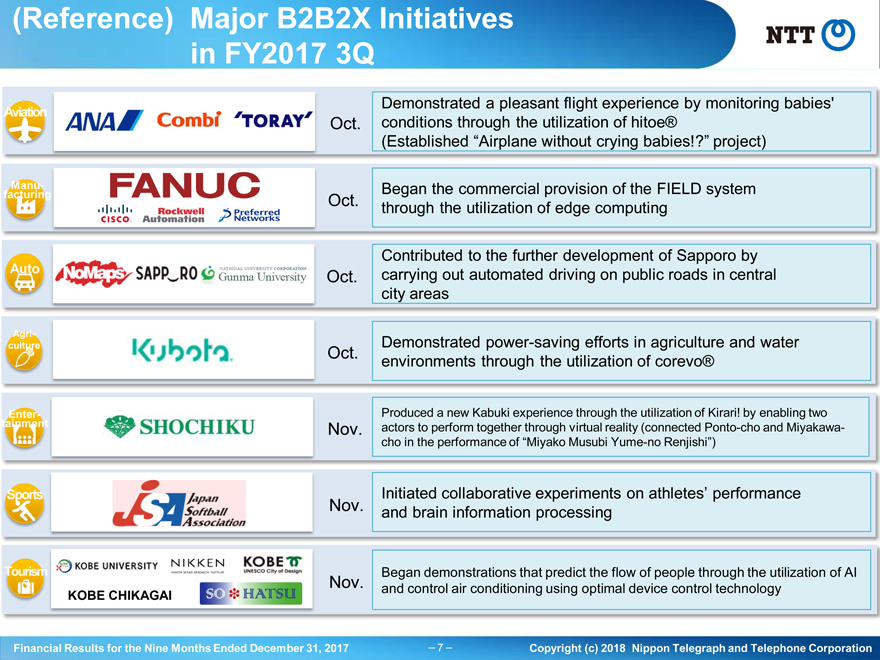

(Reference) Major B2B2X Initiatives in FY2017 3Q

Demonstrated a pleasant flight experience by monitoring babies’

Aviation

Oct. conditions through the utilization of hitoe®

(Established “Airplane without crying babies!?” project)

Manu- Began the commercial provision of the FIELD system

facturing Oct.

through the utilization of edge computing

Contributed to the further development of Sapporo by Auto Oct. carrying out automated driving on public roads in central city areas

Agri- Demonstrated power-saving efforts in agriculture and water

culture Oct.

environments through the utilization of corevo®

Enter- Produced a new Kabuki experience through the utilization of Kirari! by enabling two tainment Nov. actors to perform together through virtual reality (connected Ponto-cho andMiyakawa-cho in the performance of “Miyako MusubiYume-no Renjishi”)

Sports Initiated collaborative experiments on athletes’ performance Nov. and brain information processing

Tourism Began demonstrations that predict the flow of people through the utilization of AI Nov. and control air conditioning using optimal device control technology

KOBE CHIKAGAI

Financial Results for the Nine Months Ended December 31, 2017 7 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

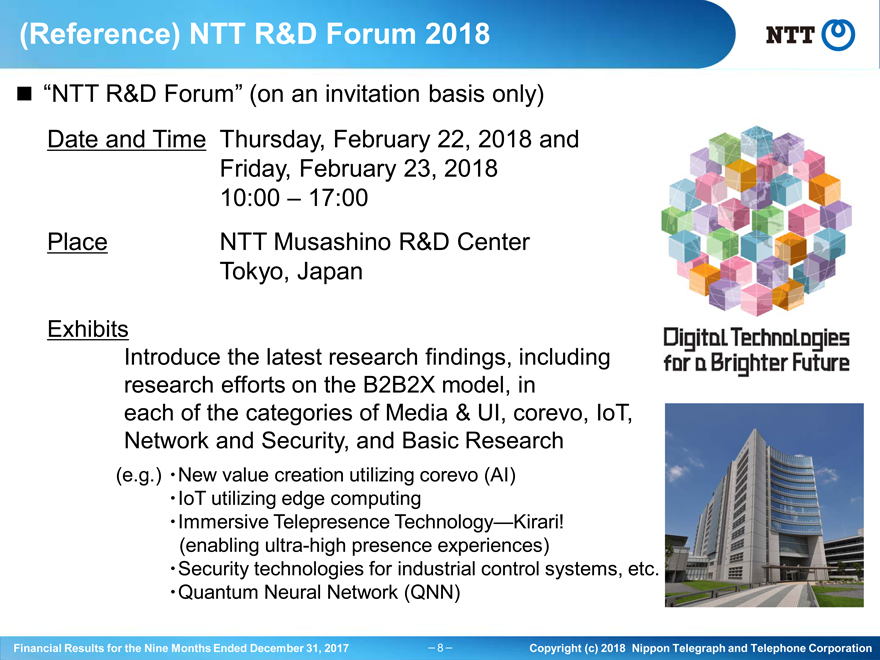

(Reference) NTT R&D Forum 2018

â– “NTT R&D Forum” (on an invitation basis only) Date and Time Thursday, February 22, 2018 and Friday, February 23, 2018 10:00 – 17:00 Place NTT Musashino R&D Center Tokyo, Japan

Exhibits

Introduce the latest research findings, including research efforts on the B2B2X model, in each of the categories of Media & UI, corevo, IoT, Network and Security, and Basic Research

(e.g.) ・New value creation utilizing corevo (AI) ・IoT utilizing edge computing ・Immersive Telepresence Technology—Kirari! (enabling ultra-high presence experiences)

Financial Results for the Nine Months Ended December 31, 2017 8 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

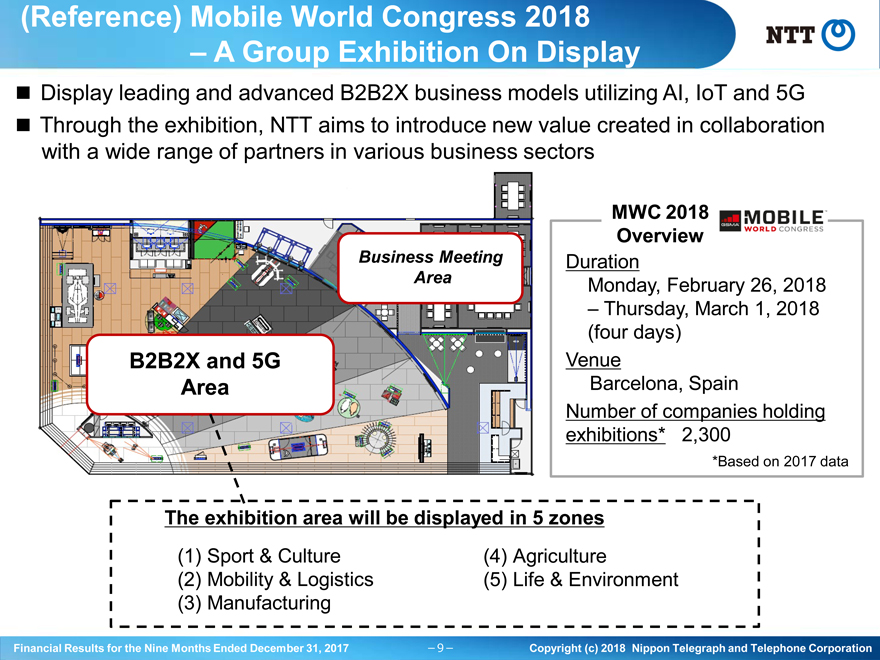

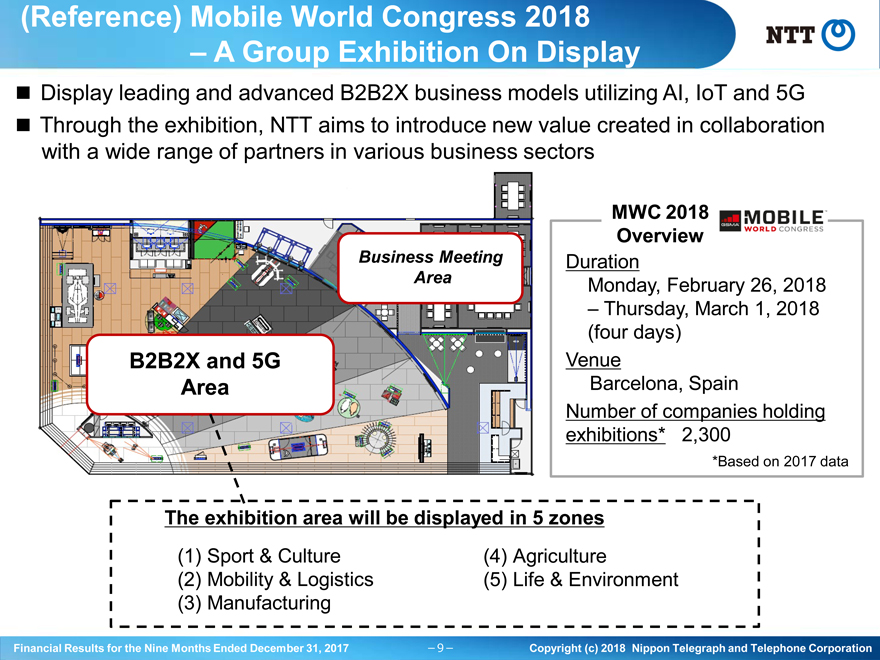

(Reference) Mobile World Congress 2018

– A Group Exhibition On Display

â– Display leading and advanced B2B2X business models utilizing AI, IoT and 5G

Through the

â– exhibition, NTT aims to introduce new value created in collaboration with a wide range of partners in various business sectors

MWC 2018 Overview

Business Meeting Duration

Area Monday, February 26, 2018

– Thursday, March 1, 2018 (four days) Venue

B2B2X and 5G

Area Barcelona, Spain

Number of companies holding exhibitions* 2,300

*Based on 2017 data

The exhibition area will be displayed in 5 zones

(1) Sport & Culture (4) Agriculture (2) Mobility & Logistics (5) Life & Environment (3) Manufacturing

Financial Results for the Nine Months Ended December 31, 2017 9 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

Appendix

Progress of Broadband Services

|

|

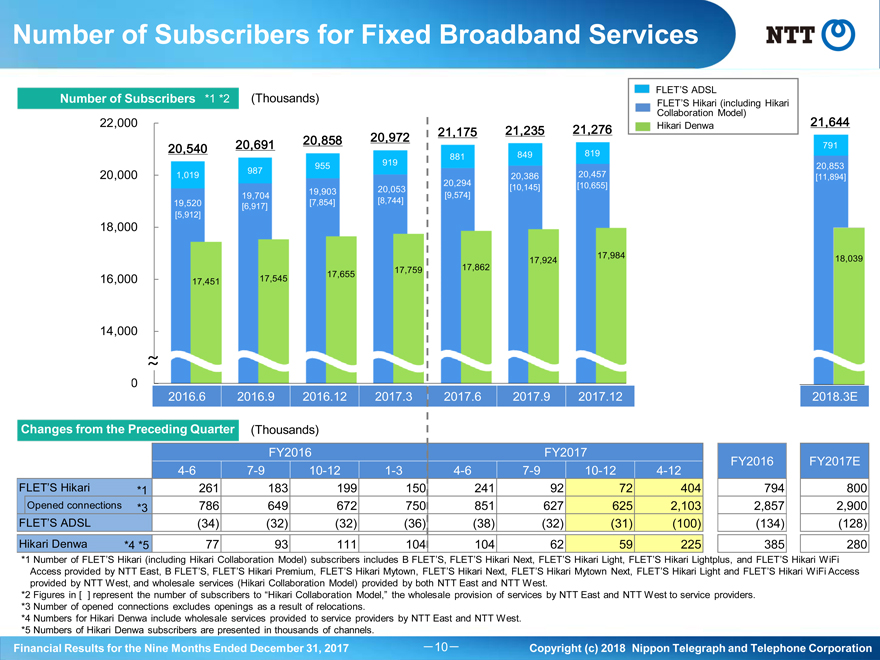

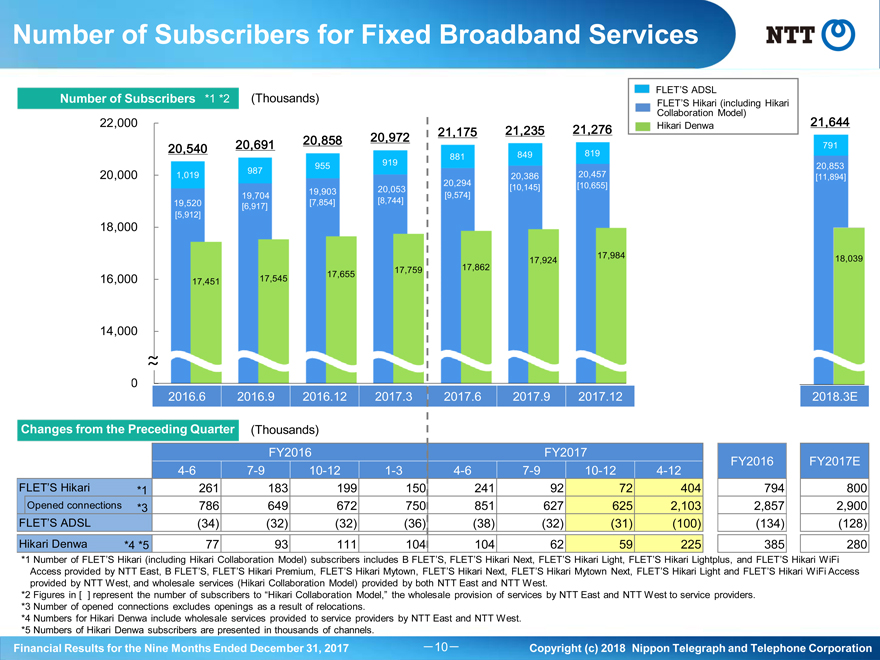

Number of Subscribers for Fixed Broadband Services

FLET’S ADSL

Number of Subscribers *1 *2 (Thousands) FLET’S Hikari (including Hikari Collaboration Model)

22,000 Hikari Denwa 21,644 21,175 21,235 21,276 20,858 20,972 20,540 20,691 791

919 881 849 819

955 20,853 20,000 1,019 987 20,457 20,386 [11,894] 20,294 [10,145] [10,655]

19,903 20,053

19,704 [9,574] 19,520 [7,854] [8,744] [5,912] [6,917]

18,000

17,984 18,039 17,924 17,759 17,862 16,000 17,545 17,655 17,451

14,000

~

2016.6 2016.9 2016.12 2017.3 2017.6 2017.9 2017.12 2018.3E

Changes from the Preceding Quarter (Thousands)

FY2016 FY2017

FY2016 FY2017E4-67-910-121-34-67-910-124-12 FLET’S Hikari *1 261 183 199 150 241 92 72 404 794 800 Opened connections *3 786 649 672 750 851 627 625 2,103 2,857 2,900 FLET’S ADSL (34) (32) (32) (36) (38) (32) (31) (100) (134) (128) Hikari Denwa *4 *5 77 93 111 104 104 62 59 225 385 280

*1 Number of FLET’S Hikari (including Hikari Collaboration Model) subscribers includes B FLET’S, FLET’S Hikari Next, FLET’S Hikari Light, FLET’S Hikari Lightplus, and FLET’S Hikari WiFi Access provided by NTT East, B FLET’S, FLET’S Hikari Premium, FLET’S Hikari Mytown, FLET’S Hikari Next, FLET’S Hikari Mytown Next, FLET’S Hikari Light and FLET’S Hikari WiFi Access provided by NTT West, and wholesale services (Hikari Collaboration Model) provided by both NTT East and NTT West.

*2 Figures in [ ] represent the number of subscribers to “Hikari Collaboration Model,” the wholesale provision of services by NTT East and NTT West to service providers.

*3 Number of opened connections excludes openings as a result of relocations.

*4 Numbers for Hikari Denwa include wholesale services provided to service providers by NTT East and NTT West.

*5 Numbers of Hikari Denwa subscribers are presented in thousands of channels.

Financial Results for the Nine Months Ended December 31, 2017 10 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

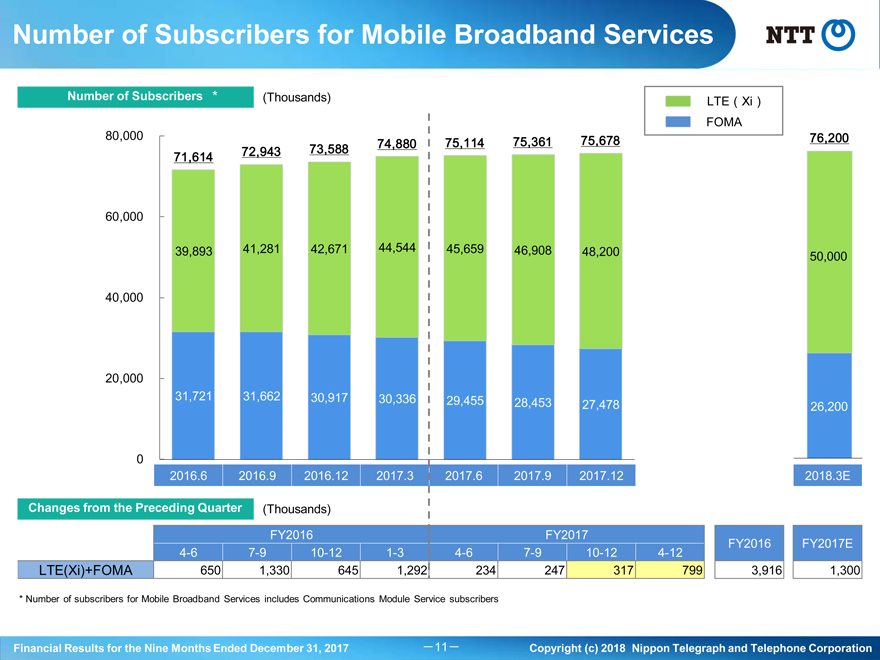

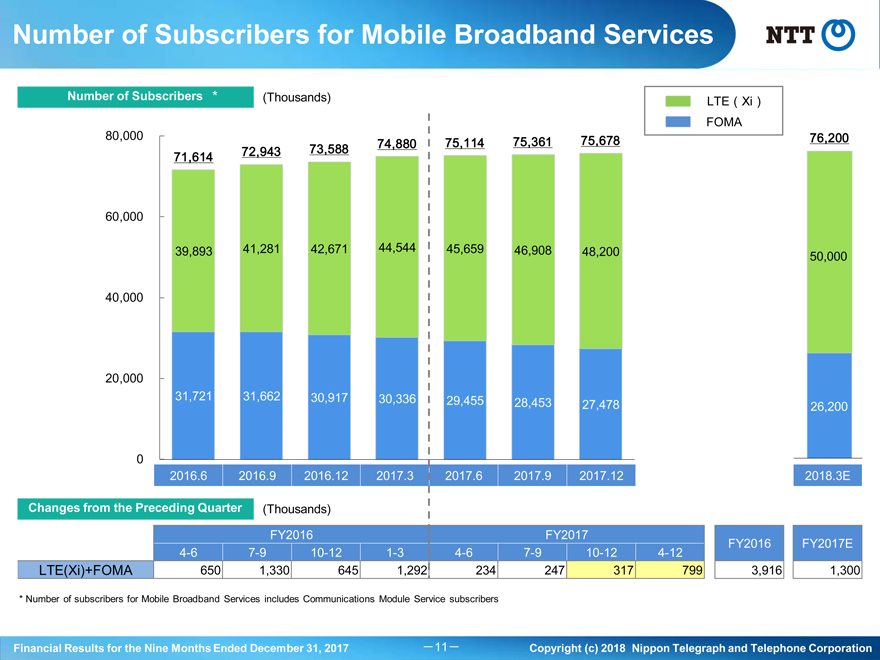

Number of Subscribers for Mobile Broadband Services

Number of Subscribers * (Thousands) LTEXi

80,000 FOMA

74,880 75,114 75,361 75,678 76,200 72,943 73,588 71,614

60,000

39,893 41,281 42,671 44,544 45,659 46,908 48,200

50,000

40,000

20,000

31,721 31,662 30,917 30,336 29,455 28,453

27,478 26,200

0

2016.6 2016.9 2016.12 2017.3 2017.6 2017.9 2017.12 2018.3E

Changes from the Preceding Quarter (Thousands)

FY2016 FY2017

FY2016 FY2017E4-67-910-121-34-67-910-124-12 LTE(Xi)+FOMA 650 1,330 645 1,292 234 247 317 799 3,916 1,300

* Number of subscribers for Mobile Broadband Services includes Communications Module Service subscribers

Financial Results for the Nine Months Ended December 31, 2017 11 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

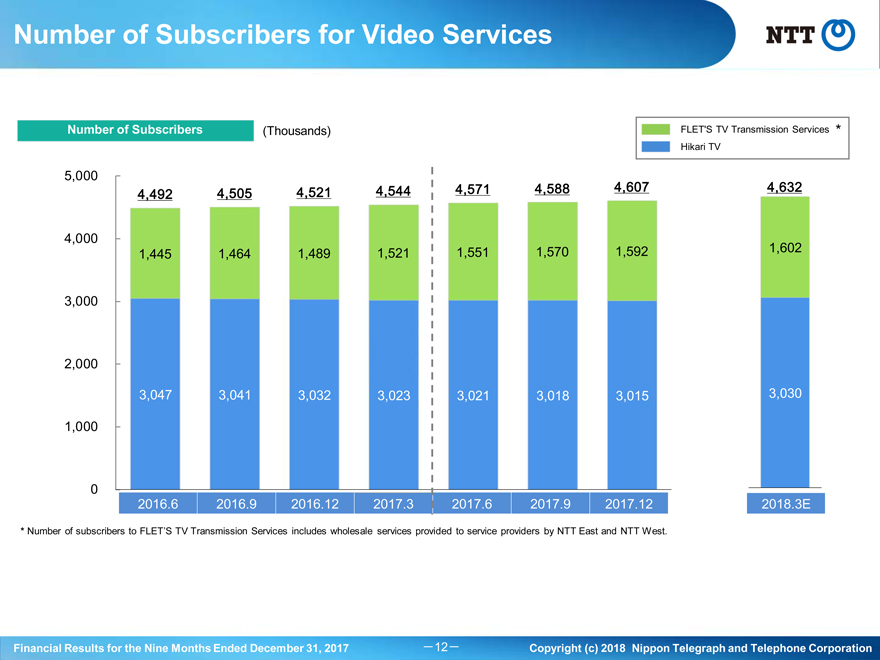

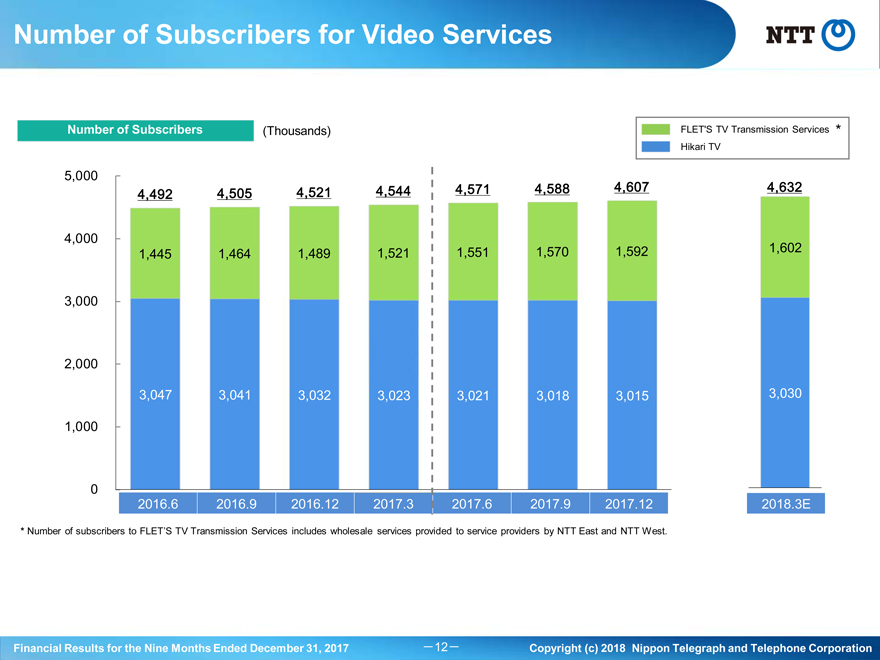

Number of Subscribers for Video Services

Number of Subscribers (Thousands) FLET’S TV Transmission Services * Hikari TV

5,000

4,505 4,521 4,544 4,571 4,588 4,607 4,632 4,492

4,000

1,445 1,464 1,489 1,521 1,551 1,570 1,592 1,602

3,000

2,000

3,047 3,041 3,032 3,023 3,021 3,018 3,015 3,030 1,000

0

2016.6 2016.9 2016.12 2017.3 2017.6 2017.9 2017.12 2018.3E

* Number of subscribers to FLET’S TV Transmission Services includes wholesale services provided to service providers by NTT East and NTT West.

Financial Results for the Nine Months Ended December 31, 2017 12 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

Financial Information

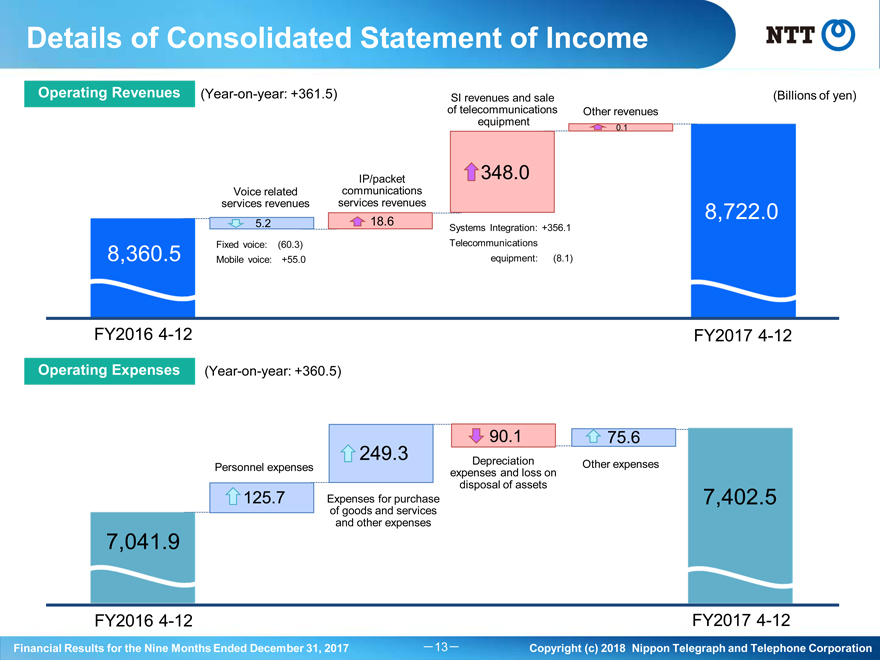

Details of Consolidated Statement of Income

Operating Revenues(Year-on-year: +361.5) SI revenues and sale (Billions of yen) of telecommunications Other revenues equipment

0.1

IP/packet 348.0 Voice related communications services revenues services revenues 8,722.0

5.2 18.6

Systems Integration: +356.1 8,360.5 Fixed voice: (60.3) Telecommunications Mobile voice: +55.0 equipment: (8.1)

FY20164-12 FY20174-12

Operating Expenses(Year-on-year: +360.5)

90.1 75.6

249.3 Depreciation

Personnel expenses Other expenses expenses and loss on disposal of assets

125.7 Expenses of goods and for purchase services 7,402.5 and other expenses

7,041.9

FY20164-12 FY20174-12

Financial Results for the Nine Months Ended December 31, 2017 13 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

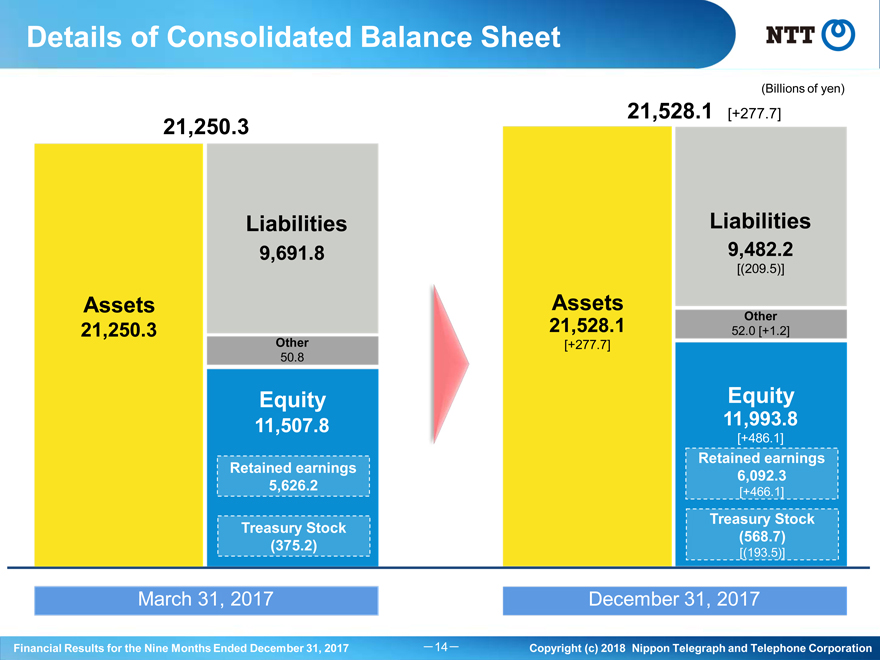

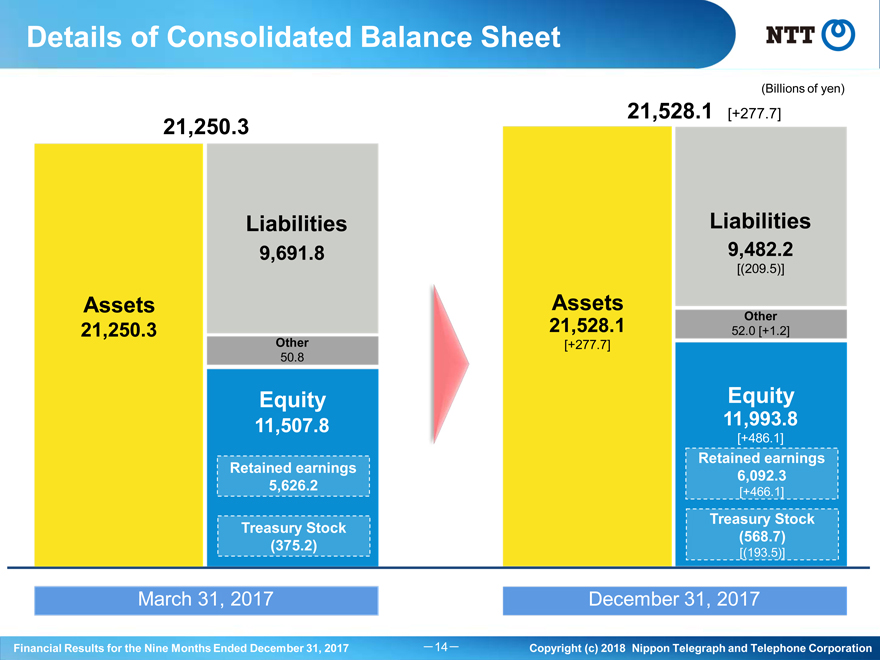

Details of Consolidated Balance Sheet

(Billions of yen)

21,528.1 [+277.7] 21,250.3

Liabilities Liabilities

9,691.8 9,482.2

[(209.5)]

Assets Assets

21,528.1 Other

21,250.3 52.0 [+1.2]

Other [+277.7]

50.8

Equity Equity

11,507.8 11,993.8

[+486.1]

Retained earnings Retained earnings 6,092.3

5,626.2 [+466.1]

Treasury Stock Treasury Stock (568.7) (375.2)

[(193.5)]

March 31, 2017 December 31, 2017

Financial Results for the Nine Months Ended December 31, 2017 14 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

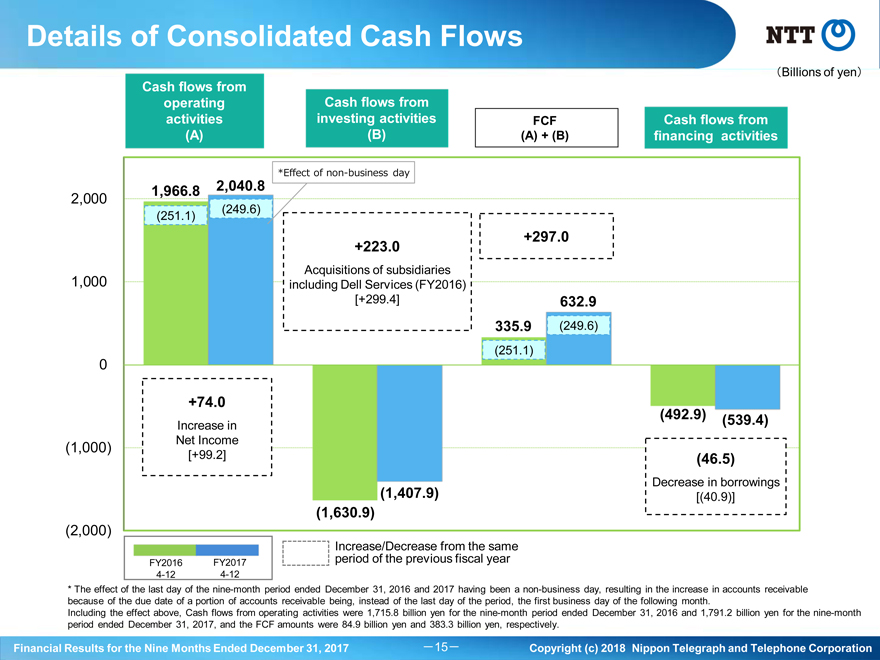

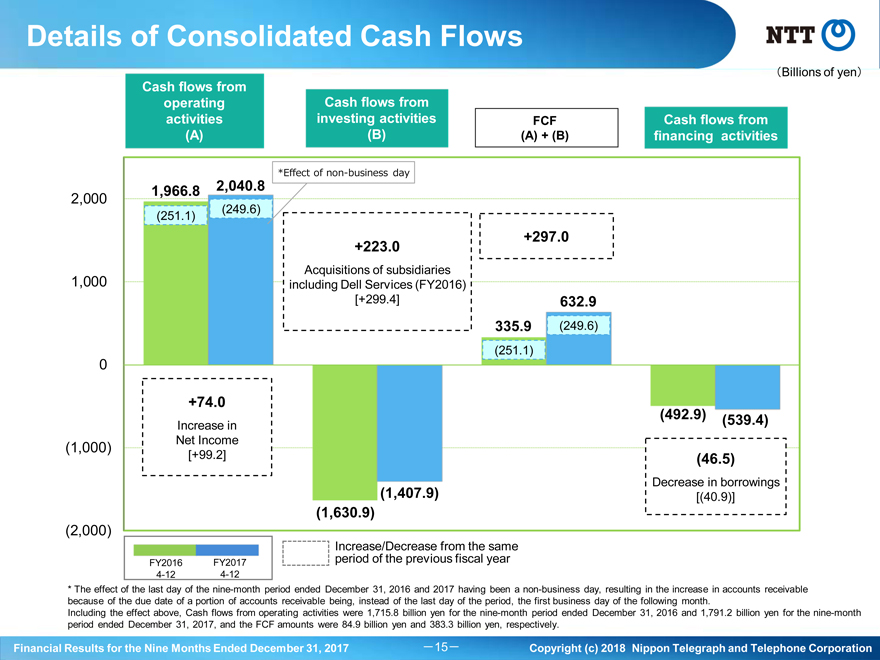

Details of Consolidated Cash Flows

Billions of yen

Cash flows from operating Cash flows from activities investing activities FCF Cash flows from (A) (B) (A) + (B) financing activities

2,040.8 *Effect ofnon-business day

1,966.8

2,000

(249.6) (251.1)

+297.0 +223.0

Acquisitions of subsidiaries 1,000 including Dell Services (FY2016)

[+299.4] 632.9 335.9 (249.6)

0 (251.1)

+74.0

(492.9) (539.4)

Increase in (1,000) Net Income

[+99.2] (46.5) Decrease in borrowings

(1,407.9) [(40.9)] (1,630.9)

(2,000)

Increase/Decrease period of the previous from fiscal the year same

FY2016 FY20174-124-12

* The effect of the last day of the nine-month period ended December 31, 2016 and 2017 having been anon-business day, resulting in the increase in accounts receivable because of the due date of a portion of accounts receivable being, instead of the last day of the period, the first business day of the following month.

Including the effect above, Cash flows from operating activities were 1,715.8 billion yen for the nine-month period ended December 31, 2016 and 1,791.2 billion yen for the nine-month period ended December 31, 2017, and the FCF amounts were 84.9 billion yen and 383.3 billion yen, respectively.

Financial Results for the Nine Months Ended December 31, 2017 15 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

Details of Capital Investment

Billions of yen

Capital Investment

1,700.0 1,700.0 1,687.2 Other

NTT DATA (Consolidated) NTT Communications NTT West

1,139.9 NTT East

1,092.3 NTT DOCOMO (Consolidated)

1,039.4

199.7 175.3 153.1

88.1 105.6 143.9

83.6 91.5 61.0 164.8 161.6 189.9 155.7 170.1 162.2

362.5 399.4 403.6

FY20154-12 FY20164-12 FY20174-12 FY2015 FY2016 FY2017 E

Financial Results for the Nine Months Ended December 31, 2017 16o Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

|

|

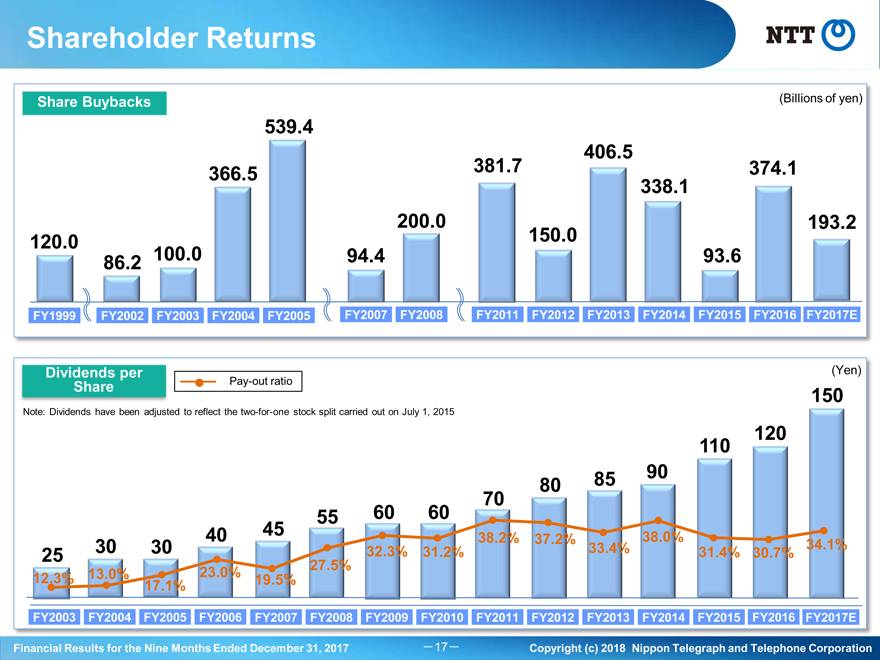

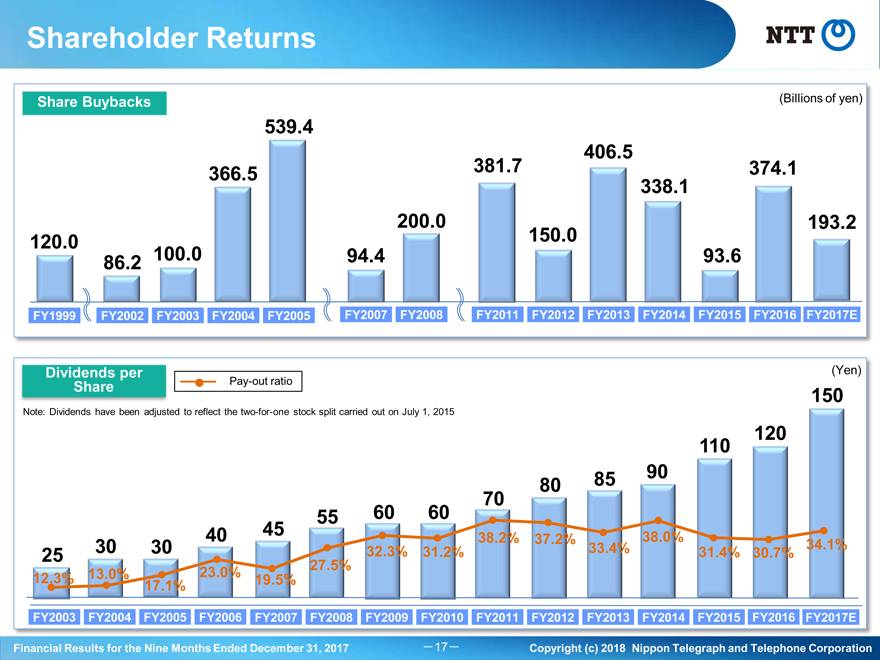

Shareholder Returns

Share Buybacks (Billions of yen)

539.4

406.5

366.5 381.7 374.1 338.1 200.0 193.2 120.0 150.0

86.2 100.0 94.4 93.6

FY1999 FY2002 FY2003 FY2004 FY2005 FY2007 FY2008 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017E

Dividends per (Yen)

Share •Pay-out ratio

150

Note: Dividends have been adjusted to reflect thetwo-for-one stock split carried out on July 1, 2015

120 110

85 90 80 70

55 60 60

40 45 38.2% 38.0%

37.2% 34.1%

25 30 30 32.3% 31.2% 33.4% 31.4% 30.7%

23.0% 27.5%

12.3% 13.0% 19.5%

17.1%

FY2003 FY2004 FY2005 FY2006 FY2007 FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017E

Financial Results for the Nine Months Ended December 31, 2017 17 Copyright (c) 2018 Nippon Telegraph and Telephone Corporation

February 9, 2018

FOR IMMEDIATE RELEASE

Financial Statements for the Nine Months Ended December 31, 2017

The financial results of Nippon Telegraph and Telephone East Corporation (NTT East) for the nine months ended December 31, 2017 are presented in the following attachments.

(Attachments)

| 1. | Non-Consolidated Comparative Balance Sheets |

| 2. | Non-Consolidated Comparative Statements of Income |

| 3. | Business Results(Non-Consolidated Operating Revenues) |

| 4. | Revised Forecasts for the Fiscal Year Ending March 31, 2018 |

For inquiries, please contact:

Mr. Kenkichi Nakata or Mr. Ryou Yamamoto

Accounting Section, Finance Division

Nippon Telegraph and Telephone East Corporation

Tel:+81-3-5359-3331

E-mail:kessan_info-ml@east.ntt.co.jp

1.Non-Consolidated Comparative Balance Sheets

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | March 31, 2017 | | | December 31, 2017 | | | Increase

(Decrease) | |

ASSETS | | | | | | | | | | | | |

Fixed assets: | | | | | | | | | | | | |

Fixed assets - telecommunications businesses | | | | | | | | | | | | |

Property, plant and equipment | | | | | | | | | | | | |

Machinery and equipment | | | 339,631 | | | | 334,501 | | | | (5,129 | ) |

Antenna facilities | | | 3,604 | | | | 3,503 | | | | (100 | ) |

Terminal equipment | | | 22,947 | | | | 21,033 | | | | (1,913 | ) |

Local line facilities | | | 866,722 | | | | 817,264 | | | | (49,457 | ) |

Long-distance line facilities | | | 2,843 | | | | 2,758 | | | | (84 | ) |

Engineering facilities | | | 588,683 | | | | 579,727 | | | | (8,956 | ) |

Submarine line facilities | | | 732 | | | | 621 | | | | (110 | ) |

Buildings | | | 409,835 | | | | 403,395 | | | | (6,439 | ) |

Construction in progress | | | 19,988 | | | | 18,536 | | | | (1,452 | ) |

Other | | | 266,121 | | | | 262,811 | | | | (3,309 | ) |

Total property, plant and equipment | | | 2,521,110 | | | | 2,444,156 | | | | (76,953 | ) |

Intangible fixed assets | | | 84,120 | | | | 82,537 | | | | (1,582 | ) |

Total fixed assets - telecommunications businesses | | | 2,605,230 | | | | 2,526,693 | | | | (78,536 | ) |

Investments and other assets | | | | | | | | | | | | |

Other investments and assets | | | 199,112 | | | | 215,999 | | | | 16,887 | |

Allowance for doubtful accounts | | | (773 | ) | | | (760 | ) | | | 13 | |

Total investments and other assets | | | 198,338 | | | | 215,239 | | | | 16,900 | |

Total fixed assets | | | 2,803,569 | | | | 2,741,933 | | | | (61,635 | ) |

Current assets: | | | | | | | | | | | | |

Cash and bank deposits | | | 5,605 | | | | 6,965 | | | | 1,360 | |

Notes receivable | | | — | | | | 39 | | | | 39 | |

Accounts receivable, trade | | | 230,736 | | | | 238,696 | | | | 7,959 | |

Supplies | | | 26,005 | | | | 23,017 | | | | (2,987 | ) |

Other current assets | | | 435,502 | | | | 294,391 | | | | (141,111 | ) |

Allowance for doubtful accounts | | | (327 | ) | | | (305 | ) | | | 22 | |

Total current assets | | | 697,521 | | | | 562,803 | | | | (134,718 | ) |

| | | | | | | | | | | | |

TOTAL ASSETS | | | 3,501,091 | | | | 3,304,737 | | | | (196,353 | ) |

| | | | | | | | | | | | |

– 1 –

| | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | March 31, 2017 | | | December 31, 2017 | | | Increase

(Decrease) | |

LIABILITIES | | | | | | | | | | | | |

Long-term liabilities: | | | | | | | | | | | | |

Long-term borrowings from parent company | | | 225,220 | | | | 225,220 | | | | — | |

Liability for employees’ retirement benefits | | | 247,366 | | | | 257,571 | | | | 10,204 | |

Reserve for point services | | | 4,145 | | | | 4,435 | | | | 290 | |

Reserve for unused telephone cards | | | 8,460 | | | | 8,211 | | | | (248 | ) |

Allowance for environmental measures | | | 3,637 | | | | 3,637 | | | | — | |

Asset retirement obligations | | | 902 | | | | 904 | | | | 1 | |

Other long-term liabilities | | | 36,166 | | | | 43,263 | | | | 7,097 | |

Total long-term liabilities | | | 525,898 | | | | 543,244 | | | | 17,345 | |

Current liabilities: | | | | | | | | | | | | |

Current portion of long-term borrowings from parent company | | | 140,615 | | | | 50,400 | | | | (90,215 | ) |

Accounts payable, trade | | | 89,029 | | | | 40,565 | | | | (48,464 | ) |

Accrued taxes on income | | | 14,186 | | | | 6,455 | | | | (7,731 | ) |

Allowance for environmental measures | | | 2,285 | | | | 269 | | | | (2,016 | ) |

Asset retirement obligations | | | 1 | | | | — | | | | (1 | ) |

Other current liabilities | | | 442,617 | | | | 411,573 | | | | (31,044 | ) |

Total current liabilities | | | 688,735 | | | | 509,262 | | | | (179,472 | ) |

| | | | | | | | | | | | |

TOTAL LIABILITIES | | | 1,214,633 | | | | 1,052,507 | | | | (162,126 | ) |

| | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | | | | |

Common stock | | | 335,000 | | | | 335,000 | | | | — | |

Capital surplus | | | 1,499,726 | | | | 1,499,726 | | | | — | |

Earned surplus | | | 447,459 | | | | 412,703 | | | | (34,755 | ) |

Total shareholders’ equity | | | 2,282,186 | | | | 2,247,430 | | | | (34,755 | ) |

Unrealized gains (losses), translation adjustments, and others: | | | | | | | | | | | | |

Net unrealized gains (losses) on securities | | | 4,271 | | | | 4,799 | | | | 528 | |

Total unrealized gains (losses), translation adjustments, and others | | | 4,271 | | | | 4,799 | | | | 528 | |

| | | | | | | | | | | | |

TOTAL NET ASSETS | | | 2,286,457 | | | | 2,252,230 | | | | (34,227 | ) |

| | | | | | | | | | | | |

TOTAL LIABILITIES AND NET ASSETS | | | 3,501,091 | | | | 3,304,737 | | | | (196,353 | ) |

| | | | | | | | | | | | |

| Note: | *NTT East participates in a consolidated tax return system, which has been adopted by NTT (Holding Company) and its wholly-owned subsidiaries in Japan. However, except for a portion of the calculation of taxes, income taxes have not been calculated on a consolidated basis in the quarterly financial statements. |

– 2 –

2.Non-Consolidated Comparative Statements of Income

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Nine months ended

December 31, 2016 | | | Nine months ended

December 31, 2017 | | | Increase

(Decrease) | | | Year ended

March 31, 2017 | |

Telecommunications businesses: | | | | | | | | | | | | | | | | |

Operating revenues | | | 1,149,281 | | | | 1,133,897 | | | | (15,383 | ) | | | 1,534,745 | |

Operating expenses | | | 989,295 | | | | 936,138 | | | | (53,156 | ) | | | 1,367,603 | |

Operating income from telecommunications businesses | | | 159,985 | | | | 197,759 | | | | 37,773 | | | | 167,142 | |

Supplementary businesses: | | | | | | | | | | | | | | | | |

Operating revenues | | | 87,407 | | | | 86,705 | | | | (701 | ) | | | 137,497 | |

Operating expenses | | | 73,617 | | | | 72,228 | | | | (1,389 | ) | | | 115,534 | |

Operating income from supplementary businesses | | | 13,790 | | | | 14,477 | | | | 687 | | | | 21,962 | |

Operating income | | | 173,775 | | | | 212,236 | | | | 38,460 | | | | 189,104 | |

Non-operating revenues: | | | | | | | | | | | | | | | | |

Interest income | | | 20 | | | | 10 | | | | (10 | ) | | | 26 | |

Dividends received | | | 3,222 | | | | 6,954 | | | | 3,731 | | | | 3,226 | |

Gains on sales of fixed assets | | | 14,403 | | | | 3,002 | | | | (11,401 | ) | | | 14,363 | |

Miscellaneous income | | | 1,816 | | | | 1,941 | | | | 124 | | | | 2,647 | |

Totalnon-operating revenues | | | 19,464 | | | | 11,908 | | | | (7,555 | ) | | | 20,263 | |

Non-operating expenses: | | | | | | | | | | | | | | | | |

Interest expenses | | | 3,547 | | | | 2,682 | | | | (864 | ) | | | 4,669 | |

Miscellaneous expenses | | | 199 | | | | 78 | | | | (121 | ) | | | 260 | |

Totalnon-operating expenses | | | 3,747 | | | | 2,761 | | | | (986 | ) | | | 4,930 | |

Recurring profit | | | 189,492 | | | | 221,384 | | | | 31,891 | | | | 204,438 | |

Special losses | | | — | | | | 60,909 | | | | 60,909 | | | | — | |

Income before income taxes | | | 189,492 | | | | 160,474 | | | | (29,018 | ) | | | 204,438 | |

Income taxes | | | 52,947 | | | | 45,571 | | | | (7,375 | ) | | | 54,774 | |

Net income | | | 136,545 | | | | 114,902 | | | | (21,643 | ) | | | 149,663 | |

| Note: | * NTT East participates in a consolidated tax return system, which has been adopted by NTT (Holding Company) and its wholly-owned subsidiaries in Japan. However, except for a portion of the calculation of taxes, income taxes have not been calculated on a consolidated basis in the quarterly financial statements. |

– 3 –

3. Business Results(Non-Consolidated Operating Revenues)

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Nine months ended

December 31, 2016 | | | Nine months ended

December 31, 2017 | | | Increase

(Decrease) | | | Percent

Increase

(Decrease) | | | Year ended

March 31, 2017 | |

Voice transmission services revenues

(excluding IP services revenues) | | | 300,683 | | | | 279,328 | | | | (21,355 | ) | | | (7.1 | ) | | | 396,519 | |

Monthly charge revenues* | | | 226,876 | | | | 211,616 | | | | (15,259 | ) | | | (6.7 | ) | | | 299,992 | |

Call rates revenues* | | | 20,181 | | | | 17,535 | | | | (2,646 | ) | | | (13.1 | ) | | | 26,272 | |

Interconnection call revenues* | | | 34,911 | | | | 32,561 | | | | (2,350 | ) | | | (6.7 | ) | | | 45,606 | |

IP services revenues | | | 637,542 | | | | 641,058 | | | | 3,515 | | | | 0.6 | | | | 850,388 | |

Leased circuit services revenues

(excluding IP services revenues) | | | 70,680 | | | | 69,547 | | | | (1,132 | ) | | | (1.6 | ) | | | 93,307 | |

Telegram services revenues | | | 8,411 | | | | 7,892 | | | | (518 | ) | | | (6.2 | ) | | | 11,422 | |

Other telecommunications services

revenues | | | 131,962 | | | | 136,069 | | | | 4,107 | | | | 3.1 | | | | 183,107 | |

| | | | | | | | | | | | | | | | | | | | |

Telecommunications total revenues | | | 1,149,281 | | | | 1,133,897 | | | | (15,383 | ) | | | (1.3 | ) | | | 1,534,745 | |

| | | | | | | | | | | | | | | | | | | | |

Supplementary business total revenues | | | 87,407 | | | | 86,705 | | | | (701 | ) | | | (0.8 | ) | | | 137,497 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating revenues | | | 1,236,688 | | | | 1,220,603 | | | | (16,085 | ) | | | (1.3 | ) | | | 1,672,243 | |

| | | | | | | | | | | | | | | | | | | | |

– 4 –

4. Revised Forecasts for the Fiscal Year Ending March 31, 2018

Based on its recent business performance, NTT East has revised its financial results forecasts that were announced in the financial results release filed on November 10, 2017 for the fiscal year ending March 31, 2018, as follows.

| | | | | | | | | | | | |

| | | (Billions of yen) | |

| | | Year Ending March 31,

2018

(Forecasts Previously

Announced on November 10,

2017) | | | Year Ending March 31,

2018

(Revised Forecasts) | | | Change | |

Operating Revenues | | | 1,640.0 | | | | 1,640.0 | | | | — | |

Operating Income | | | 190.0 | | | | 251.0 | | | | 61.0 | |

Recurring Profit | | | 195.0 | | | | 256.0 | | | | 61.0 | |

Special Profits (Losses) | | | — | | | | (61.0 | ) | | | (61.0 | ) |

Net Income | | | 135.0 | | | | 135.0 | | | | — | |

| Note: | The financial results forecasts and projected figures concerning the future performance of NTT East contained herein are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of NTT East and its parent NTT in light of information currently available to them regarding NTT, NTT East and its subsidiaries and affiliates, the economy and telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of NTT, NTT East and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from the forecasts contained herein, as well as other risks included in NTT’s most recent Annual Report on Form20-F and other filings and submissions with the United States Securities and Exchange Commission. |

– 5 –

February 9, 2018

FOR IMMEDIATE RELEASE

Financial Results for the Nine Months Ended December 31, 2017

The financial results of Nippon Telegraph and Telephone West Corporation (NTT West) for the nine months ended December 31, 2017 are presented in the following attachments.

(Attachments)

| 1. | Non-Consolidated Comparative Balance Sheets |

| 2. | Non-Consolidated Comparative Statements of Income |

| 3. | Business Results (Non-Consolidated Operating Revenues) |

| 4. | Revised Forecasts for the Fiscal Year Ending March 31, 2018 |

For inquiries, please contact:

Junichiro Maekawa or Kenichi Matsuno

Accounting Section, Finance Division

Nippon Telegraph and Telephone West Corporation

Tel:+81-6-4793-3141

E-mail: kessan-info@west.ntt.co.jp

1.Non-Consolidated Comparative Balance Sheets

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | March 31, 2017 | | | December 31, 2017 | | | Increase

(Decrease) | |

ASSETS | | | | | | | | | | | | |

Fixed assets: | | | | | | | | | | | | |

Fixed assets - telecommunications businesses | | | | | | | | | | | | |

Property, plant and equipment | | | | | | | | | | | | |

Machinery and equipment | | | 297,757 | | | | 291,301 | | | | (6,455 | ) |

Antenna facilities | | | 5,895 | | | | 5,897 | | | | 1 | |

Terminal equipment | | | 11,318 | | | | 11,388 | | | | 69 | |

Local line facilities | | | 1,051,300 | | | | 1,016,371 | | | | (34,929 | ) |

Long-distance line facilities | | | 1,693 | | | | 1,741 | | | | 47 | |

Engineering facilities | | | 517,724 | | | | 505,218 | | | | (12,506 | ) |

Submarine line facilities | | | 3,131 | | | | 3,473 | | | | 341 | |

Buildings | | | 312,924 | | | | 312,175 | | | | (748 | ) |

Construction in progress | | | 31,294 | | | | 18,411 | | | | (12,882 | ) |

Other | | | 219,918 | | | | 218,987 | | | | (931 | ) |

Total property, plant and equipment | | | 2,452,960 | | | | 2,384,966 | | | | (67,993 | ) |

Intangible fixed assets | | | 64,444 | | | | 60,605 | | | | (3,839 | ) |

Total fixed assets - telecommunications businesses | | | 2,517,404 | | | | 2,445,572 | | | | (71,832 | ) |

Investments and other assets | | | | | | | | | | | | |

Other investments and assets | | | 187,606 | | | | 205,330 | | | | 17,723 | |

Allowance for doubtful accounts | | | (681 | ) | | | (606 | ) | | | 75 | |

Total investments and other assets | | | 186,924 | | | | 204,723 | | | | 17,799 | |

Total fixed assets | | | 2,704,329 | | | | 2,650,296 | | | | (54,033 | ) |

Current assets: | | | | | | | | | | | | |

Cash and bank deposits | | | 18,251 | | | | 5,338 | | | | (12,913 | ) |

Notes receivable | | | — | | | | 1 | | | | 1 | |

Accounts receivable, trade | | | 199,820 | | | | 197,935 | | | | (1,885 | ) |

Supplies | | | 29,950 | | | | 27,045 | | | | (2,904 | ) |

Other current assets | | | 151,715 | | | | 110,512 | | | | (41,203 | ) |

Allowance for doubtful accounts | | | (339 | ) | | | (273 | ) | | | 66 | |

Total current assets | | | 399,398 | | | | 340,559 | | | | (58,839 | ) |

| | | | | | | | | | | | |

TOTAL ASSETS | | | 3,103,728 | | | | 2,990,856 | | | | (112,872 | ) |

| | | | | | | | | | | | |

– 1 –

| | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | March 31, 2017 | | | December 31, 2017 | | | Increase

(Decrease) | |

LIABILITIES | | | | | | | | | | | | |

Long-term liabilities: | | | | | | | | | | | | |

Long-term borrowings from parent company | | | 591,000 | | | | 601,000 | | | | 10,000 | |

Liability for employees’ retirement benefits | | | 242,251 | | | | 250,951 | | | | 8,699 | |

Reserve for point services | | | 3,792 | | | | 3,006 | | | | (786 | ) |

Reserve for unused telephone cards | | | 8,000 | | | | 7,765 | | | | (234 | ) |

Allowance for environmental measures | | | 9,074 | | | | 8,424 | | | | (650 | ) |

Asset retirement obligations | | | 228 | | | | 89 | | | | (139 | ) |

Other long-term liabilities | | | 4,749 | | | | 99,290 | | | | 94,540 | |

Total long-term liabilities | | | 859,097 | | | | 970,526 | | | | 111,429 | |

Current liabilities: | | | | | | | | | | | | |

Current portion of long-term borrowings from parent company | | | 110,707 | | | | 40,400 | | | | (70,307 | ) |

Accounts payable, trade | | | 71,635 | | | | 34,223 | | | | (37,411 | ) |

Short-term borrowings | | | 105,259 | | | | 126,884 | | | | 21,624 | |

Accrued taxes on income | | | 8,731 | | | * | 4,450 | | | | (4,281 | ) |

Allowance for loss on disaster | | | 4,096 | | | | 3,845 | | | | (251 | ) |

Allowance for environmental measures | | | 2,361 | | | | 1,039 | | | | (1,321 | ) |

Asset retirement obligations | | | 133 | | | | 287 | | | | 154 | |

Other current liabilities | | | 362,351 | | | | 210,352 | | | | (151,998 | ) |

Total current liabilities | | | 665,277 | | | | 421,483 | | | | (243,794 | ) |

| | | | | | | | | | | | |

TOTAL LIABILITIES | | | 1,524,374 | | | | 1,392,010 | | | | (132,364 | ) |

| | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | | | | |

Common stock | | | 312,000 | | | | 312,000 | | | | — | |

Capital surplus | | | 1,170,054 | | | | 1,170,054 | | | | — | |

Earned surplus | | | 96,911 | | | | 116,238 | | | | 19,327 | |

Total shareholders’ equity | | | 1,578,965 | | | | 1,598,292 | | | | 19,327 | |

Unrealized gains (losses), translation adjustments, and others: | | | | | | | | | | | | |

Net unrealized gains (losses) on securities | | | 388 | | | | 553 | | | | 164 | |

Total unrealized gains (losses), translation adjustments, and others | | | 388 | | | | 553 | | | | 164 | |

| | | | | | | | | | | | |

TOTAL NET ASSETS | | | 1,579,353 | | | | 1,598,845 | | | | 19,492 | |

| | | | | | | | | | | | |

TOTAL LIABILITIES AND NET ASSETS | | | 3,103,728 | | | | 2,990,856 | | | | (112,872 | ) |

| | | | | | | | | | | | |

| Note: | *NTT West participates in a consolidated tax return system, which has been adopted by NTT (Holding Company) and its wholly-owned subsidiaries in Japan. However, except for a portion of the calculation of taxes, income taxes have not been calculated on a consolidated basis in the quarterly financial statements. |

– 2 –

2.Non-Consolidated Comparative Statements of Income

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Nine months ended

December 31, 2016 | | | Nine months ended

December 31, 2017 | | | Increase

(Decrease) | | | Year ended

March 31, 2017 | |

Telecommunications businesses: | | | | | | | | | | | | | | | | |

Operating revenues | | | 993,893 | | | | 958,461 | | | | (35,431 | ) | | | 1,325,585 | |

Operating expenses | | | 904,627 | | | | 832,434 | | | | (72,193 | ) | | | 1,242,485 | |

Operating income from telecommunications businesses | | | 89,265 | | | | 126,027 | | | | 36,761 | | | | 83,099 | |

Supplementary businesses: | | | | | | | | | | | | | | | | |

Operating revenues | | | 99,331 | | | | 99,761 | | | | 429 | | | | 153,430 | |

Operating expenses | | | 91,339 | | | | 89,147 | | | | (2,191 | ) | | | 141,343 | |

Operating income from supplementary businesses | | | 7,992 | | | | 10,613 | | | | 2,621 | | | | 12,086 | |

Operating income | | | 97,257 | | | | 136,640 | | | | 39,383 | | | | 95,186 | |

| | | | |

Non-operating revenues: | | | | | | | | | | | | | | | | |

Interest income | | | 9 | | | | 9 | | | | (0 | ) | | | 12 | |

Dividends received | | | 613 | | | | 839 | | | | 225 | | | | 615 | |

Miscellaneous income | | | 1,628 | | | | 1,322 | | | | (306 | ) | | | 2,330 | |

Totalnon-operating revenues | | | 2,252 | | | | 2,171 | | | | (80 | ) | | | 2,957 | |

| | | | |

Non-operating expenses: | | | | | | | | | | | | | | | | |

Interest expenses | | | 5,477 | | | | 4,499 | | | | (978 | ) | | | 7,114 | |

Miscellaneous expenses | | | 132 | | | | 333 | | | | 201 | | | | 2,875 | |

Totalnon-operating expenses | | | 5,609 | | | | 4,832 | | | | (776 | ) | | | 9,989 | |

Recurring profit | | | 93,900 | | | | 133,979 | | | | 40,079 | | | | 88,154 | |

Special losses | | | 6,055 | | | | 63,890 | | | | 57,835 | | | | 6,915 | |

Income before income taxes | | | 87,844 | | | | 70,088 | | | | (17,755 | ) | | | 81,239 | |

Income taxes | | * | 24,201 | | | * | 19,561 | | | | (4,640 | ) | | | 21,469 | |

Net income | | | 63,643 | | | | 50,527 | | | | (13,115 | ) | | | 59,770 | |

| Note: | * NTT West participates in a consolidated tax return system, which has been adopted by NTT (Holding Company) and its wholly-owned subsidiaries in Japan. However, except for a portion of the calculation of taxes, income taxes have not been calculated on a consolidated basis in the quarterly financial statements. |

– 3 –

3. Business Results(Non-Consolidated Operating Revenues)

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Nine months ended

December 31, 2016 | | | Nine months ended

December 31, 2017 | | | Increase

(Decrease) | | | Percent

Increase

(Decrease) | | | Year ended

March 31, 2017 | |

Voice transmission services revenues (excluding IP services revenues) | | | 300,613 | | | | 277,515 | | | | (23,097 | ) | | | (7.7 | ) | | | 396,272 | |

Monthly charge revenues* | | | 225,645 | | | | 209,958 | | | | (15,686 | ) | | | (7.0 | ) | | | 298,340 | |

Call rates revenues* | | | 18,877 | | | | 16,434 | | | | (2,442 | ) | | | (12.9 | ) | | | 24,590 | |

Interconnection call revenues* | | | 38,044 | | | | 34,681 | | | | (3,362 | ) | | | (8.8 | ) | | | 49,676 | |

IP services revenues | | | 523,275 | | | | 517,220 | | | | (6,055 | ) | | | (1.2 | ) | | | 697,252 | |

Leased circuit services revenues

(excluding IP services revenues) | | | 65,194 | | | | 65,363 | | | | 169 | | | | 0.3 | | | | 86,362 | |

Telegram services revenues | | | 9,362 | | | | 8,569 | | | | (792 | ) | | | (8.5 | ) | | | 12,625 | |

Other telecommunications services revenues | | | 95,447 | | | | 89,791 | | | | (5,655 | ) | | | (5.9 | ) | | | 133,071 | |

| | | | | | | | | | | | | | | | | | | | |

Telecommunications total revenues | | | 993,893 | | | | 958,461 | | | | (35,431 | ) | | | (3.6 | ) | | | 1,325,585 | |

| | | | | | | | | | | | | | | | | | | | |

Supplementary business total revenues | | | 99,331 | | | | 99,761 | | | | 429 | | | | 0.4 | | | | 153,430 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating revenues | | | 1,093,224 | | | | 1,058,223 | | | | (35,001 | ) | | | (3.2 | ) | | | 1,479,015 | |

| | | | | | | | | | | | | | | | | | | | |

– 4 –

4. Revised Forecasts for the Fiscal Year Ending March 31, 2018

Based on its recent business performance, NTT West has revised its financial results forecasts that were announced in the financial results release filed on November 10, 2017 for the fiscal year ending March 31, 2018, as follows.

| | | | | | | | | | | | |

| | | (Billions of yen) | |

| | | Year Ending March 31,

2018

(Forecasts Previously

Announced on November 10,

2017) | | | Year Ending March 31,

2018

(Revised Forecasts) | | | Change | |

Operating Revenues | | | 1,436 | | | | 1,436 | | | | — | |

Operating Income | | | 100 | | | | 164 | | | | 64 | |

Recurring Profit | | | 95 | | | | 159 | | | | 64 | |

Special Profits (Losses) | | | — | | | | (64 | ) | | | (64 | ) |

Net Income | | | 70 | | | | 70 | | | | — | |

| Note: | The financial results forecasts and projected figures concerning the future performance of NTT West contained herein are based on a series of assumptions, projections, estimates, judgments and beliefs of the management of NTT West and its parent NTT in light of information currently available to them regarding NTT, NTT West and its subsidiaries and affiliates, the economy and telecommunications industry in Japan and overseas, and other factors. These projections and estimates may be affected by the future business operations of NTT, NTT West and its subsidiaries and affiliates, the state of the economy in Japan and abroad, possible fluctuations in the securities markets, the pricing of services, the effects of competition, the performance of new products, services and new businesses, changes to laws and regulations affecting the telecommunications industry in Japan and elsewhere, other changes in circumstances that could cause actual results to differ materially from the forecasts contained herein, as well as other risks included in NTT’s most recent Annual Report on Form20-F and other filings and submissions with the United States Securities and Exchange Commission. |

– 5 –

February 9, 2018

FOR IMMEDIATE RELEASE

NTT Com Announces Financial Results for the Nine Months Ended December 31, 2017

TOKYO, JAPAN — NTT Communications Corporation (NTT Com) announced today its financial results for the nine months ended December 31, 2017. Please see the following attachments for further details:

| I. | Financial Results of NTT Communications Group |

| II. | Non-Consolidated Comparative Balance Sheets |

| III. | Non-Consolidated Comparative Statements of Income |

| IV. | Business Results(Non-Consolidated Operating Revenues) |

| V. | Revised Forecasts for the Fiscal Year Ending March 31, 2018 |

# # #

About NTT Communications Corporation

NTT Communications provides consultancy, architecture, security and cloud services to optimize the information and communications technology (ICT) environments of enterprises. These offerings are backed by the company’s worldwide infrastructure, including a leading globaltier-1 IP network, the Arcstar Universal One™ VPN network, reaching over 190 countries/regions, and over 140 secure data centers worldwide. NTT Communications’ solutions leverage the global resources of NTT Group companies, including Dimension Data, NTT DOCOMO and NTT DATA.

www.ntt.com | Twitter@NTT Communications | Facebook@NTT Communications | LinkedIn@NTT

For more information

(Mr.) Akira Ito or (Mr.) Shinichi Shimizu

Accounting and Taxation, Finance, NTT Communications

Tel: +81 3 6700 4311

Email: info-af@ntt.com

I. Financial Results of NTT Communications Group

| | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Nine months ended

Dec 31, 2016 | | | Nine months ended

Dec 31, 2017 | | | Increase

(Decrease) | | | Percent

Increase

(Decrease) | |

Operating revenues | | | 937,331 | | | | 968,629 | | | | 31,298 | | | | 3.3 | |

Operating expenses | | | 831,468 | | | | 882,366 | | | | 50,898 | | | | 6.1 | |

Operating income | | | 105,863 | | | | 86,263 | | | | (19,600 | ) | | | (18.5 | ) |

– 1 –

II.Non-Consolidated Comparative Balance Sheets

(Based on accounting principles generally accepted in Japan)

| | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | March 31, 2017 | | | December 31, 2017 | | | Increase

(Decrease) | |

ASSETS | | | | | | | | | | | | |

Fixed assets: | | | | | | | | | | | | |

Fixed assets - telecommunications businesses | | | | | | | | | | | | |

Property, plant and equipment | | | | | | | | | | | | |

Machinery and equipment | | | 151,531 | | | | 129,614 | | | | (21,916 | ) |

Antenna facilities | | | 1,674 | | | | 1,348 | | | | (325 | ) |

Terminal equipment | | | 1,963 | | | | 2,132 | | | | 169 | |

Local line facilities | | | 1,103 | | | | 1,085 | | | | (18 | ) |

Long-distance line facilities | | | 5,122 | | | | 5,112 | | | | (9 | ) |

Engineering facilities | | | 49,878 | | | | 48,664 | | | | (1,214 | ) |

Submarine line facilities | | | 16,701 | | | | 15,360 | | | | (1,341 | ) |

Buildings | | | 205,475 | | | | 201,256 | | | | (4,218 | ) |

Construction in progress | | | 13,323 | | | | 16,013 | | | | 2,690 | |

Other | | | 105,983 | | | | 119,357 | | | | 13,374 | |

Total property, plant and equipment | | | 552,757 | | | | 539,945 | | | | (12,812 | ) |

Intangible fixed assets | | | 98,820 | | | | 100,955 | | | | 2,134 | |

Total fixed assets - telecommunications businesses | | | 651,578 | | | | 640,900 | | | | (10,677 | ) |

Investments and other assets | | | | | | | | | | | | |

Investment securities | | | 108,152 | | | | 115,989 | | | | 7,837 | |

Investments in subsidiaries and affiliated companies | | | 387,905 | | | | 417,772 | | | | 29,866 | |

Other investments and assets | | | 65,778 | | | | 66,713 | | | | 935 | |

Allowance for doubtful accounts | | | (160 | ) | | | (133 | ) | | | 26 | |

Total investments and other assets | | | 561,675 | | | | 600,342 | | | | 38,666 | |

Total fixed assets | | | 1,213,254 | | | | 1,241,242 | | | | 27,988 | |

| | | |

Current assets: | | | | | | | | | | | | |