As filed with the Securities and Exchange Commission on March 2, 2016

Reg. No. 333-209306

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PRE-EFFECTIVE AMENDMENT NO. 1

POST-EFFECTIVE AMENDMENT NO. [ ]

MIDAS SERIES TRUST

(Exact Name of Registrant as Specified in Charter)

11 Hanover Square, 12th Floor

New York, New York 10005

(Address of Principal Executive Offices)

212-785-0900

(Registrant's Telephone Number)

John F. Ramirez

General Counsel

Midas Series Trust

11 Hanover Square

New York, New York 10005

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after the registration statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Shares of beneficial interest of the Midas Fund, a series of the Registrant

No filing fee is due because the Registrant has previously registered an indefinite number of shares pursuant to Section 24(f) under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

MIDAS SERIES TRUST

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

Cover Sheet

Contents of Registration Statement

Letter to Shareholders

Notice of Joint Special Meeting to Shareholders

Part A — Proxy Statement/Prospectus

Part B — Statement of Additional Information

Part C — Other Information

Signature Page

Exhibits

Part A - Proxy Statement/Prospectus

Your action is required. Please vote today.

[DATE]

Dear Fellow Shareholder:

At Midas, we continually review each Midas series to ensure we are delivering value to our shareholders. Part of this assessment is to seek to ensure each Midas series grows large enough to achieve economies of scale that can be passed on to shareholders in terms of lower fees. Due to the lack of scale in Midas Magic ("Magic") and Midas Perpetual Portfolio ("Perpetual"), each a series of Midas Series Trust, the Board of Trustees (the "Board") of Midas Series Trust recommended to Midas Management Corporation (the "Investment Manager"), and it agreed, that both series should be merged into Midas Fund (the "Reorganizations"). The Investment Manager will continue to manage Midas Fund after the Reorganizations.

The Board of Trustees recommends that Magic and Perpetual merge into Midas Fund because their small sizes make it difficult for them to be economically viable on their own. It is hoped that, consolidated with Magic and Perpetual, Midas Fund will achieve greater economies of scale and a lower expense ratio by spreading fixed costs over a larger asset base, thereby reducing duplicative fees.

In pursuit of its investment objectives, Midas Fund invests primarily in precious metals and natural resources companies and the Investment Manager believes that the precious metals sector now offers relatively attractive valuations. Magic and Midas Fund have similar investment objectives but different investment strategies and risks in that Magic typically invests in high quality companies with large market capitalizations. Perpetual and Midas Fund differ in their investment objectives but they share similar investment strategies and risks in their orientation towards precious metals (for Perpetual, through its gold and silver target allocation investment categories) and natural resources companies (for Perpetual, through its hard asset securities target allocation investment category). Both Magic and Perpetual share similar fundamental and non-fundamental investment restrictions with Midas Fund, except that Midas Fund has more flexibility to invest in precious metals and concentrate its investments in natural resources companies.

The Reorganizations cannot proceed without the approval of shareholders, so it is our pleasure to invite you to the Joint Special Meeting of Shareholders (the "Meeting") of Magic and Perpetual (each, an "Acquired Fund" and, together, the "Acquired Funds") to be held at the Investment Manager's principal executive offices at 11 Hanover Square, 12th Floor, New York, New York 10005, on April 20, 2016 at 11:00 a.m. ET. At the Meeting, each Acquired Fund's shareholders, voting separately from the other Acquired Fund's shareholders, will be asked to approve the proposed merger into Midas Fund. If the proposals are approved and implemented, each shareholder of Magic and Perpetual will automatically become a shareholder of Midas Fund.

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE REORGANIZATIONS.

Formal notice of the Meeting appears on the next page and is followed by a brief overview of the Reorganizations in "Question and Answer" format and the proxy statement/prospectus for the Meeting. Whether or not you are able to attend the Meeting, it is important that your shares be represented at the Meeting. Your vote is important no matter how many shares you own. Voting your shares early will help prevent costly follow-up mail and telephone solicitation. Accordingly, we ask that you please sign, date, and return the enclosed Proxy Card or vote via telephone [or the Internet] at your earliest convenience.

How to vote

You may vote your shares by proxy in one of [three] ways:

| [Internet: | To vote via the Internet, go to www.proxyonline.us and enter the control number found on the enclosed proxy card.] |

| By phone: | To cast your vote by phone with a proxy voting representative, please call toll-free [ ]. Representatives are available to take your voting instructions Monday through Friday 9:00 a.m. to 10:00 p.m. Eastern Time. |

By mail: Complete the enclosed proxy card and return it in the enclosed postage-paid envelope.

I encourage you to read the enclosed proxy statement/prospectus for more information, and I thank you for acting on this matter today. On behalf of the Board of Trustees and the Investment Manager, I extend our appreciation for your continued support.

Sincerely,

Thomas B. Winmill

President

YOUR VOTE IS IMPORTANT We consider the vote of each shareholder important, whatever the number of shares held. Please sign, date, and return your proxies in the enclosed envelope or vote via telephone [or the Internet] at your earliest convenience. Delay may cause each Acquired Fund to incur additional expenses to solicit votes for the Meeting. |

MIDAS SERIES TRUST

11 Hanover Square

New York, NY 10005

www.MidasFunds.com

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

February 1, 2016

To the Shareholders of

Midas Magic and

Midas Perpetual Portfolio:

The Joint Special Meeting of Shareholders ("Meeting") of Midas Magic ("Magic") and Midas Perpetual Portfolio ("Perpetual") (each an "Acquired Fund" and, together, the "Acquired Funds"), each a series of Midas Series Trust, will be held at the principal executive offices of Midas Management Corporation (the "Investment Manager") at 11 Hanover Square, 12th Floor, New York, New York 10005, on April 20, 2016, at 11:00 a.m. ET. At the Meeting, each Acquired Fund's shareholders, voting separately from the other Acquired Fund's shareholders, will be asked:

| 1. | For Magic shareholders, to approve an Agreement and Plan of Reorganization between Magic and Midas Fund, each a series of Midas Series Trust, under which Magic would transfer all of its assets to Midas Fund in exchange solely for shares of beneficial interest of Midas Fund, the assumption by Midas Fund of the liabilities of Magic, and the issuance of Midas Fund shares of beneficial interest to the shareholders of Magic in an amount equal to the aggregate net asset value of the shares of Magic, all as described in the accompanying Proxy Statement/Prospectus. |

| 2. | For Perpetual shareholders, to approve an Agreement and Plan of Reorganization between Perpetual and Midas Fund, each a series of Midas Series Trust, under which Perpetual would transfer all of its assets to Midas Fund in exchange solely for shares of beneficial interest of Midas Fund, the assumption by Midas Fund of the liabilities of Perpetual, and the issuance of Midas Fund shares of beneficial interest to the shareholders of Perpetual in an amount equal to the aggregate net asset value of the shares of Perpetual, all as described in the accompanying Proxy Statement/Prospectus. |

| 3. | Any other business that may properly come before the Meeting. |

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THESE PROPOSALS.

These proposals are discussed in the Proxy Statement/Prospectus attached to this Notice. Each shareholder is invited to attend the Meeting in person. Only holders of record at the close of business on February 19, 2016 are entitled to receive notice of, and to vote at, the Meeting.

JOHN F. RAMIREZ

Secretary

[Important Notice regarding the Availability of Proxy Materials for the Joint Special Meeting of Shareholders to Be Held on April 20, 2016: This Notice of the Joint Special Meeting of Shareholders, Proxy Statement and form of proxy card are available [ ].]

IF YOU CANNOT BE PRESENT AT THE MEETING, WE URGE YOU TO COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD OR AUTHORIZE PROXIES VIA TELEPHONE [OR THE INTERNET]. THE PROXY CARD SHOULD BE RETURNED IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. WE ASK YOUR COOPERATION IN COMPLETING AND RETURNING YOUR PROXY PROMPTLY. THE ENCLOSED PROXY IS BEING SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES.

QUESTIONS AND ANSWERS REGARDING THE PROPOSALS

While we strongly encourage you to read the full text of the Proxy Statement/Prospectus, we also are providing the following brief overview of the proposals in "Question and Answer" format. If you have any questions about the proposals or how to vote your shares, please call [ ] toll free at [ ].

Question: What proposals will be acted upon at the Meeting?

| A. | At the Meeting, each Acquired Fund's shareholders, voting separately from the other Acquired Fund's shareholders, will be asked to approve an Agreement and Plan of Reorganization under which each Acquired Fund would transfer all of its assets to Midas Fund (the "Acquiring Fund"), also a series of Midas Series Trust, in exchange solely for shares of beneficial interest of the Acquiring Fund (the "Acquiring Fund Shares"), the assumption by the Acquiring Fund of each Acquired Fund's liabilities, and the issuance of Acquiring Fund Shares to the shareholders of each Acquired Fund in an amount equal to the aggregate net asset value of the shares of beneficial interest of each Acquired Fund. |

Question: What are shareholders being asked to approve?

| A. | Each Acquired Fund's shareholders, voting separately from the other Acquired Fund's shareholders, are being asked to approve a proposal to merge Magic and Perpetual into Midas Fund (each a "Reorganization" and, together, the "Reorganizations"). The Acquired Funds' investment manager, independent registered public accounting firm, and other service providers will continue to serve in the same roles for the Acquiring Fund following the Reorganizations. Bruce B. Huber, James E. Hunt, Peter K. Werner, and Thomas B. Winmill (the "Trustees"), each of whom currently serves on the Board of Trustees of Midas Series Trust (the "Board"), will continue to serve on the Board. |

Question: Why is the Board proposing the Reorganizations?

| A. | The Board is proposing that Magic and Perpetual merge into Midas Fund because their small sizes make it difficult for them to be economically viable on their own. It is hoped that, consolidated with Magic and Perpetual, Midas Fund will achieve greater economies of scale and a lower expense ratio by spreading fixed costs over a larger asset base, thereby reducing duplicative fees. |

In pursuit of its investment objectives, Midas Fund invests primarily in precious metals and natural resources companies and it is hoped that its performance will improve, inasmuch as the Investment Manager believes that the precious metals sector has recently declined to now offer relatively attractive historically low valuations. Magic and Midas Fund have similar investment objectives but different investment strategies and risks in that Magic typically invests in high quality companies with large market capitalizations. Perpetual and Midas Fund differ in their investment objectives but they share similar investment strategies and risks in their orientation towards precious metals (for Perpetual, through its gold and silver target allocation investment categories) and natural resources companies (for Perpetual, through its hard asset securities target allocation investment category). Both Magic and Perpetual share similar fundamental and non-fundamental investment restrictions with Midas Fund, except that Midas Fund has more flexibility to invest in precious metals and concentrate its investments in natural resources companies.

| Question: | How will the Reorganizations affect me as a shareholder? |

| A. | It is anticipated that, following the Reorganizations, the total annual operating expenses of Midas Fund will be lower than each of Magic and Perpetual's current total annual operating expenses. Midas Fund may also be better positioned in the market to increase asset size and achieve potential additional economies of scale, which may lead to lower expenses in the future. Because Magic, Perpetual, and Midas Fund are each a series of Midas Series Trust, each of their shareholders has identical rights. Accordingly, the rights of shareholders of each Acquired Fund will not change as a result of the Reorganizations. |

| Question: | Will there be any sales load, commission, or other transactional fee paid by shareholders in connection with the Reorganization? |

| A. | No. The full value of your shares of each Fund will be exchanged for the proportional number of shares of the Acquiring Fund, having the same aggregate net asset value, without any sales load, commission or other transactional fee being imposed. The costs of the Meeting and the Reorganizations will be paid by the Acquired Funds and, as applicable, the Acquiring Fund. |

Question: What will be the federal income tax consequences of the Reorganization?

| A. | There should be no federal income tax consequences as a result of the Reorganizations. Each Reorganization is designed to qualify for federal income tax purposes as a tax-free reorganization under the Internal Revenue Code of 1986, as amended. |

Question: What happens if a Reorganization is not approved?

| A. | If shareholders of an Acquired Fund do not approve a Reorganization, that Acquired Fund will continue to operate as a separate series of Midas Series Trust. If, however, the shareholders of both Acquired Funds approve the Reorganizations, the Trustees and the officers of the Acquired Funds will implement the Reorganizations on behalf of each Acquired Fund. |

Question: Who will bear the expenses related to the Meeting and Reorganizations?

| A. | The Acquired Funds and, as applicable, the Acquiring Fund will bear the expenses associated with the Meeting and the Reorganizations, including the costs of printing, mailing, tabulating, soliciting proxies, and legal and accounting fees. The total direct expenses of the Reorganizations are estimated to be approximately $120,000-$170,000. Expenses incurred prior to the Reorganizations would be allocated by relative total net assets among the Acquired Funds or other method deemed equitable by the Acquired Funds' investment manager. Expenses incurred following the Reorganizations would be borne by Midas Fund |

The Board believes it is appropriate for the Acquired Funds to bear expenses incurred prior to the Reorganizations because of the anticipated positive effect of the Reorganizations on the expense ratio of the Acquiring Fund, as discussed herein.

Question: How does the Board recommend that I vote?

| A. | After careful consideration of the proposals, the Board, including all those Trustees who are not "interested persons" (as defined in the Investment Company Act of 1940, as amended) of the Acquired Funds unanimously approved the proposals and recommend that you vote in favor of the proposals. |

Question: What number should I call if I have questions?

| A. | We will be pleased to answer your questions about this proxy solicitation. Please call the Acquired Funds' proxy solicitor, [ ], toll free at [ ] with any questions. |

Question: How do I vote?

| A. | You may use the enclosed postage-paid envelope to mail your proxy card or you may attend the Meeting in person. You may also vote by phone by calling [ ] toll free at [ ] [or via the Internet]. |

If you are a record holder of one or more than one of the Acquired Funds' shares and plan to attend the Meeting in person, in order to gain admission you must show valid photographic identification, such as your driver's license or passport.

If you hold shares of one or more than one Acquired Fund through a bank, broker or other nominee, and plan to attend the Meeting in person, in order to gain admission you must show valid photographic identification, such as your driver's license or passport, and satisfactory proof of ownership of shares in an Acquired Fund, such as your voting instruction form or a letter from your bank, broker or other nominee's statement indicating ownership as of the record date for the Meeting.

THE BOARD OF TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES,

UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" THE REORGANIZATIONS.

MIDAS SERIES TRUST

11 Hanover Square

New York, NY 10005

www.MidasFunds.com

(212) 785-0900

PROXY STATEMENT AND PROSPECTUS

Dated March 14, 2016

This proxy statement and prospectus ("Proxy Statement/Prospectus") sets forth concisely the information shareholders should know before voting on the proposed reorganization of their fund. Please read it carefully and retain it for future reference.

This Proxy Statement/Prospectus is being furnished to shareholders of Midas Magic ("Magic") and Midas Perpetual Portfolio ("Perpetual") (each a "Fund" or an "Acquired Fund" and, together, the "Funds" or the "Acquired Funds"), each a series of Midas Series Trust (the "Trust"), a Delaware statutory trust registered as an open end management investment company, in connection with the solicitation of proxies by the Board of Trustees (the "Board") of the Trust for use at a joint special meeting of each Acquired Fund's shareholders to be held on April 20, 2016 at 11:00 a.m. ET at 11 Hanover Square, New York, New York 10005 (such meeting and any adjournment(s) or postponement(s) thereof are referred to collectively as the "Meeting").

The Board has fixed the close of business on February 19, 2016 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting (the "Record Date"). It is estimated that proxy materials will be mailed to shareholders as of the Record Date on or about March 14, 2016.

| | Acquired Fund | Acquiring Fund |

| Proposal 1 | Midas Magic | Midas Fund |

| Proposal 2 | Midas Perpetual Portfolio |

As of the Record Date, the Acquired Funds and the Acquiring Fund are not aware of any person or "group" (as that term is used in Section 13(d)(3) of the Securities Exchange Act of 1934, and the rules and regulations promulgated thereunder and exemptions granted therefrom, both as amended from time to time (the "Exchange Act")), owning beneficially more than 5% of their outstanding shares, respectively, except as follows:

| | Name and Address of Owner | Amount and Nature of Beneficial Ownership | Percentage of Outstanding Shares |

Magic (Acquired Fund) | | | |

| | | | |

Perpetual (Acquired Fund) | | | |

| | | | |

Midas Fund (Acquiring Fund) | | | |

| | | | |

| | | | |

As of the Record Date, officers and trustees of the Trust directly and indirectly beneficially owned, in the aggregate, [ ]% of the outstanding shares of Magic, [ ]% of the outstanding shares of Perpetual, and [ ]% of the outstanding shares of Midas Fund.

How the Reorganizations will work

As more fully described in this Proxy Statement/Prospectus, the purpose of the Meeting is to vote on the proposed reorganizations (each a "Reorganization" and, together, the "Reorganizations") in which each Acquired Fund would transfer all of its assets to Midas Fund (the "Acquiring Fund"), also a series of the Trust, in exchange solely for shares of beneficial interest of Midas Fund (the "Acquiring Fund Shares"), the assumption by Midas Fund of each Acquired Fund's liabilities, and the issuance of Acquiring Fund Shares to the shareholders of each Acquired Fund in an amount equal to the aggregate net asset value of the shares of beneficial interest of each Acquired Fund. Each Reorganization will be effected pursuant to an Agreement and Plan of Reorganization, the form of which is attached hereto as Exhibit A. Those Acquiring Fund Shares would then be distributed to the shareholders of each Acquired Fund on the effective date of the Reorganizations. As soon as practicable following the distribution of Acquiring Fund Shares, each Acquired Fund would be liquidated. No sales charges will be imposed on the Acquiring Fund Shares received by shareholders of the Acquired Funds. For federal income tax purposes, the Reorganizations are expected to be tax-free reorganizations and are not intended to result in income, gain, or loss being recognized by the Acquired Funds or the Acquiring Fund. Because Magic, Perpetual, and Midas Fund are each a series of the Trust, each of their shareholders has identical rights. Accordingly, the rights of shareholders of each Acquired Fund will not change as a result of the Reorganizations.

The Acquired Funds and, as applicable, the Acquiring Fund will bear the expenses associated with the Meeting and the Reorganizations, including the costs of printing, mailing, tabulating, soliciting proxies, and legal and accounting fees. The total direct expenses of the Reorganizations are estimated to be approximately $120,000-$170,000. Expenses incurred prior to the Reorganizations would be allocated by relative total net assets among the Acquired Funds or other method deemed equitable by the Acquired Funds' investment manager. Expenses incurred following the Reorganizations would be borne by Midas Fund.

The Board believes it is appropriate for the Acquired Funds to bear expenses incurred prior to the Reorganizations because of the anticipated positive effect of the Reorganizations on the expense ratio of Midas Fund, as discussed herein, including estimates of the quantification of the expected benefits associated with the Reorganizations.

Rationale for the Reorganizations

The Reorganizations are being proposed because the small sizes of Magic and Perpetual make it difficult for them to be economically viable on their own. Magic and Perpetual each incurs operating costs such as for insurance, accounting, legal, transfer agency, administrative, and custodial services. The merger of Magic and Perpetual with Midas Fund may enable Magic and Perpetual's shareholders to benefit from the ability to spread fixed expenses in a manner that may contribute to a lower expense ratio in the long term than each of Magic and Perpetual would achieve separately. It is anticipated that, following the Reorganizations, the total annual operating expenses of Midas Fund will be lower than each of Magic and Perpetual's current total annual operating expenses. Midas Fund may also be better positioned in the market to increase asset size and achieve potential additional economies of scale, which may lead to lower per share expenses in the future.

Midas Fund's investment objectives are to seek primarily capital appreciation and protection against inflation and, secondarily, current income. Similarly, Magic's investment objective is to seek capital appreciation. Alternatively, Perpetual's investment objective is to seek to preserve and increase the purchasing power value of its shares over the long term.

Midas Fund's current strategy in pursuit of its investment objectives is to seek investments in higher quality senior and intermediate producers of precious metals and other natural resources with a growth component. Magic seeks its investment objective by focusing primarily on large companies, with a broad orientation towards conservatively priced value stocks and aggressively priced growth issues. Perpetual uses a core "asset allocation" strategy to seek its investment objective. Perpetual's asset allocations and target percentage ranges are gold (10-30%); silver (0-20%); Swiss franc assets (10-30%); hard asset securities (15-35%); and large capitalization growth stocks (15-35%).

Midas Management Corporation, the investment manager (the "Investment Manager") of Magic, Perpetual, and Midas Fund, will continue to manage Midas Fund after the Reorganizations. Thomas Winmill has managed Midas Fund since 2002 and, after the Reorganizations, will continue as portfolio manager. With the reduction in the number of funds it manages, the Investment Manager is expected to be in a better position to focus on its management of Midas Fund. Perpetual has been managed by the Investment Policy Committee (the "IPC") of the Investment Manager since December 29, 2008. Magic has been managed by the IPC of the Investment Manager since May 15, 2012.

Board Consideration of the Reorganizations

The Board, including the independent trustees, considered the Reorganizations over the course of multiple meetings, and reviewed information and materials regarding the Reorganizations presented or prepared by, among others, the Investment Manager. In its review of each Reorganization, the Board was assisted by legal counsel. In reaching its decision to recommend approval of each Reorganization, the Board with respect to each of the Acquired Funds and the Acquiring Fund, concluded that the participation of each Acquired Fund and the Acquiring Fund in the Reorganizations is in the best interests of the Acquired Funds and the Acquiring Fund, as well as in the best interests of each Acquired Fund's and the Acquiring Fund's shareholders, and that the interests of the shareholders of each Acquired Fund and the Acquiring Fund are not being diluted.

In determining whether to approve each Reorganization and recommend its approval to shareholders of the Acquired Funds, the Board inquired into a number of matters and considered, with respect to the Reorganizations, the following factors, among others: (1) the extent of compatibility of the investment objectives, principal investment strategies, risks, and restrictions of the Acquired Funds and the Acquiring Fund; (2) the comparative historical performance of the Acquired Funds and the Acquiring Fund; (3) the extent of any advantages to shareholders of the Acquired Funds of investing in a larger post-Reorganization asset pool; (4) the prospects for growth, and for achieving economies of scale, of the combined Acquired Funds and the Acquiring Fund; (5) the expense ratios and available information regarding the fees and expenses of the Acquired Funds and the Acquiring Fund; (6) the investment experience, expertise, and financial resources of, and the nature and quality of the services provided by, the Investment Manager; (7) the terms and conditions of the Reorganizations and whether the Reorganizations would result in dilution of shareholder interests; (8) any direct and indirect costs to be incurred by the Acquired Funds and the Acquiring Fund as a result of the Reorganizations; (9) any direct or indirect benefits to the Investment Manager or its affiliates to be realized as a result of the Reorganizations; (10) the tax consequences of the Reorganizations; and (11) possible alternatives to the Reorganizations.

After careful consideration of the Reorganizations, the Board, including the independent trustees, unanimously approved the Reorganizations and recommend that shareholders vote in favor of the proposals.

* * *

Acquiring Fund Shares are not deposits or obligations of, or guaranteed or endorsed by, any bank or other depository institution. Acquiring Fund Shares are not federally insured by the Federal Deposit Insurance Corporation, the U.S. Federal Reserve Board, or any other government agency.

Shares of the Acquiring Fund have not been approved or disapproved by the Securities and Exchange Commission (the "SEC"). The SEC has not passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

A Statement of Additional Information, dated March 14, 2016, relating to the Reorganizations (the "Reorganization SAI") has been filed with the SEC and is incorporated herein by this reference (that is, the Reorganization SAI is legally a part of this Proxy Statement/Prospectus). In addition, a Prospectus for the Trust dated April 28, 2015, as amended (the "Prospectus"); a Statement of Additional Information for the Trust dated April 28, 2015 (the "SAI"); and an Annual Report to Shareholders of the Trust for the Fiscal Year Ended December 31, 2015 (the "Annual Report"), have each been filed with the SEC and are incorporated herein by this reference.

To obtain a copy of the Reorganization SAI, or the Trust's Prospectus, SAI or Annual Report free of charge, to request other information about the Trust, or to make shareholder inquiries, please contact us using the following methods:

● By telephone, call:

1-800-400-MIDAS (6432) to speak to a Shareholder Services Representative, 8:00 a.m. to 6:00 p.m. ET, Monday through Friday, and for 24 hour, 7 day a week automated shareholder services.

● By mail, write to:

Midas Funds

P.O. Box 6110

Indianapolis, IN 46206-6110

● By e-mail, write to:

info@midasfunds.com

● On the Internet, the Trust's documents can be viewed online or downloaded from:

SEC at http://www.sec.gov, or

Midas website at http://www.midasfunds.com

The Trust is subject to the informational requirements of the Exchange Act and the Investment Company Act of 1940, as amended (the "1940 Act"), and files reports, proxy statements, and other information with the SEC. These reports, proxy statements, and other information filed by the Trust may be inspected and copied (for a duplication fee) at the public reference facilities of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549 and at the Northeast Regional Office (3 World Financial Center, New York, New York 10281). Copies of these materials can also be obtained by mail from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. In addition, copies of these documents may be viewed online or downloaded from the SEC's website at sec.gov.

Table of Contents

INTRODUCTION | 1 |

PROPOSAL 1 – REORGANIZATION OF MAGIC | 1 |

PROPOSAL 2 – REORGANIZATION OF PERPETUAL | 10 |

COMPARISON OF FEES AND EXPENSES | 18 |

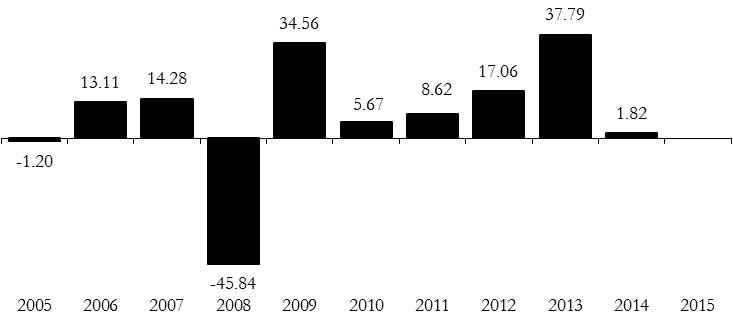

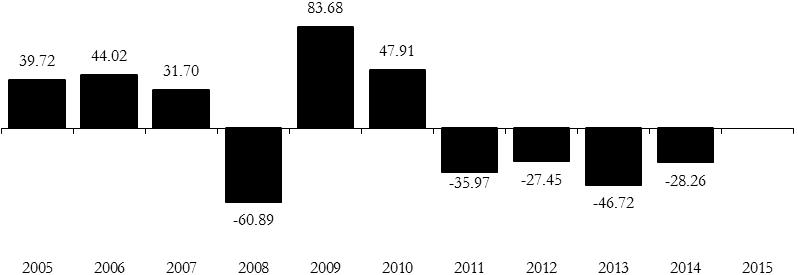

COMPARISON OF FUND PERFORMANCE | 21 |

PORTFOLIO MANAGEMENT | 23 |

PURCHASE, REDEMPTION, AND EXCHANGE PROCEDURES | 24 |

FEDERAL INCOME TAX CONSEQUENCES OF THE REORGANIZATIONS | 29 |

CAPITALIZATION | 31 |

VOTING INFORMATION | 31 |

CONFLICTS OF INTEREST | 32 |

ORGANIZATION OF THE TRUST | 32 |

LEGAL MATTERS | 32 |

EXPERTS | 32 |

FINANCIAL HIGHLIGHTS | 33 |

EXHIBIT A | A-1 |

INTRODUCTION

This Proxy Statement/Prospectus is being used by the Board of Trustees (the "Board") of Midas Series Trust (the "Trust") to solicit proxies to be voted at a Joint Special Meeting (the "Meeting") of Shareholders of Midas Magic ("Magic") and Midas Perpetual Portfolio ("Perpetual") (each an "Acquired Fund" and together, the "Acquired Funds"). This Meeting will be held at 11 Hanover Square, 12th Floor, on April 20, 2016 at 11:00 a.m. ET. The purpose of the Meeting is to consider proposals to approve the Reorganizations. This Proxy Statement/Prospectus includes information that is specific to each proposal, including summary comparisons. You should read the entire Proxy Statement/Prospectus carefully.

Who is eligible to vote?

Shareholders of record of each Acquired Fund on February 19, 2016 are entitled to attend and vote at the Meeting or any adjourned meeting. Each whole share is entitled to one vote and each fractional share is entitled to a proportionate fractional vote. Shares represented by properly executed proxies, unless revoked before or at the Meeting, will be voted according to shareholders' instructions. If you sign a proxy but do not fill in a vote, your shares will be voted to approve the Agreement and Plan of Reorganization described below. If any other business comes before the Meeting, your shares will be voted at the discretion of the persons named as proxies.

PROPOSAL 1 – REORGANIZATION OF MAGIC

Approval of Agreement and Plan of Reorganization between Magic and Midas Fund

Under the Agreement and Plan of Reorganization between Magic and Midas Fund, Magic would transfer all of its assets to Midas Fund in exchange solely for shares of beneficial interest of Midas Fund, the assumption by Midas Fund of the liabilities of Magic, and the issuance of Midas Fund shares of beneficial interest to the shareholders of Magic in an amount equal to the aggregate net asset value of the shares of Magic. The Board unanimously recommends that shareholders vote FOR this proposal.

SUMMARY COMPARISONS OF MAGIC (ACQUIRED FUND) TO MIDAS FUND (ACQUIRING FUND)

Comparison of Investment Objectives, Strategies, Risks, and Restrictions

| Magic | Midas Fund |

| (Acquired Fund) | (Acquiring Fund) |

| |

| Net Assets as of December 31, 2015 |

| [$13,151,223] | [$10,067,884] |

| | |

| Investment Adviser |

| Midas Management Corporation |

| | |

| Investment Objectives |

| The Fund seeks capital appreciation. | Midas Fund seeks primarily capital appreciation and protection against inflation and, secondarily, current income. |

| | |

| Principal Investment Strategies |

| In pursuit of its investment objective, the Fund may invest in any security type (e.g., common and preferred stocks, bonds, convertible securities, etc.) and in any industry sector, in domestic or foreign companies, and in companies of any size. Generally, the investment manager seeks what it believes to be quality companies with unique combinations of strength in operations, products, and finances with either growth or value characteristics. A security is typically sold when its potential to meet the Fund's investment objective is limited or exceeded by another potential investment, when an investment in an issuer no longer appears to meet the Fund's investment objective, or when the Fund must meet redemptions. In seeking to enhance returns, the Fund may use futures, options, and short sales and may use leverage to the extent permitted under the Investment Company Act of 1940, as amended (the "1940 Act"). To achieve the Fund's objective, the investment manager may use a seasonal investing strategy to invest the Fund's assets to gain exposure to the securities markets during periods anticipated to be favorable based on patterns of investor behavior as driven by and related to accounting periods, taxable events, and other calendar related phenomena. The investment manager's analysis also takes into consideration those periods during the year in which it anticipates that investors are more likely to invest additional money into the securities markets. These periods can be related to accounting periods and may be further refined by considerations of tax cycles, holidays, and other factors. The Fund may invest in fixed income securities of any issuer, including U.S. Government Securities, of any credit quality or maturity, although it has no current intention of investing more than 5% of its total assets in fixed income securities rated less than investment grade. The Fund may trade securities actively in pursuit of its investment objective. The Fund also may lend its portfolio securities to brokers, dealers, and other financial institutions. | In pursuit of its investment objectives, Midas Fund invests at least 65% of its total assets in (i) securities (e.g., common and preferred stocks, bonds, convertible securities, etc.) of companies primarily involved, directly or indirectly, in the business of mining, processing, fabricating, distributing or otherwise dealing in gold, silver, platinum, other precious metals, or other natural resources ("Natural Resources Companies") and (ii) gold, silver, and platinum bullion and coins. Up to 35% of Midas Fund's total assets may be invested in securities of companies that derive a portion of their gross revenues, directly or indirectly, from the business of mining, processing, fabricating, distributing, or otherwise dealing in gold, silver, platinum, or other natural resources, in securities of selected growth companies, and fixed income securities of any issuer, including U.S. Government Securities, of any credit quality or maturity, although Midas Fund has no current intention of investing more than 5% of its total assets in fixed income securities rated less than investment grade. Midas Fund may invest in domestic and foreign companies of any size. The Investment Manager seeks companies that it believes have attractive fundamentals and often looks at company characteristics such as people, projects, and pricing. A security is typically sold when its potential to meet Midas Fund's investment objective is limited or exceeded by another potential investment opportunity, when an investment in an issuer no longer appears to meet Midas Fund's investment objectives, or when Midas Fund must meet redemptions. In seeking to enhance returns, Midas Fund may use futures, options, and short sales, and may use leverage to the extent permitted under the 1940 Act. Midas Fund concentrates its investments by investing at least 25% of its total assets in Natural Resources Companies. Midas Fund may trade securities actively in pursuit of its investment objectives. Midas Fund also may lend its portfolio securities to brokers, dealers, and other financial institutions. |

| | |

| Principal Risks |

Market. The market risks associated with investing in the Fund are those related to fluctuations in the value of the investments in the Fund's portfolio. A risk of investing in stocks is that their value will go up and down, sometimes rapidly and unpredictably, reflecting overall economic conditions and other factors and you could lose money. The Fund may invest in emerging companies, such as startups and spin offs, and special situations, which include companies undergoing unusual or possibly one time developments such as reorganizations or liquidations. These investments may involve above average market price volatility and greater risk of loss. Certain unanticipated events, such as natural disasters, terrorism, war, and other geopolitical events, can have a dramatic adverse effect on the investments held by the Fund. | Market. The market risks associated with investing in Midas Fund are those related to fluctuations in the value of the investments in Midas Fund's portfolio. A risk of investing in stocks, precious metals, and other investments is that their value will go up and down, sometimes rapidly and unpredictably, reflecting overall economic conditions and other factors and you could lose money. Midas Fund may invest in emerging companies, such as startups and spin offs, and special situations, which include companies undergoing unusual or possibly one time developments such as reorganizations or liquidations. These investments may involve above average market price volatility and greater risk of loss. Certain unanticipated events, such as natural disasters, terrorism, war, and other geopolitical events, can have a dramatic adverse effect on the investments held by Midas Fund. |

| | |

Non-Diversification. The Fund is non-diversified, which means that it is not limited by the 1940 Act in the proportion of its assets that may be invested in the obligations of a single issuer. As a result, the Fund may hold a smaller number of issuers than if it were diversified. Investing in a non-diversified fund could involve more risk than investing in a fund that holds a broader range of securities because changes in the financial condition of a single issuer could cause greater fluctuation in the fund's total returns. As of December 31, 2015, the Fund held approximately [ ]% and [ ]% of its net assets in Berkshire Hathaway, Inc. and MasterCard, Inc., respectively, primarily as a result of market appreciation since the time of purchase. Thus, the volatility of the Fund's net asset value, and its performance in general, depends disproportionately more on the performance of a single issuer than that of a more diversified fund. | Non-Diversification. Midas Fund is non-diversified, which means that it is not limited by the 1940 Act in the proportion of its assets that may be invested in the obligations of a single issuer. As a result, Midas Fund may hold a smaller number of issuers than if it were diversified. Investing in a non-diversified fund could involve more risk than investing in a fund that holds a broader range of securities because changes in the financial condition of a single issuer could cause greater fluctuation in the fund's total returns. |

| | |

Leverage. The Fund may use leverage to the extent permitted under the 1940 Act. Leveraging (buying securities using borrowed money) exaggerates the effect on net asset value ("NAV") of any increase or decrease in the market value of a Fund's investments. Money the Fund borrows for leveraging is limited to 33 1/3% of the value of its total assets. These borrowings would be subject to interest costs that may or may not be offset by income or capital gain from the securities purchased. There can be no assurance that the Fund's use of leverage will be successful. | Leverage. Midas Fund may use leverage to the extent permitted under the 1940 Act. Leveraging (buying securities using borrowed money) exaggerates the effect on NAV of any increase or decrease in the market value of Midas Fund's investments. Money Midas Fund borrows for leveraging is limited to 33 1/3% of the value of its total assets. These borrowings would be subject to interest costs that may or may not be offset by income or capital gain from the securities purchased. There can be no assurance that Midas Fund's use of leverage will be successful. |

| | |

Foreign Investments. Investments in the securities of foreign issuers involve certain considerations and risks not ordinarily associated with investments in securities of domestic issuers. Foreign companies are not generally subject to the same accounting, auditing, and financial standards and requirements as those applicable to U.S. companies. There may be less publicly available information about a foreign company than a U.S. company. Investments in foreign securities could expose the Fund to the direct or indirect consequences of political, social, or economic changes in the countries where those securities are issued or in which the issuers are located. With respect to certain countries, there are risks of expropriation, confiscatory taxation, political or social instability, or diplomatic developments that could affect assets of the Fund held in custody in those foreign countries. If the value of any foreign currency in which the Fund's investments are denominated declines relative to the U.S. dollar, the value of the Fund's investments is expected to decline proportionately. In addition, a portfolio that includes foreign securities can expect to have a higher expense ratio because of the increased transaction costs on non-U.S. securities markets and the increased costs of maintaining the custody of foreign securities. In addition, investing in emerging (less developed) markets may involve higher levels of each of these risks. | Foreign Investments. Investments in the securities of foreign issuers involve certain considerations and risks not ordinarily associated with investments in securities of domestic issuers. Foreign companies are not generally subject to the same accounting, auditing, and financial standards and requirements as those applicable to U.S. companies. There may be less publicly available information about a foreign company than a U.S. company. Investments in foreign securities could expose Midas Fund to the direct or indirect consequences of political, social, or economic changes in the countries where those securities are issued or in which the issuers are located. With respect to certain countries, there are risks of expropriation, confiscatory taxation, political or social instability, or diplomatic developments that could affect assets of Midas Fund held in custody in those foreign countries. If the value of any foreign currency in which Midas Fund's investments are denominated declines relative to the U.S. dollar, the value of Midas Fund's investments is expected to decline proportionately. In addition, a portfolio that includes foreign securities can expect to have a higher expense ratio because of the increased transaction costs on non-U.S. securities markets and the increased costs of maintaining the custody of foreign securities. In addition, investing in emerging (less developed) markets may involve higher levels of each of these risks. |

| | |

Short Selling, Options, and Futures Transactions. The Fund may engage in short selling, options, and futures transactions to increase returns. There is a risk that these transactions may reduce returns or increase volatility. The Fund may incur a loss as a result of a short position if the price of the asset sold short increases in value between the date of the short position sale and the date on which an offsetting position is purchased, plus any premiums or interest paid to the third party. Because the Fund's potential loss on a short position arises from increases in the value of the asset sold short, the extent of such loss, like the price of the asset sold short, is theoretically unlimited. In addition, derivatives, such as options and futures, can be illiquid and highly sensitive to changes in their underlying security, interest rate or index, and as a result can be highly volatile. Derivatives also may be subject to certain other risks such as leverage risk, liquidity risk, interest rate risk, market risk, credit risk, the risk that a counterparty may be unable or unwilling to honor its obligations, management risk and the risk of mispricing or improper valuation. A small investment in certain derivatives could have a potentially large impact on the Fund's performance. | Short Selling, Options, and Futures Transactions. Midas Fund may engage in short selling, options, and futures transactions to increase returns. There is a risk that these transactions may reduce returns or increase volatility. Midas Fund may incur a loss as a result of a short position if the price of the asset sold short increases in value between the date of the short position sale and the date on which an offsetting position is purchased, plus any premiums or interest paid to the third party. Because Midas Fund's potential loss on a short position arises from increases in the value of the asset sold short, the extent of such loss, like the price of the asset sold short, is theoretically unlimited. In addition, derivatives, such as options and futures, can be illiquid and highly sensitive to changes in their underlying security, interest rate or index, and as a result can be highly volatile. Derivatives also may be subject to certain other risks such as leverage risk, liquidity risk, interest rate risk, market risk, credit risk, the risk that a counterparty may be unable or unwilling to honor its obligations, management risk and the risk of mispricing or improper valuation. A small investment in certain derivatives could have a potentially large impact on Midas Fund's performance. |

| | |

Medium and Large Capitalization. Compared to smaller companies, medium and large-cap companies may be less responsive to changes and opportunities. At times, the stocks of larger companies may lag other types of stocks in performance. Compared to larger companies, medium companies may have a shorter history of operations, and may have limited product lines, markets or financial resources. | Medium and Large Capitalization. Compared to smaller companies, medium and large-cap companies may be less responsive to changes and opportunities. At times, the stocks of larger companies may lag other types of stocks in performance. Compared to larger companies, medium companies may have a shorter history of operations, and may have limited product lines, markets or financial resources. |

| | |

| | Small Capitalization. Midas Fund may invest in companies that are small or thinly capitalized and may have a limited operating history. Investments in small-cap companies may involve greater risks than investments in larger, more established issuers because they generally are more vulnerable than stocks of larger companies to adverse business or economic developments. The securities of small companies generally are less liquid and have narrower product lines, more limited financial resources, and more limited markets for their stock as compared with larger companies. As a result, the value of such securities may be more volatile than the securities of larger companies. During broad market downturns, Midas Fund's NAV may fall further than those of funds investing in larger companies. Full development of small capitalization companies takes time, and for this reason, among others, Midas Fund should be considered a long term investment and not a vehicle for seeking short term profit. |

| | |

Fixed Income Securities. The Fund may invest in fixed income securities that are affected by changes in interest rates. When interest rates rise, the prices of fixed income securities typically fall in proportion to their maturities. Conversely, when interest rates fall, the value of fixed income securities generally rises. As of the date of this Proxy Statement/Prospectus, interest rates in the United States are at or near historic lows, which may increase the Fund's exposure to risks associated with rising interest rates. Fixed income securities are also subject to credit risk, i.e., the risk that an issuer of securities will be unable or unwilling to pay principal and interest when due or that the value of the security will suffer because investors believe the issuer is less able to pay. Many fixed income securities, especially those issued at high interest rates, provide that the issuer may repay them early. If issuers exercise this right, holders of these types of callable securities may not benefit fully from the increase in value that other fixed income securities experience when rates decline. Although the Fund may invest in fixed income securities of any credit quality or maturity, it has no current intention of investing more than 5% of its total assets in fixed income securities rated below investment grade (i.e., "junk bonds"). | Fixed Income Securities. Midas Fund may invest in fixed income securities that are affected by changes in interest rates. When interest rates rise, the prices of fixed income securities typically fall in proportion to their maturities. Conversely, when interest rates fall, the value of fixed income securities generally rises. As of the date of this Proxy Statement/Prospectus, interest rates in the United States are at or near historic lows, which may increase Midas Fund's exposure to risks associated with rising interest rates. Fixed income securities are also subject to credit risk, i.e., the risk that an issuer of securities will be unable or unwilling to pay principal and interest when due or that the value of the security will suffer because investors believe the issuer is less able to pay. Many fixed income securities, especially those issued at high interest rates, provide that the issuer may repay them early. If issuers exercise this right, holders of these types of callable securities may not benefit fully from the increase in value that other fixed income securities experience when rates decline. Although Midas Fund may invest in fixed income securities of any credit quality or maturity, it has no current intention of investing more than 5% of its total assets in fixed income securities rated below investment grade (i.e., "junk bonds"). |

| | |

Pricing. Many factors may influence the price at which the Fund could sell any particular portfolio investment. The sales price may well differ—higher or lower—from the Fund's last valuation, and such differences could be significant, particularly for illiquid securities and securities that trade in relatively thin markets and/or markets that experience extreme volatility. If market conditions make it difficult to value some investments, the Fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different than the value realized upon such investment's sale. As a result, you could pay more than the market value when buying Fund shares or receive less than the market value when selling Fund shares. | Pricing. Many factors may influence the price at which Midas Fund could sell any particular portfolio investment. The sales price may well differ—higher or lower—from Midas Fund's last valuation, and such differences could be significant, particularly for illiquid securities and securities that trade in relatively thin markets and/or markets that experience extreme volatility. If market conditions make it difficult to value some investments, Midas Fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different than the value realized upon such investment's sale. As a result, you could pay more than the market value when buying Fund shares or receive less than the market value when selling Fund shares. |

| | |

Security Selection. The securities selected for the Fund's portfolio may decline in value. The investment manager could be wrong in its analysis of industries, companies, economic trends, the relative attractiveness of different securities, or other matters. As a result, the Fund may underperform the markets, its benchmark index or other funds with the same objective or in the same asset class. | Security Selection. The securities selected for Midas Fund's portfolio may decline in value. The investment manager could be wrong in its analysis of industries, companies, economic trends, the relative attractiveness of different securities, or other matters. As a result, Midas Fund may underperform the markets, its benchmark index or other funds with the same objective or in the same asset class. |

| | |

Securities Lending. Any decline in the value of a portfolio security that occurs while the security is out on loan is borne by the Fund, and may adversely affect performance. Also, there may be delays in recovery of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the security. In addition, the Fund bears the risk of a decline in the value of the collateral held by the Fund in connection with a securities loan. | Securities Lending. Any decline in the value of a portfolio security that occurs while the security is out on loan is borne by Midas Fund, and may adversely affect performance. Also, there may be delays in recovery of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the security. In addition, Midas Fund bears the risk of a decline in the value of the collateral held by Midas Fund in connection with a securities loan. |

| | |

Active Trading. The Fund may trade securities actively. This strategy could increase transaction costs, reduce performance, and result in increased taxable distributions, which could lower the Fund's after tax performance. | Active Trading. Midas Fund may trade securities actively. This strategy could increase transaction costs, reduce performance, and result in increased taxable distributions, which could lower Midas Fund's after tax performance. |

| | |

| | Investments in Gold, Silver, Platinum, and Other Precious Metals. Investment in gold, silver, platinum, and other precious metals are considered speculative. Midas Fund's investments can be significantly affected by developments in the precious metals industry and are linked to the prices of gold, silver, platinum, and other precious metals. These prices can be influenced by a variety of global economic, financial, and political factors and may fluctuate substantially over short periods of time and be more volatile than other types of investments. Economic, political, or other conditions affecting one or more of the major sources of gold, silver, platinum, or other precious metals could have a substantial effect on supply and demand in countries throughout the world. Additionally, the majority of such producers are domiciled in a limited number of countries. Moreover, under the federal tax law, Midas Fund may not earn more than 10% of its annual gross income from gains resulting from selling precious metals and certain other non-securities related sources. Accordingly, Midas Fund may be required to hold precious metals or to sell them at a loss, or to sell securities at a gain, when for investment reasons it would not otherwise do so. |

| | |

| | Natural Resource Companies. The profitability of natural resource companies can be significantly affected by the supply of and demand for the produced commodities and related services, exploration and production spending and success, government regulations and taxes, international political developments, and economic conditions. The operations and financial performance of natural resources companies may be directly affected by the prices of the produced commodities, especially those natural resources companies whose reserves of the commodities are significant assets. The value of securities issued by natural resources companies may also be affected by changes in overall market movements, changes in interest rates, inflation rates, or investor expectations concerning such rates, or factors affecting a particular industry or commodity, such as weather, embargoes, tariffs, policies of commodity cartels, and international economic, political, and regulatory developments. In addition, companies in the natural resources sector may be subject to the risks generally associated with extraction of natural resources, such as the risks of mining and oil drilling, and the risks of the hazards associated with natural resources, such as natural or man-made disasters, fire, drought, liability for environmental damage claims, and increased regulatory and environmental costs. It is possible that the performance of securities of natural resources companies may lag the performance of other industries or the broader market as a whole. The prices of natural resources company stocks may exhibit greater price volatility than other types of stocks. |

| | |

| | Depletion and Exploration Risk. To maintain or increase their revenue level, natural resource companies or their customers need to maintain or expand their reserves and production through exploration, development, acquisitions, or other methods. The financial performance of natural resources companies may be adversely affected if they, or the companies to whom they provide products or services, are unable to cost-effectively expand reserves or production sufficiently to replace current depletion. |

| | |

| | Precious Metals Mining Company Risk. The profitability of companies involved in precious metals mining and related activities is significantly affected by changes in the market prices of precious metals. Precious metals mining companies also face risks related to their operations that may affect overall profitability. These risks include the uncertainty and cost of mineral exploration and acquisitions and the uncertainties and unexpected problems and delays in developing mines. In addition, the business of precious metals mining is subject to numerous risks that could adversely impact such companies. These risks include environmental hazards, industrial accidents, underground fires, labor disputes, unexpected geological formations, availability of appropriately skilled persons, unanticipated ground and water conditions, fall of ground accidents, legal and regulatory restrictions, and seismic activity. |

| | |

| | Concentration. Midas Fund is subject to industry concentration risk, which is the risk that Midas Fund's performance can be significantly affected by economic, market, political or regulatory occurrences affecting the precious metals and natural resources industries. |

| | |

| | In-Kind Redemptions. Midas Fund may require redeeming shareholders to accept readily tradable gold, silver, platinum, or other precious metals bullion, coins, ETF shares, or other Fund holdings in complete or partial payment of redemptions. |

| | |

Fundamental Investment Restrictions1 |

| | |

The Fund may not: 1. Issue senior securities as defined in the 1940 Act. The following will not be deemed to be senior securities for this purpose: (a) evidences of indebtedness that the Fund is permitted to incur, (b) the issuance of additional series or classes of securities that the Board of Trustees may establish, (c) the Fund's futures, options, and forward currency transactions, and (d) to the extent consistent with the 1940 Act and applicable rules and policies adopted by the SEC, (i) the establishment or use of a margin account with a broker for the purpose of effecting securities transactions on margin and (ii) short sales; 2. Lend its assets, provided however, that the following are not prohibited: (a) the making of time or demand deposits with banks, (b) the purchase of debt securities such as bonds, debentures, commercial paper, repurchase agreements and short term obligations in accordance with the Fund's investment objective and policies and (c) engaging in securities and other asset loan transactions limited to one third of the Fund's total assets; 3. Underwrite the securities of other issuers, except to the extent that the Fund may be deemed to be an underwriter under the federal securities laws in connection with the disposition of the Fund's authorized investments; 4. Borrow money, except to the extent permitted by the 1940 Act; 5. Purchase or sell commodities or commodity futures contracts, although it may enter into (i) financial and foreign currency futures contracts and options thereon, (ii) options on foreign currencies, and (iii) forward contracts on foreign currencies; 6. Purchase or sell real estate, provided that the Fund may invest in securities (excluding limited partnership interests) secured by real estate or interests therein or issued by companies which invest in real estate or interests therein; or 7. Purchase any securities, other than obligations of the U.S. government or its agencies or instrumentalities, if, immediately after such purchase, more than 25% of the value of the Fund's total assets would be invested in the securities of issuers in the same industry. | Midas Fund may not: 1. Issue senior securities as defined in the 1940 Act. The following will not be deemed to be senior securities prohibited by this provision: (a) evidences of indebtedness that Midas Fund is permitted to incur, (b) the issuance of additional series or classes of securities that the Board of Trustees may establish, (c) Midas Fund's futures, options, and forward transactions, and (d) to the extent consistent with the 1940 Act and applicable rules and policies adopted by the SEC, (i) the establishment or use of a margin account with a broker for the purpose of effecting securities transactions on margin and (ii) short sales; 2. Lend its assets, provided however, that the following are not prohibited: (a) the making of time or demand deposits with banks, (b) the purchase of debt securities such as bonds, debentures, commercial paper, repurchase agreements and short term obligations in accordance with Midas Fund's investment objectives and policies, and (c) engaging in securities, precious metals, and other asset loan transactions to the extent permitted by the 1940 Act; 3. Engage in the business of underwriting the securities of other issuers, except to the extent that Midas Fund may be deemed to be an underwriter under the federal securities laws in connection with the disposition of Midas Fund's authorized investments; 4. Borrow money, except to the extent permitted by the 1940 Act; 5. Purchase or sell physical commodities (other than precious metals), although it may enter into (a) commodity and other futures contracts and options thereon, (b) options on commodities, including foreign currencies and precious metals, (c) forward contracts on commodities, including foreign currencies and precious metals, and (d) other financial contracts or derivative instruments; 6. Purchase or sell real estate, provided that Midas Fund may invest in securities (excluding limited partnership interests) secured by real estate or interests therein or issued by companies which invest in real estate or interests therein; or 7. Purchase any securities, other than obligations of the U.S. government or its agencies or instrumentalities, if, immediately after such purchase, more than 25% of the value of Midas Fund's total assets would be invested in the securities of issuers in the same industry, except that Midas Fund will, under normal circumstances, invest more than 25% of the value of its total assets in securities of Natural Resources Companies. |

| | |

Non-Fundamental Restrictions2 |

| | |

Each Fund may: 1. Invest up to 15% of the value of its net assets in illiquid securities, including repurchase agreements providing for settlement in more than seven days after notice; 2. Purchase securities issued by other investment companies to the extent permitted under the 1940 Act; and 3. Pledge, mortgage, hypothecate or otherwise encumber its assets to the extent permitted under the 1940 Act. |

| | |

| 1 | "Fundamental" means that the investment restrictions can only be changed with shareholder approval. |

| 2 | "Non-Fundamental" means that the Board may change an investment restriction without shareholder approval. |

In deciding whether to approve this proposal, you should consider the similarities and differences between Magic and Midas Fund. As the previous table indicates, the investment objectives between Magic and Midas Fund are similar except that Midas Fund also seeks protection against inflation and, secondarily, current income. Additionally, Magic and Midas Fund share similar fundamental and non-fundamental investment restrictions except Midas Fund has more flexibility to invest in precious metals and concentrate its investments in natural resources companies.

In particular, you should consider that Midas Fund invests at least 65% of its total assets in natural resources companies and Magic typically invests in high quality or "blue chip" companies with large market capitalizations (which generally have strong financial characteristics). Importantly, investments in precious metals and natural resources companies may be subject to greater volatility and risks than investments in high quality or "blue chip" companies with large market capitalizations or other types of investments. You should carefully consider the risks associated with Midas Fund's investment strategies as compared to Magic's, as more fully described in the previous table.

PROPOSAL 2 – REORGANIZATION OF PERPETUAL

Approval of Agreement and Plan of Reorganization between Perpetual and Midas Fund

Under the Agreement and Plan of Reorganization between Perpetual and Midas Fund, Perpetual would transfer all of its assets to Midas Fund in exchange solely for shares of beneficial interest of Midas Fund, the assumption by Midas Fund of the liabilities of Perpetual, and the issuance of Midas Fund shares of beneficial interest to the shareholders of Perpetual in an amount equal to the aggregate net asset value of the shares of Perpetual. The Board unanimously recommends that shareholders vote FOR this proposal.

SUMMARY COMPARISONS OF PERPETUAL (ACQUIRED FUND) TO MIDAS FUND (ACQUIRING FUND)

Comparison of Investment Objectives, Strategies, Risks, and Restrictions

| Perpetual | Midas Fund |

| (Acquired Fund) | (Acquiring Fund) |

| |

| Net Assets as of December 31, 2015 |

| [$4,386,339] | [$10,067,884] |

| | |

| Investment Adviser |

| Midas Management Corporation |

| | |

| Investment Objectives |

| The Fund seeks to preserve and increase the purchasing power value of its shares over the long term. | Midas Fund seeks primarily capital appreciation and protection against inflation and, secondarily, current income. |

| | |

| Principal Investment Strategies |

In pursuit of its investment objective, the Fund normally seeks to invest in the following investment categories in accordance with the following Target Percentage Ranges, subject to certain quarterly and other adjustments (Target Percentage Range in parentheses): gold (10-30%); silver (0-20%); Swiss franc assets (10-30%); hard asset securities (15-35%); and large capitalization growth stocks (15-35%). Pending investment or if the Investment Manager determines that market conditions warrant, the Fund may hold cash, money market funds, money market instruments, bank deposits, investment grade, short term corporate bonds and banker's acceptances, and similar investments without limit. The Fund may also make these investments for temporary defensive purposes. Accordingly, from to time, the Fund's actual percentage of its total assets invested in a given investment category may vary from its Target Percentage Range, sometimes substantially. The Fund is non-diversified, which means that it is not limited by the 1940 Act in the proportion of its assets that may be invested in the obligations of a single issuer. Subsequent to each calendar quarter end, the Fund's investment manager normally compares the Fund's actual percentage of investments in a given category with the Target Percentage Range for that category, and may adjust the Fund's investments to more closely align the actual percentage to the Target Percentage Range in cases where the variance outside the Target Percentage Range is greater than one percentage point. Also, from time to time, the Fund may use leverage to increase its investment in large capitalization growth stocks to the extent permitted under the 1940 Act. As the Fund's actual percentage of investments in a given category increase, the risks associated with such investments, as described below, will tend to increase accordingly and may significantly affect the Fund's performance. Gold and silver investments typically include bullion, bullion type coins, and shares of ETFs that invest therein. From time to time, mining company shares may be used to achieve target allocations in gold and silver if deemed attractive for tax planning or other purposes. Swiss franc assets normally consist of deposits of Swiss francs at Swiss or non-Swiss banks and the bonds and other securities of the federal government of Switzerland. Hard asset securities (e.g., common and preferred stocks, bonds, convertible securities, etc.) typically include those of U.S. and foreign companies dealing primarily in real estate (such as timberland, ranching and farm land, raw land, and land with improvements and structures) and natural resources (such as oil, gas, coal, precious and non-precious metals, and minerals). Large capitalization growth stocks normally include U.S. and foreign companies with market capitalizations over $50 billion which the investment manager believes may experience growth in revenues, earnings, or other similar measures and may include options, warrants, and similar derivatives on such stocks. The Fund may trade securities actively in pursuit of its investment objective. The Fund also may lend its portfolio securities to brokers, dealers, and other financial institutions. | In pursuit of its investment objectives, Midas Fund invests at least 65% of its total assets in (i) securities (e.g., common and preferred stocks, bonds, convertible securities, etc.) of companies primarily involved, directly or indirectly, in the business of mining, processing, fabricating, distributing or otherwise dealing in gold, silver, platinum, other precious metals, or other natural resources ("Natural Resources Companies") and (ii) gold, silver, and platinum bullion and coins. Up to 35% of Midas Fund's total assets may be invested in securities of companies that derive a portion of their gross revenues, directly or indirectly, from the business of mining, processing, fabricating, distributing, or otherwise dealing in gold, silver, platinum, or other natural resources, in securities of selected growth companies, and fixed income securities of any issuer, including U.S. Government Securities, of any credit quality or maturity, although Midas Fund has no current intention of investing more than 5% of its total assets in fixed income securities rated less than investment grade. Midas Fund may invest in domestic and foreign companies of any size. The Investment Manager seeks companies that it believes have attractive fundamentals and often looks at company characteristics such as people, projects, and pricing. A security is typically sold when its potential to meet Midas Fund's investment objective is limited or exceeded by another potential investment opportunity, when an investment in an issuer no longer appears to meet Midas Fund's investment objectives, or when Midas Fund must meet redemptions. In seeking to enhance returns, Midas Fund may use futures, options, and short sales, and may use leverage to the extent permitted under the 1940 Act. Midas Fund concentrates its investments by investing at least 25% of its total assets in Natural Resources Companies. Midas Fund may trade securities actively in pursuit of its investment objectives. Midas Fund also may lend its portfolio securities to brokers, dealers, and other financial institutions. |

| | |

| Principal Risks |

Investments in Gold and Silver. Investments in gold and silver are considered speculative. The Fund's investments can be significantly affected by developments in the precious metals industries and are linked to the prices of gold and silver. These prices can be influenced by a variety of global economic, financial, and political factors and may fluctuate substantially over short periods of time and be more volatile than other types of investments. Economic, political, or other conditions affecting one or more of the major sources of gold and silver could have a substantial effect on supply and demand in countries throughout the world. Additionally, the majority of such producers are domiciled in a limited number of countries. Moreover, under the federal tax law, the Fund may not earn more than 10% of its annual gross income from gains resulting from selling gold and silver and certain other non-securities related sources. Accordingly, the Fund may be required to hold gold and silver or to sell them at a loss, or to sell securities at a gain, when for investment reasons it would not otherwise do so. | Investments in Gold, Silver, Platinum, and Other Precious Metals. Investment in gold, silver, platinum, and other precious metals are considered speculative. Midas Fund's investments can be significantly affected by developments in the precious metals industry and are linked to the prices of gold, silver, platinum, and other precious metals. These prices can be influenced by a variety of global economic, financial, and political factors and may fluctuate substantially over short periods of time and be more volatile than other types of investments. Economic, political, or other conditions affecting one or more of the major sources of gold, silver, platinum, or other precious metals could have a substantial effect on supply and demand in countries throughout the world. Additionally, the majority of such producers are domiciled in a limited number of countries. Moreover, under the federal tax law, Midas Fund may not earn more than 10% of its annual gross income from gains resulting from selling precious metals and certain other non-securities related sources. Accordingly, Midas Fund may be required to hold precious metals or to sell them at a loss, or to sell securities at a gain, when for investment reasons it would not otherwise do so. |

| | |