Exhibit 99.2

Cover Slide Title (20pt. Bold) Third Quarter 2015 Teleconference September 3, 2015

Agenda 2 1 2 3 4 Strategic Review Third Quarter 2015 Operational Results Capital Structure Fiscal 2015 Outlook 5 Questions & Answers Forward - Looking Statements and Non - GAAP Financial Information: Our discussions during this conference call will include forward - looking statements. Actual results could differ materially fro m those projected in the forward - looking statements. Some of the factors that could cause actual results to differ are discussed in the Company’s 2014 Annual Report on Form 10 - K and in our 2015 report s on Form 10 - Q and Form 8 - K. These reports are available on our website at http:// investor.abm.com under “SEC Filings”. A description of other factors that could cause actual results to differ is also set forth at the end of this presentation. Also, the discussion during this conference call will include certain financial measures that were not prepared in accordance wi th U.S. generally accepted accounting principles (“U.S. GAAP”). Reconciliations of those non - GAAP financial measures to the most directly comparable U.S. GAAP financ ial measures can be found on the Investor Relations portion of our website at http://investor.abm.com and at the end of this presentation.

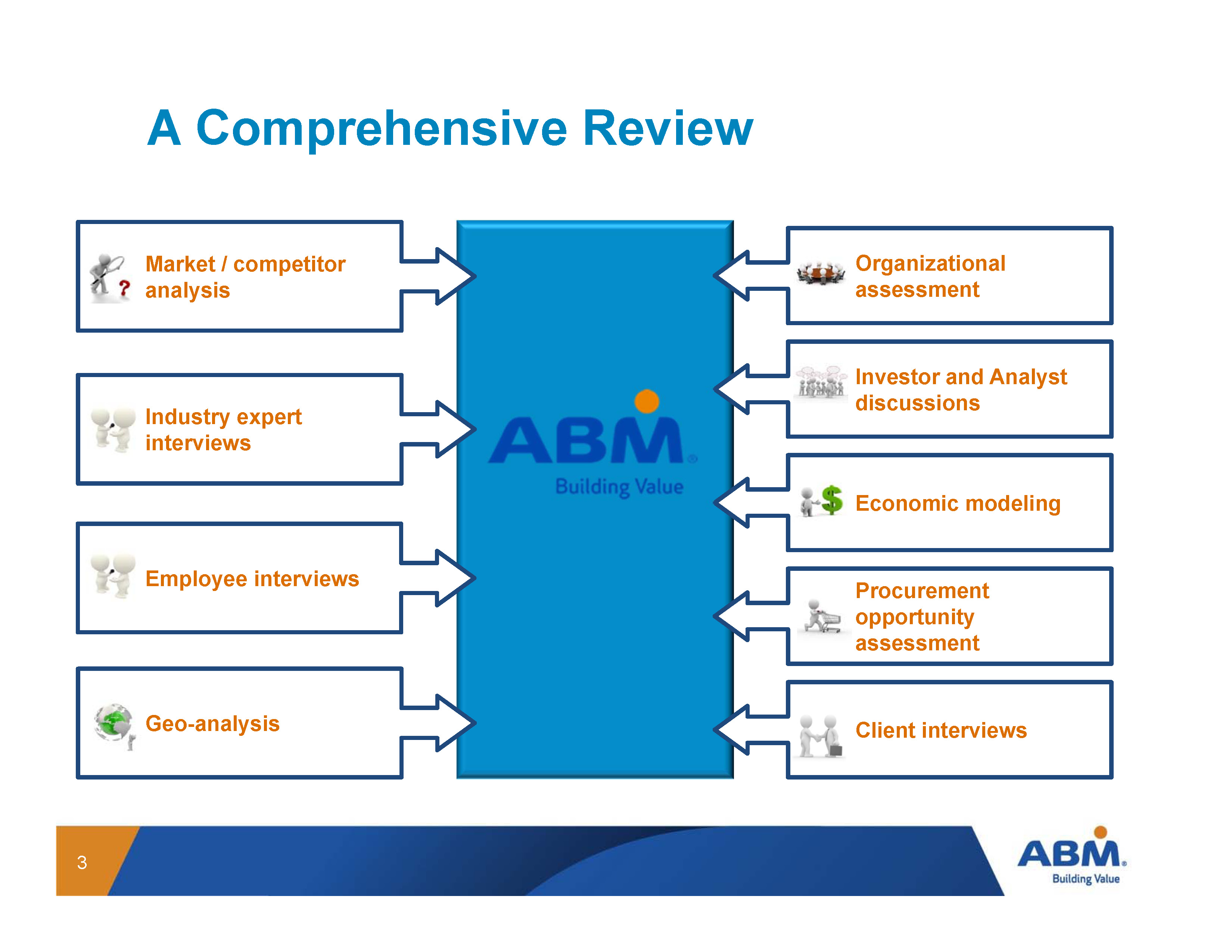

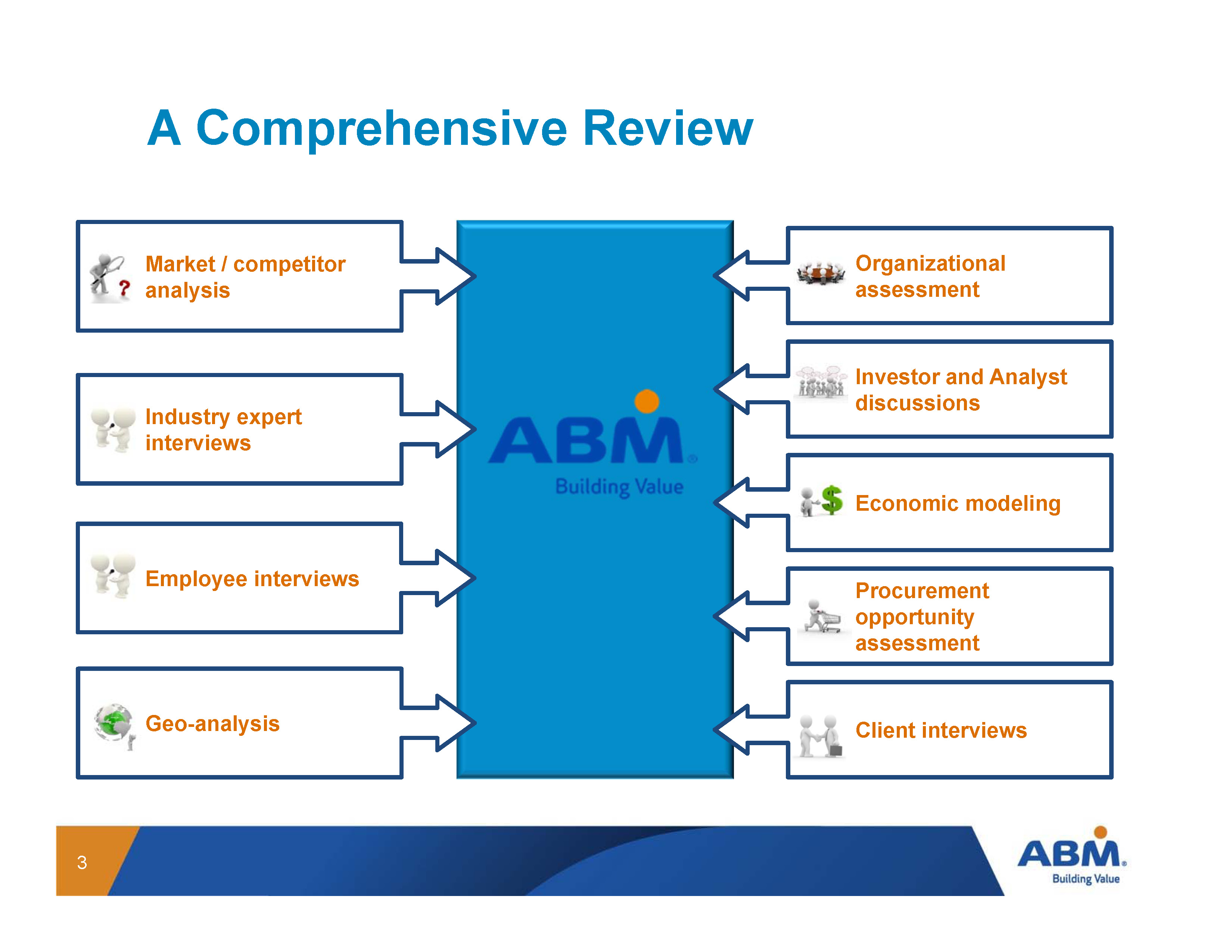

A Comprehensive Review 3 Geo - analysis Industry expert interviews Economic modeling Investor and Analyst discussions Procurement opportunity assessment Client interviews Employee interviews Organizational assessment Market / competitor analysis

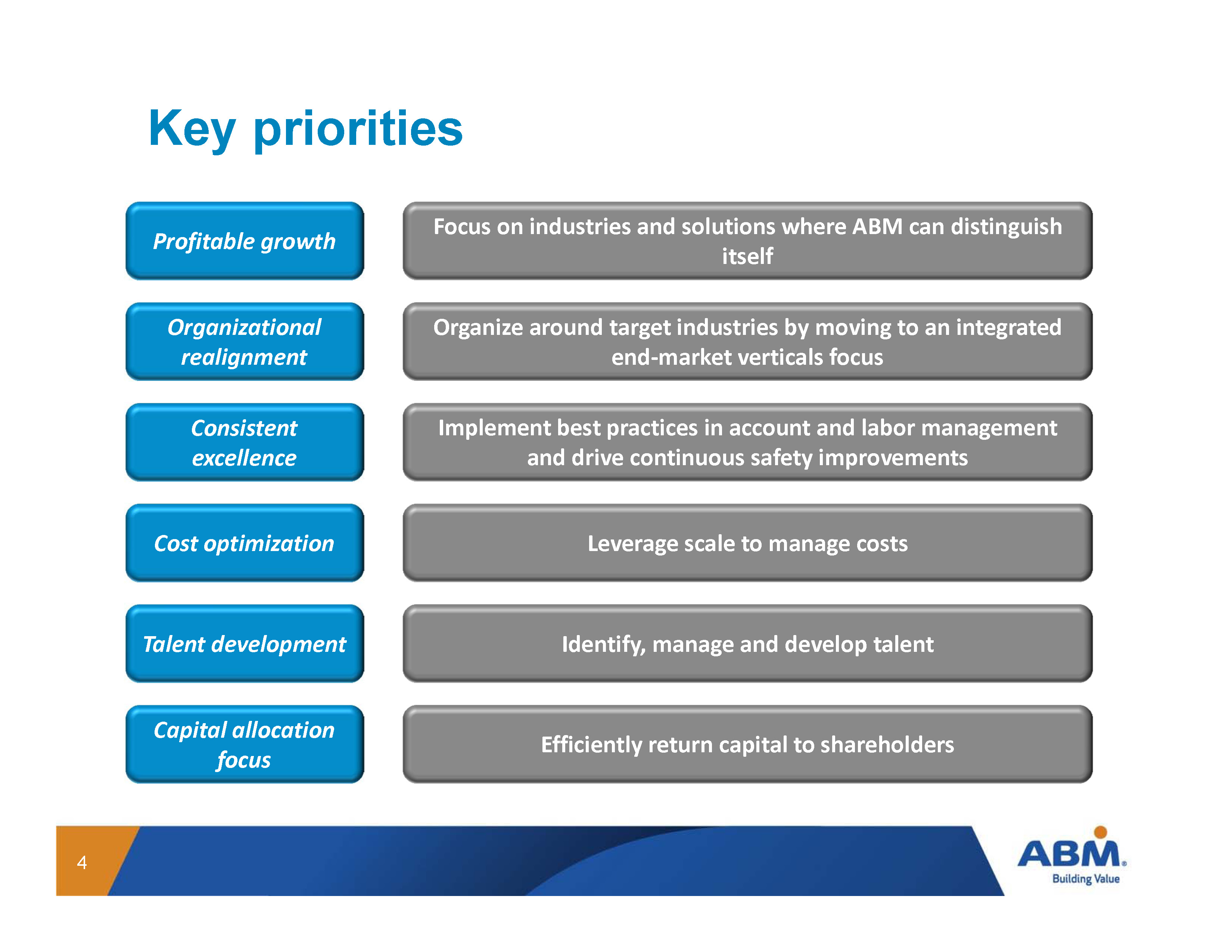

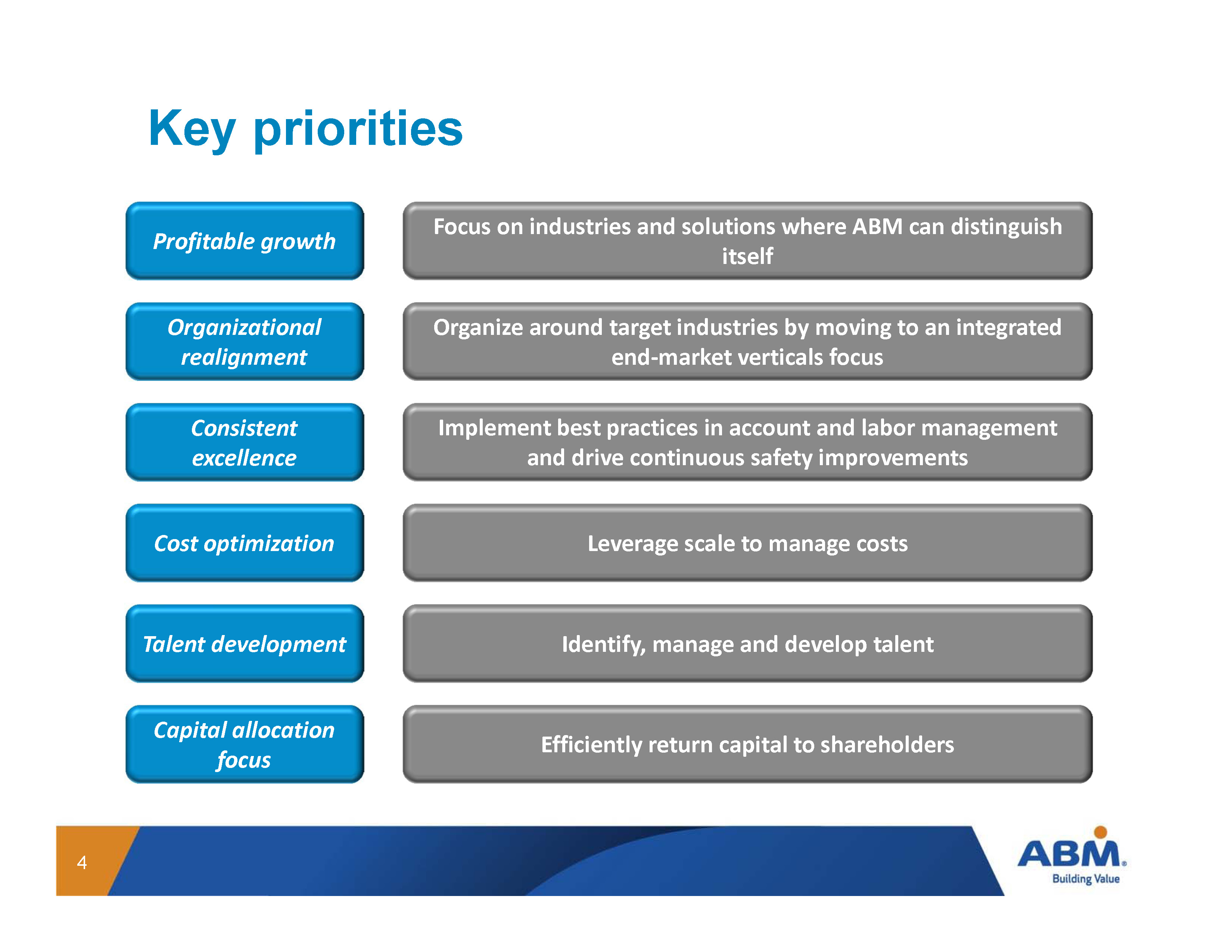

Key priorities 4 Profitable growth Capital allocation focus Talent development Cost optimization Consistent excellence Organizational realignment Focus on industries and solutions where ABM can distinguish itself Efficiently return capital to shareholders Identify, manage and develop talent Leverage scale to manage costs Implement best practices in account and labor management and drive continuous safety improvements Organize around target industries by moving to an integrated end - market verticals focus

Other BESG Government Healthcare ABES (Tech. Svcs) Onsite 4 Service Lines Service delivery model Business & Industry Geo Aviation Healthcare Education High Tech National Shared Services, Support Functions ABES (technical services) New client - centric operating model will increase customer satisfaction while also driving margin New operating model 5 Today Where we are going Janitorial Facilities Parking Security

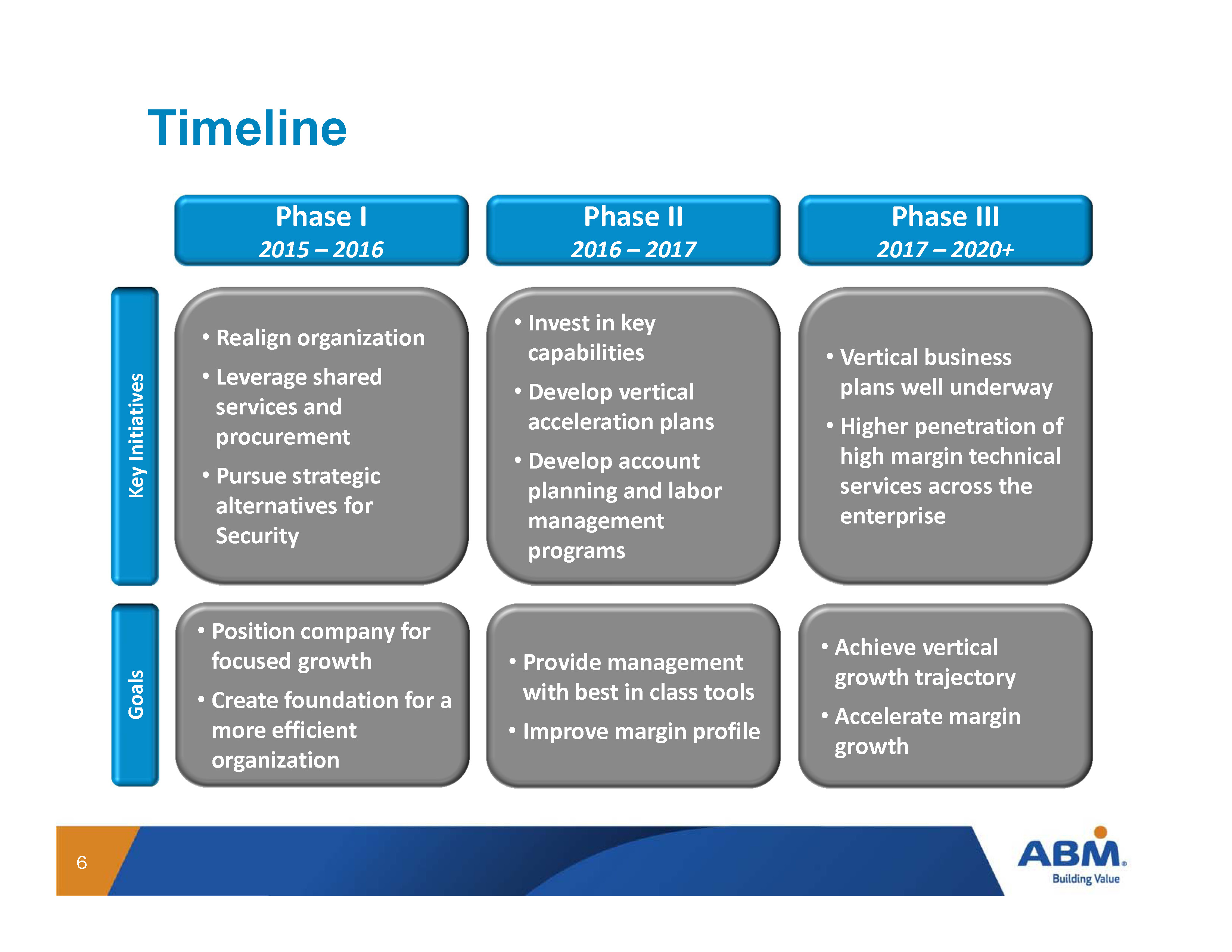

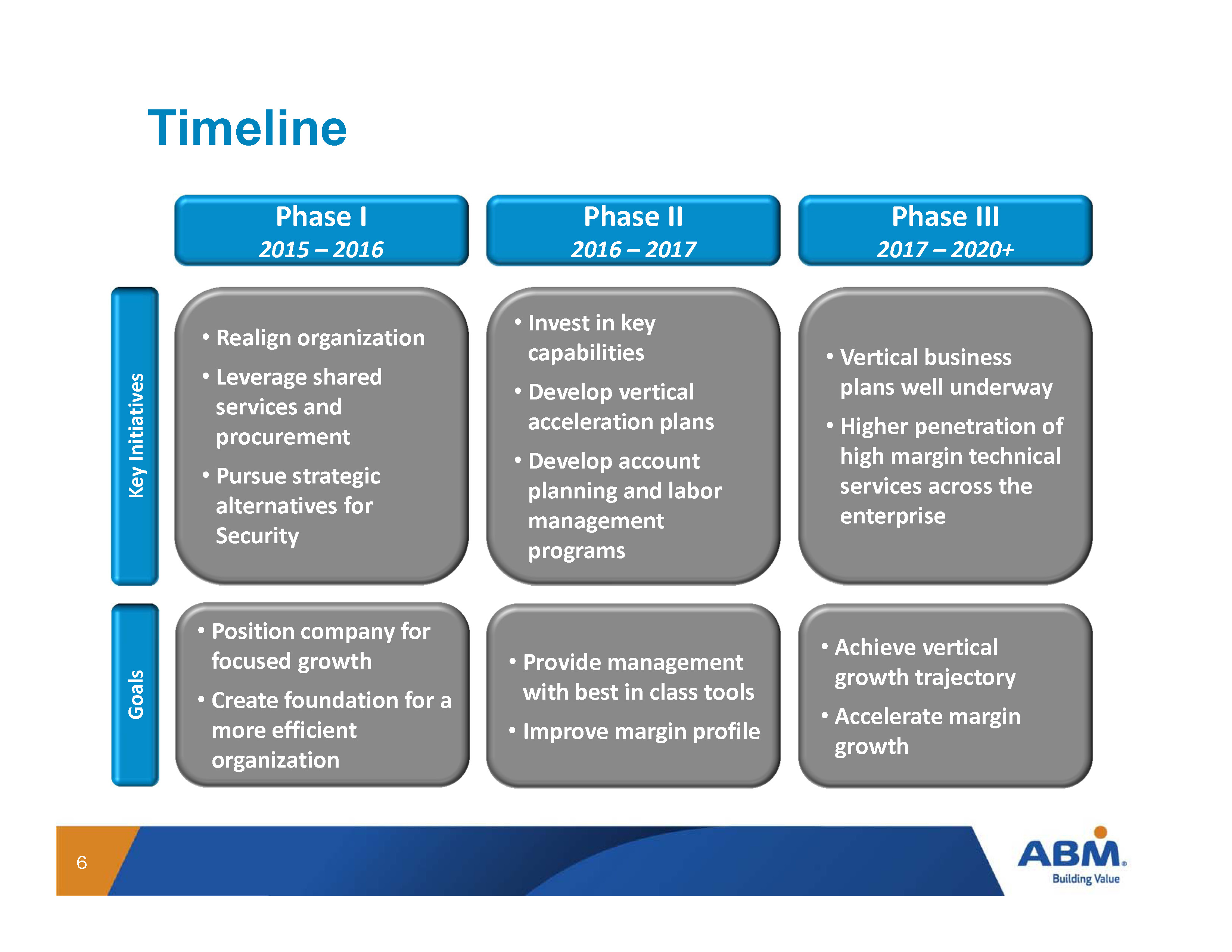

Timeline 6 Phase I 2015 – 2016 Phase II 2016 – 2017 • Realign organization • Leverage shared services and procurement • Pursue strategic alternatives for Security • Invest in key capabilities • Develop vertical acceleration plans • Develop account planning and labor management programs Phase III 2017 – 2020+ Key Initiatives Goals • Position company for focused growth • Create foundation for a more efficient organization • Provide management with best in class tools • Improve margin profile • V ertical business plans well underway • Higher penetration of high margin technical services across the enterprise • Achieve vertical growth trajectory • Accelerate margin growth

Immediate actions 7 Security Share Repurchase • Review strategic alternatives for security, including partnership, sale or other transaction • Board has authorized $200 million program Transformation • Mobilize transformation o ffice and teams

Third Quarter 2015 Review of Operational Results

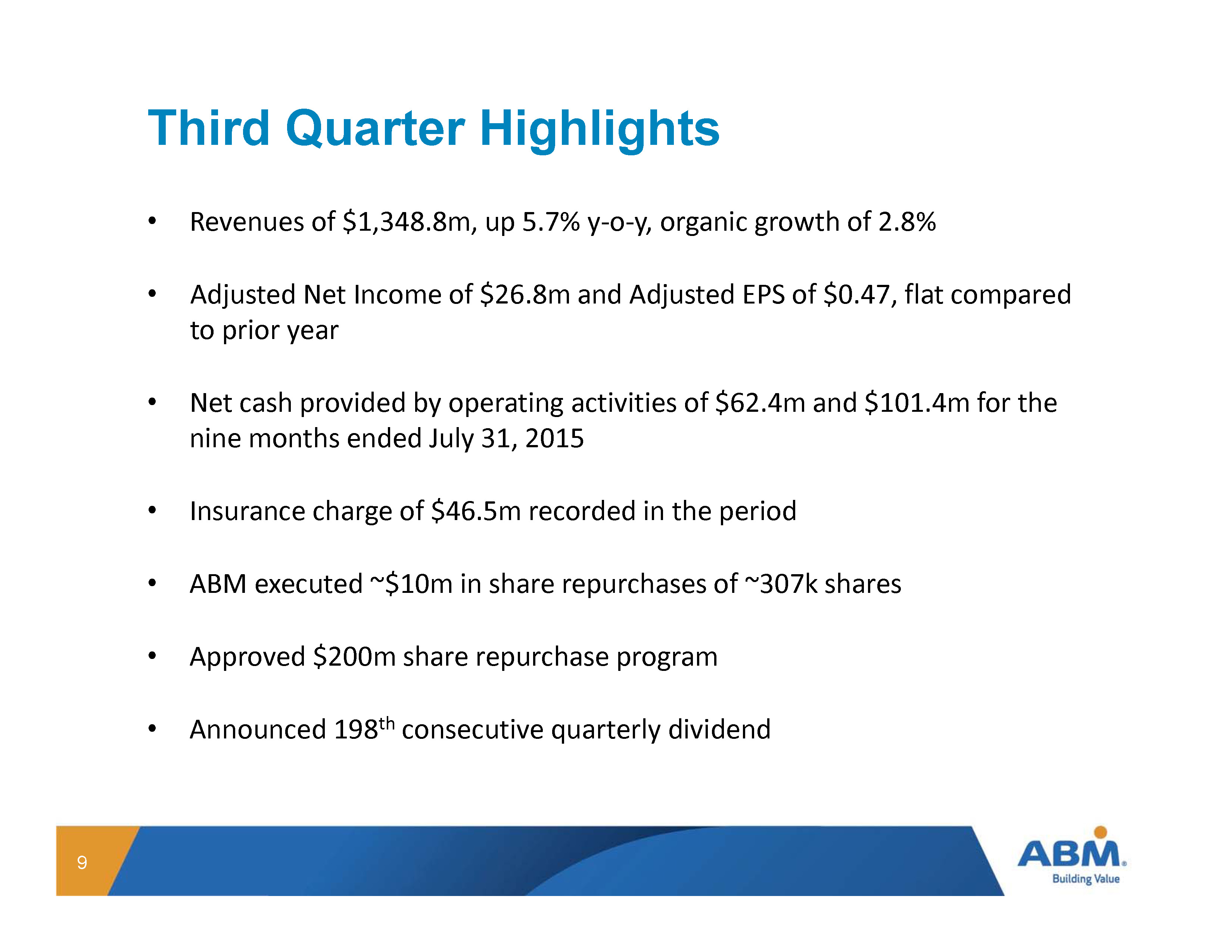

Third Quarter Highlights • Revenues of $1,348.8m, up 5.7% y - o - y, organic growth of 2.8% • Adjusted Net Income of $26.8m and Adjusted EPS of $0.47, flat compared to prior year • Net cash provided by operating activities of $62.4m and $101.4m for the nine months ended July 31, 2015 • Insurance charge of $46.5m recorded in the period • ABM executed ~$10m in share repurchases of ~307k shares • Approved $200m share repurchase program • Announced 198 th consecutive quarterly dividend 9

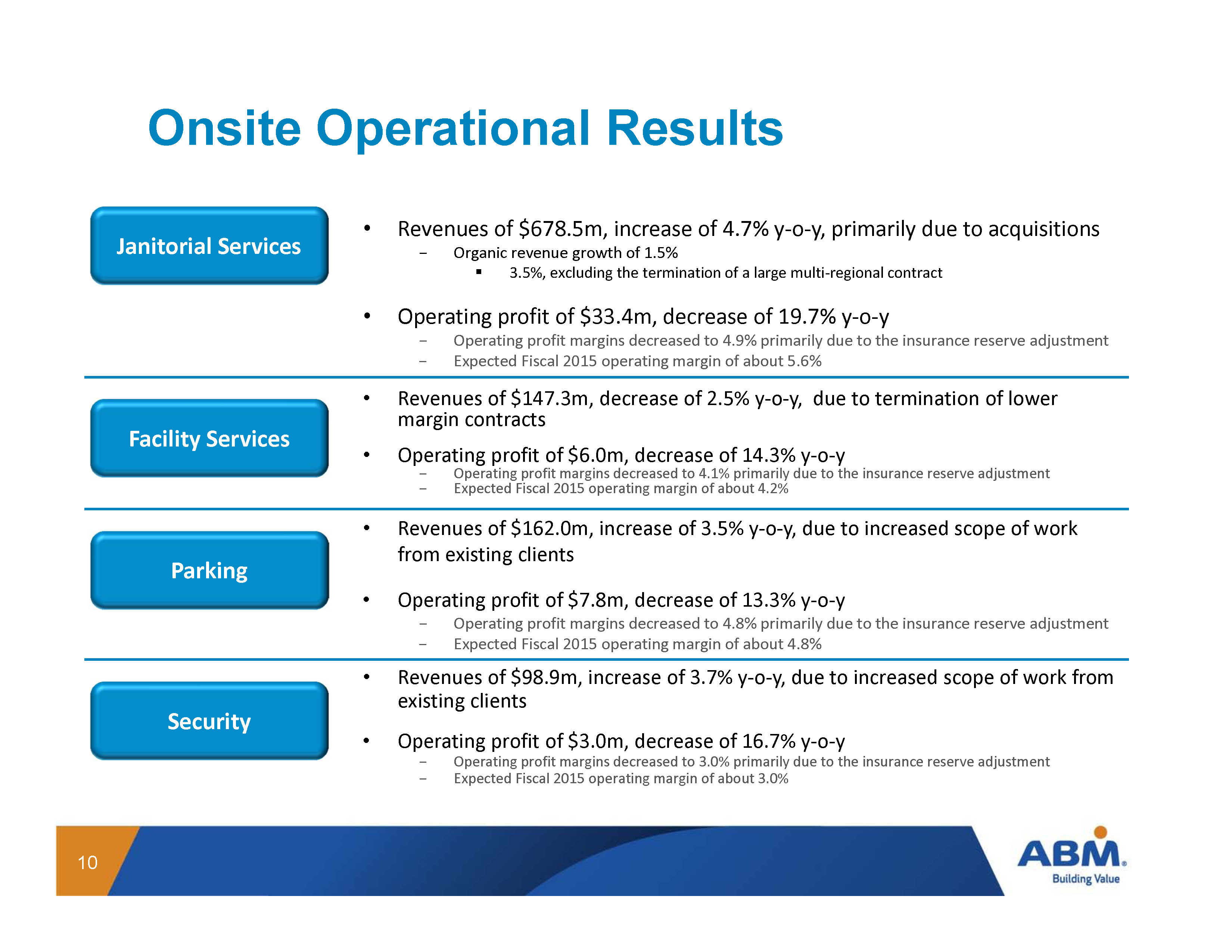

Onsite Operational Results 10 Janitorial Services • Revenues of $678.5m, increase of 4.7% y - o - y, primarily due to acquisitions − Organic revenue growth of 1.5% ▪ 3.5%, excluding the termination of a large multi - regional contract • Operating profit of $33.4m, de crease of 19.7% y - o - y − Operating profit margins decreased to 4.9% primarily due to the insurance reserve adjustment − Expected Fiscal 2015 operating margin of about 5.6% Facility Services • Revenues of $147.3m, decrease of 2.5% y - o - y, due to termination of lower margin contracts • Operating profit of $6.0m, de crease of 14.3% y - o - y − Operating profit margins decreased to 4.1% primarily due to the insurance reserve adjustment − Expected Fiscal 2015 operating margin of about 4.2% Parking • Revenues of $162.0m, increase of 3.5% y - o - y, due to increased scope of work from existing clients • Operating profit of $7.8m, de crease of 13.3% y - o - y − Operating profit margins decreased to 4.8% primarily due to the insurance reserve adjustment − Expected Fiscal 2015 operating margin of about 4.8% Security • Revenues of $98.9m, increase of 3.7% y - o - y, due to increased scope of work from existing clients • Operating profit of $3.0m, de crease of 16.7% y - o - y − Operating profit margins decreased to 3.0% primarily due to the insurance reserve adjustment − Expected Fiscal 2015 operating margin of about 3.0%

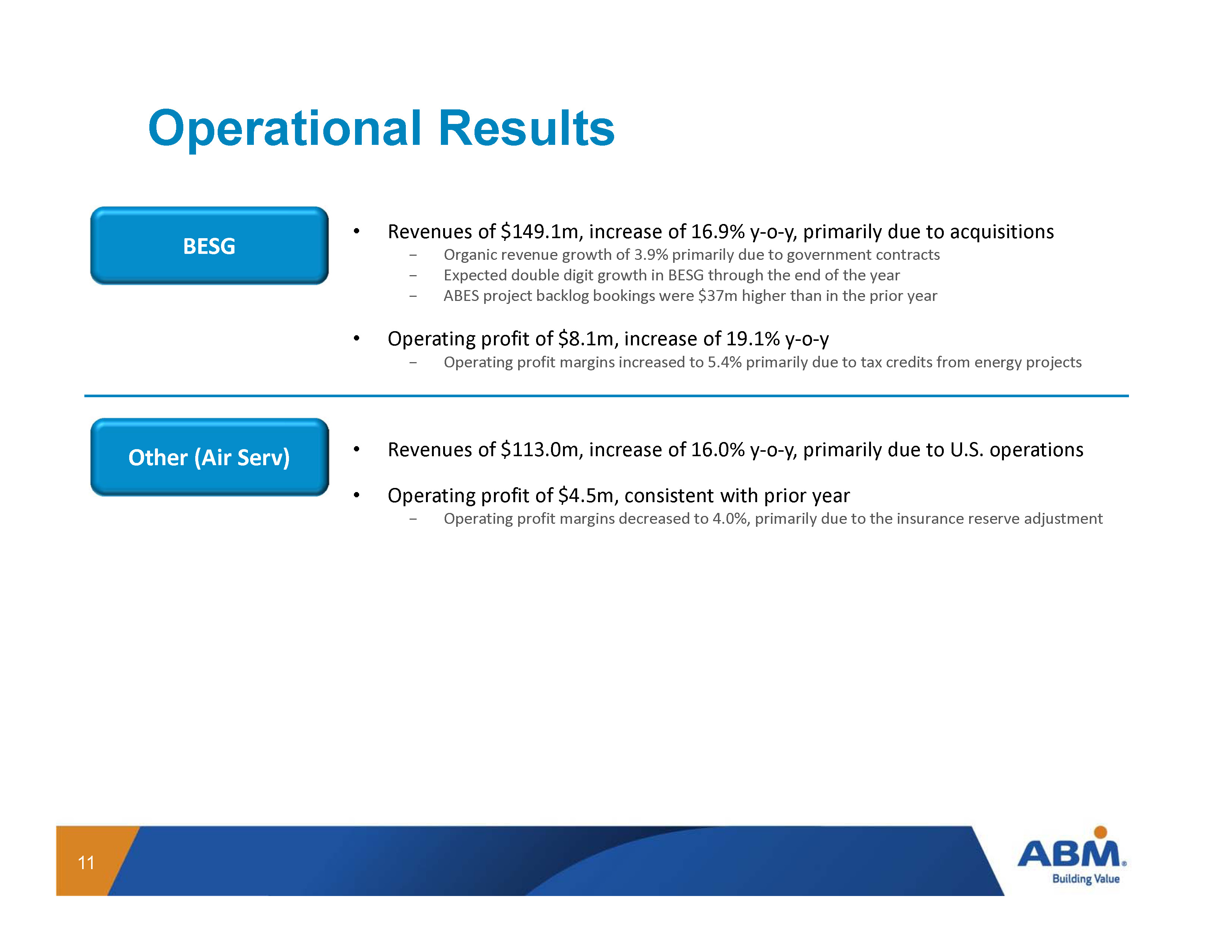

Operational Results 11 BESG Other (Air Serv ) • Revenues of $149.1m, increase of 16.9% y - o - y, primarily due to acquisitions − Organic revenue growth of 3.9% primarily due to government contracts − Expected double digit growth in BESG through the end of the year − ABES project backlog bookings were $37m higher than in the prior year • Operating profit of $8.1m, in crease of 19.1% y - o - y − Operating profit margins increased to 5.4% primarily due to tax credits from energy projects • Revenues of $113.0m, increase of 16.0% y - o - y, primarily due to U.S. operations • Operating profit of $4.5m, consistent with prior year − Operating profit margins decreased to 4.0%, primarily due to the insurance reserve adjustment

Capital Structure

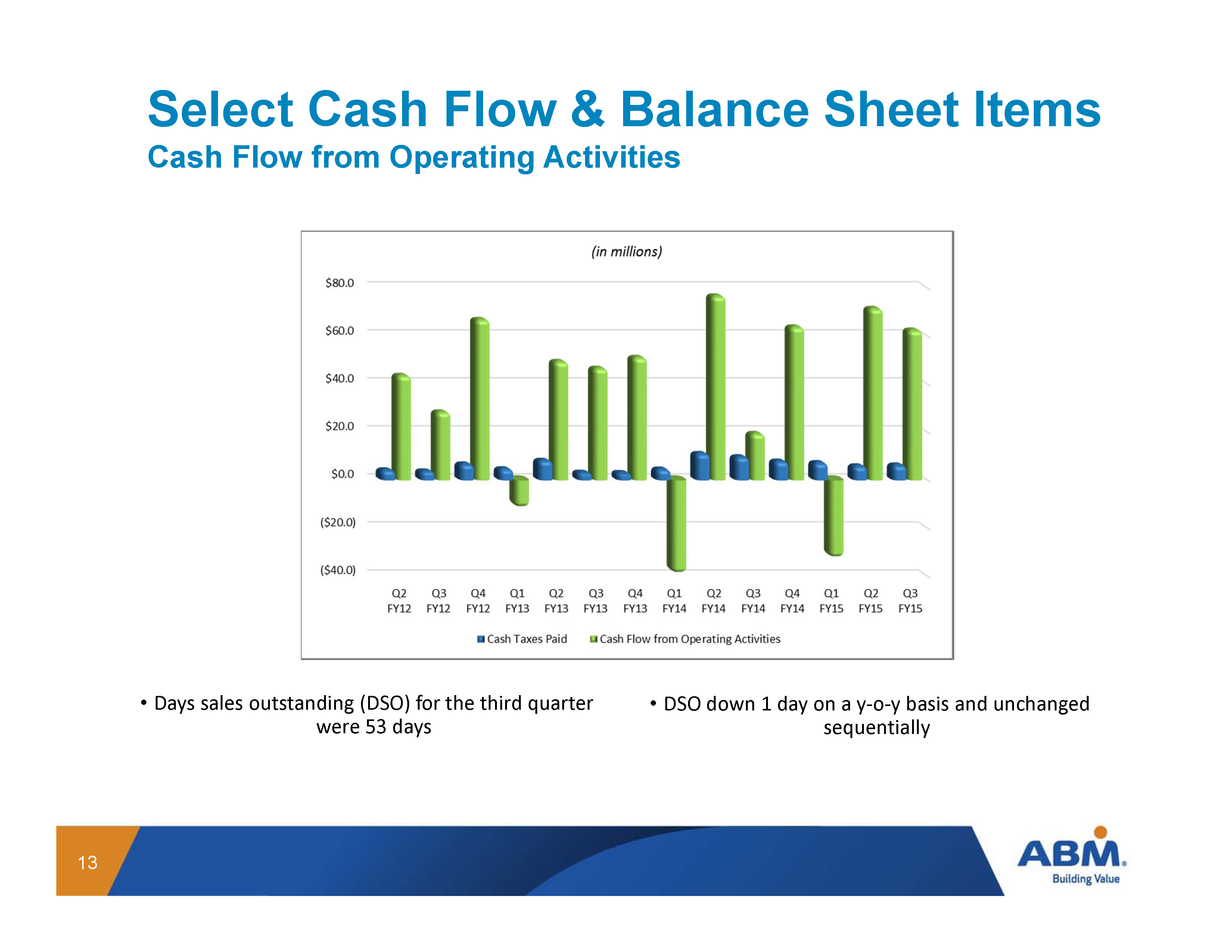

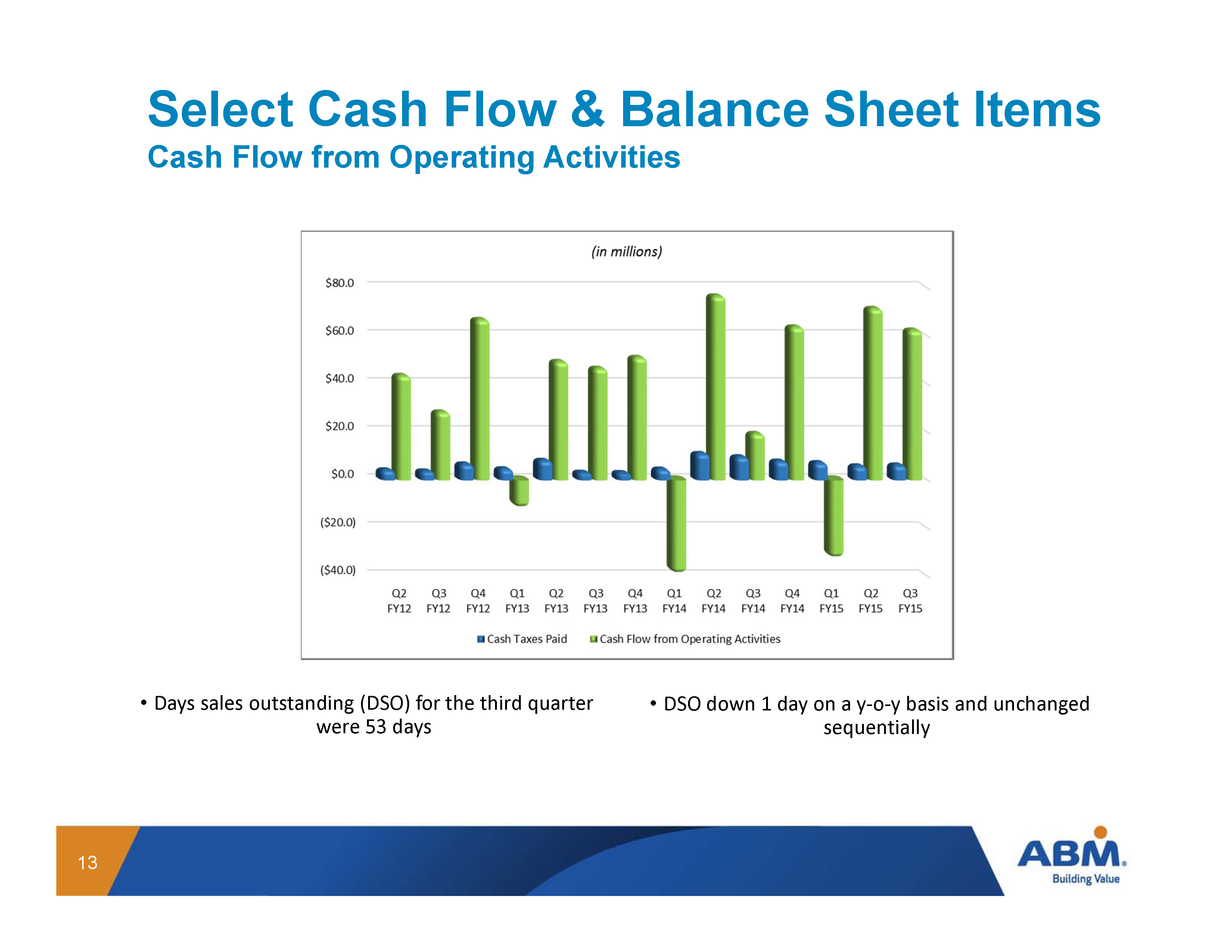

Select Cash Flow & Balance Sheet Items Cash Flow from Operating Activities 13 • DSO down 1 day on a y - o - y basis and unchanged sequentially • Days sales outstanding (DSO) for the third quarter were 53 days

Select Cash Flow & Balance Sheet Items Leverage 14 Q3 FY15 Leverage of 1.95x 1 1 Leverage as of Q3 FY15 takes into consideration the amendment of our Credit Facility Agreement Note: Acquisitions shown represent purchase above $15m

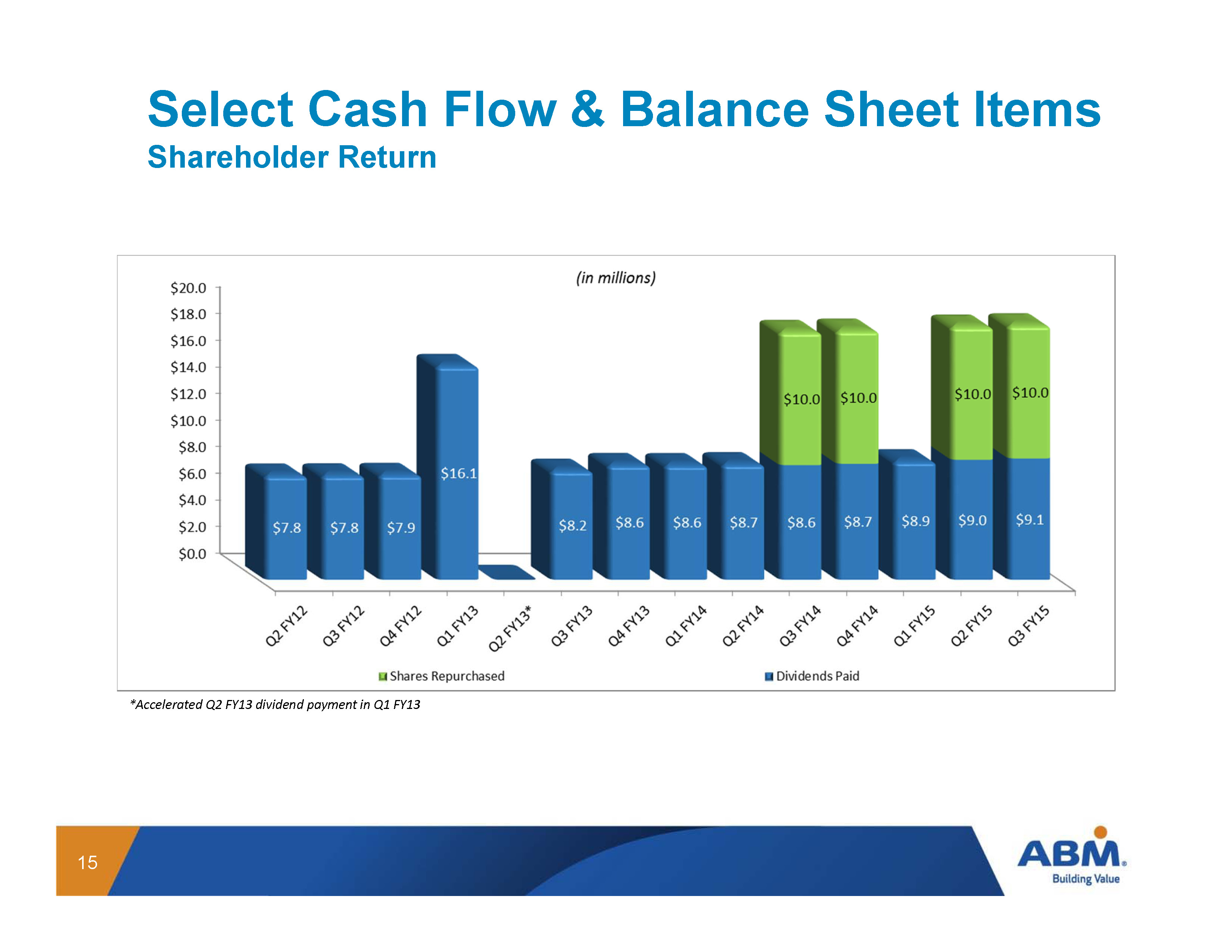

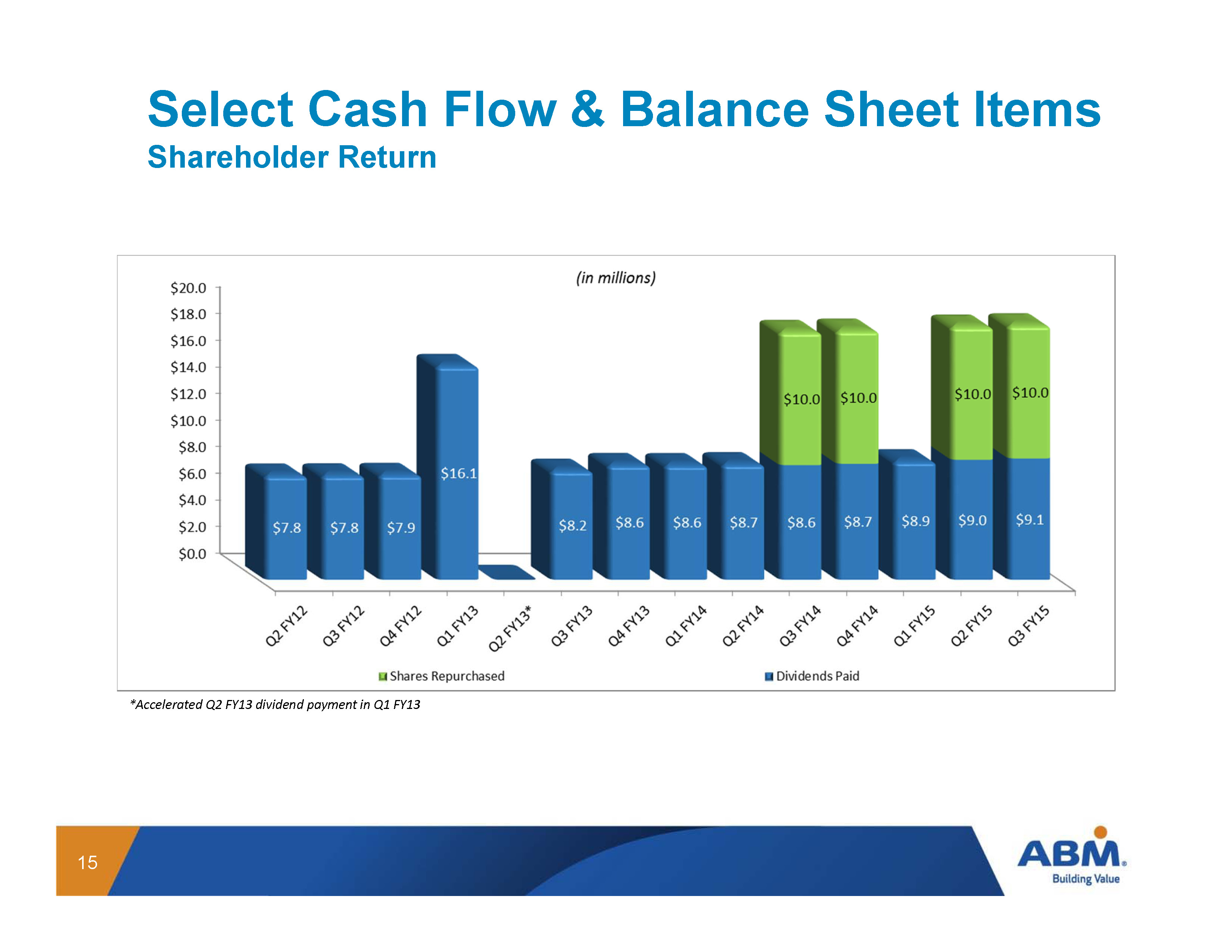

Select Cash Flow & Balance Sheet Items Shareholder Return 15 *Accelerated Q2 FY13 dividend payment in Q1 FY13

Fiscal 2015 Outlook

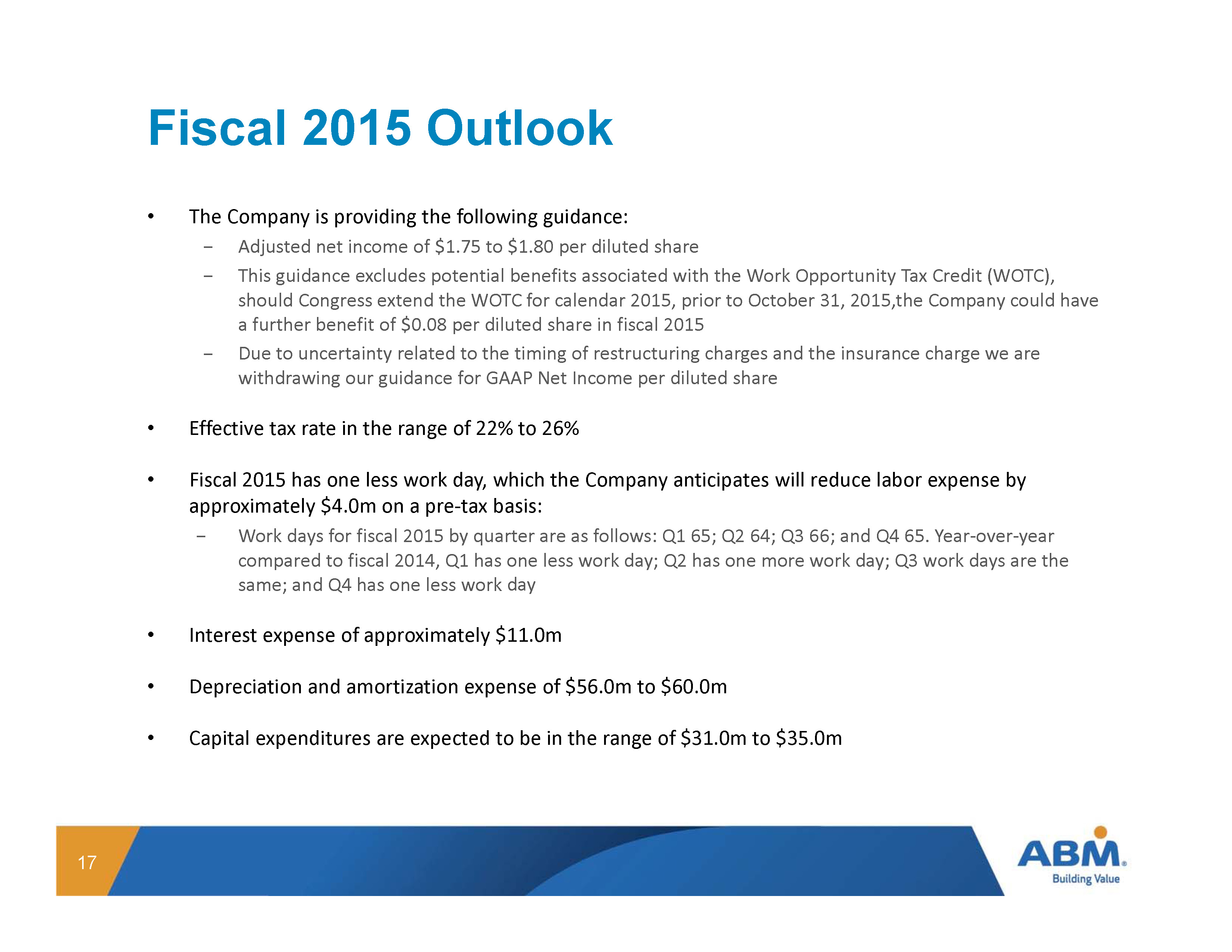

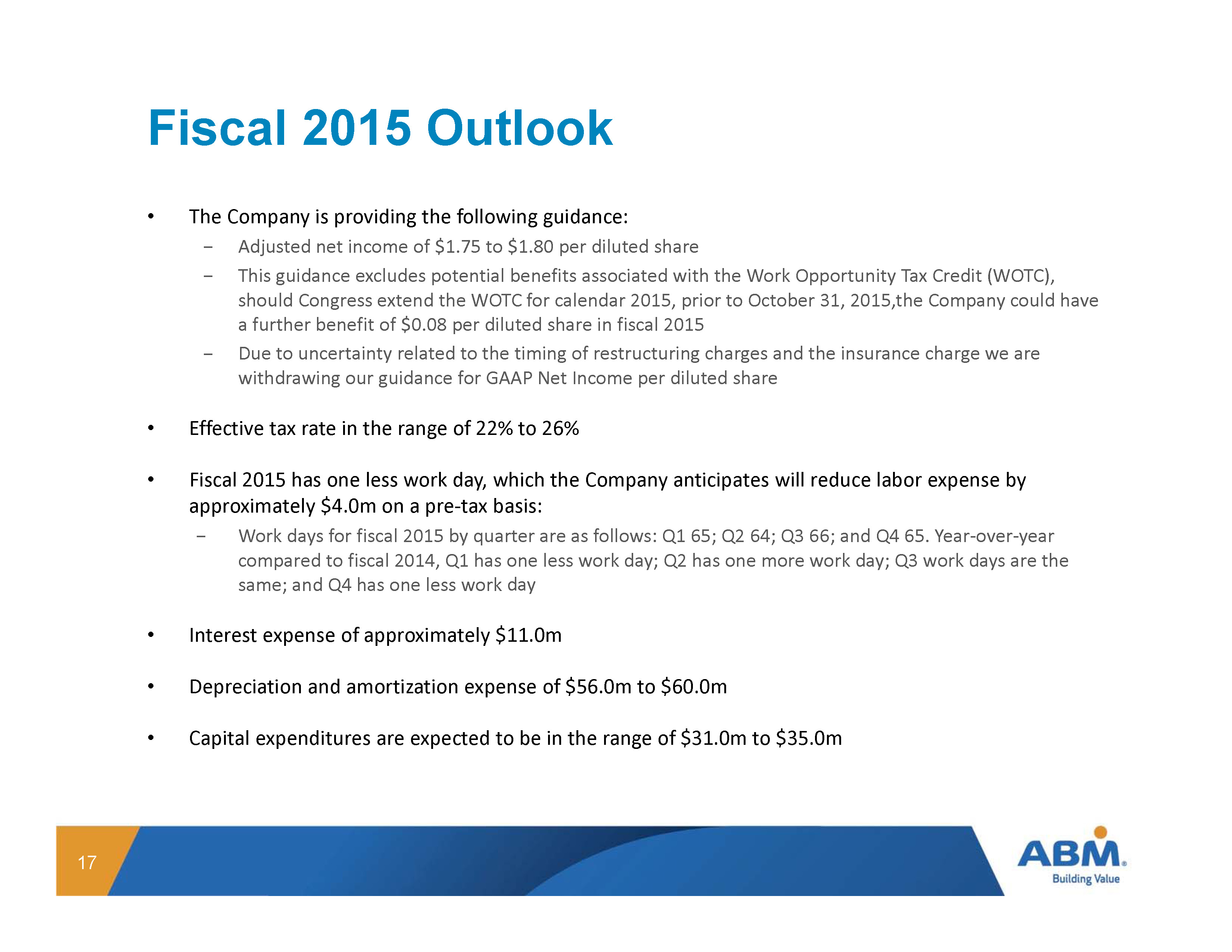

Fiscal 2015 Outlook • The Company is providing the following guidance: − A djusted net income of $1.75 to $ 1.80 per diluted share − This guidance excludes potential benefits associated with the Work Opportunity Tax Credit ( WOTC ), should Congress extend the WOTC for calendar 2015, prior to October 31, 2015,the Company could have a further benefit of $0.08 per diluted share in fiscal 2015 − Due to uncertainty related to the timing of restructuring charges and the insurance charge we are withdrawing our guidance for GAAP Net Income per diluted share • Effective tax rate in the range of 22% to 26% • Fiscal 2015 has one less work day, which the Company anticipates will reduce labor expense by approximately $ 4.0m on a pre - tax basis: − Work days for fiscal 2015 by quarter are as follows: Q1 65; Q2 64; Q3 66; and Q4 65. Year - over - year compared to fiscal 2014, Q1 has one less work day; Q2 has one more work day; Q3 work days are the same; and Q4 has one less work day • Interest expense of approximately $ 11.0m • Depreciation and amortization expense of $ 56.0m to $ 60.0m • Capital expenditures are expected to be in the range of $ 31.0m to $ 35.0m 17

Forward - Looking Statement This presentation contains both historical and forward - looking statements. Forward - looking statements are not based on historica l facts but instead reflect our current expectations, estimates or projections concerning future results or events. These statements generally can be identified by the use of forward - looking words or phrases such as “believe,” “expect,” “expectation,” “anticipate,” “may,” “could,” “intend,” “belief,” “estimate,” “plan,” “target,” “predict,” “likely,” “should,” “forecast,” “outlook,” or other similar words or phras es. These statements are not guarantees of future performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results to di ffe r materially from those indicated by those statements. Forward - looking statements in this presentation include, but are not limited to, statements regarding our future operating and financial performance, inclu din g, but not limited to, our fiscal 2015 outlook, statements regarding our plans to return capital to stockholders, whether through stock repurchases, cash dividends, or otherwise, statements regarding our review of str ategic alternatives for our security business, statements regarding the ability of our risk management and safety programs to affect our insurance reserves for casualty programs, statements regarding the adoption of our strategy and transformation initiative, statements regarding the cost savings we have projected to achieve by the realignment of our business operations to better support specific industries and efficien tly deliver client solutions and statements regarding the timing of any of the foregoing. We cannot assure you that any of our expectations, estimates or projections will be achieved. Numerous factors could cause our a ctu al results and events to differ materially from those expressed or implied by forward - looking statements. These factors include, but are not limited to the following: (1) changes to our businesses, operating str uct ure, capital structure, or personnel relating to the adoption of our strategy and transformation initiative may not have the desired effects on our financial condition and results of operations; (2) our stra teg y of moving to an integrated facility solutions provider platform, which focuses on vertical markets, may not generate the organic growth in revenues or profitability that we expect; (3) we may not achieve the cost sav ing s we have projected to achieve by the realignment of our business operations to better support specific industries; (4) we may not be able to control within expectations the costs and expenses of implement ing our strategy and transformation initiative; (5) the adoption of our strategy and transformation initiative may have an adverse impact on our relationships with employees, customers and vendors; (6) we may n ot be able to timely sell our security business at a valuation or upon such terms as our board believes is in the best interests of stockholders and the costs that we may incur in connection with reviewing strategi c a lternatives for our security business may not be recouped if a sale of the security business is not consummated; (7) risks relating to our acquisition strategy may adversely impact our results of operations; ( 8) we are subject to intense competition that can constrain our ability to gain business as well as our profitability; (9) increases in costs that we cannot pass on to clients could affect our profitability; (10) we h ave high deductibles for certain insurable risks, and therefore we are subject to volatility associated with those risks, there is the possibility that our risk management and safety programs may not have the intended eff ect of allowing us to reduce our insurance reserves for casualty programs and there is the possibility that our insurance reserves may need to be materially adjusted from time to time; (11) our captive insurance com pany may not bring us the benefits we expect; (12) our restructuring initiatives may not achieve their expected cost reductions; (13) our business success depends on our ability to preserve our long - term relations hips with clients; (14) our business success depends on retaining senior management and attracting and retaining qualified personnel; (15) we are at risk of losses stemming from accidents or other incidents at fa cilities in which we operate, which could cause significant damage to our reputation and financial loss; (16) negative or unexpected tax consequences could adversely affect our results of operations; (17) changes i n e nergy prices and government regulations could adversely impact the results of operations of our Building & Energy Solutions business; (18) significant delays or reductions in appropriations for our gover nme nt contracts may negatively affect our business and could have an adverse effect on our financial position, results of operations, and cash flows; (19) we conduct some of our operations through joint ventures, and ou r ability to do business may be affected by the failure of our joint venture partners to perform their obligations; (20) our business may be negatively affected by adverse weather conditions; (21) federal health ca re reform legislation may adversely affect our business and results of operations; (22) our services in areas of military conflict expose us to additional risks; (23) we are subject to cyber - security risks arising out of breaches of security relating to sensitive company, client, and employee information and to the technology that manages our operations and other business processes; (24) we are subject to business continuity risks ass oci ated with centralization of certain administrative functions; (25) a decline in commercial office building occupancy and rental rates could adversely affect our revenues and profitability; (26) deteriorati on in general economic conditions could reduce the demand for facility services and, as a result, reduce our earnings and adversely affect our financial condition; (27) financial difficulties or bankruptcy of one or mo re of our clients could adversely affect our results; (28) any future increase in the level of our debt or in interest rates could affect our results of operations; (29) our ability to operate and pay our debt obligation s d epends upon our access to cash; (30) goodwill impairment charges could have a material adverse effect on our financial condition and results of operations; (31) impairment of long - lived assets may adversely affect o ur operating results; (32) we are defendants in class and representative actions and other lawsuits alleging various claims that could cause us to incur substantial liabilities; (33) changes in immigration laws or en for cement actions or investigations under such laws could significantly adversely affect our labor force, operations, and financial results; (34) labor disputes could lead to loss of revenues or expense variations; (35 ) w e participate in multiemployer pension plans that under certain circumstances could result in material liabilities being incurred; (36) disasters or acts of terrorism could disrupt services and (37) actions of activi st investors could be disruptive and costly and could cause uncertainty about the strategic direction of our business. The list of factors above is illustrative, but by no means exhaustive. Additional information regarding these and other risks an d uncertainties the Company faces is contained in the Company’s Annual Report on Form 10 - K for the year ended October 31, 2014, and in other reports the Company files from time to time with the Securities and Excha nge Commission (including all amendments to those reports). The Company urges readers to consider these risks and uncertainties in evaluating its forward - looking statements. The Company cautions readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date made. The Company disclaims any obligation or undertaking to publicly release any updates or revisions to an y forward - looking statements contained herein (or elsewhere) to reflect any change in the Company’s expectations with regard thereto, or any change in events, conditions or circumstances on which any such statem ent is made, whether as a result of new information, future events or otherwise, except as otherwise required by the federal securities laws. 18

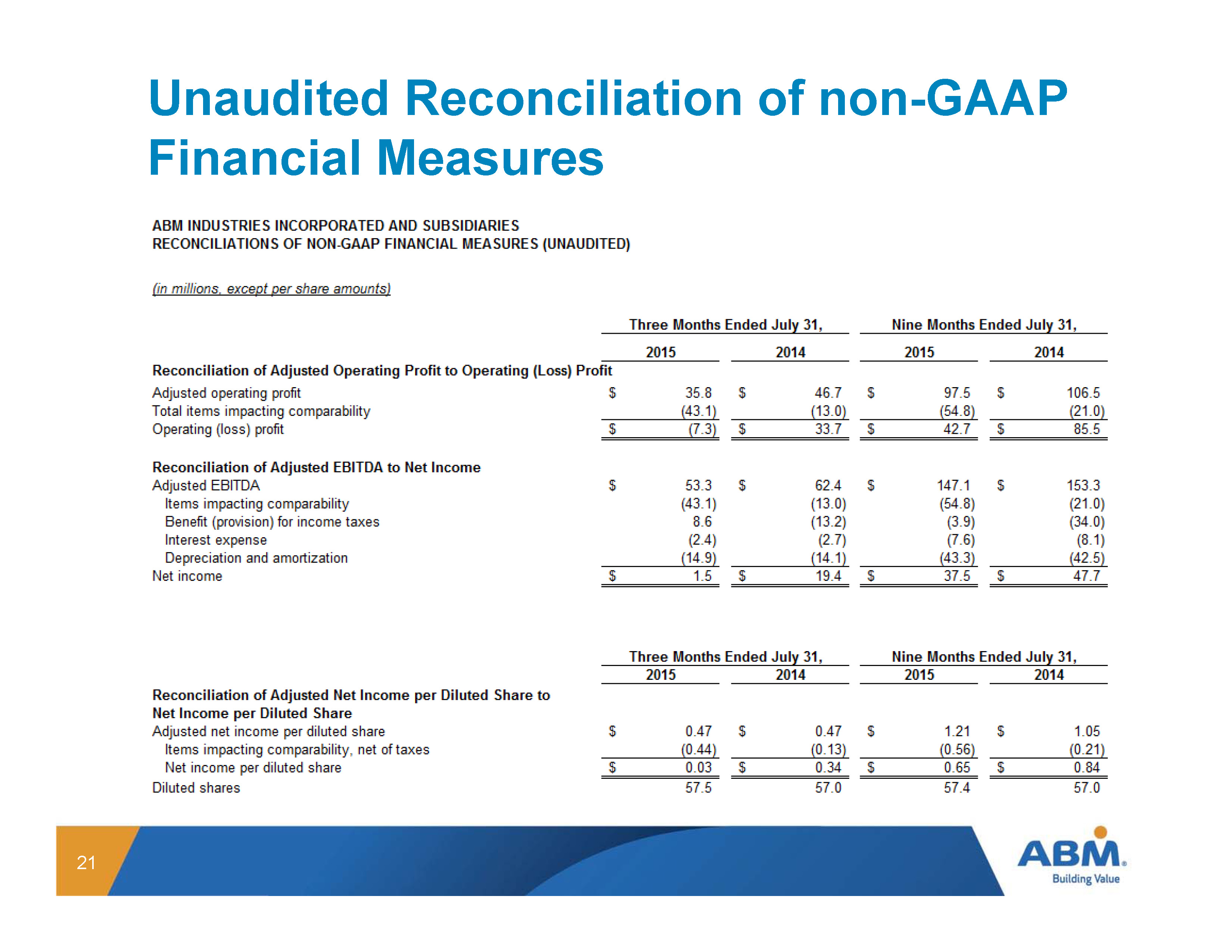

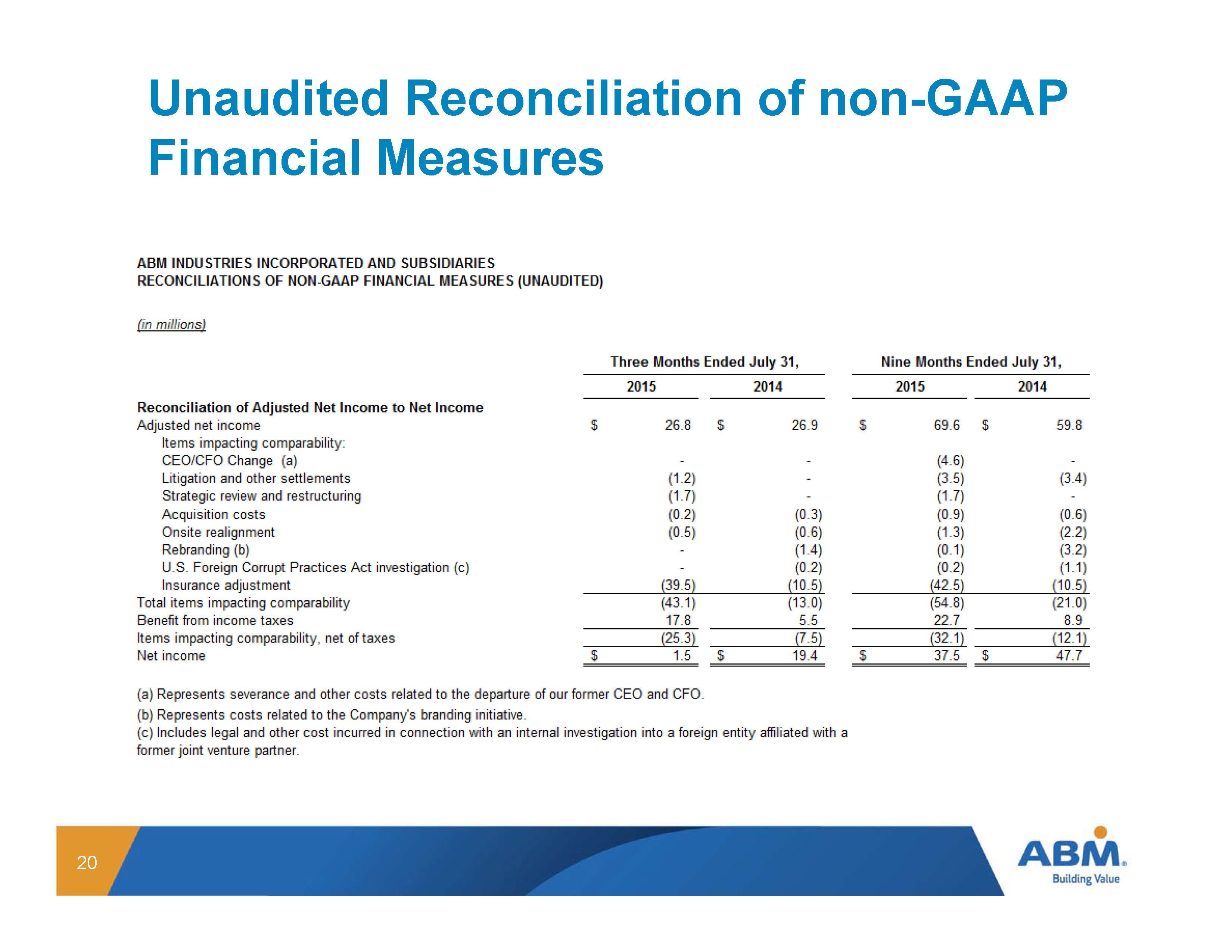

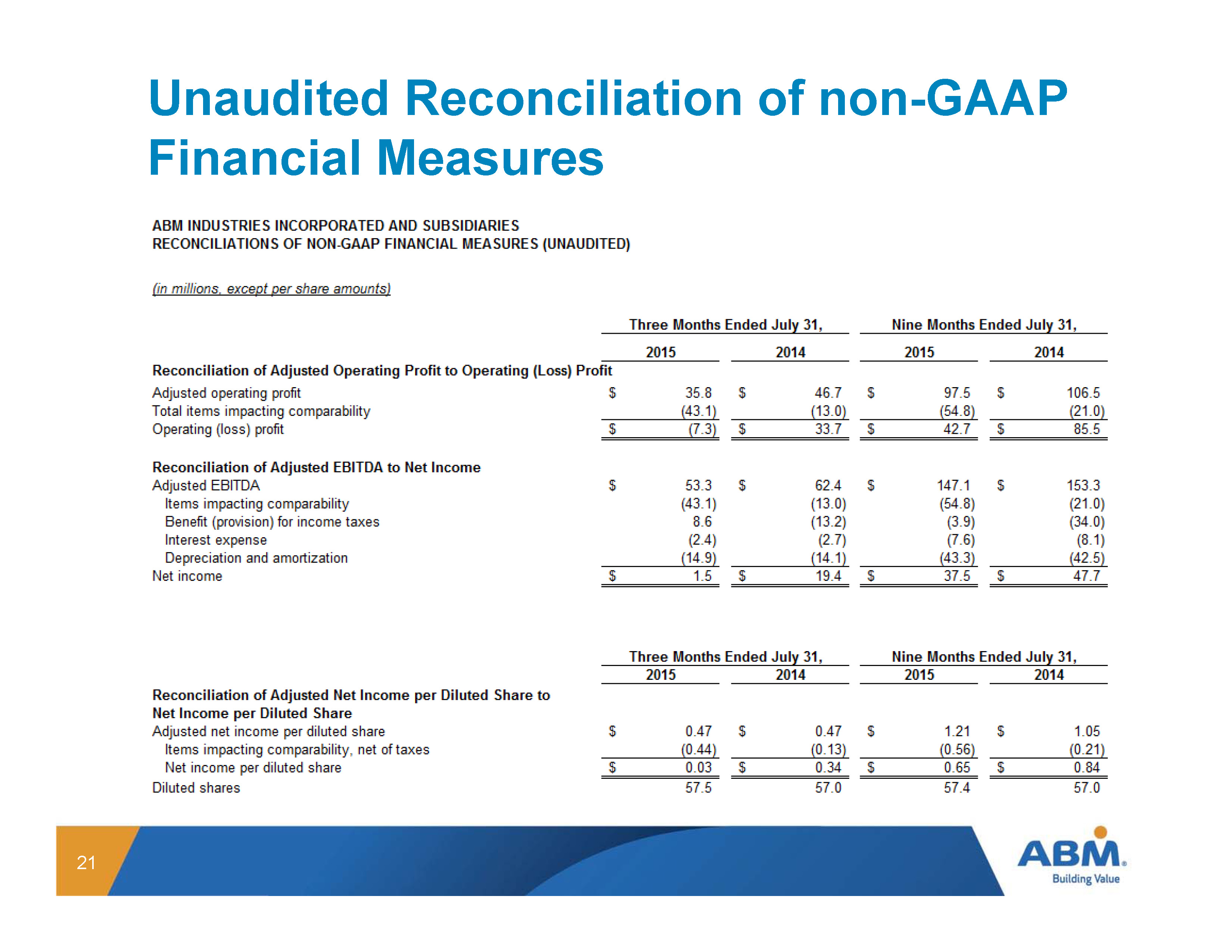

Appendix - Unaudited Reconciliation of non - GAAP Financial Measures

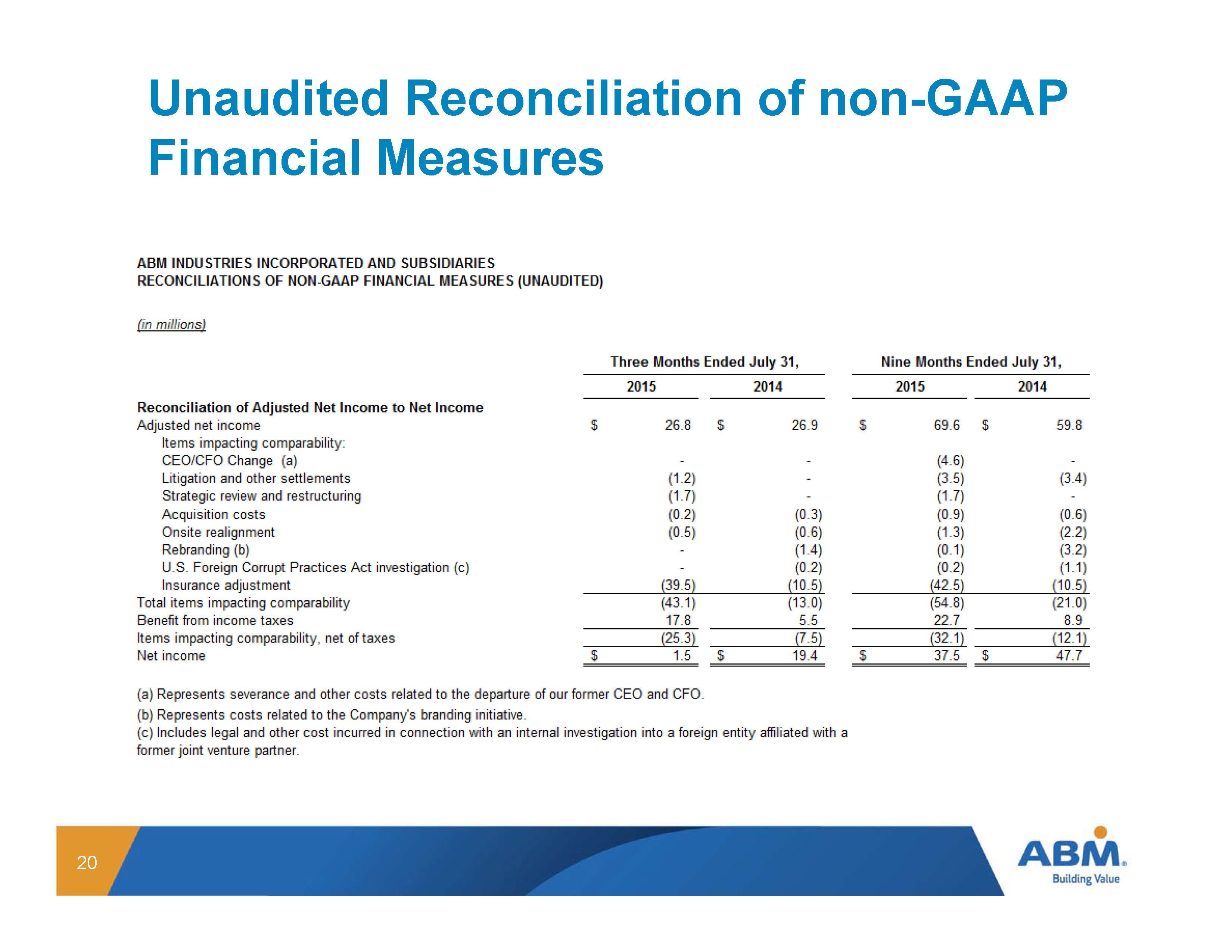

Unaudited Reconciliation of non - GAAP Financial Measures 20

Unaudited Reconciliation of non - GAAP Financial Measures 21