UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

FORM 10-K/A

(Amendment No. 1)

________________________________________________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission file number: 1-13283

_________________________________________________________

PENN VIRGINIA CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

| Virginia | | 23-1184320 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Four Radnor Corporate Center, Suite 200

100 Matsonford Road

Radnor, Pennsylvania 19087

(Address of principal executive offices)

Registrant’s telephone number, including area code: (610) 687-8900

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: |

| | |

| Title of each class | | Name of exchange on which registered |

| Common Stock, $0.01 Par Value | | New York Stock Exchange |

__________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”). Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One) |

| | | | | | | | | | |

| Large accelerated filer | ý | | Accelerated filer | o | | Non-accelerated filer | o | | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of common stock held by non-affiliates of the registrant was $1,152,221,812 as of June 30, 2014 (the last business day of its most recently completed second fiscal quarter), based on the last sale price of such stock as quoted on the New York Stock Exchange. For purposes of making this calculation only, the registrant has defined affiliates as including all directors and executive officers of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of July 14, 2015, 71,676,606 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE - NONE

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

ANNUAL REPORT (Amendment) ON FORM 10-K/A

For the Fiscal Year Ended December 31, 2014

Table of Contents

|

| | |

| | Page |

| Explanatory Note | |

| Forward-Looking Statements | |

| Glossary of Certain Industry Terminology | |

| Part I |

| Item | | |

| 2. | Properties | |

| Part II |

| | | |

| 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations: | |

| | Overview and Executive Summary | |

| | Key Developments | |

| | Results of Operations | |

| | Financial Condition | |

| | Off-Balance Sheet Arrangements | |

| | Contractual Obligations | |

| | Critical Accounting Estimates | |

| | | |

| Part IV |

| | | |

| 15. | Exhibits and Financial Statement Schedules | |

| | |

| Signatures | |

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Form 10-K/A”) to the Annual Report on Form 10-K of Penn Virginia Corporation (the “Company”) for the fiscal year ended December 31, 2014, originally filed with the Securities and Exchange Commission on February 25, 2015 (the “Original 10-K”), is being filed for the purpose of amending certain disclosures, and providing further disclosures, regarding the Company's proved undeveloped reserves as set forth on page 22 of the Original 10-K and the effect of commodity price changes on the Company's proved reserves as set forth on page 30 of the Original 10-K.

This Form 10-K/A includes Item 2 of Part I, Item 7 of Part II and Item 15 of Part IV. This Form 10-K/A also includes a currently dated consent of the Company’s independent petroleum engineers, as well as CEO and CFO certifications pursuant to Section 302 of the Sarbanes Oxley Act of 2002. Because no financial statements have been included in this Form 10-K/A, and this Form 10-K/A does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraph 3 of the CEO and CFO certifications has been revised to omit the reference to financial statements and paragraphs 4 and 5 of the CEO and CFO certifications have been omitted.

Except as described above, this Form 10-K/A does not modify or update disclosures in, or exhibits to, the Original 10-K. Furthermore, this Form 10-K/A does not change any previously reported financial results, nor does it reflect events occurring after the date of the Original 10-K. Information not affected by this Form 10-K/A remains unchanged and reflects the disclosures made at the time the Original 10-K was filed.

Forward-Looking Statements

Certain statements contained herein that are not descriptions of historical facts are “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to, the following:

| |

| • | the volatility of commodity prices for oil, natural gas liquids and natural gas; |

| |

| • | our ability to develop, explore for, acquire and replace oil and gas reserves and sustain production; |

| |

| • | our ability to generate profits or achieve targeted reserves in our development and exploratory drilling and well operations; |

| |

| • | any impairments, write-downs or write-offs of our reserves or assets; |

| |

| • | the projected demand for and supply of oil, natural gas liquids and natural gas; |

| |

| • | reductions in the borrowing base under our revolving credit facility; |

| |

| • | our ability to contract for drilling rigs, supplies and services at reasonable costs; |

| |

| • | our ability to obtain adequate pipeline transportation capacity for our oil and gas production at reasonable cost and to sell the production at, or at reasonable discounts to, market prices; |

| |

| • | the uncertainties inherent in projecting future rates of production for our wells and the extent to which actual production differs from estimated proved oil and gas reserves; |

| |

| • | drilling and operating risks; |

| |

| • | our ability to compete effectively against other oil and gas companies; |

| |

| • | our ability to successfully monetize select assets and repay our debt; |

| |

| • | leasehold terms expiring before production can be established; |

| |

| • | environmental obligations, costs and liabilities that are not covered by an effective indemnity or insurance; |

| |

| • | the timing of receipt of necessary regulatory permits; |

| |

| • | the effect of commodity and financial derivative arrangements; |

| |

| • | our ability to maintain adequate financial liquidity and to access adequate levels of capital on reasonable terms; |

| |

| • | the occurrence of unusual weather or operating conditions, including force majeure events; |

| |

| • | our ability to retain or attract senior management and key technical employees; |

| |

| • | counterparty risk related to the ability of these parties to meet their future obligations; |

| |

| • | compliance with and changes in governmental regulations or enforcement practices, especially with respect to environmental, health and safety matters; |

| |

| • | physical, electronic and cybersecurity breaches; |

| |

| • | uncertainties relating to general domestic and international economic and political conditions; and |

| |

| • | other factors set forth in our periodic filings with the Securities and Exchange Commission, including the risks set forth in Item 1A of this Annual Report on Form 10-K for the year ended December 31, 2014. |

Additional information concerning these and other factors can be found in our press releases and public periodic filings with the Securities and Exchange Commission. Many of the factors that will determine our future results are beyond the ability of management to control or predict. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Glossary of Certain Industry Terminology

The following abbreviations, terms and definitions are commonly used in the oil and gas industry and are used within this Annual Report on Form 10-K/A.

AMI. Area of mutual interest.

Bbl. A standard barrel of 42 U.S. gallons liquid volume of oil or other liquid hydrocarbons.

Bcf. One billion cubic feet of natural gas.

Bcfe. One billion cubic feet of natural gas equivalent with one barrel of crude oil, condensate or natural gas liquids converted to six thousand cubic feet of natural gas based on the estimated relative energy content.

BOE. One barrel of oil equivalent with six thousand cubic feet of natural gas converted to one barrel of crude oil based on the estimated relative energy content.

BOEPD. Barrels of oil equivalent per day.

Borrowing base. The value assigned to a collection of borrower’s assets used by lenders to determine an initial and/or continuing amount for loans. In the case of oil and gas exploration and development companies, the borrowing base is generally based on proved developed reserves.

Completion. A process of treating a drilled well, including hydraulic fracturing among other stimulation processes, followed by the installation of permanent equipment for the production of oil or gas.

Condensate. A mixture of hydrocarbons that exists in the gaseous phase at original reservoir temperature and pressure, but that, when produced, is in the liquid phase at surface temperature and pressure.

Development well. A well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive.

Dry hole. A well found to be incapable of producing either oil or gas in sufficient commercial quantities to justify completion of the well.

Drilling carry. A working interest that will be carried through the drilling and completion of a well.

Exploratory well. A well drilled to find a new field or to find a new reservoir in a field previously found to be productive of oil or gas in another reservoir. Generally, an exploratory well is any well that is not a development well, a service well or a stratigraphic test well.

EUR. Estimated ultimate reserves, the sum of reserves remaining as of a given date and cumulative production as of that date.

GAAP. Accounting principles generally accepted in the Unites States of America.

Gas lift. A method of artificial lift that uses an external source of high-pressure gas for supplementing formation gas for lifting the well fluids.

Gross acre or well. An acre or well in which a working interest is owned.

HBP. Held by production is a provision in an oil and gas or mineral lease that perpetuates the leaseholder’s right to operate the property as long as the property produces a minimum paying quantity of oil or gas.

Henry Hub. The Erath, Louisiana settlement point price for natural gas.

IP. Initial production, a measurement of a well’s production at the outset.

LLS. Light Louisiana Sweet is a crude oil pricing index reference.

LIBOR. London Interbank Offered Rate.

MBbl. One thousand barrels of oil or other liquid hydrocarbons.

MBOE. One thousand barrels of oil equivalent.

Mcf. One million barrels of oil or other liquid hydrocarbons.

MMBbl. One million barrels of oil or other liquid hydrocarbons.

MMBOE. One million barrels of oil equivalent.

MMBtu. One million British thermal units, a measure of energy content.

MMcf. One million cubic feet of natural gas.

Net acre or well. The number of gross acres or wells multiplied by the owned working interest in such gross acres or wells.

NGL. Natural gas liquid.

NYMEX. New York Mercantile Exchange.

NYSE. New York Stock Exchange.

Operator. The entity responsible for the exploration and/or production of a lease or well.

Play. A geological formation with potential oil and gas reserves.

Preferential rights. The rights that nonselling participating parties have in a lease, well or unit to proportionately acquire the interest that a participating party proposes to sell to a third party.

Productive wells. Wells that are not dry holes.

Possible reserves. Those additional reserves that are less certain to be recovered than probable reserves. When probabilistic methods are used, there should be at least a 10% probability that the total quantities ultimately recovered will equal or exceed the proved plus probable plus possible reserves estimates.

Probable reserves. Those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered. When probabilistic methods are used, there should be at least a 50% probability that the actual quantities recovered will equal or exceed the proved plus probable reserves estimates.

Proved reserves. Those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods and government regulations before the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation.

Proved developed reserves. Proved reserves that can be expected to be recovered: (a) through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared with the cost of a new well or (b) through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well.

Proved undeveloped reserves. Proved reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion. Reserves on undrilled acreage are limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled.

PV10. Present value of estimated future oil and gas revenues, net of estimated direct expenses, discounted at an annual discount rate of 10%.

Reservoir. A porous and permeable underground formation containing a natural accumulation of hydrocarbons that is confined by impermeable rock or water barriers and is separate from other reservoirs.

SEC. United States Securities and Exchange Commission.

Standardized measure. The present value, discounted at 10% per year, of estimated future cash inflows from the production of proved reserves, computed by applying prices used in estimating proved oil and gas reserves to the year-end quantities of those reserves (except for consideration of future price changes to the extent provided by contractual arrangements in existence at year-end), reduced by estimated future development and production costs, computed by estimating the expenditures to be incurred in developing and producing the proved oil and gas reserves at the end of the year (including the settlement of asset retirement obligations), based on year-end costs and assuming continuation of existing economic conditions, further reduced by estimated future income tax expenses, computed by applying the appropriate year-end statutory tax rates, with consideration of future tax rates already legislated, to the future pretax net cash flows relating to the proved oil and gas reserves, less the tax basis of the properties involved and giving effect to the tax deductions and tax credits and allowances relating to the proved oil and gas reserves.

Revenue interest. An economic interest in production of hydrocarbons from a specified property.

Royalty interest. An interest in the production of a well entitling the owner to a share of production generally free of the costs of exploration, development and production.

Unconventional. Generally refers to hydrocarbon reservoirs that lack discrete boundaries that typically define conventional reservoirs. They are typically referred to as shales, tight sands or coal beds.

Undeveloped acreage. Lease acreage on which wells have not been drilled or completed to a point that would permit the production of economic quantities of oil or gas, regardless of whether such acreage contains proved reserves.

WTI. West Texas Intermediate, a crude oil pricing index reference.

Working interest. A cost-bearing interest under an oil and gas lease that gives the holder the right to develop and produce the minerals under the lease.

Part I

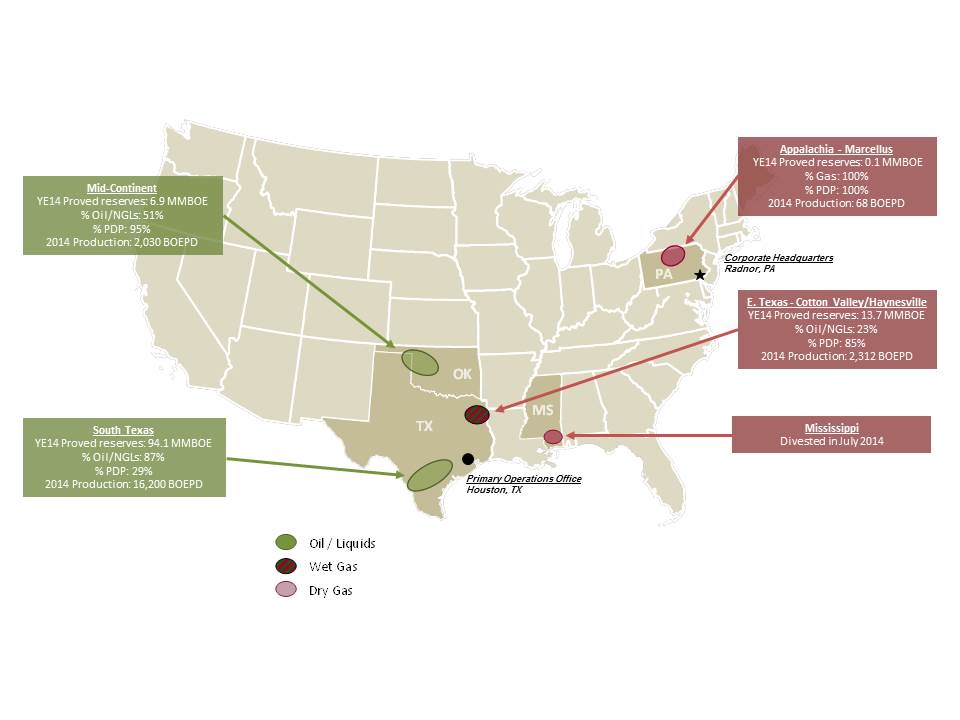

The following map shows the general locations of our oil and gas assets as of December 31, 2014:

Facilities

All of our office facilities are leased with the exception of our district operations facilities in Scottsville, Texas. We believe that our facilities are adequate for our current needs.

Title to Oil and Gas Properties

Prior to completing an acquisition of producing oil and gas assets, we review title opinions on all material leases. However, as is customary in the oil and gas industry, we make a cursory review of title to farmout acreage and when we acquire undeveloped oil and gas leases. Prior to the commencement of drilling operations, a thorough title examination is conducted. To the extent the title examination reflects defects, we cure such title defects. If we are unable to cure any title defect of a nature such that it would not be prudent to commence drilling operations on a property, we could suffer a loss of our investment in the property. Our oil and gas properties are subject to customary royalty interests, liens for debt obligations, current taxes and other burdens that we believe do not materially interfere with the use or materially affect the value of such properties. We believe that we have satisfactory title to all of our properties and the associated oil and gas in accordance with standards generally accepted in the oil and gas industry.

Summary of Oil and Gas Reserves

Proved Reserves

The following tables summarize certain information regarding our estimated proved reserves as of December 31 for each of the years presented:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Crude Oil | | NGLs | | Natural Gas | | Oil Equivalents | | Standardized Measure | | Price Measurement Used 1 |

| | (MMBbl) | | (MMBbl) | | (Bcf) | | (MMBOE) | | $ in millions | | $/Bbl of Oil | | $/Bbl of NGLs | | $/MMBtu |

| 2014 | |

| | | | |

| | |

| | |

| | |

| | |

| | |

| Developed | | | | | | |

| | | | | | | | |

| Producing | 21.8 |

| | 7.4 |

| | 77.9 |

| | 42.1 |

| | $ | 794.9 |

| | | | | | |

| Non-producing | 0.3 |

| | 0.7 |

| | 16.6 |

| | 3.8 |

| | 8.6 |

| | | | | | |

| | 22.1 |

| | 8.1 |

| | 94.5 |

| | 45.9 |

| | 803.5 |

| | | | | | |

| Undeveloped | 47.0 |

| | 11.1 |

| | 64.7 |

| | 68.9 |

| | 378.9 |

| | | | | | |

| | 69.0 |

| | 19.2 |

| | 159.2 |

| | 114.8 |

| | $ | 1,182.4 |

| | $ | 92.91 |

| | $ | 25.49 |

| | $ | 4.32 |

|

| 2013 |

| |

| |

| |

| |

| | | | | | |

| Developed | | | | | | | | | | | | | | | |

| Producing | 19.0 |

| | 7.5 |

| | 146.5 |

| | 50.9 |

| | $ | 701.7 |

| | | | | | |

| Non-producing | 0.3 |

| | 1.0 |

| | 16.7 |

| | 4.1 |

| | 7.3 |

| | | | | | |

| | 19.3 |

| | 8.5 |

| | 163.2 |

| | 55.0 |

| | 709.0 |

| | | | | | |

| Undeveloped | 41.4 |

| | 13.4 |

| | 158.9 |

| | 81.3 |

| | 554.8 |

| | | | | | |

| | 60.7 |

| | 21.9 |

| | 322.1 |

| | 136.3 |

| | $ | 1,263.8 |

| | $ | 103.11 |

| | $ | 31.10 |

| | $ | 3.47 |

|

| 2012 | | | | | | | | | | | | | | | |

| Developed | | | | | | | | | | | | | | | |

| Producing | 10.2 |

| | 7.0 |

| | 152.0 |

| | 42.5 |

| | $ | 408.5 |

| | | | | | |

| Non-producing | 0.3 |

| | 1.2 |

| | 17.4 |

| | 4.5 |

| | 43.0 |

| | | | | | |

| | 10.5 |

| | 8.3 |

| | 169.4 |

| | 47.0 |

| | 451.5 |

| | | | | | |

| Undeveloped | 14.4 |

| | 12.4 |

| | 238.1 |

| | 66.5 |

| | 46.4 |

| | | | | | |

| | 24.9 |

| | 20.7 |

| | 407.5 |

| | 113.5 |

| | $ | 497.9 |

| | $ | 102.24 |

| | $ | 39.48 |

| | $ | 2.47 |

|

1 Crude oil and natural gas prices were based on average (beginning of month basis) sales prices per Bbl and MMBtu with the representative price of natural gas adjusted for basis premium and energy content to arrive at the appropriate net price. NGL prices were estimated as a percentage of the base crude oil price.

All of our reserves are located in the continental United States. The following table sets forth by region the estimated quantities of proved reserves and the percentages thereof that are represented by proved developed reserves as of December 31, 2014:

|

| | | | | | | | | |

| | | Proved | | % of Total Proved | | % Proved |

| Region | | Reserves | | Reserves | | Developed |

| | | (MMBOE) | | |

| | |

|

| Texas | | | |

|

| | |

| South Texas | | 94.1 |

| | 82 | % | | 29 | % |

| East Texas | | 13.7 |

| | 12 | % | | 85 | % |

| Mid-Continent | | 6.9 |

| | 6 | % | | 95 | % |

Other 1 | | 0.1 |

| | — | % | | 100 | % |

| | | 114.8 |

| | 100 | % | | 40 | % |

___________________

1 Comprised of our three active Marcellus Shale wells.

Proved Undeveloped Reserves

The proved undeveloped reserves included in our reserve estimates relate to wells that are forecasted to be drilled within five years of the initial booking of such reserves. The following table sets forth the changes in our proved undeveloped reserves during the year ended December 31, 2014:

|

| | | | | | | | | | | |

| | Crude Oil | | NGLs | | Natural Gas | | Oil Equivalents |

| | (MMBbl) | | (MMBbl) | | (Bcf) | | (MMBOE) |

| Proved undeveloped reserves at beginning of year | 41.4 |

| | 13.4 |

| | 158.9 |

| | 81.3 |

|

| Revisions of previous estimates | (5.1 | ) | | (5.4 | ) | | (84.2 | ) | | (24.5 | ) |

| Extensions, discoveries and other additions | 18.4 |

| | 5.1 |

| | 26.5 |

| | 28.0 |

|

| Sale of reserves in place | — |

| | — |

| | (26.1 | ) | | (4.4 | ) |

| Conversion to proved developed reserves | (7.7 | ) | | (2.0 | ) | | (10.5 | ) | | (11.5 | ) |

| Proved undeveloped reserves at end of year | 47.0 |

| | 11.1 |

| | 64.7 |

| | 68.9 |

|

In 2014, our proved undeveloped reserves decreased by 12.4 MMBOE. Proved undeveloped reserves were revised downward from previous estimates by 24.5 MMBOE, consisting of 19.1 MMBOE in the Cotton Valley and Haynesville Shale in East Texas, 1.6 MMBOE in the Granite Wash in the Mid-Continent and 3.8 MMBOE in the Eagle Ford in South Texas. The East Texas revisions resulted from us removing predomininantly natural gas reserves associated with locations the we determined would likely not be drilled during a five-year period from initial booking because of the continued depression of natural gas prices and the better economic returns in the Eagle Ford. The Granite Wash revisions resulted from the operator of our non-operated acreage deciding to defer the drilling of several non-operated locations. We eliminated the reserves associated with those locations when we determined that the rescheduled drilling dates were beyond five years from initial booking. The Eagle Ford revisions resulted from our determination that the reserves associated with those locations would be captured by existing producing wells.

Extensions, discoveries and other additions of 28.0 MMBOE were attributable to our activities in the Eagle Ford.

We sold our Selma Chalk assets in Mississippi resulting in a decrease of 4.4 MMBOE of proved undeveloped reserves.

We also converted 11.5 MMBOE from proved undeveloped to proved developed reserves in the Eagle Ford. During 2014, we incurred capital expenditures of approximately $381 million in connection with the conversion of proved undeveloped reserves to proved developed reserves. Several factors impacted the rate at which proved undeveloped reserves were converted to developed status. Our Eagle Ford Shale development plan was significantly affected by the dramatic drop in oil prices in the second half of 2014. As we continued to develop and become more knowledgeable about our Eagle Ford Shale acreage up to and through 2014, we also changed our development plan so that we could concentrate our limited capital on our highest economic return locations. This resulted in in the deferral of our planned development of certain proved undeveloped reserves. Our conversion rate was also affected by the decision of the operator of several non-operated locations in teh Granite Wash in the Mid-Continent to defer drilling of those locations initially scheduled for 2014.

The following table sets forth the total proved undeveloped reserves as of December 31, 2014 by region:

|

| | | | | | | | | | | |

| | Crude Oil | | NGLs | | Natural Gas | | Oil Equivalents |

| | (MMBbl) | | (MMBbl) | | (Bcf) | | (MMBOE) |

| Texas | | | | | | | |

| South Texas | 46.7 |

| | 10.7 |

| | 54.7 |

| | 66.5 |

|

| East Texas | 0.2 |

| | 0.3 |

| | 8.9 |

| | 2.0 |

|

| Mid-Continent | 0.1 |

| | 0.1 |

| | 1.1 |

| | 0.4 |

|

| | 47.0 |

| | 11.1 |

| | 64.7 |

| | 68.9 |

|

Preparation of Reserves Estimates and Internal Controls

The proved reserve estimates were prepared by Wright & Company, Inc., our independent third party petroleum engineers. For additional information regarding estimates of proved reserves and other information about our oil and gas reserves, see the Supplemental Information on Oil and Gas Producing Activities (Unaudited) in our Notes to the Consolidated Financial Statements and the report of Wright & Company, Inc., prepared for us and dated January 9, 2015, which is included as an Exhibit to this Annual Report on Form 10-K. We did not file any reports during the year ended December 31, 2014 with any federal authority or agency with respect to our estimate of oil and gas reserves.

Our policies and practices regarding the recording of reserves are structured to objectively and accurately estimate our oil and gas reserve quantities and present values in compliance with the SEC’s regulations and GAAP. Our Vice President, Operations & Engineering is primarily responsible for overseeing the preparation of the reserve estimate by Wright & Company, Inc. Our Vice President, Operations & Engineering has over 29 years of industry experience in the estimation and evaluation of reserve information, holds a B.S. degree in Petroleum Engineering from Texas A&M University and is licensed by the State of Texas as a Professional Engineer. Our internal controls over reserve estimates include reconciliation and review controls, including an independent internal review of assumptions used in the estimation.

There are numerous uncertainties inherent in estimating quantities of reserves and in projecting future rates of production and timing of development expenditures, including many factors beyond our control. For additional information about the risks inherent in our estimates of proved reserves, see Item 1A, “Risk Factors.”

Qualifications of Third Party Petroleum Engineers

The technical person primarily responsible for review of our reserve estimates at Wright & Company, Inc. meets the requirements regarding qualifications, independence, objectivity and confidentiality set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers. Wright & Company, Inc. is an independent firm of petroleum engineers, geologists, geophysicists and petro physicists; they do not own an interest in our properties and are not employed on a contingent fee basis.

Oil and Gas Production, Production Prices and Production Costs

Oil and Gas Production by Region

The following tables set forth by region the total production and average daily production for the periods presented:

|

| | | | | | | | | | | | | | | |

| | | | | Total Production for the Year Ended December 31, |

| Region | | | | | | | | 2014 | | 2013 | | 2012 |

| | | | | | | | | |

| | (MBOE) | | |

|

| Texas | | | | | | | | | | | | |

South Texas 1 | | | | | | | | 5,913 |

| | 4,091 |

| | 2,334 |

|

| East Texas | | | | | | | | 844 |

| | 1,020 |

| | 1,337 |

|

| Mid-Continent | | | | | | | | 741 |

| | 937 |

| | 1,211 |

|

Other 2 | | | | | | | | 437 |

| | 776 |

| | 1,631 |

|

| | |

| |

| |

| | 7,934 |

| | 6,824 |

| | 6,513 |

|

| | | | | | | | | | | | | |

| | | | | | | | | Average Daily Production for the Year Ended December 31, |

| | | | | | | | | 2014 | | 2013 | | 2012 |

| | | | | | | | | | | (BOEPD) | | |

| Texas | | | | | | | | | | | | |

South Texas 1 | | | | | | | | 16,201 |

| | 11,208 |

| | 6,377 |

|

| East Texas | | | | | | | | 2,311 |

| | 2,795 |

| | 3,653 |

|

| Mid-Continent | | | | | | | | 2,029 |

| | 2,567 |

| | 3,309 |

|

Other 2 | | | | | | | | 1,196 |

| | 2,126 |

| | 4,456 |

|

| | | | | | | | | 21,738 |

| | 18,696 |

| | 17,795 |

|

1 We completed the EF Acquisition in April 2013.

2 Currently consists of our three active Marcellus Shale wells. We sold all of our properties in the Selma Chalk in Mississippi in July 2014, which represented annual production and average daily production of approximately 412 MBOE (1,946 BOEPD), 751 MBOE (2,058 BOEPD) and 847 MBOE (2,314 BOEPD) in 2014, 2013 and 2012, respectively. We sold all of our properties in West Virginia, Kentucky and Virginia in July 2012, which represented annual production and average daily production of approximately 741 MBOE (2,100 BOEPD) in 2012.

Production Prices and Production Costs

The following table sets forth the average sales prices per unit of volume and our average production costs, not including ad valorem and production/severance taxes, per unit of production for the periods presented:

|

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| Average prices: | | | | | |

| Crude oil ($ per Bbl) | $ | 90.50 |

| | $ | 101.13 |

| | $ | 101.95 |

|

| NGLs ($ per Bbl) | $ | 31.14 |

| | $ | 31.30 |

| | $ | 35.13 |

|

| Natural gas ($ per Mcf) | $ | 4.44 |

| | $ | 3.64 |

| | $ | 2.46 |

|

| Aggregate ($ per BOE) | $ | 64.64 |

| | $ | 63.11 |

| | $ | 47.67 |

|

| Average production and lifting cost ($ per BOE): | | | | | |

| Lease operating | $ | 6.09 |

| | $ | 5.20 |

| | $ | 4.80 |

|

| Gathering processing and transportation | 2.31 |

| | 1.88 |

| | 2.18 |

|

| | $ | 8.40 |

| | $ | 7.08 |

| | $ | 6.98 |

|

Significant Fields

Our properties in the Eagle Ford in South Texas, which contain primarily oil reserves, represent approximately 82 percent of our total equivalent proved reserve quantities and approximately 93 percent of our total crude oil and NGL reserves as of December 31, 2014. This is the only field that comprises 15% or more of our total proved reserves as of that date.

The following table sets forth certain information with respect to this field for the periods presented:

|

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| Production: | |

| | |

| | |

|

| Crude oil (MBbl) | 4,450 |

| | 3,197 |

| | 1,960 |

|

| NGLs (MBbl) | 773 |

| | 478 |

| | 205 |

|

| Natural gas (MMcf) | 4,070 |

| | 2,406 |

| | 1,015 |

|

| Total (MBOE) | 5,901 |

| | 4,077 |

| | 2,334 |

|

| Percent of total company production | 74 | % | | 60 | % | | 36 | % |

| Average prices: | | | | | |

| Crude oil ($ per Bbl) | $ | 90.57 |

| | $ | 101.55 |

| | $ | 103.33 |

|

| NGLs ($ per Bbl) | $ | 25.23 |

| | $ | 26.68 |

| | $ | 31.43 |

|

| Natural gas ($ per Mcf) | $ | 4.20 |

| | $ | 3.52 |

| | $ | 2.56 |

|

| Aggregate ($ per BOE) | $ | 74.49 |

| | $ | 84.85 |

| | $ | 90.63 |

|

Average production and lifting cost ($ per BOE)1: | | | | | |

| Lease operating | $ | 5.36 |

| | $ | 4.30 |

| | $ | 3.12 |

|

| Gathering processing and transportation | 1.76 |

| | 1.08 |

| | 0.72 |

|

| | $ | 7.12 |

| | $ | 5.38 |

| | $ | 3.84 |

|

1 Excludes production/severance and ad valorem taxes.

Drilling and Other Exploratory and Development Activities

The following table sets forth the gross and net development and exploratory wells that we drilled during the years ended December 31, 2014, 2013 and 2012 and wells that were in progress at the end of each year. The number of wells drilled refers to the number of wells completed at any time during the year, regardless of when drilling was initiated.

|

| | | | | | | | | | | | | | | | | |

| | 2014 | | 2013 | | 2012 |

| | Gross | | Net | | Gross | | Net | | Gross | | Net |

| Development | |

| | |

| | |

| | |

| | |

| | |

|

| Productive | 83 |

| | 50.8 |

| | 58 |

| | 34.1 |

| | 36 |

| | 27.8 |

|

| Non-productive | 1 |

| | 0.8 |

| | — |

| | — |

| | — |

| | — |

|

| Under evaluation | — |

| | — |

| | 1 |

| | 0.5 |

| | — |

| | — |

|

| Total development | 84 |

| | 51.6 |

| | 59 |

| | 34.6 |

| | 36 |

| | 27.8 |

|

| | | | | | | | | | | | |

| Exploratory | |

| | |

| | |

| | |

| | |

| | |

|

| Productive | — |

| | — |

| | — |

| | — |

| | 5 |

| | 3.9 |

|

| Non-productive | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Under evaluation | — |

| | — |

| | — |

| | — |

| | 1 |

| | 1.0 |

|

| Total exploratory | — |

| | — |

| | — |

| | — |

| | 6 |

| | 4.9 |

|

| Total | 84 |

| | 51.6 |

| | 59 |

| | 34.6 |

| | 42 |

| | 32.7 |

|

| | | | | | | | | | | | |

Wells in progress at end of year1 | 28 |

| | 14.3 |

| | 16 |

| | 11.5 |

| | 3 |

| | 2.7 |

|

1 Includes 12 gross (5.4 net) wells completing or flowing back, 11 gross (5.9 net) waiting on completion and five gross (3.0 net) wells being drilled as of December 31, 2014.

The following table sets forth the regions in which we drilled our wells for the periods presented:

|

| | | | | | | | | | | | | | | | | | |

| | | 2014 | | 2013 | | 2012 |

| Region | | Gross | | Net | | Gross | | Net | | Gross | | Net |

| Texas | | | | | | | | | | | | |

South Texas 1 | | 84 |

| | 51.6 |

| | 57 |

| | 34.1 |

| | 35 |

| | 29.5 |

|

| East Texas | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Mid-Continent | | — |

| | — |

| | 2 |

| | 0.5 |

| | 7 |

| | 3.2 |

|

| Other | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| | | 84 |

| | 51.6 |

| | 59 |

| | 34.6 |

| | 42 |

| | 32.7 |

|

1 Includes six gross (2.2 net) wells acquired in 2013 in connection with the EF Acquisition that were in progress when acquired.

Present Activities

As of December 31, 2014, we had 28 gross (14.3 net) wells in progress, all of which were located in the Eagle Ford in South Texas. As of February 20, 2015, 17 gross (8.6 net) of these wells had been successfully completed and were producing.

Delivery Commitments

We generally sell our oil, NGL and natural gas products using short-term floating price physical and spot market contracts. Although it is not our general practice, from time to time we enter into certain transactions in which we provide production commitments extending beyond one month. As of December 31, 2014, we did not have any material commitments to provide a fixed and determinable quantity of our products beyond the current month.

Productive Wells

The following table sets forth by region the productive wells in which we had a working interest as of December 31, 2014:

|

| | | | | | | | | | | | | | | | | | |

| | | Primarily Oil | | Primarily Natural Gas | | Total |

| Region | | Gross | | Net | | Gross | | Net | | Gross | | Net |

| Texas | | | | | | | | | |

|

| |

|

|

South Texas 1 | | 275 |

| | 175.2 |

| | — |

| | — |

| | 275 |

| | 175.2 |

|

| East Texas | | — |

| | — |

| | 356 |

| | 254.9 |

| | 356 |

| | 254.9 |

|

| Mid-Continent | | 5 |

| | 3.1 |

| | 99 |

| | 42.6 |

| | 104 |

| | 45.7 |

|

Other 2 | | — |

| | — |

| | 3 |

| | 3.0 |

| | 3 |

| | 3.0 |

|

| | | 280 |

| | 178.3 |

| | 458 |

| | 300.5 |

| | 738 |

| | 478.8 |

|

_______________________

1 Includes wells in both the lower and upper Eagle Ford, or Marl, as well as the Pearsall Shale and Austin Chalk.

2 Consists of our three active Marcellus wells.

Of the total wells presented in the table above, we are the operator of 607 gross (246 oil and 361 gas) and 433.0 net (165.3 oil and 267.7 gas) wells. In addition to the above working interest wells, we own royalty interests in nine gross wells.

Acreage

The following table sets forth by region our developed and undeveloped acreage as of December 31, 2014 (in thousands):

|

| | | | | | | | | | | | | | | | | | |

| | | Developed | | Undeveloped | | Total |

| Region | | Gross | | Net | | Gross | | Net | | Gross | | Net |

| Texas | | | | | | | | | |

|

| |

|

|

| South Texas | | 70.4 |

| | 45.2 |

| | 69.3 |

| | 56.6 |

| | 139.7 |

| | 101.8 |

|

| East Texas | | 45.3 |

| | 32.0 |

| | 2.1 |

| | 0.6 |

| | 47.4 |

| | 32.6 |

|

| Mid-Continent | | 16.5 |

| | 8.0 |

| | 5.0 |

| | 1.8 |

| | 21.5 |

| | 9.8 |

|

| Other | | 1.7 |

| | 1.3 |

| | 13.7 |

| | 13.1 |

| | 15.4 |

| | 14.4 |

|

| | | 133.9 |

| | 86.5 |

| | 90.1 |

| | 72.1 |

| | 224.0 |

| | 158.6 |

|

The primary terms of our leases generally range from three to five years and we do not have any concessions. As of December 31, 2014, our net undeveloped acreage is scheduled to expire as shown in the table below, unless the primary lease terms are, where appropriate, extended, HBP or otherwise changed:

|

| | | | | | | | | | | |

| | 2015 | | 2016 | | 2017 | | Thereafter |

| Percent of gross undeveloped acreage | 20 | % | | 44 | % | | 24 | % | | 12 | % |

| Percent of net undeveloped acreage | 15 | % | | 45 | % | | 26 | % | | 14 | % |

We do not believe that the scheduled expiration of our undeveloped acreage will substantially affect our ability or plans to conduct our exploration and development activities.

Part II

| |

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and Notes thereto included in Item 8, “Financial Statements and Supplementary Data.” All dollar amounts presented in the tables that follow are in thousands unless otherwise indicated. Certain year-over-year changes are presented as not meaningful, or “NM,” where disclosure of the actual value does not otherwise enhance the analysis. Also, due to the combination of different units of volumetric measure and the number of decimal places presented, certain results may not calculate explicitly from the values presented in the tables.

Overview and Executive Summary

We are an independent oil and gas company engaged in the exploration, development and production of oil, NGLs and natural gas in various onshore regions of the United States. Our current operations consist primarily of drilling unconventional horizontal development wells in the Eagle Ford Shale in South Texas. We also have operations in the Granite Wash in Oklahoma and the Haynesville Shale and Cotton Valley in East Texas. As of December 31, 2014, we had proved oil and gas reserves of approximately 115 MMBOE.

The following table sets forth certain summary operating and financial statistics for the periods presented:

|

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| Total production (MBOE) | 7,934 |

| | 6,824 |

| | 6,513 |

|

| Average daily production (BOEPD) | 21,738 |

| | 18,696 |

| | 17,795 |

|

| Crude oil and NGL production (MBbl) | 5,754 |

| | 4,417 |

| | 3,136 |

|

| Crude oil and NGL production as a percent of total | 73 | % | | 65 | % | | 48 | % |

| Product revenues, as reported | $ | 512,882 |

| | $ | 430,693 |

| | $ | 310,484 |

|

| Product revenues, adjusted for derivatives | $ | 505,458 |

| | $ | 429,651 |

| | $ | 338,802 |

|

| Crude oil and NGL revenues as a percent of total, as reported | 89 | % | | 88 | % | | 84 | % |

| Realized prices: | | | | | |

| Crude oil ($/Bbl) | $ | 90.50 |

| | $ | 101.13 |

| | $ | 101.95 |

|

| NGL ($/Bbl) | $ | 31.14 |

| | $ | 31.30 |

| | $ | 35.13 |

|

| Natural gas ($/Mcf) | $ | 4.44 |

| | $ | 3.64 |

| | $ | 2.46 |

|

| Aggregate ($/BOE) | $ | 64.64 |

| | $ | 63.11 |

| | $ | 47.67 |

|

| Production and lifting costs ($/BOE): | | | | | |

| Lease operating | $ | 6.09 |

| | $ | 5.20 |

| | $ | 4.80 |

|

| Gathering, processing and transportation | $ | 2.31 |

| | $ | 1.88 |

| | $ | 2.18 |

|

| Production and ad valorem taxes ($/BOE) | $ | 3.53 |

| | $ | 3.28 |

| | $ | 1.63 |

|

General and administrative ($/BOE) 1 | $ | 5.15 |

| | $ | 6.46 |

| | $ | 5.96 |

|

| Total operating costs ($/BOE) | $ | 17.08 |

| | $ | 16.82 |

| | $ | 14.57 |

|

| Depreciation, depletion and amortization ($/BOE) | $ | 37.85 |

| | $ | 35.99 |

| | $ | 31.68 |

|

Cash provided by operating activities 2 | $ | 282,724 |

| | $ | 261,512 |

| | $ | 241,458 |

|

| Cash paid for capital expenditures, excluding 2013 EF Acquisition | $ | 774,139 |

| | $ | 504,203 |

| | $ | 370,907 |

|

| Cash and cash equivalents at end of period | $ | 6,252 |

| | $ | 23,474 |

| | $ | 17,650 |

|

| Debt outstanding, net of discount, at end of period | $ | 1,110,000 |

| | $ | 1,281,000 |

| | $ | 594,759 |

|

Credit available under revolving credit facility at end of period 3 | $ | 413,196 |

| | $ | 191,346 |

| | $ | 297,922 |

|

| Proved reserves (MMBOE) | 115 |

| | 136 |

| | 113 |

|

| Net development wells drilled | 51.6 |

| | 34.6 |

| | 27.8 |

|

| Net exploratory wells drilled | — |

| | — |

| | 4.9 |

|

1 Excludes equity-classified share-based compensation, which is a non-cash expense, of $0.46, $0.84 and $0.98 and liability-classified share-based compensation of $0.57, $0.60 and $0.11 for the years ended December 31, 2014, 2013 and 2012.

2 Includes the receipt of a federal income tax refund of approximately $32 million in the year ended December 31, 2012 attributable to 2010 and prior years.

3 As reduced by outstanding borrowings and letters of credit. Also, excludes an additional $50 million attributable to the excess of the borrowing base of $500 million over the current commitment of $450 million for 2014.

In 2014, our crude oil and NGL production increased to 73 percent compared to 65 percent of our total production in 2013. Consistent with our growth in liquids-focused production, our cash from operating activities, excluding working capital changes, increased approximately $41 million, or 17 percent, for 2014 compared to 2013, despite declining crude oil and NGL prices during the second half of 2014.

Our growth in crude oil and NGL production has been focused exclusively in the Eagle Ford in South Texas. Since our initial acquisition in this region in 2010 and through February 20, 2015, we have added a total of 280 gross wells, including 246 gross wells that are operated by us and 34 gross wells that are operated by our partners. We are currently operating a total of three drilling rigs, all in the Eagle Ford. Our capital program, which is substantially dedicated to this play, is being financed with a combination of cash from operating activities and borrowings under the Revolver.

To mitigate the volatile effect of commodity price fluctuations, we have a comprehensive hedging program in place. The Financial Condition discussion that follows and Note 5 to the Consolidated Financial Statements provide a detailed summary of our open commodity derivative positions as well as the historical results of our hedging program for the years ended December 31, 2014, 2013 and 2012.

Key Developments

The following general business developments and corporate actions in 2014 had or are expected to have a significant impact on our results of operations, financial position and cash flows: (i) significant decline in commodity prices and the addition of crude oil hedge contracts for calendar year 2015 and 2016, (ii) drilling results and future development plans in the Eagle Ford, (iii) an increase in our borrowing base under the Revolver, (iv) the acquisition of additional Eagle Ford acreage, (v) the sale of our Mississippi assets, South Texas oil gathering rights and South Texas natural gas gathering and gas lift assets, (vi) the resolution of arbitration related to the EF Acquisition and (vii) our recent preferred stock offering.

Significant Decline in Commodity Prices and Addition of Crude Oil Hedge Contracts for Calendar Years 2015 and 2016

In the second half of 2014, commodity prices, particularly crude oil, began to decline from recent high levels. The decline became precipitous late in the fourth quarter of 2014 and into the first quarter of 2015. As discussed below, the significant magnitude of this price decline has led to substantial changes in our operating and drilling programs.

In addition to adjusting our capital program as a result of the decline in commodity pricing, we were also able to enter into additional crude oil derivative contracts for calendar years 2015 and 2016 in order to hedge a portion of our crude oil production for those periods prior to the most significant price declines. Accordingly, in 2014, we provided additional hedge contracts for an average of 9,500 BOPD at a weighted-average price of $89.47 per Bbl for 2015 and 4,000 BOPD at a price of $88.12 per Bbl for 2016. The addition of these contracts has increased our total hedged crude oil production to 13,000 BOPD at a weighted-average price of $90.48 per Bbl for the first half of 2015 and 11,000 BOPD at a weighted-average price of $89.86 per Bbl for the second half of 2015. As a result of these activities, approximately 80 to 90 percent of our total estimated crude oil production for 2015 is subject to favorable hedges.

A prolonged period of depressed commodity prices could have a significant impact on the value and volumetric quantities of our proved reserve portfolio, assuming no other changes in our development plans. At year-end NYMEX calendar year forward contract strip prices, the present value (discounted at 10% per annum) of estimated future net revenues of our proved reserves would be approximately 63% smaller and total proved reserve equivalent volumes would be approximately 24% smaller compared to the results obtained using SEC-mandated 2014 beginning of teh month average prices held constant, as is required for the estimation of proved reserves and the calculation of the related standardized measure of discounted future net cash flows.

Drilling Results and Future Development Plans for the Eagle Ford

During 2014, we completed and turned in line 84 gross (51.6 net) operated wells in the Eagle Ford. Our Eagle Ford production was 17,459 net barrels of oil equivalent per day, or BOEPD, during the three months ended December 31, 2014 with oil comprising 12,676 BOPD, or 73 percent, and NGLs and natural gas comprising approximately 14 percent and 13 percent, respectively. In the month of December 2014, our average Eagle Ford production was 18,636 BOEPD, 71 percent of which was crude oil, 15 percent was NGLs and 14 percent was natural gas.

Beginning in March 2014, we have completed and turned in line 17 Upper Eagle Ford wells, including one well that had an operational issue. The average IP rate for the other 16 wells was1,217 BOEPD (61 percent crude oil) and the average 30-day rate for 14 of these 16 wells with sufficient production history was 1,009 BOEPD (61 percent crude oil). The early performance and lower initial rates of decline for the Upper Eagle Ford wells are an improvement over what we have experienced thus far in the Lower Eagle Ford. The internal EUR for these wells averaged approximately 717 MBOE, with a range of 388 to 1,231 MBOE. Due to these favorable results, we plan to devote approximately 42 percent of our 2015 capital expenditures to drilling additional Upper Eagle Ford wells.

Our total capital expenditures for 2015 are anticipated to be up to approximately $345 million, of which 90 percent has been allocated to drilling and completion activities. We intend to operate three to four drilling rigs in the Eagle Ford during

2015. We expect to drill and complete approximately 64 gross wells in the Eagle Ford in 2015 including 24 gross wells in the Upper Eagle Ford. We anticipate our 2015 drilling and completion costs to decrease from 2014 levels as a result of: (i) a decrease in the number of frac stages per well due to an increase in the distance between stages, (ii) a reduction in the amount of proppant per stage, (iii) renegotiated service sector costs and (iv) an ongoing improvement in operational execution of the drilling and completion program. In the event that commodity prices continue to decline, or if prices remain depressed for an extended period beyond 2015, we may be required to further reduce that magnitude of our drilling program.

Borrowing Base Increase

In October 2014, the borrowing base under the Revolver was increased to $500 million from $437.5 million in connection with our regular semi-annual redetermination. For more information about our Revolver, please read “Capital Resources—Revolver Borrowings.”

Acquisition of Additional Eagle Ford Acreage

In July 2014, we entered into a definitive agreement to acquire approximately 13,125 gross (11,660 net) acres in Lavaca County, Texas, the vast majority of which are in the “volatile oil window” of the Eagle Ford. The transaction closed in August 2014 for $45.6 million, of which $34.9 million was paid at closing and the balance of $10.6 million will be paid over the next three years as a drilling carry. We anticipate commencing drilling activities on this acreage in 2015. The transaction, combined with recent leasing, brings our total Eagle Ford acreage position to approximately 140,000 gross (101,800 net) acres. The acquired acreage, most of which we expect will be prospective in the Upper Eagle Ford, is adjacent to our Shiner area.

2014 Asset Dispositions

Sale of Mississippi Assets. In July 2014, we sold our Selma Chalk assets in Mississippi for proceeds of $67.9 million, net of transaction costs and customary closing adjustments. An impairment charge of $117.9 million was recognized in the three months ended June 30, 2014 to write down these assets to their estimated fair value.

Sale of Rights to Construct an Oil Gathering System in South Texas. In July 2014, we sold the rights to construct a crude oil gathering and intermediate transportation system in South Texas to Republic Midstream, LLC, or Republic, for proceeds of $147.1 million, net of transaction costs. Concurrent with the sale, we entered into agreements with Republic to provide us gathering and intermediate pipeline transportation services for a substantial portion of our South Texas crude oil and condensate production for a term of 25 years. We realized a gain of $147.1 million, of which $63.0 million was recognized upon the closing of the transaction and the remaining $84.1 million was deferred and will be recognized over a twenty-five year period after the system has been constructed and is operational, currently expected to be in the third quarter of 2015.

Sale of South Texas Natural Gas Gathering and Gas Lift Assets. In January 2014, we sold our natural gas gathering and gas lift assets in South Texas to American Midstream Partners, LP, or AMID, for proceeds of approximately $96 million, net of transaction costs. Concurrent with the sale, we entered into an agreement with AMID to provide us natural gas gathering, compression and gas lift services for a substantial portion of our current and future South Texas natural gas production. We realized a gain of $67.3 million, of which $56.7 million was recognized upon the closing of the transaction and the remaining $10.6 million was deferred and is being recognized over a twenty-five year period.

Settlement of Arbitration

Commencing December 2013, we were involved in arbitration with Magnum Hunter Resources Corporation, or MHR, the seller in the EF Acquisition. The arbitration related to disputes we had with MHR regarding contractual adjustments to the purchase price for the EF Acquisition and suspense funds that we believed MHR was obligated to transfer to us. In July 2014, we received the arbitrator’s determination, which required MHR to pay us a total of $35.1 million, including purchase price adjustments, revenue suspense funds due to partners and royalty owners and interest ($1.3 million) on the funds since the date of acquisition. Payment of the arbitration settlement was made by MHR in August 2014.

Preferred Stock Offering and Induced Conversion of Outstanding Preferred Stock

In June 2014, we completed a private offering of 3,250,000 depositary shares each representing 1/100th interest in a share of our 6% Series B Convertible Perpetual Preferred Stock, or the Series B Preferred Stock, for approximately $313 million of proceeds, net of underwriting fees and issuance costs. Concurrent with the Series B Preferred Stock offering and subsequently in July 2014, we paid a total of $4.3 million to induce the conversion of 3,527 shares, or 352,732 depositary shares, of our 6% Series A Convertible Perpetual Preferred Stock, or the Series A Preferred Stock. A total of 5.9 million shares of our common stock were issued in connection with the induced conversion of the Series A Preferred Stock.

Results of Operations

Production

The following tables set forth a summary of our total and daily production volumes by product and geographic region for the periods presented (certain results in the tables below may not calculate due to rounding):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Production | | Average Daily Production |

| Crude oil | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | (MBbl) | | (Bbl per day) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | 4,459 |

| | 3,199 |

| | 1,960 |

| | 1,259 |

| | 1,240 |

| | 12,216 |

| | 8,766 |

| | 5,354 |

| | 3,451 |

| | 3,412 |

|

| East Texas | 54 |

| | 63 |

| | 71 |

| | (10 | ) | | (8 | ) | | 148 |

| | 174 |

| | 194 |

| | (26 | ) | | (20 | ) |

| Mid-Continent | 126 |

| | 160 |

| | 206 |

| | (35 | ) | | (46 | ) | | 345 |

| | 440 |

| | 563 |

| | (94 | ) | | (124 | ) |

| Other | 5 |

| | 12 |

| | 15 |

| | (7 | ) | | (3 | ) | | 14 |

| | 33 |

| | 41 |

| | (19 | ) | | (8 | ) |

| | 4,644 |

| | 3,435 |

| | 2,252 |

| | 1,209 |

| | 1,183 |

| | 12,723 |

| | 9,412 |

| | 6,153 |

| | 3,311 |

| | 3,259 |

|

| % Change | | | | | | | | | | | | | | | | | 35 | % | | 53 | % |

| | | | | | | | | | | | | | | | | | | | |

| NGLs | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | (MBbl) | | (Bbl per day) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | 775 |

| | 485 |

| | 205 |

| | 289 |

| | 280 |

| | 2,122 |

| | 1,330 |

| | 561 |

| | 793 |

| | 769 |

|

| East Texas | 122 |

| | 191 |

| | 281 |

| | (68 | ) | | (90 | ) | | 335 |

| | 523 |

| | 767 |

| | (187 | ) | | (244 | ) |

| Mid-Continent | 213 |

| | 306 |

| | 397 |

| | (94 | ) | | (91 | ) | | 582 |

| | 840 |

| | 1,085 |

| | (257 | ) | | (246 | ) |

| Other | — |

| | — |

| | 1 |

| | — |

| | (1 | ) | | — |

| | — |

| | 2 |

| | — |

| | (2 | ) |

| | 1,110 |

| | 982 |

| | 884 |

| | 127 |

| | 98 |

| | 3,040 |

| | 2,692 |

| | 2,415 |

| | 348 |

| | 277 |

|

| % Change | | | | | | | | | | | | | | | | | 13 | % | | 11 | % |

| | | | | | | | | | | | | | | | | | | | |

| Natural gas | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | (MMcf) | | (MMcf per day) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | 4,081 |

| | 2,436 |

| | 1,015 |

| | 1,644 |

| | 1,422 |

| | 11 |

| | 7 |

| | 3 |

| | 5 |

| | 4 |

|

| East Texas | 4,004 |

| | 4,593 |

| | 5,909 |

| | (588 | ) | | (1,316 | ) | | 11 |

| | 13 |

| | 16 |

| | (2 | ) | | (4 | ) |

| Mid-Continent | 2,413 |

| | 2,823 |

| | 3,646 |

| | (410 | ) | | (823 | ) | | 7 |

| | 8 |

| | 10 |

| | (1 | ) | | (2 | ) |

| Other | 2,586 |

| | 4,583 |

| | 9,692 |

| | (1,996 | ) | | (5,109 | ) | | 7 |

| | 13 |

| | 26 |

| | (5 | ) | | (14 | ) |

| | 13,085 |

| | 14,435 |

| | 20,261 |

| | (1,350 | ) | | (5,826 | ) | | 36 |

| | 40 |

| | 55 |

| | (4 | ) | | (16 | ) |

| % Change | | | | | | | | | | | | | | | | | (9 | )% | | (29 | )% |

| | | | | | | | | | | | | | | | | | | | |

| Combined total | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | (MBOE) | | (BOE per day) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | 5,913 |

| | 4,091 |

| | 2,334 |

| | 1,823 |

| | 1,757 |

| | 16,201 |

| | 11,208 |

| | 6,378 |

| | 4,994 |

| | 4,830 |

|

| East Texas | 844 |

| | 1,020 |

| | 1,337 |

| | (176 | ) | | (317 | ) | | 2,311 |

| | 2,794 |

| | 3,653 |

| | (482 | ) | | (859 | ) |

| Mid-Continent | 741 |

| | 937 |

| | 1,211 |

| | (197 | ) | | (273 | ) | | 2,029 |

| | 2,568 |

| | 3,308 |

| | (539 | ) | | (740 | ) |

Other 1 | 437 |

| | 776 |

| | 1,631 |

| | (339 | ) | | (855 | ) | | 1,196 |

| | 2,126 |

| | 4,457 |

| | (929 | ) | | (2,332 | ) |

| | 7,934 |

| | 6,824 |

| | 6,513 |

| | 1,111 |

| | 311 |

| | 21,738 |

| | 18,696 |

| | 17,795 |

| | 3,043 |

| | 900 |

|

| % Change | | | | | | | | | | | | | | | | | 16 | % | | 5 | % |

1 Comprised of: (i) our three active Marcellus Shale wells in Pennsylvania, (ii) for periods through July 2014, our divested Selma Chalk assets in Mississippi, and (iii) for periods through July 2012, our divested Appalachian natural gas properties in West Virginia, Kentucky and Virginia.

2014 vs. 2013. Total production increased during the year ended December 31, 2014 compared to 2013 due primarily to production from the continued expansion of our Eagle Ford development program in South Texas. The increase was partially offset by natural production declines in our East Texas, Mid-Continent and Mississippi regions, as well as the effect of the sale of our Mississippi properties in July 2014. Approximately 73 percent of total production during 2014 was attributable to oil and NGLs, which represents an increase of approximately 30 percent over 2013. During 2014, our Eagle Ford production represented approximately 74 percent of our total production compared to approximately 60 percent from this play during 2013.

2013 vs. 2012. Total production increased during 2013 compared to 2012 due primarily to the EF Acquisition and the continued expansion of our development program in the Eagle Ford. The increase was partially offset by the effect of production declines in our East Texas and Mid-Continent regions and the sale of our Appalachian properties in July 2012. Approximately 65% of total production during 2013 was attributable to oil and NGLs, which represents an increase of approximately 41% over 2012. During 2013, our Eagle Ford production represented approximately 60 percent of our total production compared to approximately 36 percent during 2012.

Product Revenues and Prices

The following tables set forth a summary of our revenues and prices per unit of volume by product and geographic region for the periods presented:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Crude oil | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | ($ per Bbl) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | $ | 403,879 |

| | $ | 324,899 |

| | $ | 202,479 |

| | $ | 78,980 |

| | $ | 122,420 |

| | $ | 90.58 |

| | $ | 101.55 |

| | $ | 103.33 |

| | $ | (10.96 | ) | | $ | (1.78 | ) |

| East Texas | 4,852 |

| | 6,325 |

| | 6,862 |

| | (1,473 | ) | | (537 | ) | | 90.08 |

| | 99.69 |

| | 96.55 |

| | (9.61 | ) | | 3.14 |

|

| Mid-Continent | 11,027 |

| | 14,920 |

| | 18,667 |

| | (3,893 | ) | | (3,747 | ) | | 87.59 |

| | 93.01 |

| | 90.55 |

| | (5.42 | ) | | 2.46 |

|

| Other | 528 |

| | 1,263 |

| | 1,564 |

| | (735 | ) | | (301 | ) | | 96.02 |

| | 104.75 |

| | 103.81 |

| | (8.73 | ) | | 0.94 |

|

| | $ | 420,286 |

| | $ | 347,407 |

| | $ | 229,572 |

| | $ | 72,879 |

| | $ | 117,835 |

| | $ | 90.50 |

| | $ | 101.13 |

| | $ | 101.95 |

| | $ | (10.62 | ) | | $ | (0.83 | ) |

| % Change | | | | | | | | | | | | | | | | | (11 | )% | | (1 | )% |

| | | | | | | | | | | | | | | | | | | | |

| NGLs | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | ($ per Bbl) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | $ | 19,555 |

| | $ | 12,969 |

| | $ | 6,451 |

| | $ | 6,586 |

| | $ | 6,518 |

| | $ | 25.24 |

| | $ | 26.72 |

| | $ | 31.43 |

| | $ | (1.48 | ) | | $ | (4.71 | ) |

| East Texas | 5,440 |

| | 6,743 |

| | 10,195 |

| | (1,303 | ) | | (3,452 | ) | | 44.44 |

| | 35.35 |

| | 36.32 |

| | 9.09 |

| | (0.97 | ) |

| Mid-Continent | 9,557 |

| | 11,036 |

| | 14,365 |

| | (1,479 | ) | | (3,329 | ) | | 44.95 |

| | 36.01 |

| | 36.16 |

| | 8.94 |

| | (0.15 | ) |

| Other | — |

| | — |

| | 40 |

| | — |

| | (40 | ) | | — |

| | — |

| | 51.61 |

| | — |

| | (51.61 | ) |

| | $ | 34,552 |

| | $ | 30,748 |

| | $ | 31,051 |

| | $ | 3,804 |

| | $ | (303 | ) | | $ | 31.14 |

| | $ | 31.30 |

| | $ | 35.13 |

| | $ | (0.17 | ) | | $ | (3.82 | ) |

| % Change | | | | | | | | | | | | | | | | | (1 | )% | | (11 | )% |

| | | | | | | | | | | | | | | | | | | | |

| Natural gas | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | ($ per Mcf) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | $ | 17,132 |

| | $ | 8,586 |

| | $ | 2,593 |

| | $ | 8,546 |

| | $ | 5,993 |

| | $ | 4.20 |

| | $ | 3.52 |

| | $ | 2.56 |

| | $ | 0.67 |

| | $ | 0.97 |

|

| East Texas | 17,875 |

| | 15,571 |

| | 13,607 |

| | 2,304 |

| | 1,964 |

| | 4.46 |

| | 3.39 |

| | 2.30 |

| | 1.07 |

| | 1.09 |

|

| Mid-Continent | 11,060 |

| | 10,655 |

| | 7,920 |

| | 405 |

| | 2,735 |

| | 4.58 |

| | 3.77 |

| | 2.17 |

| | 0.81 |

| | 1.60 |

|

| Other | 11,977 |

| | 17,726 |

| | 25,741 |

| | (5,749 | ) | | (8,015 | ) | | 4.63 |

| | 3.87 |

| | 2.66 |

| | 0.76 |

| | 1.21 |

|

| | $ | 58,044 |

| | $ | 52,538 |

| | $ | 49,861 |

| | $ | 5,506 |

| | $ | 2,677 |

| | $ | 4.44 |

| | $ | 3.64 |

| | $ | 2.46 |

| | $ | 0.80 |

| | $ | 1.18 |

|

| % Change | | | | | | | | | | | | | | | | | 22 | % | | 48 | % |

| | | | | | | | | | | | | | | | | | | | |

| Combined total | Year Ended December 31, | | 2014 vs. | | 2013 vs. | | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 | | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | ($ per BOE) |

| Texas | | | | | | | | | | | | | | | | | | | |

| South Texas | $ | 440,566 |

| | 346,454 |

| | 211,523 |

| | $ | 94,112 |

| | $ | 134,931 |

| | $ | 74.50 |

| | $ | 84.69 |

| | $ | 90.62 |

| | $ | (10.19 | ) | | $ | (5.93 | ) |

| East Texas | 28,167 |

| | 28,639 |

| | 30,664 |

| | (472 | ) | | (2,025 | ) | | 33.39 |

| | 28.09 |

| | 22.94 |

| | 5.29 |

| | 5.15 |

|

| Mid-Continent | 31,644 |

| | 36,611 |

| | 40,952 |

| | (4,967 | ) | | (4,341 | ) | | 42.72 |

| | 39.09 |

| | 33.83 |

| | 3.63 |

| | 5.27 |

|

| Other | 12,505 |

| | 18,989 |

| | 27,345 |

| | (6,484 | ) | | (8,356 | ) | | 28.64 |

| | 24.48 |

| | 16.76 |

| | 4.17 |

| | 7.71 |

|

| | $ | 512,882 |

| | $ | 430,693 |

| | $ | 310,484 |

| | $ | 82,189 |

| | $ | 120,209 |

| | $ | 64.64 |

| | $ | 63.11 |

| | $ | 47.67 |

| | $ | 1.53 |

| | $ | 15.44 |

|

| % Change | | | | | | | | | | | | | | | | | 2 | % | | 32 | % |

The following table provides an analysis of the changes in our revenues for the periods presented:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2014 vs. 2013 Revenue Variance Due to | | 2013 vs. 2012 Revenue Variance Due to |

| | Volume | | Price | | Total | | Volume | | Price | | Total |

| Crude oil | $ | 122,219 |

| | $ | (49,340 | ) | | $ | 72,879 |

| | $ | 120,652 |

| | $ | (2,817 | ) | | $ | 117,835 |

|

| NGLs | 3,987 |

| | (183 | ) | | 3,804 |

| | 3,460 |

| | (3,763 | ) | | (303 | ) |

| Natural gas | (4,962 | ) | | 10,468 |

| | 5,506 |

| | (14,356 | ) | | 17,033 |

| | 2,677 |

|

| | $ | 121,244 |

| | $ | (39,055 | ) | | $ | 82,189 |

| | $ | 109,756 |

| | $ | 10,453 |

| | $ | 120,209 |

|

Effects of Derivatives

In 2014 and 2013, respectively, we paid $7.4 million and $1.0 million, and in 2012, we received $28.3 million from cash settlements of oil and gas derivatives. The following table reconciles crude oil and natural gas revenues to realized prices, as adjusted for derivative activities, for the periods presented:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Increase | | Year Ended December 31, | | Favorable |

| | 2014 | | 2013 | | (Unfavorable) | | 2013 | | 2012 | | (Unfavorable) |

| Crude oil revenues as reported | $ | 420,286 |

| | $ | 347,407 |

| | $ | 72,879 |

| | $ | 347,407 |

| | $ | 229,572 |

| | $ | 576,979 |

|

| Derivative settlements, net | (6,170 | ) | | (2,624 | ) | | (3,546 | ) | | (2,624 | ) | | 8,428 |

| | 5,804 |

|

| | $ | 414,116 |

| | $ | 344,783 |

| | $ | 69,333 |

| | $ | 344,783 |

| | $ | 238,000 |

| | $ | 582,783 |

|

| | | | | | | | | | | | |

| Crude oil prices per Bbl, as reported | $ | 90.50 |

| | $ | 101.13 |

| | $ | (10.63 | ) | | $ | 101.13 |

| | $ | 101.94 |

| | $ | (0.81 | ) |

| Derivative settlements per Bbl | (1.33 | ) | | (0.76 | ) | | (0.57 | ) | | (0.76 | ) | | 3.74 |

| | (4.50 | ) |

| | $ | 89.17 |

| | $ | 100.37 |

| | $ | (11.20 | ) | | $ | 100.37 |

| | $ | 105.68 |

| | $ | (5.31 | ) |

| | | | | | | | | | | | |

| Natural gas revenues as reported | $ | 58,044 |

| | $ | 52,538 |

| | $ | 5,506 |

| | $ | 52,538 |

| | $ | 49,861 |

| | $ | 2,677 |

|

| Derivative settlements, net | (1,254 | ) | | 1,582 |

| | (2,836 | ) | | 1,582 |

| | 19,890 |

| | (18,308 | ) |

| | $ | 56,790 |

| | $ | 54,120 |

| | $ | 2,670 |

| | $ | 54,120 |

| | $ | 69,751 |

| | $ | (15,631 | ) |

| | | | | | | | | | | | |

| Natural gas prices per Mcf, as reported | $ | 4.44 |

| | $ | 3.64 |

| | $ | 0.80 |

| | $ | 3.64 |

| | $ | 2.46 |

| | $ | 1.18 |

|

| Derivative settlements per Mcf | (0.10 | ) | | 0.11 |

| | (0.21 | ) | | 0.11 |

| | 0.98 |

| | (0.87 | ) |

| | $ | 4.34 |

| | $ | 3.75 |

| | $ | 0.59 |

| | $ | 3.75 |

| | $ | 3.44 |

| | $ | 0.31 |

|

Gain (Loss) on Sales of Property and Equipment

In 2014, we recognized a gain of $63.0 million in connection with the sale of rights to construct a crude oil gathering and intermediate transportation system and a gain of $57.1 million on the sale of our natural gas gathering and gas lift assets in South Texas, including $56.7 million recognized upon the closing of the sale and $0.4 million attributable to the deferred portion of the gain. In 2013, we recognized losses of $0.3 million related primarily to certain post-closing adjustments for asset sales that occurred in prior years. In 2012, we recognized gains of $3.9 million attributable to the sale of substantially all of our Appalachian natural gas assets as well as certain undeveloped Marcellus Shale acreage in Pennsylvania. In addition, we recognized several individually insignificant gains and losses on the sale of property, equipment, tubular inventory and well material during all periods presented.

Other Revenues

2014 vs. 2013. Other revenues, which includes gathering, transportation, compression, water supply and disposal fees that we charge to other parties, net of marketing and related expenses and accretion of our unused firm transportation obligation, increased during 2014 from 2013 due primarily to income related to water supply and disposal which began in April 2014. The increase was partially offset by the effect of a $1.6 million gain in 2013 attributable to the sale of certain proprietary seismic data.

2013 vs. 2012. Net revenues from gathering, transportation and compression decreased during 2013 from 2012 due to lower production by other parties in our East Texas AMI. In addition, we recognized a full year of accretion expense, or $1.7 million, in 2013 on our unused firm transportation obligation as compared to one quarter in 2012. These decreases were partially offset by a $1.6 million gain on the sale of certain proprietary seismic data in 2013.

Production and Lifting Costs

|

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, | | 2014 vs. | | 2013 vs. |

| | 2014 | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | | | | | Favorable (unfavorable) |

| Lease operating | $ | 48,298 |

| | $ | 35,461 |

| | $ | 31,266 |

| | $ | (12,837 | ) | | $ | (4,195 | ) |

| Per unit of production ($/BOE) | $ | 6.09 |

| | $ | 5.20 |

| | $ | 4.80 |