Management’s Discussion and Analysis FOR THE THREE MONTHS ENDED MARCH 31, 2022

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

| | | | | |

| TABLE OF CONTENTS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Disclosure Controls and Procedures and Technical Information | |

| |

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 1 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

May 11, 2022

This Management’s Discussion and Analysis (“MD&A”) is intended to help the reader understand the significant factors that influence the performance of Pan American Silver Corp. and its subsidiaries (collectively “Pan American”, “we”, “us”, “our” or the “Company”) and such factors that may affect its future performance. This MD&A should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2021 (the “2021 Annual Financial Statements”), and the related notes contained therein, and the unaudited condensed interim consolidated financial statements for the three months ended March 31, 2022 (the “Q1 2022 Financial Statements”), and the related notes contained therein. All amounts in this MD&A, the 2021 Annual Financial Statements, and the Q1 2022 Financial Statements are expressed in United States dollars (“USD”) unless identified otherwise. The Company reports its financial position, financial performance and cash flows in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). Pan American’s significant accounting policies are set out in Note 3 of the 2021 Annual Financial Statements.

This MD&A refers to various non-Generally Accepted Accounting Principles (“non-GAAP”) measures, such as “all-in sustaining costs per ounce sold”, “cash costs per ounce sold”, “adjusted earnings” and “basic adjusted earnings per share”, “cash mine operating earnings”, “total debt”, “capital”, and “working capital”, which are used by the Company to manage and evaluate operating performance at each of the Company’s mines and are widely reported in the mining industry as benchmarks for performance, do not have standardized meanings under IFRS, and the methodology by which these measures are calculated may differ from similar measures reported by other companies. To facilitate a better understanding of these non-GAAP measures as calculated by the Company, additional information has been provided in this MD&A. Please refer to the section of this MD&A entitled “Alternative Performance (Non-GAAP) Measures” for a detailed description of “all-in sustaining cost per ounce sold”, “cash costs per ounce sold”, “adjusted earnings” and “basic adjusted earnings per share”, “cash mine operating earnings”, “total debt”, “capital”, and “working capital” as well as details of the Company’s by-product credits and a reconciliation, where appropriate, of these measures to the Q1 2022 Financial Statements.

Any reference to “cash costs” in this MD&A should be understood to mean cash costs per ounce of silver or gold sold, net of by-product credits. Any reference to “AISC” in this MD&A should be understood to mean all-in sustaining costs per silver or gold ounce sold, net of by-product credits.

Except for historical information contained in this MD&A, the following disclosures are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian provincial securities laws, or are future oriented financial information and as such, are based on an assumed set of economic conditions and courses of action. Please refer to the cautionary note regarding forward-looking statements and information at the back of this MD&A and the “Risks Related to Pan American’s Business” contained in the Company’s most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and Form 40-F on file with the U.S. Securities and Exchange Commission (the “SEC”). Additional information about Pan American and its business activities, including its Annual Information Form, is available on SEDAR at www.sedar.com.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 2 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

CORE BUSINESS AND STRATEGY Pan American engages in silver and gold mining and related activities, including exploration, mine development, extraction, processing, refining and reclamation. The Company owns and operates silver and gold mines located in Peru, Mexico, Argentina, Bolivia, and Canada. We also own the Escobal mine in Guatemala that is currently not operating. In addition, the Company is exploring for new silver deposits and opportunities throughout the Americas. The Company is listed on the Toronto Stock Exchange (Symbol: PAAS) and on the Nasdaq Global Select Market in New York (Symbol: PAAS).

Pan American’s vision is to be the world’s premier silver mining company, with a reputation for excellence in discovery, engineering, innovation and sustainable development. To achieve this vision, we base our business on the following strategy:

•Generate sustainable profits and superior returns on investments through the safe, efficient and environmentally sound development and operation of our assets.

•Constantly replace and grow our mineral reserves and mineral resources through targeted near-mine exploration and global business development.

•Foster positive long-term relationships with our employees, shareholders, communities and local governments through open and honest communication and ethical and sustainable business practices.

•Continually search for opportunities to upgrade and improve the quality of our assets, both internally and through acquisition.

•Encourage our employees to be innovative, responsive and entrepreneurial throughout our entire organization.

To execute this strategy, Pan American has assembled a sector-leading team of mining professionals with a depth of knowledge and experience in all aspects of our business, which enables the Company to confidently advance early stage projects through construction and into operation.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 3 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Operations

•Silver production of 4.62 million ounces

Consolidated silver production for Q1 2022 of 4.62 million ounces was comparable with the 4.58 million ounces produced in the three months ended March 31, 2021 ("Q1 2021"), primarily reflecting higher production at La Colorada and Manantial Espejo being offset by lower production from San Vicente and Morococha. The production variances for each of Pan American's mines are further described in the "Individual Mine Performance" section of this MD&A.

The Company reaffirms its 2022 operating outlook for silver production, as presented in the Company's 2021 Annual MD&A dated February 23, 2022.

•Gold production of 131.0 thousand ounces

Consolidated gold production for Q1 2022 of 131.0 thousand ounces was 5% lower than the 137.6 thousand ounces produced in Q1 2021, primarily reflecting lower production at La Arena and Dolores, which was partially offset by higher production at Shahuindo, as further described in the "Individual Mine Performance" section of this MD&A.

The Company reaffirms its 2022 operating outlook for gold production, as presented in the Company's 2021 Annual MD&A dated February 23, 2022.

•Base metal production

Zinc, lead and copper ("base metal") production in Q1 2022 of 10.2 thousand tonnes, 4.7 thousand tonnes, and 1.8 thousand tonnes, respectively, was lower than Q1 2021, primarily as a result of lower production at Morococha as the operation was placed on care and maintenance in February 2022 as previously announced in the Company's 2021 Annual MD&A, and decreased grades at Huaron.

The Company reaffirms its 2022 original annual forecast for zinc, lead and copper production, as presented in the Company's 2021 Annual MD&A dated February 23, 2022.

Financial

Cash Flow, liquidity and working capital position

Cash flow from operations: in Q1 2022 totaled $68.8 million, $38.9 million more than the $29.9 million generated in Q1 2021, reflecting: an $8.8 million increase in cash mine operating earnings(1) and a $32.3 million reduction in the build-up of non-cash working capital, largely related to changes in inventory that were a draw-down in Q1 2022 compared with a build-up in Q1 2021. These factors offset a $5.2 million increase in care and maintenance expenditures and general and administrative expenses. The cash flow movements are further described in the "Overview of Q1 2022 Financial Results" section.

As at March 31, 2022, the Company had working capital of $620.7 million, inclusive of cash and short-term investment balances of $326.3 million; a long-term investment in Maverix Metals Inc. ("Maverix") with a market value of $124.7 million; and $500.0 million available under its Sustainability-Linked Credit Facility. Total debt of $47.0 million was related to lease liabilities and construction loans.

Revenue and net income

Revenue in Q1 2022 of $439.9 million was 20% higher than in Q1 2021 as a result of an increase in silver and gold ounces sold by 40% and 9%, respectively. This was, largely due to draw downs of Q1 2022 inventories compared to build ups of Q1 2021 inventories.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 4 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Net earnings of $76.8 million ($0.36 basic earnings per share) was recorded for Q1 2022, compared with net losses of $7.6 million ($0.04 basic loss per share) in Q1 2021. The $84.4 million quarter-over-quarter increase is mainly due to:

i.a $44.8 million increase in gains and income from long-term assets. This was primarily due to a $44.6 million fair-value adjustment gain recognized in Q1 2022 from a change in the accounting treatment for the Company's investment in Maverix from an investment in associate to a long-term financial asset.

ii.a $41.9 million positive variance from investment income with income of $2.8 million in Q1 2022 relative to losses of $39.0 million in Q1 2021, primarily due to the fair value mark-to-market adjustments on short-term investments in equity securities, largely New Pacific Metals Corp;

iii.a $26.5 million decrease in income tax expense due to changes in foreign exchange rates increasing the value of deductible tax attributes in Q1 2022 compared to a reduction in the value of deductible tax attributes in Q1 2021; partially offset by,

iv.a $23.2 million decrease in mine operating earnings from increased production costs. This was a result of: a $22.6 million negative variation in quarter-over-quarter Net Realizable Value ("NRV") inventory adjustments; the COVID Omicron variant's impact on workforce deployment levels; and inflationary pressures.

See the "Overview of Q1 2022 Financial Results" section of this MD&A for further information.

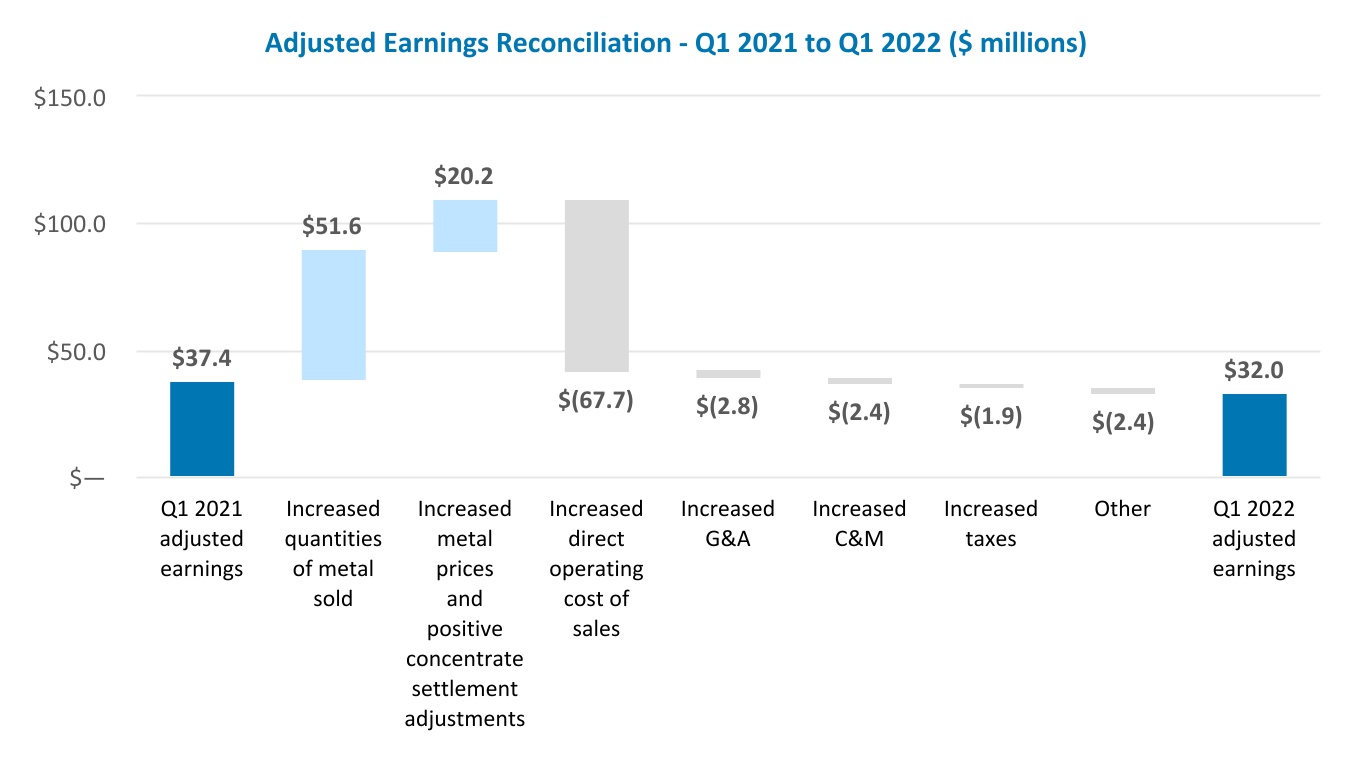

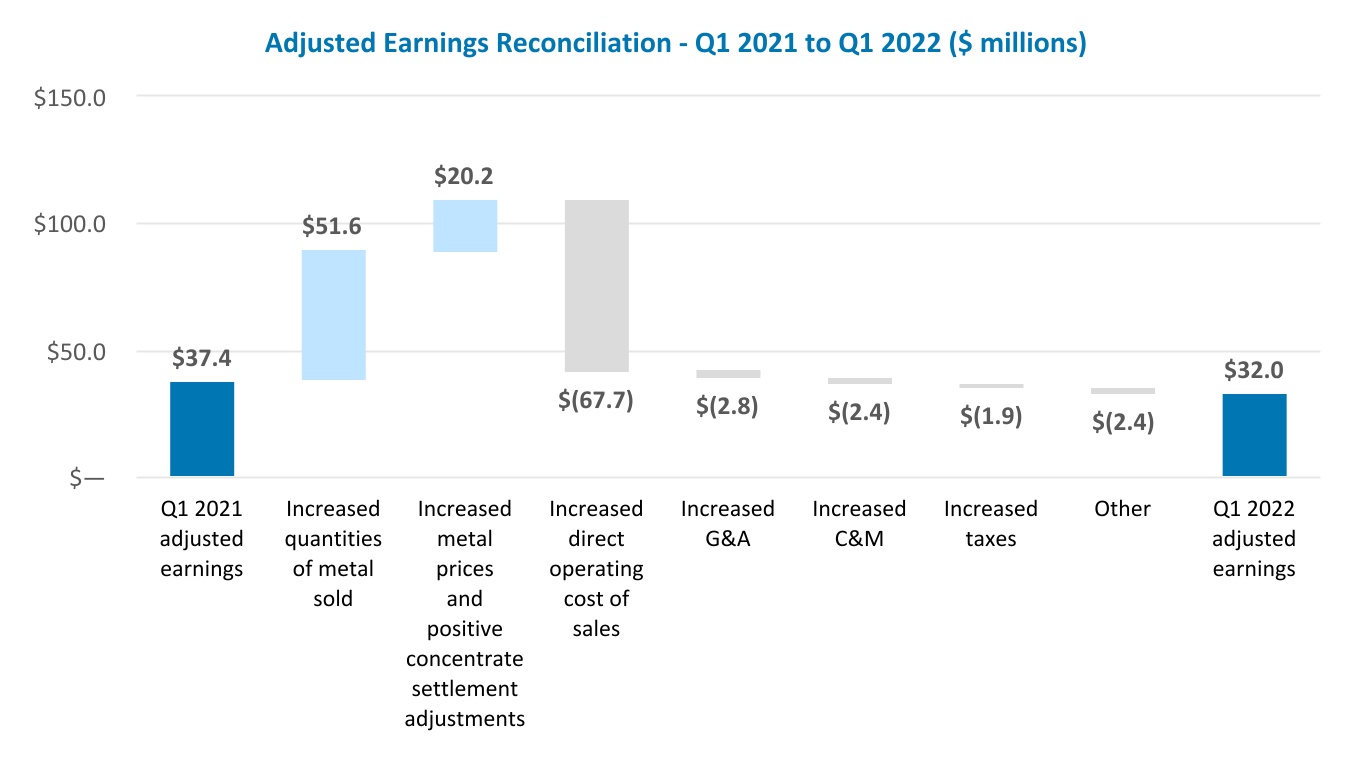

Adjusted earnings(1): of $32.0 million ($0.15 per share) was recorded in Q1 2022, compared to the Q1 2021 adjusted earnings of $37.4 million ($0.18 per share).

Cash Costs(1)

During Q1 2022, all operations experienced reduced workforce deployments due to the spread of the COVID Omicron variant, which affected throughput and unit costs. Costs across the portfolio were also negatively impacted by inflationary pressures, particularly from an increase in prices for wages, diesel and certain consumables, including cyanide, explosives, and steel products, such as grinding media, as well as supply-chain shortages. These challenges are collectively referred as "Omicron, Inflationary and Supply Chain Cost Increases" throughout the report.

Despite the Omicron, Inflationary and Supply Chain Cost Increases listed above, Silver Segment Cash Costs per ounce in Q1 2022 of $10.23 were $2.07 lower than in Q1 2021. The decrease in quarter-over-quarter Cash Costs is driven primarily from:

i.a $1.45 per ounce decrease driven by Huaron and Morococha, largely from higher base metal prices;

ii.a $1.17 per ounce decrease from lower costs per ounce at La Colorada, which is further described in the "Individual Mine Performance" section of this MD&A; and,

iii.a $0.39 per ounce decrease at Manantial Espejo, largely due to higher grades.

These increases were partially offset by a $0.93 per ounce increase to Silver Segment Cash Costs from San Vicente due to narrower vein structures reducing silver and zinc grades.

Gold Segment Cash Costs per ounce in Q1 2022 were $1,069, $223 higher than in Q1 2021, reflecting increases at all Gold Segment mines, largely driven by lower mined grades due to mine sequencing, and inflationary pressures and supply chain shortages as previously described.

All-In Sustaining Costs (“AISC”)(1)

Silver Segment AISC for Q1 2022 of $13.41 per ounce were $3.58 lower than Q1 2021. The decrease primarily reflects the same factors that impacted Cash Costs described above, in addition to a $1.51 per ounce decrease, largely from lower sustaining capital expenditures per ounce sold in Q1 2022, and lower greenfield exploration expenditures allocated to the Silver Segment operations.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 5 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Gold Segment AISC for Q1 2022 of $1,502 per ounce were $444 higher than Q1 2021, largely reflecting the same factors that impacted Cash Costs described above, as well as higher sustaining capital and the impact from NRV adjustments at Dolores, which increased costs by $13.1 million, or $94 per ounce, in Q1 2022 and decreased costs by $9.6 million, or $75 per ounce, in the comparative quarter of 2021.

(1) Adjusted earnings, Cash Costs, AISC and Cash Mine Operating Earnings are non-GAAP measures, please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to the Q1 2022 Financial Statements.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) Pan American is committed to conducting its business in a responsible and sustainable manner. Our ESG values include: caring for the environment in which we operate; contributing to the long-term development of our host communities; ensuring safe and secure workplaces for our employees; contributing to the welfare of our employees, local communities and governments; and, operating transparently.

Pan American released its 2021 sustainability report (the "Sustainability Report") on May 5, 2022, which is available on our website at www.panamericansilver.com. The Sustainability Report articulates our vision of sustainability, shares our management approach to sustainable development in the context of our business, discloses environmental, workplace and social performance, including challenges and opportunities, and demonstrates our progress toward our sustainability goals and initiatives. The Sustainability Report is prepared in accordance to the Global Reporting Initiative (GRI) Standards and is aligned with the Sustainability Accounting Standards Board (SASB) Standard. It also contains information in consideration of the Task Force on Climate Related Financial Disclosures (TCFD) reporting framework, which is included in the Climate, Energy, and Greenhouse Gas Emissions section of the Sustainability Report. The 2021 Sustainability Report also serves as our annual Communication on Progress for the United Nations Global Compact (UNGC).

The Company plans on providing a mid-year update on our progress with regards to our 2022 ESG goals, which can be found in our 2021 sustainability report, later in 2022.

Silver and Gold Production

The following table provides silver and gold production at each of Pan American’s operations for the three month periods ended March 31, 2022 and 2021. Each operation’s production variances are further discussed in the “Individual Mine Performance” section of this MD&A.

| | | | | | | | | | | | | | | | | | |

| | | | Silver Production

(ounces ‘000s) | | | Gold Production

(ounces ‘000s) |

| | | Three months ended

March 31, | | Three months ended

March 31, |

| | | | 2022 | 2021 | | | 2022 | 2021 |

| La Colorada | | | 1,419 | | 1,065 | | | | 0.6 | | 0.5 | |

| Huaron | | | 899 | | 884 | | | | 0.2 | | 0.3 | |

Morococha(1) | | | 324 | | 521 | | | | 0.1 | | 0.2 | |

San Vicente(2) | | | 476 | | 701 | | | | — | | 0.1 | |

| Manantial Espejo | | | 903 | | 697 | | | | 6.1 | | 5.9 | |

| Dolores | | | 518 | | 634 | | | | 34.6 | | 37.0 | |

| Shahuindo | | | 66 | | 65 | | | | 34.3 | | 29.5 | |

| La Arena | | | 11 | | 11 | | | | 23.3 | | 33.2 | |

| Timmins | | | 4 | | 4 | | | | 31.8 | | 31.0 | |

| Total | | | 4,619 | | 4,583 | | | | 131.0 | | 137.6 | |

Total Payable Production(3) | | | 4,312 | | 4,270 | | | | 130.5 | | 136.9 | |

(1)Morococha data represents Pan American's 92.3% interest in the mine's production. Morococha was placed on care and maintenance in February 2022.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 6 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

(2)San Vicente data represents Pan American's 95.0% interest in the mine's production.

(3)Payable production reflects sellable metal after deducting commercial contract metal payable deductions.

Base Metal Production

The following table provides the Company’s base metal production for the three months ended March 31, 2022 and 2021: | | | | | | | | | | |

| | | | Base Metal Production |

| Three months ended

March 31, |

| | 2022 | 2021 |

| Zinc – kt | | | 10.2 | | 13.1 | |

| Lead – kt | | | 4.7 | | 5.0 | |

| Copper – kt | | | 1.8 | | 2.1 | |

| | | | | | | | | | |

| | | | Base Metal Payable Production |

| Three months ended

March 31, |

| | 2022 | 2021 |

| Zinc – kt | | | 8.5 | | 10.9 | |

| Lead – kt | | | 4.4 | | 4.7 | |

| Copper – kt | | | 1.6 | | 1.7 | |

Cash Costs and AISC

The quantification of both Cash Costs and AISC measures is described in detail, and where appropriate reconciled to the Q1 2022 Financial Statements, in the "Alternative (Non-GAAP) Performance Measures" section of this MD&A.

The following table reflects the Cash Costs and AISC net of by-product credits at each of Pan American’s operations for the three months ended March 31, 2022, as compared to the same periods in 2021:

| | | | | | | | | | | | | | | | | | |

| | | Cash Costs(1) ($ per ounce) | | | AISC(1) ($ per ounce) |

| Three months ended

March 31, | | Three months ended

March 31, |

| | 2022 | 2021 | | | 2022 | 2021 |

| La Colorada | | | 9.73 | | 15.62 | | | | 12.19 | | 42.44 | |

| Huaron | | | (1.16) | | 2.35 | | | | 3.49 | | 4.82 | |

| Morococha | | | 5.68 | | 13.89 | | | | 7.08 | | 17.47 | |

| San Vicente | | | 19.39 | | 13.35 | | | | 23.94 | | 14.20 | |

| Manantial Espejo | | | 15.42 | | 19.78 | | | | 18.38 | | 24.43 | |

Silver Segment Consolidated(2) | | | 10.23 | | 12.30 | | | | 13.41 | | 16.99 | |

| Dolores | | | 976 | | 718 | | | | 1,682 | | 723 | |

| Shahuindo | | | 915 | | 751 | | | | 1,152 | | 844 | |

| La Arena | | | 963 | | 598 | | | | 1,424 | | 1,072 | |

| Timmins | | | 1,414 | | 1,292 | | | | 1,695 | | 1,568 | |

Gold Segment Consolidated(2) | | | 1,069 | | 846 | | | | 1,502 | | 1,058 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of these measures and where appropriate a reconciliation of the measure to the Q1 2022 Financial Statements.

(2)Silver Segment Cash Costs and AISC are calculated net of credits for realized revenues from all metals other than silver ("silver segment by-product credits"), and are calculated per ounce of silver sold. Gold segment Cash Costs and AISC are calculated net of credits for realized silver revenues ("gold segment by-product credits"), and are calculated per ounce of gold sold.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 7 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Individual Mine Performance

An analysis of performance at each operation in Q1 2022 compared with Q1 2021 follows. The project capital amounts invested in Q1 2022 are further discussed in the "Project Development Update" section of this MD&A.

La Colorada Operation | | | | | | | | | | |

| | | Three months ended

March 31, |

| | | | 2022 | 2021 |

| Ore tonnes mined – kt | | | 138.3 | | 130.4 | |

| Tonnes milled – kt | | | 138.4 | | 133.5 | |

| Average silver grade – grams per tonne | | | 350 | | 276 | |

| Average zinc grade - % | | | 1.83 | | 1.98 | |

| Average lead grade - % | | | 1.03 | | 1.04 | |

| Production: | | | | |

| Silver – koz | | | 1,419 | | 1,065 | |

| Gold – koz | | | 0.61 | | 0.53 | |

| Zinc – kt | | | 2.15 | | 2.25 | |

| Lead – kt | | | 1.19 | | 1.17 | |

| Payable Production | | | | |

| Silver – koz | | | 1,351 | | 1,009 | |

| Gold – koz | | | 0.52 | | 0.42 | |

| Zinc – kt | | | 1.83 | | 1.91 | |

| Lead – kt | | | 1.11 | | 1.08 | |

Cash Costs - $ per ounce(1) | | | 9.73 | | 15.62 | |

Sustaining capital - $ thousands(2) | | | 3,855 | | 5,386 | |

AISC - $ per ounce(1) | | | 12.19 | | 42.44 | |

| Payable silver sold - koz | | | 1,620 | | 225 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales.

(2)Sustaining capital expenditures exclude $8.6 million of investing activity cash outflows for Q1 2022 (Q1 2021: $4.1 million) related to investment capital incurred on the La Colorada projects, as disclosed in the “Project Development Update” section of this MD&A.

Q1 2022 vs. Q1 2021

Production:

•Silver: 33% increase, largely from higher grades and throughput, both of which benefited from improved ventilation rates in the mine that resulted in higher mining rates and allowed access to high-grade zones. Throughput increased despite significant Omicron-related absenteeism.

•By-products: 4% decrease and 2% increase in zinc and lead production, respectively, as a result of mine sequencing.

Cash Costs: decreased by $5.88 per ounce, primarily driven by higher silver grades driving lower costs per ounce, as well as higher by-product metal prices, which more than offset the Omicron, Inflationary and Supply Chain Cost Increases.

Sustaining Capital: was lower in Q1 2022, driven by lower spend on the expansion of the tailings storage facility. The balance of the Q1 2022 spending primarily related to mine deepening, improvements in ventilation infrastructure, equipment replacements, lease payments for equipment, and near-mine exploration activities.

AISC: were $30.25 per ounce lower, largely due to lower sustaining capital per ounce, as Q1 2021 AISC was impacted by the timing of shipments, in addition to the same factors decreasing quarter-over-quarter Cash Costs.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 8 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Huaron Operation | | | | | | | | | | |

| | | Three months ended

March 31, |

| | | | 2022 | 2021 |

| Ore tonnes mined – kt | | | 237.8 | | 235.7 | |

| Tonnes milled – kt | | | 234.9 | | 237.7 | |

| Average silver grade – grams per tonne | | | 143 | | 139 | |

| Average zinc grade - % | | | 2.22 | | 2.74 | |

| Average lead grade - % | | | 1.40 | | 1.30 | |

| Average copper grade - % | | | 0.70 | | 0.87 | |

| Production: | | | | |

| Silver – koz | | | 899 | | 884 | |

| Gold – koz | | | 0.24 | | 0.28 | |

| Zinc – kt | | | 4.05 | | 5.13 | |

| Lead – kt | | | 2.58 | | 2.30 | |

| Copper – kt | | | 1.22 | | 1.56 | |

| Payable Production: | | | | |

| Silver – koz | | | 740 | | 739 | |

| Gold – koz | | | 0.05 | | 0.02 | |

| Zinc – kt | | | 3.34 | | 4.23 | |

| Lead – kt | | | 2.43 | | 2.16 | |

| Copper – kt | | | 1.10 | | 1.24 | |

Cash Costs - $ per ounce(1) | | | (1.16) | | 2.35 | |

| Sustaining capital - $ thousands | | | 3,149 | | 1,612 | |

AISC-$ per ounce(1) | | | 3.49 | | 4.82 | |

| Payable silver sold – koz | | | 720 | | 709 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales.

Q1 2022 vs. Q1 2021

Production:

•Silver: 2% higher, primarily from higher grades due to mine sequencing.

•By-products: zinc and copper production were 21% and 22% lower, respectively, while lead was 12% higher, all due to mine sequencing.

Cash Costs: decreased $3.50 per ounce, primarily from higher base metal prices net of lower zinc and copper grades, and lower treatment and refining charges per ounce. These, more than offset the Omicron, Inflationary and Supply Chain Cost Increases.

Sustaining Capital: was higher than Q1 2021 due to an increase in spending on mine equipment and the expansion of the tailings storage facility. The balance of Q1 2022 capital spending related to equipment and facility leases, and near-mine exploration activities.

AISC: decreased by $1.33 per ounce as a result of the same factors that affected Cash Costs, partially offset by higher sustaining capital per ounce.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 9 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Dolores Operation | | | | | | | | | | |

| | | Three months ended

March 31, |

| | | | 2022 | 2021 |

| Ore tonnes mined – kt | | | 1,532.6 | | 2,934.2 | |

| Waste tonnes mined – kt | | | 6,317.1 | | 6,497.5 | |

| Tonnes placed – kt | | | 2,002.2 | | 1,859.8 | |

| Average silver grade – grams per tonne | | | 14 | | 19 | |

| Average gold grade – grams per tonne | | | 0.63 | | 1.06 | |

| Production: | | | | |

| Silver – koz | | | 518 | | 634 | |

| Gold – koz | | | 34.6 | | 37.0 | |

| Payable Production: | | | | |

| Silver – koz | | | 517 | | 633 | |

| Gold – koz | | | 34.5 | | 36.9 | |

Cash Costs - $ per gold ounce(1) | | | 976 | | 718 | |

| Sustaining capital - $ thousands | | | 14,353 | | 8,919 | |

AISC - $ per gold ounce(1) | | | 1,682 | | 723 | |

| Payable gold sold - koz | | | 40.8 | | 31.5 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales. Previously reported Cash Costs and AISC on a per silver ounce basis are disclosed in the Cash Costs and AISC section.

Q1 2022 vs. Q1 2021

Production:

•Silver: 18% lower, largely from a decrease in silver grades due to a reserve estimate shortfall in the section of the open pit Phase 9B being mined during the quarter.

•Gold: 7% lower, primarily from a combination of mine sequencing into lower gold grade ores and a decrease in gold grades due to the reserve shortfall described above, which was partially offset by expected leach sequencing favoring timing of gold production.

Cash Costs: increased $258 per ounce, primarily from higher operating costs per ounce and lower by-product credits per ounce, both largely driven by the decrease in grades described above, as well as Omicron, Inflationary and Supply Chain Cost Increases.

Sustaining Capital: was higher than Q1 2021, primarily driven by greater capitalized Phase 10 waste mining and increased heap leach pad expansion expenses in Q1 2022.

AISC: increased $959 per ounce, primarily due to the impact of NRV inventory adjustments, the increased sustaining capital, and the factors affecting quarter-over-quarter Cash Costs. The NRV inventory adjustments increased costs by $13.1 million, or $321 per ounce, in Q1 2022 compared with a cost-reducing $9.6 million, or $304 per ounce, adjustment in Q1 2021.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 10 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Shahuindo Operation | | | | | | | | | | |

| | | Three months ended

March 31, |

| | | | 2022 | 2021 |

| Ore tonnes mined – kt | | | 3,211.5 | | 3,141.6 | |

| Waste tonnes mined – kt | | | 4,314.2 | | 3,511.5 | |

| Tonnes placed – kt | | | 3,327.2 | | 2,806.5 | |

| Average silver grade – grams per tonne | | | 6 | | 5 | |

| Average gold grade – grams per tonne | | | 0.41 | | 0.46�� | |

| Production: | | | | |

| Silver – koz | | | 66 | | 65 | |

| Gold – koz | | | 34.26 | | 29.54 | |

| Payable Production: | | | | |

| Silver – koz | | | 65.25 | | 64.49 | |

| Gold – koz | | | 34.23 | | 29.51 | |

Cash Costs - $ per ounce(1) | | | 915 | | 751 | |

Sustaining capital - $ thousands(2) | | | 7,381 | | 2,681 | |

AISC - $ per ounce(1) | | | 1,152 | | 844 | |

| Payable gold sold - koz | | | 33.8 | | 31.7 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales.

(2)Sustaining capital expenditures exclude $0.2 million of investing activity cash outflows for Q1 2022, (Q1 2021: $0.1 million) related to lease payments for the crushing and agglomeration plant completed by Tahoe, and is included in Other Projects, as disclosed in the “Project Development Update” section of this MD&A.

Q1 2022 vs. Q1 2021

Production:

•Gold: 16% higher, primarily from higher tonnes stacked and a higher ratio of ounces recovered to stacked, partially offset by lower grades due to mine sequencing. The increase in tonnes stacked during Q1 2022 reflects improved ore blending characteristics and drier conditions than typical for the wet summer months, which allowed for increased stacking rates.

Cash Costs: were $164 per ounce higher, primarily due to a higher ratio of waste to ore in the current section of the mine plan, lower gold grades due to mine sequencing, and Omicron, Inflationary and Supply Chain Cost Increases.

Sustaining Capital: an increase from Q1 2021, due to the timing of payments on leach pad construction and site infrastructure investments. Capital in both periods also included near-mine exploration and payments for leased mining equipment.

AISC: were $308 per ounce higher, largely due to the same factors affecting Cash Costs, as well as the higher sustaining capital expenditures.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 11 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

La Arena Operation | | | | | | | | | | |

| | | Three months ended

March 31, |

| | | | 2022 | 2021 |

| Ore tonnes mined – kt | | | 2,035.1 | | 2,040.8 | |

| Waste tonnes mined – kt | | | 6,869.7 | | 8,003.7 | |

| Tonnes placed – kt | | | 2,035.1 | | 2,040.8 | |

| Average silver grade – grams per tonne | | | 1 | | 1 | |

| Average gold grade – grams per tonne | | | 0.33 | | 0.38 | |

| Production: | | | | |

| Silver – koz | | | 11 | | 11 | |

| Gold – koz | | | 23.35 | | 33.15 | |

| Payable Production: | | | | |

| Silver – koz | | | 10.88 | | 10.83 | |

| Gold – koz | | | 23.33 | | 33.13 | |

Cash Costs - $ per ounce(1) | | | 963 | | 598 | |

| Sustaining capital - $ thousands | | | 12,959 | | 14,719 | |

AISC - $ per ounce(1) | | | 1,424 | | 1,072 | |

| Payable gold sold - koz | | | 29.7 | | 31.4 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales.

Q1 2022 vs. Q1 2021

Production:

•Gold: 30% lower as a result of lower grades due to mine sequencing and a decrease in the ratio of ounces recovered to stacked due to timing of leach sequencing.

Cash Costs: increased by $365 per ounce, primarily reflecting Omicron, Inflationary and Supply Chain Cost Increases and lower grades.

Sustaining Capital: lower than Q1 2021, largely as a result of lower rates of capitalized deferred stripping. Expenditures in Q1 2022 were comprised mainly of capitalized deferred stripping, waste storage facility preparation, and other camp and mine infrastructure.

AISC: increased by $352 per ounce, largely from the same factors affecting quarter-over-quarter Cash Costs.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 12 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Timmins Operation | | | | | | | | | | |

| | | Three months ended

March 31, |

| | | | 2022 | 2021 |

| Ore tonnes mined – kt | | | 415.6 | | 397.1 | |

| Tonnes milled – kt | | | 409.4 | | 400.0 | |

| Average silver grade – grams per tonne | | | — | | — | |

| Average gold grade – grams per tonne | | | 2.51 | | 2.64 | |

| Production: | | | | |

| Silver – koz | | | 4 | | 4 | |

| Gold – koz | | | 31.79 | | 30.98 | |

| Payable Production: | | | | |

| Silver – koz | | | 3.75 | | 3.86 | |

| Gold – koz | | | 31.76 | | 30.96 | |

Cash Costs - $ per ounce(1) | | | 1,414 | | 1,292 | |

Sustaining capital - $ thousands(2) | | | 9,924 | | 8,222 | |

AISC - $ per ounce(1) | | | 1,695 | | 1,568 | |

| Payable gold sold - koz | | | 35.4 | | 33.2 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales.

(2)Sustaining capital expenditures exclude $0.4 million of investing activity cash outflows for Q1 2022, (Q1 2021: $0.6 million) related to investment capital incurred on the Timmins projects, as disclosed in the “Project Development Update” section of this MD&A.

Q1 2022 vs. Q1 2021

Production:

•Gold: 3% higher, reflecting higher mining rates and increased mill recoveries due to in-process inventory movements, partially offset by lower grades.

Cash Costs: increased $122 per ounce, primarily as a result of the lower grades and higher operating costs from Omicron, Inflationary and Supply Chain Cost Increases, increased ventilation and ground control needs at Bell Creek.

Sustaining Capital: higher than Q1 2021, due to increased mobile mine equipment refurbishment and replacements, and increased near-mine exploration, partially offset by lower tailings expansion expenditures.

AISC: the $128 per ounce increase reflects the same factors that affected Cash Costs.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 13 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Other Operations(1)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended

March 31, 2022 | Three months ended

March 31, 2021 | |

| | Morococha | San Vicente | Manantial Espejo | Morococha | San Vicente | Manantial Espejo | | | |

| | | | | | | | | |

| Tonnes milled – kt | 100.5 | | 75.1 | | 134.7 | | 149.2 | | 89.0 | | 157.3 | | | | |

| Average silver grade – grams per tonne | 112 | | 222 | | 234 | | 121 | | 265 | | 157 | | | | |

| Average gold grade – grams per tonne | | | 1.55 | | | | 1.30 | | | | |

| Average zinc grade - % | 3.12 | | 2.16 | | — | | 2.88 | | 2.58 | | — | | | | |

| Average lead grade - % | 0.96 | | 0.28 | | — | | 1.17 | | 0.13 | | — | | | | |

| Average copper grade - % | 0.60 | | 0.21 | | — | | 0.38 | | 0.24 | | — | | | | |

| Production: | | | | | | | | | |

| Silver – koz | 324 | | 476 | | 903 | | 521 | | 701 | | 697 | | | | |

| Gold – koz | 0.15 | | 0.02 | | 6.07 | | 0.16 | | 0.08 | | 5.89 | | | | |

| Zinc – kt | 2.67 | | 1.34 | | — | | 3.72 | | 1.96 | | — | | | | |

| Lead – kt | 0.73 | | 0.19 | | — | | 1.43 | | 0.11 | | — | | | | |

| Copper – kt | 0.47 | | 0.12 | | — | | 0.37 | | 0.16 | | — | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Cash Costs - $ per ounce(2) | 5.68 | | 19.39 | | 15.42 | | 13.89 | | 13.35 | | 19.78 | | | | |

| | | | | | | | | |

| | | | | | | | | |

AISC - $ per ounce(2) | 7.08 | | 23.94 | | 18.38 | | 17.47 | | 14.20 | | 24.43 | | | | |

| | | | | | | | | |

(1)Production figures are for Pan American’s 92.3% share of Morococha and 95% share of San Vicente, respectively, unless otherwise noted. Morococha was placed on care and maintenance in February 2022.

(2)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed reconciliation of these measures to cost of sales.

Q1 2022 vs. Q1 2021

Morococha: production reflects the operation being placed on care and maintenance in late February 2022 while we explore alternatives to optimize value given the requirement to move the processing facilities to allow for the expansion of a neighboring open pit mine.

San Vicente: mined grades continue to decrease from increasing dilution from the narrowing vein structures encountered as we mine deeper.

Manantial Espejo: the quarter-over-quarter production increase is due to higher tonnages and grades of ores mined at COSE and Joaquin. The Company expects to complete mining operations at COSE in the second quarter of 2022. This has been incorporated in the Company's 2022 guidance issued on February 23, 2022.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 14 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

2022 ANNUAL OPERATING OUTLOOK All 2022 forecast amounts in this section refer to the 2022 Operating Outlook, as provided in the Company's 2021 MD&A dated February 23, 2022. These estimates are forward-looking statements and information that are subject to the cautionary note associated with forward-looking statements and information at the end of this MD&A.

Production Relative to Forecast:

The following table summarizes the metal production during 2022 compared to the 2022 Operating Outlook:

| | | | | | | | | | | |

| | | 2022 Operating Outlook | Q1 2022 | | |

| Silver – Moz | | 19.00 - 20.50 | 4.62 | | |

| Gold – koz | | 550.0 - 605.0 | 131.0 | | |

| Zinc – kt | | 35.0 - 40.0 | 10.2 | | |

| Lead – kt | | 15.0 - 17.0 | 4.7 | | |

| Copper – kt | | 5.5 - 6.5 | 1.8 | | |

Based on Q1 2022 production results and the expected production for the remainder of the year, Management reaffirms the 2022 Operating Outlook annual consolidated metal production, as shown in the table above.

Cash Costs and AISC Compared to Forecast:

The following table summarizes Cash Costs and AISC for each operation for 2022 compared to the respective 2022 Operating Outlook amounts. These forecast estimates are largely influenced by Management's assumptions and estimates for productivity, input costs, commodity prices and currency exchange rates. | | | | | | | | | | | | | | | | |

| Cash Costs(1) ($ per ounce) | AISC(1) ($ per ounce) |

| 2022 Operating Outlook | Q1 2022 | | 2022 Operating Outlook | Q1 2022 | |

| Silver Segment: | | | | | | |

| La Colorada | 8.00 - 9.00 | 9.73 | | 12.40 - 13.40 | 12.19 | |

| Huaron | 1.80 - 4.50 | (1.16) | | 7.80 - 9.90 | 3.49 | |

| Morococha | n/a | 5.68 | | n/a | 7.08 | |

| San Vicente | 15.30 - 16.55 | 19.39 | | 18.70 - 19.70 | 23.94 | |

| Manantial Espejo | 21.00 - 24.00 | 15.42 | | 22.00 - 24.80 | 18.38 | |

| Total | 10.70 - 12.20 | 10.23 | | 14.50 - 16.00 | 13.41 | |

| Gold Segment: | | | | | | |

| Dolores | 715 - 840 | 976 | | 925 - 1,070 | 1,682 | |

| Shahuindo | 910 - 995 | 915 | | 1,170 - 1,275 | 1,152 | |

| La Arena | 990 - 1,070 | 963 | | 1,380 - 1,475 | 1,424 | |

| Timmins | 1,340 - 1,415 | 1,414 | | 1,615 - 1,695 | 1,695 | |

| Total | 970 - 1,070 | 1,069 | | 1,240 - 1,365 | 1,502 | |

(1)Cash Costs and AISC are non-GAAP measures. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of these calculations and a reconciliation of these measures to the Q1 2022 Financial Statements.

(2)The cash costs and AISC forecasts assume realized metal prices for Q1 2022 and the following metal prices for the remainder of 2022: of $22.50/oz for silver, $3,000/tonne ($1.36/lb) for zinc, $2,200/tonne ($1.00/lb) for lead, $9,200/tonne ($4.17/lb) for copper, and $1,750/oz for gold; and average annual exchange rates relative to 1 USD of 20.00 for the Mexican peso ("MXN"), 4.10 for the Peruvian sol ("PEN"), 122.17 for the Argentine peso ("ARS"), 7.00 for the Bolivian boliviano ("BOB"), and $1.25 for the Canadian dollar ("CAD").

Based on Q1 2022 Cash Costs and AISC results, Management reaffirms the 2022 Operating Outlook for Cash Costs and AISC, as shown in the table above.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 15 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Capital Expenditures Relative to Forecast:

The following table summarizes the 2022 capital expenditures compared to the 2022 Operating Outlook:

| | | | | | | | | | |

| 2022 Capital Expenditures

($ millions) | | |

| 2022 Operating Outlook | Q1 2022 | | |

| La Colorada | 28.0 - 29.0 | 3.9 | | |

| Huaron | 16.0 - 19.0 | 3.1 | | |

| Morococha | n/a | 0.3 | | |

| San Vicente | 7.0 - 8.0 | 2.9 | | |

| Manantial Espejo | 2.0 - 3.0 | 1.1 | | |

| Dolores | 33.0 - 34.0 | 14.4 | | |

| Shahuindo | 37.0 - 38.0 | 7.4 | | |

| La Arena | 39.0 - 40.0 | 13.0 | | |

| Timmins | 38.0 - 39.0 | 9.9 | | |

| Sustaining Capital Sub-total | 200.0 - 210.0 | 56.0 | | |

| La Colorada Skarn projects | 68.0 - 81.0 | 8.6 | | |

| Timmins projects | 12.0 - 14.0 | 0.4 | | |

| Other | n/a | 0.2 | | |

| Project Capital Sub-total | 80.0 - 95.0 | 9.2 | | |

| Total Capital | 280.0 - 305.0 | 65.2 | | |

| | | | |

Management reaffirms the 2022 Operating Outlook for sustaining and project capital, as shown in the table above.

PROJECT DEVELOPMENT UPDATE The following table reflects the amounts spent on each of Pan American’s major projects in Q1 2022 compared with Q1 2021:

| | | | | | | | | | |

| Project Development Capital | | Three months ended

March 31, |

| (thousands of USD) |

| | | | 2022 | 2021 |

| La Colorada projects | | | 8,560 | | 4,082 | |

| Timmins projects | | | 401 | | 644 | |

| Other projects | | | 163 | | 225 | |

| Total | | | $ | 9,124 | | 4,951 | |

During Q1 2022, the Company invested $9.1 million, largely on exploration and development of the La Colorada Skarn project, including advancing construction of the new concrete-lined ventilation shaft and beginning commissioning of the refrigeration plant.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 16 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

OVERVIEW OF Q1 2022 FINANCIAL RESULTS Selected Annual and Quarterly Information

The following tables set out selected quarterly results for the past ten quarters as well as selected annual results for the past two years. The dominant factors affecting results in the quarters and years presented below are the volatility of realized metal prices and the timing of sales, which vary with the timing of shipments and impairment charges.

| | | | | | | | | | | | | | |

| 2022 | | | Quarter Ended | | | | | | | |

| (In thousands of USD, other than per share amounts) | | | March 31 | | | | | | | |

| Revenue | | | $ | 439,888 | | | | | | | | |

| Mine operating earnings | | | $ | 66,755 | | | | | | | | |

| Earnings for the period attributable to equity holders | | | $ | 76,517 | | | | | | | | |

| Basic (loss) earnings per share | | | $ | 0.36 | | | | | | | | |

| Diluted (loss) earnings per share | | | $ | 0.36 | | | | | | | | |

| Cash flow from operating activities | | | $ | 68,758 | | | | | | | | |

| Cash dividends paid per share | | | $ | 0.12 | | | | | | | | |

| Other financial information | | |

| | | | | | | |

| Total assets | | | $ | 3,540,297 | | | | | | | | |

Total long-term financial liabilities(1) | | | $ | 303,984 | | | | | | | | |

| Total attributable shareholders’ equity | | | $ | 2,683,201 | | | | | | | | |

(1)Total long-term financial liabilities are comprised of non-current liabilities excluding deferred tax liabilities, and deferred revenue.

| | | | | | | | | | | | | | | | | | | | | |

| 2021 | Quarter Ended | Year

Ended | | | | |

| (In thousands of USD, other than per share amounts) | Mar 31 | Jun 30 | Sep 30 | Dec 31 | Dec 31 | | | | |

| Revenue | $ | 368,099 | | $ | 382,132 | | $ | 460,349 | | $ | 422,170 | | $ | 1,632,750 | | | | | |

| Mine operating earnings | $ | 89,964 | | $ | 103,048 | | $ | 98,887 | | $ | 76,039 | | $ | 367,938 | | | | | |

| (Loss) earnings for the period attributable to equity holders | $ | (7,798) | $ | 70,939 | $ | 20,251 | $ | 14,036 | $ | 97,428 | | | | | |

| Basic (loss) earnings per share | $ | (0.04) | | $ | 0.34 | | $ | 0.10 | | $ | 0.06 | | $ | 0.46 | | | | | |

| Diluted (loss) earnings per share | $ | (0.04) | | $ | 0.34 | | $ | 0.10 | | $ | 0.06 | | $ | 0.46 | | | | | |

| Cash flow from operating activities | $ | 29,850 | | $ | 87,143 | | $ | 157,017 | | $ | 118,098 | | $ | 392,108 | | | | | |

| Cash dividends paid per share | $ | 0.07 | | $ | 0.07 | | $ | 0.10 | | $ | 0.10 | | $ | 0.34 | | | | | |

| Other financial information | | | | | | | | | |

| Total assets | | | | | $ | 3,518,584 | | | | | |

Total long-term financial liabilities(1) | | | | | $ | 297,600 | | | | | |

| Total attributable shareholders’ equity | | | | | $ | 2,631,554 | | | | | |

(1)Total long-term financial liabilities are comprised of non-current liabilities excluding deferred tax liabilities, and deferred revenue.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 17 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

| | | | | | | | | | | | | | | | | | | | | |

| 2020 | Quarter Ended | Year

Ended | | | | |

| (In thousands of USD, other than per share amounts) | Mar 31 | Jun 30 | Sep 30 | Dec 31 | Dec 31 | | | | |

| Revenue | $ | 358,428 | | $ | 249,509 | | $ | 300,414 | | $ | 430,461 | | $ | 1,338,812 | | | | | |

| Mine operating earnings | $ | 50,058 | | $ | 48,386 | | $ | 124,561 | | $ | 137,172 | | $ | 360,177 | | | | | |

| (Loss) earnings for the period attributable to equity holders | $ | (76,807) | | $ | 20,063 | | $ | 65,741 | | $ | 168,885 | | $ | 177,882 | | | | | |

| Basic (loss) earnings per share | $ | (0.37) | | $ | 0.10 | | $ | 0.31 | | $ | 0.80 | | $ | 0.85 | | | | | |

| Diluted (loss) earnings per share | $ | (0.37) | | $ | 0.10 | | $ | 0.31 | | $ | 0.80 | | $ | 0.85 | | | | | |

| Cash flow from operating activities | $ | 114,051 | | $ | 62,750 | | $ | 114,943 | | $ | 170,571 | | $ | 462,315 | | | | | |

| Cash dividends paid per share | $ | 0.05 | | $ | 0.05 | | $ | 0.05 | | $ | 0.07 | | $ | 0.22 | | | | | |

| Other financial information | | | | | | | | | |

| Total assets | | | | | $ | 3,433,875 | | | | | |

Total long-term financial liabilities(1) | | | | | $ | 277,696 | | | | | |

| Total attributable shareholders’ equity | | | | | $ | 2,602,519 | | | | | |

(1)Total long-term financial liabilities are comprised of non-current liabilities excluding deferred tax liabilities, and deferred revenue.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 18 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Income Statement: Q1 2022 vs. Q1 2021

Net earnings of $76.8 million were recorded in Q1 2022 compared to a net loss of $7.6 million in Q1 2021, which corresponds to basic earnings per share of $0.36 and a loss of $0.04, respectively.

The following table highlights the differences between the Q1 2021 and Q1 2022 net earnings: | | | | | | | | | | | |

| Net loss, three months ended March 31, 2021 | | $ | (7,562) | | Note |

| Revenue: | | | |

| Increased realized metal prices | $ | 13,875 | | | |

| Higher quantities of metal sold | 51,649 | | | |

| Decreased direct selling costs | 1,899 | | | |

| Decreased negative settlement adjustments | 4,366 | | | |

| Total increase in revenue | | $ | 71,789 | | (1) |

| Cost of sales: | | | |

| Increased production costs and decreased royalty charges | $ | (85,565) | | | (2) |

| Increased depreciation and amortization | (9,433) | | | (3) |

| Total increase in cost of sales | | $ | (94,998) | | |

| Increased gains and income from associates | | 44,835 | | (4) |

| Decreased investment loss | | 41,859 | | (5) |

| Decreased income tax expense | | 26,537 | | (6) |

| Increased net gain on asset sales, and derivatives | | 1,705 | | |

| Decreased other expense | | 227 | | |

| Increased general and administrative expense | | (2,841) | | |

| Increased care and maintenance costs | | (2,402) | | |

| Increased interest and finance expense | | (1,354) | | |

| Increased foreign exchange loss | | (645) | | |

| Increased exploration and project development expense | | (319) | | |

| | | |

| | | |

| | | |

| Net earnings, three months ended March 31, 2022 | | $ | 76,831 | | |

(1)Revenue for Q1 2022 was $71.8 million higher than in Q1 2021, largely from increased quantities of metal sold and higher metal prices. The quarter-over-quarter increase in quantities of metal sold was driven mainly by silver and gold sales, with increases of 40% and 9%, respectively (see table below). These increases arose from a combination of the timing of sales and increased payable silver production, partially offset by lower payable gold production. The timing of sales relates to precious metals inventory draw-downs in Q1 2022 compared to build-ups in Q1 2021. The majority of the silver sales quantity variance reflects increased production and an inventory draw-down at La Colorada in Q1 2022 compared to a shipping delay-driven concentrate build up and lower production from ventilation constraints in Q1 2021. The increased quantities of gold sold was mainly attributable to the timing of sales at Dolores and La Arena, which resulted in inventory draw-downs in Q1 2022 compared to build-ups in Q1 2021, partially offset by the lower Gold Segment payable production, as described in the "Operating Performance" section of this MD&A.

In addition to the increase in quantities of metal sold were higher realized metal prices for all metals except silver, which decreased 9% from Q1 2021. Realized gold prices increased 5%, and realized prices for copper, zinc and lead increased 15%, 38%, and 15%, respectively (see realized prices in table below).

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 19 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

The following table reflects the metal prices realized by the Company and the quantities of metal sold during each quarter:

| | | | | | | | | | | | | | | | | | |

| | Realized Metal Prices (1) | Quantities of Metal Sold (2) |

| | Three months ended

March 31, | | Three months ended

March 31, | |

| | 2022 | 2021 | | | 2022 | 2021 | | |

| Silver | $ | 24.03 | | $ | 26.41 | | | | 4,890 | | 3,490 | | | |

| Gold | $ | 1,880 | | $ | 1,788 | | | | 148.1 | | 136.0 | | | |

| Zinc | $ | 3,792 | | $ | 2,756 | | | | 7.9 | | 11.1 | | | |

| Lead | $ | 2,341 | | $ | 2,036 | | | | 4.9 | | 3.9 | | | |

| Copper | $ | 9,767 | | $ | 8,515 | | | | 1.7 | | 1.8 | | | |

(1)Metal price stated as dollars per ounce for silver and gold, and dollars per tonne for zinc, lead and copper, inclusive of final settlement adjustments on concentrate sales.

(2)Metal quantities stated as koz for silver and gold and kt for zinc, lead and copper.

(2)Production and royalty costs in Q1 2022 were $85.6 million higher than in Q1 2021. The increase was driven by an $85.6 million, or 44%, increase in production costs. The increased production costs were largely driven by the previously discussed quarter-over-quarter increase in quantities of gold and silver sold and NRV inventory adjustments, as well as Omicron, Inflationary and Supply Chain Cost Increases. Excluding the impact of NRV inventory adjustments, Gold Segment production costs increased by $39.5 million from higher costs at all operations, driven by the 12.0 thousand ounce, or 9%, increase in quantities of gold sold and increased operating costs, including Omicron, Inflationary and Supply Chain Cost Increases, as further described for each operation in the" Operating Performance" section of this MD&A. Silver Segment production costs, excluding the impact of NRV inventory adjustments, increased by $17.1 million, from a $20.1 million increase in costs at La Colorada from the increase in production and sales volumes in Q1 2022 compared to Q1 2021.

Additionally, there was a $22.6 million quarter-over-quarter cost increase from NRV inventory adjustments, which increased costs by $14.4 million in Q1 2022 compared to a $8.1 million decrease to costs in Q1 2021. NRV inventory adjustments in both quarters were related mainly to Dolores and were driven largely by inflationary pressures.

(3)Depreciation and amortization ("D&A") expense was $9.4 million higher than in Q1 2021. The increase was largely from higher sales volumes, which is predominantly recorded on a units-of-production basis, and mainly from higher quantities of gold sold at Dolores and silver sold at La Colorada. Annual changes to depreciation rates in late 2021, primarily those relating to open pit operations, are also reflected in the quarter-over-quarter increase.

(4)Gains and income from associates in Q1 2022 was $45.0 million compared to $0.2 million in Q1 2021, representing a $44.8 million increase. The income in Q1 2022 primarily reflects a $44.6 million fair-value adjustment gain that was recognized due to a change in accounting treatment for the Company's investment in Maverix. Management determined that, as of March 31, 2022, the Company no longer held significant influence over Maverix due to declining to exercise its right to nominate a representative to serve as a director on Maverix’s Board of Directors to replace its previous representative who had retired, and accordingly the Company no longer has the power to participate in the financial and operating policy decisions of Maverix. As a result, the Company's investment in Maverix was redesignated from "Investment in Associate", accounted using the "equity method" whereby the Company recorded into income its ownership proportion of Maverix's estimated earnings, to a "long-term financial asset", which will be recorded at fair value going forward. The Q1 2021 gains and income from associates represented income recorded under the equity-method, with no such accounting treatment change related to valuation gain.

(5)Investment income of $2.8 million in Q1 2022 was a $41.9 million positive change relative to investment losses of $39.0 million in Q1 2021, both driven primarily by fair value mark-to-market adjustments on the Company's equity investment in New Pacific Metals Corp.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 20 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

(6)Income tax expense in Q1 2022 was $11.4 million compared to $38.0 million in Q1 2021. The $26.5 million decrease in tax expense is due primarily to the appreciation of the PEN on Peruvian tax attributes in Q1 2022 compared to devaluation of the PEN and MXN, respectively, on Peruvian and Mexican tax attributes in Q1 2021.

Statement of Cash Flows: Q1 2022 vs. Q1 2021

Cash flow from operations in Q1 2022 totaled $68.8 million, $38.9 million more than the $29.9 million generated in Q1 2021. The increase was primarily driven from less cash used in working capital changes, increased cash mine operating earnings and decreased income tax cash payments.

Working capital changes in Q1 2022 resulted in a $15.1 million use of cash compared with a $47.4 million use of cash in Q1 2021. The Q1 2022 use of cash was mainly driven by a $12.4 million build-up in trade and other receivable balances, an $11.7 million net pay-down in accounts payable and accrued liability balances, partially offset by a $10.3 million reduction in inventories. The Q1 2021 use of cash was mainly driven by a $39.9 million build-up in inventories, largely the result of the delay in transporting concentrate inventories from La Colorada, and a $6.4 million decrease in accounts payables.

Investing activities used $51.1 million in Q1 2022, primarily related to the $61.5 million spent on mineral properties, plant and equipment ("MPP&E") at the Company’s mines and projects, as previously described in the “Operating Performance” section of this MD&A, which was partially offset by $7.7 million in MPP&E related proceeds, which largely reflect a $7.0 million payment from an arm's length party to be applied to costs associated with the closure and reclamation of the Morococha mine processing facility, and $2.0 million in proceeds from the settlement of the Company's derivatives comprised of commodity and FX hedging contracts. In Q1 2021, investing activities used $44.5 million, primarily from the $48.0 million spent on mineral properties, plant and equipment, which offset $0.3 million in proceeds from the sale of short-term investments.

Financing activities in Q1 2022 used $29.2 million compared to $18.0 million used in Q1 2021. Cash used in Q1 2022 primarily consisted of $25.3 million in dividends and $3.4 million of lease repayments. The net cash used in Q1 2021 consisted primarily of $14.7 million paid as dividends to shareholders and $3.0 million of lease payments. The increase in dividend payments reflects the Company's new dividend policy announced on February 24, 2022, as described in the Annual Information Form published on February 23, 2022.

Adjusted Earnings: Q1 2022 vs Q1 2021

Adjusted earnings is a non-GAAP measure. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of “adjusted earnings”, and a reconciliation of these measures to the Q1 2022 Financial Statements.

Adjusted Earnings in Q1 2022 was $32.0 million, representing basic adjusted earnings per share of $0.15, compared to Q1 2021 adjusted earnings of $37.4 million, and basic adjusted earnings per share of $0.18. A reconciliation of adjusted earnings for the three months ended March 31, 2022 and 2021, to the net earnings for each period is included in the “Alternative Performance (Non-GAAP) Measures” section of this MD&A.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 21 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

The following chart illustrates the key factors leading to the change in adjusted earnings from Q1 2021 to Q1 2022:

LIQUIDITY AND CAPITAL POSITION | | | | | | | | | | | | | | | |

| Liquidity and Capital Measures (in $000s) | March 31, 2022 | | | Dec. 31, 2021 | | Q1 2022

Change | |

| Cash and cash equivalents ("Cash") | $ | 271,876 | | | | $ | 283,550 | | | $ | (11,674) | | |

| Short-term Investments | $ | 54,410 | | | | $ | 51,723 | | | $ | 2,687 | | |

| Cash and Short-term investments | $ | 326,286 | | | | $ | 335,273 | | | $ | (8,987) | | |

| Working Capital | $ | 620,663 | | | | $ | 613,494 | | | $ | 7,169 | | |

| Credit Facility committed amount | $ | 500,000 | | | | $ | 500,000 | | | $ | — | | |

| Credit Facility amounts drawn | $ | — | | | | $ | — | | | $ | — | | |

| | | | | | | |

| Shareholders' equity | $ | 2,683,201 | | | | $ | 2,631,554 | | | $ | 51,647 | | |

Total debt (1) | $ | 47,046 | | | | $ | 45,861 | | | $ | 1,185 | | |

Capital (1) | $ | 2,403,961 | | | | $ | 2,342,142 | | | $ | 61,819 | | |

(1)Total debt is a non-GAAP measure calculated as the total of amounts drawn on the Sustainability-Linked Credit Facility, finance lease liabilities and loans payable. Capital is a non-GAAP measure and consists of shareholders’ equity and debt net of cash and cash equivalents and short term investments. Please refer to the “Alternative Performance (Non-GAAP) Measures” section of this MD&A for a detailed description of the calculations.

Liquidity and Capital Resources

The Company's cash and short term investments decreased by $9.0 million during Q1 2022. The decrease was driven by an $11.7 million decrease in cash and cash equivalents from the previously described increase in MPP&E additions and higher dividend payments, partially offset by increased operating cash flows from cash mine operating earnings. Cash mine operating earnings of $165.7 million in Q1 2022 was higher than the $156.9 million generated in Q1 2021 and was sufficient to fund corporate overhead, exploration and care and maintenance expenses, tax payments, and investing and financing activities, which mostly related to payments for property, plant and equipment.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 22 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

Pan American’s investment objectives for its cash balances are to preserve capital, to provide liquidity and to maximize returns. The Company’s strategy to achieve these objectives is to invest excess cash balances in a portfolio of primarily fixed income instruments with specified credit rating targets established by the Board of Directors, and by diversifying the currencies in which it maintains its cash balances. The Company does not own any asset-backed commercial paper or other similar, known, at-risk investments in its investment portfolio.

Working capital of $620.7 million at March 31, 2022 was $7.2 million higher than working capital of $613.5 million at December 31, 2021. The Company also maintains a long term investment in Maverix that was valued at $124.7 million at March 31, 2022.

As of March 31, 2022, the Company was in compliance with all financial covenants under the $500 million revolving Sustainability-Linked Credit Facility, which was undrawn. The borrowing costs under the Company's Sustainability-Linked Credit Facility are based on the Company's leverage ratio subject to pricing adjustments based on the Company's sustainability performance ratings and scores at either (i) LIBOR plus 1.825% to 2.80% or; (ii) The Bank of Nova Scotia's Base Rate on U.S. dollar denominated commercial loans plus 0.825% to 1.80%. Undrawn amounts under the Sustainability-Linked Credit Facility are subject to a stand-by fee of 0.41% to 0.63% per annum, dependent on the Company's leverage ratio and subject to pricing adjustments based on sustainability performance ratings and scores. The Company's Sustainability-Linked Credit Facility matures on August 8, 2025.

The net cash generated from the sales of metal production provides our primary source of cash flows, and we do not currently expect to experience payment delinquencies from our metal sales counterparties during the COVID-19 pandemic, though the impact of COVID-19 on the credit risk associated with our counterparties cannot be determined with any degree of certainty.

The Company’s financial position at March 31, 2022, and the operating cash flows that are expected over the next 12 months, lead Management to believe that the Company’s liquid assets are sufficient to satisfy our 2022 working capital requirements, fund currently planned capital expenditures, and to discharge liabilities as they come due. The Company remains well positioned to take advantage of strategic opportunities as they become available. Liquidity risks are discussed further in the “Risks and Uncertainties” section of this MD&A.

In the normal course of business, the Company enters into contracts that give rise to commitments for future minimum payments, details of which are described in Note 8(e)(ii) of the 2021 Annual Financial Statements, and in the "Liquidity and Capital Position" section of the Company's annual 2021 Management Discussion and Analysis (the "2021 Annual MD&A"). Since December 31, 2021, there have been no significant changes to these contractual obligations and commitments.

The impact of inflation on the Company’s financial position, operational performance, or cash flows over the next 12 months cannot be determined with any degree of certainty due to a number of uncertainties, including those related to the COVID-19 pandemic.

Outstanding Share Amounts

As at March 31, 2022, the Company had approximately 0.2 million stock options outstanding (each exercisable for one common share of the Company), with exercise prices in the range of CAD $9.76 to CAD $39.48 and a weighted average life of 3.9 years. Approximately 0.2 million of the stock options were vested and exercisable at March 31, 2022, with an average weighted exercise price of CAD $18.85 per share.

The following table sets out the common shares and options outstanding as at the date of this MD&A:

| | | | | |

| | Outstanding as at May 11, 2022 |

| Common shares | 210,511,219 | |

| Options | 220,984 | |

| Total | 210,732,203 | |

As part of the acquisition of Tahoe Resources Inc. on February 22, 2019, the Company issued 313,887,490 Contingent Value Rights ("CVRs"), with a term of 10 years, which are convertible into 15,600,208 common shares

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 23 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

upon the first commercial shipment of concentrate following the restart of operations at the Escobal mine. As of March 31, 2022, there were 313,883,990 CVRs outstanding which were convertible into 15,600,034 common shares.

CLOSURE AND DECOMMISSIONING COST PROVISION The estimated future closure and decommissioning costs are based principally on the requirements of relevant authorities and the Company’s environmental policies. The provision is measured using management’s assumptions and estimates for future cash outflows. The Company accrues these costs, which are determined by discounting costs using rates specific to the underlying obligation. Upon recognition of a liability for the closure and decommissioning costs, the Company capitalizes these costs to the related mine and amortizes such amounts over the life of each mine on a unit-of-production basis except in the case of exploration projects for which the offset to the liability is expensed. The accretion of the discount due to the passage of time is recognized as an increase in the liability and a finance expense.

The total inflated and undiscounted amount of estimated cash flows required to settle the Company’s estimated future closure and decommissioning costs as of March 31, 2022 was $451.7 million (December 31, 2021 - $413.0 million) using inflation rates of between 1% and 6% (December 31, 2021 - between 1% and 5%). The inflated and discounted provision on the statement of financial position as at March 31, 2022 was $252.8 million (December 31, 2021 - $242.9 million), using discount rates between 2% and 10% (December 31, 2021 - between 1% and 9%). Spending with respect to decommissioning obligations at Alamo Dorado and Manantial Espejo began in 2016, while the remainder of the obligations are expected to be paid through 2047, or later if the mine lives are extended. Revisions made to the reclamation obligations in Q1 2022 were primarily a result of increased inflation rates, increased discount rates from higher government debt yields, increased site disturbance from the ordinary course of operations at the mines, reclamation activities, and revisions to the estimates based on periodic reviews of closure plans and related costs, actual expenditures incurred, and closure activities completed. These obligations will be funded from operating cash flows, reclamation deposits, and cash on hand.

The accretion of the discount charged in Q1 2022 as finance expense was $3.7 million (Q1 2021 - $1.9 million). Reclamation expenditures incurred during Q1 2022 were $1.0 million (Q1 2021 $0.8 million).

RELATED PARTY TRANSACTIONS The Company’s related parties include its subsidiaries, associates over which it exercises significant influence, and key management personnel. Transactions with the Company's subsidiaries have been eliminated on consolidation. Maverix remained a related party until March 31, 2022. There were no other related party transactions for the three months ended March 31, 2022 and 2021.

ALTERNATIVE PERFORMANCE (NON-GAAP) MEASURES Per Ounce Measures

Cash Costs and AISC are non-GAAP financial measures that do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies.

Pan American produces by-product metals incidentally to our silver and gold mining activities. We have adopted the practice of calculating a performance measure with the net cost of producing an ounce of silver and gold, our primary payable metals, after deducting revenues gained from incidental by-product production. This performance measurement has been commonly used in the mining industry for many years and was developed as a relatively simple way of comparing the net production costs of the primary metal for a specific period against the prevailing market price of that metal.

Silver segment Cash Costs and AISC are calculated net of credits for realized revenues from all metals other than silver ("silver segment by-product credits"), and are calculated per ounce of silver sold. Gold segment Cash Costs

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 24 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

and AISC are calculated net of credits for realized silver revenues ("gold segment by-product credits"), and are calculated per ounce of gold sold.

Cash costs per ounce metrics, net of by-product credits, is used extensively in our internal decision making processes. We believe the metric is also useful to investors because it facilitates comparison, on a mine-by-mine basis, notwithstanding the unique mix of incidental by-product production at each mine, of our operations’ relative performance on a period-by-period basis, and against the operations of our peers in the silver industry. Cash costs per ounce is conceptually understood and widely reported in the mining industry.

We believe that AISC, also calculated net of by-products, is a comprehensive measure of the full cost of operating our consolidated business, given it includes the cost of replacing silver and gold ounces through exploration, the cost of ongoing capital investments (sustaining capital), as well as other items that affect the Company’s consolidated cash flow.

To facilitate a better understanding of these measure as calculated by the Company, the following table provides the detailed reconciliation of these measure to the applicable cost items, as reported in the consolidated financial statements for the respective periods.

| | | | | | | | |

| PAN AMERICAN SILVER CORP. | 25 |

| | | | | |

| Management Discussion and Analysis |

For the three months ended March 31, 2022 and 2021

(tabular amounts are in thousands of U.S. dollars except number of shares, options,

warrants, per share amounts, and per ounce amounts, unless otherwise noted) |

| | | | | | | | | | | | | | |

| | Silver Segment | Gold Segment |

| (In thousands of USD, except as noted) | March 31, 2022 | March 31, 2021 | March 31, 2022 | March 31, 2021 |

Production costs(1) | $ | 97,589 | | $ | 80,601 | | $ | 174,383 | | $ | 112,580 | |

| Purchase Price Allocation Inventory Fair Value Adjustment | — | | — | | — | | (327) | |

| NRV inventory adjustments | (1,353) | | (1,441) | | (13,090) | | 9,585 | |

| On-site direct operating costs | 96,236 | | 79,159 | | 161,293 | | 121,837 | |