NOTICE OF

2021 ANNUAL GENERAL AND SPECIAL

MEETING OF SHAREHOLDERS

INFORMATION CIRCULAR

MARCH 22, 2021

(This page intentionally left blank)

| | | | | | | | |

| What’s Inside | |

| Notice of our 2021 Annual General and Special Meeting of Shareholders ............. | i |

| About this Information Circular ………………………………………………………………..…..…..…… | iii |

| About the Meeting …………………………………………………………………………………….……..…….. | 1 |

| Items of Business …………………………………………………………………………….…….…..………. | 2 |

| Notice and Access ………………………………………………………………………………….…..………. | 3 |

| Voting ………………………………………………………………………………………….……………..…….. | 4 |

| Director Nominees ………………………………………………………………………..…………..……… | 8 |

| About the Auditor ……………………………………………………………………………………….…….. | 13 |

| Advisory ‘Say on Pay’ Resolution …………………………………………………………………..…… | 14 |

| Governance …………………………………………………………………………………………………………..…. | 15 |

| Corporate Governance Overview ……………………………………………………………………..… | 16 |

| Ethical Business Conduct ……………………………………………………………………………………. | 16 |

| About the Board …………………………………………………………………………………………………. | 18 |

| Board Education …………………………………………………………………………………………………. | 21 |

| Board Committees ……………………………………………………………………………………………… | 21 |

| Director Attendance …………………………………………………………………………………………… | 24 |

| Director Compensation ………………………………………………………………………………………. | 25 |

| Executive Compensation ………………………………………………………………………………………….. | 27 |

| Compensation Discussion and Analysis ………………………………………………………………. | 28 |

| Components of Executive Compensation ……………………………………………………………. | 37 |

| Executive Share Ownership ………………………………………………………………………………… | 45 |

| Total Executive Compensation Summary ………………………………………………………….... | 47 |

| Employment Agreements, Change Of Control and Other Termination Payments ... | 48 |

| Additional Company Information …………………………………………………………………………….. | 50 |

| Additional Governance Disclosure and Appendices …………………………………………………. | 52 |

| Appendix A Corporate Governance Disclosure …………………………………………………… | 53 |

| Appendix B Mandate of the Board of Directors ………………………………………………… | 61 |

| Appendix C Summary of Option Plan ………………………………………………………………….. | 65 |

| | |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Notice of our 2021 Annual General and Special Meeting of Shareholders | | | | | |

| |

| WHEN: | WHERE: |

| Wednesday, May 12, 2021 3:00 p.m. (Vancouver time) | 1200 Waterfront Centre, 200 Burrard Street, Vancouver, British Columbia V7X 1T2 |

Due to ongoing governmental restrictions and guidelines relating to the COVID-19 pandemic, shareholders and proxyholders should not attend in person to our 2021 annual general and special meeting of shareholders (the “Meeting”) and all shareholders are urged to vote in advance by proxy as discussed in more detail below and in the accompanying management information circular (the “Circular”).

The Meeting may be accessed remotely via live conference call and audio webcast as detailed below, and further under the heading “Participating in the Meeting” on page 7 of the Circular.

CONFERENCE CALL AND WEBCAST: | | | | | | | | |

| Dial-in: | 1-800-319-4610 (toll-free in Canada and the U.S.) |

| +1-604-638-5340 (international participants) |

| Webcast: | Via our website at | https://www.panamericansilver.com/investors/events-and-presentations/ |

| Or directly at | http://services.choruscall.ca/links/panamericansilveragm20210512.html |

Participants should dial-in approximately 5 to 10 minutes prior to the scheduled start time of the Meeting.

| | | | | |

We will cover the following items of business: |

| 1. | Receive our consolidated financial statements for the financial year ended December 31, 2020 and the auditor’s report thereon. |

| 2. | Elect eight directors to hold office until our 2022 annual general and special meeting of shareholders. |

| 3. | Reappoint Deloitte LLP as our independent auditor to hold office until our 2022 annual general and special meeting of shareholders and authorize the directors to set the auditor’s pay. |

| 4. | Consider a non-binding advisory “say on pay” resolution approving our approach to executive compensation. |

| 5. | Transact any other business that may properly come before the meeting. |

Your Vote is Important.

You are entitled to receive this notice and vote at the Meeting if you owned common shares of Pan American Silver Corp. (“Pan American” or the “Company”) as of the close of business on March 19, 2021.

The accompanying Circular will be made available to our shareholders on or about April 6, 2021 with a proxy or voting instruction form (“VIF”) in accordance with applicable laws.

If you are a registered shareholder, send your completed proxy by fax or mail, to our transfer agent, Computershare Investor Services Inc. (“Computershare”), or complete your proxy on the internet in accordance with the instructions provided on the form of proxy. Computershare must receive your proxy by 3:00 p.m. (Vancouver time) on Monday, May 10, 2021, or at least 48 hours (excluding Saturdays, Sundays and statutory holidays in British Columbia) prior to the time of any adjournment or postponement of the Meeting. The Chair of the Meeting has the discretion to accept or reject any late proxies, and can waive or extend the deadline for receiving proxy voting instructions without notice.

If you are a non-registered shareholder and you have received these materials from us or our agent, we have obtained your name, address and information about your shareholdings from your securities broker, custodian, nominee, fiduciary, or other intermediary holding these securities on your behalf in accordance with applicable requirements of securities regulators. By sending these materials to you directly, we (and not your intermediary) have assumed responsibility for delivering them to you and executing your proper voting instructions. Please return your voting instructions as specified in the enclosed VIF.

If you are a non-registered shareholder and object to us receiving access to your personal name and address, we have provided these documents to your broker, custodian, fiduciary or other intermediary to forward to you. Please follow the voting instructions

| | |

NOTICE OF MEETING | Page i |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

that you receive from your intermediary. Your intermediary is responsible for properly executing your voting instructions.

The accompanying Circular contains important information about what the Meeting will cover, who can vote and how to vote. Please read it carefully.

The Circular contains further particulars of matters to be considered at the Meeting. The Meeting will also consider any permitted amendment to or variations of any matter identified in this Notice, and transact such other business as may properly come before the Meeting or any adjournment thereof. Copies of the audited financial statements for the year ended December 31, 2020, report of the auditor and related management discussion and analysis, as well as the Annual Information Form, will be made available at the Meeting and are available on SEDAR at www.sedar.com.

You are receiving this Notice because Pan American has elected to use the notice-and-access model as such provisions are set out under National Instrument 51-102 – Continuous Disclosure Obligations and National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (the “Notice-and-Access Provisions”) for the delivery of meeting materials relating to this Meeting. Notice-and-Access Provisions are a set of rules developed by the Canadian Securities Administrators that allow a company to reduce the volume of materials to be physically mailed to shareholders by posting the Circular and any additional annual meeting materials (the “Proxy Materials”) online. Under the Notice-and-Access Provisions, instead of receiving paper copies of the Circular, shareholders will receive this Notice and a form of proxy. In the case of beneficial (non-registered) shareholders, they will receive this Notice and a VIF. The form of proxy/VIF enables shareholders to vote. Before voting, shareholders are reminded to review the Circular online by logging onto the website access page provided and following the instructions set out below. Shareholders may also choose to receive a printed copy of the Circular by following the procedures set out below.

Copies of the Proxy Materials and the annual financials are posted on the Company’s website at https://www.panamericansilver.com/investors/reports-and-filings.

All shareholders may call Computershare at 1-866-964-0492 (toll-free) in order to obtain additional information relating to Notice-and-Access Provisions.

How to Obtain Paper Copies of the Information Circular

Any shareholder may request a paper copy of the Circular be mailed to them at no cost by contacting the Company at 625 Howe Street, Suite 1440, Vancouver, British Columbia V6C 2T6; by telephone: 604-684-1175; by telephone toll-free: 1-800-677-1845 or by fax 604-684-0147.

To allow adequate time for a shareholder to receive and review a paper copy of the Circular and then to submit their vote by 3:00 p.m. (Vancouver time) on Monday, May 10, 2021, a shareholder requesting a paper copy of the Circular as described above, should ensure such request is received by the Company no later than 5 p.m. (Vancouver time) on Wednesday, April 28, 2021. Under Notice-and-Access Provisions, Proxy Materials must be available for viewing for up to 1 year from the date of posting and a paper copy of the materials can be requested at any time during this period. To obtain a paper copy of the Circular after the Meeting date, please contact the Company.

The Company will not use a procedure known as ‘stratification’ in relation to its use of Notice-and-Access Provisions. Stratification occurs when a reporting issuer while using the Notice-and-Access Provisions also provides a paper copy of the Circular to some of its shareholders with the notice package. In relation to the Meeting, all shareholders will receive the required documentation under Notice-and-Access Provisions, and will not include a paper copy of the Circular.

BY ORDER OF THE BOARD OF DIRECTORS

(signed) Michael Steinmann

Michael Steinmann,

President, CEO and Director

Vancouver, British Columbia

March 22, 2021

| | |

NOTICE OF MEETING | Page ii |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

About this Information Circular

References in this management information circular (the “Circular”) to “Pan American”, the “Company”, “we”, “us” and “our” are references to Pan American Silver Corp. and its subsidiaries unless otherwise specified or the context otherwise requires.

This Circular has been prepared in connection with the 2021 annual general and special meeting of shareholders to be held at 3:00 p.m. (Vancouver time) on Wednesday, May 12, 2021 (the “Meeting”). If you owned Pan American common shares (“Shares”) as of the close of business on March 19, 2021 (the “Record Date”), you have the right to attend the Meeting and vote on the various items of business to be addressed at the Meeting in person or by proxy. You retain these rights if the Meeting is adjourned or postponed.

Due to ongoing governmental restrictions and guidelines relating to the COVID-19 pandemic, however, shareholders and proxyholders should not attend the Meeting in person and all shareholders are urged to vote in advance by proxy as discussed in more detail in this Circular. While we have made arrangements to accept votes cast in person if necessary, access to the Meeting will likely not be permitted.

| | | | | | | | |

Please refer to page 7 of this Circular for important information about your ability to participate in the Meeting despite restrictions on in-person attendance due to COVID-19. Both the Board of Directors (the “Board”) and management of Pan American encourage you to vote. Our management will be soliciting your vote for this Meeting and any meeting that is reconvened if it is postponed or adjourned. Management’s solicitation of proxies will be conducted by mail and may be supplemented by telephone or other personal contact to be made without special compensation by our directors, officers and employees or by our transfer agent. We will bear all costs of solicitation. Unless otherwise indicated, all currency amounts stated in this Circular are stated in the lawful currency of the United States. |

| |

In this Circular, we, us, our, Pan American, and the Company mean Pan American Silver Corp. You, your, and shareholder mean holders of Shares of Pan American as of the Record Date. Your vote is important. This Circular describes what the Meeting will cover and how to vote. Please read it carefully and vote, either by completing the proxy or voting instructions or by attending the Meeting in person. |

|

This Circular is dated March 22, 2021. Unless otherwise stated, information in this Circular is as of March 19, 2021.

Receiving Documents

As a shareholder, you can decide if you want to receive paper copies of our interim and annual financial statements and management’s discussion and analysis (“MD&A”). To receive paper copies of these materials, please complete the enclosed card to send us your instructions, complete the request contained on the form of proxy provided in connection with the Meeting or register online at www.computershare.com/mailinglist.

If you have any questions about the procedures to be followed to qualify your vote at the Meeting or about obtaining and depositing the required form of proxy, you should contact Computershare Investor Services Inc. (“Computershare”) by telephone (toll free) at

1-800-564-6253 or 514-982-7555 (international direct dial).

Additional Information

You can find financial information relating to Pan American in our comparative financial statements and MD&A for our most recently completed financial year. See our MD&A, financial statements and our annual information form (and United States Securities Exchange Commission filing in respect of the Form 40-F) for additional information about us. These documents are available on:

• our website (www.panamericansilver.com);

• SEDAR (www.sedar.com); and

• EDGAR (www.sec.gov/edgar.shtml).

| | |

NOTICE OF MEETING | Page iii |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

| | | | | |

| You can also request copies of these documents or this Circular, free of charge, by contacting our Corporate Secretary: |

Corporate Secretary Pan American Silver Corp. 1440 – 625 Howe Street Vancouver, British Columbia V6C 2T6 | legal@panamericansilver.com 1-800-677-1845 (North America toll-free) 604-684-0147 (fax) |

Our Board has approved the contents of this Circular and have authorized us to send it to you, each of our directors, and our auditor.

BY ORDER OF THE BOARD OF DIRECTORS

(signed) Michael Steinmann

Michael Steinmann,

President, CEO and Director

Vancouver, British Columbia

March 22, 2021

| | |

NOTICE OF MEETING | Page iv |

(This page intentionally left blank)

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

About the Meeting

| | | | | | | | | | | | | | |

| What’s Inside | |

| | | | |

| Items of Business ................................................................... | | |

| Notice and Access ................................................................. | | |

| Voting ................................................................................... | | |

| Director Nominees ................................................................ | | |

| About the Auditor ................................................................. | | |

| Advisory ‘Say on Pay’ Resolution ........................................... | | |

Your vote is important.

Please read page 4 to find out how to make sure your vote is counted.

We value shareholder participation despite restrictions

on the ability to attend in person.

Please read page 7 to find out how you can still participate in the Meeting.

| | |

ABOUT THE MEETING | Page 1 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Items of Business

At the Meeting we will cover the following items of business:

1. Receiving Our Financial Statements and the Auditor’s Report Thereon

Our consolidated financial statements for the year ended December 31, 2020, and the auditor’s report thereon, are included in our 2020 annual report, which is mailed to shareholders and is available on our website (www.panamericansilver.com) and on SEDAR (www.sedar.com).

2. Electing Directors (see page 8) You will vote to elect eight directors to the Board. The nominees for election to the Board are:

| | | | | |

| Michael Carroll | Neil de Gelder |

| Charles Jeannes | Jennifer Maki |

| Walter Segsworth | Kathleen Sendall |

| Michael Steinmann | Gillian Winckler |

Directors are elected to serve for a one-year term, which will expire at the end of our 2022 annual general and special meeting of shareholders.

3. Appointing our Independent Auditor and Setting the Auditor’s Pay (see page 13) You will vote on appointing our auditor and authorizing the Board to set the auditor’s pay for the ensuing year. Our Board, on the recommendation of our Audit Committee, has recommended that Deloitte LLP be reappointed as our independent auditor to serve until the end of our 2022 annual meeting of shareholders. You will also vote on authorizing the Board to set the auditor’s pay for the ensuing year.

| | | | | |

4. Advisory ‘Say on Pay’ Vote on Executive Compensation (see page 14) You will have an advisory and non-binding vote on our approach to executive compensation as disclosed in this Circular, which will provide the Board and the Human Resources and Compensation Committee with important feedback. 5. Other Business If other items of business are properly brought before the Meeting, you (or your proxyholder, if you are voting by proxy) can vote as you (or your proxyholder) see fit. As of the date of this Circular, we are not aware of any other items of business to be considered at the Meeting. | Questions about voting? Contact: Computershare Investor Services Inc. Attention: Stock Transfer Services 100 University Avenue, 8th Floor Toronto, Ontario M5J 2Y1 Tel: 1-800-564-6253 (toll free) |

Our Board unanimously recommends that shareholders vote FOR all nominees and resolutions at the Meeting.

Quorum and Approval

A quorum of shareholders is required to transact business at the Meeting. According to our articles of incorporation, a quorum for the transaction of business at a meeting is two individuals who are shareholders, proxyholders representing shareholders or duly authorized representatives of corporate shareholders personally present and representing Shares aggregating not less than 25% of the issued Shares carrying the right to vote at that meeting.

In order for a resolution electing a director or appointing the auditor to pass at the Meeting, such resolution must receive votes cast “FOR” such resolution by the shareholders, in person or by proxy at the Meeting.

| | |

ABOUT THE MEETING | Page 2 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Notice and Access

The Company has chosen to deliver the Notice of Meeting of its shareholders, this Circular and form of proxy forming the proxy-related materials (the “Proxy Materials”) using Notice-and-Access provisions, which govern the delivery of proxy-related materials to shareholders utilizing the internet. Notice-and-Access provisions are found in section 9.1.1 of National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”), for delivery to registered shareholders, and in section 2.7.1 of National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), for delivery to beneficial shareholders (together, “Notice-and-Access Provisions”).

Notice-and-Access Provisions allow the Company to choose to deliver Proxy Materials to shareholders by posting them on a non-SEDAR website (usually the reporting issuer’s website or the website of their transfer agent), provided that the conditions of NI 51-102 and NI 54-101 are met, rather than by printing and mailing the Proxy Materials. Notice-and-Access Provisions can be used to deliver materials for both general and special meetings. Shareholders are entitled to request a paper copy of the Proxy Materials, and more particularly, the Circular, be mailed to them at the Company’s expense.

Use of Notice-and-Access Provisions reduces paper waste and the Company’s printing and mailing costs. Under Notice-and-Access Provisions the Company must send a notice and form of proxy (the “notice package”) to each shareholder, including registered and beneficial shareholders, indicating that the Proxy Materials have been posted and explaining how a shareholder can access them or obtain a paper copy of the Proxy Materials, including the Circular, from the Company. This Circular has been posted in full, together with the Notice of Annual General Meeting, the form of proxy, and the form of voting instruction form (“VIF”), on the Company’s website at https://www.panamericansilver.com/investors/reports-and-filings and under the Company’s SEDAR profile at www.sedar.com.

The Circular contains details of matters to be considered at the Meeting. Please review the Circular before voting.

How to Obtain Paper Copies of the Information Circular

Any shareholder may request a paper copy of the Circular be mailed to them at no cost by contacting the Company at 625 Howe Street, Suite 1440, Vancouver, British Columbia V6C 2T6; by telephone: 604-684-1175; by telephone toll-free: 1-800-677-1845 or by fax 604-684-0147.

To allow adequate time for a shareholder to receive and review a paper copy of the Circular and then to submit their vote by 3:00 p.m. (Vancouver time) on Monday, May 10, 2021, a shareholder requesting a paper copy of the Circular as described above, should ensure such request is received by the Company no later than 5:00 p.m. (Vancouver time) on Wednesday, April 28, 2021. Under Notice and-Access Provisions, Proxy Materials must be available for viewing for up to one year from the date of posting and a paper copy of the Proxy Materials can be requested at any time during this period. To obtain a paper copy of the Circular after the Meeting date, please contact the Company.

Pursuant to Notice-and-Access Provisions, the Company has set the Record Date for the Meeting to be at least 40 days prior to the Meeting to ensure there is sufficient time for the Proxy Materials to be posted on the applicable website and for them to be delivered to shareholders. The requirements of the notice of meeting (the “Notice of Meeting”) included with the Company’s notice package, and in which the Company must (i) provide basic information about the Meeting and the matters to be voted on, (ii) explain how a shareholder can obtain a paper copy of the Circular and any related financial statements and related MD&A, and (iii) explain the Notice-and-Access Provisions process have been built into the Notice of Meeting. The Notice of Meeting has been delivered to shareholders by the Company, along with the applicable voting document: a form of proxy in the case of registered shareholders, or a VIF in the case of non-registered (beneficial) holders.

The Company will not rely upon the use of “stratification”. Stratification occurs when a reporting issuer using Notice-and-Access Provisions provides a paper copy of its information circular to some shareholders together with the notice to be provided to shareholders as described above. In relation to the Meeting, all shareholders will have received the required documentation under Notice-and-Access Provisions and all documents required to vote in respect of all matters to be voted on at the Meeting. Shareholders will not receive a paper copy of the Circular from the Company, or from any intermediary, unless such shareholder specifically requests one.

All shareholders may call our transfer agent, Computershare at 1-866-964-0492 (toll-free) in order to obtain additional information relating to Notice-and-Access Provisions or to obtain a paper copy of the Circular, up to and including the date of the Meeting, including any adjournment of the Meeting.

| | |

ABOUT THE MEETING | Page 3 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Voting

Who Can Vote

You are entitled to receive notice of and vote at the Meeting to be held on May 12, 2021, if you held Shares as of the close of business on March 19, 2021, the Record Date for the Meeting.

Each Share you own entitles you to one vote on each item of business to be considered at the Meeting.

How to Vote

You can vote by proxy or VIF or you can attend the Meeting and vote your Shares in person. Please note that due to COVID-19 restrictions, while we have made arrangements to accept votes cast in person, access to the Meeting will likely not be permitted.

Voting by Proxy or VIF

| | | | | | | | |

|

| Voting by proxy or by VIF is the easiest way to vote. It means you are giving someone else (called your proxyholder) the authority to attend the Meeting and vote your Shares for you. There are different ways to submit your voting instructions, depending on whether you are a registered or non-registered shareholder. Registered Shareholders You are a registered shareholder if you hold a share certificate in your name or appear as the registered shareholder in the records of our transfer agent. Michael Steinmann, our President and Chief Executive Officer, or failing him, A. Robert Doyle, our Chief Financial Officer, have agreed to act as the Pan American management proxyholders in connection with the Meeting. You can appoint a person or an entity other than the Pan American management proxyholders to attend the Meeting and vote on your behalf. If you want to appoint someone else as your proxyholder, strike out the names on the enclosed proxy form and print the name of the person you want to appoint as your proxyholder in the space provided. This person does not need to be a Pan American shareholder. By completing and returning a proxy, you are authorizing the person named in the proxy to vote or withhold from voting your Shares represented thereby in accordance with your instructions on any ballot that may be called for. If you specify a choice with respect to any matter to be acted upon, your Shares will be voted accordingly. If there are other items of business that properly come before the Meeting (or any adjournment or postponement thereof), or amendments or variations to the items of business, the person named in the proxy has the discretion to vote your Shares as such person sees fit. |

The voting process is different depending on whether you are a registered or non-registered shareholder. You are a registered shareholder if your name appears on your share certificate or appears as the registered shareholder with our transfer agent. You are a non-registered (beneficial) shareholder if your Shares are registered in the name of a bank, trust company, securities broker, trustee or other financial institution or nominee on your behalf (your nominee). Please be sure to follow the appropriate voting procedure. |

|

|

|

It is important you provide voting instructions with your proxy. If you appoint the Pan American management proxyholders, but do not tell them how to vote, your Shares will be voted:

•FOR the election of the nominated directors listed on the proxy form and in this Circular;

•FOR reappointing Deloitte LLP as the independent auditor and authorizing the Board to set the auditor’s pay; and

•FOR the advisory “say on pay” resolution approving our approach to executive compensation.

This is consistent with the voting recommendations of the Board. If there are other items of business that properly come before the Meeting, or amendments or variations to the items of business, the Pan American management proxyholders will vote according to management’s recommendation.

If you appoint someone other than the Pan American management proxyholders to be your proxyholder, that person must attend and vote at the Meeting for your vote to be counted.

A proxy will not be valid unless it is dated and signed by the registered shareholder or by the registered shareholders’ attorney with proof that they are authorized to sign, and completed according to the instructions therein. If you represent a registered shareholder who is a corporation or association, your proxy should have the seal of the corporation or association, where applicable, and must be executed by an officer or an attorney who has written authorization. If you execute a proxy as an attorney

| | |

ABOUT THE MEETING | Page 4 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

for an individual registered shareholder, or as an officer or attorney of a registered shareholder who is a corporation or association, you must include the original, or a notarized copy of the written authorization for the officer or attorney, with your proxy form.

If you are voting by proxy, you may vote by phone, by mail or on the internet.

Computershare must receive your proxy by 3:00 p.m. (Vancouver time) on Monday, May 10, 2021, or at least 48 hours (excluding Saturdays, Sundays and statutory holidays in the province of British Columbia) prior to the time set for the Meeting or any adjournment or postponement of the Meeting. The Chair of the Meeting has the discretion to accept or reject any late proxies, and can waive or extend the deadline for receiving proxy voting instructions without notice.

Voting by Telephone:

You may vote your Shares by telephone by dialing the following toll-free number: 1-866-732-8683. If you vote by telephone, you will need your control number, which appears at the bottom of the first page of your proxy form. If you vote by telephone, you cannot appoint anyone other than the designated management proxyholders named on your proxy form as your proxyholder.

Voting by Mail:

Complete your proxy form, sign and date it, and send it to Computershare in the envelope provided.

If you did not receive a return envelope, please send the completed form to:

Computershare Investor Services Inc. Attention: Proxy Department

100 University Avenue, 8th Floor

Toronto, Ontario, Canada M5J 2Y1

Voting on the Internet:

Go to www.investorvote.com and follow the instructions on screen. If you vote using the internet, you will need your control number, which appears at the bottom of the first page of your proxy form.

Non-Registered or Beneficial Shareholders

You are a non-registered (or beneficial) shareholder if your Shares are registered in the name of:

•your bank, trust company, securities dealer or broker, trustee, administrator, custodian or other intermediary or nominee who holds your Shares in a nominee account or in the name of such nominee, or

•a clearing agency, like CDS.

OBOs are objecting beneficial shareholders who do not want us to know their identity.

NOBOs are non-objecting beneficial shareholders that do not object to us knowing their identity.

Under NI 54-101, we can deliver proxy-related materials directly to NOBOs. Our agent sends NOBOs the Meeting materials and a VIF, along with instructions for completing the form and returning it to them. Our agent is responsible for following the voting instructions it receives, tabulating the results and then providing appropriate instructions to our transfer agent, Computershare.

If you are an OBO, we must send the Meeting materials to your intermediary so they or their service company can forward them to you, unless you have waived the right to receive certain proxy-related materials. The Company does not intend to pay for intermediaries to forward proxy-related materials to OBOs and OBOs will not receive the materials unless the OBOs’ intermediary assumes the cost of delivery. The package should include a VIF for you to complete with your voting instructions.

In order to vote using the VIF:

•NOBOs: Fill in the VIF you received with this package and carefully follow the instructions provided. You can send your voting instructions by phone or by mail or through the internet.

•OBOs: Sign and date the VIF your intermediary sends to you and follow the instructions for returning the form. Your intermediary is responsible for properly executing your voting instructions.

If you are a non-registered shareholder and would like additional information or assistance in completing your VIF or in obtaining the required information to submit your vote on the matters to be dealt with at the Meeting, you may contact Computershare Investor Services Inc. by telephone at 1-800-564-6253 (toll free) or 514-982-7555 (international direct dial).

| | |

ABOUT THE MEETING | Page 5 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Attending the Meeting and Voting in Person

Due to the continuing COVID-19 pandemic and Provincial and Federal guidance and restrictions on public gatherings, the meeting will be held in a ‘hybrid’ format. There will be strict limitations on the number of persons permitted entry to the physical Meeting location, but the Meeting will be made accessible through a live conference call and webcast. This means that shareholders and proxyholders will likely not be permitted entry, and guests will not be permitted in any case. Accordingly, shareholders and proxyholders should not attend the Meeting in person.

We urge all shareholders to vote by proxy in advance of the Meeting date and to access the Meeting via the live conference call and webcast detailed below under the heading “Participating in the Meeting” on page 7 of this Circular.

The following will apply to voting in person:

Registered Shareholders

You do not need to complete the enclosed proxy form if you want to attend the Meeting and vote in person. Simply register with a representative from Computershare when you arrive at the Meeting.

Non-Registered or Beneficial Shareholders

Non-registered (or beneficial) shareholders cannot use the VIF to vote directly at the Meeting. If a non-registered shareholder wishes to attend and vote at the Meeting in person, the non-registered shareholder should follow the instructions on the VIF and insert his or her name (or the name of such other individual as the non-registered shareholder wishes to attend and vote on his or her behalf) in the blank space provided for that purpose on the VIF and return the completed VIF in accordance with the instructions thereon in advance of the Meeting. When you (or the person named in the VIF) arrive at the Meeting, make sure you (or the person named in the VIF) register with a representative from Computershare so your voting instructions can be taken at the Meeting.

Send Your Voting Instructions Immediately

If you are a non-registered shareholder, your vote will only be counted if Computershare receives your vote or, if you intend to attend the Meeting in person, your completed VIF, as applicable, before 3:00 p.m. (Vancouver time) on Monday, May 10, 2021.

Make sure your VIF or proxy form, as applicable, is properly completed and that you allow enough time for your vote to reach Computershare if you are sending it by mail.

If the Meeting is postponed or adjourned, Computershare must receive your voting instructions at least 48 hours before the Meeting is reconvened.

Changing Your Vote

Registered Shareholders

You can revoke your proxy by sending a new completed proxy form with a later date, or a written notice signed by you or by your attorney if such attorney has your written authorization. You can also revoke your proxy in any other manner permitted by law.

If you represent a registered shareholder who is a corporation or association, your written notice must have the seal of the corporation or association, if applicable, and must be executed by an officer or an attorney who has their written authorization. The written authorization must accompany the revocation notice.

We must receive the written notice any time up to and including the last business day before the day of the Meeting, or the day the Meeting is reconvened if it was postponed or adjourned.

Send the signed written notice to:

Pan American Silver Corp.

Suite 1440, 625 Howe Street

Vancouver, British Columbia, Canada, V6C 2T6

Attention: Corporate Secretary

If you attend the Meeting in person, you can give your written notice to the Chair of the Meeting on the day of the Meeting. If the Meeting has already started, your new voting instructions can only be executed for items that have not yet been voted on.

If you have sent in your completed proxy form and subsequently decided that you want to attend the Meeting and vote in person, you need to revoke the proxy form before you vote at the Meeting.

| | |

ABOUT THE MEETING | Page 6 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

As noted above, while you will be able to register your voting instructions at the Meeting, shareholders and proxyholders will likely not be permitted entry to the Meeting.

Non-Registered Shareholders

Only registered shareholders have the right to revoke a proxy.

Non-registered shareholders can change their vote:

•NOBOs: contact our agent on the VIF immediately so they have enough time before the Meeting to change your vote.

•OBOs: contact your intermediary immediately so they have enough time before the Meeting to change your vote and, if necessary, revoke the proxy.

Processing the Votes

Our transfer agent, Computershare, or its authorized agents count and tabulate the votes on our behalf. We will file the voting results of the Meeting on SEDAR (www.sedar.com) and EDGAR (www.sec.gov/edgar.shtml) after the Meeting.

Participating in the Meeting

We value our shareholders and believe that the ability to participate in the Meeting in a meaningful way remains important despite the decision to hold this year’s Meeting in a hybrid format due to the ongoing COVID-19 restrictions. We have developed the following procedures to enable the participation of shareholders and to allow for engagement with our Board and management.

The Company will accept written questions pertinent to the business of the Meeting from shareholders in advance of the Meeting, which may be submitted via email to the Company starting on April 19, 2021. Questions must be received no later than 5:00 p.m. (Vancouver time) on May 5, 2021, in order to allow time for the Company to respond in advance of the May 10, 2021, proxy cut-off date. Questions received after that time will not be posted, nor responded to, in advance of the Meeting. Questions may be submitted utilizing the following email address: AGM2021@panamericansilver.com

We will review the questions received and post appropriate questions, or summaries if multiple, similar questions are received, along with our responses on our website at www.panamericansilver.com/investors/agm2021 once per week on or before the following dates: April 23, April 30, and May 7, 2021.

In addition, the Company will accept written questions during the Meeting via the webcast through our audio webcast provider, Chorus Call, to be addressed after the Meeting. Instructions for submitting questions utilizing the audio webcast will be available on the webcast site shortly before and during the Meeting, and Chorus Call will provide details for technical assistance should help be required. The Company will endeavour to respond to written questions that are received during the Meeting by providing written responses on our website at www.panamericansilver.com/investors/agm2021 on or before May 17, 2021. Time permitting, certain written questions that are received relating to matters that do not pertain to the business of the Meeting may be addressed on the live conference call and audio webcast by management following the conclusion of the business of the Meeting.

With respect to questions received in advance of the Meeting and during the Meeting, only questions that pertain to the business of the Meeting will be posted and responses provided on the website. Questions that are not related to the Meeting, that are inflammatory, abusive, discriminatory, or are otherwise inappropriate in nature, will not be posted. We may summarize or paraphrase questions where we think this would be useful and efficient to other shareholders.

Shareholders may contact us directly at 1-604-684-1175 during business hours if they experience technical difficulties submitting questions via email or locating the questions and answers posted on our website. Technical support for the live conference call and audio webcast will be available immediately prior to and during the conference call and audio webcast by the provider, Chorus Call.

Shareholders are reminded that they can contact the Investor Relations department of the Company throughout the year with questions via email at ir@panamericansilver.com or by calling 1-604-806-3191.

Live audio conference call and audio webcast details:

| | | | | | | | |

| Dial-in numbers: | 1-800-319-4610 (toll-free in Canada and the U.S.) |

| +1-604-638-5340 (international participants) |

| Webcast: | Via our website at | https://www.panamericansilver.com/investors/events-and-presentations/ |

| Or directly at | http://services.choruscall.ca/links/panamericansilveragm20210512.html |

| | |

ABOUT THE MEETING | Page 7 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Director Nominees

Seven directors of the Company will be standing for re-election at the Meeting, and we have nominated one additional candidate for election to the Board. These directors have been nominated based on the diversity of skills and experience that the Board believes is necessary to effectively fulfill its duties and responsibilities.

Our Policy on Majority Voting

We have adopted a majority voting policy. Under our majority voting policy, any nominee proposed for election as a director must submit his or her resignation if they receive more WITHHELD votes than FOR votes. The policy only applies to uncontested elections of directors – where the number of nominees is the same as the number of directors to be elected.

Within 90 days of the relevant shareholders’ meeting, the Board will determine whether to accept the resignation and issue a press release either announcing the resignation of the director or explaining its reasons for not accepting the resignation. The Board will accept the resignation unless there are exceptional circumstances. The resignation will be effective when accepted by the Board. A director who tenders a resignation under this policy will not participate in any Board or committee meeting at which the resignation is considered.

Nominees for Election as Directors

The term of office of each of the present directors expires at the close of the Meeting. Persons named below will be presented for election at the Meeting as management’s nominees. Unless otherwise instructed, the accompanying form of proxy will be voted FOR management’s nominees.

We do not contemplate that any of these nominees will be unable to serve as a director. If that should occur before the Meeting, the persons named in the proxy reserve the right to vote for another nominee, unless you specify that Shares are to be withheld from voting on the election of directors.

Each director elected at the Meeting will hold office until the close of our next annual meeting of shareholders or until his or her successor is elected or appointed, unless his or her office is earlier vacated in accordance with our articles or with the provisions of the Business Corporations Act (British Columbia).

| | |

ABOUT THE MEETING | Page 8 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

| | | | | | | | | | | | | | | | | | | | | |

| MICHAEL CARROLL, 68 Walnut Creek, CA USA Director since January 2,, 2011

Director (independent)

Principal Occupation: Corporate Director |

Mr. Carroll is a Corporate Director. He is a Certified Public Accountant with over 30 years of financial management expertise, primarily with publicly traded mining companies including Homestake Mining Company, Bond International Gold, and Cumberland Resources Ltd. His professional expertise includes equity and debt financing, mergers and acquisitions, strategic planning, IFRS, GAAP, international tax planning and regulatory reporting. Mr. Carroll also served as Chair of the Audit Committee and designated financial expert of Centenario Copper Corporation between 2006 until its acquisition in 2009.

|

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD(1) |

| Shares | 40,613 | | | $ | 1,701,685 |

| Meets Share ownership requirement | TOTAL CAD | $ | 1,701,685 |

|

| VOTING RESULTS | | |

| 2020 | FOR: 97.38% | WITHHELD: 2.62% |

| 2019 | FOR: 99.60% | WITHHELD: 0.40% |

| BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020 |

| Board of Directors | 6 of 6 |

| Committees: | |

| Audit (Chair) | 5 of 5 |

| Finance (Chair) | 2 of 2 |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

| None |

| AREAS OF EXPERTISE |

| Accounting and Tax | |

| Finance | |

| Corporate Social Responsibility | |

| Human Resources and Compensation | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90). |

| | | | | | | | | | | | | | | | | | | | |

| NEIL DE GELDER, QC, 68 Vancouver, B.C. Canada Director since July 3, 2012

Director (independent) Principal Occupation: Vice Chair, Stern Partners |

Mr. de Gelder joined Pan American's Board of Directors in 2012. He Chairs the Nominating and Governance Committee, and is a member of the Audit Committee. Mr.de Gelder is Vice-Chair of Stern Partners, a private diversified investment firm based in Vancouver. Prior to joining Stern Partners in 2005, he was a senior partner of a major Canadian law firm specializing in mergers and acquisitions, finance, and corporate law. Mr. de Gelder is a past Executive Director of the British Columbia Securities Commission, and has served on a wide variety of corporate, crown, charitable and community boards over the years.

|

| SECURITIES HELD | | VALUE AS AT MARCH 19, 2021 IN CAD(1)(2) |

| Shares | 28,795 | | $ | 1,206,511 |

| Options | 12,245 | | $ | 304,656 |

| Meets Share ownership requirement | TOTAL CAD | $ | 1,511,167 |

| | | | |

| VOTING RESULTS | | | |

| 2020 | FOR: 85.18% | WITHHELD: 14.82% |

| 2019 | FOR: 95.46% | WITHHELD: 4.54% |

| BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020 |

| Board of Directors | 6 of 6 |

| Committees: |

| Audit | 5 of 5 |

| Nominating and Governance (Chair) | 2 of 2 |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

| None |

|

| AREAS OF EXPERTISE |

| Regulatory | |

| Finance | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90) (2)Option value is calculated by multiplying the difference between the exercise price and the closing price of our Shares on the TSX as set out in note (1) above by the number of Options. |

| | |

ABOUT THE MEETING | Page 9 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

| | | | | | | | | | | | | | | | | | | | | |

| CHARLES JEANNES, 62 Reno, NV USA Director since February 22, 2019

Director (independent)

Principal Occupation: Corporate Director |

Mr. Chuck Jeannes is a mining industry veteran with over 30 years of experience. From December 2008 to April 2016, he was President and CEO of Goldcorp Inc., leading the company’s development into one of the world’s largest and most successful gold mining companies with operations and development projects throughout the Americas. Prior to his appointment as President and CEO, he held the role of Executive VP, Corporate Development. Chuck retired from Goldcorp in April 2016 and relocated to Reno, Nevada. Prior to Goldcorp, Chuck held senior positions with Glamis Gold Ltd. and Placer Dome Inc., Mr. Jeannes was a director of Tahoe Resources Inc. until its acquisition by Pan American in February 2019. Mr. Jeannes holds a B.A. degree from the University of Nevada (1980) and graduated from the University of Arizona College of Law with honors in 1983. He practiced law for 11 years with Woodburn and Wedge in Reno, Nevada, where he focused on mining and natural resources. Mr. Jeannes has broad experience in capital markets, mergers and acquisitions, public and private financing, and international operations. Mr. Jeannes has received numerous awards including British Columbia CEO of the Year for 2013, Canada’s Most Admired CEO for 2015, 2016 Alumnus of the Year for the University of Nevada and 2015 Alumnus of the Year for the University of Arizona College of Law. Mr. Jeannes is involved in various philanthropic activities and currently serves as a Trustee of the University of Nevada, Reno Foundation. |

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD(1)(2) |

| Shares | 14,643 | | | $ | 613,542 |

| Meets Share ownership requirement | TOTAL CAD | $ | 613,542 |

|

| VOTING RESULTS | | |

| 2020 | FOR: 97.61% | WITHHELD: 2.39% |

| 2019 | FOR: 98.60% | WITHHELD: 1.40% |

| BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020 |

| Board of Directors | 6 of 6 |

| Committees: | |

| Health, Safety, Environment & Communities | 4 of 4 |

| Human Resources and Compensation | 5 of 5 |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

Orla Mining Limited Wheaton Precious Metals Corp. |

| AREAS OF EXPERTISE |

| Regulatory | |

| Finance | |

| Corporate Social Responsibility | |

| Human Resources and Compensation | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90). (2)Mr. Jeannes holds 43,375 contingent value rights (“CVRs”) that formed part of the consideration to Tahoe Resources Inc. (“Tahoe”) shareholders pursuant to the plan of arrangement which completed on February 22, 2019, in which Pan American acquired all of the issued and outstanding shares of Tahoe. Each CVR entities holders to 0.0497 Shares on the satisfaction of certain payment conditions and have a term of 10 years from the closing date. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| JENNIFER MAKI, 50 North York, ON Canada Director nominee

Independent Principal Occupation: Corporate Director |

Ms. Maki, CA/CPA, is an accomplished mining executive and finance expert with strong leadership experience in public mining companies operating in complex international jurisdictions. She is the former Executive Director – Vale Base Metals and CEO of Vale Canada, and previously served as EVP & CFO of Vale Base Metals. Ms. Maki began her professional career in the mining group with PricewaterhouseCoopers. She is presently a Director and Chair of the Audit Committee at Franco-Nevada Corporation, and is a Director and member of the Audit Committee at Baytex Energy Corp. Ms. Maki has a Bachelor of Commerce degree from Queen’s University and holds the ICD.D designation from the Institute of Corporate Directors. In 2015, she was recognized as one of Canada’s Top 100 Most Powerful Women by the Women’s Executive Network.

|

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD |

| Shares | 0 | | | $ | 0 |

Share ownership requirement – N/A(1) | TOTAL CAD | $ | 0 |

|

VOTING RESULTS(1) | |

| - | | |

| | |

BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020(1) |

| Board of Directors | - |

| Committees: | - |

|

|

|

|

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

Franco-Nevada Corporation Baytex Energy Corp. |

| AREAS OF EXPERTISE |

| Accounting and Tax | |

| Finance | |

| Corporate Social Responsibility | |

| Human Resources and Compensation | |

| Regulatory | |

Notes: (1)Ms. Maki is a new nominee to the Board and has not previously served with the Company in any capacity. If elected at the Meeting, Ms. Maki will become subject to the Director share ownership requirements. |

| | |

ABOUT THE MEETING | Page 10 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

| | | | | | | | | | | | | | | | | | | | | | | |

| WALTER SEGSWORTH, 72 West Vancouver, B.C. Canada Director since May 12, 2009

Lead Director (independent)

Principal Occupation: Corporate Director |

Mr. Segsworth is a Corporate Director with over 50 years of experience in mining in Canada and overseas. He holds a B.Sc. in Mining Engineering from Michigan Tech. Mr. Segsworth has served on the Boards of Directors of several mining companies including Westmin Resources, where he was President and CEO, and Homestake Mining Company, where he was President and COO. He was also the former Lead Director of the Board of Alterra Power Corp. Mr. Segsworth is past Chair of both the Mining Associations of BC and Canada and was named BC’s Mining Person of the year in 1996.

|

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD(1) |

| Shares | 29,485 | | $ | 1,235,422 |

| Meets Share ownership requirement | TOTAL CAD | $ | 1,235,422 |

|

| VOTING RESULTS | | |

| 2020 | FOR: 92.78% | WITHHELD: 7.22% |

| 2019 | FOR: 95.89% | WITHHELD: 4.11% |

| BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020 |

| Board of Directors | 6 of 6 |

| Committees: | |

| Health, Safety, Environment & Communities (Chair) | 4 of 4 |

| Human Resources and Compensation | 5 of 5 |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

Happy Creek Minerals Ltd. Sabina Gold & Silver Corp. |

| AREAS OF EXPERTISE |

| Technical | |

| Corporate Social Responsibility | |

| Human Resources and Compensation | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90). |

| | | | | | | | | | | | | | | | | | | | | | | | |

| KATHLEEN SENDALL, 67 Calgary AB. Canada Director since December 16, 2020 Director (independent)

Principal Occupation: Corporate Director |

Ms. Sendall joined Pan American’s Board of Directors in December 2020. She has more than 30 years of experience in the energy sector. Prior to her retirement, she led Petro Canada’s Natural Gas Business Unit and held other executive positions at the company responsible for exploration and production, marketing, engineering, technology, and product sales. She is currently a director of Enmax Corporation, an electricity utility company owned by the City of Calgary, and a member of the Member Council for Sustainable Development Technology Canada, an independent federal foundation that helps Canadian companies develop and deploy clean energy technology solutions. Previously, Ms. Sendall served as: a director of CGG, a geophysical services company; Board Chair of Emissions Reduction Alberta, which invests in clean technology solutions in Alberta to reduce greenhouse gas emissions and support economic growth; Vice Chair of Alberta Innovates – Energy and Environment Solutions, the province’s environmental innovation engine; and as the first female Board Chair of the Canadian Association of Petroleum Producers. In addition, she was formerly the President and a director of the Canadian Academy of Engineering. Ms. Sendall holds a Bachelor of Science (Mechanical Engineering) degree from Queen’s University. She received an Honorary Doctor of Laws Degree from the University of Calgary and was named a Jarislowsky Fellow at the Haskayne School of Business. Ms. Sendall is the recipient of numerous awards, including: the Order of Canada, Queen Elizabeth II Diamond Jubilee Medal, Honorary Lieutenant Colonel of the Department of National Defense, and Fellow of the Canadian Academy of Engineering. She was also named four times as one of Canada's Top 100 Most Powerful Women in the Corporate Executive category and was inducted into Canada's Most Powerful Women Hall of Fame. |

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD(1) |

| Shares | 427 | | | $ | 17,891 |

| Meets Share ownership requirement | TOTAL CAD | $ | 17,891 |

|

VOTING RESULTS(2) | |

| - | | |

| | |

BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020(2) |

| Board of Directors | - |

| Committees: | - |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

| Enmax Corporation |

| AREAS OF EXPERTISE |

| Regulatory | |

| Finance | |

| Technical | |

| Corporate Social Responsibility | |

| Human Resources and Compensation | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90). (2)Ms. Sendall was appointed to the Board on December 16, 2020, and there were no Board or committee meetings remaining in 2020. |

| | |

ABOUT THE MEETING | Page 11 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

| | | | | | | | | | | | | | | | | | | | | | | | |

| MICHAEL STEINMANN, 55 North Vancouver, B.C. Canada Director since January 1, 2016 President, Chief Executive Officer, and Director (non-independent)

Principal Occupation: President & CEO of the Company |

Mr. Steinmann has been with the Company in different roles since 2004, when he began as Vice President, Geology Mines & Projects. He was promoted to President in February 2015 and named President & CEO in January 2016. Mr. Steinmann has over 20 years of experience in the base and precious metals industry. He joined Pan American after serving as Manager of Geology and Business Development for Glencore in South America. Mr. Steinmann holds a Ph.D. in Natural Science (Geology) from the Swiss Federal Institute of Technology (ETHZ) a M.Sc. in Geology from the University of Zurich and a Degree in Corporate Finance from Escuela Superior de Administración y Negocios, Lima. Mr. Steinmann has extensive experience throughout South America in mine operations, project development and corporate M&A having participated in numerous mine construction projects from exploration and feasibility studies, through start-up and into continuous operation. He was involved in many capital market transactions including placements of equity and debt, as well as in numerous other exploration and business development initiatives.

|

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD(1) |

| Shares | 99,276 | | | $ | 4,159,664 |

| Options | 0 | | | $ | 0(2) |

| PSUs | 102,407 | | | $ | 4,326,222(3) |

| RSUs | 36,130 | | | $ | 1,524,180(3) |

| Meets Share ownership requirement | TOTAL CAD | $ | 10,010,066 |

|

| VOTING RESULTS | | |

| 2020 | FOR: 97.38% | WITHHELD: 2.62% |

| 2019 | FOR: 96.62% | WITHHELD: 3.38% |

| BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020 |

| Board of Directors | 6 of 6 |

| Committees: | |

| Finance | 2 of 2 |

| Health, Safety, Environment and Communities | 4 of 4 |

| | | | | | | | |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

| Lumina Gold Corp. (formerly Odin Mining & Exploration Ltd.) |

|

| AREAS OF EXPERTISE |

| Regulatory | |

| Finance | |

| Technical | |

| Corporate Social Responsibility | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90). (2)Option value is calculated by multiplying the difference between the exercise price and the closing price of our Shares on the TSX as set out in note (1) above by the number of Options. (3)Assuming all RSUs and PSUs had vested as of March 19, 2021 and payment of all related dividends is included at an exchange rate of 1.2506 as at March 19, 2021. |

| | | | | | | | | | | | | | | | | | | | | | | |

| GILLIAN WINCKLER, 58 Vancouver, B.C. Canada Director since May 11, 2016 Director (independent) Principal Occupation: Corporate Director |

Ms. Winckler is a former mining and business executive with over 25 years of diversified experience in the metals and mining industry and the financial sector. Ms. Winckler spent 16 years with BHP Billiton in London, England and Vancouver, Canada where she was involved with corporate and divisional strategy, mergers and acquisitions, divestments, exploration as well as project evaluation and development. Upon leaving the company she joined Coalspur Limited, a thermal coal development company listed in Canada and Australia as the CEO and President. Ms. Winckler held this position, as well as CFO for a brief period, for three years until the company was acquired in June 2015. Ms Winckler currently serves as a director and member of the audit committee of two other publicly listed companies. Prior to the mining industry, Ms. Winckler spent five years as a corporate financier in South Africa and London and five years in the auditing profession. Ms. Winckler is a Chartered Accountant (South Africa), with a BSc and BComm (Hons) obtained in South Africa. Her professional expertise includes mergers and acquisitions, strategic planning, IFRS, GAAP, risk management, regulatory reporting and environment, social and governance (“ESG”) matters. Ms. Winckler has attained the ESG Competent Boards Certificate and Designation 2021 (GCB.D). |

| SECURITIES HELD | VALUE AS AT MARCH 19, 2021 IN CAD(1) |

| Shares | 17,527 | | $ | 734,381 |

| Meets Share ownership requirement | TOTAL CAD | $ | 734,381 |

| |

| VOTING RESULTS | |

| 2020 | FOR: 99.16% | WITHHELD: 0.84% |

| 2019 | FOR: 96.76% | WITHHELD: 3.24% |

| BOARD AND COMMITTEE MEMBERSHIP AND ATTENDANCE – 2020 |

| Board of Directors | 6 of 6 |

| Committees: | |

| Audit | 5 of 5 |

| Human Resources and Compensation (Chair) | | 5 of 5 |

| Nominating and Governance | 2 of 2 |

| OTHER DIRECTORSHIPS WITH REPORTING ISSUERS |

FLSmidth & Co. A/S West Fraser Timber Co. Ltd. |

| AREAS OF EXPERTISE |

| Regulatory | |

| Finance | |

| Accounting and Tax | |

| Corporate Social Responsibility | |

| Human Resources and Compensation | |

Notes: (1)Calculated using the closing price of our Shares on the TSX on March 19, 2021 (CAD$41.90). |

| | |

ABOUT THE MEETING | Page 12 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

The municipality and province or state of residence, principal occupation and business or employment of each director has been furnished by the individual nominees. The number of Shares, options (“Options”), restricted share units (“RSUs”) and performance share units (“PSUs”) beneficially owned by each nominee or over which each nominee exercises control or direction set out in the above table has been obtained from publicly available insider reporting as at March 19, 2021, or has been provided by individual nominees.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

From May 2010 to April 2018, Ms. Sendall was a board member of CGG SA, a French company listed at the time on the New York Stock Exchange and Euronext Paris. On June 15, 2017, following the execution of legally binding agreements in support of the terms of the agreement-in-principle with its key financial creditors, CGG SA began legal processes to implement a comprehensive pre-arranged restructuring, with the opening of a Safeguard proceeding in France and Chapter 11 and Chapter 15 filings in the U.S. The restructuring plan was approved by both the Paris Commercial Court and the New York Bankruptcy Court. The implementation of the financial restructuring plan was finalized in February 2018.

Other than as noted above, in the last 10 years, none of the proposed directors is, or has been a director or executive officer of any company (including ours) that has (while, or within a year of, acting in that capacity), or in their personal capacity:

•become bankrupt,

•made a proposal under any legislation relating to bankruptcy or insolvency,

•been subject to or instituted any proceedings, arrangement of compromise with creditors, or

•had a receiver, receiver manager or trustee appointed to hold its assets, or the assets of the nominated director.

None of the proposed directors is, or has been within the last 10 years, a director, chief executive officer or chief financial officer of any company that was subject to:

•a cease trade order,

•an order similar to a cease trade order, or

•an order that denied the relevant company access to any exemption under securities legislation,

that was issued while the proposed director was acting in such capacity, or that was issued after the proposed director was no longer acting in such capacity, and which resulted from an event that occurred while that person was acting in that capacity.

As at the date of this Circular and within the past 10 years, none of the proposed directors has been subject to any penalties or sanctions imposed by a court or regulatory body, or have entered into a settlement agreement with any securities regulatory authority or other regulatory authority, or been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

About the Auditor

| | | | | | | | |

Deloitte LLP has been our auditor since October 26, 1993. The auditor conducts the annual audit of our financial statements, provides audit-related, tax and other services, and reports to the Audit Committee of the Board. Unless otherwise instructed, the management proxyholders appointed pursuant to the accompanying form of proxy will vote FOR the resolution appointing Deloitte LLP as our auditor to hold office until our 2022 annual meeting of shareholders and FOR authorizing the Board to fix the auditor’s pay. |

| At last year’s annual general and special meeting, 95.26% of the votes were cast in favour to appoint Deloitte LLP as Pan American’s auditor and 4.74% of votes were cast withheld. |

| | |

ABOUT THE MEETING | Page 13 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Auditor’s Fees

The following table shows the fees earned by Deloitte LLP for services in 2020 and 2019(1):

| | | | | | | | |

| Year ended

December 31,

2020 ($) | Year ended December 31, 2019($) |

Audit Fees(2) | 2,497,000 | 2,748,500(3) |

Audit-Related Fees(4) | 34,400 | 103,900 |

Tax-Related Fees(5) | 1,600 | 2,600 |

| Other Fees | Nil | 38,900(6) |

| Total: | 2,533,000 | 2,893,900 |

(1) The Audit Committee approved all audit and non-audit services provided to us by Deloitte LLP in 2020 and 2019.

(2) Audit Fees are comprised of audit and interim reviews.

(3) The Audit Fees in 2019 include amounts related to the audit of Tahoe for the year ended December 31, 2018, of approximately $291,100.

(4) Audit-Related Fees in both 2020 and 2019 include amounts with respect to the Company’s Canadian Public Accountability Board fees that are remitted by Deloitte on behalf of the Company. The 2019 Audit-Related Fees also included services performed in connection with the Company’s business acquisition report and other filings relating to the acquisition of Tahoe.

(5) Tax-Related Fees are comprised primarily of compliance services.

(6) Other Fees in 2019 were related to services provided in respect of the Company’s integration with Tahoe.

Advisory ‘Say on Pay’ Resolution

You will have the opportunity to vote on our approach to executive compensation at the Meeting. Since the resolution is advisory in nature, it will not be binding. However, we, together with the Human Resources and Compensation Committee (the “HRC Committee”), will consider the outcome of the vote as part of our ongoing review of executive compensation and, in the event that a significant number of shareholders oppose the resolution, consider our approach to executive compensation in the context of those concerns. For information on our approach to executive compensation, see “Executive Compensation” beginning on page 27. Unless otherwise instructed, management proxyholders appointed pursuant to the accompanying form of proxy will vote FOR this ordinary resolution. | | | | | | | | |

The full text of the advisory resolution on our approach to executive compensation is as follows: Be it resolved, on an advisory basis and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in Pan American’s Circular for the annual general and special meeting of shareholders of Pan American held on Wednesday, May 12, 2021. The complete voting results will be filed under Pan American’s profile on SEDAR (www.sedar.com). |

| At last year’s annual general and special meeting, 93.65% of the votes were cast in favour of our approach to executive compensation and 6.35% of votes were cast against. |

| | |

ABOUT THE MEETING | Page 14 |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Governance

| | | | | | | | |

| What’s Inside | |

| | |

| Corporate Governance Overview................................................. | |

| Ethical and Responsible Business Conduct ................................... | |

| About the Board .......................................................................... | |

| Board Education ......................................................................... | |

| Board Committees ....................................................................... | |

| Director Attendance .................................................................... | |

| Director Compensation ................................................................ | |

| | | | | |

At a Glance – What We Do | Page(s) |

✓ Annual, individual director elections | |

✓ Majority voting policy for the election of directors | |

✓ Board approved Global Code of Ethical Conduct | |

✓ 88% independent directors upon election of all nominees to the Board | |

✓ Separate CEO and Chair | |

✓ Independent Board Chair and an independent Lead Director | |

✓ Diversity Policies | |

✓ Ongoing director education and support | |

✓ 100% independent Audit, HRC and N&G Committees | |

✓ Require directors to hold a minimum number of Shares | |

✓ Prohibit directors from engaging in hedging or derivative trading in our securities | |

✓ No loans to any director | |

✓ Orientations for new directors | |

✓ Annual Board and committee performance evaluations | |

✓ No director retirement policy or term limits | |

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

Corporate Governance Overview

The Board believes that good corporate governance is important to our effective performance and plays a significant role in protecting our shareholders’ interests and maximizing shareholder value.

Guidelines for effective corporate governance of listed companies are established by a number of sources, including:

•National Instrument 58-101 – Disclosure of Corporate Governance Practices (“NI 58-101” or the “Corporate Governance Disclosure Rules”);

•National Instrument 58-201 – Corporate Governance Guidelines;

•Sarbanes-Oxley Act of 2002;

•Corporate governance requirements of the Nasdaq Stock Market (the “Nasdaq Rules”); and

•Toronto Stock Exchange (the “TSX”) corporate governance requirements.

The Board is of the view that our system of corporate governance meets or exceeds these guidelines.

Our goal is to continuously improve and enhance our corporate governance standards and best practices, including in respect of matters directly related to the Meeting. Since 2010 we have presented a “say on pay” resolution at each annual meeting of our shareholders. We adopted a majority voting policy on the election of directors in 2011. In 2015, the Board also approved a board and senior management diversity policy (the “Board Diversity Policy”) that recognizes the importance of diversity, including gender diversity, on our Board and amongst our senior management team. In 2019, the Board revised its Board Diversity Policy to specifically target gender diversity. In 2020 the Board also approved an organization-wide Inclusion and Diversity Policy (the “Inclusion and Diversity Policy”) and consequential amendments were made to the Board Diversity Policy.

For more details with respect to our approach to inclusion and diversity and related objectives, please refer to the more detailed discussion under the headings “Diversity” and “Board and Senior Management Diversity” on page 20.

In addition to the discussions here and in the below section “Ethical and Responsible Business Conduct” relating to governance, our overall corporate governance practices are outlined in Appendix A to this Circular in accordance with NI 58-101.

Ethical and Responsible Business Conduct

We are committed to the principles of sustainable development and conducting our activities in an ethical and environmentally and socially responsible manner. Our core ESG values are: caring for the environment in which we operate; contributing to the long-term development of our host communities; ensuring safe and secure workplaces for our employees; contributing to the welfare of our employees, local communities and governments; and, operating transparently.

Our Global Code of Ethical Conduct (the “Code”) was first established in 2003 and is reviewed annually by the Nominating & Governance Committee (the “N&G Committee”) and, if necessary, updated to ensure we are current with evolving governance and ethics practices. The Code was last updated and approved by the Board in March 2017. The Code is designed to:

•deter wrong-doing;

•promote honest and ethical conduct; and

•require full, accurate, and timely disclosure.

The Code applies to all of our directors, officers and employees. A copy of the Code is available on our website at: www.panamericansilver.com.

In addition to the Code, we have adopted a number of other policies and guidelines that provide a framework for ethical and responsible business practices and pursuant to which we accept our corporate responsibility to operate ethically and to practice environmental stewardship, community engagement and development, and provide a safe, healthy, respectful and open and inclusive workplace for our employees. These include the Global Anti-Corruption Policy, (the “Anti-Corruption Policy”) Gifts and Hospitality Guidelines, the Corporate Social Responsibility Policy (the “CSR Policy”), the Environmental Policy, and the Global Human Rights Policy (the “Human Rights Policy”). In 2019, we also adopted a Supplier Code of Conduct to provide guidelines to our suppliers with respect to our expectations of their ethical business conduct and compliance with our policies and applicable laws. Together, these policies promote integrity, accountability and transparency throughout the Company, and also help ensure that we are compliant with legal and regulatory requirements and industry best practices.

All operations are also continuing to implement and align their management systems with Towards Sustainable Mining (“TSM”)

| | |

| 2021 ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS |

protocols and frameworks of the Mining Association of Canada, a world-class management framework designed to enhance our community engagement processes, drive environmental and tailings best practices and reinforce our commitment to the safety and health of our employees and surrounding communities. While progress on TSM was delayed in 2020 due to COVID-19, we successfully achieved TSM B Level or higher for all TSM protocols at all operations.

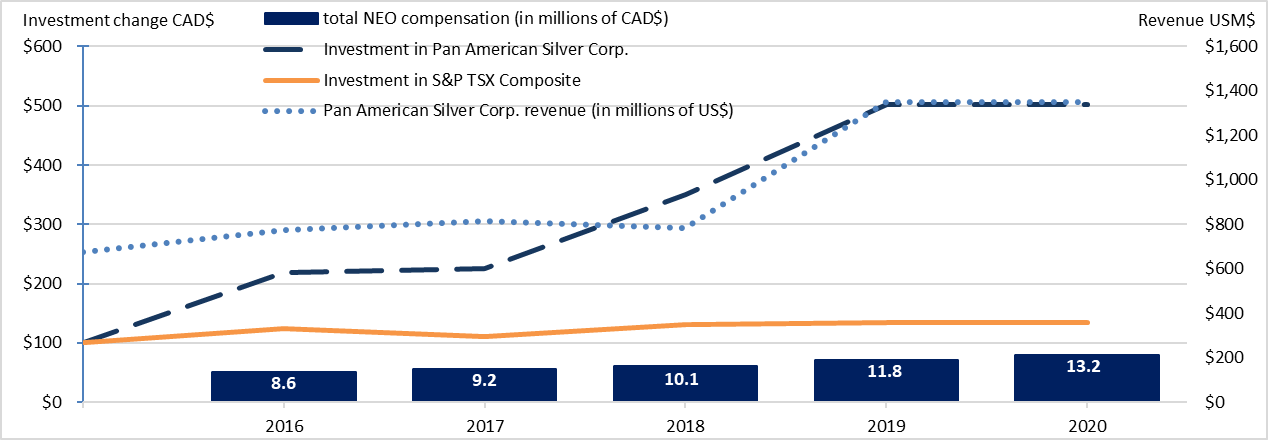

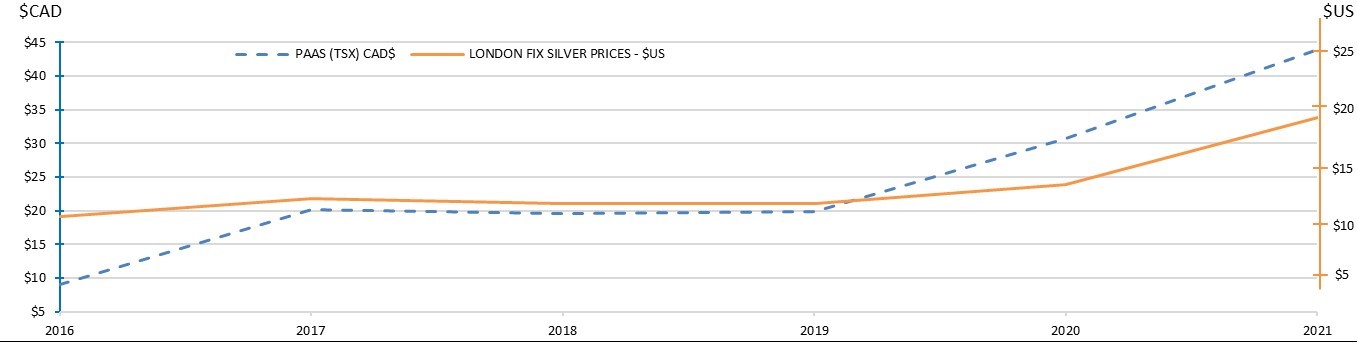

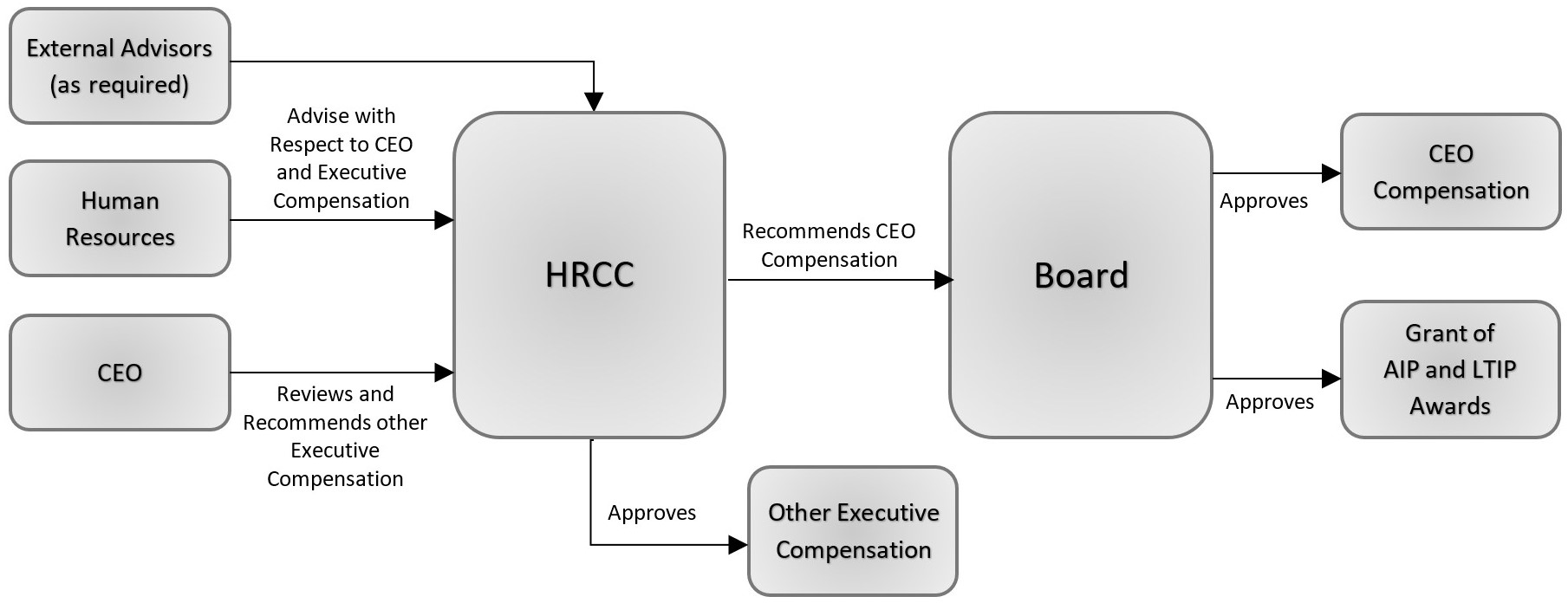

Our social management framework provides a consistent methodology for measuring and tracking social impacts and sustainability performance across our mines, while offering the flexibility needed to tailor our approach to the circumstances of each operation. We conduct social audits at all operations to help us monitor and manage the impacts of our activities on communities, our work force, and in our regional supply chains. Our audit framework is based on the ISO 26000 guidance on social responsibility and incorporates content from best practices and other standards, including the United Nations Guiding Principles on Business and Human Rights, as well as the TSM Protocol on Community and Aboriginal Relationships.