Except where noted, the following discussion of cash flows and contractual obligations relates to consolidated results of the Company.

Capital expenditures totaled $435.8 million for the nine months ended September 30, 2005, compared with $124.6 million during the same period in 2004. The following table sets forth capital expenditures by segment, made during the periods indicated:

We are committed to expanding our oil and natural gas operations over the next several years through a combination of exploration, development and acquisition of new properties. We have a portfolio of assets which balances relatively low risk, moderate return development projects in Appalachia and Mississippi with relatively moderate risk, potentially higher return development projects and exploration prospects in south Texas and south Louisiana.

Oil and gas segment capital expenditures for 2005 are expected to be approximately $171 million to $177 million. The increase in anticipated 2005 capital expenditures from our original capital expenditures budget of $146 million is primarily due to increased expenditures to expand the Company’s Cotton Valley program in east Texas and north Louisiana, the horizontal CBM program in Appalachia and the Selma Chalk program in Mississippi. As of September 30, 2005, outstanding borrowings under our $150 million credit facility were $89 million, and we expect to fund our 2005 capital expenditures with a combination of internal cash flow and credit facility borrowings.

During the first nine months of 2005, PVR made aggregate capital expenditures of approximately $289 million for the Cantera Acquisition and four coal reserve acquisitions. All acquisitions were initially funded using credit facility borrowings. Funding of the Cantera Acquisition is further described in the following section, “Cash Flows from Financing Activities.”

Cash Flows from Financing Activities

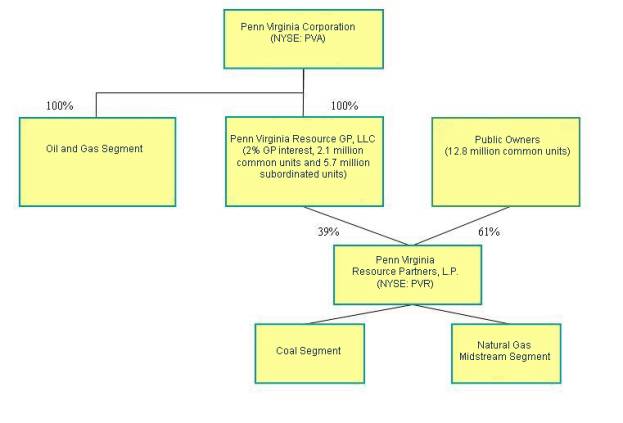

Consolidated net cash provided by financing activities was $250.7 million for the nine months ended September 30, 2005, compared with $16.3 million provided by financing activities for the same period in 2004. PVR had borrowings, net of repayments, of $140 million in the nine months ended September 30, 2005, to finance acquisitions, compared to $26 million in net borrowings by PVR in the same period of 2004 to finance an equity investment. During the nine months ended September 30, 2005, we borrowed $13 million on PVA’s credit facility, net of repayments. During the nine months ended September 30, 2004, we borrowed $9 million under PVA’s credit facility, net of repayments. PVR received proceeds of $126.5 million, net of a $2.8 million contribution by the general partner, from the sale of its common units in a public offering which was completed in March 2005. In the nine months ended September 30, 2005 and 2004, we received $15.6 million and $12.9 million of cash distributions from PVR. These distributions were primarily used for capital expenditure needs.

In October 2005, PVR announced a $0.65 per unit quarterly distribution for the three months ended September 30, 2005, or $2.60 per unit on an annualized basis. The distribution will be paid on November 14, 2005, to unitholders of record on November 3, 2005. As a result of the 7.8 million limited partner units and incentive distribution rights we own as PVR’s general partner, cash distributions we receive from PVR are expected to be approximately $5.6 million in the fourth quarter of 2005.

As of September 30, 2005, we had outstanding borrowings of $89 million under our revolving credit facility which has an initial commitment of $150 million and which can be expanded at our option to our current approved borrowing base of $200 million. We also have a $5 million line of credit, which had no borrowings against it as of September 30, 2005. The line of credit is effective through June 2006 and is renewable annually in June. The financial covenants in our credit agreements require us to maintain certain levels of debt-to-earnings and dividend limitation restrictions. At September 30, 2005, we were in compliance with all of our covenants.

As of September 30, 2005, PVR had outstanding borrowings of $258 million, consisting of $175 million borrowed under its revolving credit facility and $83 million of senior unsecured notes (the “Notes”). The current portion of the Notes as of September 30, 2005, was $8 million.

In connection with the Notes, PVR entered into an interest rate swap agreement with an original notional amount of $30 million to hedge a portion of the fair value of the Notes (the “Senior Notes Swap”). The notional amount decreased by one-third of each principal payment. Under the terms of the Senior Notes Swap agreement, the counterparty paid a fixed rate of 5.77 percent on the notional amount and received a variable rate equal to the floating interest rate which was determined semi-annually and was based on the six month London Interbank Offering Rate (“LIBOR”) plus 2.36 percent. Settlements on the Senior Notes Swap were recorded as interest expense. In conjunction with the closing of the Cantera Acquisition on March 3, 2005, PVR entered into an amendment to the Notes in which it agreed to a 0.25 percent increase in the fixed interest rate on the Notes, from 5.77 percent to 6.02 percent. The Senior Notes Swap was redesignated as a fair value hedge on that date and was determined to be highly effective.

The Senior Notes Swap agreement was settled on June 30, 2005, for $0.8 million. The settlement was paid in cash by PVR to the counterparty in July 2005. Upon settlement of the interest rate swap agreement, the $0.8 million negative fair value adjustment of the carrying amount of long-term debt will be amortized as interest expense over the remaining term of the Notes using the interest rate method.

37

Concurrent with the closing of the Cantera Acquisition in March 2005, PVR entered into a new unsecured $260 million, five-year credit agreement consisting of a $150 million revolving credit facility (the “PVR revolver”) that matures in March 2010 and a $110 million term loan. A portion of the PVR revolver and the term loan were used to fund the Cantera Acquisition and to repay borrowings under PVR’s previous credit facility. Proceeds of $126.5 million received from a subsequent public offering of 2.5 million of PVR’s common units in March 2005 were used to repay the $110 million term loan and a portion of the amount outstanding under the PVR revolver. The term loan cannot be re-borrowed. The PVR revolver is available for general Partnership purposes, including working capital, capital expenditures and acquisitions, and includes a $10 million sublimit for the issuance of letters of credit.

In July 2005, PVR amended the credit agreement to increase the size of the PVR revolver from $150 million to $300 million. PVR increased its one-time option under the PVR revolver to expand the facility from $100 million to $150 million, for a potential total credit facility of $450 million, upon receipt by the credit facility’s administrative agent of commitments from one or more lenders. The amendment also updated certain debt covenant definitions. The interest rate under the credit agreement remained unchanged and will fluctuate based on our ratio of total indebtedness to EBITDA. At our option, interest shall be payable at a base rate plus an applicable margin ranging up to 1.00 percent or at a rate derived from the London Interbank Offering Rate (“LIBOR”) plus an applicable margin ranging from 1.00 percent to 2.00 percent. Other terms of the credit agreement remained unchanged.

In September 2005, PVR entered into two interest rate swap agreements to establish fixed rates on $60 million of the LIBOR-based portion of the outstanding balance of the PVR revolver until March 2010 (the “Revolver Swaps”). PVR pays a fixed rate of 4.22 percent plus the applicable margin on the notional amount, and the counterparties pay a variable rate equal to the three month LIBOR. Settlements on the Revolver Swaps are recorded as interest expense. The Revolver Swap agreements were designated as cash flow hedges. Accordingly, the effective portion of the change in the fair value of the swap transactions is recorded each period in other comprehensive income. The ineffective portion of the change in fair value, if any, is recorded to current period earnings in interest expense. After considering the applicable margin of 1.75 percent currently in effect on the revolver, the total interest rate on the $60 million portion of the PVR revolver borrowings covered by the Revolver Swaps is 5.97 percent.

Future Capital Needs and Commitments. For the year ending December 31, 2005, we anticipate making total capital expenditures in our oil and gas segment, excluding acquisitions, of approximately $171 million to $177 million. These expenditures are expected to be funded primarily by operating cash flow. Additional funding will be provided as needed from our revolving credit facility, under which we had $61 million of borrowing capacity as of September 30, 2005.

In the coal and natural gas midstream segments, over the remainder of 2005, PVR anticipates making total capital expenditures, excluding acquisitions, of approximately $6 million to $8 million, primarily for construction of a processing plant and high speed rail loading facility on the Wayland property acquired in July 2005 and for midstream system expansion projects. Part of PVR’s strategy is to make acquisitions which increase cash available for distribution to its unitholders. PVR’s ability to make these acquisitions in the future will depend in part on the availability of debt financing and on its ability to periodically use equity financing through the issuance of new partnership common units.

Environmental Matters

Our businesses are subject to various environmental hazards. Numerous federal, state and local laws, regulations and rules govern the environmental aspects of our businesses. Noncompliance with these laws, regulations and rules can result in substantial penalties or other liabilities. We do not believe our environmental risks are materially different from those of comparable companies or that cost of compliance will have a material adverse effect on our profitability, capital expenditures, cash flows or competitive position; however, there is no assurance that future changes in or additions to laws, regulations or rules regarding the protection of the environment will not have such an impact. We believe we are materially in compliance with environmental laws, regulations and rules.

In conjunction with the Partnership’s leasing of property to coal operators, environmental and reclamation liabilities are generally the responsibilities of the Partnership’s lessees. Lessees post performance bonds pursuant to federal and state mining laws and regulations for the estimated costs of reclamation and mine closing, including the cost of treating mine water discharge when necessary.

Recent Accounting Pronouncements

See Note 15 in the Notes to Consolidated Financial Statements for a description of recent accounting pronouncements.

38

In August 2005, the Securities and Exchange Commission (“SEC”) issued a complex reform package that is effective December 1, 2005, and requires large registrants to disclose in annual reports material comments from the SEC staff unresolved for more than 180 days. The reform package divides all issuers into four categories and streamlines the shelf registration process. New rules require disclosure of risk factors in annual reports on Form 10-K. Previously disclosed risk factors would be updated quarterly for material changes and reported on Form 10-Q.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Interest Rate Risk. At September 30, 2005, we had $89 million of long-term debt borrowed under PVA’s credit facility. The credit facility matures in December 2007 and is governed by a borrowing base calculation that is re-determined semi-annually. We have the option to elect interest at (i) LIBOR plus a Eurodollar margin ranging from 1.25 percent to 2.00 percent, based on the percentage of the borrowing base outstanding or (ii) the greater of the prime rate or federal funds rate plus a margin ranging from 0.30 percent to 0.50 percent. As a result, our 2005 interest costs will fluctuate based on short-term interest rates relating to our credit facility.

As of September 30, 2005, $82.9 million of PVR’s outstanding indebtedness under the Notes carried a fixed interest rate throughout its term. PVR executed an interest rate derivative transaction in March 2003 to effectively convert the interest rate on one-third of the amount financed under the Notes from a fixed rate of 5.77 percent to a floating rate of LIBOR plus 2.36 percent. The interest rate swap was accounted for as a fair value hedge in compliance with SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, as amended by SFAS No. 137 and SFAS No. 138. The interest rate swap was settled on June 30, 2005, for $0.8 million. The settlement was paid in cash by PVR to the counterparty in July 2005.

As of September 30, 2005, $175.0 million of PVR’s outstanding indebtedness under its revolving credit facility carried a variable interest rate throughout its term. PVR executed interest rate derivative transactions in September 2005 to effectively convert the interest rate on $60 million of the amount financed under the revolving credit facility from a LIBOR-based floating rate to a fixed rate of 4.22 percent plus the applicable margin. The interest rate swaps are accounted for as cash flow hedges in compliance with SFAS No. 133.

Price Risk Management. Our price risk management program permits the utilization of derivative financial instruments (such as futures, forwards, option contracts and swaps) to seek to mitigate the price risks associated with fluctuations in natural gas and crude oil prices as they relate to our anticipated production. These financial instruments are designated as cash flow hedges and accounted for in accordance with SFAS No. 133, as amended by SFAS No. 137, SFAS No. 138 and SFAS No. 139. The derivative financial instruments are placed with major financial institutions that we believe are of minimum credit risk. The fair value of our price risk management assets are significantly affected by energy price fluctuations. See the discussion and table in Note 8 in the Notes to Consolidated Financial Statements for a description of our hedging program and a listing of open derivative agreements and their fair value as of September 30, 2005.

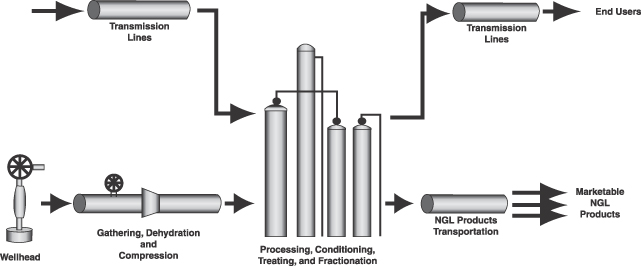

When PVR agreed to acquire Cantera, management wanted to ensure an acceptable return on the investment. This objective was supported by entering into pre-closing commodity price derivative agreements covering approximately 75 percent of the net volume of NGLs expected to be sold from April 2005 through December 2006. Rising commodity prices resulted in an increase in the market value of those derivative agreements before they qualified for hedge accounting. This change in market value resulted in a $13.9 million noncash charge to earnings for the unrealized loss on these derivatives. Subsequent to the Cantera Acquisition, PVR evaluated the effectiveness of the derivative agreements in relation to the underlying commodities and designated the agreements as cash flow hedges in accordance with SFAS No. 133. Upon qualifying for hedge accounting, changes in the market value of the derivative agreements are accounted for as other comprehensive income or loss to the extent they are effective, rather than as a direct impact on net income. SFAS No. 133 requires the Partnership to continue to measure the effectiveness of the derivative agreements in relation to the underlying commodity being hedged, and it will be required to record the ineffective portion of the agreements in net income for the respective period. During the third quarter of 2005, we reported a $3.6 million net unrealized gain on derivatives for the ineffective portion of the agreements as of September 30, 2005. Cash settlements with the counterparties to the derivative agreements will occur monthly over the life of the agreements, with PVR receiving a correspondingly higher or lower amount for the physical sale of the commodity over the same period. In addition, PVR entered into derivative agreements for ethane, propane, crude oil and natural gas to further protect its margins subsequent to the Cantera Acquisition. These derivative agreements have been designated as cash flow hedges. See Note 8 in the Notes to Consolidated Financial Statements for a description of PVR’s hedging program and a listing of open derivative agreements and their fair value.

39

Forward-Looking Statements

Statements included in this report which are not historical facts (including any statements concerning plans and objectives of management for future operations or economic performance, or assumptions related thereto) are forward-looking statements. In addition, the Company and its representatives may from time to time make other oral or written statements which are also forward-looking statements. These statements use forward-looking words such as “may,” “will,” “anticipate,” “believe,” “expect,” “project” or other similar words. These statements discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition or state other “forward looking” information.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, we caution you that assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this report and the documents we have incorporated by reference. These statements reflect our current views with respect to future events and are subject to various risks, uncertainties and assumptions including, but not limited, to the following:

| • | the cost of finding and successfully developing oil and gas reserves; |

| | |

| • | our ability to acquire new oil and gas reserves and the price for which such reserves can be acquired; |

| | |

| • | energy prices generally and the specific and relative prices of crude oil, natural gas, NGLs and coal; |

| | |

| • | the volatility of commodity prices for crude oil, natural gas, NGLs and coal; |

| | |

| • | the projected supply of and demand for crude oil, natural gas, NGLs and coal; |

| | |

| • | our ability to obtain adequate pipeline transportation capacity for our oil and gas production; |

| | |

| • | availability of required drilling rigs, materials and equipment; |

| | |

| • | non-performance by third party operators in wells in which we own an interest; |

| | |

| • | competition among producers in the oil and natural gas, coal and natural gas midstream industries generally; |

| | |

| • | the extent to which the amount and quality of actual production of our oil and natural gas or PVR’s coal differs from estimated recoverable proved oil and gas reserves and coal reserves; |

| | |

| • | PVR’s ability to make cash distributions to its general partner and its unitholders; |

| | |

| • | hazards or operating risks incidental to our business and to PVR’s coal or midstream business; |

| | |

| • | PVR’s ability to integrate and manage its new midstream business; |

| | |

| • | PVR’s ability to continually find and contract for new sources of natural gas supply for its midstream business; |

| | |

| • | PVR’s ability to retain its existing or acquire new midstream customers; |

| | |

| • | PVR’s ability to acquire new coal reserves and the price for which such reserves can be acquired; |

| | |

| • | PVR’s ability to lease new and existing coal reserves; |

| | |

| • | the ability of PVR’s lessees to produce sufficient quantities of coal on an economic basis from PVR’s reserves; |

| | |

| • | unanticipated geological problems; |

| | |

| • | the occurrence of unusual weather or operating conditions including force majeure events; |

| | |

| • | the failure of equipment or processes to operate in accordance with specifications or expectations; |

40

| • | delays in anticipated start-up dates of our oil and natural gas production and PVR’s lessees’ mining operations; |

| | |

| • | environmental risks affecting the drilling and producing of oil and gas wells, the mining of coal reserves or the production, gathering and processing of natural gas; |

| | |

| • | the timing of receipt of necessary governmental permits by us and by PVR or PVR’s lessees; |

| | |

| • | the risks associated with having or not having price risk management programs; |

| | |

| • | labor relations and costs; |

| | |

| • | accidents; |

| | |

| • | changes in governmental regulation or enforcement practices, especially with respect to environmental, health and safety matters, including with respect to emissions levels applicable to coal-burning power generators; |

| | |

| • | risks and uncertainties relating to general domestic and international economic (including inflation and interest rates) and political conditions (including the impact of potential terrorist attacks); |

| | |

| • | the experience and financial condition of PVR’s coal lessees and midstream customers; |

| | |

| • | changes in financial market conditions; and |

| | |

| • | other risk factors as detailed in the our Annual Report on Form 10-K for the year ended December 31, 2004. |

Many of such factors are beyond our ability to control or predict. Readers are cautioned not to put undue reliance on forward-looking statements.

While we periodically reassess material trends and uncertainties affecting our results of operations and financial condition in connection with the preparation of Management’s Discussion and Analysis of Results of Operations and Financial Condition and certain other sections contained in our quarterly, annual and other reports filed with the Securities and Exchange Commission, we do not undertake any obligation to review or update any particular forward-looking statement, whether as a result of new information, future events or otherwise.

Item 4. Controls and Procedures

(a) Disclosure Controls and Procedures

We have established disclosure controls and procedures to ensure that material information relating to the Company and its consolidated subsidiaries is made known to the officers who certify the Company’s financial reports. There are inherent limitations to the effectiveness of any system of disclosure controls and procedures, including the possibility of human error and the circumvention or overriding of controls and procedures. Accordingly, even effective disclosure controls and procedures can only provide reasonable assurance of achieving their control objectives.

The Company, under the supervision and with the participation of its management, including its principal executive officer and principal financial officer, performed an evaluation of the design and operation of the Company’s disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of the end of the period covered by this report. Based on that evaluation, the Company’s principal executive officer and principal financial officer concluded that such disclosure controls and procedures are effective to ensure that material information relating to the Company, including its consolidated subsidiaries, is accumulated and communicated to the Company’s management and made known to the principal executive officer and principal financial officer, particularly during the period for which this periodic report was being prepared.

(b) Changes in Internal Control over Financial Reporting

No changes were made in our internal control over financial reporting that occurred during our last fiscal quarter that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting, except that we are in the process of evaluating the controls in the newly acquired natural gas midstream business and integrating the segment into our existing internal control structure.

41

PART II. Other Information

Items 1, 2, 3, 4 and 5 are not applicable and have been omitted.

Item 6. Exhibits

12 | | Statement of Computation of Ratio of Earnings to Fixed Charges Calculation. |

| | |

31.1 | | Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 302 of the Sarbanes- Oxley Act of 2002. |

| | |

31.2 | | Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 302 of the Sarbanes- Oxley Act of 2002. |

| | |

32.1 | | Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes- Oxley Act of 2002. |

| | |

32.2 | | Certification Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes- Oxley Act of 2002. |

42

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PENN VIRGINIA CORPORATION | | |

| | |

Date: November 3, 2005 | By: | /s/ Frank A. Pici |

| |

|

| | Frank A. Pici |

| | Executive Vice President and |

| | Chief Financial Officer |

| | |

| | |

Date: November 3, 2005 | By: | /s/ Forrest W. McNair |

| |

|

| | Forrest W. McNair |

| | Vice President and Controller |

43