|

|

| Technical Report for the La Colorada Property, Zacatecas, Mexico |

| |

| |

| |

| Effective date: December 31, 2019 |

| |

| |

| Prepared by: |

| Martin Wafforn, P. Eng. Senior Vice President, Technical Services and Process Optimization |

| Christopher Emerson, FAusIMM. Vice President, Business Development and Geology |

| Americo Delgado, P. Eng. Vice President, Mineral Processing, Tailings, and Dams |

December 31, 2019 1 of 50

|

| | |

| Contents | |

| 1 | Summary | 6 |

| 1.1 | Property description and ownership | 6 |

| 1.2 | Geology and mineralization | 6 |

| 1.3 | Status of exploration, development, and operations | 6 |

| 1.4 | Mineral resource and reserve estimates | 7 |

| 1.5 | Conclusions and recommendations | 8 |

| 2 | Introduction | 10 |

| 3 | Reliance on other experts | 12 |

| 4 | Property description and location | 13 |

| 4.1 | Location, issuer’s interest, mineral tenure, and surface rights | 13 |

| 4.2 | Royalties, back-in rights, payments, agreements, and encumbrances | 15 |

| 4.3 | Environmental liabilities | 15 |

| 4.4 | Permits | 16 |

| 4.5 | Significant factors and risks | 16 |

| 5 | Accessibility, climate, local resources, infrastructure, and physiography | 17 |

| 5.1 | Physiography, vegetation, and climate | 17 |

| 5.2 | Accessibility, local resources, population centres, and transport | 17 |

| 5.3 | Surface rights | 17 |

| 5.4 | Power and water | 17 |

| 5.5 | Infrastructure | 17 |

| 6 | History | 18 |

| 7 | Geological setting and mineralization | 19 |

| 7.1 | Regional geology | 19 |

| 7.2 | Local and Property geology | 19 |

| 7.3 | Mineralization | 20 |

| 8 | Deposit types | 22 |

| 9 | Exploration | 23 |

| 10 | Drilling | 24 |

December 31, 2019 2 of 50

|

| | |

| 10.1 | Drilling summary | 24 |

| 10.2 | Material impact on the accuracy and reliability of drilling results | 24 |

| 11 | Sample preparation, analyses, and security | 25 |

| 11.1 | On-site sample preparation and security | 25 |

| 11.2 | Laboratory sample preparation and analytical methods | 25 |

| 11.3 | Quality assurance and quality control | 25 |

| 11.4 | Bulk density | 25 |

| 11.5 | Material impact on the accuracy and reliability of sample data | 25 |

| 12 | Data verification | 26 |

| 12.1 | Geology data reviews | 26 |

| 12.2 | Mine engineering data reviews | 26 |

| 12.3 | Metallurgy data reviews | 26 |

| 12.4 | Data adequacy | 26 |

| 13 | Mineral processing and metallurgical testing | 27 |

| 13.1 | Introduction and previous work | 27 |

| 13.2 | Metallurgical recovery | 27 |

| 13.3 | Material issues and deleterious elements | 27 |

| 13.4 | Recommendations | 27 |

| 14 | Mineral resource estimates | 28 |

| 14.1 | Disclosure | 28 |

| 14.2 | Available data, interpretation, and estimation | 28 |

| 14.3 | Confidence classification, planned dilution and loss, and value estimates | 30 |

| 14.4 | Mineral resource tabulation | 30 |

| 15 | Mineral reserve estimates | 31 |

| 15.1 | Disclosure | 31 |

| 15.2 | Methods and parameters | 31 |

| 15.3 | Mineral reserve tabulation | 31 |

| 16 | Mining methods | 33 |

| 16.1 | Mining methods and geotechnical parameters | 33 |

December 31, 2019 3 of 50

|

| | |

| 16.2 | Hydrogeological parameters | 33 |

| 16.3 | Production rates and expected mine life | 33 |

| 16.4 | Mining fleet, equipment, and services | 33 |

| 17 | Recovery methods | 34 |

| 17.1 | Oxide processing plant | 34 |

| 17.2 | Sulphide processing plant | 35 |

| 17.3 | Power, water, and reagent requirements | 35 |

| 18 | Project infrastructure | 36 |

| 18.1 | Transportation and logistics | 37 |

| 18.2 | Mine and processing facilities | 37 |

| 18.3 | Power and water | 37 |

| 19 | Market studies and contracts | 38 |

| 19.1 | Contracts and marketing | 38 |

| 19.2 | Review by the Qualified Person | 38 |

| 20 | Environmental studies, permitting, and social and community impact | 39 |

| 20.1 | Environmental studies, issues, and permits | 39 |

| 20.2 | Mine waste disposal and water management | 39 |

| 20.3 | Social and community factors | 39 |

| 20.4 | Project reclamation and closure | 40 |

| 21 | Capital and operating costs | 41 |

| 22 | Economic analysis | 42 |

| 23 | Adjacent properties | 43 |

| 24 | Other relevant data and information | 44 |

| 25 | Interpretation and conclusions | 45 |

| 26 | Recommendations | 46 |

| 27 | References | 47 |

| 28 | Date, signatures, and certificates | 48 |

| Tables | |

| Table 1.1 | La Colorada mineral resources effective December 31, 2019 | 8 |

December 31, 2019 4 of 50

|

| | |

| Table 1.2 | La Colorada mineral reserves effective December 31, 2019 | 8 |

| Table 2.1 | Responsibilities of each Qualified Person | 11 |

| Table 4.1 | Mining concession details | 14 |

| Table 14.1 | La Colorada mineral resources effective December 31, 2019 | 30 |

| Table 15.1 | La Colorada mineral reserves effective December 31, 2019 | 32 |

| Table 16.1 | Current underground mobile mining equipment | 33 |

| Table 21.1 | Estimated annual operating costs | 41 |

| | | |

| Figures |

| Figure 4.1 | Plan of Property location | 13 |

| Figure 4.2 | Plan of mining concessions and workings | 14 |

| Figure 7.1 | Plan of regional geological setting | 19 |

| Figure 7.2 | Plan of local geology | 20 |

| Figure 7.3 | Plan of main structures and Property geology | 21 |

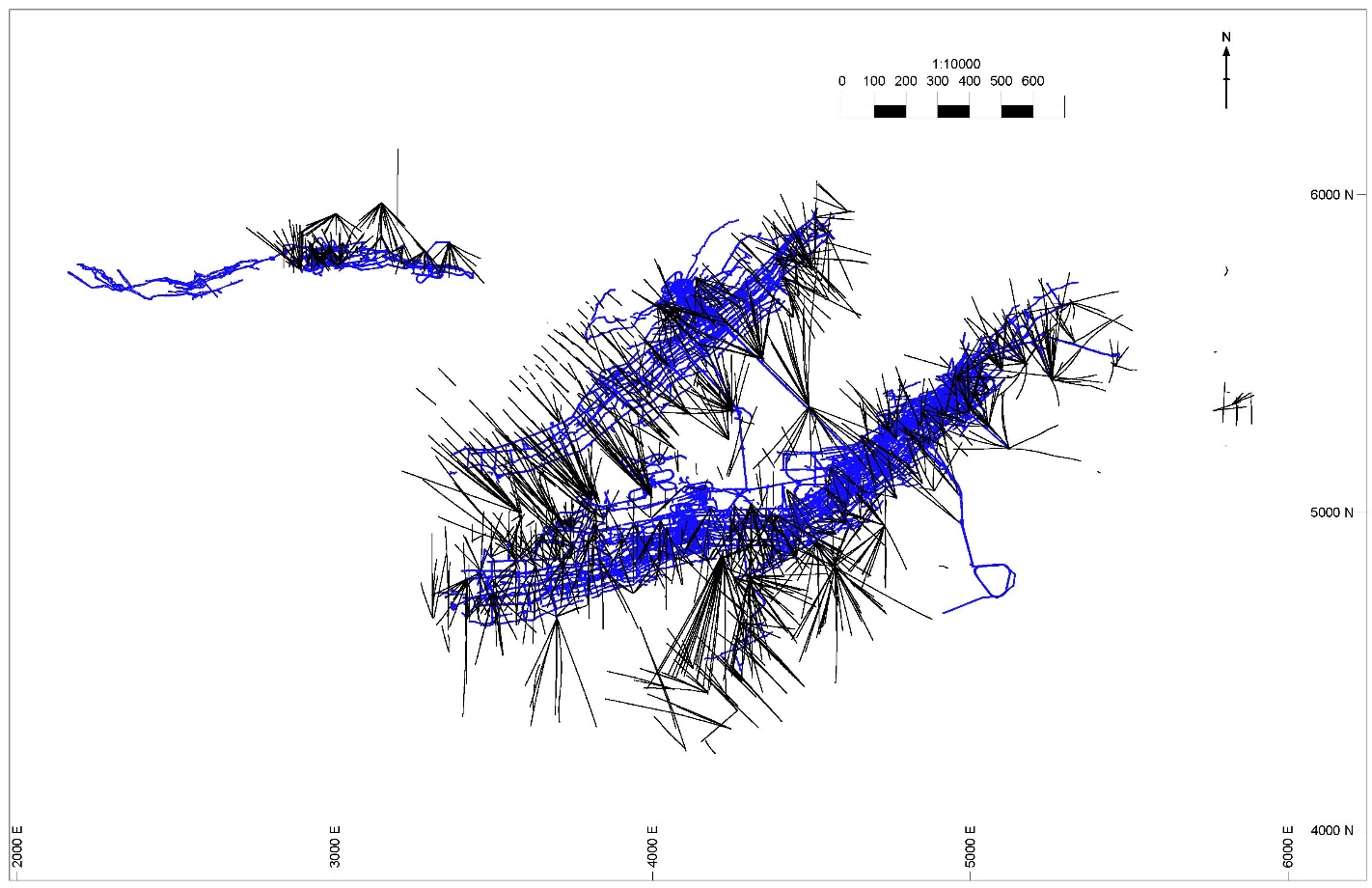

| Figure 10.1 | Plan of drillhole locations and mine workings | 24 |

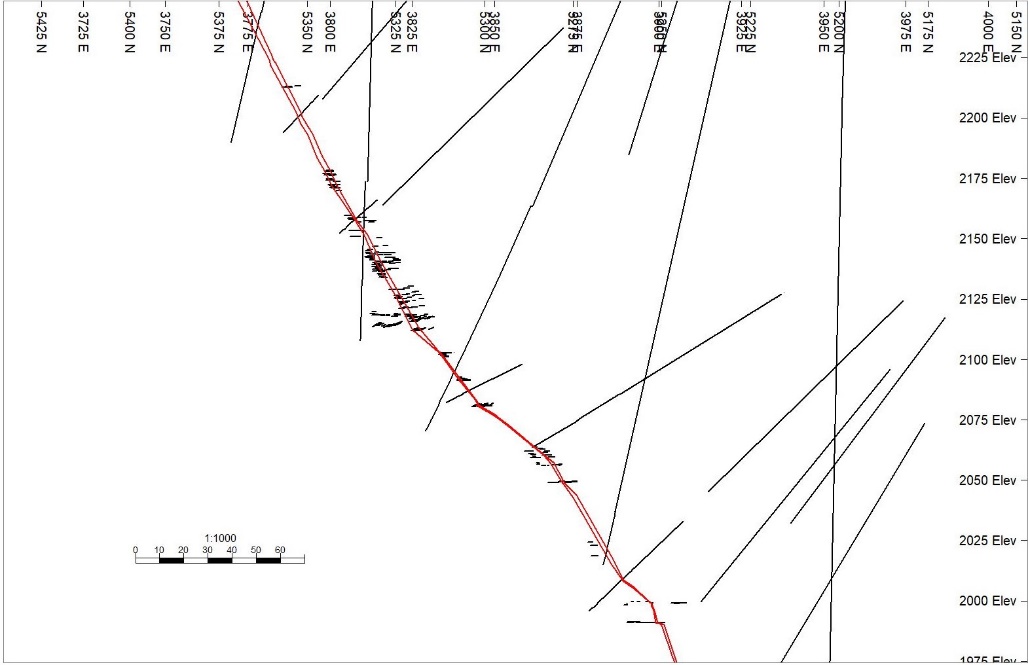

| Figure 14.1 | Cross section of typical structure and available data | 29 |

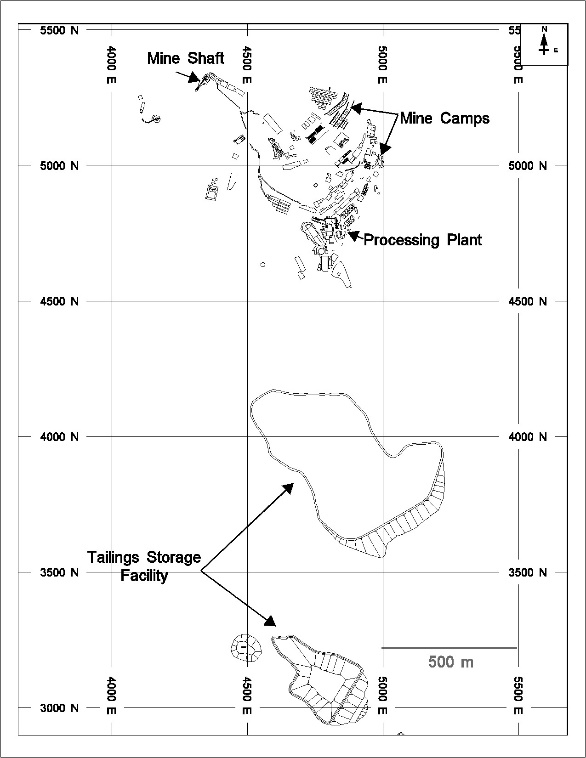

| Figure 18.1 | Plan of mine infrastructure | 36 |

December 31, 2019 5 of 50

This Technical Report has been prepared by Pan American Silver Corp. (“Pan American”) based on the disclosure requirements of Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) to disclose current information about the La Colorada property (the “Property” or “La Colorada”).

| |

| 1.1 | Property description and ownership |

La Colorada is an underground silver-gold-lead-zinc mine located in Zacatecas State, Mexico. Pan American is the 100% owner of the Property through its wholly owned subsidiary, Plata Panamericana S. A. de C.V. (“Plata”), and references to Pan American herein should be understood to refer to, or include, Plata as applicable.

| |

| 1.2 | Geology and mineralization |

The Property is located in the Sierra Madre Occidental volcanic belt at the contact between the Lower Volcanic Supergroup and the Upper Volcanic Supergroup. The Lower Volcanic Supergroup comprises late Cretaceous to early Tertiary calc-alkaline batholiths and volcano-sedimentary rocks. The Upper Volcanic Supergroup comprises early Oligocene and early Miocene ignimbrites.

The oldest rocks exposed on the Property are Cretaceous limestones of the Cuesta del Cura Formation and calcareous clastic rocks of the Indidura Formation. They are overlain by conglomerates of the early Tertiary Ahuichilla Formation. Most of the outcrop on the Property is dacite of the Lower Volcanic Supergroup. East to northeast striking faults form the dominant structures at the Property and play a strong role in local mineralization.

Economic mineralization at La Colorada is found in veins, replacement mantos within limestone, and skarn. The majority of the mineral resources and reserves are sourced from the NC vein series, the HW vein series, Veta 3, the Amolillo vein system, vein and manto mineralization at the Recompensa system, and the new undeveloped skarn deposit.

| |

| 1.3 | Status of exploration, development, and operations |

Mineralization at La Colorada has been defined by approximately 1,700 diamond drillholes and has been the subject of mineral resource and reserve estimates. Typical near mine exploration takes place on an annual basis, including testing of the undrilled areas of the deposit at depth and along strike, as well as infill drilling to upgrade the confidence categories of mineral resource and reserve estimates.

The existing infrastructure includes the typical components of an operating underground mine, including the mine workings, shaft, hoist room, compressors, workshops, laboratories, storage facilities, offices, drill core and logging sheds, water and power lines, access roads, and the worker’s camp. The processing facilities consist of stockpiles, crushing, grinding, flotation, reagent preparation areas, thickening, filtration, and concentrate storage areas, and the Merrill-Crowe plant. The processing facilities area also includes process plant offices, maintenance, analytical and metallurgical laboratories, water treatment plants, pumping facilities, and the tailings storage facilities.

December 31, 2019 6 of 50

Pan American has been underground mining and operating the process plant at La Colorada since 1998, recently producing on the order of 8 million ounces of silver, 5,000 ounces of gold, 21,000 tonnes of zinc, and 11,000 tonnes of lead annually.

The life of mine plan contemplates an annual processing rate of 814,000 tonnes throughout the mine life. Based on the mineral reserves estimated effective December 31, 2019, this corresponds to a remaining mine life of 11 years. The projected mine life may increase if the mineral resources can be converted to mineral reserves as the result of improvements to metallurgical recoveries, costs, or metal prices, or if additional mineral resources are defined and can be converted to mineral reserves.

| |

| 1.4 | Mineral resource and reserve estimates |

Mineral resources for La Colorada effective December 31, 2019 are given in Table 1.1. Metal prices used for the mineral resource estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc, except for the skarn deposit, where metal prices of $18.50 per ounce of silver, $6,500 per tonne of copper, $2,200 per tonne of lead, and $2,600 per tonne of zinc were used.

Mineral resource and reserve estimates are based on assumptions that include mining, metallurgical, infrastructure, title, permitting, taxation, and economic parameters that have a degree of uncertainty. Although Pan American has no current expectation that the mineral reserve and resource estimates in this Technical Report will be materially negatively impacted by external factors such as environmental, permitting, title, access, legal, taxation, availability of resources, and other similar factors, changes in relation to such factors are not uncommon in the mining industry and there can be no assurance that these factors will not have a material impact. In addition, the accuracy of any mineral reserve and resource estimate is, among other things, the function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices, changes in the planned mining method, or various operating factors that occur subsequent to the date of the estimates may justify revision of such estimates and may differ, perhaps materially, from those currently anticipated.

December 31, 2019 7 of 50

|

| | | | | | | | | | | |

| Table 1.1 La Colorada mineral resources effective December 31, 2019 |

| Classification | Tonnes Mt | Ag ppm | Au ppm | Cu% | Pb % | Zn% | Ag Moz | Au koz | Cu kt | Pb kt | Zn kt |

| Measured | 0.5 | 229 | 0.24 | 0.00 | 0.65 | 1.16 | 3.8 | 4.0 | 0.0 | 3.3 | 5.9 |

| Indicated | 1.6 | 185 | 0.15 | 0.00 | 0.56 | 1.16 | 9.6 | 7.8 | 0.0 | 9.0 | 18.7 |

| Measured + Indicated | 2.1 | 196 | 0.17 | 0.00 | 0.58 | 1.16 | 13.4 | 11.8 | 0.0 | 12.3 | 24.7 |

| Inferred | 5.0 | 190 | 0.16 | 0.00 | 2.16 | 4.28 | 30.6 | 25.3 | 0.0 | 107.8 | 214.1 |

| Inferred skarn | 72.5 | 44 | 0.00 | 0.17 | 2.02 | 4.40 | 101.6 | 0.0 | 120.8 | 1,1465.4 | 3,190.6 |

| Notes: Totals may not add up due to rounding. Mineral resource estimates were prepared under the supervision of or were reviewed by Christopher Emerson, FAusIMM, Vice President Business Development and Geology of Pan American. Metal prices used for the mineral resource estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc, except for the skarn deposit, where metal prices of $18.50 per ounce of silver, $6,500 per tonne of copper, $2,200 per tonne of lead, and $2,600 per tonne of zinc were used. At the skarn deposit, a cut-off value of $60 per tonne, which used metallurgical recoveries of 91% silver, 90% lead, 85% zinc, and 38% copper, was used to tabulate resources. Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability. |

Mineral reserves for La Colorada effective December 31, 2019 are given in Table 1.2. Metal prices used for the mineral reserve estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc.

|

| | | | | | | | | |

| Table 1.2 La Colorada mineral reserves effective December 31, 2019 | | | |

| Classification | Tonnes Mt | Ag ppm | Au ppm | Pb % | Zn % | Ag Moz | Au koz | Pb kt | Zn kt |

| Proven | 3.7 | 395 | 0.33 | 1.72 | 3.11 | 47.3 | 39.1 | 64.2 | 115.9 |

| Probable | 5.3 | 287 | 0.26 | 1.35 | 2.44 | 49.1 | 44.0 | 71.7 | 130.1 |

| Proven + Probable | 9.0 | 331 | 0.29 | 1.50 | 2.72 | 96.4 | 83.1 | 135.8 | 246.0 |

| Notes: Totals may not add up due to rounding. Mineral reserve estimates were prepared under the supervision of or were reviewed by Martin Wafforn, P.Eng., Senior Vice President, Technical Services and Process Optimization of Pan American. Metal prices used for the mineral reserve estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc. |

| |

| 1.5 | Conclusions and recommendations |

Pan American has been underground mining and operating the process plant at La Colorada since 1998, recently producing on the order of 8 million ounces of silver, 5,000 ounces of gold, 21,000 tonnes of zinc, and 11,000 tonnes of lead annually.

The life of mine plan contemplates an annual processing rate of 814,00 throughout the mine life. Based on the mineral reserves estimated effective December 31, 2019, this corresponds to a remaining mine life of 11 years. The projected mine life may increase if the mineral resources can be converted to mineral reserves as the result of improvements to metallurgical recoveries, costs, or metal prices, or if additional mineral resources are defined and can be converted to mineral reserves.

Pan American conducts infill and near-mine drilling annually and updates the mineral resource and reserve estimates on an annual basis following reviews of metal price trends, treatment and refining charge trends for base metal concentrates, operational performance and costs experienced in the previous year, and forecasts of production and costs over the life of the mine.

December 31, 2019 8 of 50

Mineral resource and reserve estimates are based on assumptions that include mining, metallurgical, infrastructure, title, permitting, taxation, and economic parameters that have a degree of uncertainty. Although Pan American has no current expectation that the mineral reserve and resource estimates in this Technical Report will be materially negatively impacted by external factors such as environmental, permitting, title, access, legal, taxation, availability of resources, and other similar factors, changes in relation to such factors are not uncommon in the mining industry and there can be no assurance that these factors will not have a material impact. In addition, the accuracy of any mineral reserve and resource estimate is, among other things, the function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices, changes in the planned mining method, or various operating factors that occur subsequent to the date of the estimates may justify revision of such estimates and may differ, perhaps materially, from those currently anticipated.

In 2020, Pan American plans to invest US$16 million to US$18 million on a drilling program, early stage engineering, and metallurgical testing to advance the new skarn discovery. The 44,000 metre drill program is focused on infill and exploration drilling to further define, expand, and add confidence to the current resource estimate.

December 31, 2019 9 of 50

This Technical Report has been prepared by and for Pan American in compliance with the disclosure requirements of NI 43-101, to disclose current information about La Colorada.

The effective date of this Technical Report is December 31, 2019. No new material information has become available between this date and the signature date given on the certificate of the qualified persons (“Qualified Persons”).

Pan American is a silver mining and exploration company listed on the Toronto and NASDAQ stock exchanges under the ticker “PAAS”.

Unless otherwise stated, information, data, and illustrations contained in this report or used in its preparation have been prepared by Pan American for the purpose of this Technical Report. This Technical Report was prepared by Martin Wafforn, P. Eng., Senior Vice President, Technical Services and Process Optimization for Pan American, Christopher Emerson, FAusIMM, Vice President, Business Development and Geology for Pan American, and Americo Delgado, P. Eng., Vice President, Mineral Processing, Tailings, and Dams for Pan American. Messrs. Wafforn, Emerson, and Delgado are Qualified Persons as defined by NI 43-101 and are not independent of Pan American. The responsibilities of each co-author are provided in Table 2.1.

Mr. Wafforn most recently visited the Property on April 11, 2019, September 25, 2019, and January 7 to 9, 2020. During these visits, Mr. Wafforn reviewed operating costs, cut-off grade calculations, reconciliation, mining parameters, mine planning, budgeting, grade control and blasting protocols, interpretations of the vein structures, and the mineral reserve estimation processes and parameters. He also reviewed the mining progress relative to the annual plan and estimated mining costs, and visited the underground operations to review key production areas, ground conditions, ventilation, development and pumping requirements, and the nature of the structures being mined. He also visited the core logging facilities and discussed the geotechnical data collection procedures. Other reviews included the plant and tailings storage facilities, the site layout and logistics for mining and processing, safety protocols and indicators, the environmental layout, and general business performance.

Mr. Emerson most recently visited the Property on September 25, 2019, November 25 to 29, 2019, and January 13 to 15, 2020. During these visits, Mr. Emerson reviewed operating costs, cut-off grade calculations, reconciliation, mining parameters, interpretations of the veins and mineralized structures, the location of existing and planned drillholes, and the mineral resource estimation process and parameters. He also reviewed the channel sampling, exploration drilling, sampling, and sample security protocols, drill core and the core cutting and storage facilities, the onsite geochemical laboratory, geological mapping, grade control protocols, the operational mine plan, actual mine operation data, and general business performance.

Mr. Delgado most recently visited the Property on June 17 to 21, 2019, October 29 to November 1, 2019, and February 10 to 13, 2020. During these visits, Mr. Delgado reviewed the processing and tailings storage facilities, the flowsheet, processing parameters, metallurgical balance reconciliation, operational practices, metallurgical test results, the analytical and metallurgical laboratories, the long term mine plan, new sampling programs for additional metallurgical testing, and general business performance.

December 31, 2019 10 of 50

|

|

Table 2.1 Responsibilities of each Qualified Person |

| Qualified Person |

| Martin Wafforn, P. Eng. Senior Vice President, Technical Services and Process Optimization |

| Responsible for sections |

| 1: Summary; 2: Introduction; 3: Reliance on Other Experts; 4: Property Description and Location; 5: Accessibility, Climate, Local Resources, Infrastructure and Physiography; 12: Data Verification; 15: Mineral Reserve Estimates; 16: Mining Methods; 19: Market Studies and Contracts; 20: Environmental Studies, Permitting and Social or Community Impact; 21: Capital and Operating Costs; 22: Economic Analysis; 24: Other relevant data and information; 25: Interpretation and Conclusions; 26: Recommendations; 27: References |

| Qualified Person |

| Christopher Emerson, FAusIMM, Vice President, Business Development and Geology |

| Responsible for sections |

| 1: Summary; 2 :Introduction; 6: History; 7: Geological Setting and Mineralization; 8: Deposit Types, 9: Exploration; 10: Drilling; 11: Sample Preparation, Analyses and Security; 12: Data Verification: 14: Mineral Resource Estimates; 23: Adjacent Properties; 25: Interpretation and Conclusions; 26: Recommendations |

| Qualified Person |

| Americo Delgado, P. Eng., Vice President, Mineral Processing, Tailings, and Dams |

| Responsible for sections |

| 1: Summary; 2: Introduction; 12: Data Verification; 13:Mineral Processing and Metallurgical Testing; 17: Recovery Methods; 18: Project Infrastructure; 21: Capital and Operating Costs; 25: Interpretation and Conclusions; 26: Recommendations |

Unless otherwise stated, all units are metric and currencies are expressed in United States dollars. Project data coordinates are in a local coordinate based on a transformation relative to the Mexico 97 geoid.

December 31, 2019 11 of 50

| |

| 3 | Reliance on other experts |

The Qualified Persons responsible for this Technical Report have not relied on the reports, opinions, and statements of other experts for the preparation of this Technical Report.

December 31, 2019 12 of 50

| |

| 4 | Property description and location |

| |

| 4.1 | Location, issuer’s interest, mineral tenure, and surface rights |

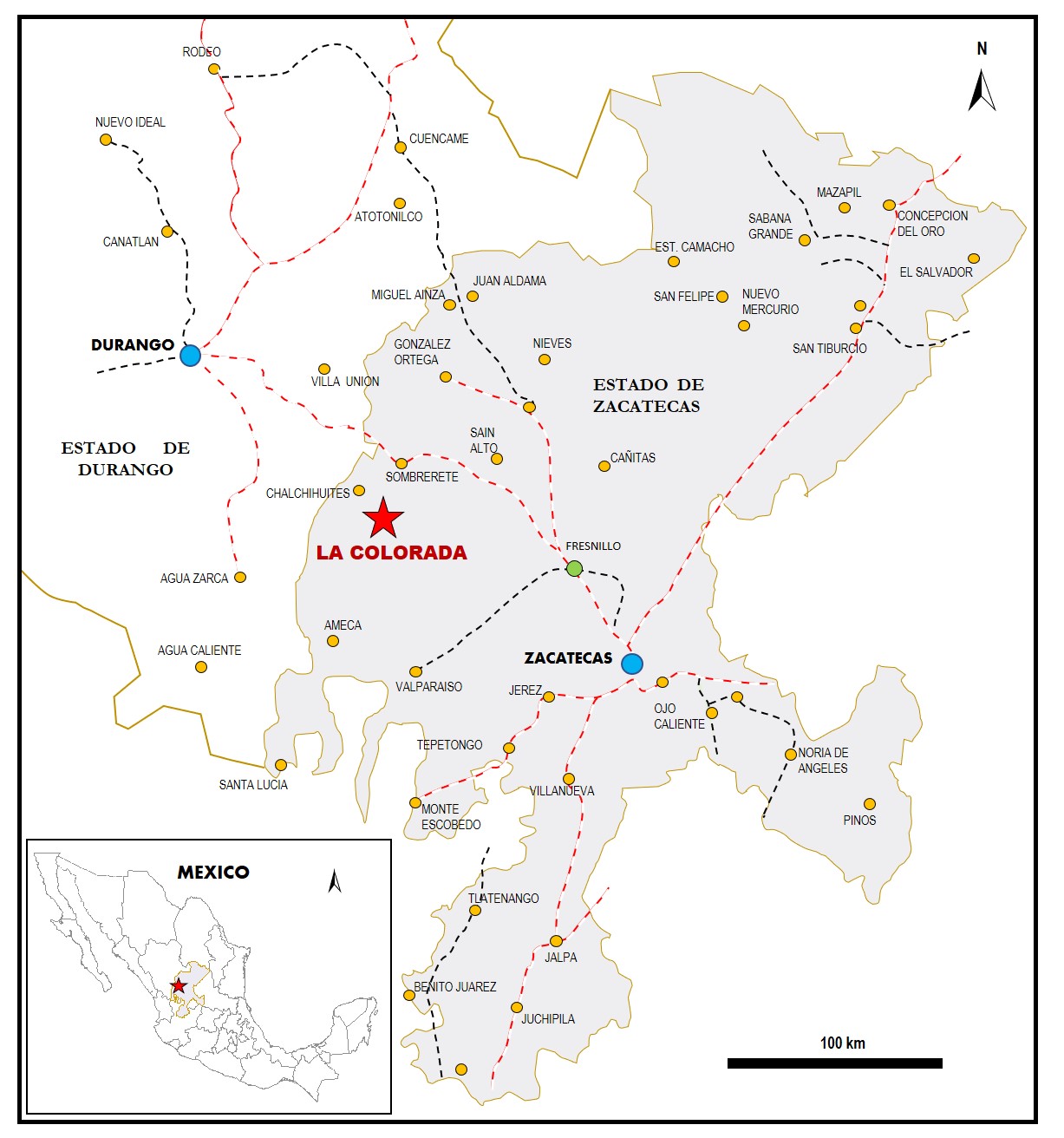

La Colorada is located in Chalchihuites district in Zacatecas State, Mexico, approximately 100 kilometres south of the city of Durango and 155 kilometres northwest of the city of Zacatecas, at 23°22’N and 103°45’W. Pan American is the 100% owner of the Property through its wholly owned subsidiary, Plata. A map of the Property location is shown in Figure 4.1.

|

|

| Figure 4.1 Plan of Property location |

|

December 31, 2019 13 of 50

The Property, including certain exploration concessions outside the mining area, is comprised of 56 mining claims totalling approximately 8,840 hectares. A plan of the claims and the mine workings is given in Figure 4.2 and claim details are given in Table 4.1. Pan American pays an annual fee to maintain the claims in good standing, and to Pan American’s knowledge, it has met all of the necessary obligations to retain the Property. Pan American has control over, or rights in respect of, approximately 1,300 hectares of surface rights covering the main workings. All of the La Colorada mineral reserves and resources and all of the known mineralized zones, mine workings, processing plant, effluent management and treatment systems, and tailings disposal areas are located within the mining claims controlled by Pan American.

|

| | | | | | | |

| Figure 4.2 Plan of mining concessions and workings |

|

|

| | | | | | | |

| Table 4.1 Mining concession details |

| Claim name | Title | Area (ha) | Expiry date | Claim name | Title | Area (ha) | Expiry date |

| Ampl De San Cristobal | 170097 | 29.1 | 2023-03-15 | Marieta | 171833 | 9.0 | 2033-06-14 |

| Ampl Al Tepozan | 182730 | 10.8 | 2038-08-15 | Melisa | 217670 | 69.6 | 2052-08-05 |

| Creston | 213594 | 9.0 | 2051-05-17 | Mississippi | 195070 | 432.1 | 2042-08-24 |

| Cruz del Sur | 170155 | 11.1 | 2032-03-16 | Nueva Era | 214659 | 29.7 | 2051-10-25 |

| El Cristo | 228944 | 119.7 | 2057-02-20 | Pan Am | 233733 | 4332.6 | 2061-10-24 |

| El Cristo 1 | 229247 | 224.0 | 2057-03-26 | Pan Am I | 244604 | 53.1 | 2065-11-03 |

| El Cristo 2 | 230727 | 98.5 | 2057-10-04 | Platosa | 216290 | 41.0 | 2052-04-29 |

| El Real | 214498 | 20.0 | 2051-10-01 | San Acacio Y San Miguel | 179719 | 73.1 | 2036-12-11 |

| El Real 2 | 228945 | 561.3 | 2057-02-20 | San Cristobal | 170095 | 10.0 | 2023-03-15 |

December 31, 2019 14 of 50

|

| | | | | | | |

| Eureka | 244603 | 0.6 | 2065-11-03 | San Geronimo | 172102 | 4.0 | 2033-09-25 |

| Fatima | 233977 | 288.4 | 2059-05-12 | San Joaquin | 172103 | 16.0 | 2033-09-25 |

| Fatima Fraccion | 234041 | 0.1 | 2059-05-21 | San Francisco | 221728 | 7.8 | 2048-01-29 |

| Fatima Fraccion 1 | 234042 | 3.5 | 2059-05-21 | Sn Fco I Fracc 1 | 223953 | 165.5 | 2055-03-14 |

| Fatima Fraccion 2 | 234043 | 0.8 | 2059-05-21 | Sn Fco I Fracc 2 | 223952 | 3.3 | 2055-03-14 |

| Fatima Fraccion 4 | 234044 | 0.9 | 2059-05-21 | Tepozan Segundo | 163260 | 13.5 | 2028-09-03 |

| Fatima Fraccion 5 | 234045 | 7.1 | 2059-05-21 | Tres Flores | 229893 | 13.6 | 2057-06-25 |

| Fatima Fraccion 6 | 234046 | 2.8 | 2059-05-21 | Unif El Conjuro | 170592 | 44.9 | 2023-06-01 |

| Fatima Fraccion 7 | 234047 | 0.3 | 2059-05-21 | Unif Victoria Eugenia | 188078 | 285.6 | 2040-11-21 |

| Fatima Fraccion 8 | 234048 | 4.0 | 2059-05-21 | Unificacion Canoas | 211969 | 18.5 | 2023-03-15 |

| Fatima 1 | 233147 | 241.2 | 2058-12-11 | Victoria 2 | 217628 | 16.7 | 2052-08-05 |

| Feryter | 192967 | 38.3 | 2041-12-18 | Victoria 3 Fracc A | 217629 | 459.3 | 2052-08-05 |

| Jul | 232538 | 24.7 | 2058-08-25 | Victoria 3 Fracc B | 217630 | 14.2 | 2052-08-05 |

| La Cruz | 211085 | 8.5 | 2050-03-30 | Victoria 5 | 226310 | 693.4 | 2055-12-05 |

| La Libertad | 244944 | 3.0 | 2066-05-30 | Victoria Eugenia | 211587 | 36.1 | 2050-06-15 |

| La Reforma | 218667 | 135.6 | 2052-12-02 | Victoria Eugenia I | 204862 | 23.3 | 2047-05-12 |

| Lizette | 221172 | 23.4 | 2053-12-02 | Victoria Eugenia II | 211166 | 49.0 | 2050-04-10 |

| Manto 1 | 238175 | 19.5 | 2061-08-08 | Victoria Eugenia III | 204756 | 1.1 | 2047-04-24 |

| Manto 2 | 238757 | 0.7 | 2061-10-24 | Victoria Eugenia IV | 217627 | 36.9 | 2052-08-05 |

| |

| 4.2 | Royalties, back-in rights, payments, agreements, and encumbrances |

In 2016, Maverix Metals Inc. (“Maverix”) acquired a gold stream equivalent of 100% of the payable gold production from the La Colorada mine, less a fixed price of USD$650 per ounce for the life of the mine. To the best of Pan American’s knowledge, La Colorada is not subject to any other royalties, overrides, back-in rights, payments, or other agreements and encumbrances, other than governmental taxes, fees, and duties. Plata is subject to governmental taxes, fees, and duties, including a special mining duty (“SMD”) of 7.5% applied to taxable earnings before interest, inflation, taxes, depreciation, and amortization; and a deductible extraordinary mining duty (“EMD”) of 0.5% that is applied to the sale of gold and silver.

| |

| 4.3 | Environmental liabilities |

There are no known significant environmental liabilities on or related to the Property. There are no known environmental issues that could materially impact Pan American’s activities on the Property.

In December 2016, the Zacatecas state government enacted a new set of ecological taxes which took effect on January 1, 2017 (the “Zacatecas Tax”), but have been challenged on constitutional grounds. The Zacatecas Tax primarily affects the La Colorada mine in respect of the materials placed in its tailings storage facility.

December 31, 2019 15 of 50

The mine workings, processing plant, tailings storage facilities, waste disposal areas, effluent management and treatment facilities, roads, and power and water lines have already been constructed and are located within the boundaries of the mining leases and surface rights controlled by us. To the best of Pan American’s knowledge, all permits and licenses required to conduct our activities on the Property have been obtained and are currently in good standing.

| |

| 4.5 | Significant factors and risks |

Certain individuals have asserted community rights and land ownership over a portion of La Colorada’s surface lands in the Agrarian Courts of Mexico. They have also initiated a process before the Secretariat of Agrarian, Territorial and Urban Development of Mexico’s Federal Government (“SEDATU”) in Zacatecas State to declare such lands as national property. In 2019 Pan American filed an amparo against such process and obtained an injunction to protect it’s ownership of these surface rights pending the outcome of the amparo and a further review by SEDATU. If Pan American is unable to acquire or maintain access to those surface rights, there could be material adverse impacts on La Colorada’s future mining operations.

Pan American is exposed to many risks in conducting its business, both known and unknown, and there are numerous uncertainties inherent in estimating mineral reserves and resources and in maintaining viable operations. Although Pan American has no current expectation that the mineral reserve and resource estimates in this Technical Report will be materially negatively impacted by external factors such as environmental, permitting, title, access, legal, taxation, availability of resources, and other similar factors, changes in relation to such factors are not uncommon in the mining industry and there can be no assurance that these factors will not have a material impact. For example, the third-party claims with respect to a portion of Pan American ‘s surface rights described herein could, if determined adversely, have a material impact on the La Colorada operation. The political, economic, regulatory, judicial and social risks related to conducting business in foreign jurisdictions, and changes in metal and commodity prices, pose particular risk and uncertainty to Pan American and could result in material impacts to Pan American’s business and performance. In addition to external factors and risks, the accuracy of any mineral reserve and resource estimate is, among other things, the function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices, changes in the planned mining method, or various operating factors that occur subsequent to the date of the estimate may justify revision of such estimates and may differ, perhaps materially, from those currently anticipated, and readers are cautioned against attributing undue certainty to estimates of mineral reserves and resources.

December 31, 2019 16 of 50

| |

| 5 | Accessibility, climate, local resources, infrastructure, and physiography |

| |

| 5.1 | Physiography, vegetation, and climate |

The physiography is characterized by wide flat valleys and narrow, relatively low mountain ranges and hills at elevations ranging between 2,100 metres and 2,550 metres above sea level. The climate is arid to semi-arid, and vegetation typically includes mesquite and cactus. The rainy season is from July to September, and winter temperatures are around freezing at night. The mine operates throughout the year.

| |

| 5.2 | Accessibility, local resources, population centres, and transport |

The Property is accessed from Durango by a 120 kilometre paved highway and a 23 kilometre public, all-weather gravel road. The mine is also accessible from the city of Zacatecas by similar types of roads. Both cities are major industrial and supply centres for the region and are a source of experienced workers. Flights to both cities are scheduled daily from Mexico City and other major commercial and industrial centres in Mexico. Chalchihuites, with a population of approximately 10,500, is the closest municipality to the Property, and is located 16 kilometres northwest of the Property.

The mine workings, processing plant, tailings storage facilities, waste disposal areas, effluent management and treatment facilities, roads, and power lines are located within the boundaries of the mining leases and approximately 1,300 hectares of surface rights controlled by Pan American.

Pan American has agreements in place with the national power utility, Comisión Federal de Electricidad (“CFE”), for the supply of power sufficient for the current operating plans. The mine also maintains diesel generators onsite to provide backup power when necessary. Water for the mining operation is supplied from the underground mine dewatering systems, tailings facilities, and wells located on the Property, and is adequate for the existing and planned future requirements of the mine.

The surface infrastructure includes the plant processing facilities, tailings and waste rock storage facilities, offices and workshops, accommodation camps, change houses, warehouses, fuel and lubricant facilities, water and diesel tanks, surface electrical distribution, air compressors, explosive magazine, water treatment plants, sludge settling ponds and piping, surface ventilation fans, mine portals, run of mine ore stockpiles, domestic waste landfill, roads, surface grading and drainage, security gates and fencing, and satellite communication.

December 31, 2019 17 of 50

6 History

The Dorado family operated mines at two locations on the Property in 1925. From 1929 to 1955, Candelaria y Canoas S.A., a subsidiary of Fresnillo S. A., installed a 100 tonne per day flotation plant and worked the old dumps of two previous mines on the Property. From 1933 to the end of World War II, La Compañas de Industrias Peñoles also conducted mining operations on the Property. From 1949 to 1993, Compañia de Minas Victoria Eugenia S. A. de C. V. (“Eugenia”) operated a number of mines on the Property. In 1994, Minas La Colorada S. A. de C. V. (“MLC”) acquired the exploration and exploitation claims and surface rights of Eugenia. Until 1997, MLC conducted mining operations on three of the old mines on the Property at a rate of approximately 150 tonnes per day. During these time periods, exploration was mainly in the form of development along the veins. Prior to Pan American’s ownership of the Property, 131 diamond drillholes had been drilled.

In 1997, Pan American entered into an option agreement with MLC, during which time Pan American conducted exploration and diamond drilling as part of its due diligence reviews Pan American acquired the Property from MLC in April 1998 and has focused its production on the Candelaria, Estrella, and Recompensa mines. Pan American has been producing annually since 1998.

In 2016, Maverix acquired a gold stream equivalent of 100% of the payable gold production from the La Colorada mine.

December 31, 2019 18 of 50

| |

| 7 | Geological setting and mineralization |

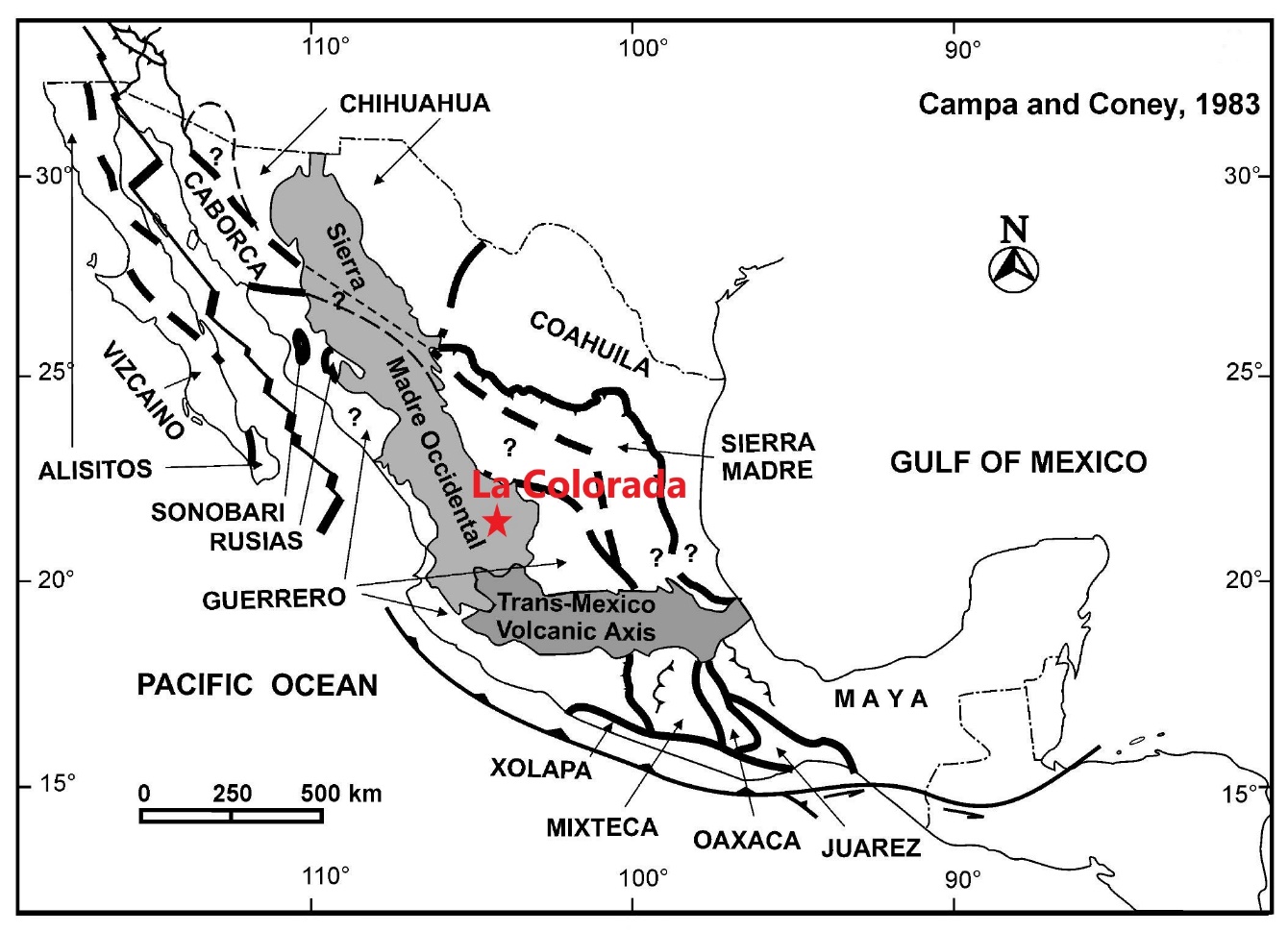

La Colorada is located in the Sierra Madre Occidental volcanic belt, at the contact between the Lower Volcanic Supergroup and the Upper Volcanic Supergroup. The Sierra Madre metallogenic terrane is well known for its epithermal precious metal deposits. The Lower Volcanic Supergroup comprises late Cretaceous to early Tertiary calc-alkaline batholiths and volcano-sedimentary rocks. The Upper Volcanic Supergroup comprises early Oligocene and early Miocene ignimbrites. Figure 7.1 shows a regional map of the tectono-stratigraphic terranes of Mexico, as redrawn from Campa and Coney (1983).

|

|

| Figure 7.1 Plan of regional geological setting (Redrawn from Campa and Coney, 1983) |

|

| |

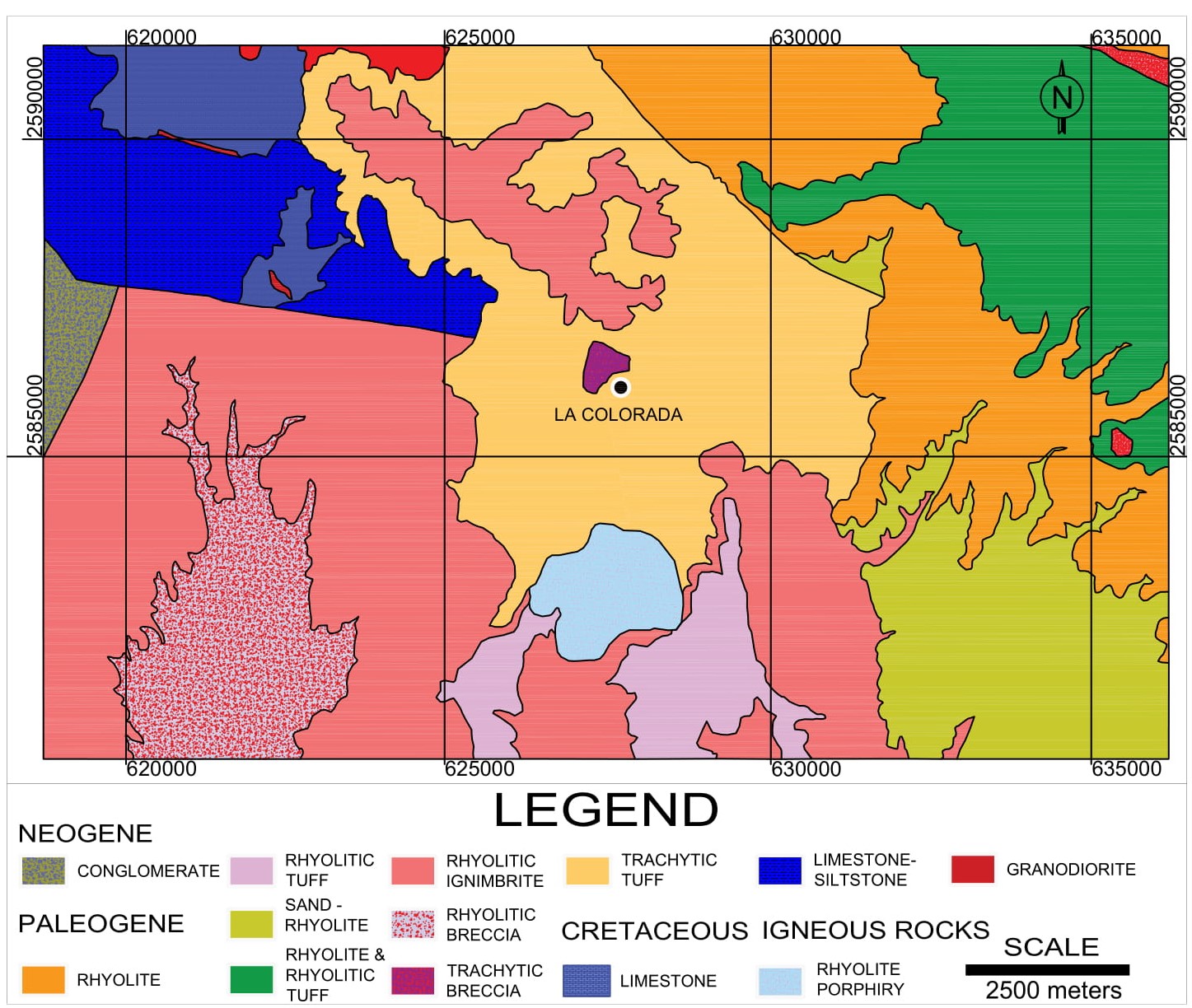

| 7.2 | Local and Property geology |

The oldest rocks exposed on the Property are Cretaceous limestones of the Cuesta del Cura Formation and calcareous clastic rocks of the Indidura Formation. They are overlain by conglomerates of the early Tertiary Ahuichilla Formation. Most of the outcrop on the Property is dacite of the Lower Volcanic Supergroup. Several small-scale subgroups within this unit, including plagioclase porphyry, tuffs, and volcanic breccias, are also present. A plan of the local geology is shown in Figure 7.2.

Regional deformation during the Laramide Orogeny, which occurred between 80 million and 35 million years ago, caused widespread folds and faults cross cutting bedding within the Cretaceous aged rocks. East to northeast striking faults form the dominant structures at the Property and play a strong role in local mineralization. Fault displacement may be on the order of ten metres to over a hundred metres.

December 31, 2019 19 of 50

Several breccia pipes up to 100 m in diameter and extending more than 400 m vertically below the surface are located along or to the south of the main vein complexes.

|

|

| Figure 7.2 Plan of local geology |

|

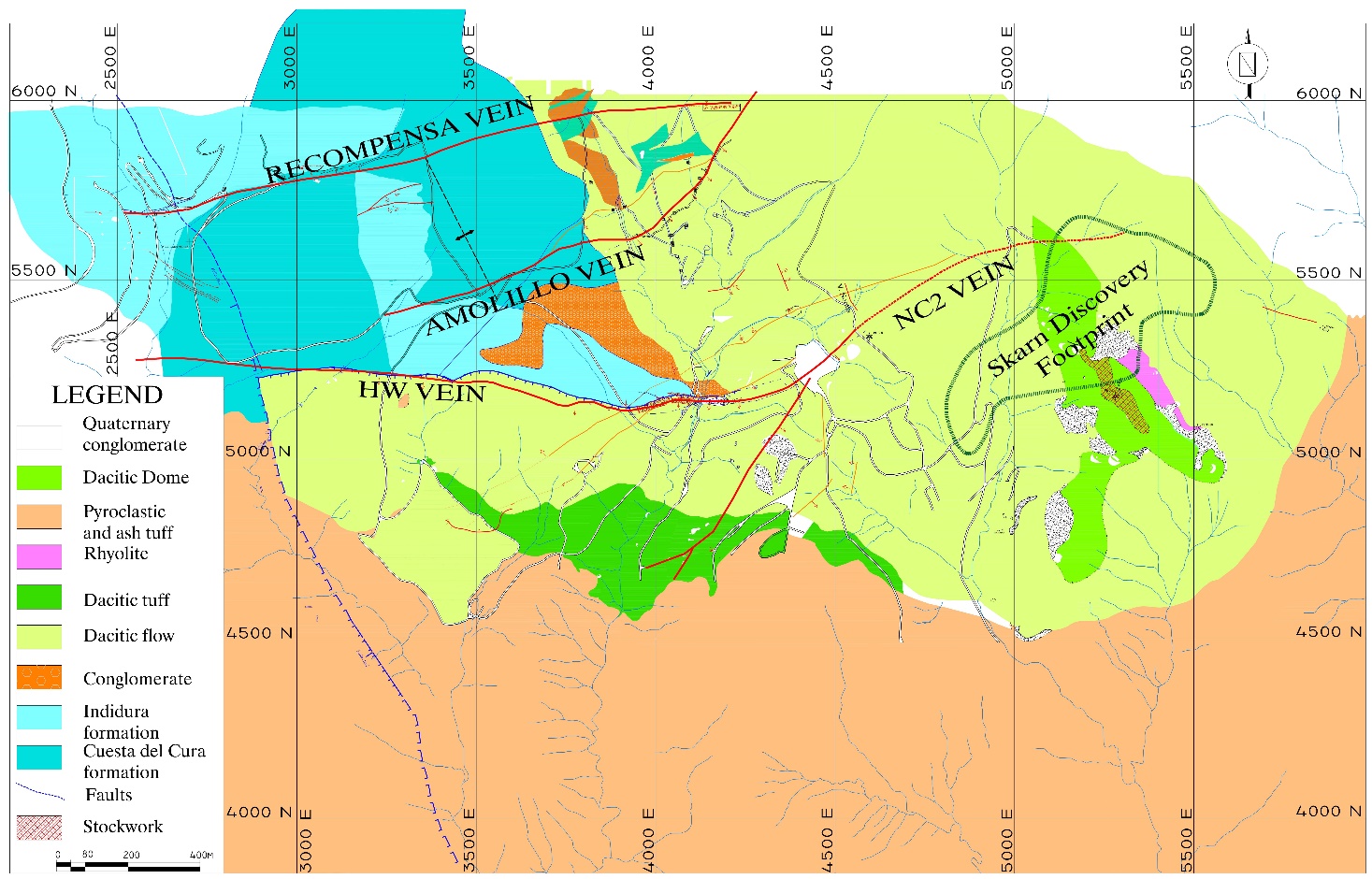

Economic mineralization at La Colorada is found in veins, replacement mantos within limestone, and skarn. The majority of the mineral resources and reserves are sourced from the NC vein series, the HW vein series, and Veta 3, all at the Candelaria mine; the Amolillo vein system at the Estrella mine; vein and manto mineralization at the Recompensa system at the Recompensa mine; and the new undeveloped skarn deposit, which is parallel to and below the NC vein series, east of the Candelaria mine. A plan of the main structures and the Property geology is shown in Figure 7.3.

Most mineralized veins on the Property strike east to northeast and dip moderately to steeply to the south. Veins occur in dacite and limestone, and cross cut bedding and lithological contacts. Most of the mineralization of economic significance is located in quartz veins that average 1 metre to 2 metres wide, but may be significantly wider. The vein fillings consist of quartz, calcite, and locally barite and rhodochrosite. Galena, sphalerite, pyrite, native silver, and silver sulphosalts are present in unoxidized veins. The major mineralized veins are strongly

December 31, 2019 20 of 50

brecciated and locally oxidized. Amolillo strikes over 1.5 km to the northeast and dips 60° to the southeast, for over 800 metres down dip. The average vein width is 2.2 metres. The NC series of veins lies around 700 m to the southeast of Amolillo. The most significant of these veins, NC2, strikes around 1.2 km to the northeast and dips 75° to the southeast, for over 1 km down dip. The average vein width is 1.9 metres. The HW series is the western continuation of the NC series, strikes east-west, and dips 50° to the south, for over 600 m down dip. The average vein width is 1.8 metres. Veta 3 runs parallel to the HW and NC series, strikes for over 900 m to the northeast, and dips 75° to the northwest, for around 400 m down dip. The average vein width is 1.7 metres.

Manto style mineralization is found near vein contacts where the primary host rock is limestone. This style of mineralization was mined at Recompensa and can also be seen in some areas of the Candelaria mine.

A significant skarn deposit was discovered in 2018 at depth and to the east of the Candelaria mine. With increasing depth, mineralization styles progress from epithermal style veins, to manto style mineralization in calcareous sediments, skarn, magmatic hydrothermal breccia skarn, proximal skarn, epithermal veins overprinting porphyry, and copper-molybdenum porphyry. Common minerals include galena and sphalerite, with quartz, carbonate, feldspar, pyroxene, and garnet. The deposit, as currently defined, comprises several zones of mineralization located between 600 metres to 1,700 metres below surface, over an area of around 500 metres by 600 metres.

|

|

| Figure 7.3 Plan of main structures and Property geology |

|

December 31, 2019 21 of 50

La Colorada is located in a region with significant silver and base metal production from vein and skarn deposits, and is considered a typical hydrothermal polymetallic deposit, with a transition of silver rich mineralization to more base metal rich mineralization at depth. This is the geological model considered for exploration and mineral resource and reserve estimation.

The skarn deposit is a typical skarn system comprising altered diorite and quartz feldspar intrusive stocks on the contact with limestone and siltstone. Zoned endoskarn and exoskarn are present, with a prograde garnet and pyroxene zone, and a retrograde zone with zinc, lead, copper, and silver mineralization. Carbonate replacement deposits, breccia pipes, epithermal silver, lead, and zinc systems, and a deep copper molybdenum porphyry are present, related to multiphase hydrothermal and magmatic activity.

December 31, 2019 22 of 50

The mine had been working for several decades prior to any specific exploration work. During that time, most major structures became known through mine development. Prior to Pan American’s ownership of the Property, 131 diamond drillholes for a total of 8,665 metres was completed by MLC.

Between September 1997 and March 1998, while the Property was under option, Pan American conducted a geophysical survey comprising very low frequency radio and induced polarization.

Since Pan American acquired the Property, staff and consulting structural geologists have carried out near mine surface and underground geological and structural mapping. Underground channel and raise sampling is conducted for grade control and mineral resource and reserve estimates as mining progresses. Near mine surface and underground diamond drilling exploration campaigns are ongoing on an annual basis for mineral resource and reserve estimates.

December 31, 2019 23 of 50

All drilling at the Property is by diamond drilling from surface and underground using industry standard drill machines and downhole survey tools. Drilling is conducted by both company employees and private drilling contractors, under the supervision of the La Colorada mine geology department. Drill core diameter ranges from HQ, NQ, and BQ depending on location and hole depth. Since 1997, on the order of 1,700 drillholes have been completed by Pan American over the deposits at the Recompensa, Estrella, and Candelaria mines and the new skarn deposit, and the results have been used for geological interpretation and mineral resource and reserve estimates. A plan of the drillhole locations relative to the mine workings is given in Figure 10.1.

|

|

| Figure 10.1 Plan of drillhole locations and mine workings |

|

| |

| 10.2 | Material impact on the accuracy and reliability of drilling results |

There are currently no known drilling, sampling, or recovery factors that are reasonably expected to materially impact the accuracy and reliability of the results.

December 31, 2019 24 of 50

| |

| 11 | Sample preparation, analyses, and security |

| |

| 11.1 | On-site sample preparation and security |

Diamond drillholes are logged, photographed, halved, and sampled in a secure core logging facility at the Property. The drill core is cut in half with a diamond bladed saw and samples are selected with respect to geological features, at 2 metre lengths or less. Channel samples of approximately one metre in width are taken in ore development areas and stopes by sampling crews under the supervision of the mine geologist. We have no reason to believe that the integrity of the samples has been compromised.

| |

| 11.2 | Laboratory sample preparation and analytical methods |

The drillhole samples are prepared by the internal La Colorada mine laboratory, which is operated by Pan American’s employees, and by independent laboratories including SGS of Durango, Activation Laboratories Ltd (“Actlabs”) of Zacatecas, and Bureau Veritas of Hermosillo. Both Actlabs and SGS used fire assay with gravimetric finish for gold and acid digestion with ICP finish for silver, lead, zinc, and copper. Bureau Veritas used fire assay with gravimetric finish for gold and acid digestion with ICP finish for silver, lead, zinc, and copper in their Vancouver, Canada laboratory. The La Colorada mine laboratory used fire assay with gravimetric finish for gold and silver, and acid digestion with atomic absorption finish for lead, zinc, and copper.

The La Colorada mine laboratory and Actlabs are certified with ISO 9001:2015. SGS and Bureau Veritas are accredited with ISO/IEC 17025.

| |

| 11.3 | Quality assurance and quality control |

Pan American implements a quality assurance and quality control (“QAQC”) program including the submission of certified standards, blanks, and duplicate samples to the laboratories. The results are reviewed regularly to ensure that appropriate and timely action is taken in the event of a failure. Any sample batches with QAQC failures are re-submitted to another laboratory for analysis.

Spatially and geologically representative samples have been measured for bulk density using the water displacement method and the results are used for the estimation of tonnes and contained metal in the mineral resource and reserve estimates.

| |

| 11.5 | Material impact on the accuracy and reliability of sample data |

The opinion of the Qualified Person responsible for this section of the Technical Report is that the sample preparation, analytical, and security procedures followed for the samples are sufficient and reliable for the purpose of the mineral resource and reserve estimates.

December 31, 2019 25 of 50

The Qualified Person undertakes regular reviews of drilling plans; drilling, sampling, and QAQC results; drill core and geological interpretations; mineral resource estimation procedures including the mineralization interpretations; and reconciliation between the mine plan and the processing plant. During site visits, the exploration drilling, sample, and security protocols are reviewed, along with the operational mine plan, actual mine operation data, and grade control protocols.

In the opinion of the Qualified Person, the data and parameters used to estimate mineral resources and reserves are sufficiently reliable for those purposes.

| |

| 12.2 | Mine engineering data reviews |

The Qualified Person undertakes regular reviews of the mining fleet; mine operational and production data; grade control data including dilution and ore loss; geotechnical and hydrological studies; waste disposal requirements; environmental and community factors; processing data; development of the life of mine plan including production and recovery rates, capital and operating cost estimates for the mine and processing facilities, transportation, logistics, power and water consumption and future requirements, taxation and royalties; and the parameters and assumptions used in the mineral resource and reserve estimates and economic model.

In the opinion of the Qualified Person, the data, assumptions, and parameters used to estimate mineral resources and reserves are sufficiently reliable for those purposes.

| |

| 12.3 | Metallurgy data reviews |

The Qualified Person undertakes regular reviews of the processing plants and operational data including metallurgical results, production, reagent consumption, treatment rates, plant availabilities and utilization, pumping capacities, pond levels, solution concentrations, metallurgical and analytical lab procedures, and general business performance.

In the opinion of the Qualified Person, the data and assumptions used to estimate the metallurgical recovery model for the mineral resource and reserve estimates are sufficiently reliable for those purposes.

It is the opinion of the Qualified Persons responsible for the preparation of this Technical Report that the data used to support the conclusions presented here are adequate for the purposes of the mineral resource and reserve estimates.

December 31, 2019 26 of 50

| |

| 13 | Mineral processing and metallurgical testing |

| |

| 13.1 | Introduction and previous work |

The metallurgical assumptions used for the mineral resource and reserve estimates and the economic analysis in this Technical Report are based on operational plant performance and confirmed by bench scale testing of samples representative of the planned mine feed. This work has confirmed that the optimum processing method is cyanidation for oxide ore and selective lead/zinc sulphide flotation for sulphide ore.

Test work including flotation and cyanide leach testing, locked cycle tests, and bottle roll tests, has confirmed the projected recoveries in the mine feed.

| |

| 13.2 | Metallurgical recovery |

In the oxide plant, metallurgical recoveries average 84% for silver and 48% for gold. In the sulphide plant, recoveries average 93% for silver, 61% for gold, 88% for lead, and 88% for zinc.

| |

| 13.3 | Material issues and deleterious elements |

All processing factors and an allowance for deleterious elements have been considered in the flow sheet and financial model, based on operational performance and results.

In 2020, Pan American plans to invest US$16 million to $18 million on a drilling program, early stage engineering, and metallurgical testing to advance the new skarn discovery.

December 31, 2019 27 of 50

| |

| 14 | Mineral resource estimates |

Pan American updates mineral resource estimates on an annual basis following reviews of metal price trends, operational performance and costs experienced in the previous year, the results of diamond drilling and underground channel sampling conducted during the year, and production and cost forecasts over the life of the mine. The effective date of the mineral resource estimate is December 31, 2019. Other than typical metal price fluctuation, no new material information has become available between December 31, 2019 and the signature date given on the certificates of the Qualified Persons. Mineral resources were prepared by Pan American staff under the supervision of and reviewed by Christopher Emerson, FAusIMM, Vice President, Business Development and Geology of Pan American Silver, who is a Qualified Person as that term is defined by NI 43-101.

Mineral resource and reserve estimates are based on assumptions that include mining, metallurgical, infrastructure, title, permitting, taxation, and economic parameters that have a degree of uncertainty. Although Pan American has no current expectation that the mineral reserve and resource estimates in this Technical Report will be materially negatively impacted by external factors such as environmental, permitting, title, access, legal, taxation, availability of resources, and other similar factors, changes in relation to such factors are not uncommon in the mining industry and there can be no assurance that these factors will not have a material impact. In addition, the accuracy of any mineral reserve and resource estimate is, among other things, the function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices, changes in the planned mining method, or various operating factors that occur subsequent to the date of the estimates may justify revision of such estimates and may differ, perhaps materially, from those currently anticipated.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resources reported here are in additional to mineral reserves.

| |

| 14.2 | Available data, interpretation, and estimation |

The available data includes channel and diamond drillhole samples, including collar coordinates, downhole surveys, sample assays of silver, gold, copper, lead, and zinc, density measurements, and lithology codes.

Resource estimates were made using either two dimensional or three dimensional methods.

Following the two dimensional method, mineral resources are estimated using averaging of the data collected from diamond drilling and channel samples. A long section is produced of each structure and divided into mineable panels. The volume of the panel is estimated from the average width of the vein or mineralization intersection of each drillhole or channel located within a 30 metre radius of the panel. The grade of each panel is estimated by the length weighted average of the sample grade of each intersection within a 30 metre radius of the panel. The samples are assessed and treated for extreme sample grades prior to averaging.

December 31, 2019 28 of 50

Following the three dimensional method, three dimensional interpretations are made in each vein or mineralized structure around spatially continuous trends of drillhole and channel sample grades greater than the sub-marginal cut-off values for each vein. A similar interpretation was made of hangingwall and footwall dilution volumes expected to be mined with each structure. The wireframe interpretations were then filled with blocks for the ordinary kriged estimate. Samples were composited to an equal weight and top cut for extreme grades if necessary. Experimental variograms aligned parallel to the dip and strike of each mineralized trend were calculated for both the mineralization and the surrounding waste and applied to the estimate. A long section is produced of each structure and divided into mineable panels.

For both estimation methods, average bulk density values from samples selected from spatially and geologically representative locations are applied to each mining panel volume to estimate the tonnes of each panel. The volumes are depleted annually for mining in the previous year.

A typical cross section of a vein interpretation indicating the relative orientation and spacing of channel samples and drillholes is shown in Figure 14.1.

|

|

| Figure 14.1 Cross section of typical structure and available data |

|

December 31, 2019 29 of 50

| |

| 14.3 | Confidence classification, planned dilution and loss, and value estimates |

Mineral resource confidence classifications are based on the proximity and density of sample information in each block, as well as the interpretation and the experience of the mine geologists.

Planned dilution is applied to each intersection to account for minimum mining width requirements, anticipated dilution, and to account for any backfill that might be mucked during cut and fill mining. Additional unplanned dilution is also applied in order to reconcile between the mineral reserve estimate and operational results. Mining recovery is estimated depending on vein width and based on experience and observation at each mining area.

A value per tonne is calculated in each panel considering the value paid for each metal, the expected metallurgical recovery of each metal to concentrate or to doré, and costs including insurance, penalties, refining, and transport. Any panel with a value above the mineral resource cut-off is converted to mineral resources.

| |

| 14.4 | Mineral resource tabulation |

Mineral resources for La Colorada effective December 31, 2019 are given in Table 14.1. Metal prices used for the mineral resource estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc, except for the skarn deposit, where metal prices of $18.50 per ounce of silver, $6,500 per tonne of copper, $2,200 per tonne of lead, and $2,600 per tonne of zinc were used.

|

| | | | | | | | | | | |

| Table 14.1 La Colorada mineral resources effective December 31, 2019 |

| Classification | Tonnes Mt | Ag ppm | Au ppm | Cu% | Pb % | Zn% | Ag Moz | Au koz | Cu kt | Pb kt | Zn kt |

| Measured | 0.5 | 229 | 0.24 | 0.00 | 0.65 | 1.16 | 3.8 | 4.0 | 0.0 | 3.3 | 5.9 |

| Indicated | 1.6 | 185 | 0.15 | 0.00 | 0.56 | 1.16 | 9.6 | 7.8 | 0.0 | 9.0 | 18.7 |

| Measured + Indicated | 2.1 | 196 | 0.17 | 0.00 | 0.58 | 1.16 | 13.4 | 11.8 | 0.0 | 12.3 | 24.7 |

| Inferred | 5.0 | 190 | 0.16 | 0.00 | 2.16 | 4.28 | 30.6 | 25.3 | 0.0 | 107.8 | 214.1 |

| Inferred skarn | 72.5 | 44 | 0.00 | 0.17 | 2.02 | 4.40 | 101.6 | 0.0 | 120.8 | 1,1465.4 | 3,190.6 |

| Notes: Totals may not add up due to rounding. Mineral resource estimates were prepared under the supervision of or were reviewed by Christopher Emerson, FAusIMM, Vice President Business Development and Geology of Pan American. Metal prices used for the mineral resource estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc, except for the skarn deposit, where metal prices of $18.50 per ounce of silver, $6,500 per tonne of copper, $2,200 per tonne of lead, and $2,600 per tonne of zinc were used. At the skarn deposit, a cut-off value of $60 per tonne, which used metallurgical recoveries of 91% silver, 90% lead, 85% zinc, and 38% copper, was used to tabulate resources. Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability. |

December 31, 2019 30 of 50

| |

| 15 | Mineral reserve estimates |

Pan American updates mineral reserve estimates on an annual basis following reviews of metal price trends, operational performance and costs experienced in the previous year, the results of diamond drilling and underground channel sampling conducted during the year, and production and cost forecasts over the life of the mine. The effective date of the mineral reserve estimate is December 31, 2019. Other than typical metal price fluctuation, no new material information has become available between December 31, 2019 and the signature date given on the certificates of the Qualified Persons. Mineral reserves were prepared by Pan American staff under the supervision of and reviewed by Martin Wafforn, P.Eng., Senior Vice President, Technical Services and Process Optimization, who is a Qualified Person as that term is defined by NI 43-101.

Mineral resource and reserve estimates are based on assumptions that include mining, metallurgical, infrastructure, title, permitting, taxation, and economic parameters that have a degree of uncertainty. Although Pan American has no current expectation that the mineral reserve and resource estimates in this Technical Report will be materially negatively impacted by external factors such as environmental, permitting, title, access, legal, taxation, availability of resources, and other similar factors, changes in relation to such factors are not uncommon in the mining industry and there can be no assurance that these factors will not have a material impact. In addition, the accuracy of any mineral reserve and resource estimate is, among other things, the function of the quality and quantity of available data and of engineering and geological interpretation and judgment. Results from drilling, testing, and production, as well as a material change in metal prices, changes in the planned mining method, or various operating factors that occur subsequent to the date of the estimates may justify revision of such estimates and may differ, perhaps materially, from those currently anticipated.

| |

| 15.2 | Methods and parameters |

The estimated mineral resources, using the methods and parameters described in Chapter 15, are converted to mineral reserves if they can be economically mined. This tabulation excludes some economic mineral resources that may not be converted to mineral reserves for reasons such as accessibility, and mining recovery.

| |

| 15.3 | Mineral reserve tabulation |

Mineral reserves for La Colorada effective December 31, 2019 are given in Table 15.1. Metal prices used for the mineral reserve estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc.

December 31, 2019 31 of 50

|

| | | | | | | | | |

| Table 1.2 La Colorada mineral reserves effective December 31, 2019 | | | |

| Classification | Tonnes Mt | Ag ppm | Au ppm | Pb % | Zn % | Ag Moz | Au koz | Pb kt | Zn kt |

| Proven | 3.7 | 395 | 0.33 | 1.72 | 3.11 | 47.3 | 39.1 | 64.2 | 115.9 |

| Probable | 5.3 | 287 | 0.26 | 1.35 | 2.44 | 49.1 | 44.0 | 71.7 | 130.1 |

| Proven + Probable | 9.0 | 331 | 0.29 | 1.50 | 2.72 | 96.4 | 83.1 | 135.8 | 246.0 |

| Notes: Totals may not add up due to rounding. Mineral reserve estimates were prepared under the supervision of or were reviewed by Martin Wafforn, P.Eng., Senior Vice President, Technical Services and Process Optimization of Pan American. Metal prices used for the mineral reserve estimate were $17 per ounce of silver, $1,300 per ounce of gold, $2,100 per tonne of lead, and $2,500 per tonne of zinc. |

December 31, 2019 32 of 50

| |

| 16.1 | Mining methods and geotechnical parameters |

Underground mining currently takes place at the Candelaria and Estrella mines utilizing cut and fill and long hole open stoping methods. The main access ramps and haulage drifts are designed at 3.5 metres wide by 3.5 metres high, with a maximum gradient of 15%. Main levels have a vertical interval of 30 metres. Minimum mining widths are either 1.8 metres with planned dilution of 0.3 metres either side, or 1.5 metres with planned dilution of 0.2 metres either side, depending on vein width, and cuts are 2.4 metres high.

Hand held drills or electric hydraulic jumbo drills are used for development mining to access the ore, depending on the size of excavation required. Scoops are used for tramming ore and backfill to and from stopes, and haul trucks are used for underground ore haulage. Ground support is provided by rock bolts, with screen and shotcrete as required, as well as by backfilling mining voids with development waste rock or mill tailings. Ore is hoisted to the surface in a shaft with a capacity in excess of 2,300 tpd, and hauled to the mill crusher stockpile. When required, ore can be hauled to the surface using the two mine access ramps present in both mines.

| |

| 16.2 | Hydrological parameters |

The Candelaria mine, and the Estrella mine located above it, are dewatered via pump stations comprising sixteen 150 hp pumps, which includes a set of standby units for periods of peak flows and maintenance. The main heat sources in the mine include equipment, oxidation, and transfer through rock and ground water. Heat and gases are removed, and fresh air is provided by the ramps and ventilation raises with exhaust fans.

| |

| 16.3 | Production rates and expected mine life |

An underground mine schedule based on the underground mine plan has a life of mine of 11 years producing 9.0 million tonnes.

| |

| 16.4 | Mining fleet, equipment, and services |

The current and budgeted underground mobile mining equipment fleet owned by Pan American is shown in Table 16.1. Standard mine services include compressed air, service water, electrical, communication, pump lines, and ventilation ducting. Hydrocarbon and water storage facilities, water treatment and waste disposal facilities, a hydraulic backfill plant, air compressors, and power distribution facilities are located on surface.

|

| | | | | |

| | | | | | |

| Item | Description | Quantity | Item | Description | Quantity |

| Scoop tram | 1.5 m3 Sandvik LH 203 | 20 | Rock bolter | Sandvik DS2710 | 1 |

| Scoop tram | 3.0 m3 Sandvik LH 307 | 10 | Haul truck | Sandvik TH315 | 10 |

| Jumbo drill | Atlas Copco S1 D | 5 | Haul truck | Sandvik TH320 | 2 |

| Jumbo drill | Sandvik DD210 | 9 | Scaler | Partindus | 1 |

| Long hole drill | Sandvik DL210 | 2 | | | |

December 31, 2019 33 of 50

Ore processing is by separate oxide and sulphide circuits. The oxide plant is a conventional cyanide leach process comprised of crushing, grinding, leaching, Merrill-Crowe zinc precipitation, and smelting of the precipitate to produce doré. The sulphide plant is a conventional flotation process comprised of crushing, grinding, and selective lead and zinc froth flotation circuits to produce lead and zinc concentrates. The silver content is typically around 87% in the lead concentrates and 7% in the zinc concentrates. Lead concentrates average 52% lead and zinc concentrates average 58% zinc. The processing capacity is a nominal 400 tonnes per day in the oxide plant and a nominal 1,400 tonnes per day in the sulphide plant, although 1,700 tonnes per day in the sulphide plant is regularly achieved. Metallurgical recoveries in the oxide plant average around 84% for silver and 48% for gold. In the sulphide plant, recoveries average 93% silver, 61% gold, and 88% for both lead and zinc.

| |

| 17.1 | Oxide processing plant |

Oxide ore is reclaimed from the coarse ore stockpile and passed through a stationary grizzly for sizing prior to crushing in a 600 mm x 900 mm primary jaw crusher. The crushed product is conveyed to a double deck vibrating screen for size classification. Any oversize reports to a secondary HP4 cone crusher in a closed loop for further size reduction. Screen undersize reports to a fine ore stockpile for grinding via a diverter gate and pant leg chute.

The crushed ore is reclaimed from the fine ore stockpile by a belt feeder and conveyed to a 2.9 metre x 3.4 metre ball mill. The milled product is pumped to a bank of cyclones for size classification. Cyclone underflow reports to a 2.4 metre x 3.0 metre ball mill for additional grinding, then the milled product returns to the cyclone for classification. Dilute cyanide solution is used in the grinding circuit to initiate leaching of gold and silver.

Cyclone overflow reports to two 7.9 metre x 2.4 metre primary leach thickeners. Clear solution overflow from the thickeners reports to the pregnant solution tank and slurry underflow reports to a series of seven agitated leach tanks. The slurry passes through five of these agitated leach tanks for leaching and then reports to a 7.9 metre x 2.4 metre intermediate leaching thickener. Clear solution overflow reports to the pregnant solution tank and the slurry underflow reports to a series of four additional agitated leach tanks for continued leaching.

Following the leaching period, the leached solids are sent through four 7.9 metre x 2.4 metre countercurrent rinse thickeners for further metal recovery and to reduce the cyanide content in the tailings. Rinse water reports to the mill water storage tank for re-use in the recovery process and the thickened tailings report to a lined tailings storage facility.

The pregnant leach solution is pumped through a set of clarifiers to remove suspended solids, and after clarification, the solution passes through a vacuum tower to remove dissolved oxygen. Zinc dust is added to the solution stream causing the precipitation of gold and silver. The solution with the metal precipitate passes through a set of plate and frame filter presses to separate the metal precipitate from the solution stream. After leaving the filter press, the barren solution is returned to the process water tank for re-use in the recovery process. The filtered precipitate is mixed with refining fluxes and melted in a gas fired furnace to separate the contained metal from impurities. The molten metal is poured into molds and solidified into doré bars for shipping.

December 31, 2019 34 of 50

| |

| 17.2 | Sulphide processing plant |

Sulphide ore is trucked to a 500 tonne capacity ore bin and fed via an apron feeder to a C-100 jaw crusher. The minus 6” material is conveyed to double deck 2.4 metre x 6.1 metre screen for size classification. Material oversize reports to a short head Hp4 crusher in a closed loop for further size reduction. Screen undersize reports to one of two 800 tonne capacity fine ore bins and then fed to a 4.0 m x 5.7 m ball mill. Mill product is pumped to a bank of three cyclones for size classification. Cyclone underflow is returned to the ball mills for additional grinding to form a closed loop within the grinding circuit.

Cyclone overflow reports to the lead flotation circuit, which comprises six 30 m3 tank cells, four for rougher flotation and two for scavenger flotation, followed by six 10 m3 flotation machines to provide first and second cleaner stages in the circuit. Flotation concentrate from the cleaner circuit reports to a 7.0 metre diameter lead concentrate thickener, and the slurry underflow reports to a filter press for dewatering. After filtering, the filter cake is stored in a lead-concentrate holding area for shipping to a smelter and the clear solution from the concentrate thickener is returned to the process water tank for re-use in the mill and flotation circuit.

Tailings from the lead scavenger circuit report to the zinc flotation circuit conditioning tank where reagents for zinc flotation are added. The zinc flotation equipment and processes are similar to the lead flotation circuit, using a 4.3 metre diameter conditioning tank, a bank of six 30 m3 tank cells, four for rougher flotation and two for scavenger flotation, and six 10 m3 cleaner flotation cells for first and second cleaning stages. Flotation concentrate from the rougher cells reports to the zinc cleaning circuit and tailings report to the zinc scavenger circuit. Flotation concentrate from the cleaner circuit reports to an 8.0 metre diameter zinc concentrate thickener, and the slurry underflow reports to a plate and frame filter press for dewatering. After filtering, the filter cake is stored in the zinc concentrate holding area for shipping to a smelter. Clear solution overflow is returned to the plant process water for re-use in the recovery process.

Tailings from the zinc scavenger circuit report to the tailings system feed box for classification and disposal and pumped to two cyclones for classification, with the coarser material directed to the hydraulic backfill plant for re-use underground as backfill in the sulphide stopes. The finer material is directed to a 22 metre diameter thickener, for disposal in a lined tailings storage facility. Clear solution from the tailings thickener is used in the preparation of the hydraulic backfill or returned to the process water tank for re-use in the recovery process.

| |

| 17.3 | Power, water, and reagent requirements |

Power is supplied from the national grid and supplemented by backup generator sets if necessary. Water is sourced from the underground mine dewatering, tailings storage facilities, and wells located on the Property. Estimated reagent requirements for processing the ore are 4.6 kg per tonne of lime and 3 kg per tonne of sodium cyanide for oxide ore, and 1.0 kg per tonne of lime for sulphide ore.

December 31, 2019 35 of 50

A plan of the current site facilities is shown in Figure 18.1.

|

|

| Figure 18.1 Plan of mine infrastructure |

|

December 31, 2019 36 of 50

| |

| 18.1 | Transportation and logistics |

Consumables and other materials are transported to the Property from Durango by a 120 kilometre paved highway and a 23 kilometre public, all-weather gravel road. The mine is also accessible from the city of Zacatecas by similar types of roads. Both cities are major industrial and supply centres for the region and are a source of experienced workers.

| |

| 18.2 | Mine and processing facilities |

The existing infrastructure includes the typical components of an operating underground mine, including the mine workings, shaft, hoist room, compressors, workshops, laboratories, storage facilities, offices, drill core and logging sheds, water and power lines, access roads, and the worker’s camp.

The processing facilities consist of stockpiles, crushing, grinding, flotation, reagent preparation areas, thickening, filtration, and concentrate storage areas, and the Merrill-Crowe plant. The processing facilities area also includes process plant offices, maintenance, analytical and metallurgical laboratories, and metallurgical laboratory, water treatment plants, pumping facilities, and the tailings storage facilities.

La Colorada has agreements in place with CFE for the supply of power sufficient for the current operating plans. Water for the mining operation is supplied from the mine dewatering systems, tailings facilities, and wells located on the Property, and is adequate for the existing and planned future requirements of the mine.

December 31, 2019 37 of 50

| |

| 19 | Market studies and contracts |

| |

| 19.1 | Contracts and marketing |

Contracts and agreements are currently in place for the supply of goods and services necessary for the mining operations. These include contracts for the supply of diesel for equipment operation and power generation, process reagents including sodium cyanide, camp services including catering, and maintenance equipment for the mining equipment.

The doré produced at the mine is sent to one of two arm’s length precious metals refineries for refining under fixed-term contracts. After refining, the silver is sold on the spot market to various bullion traders and banks, and the gold is sold to Maverix. All lead and zinc concentrates produced are sold to arm’s length smelters and concentrate traders under negotiated fixed-term contracts, which consider the presence of any deleterious elements. To date, Pan American has not experienced difficulty with renewing existing or securing new contracts for the sale of the doré or concentrates, and none are expected.

| |

| 19.2 | Review by the Qualified Person |

Martin Wafforn, the Qualified Person responsible for this section of the Technical Report, has reviewed the contract terms, rates, and charges for the production and sale of the doré and concentrates, and considers them within industry norms and sufficient to support the assumptions made in the mineral resource and reserve estimates.

December 31, 2019 38 of 50

| |

| 20 | Environmental studies, permitting, and social or community impact |

| |

| 20.1 | Environmental studies, issues, and permits |

An environmental impact statement (“EIS”) and risk assessment on the Property was submitted to the Mexican environmental authorities in 1999. The EIS described the impact of proposed development and mining activities and provided conceptual plans for closure and remediation. The EIS was approved by the Mexican authorities in 1999 and renewed in 2010. In 2013, the Mexican authorities approved a modification to the existing environmental permits that allowed the expansion of the mine and process plant up to 2,000 tonnes per day. A modification application to the plant expansion permit was approved in early 2015.

The main environmental projects at the Property focus on the stability and revegetation of historic tailings facilities. There are no known environmental issues that could materially impact our ability to extract the mineral resources or mineral reserves.

The mine has voluntarily participated in the Mexican Environmental Protection Authority’s “Clean Industry” program, which involves independent verification of compliance with all environmental permits and the implementation of good practice environmental management procedures and practices. The mine obtained its first certification in 2008 and is periodically re-certified.

| |

| 20.2 | Mine waste disposal and water management |

All waste rock and a portion of the tailings are repurposed as backfill during the mining process. Two engineered tailings storage facilities are located on the Property, and additional lifts are added as required.

Water for the mining operation is supplied from the underground mine dewatering systems, tailings facilities, and wells located on the Property, and is adequate for the existing and planned future requirements of the mine. As permitted by Mexican law, mine dewatering is pumped to the surface, treated in a mine water treatment plant, and stored in tanks for use in the milling process and for domestic services. Treated mine dewatering is also pumped to a potable water treatment plant to provide water for camp use.

| |

| 20.3 | Social and community factors |

Certain individuals have asserted community rights and land ownership over a portion of La Colorada’s surface lands in the Agrarian Courts of Mexico. They have also initiated a process before SEDATU to declare such lands as national property. In 2019 Pan American filed an amparo against such process and obtained an injunction to protect it’s ownership of these surface rights pending the outcome of the amparo and further review by SEDATU. If Pan American is unable to acquire or maintain access to those surface rights, there could be material adverse impacts on La Colorada’s future mining operations.

December 31, 2019 39 of 50

| |

| 20.4 | Project reclamation and closure |

A closure cost estimate for the Property was prepared according to the State of Nevada approved SRCE methodology in 2011 and is updated every year. The present value of the final site reclamation costs for the Property is estimated to be approximately $8.1 million as at December 31, 2019. No reclamation bond is required by Mexican law.

December 31, 2019 40 of 50

| |

| 21 | Capital and operating costs |