- ABM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ABM Industries (ABM) DEF 14ADefinitive proxy

Filed: 14 Feb 25, 12:37pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. ___)

Filed by the Registrant ☒ |

| Filed by a Party Other than the Registrant ☐ |

|

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

ABM Industries Incorporated

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| February 14, 2025

As Chairman of the Board of ABM Industries Incorporated, I am honored on behalf of the Board to share the Company's achievements and highlight our areas of focus over the past year. Fiscal 2024 was a period of significant progress and resilience for ABM, marked by notable advancements in the Company’s service offerings, operational efficiency, and strategic growth initiatives. Strategic Oversight and Board Focus To ensure long-term growth and resilience, the Board is keenly focused on the Company’s ability to adapt to shifting market demands, as we saw with the recent challenges in the commercial real estate market. In fiscal year 2024, ABM continued to deliver essential services and mitigate economic and operational risks. The Board is enthusiastic about management’s strategy to expand the Company’s core capabilities in commercial facility services through investments in advanced technologies that optimize operations, such as smart building systems and AI-driven facility management tools. The Board also supports ABM’s investments in electrical resiliency service lines that are exposed to secular tailwinds such as an aging U.S. electrical grid and the proliferation of datacenters. Cybersecurity remains a top priority, and the Board continues to provide oversight of the Company’s risk management and strategy related to its cybersecurity programs. Corporate responsibility advancements remain a central theme, with the Board supporting the Company’s efforts to enhance workforce satisfaction and retention across ABM’s operations, and also improve energy efficiency in client facilities and reduce carbon emissions. By aligning these priorities with its mission, the Board is helping to position ABM as an innovator and trusted partner in facility services for the long term. Strategy in Action Throughout the year, ABM made significant strides in enhancing the Company’s service capabilities and expanding its market presence: • ELEVATE Strategy: The Company continued to advance its ELEVATE strategy, emphasizing innovation, technology integration, and service excellence. This approach has enabled ABM to deliver superior value to its clients and solidify its position in the competitive facility services market. • Workforce Productivity Optimization: The introduction of a workforce productivity optimization tool has streamlined operations, resulting in reduced labor usage and improved service delivery. • Microgrid Business Expansion: ABM’s microgrid business has achieved substantial growth in 2024, growing revenue over 2.5 times. This success positions the Company as a leader in energy resiliency solutions. Financial Performance In fiscal 2024, ABM reported revenue of $8.4 billion, reflecting a 3.2% increase over the prior year. The Company achieved healthy adjusted EBITDA and adjusted EBITDA margins despite headwinds in its largest market, commercial real estate. These strong results underscored ABM’s operational efficiency, financial discipline, and strategy of diversification. ABM also thoughtfully |

| allocated capital in 2024, dedicating roughly 50% of available capital to growth initiatives and the balance returned to stockholders through dividends and share repurchases. Notably, subsequent to the fiscal year-end, the Board approved an 18% increase in the quarterly dividend, reinforcing the Board’s belief in ABM's long-term direction and the Company’s commitment to delivering stockholder value. Future Prospects Looking forward, the Board is confident in ABM’s ability to achieve long-term revenue and earnings growth and strengthen its competitive position. By continuing to focus on innovation, operational excellence, and strategic investments, the Company aims to meet the evolving needs of its clients while driving stockholder value creation. Appreciation The Board extends its deepest gratitude to ABM’s dedicated employees, whose unwavering commitment and professionalism are the cornerstone of the Company’s success. The Board also expresses sincere thanks to the management team for their exceptional leadership and vision in navigating the complexities of the year. Together, the Board is confident ABM will build on its legacy of excellence and drive toward a prosperous and sustainable future. |

| Sincerely, |

|

|

| Sudhakar Kesavan Chairman of the Board |

ABM Industries Incorporated, One Liberty Plaza, 7th Floor, New York, New York 10006

| ||

NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS | ||

WHEN Wednesday, March 26, 2025 | PROXY VOTING – CAST YOUR VOTE RIGHT AWAY Your vote is important. Even if you plan to attend the Annual Meeting, please vote as soon as possible using the Internet or by telephone, or by completing, signing, dating and returning your proxy card or voting instruction form. | |

WHERE Virtual www.virtualshareholdermeeting.com/ABM2025 |

| Using the Internet and voting at the website listed on the proxy card or the notice; |

| Using the toll-free phone number listed on your proxy card or voting instruction form; or | |

| If you received physical proxy materials with an enclosed postage paid envelope, completing, signing, dating and mailing your proxy card or voting instruction form. | |

ITEMS OF BUSINESS

RECORD DATE

Stockholders of record at the close of business on January 27, 2025, are entitled to notice of, and to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2025 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCH 26, 2025:

The Notice of Annual Meeting, Proxy Statement and the Annual Report to Stockholders are available on the Internet at www.proxyvote.com. |

Whether or not you plan to attend the Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card or voting instruction card you received in the mail.

By Order of the Board of Directors,

David R. Goldman

Vice President and Corporate Secretary

TABLE OF CONTENTS

|

| Page |

| i | |

| i | |

| 1 | |

PROPOSAL 1–ELECTION OF TEN DIRECTOR NOMINEES TO SERVE ONE-YEAR TERMS |

| 2 |

Nominees for Election to Serve as Directors for a One-Year Term Expiring in 2026 |

| 2 |

| 8 | |

| 8 | |

| 8 | |

| 9 | |

| 10 | |

| 10 | |

| 10 | |

| 11 | |

| 12 | |

| 14 | |

| 14 | |

| 14 | |

| 15 | |

| 16 | |

| 16 | |

| 17 | |

| 17 | |

| 18 | |

| 19 | |

| 20 | |

| 21 | |

| 21 | |

| 27 | |

| 35 | |

| 37 | |

| 38 | |

| 38 | |

| 39 | |

| 40 | |

| 41 | |

| 41 | |

| 42 | |

| 46 | |

| 47 | |

| 51 | |

| 52 | |

| 53 | |

| 53 | |

| 54 | |

Policy on Preapproval of Independent Registered Public Accounting Firm Services |

| 54 |

| 55 | |

| 56 | |

PROPOSAL 5–APPROVAL OF THE ABM INDUSTRIES INCORPORATED 2025 EMPLOYEE STOCK PURCHASE PLAN |

| 66 |

Note About Forward-Looking Statements

This Proxy Statement contains both historical and forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. We make forward-looking statements related to future expectations, estimates, and projections that are uncertain and often contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “outlook,” “plan,” “predict,” “should,” “target,” or other similar words or phrases. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and assumptions that are difficult to predict. Factors that might cause such differences include, but are not limited to, those discussed in Part 1 of ABM’s Annual Report on Form 10-K for the fiscal year ended October 31, 2024 under Item 1A., “Risk Factors,” and we urge readers to consider these risks and uncertainties in evaluating our forward-looking statements. We caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

|

|

____________________________________________________________________________________ | |

PROXY STATEMENT

We are providing the enclosed proxy materials to you in connection with the solicitation by the board of directors (the “Board”) of ABM Industries Incorporated (“ABM” or the “Company”) of proxies to be voted at the Annual Meeting of Stockholders to be held on Wednesday, March 26, 2025 (the “Annual Meeting”). We began making our proxy materials available to stockholders on February 14, 2025.

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. You should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders | ||

Time and Date:

Wednesday, March 26, 2025 11:00 a.m. Eastern Time | Place:

www.virtualshareholdermeeting.com/ABM2025

| Record Date:

January 27, 2025 |

Stockholders of ABM as of January 27, 2025 (the “Record Date”) are entitled to vote. Each share of ABM common stock is entitled to one vote for each director nominee and one vote for each of the other proposals.

Virtual Annual Meeting

We have decided to hold the Annual Meeting virtually again this year because we believe that hosting a virtual Annual Meeting, (i) facilitates stockholder access by enabling stockholders to participate fully and equally from any location around the world at no cost, and (ii) improves meeting efficiency and our ability to effectively communicate and engage with our stockholders, regardless of their size, resources, or physical location.

We have designed the virtual Annual Meeting to provide substantially the same opportunities to participate as you would have at an in-person meeting. Our virtual Annual Meeting will be conducted on the internet via live webcast. Stockholders will be able to attend and participate online and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ABM2025. Stockholders will be able to vote their shares electronically during the Annual Meeting.

Stockholders who would like to attend and participate in the Annual Meeting will need the 16-digit control number included on their Notice of Internet Availability of Proxy Materials (the “Notice”), proxy card, or voting instruction form. The Annual Meeting will begin promptly at 11:00 a.m. Eastern Time. We encourage you to access the Annual Meeting prior to the start time. Online access will begin 15 minutes prior to the start of the Annual Meeting, at 10:45 a.m. Eastern Time.

You may submit questions in advance on the day of the Annual Meeting by logging into www.proxyvote.com and entering your 16-digit control number. Once past the log-in screen, click on “Question for Management,” type in the question, and click “Submit.” Alternatively, stockholders will be able to submit questions live during the Annual Meeting by typing the question into the “Ask a Question” field, and clicking submit. We will answer questions that comply with the Annual Meeting rules of conduct during the Annual Meeting, subject to time constraints. Questions relevant to Annual Meeting matters that we do not have time to answer during the Annual Meeting will be posted to our website following the meeting along with those questions that were addressed during the Annual Meeting. Questions regarding personal matters or matters not relevant to Annual Meeting matters will not be answered.

Although the live webcast is available only to stockholders at the time of the Annual Meeting, a replay of the Annual Meeting will be made publicly available for one year at www.virtualshareholdermeeting.com/ABM2025.

Additional information regarding the ability of stockholders to ask questions during the Annual Meeting, related rules of conduct, and other materials for the Annual Meeting, including the list of our stockholders of record, will be available during the Annual Meeting at www.virtualshareholdermeeting.com/ABM2025.

If you have difficulty accessing the meeting, please call the technical support number that will be posted on the virtual Annual Meeting login page for assistance. Technical support will be available beginning approximately 15 minutes prior to the start of the Annual Meeting through its conclusion.

ABM Industries Incorporated 2025 Proxy Statement i

|

|

____________________________________________________________________________________ | |

Voting Matters and Board Recommendations | |||

Proposals | Board Vote Recommendation | Page Reference (for more detail) | |

01 |

Election of ten director nominees to serve one-year terms |

FOR EACH DIRECTOR NOMINEE |

2 |

02 |

Advisory approval of our executive compensation |

FOR

|

20 |

03 |

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2025 |

FOR

|

52 |

04 |

Approval of the ABM Industries Incorporated 2021 Equity and Incentive Compensation Plan (Amended and Restated) |

FOR |

56

|

05 |

Approval of the ABM Industries Incorporated 2025 Employee Stock Purchase Plan |

FOR |

66 |

ii ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

ABM’s Business Highlights and Accomplishments in Fiscal Year 2024

ABM’s 2024 Achievements

We achieved a 3.2% increase in revenue, reaching $8.4 billion, driven by 2.9% organic growth and the remainder from acquisitions. Organic growth was led by our Technical Solutions segment, up 16.1% due to strong microgrid performance, and our Aviation segment, up 11.5% from robust travel markets and client expansion. Our Education and Manufacturing & Distribution segments also delivered solid growth. Our Business & Industry segment remained resilient, supported by diversification and a focus on Class A properties, which helped to partially mitigate the impact of soft commercial real estate markets. Acquisition growth was primarily driven by the mid-2024 addition of Quality Uptime Services, Inc. |

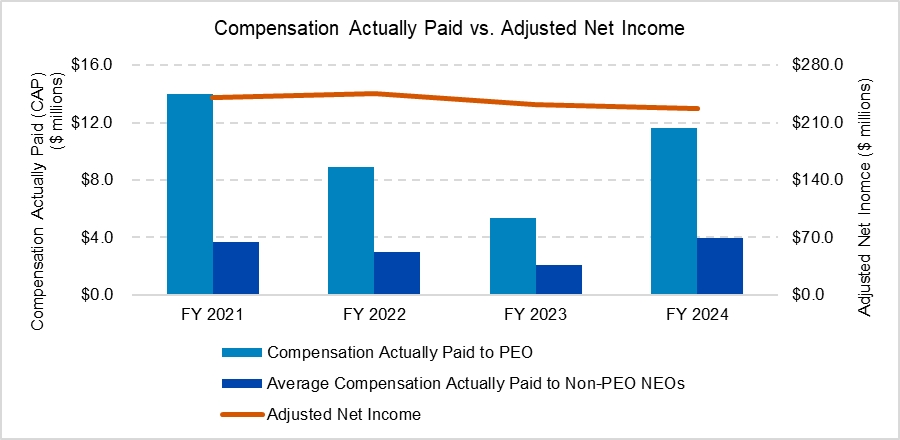

We delivered net income of $81.4 million, adjusted net income of $227.3 million, and adjusted EBITDA of $498.1 million(1), with an adjusted EBITDA margin of 6.2%(1). While adjusted net income decreased slightly year-over-year, this reflects our proactive investments in corporate initiatives to support long-term growth. Importantly, higher segment earnings and the positive impact of cost controls and price increases demonstrate the strength of our operations and our focus on sustaining profitability. |

We generated full year 2024 operating cash flow of $226.7 million and free cash flow of $167.3 million(1). This solid performance reflects our asset light business model and has enabled us to invest in our business via our ELEVATE initiatives, as well as to return capital to our stockholders. |

We doubled our participation in the high growth mission-critical datacenter market with the acquisition of Quality Uptime Services, Inc., a leader in uninterrupted power supply system (“UPS”) maintenance and UPS battery maintenance company providing customized preventive and emergency service programs for mission-critical data centers and other facilities. |

We demonstrated our commitment to balanced capital allocation by returning $112.3 million to stockholders through the repurchase of 1.2 million shares of common stock for $55.8 million and dividend payments totaling $56.5 million. Simultaneously, we invested $114.3 million in the acquisition of Quality Uptime Services, Inc., reinforcing our strategy of delivering value to shareholders while pursuing strategic growth opportunities. |

We maintained our long-standing history of increasing our annual cash dividend to our stockholders, by increasing the dividend for the 57th consecutive year. ABM remains one of a small group of public companies, known as “Dividend Kings”, who have raised their annual dividend for over 50 consecutive years. After fiscal year-end, our Board of Directors increased our quarterly dividend 18% to $0.265 per share. This increase represents another step in ABM’s plan to achieve an adjusted net income payout ratio of approximately 30% over the mid-term. |

We made further progress on our ELEVATE initiatives in 2024, including the migration of our Education segment to a cloud-based Enterprise Resource Planning system and initiating transitions for Business & Industry and Manufacturing & Distribution segments. We also invested in and began utilizing various artificial intelligence-empowered tools to identify opportunities to gain operating efficiencies, streamline request for proposal processes, and enhance employee experiences. |

We released our 2023 Corporate Responsibility Report. The report highlights progress on the Company’s long-term commitments and solutions that enable clients to address key risks and opportunities. We were also pleased to be named one of Barron’s most sustainable companies and to be included on Newsweek’s list of most responsible companies, among other awards. |

CORPORATE GOVERNANCE AND BOARD HIGHLIGHTS

Board Composition and Nominees

The following chart reflects the principal occupation, age, tenure and committee memberships of each member of our Board of Directors ("Board").

ABM Industries Incorporated 2025 Proxy Statement iii

|

|

____________________________________________________________________________________ | |

Name | Age | Director Since | Occupation | Independent | Committee Assignments |

Quincy L. Allen | 64 | 2021 | Former Chief Marketing Officer of IBM Cloud, IBM Corporation | Yes | Audit; Stakeholder and Enterprise Risk |

LeighAnne G. Baker | 66 | 2018 | Former Senior Vice President and Chief Human Resources Officer, Cargill, Inc. | Yes | Compensation, Chair; Governance |

Donald F. Colleran | 69 | 2018 | Former President and Chief Executive Officer of FedEx Express | Yes | Compensation; |

James D. DeVries | 61 | 2022 | Chairman, President and Chief Executive Officer, ADT Corporation | Yes | Compensation |

Art A. Garcia | 63 | 2017 | Former Executive Vice President and Chief Financial Officer, Ryder System, Inc. | Yes | Audit, Chair; |

Thomas M. Gartland | 67 | 2015 | Chairman and Chief Executive Officer of Montway Auto Group | Yes | Compensation; |

Jill M. Golder | 62 | 2019 | Former Chief Financial Officer, Cracker Barrel Old Country Store, Inc. | Yes | Audit; |

Sudhakar Kesavan | 70 | 2012 | Former Executive Chairman, ICF International, Inc. | Yes | Governance |

Scott Salmirs | 62 | 2015 | President and Chief Executive Officer, ABM Industries Incorporated | No | |

Winifred M. Webb | 66 | 2014 | Former Senior Executive, Ticketmaster and The Walt Disney Company | Yes | Audit; |

Corporate Governance

Our Board is committed to thoughtful and independent representation of stockholder interests and corporate governance policies and practices that drive long-term stockholder value. The following points summarize certain aspects of our corporate governance:

ü | All directors and nominees other than Chief Executive Officer are independent | ü | Robust director and executive officer stock ownership guidelines |

ü | Separate Chairman of Board and Chief Executive Officer | ü | Regular executive sessions of independent directors |

ü | Director overboarding policy | ü | Risk oversight by Board and Committees |

ü | Majority voting with resignation policy for directors in uncontested elections | ü | Declassified Board |

ü | Board focused on refreshment and director succession planning | ü | Thorough annual Board and Committee self-evaluation process |

ü | Experienced Board that provides a range of viewpoints | ü | Annual Board review of Company’s strategic plan |

iv ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

Board Independence, Composition and Tenure

Our Corporate Governance Principles provide that a majority of our directors must be independent. Our Board is comprised of independent directors, with the exception of Mr. Salmirs.

Our Board maintains an ongoing commitment to refreshment and proactive assessment of its collective skills, experience and perspectives. The Board and the Governance Committee believe that this balance of backgrounds, experience, continuity and refreshment helps the Board most effectively serve the Company and its stockholders. The average tenure of our Board members is 7.9 years. 30% of our Board nominees are female and 30% are ethnically or racially diverse.

|

|

|

|

Director Nominee Skills and Experience Matrix

Our director nominees bring a well-rounded variety of experiences, qualifications, attributes and skills, and represent a mix of perspectives that contribute to the Company’s execution of its business and strategies. The director nominee skills and experience matrix below summarizes some of the key attributes that management and our Board have identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy. This director nominee skills and experience matrix is not intended to be an exhaustive list of each of our director nominees’ skills or contributions to the Board. Further information on each director nominee, including some of their specific experience, qualifications, attributes and skills is included in their biographies beginning on page 2 of this Proxy Statement.

ABM Industries Incorporated 2025 Proxy Statement v

|

|

____________________________________________________________________________________ | |

SKILL | Allen | Baker | Colleran | DeVries | Garcia | Gartland | Golder | Kesavan | Salmirs | Webb |

Business Leadership / Strategy. | • | • | • | • | • | • | • | • | • | • |

Specific End Market Industries. |

| • | • |

| • | • |

| • | • | • |

Financial / Capital Allocation. | • |

|

| • | • | • | • | • | • | • |

Sales and Marketing. | • |

| • | • |

| • | • | • | • | • |

Human Capital / Safety. | • | • | • | • | • | • | • | • | • | • |

Risk Oversight. | • | • | • | • | • | • | • | • | • | • |

Information Technology / Cybersecurity. | • |

|

|

| • |

| ||||

Other Public Company Board Experience. | • | • | • | • | • | • | • | • | • | • |

Mergers and Acquisitions. | • | • | • | • | • | • | • | • | • | • |

Environmental. | • |

| • |

| • | • | • | • | • | • |

vi ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

EXECUTIVE COMPENSATION HIGHLIGHTS

Our Compensation Practices

What We Do |

• Design Compensation Programs to Pay for Performance |

• Use Equity Awards for Long-Term Incentive and Retention |

• Maintain a Clawback Policy |

• Utilize Short-Term and Long-Term Performance-Based Incentives/Measures |

• Ensure rigorous and fair goals are established annually under both our annual and long-term incentive plans |

• Use an Independent Compensation Consultant |

• Require Significant Share Ownership and Retention by Executive Officers |

• Limit Perquisites |

• Use Double-Trigger Change-in-Control Arrangements |

• Hold Annual Say-on-Pay Vote |

What We Don’t Do |

• No Fixed-Term Employment Agreements |

• No Gross-Ups for Taxes |

• No Repricing of Stock Options |

• No Mid-cycle Adjustments to Performance Metrics |

• No Hedging and Pledging of ABM Stock |

Our Executive Compensation Programs

In fiscal year 2024, our compensation programs continued to reflect the compensation philosophy established by our Compensation Committee – one that is intended to align our executives’ compensation with our strategic goals, and motivate and retain executives who are critical to our future success and long-term performance. Key features of our compensation philosophy include:

► | Performance-Based – Tie significant portions of compensation to performance metrics that align to our short-term and long-term business goals; |

► | Align with Stockholder Interests – Align each executive’s interests with stockholders’ interests by requiring significant stock ownership and paying a significant portion of compensation in equity subject to performance conditions and multi-year vesting requirements; and |

► | Market Competitiveness – Attract and retain key executives who possess the capability to lead the business forward by providing innovative and effective service to our clients and customers. |

Elements of Total Direct Compensation:

► | Base Salary – Fixed cash compensation with adjustments tied to individual responsibilities, performance and marketplace dynamics; |

► | Annual Cash Incentive Program – Focuses on near-term performance objectives reflecting Company strategy; |

► | Performance-Based Equity Grants – Aligns business objectives with longer-term stockholder interests; and |

► | Time-Based Equity Grants – Fosters retention by delivering more stable value and continuity of leadership. |

ABM Industries Incorporated 2025 Proxy Statement vii

|

|

____________________________________________________________________________________ | |

At-Risk Compensation

A significant portion of our executives’ compensation is at risk. At-risk compensation includes: annual cash incentive compensation (“bonus”), which is tied to annual financial and individual performance measures; performance-based equity awards, which are paid only if performance metrics established at the beginning of the three-year performance period are met; and time-based equity awards. Approximately 88% of our CEO’s compensation is at risk. An average of approximately 79% of our other named executive officers’ (“NEOs”) compensation is at risk.

CEO COMPENSATION | NEO COMPENSATION |

|

|

viii ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

CORPORATE GOVERNANCE AND BOARD MATTERS |

|

|

|

PROPOSAL 1—ELECTION OF TEN DIRECTOR NOMINEES TO SERVE ONE-YEAR TERMS |

Nominees for Election to Serve as Directors for One-Year Terms Expiring in 2026 |

ABM Industries Incorporated 2025 Proxy Statement 1

|

|

____________________________________________________________________________________ | |

PROPOSAL 1—ELECTION OF TEN DIRECTOR NOMINEES TO SERVE ONE-YEAR TERMS

Proposal Summary

We are asking our stockholders to elect ten director nominees to serve on the Board for a one-year term and until their successors are duly elected and qualified. Information about the Board and each director nominee is included in this section. The number of directors is currently fixed at ten.

Board Recommendation

The Board unanimously recommends that you vote “FOR” each director nominee. After consideration of each nominee’s qualifications, skills and experience, as well as his or her prior contributions to our Board, the Board believes that each nominee should continue to serve on the Board.

Voting

Unless contrary instructions are received, the shares represented by a properly executed proxy will be voted “FOR” each of the director nominees presented below. If, at the time of the Annual Meeting, one or more of the director nominees has become unavailable to serve, the shares represented by proxies will be voted for the remaining nominees and for any substitute director nominee or nominees designated by the Board unless the size of the Board is reduced. The Board knows of no reason why any of the director nominees will be unavailable or unable to serve.

Director nominees are elected by stockholders by a majority of the votes cast. This means that the number of shares voted “for” a director’s election must exceed 50% of the number of votes cast on the issue of that director’s election at a stockholder meeting as more fully described under “Questions and Answers About the Proxy Materials and the 2025 Annual Meeting” of this Proxy Statement. Any nominee standing for re-election who does not receive a majority of votes cast “for” his or her re-election will be required to tender his or her resignation promptly following the failure to receive the required vote. The Governance Committee will then make a recommendation to the Board as to whether the Board should accept the resignation, and the Board will decide whether to accept the resignation.

Nominees for Election to Serve as Directors for a One-Year Term Expiring in 2026

| Quincy L. Allen | Director Since 2021 | Age 64 |

Mr. Allen is former chief marketing officer of IBM Cloud at IBM Corporation (NYSE: IBM), an international technology solutions company, a position he held from 2015 until his retirement in 2018. Prior to joining IBM, Mr. Allen served as chief marketing and strategy officer at Unisys Corporation (NYSE: UIS), an international information technology services and consulting company, from 2012 to 2015. He previously served as chief executive officer of Vertis Communications, a direct marketing and advertising company, a position he held from 2009 to 2010. Prior to Vertis Communications, Mr. Allen held several leadership positions with Xerox Corporation, including serving as president of the Global Services and Strategic Marketing Group and president of Production Systems Group, as well as vice president of Xerox Corporation. Mr. Allen has served on the board of The ODP Corporation (Office Depot) (NASDAQ: ODP), a leading provider of products and services through an integrated business-to-business platform and omnichannel presence, since 2020, where he serves as a member of the Audit and the Corporate Governance and Nominating Committees; and Lumen Technologies Corporation (NYSE:LUMN), an international facilities-based technology and communications company, since 2021, where he serves as a member of the Audit and the Risk and Security Committees. He previously served on the boards of NCR Corporation (NYSE: NCR) from 2009 to 2012 and Gateway, Inc. from 2006 to 2007. Mr. Allen’s qualifications to serve on the Board include his extensive operational and technology experience at major multinational technology services corporations, background in business development, cybersecurity, and leadership experience in the development and execution of sales and marketing strategies for multinational companies. Mr. Allen also brings public company experience to our Board that provides us with a broader market view of company-specific considerations that are relevant to ABM. | |||

2 ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

| LeighAnne G. Baker | Director Since 2018 | Age 66 |

Ms. Baker is former senior corporate vice president and chief human resources officer of Cargill, Inc. (“Cargill”), a global food and agricultural company, a position she held from 2014 until her retirement in 2020. She served as a member of the executive team and was responsible for Cargill’s global human resources strategy and practices. Prior to joining Cargill in 2014, she served as executive vice president and chief human resources officer of Hertz Global Holdings, Inc. (NASDAQ GS: HTZ) from 2007 to 2014. Before joining Hertz, Ms. Baker was senior vice president, global human resources of The Reynolds & Reynolds Company, a leading provider of automotive dealer management systems, from 2005 to 2007. She also served in various management and leadership roles at The Timken Company from 1981 to 2005. Ms. Baker has served on the board of Pactiv Evergreen (NASDAQ: PTVE), one of the largest manufacturers of fresh food and beverage packaging in North America, since 2020, where she serves as chairwoman of the board, chair of the Compensation Committee and as a member of the Nominating and Corporate Governance Committee. Ms. Baker’s qualifications to serve on our Board include many years of executive experience for large enterprises, including direct experience in industries and end markets similar to ABM’s, during which she gained extensive expertise in global human resources management, leadership development and large-scale organizational change. Ms. Baker also brings her public company board experience that provides us with a broader market view of public company-specific considerations that are relevant to ABM. | |||

| Donald F. Colleran | Director Since 2018 | Age 69 |

Mr. Colleran is former president and chief executive officer/executive advisor of FedEx Express, a subsidiary of FedEx Corporation, a global provider of supply chain, transportation, business and related information services, a position he held from 2019 until his retirement in 2022. From 2017 to 2019, Mr. Colleran was executive vice president and chief sales officer of FedEx Corporation. He also served on the FedEx Corporation Strategic Management Committee, which sets the strategic direction for FedEx. Mr. Colleran joined FedEx in 1989, where he served in a variety of leadership roles including executive vice president, global sales of FedEx Services from 2006 through 2016. He has served on the board of EastGroup Properties, Inc. (NYSE: EGP), an equity real estate investment trust, since 2017, and as chairman of the board since 2023, and serves as a member of the Compensation Committee and Nominating and Corporate Governance Committee. Mr. Colleran’s qualifications to serve on our Board include his extensive experience in a variety of leadership roles at a multinational company, through which he gained expertise in business, sales, and global operations matters. This experience enables him to contribute insights to ABM regarding complex global supply chain, logistics, sales and marketing strategies in the service industry. Mr. Colleran also brings public company experience to our Board that provides us with a broader market view of public company-specific considerations that are relevant to ABM. | |||

ABM Industries Incorporated 2025 Proxy Statement 3

|

|

____________________________________________________________________________________ | |

| James D. DeVries | Director Since 2022 | Age 61 |

Mr. DeVries is chairman of the board, president and chief executive officer of ADT Corporation (NYSE: ADT), having been appointed president in September 2017, chief executive officer in December 2018, and chairman of the board in September 2023. He previously served as executive vice president and chief operating officer of ADT from 2016 to 2017. Prior to joining ADT, Mr. DeVries served as executive vice president of Brand Operations at Allstate Insurance Company from 2014 to 2016, and as executive vice president and chief administrative officer from 2008 to 2014. Mr. DeVries has served on the board of ADT since 2018, where he serves on the Executive and the Nominating and Corporate Governance Committees; and on the board of Amsted industries Inc., a private diversified global manufacturer of industrial components serving primarily the railroad, vehicular and construction and building markets, since 2016, and as lead director since March 2023. Mr. DeVries’ qualifications to serve on our Board include his extensive business and management experience leading a major company, including with respect to executive leadership strategies regarding enterprise risk management, financial management and capital allocation, human capital management and mergers and acquisitions. Mr. DeVries also brings public company experience to our Board that provides us with a broader market view of public company-specific considerations from both executive management and board perspectives that are relevant to ABM. | |||

| Art A. Garcia | Director Since 2017 | Age 63 |

Mr. Garcia retired in 2019 as the executive vice president and chief financial officer of Ryder System, Inc. (NYSE: R), a commercial fleet and supply chain management solutions company (“Ryder”), a position he had held since 2010. Previously, Mr. Garcia served as senior vice president, controller and chief accounting officer of Ryder from 2005 to 2010. Mr. Garcia joined Ryder in 1997 as senior manager of corporate accounting. He later served as director of corporate accounting and, subsequently, as group director of accounting services. Prior to joining Ryder, Mr. Garcia spent 14 years with the Miami office of the accounting firm Coopers & Lybrand LLP as senior manager of business assurance. Mr. Garcia has served on the board of Elanco Animal Health (NYSE: ELAN), a provider of products and services to improve animal health production in more than 90 countries around the world since 2019, and serves as a member of the Audit Committee and the Finance and Oversight Committee; American Electric Power (NASDAQ: AEP), an electric public utility company, delivering electricity and custom energy solutions, since 2019, where he serves as chair of the Audit Committee and a member of the Director & Corporate Governance, Finance, and Policy Committees; and Raymond James Financial, Inc. (NYSE: RJF), a leading diversified financial services company providing private client group, capital markets, asset management, banking and other services to individuals, corporation and municipalities, since 2023, where he serves as a member of the Risk Committee. Mr. Garcia’s qualifications to serve on our Board include his extensive business, financial and management experience and his experience as the most senior financial officer of a publicly traded multinational company. Mr. Garcia brings valuable accounting, financial management, mergers and acquisitions, risk management, environment and climate, and supply chain experience to our Board and ABM, as well as public company experience that provides us with a broader market view of public company-specific considerations that are relevant to ABM. | |||

4 ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

| Thomas M. Gartland | Director Since 2015 | Age 67 |

Mr. Gartland is the chairman and chief executive officer of Montway Auto Transport, a privately held auto transport company since 2023. From 2011 to 2014, Mr. Gartland served as president, North America for Avis Budget Group, Inc., a leading global provider of vehicle rental services. Previously, he was executive vice president, Sales, Marketing and Customer Care at Avis Budget Group, Inc. from 2008 to 2011, where he developed the overall strategic direction for marketing and sales. Mr. Gartland was employed by JohnsonDiversey, Inc. from 1994 to 2008, in various high-level capacities, including as president of the company’s North American region from 2003 to 2008, vice president, Sales, Health and Hospitality from 2002 to 2003, vice president, Business Development from 1998 to 2002, with various positions of increasing responsibility within the company from 1994 to 1998. Prior to that, Mr. Gartland served as vice president and director of national accounts at Ecolab, Inc. from 1980 to 1994. Mr. Gartland has served on the board of directors of Xenia Hotels & Resorts, Inc. (NYSE: XHR), a self-advised and self-administered REIT that invests primarily in premium full-service, lifestyle and urban upscale hotels, since 2015 and serves as chair of the Compensation Committee. Mr. Gartland’s qualifications to serve on our Board include his extensive experience in senior executive positions at multinational companies in similar industries as ABM’s, including experience with respect to sales, operations, financial management, leadership, risk management, and mergers and acquisitions. He also brings public company board experience to our Board that provides us with a broader market view of public company-specific considerations that are relevant to ABM. | |||

| Jill M. Golder | Director Since 2019 | Age 62 |

Ms. Golder is former senior vice president and chief financial officer of the restaurant and gift store chain Cracker Barrel Old Country Store, Inc. (NASDAQ: CBRL), a position she held from 2016 until her retirement in 2020. She previously served in finance leadership roles at Ruby Tuesday, Inc. from 2013 to 2016, including as executive vice president and chief financial officer from 2014 to 2016. Ms. Golder served in progressively more responsible finance positions during her 23 years at Darden Restaurants, Inc., including senior vice president finance for Olive Garden, senior vice president finance of Smokey Bones, senior vice president finance of Specialty Restaurant Group and senior vice president finance of Red Lobster. Ms. Golder has served on the board of Sysco, Inc. (NYSE: SYY), a global leader in selling, marketing and distributing food and non-food products to restaurants, healthcare and educational facilities, lodging establishments and other customers around the world, since 2022, and serves as a member of the Audit, Technology and Compensation and Leadership Development Committees. She previously served on the board of MOD Superfast Pizza Holdings, LLC, a private company, from April 2021 to March 2024; and IZEA Worldwide, Inc. (NASDAQ: IZEA), an influencer marketing technology company, in 2021, serving as the chair of the Audit Committee, and from 2015 to 2019. Ms. Golder’s qualifications to serve on our Board include her extensive financial experience in a variety of leadership roles at various multinational companies similar to ABM, where she managed the financial teams and oversaw business continuity planning, risk management and cybersecurity efforts. Ms. Golder also brings public company experience to our Board that provides us with a broader market view of public company-specific considerations that are relevant to ABM. | |||

ABM Industries Incorporated 2025 Proxy Statement 5

|

|

____________________________________________________________________________________ | |

| Sudhakar Kesavan | Director Since 2012 | Age 70 |

Mr. Kesavan is former chief executive officer and executive chairman of ICF International, Inc. (NASDAQ: ICFI), a leading provider of consulting services and technology solutions to government and commercial clients (“ICF International”). He served as chairman and chief executive officer from 1999 to 2019 and as executive chairman from 2019 until his retirement in 2020. Previously, Mr. Kesavan served as the president of ICF Consulting Group, a subsidiary of ICF Kaiser, from 1997 to 1999. Mr. Kesavan serves on the boards of Cadmus Group and Dexis, serves as board member emeritus for Northern Virginia Technology Council and serves as a trustee of the Shakespeare Theater Company in Washington, DC. Mr. Kesavan’s qualifications to serve on our Board include his leadership and operational experience gained from serving as a chief executive officer and director of another public company similar to ABM. Mr. Kesavan brings valuable experience leading both organic growth and acquisition activities, a thorough understanding of corporate governance, compensation expertise, and operations, industry, public company board, financial, mergers and acquisitions, government and government relations, and global operations experience to our Board. | |||

| Scott Salmirs | Director Since 2015 | Age 62 |

Mr. Salmirs is president and chief executive officer of the Company, a position he has held since 2015. Previously, he served as executive vice president of the Company from 2014 to 2015, with global responsibility for the Company’s aviation division and all international activities. Mr. Salmirs served as executive vice president of ABM Janitorial Services – Northeast from 2003 to 2014. Prior to joining the Company, Mr. Salmirs held various leadership positions at Goldman, Sachs & Company (NYSE: GS), Lehman Brothers, Inc., and CBRE Group (NYSE: CBRE). Mr. Salmirs has served as a director of ICF International (NASDAQ: ICFI) since 2021, where he serves on the Governance and Nominating Committee and the Human Capital Committee. He also serves on the board of Outreach, a New York nonprofit organization dedicated to rehabilitating teens with substance abuse issues, is a founding board member of Donate Eight, a nonprofit group associated with LiveOnNY, and also serves on the Business Advisory Council for the business program at SUNY Oneonta. Mr. Salmirs’ qualifications to serve on our Board include his experience in the facility services industry, and his knowledge of and perspective on the Company as its president and chief executive officer. Mr. Salmirs brings valuable leadership skills and operations, financial management, industry, mergers and acquisitions, sales and marketing, and global operations experience to the Board.

| |||

6 ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

| Winifred (Wendy) M. Webb | Director Since 2014 | Age 66 |

Ms. Webb served as a senior executive, as well as managing director, for several publicly traded companies, and as a Corporate Foundation’s executive director. From 2010 to 2013, she was managing director for Tennenbaum Capital Partners. Ms. Webb was a member of the corporate executive team for Ticketmaster from 2008 to 2010. She served for 20 years with The Walt Disney Company, from 1988 to 2008, in various senior positions including corporate senior vice president of investor relations and shareholder services, and governance outreach. She was also executive director for The Walt Disney Company Foundation. Before Disney, she held roles in investment banking. She has served on the board of directors of Wynn Resorts, Limited (NASDAQ: WYNN), a developer and operator of luxury integrated resorts, since 2018, serving as chair of the Audit Committee; AppFolio, Inc. (NASDAQ: APPF), a technology leader powering the future of the real estate industry, since 2019, where she is chair of the Audit Committee and a member of the Nominating and Corporate Governance Committee; and has served on the board of trustees of AMH (NYSE: AMH), a leader in the single-family home rental industry, since 2019, and is a member of the Human Capital and Compensation, and Nominating and Corporate Governance Committees. She also serves on the board of nonprofit Sun Valley Music Festival. She previously served on the boards of TiVo Inc. (2016), Jack in the Box Inc. (NASDAQ: JACK) (2008 to 2014), and nonprofit PetSmart Charities, Inc. (2014 to 2016). She served as co-chair of nonprofit WomenCorporateDirectors, LA/OC Chapter (2017 to 2020). Ms. Webb has been recognized as an NACD Directorship 100 honoree, a WomenInc. Most Influential Corporate Board Director, and a Directors & Boards Director to Watch. Ms. Webb’s qualifications to serve on our Board include her experience in senior management at global public companies similar to ABM, and her experience in the global financial services industry. Ms. Webb brings valuable public company board, investor relations, communications, media and public relations, treasury, corporate governance, global operations, corporate social responsibility, strategic planning, mergers and acquisitions, investment banking and capital markets experience to our Board. | |||

ABM Industries Incorporated 2025 Proxy Statement 7

|

|

____________________________________________________________________________________ | |

The Board of Directors

Name and Principal Occupation | Age | Director since | Independent | Committee memberships | |||

|

|

|

| AC | CC | GC | SER |

Quincy L Allen Former Chief Marketing Officer of IBM Cloud, | 64 | 2021 | Yes | ü |

|

| ü |

LeighAnne G. Baker Former Senior Vice President and Chief Human Resources Officer, Cargill, Inc. | 66 | 2018 | Yes |

| ‡ | ü |

|

Donald F. Colleran Former President and Chief Executive Officer of FedEx Express, a subsidiary of FedEx Corporation | 69 | 2018 | Yes |

| ü |

| ü |

James D. DeVries Chairman, President and Chief Executive Officer, ADT Corporation | 61 | 2022 | Yes |

| ü |

|

|

Art A. Garcia Former Executive Vice President and Chief Financial Officer, Ryder System, Inc. | 63 | 2017 | Yes | ‡* |

|

| ü |

Thomas M. Gartland Chairman and Chief Executive Officer of Montway Auto Group; Former President, North America of Avis Budget Group, Inc. | 67 | 2015 | Yes |

| ü | ‡ |

|

Jill M. Golder Former Chief Financial Officer, Cracker Barrel Old Country Store, Inc. | 62 | 2019 | Yes | ü* |

| ü |

|

Sudhakar Kesavan† Former Executive Chairman, ICF International, Inc. | 70 | 2012 | Yes |

|

| ü |

|

Scott Salmirs President and Chief Executive Officer, ABM Industries Incorporated | 62 | 2015 | No |

|

|

|

|

Winifred (Wendy) M. Webb Former Senior Executive, Ticketmaster and The Walt Disney Company | 66 | 2014 | Yes | ü* |

|

| ‡ |

Legend:

AC – Audit Committee: CC – Compensation Committee; GC – Governance Committee; SER – Stakeholder and Enterprise Risk Committee

† | Indicates Board Chair |

‡ | Indicates Committee Chair |

* | Indicates Audit Committee Financial Expert |

Corporate Governance

Our Board has adopted Corporate Governance Principles that reflect our commitment to sound corporate governance and the role of governance in building long-term stockholder value. Our Corporate Governance Principles, which include our independence standards, can be found on our website at http://investor.abm.com/corporate-governance.cfm. Other information relating to our corporate governance is also available on our website at the same address, including our Bylaws, our Code of Business Conduct, and the Charters of our Audit Committee, Compensation Committee, Governance Committee, and Stakeholder and Enterprise Risk Committee. These documents are also available in printed hard-copy format upon written request to the Corporate Secretary at the Company’s corporate headquarters.

Identifying and Evaluating Nominees for Directors

Our Board is responsible for selecting nominees for election as directors. The Board delegates the screening process to the Governance Committee with the expectation that other members of the Board will participate in this process, as appropriate. The Governance Committee does not have specific minimum qualifications that must be met for a potential candidate to be nominated to serve as a director of the Company. The Governance Committee periodically reviews the skills and types of experience that it believes should be represented on the Board in light of the Company’s current

8 ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

business needs and strategy. The Governance Committee then uses this information to consider whether all of the identified skills and experience are represented on the Board. Based upon its review, the Governance Committee may recommend to the Board that the expertise of the current members should be supplemented. The Governance Committee takes these factors into account when looking for candidates for the Board. Candidates recommended by the Governance Committee are subject to approval by the full Board. Our Governance Committee regularly assesses the appropriate size of the Board and whether any vacancies on the Board are anticipated because of retirement or otherwise. In the event that any vacancy is anticipated, or otherwise arises, the Governance Committee considers various potential candidates for director.

Our Governance Committee recommends to the Board the criteria for director candidates, and the Board establishes the criteria. The Governance Committee is also responsible for reviewing with the Board the requisite skills and characteristics of new Board candidates and current Board members in the context of the current composition of the Board.

In analyzing director nominations and director vacancies, our Governance Committee seeks to recommend candidates for director positions who will create a collective membership on the Board with varied experience, backgrounds and perspectives, including the specific qualifications of industry knowledge; finance; administration; corporate governance; operations and marketing; and other public board experience.

With individual members of the Board, the Governance Committee seeks individuals that have leadership in other organizations and have significant experience in a specific area or endeavor, and who understand the role of a public company director and can provide insights and practical wisdom based on their experience and expertise.

The Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director, such as professional search firms and the relationships of current directors. In the case of a search firm, the Governance Committee will pay a fee for such a firm to assist it in the recruitment and identification of potential candidates for the Board. The Governance Committee generally provides the search firm with guidance as to the qualifications, qualities and skills that the Governance Committee is seeking in potential candidates, and the search firm identifies candidates for the Governance Committee’s consideration.

Candidates may also come to the attention of the Governance Committee through stockholders or other persons. The Governance Committee will consider such candidates on the same basis and in the same manner as it considers all director candidates. Stockholders wishing to submit candidates for election as directors should provide the names of such candidates to the Corporate Secretary, ABM Industries Incorporated, One Liberty Plaza, New York, New York 10006. See “Questions and Answers About the Proxy Materials and the 2025 Annual Meeting” for more information on submitting stockholder director nominations to the Company.

Our directors are expected to prepare for, attend and participate in Board meetings and meetings of the Committees of the Board on which they serve. They are also expected to meet as frequently and spend as much time as necessary to properly discharge their responsibilities and duties as directors and to arrange their schedules so that other existing and planned future commitments do not materially interfere with their service as a director. Directors who are full-time employees of ABM or who serve as chief executive officers or in equivalent positions at other public companies may not serve on the boards of more than one other publicly traded company. Other directors may not serve on the boards of more than three other publicly traded companies. Service on other boards and other commitments are considered by the Governance Committee and the Board when reviewing Board candidates.

Board Leadership Structure

The Board recognizes that good governance is not tied to any one practice with respect to leadership structure, and that the best practice is often determined by facts and circumstances that may change from time to time. The Board periodically evaluates its leadership structure and determines the most appropriate leadership structure at that time. In considering which leadership structure will allow it to most effectively carry out its responsibilities and best represent stockholders’ interests, the Board takes into account various factors, including the Company’s specific business needs, the Company’s operating and financial performance, industry conditions, economic and regulatory environments, the current composition of the Board, the policies and practices in place to provide independent Board oversight of management, the results of Board and committee annual self-assessments, and the advantages and disadvantages of alternative leadership structures based on circumstances at that time.

The Company currently has separate persons serving as its Chairman and its Chief Executive Officer. The Chief Executive Officer (Mr. Salmirs) has general and active management over the business and affairs of the Company, subject to the control of the Board. The Chairman of our Board (Mr. Kesavan) is charged with presiding over all meetings of the Board and our stockholders, as well as providing advice and counsel to the Chief Executive Officer, coordinating

ABM Industries Incorporated 2025 Proxy Statement 9

|

|

____________________________________________________________________________________ | |

the preparation of agendas, keeping directors informed of matters impacting the Company, and maintaining contact with the Company’s General Counsel.

The Board believes that at this time, the separation of these roles is the most appropriate and effective leadership structure, because this structure best serves the Board’s ability to carry out its roles and responsibilities on behalf of ABM's stockholders, including the Board’s oversight of ABM's management and ABM's overall corporate governance. The Board also believes that the current structure allows our Chief Executive Officer to focus on most effectively managing ABM.

Mr. Kesavan’s extensive management, operations, and leadership experience provides him with unique capabilities and insight, which are brought to bear in the performance of his responsibilities as Board Chairman. In particular, with respect to risk oversight, Mr. Kesavan is well positioned as a result of his risk management background of over 20 years as chief executive officer of another multinational public company. Mr. Kesavan leverages this knowledge and experience to provide leadership for the Board on the material risks facing ABM and to help guide the Board’s independent oversight of the Company’s risk exposures through his input in the Board’s meeting agendas and his facilitation of communications between the Board and management.

Director Independence

Our Corporate Governance Principles provide that a majority of our directors must be independent; Further, the Committee Charters for our Audit Committee, Compensation Committee, Governance Committee, and Stakeholder and Enterprise Risk Committee require all members be independent. Each year, our Governance Committee reviews the independence of each of our directors under applicable New York Stock Exchange (“NYSE”) listing standards and considers any current or previous employment relationships as well as any transactions or relationships between our Company and our directors or any members of their immediate families (or any entity of which a director or an immediate family member is an executive officer, general partner or significant equity holder). The purpose of this review is to determine whether any relationships or transactions exist that preclude a director from being deemed independent under applicable NYSE listing standards or are otherwise inconsistent with a determination that the director is independent.

Our Governance Committee has affirmatively determined and recommended to our Board, and the Board has affirmatively determined, that each of our currently-serving directors and director nominees (including Messrs. Allen, Colleran, DeVries, Garcia, Gartland, and Kesavan and Mmes. Baker, Golder, and Webb) other than Mr. Salmirs, our Chief Executive Officer, is independent under applicable NYSE and Securities and Exchange Commission (“SEC”) rules and regulations.

Board and Committee Evaluations

The Board recognizes that a robust and constructive evaluation process is an essential component of good corporate governance, and undertakes an annual evaluation process to identify ways to enhance the Board’s and committees’ effectiveness. Pursuant to its charter, the Governance Committee is responsible for overseeing the process for the Board’s and each Board committee’s annual self-evaluation. The Governance Committee annually reviews the format of the evaluation process, including whether to utilize a third-party facilitator, to ensure that the Board actively solicits actionable feedback on the operation and effectiveness of the Board, Board committees and individual directors.

For fiscal year 2024, the evaluation process included self-evaluations by the full Board and each Board committee, and interviews of each director and members of senior management conducted by a third-party governance expert. The third-party governance expert then reviewed the results of the individual evaluation discussions with each of the Governance Committee and the Board.

Our multi-step evaluation process generates meaningful comments and discussion, and the Board and committees identify and hold themselves accountable for action items stemming from the evaluations. The evaluation results have led to changes designed to increase our Board’s effectiveness and efficiency. For example, in recent years, as a result of the evaluations, enhancements have been made regarding Board and committee meeting materials and discussion topics, the structure and responsibilities of the Board’s committees, executive session discussions, committee reports to the Board, as well as the Board’s evaluation process.

The Board’s Oversight of Risk Management

Company management is responsible for day-to-day risk management activities, including the continuing development and implementation of our enterprise risk management (“ERM”) program. Our ERM processes are designed to work across the Company to assess, govern and manage risks identified by management in the short-, intermediate- and long-term and manage the Company’s responses to those risks. Management performs an annual risk assessment,

10 ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

which considers industry trends, benchmarks and internal surveys of key employees. In fiscal year 2024 the Company’s management again engaged an independent third-party expert to assist the Company in its enterprise risk identification and assessment processes. The third-party’s review included (i) potential future enterprise risks, (ii) feedback regarding management’s risk appetite and risk evaluation processes, and (iii) assistance in executing and evaluating the outcomes of the Company’s annual risk identification and assessment processes.

The Board, acting directly and through its committees, is responsible for the oversight of management’s ERM process and the Company’s risk management programs and processes generally, including oversight of the Company’s business to evaluate whether systemic risks are being adequately addressed. The Board is also responsible for periodically reviewing and overseeing the Company’s risk management and strategy related to its cybersecurity programs, policies, and practices, including (i) the Company’s processes for assessing, identifying, managing, and mitigating material risks from cybersecurity threats and emerging cybersecurity developments and threats; (ii) whether any risks from cybersecurity threats have materially affected or are reasonably likely to materially affect the Company; (iii) the expertise of members of management with respect to assessing and managing risks from cybersecurity threats; and (iv) the Company’s disclosure controls and procedures with respect to material cybersecurity threats and incidents.

Our Stakeholder and Enterprise Risk Committee assists the Board in its oversight of the Company’s ERM program, including providing input with respect to the risks identified in the ERM process (e.g., changes in significant risks), identification and potential impacts of emerging risks, and discussions with management about how such risks are being mitigated by the Company. Management regularly provides reports to the Stakeholder and Enterprise Risk Committee covering the ERM process and significant risks, including summaries of the findings and recommendations of third-party experts.

Our Stakeholder and Enterprise Risk Committee also oversees risks related to (i) certain social issues, including, but not limited to, culture and inclusion, employee engagement, talent acquisition, development, and retention, and health and safety; (ii) certain environmental issues, including, but not limited to, climate change, emissions tracking and energy consumption; and (iii) cybersecurity, including by reviewing the Company’s cybersecurity risk tolerances and mitigation strategies. The Stakeholder and Enterprise Risk Committee also receives and reviews presentations on selected risk topics, including emerging risks, as management or the Stakeholder and Enterprise Risk Committee deem appropriate from time to time, and provides oversight to management relating to the identification, evaluation, and mitigation of stakeholder risks, including, but not limited to, risks related to social and environmental matters.

Our Audit Committee reviews and discusses guidelines and policies with respect to risk assessment and risk management, the Company’s major financial risk exposures (including risks relating to the Company’s accounting, reporting and financial practices, including financial controls) and the steps management has taken to monitor and control these exposures, The Audit Committee also assists the Board in its oversight of the Company’s compliance with legal and regulatory requirements.

Our Compensation Committee reviews and assesses annually risks arising from the Company’s compensation policies and practices for its employees and whether any such risks are reasonably likely to have a material adverse effect on the Company, as further discussed in “Compensation Discussion and Analysis” later in this Proxy Statement.

Our Governance Committee reviews and assesses risks associated with board structure and other corporate governance policies and practices, and whether any such risks are reasonably likely to have a material adverse effect on the Company.

In fulfilling their oversight responsibilities, all committees receive regular reports on their respective areas of responsibility from members of management. Each committee reports regularly to the full Board on its activities, including on matters relating to risk oversight. In addition, the Board participates in regular discussions in executive sessions led by the Chairman of the Board, as well as with the Company’s senior management on many key subjects, including strategy, industry group performance, operations, information systems, finance, and legal.

The Board’s Role in Cybersecurity Risk Oversight

ABM recognizes the importance of cybersecurity risk management, which is integrated within ABM’s overall ERM framework and is aligned with standard industry information security frameworks. Specifically, cybersecurity is one of

ABM Industries Incorporated 2025 Proxy Statement 11

|

|

____________________________________________________________________________________ | |

the key risk topics covered within ABM’s enterprise risk framework through the Company’s regular identification, assessment, and reporting processes.

ABM’s management is responsible for the day-to-day administration of the Company’s cybersecurity policies, processes, practices, and risk management. Our internal information security program is managed by a dedicated team of cybersecurity professionals led by our Chief Information Security Officer, who has specific responsibility for cybersecurity risk management and reports to our Chief Information Officer. The Chief Information Security Officer meets regularly with our executive management team to review our cybersecurity programs, objectives, trends and threats.

Our Board has ultimate oversight of the Company’s risk management and strategy related to its cybersecurity programs, policies, and practices, including (i) the Company’s processes for assessing, identifying, managing, and mitigating material risks from cybersecurity threats and emerging cybersecurity developments and threats; (ii) whether any risks from cybersecurity threats have materially affected or are reasonably likely to materially affect the Company; (iii) the expertise of members of management with respect to assessing and managing risks from cybersecurity threats; and (iv) the Company’s disclosure controls and procedures with respect to material cybersecurity threats and incidents. The Board is assisted by its Stakeholder and Enterprise Risk Committee, which oversees the Company’s enterprise risk management program and the Company’s identification, evaluation, and mitigation of stakeholder risks, including those relating to cybersecurity. In addition, ABM has a monitoring system and an escalation process in place to inform senior management and the Board of any potentially material cybersecurity issues.

ABM’s Chief Information Officer and Chief Information Security Officer regularly provide reports and updates to other members of senior management, the Board, and the Stakeholder and Enterprise Risk Committee. In connection with these updates, the Board reviews the Company’s cybersecurity programs and oversees the Company’s efforts to continually enhance the Company’s cybersecurity profile and to mitigate the risks relating to cybersecurity. The reports from ABM’s Chief Information Officer and Chief Information Security Officer also include updates on emerging trends and progress on overall enterprise cybersecurity priorities.

Corporate Responsibility

As one of the world’s largest facilities solutions providers, we embrace our role in taking care of people, spaces and places in ways that are responsible, ethical, environmentally sustainable, and respectful. Guided by our mission and values, we embrace a culture that integrates responsible, sustainable, and inclusive business practices within our operations to support the long-term success of our business, stockholders, employees, and clients.

Empowering People

Given that ABM is a service-oriented business, our employees are the driving force behind our success, and we believe our ability to attract, develop, and retain our employees at all levels of our organization has a direct impact on client satisfaction and our ability to grow the Company. To succeed in a competitive labor market, ABM has developed key recruitment and retention strategies, objectives, and measures that we focus on as part of the overall management of our business.

We strive to create a workplace where every team member feels heard, valued, and empowered. With a widely distributed workforce of approximately 117,000 employees serving over 20,000 clients across multiple nations and geographic regions, ABM’s culture, and the team member experience it supports, plays a vital role in attracting, retaining, and engaging talent. The Company works to develop an increasingly inclusive culture, where individuals from all backgrounds are equally able to contribute and are provided with opportunities to develop in their careers. We strive to provide a safe work environment for all team members and follow a comprehensive approach to proactively prevent and correct unlawful discrimination and harassment. Our programs are designed to meet or exceed compliance standards of the Occupational Safety and Health Administration and other regulatory bodies and to protect the health and welfare of our employees and our clients. Our “Think Safe” approach to safety includes establishing a safety mindset from day one of employment. This safety culture is continuously reinforced through daily moments for safety messaging, relevant monthly training topics, and unique programs and materials created for our employees.

In 2024, we re-launched our Leadership Academy designed for middle and senior-level leaders from across the enterprise. The first class of 25 leaders participated in the four-month development program, which is intended to provide a broader operational understanding of the organization, identify and close development gaps and accelerate such employees’ readiness to become effective leaders.

Our online training platform, ABM University, provides our staff and management employees with access to a multitude of training courses, videos, reference material, and other tools. Additionally, our frontline employees receive on-the-job training specific to their role and location to enable us to deliver services to our clients in a safe and efficient manner.

12 ABM Industries Incorporated 2025 Proxy Statement

|

|

____________________________________________________________________________________ | |

Responsible Business Practices

Since our founding more than a century ago, ABM has strived to implement business and compliance policies, practices, and reporting so that our business operates ethically and responsibly, and these values remain the foundation of our business. Our Code of Business Conduct, which covers topics including conflicts of interest, duty of loyalty, gifts and gratuities, bribery and corruption and harassment and discrimination, among others, drives the application of our core values of respect, integrity, collaboration, innovation, trust, and excellence throughout our operations, and serves as a critical tool to help all ABM team members to recognize and report unethical conduct, while preserving and nurturing our culture of honesty and accountability.

The Company provides comprehensive annual training and certification programs on our Code of Business Conduct for our Board of Directors and all of our staff and management employees. All ABM employees are empowered to report any violations of the Code of Business Conduct or applicable law and are provided with various channels to do so.

We also maintain a Supplier Code of Conduct, which conveys ABM’s expectations that its suppliers uphold the policies of ABM concerning compliance with applicable laws, respect for human rights, environmental conservation and the safety of products and services.

Oversight and Reporting

Our Board oversees ABM’s corporate responsibility-related risks and priorities with the assistance of its committees. Our Board receives regular reports from meetings of its Stakeholder and Enterprise Risk Committee, which is responsible for the oversight of the Company’s programs, policies, and practices relating to social and environmental matters that may impact the Company’s business and key stakeholders. Our Board also receives regular reports from meetings of its Governance Committee, which is responsible for oversight of our Company’s corporate governance practices and overall corporate-responsibility related framework.

Since 2011, we have voluntarily published a Corporate Responsibility Report on an annual basis, which aligns with the Global Reporting Initiative framework and the disclosure framework of the Sustainability Accounting Standards Board. Additional information about our Corporate Responsibility approach can be found on our corporate website.

Planet Stewardship

Through our actions, policies, and partnerships, we strive to reduce our environmental footprint and that of our more than 20,000 clients around the world. Through our wide and growing range of environmentally mindful product and service offerings, we seek to help our clients optimize their operations, reduce their environmental footprint, and meet their environmental goals.

For example, ABM is a leading provider of electrical infrastructure and energy resiliency solutions, providing clients with end-to-end services to keep operations powered, increasing reliability, reducing downtime, as well as meeting carbon emissions and energy usage goals. Internally, we have created contingency and business continuity plans, as well as crisis management and disaster recovery procedures, to navigate any adverse weather conditions brought on by climate change that could affect service delivery.

In 2024, our ABM Electrification Center opened in Forsyth County, GA, centralizing ABM’s electrical infrastructure operations, distribution, and training. The Center is also a hub for local schools and universities to provide students with access to learn about electrical infrastructure occupations.

ABM’s planet stewardship initiatives were recognized in 2024, with ABM being named again among Newsweek’s America’s Most Responsible Companies and Barron’s 100 Most Sustainable Companies.