Exhibit 99.2

Cover Slide Title (20pt. Bold) Fourth Quarter 2016 Teleconference December 14, 2016

Agenda 2 4 5 Full Year 2016 Review Capital Structure Forward - Looking Statements and Non - GAAP Financial Information: Our discussions during this conference call will include forward - looking statements. Actual results could differ materially fro m those projected in the forward - looking statements. Some of the factors that could cause actual results to differ are discussed in the Company’s 2015 Annual Report on Form 10 - K and in our 2016 reports on Form 10 - Q and Form 8 - K. These reports are available on our website at http:// investor.abm.com under “SEC Filings”. A description of other factors that could cause actual results to differ is also set forth at the end of this presentation. Also, the discussion during this conference call will include certain financial measures that were not prepared in accordance wi th U.S. generally accepted accounting principles (“U.S. GAAP”). Reconciliations of those non - GAAP financial measures to the most directly comparable U.S. GAAP financ ial measures can be found on the Investor Relations portion of our website at http://investor.abm.com and at the end of this presentation. 2 ABM Business Overview 3 Fourth Quarter 2016 Review 6 Fiscal 2017 Outlook 1 Mission, Vision, Purpose

Fourth Quarter 2016 Review 4

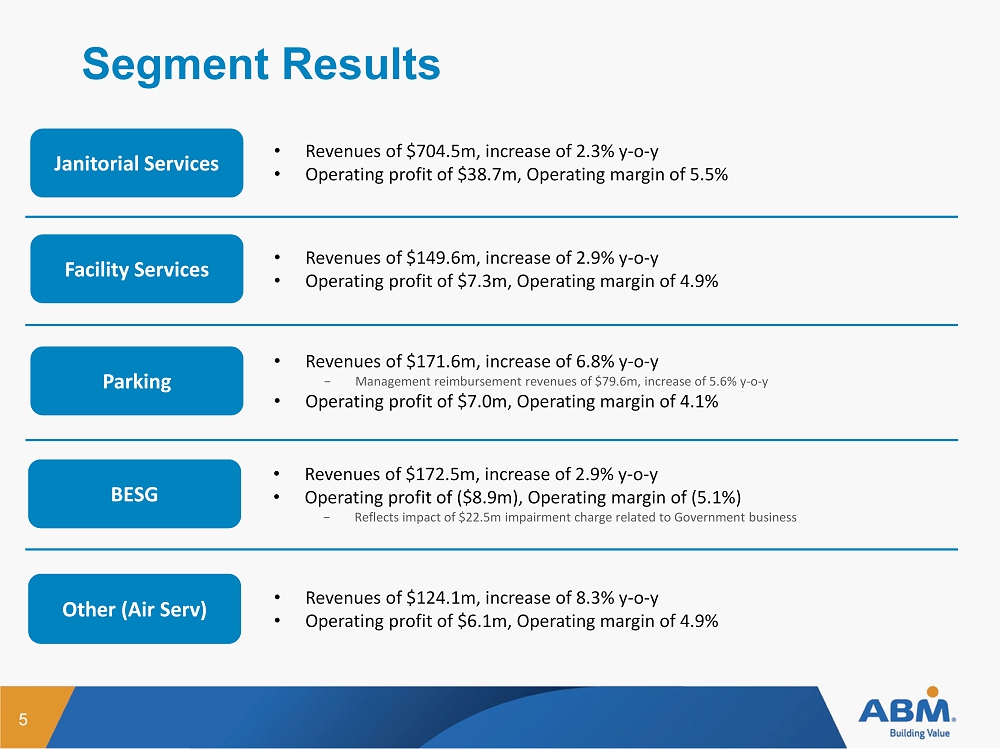

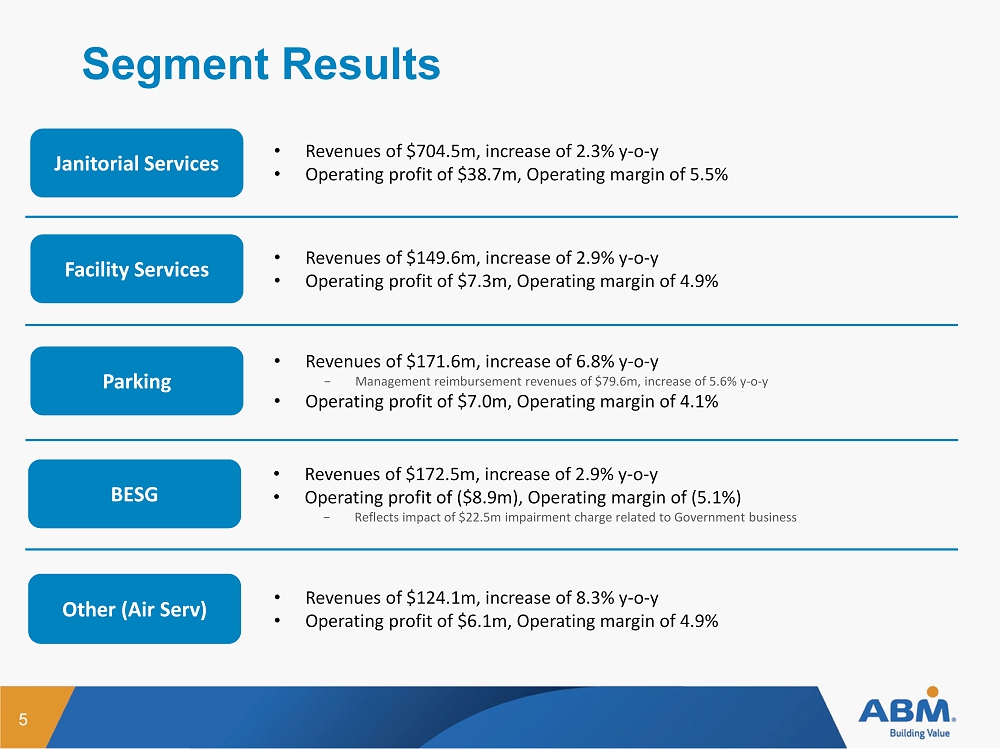

Segment Results 5 Janitorial Services • Revenues of $704.5m, increase of 2.3% y - o - y • Operating profit of $ 38.7 m, Operating margin of 5.5 % Facility Services • Revenues of $149.6m, increase of 2.9% y - o - y • Operating profit of $ 7.3 m, Operating margin of 4.9 % Parking • Revenues of $171.6m, increase of 6.8% y - o - y − Management reimbursement revenues of $79.6m, increase of 5.6% y - o - y • Operating profit of $ 7.0 m, Operating margin of 4.1% BESG Other (Air Serv ) • Revenues of $172.5m, increase of 2.9% y - o - y • Operating profit of ($ 8.9 m), Operating margin of (5.1%) − Reflects impact of $22.5m impairment charge related to Government business • Revenues of $124.1m, increase of 8.3% y - o - y • Operating profit of $ 6.1 m, Operating margin of 4.9 %

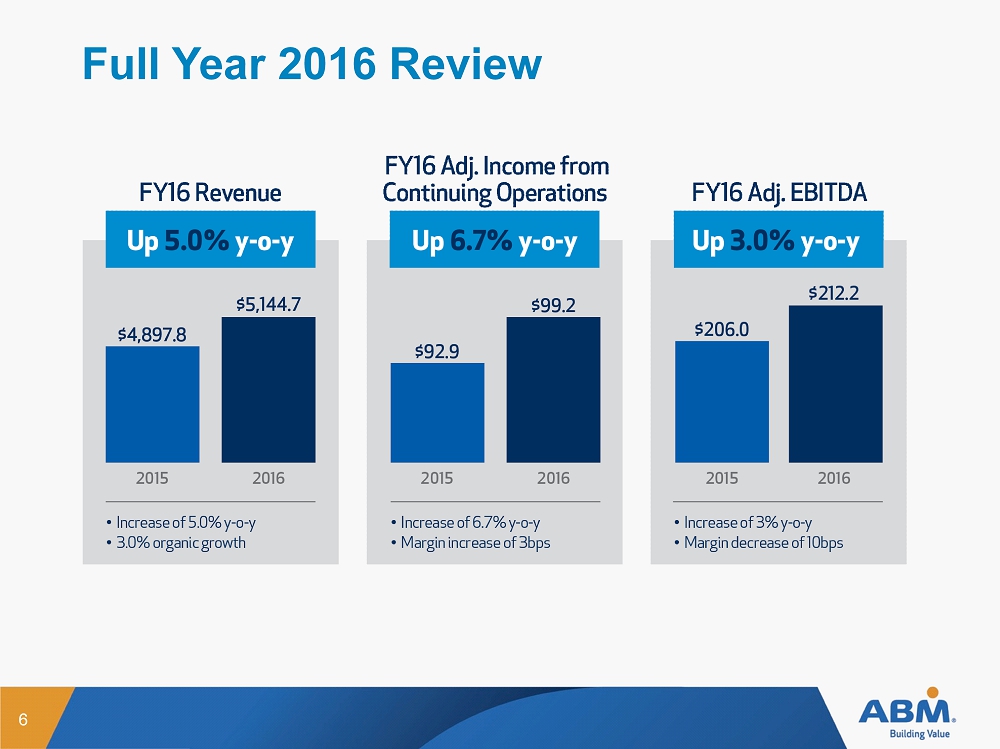

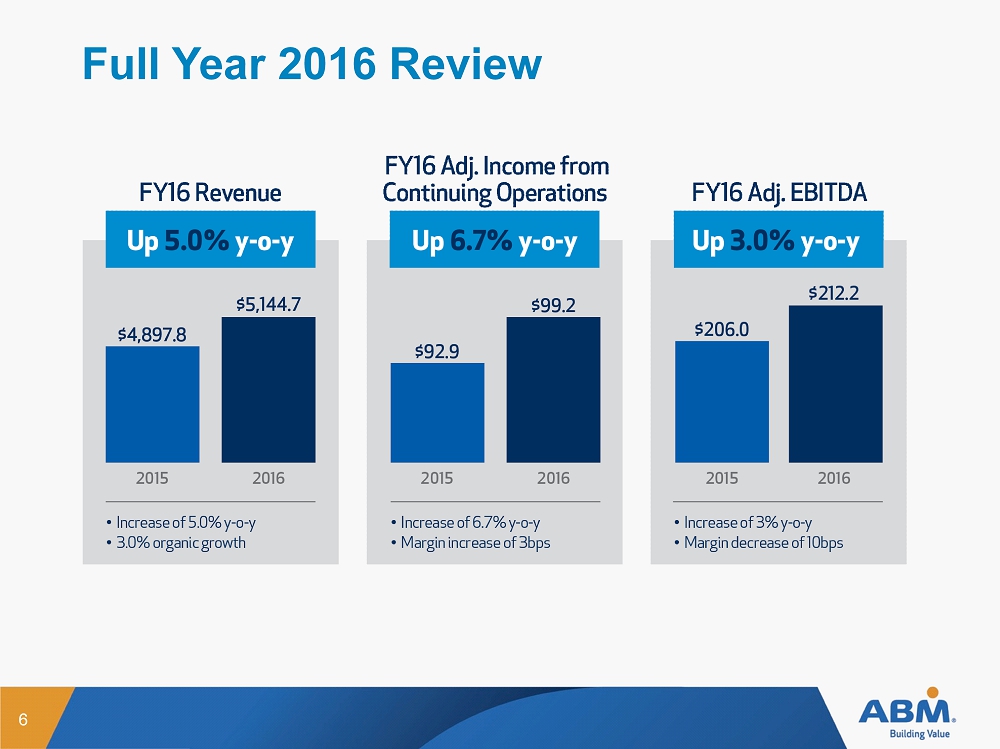

Full Year 2016 Review 6

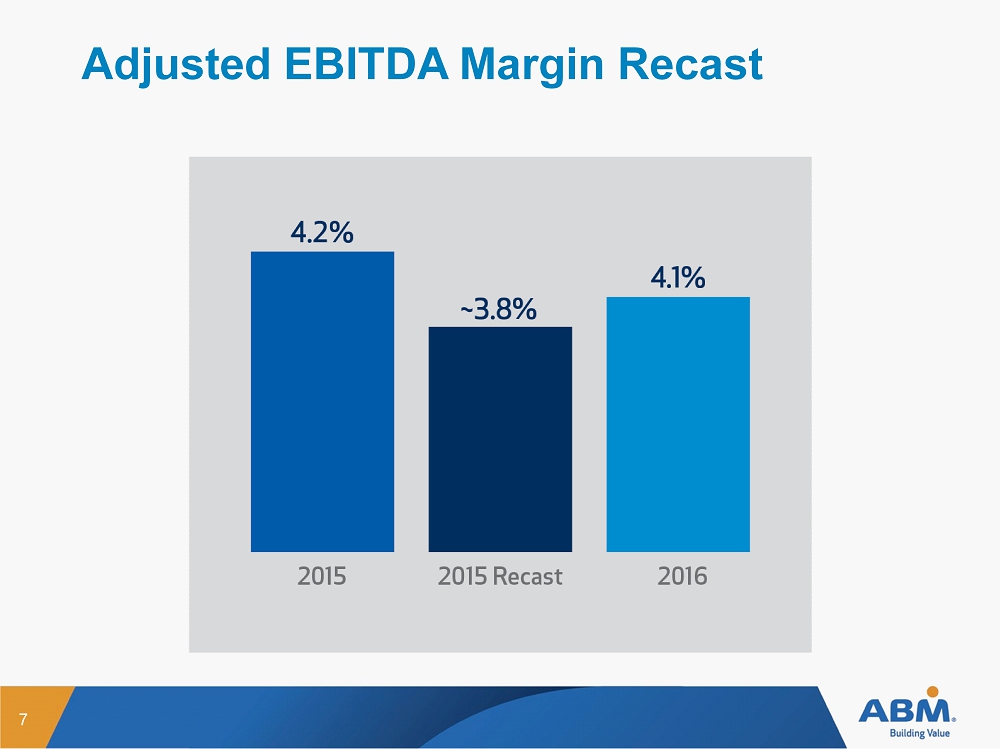

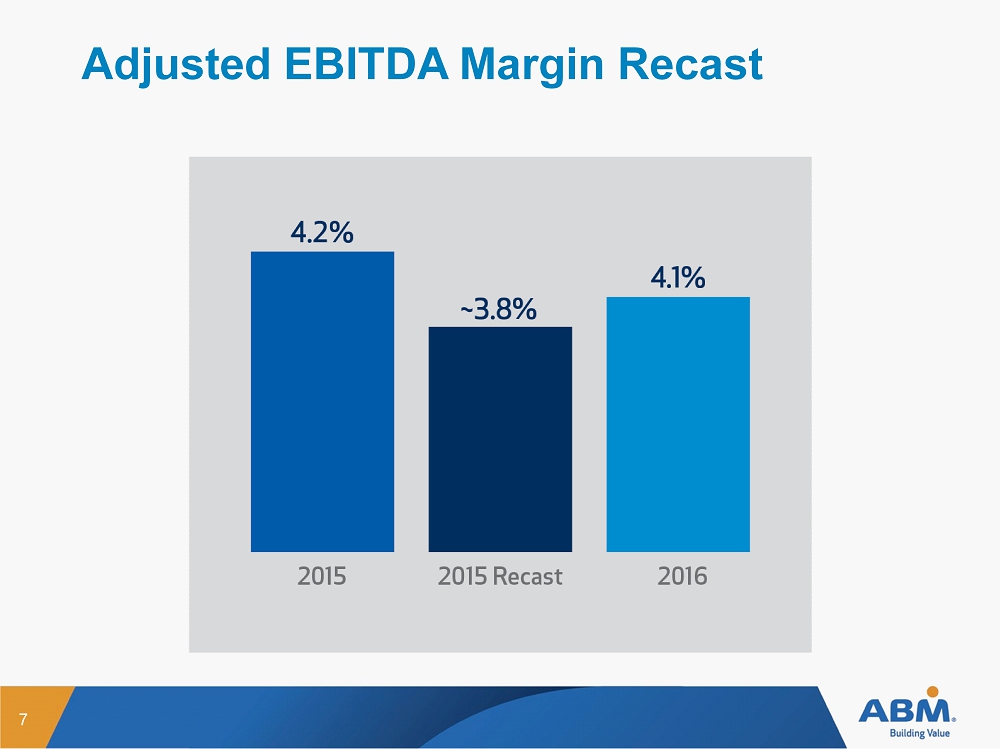

Adjusted EBITDA Margin Recast 7

Capital Structure

Select Cash Flow & Balance Sheet Items Leverage 9 Q4 FY16 Leverage of 2.17x * Note: Acquisitions shown represent purchase above $15m Long - Term Leverage Target 2.5x Future State 1 Decrease in FY15 Q4 leverage due to disposition of Security * Leverage calculated as total indebtedness / pro - forma adjusted EBITDA

Select Cash Flow & Balance Sheet Items Shareholder Return 10

Fiscal 2017 Outlook

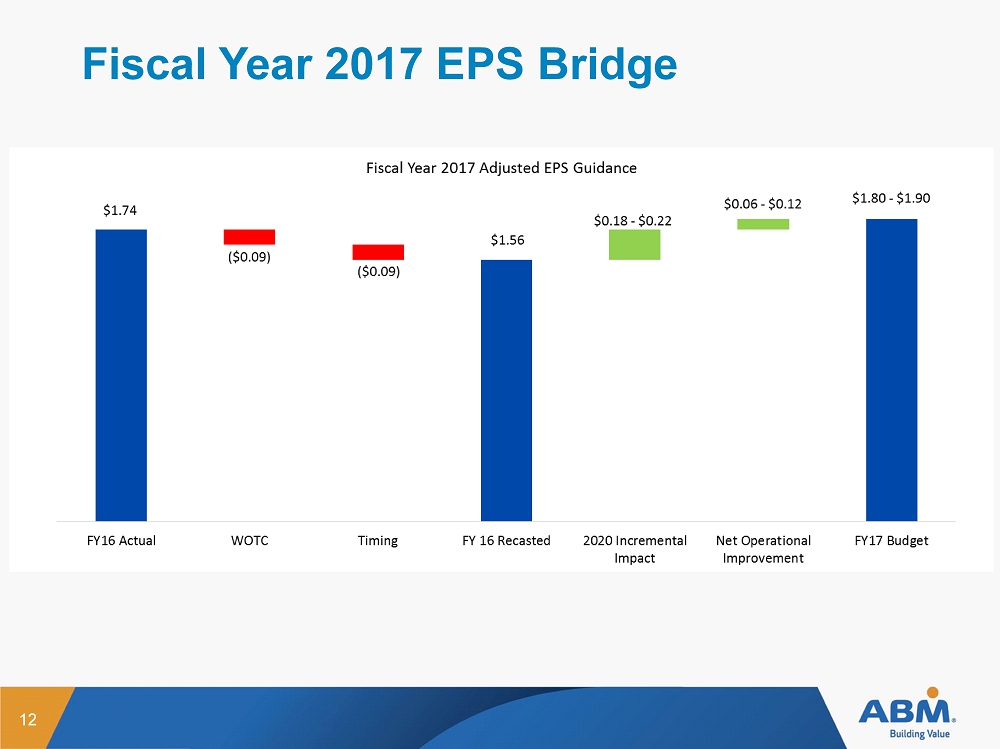

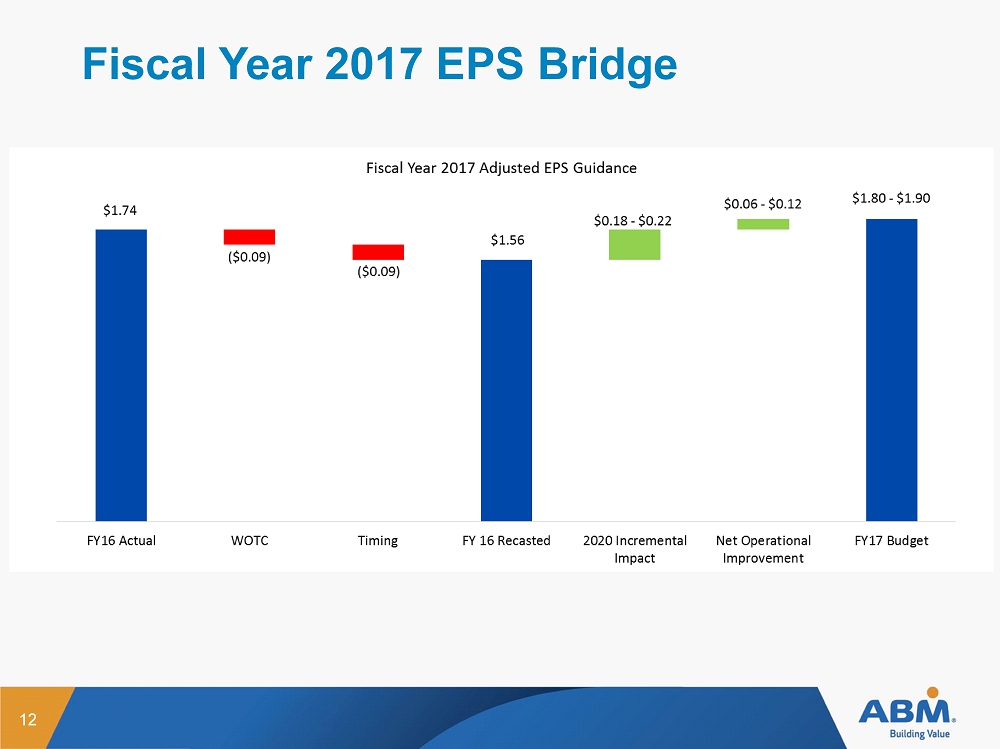

Fiscal Year 2017 EPS Bridge 12

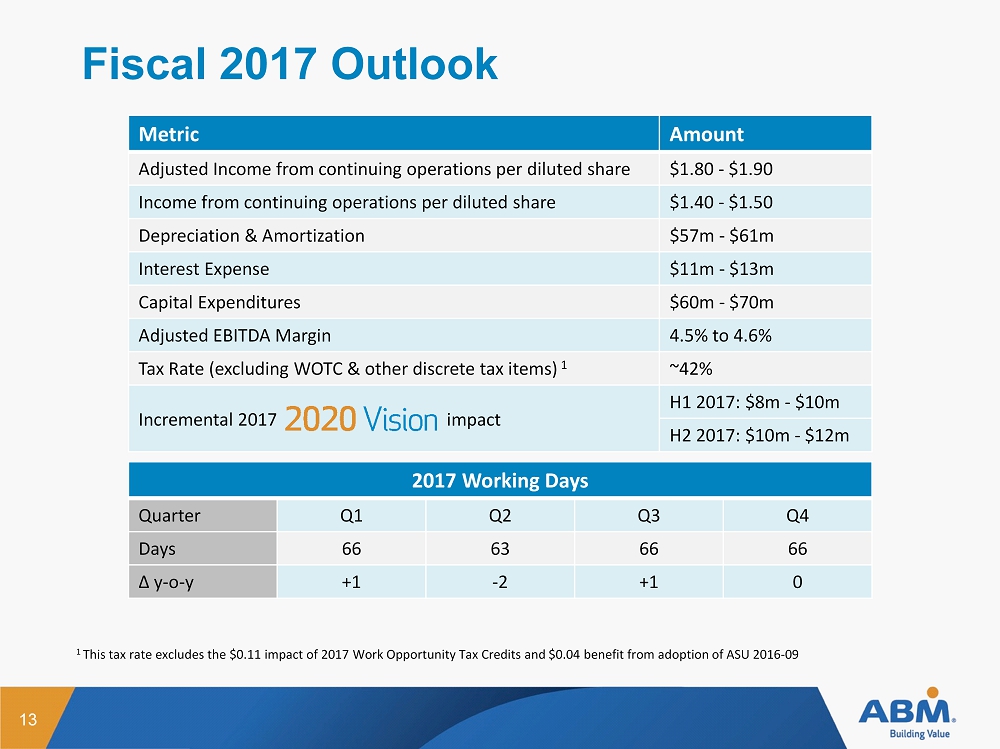

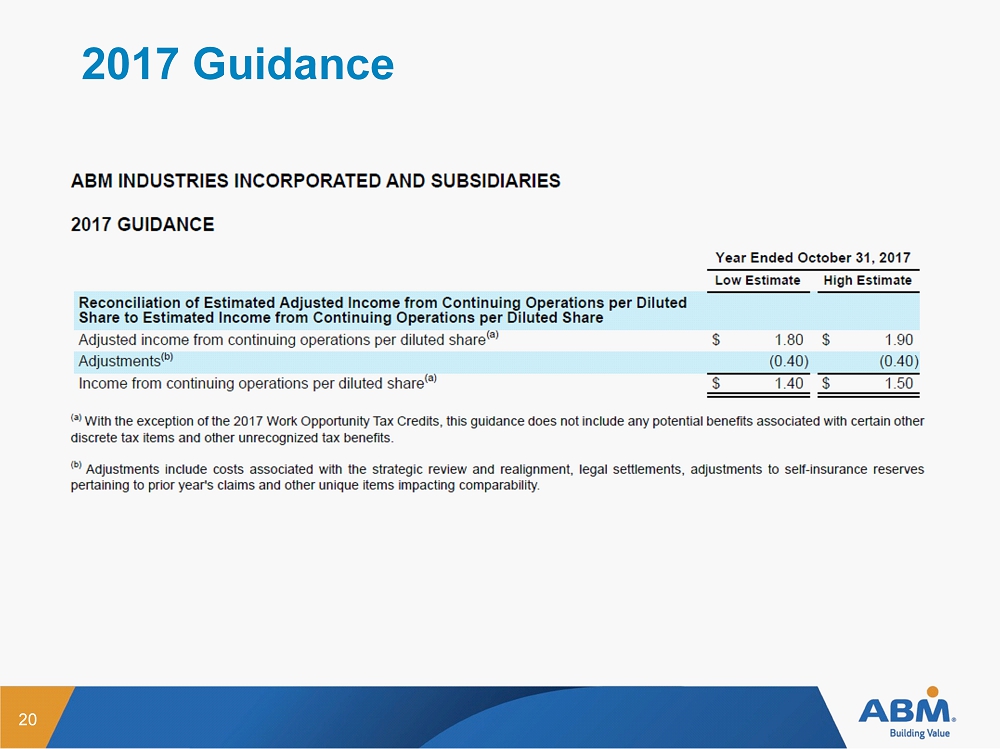

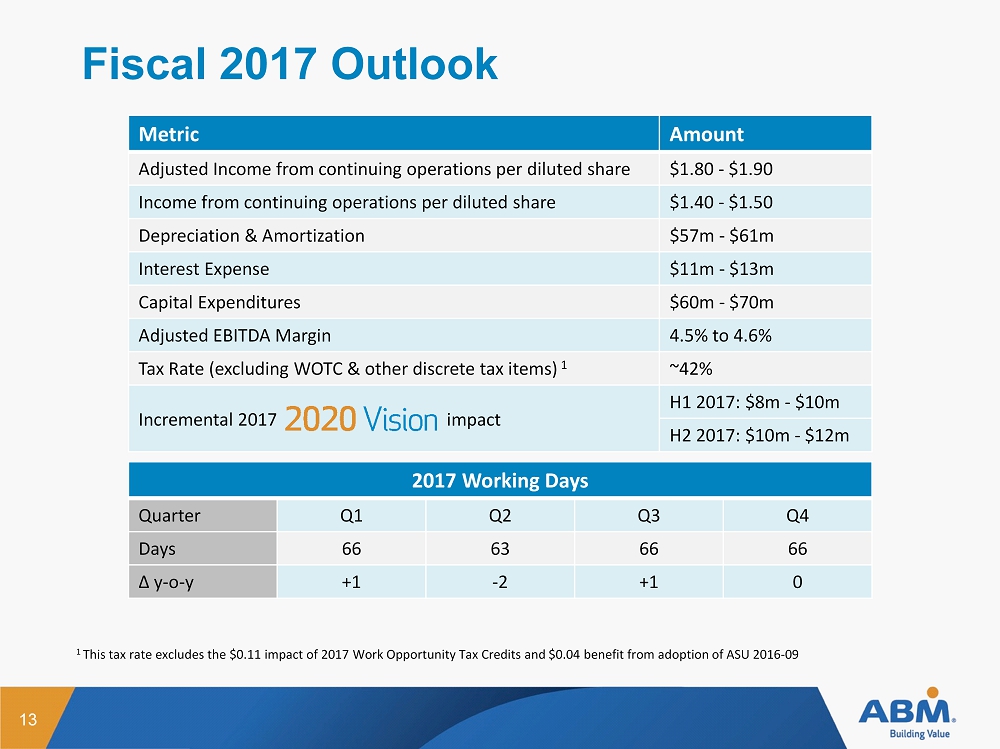

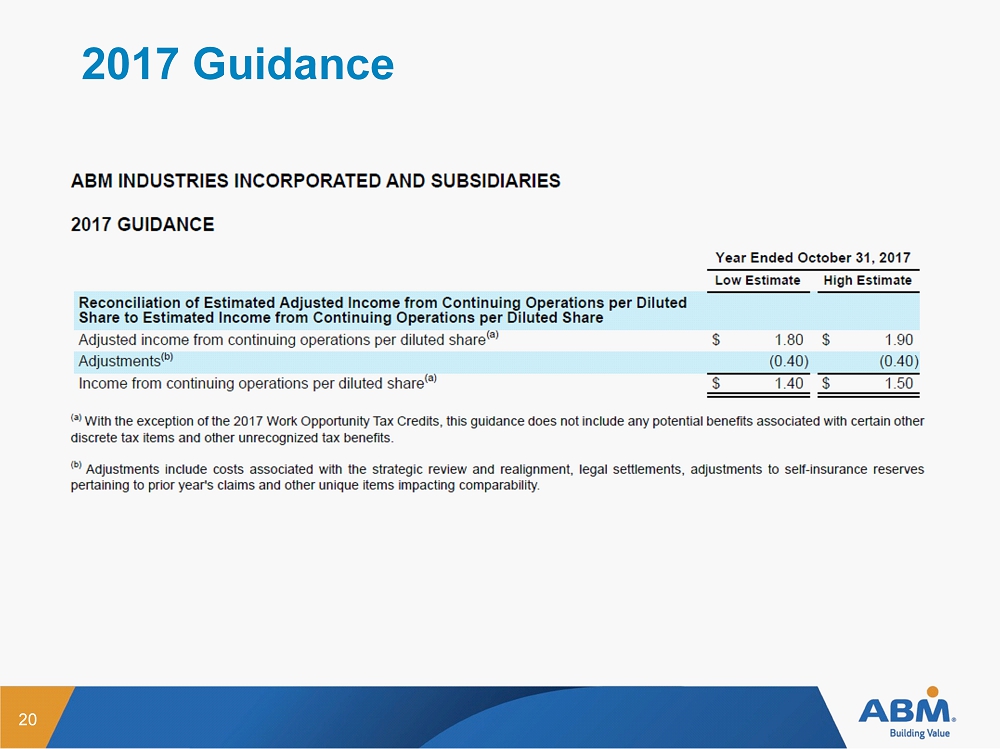

Fiscal 2017 Outlook 13 Metric Amount Adjusted Income from continuing operations per diluted share $1.80 - $1.90 Income from continuing operations per diluted share $1.40 - $1.50 Depreciation & Amortization $57m - $61m Interest Expense $11m - $13m Capital Expenditures $60m - $70m Adjusted EBITDA Margin 4.5% to 4.6% Tax Rate (excluding WOTC & other discrete tax items) 1 ~42% Incremental 2017 impact H1 2017: $8m - $10m H2 2017: $10m - $12m 1 This tax rate excludes the $0.11 impact of 2017 Work Opportunity Tax Credits and $0.04 benefit from adoption of ASU 2016-09 2017 Working Days Quarter Q1 Q2 Q3 Q4 Days 66 63 66 66 Δ y-o-y +1 -2 +1 0

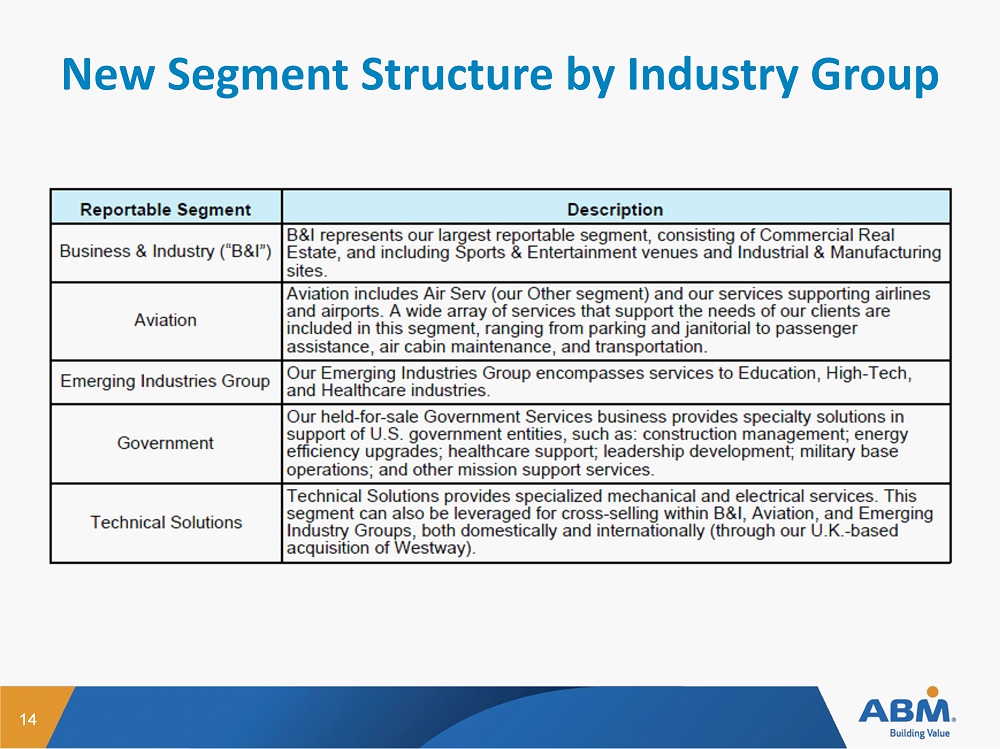

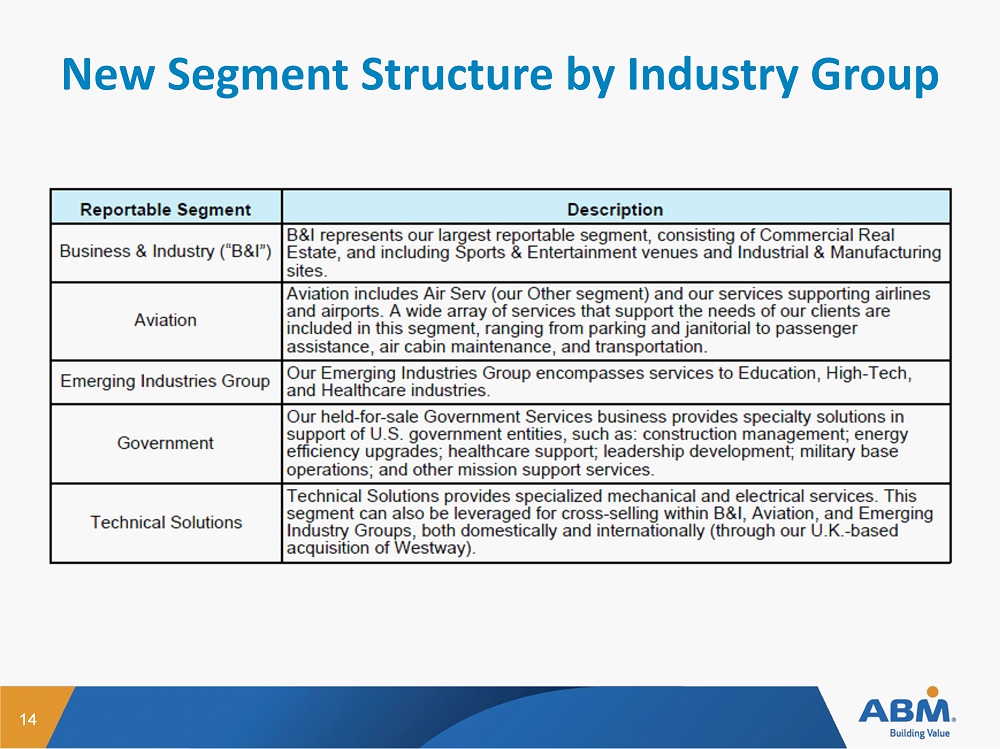

14 New Segment Structure by Industry Group

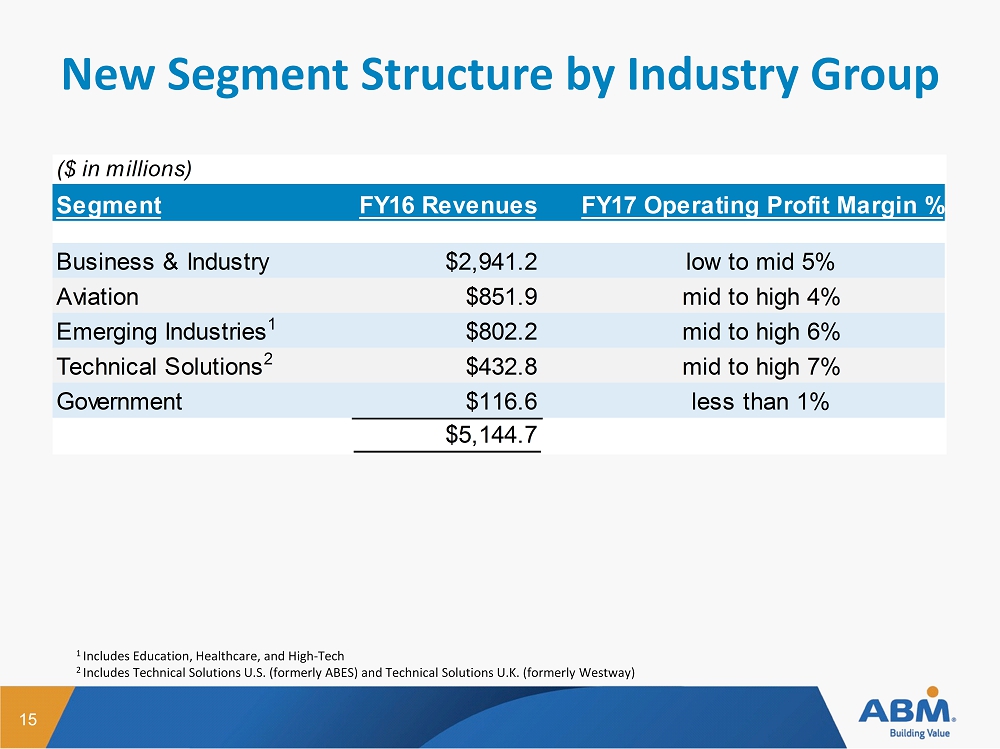

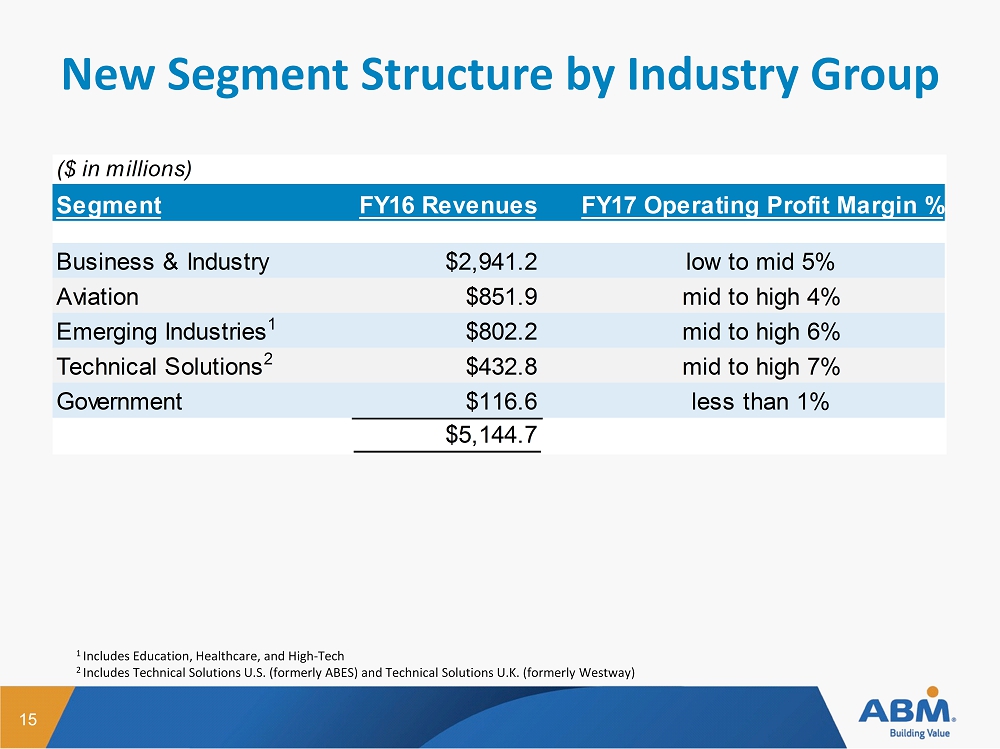

($ in millions) Segment FY16 Revenues FY17 Operating Profit Margin % Business & Industry $2,941.2 low to mid 5% Aviation $851.9 mid to high 4% Emerging Industries 1 $802.2 mid to high 6% Technical Solutions 2 $432.8 mid to high 7% Government $116.6 less than 1% $5,144.7 15 New Segment Structure by Industry Group 1 Includes Education, Healthcare, and High - Tech 2 Includes Technical Solutions U.S. (formerly ABES) and Technical Solutions U.K. (formerly Westway )

Forward - Looking Statement This presentation contains both historical and forward - looking statements. In this context, ABM Industries Incorporated (“ABM”) and its subsidiari es (collectively referred to as “ABM,” “we,” “us,” “our,” or the “Company”). We make forward - looking statements related to future expectations, estimates and pr ojections that are uncertain, and often contain words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “may,” “outlook,” “plan ,” “predict,” “should,” “target,” or other similar words or phrases. These statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, an d assumptions that are difficult to predict. For us, particular uncertainties that could cause our actual results to be materially different from those expressed in our forward - look ing statements include: (1) changes to our businesses, operating structure, financial reporting structure, or personnel relating to the implementation of our 2020 Vision strategic tra nsformation initiative may not have the desired effects on our financial condition and results of operations; (2) we may face difficulties identifying, acquiring, and integrating bu sin esses; (3) we have high deductibles for certain insurable risks, and therefore we are subject to volatility associated with those risks, including the possibility that changes in esti mat es of ultimate insurance losses could result in a material charge against our earnings; (4) our risk management and safety programs may not have the intended effect of allowing us to r edu ce our insurance costs for casualty programs; (5) our business success depends on our ability to attract and retain qualified personnel and senior management; (6) our business su ccess depends on our ability to preserve our long - term client relationships; (7) losses or other incidents at facilities in which we operate could cause significant damage to our reputation and financial loss; (8) our success depends on our ability to continue to gain profitable business despite competitive pressures; (9) costs that we cannot pass through to c lie nts could affect our profitability; (10) our business may be negatively impacted by adverse weather conditions; (11) negative or unexpected tax consequences could adversely affect our re sults of operations; (12) we may not achieve the expected benefits from our captive insurance company; (13) changes in energy prices and government regulations could adversel y i mpact the results of operations of our Building & Energy Solutions business; (14) significant delays or reductions in appropriations for our government contracts may negativel y a ffect our business and could have an adverse effect on our financial position, results of operations, and cash flows; (15) our ability to do business may be affected by the fail ure of our joint venture partners to perform their obligations; (16) we could be subject to cyber - security risks, information technology interruptions, and business continuity risks; (17) oper ations in areas of military conflict expose us to additional risks; (18) general reductions in commercial office building occupancy could affect our revenues and profitability ; ( 19) deterioration of general economic conditions could reduce the demand for facility services and, as a result, reduce our earnings and adversely affect our financial condition; ( 20) unfavorable developments in our class and representative actions and other lawsuits alleging various claims could cause us to incur substantial liabilities; (21) chang es in immigration laws or enforcement actions or investigations under such laws could significantly adversely affect our labor force, operations, and financial results; (22) our participation in multiemployer pension plans could result in material liabilities; (23) future increases in the level of our borrowings or in interest rates could affect our results o f o perations; (24) impairment of goodwill and long - lived assets could have a material adverse effect on our financial condition and results of operations; (25) actions of activist investors co uld disrupt our business; and (26) catastrophic events, disasters, and terrorist attacks could disrupt our services. The list of factors above is illustrative and by no means exhaus tiv e. Additional information regarding these and other risks and uncertainties we face is contained in our Annual Report on Form 10 - K for the year ended October 31, 2015 and in other reports we file from time to time with the Securities and Exchange Commission (including all amendments to those reports). We ur ge readers to consider these risks and uncertainties in evaluating our forward - looking statements. We caution readers not to place undue reliance upon any such forward - looking statements, which speak only as of the date made. We undertake no obligation to publicly update any forward - looking statements, whether as a result of new information, future events, or otherwise, except as required by law. 16

Appendix

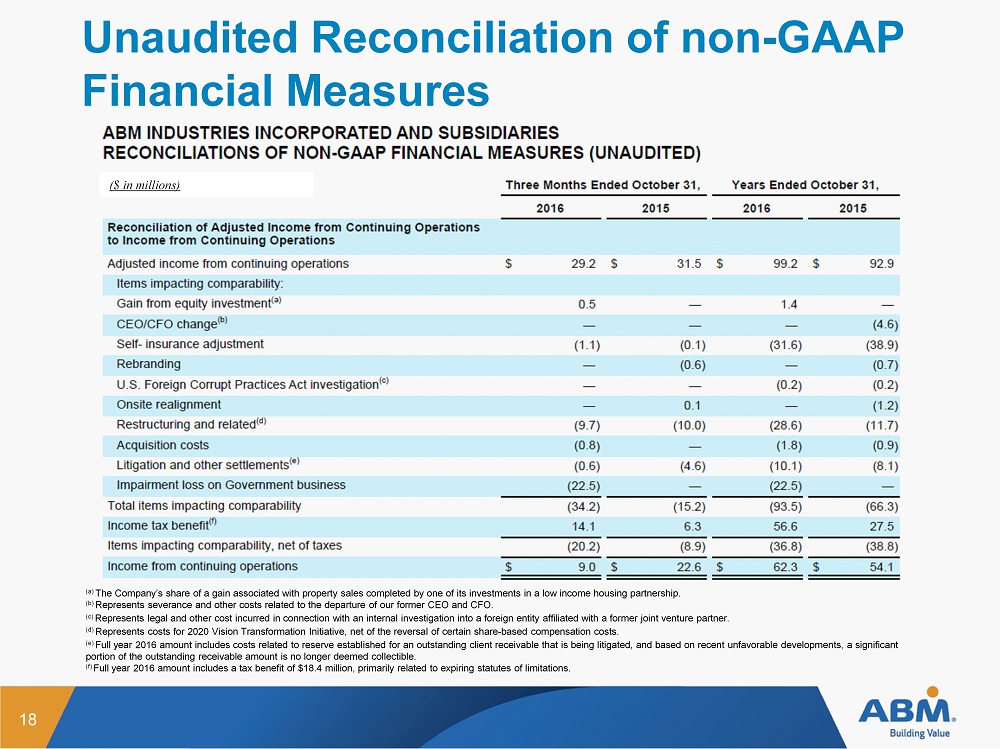

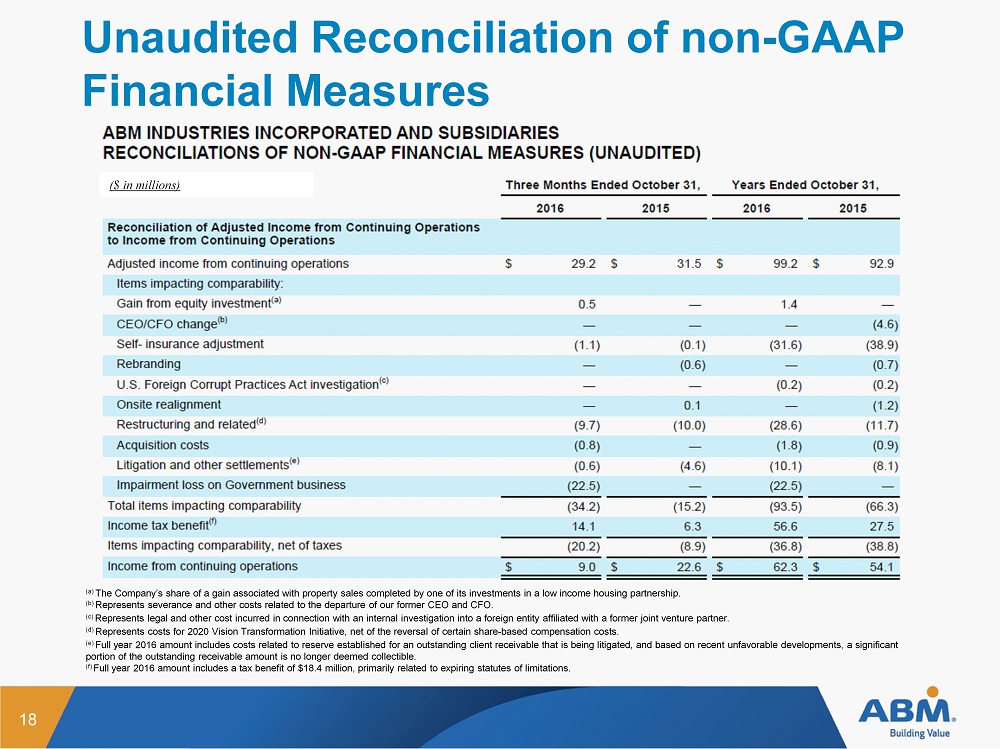

Unaudited Reconciliation of non - GAAP Financial Measures 18 (a) The Company’s share of a gain associated with property sales completed by one of its investments in a low income housing part ner ship. (b) Represents severance and other costs related to the departure of our former CEO and CFO. (c) Represents legal and other cost incurred in connection with an internal investigation into a foreign entity affiliated with a former joint ven tur e partner . (d) Represents costs for 2020 Vision Transformation Initiative, net of the reversal of certain share - based compensation costs . (e) Full year 2016 amount includes costs related to reserve established for an outstanding client receivable that is being litiga ted , and based on recent unfavorable developments, a significant portion of the outstanding receivable amount is no longer deemed collectible. (f) Full year 2016 amount includes a tax benefit of $18.4 million, primarily related to expiring statutes of limitations. ($ in millions)

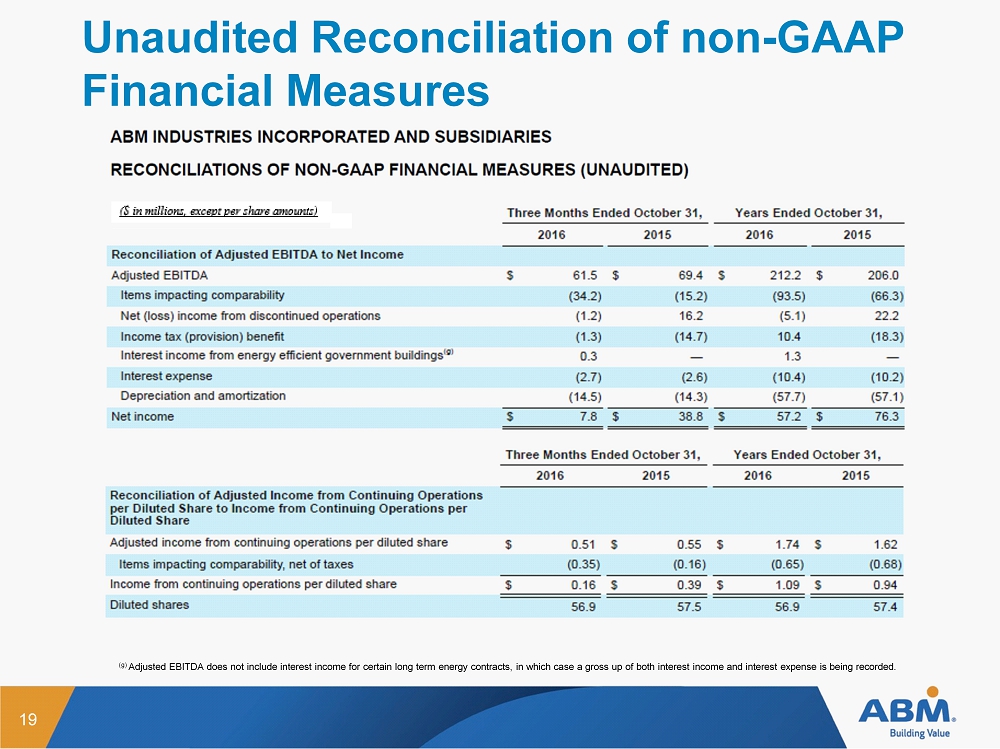

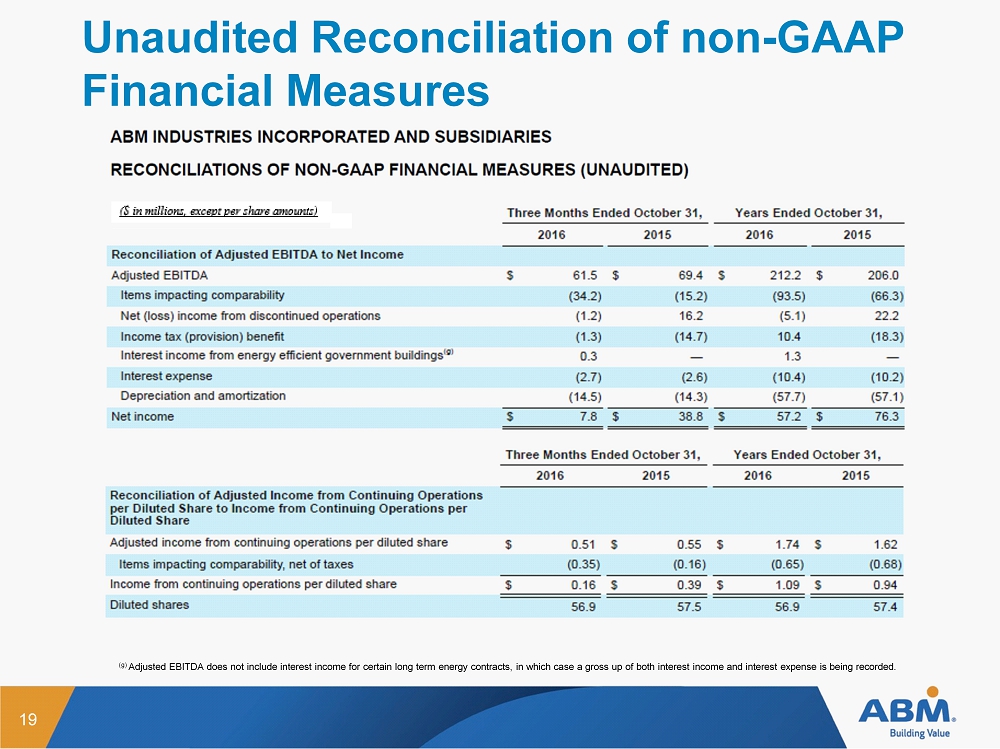

Unaudited Reconciliation of non - GAAP Financial Measures 19 ($ in millions, except per share amounts) (g) Adjusted EBITDA does not include interest income for certain long term energy contracts, in which case a gross up of both int ere st income and interest expense is being recorded.

2017 Guidance 20