SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No.______)

Filed by the Registrant [ X ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ X ] Soliciting Material Pursuant to Sec. 240.14a-11(c) or

Federated Total Return Government Bond Fund

(Name of Registrant as Specified In Its Charter)

Federated Investors

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4)

and 0-11.

1. Title of each class of securities to which transaction applies:

2. Aggregate number of securities to which transaction applies:

3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4. Proposed maximum aggregate value of transaction:

[ ] Fee paid previously with preliminary proxy materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

_______________________________________________________________

2) Form, Schedule or Registration Statement No.:

_______________________________________________________________

3) Filing Party:

_______________________________________________________________

4) Date Filed:

_______________________________________________________________

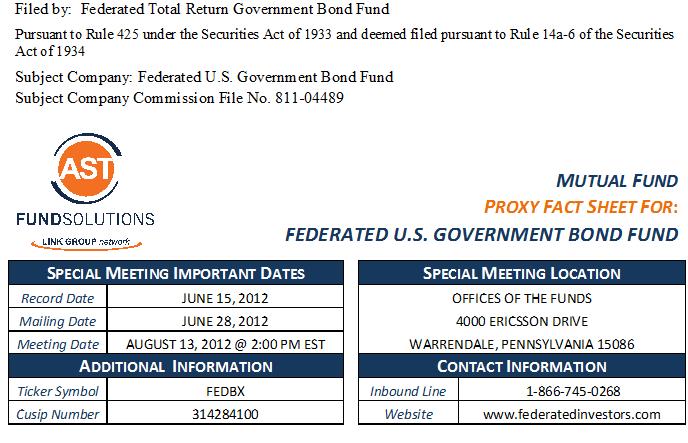

ACQUIRED FUND (CURRENT) | CUSIP | TICKER SYMBOL | ACQUIRING FUND (NEW) | CUSIP | TICKER SYMBOL |

| Federated U.S. Government Bond Fund | 314284100 | FEDBX | Federated Total Return Government Bond Fund | 31429A204 | FTGSX |

What are shareholders being asked to vote on?

| 1. | To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which Federated Total Return Government Bond Fund (“Acquiring Fund”), would acquire all or substantially all of the assets of Federated U.S. Government Bond Fund (“Acquired Fund”) in exchange for Service Shares of Acquiring Fund to be distributed pro rata by Acquired Fund in complete liquidation and termination of Acquired Fund. |

BOARD OF TRUSTEES RECOMMENDATION: FOR

PROPOSAL 1:

Why are shareholders being asked to approve or disapprove a proposed Agreement and Plan of Reorganization?

The Reorganization was recommended to the Board becauseFederated U.S. Government Bond Fund has experienced net outflows over the last five calendar years totaling $45 million, and in the opinion of Federated Investment Management Company, as the investment adviser to bothFunds, Federated U.S. Government Bond Fund‘s ability to generate significant flows over the long term is uncertain. There will be no dilution to shareholders in the transaction, because eachFederated U.S. Government Bond Fund shareholder will become the owner of shares ofFederated Total Return Government Bond Fund having a total net asset value equal to the total net asset value of his or her holdings inFederated U.S. Government Bond Fund on the date of the Reorganization. The Board has approved, and is recommending thatFederated U.S. Government Bond Fund shareholders approve, the Reorganization ofFederated U.S. Government Bond Fund intoFederated Total Return Government Bond Fund.

How will shareholders of the fund benefit from the proposed Reorganization?

| · | Federated U.S. Government Bond Fund shareholders will be receiving shares in a more viable fund with significantly lower expenses. |

| · | Federated Total Return Government Bond Fund has a larger asset base thanFederated U.S. Government Bond Fund, giving it greater viability and growth prospects; |

| · | Because each Fund has somewhat similar investment objectives and policies, their principal risks will be similar. Federated U.S. Government Bond Fund shareholders will receive shares in a more diversified portfolio of government securities with less interest rate sensitivity. |

Which Fund has historically performed better?

WhileFederated U.S. Government Bond Fund has outperformedFederated Total Return Government Bond Fund, this can largely be attributed toFederated U.S. Government Bond Fund’s longer duration which has benefited from a secular declining interest rate environment. On a risk adjusted basis,Federated Total Return Government Bond Fund has performance metrics that have been superior toFederated U.S. Government Bond Fund. The Reorganization would provide the shareholders ofFederated U.S. Government Bond Fund with an investment product that continues to provide shareholders with total return investment strategy, consistent with current income.

Will fees & expenses increase as a result of the proposed Reorganization?

The Adviser believes that the proposed Reorganization will result inFederated U.S. Government Bond Fund’s shareholders receiving shares in a fund that has significantly lower expenses thanFederated U.S. Government Bond Fund. While the Service Shares ofFederated Total Return Government Bond Fund charge up to 25 basis point in a 12b-1 distribution fee whereasFederated U.S. Government Bond Fund does not charge any 12b-1 distribution fee,Federated Total Return Government Bond Fund’s total gross and net expenses, including Acquired Fund Fees and Expenses, are lower than those ofFederated U.S. Government Bond Fund.

In addition:

the Adviser has indicated that it may eliminate or substantially reduce the voluntary waiver and reimbursement of certain fees and operating expenses such thatFederated U.S. Government Bond Fund would be unable to maintain its expenses at their current levels as they reflect significant fee waivers.

Will the value of my investment change if the proposed Reorganization is approved?

The cash value of each shareholder’s investment will not change as a result of the Reorganization, and shareholders will not have to pay any sales charge in connection with the transfer of their assets. Shareholders will receive shares of Federated Total Return Government Bond Fund with a total dollar value equal to the total dollar value of the Federated U.S. Government Bond Fund shares that are owned at the time of the Reorganization.

Will the investment objectives and strategies of the Fund change if the proposed Reorganization is approved?

The investment objective of Federated U.S. Government Bond Fund is to pursue total return. The investment objective of Federated Total Return Government Bond Fund is to pursue total return consistent with current income. The investment objectives, policies and risks of the Funds are somewhat similar. While Federated U.S. Government Bond Fund and Federated Total Return Government Bond Fund are both government bond funds, with somewhat similar objectives and strategies, their duration strategy is quite different. FUSGBF’s average effective duration is 6.2 units longer than that of FTRGBF (11.1 for FUSGBF and 4.9 for FTRGBF as of March 31, 2012.)

Will my current account options transfer over to my new account? (Account servicing options)

Servicing features will transfer automatically to each shareholder’s Federated Total Return Government Bond Fund account. However, if a shareholder participates in a systematic investment program a communication will be received requesting confirmation of continued participation in such a plan.

If the proposed Reorganization is approved, when will it occur?

Assuming shareholder approval is obtained, the Reorganization is currently expected to occur after the close of business on or aboutAugust 24, 2012.

Will the reorganization qualify as tax-free for federal income tax purposes?

The Reorganization is expected to be a tax-free reorganization under the Internal Revenue Code of 1986, as amended.

Who will bear the costs of the proposed Reorganization?

| · | Given Federated U.S. Government Bond Fund’s large waiver positions and the fact that Federated U.S. Government Bond Fund is being operated at its applicable voluntary expense caps, Federated will likely indirectly pay the expenses that Federated U.S. Government Bond Fund is being asked to pay; |

| · | The Adviser will pay the other direct and indirect expenses of the Reorganization (consisting primarily of legal and accounting fees); |

Additional Information:

| • | Federated U.S. Government Bond Fund will pay direct proxy expenses (e.g., mailing, processing, tabulation, printing and solicitation costs and expenses) associated with the Reorganization estimated at $20,000; |

| • | Federated Total Return Government Bond Fund will pay registration fees, with respect to securities issued pursuant to the Reorganization, on an as incurred basis; |

| • | Federated Total Return Government Bond Fund will pay brokerage expenses related to the sale of any assets acquired in the proposed Reorganization and purchase of replacement securities (to maintain Federated Total Return Government Bond Fund’s duration and market position), estimated at $19,000. The Adviser estimates that up to 90% of the securities received from Federated U.S. Government Bond Fund may be sold following the Reorganization. |

THE BOARD OF TRUSTEES RECOMMENDS A VOTE “FOR” PROPOSAL 1

What was included in the proxy package?

Included in the proxy package were a Notice of Special Meeting, Proxy Statement and Proxy Ballot.

Is there a number to contact the Fund regarding non-proxy related questions?

1-800-341-7400.

INTERNET:Log on to the website provided on your proxycardand make sure to have your proxy card available when you plan to vote your shares.

| MAIL: | Simply sign, date, and complete the reverse side of your proxy card and return it in the postage paid envelope provided. |

IN PERSON: All shareholders as of the record date may attend the Annual Meeting.

PROXY MATERIALS AVAILABLE ONLINE AT:www.proxyonline.us/docs/fusgbf.pdf

Federated Total Return Government Bond Fund (ICA No. 811-7309) has filed a prospectus/proxy statement and other relevant documents, concerning the planned transaction with the United States Securities and Exchange Commission (the “SEC”). INVESTORS ARE URGED TO READ THE PROSPECTUS/PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PLANNED TRANSACTION, OR INCORPORATED BY REFERENCE INTO THE PROSPECTUS/PROXY STATEMENT, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. These documents are available free of charge on the SEC’s Web site atwww.sec.gov. In addition, documents filed with the SEC by Federated Total Return Government Bond Fund are available free of charge at 1-800-341-7400 orwww.federatedinvestors.com.