UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

FOR ANNUAL AND TRANSITION REPORTS

PURSUANT TO SECTIONS 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

(MARK ONE)

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2007

OR

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-16541

REMEC, INC.

(Exact name of Registrant as specified in its charter)

| | |

| California | | 95-3814301 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

3790 Via De La Valle, Suite 311 Del Mar, California | | 92014 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (858) 259-4302

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 Par Value Per Share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve (12) months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past ninety (90) days: Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Securities Exchange Act of 1934.

| | | | |

| Large Accelerated Filer ¨ | | Accelerated Filer ¨ | | Non-Accelerated Filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ¨ No x

The aggregate market value of the registrant’s common stock, $0.01 par value per share, held by non-affiliates of the registrant on August 4, 2006, the last business day of the registrant’s most recently completed second fiscal quarter, was $31,968,086 (based on the closing sales price of the registrant’s common stock on that date). Shares of the registrant’s common stock held by each officer and director and each person who owns 10% or more of the outstanding voting power of the registrant have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not a determination for other purposes.

The number of outstanding shares of REMEC common stock as of April 2, 2007 was 30,031,000.

REMEC, INC.

ANNUAL REPORT ON FORM 10-K

FOR FISCAL YEAR ENDED JANUARY 31, 2007

i

As used in this Annual Report on Form 10-K, unless the context otherwise requires, the terms “we,” “us,” “our,” “the Company” and “REMEC” refer to REMEC, Inc., a California corporation and its wholly-owned subsidiaries.

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements represent our current expectations, assumptions, estimates and projections about REMEC and include, but are not limited to, the following:

| | • | | any statements regarding the execution, timing and expenses associated with the complete dissolution of REMEC; |

| | • | | any statements regarding the disposition of our existing assets; |

| | • | | any statements regarding the resolution of outstanding creditor claims and the ongoing litigation against us; |

| | • | | any statements regarding the amount of future liquidating distributions, if any, and the timing thereof, to our shareholders. |

Forward-looking statements involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, as more fully described elsewhere in this report. Readers are urged to carefully review and consider the various disclosures we make, which attempt to advise them of the factors that affect our business, including without limitation, the disclosures made under Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and under Part I, Item 1A, “Risk Factors” included herein and throughout this Annual Report on Form 10-K for the year ended January 31, 2007. The important factors listed in these disclosures, which could cause our actual results to differ materially from the forward-looking statements contained herein, include but are not limited to, the following:

| | • | | our ability to accurately estimate the expenses associated with executing our plan of complete liquidation and dissolution; and |

| | • | | our ability to successfully resolve all our outstanding or future creditor claims and litigation. |

In light of these risks, uncertainties and assumptions, readers are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements represent beliefs and assumptions only as of the date of this report. We do not intend to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future, except as otherwise required pursuant to our on-going reporting obligations under the Securities Exchange Act of 1934, as amended.

ii

PART I

ITEM 1. BUSINESS

INTRODUCTION

REMEC, Inc. (“REMEC” or the “Company” or “us”, “our” or “we”) was incorporated in California in January 1983. Our principal executive offices are located at 3790 Via de la Valle, Suite 311, Del Mar, California 92014, and the telephone number for that location is (858) 259-4302. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports and other Securities and Exchange Commission, or “SEC,” filings are electronically filed with, or furnished to, the SEC. All reports filed by REMEC, Inc. with the SEC are available free of charge via EDGAR through the SEC website at www.sec.gov. In addition, the public may read and copy materials filed by REMEC with the SEC at the SEC’s public reference room located at 100 F Street, N.E, Washington, D.C. 20549. REMEC, Inc. also provides access to its most recently filed reports and is available through the Company’s website at www.remec.com after filing such material with the SEC. Our common stock trades on the National Association of Securities Dealers (NASD) Over-the-Counter Bulletin Board (OTCBB) exchange under the symbol “REMC.OB”.

Liquidation, Winding Up and Dissolution

On July 21, 2005, our Board of Directors approved the liquidation and dissolution of REMEC, Inc. pursuant to a Plan of Complete Liquidation and Dissolution (the “Plan of Dissolution”), intended to allow for the orderly disposition of the Company’s remaining assets and liabilities. At our August 31, 2005 special meeting of shareholders, the holders of a majority of our outstanding shares approved the Plan of Dissolution. The key features of the Plan of Dissolution include (1) ceasing to conduct normal business operations, except as may be required to wind up our business affairs; (2) attempting to convert all of our remaining assets into cash or cash equivalents in an orderly fashion; (3) paying or adequately providing for payment for all of our known obligations and liabilities; (4) filing a certificate of dissolution for REMEC, Inc. and the remaining REMEC businesses with their respective jurisdictions of formation or incorporation; and (5) distributing pro rata, in one or more liquidating distributions, all of our remaining assets to our shareholders as of the applicable record date.

REMEC will continue in existence until its final dissolution, which may occur, subject to our ability to successfully resolve all our outstanding or future creditor claims and litigation, during the fiscal year ending January 31, 2008 at which time all remaining assets and liabilities may be transferred to a liquidating trust. However, the Board of Directors may determine to not retain a third party liquidator or trustee until such time as our outstanding litigation and other significant creditor claims have been resolved. Our Plan of Dissolution gives us the power to retain a third party liquidator or trustee without further approval by our shareholders at the discretion of our Board of Directors.

In connection with the adoption of the Plan of Dissolution and the anticipated liquidation of the Company, we adopted the liquidation basis of accounting effective September 3, 2005, whereby assets are valued at their estimated net realizable cash values and liabilities are stated at their estimated settlement amounts.

On October 10, 2005, we provided a delisting notice to the Nasdaq National Market (Nasdaq) and voluntarily requested that our common stock be de-listed from Nasdaq as of October 13, 2005, with the last trading day being October 12, 2005. Since our common stock was de-listed from Nasdaq and we closed our stock records on October 13, 2005, our shares have continued to trade on the National Association of Securities Dealers (NASD) Over-the-Counter Bulletin Board (OTCBB) exchange. From time to time, trading volume in our shares has been relatively high, and our shares have traded at prices in excess of the highest price we have estimated for potential liquidation distributions. Traders in our shares are cautioned that our shares are highly speculative, and we cannot predict with any accuracy when, or if, additional liquidation distributions will be made, or the amounts of any such distributions.

Based on our projections of operating expenses and liquidation costs as of January 31, 2007, we estimate that the remaining amount of additional future liquidating distributions will range between $0.25 and $1.80 per

1

share of common stock. The actual amount available for distribution, if any, could be less if we discover or third parties assert additional liabilities or claims or we incur unexpected or greater than expected expenses related to existing and future claims and liabilities, or more if we are able to favorably resolve creditor claims, litigation and other liabilities and obligations in a manner more favorable than we currently estimate. Uncertainties as to the precise net value of our non-cash assets, and the ultimate amount of our liabilities make it impracticable to predict the aggregate net value that may ultimately be distributed to shareholders. Claims, liabilities and future expenses for operations, although currently declining in the aggregate, will continue to be incurred with execution of the Plan of Dissolution. These costs will reduce the amount of net assets available for ultimate distribution to shareholders. Although we do not believe that a precise estimate of those expenses can currently be made, we believe that available cash and amounts received from liquidation of non-cash assets will be adequate to provide for our obligations, liabilities, operating costs and claims, and to make cash distributions to shareholders. If available cash and amounts received from liquidation of non-cash assets are not adequate to provide for our obligations, liabilities, operating costs and claims, estimated future distributions of cash to our shareholders may not be possible.

Although our Board of Directors has not established a firm timetable for future liquidating distributions, the Board of Directors intends to, subject to contingencies inherent in winding up our business, make such distributions as promptly as practicable and periodically as we convert our remaining assets to cash and pay or otherwise resolve our remaining liabilities and obligations in accordance with applicable law. We cannot predict precisely when or if these matters will be resolved, or when or if we will engage a third party liquidator or trustee.

Company History

Prior to the approval of the Plan of Dissolution, REMEC designed and manufactured high frequency subsystems used in the transmission of voice, video and data traffic over wireless communications networks in the defense and commercial sectors. Our products were designed to improve the capacity, efficiency, quality and reliability of wireless communications infrastructure equipment. We also developed and manufactured sophisticated wireless communications equipment used in the defense industry, including communications equipment integrated into electronic systems for tactical aircraft, ships, ground systems, satellites, missile systems and smart weapons. We manufactured products that operated at the full range of frequencies used in wireless communications transmission, including radio frequencies, microwave frequencies and millimeter wave frequencies.

Segment Information

While we no longer have business operations, the following description of our business operations and segments prior to the Company’s Plan of Dissolution is provided to aid our readers’ understanding of our historical financial statements.

Financial information regarding our discontinued business segments may be found in Note 3 to our Consolidated Financial Statements, which is incorporated herein by reference, and appears elsewhere in this Form 10-K.

Prior to the approval of the Plan of Dissolution, our business unit structure included two segments;

Wireless Systems Segment

The Wireless Systems segment developed and manufactured radio frequencies, or “RF” power amplifiers, filters, tower-mounted amplifiers, outdoor radio units, and manufacturing services used in the transmission of voice, video and data traffic over mobile wireless communication networks. These product lines have similar

2

characteristics regarding (a) competitive pricing pressures, (b) life-cycle cost fluctuations, (c) number of competitors, (d) product differentiation, and (e) size of market opportunity.

Defense & Space Segment

The Defense & Space segment provided a broad spectrum of RF, microwave and guidance products for systems integrated by prime contractors in military and space applications.

Fiscal 2007 Developments

| | • | | In February 2006, we entered into an agreement to terminate our lease agreement for our Poway, California facility located at 14020 Stowe Drive effective May 31, 2006. |

| | • | | During the third quarter of fiscal 2007, we finalized our 2005 tax returns with an overall favorable tax position which allowed us to significantly reduce our estimated tax liability. As a result, cash assets that were previously reserved for tax liabilities were released and made available for cash distributions, upon approval by the Board of Directors. |

| | • | | On October 19, 2006, we announced that our Board of Directors approved a cash liquidating distribution of $0.75 per share to shareholders of record on November 1, 2006. On November 8, 2006, a cash liquidating distribution was made to all shareholders of record on November 1, 2006 at a rate of $0.75 per share, totaling $22.5 million. |

| | • | | Effective January 31, 2007, in accordance with the adoption of the Plan of Dissolution, the REMEC Employee Stock Purchase Plan and the REMEC 2001 Equity Incentive Plan were terminated; and the REMEC 1995 Equity Incentive Plan reserve was limited to 3,000,000 shares. |

| | • | | We were able to resolve the following litigation claims or potential liabilities: |

| | — | | During the second quarter of fiscal 2007, the Company settled claims with 3G Infrastructure Services, AB and Telenor ASA (formerly Vodafone Sverige). |

| | — | | During the third quarter of fiscal 2007, the Company settled claims with Peter Zanni and with Chelton Microwave. |

Employees

As of January 31, 2007 we had four full-time employees. We consider our relationships with our existing employees to be good.

Contract Personnel

From time to time, we also utilize contract personnel to assist us in implementing our Plan of Dissolution.

ITEM 1A. RISK FACTORS

Risks Associated with Our Liquidation and Dissolution

In addition to other information in this annual report on Form 10-K, the following risk factors should be carefully considered in evaluating us and our liquidation and dissolution because such factors may have a significant impact on the execution of our Plan of Dissolution and the timing and amount of liquidating distributions, if any, to our shareholders. As a result of the risk factors set forth below and elsewhere in this Form 10-K, and the risks discussed in our other filings with the Securities and Exchange Commission, actual results could differ materially from those projected in any forward-looking statements.

3

We cannot assure you of the exact amount or timing of any future distribution to our shareholders under the Plan of Dissolution.

The liquidation and dissolution process is subject to numerous uncertainties and may not result in any capital remaining available for future distribution to our shareholders. The precise nature, amount and timing of any future distribution to our shareholders will depend on and could be delayed by, among other things, sales of our non-cash assets, claim settlements with creditors, resolution of outstanding litigation matters, new claims filed by third parties, whether our insurance policies will provide coverage for defense costs and any damages payable under our outstanding and any future litigation matters and unexpected or greater than expected expenses. We cannot assure you that we will successfully defend against the outstanding litigation matters filed against us or any new claims filed against us. In addition, regardless of the merit or eventual outcome of our existing litigation matters or any new claims which may be filed against us, these existing or potential litigation matters may result in the expenditure of a significant amount of cash on legal fees, expenses or payment of settlements. Furthermore, we cannot provide any assurances that we will actually make additional distributions. The estimates we have provided are based on currently available information, and actual payments, if any, could be less than the range we have estimated. Any amounts to be distributed to our shareholders may be less than the price or prices at which our common stock has recently traded or may trade in the future.

Our common stock is continuing to trade even though we are in the process of liquidation and liquidating distributions, if any, may be below any trading price.

Effective at the close of business on October 12, 2005, we voluntarily de-listed our common stock and closed our transfer books. Our common stock was traded on the Nasdaq National Market (Nasdaq) under the symbol “REMC.” Since the de-listing, our common stock has been trading in the Over the Counter Market’s “Bulletin Board” under the symbol “REMC.OB”. It has been trading under “due-bill” contractual obligations between the seller and purchaser of the stock, who negotiate and rely on themselves with respect to the allocation of shareholder proceeds arising from ownership of the shares. No assignments or transfers of our common stock were recorded or will be recorded after October 12, 2005. Trading in our stock is highly speculative and the market for our stock is highly illiquid. The only value associated with our shares is the right to receive further distributions as part of the liquidation process. Because of the difficulty in estimating the amount and timing of the liquidating distributions, and due to the other risk factors discussed herein, our common stock may be subject to significant volatility and may trade above the amount of any liquidating distribution that is made.

We may not be able to settle all of our obligations to creditors and resolve all of our outstanding litigation in a favorable manner.

If we do not settle all of our obligations to creditors and resolve all of our outstanding and any new litigation, we may be prevented from completing our Plan of Dissolution. Our obligations to creditors include, among other things, long-term contractual obligations, including certain product warranties to certain customers, and contractual obligations to certain of our vendors. The Company’s commitments and contingencies include claims and litigation arising out of our previous ordinary course of business and the sale of our business units and assets. As part of the wind up process, we will attempt to settle our obligations with our creditors and resolve all of the outstanding litigation. Our inability to reach settlement with our creditors and resolve outstanding litigation in a favorable manner could delay or even prevent us from completing the Plan of Dissolution. Any new claims filed by third parties could further delay us from completing the Plan of Dissolution. Amounts required to settle our obligations to creditors and to resolve our outstanding and any new litigation will reduce the amount of remaining capital available for future distribution to shareholders. The amounts of settlements or damage payments, if we do not successfully defend cases that are not settled, could reduce future distributions to the lower end, or below the lower end, of our current estimated distribution range.

4

Some of our customers have filed or may file for breach of contract and breach of express and implied warranties with regard to products sold by the Company.

Our products consisted of and incorporate numerous component parts designed and manufactured by certain former REMEC subsidiaries. We cannot assure you that these products and/or parts are free of defects or errors. Given the complex nature of our products and our dependence on a large number of highly intricate component parts, our products may contain defects or errors not detectable during our quality assurance and testing procedures. Any such defects or errors could result in legal claims against us.

We will continue to incur claims, liabilities and expenses that will reduce the amount available for distribution out of the liquidation to shareholders.

Claims, liabilities and expenses from operations, such as operating costs, directors and officers liability insurance, payroll and local taxes, legal, accounting and consulting fees and miscellaneous office expenses, will continue to be incurred as we wind up our operations and implement our Plan of Dissolution. Additionally, indemnification claims potentially in excess of $15 million have been made against funds held in escrow pending the closing of the sale of our business units. These expenses and claims may reduce the amount of assets available for future distribution out of the liquidation to shareholders. In addition, we cannot assure you that third parties will not assert additional claims or causes of action against us. If available cash and amounts received on the sale of non-cash assets are not adequate to provide for our obligations, liabilities, expenses and claims, we may not be able to distribute the amounts indicated in our current estimated distribution range or any cash at all, to our shareholders.

We may be subject to final examinations by taxing authorities across various jurisdictions which may impact the amount of taxes that we pay and the ultimate distributions to our shareholders

In evaluating the exposure associated with various tax filing positions, the Company accrues charges for probable exposures. At January 31, 2007, the Company believes it has appropriately accrued for probable exposures. To the extent the Company were to prevail in matters for which accruals have been established or be required to pay amounts in excess of these accruals, the Company’s effective tax rate in a given financial statement period could be materially affected.

Significant judgment is required in determining the Company’s provision for income taxes payable. In the ordinary course of a global business, there are many transactions for which the ultimate tax outcome is uncertain.

Our reported results may be subject to final examination by taxing authorities. Because many transactions are subject to varying interpretations of the applicable federal, state or foreign tax laws, our reported tax liabilities and taxes may be subject to change at a later date upon final determination by the taxing authorities. The impact of this final determination on our estimated tax obligations could increase or decrease amounts of cash available for distribution to our shareholders, perhaps significantly.

Distribution of cash out of the liquidation, if any, to our shareholders could be delayed.

Although our Board of Directors has not established a firm timetable for future cash liquidating distributions to our shareholders, the Board of Directors intends, subject to contingencies inherent in winding up our business, to make such distributions as promptly as practicable as creditor and litigant claims are paid, or settled or resolved. However, we are currently unable to predict the precise timing of any such distributions. The timing of such distributions will depend on and could be delayed by, among other things, the timing of sales of our non-cash assets, claim settlements with creditors, new claims made by third parties and the settlement or the final resolution of any outstanding or future litigation matters. Additionally, a creditor could seek an injunction against the making of such distributions to our shareholders on the grounds that the amount to be distributed was needed to provide for the payment of our liabilities and expenses. Any action of this type could delay or diminish the amount available for such distribution to our shareholders.

5

If we fail to create an adequate contingency reserve for payment of our expenses and liabilities, each shareholder could be held liable for payment to our creditors of his or her pro rata share of amounts owed to creditors in excess of the contingency reserve, up to the amount actually distributed to such shareholder.

In the event we fail to create an adequate contingency reserve for payment of our expenses and liabilities, each shareholder could be held liable for payment to our creditors of such shareholder’s pro rata share of amounts owed to creditors in excess of the contingency reserve, up to the amount actually distributed to such shareholder.

Although the liability of any shareholder is limited to the amounts previously received by such shareholder from us (and from any liquidating trust or trusts) in the dissolution, this means that a shareholder could be required to return all distributions previously made to such shareholder and receive nothing from us under the Plan of Dissolution. Moreover, in the event a shareholder has paid taxes on amounts previously received, a repayment of all or a portion of such amount could result in a shareholder incurring a net tax cost if the shareholder’s repayment of an amount previously distributed does not cause a commensurate reduction in taxes payable. While we will endeavor to make adequate reserves for all known and contingent liabilities, there is no guarantee that the reserves established by us will be adequate to cover all such expenses and liabilities.

We will continue to incur the expenses of complying with public company reporting requirements.

We have an obligation to continue to comply with the applicable reporting requirements of the Securities Exchange Act of 1934, as amended, even though compliance with such reporting requirements is economically burdensome until the Company is fully dissolved.

Our Board of Directors may determine to turn management of the liquidation of REMEC, Inc. over to a third party, and some or all of our directors may resign from our board at that time.

Our Board of Directors may determine at any time that it is in the best interests of the Company and its shareholders to turn the management of the Company over to a third party to complete the liquidation of our remaining assets and distribute the available proceeds to our shareholders, and some or all of our directors may resign from our board at that time. If management is turned over to a third party and all of our directors resign from our board, the third party would have sole control over the liquidation process, including the sale or distribution of any remaining assets.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

6

ITEM 2. PROPERTIES

Our principal executive offices are located at 3790 Via de la Valle, Suite 311, Del Mar, California 92014, under a lease that expires in September 2011.

On February 10, 2006, we entered into an agreement to terminate our lease agreement with Lloyd H. Wells, Trustee of the Lloyd Wells Gift Trust for our Poway, California facility located at 14020 Stowe Drive effective May 31, 2006. That lease agreement covered approximately 80,878 square feet of facilities and expired in June 2011.

We are working to terminate our remaining facility leases which include our principal offices located in Del Mar, California and our remaining Poway facility located at 13950 Stowe Drive, Poway, California, which is currently fully sub-let.

Lease termination penalties may be assessed for early lease settlement based on original agreements for our remaining properties. As of January 31, 2007 the estimated net leases settlements on the remaining facility obligations are $1.1 million. We anticipate the remaining leases will be settled through early lease termination settlements within 12 months.

As of January 31, 2007, we had approximately 6,402 square feet of remaining facility lease space obligations net of sub-leases.

7

ITEM 3. LEGAL PROCEEDINGS

Claims and Litigation

Our commitments and contingencies include the following claims and litigation:

Securities Class Action

On September 29, 2004, three class action lawsuits were filed against the Company and certain former officers (the “Defendants”) in the United States District Court for the Southern District of California alleging the Defendants made false and misleading statements and failed to disclose material information regarding the Company’s financial condition and performance, operations, earnings and business prospects in violation of federal securities laws between September 8, 2003 and September 8, 2004 (the “Class Period”). On January 18, 2005, the law firm of Milberg Weiss Bershad & Schulman LLP (“Milberg Weiss”) was appointed Lead Counsel and its client was appointed Lead Plaintiff.

After several consolidated and amended complaints were filed, challenged by the Company and dismissed by the Court with leave to amend, the Court denied REMEC’s Motion to Dismiss the Fourth Amended Complaint on September 25, 2006. REMEC filed its Answer to the Fourth Amended Complaint on November 6, 2006, denying all liability and asserting certain affirmative defenses. Discovery has commenced. REMEC maintains directors’ and officers’ liability insurance, and has tendered the defense of this lawsuit to its insurance carrier. The insurance carrier has agreed to provide coverage and defense of this action, subject to customary reservation of rights.

Cardinal Litigation

On November 16, 2004, a civil complaint was filed in San Diego Superior Court by Cardinal Health 301, Inc. (formerly known as Pyxis Corporation) (“Cardinal”) against Tyco Electronics Corporation (“Tyco”), Thomas & Betts Corporation and the Company alleging breach of contract and breach of express and implied warranties with regard to certain products sold by the Company’s Electronic Manufacturing Services business unit to Cardinal that incorporated allegedly defective components from Tyco and Thomas & Betts (the “Cardinal Complaint”). On March 29, 2005, after the Cardinal Complaint was successfully challenged by REMEC, Cardinal filed an amended complaint seeking $7.0 million in damages plus legal expenses. On April 7, 2005, the Company filed its answer to the amended Cardinal Complaint, denying Cardinal’s claims and asserting a number of defenses. Trial commenced on May 8, 2006. On June 8, 2006, the Court granted REMEC’s motion for nonsuit, made at the close of Cardinal’s case in chief, as to all causes of action. On August 8, 2006, the Court entered judgment in the case in favor of Cardinal against Tyco and Thomas & Betts in a total amount exceeding $12.7 million, and in favor of REMEC against Cardinal on its nonsuit motion. The Court granted REMEC’s motion to recover its costs of suit of approximately $80,000.00. Cardinal filed a Notice of Appeal as to REMEC on October 31, 2006. On February 6, 2007, REMEC filed a Motion to Dismiss Cardinal’s appeal. On February 26, 2007, the Court notified all parties that the Motion to Dismiss would be considered concurrently with the appeal.

Retiree Medical Claim Arbitration

On May 11, 2006, the Company received written notice from each of two retired former officers of asserting a claim for lifetime medical benefits from the Company. The total of both claims exceeds $11.0 million. On or about November 13, 2006, the Company and each of the former officers agreed to a private binding arbitration to resolve this dispute. Discovery has commenced.

Powerwave Indemnity Claims

On May 17, 2006, in connection with the Asset Purchase Agreement dated March 13, 2005, and amended on July 11, 2005 by and between Powerwave Technologies, Inc. (“Powerwave”) and REMEC, Inc. (“REMEC”)

8

and the related Escrow Agreement dated as of September 2, 2005 by and among Powerwave, REMEC and Greater Bay Trust Company (the “Escrow Agent”), REMEC received a copy of a certificate, submitted by Powerwave to the Escrow Agent on May 12, 2006, certifying indemnification claims by Powerwave against REMEC potentially in excess of the escrow funds ($15.0 million), together with instructions not to release the escrow funds on the release date of June 2, 2006. REMEC and Powerwave have agreed to litigate this matter in Orange County (California) Superior Court under California law.

Other

On June 20, 2006, also in connection with the Asset Purchase Agreement dated March 13, 2005, and amended on July 11, 2005 by and between Powerwave Technologies, Inc. (“Powerwave”) and REMEC, Inc. (“REMEC”), REMEC received a proposed Closing Balance Sheet from Powerwave for the Wireless Systems sale transaction. The Closing Balance Sheet as proposed by Powerwave would result in a payment by REMEC to Powerwave of approximately $0.9 million in accordance with the Agreement. REMEC believes that the proposed Closing Balance Sheet is not correct, and that under a correct Closing Balance Sheet, Powerwave would be required to pay REMEC $3.0 million. On or about March 23, 2007, REMEC and Powerwave engaged an independent accounting firm to render a final determination of the Net Asset Value at Closing, and the amount either party is required to pay in accordance with the terms of the Asset Purchase Agreement.

Other than the claims and lawsuits described above, neither REMEC nor any of its subsidiaries is presently subject to any material claims or litigation, nor to REMEC’s knowledge, are such claims or litigation threatened against REMEC or its subsidiaries, other than routine actions and administrative proceedings arising in the ordinary course of business, all of which collectively are not anticipated to have a material adverse effect on the financial condition of REMEC.

Environmental Matters

We follow the policy of monitoring our properties for the presence of hazardous or toxic substances. While there can be no assurance that a material environmental liability does not exist, we are not currently aware of any environmental liability with respect to our properties that would have a material effect on our financial condition, results of operations and cash flows. Further, we are not aware of any environmental liability or any unasserted claim or assessment with respect to an environmental liability that we believe would require additional disclosure or the recording of a loss contingency.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matter was submitted to a vote of security holders during the fourth quarter of fiscal 2007.

9

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

Our common stock was previously traded on the Nasdaq National Market (Nasdaq) beginning on February 1, 1996 under the symbol “REMC.” On October 10, 2005, we provided a delisting notice to Nasdaq and voluntarily requested that our common stock be de-listed from Nasdaq as of October 13, 2005, the last trading day being October 12, 2005. Since we were de-listed from NASDAQ, October 13, 2005, our shares have continued to trade on the National Association of Securities Dealers (NASD) Over-the-Counter Bulletin Board (OTCBB) exchange under the symbol “REMC.OB”. The Over-the-Counter quotations reflect inter-dealer bid prices, without retail mark-up, markdown or commission and may not represent actual transactions.

On April 2, 2007, the number of shareholders of record of REMEC common stock was 495 and the closing sale price of REMEC common stock was $1.52 per share. The following table sets forth the range of high and low closing sale prices of our common stock as reported on Nasdaq and the NASD OTCBB for the quarterly periods indicated.

| | | | | | |

| | | High

| | Low

|

Fiscal 2006 | | | | | | |

First Quarter | | $ | 7.02 | | $ | 4.95 |

Second Quarter | | | 6.63 | | | 4.93 |

Third Quarter | | | 6.66 | | | 1.14 |

Fourth Quarter | | | 1.30 | | | 1.13 |

| | |

Fiscal 2007 | | | | | | |

First Quarter | | $ | 1.36 | | $ | 1.29 |

Second Quarter | | | 1.38 | | | 1.08 |

Third Quarter | | | 1.89 | | | 1.08 |

Fourth Quarter | | | 1.90 | | | 1.09 |

| | |

Fiscal 2008 | | | | | | |

First Quarter (through April 2, 2007) | | $ | 1.55 | | $ | 1.47 |

DIVIDEND POLICY

During the second quarter of fiscal 2006, the Company completed the reclassification of its common stock to allow for the distribution of proceeds from the sale of REMEC Defense & Space group. Pursuant to the reclassification, which was approved by the shareholders on May 18, 2005, effective May 20, 2005, each share of its existing common stock was converted into a fractional share of common stock, which entitled the shareholder to voting rights and participation in earnings of the Company, and one share of redemption stock, which was automatically redeemed by the Company. As a result of the reclassification and redemption, each holder of one share of REMEC’s existing common stock at the close of trading on the Nasdaq National Market on May 20, 2005 received 0.446 of a new share of common stock plus $2.80 in cash for the redemption share. The reclassification and redemption resulted in a substantial decrease in the number of outstanding shares and thus is reflected retroactively in our per share calculations for all periods presented.

During the third quarter of fiscal 2006, 10 million shares of Powerwave stock were issued to the shareholders’ of record of REMEC stock on September 13, 2005. On October 4, 2005, a cash distribution was made to shareholders of record of REMEC stock on September 13, 2005 at a rate of $1.35 per share.

On October 19, 2006, the Board of Directors approved a cash liquidating distribution of approximately $22.5 million, or $0.75 per share to shareholders of record as of November 1, 2006 pursuant to our Plan of

10

Dissolution. On November 8, 2006, a cash liquidating distribution was made to all shareholders of record as of November 1, 2006 at a rate of $0.75 per share, totaling $22.5 million.

Subsequent cash distributions are pending, subject to review by REMEC’s Board of Directors of the Company’s remaining obligations and contingencies. Based on our projections of operating expenses and liquidation costs as of January 31, 2007, we estimate the amount of future liquidating distributions will range between $0.25 and $1.80 per share of common stock. However, the significant number of potential liabilities and obligations that REMEC must satisfy along with the uncertainty surrounding these obligations makes the actual amount and timing of distributions uncertain and may result in the actual cash distribution being lower or higher than the expected range. Although our Board of Directors has not established a firm timetable for the liquidating distributions, the Board of Directors intends to, subject to contingencies inherent in winding up our business, make such distributions as promptly as practicable and periodically as we convert our remaining assets to cash and pay or otherwise resolve our remaining liabilities and obligations in accordance with applicable law.

11

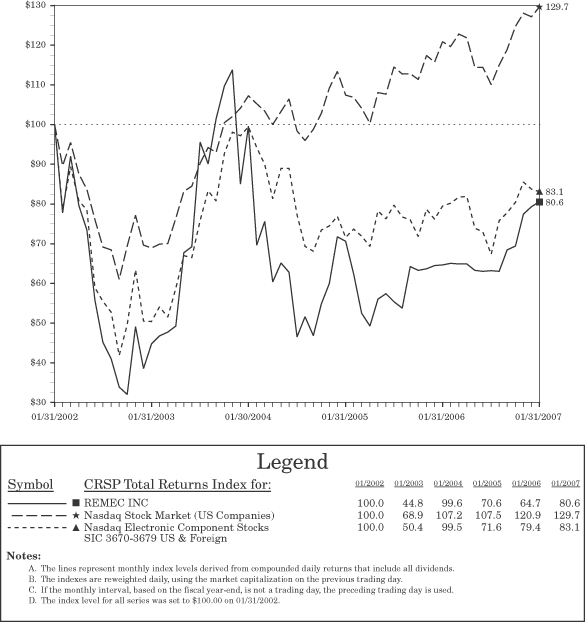

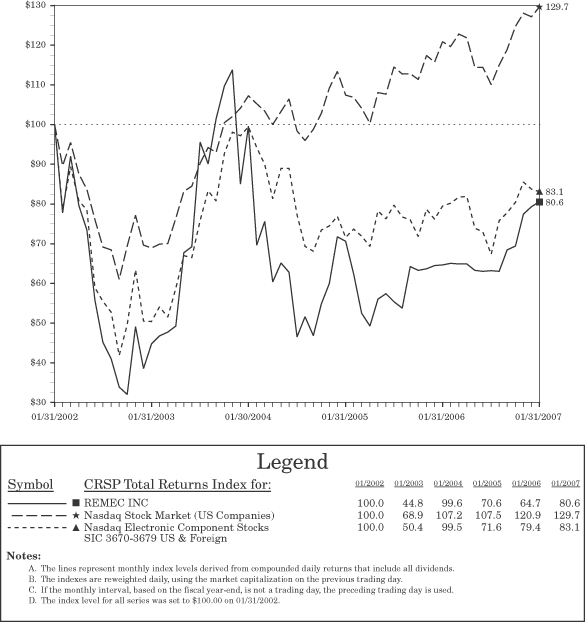

STOCK PERFORMANCE COMPARISON

The graph set forth below compares the split adjusted cumulative total shareholder return on REMEC common stock with the cumulative total return on the Nasdaq Stock Market (U.S.) Index and the Nasdaq Electronic Components Index over a five-year period, beginning January 31, 2002 and ending January 31, 2007. The total shareholder return assumes (i) the investment of $100 at the beginning of the period in REMEC common stock, the Nasdaq Stock Market (U.S.) Index and the Nasdaq Electronic Components Index and (ii) the reinvestment of all dividends.

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

REMEC, INC.

12

| ITEM 6. | SELECTED FINANCIAL DATA |

The following selected consolidated financial data (in thousands, except per share data) should be read in conjunction with the consolidated financial statements and the notes to the consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which are included elsewhere in this report. Our historical results are not necessarily indicative of results for any future periods.

On July 21, 2005, our Board of Directors approved the liquidation and dissolution of REMEC, Inc. pursuant to a Plan of Complete Liquidation and Dissolution (the “Plan of Dissolution”), intended to allow for the orderly disposition of the Company’s remaining assets and liabilities. The holders of a majority of our outstanding shares approved the Plan of Dissolution at our August 31, 2005 special shareholder meeting, effective on September 3, 2005. The Company completed the sale of its Wireless Systems business on September 2, 2005, which was the last operating business unit of the Company. Effective September 3, 2005, REMEC adopted the liquidation basis of accounting. In connection with the adoption of the Plan of Dissolution, we will not generate revenues from sales of our products in the future. We have ceased all sales and marketing efforts related to the sales of our products and have no supply of product available for sale, and, therefore, will not incur cost of revenues in the future.

The selected financial data for the period February 1, 2005 to September 2, 2005 are not comparable to the prior years ended January 31 due to the shortened reporting period. A comparison of the results of operations for the period fiscal 2006 to fiscal 2005 would not be meaningful. The information on changes to our net assets since our adoption of the liquidation basis of accounting effective September 3, 2005 is presented in the table below in a format consistent with our consolidated financial statements under Part II, Item 8 of this annual report on Form 10-K. The following tables present summarized consolidated financial information including net assets in liquidation, changes in net assets in liquidation, balance sheet information, operating results, and cash flows on the liquidation and going concern basis for the respective periods. (In thousands, except per share data):

| | | | | | | | |

| | | Liquidation Basis As of

January 31, 2007

| | | Liquidation Basis As of

January 31, 2006

| |

Statements of Net Assets: | | | | | | | | |

Total assets | | $ | 75,240 | | | $ | 115,977 | |

Total liabilities | | | (20,683 | ) | | | (68,362 | ) |

| | |

|

|

| |

|

|

|

Net assets in liquidation | | | 54,557 | | | | 47,615 | |

| | |

|

|

| |

|

|

|

Number of common shares outstanding | | | 30,031 | | | | 29,062 | |

Net asset value per share | | $ | 1.82 | | | $ | 1.64 | |

| | |

| | | Liquidation Basis Year Ended

January 31, 2007

| | | Liquidation Basis For the period September 3, 2005 to January 31, 2006

| |

Statements of Changes in Net Assets: | | | | | | | | |

Net assets in liquidation, beginning of period | | $ | 47,615 | | | $ | 212,778 | |

| | |

|

|

| |

|

|

|

Liquidation basis adjustments | | | 29,461 | | | | (19,499 | ) |

Distributions to shareholders | | | (22,519 | ) | | | (145,664 | ) |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets in liquidation | | | 6,942 | | | | (165,163 | ) |

| | |

|

|

| |

|

|

|

Net assets in liquidation, end of period | | $ | 54,557 | | | $ | 47,615 | |

| | |

|

|

| |

|

|

|

13

| | | | | | | | | | | | | | | |

| | | Going Concern Basis For the period February 1, 2005 to September 2, 2005

| | Going Concern Basis. Fiscal Years Ended January 31,

| |

| | | | 2005

| | | 2004

| | | 2003

| |

Statements of Operations Data: | | | | | | | | | | | | | | | |

Net sales | | $ | — | | $ | — | | | $ | — | | | $ | — | |

Cost of sales | | | — | | | — | | | | — | | | | — | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | — | | | — | | | | — | | | | — | |

Operating expenses | | | — | | | — | | | | — | | | | — | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

Loss from continuing operations | | | — | | | — | | | | — | | | | — | |

Income (loss) from discontinued operations including gain/(loss) on disposal, net of tax (Note 3) | | | 221,391 | | | (90,781 | ) | | | (49,408 | ) | | | (63,794 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 221,391 | | $ | (90,781 | ) | | $ | (49,408 | ) | | $ | (63,794 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

Earnings (loss) per share: | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations | | $ | — | | $ | — | | | $ | — | | | $ | — | |

Net income (loss) from discontinued operations | | | 7.88 | | | (3.28 | ) | | | (1.87 | ) | | | (3.06 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

| | | $ | 7.88 | | $ | (3.28 | ) | | $ | (1.87 | ) | | $ | (3.06 | ) |

Diluted | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations | | $ | — | | $ | — | | | $ | — | | | $ | — | |

Net income (loss) from discontinued operations | | | 7.44 | | | (3.28 | ) | | | (1.87 | ) | | | (3.06 | ) |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

| | | $ | 7.44 | | $ | (3.28 | ) | | $ | (1.87 | ) | | $ | (3.06 | ) |

Shares used in per share calculations:(*) | | | | | | | | | | | | | | | |

Basic | | | 28,084 | | | 27,683 | | | | 26,373 | | | | 20,866 | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted | | | 29,775 | | | 27,683 | | | | 26,373 | | | | 20,866 | |

| | |

|

| |

|

|

| |

|

|

| |

|

|

|

| (*) | | Reflects the effect of a share reclassification in which each existing share of common stock was converted into 0.446 of a share of common stock on May 20, 2005. |

| | | | | | | | | |

| | | Going Concern Basis Fiscal Years Ended January 31,

|

| | | 2005

| | 2004

| | 2003

|

Balance Sheet Data: | | | | | | | | | |

Cash, cash equivalents and short term-investments | | $ | 36,770 | | $ | 54,924 | | $ | 76,845 |

Working capital | | | 76,855 | | | 110,215 | | | 125,373 |

Total assets | | | 274,923 | | | 363,207 | | | 336,911 |

Long-term debt | | | — | | | 1,160 | | | 700 |

| | | |

Total shareholders’ equity | | | 164,505 | | | 253,274 | | | 262,698 |

14

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with Item 6, “Selected Financial Data,” and our historical consolidated financial statements and related notes thereto included elsewhere in this report.

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements represent our current expectations, assumptions, estimates and projections about REMEC. These forward-looking statements include estimates of the net assets of the Company in liquidation, statements about the amount and timing of the payment of additional liquidating distributions and statements about the Company’s operating costs through final dissolution, including the additional wind up costs, which will vary with the length of time it operates. The forward-looking statements in this report are subject to a number of other significant risks and uncertainties, and there can be no assurance that the expectations reflected in those statements will be realized or achieved. Such risks and uncertainties include, without limitation, possible contingent liabilities and post-closing indemnification and other obligations arising from the sale of the Company’s remaining assets; the risk that federal, state or local taxing authorities will audit the tax returns filed by the Company resulting in additional taxes being assessed against the Company; the risk that income, sales, use and other tax returns filed by the Company prior to the divestiture of its business units might be audited by federal, state or local taxing authorities resulting in additional taxes being assessed against the Company; the risk that the Company may not be able to realize its current estimate of the net value of its assets; the risk that the Company may have underestimated the settlement expense of its obligations and liabilities, including without limitation, accrued compensation and tax liabilities; risks associated with the liquidation and dissolution of the Company, including without limitation, settlement of the Company’s litigation, liabilities and obligations, costs including professional fees, incurred in connection with carrying out the Plan of Dissolution, discharge of any outstanding creditor claims, and the winding up and dissolution of the Company. See Item 1A, “Risk Factors” for additional information regarding these risks and uncertainties. In light of these risks, uncertainties and assumptions, readers are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements represent beliefs and assumptions only as of the date of this report. Except as required by applicable law, we do not intend to update or revise forward-looking statements contained in this report to reflect future events or circumstances.

OVERVIEW AND BACKGROUND

During fiscal year 2005, we engaged the services of financial advisors to evaluate strategic alternatives to enhance shareholder value, which included exploring the disposition of some or all of our business units. It was determined that in the best interest of shareholder value that the Company divest all remaining product line business units. During fiscal 2006, with shareholder approval, the Company divested all its remaining business units and adopted the Plan of Dissolution. Effective September 3, 2005, the Company is in the process of finalizing the disposition of remaining assets and liabilities and during this period will not continue as a going concern. Actions to date are detailed below.

In March 2005, we entered into a definitive agreement to sell selected assets and liabilities of our Wireless Systems business, including certain RF conditioning products, filters, tower-mounted amplifiers and RF power amplifiers, as well as its manufacturing facilities in Costa Rica, China and the Philippines, to Powerwave Technologies, Inc. (“Powerwave”) for 10 million shares of Powerwave common stock and $40 million in cash (less a $15.0 million escrow holdback), subject to certain post-closing adjustments. The transaction was subject to approval by REMEC and Powerwave shareholders, which was obtained on August 31, 2005.

On May 20, 2005, we completed the sale of the Defense & Space group to Chelton Microwave for $256 million cash after certain post-closing adjustments and the assumption of certain liabilities. The transaction required shareholder approval, which was obtained May 18, 2005 and the sale closed on May 20, 2005. In

15

conjunction with the sale, the Company amended its existing Articles of Incorporation to reclassify our common stock so that a substantial portion of the proceeds from the sale of Defense & Space were distributed to our shareholders. Each outstanding share of common stock was converted into a fractional share of common stock and one (1) share of redeemable common. In May 2005, the Company completed the reclassification of its common stock to allow for the distribution of proceeds from the sale of the Defense & Space group. Effective May 20, 2005, each share of the Company’s existing common stock was converted into a fractional share of common stock, which entitled the shareholder to voting rights and participation in earnings of the Company, and one share of redemption stock, which was automatically redeemed by the Company. As a result of the reclassification and redemption, each holder of one share of the Company’s existing common stock at the close of trading on the Nasdaq National Market on May 20, 2005 received 0.446 of a new share of common stock plus $2.80 in cash for the redemption share.

On July 1, 2005, we completed the sale of certain assets and liabilities constituting a substantial portion of the Electronic Manufacturing Services business to Veritek Manufacturing Services, LLC and Samjor Family Limited Partnership for approximately $19 million in cash, subject to certain post closing adjustments.

On August 2, 2005, we filed additional proxy material with the SEC that provided shareholders with an estimate of the cash and the number of shares of Powerwave common stock that would be distributed to REMEC shareholders following the sale of REMEC’s Wireless Systems business to Powerwave. That filing indicated shareholders were expected to receive between $2.45 to $2.95 in cash distributions and 0.333 shares of Powerwave stock for every share of REMEC stock held at the time the transaction closed.

On August 26, 2005, we completed the sale of the Outdoor Unit/Transceiver (“ODU”) business to Wireless Holdings International, Inc. (“Wireless Holdings”), for approximately $15 million in cash (less $1.0 million escrow holdback), and the assumption by Wireless Holdings of certain liabilities. The sale was made pursuant to an Asset Purchase Agreement dated July 26, 2005.

On August 31, 2005, the shareholders also approved the Plan of Dissolution, intended to allow for the orderly disposition of the Company’s remaining assets and businesses effective September 3, 2005. As a result, the Company has changed its basis of accounting for the periods subsequent to September 2, 2005 from the going concern basis to the liquidation basis. The key features of the Plan of Dissolution include (1) filing a certificate of dissolution for REMEC, Inc. and the remaining REMEC businesses with their respective States of Incorporation; (2) ceasing conducting normal business operations, except as may be required to wind up our business affairs; (3) attempting to convert all of our remaining assets into cash or cash equivalents in an orderly fashion; (4) paying or attempting to adequately provide payment for all of our known obligations and liabilities; and (5) distributing pro rata, in one or more liquidating distributions all of our remaining assets to our shareholders as of the applicable record date.

On September 2, 2005, we completed the sale of the Wireless Systems business assets and liabilities to Powerwave, in a transaction valued at $147 million and received all consideration including the 10 million shares of Powerwave common stock. The sale of the Wireless Systems business assets resulted in the Company divesting the majority of its remaining operating assets and liabilities.

On September 3, 2005, we adopted the liquidation basis of accounting pursuant to the Plan of Dissolution approved by our shareholders on August 31, 2005 and have discontinued the sale of products and will not continue as a going concern.

In September 2005, 10 million shares of Powerwave stock were distributed to shareholders of record of REMEC stock on September 13, 2005. On October 4, 2005, a cash distribution was made to shareholders of record of REMEC stock on September 13, 2005 at a rate of $1.35 per share, totaling $39.2 million.

At the close of business on October 12, 2005, our common stock was de-listed from the Nasdaq National Market (Nasdaq). Since we were de-listed from Nasdaq on October 12, 2005, our shares have continued to trade on the National Association of Securities Dealers (NASD) Over-the-Counter Bulletin Board (OTCBB) exchange.

16

On November 8, 2006, pursuant to the Plan of Dissolution, a cash liquidating distribution was made to all shareholders of record as of November 1, 2006 at a rate of $0.75 per share, totaling $22.5 million.

The Company is continuing in the liquidation process and will continue in existence until its final dissolution, which is currently expected to occur, subject to settlement of outstanding litigation and the payment of liabilities, during fiscal year 2008.

Traders in our shares are cautioned that our shares are highly speculative, and we cannot predict with any accuracy when, or if, additional liquidation distributions will be made.

Under the Plan of Dissolution, we will liquidate our assets, resolve liabilities and make liquidating distributions to shareholders. We have not established a firm timetable for liquidating distributions to shareholders, but we intend, subject to contingencies inherent in winding up our business, to make such liquidating distributions as promptly and periodically as practicable.

Since the Company is in liquidation without continuing operations, the need to present future quarterly Statements of Operations and Comprehensive Income Statements as well as a Statement of Cash Flows is eliminated.

LIQUIDATION BASIS OF ACCOUNTING AND PLAN OF DISSOLUTION

The condensed consolidated financial statements for the year ended January 31, 2007 and for the period September 3, 2005 to January 31, 2006 were prepared on the liquidation basis of accounting. Under the liquidation basis of accounting, assets are stated at their estimated net realizable values and liabilities are stated at their estimated settlement amounts, which estimates will be periodically reviewed and adjusted. Uncertainties as to the precise net value of our non-cash assets and the ultimate amount of our liabilities make it impracticable to predict the aggregate net value that may ultimately be distributable to shareholders. Claims, liabilities and future expenses for operations, although currently declining in the aggregate, will continue to be incurred with execution of the plan. These costs will reduce the amount of net assets available for ultimate distribution to shareholders. Although we do not believe that a precise estimate of those expenses can currently be made, we believe that available cash and amounts received from sales of non-cash assets will be adequate to provide for our obligations, liabilities, operating costs and claims, and to make cash distributions to shareholders. If available cash and amounts received from sales of non-cash assets are not adequate to provide for our obligations, liabilities, operating costs and claims, estimated future distributions of cash to our shareholders will be reduced.

The valuation of assets at their net realizable value and liabilities at their anticipated settlement amounts necessarily requires many estimates and assumptions. In addition, there are substantial risks and uncertainties associated with carrying out the liquidation of the Company’s existing operations. The valuations presented in the accompanying Statement of Net Assets in Liquidation represent estimates, based on present facts and circumstances, of the net realizable values of assets and costs associated with carrying out the dissolution and liquidation plan based on the assumptions set forth below. The actual values and costs are expected to differ from the amounts shown herein and could be greater or lesser than the amounts recorded. Accordingly, it is not possible to predict the aggregate amount that will ultimately be distributable to shareholders and no assurance can be given that the amount to be received in liquidation will equal or exceed the net assets in liquidation per share in the accompanying Statement of Net assets in Liquidation or the price or prices at which the Common Stock has generally traded or is expected to trade in the future. The cautionary statements regarding estimates of net assets in liquidation set forth in the Forward-Looking Statements portion of this report are incorporated herein by reference.

Based on our projections of operating expenses and liquidation costs as of January 31, 2007, we estimate that the remaining amount of additional future liquidating distributions will range from $0.25 to $1.80 per common share. The actual amount available for distribution, if any, could be less if we discover additional

17

liabilities or claims or incur unexpected or greater than expected expenses. We are subject to litigation, the outcome of which is not presently known and which may increase our expenses and reduce cash available for distribution to shareholders. In addition, we may be subject to final examination by taxing authorities; thus amounts presently estimated for taxes may vary from ultimate amounts, which may cause our final distributions to change, perhaps significantly. Although our Board of Directors has not established a firm timetable for the liquidating distributions, the Board of Directors intends to, subject to contingencies inherent in winding up our business, make such distributions as promptly as practicable and periodically as we convert our remaining assets to cash and pay our remaining liabilities and obligations subject to law.

Our Plan of Dissolution gives us the power to retain a third party liquidator or trust without further approval by our shareholders at the discretion of our Board of Directors. We may determine that the continued liquidation of REMEC may be more efficiently handled by retaining a third party liquidator or trust to manage the liquidation process. In particular, we may determine to do so at such time as our outstanding litigation and other significant creditor claims have been resolved. We cannot predict when or if these matters will be resolved, or when or if we will engage a third party liquidator or trust.

NET ASSETS IN LIQUIDATION

Net assets in liquidation increased $6.9 million, or $0.18 per share, to $54.6 million for the year ended January 31, 2007 from $47.6 million for the year ended January 31, 2006. (In thousands, except per share data):

| | | | | | |

| | | January 31,

|

| | | 2007

| | 2006

|

Net assets in liquidation | | $ | 54,557 | | $ | 47,615 |

Number of common shares outstanding at each respective date | | | 30,031 | | | 29,062 |

Net asset value per outstanding share | | $ | 1.82 | | $ | 1.64 |

The following paragraph summarizes certain material actions and events which have occurred regarding the Company’s liquidation process during the year ended January 31, 2007.

Certain changes in net assets in liquidation include: (i) a decrease in estimated taxes payable reserve of $16.1 million; (ii) a decrease in estimated litigation costs reserve of $3.2 million; (iii) a liquidating cash distribution paid to our shareholders on November 8, 2006 of approximately $22.5 million, or $0.75 per share (see ITEM 5).

Results of Operations

In connection with the adoption of the Plan of Dissolution, we will not generate revenues from sales of our products in the future. We have ceased all sales and marketing efforts related to the sales of our products and have no supply of product available for sale, and, therefore, will not incur cost of revenues in the future.

Prior to the adoption of our Plan of Dissolution, operating results were primarily comprised of income derived from our business units. Because of the adoption of our Plan of Dissolution and the sale of our business units, all operating activity from February 1, 2005 through September 2, 2005 and the year ended January 31, 2005 have been reclassified to discontinued operations. The selected financial data for the period February 1, 2005 to September 2, 2005 are not comparable to the prior years ended January 31 due to the shortened reporting period. A comparison of the results of operations for the period fiscal 2006 to fiscal 2005 would not be meaningful.

LIQUIDITY AND CAPITAL RESOURCES

As of January 31, 2007, net assets in liquidation totaled $54.6 million, consisting of $50.4 million in cash and cash equivalents and $19.7 million of restricted cash. Restricted cash consists of approximately $15.8 million

18

for escrow funds and interest held back in escrow pending the closing of the sale of Wireless Systems, and $3.9 million of restricted cash held as security on letters of credit. Total assets consist of $2.6 million of receivables and other current assets primarily related to an income tax receivable of $1.5 million, $2.6 million of other long-term assets primarily consisting of long-term notes receivable. Total assets are offset by $20.7 million of estimated total liabilities to be incurred during liquidation, consisting of $4.1 million of estimated operating costs (“Costs to be incurred during Liquidation”), $1.1 million of estimated lease settlement costs, $2.6 million of estimated litigation costs including defense and resolution, $6.2 million related to estimated purchase price adjustments and indemnification costs and $6.7 million in taxes payable.

We expect to use our capital resources to execute and complete our Plan of Dissolution, settle existing claims against the Company, including existing litigation and other current liabilities and accrued expenses, and to make liquidating distributions to our shareholders. Capital resources available for liquidating distributions to shareholders may vary if we incur greater than estimated operating expenses associated with executing the Plan of Dissolution, actual settlement costs for existing claims against the Company vary from estimates, or if there are existing, but unknown claims made against us in the future. We intend to distribute net assets in liquidation to shareholders as liquidating distributions as promptly as practicable as we convert our remaining assets to cash. At January 31, 2007, our cash and cash equivalents were held primarily in money market funds. We expect to continue to hold our cash and cash equivalents primarily in money market funds while we execute the Plan of Dissolution.

Distributions

On August 2, 2005, we filed additional proxy material with the SEC that provided shareholders with an estimate of the cash and the number of shares of Powerwave common stock that would be distributed to REMEC shareholders following the sale of REMEC’s Wireless Systems business to Powerwave. That filing indicated shareholders were ultimately expected to receive between $2.45 to $2.95 in total cash distributions and 0.333 shares of Powerwave stock for every share of REMEC stock held at the time the transaction closed. In September 2005, 10 million shares of Powerwave stock were issued to the shareholders of record on September 13, 2005 of REMEC stock at a ratio of 0.3443 shares of Powerwave stock for every share of REMEC stock held. On October 4, 2005, an initial cash liquidating distribution was made to shareholders of record of REMEC stock on September 13, 2005 at a rate of $1.35 per share totaling $39.2 million.

On October 19, 2006, the Board of Directors approved a cash liquidating distribution of approximately $22.5 million, or $0.75 per share to shareholders of record as of November 1, 2006 pursuant to our Plan of Dissolution. On November 8, 2006, a cash liquidating distribution was made to all shareholders of record as of November 1, 2006 at a rate of $0.75 per share, totaling $22.5 million.

The source for payment of these distributions was funds from operating activities and proceeds from the sales of operating business units.

Subsequent cash distributions are pending, subject to review by REMEC’s Board of Directors of the Company’s remaining obligations. Based on our projections of operating expenses and liquidation costs as of January 31, 2007, we estimate that the amount of future liquidating distributions will range between $0.25 and $1.80 per share of common stock. However, the significant number of liabilities and obligations that REMEC must satisfy along with the uncertainty surrounding these obligations makes the actual amount and timing of distributions uncertain and may result in the actual cash distribution being lower or higher than the expected range. Although our Board of Directors has not established a firm timetable for the liquidating distributions, the Board of Directors intends to, subject to contingencies inherent in winding up our business, make such distributions as promptly as practicable and periodically as we convert our remaining assets to cash and pay our remaining liabilities and obligations in accordance with applicable law.

19

Off-Balance Sheet Arrangements

As of January 31, 2007, we did not have any other relationships with unconsolidated entities or financial partners, such as entities often referred to as structured finance or special purpose entities, which would have been established for the purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes. As such, we are not materially exposed to any financing, liquidity, market or credit risk that could arise if we had engaged in such relationships.

Obligations and Commitments

Our contractual obligations and commitments as of January 31, 2007 are reported in the condensed consolidated statements of net assets in liquidation as accrued expenses and accounts payable or estimated costs to be incurred during liquidation. The remaining obligations and commitments of the Company include facility operating leases. The Company is working to terminate these remaining facility leases. As of January 31, 2007 the accrual for the estimated net lease settlements on the remaining facility obligations is $1.1 million.

SIGNIFICANT RECENT ACCOUNTING PRONOUNCEMENTS

In February 2006, the FASB Staff Position (FSP) issued FAS No. 123(R)-4,Classification of Options and Similar Instruments Issued as Employee Compensation That Allow for Cash Settlement upon the Occurrence of a Contingent Event.FAS 123(R)-4 concludes that a cash settlement feature that can be exercised only upon the occurrence of a contingent event that is outside the employee’s control does not become a liability until it becomes probable that the event will occur. An option or similar instrument that is classified as equity, but subsequently becomes a liability because the occurrence of the contingent cash settlement event is probable, shall be accounted for similar to modification from an equity to liability award. To the extent that the liability exceeds the amount previously recognized in equity, the excess is recognized as compensation cost. The total recognized compensation cost for an award with a contingent cash settlement feature shall at least equal the fair value of the award at the grant date. The FSP is applicable only for options or similar instruments issued as part of employee compensation arrangements. The guidance in this FSP was applied upon initial adoption of Statement 123(R). As of January 31, 2007, this pronouncement had no impact on the Company’s consolidated financial statements.

In June 2006, the FASB issued Financial Interpretation No. (FIN) 48,Accounting for Uncertainty in Income Taxes, FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS 109,Accounting for Income Taxes. FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. The requirements of FIN 48 are effective for our fiscal year beginning February 1, 2007. We are in the process of evaluating this guidance and therefore have not yet determined the impact that the adoption of FIN 48 will have on our financial position, results of operations or cash flows.

In September 2006, the FASB issued Statement of Financial Accounting Standards, or SFAS, No. 157,Fair Value Measurement, or SFAS No. 157. SFAS No. 157 defines fair value, establishes a framework for measuring fair value in accordance with GAAP, and expands disclosures about fair value measurements. The provisions of SFAS No. 157 are effective for fiscal years beginning after November 15, 2007. If we have not liquidated our company prior to the required adoption of SFAS No. 157, we will adopt SFAS No. 157 on January 1, 2008. SFAS No. 157 will not have a material effect on our consolidated financial statements.

In September 2006, the SEC released Staff Accounting Bulletin, or SAB, No. 108,Considering the Effects of Prior Year Misstatements When Quantifying Current Year Misstatements, or SAB No. 108, to address diversity in practice regarding consideration of the effects of prior year errors when quantifying misstatements in current year financial statements. The SEC staff concluded that registrants should quantify financial statement

20

errors using both a balance sheet approach and an income statement approach and evaluate whether either approach results in quantifying a misstatement that, when all relevant quantitative and qualitative factors are considered, is material. SAB No. 108 states that if correcting an error in the current year materially affects the current year’s income statement, the prior period financial statements must be restated. SAB No. 108 is effective for fiscal years ending after November 15, 2006. The adoption of SAB No. 108 in the fourth quarter of 2006 did not have a material impact on our consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159,The Fair Value Option for Financial Assets and Financial Liabilities, or SFAS No. 159. SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value. The objective of the guidance is to improve financial reporting by providing entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. SFAS No. 159 is effective as of the beginning of the first fiscal year that begins after November 15, 2007. Early adoption is permitted as of the beginning of the fiscal year beginning on or before November 15, 2007, provided the provisions of SFAS No. 157 are applied. If we have not liquidated our company prior to the required adoption of SFAS No. 159, we will adopt SFAS No. 159 on January 1, 2008. We are evaluating SFAS No. 159 and have not yet determined the impact the adoption, if any, will have on our consolidated financial statements.

ITEM 7A. QUALITATIVE AND QUANTITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk In connection with the adoption of our Plan of Dissolution, certain letters of credit that were previously secured by our domestic trade receivables and inventory are now secured by $3.9 million in restricted cash, which has no related exposure to interest rate movement.

Investments. At January 31, 2007, our investment portfolio includes cash equivalent securities held in a money market account with a recorded value of approximately $35 million. The Company considers all investments with original maturities of three months or less to be cash equivalents. These securities are subject to interest rate risk and might decline in value if interest rates increase. Due to their short-term nature interest rates would not materially affect their value.