UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

REMEC, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

Beginning on August 2, 2005, members of REMEC management team made the following presentation to certain investors of REMEC:

REMEC

Sale of Wireless Systems to Powerwave

August 2005

Disclaimer

Certain statements in this presentation, including statements regarding benefits of the proposed acquisition, integration plans and expected synergies, anticipated future financial and operating performance and results, the time schedule for closing the transaction, satisfaction of conditions to closing, distributions to shareholders, and accretion to per share earnings are “forward-looking” statements that are subject to risks and uncertainties. Actual results could differ materially based on various factors including, and without limitation: we may be unable to obtain stockholder approval required for the transaction; Powerwave may encounter problems in successfully integrating the assets and product lines acquired from REMEC; the transaction may involve unexpected costs; Powerwave may be unable to achieve cost-cutting synergies; customers may reduce orders due to uncertainties related to the proposed transaction or the economy in general, economic conditions and the related impact on the wireless communications infrastructure spending; and there may be adverse changes in market conditions in both the United States and internationally. Further information on other risks and uncertainties are detailed in the Proxy Statement, REMEC’s Annual Report on Form 10K as amended and other documents the Company files from time to time with the Securities and Exchange Commission. Undue reliance should not be placed on forward-looking statements, which speak only as of the date hereof.

2

Building Solutions Through Teamwork

REMEC Proprietary

Topics

Transaction Process & Distributions Summary Deal Highlights of Wireless Systems Sale Timetable of Key Events Overview of REMEC and Powerwave Industry Trends / Powerwave Transaction Benefits Risk to REMEC of Failure to Complete Strategic Actions Update Recommendation

3

Building Solutions Through Teamwork

REMEC Proprietary

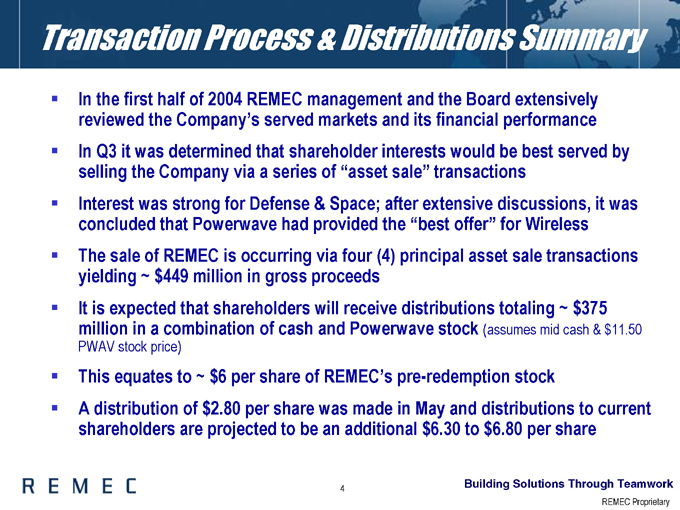

Transaction Process & Distributions Summary

In the first half of 2004 REMEC management and the Board extensively reviewed the Company’s served markets and its financial performance In Q3 it was determined that shareholder interests would be best served by selling the Company via a series of “asset sale” transactions Interest was strong for Defense & Space; after extensive discussions, it was concluded that Powerwave had provided the “best offer” for Wireless The sale of REMEC is occurring via four (4) principal asset sale transactions yielding ~ $449 million in gross proceeds It is expected that shareholders will receive distributions totaling ~ $375 million in a combination of cash and Powerwave stock (assumes mid cash & $11.50

PWAV stock price)

This equates to ~ $6 per share of REMEC’s pre-redemption stock

A distribution of $2.80 per share was made in May and distributions to current shareholders are projected to be an additional $6.30 to $6.80 per share

4

Building Solutions Through Teamwork

REMEC Proprietary

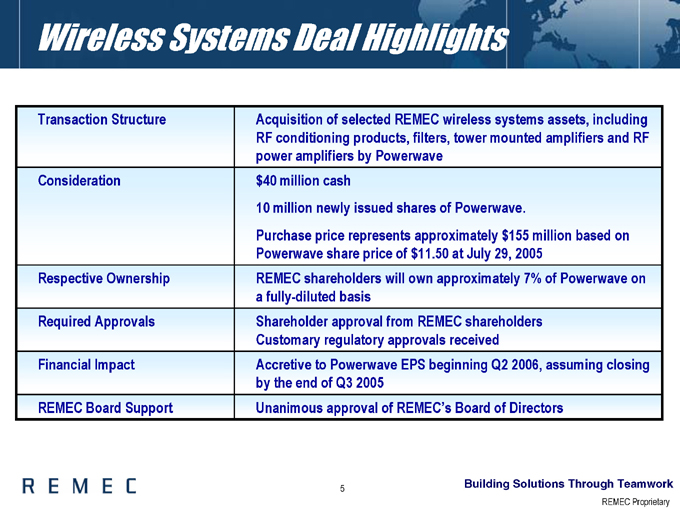

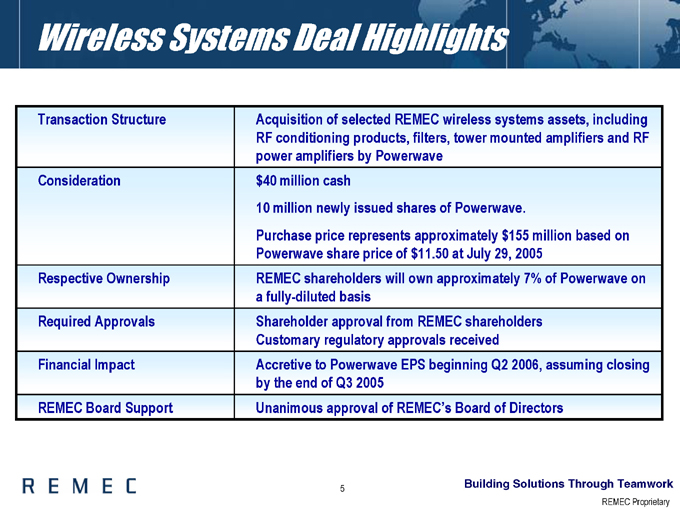

Wireless Systems Deal Highlights

Transaction Structure Acquisition of selected REMEC wireless systems assets, including RF conditioning products, filters, tower mounted amplifiers and RF power amplifiers by Powerwave

Consideration $40 million cash

10 million newly issued shares of Powerwave.

Purchase price represents approximately $155 million based on Powerwave share price of $11.50 at July 29, 2005

Respective Ownership REMEC shareholders will own approximately 7% of Powerwave on a fully-diluted basis

Required Approvals Shareholder approval from REMEC shareholders Customary regulatory approvals received

Financial Impact Accretive to Powerwave EPS beginning Q2 2006, assuming closing by the end of Q3 2005

REMEC Board Support Unanimous approval of REMEC’s Board of Directors

5

Building Solutions Through Teamwork

REMEC Proprietary

Transaction Timeline

Week beginning

Mar 14, 2005 Announcement of Strategic Acquisition

Jul 12 2005 Powerwave files Registration Statement on Form S-4

Jul 26, 2005 REMEC files Proxy Statement with SEC

Jul 29, 2005 Prospectus mailed to shareholders of REMEC, Inc.

Aug 31, 2005 Special Meeting of REMEC Shareholders

Sep 2, 2005 Expected closing date

Post Close Key events

Sept 2005 Distribution of all Powerwave stock (1st ) & between

Sept / Oct 2005 Distribution of between $1.25 and $1.75 per share in cash

( ~ $160 million total @ mid cash)

Early June 2006 Powerwave’s escrow period ends

6

Building Solutions Through Teamwork

REMEC Proprietary

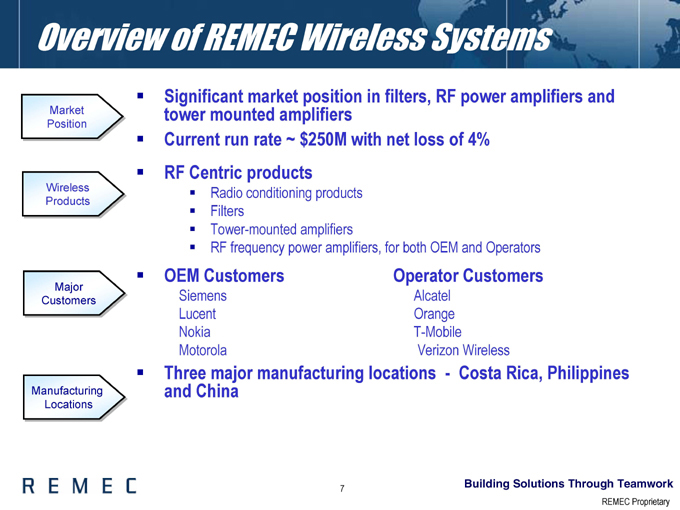

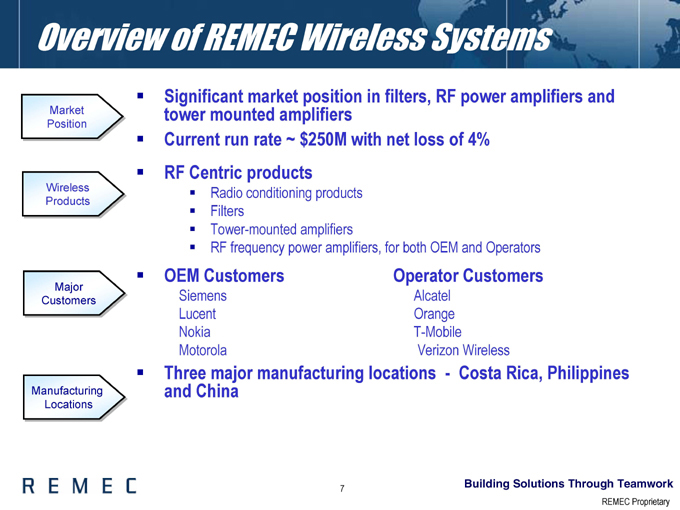

Overview of REMEC Wireless Systems

Market Position

Wireless Products

Major Customers

Manufacturing Locations

Significant market position in filters, RF power amplifiers and tower mounted amplifiers Current run rate ~ $250M with net loss of 4% RF Centric products

Radio conditioning products Filters Tower-mounted amplifiers

RF frequency power amplifiers, for both OEM and Operators

OEM Customers Operator Customers

Siemens Alcatel

Lucent Orange

Nokia T-Mobile

Motorola Verizon Wireless

Three major manufacturing locations—Costa Rica, Philippines and China

7

Building Solutions Through Teamwork

REMEC Proprietary

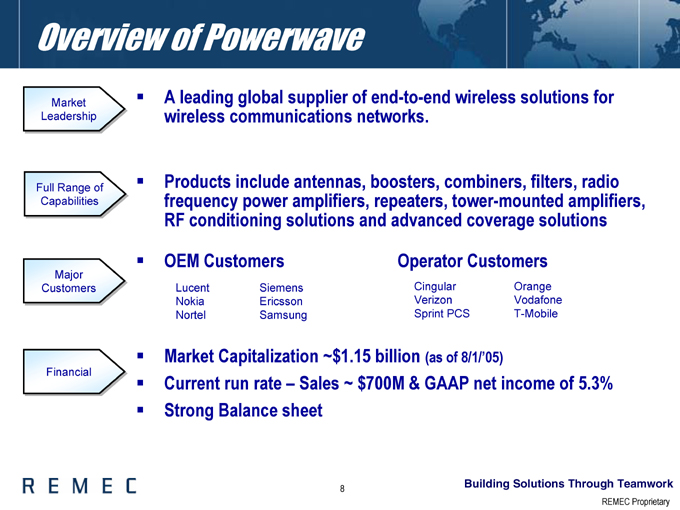

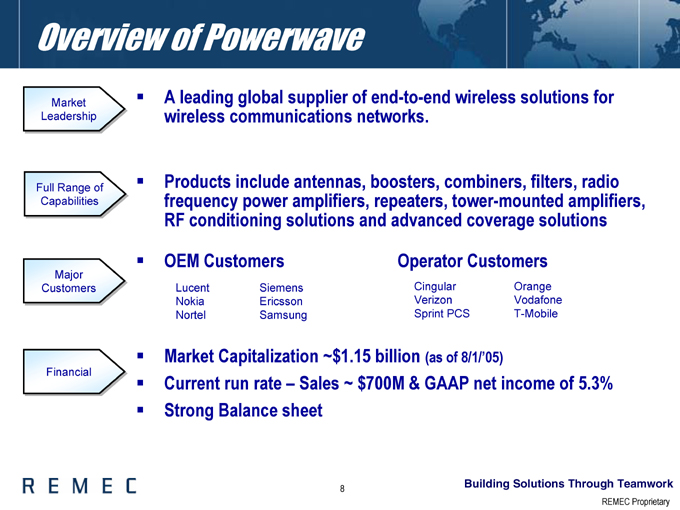

Overview of Powerwave

Market Leadership

Full Range of Capabilities

Major Customers

Financial

A leading global supplier of end-to-end wireless solutions for wireless communications networks.

Products include antennas, boosters, combiners, filters, radio frequency power amplifiers, repeaters, tower-mounted amplifiers, RF conditioning solutions and advanced coverage solutions

OEM Customers Operator Customers

Lucent Siemens Cingular Orange

Nokia Ericsson Verizon Vodafone

Nortel Samsung Sprint PCS T-Mobile

Market Capitalization ~$1.15 billion (as of 8/1/’05)

Current run rate – Sales ~ $700M & GAAP net income of 5.3% Strong Balance sheet

8

Building Solutions Through Teamwork

REMEC Proprietary

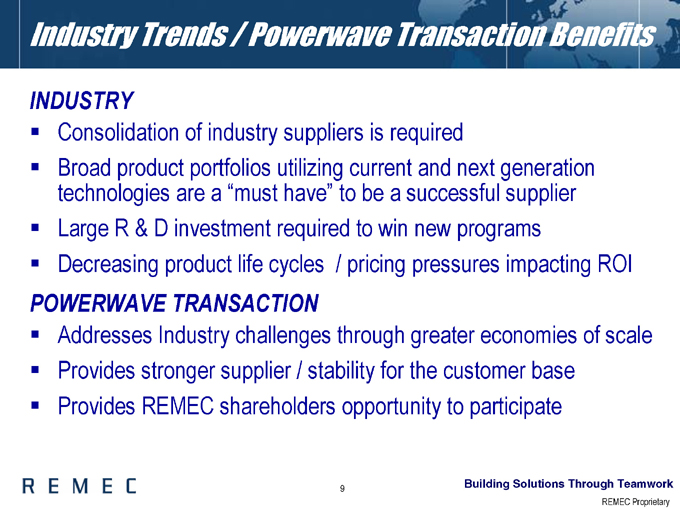

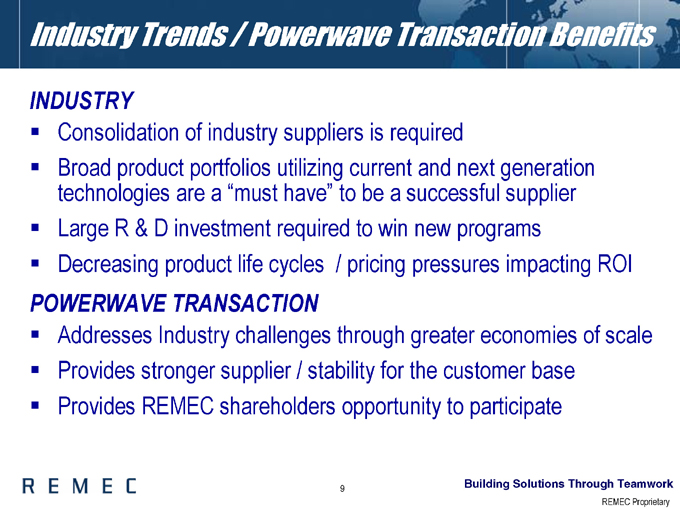

Industry Trends / Powerwave Transaction Benefits

INDUSTRY

Consolidation of industry suppliers is required

Broad product portfolios utilizing current and next generation technologies are a “must have” to be a successful supplier Large R & D investment required to win new programs Decreasing product life cycles / pricing pressures impacting ROI

POWERWAVE TRANSACTION

Addresses Industry challenges through greater economies of scale Provides stronger supplier / stability for the customer base Provides REMEC shareholders opportunity to participate

9

Building Solutions Through Teamwork

REMEC Proprietary

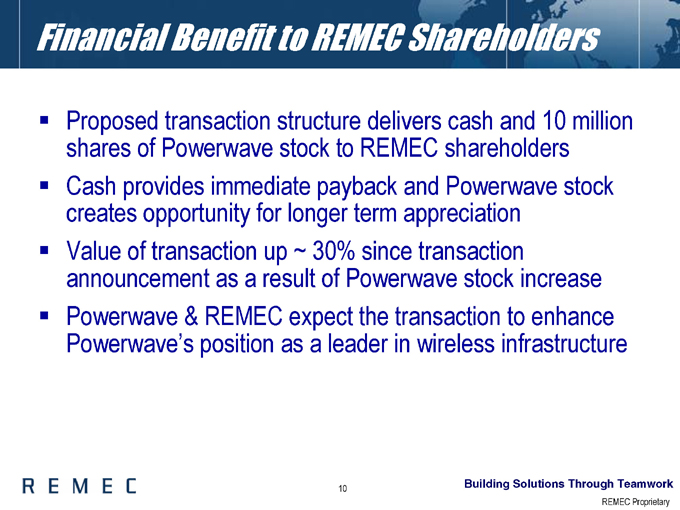

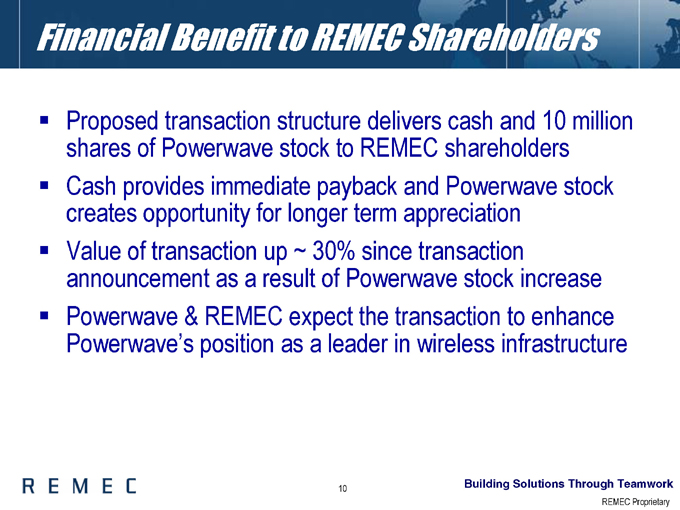

Financial Benefit to REMEC Shareholders

Proposed transaction structure delivers cash and 10 million shares of Powerwave stock to REMEC shareholders Cash provides immediate payback and Powerwave stock creates opportunity for longer term appreciation Value of transaction up ~ 30% since transaction announcement as a result of Powerwave stock increase Powerwave & REMEC expect the transaction to enhance Powerwave’s position as a leader in wireless infrastructure

10

Building Solutions Through Teamwork

REMEC Proprietary

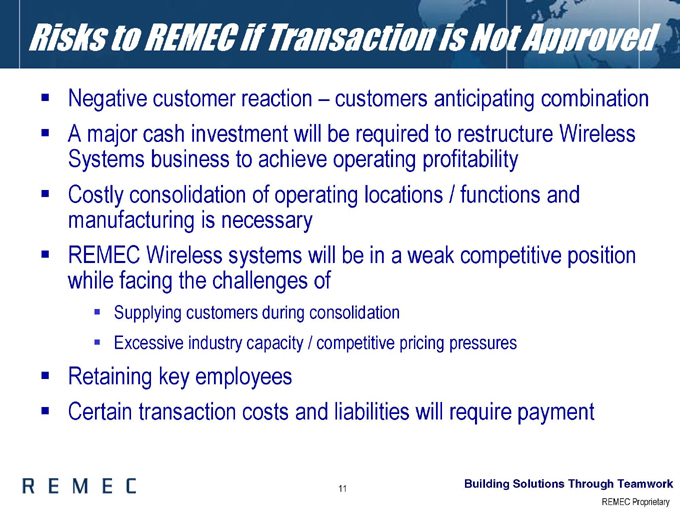

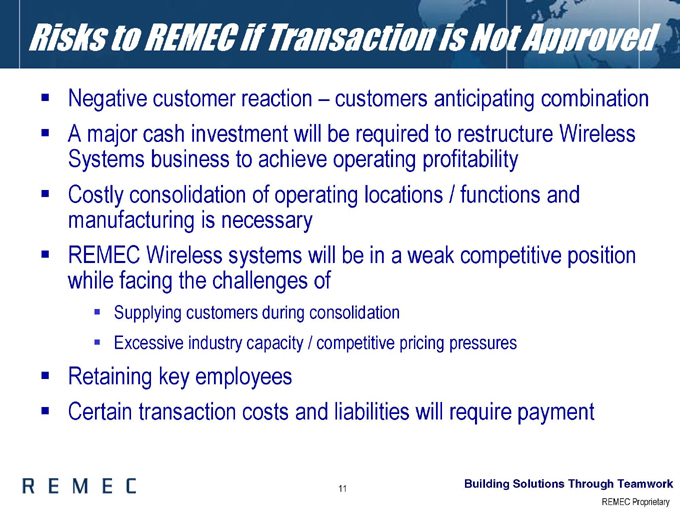

Risks to REMEC if Transaction is Not Approved

Negative customer reaction – customers anticipating combination A major cash investment will be required to restructure Wireless Systems business to achieve operating profitability Costly consolidation of operating locations / functions and manufacturing is necessary REMEC Wireless systems will be in a weak competitive position while facing the challenges of

Supplying customers during consolidation

Excessive industry capacity / competitive pricing pressures

Retaining key employees

Certain transaction costs and liabilities will require payment

11

Building Solutions Through Teamwork

REMEC Proprietary

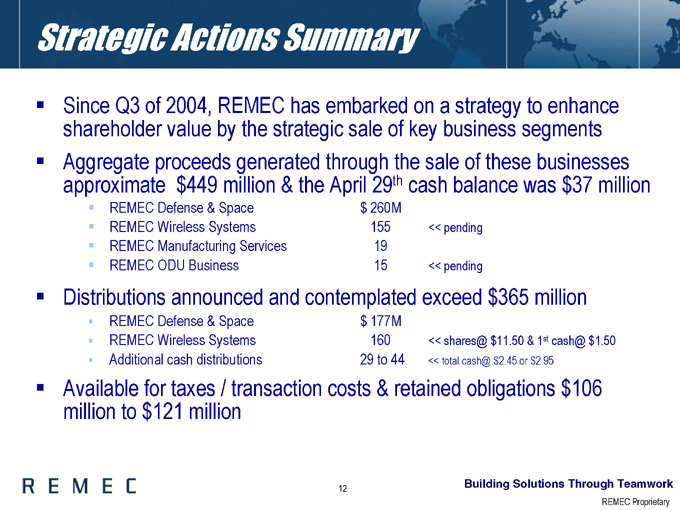

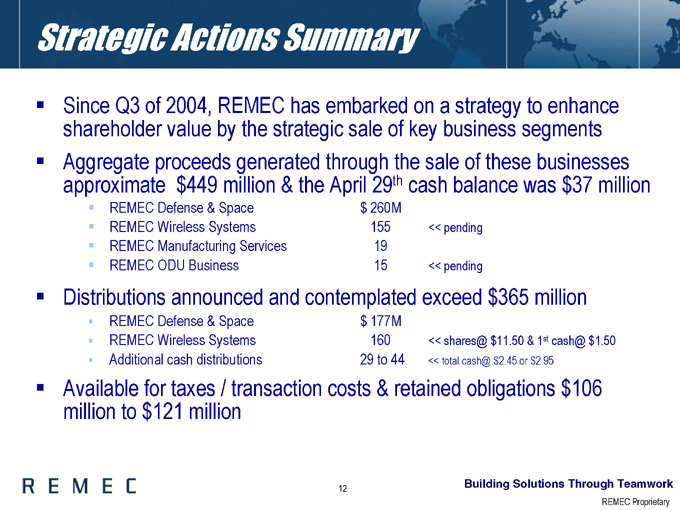

Strategic Actions Summary

Since Q3 of 2004, REMEC has embarked on a strategy to enhance shareholder value by the strategic sale of key business segments Aggregate proceeds generated through the sale of these businesses approximate $449 million & the April 29th cash balance was $37 million

REMEC Defense & Space $260M

REMEC Wireless Systems 155 << pending

REMEC Manufacturing Services 19

REMEC ODU Business 15 << pending

Distributions announced and contemplated exceed $365 million

REMEC Defense & Space $177M

REMEC Wireless Systems 160 << shares@ $11.50 & 1st cash@ $1.50

Additional cash distributions 29 to 44 << total cash@ $2.45 or $2.95

Available for taxes / transaction costs & retained obligations $106 million to $121 million

12

Building Solutions Through Teamwork

REMEC Proprietary

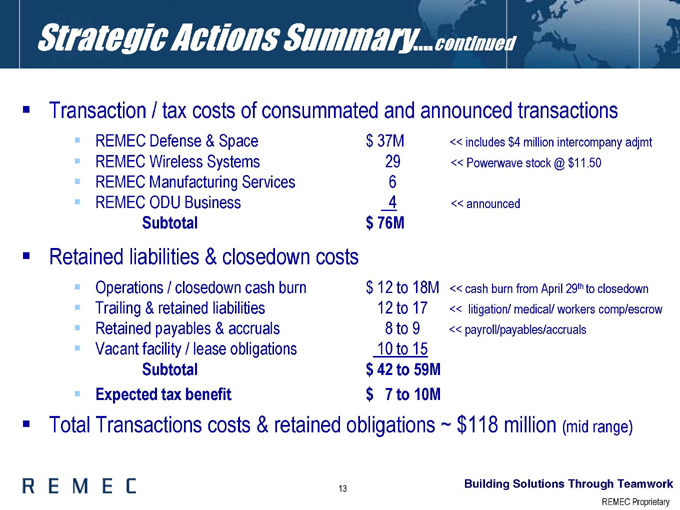

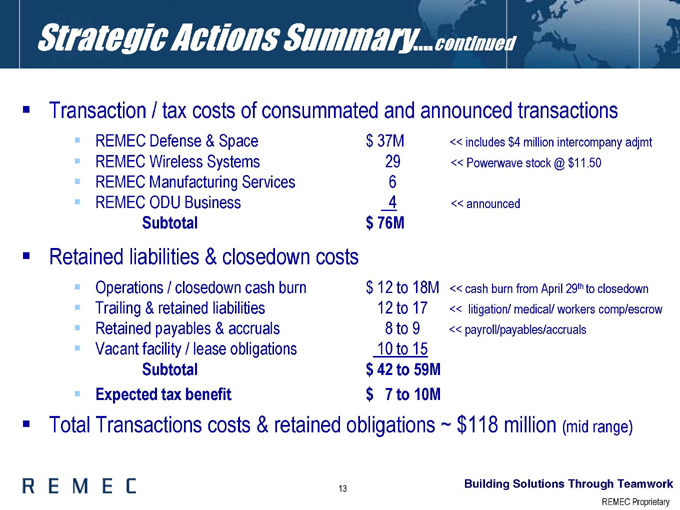

Strategic Actions Summary... continued

Transaction / tax costs of consummated and announced transactions

REMEC Defense & Space $37M << includes $4 million intercompany adjmt

REMEC Wireless Systems 29 << Powerwave stock @ $11.50

REMEC Manufacturing Services 6

REMEC ODU Business 4 << announced

Subtotal $76M

Retained liabilities & closedown costs

Operations / closedown cash burn $12 to 18M << cash burn from April 29th to closedown

Trailing & retained liabilities 12 to 17 << litigation/ medical/ workers comp/escrow

Retained payables & accruals 8 to 9 << payroll/payables/accruals

Vacant facility / lease obligations 10 to 15

Subtotal $42 to 59M

Expected tax benefit $7 to 10M

Total Transactions costs & retained obligations ~ $118 million (mid range)

13

Building Solutions Through Teamwork

REMEC Proprietary

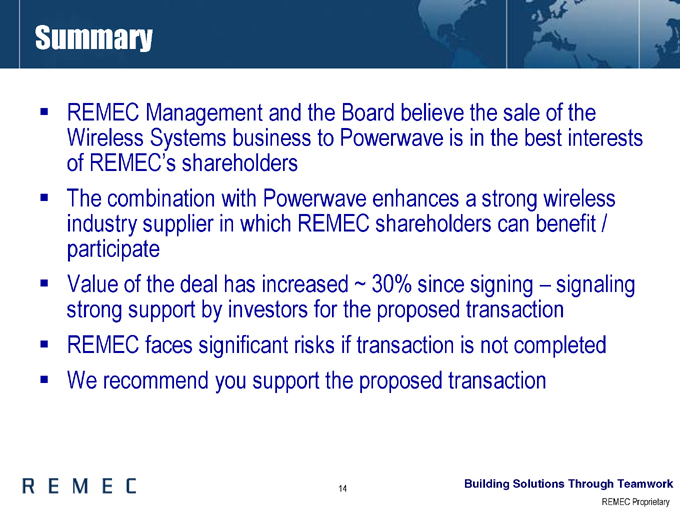

Summary

REMEC Management and the Board believe the sale of the Wireless Systems business to Powerwave is in the best interests of REMEC’s shareholders The combination with Powerwave enhances a strong wireless industry supplier in which REMEC shareholders can benefit / participate Value of the deal has increased ~ 30% since signing – signaling strong support by investors for the proposed transaction REMEC faces significant risks if transaction is not completed We recommend you support the proposed transaction

14

Building Solutions Through Teamwork

REMEC Proprietary