UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2006

Commission File Number: 1-13283

Penn Virginia Corporation

(Exact name of registrant as specified in its charter)

| | |

| Virginia | | 23-1184320 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

Three Radnor Corporate Center, Suite 300

100 Matsonford Road

Radnor, Pennsylvania 19087

(Address of principal executive offices)

Registrant’s telephone number, including area code: (610) 687-8900

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| | |

Title of each class | | Name of exchange on which registered |

| Common Stock, $0.01 Par Value | | New York Stock Exchange |

Indicate by check mark if the registrant is a well known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check One)

| | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of common stock held by non-affiliates of the registrant was $1,289,572,927 as of June 30, 2006 (the last business day of its most recently completed second fiscal quarter), based on the last sale price of such stock as quoted on the New York Stock Exchange. For purposes of making this calculation only, the registrant has defined affiliates as including all directors and all executive officers of the registrant, but excluding any institutional shareholders. This determination is not necessarily a conclusive determination for other purposes.

As of February 28, 2007, 18,791,869 shares of common stock of the registrant were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

| | |

| | | Part Into Which Incorporated |

(1) Proxy Statement for Annual Meeting of Shareholders on May 8, 2007 | | Part III |

PENN VIRGINIA CORPORATION AND SUBSIDIARIES

Table of Contents

PART I

General

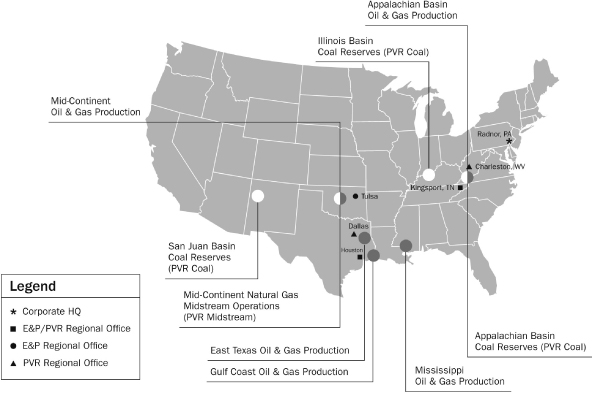

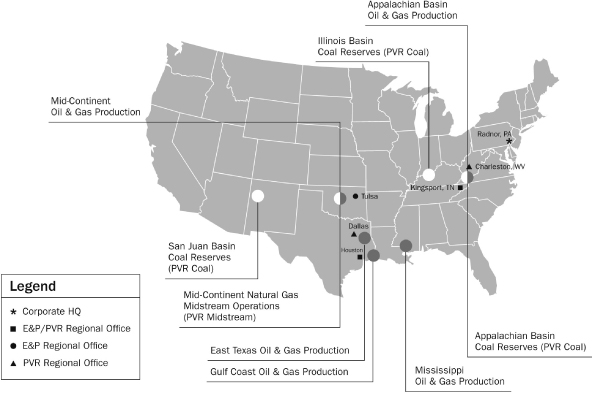

Penn Virginia Corporation is a Virginia corporation founded in 1882 whose common stock is traded on the New York Stock Exchange under the symbol “PVA.” We are engaged in the exploration, development and production of crude oil and natural gas primarily in the Appalachian, Mississippi, Mid-Continent and Gulf Coast onshore areas of the United States. We also collect royalties on various oil and gas properties in which we own a mineral fee interest. Unless the context requires otherwise, references to the “Company,” “we,” “us” or “our” in this Annual Report on Form 10-K refer to Penn Virginia Corporation and its subsidiaries.

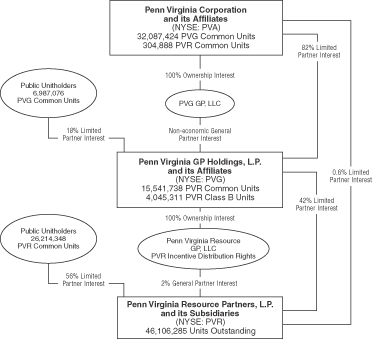

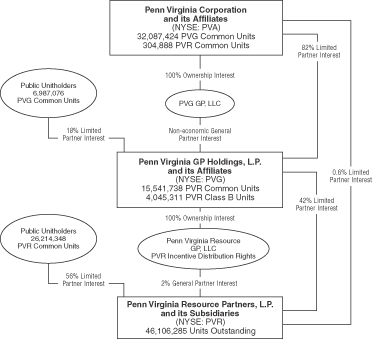

We are also indirectly involved in the businesses engaged in by Penn Virginia Resource Partners, L.P., or PVR, a Delaware limited partnership whose common units are traded on the New York Stock Exchange under the symbol “PVR.” We own PVG GP, LLC, the sole general partner of Penn Virginia GP Holdings, L.P., or PVG, a Delaware limited partnership whose common units are traded on the New York Stock Exchange under the symbol “PVG.” We also own an approximately 82% limited partner interest in PVG. As of December 31, 2006, PVG owned approximately 44% of PVR, consisting of a 2% general partner interest and an approximately 42% limited partner interest in PVR. We directly own an additional 0.6% interest in PVR. As part of its ownership of PVR’s general partner, PVG also own the rights, referred to as “incentive distribution rights,” to receive an increasing percentage of PVR’s quarterly distributions of available cash from operating surplus after certain levels of cash distributions have been achieved. See Item 1, “Business—Partnership Distributions,” for more information on incentive distribution rights.

PVR conducts operations in two business segments: coal and natural gas midstream. PVR does not operate any coal mines, but rather leases its coal reserves to various mining operators in exchange for royalty payments. Additionally, PVR provides fee-based coal preparation and loading facilities to some of its lessees and to other third party industrial end-users. With the acquisition of a natural gas midstream business in March 2005, PVR entered the midstream gas gathering and processing business with primary locations in the Mid-Continent area of Oklahoma and the Texas panhandle.

Segments

We operate in three primary business segments. We are in the crude oil and natural gas exploration and production business and, through our direct and indirect ownership interests in PVR, we are in the coal and natural gas midstream businesses. In 2006, approximately 50% of our operating income was attributable to our oil and gas segment, 43% was attributable to our coal segment and 17% was attributable to our natural gas midstream segment, less a 10% operating loss related to corporate and other functions. See Note 20 in the Notes to Consolidated Financial Statements for financial information concerning our business segments.

Oil and Gas Segment Overview

In our oil and gas segment, we explore for, develop, produce and sell crude oil, condensate and natural gas primarily in the Appalachian, Mississippi, Mid-Continent and Gulf Coast onshore regions of the United States. At December 31, 2006, we had proved oil and natural gas reserves of approximately 5 million barrels of oil and condensate and 457 billion cubic feet (or Bcf) of natural gas, or 487 billion cubic feet equivalent (or Bcfe). Oil and natural gas production from our properties increased to 31.3 Bcfe in 2006, an increase of 14% from 27.4 Bcfe produced in 2005.

Our revenues, profitability and future rate of growth are highly dependent on the prevailing prices for oil and natural gas, which are affected by numerous factors that are generally beyond our control. Crude oil prices are generally determined by global supply and demand. Natural gas prices are influenced by national and

1

regional supply and demand. A substantial or extended decline in the price of oil or natural gas could have a material adverse effect on our revenues, profitability and cash flow and could, under certain circumstances, result in an impairment of some of our oil and natural gas properties. Our future profitability and growth is also highly dependent on the results of our exploratory and development drilling programs.

In addition to our conventional development program, we have continued to expand our development of unconventional plays such as coal bed methane (or CBM) gas reserves in Appalachia and Mid-Continent and the Cotton Valley play in east Texas. We are committed to expanding our oil and gas reserves and production primarily by developing our existing inventory of drilling locations and by using our ability to internally generate exploratory prospects and development drilling programs.

PVR Coal Segment Overview

PVR’s coal segment includes management and leasing of coal properties and subsequent collection of royalties. Substantially all of PVR’s leases require the lessee to pay minimum rental payments to PVR in monthly or annual installments. PVR actively works with its lessees to develop efficient methods to exploit its reserves and to maximize production from its properties. PVR also earns revenues from providing fee-based coal preparation and transportation services to its lessees, which enhance their production levels and generate additional coal royalty revenues, and from industrial third party coal end-users by owning and operating coal handling facilities through its joint venture with Massey Energy Company, or Massey. In addition, PVR earns revenues from oil and gas royalty interests it owns, from coal transportation, or wheelage, rights and from the sale of standing timber on its properties.

As of December 31, 2006, PVR owned or controlled approximately 765 million tons of proven and probable coal reserves in Central and Northern Appalachia, the San Juan Basin and the Illinois Basin. As of December 31, 2006, approximately 87% of PVR’s proven and probable coal reserves was “steam” coal used primarily by electric generation utilities, and the remaining 13% was metallurgical coal used primarily by steel manufacturers. PVR enters into long-term leases with experienced, third-party mine operators providing them the right to mine its coal reserves in exchange for royalty payments. PVR does not operate any mines. In 2006, PVR’s lessees produced 32.8 million tons of coal from its properties and paid to PVR coal royalty revenues of $98.2 million, for an average gross coal royalty per ton of $2.99. Approximately 84% of PVR’s coal royalty revenues in 2006 and 83% of PVR’s coal royalty revenues in 2005 were derived from coal mined on its properties under leases containing royalty rates based on the higher of a fixed base price or a percentage of the gross sales price. The balance of PVR’s coal royalty revenues for the respective periods was derived from coal mined on its properties under leases containing fixed royalty rates that escalate annually.

PVR’s management continues to focus on acquisitions that increase and diversify its sources of cash flow. During 2006, PVR increased its coal reserves by 96 million tons, or 14%, from its coal reserves as of December 31, 2005, by completing three coal reserve acquisitions with an aggregate purchase price of approximately $76 million. For a more detailed discussion of PVR’s acquisitions, see Item 7, “Managements’ Discussion and Analysis of Financial Condition and Results of Operations—Acquisitions and Investments.”

PVR Natural Gas Midstream Segment Overview

PVR owns and operates midstream assets that include approximately 3,631 miles of natural gas gathering pipelines and three natural gas processing facilities located in Oklahoma and the panhandle of Texas, which have 160 million cubic feet per day (or MMcfd) of total capacity. PVR’s midstream business derives revenues primarily from gas processing contracts with natural gas producers and from fees charged for gathering natural gas volumes and providing other related services. PVR also owns a natural gas marketing business, which aggregates third-party volumes and sells those volumes into intrastate pipeline systems and at market hubs accessed by various interstate pipelines. PVR acquired its natural gas midstream assets from Cantera Gas Resources, LLC, or Cantera, in March 2005. PVR’s management believes that this acquisition established a

2

platform for future growth in the natural gas midstream sector and diversified its cash flows into another long-lived asset base. Since acquiring these assets, PVR has expanded its natural gas midstream business by adding 181 miles of new gathering lines.

For the year ended December 31, 2006, inlet volumes at PVR’s gas processing plants and gathering systems, including gathering-only volumes, were 56.0 Bcf, or approximately 153 MMcfd. Two of PVR’s natural gas midstream customers, ConocoPhillips Company and BP Canada Energy Marketing Corp., accounted for 32% and 17% of PVR’s natural gas midstream revenues in 2006.

Corporate and Other

Corporate and other primarily represents corporate functions.

Business Strategy

We intend to pursue the following business strategies:

| | • | | Focus on relatively low risk, unconventional natural gas-oriented resource plays. In addition to our established core areas, such as the horizontal CBM play in Appalachia, the Cotton Valley play in east Texas and north Louisiana and the Selma Chalk in Mississippi, we are assessing the potential to establish new sustainable growth in organic shale and other unconventional plays in new areas, such as the Williston and Illinois Basins. We work with established industry partners in several of these core and potential new areas. |

| | • | | Generate and drill exploratory prospects. We intend to concentrate on exploratory prospects in south Texas and south Louisiana, which could result in an increase in our proved reserves and production. As compared to our lower risk unconventional plays, these prospects tend to have relatively higher risk profiles and higher returns when successful, and we work with industry partners to better manage costs and risks. |

| | • | | Continue to grow coal reserve holdings through acquisitions and investments in PVR’s existing market areas, as well as strategically entering new markets. During 2006, PVR increased its coal reserves by 96 million tons, or 14%, from its coal reserves as of December 31, 2005, by completing three coal reserve acquisitions with an aggregate purchase price of approximately $76 million. While PVR continues to build upon its core holdings in Appalachia, it also continues to monitor coal opportunities in other areas. For example, in 2005 and 2006, PVR made investments in Illinois Basin coal reserves because PVR views the Illinois Basin as a growth area, both because of its proximity to power plants and because PVR expects future environmental regulations will require scrubbing of not only higher sulfur Illinois Basin coal, but most coals, including lower sulfur coals from other basins. PVR expects to continue to diversify its coal reserve holdings into this and other domestic basins in the future. |

| | • | | Expand PVR’s coal services and infrastructure business on its properties. Coal infrastructure projects typically involve long-lived, fee-based assets that generally produce steady and predictable cash flows and are therefore, attractive to publicly traded limited partnerships. PVR owns a number of such infrastructure facilities and intends to continue to look for growth opportunities in this area of operations. For example, PVR completed construction of a new preparation and loading facility in September 2006 on property it acquired in 2005. Operations at the facility commenced in the fourth quarter of 2006. PVR’s joint venture with Massey is expected to provide other development opportunities for coal-related infrastructure projects. |

| | • | | Expand PVR’s midstream operations through acquisitions of new gathering and processing related assets and by adding new production to existing systems.PVR continually seeks new supplies of natural gas both to offset the natural declines in production from the wells currently connected to its systems and to increase throughput volume. New natural gas supplies are obtained for all of PVR’s systems by contracting for production from new wells, connecting new wells drilled on dedicated |

3

| | acreage and by contracting for natural gas that has been released from competitors’ systems. In 2006, PVR added approximately 181 miles of new gathering lines, allowing it to connect 158 new wells to its systems. |

| | • | | Expand PVR’s midstream operations by utilizing the advantages of PVR’s relationship with us. During 2006, PVR began marketing our natural gas production in Louisiana, Oklahoma and Texas, replacing a third party marketing company and allowing us to realize higher prices for our oil and natural gas sold in that region. We will continue to look for ways to take advantage of our natural relationship with PVR in mutually beneficial ways. |

| | • | | Maintain financial discipline and flexibility.We, PVG and PVR operate with separate, independent capital structures. We intend to continue to be fiscally conservative in all three entities and to manage our capital structure for the long term, which means that we will continue to be cautious regarding debt levels and dividend or distribution increases. |

Contracts

Oil and Gas Segment

Transportation.The majority of our natural gas production is transported to market on three major pipeline or transmission systems. NiSource Inc., Crosstex Energy Services L.P. and Gulf South Pipeline Company, LP transported 32%, 20% and 19% of our 2006 natural gas production. The remainder of our natural gas production was transported by several pipeline companies in Louisiana, Texas and West Virginia. In almost all cases, our natural gas is sold at interconnects with transmission pipelines.

We have entered into contracts which provide firm transportation capacity rights for specified volumes per day on a pipeline system for terms ranging from one to 15 years. The contracts require us to pay transportation demand charges regardless of the amount of pipeline capacity we use. We may sell excess capacity to third parties at our discretion.

Marketing.We generally sell our natural gas using spot market and short-term fixed price physical contracts. For the year ended December 31, 2006, three customers of our oil and gas segment, Crosstex Gulfcoast Marketing, Dominion Field Services and Amerada Hess Corporation, accounted for approximately 24%, 22% and 11% of our natural gas and oil and condensate revenues of $234.2 million.

PVR Coal Segment

PVR earns most of its coal royalty revenues under long-term leases that generally require its lessees to make royalty payments to it based on the higher of a percentage of the gross sales price or a fixed price per ton of coal they sell. The balance of PVR’s coal royalty revenues are earned under two long-term leases with affiliates of Peabody Energy Corporation (NYSE: BTU), or Peabody, that require the lessees to make royalty payments to PVR based on fixed royalty rates which escalate annually. A typical lease either expires upon exhaustion of the leased reserves, which is the case with the two Peabody leases, or has a five to ten-year base term, with the lessee having an option to extend the lease for at least five years after the expiration of the base term.

Substantially all of PVR’s leases require the lessee to pay minimum rental payments in monthly or annual installments, even if no mining activities are ongoing. These minimum rentals are recoupable, usually over a period from one to three years from the time of payment, against the production royalties owed to PVR once coal production commences.

In addition to the terms described above, substantially all of PVR’s leases impose obligations on the lessees to diligently mine the leased coal using modern mining techniques, indemnify PVR for any damages it incurs in connection with the lessee’s mining operations, including any damages it may incur due to the lessee’s failure to fulfill reclamation or other environmental obligations, conduct mining operations in compliance with all

4

applicable laws, obtain our written consent prior to assigning the lease and maintain commercially reasonable amounts of general liability and other insurance. Substantially all of the leases grant PVR the right to review all lessee mining plans and maps, enter the leased premises to examine mine workings and conduct audits of lessees’ compliance with lease terms. In the event of a default by a lessee, substantially all of the leases give PVR the right to terminate the lease and take possession of the leased premises.

PVR Natural Gas Midstream Segment

PVR’s natural gas midstream segment is engaged in providing gas processing, gathering and other related natural gas services. PVR’s midstream business generates revenues primarily from gas purchase and processing contracts with natural gas producers and from fees charged for gathering natural gas volumes and providing other related services. During the year ended December 31, 2006, PVR’s natural gas midstream business generated a majority of its gross margin from two types of contractual arrangements under which its margin is exposed to increases and decreases in the price of natural gas and natural gas liquids (or NGLs): (i) percentage-of-proceeds and (ii) keep-whole arrangements. In 2006, approximately 50% of PVR’s natural gas volumes were processed under gas purchase/keep-whole contracts, 25% were processed under percentage of proceeds contracts, and 25% were processed under fee-based gathering contracts. A majority of the gas purchase/keep-whole and percentage of proceeds contracts include fee-based components such as gathering and compression charges. There is also a processing fee floor included in many of the gas purchase/keep-whole contracts that ensures a minimum processing margin should the actual margins fall below the floor.

Gas purchase/keep-whole arrangements. Under these arrangements, PVR generally purchases natural gas at the wellhead at either (i) a percentage discount to a specified index price, (ii) a specified index price less a fixed amount or (iii) a combination of (i) and (ii). PVR then gathers the natural gas to one of its plants where it is processed to extract the entrained NGLs, which are then sold to third parties at market prices. PVR resells the remaining natural gas to third parties at an index price which typically corresponds to the specified purchase index. Because the extraction of the NGLs from the natural gas during processing reduces the British thermal unit (or BTU) content of the natural gas, PVR retains a reduced volume of gas to sell after processing. Accordingly, under these arrangements, PVR’s revenues and gross margins increase as the price of NGLs increases relative to the price of natural gas, and its revenues and gross margins decrease as the price of natural gas increases relative to the price of NGLs. PVR has generally been able to mitigate its exposure in the latter case by requiring the payment under many of its gas purchase/keep-whole arrangements of minimum processing charges which ensures that PVR receives a minimum amount of processing revenue. The gross margins that PVR realizes under the arrangements described in clauses (i) and (iii) above also decrease in periods of low natural gas prices because these gross margins are based on a percentage of the index price.

Percentage-of-proceeds arrangements. Under percentage-of-proceeds arrangements, PVR generally gathers and processes natural gas on behalf of producers, sells the resulting residue gas and NGL volumes at market prices and remits to producers an agreed upon percentage of the proceeds of those sales based on either an index price or the price actually received for the gas and NGLs. Under these types of arrangements, PVR’s revenues and gross margins increase as natural gas prices and NGL prices increase, and its revenues and gross margins decrease as natural gas prices and NGL prices decrease.

Fee-based arrangements. Under fee-based arrangements, PVR receives fees for gathering, compressing and/or processing natural gas. The revenue PVR earns from these arrangements is directly dependent on the volume of natural gas that flows through its systems and is independent of commodity prices. To the extent a sustained decline in commodity prices results in a decline in volumes, however, PVR’s revenues from these arrangements would be reduced due to the related reduction in drilling and development of new supply.

In many cases, PVR provides services under contracts that contain a combination of more than one of the arrangements described above. The terms of its contracts vary based on gas quality conditions, the competitive environment at the time the contracts were signed and customer requirements. The contract mix and, accordingly,

5

exposure to natural gas and NGL prices, may change as a result of changes in producer preferences, expansion in regions where some types of contracts are more common and other market factors.

PVR is also engaged in natural gas marketing by aggregating third-party volumes and selling those volumes into interstate and intrastate pipeline systems such as Enogex and ONEOK and at market hubs accessed by various interstate pipelines. The largest third-party customer is Chesapeake Energy Corp. with volumes contracted through 2007. Revenue from this business does not generate qualifying income for a master limited partnership, but PVR does not expect it to have an impact on its tax status, as it does not represent a significant percentage of its operating income. For the year ended December 31, 2006, this business generated $2.2 million in net revenue.

Commodity Derivative Contracts

Our oil and gas and natural gas midstream segments utilize costless collars, three-way collars and swap derivative contracts to hedge against the variability in cash flows associated with forecasted oil and gas revenues and natural gas midstream revenues and cost of midstream gas purchased. While the use of derivative instruments limits the risk of adverse price movements, their use also may limit future revenues or cost savings from favorable price movements. With respect to a costless collar contract, the counterparty is required to make a payment to us if the settlement price for any settlement period is below the floor price for such contract. We are required to make payment to the counterparty if the settlement price for any settlement period is above the ceiling price for such contract. Neither party is required to make a payment to the other party if the settlement price for any settlement period is equal to or greater than the floor price and equal to or less than the ceiling price for such contract. A three-way collar contract consists of a collar contract as described above plus a put option contract sold by us with a price below the floor price of the collar. This additional put requires us to make a payment to the counterparty if the settlement price for any settlement period is below the put option price. By combining the collar contract with the additional put option, we are entitled to a net payment equal to the difference between the floor price of the collar contract and the additional put option price if the settlement price is equal to or less than the additional put option price. If the settlement price is greater than the additional put option price, the result is the same as it would have been with a collar contract only. This strategy enables us to increase the floor and the ceiling price of the collar beyond the range of a traditional collar contract while defraying the associated cost with the sale of the additional put option. With respect to a swap contract, the counterparty is required to make a payment to us if the settlement price for any settlement period is less than the swap price for such contract, and we are required to make a payment to the counterparty if the settlement price for any settlement period is greater than the swap price for such contract. See Note 10 in the Notes to Consolidated Financial Statements for a description of our derivative program.

6

Corporate Structure

Because we control the general partner of PVG, the financial results of PVG are included in our consolidated financial statements. Because PVG controls the general partner of PVR, the financial results of PVG include those of PVR. However, PVG and PVR function with a capital structure that is independent of each other and us, with each having publicly traded common units and PVR having its own debt instruments. PVG does not currently have any debt instruments. The following diagram depicts our ownership of PVG and PVR as of December 31, 2006 (after giving effect to the exercise of the underwriters’ option to purchase additional PVG common units granted in connection with PVG’s initial public offering, or the PVG IPO):

Partnership Distributions

PVG Cash Distributions

PVG paid a cash distribution of $0.07 per common unit on February 14, 2007, which represented a $0.96 per unit distribution on an annualized basis that was prorated for the period beginning on December 5, 2006, the initial trading date of PVG’s common units on the New York Stock Exchange, and ending on December 31, 2006. We received total distributions from PVG of $2.2 million in February 2007. For the remainder of 2007, PVG expects to make quarterly distributions of $0.24 ($0.96 on an annualized basis) or more per common unit.

PVR Cash Distributions

PVR paid cash distributions of $1.475 per common and subordinated unit during the year ended December 31, 2006. In the first quarter of 2007, PVR paid a quarterly distribution of $0.40 ($1.60 on an annualized basis) per unit with respect to the fourth quarter of 2006. For the remainder of 2007, PVR expects to pay quarterly distributions of $0.40 ($1.60 on an annualized basis) or more per common and Class B unit.

7

Prior to the PVG IPO in December 2006, we indirectly owned common units representing an approximately 37% limited partner interest in PVR, as well as the sole 2% general partner interest and all of the incentive distribution rights in PVR. We received total distributions from PVR of $28.3 million and $21.2 million in 2006 and 2005, as shown in the following table (in thousands):

| | | | | | |

| | | Year Ended December 31, |

| | | 2006 | | 2005 |

Limited partner units | | $ | 22,799 | | $ | 19,281 |

General partner interest (2%) | | | 1,254 | | | 1,021 |

Incentive distribution rights | | | 4,273 | | | 910 |

| | | | | | |

Total | | $ | 28,326 | | $ | 21,212 |

| | | | | | |

In conjunction with the PVG IPO, we contributed our limited partner interest and general partner interest, including our incentive distribution rights, in PVR to PVG in exchange for a limited partner interest and the general partner interest in PVG. PVG also purchased additional common units and Class B units of PVR with the proceeds of the PVG IPO. Consequently, PVG is currently entitled to receive certain cash distributions payable with respect to the common and Class B units of PVR, the 2% general partner interest in PVR and the incentive distribution rights in PVR.

PVR Incentive Distribution Rights

A wholly owned subsidiary of PVG is the general partner of PVR and, as such, holds certain incentive distribution rights which represent the right to receive an increasing percentage of quarterly distributions of available cash from operating surplus after PVR has paid minimum quarterly distributions and certain target distribution levels have been achieved. The minimum quarterly distribution is $0.25 per unit ($1.00 per unit on an annualized basis). PVR’s general partner currently holds 100% of the incentive distribution rights, but may transfer these rights separately from its general partner interest to an affiliate (other than an individual) or to another entity as part of the merger or consolidation of the general partner with or into such entity or the transfer of all or substantially all of the general partner’s assets to another entity without the prior approval of PVR’s unitholders if the transferee agrees to be bound by the provisions of PVR’s partnership agreement. Prior to September 30, 2011, other transfers of incentive distribution rights will require the affirmative vote of holders of a majority of PVR’s outstanding common units and subordinated units, voting as separate classes. On or after September 30, 2011, the incentive distribution rights will be freely transferable. The incentive distributions rights are payable as follows:

If for any quarter:

| | • | | PVR has distributed available cash from operating surplus to its common, subordinated and Class B unitholders and in an amount equal to the minimum quarterly distribution; and |

| | • | | PVR has distributed available cash from operating surplus on outstanding common units in an amount necessary to eliminate any cumulative arrearages in payment of the minimum quarterly distribution; |

then, PVR will distribute any additional available cash from operating surplus for that quarter among the unitholders and our general partner subsidiary in the following manner:

| | • | | First, 98% to all unitholders, and 2% to the general partner, until each unitholder has received a total of $0.275 per unit for that quarter; |

| | • | | Second, 85% to all unitholders, and 15% to the general partner, until each unitholder has received a total of $0.325 per unit for that quarter; |

| | • | | Third, 75% to all unitholders, and 25% to the general partner, until each unitholder has received a total of $0.375 per unit for that quarter; and |

| | • | | Thereafter, 50% to all unitholders and 50% to the general partner. |

8

Subordinated Units

Until November 14, 2006, PVR had a separate class of subordinated units representing of limited partner interests in PVR, and the rights of holders of subordinated units to participate in distributions to limited partners were subordinated to the rights of the holders of PVR’s common units. On November 14, 2006, all of PVR’s subordinated units converted into common units on a one-for-one basis and no subordinated units remain outstanding.

Class B Units

PVR currently has a separate class of units representing limited partner interests in PVR called Class B units. Each Class B unit is currently entitled to receive 100% of the quarterly cash distribution paid in respect of each common unit except that the Class B units are subordinated to the common units with respect to the payment of the minimum quarterly distribution and any arrearages with respect to the payment of the minimum quarterly distribution. PVR is required to submit to a vote of its unitholders, as promptly as practicable, a proposal to change the terms of the Class B units in order to provide that the Class B units will convert into common units, on a one-for-one basis, immediately upon the approval by PVR’s unitholders. Holders of the Class B units will not be entitled to vote upon the proposal to change the terms of the Class B units, but otherwise will vote with the common units as a single class on each matter with respect to which the common units are entitled to vote. If PVR’s unitholders do not approve the proposal to change the terms of the Class B units before December 8, 2007, then each Class B unit will be entitled to receive 115% of the quarterly amount PVR distributes in respect of each common unit on a subordinated basis to the payment of the minimum quarterly distribution on the common units.

Upon the dissolution and liquidation of PVR, each Class B unit is currently entitled to receive 100% of the amount distributed on each common unit, but only after each common unit has received an amount equal to its capital account, plus the minimum quarterly distribution for the quarter in which the liquidation occurs, plus any arrearages in the minimum quarterly distribution with respect to prior quarters. If, however, PVR’s unitholders do not approve the proposal to change the terms of the Class B units to make them convertible into common units, then each Class B unit will be entitled upon liquidation to receive 115% of the amount distributed in respect of each common unit, but only after each common unit has received an amount equal to its capital account, plus the minimum quarterly distribution for the quarter in which the liquidation occurs, plus any arrearages in the minimum quarterly distribution with respect to prior quarters on a subordinated basis to liquidating distributions on the common units.

Competition

Oil and Gas Segment

The oil and natural gas industry is very competitive, and we compete with a substantial number of other companies that are large, well-established and have greater financial and operational resources than we do, which may adversely affect our ability to compete or grow our business. Many such companies not only engage in the acquisition, exploration, development and production of oil and natural gas reserves, but also carry on refining operations, electricity generation and the marketing of refined products. Competition is particularly intense in the acquisition of prospective oil and natural gas properties and oil and gas reserves. Our competitive position depends on our geological, geophysical and engineering expertise, our financial resources, our ability to develop properties and our ability to select, acquire and develop proved reserves. We compete with other oil and natural gas companies to secure drilling rigs and other equipment necessary for the drilling and completion of wells and recruiting and retaining qualified personnel, including geologists, geo-physicists, engineers and other specialists. Such equipment and labor may be in short supply from time to time. Shortages of equipment, labor or materials may result in increased costs or the inability to obtain such resources as needed. We also compete with major and independent oil and gas companies in the marketing and sale of oil and natural gas, and the oil and natural gas industry in general competes with other industries supplying energy and fuel to industrial, commercial and individual consumers.

9

PVR Coal Segment

The coal industry is intensely competitive primarily as a result of the existence of numerous producers. PVR’s lessees compete with both large and small coal producers in various regions of the United States for domestic sales. The industry has undergone significant consolidation which has led to some of the competitors of PVR’s lessees having significantly larger financial and operating resources than most of PVR’s lessees. PVR’s lessees compete on the basis of coal price at the mine, coal quality (including sulfur content), transportation cost from the mine to the customer and the reliability of supply. Continued demand for PVR’s coal and the prices that PVR’s lessees obtain are also affected by demand for electricity, demand for metallurgical coal, access to transportation, environmental and government regulations, technological developments and the availability and price of alternative fuel supplies, including nuclear, natural gas, oil and hydroelectric power. Demand for PVR’s low sulfur coal and the prices PVR’s lessees will be able to obtain for it will also be affected by the price and availability of high sulfur coal, which can be marketed in tandem with emissions allowances which permit the high sulfur coal to meet federal Clean Air Act requirements.

PVR Midstream Segment

The ability to offer natural gas producers competitive gathering and processing arrangements and subsequent reliable service is fundamental to obtaining and keeping gas supplies for PVR’s gathering systems. The primary concerns of the producer are:

| | • | | the pressure maintained on the system at the point of receipt; |

| | • | | the relative volumes of gas consumed as fuel and lost; |

| | • | | the gathering/processing fees charged; |

| | • | | the timeliness of well connects; |

| | • | | the customer service orientation of the gatherer/processor; and |

| | • | | the reliability of the field services provided. |

PVR experiences competition in all of its midstream markets. PVR’s competitors include major integrated oil companies, interstate and intrastate pipelines and companies that gather, compress, process, transport and market natural gas. Many of PVR’s competitors have greater financial resources and access to larger natural gas supplies than PVR does.

Government Regulation and Environmental Matters

The operations of our oil and segment and PVR’s coal segment and natural gas midstream segment are subject to environmental laws and regulations adopted by various governmental authorities in the jurisdictions in which these operations are conducted.

Oil and Gas Segment

State Regulatory Matters. Various aspects of our oil and natural gas operations are regulated by administrative agencies under statutory provisions of the states where such operations are conducted. All of the jurisdictions in which we own or operate producing crude oil and natural gas properties have statutory provisions regulating the exploration for and production of crude oil and natural gas. These provisions include permitting regulations regarding the drilling of wells, maintaining bonding requirements to drill or operate wells, locating wells, the method of drilling and casing wells, the surface use and restoration of properties upon which wells are drilled and the plugging and abandoning of wells. Our operations are also subject to various conservation laws and regulations. These include the regulation of the size of drilling and spacing units or proration units, the number of wells that may be drilled in an area and the unitization or pooling of crude oil and natural gas properties. In addition, state conservation laws establish maximum rates of production from crude oil and natural

10

gas wells, generally prohibit the venting or flaring of natural gas and impose certain requirements regarding the ratability or fair apportionment of production from fields and individual wells. The effect of these regulations is to limit the amounts of crude oil and natural gas we can produce from our wells and to limit the number of wells or the locations at which we can drill.

Federal Energy Regulatory Commission. The Federal Energy Regulatory Commission (or the FERC) regulates the transportation and sale for resale of natural gas in interstate commerce under the Natural Gas Act of 1938 (or the NGA) and the Natural Gas Policy Act of 1978 (or the NGPA). In the past, the federal government has regulated the prices at which oil and gas could be sold. The Natural Gas Wellhead Decontrol Act of 1989 removed all NGA and NGPA price and nonprice controls affecting producers’ wellhead sales of natural gas effective January 1, 1993. While sales by producers of their own natural gas production and all sales of crude oil, condensate and natural gas liquids can currently be made at market prices, Congress could reenact price controls in the future.

Commencing in April 1992, the FERC issued Order Nos. 636, 636-A, 636-B and 636-C (or Order No. 636), which require interstate pipelines to provide transportation separate, or “unbundled,” from the pipelines’ sale of gas. Also, Order No. 636 requires pipelines to provide open-access transportation on a basis that is equal for all gas supplies. Although Order No. 636 does not directly regulate gas producers like us, the FERC has stated that it intends for Order No. 636 to foster increased competition within all phases of the natural gas industry. The courts have largely affirmed the significant features of Order No. 636 and numerous related orders pertaining to the individual pipelines, although certain appeals remain pending and the FERC continues to review and modify its open access regulations. In particular, the FERC has issued Order Nos. 637, 637-A and 637-B which, among other things, (i) permit pipelines to charge different maximum cost-based rates for peak and off-peak periods, (ii) encourage auctions for pipeline capacity, (iii) require pipelines to implement imbalance management services and (iv) restrict the ability of pipelines to impose penalties for imbalances, overruns and non-compliance with operational flow orders.

The Energy Policy Act of 2005 amended the NGA and the NGPA and gave the FERC the authority to assess civil penalties of up to $1 million per day per violation for violations of rules, regulations, and orders issued under these acts. In addition, the FERC has issued regulations that make it unlawful for any entity in connection with the purchase or sale of natural gas or the purchase or sale of transportation services subject to the jurisdiction of the FERC to use any manipulative or deceptive device or contrivance.

While any additional FERC action on these matters would affect us only indirectly, these changes are intended to further enhance competition in, and prevent manipulation of, natural gas markets. We cannot predict what further action the FERC will take on these matters, nor can we predict whether the FERC’s actions will achieve its stated goal of increasing competition in, and preventing manipulation of, natural gas markets. However, we do not believe that we will be treated materially differently than other natural gas producers with which we compete.

Environmental Matters.Extensive federal, state and local laws govern oil and natural gas operations, regulate the discharge of materials into the environment or otherwise relate to the protection of the environment. Numerous governmental departments issue rules and regulations to implement and enforce such laws that are often difficult and costly to comply with and which carry substantial administrative, civil and even criminal penalties for failure to comply. Some laws, rules and regulations relating to protection of the environment may, in certain circumstances, impose “strict liability” for environmental contamination, rendering a person liable for environmental and natural resource damages and cleanup costs without regard to negligence or fault on the part of such person. Other laws, rules and regulations may restrict the rate of oil and natural gas production below the rate that would otherwise exist or even prohibit exploration or production activities in sensitive areas. In addition, state laws often require some form of remedial action to prevent pollution from former operations, such as closure of inactive pits and plugging of abandoned wells. The regulatory burden on the oil and natural gas industry increases its cost of doing business and consequently affects its profitability. These laws, rules and

11

regulations affect our operations, as well as the oil and gas exploration and production industry in general. We believe that we are in substantial compliance with current applicable environmental laws, rules and regulations and that continued compliance with existing requirements will not have a material adverse impact on us. Nevertheless, changes in existing environmental laws or the adoption of new environmental laws have the potential to adversely affect our operations.

OSHA.We are subject to the requirements of the Occupational Safety and Health Act (or OSHA) and comparable state laws that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that information be maintained about hazardous materials used or produced in our operations and that this information be provided to employees, state and local government authorities and citizens

PVR Coal Segment

General Regulation Applicable to Coal Lessees.PVR’s lessees are obligated to conduct mining operations in compliance with all applicable federal, state and local laws and regulations. These laws and regulations include matters involving the discharge of materials into the environment, employee health and safety, mine permits and other licensing requirements, reclamation and restoration of mining properties after mining is completed, management of materials generated by mining operations, surface subsidence from underground mining, water pollution, legislatively mandated benefits for current and retired coal miners, air quality standards, protection of wetlands, plant and wildlife protection, limitations on land use, storage of petroleum products and substances which are regarded as hazardous under applicable laws and management of electrical equipment containing polychlorinated biphenyls (or PCBs). Because of extensive and comprehensive regulatory requirements, violations during mining operations are not unusual in the industry and, notwithstanding compliance efforts, PVR does not believe violations by its lessees can be eliminated completely. However, none of the violations to date, or the monetary penalties assessed, have been material to us, PVR or, to our knowledge, to PVR’s lessees. PVR does not currently expect that future compliance will have a material adverse effect on PVR.

While it is not possible to quantify the costs of compliance by PVR’s lessees with all applicable federal, state and local laws and regulations, those costs have been and are expected to continue to be significant. The lessees post performance bonds pursuant to federal and state mining laws and regulations for the estimated costs of reclamation and mine closing, including the cost of treating mine water discharge when necessary. We do not accrue for such costs because PVR’s lessees are contractually liable for all costs relating to their mining operations, including the costs of reclamation and mine closure. However, PVR does require some smaller lessees to deposit into escrow certain funds for reclamation and mine closure costs or post performance bonds for these costs. Although the lessees typically accrue adequate amounts for these costs, their future operating results would be adversely affected if they later determined these accruals to be insufficient. Compliance with these laws and regulations has substantially increased the cost of coal mining for all domestic coal producers.

In addition, the utility industry, which is the most significant end-user of coal, is subject to extensive regulation regarding the environmental impact of its power generation activities which could affect demand for coal mined by PVR’s lessees. The possibility exists that new legislation or regulations may be adopted which have a significant impact on the mining operations of PVR’s lessees or their customers’ ability to use coal and may require PVR, its lessees or their customers to change operations significantly or incur substantial costs.

Air Emissions.The federal Clean Air Act and corresponding state and local laws and regulations affect all aspects of PVR’s business. The Clean Air Act directly impacts PVR’s lessees’ coal mining and processing operations by imposing permitting requirements and, in some cases, requirements to install certain emissions control equipment, on sources that emit various hazardous and non-hazardous air pollutants. The Clean Air Act also indirectly affects coal mining operations by extensively regulating the air emissions of coal-fired electric power generating plants. There have been a series of recent federal rulemakings that are focused on emissions

12

from coal-fired electric generating facilities. Installation of additional emissions control technology and additional measures required under U.S. Environmental Protection Agency (or the EPA) laws and regulations will make it more costly to operate coal-fired power plants and, depending on the requirements of individual state implementation plans, could make coal a less attractive fuel alternative in the planning and building of power plants in the future. Any reduction in coal’s share of power generating capacity could negatively impact PVR’s lessees’ ability to sell coal, which could have a material effect on PVR’s coal royalty revenues.

The EPA’s Acid Rain Program, provided in Title IV of the Clean Air Act, regulates emissions of sulfur dioxide from electric generating facilities. Sulfur dioxide is a by-product of coal combustion. Affected facilities purchase or are otherwise allocated sulfur dioxide emissions allowances, which must be surrendered annually in an amount equal to a facility’s sulfur dioxide emissions in that year. Affected facilities may sell or trade excess allowances to other facilities that require additional allowances to offset their sulfur dioxide emissions. In addition to purchasing or trading for additional sulfur dioxide allowances, affected power facilities can satisfy the requirements of the EPA’s Acid Rain Program by switching to lower sulfur fuels, installing pollution control devices such as flue gas desulfurization systems, or “scrubbers,” or by reducing electricity generating levels.

The EPA has promulgated rules, referred to as the “NOx SIP Call,” that require coal-fired power plants and other large stationary sources in 21 eastern states and Washington D.C. to make substantial reductions in nitrogen oxide emissions in an effort to reduce the impacts of ozone transport between states. Additionally, in March 2005, the EPA issued the final Clean Air Interstate Rule (or CAIR), which will permanently cap nitrogen oxide and sulfur dioxide emissions in 28 eastern states and Washington, D.C beginning in 2009 and 2010, respectively. CAIR requires these states to achieve the required emission reductions by requiring power plants to either participate in an EPA-administered “cap-and-trade” program that caps emission in two phases, or by meeting an individual state emissions budget through measures established by the state.

In March 2005, the EPA finalized the Clean Air Mercury Rule (or CAMR), which establishes a two-part, nationwide cap on mercury emissions from coal-fired power plants beginning in 2010. While currently the subject of extensive controversy and litigation, if fully implemented, CAMR would permit states to implement their own mercury control regulations or participate in an interstate cap-and-trade program for mercury emission allowances.

The EPA has adopted new, more stringent national air quality standards for ozone and fine particulate matter. As a result, some states will be required to amend their existing state implementation plans to attain and maintain compliance with the new air quality standards. For example, in December 2004, the EPA designated specific areas in the United States as in “non-attainment” with the new national ambient air quality standard for fine particulate matter. In November 2005, the EPA published proposed rules addressing how states would implement plans to bring applicable non-attainment regions into compliance with the new air quality standard. Under the EPA’s proposed rulemaking, states would have until April 2008 to submit their implementation plans to the EPA for approval. Because coal mining operations and coal-fired electric generating facilities emit particulate matter, PVR’s lessees’ mining operations and their customers could be affected when the new standards are implemented by the applicable states.

In June 2005, the EPA announced final amendments to its regional haze program originally developed in 1999 to improve visibility in national parks and wilderness areas. As part of the new rules, affected states must develop implementation plans by December 2007 that, among other things, identify facilities that will have to reduce emissions and comply with stricter emission limitations. This program may restrict construction of new coal-fired power plants where emissions are projected to reduce visibility in protected areas. In addition, this program may require certain existing coal-fired power plants to install emissions control equipment to reduce haze-causing emissions such as sulfur dioxide, nitrogen oxide and particulate matter.

The U.S. Department of Justice, on behalf of the EPA, has filed lawsuits against a number of coal-fired electric generating facilities alleging violations of the new source review provisions of the Clean Air Act. The

13

EPA has alleged that certain modifications have been made to these facilities without first obtaining certain permits issued under the new source review program. Several of these lawsuits have settled, but others remain pending. Depending on the ultimate resolution of these cases, demand for PVR’s coal could be affected, which could have an adverse effect on PVR’s coal royalty revenues.

Carbon Dioxide Emissions.The Kyoto Protocol to the United Nations Framework Convention on Climate Change calls for developed nations to reduce their emissions of greenhouse gases to 5% below 1990 levels by 2012. Carbon dioxide, which is a major byproduct of the combustion of coal and other fossil fuels, is subject to the Kyoto Protocol. The Kyoto Protocol went into effect on February 16, 2005 for those nations that ratified the treaty.

In 2002, the United States withdrew its support for the Kyoto Protocol. Since the Kyoto Protocol became effective, there has been increasing international pressure on the United States to adopt mandatory restrictions on carbon dioxide emissions. The United States Congress has considered bills in the past that would regulate domestic carbon dioxide emissions, but such bills have not yet received sufficient Congressional support for passage into law. Several states have also either passed legislation or announced initiatives focused on decreasing or stabilizing carbon dioxide emissions associated with the combustion of fossil fuels, and many of these measures have focused on emissions from coal-fired electric generating facilities. For example, in December 2005, seven northeastern states agreed to implement a regional cap-and-trade program to stabilize carbon dioxide emissions from regional power plants beginning in 2009. This initiative aims to reduce emissions of carbon dioxide to levels roughly corresponding to average annual emissions between 2000 and 2004. Recently, in February 2007, Massachusetts and Rhode Island agreed to join this group. Maryland is required to join the group by June 2007, but implementing regulations have not been finalized as of yet.

It is possible that future federal and state initiatives to control carbon dioxide emissions could result in increased costs associated with coal consumption, such as costs to install additional controls to reduce carbon dioxide emissions or costs to purchase emissions reduction credits to comply with future emissions trading programs. Such increased costs for coal consumption could result in some customers switching to alternative sources of fuel, which could negatively impact PVR’s lessees’ coal sales, and thereby have an adverse affect on PVR’s coal royalty revenues.

Surface Mining Control and Reclamation Act of 1977.The Surface Mining Control and Reclamation Act of 1977 (or SMCRA) and similar state statutes impose on mine operators the responsibility of restoring the land to its original state and compensating the landowner for types of damages occurring as a result of mining operations, and require mine operators to post performance bonds to ensure compliance with any reclamation obligations. Regulatory authorities may attempt to assign the liabilities of PVR’s coal lessees to it if any of those lessees are not financially capable of fulfilling those obligations. In conjunction with mining the property, PVR’s coal lessees are contractually obligated under the terms of their leases to comply with all state and local laws, including SMCRA, with obligations including the reclamation and restoration of the mined areas by grading, shaping and reseeding the soil. Upon completion of the mining, reclamation generally is completed by seeding with grasses or planting trees for use as pasture or timberland, as specified in the approved reclamation plan.

Hazardous Materials and Wastes.The Federal Comprehensive Environmental Response, Compensation and Liability Act (or CERCLA or the Superfund law), and analogous state laws, impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed to the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site where the release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Persons who are or were responsible for releases of hazardous substances under CERCLA may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment and for damages to natural resources.

Some products used by coal companies in operations generate waste containing hazardous substances. PVR could become liable under federal and state Superfund and waste management statutes if PVR’s lessees are

14

unable to pay environmental cleanup costs. CERCLA authorizes the EPA and, in some cases, third parties, to take actions in response to threats to the public health or the environment and to seek recovery from the responsible classes of persons the costs they incurred in connection with such response. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other wastes released into the environment.

Water Discharges.PVR’s coal lessees’ operations can result in discharges of pollutants into waters. The Clean Water Act and analogous state laws and regulations impose restrictions and strict controls regarding the discharge of pollutants into waters of the United States or state waters. The unpermitted discharge of pollutants such as from spill or leak incidents is prohibited. The Clean Water Act and regulations implemented thereunder also prohibit discharges of fill material and certain other activities in wetlands unless authorized by an appropriately issued permit.

PVR’s lessees’ mining operations are strictly regulated by the Clean Water Act, particularly with respect to the discharge of overburden and fill material into jurisdictional waters, including wetlands. Recent federal district court decisions in West Virginia, and related litigation filed in federal district court in Kentucky, have created uncertainty regarding the future ability to obtain certain general permits authorizing the construction of valley fills for the disposal of overburden from mining operations. A July 2004 decision by the Southern District of West Virginia inOhio Valley Environmental Coalition v. Bulen enjoined the Huntington District of the U.S. Army Corps of Engineers from issuing further permits pursuant to Nationwide Permit 21, which is a general permit issued by the U.S. Army Corps of Engineers to streamline the process for obtaining permits under Section 404 of the Clean Water Act. While the decision was vacated by the Fourth Circuit Court of Appeals in November 2005, a similar lawsuit has been filed in federal district court in Kentucky that seeks to enjoin the issuance of permits pursuant to Nationwide Permit 21 by the Louisville District of the U.S. Army Corps of Engineers. In the event similar lawsuits prove to be successful in adjoining jurisdictions, PVR’s lessees may be required to apply for individual discharge permits pursuant to Section 404 of the Clean Water Act in areas where they would have otherwise utilized Nationwide Permit 21. Such a change could result in delays in PVR’s lessees obtaining the required mining permits to conduct their operations, which could in turn have an adverse effect on PVR’s coal royalty revenues. Moreover, such individual permits are also subject to challenge. Alex Energy, Inc., a PVR lessee operating the Republic No. 2 Mine in Kanawha County, West Virginia, is currently a defendant inOhio Valley Environmental Coalition vs. U.S. Army Corps of Engineers, a lawsuit in the Southern District of West Virginia in which environmental groups challenged the issuance of individual valley fill permits to multiple coal operators in the state. On June 13, 2006, the Corps of Engineers suspended the valley fill permits at issue in the case, including the permit under which PVR’s lessee operates. The court has since stayed all proceedings pending further action by the Corps on these permits. Although portions of the Republic No. 2 Mine continue to operate under separate authorizations, delays in securing additional permit authorization for the areas affected by the aforementioned permit withdrawal could have an adverse effect on PVR’s coal royalty revenues.

The Clean Water Act also requires states to develop anti-degradation policies to ensure non-impaired waterbodies in the state do not fall below applicable water quality standards. These and other regulatory developments may restrict PVR’s lessees’ ability to develop new mines or could require its lessees to modify existing operations, which could have an adverse effect on PVR’s coal business.

The Federal Safe Drinking Water Act (or the SDWA) and its state equivalents affect coal mining operations by imposing requirements on the underground injection of fine coal slurries, fly ash and flue gas scrubber sludge, and by requiring permits to conduct such underground injection activities. In addition to establishing the underground injection control program, the SDWA also imposes regulatory requirements on owners and operators of “public water systems.” This regulatory program could impact PVR’s lessees’ reclamation operations where subsidence or other mining-related problems require the provision of drinking water to affected adjacent homeowners.

Mine Health and Safety Laws.The operations of PVR’s lessees are subject to stringent health and safety standards that have been imposed by federal legislation since the adoption of the Mine Health and Safety Act of

15

1969. The Mine Health and Safety Act of 1969 resulted in increased operating costs and reduced productivity. The Mine Safety and Health Act of 1977, which significantly expanded the enforcement of health and safety standards of the Mine Health and Safety Act of 1969, imposes comprehensive health and safety standards on all mining operations. In addition, as part of the Mine Health and Safety Acts of 1969 and 1977, the Black Lung Acts require payments of benefits by all businesses conducting current mining operations to coal miners with black lung or pneumoconiosis and to some beneficiaries of miners who have died from this disease.

Recent mining accidents in West Virginia and Kentucky have received national attention and instigated responses at the state and national level that are likely to result in increased scrutiny of current safety practices and procedures at all mining operations, particularly underground mining operations. In January 2006, West Virginia passed a law imposing stringent new mine safety and accident reporting requirements and increased civil and criminal penalties for violations of mine safety laws. On March 7, 2006, New Mexico Governor Bill Richardson signed into law an expanded miner safety program including more stringent requirements for accident reporting and the installation of additional mine safety equipment at underground mines. Similarly, on April 27, 2006, Kentucky Governor Ernie Fletcher signed mine safety legislation that includes requirements for increased inspections of underground mines and additional mine safety equipment and authorizes the assessment of penalties of up to $5,000 per incident for violations of mine ventilation or roof control requirements.

On June 15, 2006, the President signed new mining safety legislation that mandates similar improvements in mine safety practices, increases civil and criminal penalties for non-compliance, requires the creation of additional mine rescue teams, and expands the scope of federal oversight, inspection and enforcement activities. Earlier, the federal Mine Safety Health Administration announced the promulgation of new emergency rules on mine safety that took effect immediately upon their publication in theFederal Register on March 9, 2006. These rules address mine safety equipment, training, and emergency reporting requirements. Implementing and complying with these new laws and regulations could adversely affect PVR’s lessees’ coal production and could therefore have an adverse affect on PVR’s coal royalty revenues.

Mining Permits and Approvals.Numerous governmental permits or approvals are required for mining operations. In connection with obtaining these permits and approvals, PVR’s lessees may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed production of coal may have upon the environment. The requirements imposed by any of these authorities may be costly and time consuming and may delay commencement or continuation of mining operations.

In order to obtain mining permits and approvals from state regulatory authorities, mine operators, including PVR’s lessees, must submit a reclamation plan for restoring, upon the completion of mining operations, the mined property to its prior condition, productive use or other permitted condition. Typically, PVR’s lessees submit the necessary permit applications between 12 and 24 months before they plan to begin mining a new area. In PVR’s experience, permits generally are approved within 12 months after a completed application is submitted. In the past, PVR’s lessees have generally obtained their mining permits without significant delay. PVR’s lessees have obtained or applied for permits to mine a majority of the reserves that are currently planned to be mined over the next five years. PVR’s lessees are also in the planning phase for obtaining permits for the additional reserves planned to be mined over the following five years. However, there are no assurances that they will not experience difficulty in obtaining mining permits in the future. See “—PVR Coal Segment—Water Discharges.”

OSHA.PVR’s lessees and its own business are subject to OSHA. See “—Oil and Gas Segment—OSHA.”

PVR Natural Gas Midstream Segment

General Regulation. PVR’s natural gas gathering facilities generally are exempt from the FERC’s jurisdiction under the NGA, but FERC regulation nevertheless could significantly affect PVR’s gathering business and the market for its services. In recent years, the FERC has pursued pro-competitive policies in its

16

regulation of interstate natural gas pipelines into which PVR’s gathering pipelines deliver. However, we cannot assure you that the FERC will continue this approach as it considers matters such as pipeline rates and rules and policies that may affect rights of access to natural gas transportation capacity.

For example, the FERC will assert jurisdiction over an affiliated gatherer that acts to benefit its pipeline affiliate in a manner that is contrary to the FERC’s policies concerning jurisdictional services adopted pursuant to the NGA. In addition, natural gas gathering may receive greater regulatory scrutiny at both the state and federal levels now that the FERC has taken a less stringent approach to regulation of the gathering activities of interstate pipeline transmission companies and a number of such companies have transferred gathering facilities to unregulated affiliates. PVR’s gathering operations could be adversely affected should they be subject in the future to the application of state or federal regulation of rates and services. PVR’s gathering operations also may be or become subject to safety and operational regulations relating to the design, installation, testing, construction, operation, replacement and management of gathering facilities. Additional rules and legislation pertaining to these matters are considered or adopted from time to time. We cannot predict what effect, if any, such changes might have on PVR’s midstream operations, but the industry could be required to incur additional capital expenditures and increased costs depending on future legislative and regulatory changes.

In Texas, PVR’s gathering facilities are subject to regulation by the Texas Railroad Commission, which has the authority to ensure that rates, terms and conditions of gas utilities, including certain gathering facilities, are just and reasonable and not discriminatory. PVR’s operations in Oklahoma are regulated by the Oklahoma Corporation Commission, which prohibits PVR from charging any unduly discriminatory fees for its gathering services. PVR cannot predict whether its gathering rates will be found to be unjust, unreasonable or unduly discriminatory.

PVR is subject to ratable take and common purchaser statutes in Texas and Oklahoma. Ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes generally require gatherers to purchase without undue discrimination as to source of supply or producer. These statutes have the effect of restricting PVR’s right as an owner of gathering facilities to decide with whom it contracts to purchase or transport natural gas. Federal law leaves any economic regulation of natural gas gathering to the states, and Texas and Oklahoma have adopted complaint-based regulation that generally allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to natural gas gathering rates and access. We cannot assure you that federal and state authorities will retain their current regulatory policies in the future.

Texas and Oklahoma administer federal pipeline safety standards under the Natural Gas Pipeline Safety Act of 1968, as amended (or the NGPSA), which requires certain pipelines to comply with safety standards in constructing and operating the pipelines, and subjects pipelines to regular inspections. In response to recent pipeline accidents, Congress and the U.S. Department of Transportation have recently instituted heightened pipeline safety requirements. Certain of PVR’s gathering facilities are exempt from these federal pipeline safety requirements under the rural gathering exemption. We cannot assure you that the rural gathering exemption will be retained in its current form in the future.

Failure to comply with applicable regulations under the NGA, the NGPSA and certain state laws can result in the imposition of administrative, civil and criminal remedies.

Air Emissions.PVR’s midstream operations are subject to the Clean Air Act and comparable state laws and regulations. See “—PVR Coal Segment—Air Emissions.” These laws and regulations govern emissions of pollutants into the air resulting from the activities of PVR’s processing plants and compressor stations and also impose procedural requirements on how PVR conducts its midstream operations. Such laws and regulations may include requirements that PVR obtain pre-approval for the construction or modification of certain projects or facilities expected to produce air emissions, strictly comply with the emissions and operational limitations of air emissions permits PVR is required to obtain or utilize specific equipment or technologies to control emissions.

17

PVR’s failure to comply with these requirements could subject PVR to monetary penalties, injunctions, conditions or restrictions on operations, and potentially criminal enforcement actions. PVR will be required to incur certain capital expenditures in the future for air pollution control equipment in connection with obtaining and maintaining operating permits and approvals for air emissions.

Hazardous Materials and Wastes.PVR’s midstream operations could incur liability under CERCLA and comparable state laws resulting from the disposal or other release of hazardous substances or wastes originating from properties PVR owns or operates, regardless of whether such disposal or release occurred during or prior to PVR’s acquisition of such properties. See “—PVR Coal Segment—Hazardous Materials and Waste.” Although petroleum, including natural gas and NGLs are generally excluded from CERCLA’s definition of “hazardous substance,” PVR’s midstream operations do generate wastes in the course of ordinary operations that may fall within the definition of a “hazardous substance.”

PVR’s midstream operations generate wastes, including some hazardous wastes, that are subject to the Resource Conservation and Recovery Act (or RCRA) and comparable state laws. However, RCRA currently exempts many natural gas gathering and field processing wastes from classification as hazardous waste. Specifically, RCRA excludes from the definition of hazardous waste produced waters and other wastes associated with the exploration, development or production of crude oil, natural gas or geothermal energy. Unrecovered petroleum product wastes, however, may still be regulated under RCRA as solid waste. Moreover, ordinary industrial wastes such as paint wastes, waste solvents, laboratory wastes and waste compressor oils may be regulated as hazardous waste. The transportation of natural gas and NGLs in pipelines may also generate some hazardous wastes. Although PVR believes it is unlikely that the RCRA exemption will be repealed in the near future, repeal would increase costs for waste disposal and environmental remediation at PVR’s facilities.

PVR currently owns or leases numerous properties that for many years have been used for the measurement, gathering, field compression and processing of natural gas and NGLs. Although we believe that the operators of such properties used operating and disposal practices that were standard in the industry at the time, hydrocarbons or wastes may have been disposed of or released on or under such properties or on or under other locations where such wastes have been taken for disposal. These properties and the substances disposed or released on them may be subject to CERCLA, RCRA and analogous state laws. Under such laws, PVR could be required to remove or remediate previously disposed wastes (including waste disposed of or released by prior owners or operators) or property contamination (including groundwater contamination, whether from prior owners or operators or other historic activities or spills) or to perform remedial plugging or pit closure operations to prevent future contamination. PVR has ongoing remediation projects underway at several sites, but it does not believe that the costs associated with such cleanups will have a material adverse impact on PVR’s operations or revenues.

Water Discharges.PVR’s midstream operations are subject to the Clean Water Act. See “—PVR Coal Segment—Water Discharges.” Any unpermitted release of pollutants, including NGLs or condensates, from PVR’s systems or facilities could result in fines or penalties as well as significant remedial obligations.

OSHA.PVR midstream’s operations are subject to OSHA. See “—Oil and Gas Segment—OSHA.”

Employees and Labor Relations