UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| x | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

FIRST INVESTORS LIFE SERIES FUNDS

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Proxy FACT SHEET | | IMPORTANT DATES: |

| | RECORD DATE: | September 30, 2010 |

| | | MAIL DATE: | October 7, 2010 |

| SPECIAL MEETING OF SHAREHOLDERS FOR: | | MEETING DATE: | November 19, 2010 |

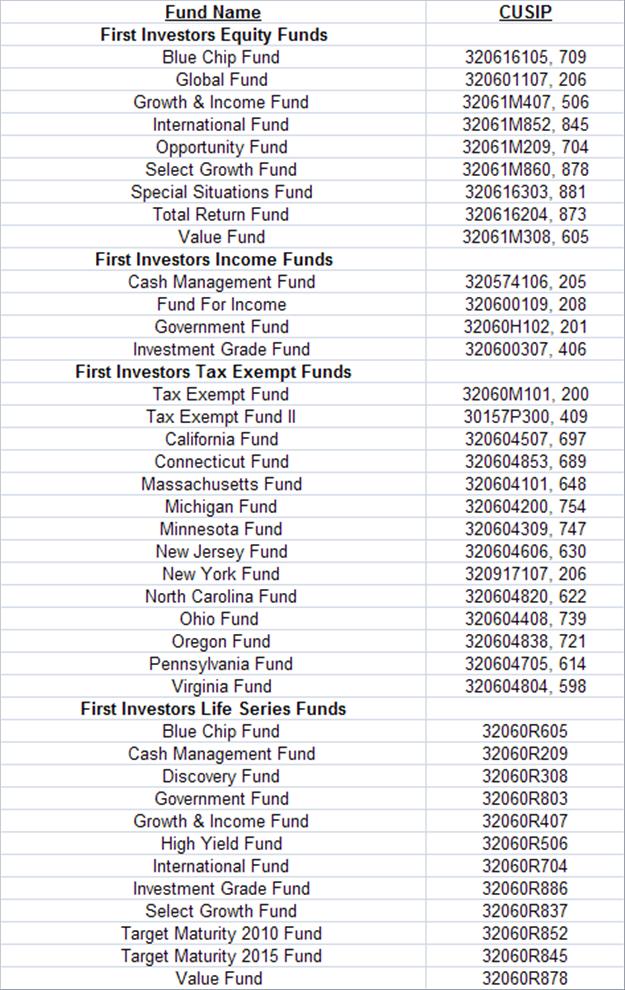

FIRST INVESTORS FUNDS (SEE ATTACHED FOR LIST OF FUNDS & CUSIPS) | | MEETING TIME: | 1:00 p.m. Eastern Time |

| | LOCATION: | 110 Wall Street New York, NY 10005 |

| | |

| | | | |

| ADDITIONAL INFORMATION: | | CONTACT INFO: |

| | | INBOUND LINE: | (800) 591-6313 |

| | WEBSITE: | www.firstinvestors.com |

WHAT IS HAPPENING?

First Investors Equity Funds, First Investors Income Funds, First Investors Tax Exempt Funds and First Investors Life Series Funds (each, a “Trust”), on behalf of each of their investment series (the “Funds”), will hold a special meeting of their shareholders at 110 Wall Street, New York, New York 10005, on November 19, 2010 at 1:00 p.m., Eastern Time.

WHAT AM I BEING ASKED TO VOTE ON?

The Special Meeting of Shareholders is being held for the following purposes:

| (1) | To elect six Trustees to the Board of Trustees of each Trust. |

| (2) | To approve a new investment advisory agreement between each Fund and First Investors Management Company, Inc. |

CONTENTS OF THE PROXY PACKAGE : Proxy Statement, Voting Ballot, and Business Reply Envelope.

WHY ARE SHAREHOLDERS BEING ASKED TO APPROVE ELECTION OF TRUSTEES?

The purpose of this Proposal is to elect six Trustees to the Board of each Trust so that all members of the Board of Trustees will have been elected by shareholders. The Board has nominated the individuals listed below (the “Nominees”) for election as Trustees, each to hold office until his successor is elected and duly qualified, or until his death, termination, resignation or removal. Each nominee other than Mr. Pinkerton currently serves as an Independent Trustee. If elected, Mr. Pinkerton will serve as an interested Trustee effective as of the Closing. Mr. Pinkerton is being proposed for election in anticipation of the retirement of FIMCO’s President, who currently serves on the Board as an interested Trustee, effective as of the Closing. Each Nominee has indicated a willingness to continue to serve if elected. Upon the Closing, if all Nominees are elected, the Board would continue to be comprised of six Trustees, five of whom would be Independent Trustees.

| | 1. | Charles R. Barton, III |

| | 6. | Christopher H. Pinkerton |

WHAT ARE THE TRUSTEES’ QUALIFICATIONS?

The Board has concluded that, based on each Trustee’s experience, qualifications, attributes or skills, on an individual basis, each Trustee should serve as a Trustee of the Funds. Among the attributes common to all Trustees are their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the other Trustees, FIMCO, the sub-advisers, other service providers, counsel and the independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Trustees. A Trustee’s ability to perform his or her duties effectively may have been attained through the Trustee’s business or consulting positions; experience fro m service as a board member of the Funds, other investment funds, public companies, or non-profit entities or other organizations; and/or other life experiences.

*For more information about each individual Trustee’s experience please refer to page 15 in the statement.*

WHAT ARE THE BOARD’S LEADERSHIP STRUCTURE AND OVERSIGHT RESPONSIBILITIES?

The Trusts share a common Board. The Board is responsible for oversight of the Funds. The Trust has engaged FIMCO to manage each Fund on a day-to-day basis. The Board is responsible for overseeing: FIMCO; the sub-advisers, as applicable; and certain other principal service providers in the operations of the Funds. The Board currently is composed of six Trustees, five of whom are Independent Trustees. The Board currently conducts regular meetings six times a year, four of which are formal meetings and two of which are informal meetings. In addition, the Board may hold special in-person or telephonic meetings and informal conference calls to discuss matters that arise or require action between regular Board meetings. The Independent Trustees me et regularly outside the presence of Fund management, in executive session or with other service providers to the Funds. The Independent Trustees have engaged independent legal counsel to assist them in performing their oversight responsibilities.

WHY AM I BEING ASKED TO VOTE ON A NEW INVESTMENT ADVISORY AGREEMENT FOR MY FUND?

First Investors Consolidated Corporation (“FICC”), the parent company of FIMCO, your Fund’s investment adviser, recently entered into an agreement with The Independent Order of Foresters (“Foresters”) pursuant to which FICC will merge with and into a newly-formed subsidiary of Foresters (the “Transaction”). Foresters is a Canadian fraternal benefit society with operations in Canada, the United States and the United Kingdom. As a result of the Transaction, FIMCO will become an indirect subsidiary of Foresters. The Funds themselves are not parties to the Transaction and the Transaction will not result in any direct change in the structure or operation of the Funds.

However, upon the closing of the Transaction (the “Closing”), your Fund’s existing investment advisory agreement (the “Current Agreement”) with FIMCO automatically will terminate as required by applicable law. To ensure that the management of your Fund can continue without any interruption and that FIMCO can continue to provide your Fund with the same investment management services as FIMCO currently does, the Board of Trustees is seeking your approval of a new agreement between the Fund and FIMCO (the “New Agreement”).

WHAT DID THE BOARD CONSIDER IN APPROVING THE NEW AGREEMENT AND THE INTERIM AGREEMENT?

The Board considered, among other matters:

| | 1) | That the terms of the New Agreement, the Current Agreement and the Interim Agreement are substantially the same; |

| | 2) | That the level of service and the manner in which each Fund’s assets are managed are not expected to change as a result of the Transaction, and that the same people who manage the Fund’s assets are expected to continue to do so after the Closing; |

| | 3) | That advisory fee rates payable by each Fund under the New Agreement and the Interim Agreement are the same as the fee rates payable under the Current Agreement; |

| | 4) | That each Fund’s expense ratios were not expected to increase as a result of the Transaction or approval of the New Agreement or the Interim Agreement; |

| | 5) | That Foresters does not currently contemplate modifying the Funds’ current service provider and sub-advisory relationships; |

| | 6) | That Foresters has no current intention to change the current advisory fee waiver and/or expense reimbursement arrangements; |

| | 7) | That the Transaction is expected to have minimal impact on FIMCO’s day-to-day operations; |

| | 8) | That the Transaction is not expected to result in any change in the structure or operation of the Funds; |

| | 9) | The history, reputation, qualification and background of Foresters, the qualifications of its personnel and Foresters’ financial condition; |

| | 10) | The capabilities, experience, corporate structure and capital resources of Foresters; |

| | 11) | The long-term business goals of Foresters with regard to FIMCO and the Funds; |

| | 12) | Foresters’ intent to retain key personnel currently employed by FIMCO who provide services to the Funds (other than Kathryn S. Head, Chairman and President of FIMCO, and Larry R. Lavoie, Chief Compliance Officer, who indicated their intent to retire from FIMCO) and to maintain the existing level and quality of services to the Funds; |

| | 13) | That shareholders would not bear any costs in connection with the Transaction, inasmuch as FICC and Foresters will bear the costs, fees and expenses incurred by the Funds in connection with the Proxy Statement, the fees and expenses of accountants and attorneys relating to the Transaction and Proxy Statement, and any other fees and expenses incurred by the Funds in connection with the Transaction; |

| | 14) | The potential for the Funds to realize benefits as a result of the Transaction, including long-term economies of scale; and |

| | 15) | Information furnished to the Board by Foresters and FIMCO for the August 18, 2010 and September 16, 2010 Board meetings, information discussed throughout the year at regularly scheduled Board and Committee meetings and information provided by FIMCO for the Board’s consideration at its May 20, 2010 meeting (the “May Meeting”) specifically in relation to the renewal of the Current Agreement. In this regard, FIMCO confirmed that there have been no material changes to the information provided to the Board in connection with the renewal of the Current Agreement at the May Meeting. |

WHAT ARE THE MATERIAL TERMS OF THE INTERIM AGREEMENT?

The terms of the Interim Agreement are identical in all respects to the terms of the Current Agreement and the New Agreement, other than with respect to the duration and termination of the agreement. The Interim

Agreement will not become effective with respect to a Fund unless the Closing occurs prior to shareholder approval of the New Agreement for that Fund. The Interim Agreement will terminate with respect to any such Fund upon the earlier of: (1) 150 days from the termination of the Current Agreement, or (2) the effective date of the New Agreement after it has been approved by each Fund’s shareholders. The Interim Agreement can also be terminated with respect to a Fund at any time by the Board or by a majority of the outstanding shares of a Fund or by FIMCO in each instance upon 60 days’ written notice.

DOES THE NEW AGREEMENT DIFFER FROM THE CURRENT AGREEMENT?

The terms of the New Agreement are the same as the Current Agreement, except for the effective dates of those agreements. The fee rates payable under the New Agreement will not increase from the Current Agreement.

WILL THERE BE ANY CHANGES TO THE OPERATIONS OF THE FUNDS? / WILL THE PORTFOLIO MANAGER OF MY FUND CHANGE?

The Funds themselves are not parties to the Transaction and the Transaction will not result in any direct change in the structure and operation of the Funds. FIMCO will continue to provide the same management services as it currently does. FIMCO has advised the Board that FIMCO does not anticipate any change in any Fund’s portfolio managers in connection with the Transaction. However, there can be no assurance that any particular FIMCO employee will choose to remain at FIMCO before or after the closing.

WHEN WILL THE NEW ADVISORY AGREEMENT TAKE PLACE?

If approved by shareholders, the New Agreement will become effective upon the Closing. The Closing may occur as early as December 2010 and is expected to occur by the end of the first quarter of 2011.

HOW DOES THE BOARD OF TRUSTEES RECOMMEND I VOTE?

The Board of Trustees of each Fund has unanimously approved both Proposals, and recommends that Fund shareholders also vote for each Proposal.

IS THERE A PHONE NUMBER THAT I CAN CALL REGARDING NON-PROXY RELATED QUESTIONS? Please call the Funds’ transfer agent, Administrative Data Management Corp., at 1-800-423-4026 for non-proxy related questions about the Funds. |

REGISTERED SHAREHOLDERS: (REG at the beginning of account number in Pavlov)

| By TouchTone: | Call (866) 458-9863. The shareholder will need the control number found on the card. |

| By Internet: | Go to www.proxyonline.com and follow the instructions found on the website. Shareholders will need the control number found on the card. |

| By Mail: | Using the postage-paid envelope mailed with the proxy ballot |

| By Fax: | Fax us the completed proxy card to 1-888-810-3042 |

BENEFICIAL SHAREHOLDERS: (NOBO in front of the account number in Pavlov)

| By Touchtone: | Call 1-800-690-6903 and follow the simple instructions. Shareholders will need their control number found on the top right of their proxy card. |

| By Internet: | Go to www.proxyvote.com and follow the instructions found on the website. Shareholders will need their control number found on the top right of their proxy card. |

| By Mail: | Using the postage-paid envelope mailed with the proxy ballot |