Exhibit 99.2

Management’s Discussion

and Analysis

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2018

|

| |

| TABLE OF CONTENTS | |

| | |

| |

| |

| Highlights | |

| Operating Performance | |

| 2018 Annual Operating Outlook | |

| Project Development Update | |

| Overview of Financial Results | |

| |

| |

| |

| |

| |

| |

| |

| |

| Cautionary Note | |

|

| | |

| | PAN AMERICAN SILVER CORP. | 14 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

August 8, 2018

This Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand the significant factors that influence the performance of Pan American Silver Corp. and its subsidiaries (collectively “Pan American”, “we”, “us”, “our” or the “Company”) and such factors that may affect its future performance. This MD&A should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2017 (the "2017 Financial Statements"), and the related notes contained therein, and the unaudited condensed interim consolidated financial statements for the three and six months ended June 30, 2018 (the “Q2 2018 Financial Statements”), and the related notes contained therein. All amounts in this MD&A, the 2017 Financial Statements, and the Q2 2018 Financial Statements are expressed in United States dollars (“USD”), unless identified otherwise. The Company reports its financial position, results of operations and cash flows in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board. Pan American’s significant accounting policies are set out in Note 2 of the 2017 Financial Statements.

This MD&A refers to various non-Generally Accepted Accounting Principles (“non-GAAP”) measures, such as “all-in sustaining cost per silver ounce sold", “cash costs per ounce of silver”, "total debt", “working capital", “general and administrative cost per silver ounce produced”, “adjusted earnings” and “basic adjusted earnings per share”, which are used by the Company to manage and evaluate operating performance at each of the Company’s mines and are widely reported in the mining industry as benchmarks for performance, but do not have standardized meaning under IFRS. To facilitate a better understanding of these non-GAAP measures as calculated by the Company, additional information has been provided in this MD&A. Please refer to the section of this MD&A entitled “Alternative Performance (Non-GAAP) Measures” for a detailed description of “all-in sustaining cost per silver ounce sold”, “cash costs per ounce of silver”, “working capital”, “general and administrative cost per silver ounce produced”, “adjusted earnings“ and “basic adjusted earnings per share”, as well as details of the Company’s by-product credits and a reconciliation of these measures to the Q2 2018 Financial Statements.

Any reference to “cash costs” or “cash costs per ounce of silver” in this MD&A should be understood to mean cash costs per ounce of silver, net of by-product credits. Any reference to “AISCSOS” in this MD&A should be understood to mean all-in sustaining costs per silver ounce sold, net of by-product credits.

Except for historical information contained in this MD&A, the following disclosures are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian provincial securities laws or are future oriented financial information and as such are based on an assumed set of economic conditions and courses of action. Please refer to the cautionary note regarding forward-looking statements and information at the back of this MD&A and the “Risks Related to Pan American’s Business” contained in the Company’s most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and Form 40-F on file with the U.S. Securities and Exchange Commission (the “SEC”). Additional information about Pan American and its business activities, including its Annual Information Form, is available on SEDAR at www.sedar.com

|

| | |

| | PAN AMERICAN SILVER CORP. | 15 |

|

| | |

| CORE BUSINESS AND STRATEGY | | |

Pan American engages in silver mining and related activities, including exploration, mine development, extraction, processing, refining and reclamation. The Company owns and operates silver mines located in Peru, Mexico, Argentina, and Bolivia. In addition, the Company is exploring for new silver deposits and opportunities throughout North and South America. The Company is listed on the Toronto Stock Exchange (Symbol: PAAS) and on the Nasdaq Global Select Market (“NASDAQ”) in New York (Symbol: PAAS).

Pan American’s vision is to be the world’s pre-eminent silver producer, with a reputation for excellence in discovery, engineering, innovation and sustainable development. To achieve this vision, we base our business on the following strategy:

| |

| • | Generate sustainable profits and superior returns on investments through the safe, efficient and environmentally sound development and operation of silver assets |

| |

| • | Constantly replace and grow our mineable silver reserves and resources through targeted near-mine exploration and global business development |

| |

| • | Foster positive long-term relationships with our employees, our shareholders, our communities and our local governments through open and honest communication and ethical and sustainable business practices |

| |

| • | Continually search for opportunities to upgrade and improve the quality of our silver assets both internally and through acquisition |

| |

| • | Encourage our employees to be innovative, responsive and entrepreneurial throughout our entire organization |

To execute this strategy, Pan American has assembled a sector-leading team of mining professionals with a depth of knowledge and experience in all aspects of our business, which enables the Company to confidently advance early stage projects through construction and into operation.

Pan American is determined to conduct its business in a responsible and sustainable manner. Caring for the environment in which we operate, contributing to the long-term development of our host communities and ensuring that our employees can work in a safe and secure manner are core values at Pan American. We are committed to maintaining positive relations with our employees, the local communities and the government agencies, all of whom we view as partners in our enterprise.

|

| | |

| | PAN AMERICAN SILVER CORP. | 16 |

Operations

| |

| • | Silver production of 6.29 million ounces |

Consolidated silver production for the three months ended June 30, 2018 ("Q2 2018") of 6.29 million ounces was similar to the 6.30 million produced in the three months ended June 30, 2017 ("Q2 2017"). Silver production for the six months ended June 30, 2018 ("H1 2018") totaled 12.4 million ounces, in-line with expectations and on-track to achieve management's annual guidance for 2018 of 25.0 million to 26.5 million ounces.

| |

| • | By-product production on track to achieve annual guidance |

Consolidated gold production in Q2 2018 was 53.4 thousand ounces, 15.7 thousand ounces higher than the 37.7 thousand ounces produced in Q2 2017. H1 2018 gold production of 99.6 thousand ounces was in-line with expected production required to achieve guidance for 2018 of 175.0 thousand to 185.0 thousand ounces.

Zinc production in Q2 2018 was 14.9 thousand tonnes, 8% higher than in the comparable quarter of 2017. Lead production was 5.1 thousand tonnes, 6% less than Q2 2017 production. Copper production of 2.0 thousand tonnes was 44% lower than in Q2 2017. Base metal production in H1 2018 was 29.6 thousand tonnes of zinc, 10.4 thousand tonnes of lead, and 4.9 thousand tonnes of copper, all in-line with expectations and on-track to achieve management's guidance for 2018 of 60.0 thousand to 62.0 thousand tonnes of zinc, 21.0 thousand to 22.0 thousand tonnes of lead, and 12.0 thousand to 12.5 thousand tonnes of copper.

| |

| • | Cash Costs forecast lowered on record low cash costs of $0.92 per ounce |

Consolidated cash costs for Q2 2018 were a record $0.92 per ounce, $4.79 per ounce or 84% lower than in Q2 2017. H1 2018 cash costs of $1.04 per ounce were $4.90 per ounce or 82% lower than H1 2017. Cash costs for H1 2018 were $2.56 per ounce less than the low end of management’s annual forecast range of $3.60 to $4.60 per ounce, hence management has revised the 2018 cash costs forecast to $2.80 to $3.80 per ounce, representing a 20% decrease from the mid-points of the forecast ranges. Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to cost of sales.

Financial

| |

| • | Revenue and net earnings up quarter-over-quarter |

Revenue in Q2 2018 of $216.5 million was up 8% from Q2 2017, mainly due to higher by-product prices and lower treatment and refining charges.

Net earnings in Q2 2018 were $36.7 million ($0.24 basic earnings per share) compared with $36.0 million ($0.23 basic earnings per share) in Q2 2017. Increased mine operating earnings, from increased revenues and lower production costs, were offset by higher income tax expense in Q2 2018.

Adjusted earnings in Q2 2018 were $35.4 million ($0.23 basic adjusted earnings per share) compared with $22.3 million ($0.15 basic adjusted earnings per share) in Q2 2017. Increased revenue from higher by-product metal prices; decreased production costs; and lower income tax expense, from income tax recoveries in Q2 2018 relating to the recognition of certain tax assets, were the major drivers in the quarter-over-quarter increase.

| |

| • | Strong liquidity and working capital position |

As at June 30, 2018, the Company had cash and short-term investment balances of $250.2 million, working capital of $463.1 million, and $300.0 million available under its undrawn revolving credit facility. Total debt of $9.7 million was related entirely to finance lease liabilities.

| |

| • | Forecast lowered for 2018 All-In Sustaining Costs per Silver Ounce Sold (“AISCSOS”) |

Q2 2018 AISCSOS of $6.45 was $4.28, or 40%, lower than in Q2 2017, and was mainly attributable to higher than anticipated by-product credits. H1 2018 AISCSOS of $6.71 was $2.59 below the low end of management's forecast for 2018 of $9.30 to $10.80. Management has revised the 2018 AISCSOS forecast to $8.50 to $10.00, representing an 8% decrease from the mid-points of the forecast ranges. AISCSOS is a non-GAAP measure, please refer to the

|

| | |

| | PAN AMERICAN SILVER CORP. | 17 |

section “Alternative Performance (Non-GAAP) Measures” of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements.

The following table provides silver production and cash costs at each of Pan American’s operations for the respective three and six-month periods ended June 30, 2018 and 2017:

|

| | | | | | | | | | | | | | | | | |

| | | Silver Production (ounces ‘000s) | Cash Costs(1) ($ per ounce) |

| | | Three months ended

June 30, | Six months ended

June 30, | Three months ended

June 30, | Six months ended

June 30, |

| | | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | 2017 |

| La Colorada | | 1,873 |

| 1,731 |

| 3,523 |

| 3,361 |

| 1.93 |

| 3.38 |

| 1.34 |

| 3.20 |

|

| Dolores | | 1,088 |

| 1,037 |

| 2,290 |

| 2,002 |

| (9.80 | ) | 0.12 |

| (6.29 | ) | (0.74 | ) |

| Alamo Dorado | | — |

| 261 |

| — |

| 608 |

| NA |

| 11.18 |

| NA |

| 17.03 |

|

| Huaron | | 742 |

| 898 |

| 1,673 |

| 1,794 |

| 1.95 |

| 2.24 |

| 0.03 |

| 1.51 |

|

Morococha(2) | | 652 |

| 634 |

| 1,383 |

| 1,278 |

| (6.41 | ) | (2.35 | ) | (9.03 | ) | (2.78 | ) |

San Vicente(3) | | 976 |

| 766 |

| 1,740 |

| 1,701 |

| 9.36 |

| 14.02 |

| 10.09 |

| 13.16 |

|

| Manantial Espejo | | 962 |

| 975 |

| 1,787 |

| 1,762 |

| 6.62 |

| 15.11 |

| 9.06 |

| 17.46 |

|

Total (4) | | 6,294 |

| 6,303 |

| 12,396 |

| 12,507 |

| 0.92 |

| 5.71 |

| 1.04 |

| 5.94 |

|

| |

| (1) | Cash costs is a non-GAAP measure. Please refer to the section “Alternative Performance (Non-GAAP) Measures” of this MD&A for a detailed description of the cash cost calculation, details of the Company’s by-product credits and a reconciliation of this measure to the Q2 2018 Financial Statements. |

| |

| (2) | Morococha data represents Pan American's 92.3% interest in the mine's production. |

| |

| (3) | San Vicente data represents Pan American's 95.0% interest in the mine's production. |

| |

| (4) | Totals may not add due to rounding. |

Silver Production

Consolidated silver production in Q2 2018 was comparable to Q2 2017 production as a result of higher production at San Vicente and La Colorada largely offsetting the discontinued production at Alamo Dorado and lower production at Huaron. The increase in production at San Vicente was from accessing higher-grade stopes and better ore control. La Colorada production continues to benefit from the mine expansion completed in 2017. Each operation’s silver production variances are further discussed in the “Individual Mine Performance” section of this MD&A.

Cash Costs

Consolidated cash costs for Q2 2018 were $0.92, down 84% from Q2 2017, as a result of higher by-product credits and decreased direct selling costs. By-product credits increased by $4.50 per ounce, driven by increased gold and zinc production, and higher metal prices for all by-products. The decrease in direct selling costs primarily reflects improved contract terms for concentrate treatment and refining.

By-Product Production

The following table provides the Company’s by-product production for the three and six-month periods ended June 30, 2018 and 2017:

|

| | | | | | | | |

| | By-Product Production |

Three months ended

June 30, | Six months ended

June 30, |

| 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Gold – koz | 53.4 |

| 37.7 |

| 99.6 |

| 75.4 |

|

| Zinc – kt | 14.9 |

| 13.7 |

| 29.6 |

| 26.5 |

|

| Lead – kt | 5.1 |

| 5.5 |

| 10.4 |

| 10.8 |

|

| Copper – kt | 2.0 |

| 3.5 |

| 4.9 |

| 6.7 |

|

|

| | |

| | PAN AMERICAN SILVER CORP. | 18 |

The 42% increase in quarterly gold production reflects record quarterly production at Dolores due to higher throughput and grades and faster recoveries from the pulp agglomeration plant.

Zinc production in Q2 2018 was 8% higher than Q2 2017, driven by higher grades at Morococha from mine sequencing and higher throughput at the expanded La Colorada operations. Lead production in Q2 2018 was relatively comparable with Q2 2017, with increases at Morococha and San Vicente being offset by a decrease at Huaron. Copper production in Q2 2018 was 44% lower than in Q2 2017, primarily because of anticipated lower copper grades at Morococha from mine sequencing and decreased production at Huaron. Production at Huaron during Q2 2018 was impacted by an 18-day suspension of operations, as further described in the "Individual Mine Performance" section of this MD&A.

Average Market Metal Prices

The following tables set out the average market price for each metal produced for the three and six-month periods ended June 30, 2018 and 2017:

|

| | | | | | | | |

| Average Market Metal Prices(1) |

Three months ended

June 30, | Six months ended

June 30, |

| 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Silver $/ounce | 16.53 |

| 17.21 |

| 16.65 |

| 17.32 |

|

| Gold $/ounce | 1,306 |

| 1,257 |

| 1,318 |

| 1,238 |

|

| Zinc $/tonne | 3,112 |

| 2,596 |

| 3,268 |

| 2,690 |

|

| Lead $/tonne | 2,388 |

| 2,161 |

| 2,456 |

| 2,221 |

|

| Copper $/tonne | 6,872 |

| 5,662 |

| 6,917 |

| 5,749 |

|

| |

| (1) | Average market prices for zinc, lead and copper are the London Metal Exchange cash prices for the three and six-month periods ended June 30, 2018 and 2017. Silver and gold prices are the London Bullion Metal Association prices for the same periods. |

AISCSOS

The following table reflects the quantities of payable silver sold and AISCSOS at each of Pan American’s operations for the three and six months ended June 30, 2018, as compared to the same periods in 2017:

|

| | | | | | | | | | | | | | | | |

| Payable Silver Sold (ounces ‘000s) | AISCSOS(1) ($ per ounce) |

Three months ended

June 30, | Six months ended

June 30, | Three months ended

June 30, | Six months ended

June 30, |

| 2018 |

| 2017 |

| 2018 |

| 2017 |

| 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| La Colorada | 1,486 |

| 1,678 |

| 3,030 |

| 3,363 |

| 3.46 |

| 5.86 |

| 2.65 |

| 5.80 |

|

| Dolores | 1,145 |

| 1,039 |

| 2,385 |

| 1,931 |

| 1.18 |

| 7.28 |

| 5.78 |

| 8.66 |

|

| Alamo Dorado | — |

| 342 |

| — |

| 642 |

| — |

| 21.53 |

| — |

| 19.34 |

|

| Huaron | 674 |

| 766 |

| 1,452 |

| 1,550 |

| 8.11 |

| 5.01 |

| 5.07 |

| 5.55 |

|

| Morococha | 609 |

| 638 |

| 1,290 |

| 1,215 |

| (0.19 | ) | 3.30 |

| (1.50 | ) | 3.50 |

|

| San Vicente | 893 |

| 865 |

| 1,676 |

| 1,752 |

| 13.15 |

| 13.81 |

| 12.34 |

| 14.33 |

|

| Manantial Espejo | 987 |

| 981 |

| 1,661 |

| 1,843 |

| 7.08 |

| 18.13 |

| 8.84 |

| 22.53 |

|

Total (2) | 5,795 |

| 6,311 |

| 11,494 |

| 12,297 |

| 6.45 |

| 10.73 |

| 6.71 |

| 11.66 |

|

| |

| (1) | AISCSOS is a non-GAAP measure. Please refer to the section “Alternative Performance (Non-GAAP) Measures” of this MD&A for a detailed description of the AISCSOS calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. G&A costs are included in the consolidated AISCSOS, but not allocated in calculating AISCSOS for each operation. |

| |

| (2) | Totals may not add due to rounding. |

Consolidated AISCSOS for Q2 2018 were $6.45, representing a 40% decrease from the comparable period in 2017. The quarter-over-quarter decrease largely reflects the higher by-product credits at all operations, except Huaron, decreased direct operating costs, and the effects of net realizable value ("NRV") adjustments, which decreased Q2 2018 AISCSOS by $1.21 compared to a $0.91 decrease to Q2 2017 AISCSOS. These decreases in AISCSOS were partially offset by higher royalty costs and a lower volume of silver ounces sold.

|

| | |

| | PAN AMERICAN SILVER CORP. | 19 |

Individual Mine Performance

An analysis of performance at each operation in Q2 2018 compared with Q2 2017 follows. The project capital amounts invested in Q2 2018 are further discussed in the Project Development Update section of this MD&A.

La Colorada mine

|

| | | | | | | | | | | | |

| | Three months ended

June 30, | Six months ended

June 30, |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Tonnes milled - kt | 176.9 |

| 156.9 |

| 347.3 |

| 309.3 |

|

| Average silver grade – grams per tonne | 361 |

| 377 |

| 347 |

| 372 |

|

| Average zinc grade - % | 2.77 |

| 2.90 |

| 2.80 |

| 2.84 |

|

| Average lead grade - % | 1.36 |

| 1.58 |

| 1.39 |

| 1.54 |

|

| Average silver recovery - % | 91.2 |

| 91.1 |

| 90.8 |

| 91.0 |

|

| Average zinc recovery - % | 86.4 |

| 84.0 |

| 86.0 |

| 83.8 |

|

| Average lead recovery - % | 87.8 |

| 87.7 |

| 87.5 |

| 87.4 |

|

| Production: | |

| |

| | |

| Silver – koz | 1,873 |

| 1,731 |

| 3,523 |

| 3,361 |

|

| Gold – koz | 1.05 |

| 0.94 |

| 2.10 |

| 1.82 |

|

| Zinc – kt | 4.23 |

| 3.83 |

| 8.37 |

| 7.37 |

|

| Lead – kt | 2.11 |

| 2.18 |

| 4.23 |

| 4.16 |

|

| | | | | |

Cash cost per ounce net of by-products(1) | $ | 1.93 |

| $ | 3.38 |

| $ | 1.34 |

| $ | 3.20 |

|

| | | | | |

AISCSOS(2) | $ | 3.46 |

| $ | 5.86 |

| $ | 2.65 |

| $ | 5.80 |

|

| | | | | |

| Payable silver sold - koz | 1,486 |

| 1,678 |

| 3,030 |

| 3,363 |

|

| | | | | |

Sustaining capital - (’000s)(3) | $ | 3,309 |

| $ | 4,680 |

| $ | 6,195 |

| $ | 7,715 |

|

| |

| (1) | Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to cost of sales. |

| |

| (2) | AISCSOS is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. |

| |

| (3) | Sustaining capital expenditures exclude $1.5 million and $3.1 million of investing activity cash outflow for Q2 2018 and H1 2018, respectively (Q2 2017 and H1 2017: $2.8 million and $5.4 million, respectively) related to investment capital incurred on the La Colorada expansion project as disclosed in the “Project Development Update” section of this MD&A. |

Q2 2018 vs. Q2 2017

Production:

| |

| • | Silver: 8% increase from improved throughput attributable to the mine expansion completed in 2017, partially offset by lower silver grades from mine sequencing and mine plan adjustments to accommodate an upgrade to the mine backfill circuit that is currently underway. |

| |

| • | By-products: 11% increase in zinc from increased throughput, offset by lower grades from mine sequencing. |

Cash costs: the 43% decrease was primarily the result of improved by-product credits (largely from higher base metal prices and increased zinc production), and improved unit cost per tonne from the increased throughput.

AISCSOS: the 41% decrease was due to a combination of decreased direct operating costs, improved by-product credits, and lower sustaining capital.

Sustaining Capital: primarily related to equipment replacements and rehabilitations, underground infrastructure, and near-mine exploration.

|

| | |

| | PAN AMERICAN SILVER CORP. | 20 |

Dolores mine

|

| | | | | | | | | | | | |

| | Three months ended

June 30, | Six months ended

June 30, |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Tonnes placed - kt | 1,664.0 |

| 1,622.8 |

| 3,561.9 |

| 3,190.1 |

|

| Average silver grade – grams per tonne | 31 |

| 38 |

| 33 |

| 40 |

|

| Average gold grade – grams per tonne | 1.03 |

| 0.64 |

| 0.94 |

| 0.62 |

|

| Average silver produced to placed ratio - % | 65.2 |

| 51.9 |

| 60.3 |

| 48.8 |

|

| Average gold produced to placed ratio - % | 72.3 |

| 66.8 |

| 68.5 |

| 73.3 |

|

| Production: | |

| |

| | |

| Silver – koz | 1,088 |

| 1,037 |

| 2,290 |

| 2,002 |

|

| Gold – koz | 39.8 |

| 22.4 |

| 74.1 |

| 46.8 |

|

| | | | | |

Cash cost per ounce net of by-products(1) | $ | (9.80 | ) | $ | 0.12 |

| $ | (6.29 | ) | $ | (0.74 | ) |

| | | | | |

AISCSOS(2) | $ | 1.18 |

| $ | 7.28 |

| $ | 5.78 |

| $ | 8.66 |

|

| | | | | |

| Payable silver sold - koz | 1,145 |

| 1,039 |

| 2,385 |

| 1,931 |

|

| | | | | |

Sustaining capital - (’000s)(3) | $ | 11,245 |

| $ | 13,451 |

| $ | 25,616 |

| $ | 18,955 |

|

| |

| (1) | Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to cost of sales. |

| |

| (2) | AISCSOS is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. |

| |

| (3) | Sustaining capital expenditures exclude $4.1 million and $8.5 million of investing activity cash outflow for Q2 2018 and H1 2018, respectively (Q2 2017 and H1 2017: $13.7 million and $27.8 million, respectively) related to investment capital incurred on Dolores expansion projects, as disclosed in the “Project Development Update” section of this MD&A. |

Q2 2018 vs. Q2 2017

Production:

| |

| • | Silver: 5% higher as a result of higher recoveries and increased stacking rates, attributable to the pulp agglomeration plant completed in 2017, partially offset by lower grades from mine sequencing. |

| |

| • | By-products: 77% increase in gold due to better grades from mine sequencing, higher stacking rates, and higher recoveries due to benefits of the pulp agglomeration plant and the timing of leach pad kinetics. |

| |

| • | As previously announced by the Company on May 28, 2018 and June 4, 2018, the Company suspended transport of personnel and materials to the Dolores mine as a result of security incidents on the access roads to the mine. Production of silver and gold continued at normal rates during the approximately 15-day suspension due to the large reserve of high and low grade ore stockpiles; however, project works, open pit mining and underground mining activities were curtailed. The security situation improved following patrol and enforcement by the Mexican authorities, and the Company resumed transport of personnel and materials on the mine access roads in early June. As a result of the suspension, delivery and installation of additional plate and frame expansion kits, to maximize the capacity of the existing filter units in the pulp agglomeration plant, has been delayed until later this year. As well, the Company decided to take advantage of the curtailment in underground mining to accelerate the demobilization and replacement of the contractor workforce with the Company’s employees. Work on the leach pad expansion is expected to resume in October 2018 to avoid construction during the rainy season. |

Cash costs: decreased $9.92 per ounce due to higher by-product credits from higher gold prices and gold production, partially offset by higher operating costs due to the addition of the pulp agglomeration plant.

AISCSOS: decreased 84%, primarily due to improved by-product credits and lower sustaining capital, partially offset by increased production costs, including lower negative NRV adjustments.

Sustaining Capital: comprised mainly of pre-stripping and leach pad expansion capital.

|

| | |

| | PAN AMERICAN SILVER CORP. | 21 |

Huaron mine

|

| | | | | | | | | | | | |

| | Three months ended

June 30, | Six months ended

June 30, |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Tonnes milled - kt | 203.6 |

| 227.6 |

| 438.3 |

| 455.1 |

|

| Average silver grade – grams per tonne | 137 |

| 146 |

| 143 |

| 146 |

|

| Average zinc grade - % | 2.58 |

| 2.75 |

| 2.44 |

| 2.79 |

|

| Average lead grade - % | 1.15 |

| 1.31 |

| 1.10 |

| 1.33 |

|

| Average copper grade - % | 0.57 |

| 0.90 |

| 0.72 |

| 0.89 |

|

| Average silver recovery - % | 81.3 |

| 86.1 |

| 82.7 |

| 85.6 |

|

| Average zinc recovery - % | 77.0 |

| 78.5 |

| 76.0 |

| 77.4 |

|

| Average lead recovery - % | 75.9 |

| 78.6 |

| 74.7 |

| 78.7 |

|

| Average copper recovery - % | 68.7 |

| 79.5 |

| 75.1 |

| 78.8 |

|

| Production: | |

| |

| | |

| Silver – koz | 742 |

| 898 |

| 1,673 |

| 1,794 |

|

| Gold – koz | 0.14 |

| 0.44 |

| 0.36 |

| 0.69 |

|

| Zinc – kt | 4.01 |

| 4.91 |

| 8.11 |

| 9.76 |

|

| Lead – kt | 1.75 |

| 2.32 |

| 3.56 |

| 4.72 |

|

| Copper – kt | 0.77 |

| 1.60 |

| 2.35 |

| 3.14 |

|

| | | | | |

Cash cost per ounce net of by-products(1) | $ | 1.95 |

| $ | 2.24 |

| $ | 0.03 |

| $ | 1.51 |

|

| | | | | |

AISCSOS(2) | $ | 8.11 |

| $ | 5.01 |

| $ | 5.07 |

| $ | 5.55 |

|

| | | | | |

| Payable silver sold – koz | 674 |

| 766 |

| 1,452 |

| 1,550 |

|

| | | | | |

| Sustaining capital - (’000s) | $ | 3,513 |

| $ | 2,102 |

| $ | 5,723 |

| $ | 5,207 |

|

| |

| (1) | Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to cost of sales. |

| |

| (2) | AISCSOS is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. |

Q2 2018 vs. Q2 2017

Production:

| |

| • | Silver: 17% lower, primarily due to an approximately three-week suspension of operations as a result of temporary community road blockades, as announced by the Company on April 27, 2018. As further announced, the Company reached an agreement with representatives of the Huayllay community to end the blockade on May 9, 2018. |

| |

| • | By-products: 18%, 24% and 52% decreases in zinc, lead, and copper, respectively, due to the suspension of operations, and from lower grades from mine sequencing. |

Cash costs: $0.29 per ounce lower than in Q2 2017, due primarily to improved by-product credits (from higher base metal prices partially offset by lower base metal production), and improved concentrate treatment terms, partially offset by lower payable silver production.

AISCSOS: a 62% increase due to lower by-product credits (driven by lower base metal sales volumes), higher sustaining capital, and a lower volume of silver sold, partially offset by decreased production costs.

Sustaining Capital: related primarily to equipment replacements and refurbishments, plant and infrastructure upgrades, and near-mine exploration. The increase from Q2 2017 was related to investments in near-mine exploration, a tailings dam raise, equipment replacements, site infrastructure upgrades and mine deepening.

|

| | |

| | PAN AMERICAN SILVER CORP. | 22 |

Morococha mine(1)

|

| | | | | | | | | | | | |

| | Three months ended

June 30, | Six months ended

June 30, |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Tonnes milled – kt | 171.3 |

| 170.8 |

| 339.5 |

| 334.6 |

|

| Average silver grade – grams per tonne | 136 |

| 133 |

| 143 |

| 136 |

|

| Average zinc grade - % | 3.50 |

| 2.86 |

| 3.64 |

| 2.85 |

|

| Average lead grade - % | 0.83 |

| 0.79 |

| 0.85 |

| 0.79 |

|

| Average copper grade - % | 0.68 |

| 1.27 |

| 0.77 |

| 1.23 |

|

| Average silver recovery - % | 89.3 |

| 88.5 |

| 89.9 |

| 88.4 |

|

| Average zinc recovery - % | 87.3 |

| 77.3 |

| 86.5 |

| 78.7 |

|

| Average lead recovery - % | 75.6 |

| 64.3 |

| 75.7 |

| 65.5 |

|

| Average copper recovery - % | 77.3 |

| 84.4 |

| 78.8 |

| 83.6 |

|

| Production: | |

| |

| | |

| Silver – koz | 652 |

| 634 |

| 1,383 |

| 1,278 |

|

| Gold – koz | 0.66 |

| 1.03 |

| 1.46 |

| 1.63 |

|

| Zinc – kt | 5.18 |

| 3.77 |

| 10.60 |

| 7.46 |

|

| Lead – kt | 1.04 |

| 0.86 |

| 2.15 |

| 1.71 |

|

| Copper – kt | 0.88 |

| 1.76 |

| 2.01 |

| 3.35 |

|

| | | | | |

Cash cost per ounce net of by-products (2) | $ | (6.41 | ) | $ | (2.35 | ) | $ | (9.03 | ) | $ | (2.78 | ) |

| | | | | |

AISCSOS(3) | $ | (0.19 | ) | $ | 3.30 |

| $ | (1.50 | ) | $ | 3.50 |

|

| | | | | |

| Payable silver sold (100%) - koz | 609 |

| 638 |

| 1,290 |

| 1,215 |

|

| | | | | |

| Sustaining capital (100%) - (’000s) | $ | 3,390 |

| $ | 3,999 |

| $ | 8,292 |

| $ | 6,270 |

|

| |

| (1) | Production figures are for Pan American’s 92.3% share only, unless otherwise noted. |

| |

| (2) | Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to our cost of sales. |

| |

| (3) | AISCSOS is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. |

Q2 2018 vs. Q2 2017

Production:

| |

| • | Silver: 3% higher, primarily due to higher grades and recoveries. |

| |

| • | By-products: 37% and 21% increase in zinc and lead, respectively, and a 50% decrease in copper. The variations were related to mine sequencing. |

Cash costs: $4.06 per ounce lower, primarily the result of higher by-product prices, improved concentrate treatment terms, and increased lead and zinc production, which more than offset lower copper production.

AISCSOS: a $3.49 per ounce decrease was driven by the same factors affecting quarter-over-quarter cash costs.

Sustaining Capital: primarily related to equipment replacements and refurbishments, plant and infrastructure upgrades, near-mine exploration and the acquisition of mobile equipment.

|

| | |

| | PAN AMERICAN SILVER CORP. | 23 |

San Vicente mine (1)

|

| | | | | | | | | | | | |

| | Three months ended

June 30, | Six months ended

June 30, |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Tonnes milled – kt | 86.0 |

| 81.3 |

| 161.8 |

| 152.0 |

|

| Average silver grade – grams per tonne | 374 |

| 316 |

| 361 |

| 380 |

|

| Average zinc grade - % | 2.34 |

| 2.11 |

| 2.10 |

| 1.98 |

|

| Average lead grade - % | 0.33 |

| 0.30 |

| 0.33 |

| 0.31 |

|

| Average silver recovery - % | 94.5 |

| 93.3 |

| 93.9 |

| 92.8 |

|

| Average zinc recovery - % | 72.1 |

| 71.3 |

| 74.0 |

| 64.8 |

|

| Average lead recovery - % | 77.1 |

| 81.3 |

| 78.4 |

| 83.0 |

|

| Production: | |

| |

| | |

| Silver – koz | 976 |

| 766 |

| 1,740 |

| 1,701 |

|

| Gold – koz | 0.14 |

| 0.12 |

| 0.27 |

| 0.24 |

|

| Zinc – kt | 1.43 |

| 1.22 |

| 2.49 |

| 1.94 |

|

| Lead – kt | 0.22 |

| 0.10 |

| 0.42 |

| 0.21 |

|

| Copper – kt | 0.30 |

| 0.12 |

| 0.59 |

| 0.20 |

|

| | | | | |

Cash cost per ounce net of by-products (2) | $ | 9.36 |

| $ | 14.02 |

| $ | 10.09 |

| $ | 13.16 |

|

| | | | | |

AISCSOS(3) | $ | 13.15 |

| $ | 13.81 |

| $ | 12.34 |

| $ | 14.33 |

|

| | | | | |

| Payable silver sold (100%) - koz | 893 |

| 865 |

| 1,676 |

| 1,752 |

|

| | | | | |

| Sustaining capital (100%) - (’000s) | $ | 2,132 |

| $ | 2,241 |

| $ | 3,590 |

| $ | 3,807 |

|

| |

| (1) | Production figures are for Pan American’s 95.0% share only, unless otherwise noted. |

| |

| (2) | Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to cost of sales. |

| |

| (3) | AISCSOS is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. |

Q2 2018 vs. Q2 2017

Production:

| |

| • | Silver: 27% higher due to an 18% increase in head grades and higher throughput, attributable to accessing higher-grade stopes, and better ore control. |

| |

| • | By-products: 146%, 123%, and 17% increases in copper, lead and zinc, respectively, were due to better grades and throughput. |

Cash costs: 33% lower due to increased base metal quantities and prices, improved concentrate terms, and increased silver production partially offset by higher royalties.

AISCSOS: the 5% reduction was driven by higher by-product credits and lower direct operating costs partially offset by higher royalties from the increase in revenue and the timing of royalty payments.

Sustaining Capital: Q2 2018 expenditures primarily relate to a tailings storage facility expansion, mine equipment additions, near-mine exploration and mine site and camp infrastructure.

|

| | |

| | PAN AMERICAN SILVER CORP. | 24 |

Manantial Espejo mine

|

| | | | | | | | | | | | |

| | Three months ended

June 30, | Six months ended

June 30, |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

| Tonnes milled - kt | 197.1 |

| 193.8 |

| 399.9 |

| 382.2 |

|

| Average silver grade – grams per tonne | 177 |

| 170 |

| 163 |

| 156 |

|

| Average gold grade – grams per tonne | 1.91 |

| 2.11 |

| 1.79 |

| 1.94 |

|

| Average silver recovery - % | 86.8 |

| 90.9 |

| 87.6 |

| 91.4 |

|

| Average gold recovery - % | 94.0 |

| 94.3 |

| 93.3 |

| 93.9 |

|

| Production: | |

| |

| | |

| Silver – koz | 962 |

| 975 |

| 1,787 |

| 1,762 |

|

| Gold – koz | 11.62 |

| 12.05 |

| 21.31 |

| 22.18 |

|

| | | | | |

Cash cost per ounce net of by-products (1) | $ | 6.62 |

| $ | 15.11 |

| $ | 9.06 |

| $ | 17.46 |

|

| | | | | |

AISCSOS(2) | $ | 7.08 |

| $ | 18.13 |

| $ | 8.84 |

| $ | 22.53 |

|

| | | | | |

| Payable silver sold - koz | 987 |

| 981 |

| 1,661 |

| 1,843 |

|

| | | | | |

| Sustaining capital - (’000s) | $ | 1,094 |

| $ | 166 |

| $ | 1,627 |

| $ | 1,264 |

|

| |

| (1) | Cash costs is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of this measure to cost of sales. |

| |

| (2) | AISCSOS is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculation and a reconciliation of this measure to the Q2 2018 Financial Statements. |

Q2 2018 vs. Q2 2017

Production:

| |

| • | Silver: comparable due to lower recoveries partially offset by slightly higher throughput and grades from mine sequencing and stockpile processing. |

| |

| • | By-products: gold down 4% due to a greater amount of lower grade stockpile ore being processed, as planned. |

Cash costs: a decrease of $8.49 per ounce was the result of lower direct unit operating costs from the devaluation in the Argentine peso over the quarter. In addition, costs are no longer being incurred for open pit mining following the completion of that activity in 2017.

AISCSOS: 61% lower due to the same drivers reducing cash costs.

Sustaining Capital: primarily related to the acquisition of mobile equipment.

|

| | |

| | PAN AMERICAN SILVER CORP. | 25 |

|

| | |

| 2018 ANNUAL OPERATING OUTLOOK | | |

All 2018 forecast amounts in this section refer to the 2018 annual forecasts, as provided in the Company's 2017 Annual MD&A dated March 22, 2018 ("2018 Forecast").

Production:

The following table summarizes the H1 2018 metal production compared to the respective 2018 Forecast amounts:

|

| | | |

| | H1 2018 Actual | 2018 Forecast | % of 2018 Forecast (1) |

| |

| Silver – Moz | 12.40 | 25.00 - 26.50 | 48% |

| Gold – koz | 99.6 | 175.0 - 185.0 | 55% |

| Zinc – kt | 29.6 | 60.0 - 62.0 | 49% |

| Lead – kt | 10.4 | 21.0 - 22.0 | 48% |

| Copper – kt | 4.9 | 12.0 - 12.5 | 40% |

| |

| (1) | Percentage calculated based on mid-point of the related 2018 guidance range. |

Based on year-to-date production results and the expected production for the remainder of the year, management reaffirms the annual metal production guidance given in the 2018 Forecast for all metals except copper. Based on year-to-date copper production results and the expected copper production for the remainder of the year Management is revising its 2018 annual copper production forecast range to 9.0 to 10.4 thousand tonnes.

Cash Costs and AISCSOS:

The following table summarizes H1 2018 cash costs and AISCSOS for each operation compared to the respective 2018 Forecast amounts.

For the purposes of these comparisons, the symbols have the following meanings:

|

| |

| üü | Actual results were better than 2018 Forecast range |

| ü | Actual results met 2018 Forecast range |

| û | Actual results were short of 2018 Forecast range |

|

| | | | | | |

| | Cash Costs(1) ($ per ounce) | AISCSOS(1) ($ per ounce) |

2018 Forecast

| H1 2018 Actual | 2018

Forecast

| H1 2018 Actual |

| La Colorada | 1.35 - 1.70 | $1.34 | üü | 3.80 - 4.30 | $2.65 | üü |

| Dolores | (1.25) - 0.45 | (6.29) | üü | 9.00 - 12.00 | $5.78 | üü |

| Huaron | 0.75 - 1.50 | 0.03 | üü | 6.50 - 7.75 | $5.07 | üü |

Morococha(2) | (5.80) - (4.30) | (9.03) | üü | 1.05 - 3.50 | $(1.50) | üü |

San Vicente(2) | 10.00 -10.50 | 10.09 | ü | 11.60 - 12.50 | $12.34 | ü |

| Manantial Espejo | 17.60 -19.00 | 9.06 | üü | 18.45 - 20.20 | $8.84 | üü |

| Total | 3.60 - 4.60 | $1.04 | üü | 9.30 - 10.80 | $6.71 | üü |

| |

| (1) | Cash Costs and AISCSOS are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of these calculations and a reconciliation of these measures to the Q2 2018 Financial Statements. |

| |

| (2) | Production figures are only for Pan American’s ownership share of Morococha (92.3%), and San Vicente (95.0%). |

Based on H1 2018 cash costs and AISCSOS, and the expected results for the remainder of 2018, management is lowering its annual 2018 cash costs and AISCSOS forecasts to between $2.80 and $3.80 per ounce, and $8.50 and $10.00, respectively. These estimates are largely influenced by management's assumptions for commodity prices and currency exchange rates.

|

| | |

| | PAN AMERICAN SILVER CORP. | 26 |

The revised forecasts for 2018 annual cash costs and AISCSOS per mine are as follows:

|

| | |

| | Revised 2018 Annual Forecast |

Cash Costs(1)(2)

($ per ounce) | AISCSOS (1)(2)

($ per ounce) |

| La Colorada | 1.90 - 2.50 | 4.80 - 5.70 |

| Dolores | (2.00) - (2.50) | 7.25 - 8.25 |

| Huaron | 1.25 - 2.00 | 7.35 - 8.35 |

| Morococha | (4.70) - (3.40) | 3.20 - 5.20 |

| San Vicente | 10.25 - 11.25 | 12.00 - 13.25 |

| Manantial Espejo | 10.75 - 14.50 | 9.00 - 12.75 |

| Total | 2.80 - 3.80 | 8.50 - 10.00 |

| |

| (1) | Cash Costs and AISCSOS are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of theses calculation and a reconciliation of these measures to the Q2 2018 Financial Statements. |

| |

| (2) | The forecasts assume metal prices for the remainder of 2018 of: $16.50/ounce for silver; $1,250/ounce for gold; $2,600/tonne for zinc; $2,300/tonne for lead; and $6,200/tonne for copper. The assumed foreign currency exchange rates, relative to $1.00 USD, were: 18.50 for the Mexican peso, 3.23 for the Peruvian sol; 27.00 for the Argentine peso, and 7.00 of the Bolivian boliviano. |

Capital Expenditures:

The following table summarizes the H1 2018 capital expenditures compared to the respective 2018 Forecast amounts:

|

| | | |

| | 2018 Capital Investment ($ millions)

|

| | H1 2018 Actual(1) | 2018 Forecast | % of Annual Forecast (2) |

| La Colorada | 6.3 | 16.5 – 17.0 | 38% |

| Dolores | 24.8 | 47.5 – 49.0 | 51% |

| Huaron | 5.3 | 17.0 – 17.5 | 31% |

| Morococha | 8.0 | 12.0 – 12.5 | 65% |

| San Vicente | 3.6 | 6.0 – 7.0 | 55% |

| Manantial Espejo | 1.6 | 1.0 – 2.0 | 107% |

| Sustaining Capital Sub-total | 49.6 | 100.0 - 105.0 | 48% |

| Morococha projects | — | 2.0 | —% |

| Mexico projects | 10.0 | 13.0 | 77% |

| Joaquin and COSE projects | 11.1 | 35.0 | 32% |

| Project Capital Sub-total | 21.1 | 50.0 | 42% |

| Total Capital | 70.7 | 150.0 – 155.0 | 46% |

| |

| (1) | Total sustaining capital investments capitalized in H1 2018 were $1.4 million less than the $51.0 million of sustaining capital cash outflows referenced in the individual mine tables and included in the H1 2018 AISCSOS calculations, shown in the “Alternative Performance (Non-GAAP) Measures” section of this MD&A. In addition, project capital investments in H1 2018 were $1.7 million less than the $22.8 million of H1 2018 project capital cash outflows. These differences are due to the timing between the cash payment of capital investments compared with the period in which the investments are capitalized. |

| |

| (2) | Percentage calculated based on mid-point of the related 2018 guidance range. |

Based on year-to-date capital expenditures and those expected for the remainder of the year, management reaffirms the 2018 Forecast for capital expenditures.

|

| | |

| | PAN AMERICAN SILVER CORP. | 27 |

|

| | |

| PROJECT DEVELOPMENT UPDATE | | |

The following table reflects the amounts spent at each of Pan American’s major projects in Q2 2018 and H1 2018 as compared with Q2 2017 and H1 2017.

|

| | | | | | | | |

| Project Development Investment | Three months ended

June 30, | Six months ended

June 30, |

| (thousands of USD) |

| | 2018 |

| 2017 |

| 2018 |

| 2017 |

|

Dolores projects (1) | 1,406 |

| 13,747 |

| 6,691 |

| 26,864 |

|

La Colorada projects (2) | 1,898 |

| 1,229 |

| 3,280 |

| 2,991 |

|

Joaquin and COSE projects (3) | 8,196 |

| — |

| 11,127 |

| — |

|

| Total | 11,500 |

| 14,976 |

| 21,098 |

| 29,855 |

|

| |

| (1) | As a result of periodic changes in accounts payable balances, the amounts capitalized for the projects during Q2 2018 and H1 2018 were $2.7 million and $1.8 million less than the project cash outflows, respectively (Q2 2017: $nil and $0.9 million less, respectively). |

| |

| (2) | As a result of periodic changes in accounts payable balances, the amounts capitalized for the projects during Q2 2018 and H1 2018 were $0.4 million and $0.1 million more than the project cash outflows, respectively (Q2 2017: $1.5 million and $2.4 million less, respectively). |

| |

| (3) | As a result of periodic changes in accounts payable balances, the amounts capitalized for the projects during Q2 2018 and H1 2018 were $1.1 million and $0.1 million less than the project cash outflows, respectively. |

Mexico Projects:

During Q2 2018, the Company invested $1.4 million on completing the Dolores expansion projects, with the majority of the spending related to delivery of additional units of the underground mobile equipment fleet.

During Q2 2018, the Company invested $1.9 million on the La Colorada projects, primarily relating to a tailings storage facility raise and continued development of a neutralization plant.

Joaquin and COSE Project Developments:

During Q2 2018, the Company invested $5.4 million on the Joaquin project, primarily on the surface facilities and the initial fleet of development mining equipment. During the quarter, 72 metres of development was completed on the decline access for the underground mine, which is slightly behind plan due to difficult ground being encountered close to surface; this may result in completion of the project being delayed by a few weeks. The Joaquin project remains on budget.

During Q2 2018, the Company invested $2.8 million at COSE, primarily on the decline access to the underground mine; during the quarter, 322 metres of development was completed for a total of 817 metres to date. The COSE project remains on budget.

|

| | |

| OVERVIEW OF Q2 2018 FINANCIAL RESULTS | | |

Selected Annual and Quarterly Information

The following tables set out selected quarterly results for the past ten quarters as well as selected annual results for the past two years. The dominant factors affecting results in the quarters and years presented below are volatility of realized metal prices, and the timing of the sales of production, which varies with the timing of shipments. The fourth quarter of 2017 included an impairment reversal to Morococha and Calcatreu.

|

| | |

| | PAN AMERICAN SILVER CORP. | 28 |

|

| | | | | | |

| 2018 | Quarter Ended |

| (In thousands of USD, other than per share amounts) | March 31 | June 30 |

| Revenue | $ | 206,961 |

| $ | 216,460 |

|

| Mine operating earnings | $ | 55,124 |

| $ | 54,851 |

|

| Earnings for the period attributable to equity holders | $ | 47,376 |

| $ | 36,187 |

|

| Basic earnings per share | $ | 0.31 |

| $ | 0.24 |

|

| Diluted earnings per share | $ | 0.31 |

| $ | 0.24 |

|

| Cash flow from operating activities | $ | 34,400 |

| $ | 66,949 |

|

| Cash dividends paid per share | $ | 0.035 |

| $ | 0.035 |

|

| Other financial information |

|

|

|

|

| Total assets |

|

| $ | 2,030,025 |

|

Total long-term financial liabilities(1) |

|

| $ | 84,514 |

|

| Total attributable shareholders’ equity |

|

| $ | 1,590,871 |

|

| |

| (1) | Total long-term financial liabilities are comprised of non-current liabilities excluding deferred tax liabilities, deferred revenue, and share purchase warrant liabilities. |

|

| | | | | | | | | | | | | | | |

| 2017 | Quarter Ended | Year

Ended |

| (In thousands of USD, other than per share amounts) | March 31 | June 30 | Sept 30 | Dec 31 | Dec 31 |

| Revenue | $ | 198,687 |

| $ | 201,319 |

| $ | 190,791 |

| $ | 226,031 |

| $ | 816,828 |

|

| Mine operating earnings | $ | 32,875 |

| $ | 44,782 |

| $ | 47,818 |

| $ | 43,285 |

| $ | 168,760 |

|

| Earnings for the period attributable to equity holders | $ | 19,371 |

| $ | 35,472 |

| $ | 17,256 |

| $ | 48,892 |

| $ | 120,991 |

|

| Basic earnings per share | $ | 0.13 |

| $ | 0.23 |

| $ | 0.11 |

| $ | 0.32 |

| $ | 0.79 |

|

| Diluted earnings per share | $ | 0.13 |

| $ | 0.23 |

| $ | 0.11 |

| $ | 0.32 |

| $ | 0.79 |

|

| Cash flow from operating activities | $ | 38,569 |

| $ | 42,906 |

| $ | 63,793 |

| $ | 79,291 |

| $ | 224,559 |

|

| Cash dividends paid per share | $ | 0.025 |

| $ | 0.025 |

| $ | 0.025 |

| $ | 0.025 |

| $ | 0.100 |

|

| Other financial information | | | | | |

| Total assets | | | | | $ | 1,993,332 |

|

Total long-term financial liabilities(1) | | | | | $ | 90,027 |

|

| Total attributable shareholders’ equity | | | | | $ | 1,516,850 |

|

| |

| (1) | Total long-term financial liabilities are comprised of non-current liabilities excluding deferred tax liabilities, deferred revenue, and share purchase warrant liabilities. |

|

| | | | | | | | | | | | | | | |

| 2016 | Quarter Ended | Year

Ended |

| (In thousands of USD, other than per share amounts) | March 31 | June 30 | Sept 30 | Dec 31 | Dec 31 |

| Revenue | $ | 158,275 |

| $ | 192,258 |

| $ | 233,646 |

| $ | 190,596 |

| $ | 774,775 |

|

| Mine operating earnings | $ | 16,698 |

| $ | 44,730 |

| $ | 88,495 |

| $ | 48,956 |

| $ | 198,879 |

|

Earnings for the period attributable to equity holders

| $ | 1,738 |

| $ | 33,804 |

| $ | 42,766 |

| $ | 21,777 |

| $ | 100,085 |

|

| Basic earnings per share | $ | 0.01 |

| $ | 0.22 |

| $ | 0.28 |

| $ | 0.14 |

| $ | 0.66 |

|

| Diluted earnings per share | $ | 0.01 |

| $ | 0.22 |

| $ | 0.28 |

| $ | 0.14 |

| $ | 0.66 |

|

| Cash flow from operating activities | $ | 771 |

| $ | 66,019 |

| $ | 102,346 |

| $ | 45,668 |

| $ | 214,804 |

|

| Cash dividends paid per share | $ | 0.0125 |

| $ | 0.0125 |

| $ | 0.0125 |

| $ | 0.0125 |

| $ | 0.0500 |

|

| Other financial information | |

| |

| | | |

| Total assets | | | | | $ | 1,898,141 |

|

Total long-term financial liabilities(1) | | | | | $ | 118,594 |

|

| Total attributable shareholders’ equity | | | | | $ | 1,396,298 |

|

| |

| (1) | Total long-term financial liabilities are comprised of non-current liabilities excluding deferred tax liabilities, deferred revenue, and share purchase warrant liabilities. |

|

| | |

| | PAN AMERICAN SILVER CORP. | 29 |

Income Statement: Q2 2018 vs. Q2 2017

Net earnings of $36.7 million were recorded in Q2 2018 compared to $36.0 million in Q2 2017, which corresponds to basic earnings per share of $0.24 and $0.23, respectively.

The following table highlights the key items driving the difference between net earnings in Q2 2018 compared with Q2 2017:

|

| | | | | | | | | |

Net earnings, three months ended June 30, 2017 (in thousands of USD) | | |

| | $ | 36,011 |

| Note |

| Revenue: | | |

| | |

| |

| Increased realized metal prices | | $ | 6,584 |

| | | |

| Higher quantities of metal sold | | 288 |

| | | |

| Decreased direct selling costs | | 3,688 |

| | | |

| Decreased negative settlement adjustments | | 4,581 |

| | | |

| Total increase in revenue | | | | 15,141 |

| (1) |

| Cost of sales: | | | | | |

| Decreased production costs and increased royalty charges | | $ | 1,853 |

| | | (2) |

| Increased depreciation and amortization | | (6,925 | ) | | | (3) |

| Total increase in cost of sales | | | | (5,072 | ) | |

| Total increase in mine operating earnings | | | | 10,069 |

| |

| Increased income tax expense | | | | (15,023 | ) | (4) |

| Increased dilution gain, net of share of income from associate | | | | 13,464 |

| (5) |

| Increased foreign exchange loss | | | | (5,031 | ) | (6) |

| Decreased exploration and project development expense | | | | 2,557 |

| (7) |

| Increased interest and finance expense | | | | (1,237 | ) | (8) |

| Decreased net gain on asset sales, commodity contracts and derivatives | | | | (1,265 | ) | |

| Decreased investment income and other expense | | | | (2,576 | ) | |

| Increased general and administrative expense | | | | (273 | ) | |

| Net earnings, three months ended June 30, 2018 | | |

| | $ | 36,696 |

| |

| |

| 1. | Revenue for Q2 2018 was $15.1 million higher than in Q2 2017. The major factor for the increase was a $6.6 million price variance, attributable to increased by-product prices, largely from higher zinc, gold and copper prices. Decreased direct selling costs, primarily from favorable changes in contract terms relating to concentrate treatment and refining charges, also contributed to the increase in revenues. The following table reflects the metal prices realized by the Company and the quantities of metal sold during each quarter: |

|

| | | | | | | | | | | |

| | | Realized Metal Prices | Quantities of Metal Sold |

| | | Three months ended

June 30, | Three months ended

June 30, |

| | | 2018 | 2017 | 2018 | 2017 |

Silver(1) – koz | | $ | 16.40 |

| $ | 17.19 |

| 5,795 |

| 6,311 |

|

Gold(1) – koz | | $ | 1,304 |

| $ | 1,257 |

| 52.0 |

| 37.7 |

|

Zinc(1) – kt | | $ | 3,045 |

| $ | 2,604 |

| 13.0 |

| 12.6 |

|

Lead(1) – kt | | $ | 2,378 |

| $ | 2,203 |

| 4.5 |

| 5.2 |

|

Copper(1) – kt | | $ | 6,840 |

| $ | 5,685 |

| 1.9 |

| 3.4 |

|

(1) Metal price stated as dollars per ounce for silver and gold, and dollars per tonne for zinc, lead and copper, inclusive of final settlement adjustments on concentrate sales.

| |

| 2. | Production costs in Q2 2018 were $5.5 million lower than in Q2 2017. The decrease was mainly the result of: discontinued production from Alamo Dorado; lower costs at Manantial Espejo, driven by the devaluation of the Argentine peso; and NRV inventory adjustments. The NRV inventory adjustments reduced Q2 2018 production costs by $7.0 million compared to reducing costs by $5.3 million in Q2 2017. These factors reducing production costs in Q2 2018 were partially offset by higher production costs at Dolores from increased sales |

|

| | |

| | PAN AMERICAN SILVER CORP. | 30 |

volumes. Royalty expense increased by $3.7 million over Q2 2017 levels, mainly attributable to the timing of royalty payments and higher sales volumes at San Vicente, as well as higher sales volumes at Dolores.

| |

| 3. | Depreciation and amortization ("D&A") expense was $6.9 million higher than in Q2 2017, largely the result of increased D&A at Dolores due to increased metal production and sales volumes, and at Morococha, on account of the increased depreciable asset base from the impairment reversal in the fourth quarter of 2017. |

| |

| 4. | Income tax expense in Q2 2018 was $15.0 million higher than in Q2 2017, largely due to higher net income before tax and the devaluation of the Mexican peso ("MXN") during the quarter, which reduced the value of certain MXN denominated tax assets. Further, the Company restructured certain inter-company debt agreements in Q2 2018 to allow certain subsidiaries to utilize losses and other deductible tax attributes. As a result the Company recognized deferred tax assets of approximately $11.7 million during the quarter, which partially offset the aforementioned increases in tax expense. |

| |

| 5. | Share of income from associate and dilution gain for Q2 2018 was $14.1 million compared to $0.6 million in Q2 2017, and related to the Company's investment in Maverix Metals Inc. ("Maverix"), accounted for using the equity method whereby the Company records its portion of Maverix's income or loss based on Pan American's fully diluted ownership interest. During Q2 2018, as a result of Maverix issuing common shares to acquire certain royalty assets, Pan American's ownership in Maverix was diluted to approximately 26% (approximately 29% fully diluted). The net result of this transaction was the recognition of a $13.4 million dilution gain representing the difference between the fair value of Pan American's portion of the assets acquired by Maverix and the Company's interest in Maverix following the dilution in ownership. A $0.5 million dilution gain was recorded in Q2 2017 in relation to a different Maverix transaction that diluted Pan American's ownership to approximately 36% (approximately 40% fully diluted). |

| |

| 6. | Foreign exchange (“FX”) losses in Q2 2018 were $4.9 million compared to FX gains of $0.1 million in Q2 2017. Losses in Q2 2018 resulted primarily from the approximately 30% depreciation of the Argentine peso ("ARS") and the approximately 8% devaluation of the MXN on the Company's ARS and MXN denominated monetary assets. FX gains in Q2 2017 resulted primarily from the approximate 5% appreciation of the MXN on MXN denominated monetary assets, which were substantially offset by the approximate 8% depreciation of the ARS. |

| |

| 7. | Exploration and project development expenses were $1.9 million in Q2 2018 compared to $4.4 million incurred in Q2 2017. The expenses related to exploration and project development activities near the Company’s existing mines, at select greenfield projects, and on the holding and maintenance costs associated with the Navidad project, where approximately $0.3 million was spent in Q2 2018 compared to approximately $0.8 million in Q2 2017 due to the devaluation of the Argentine peso. The remainder of the quarter-over-quarter decrease was attributable to expenditures for the COSE and Joaquin projects, which were included in project capital in Q2 2018 and were expensed in Q2 2017. |

| |

| 8. | Interest and finance expense for Q2 2018 was $1.2 million compared to a $0.1 million recovery in Q2 2017, which included a $2.8 million reversal of an interest expense accrual from previous periods. The remaining portion of interest and finance expense consisted of accretion of the Company’s closure liabilities and interest expense associated with the revolving credit facility fees, short-term loans, and leases. |

|

| | |

| | PAN AMERICAN SILVER CORP. | 31 |

Statement of Cash Flows: Q2 2018 vs. Q2 2017

Cash flow from operations in Q2 2018 totaled $66.9 million, $24.0 million more than the $42.9 million generated in Q2 2017. The increase was largely from an approximately $15.7 million increase in cash flows from higher mine operating earnings, a $16.0 million increase in operating cash flows from changes in working capital items, partially offset by a $7.8 million increase in income tax payments.

Working capital changes in Q2 2018 resulted in a $7.8 million source of cash, comprised mainly of accounts receivables and inventory draw-downs, partially offset by accounts payable and accrued liability reductions. Comparatively, working capital changes reduced operating cash flows by $8.2 million in Q2 2017, due mainly to an increase in accounts receivables.

Investing activities utilized $39.9 million in Q2 2018, inclusive of $6.9 million for the net purchase of short-term investments. The balance related primarily to $35.9 million on mineral properties, plant and equipment at the Company’s mines and projects, as previously described in the “Operating Performance” section of this MD&A. Investing cash flows in Q2 2018 included $10.4 million in proceeds received on the sale of assets, largely from the sale of 100% of the Company's shares in Minera Aquiline Argentina SA, which owns the Calcatreu project in Argentina in Q1 2018. In Q2 2017, investing activities utilized $63.2 million inclusive of $15.9 million used for the net purchase of short-term investments, with $41.8 million spent on mineral properties, plant and equipment additions at the Company’s mines and projects. Investing activities in both Q2 2018 and Q2 2017 included a $7.5 million payment towards the acquisition of the COSE project in Argentina.

Financing activities in Q2 2018 used $6.9 million compared to $2.5 million in Q2 2017. Cash used in Q2 2018 consisted of $5.2 million paid as dividends to shareholders and $2.0 million of lease repayments, partially offset by $0.5 million generated on the issuance of shares related to the exercise of stock options. In Q2 2017, cash used in financing activities consisted of $3.8 million in dividends to shareholders and $1.0 million of lease repayments, partially offset by $2.5 million in short-term loan proceeds and $0.4 million generated on the issuance of shares related to the exercise of stock options.

|

| | |

| | PAN AMERICAN SILVER CORP. | 32 |

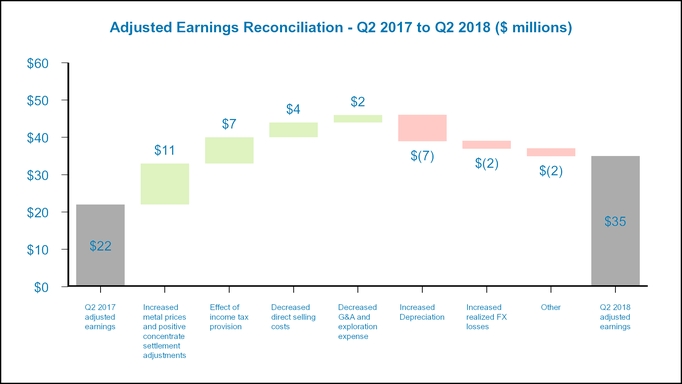

Adjusted Earnings: Q2 2018 vs Q2 2017

Adjusted earnings is a non-GAAP measure. Please refer to the section of this MD&A entitled “Alternative Performance (Non-GAAP) Measures” for a detailed description of “adjusted earnings”, and a reconciliation of these measures to the Q2 2018 Financial Statements.

Adjusted Earnings in Q2 2018 were $35.4 million, representing basic adjusted earnings per share of $0.23, which was $13.1 million, or $0.09 per share, higher than Q2 2017 adjusted earnings of $22.3 million, and basic adjusted earnings per share of $0.15, respectively.

The following chart illustrates the key factors leading to the change in adjusted earnings from Q2 2017 to Q2 2018:

|

| | |

| | PAN AMERICAN SILVER CORP. | 33 |

Income Statement: H1 2018 vs. H1 2017

Net earnings of $84.9 million were recorded in H1 2018 compared to $56.0 million in H1 2017, which corresponds to basic earnings per share of $0.55 and $0.36, respectively.

The following table highlights the key items driving the difference between net earnings in H1 2018 compared with H1 2017:

|

| | | | | | | | | |

Net earnings, six months ended June 30, 2017 (in thousands of USD) | | |

| | $ | 55,961 |

| Note |

| Revenue: | | |

| | |

| |

| Increased realized metal prices | | $ | 19,740 |

| | | |

| Higher quantities of metal sold | | 1,321 |

| | | |

| Decreased direct selling costs | | 6,131 |

| | | |

| Decreased positive settlement adjustments | | (3,777 | ) | | | |

| Total increase in revenue | | | | 23,415 |

| (1) |

| Cost of sales: | | | | | |

| Decreased production costs and increased royalty charges | | $ | 21,013 |

| | | (2) |

| Increased depreciation and amortization | | (12,110 | ) | | | (3) |

| Total decrease in cost of sales | | | | 8,903 |

| |

| Total increase in mine operating earnings | | | | 32,318 |

| |

| Increased income tax expense | | | | (13,692 | ) | (4) |

| Increased dilution gain, net of share of loss from associate | | | | 12,852 |

| (5) |

| Increased foreign exchange loss | | | | (9,215 | ) | (6) |

| Increased net gain on asset sales, commodity contracts and derivatives | | | | 6,575 |

| (7) |

| Decreased exploration and project development expense | | | | 3,337 |

| |

| Increased interest and finance expense | | | | (1,205 | ) | |

| Increased general and administrative expense | | | | (472 | ) | |

| Decreased investment income and other expense | | | | (1,607 | ) | |

| Net earnings, six months ended June 30, 2018 | | |

| | $ | 84,852 |

| |

| |

| 1. | Revenue for H1 2018 was $23.4 million higher than in H1 2017. The major factor for the increase was a $19.7 million price variance, which was attributable to increased by-product prices, largely from higher zinc and gold prices. Decreased direct selling costs, primarily from favorable changes in contract terms relating to concentrate treatment and refining charges, and increased zinc and gold sales volumes also contributed to the increase in revenues. The following table reflects the metal prices realized by the Company and the quantities of metal sold during each period: |

|

| | | | | | | | | | | |

| | | Realized Metal Prices | Quantities of Metal Sold |

| | | Six months ended

June 30, | Six months ended

June 30, |

| | | 2018 | 2017 | 2018 | 2017 |

Silver(1) – koz | | $ | 16.59 |

| $ | 17.31 |

| 11,494 |

| 12,297 |

|

Gold(1) – koz | | $ | 1,317 |

| $ | 1,238 |

| 92.8 |

| 76.7 |

|

Zinc(1) – kt | | $ | 3,252 |

| $ | 2,714 |

| 25.5 |

| 23.2 |

|

Lead(1) – kt | | $ | 2,419 |

| $ | 2,258 |

| 9.4 |

| 10.6 |

|

Copper(1) – kt | | $ | 6,931 |

| $ | 5,749 |

| 4.6 |

| 6.1 |

|

(1) Metal price stated as dollars per ounce for silver and gold, and dollars per tonne for zinc, lead and copper, inclusive of final settlement adjustments on concentrate sales.

| |

| 2. | Production and royalty costs in H1 2018 were $22.3 million lower and $1.3 million higher, respectively, than in H1 2017. The decrease in production costs was mainly the result of a $17.8 million variance in NRV inventory adjustments at Manantial Espejo and Dolores. The NRV inventory adjustments reduced production costs in H1 2018 by $12.4 million compared with increasing them by $5.5 million in H1 2017. The remainder of the decrease in production costs was from the cessation of Alamo Dorado production and lower costs at Manantial |

|

| | |

| | PAN AMERICAN SILVER CORP. | 34 |

Espejo, driven by the devaluation of the Argentine peso, partially offset by higher Dolores production costs from increased sales volumes. The increased royalty expense was mainly attributable to higher sales volumes at Dolores.

| |

| 3. | D&A expense was $12.1 million higher than in H1 2017, largely the result of increased D&A at Dolores due to increased metal production and sales volumes, and at Morococha, on account of the impairment reversal in the fourth quarter of 2017. |

| |

| 4. | Income tax expense in H1 2018 was $13.7 million higher than in H1 2017, largely attributable to higher net income before tax, which resulted in an increase to tax expense of $17.2 million. Offsetting this increase was a reduction in tax expense of $3.6 million resulting from a $13.4 million dilution gain recorded in relation to the Company’s interest in Maverix, as this dilution is not a taxable event. |

| |

| 5. | Share of income from associate and dilution gain for H1 2018 was $12.9 million higher than in H1 2017. The increase was driven by the previously discussed $13.4 million dilution gain recognized in relation to Maverix issuing common shares to acquire certain royalty assets in Q2 2018. |

| |

| 6. | FX losses in H1 2018 were $6.6 million compared to FX gains of $2.6 million in H1 2017. Losses in H1 2018 resulted primarily from the devaluation of the ARS on the Company's ARS denominated ARS assets. The H1 2017 gains were driven largely by the appreciation of the MXN on the Company's MXN denominated cash and tax receivables, partially offset by the depreciation of ARS denominated commodity tax receivables. |

| |

| 7. | Gain on sale of mineral properties, plant and equipment was $7.5 million higher in H1 2018 than in H1 2017. The H1 2018 gain was attributable to the Q1 2018 sale of 100% of the Company's shares in Minera Aquiline Argentina SA, which owns the Calcatreu project in Argentina. |

Statement of Cash Flows: H1 2018 vs. H1 2017

Cash flow from operations in H1 2018 totaled $101.3 million, $19.9 million more than the $81.5 million generated in H1 2017. The increase was largely the result of an approximately $26.6 million increase in mine operating earnings, and a $6.9 million decrease in cash flows used for working capital changes, partially offset by a $15.3 million increase in income tax payments.

Working capital changes in H1 2018 resulted in a $3.5 million use of cash, comprised mainly of accounts payable and accrued liability pay-downs, partially offset by the collection of receivables. Comparatively, working capital changes reduced operating cash flows by $10.4 million in H1 2017, comprised mainly of accounts payable and accrued liability pay-downs and receivables build-ups.

Investing activities utilized $72.8 million in H1 2018, inclusive of $12.0 million for the net purchase of short-term investments. The balance related primarily to $68.5 million on mineral properties, plant and equipment additions at the Company’s mines and projects, $15.5 million in proceeds from asset sales (the majority from the sale of the Company's shares in Minera Aquiline SA, which owned the Calcatreu project), and $7.5 million for the second and final payment for the acquisition of the COSE project. In H1 2017, investing activities utilized $96.2 million inclusive of $1.1 million used for the net purchase of short-term investments, with $73.8 million spent on mineral properties, plant and equipment additions at the Company’s mines and projects, and $20.2 million used for the acquisition of the COSE and Joaquin projects.

Financing activities in H1 2018 used $17.0 million compared to $5.3 million in H1 2017. Cash used in H1 2018 consisted of $10.6 million paid as dividends to shareholders, $3.5 million of lease repayments and $3.0 million used to repay short-term loans, partially offset by $0.6 million generated on the issuance of shares related to the exercise of stock options. In H1 2017, cash used in financing activities consisted of $7.7 million in dividends to shareholders and $1.9 million of lease repayments, partially offset by $2.5 million in proceeds from short-term loans and $2.5 million generated on the issuance of shares related to the exercise of stock options.

|

| | |

| | PAN AMERICAN SILVER CORP. | 35 |

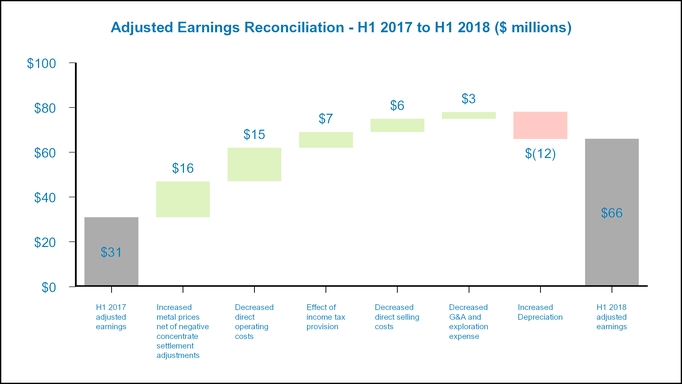

Adjusted Earnings: H1 2018 vs H1 2017

Adjusted earnings is a non-GAAP measure. Please refer to the section of this MD&A entitled “Alternative Performance (Non-GAAP) Measures” for a detailed description of “adjusted earnings”, and a reconciliation of these measures to the Q2 2018 Financial Statements.

Adjusted Earnings in H1 2018 were $66.1 million, representing basic adjusted earnings per share of $0.43, which was $34.8 million, or $0.23 per share, higher than H1 2017 adjusted earnings of $31.3 million, and basic adjusted earnings per share of $0.20.

The following chart illustrates the key factors leading to the change in adjusted earnings from H1 2017 to H1 2018:

|

| | |

| LIQUIDITY AND CAPITAL POSITION | | |

|

| | | | | | | | | | |

| Liquidity and Capital Measures (in $000s) | June 30, 2018 | March 31, 2018 | Dec 31, 2017 | Q2 2018

Change | H1 2018 Change |

| Cash and cash equivalents ("Cash") | 187,403 |

| 167,282 |

| 175,953 |

| 20,121 |

| 11,450 |

|

| Short-term Investments ("STI") | 62,845 |

| 57,560 |

| 51,590 |

| 5,285 |

| 11,255 |

|

| Cash and STI | 250,248 |

| 224,842 |

| 227,543 |

| 25,406 |

| 22,705 |

|

| Working Capital | 463,096 |

| 448,737 |

| 410,756 |

| 14,359 |

| 52,340 |

|

| Revolving Credit Facility ("RCF") | 300,000 |

| 300,000 |

| 300,000 |

| — |

| — |

|

| Amount drawn on RCF | — |

| — |

| — |

| — |

| — |

|

Total debt (1) | 9,700 |

| 10,017 |

| 10,559 |

| (317 | ) | (859 | ) |

| |

| (1) | Total debt is a Non-GAAP measure calculated as the total of amounts drawn on the RCF, finance lease liabilities and loans payable. |

The Company's net liquidity position increased by $25.4 million during Q2 2018. Operating cash flows of $66.9 million, which included $18.0 million in tax payments, and a $7.8 million source of cash from working capital changes, more than funded the Company's investing and financing activities in the quarter.

|

| | |

| | PAN AMERICAN SILVER CORP. | 36 |