Annual

Information

Form

For the Year

Ended December 31, 2022

February 22, 2023

1500-625 Howe Street

Vancouver, British Columbia

V6C 2T6

www.panamericansilver.com

PAN AMERICAN SILVER CORP.

ANNUAL INFORMATION FORM

WHAT’S INSIDE

IMPORTANT INFORMATION ABOUT THIS DOCUMENT

This annual information form (“AIF”) provides important information about Pan American Silver Corp. It describes our business, including our goals and strategy, our history, our operations and development projects, our mineral reserves and mineral resources, our approach to environmental, social and governance (“ESG”) matters, the regulatory environment that we operate in, the risks we face, and the market for our products, among other things.

| | | | | | | | |

| We have prepared this document to meet the requirements of Canadian securities laws, which are different from what US securities laws require. | | Throughout this document, the term Pan American means Pan American Silver Corp. and the terms we, us, and our mean Pan American and its subsidiaries. |

Reporting Currency and Financial Information

Unless we have specified otherwise, all references to dollar amounts or $ or USD are United States dollars. Any references to CAD or CAD$ are Canadian dollars.

All financial information presented in this AIF was prepared in accordance with international financial reporting standards (“IFRS”) as issued by the International Accounting Standards Board.

Non-GAAP Measures

This AIF refers to various non-generally accepted accounting principles (“non-GAAP”) measures, such as cash costs per ounce sold, net of by-product credits (“Cash Costs”), all-in sustaining costs per ounce sold (“AISC”), working capital, net cash, and total debt. Readers should refer to the section entitled “Alternative Performance (Non-GAAP) Measures” in our management’s discussion and analysis for the year ended December 31, 2022 (the “2022 MD&A”) for a detailed description and reconciliation of these non-GAAP measures. The 2022 MD&A is available under our SEDAR profile at www.sedar.com and on our website at www.panamericansilver.com.

Per Ounce Measures - Cash Costs and AISC

Cash Costs and AISC are non-GAAP financial measures that do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies.

Pan American produces by-product metals incidentally to our silver and gold mining activities. We have adopted the practice of calculating a performance measure with the net cost of producing an ounce of silver and gold, our primary payable metals, after deducting revenues gained from incidental by-product production. This performance measurement has been commonly used in the mining industry for many years and was developed as a relatively simple way of comparing the net production costs of the primary metal for a specific period against the prevailing market price of that metal.

Cash costs per ounce metrics, net of by-product credits, is used extensively in our internal decision-making processes. We believe the metric is also useful to investors because it facilitates comparison, on a mine-by-mine basis, notwithstanding the unique mix of incidental by-product production at each mine, of our operations’ relative performance on a period-by-period basis, and against the operations of our peers in the silver and gold industry. Cash costs per ounce is conceptually understood and widely reported in the mining industry.

We believe that AISC, also calculated net of by-products, is a comprehensive measure of the full cost of operating our business, given it includes the cost of replacing silver and gold ounces through exploration, the cost of ongoing capital investments (sustaining capital), general and administrative expenses, as well as other items that affect our consolidated cash flow.

Silver Segment Cash Costs and AISC are calculated net of credits for realized revenues from all metals other than silver (“silver segment by-product credits”) and are calculated per ounce of silver sold. Gold Segment Cash Costs and AISC are calculated net of credits for realized silver revenues (“gold segment by-product credits”) and are calculated per ounce of gold sold.

Included in the Silver Segment for 2022 were the La Colorada, Huaron, Morococha, San Vicente, and Manantial Espejo (including COSE and Joaquin) mines, while the Gold Segment was comprised of the Dolores, Shahuindo, La Arena, Timmins West and Bell Creek mines. The Dolores mine was formerly included in the Silver Segment, but due to the mine’s production profile, we have determined that the Dolores mine is better identified as a Gold Segment operation going forward. As such, beginning in 2021, we began to report Dolores Cash Costs and AISC, including recast comparative amounts, on a per ounce of gold basis and include it as part of its Gold Segment Cash Costs and AISC calculations.

Working Capital

Working capital is a non-GAAP measure calculated as current assets less current liabilities. Working capital does not have any standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. Pan American and certain investors use this information to evaluate whether Pan American is able to meet its current obligations using its current assets.

Total Debt

Total debt is a non-GAAP measure calculated as the total current and non-current portions of long-term debt, finance lease liabilities, and loans payable. Total debt does not have any standardized meaning prescribed by GAAP and is therefore unlikely to be comparable to similar measures presented by other companies. Pan American and certain investors use this information to evaluate the financial debt leverage of Pan American.

Glossary of Terms

The glossary of terms under “Glossary of Terms” of this AIF contains definitions of certain scientific or technical terms used in this AIF that might be useful for your understanding.

Conversion Table

In this AIF, metric units are used with respect to mineral properties unless otherwise indicated. Conversion rates from imperial to metric units and from metric to imperial units are provided in the table set out below.

| | | | | | | | | | | | | | |

| Imperial Measure = Metric Unit | | Metric Unit = Imperial Measure |

| 2.47 acres | 1 hectare | | 0.405 hectares | 1 acre |

| 3.28 feet | 1 metre | | 0.305 metres | 1 foot |

| 0.621 miles | 1 kilometre | | 1.609 kilometres | 1 mile |

| 0.032 ounces (troy) | 1 gram | | 31.1 grams | 1 ounce (troy) |

| 1.102 tons (short) | 1 tonne | | 0.907 tonnes | 1 ton (short) |

| 0.029 ounces (troy)/ton (short) | 1 gram/tonne | | 34.28 grams/tonne | 1 ounce (troy)/ton (short) |

| 2205 pounds | 1 tonne | | 0.454 kilograms | 1 pound |

Caution About Forward-Looking Information

This AIF includes statements and information about our expectations for the future. When we discuss our strategy, plans and future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information or forward-looking statements under Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. We refer to such forward-looking information and forward-looking statements together in this AIF as forward-looking information.

Key things to understand about the forward-looking information in this AIF are:

•It typically includes words and phrases about the future, such as believe, estimate, anticipate, expect, plan, intend, predict, goal, target, forecast, project, scheduled, potential, strategy and proposed (see examples starting on page 4). •It is based on a number of material assumptions, including, but not limited to, those we have listed below, that may prove to be incorrect.

•Actual results and events may be significantly different from what we currently expect, because of, among other things, the risks associated with our business. We list a number of these material risks below under “Material Risks and Assumptions”. We recommend you also review other parts of this AIF, including "Risks Related to Our Business" starting on page 60, and our 2022 MD&A, which includes a discussion of other material risks that could cause our actual results to differ from our current expectations. Forward-looking information is designed to help you understand management’s current views of our near- and longer-term prospects. It may not be appropriate for other purposes. We do not intend to update forward-looking information unless we are required to do so by applicable securities laws.

Examples of Forward-Looking Information in this AIF:

•the price of silver, gold and other metals and assumed foreign exchange rates;

•the sufficiency of our liquid assets to satisfy our 2023 working capital requirements, fund currently planned capital expenditures (including both sustaining and project capital) for existing operations, and to discharge liabilities as they come due;

•the accuracy of mineral reserve and mineral resource estimates at the La Colorada, Dolores, Huaron, Shahuindo, Timmins West, and Bell Creek mines, as well as the Escobal mine and other projects and properties;

•estimated production rates for silver and other payable metals we produce, timing of production and estimated cash and total costs of production;

•our anticipated operating cash flow and the estimated cost of and availability of funding for working capital requirements and capital replacement, improvement or remediation programs, care and maintenance programs, and for future construction and development projects;

•our expectations with respect to successfully closing the Arrangement (as defined below), and the timing for the same;

•our expectation that the Arrangement, if completed, will result in a transformational growth in scale for Pan American;

•our expectation that the Arrangement, if completed, will meaningfully impact our production profile, increase our financial flexibility and enhance our ability to advance internal growth projects;

•our ability to take advantage of further strategic opportunities as they are identified and become available;

•expectations with respect to the anticipated impact of COVID-19 on our operations, assumptions related to the global supply and effectiveness of vaccines, the lessening or increase in pandemic-related restrictions, and the impacts on and duration of global supply chain of goods and services resulting from COVID-19;

•the outcome of the International Labour Organization Convention No. 169 (“ILO 169”) consultation process in Guatemala with respect to the Escobal mine, the resolution of other matters ordered by the courts in Guatemala, and our anticipated engagement with local communities and the Xinka population;

•our plan to provide our 2023 operating outlook and guidance in the second quarter of 2023 following completion of the Arrangement;

•the Escobal and Morococha mines remaining on care and maintenance, and the Manantial Espejo mine entering into the reclamation phase, in 2023;

•our ability to successfully restart the Escobal mine if the ILO 169 consultation-related suspension ends;

•our ability to identify and realize any alternative opportunities for the Morococha mine and what impact such alternatives, if any, may have on our business;

•our ability to obtain necessary permits and licenses, including for current or future operations, project development and expansion;

•the potential future successful development of the Navidad project, the La Colorada skarn and other development projects;

•the effect of the New Mining Law (as defined below) established by the Bolivian government on the current joint venture agreement relating to the San Vicente mine;

•the effects of laws, regulations and government policies affecting our operations, including, without limitation, expectations relating to or the effect of certain highly restrictive laws and regulations applicable to mining in the Province of Chubut, Argentina;

•the estimates of expected or anticipated economic returns from a mining project, as reflected in preliminary economic assessments, pre-feasibility, and feasibility studies or other reports prepared in relation to development of projects;

•our expectation that the ventilation shaft project at La Colorada mine will be completed in mid-2023;

•that we will continue to oppose the SEDATU (as defined below) process relating to La Colorada mine’s surface lands;

•our expectation that UNDRIP and the UNDRIP Act (as those terms are defined below) are likely to result in more robust consultation processes with potentially affected Indigenous peoples;

•estimated exploration expenditures to be incurred on our various exploration properties;

•compliance with environmental, health, safety, and other regulations;

•our goal to continue to be a responsible company, committed to sustainable development and conducting our activities in an environmentally and socially responsible manner, including the development and implementation of policies and practices in support of these goals

•our plan to meet climate-related goals and the anticipated nature and effect of climate-related risks;

•our ability to manage physical and transition risks related to climate change and successfully adapt our business strategy to a low carbon global economy;

•the future results of, and impact on the Pan American, of class action claims in Canada and the United States relating to alleged misrepresentations by Tahoe Resources Inc. ("Tahoe");

•the pursuit of legal and commercial avenues to collect amounts owing to us under our contracts;

•estimated future closure, reclamation and remediation costs;

•our belief that we are well positioned to take advantage of strategic opportunities as they become available;

•forecast capital and non-operating spending;

•future income tax rates;

•our dividend policy;

•future sales of the metals, concentrates or other products produced by us, the availability and location of refining facilities and sales counterparts, and any plans and expectations with respect to hedging;

•our ability to maintain relationships of trust with our stakeholders and community support for our activities;

•continued access to necessary infrastructure, including, without limitation, access to power, water, lands and roads to carry on activities as planned;

•that we will be, or will continue to be, the world’s premier silver producer and one of the world’s leading silver mining companies;

•our intention to acquire or discover silver resources that have the potential to be developed economically and to add meaningfully to our production profile while lowering consolidated costs of production; and

•the results of investment and development activities at our material mineral properties.

Material Risks and Assumptions:

The forward-looking information in this AIF reflects our current views with respect to future events and is based upon a number of assumptions and estimates that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political, environmental, and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by forward-looking information in this AIF and documents incorporated by reference herein, and we have made assumptions based on or related to many of these factors.

Such factors include, without limitation:

•fluctuations in spot and forward markets for silver, gold, base metals, and certain other commodities (such as natural gas, fuel oil and electricity);

•restrictions on mining in the jurisdictions in which we operate;

•laws and regulations governing our operation, exploration, and development activities, including international laws and legal norms, such as those relating to Indigenous peoples and human rights;

•our ability to obtain or renew the licenses and permits necessary for the operation and expansion of our existing operations and for the development, construction, and commencement of new operations, including the license and export permits necessary to operate the Escobal mine which are currently suspended or have not been renewed;

•risks relating to our operations in Canada, Mexico, Peru, Bolivia, Argentina, Guatemala, and other foreign jurisdictions where we may operate;

•the risk that the Mexican Federal Economic Competition Commission will not approve the Arrangement;

•if the Arrangement is completed, our ability to successfully integrate the operations and employees of Yamana Gold Inc. ("Yamana") and its subsidiaries;

•if the Arrangement is completed, the risks associated with maintaining required credit ratings in respect of Pan American, Yamana and Yamana's $500 million aggregate principal amount of 2.63% senior notes due August 2031 and $300 million aggregate principal amount of 4.625% senior notes due December 2027 (collectively, the “Senior Notes”) by third party rating organizations

•Pan American will incur substantial costs in connection with the proposed Arrangement, even if the Arrangement is not completed;

•the consummation of the Arrangement may result in one or more ratings organizations taking actions which may adversely affect Pan American’s business, financial condition and operating results, as well as the market price of the Pan American Shares;

•the Arrangement Agreement may be terminated in certain circumstances;

•if the Arrangement is completed, the integration of Pan American and Yamana may not occur as planned;

•we may not realize the benefits of our newly acquired projects;

•there may be potential undisclosed liabilities associated with the Arrangement;

•failure to complete the Arrangement could also negatively impact the market price of the Pan American Shares;

•if the Arrangement is completed, Pan American will be subject to risks that Yamana currently faces with respect to its business and affairs

•the impact of pandemics such as COVID-19 on our operations, and our and governments’ ability to curtail or control the spread of the virus through health protocols, vaccines, and other means, and to mitigate the multitude of negative effects caused by it;

•inherent risks associated with tailings facilities and heap leach operations, including failure or leakages;

•work stoppages or other impacts of roadblocks, civil unrest, riots, terrorism, and other similar events;

•relations with and claims by Indigenous peoples, local communities, and non-governmental organizations;

•the speculative nature of mineral exploration and development;

•diminishing quantities or grades of mineral reserves as properties are mined;

•the inability to determine, with certainty, the production of metals and cost estimates, or the prices to be received before mineral reserves or mineral resources are actually mined;

•inadequate or unreliable infrastructure (such as roads, bridges, power sources and water supplies);

•environmental regulations and legislation;

•our ability to obtain, maintain, and, when necessary, defend challenges to surface rights or other access that are necessary for continuing and future operations and planned developments, including with respect to the La Colorada mine;

•risks and hazards associated with the business of mineral exploration, development, and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins, and flooding);

•reclamation and ongoing post-closure monitoring and maintenance requirements;

•the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues, including risks and strategies related to the transition to a low-carbon global economy;

•risks relating to the creditworthiness and financial condition of our suppliers, refiners, and other parties;

•fluctuations in currency markets (such as the Peruvian nuevo sol (“PEN”), Mexican peso (“MXN”), Argentine peso (“ARS”), the Bolivian boliviano (“BOB”), and the Guatemalan quetzal (“GTQ”) versus the USD and CAD);

•the volatility of the metals markets, and its potential to impact our ability to meet our financial obligations;

•the inability to recruit and retain qualified personnel, or maintain positive relationships with our employees;

•disputes as to the validity of mining or exploration titles, claims or rights, which constitute most of our property holdings;

•our ability to complete and successfully integrate acquisitions;

•increased competition in the mining industry for properties and equipment;

•limited supply of materials and supply chain disruptions;

•the effectiveness of our internal control over financial reporting;

•claims and legal proceedings arising in the ordinary course of business activities, including the class action claims initiated against Tahoe, or securities class actions or derivative lawsuits in connection with the Arrangement; and

•those factors identified under the caption “Risks Related to our Business” in this AIF and the documents incorporated by reference herein, if any.

You should not attribute undue certainty to forward-looking information. Although we have attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as described. We do not intend to update forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such information, other than as required by applicable law.

Please see “Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources” on page 8 of this AIF. Scientific and Technical Information

Christopher Emerson, FAusIMM, our VP, Business Development and Geology, and Martin Wafforn, P. Eng., our Senior VP, Technical Services and Process Optimization, have reviewed and approved the scientific and technical information in this AIF. Scientific and technical disclosure in this AIF for our material properties is based on reports prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) (collectively, the “Technical Reports”). The Technical Reports have been filed on SEDAR at www.sedar.com. The technical information in this AIF has been updated with more current information where applicable, such updated information having been prepared under the supervision of, or reviewed by, Christopher Emerson and Martin Wafforn. Scientific and technical information relating to current and planned exploration programs set out in this AIF are prepared and/or designed and carried out under the supervision of, or were reviewed by, Christopher Emerson.

The Technical Reports are as follows:

•a report relating to the La Colorada mine entitled “Technical Report for the La Colorada Property, Zacatecas, Mexico”, dated effective December 31, 2019, by M. Wafforn, C. Emerson, and A. Delgado;

•a report relating to the Dolores mine entitled “Technical Report for the Dolores Property, Chihuahua, Mexico”, dated effective June 30, 2022, by M. Wafforn, C. Emerson, and A. Delgado;

•a report relating to the Huaron mine entitled “Technical Report for the Huaron Property, Pasco, Peru” dated effective October 30, 2022, by M. Wafforn, C. Emerson, and A. Delgado;

•a report relating to the Shahuindo mine entitled “Technical Report on the Shahuindo Mine, Cajabamba, Peru” dated effective November 30, 2022, by M. Wafforn, C. Emerson, and A. Delgado;

•a report relating to the Timmins West mine entitled “National Instrument 43-101 Technical Report, Updated Mineral Resource and Mineral Reserve Estimate for the Timmins West Mine Property, Bristol Township, Timmins, Ontario, Canada” dated effective June 30, 2021, by A. Mainville, E. Lachapelle, and D. Felsher;

•a report relating to the Bell Creek mine entitled “National Instrument 43-101 Technical Report, Updated Mineral Resource and Mineral Reserve Estimate For the Bell Creek Mine Property, Hoyle Township, Timmins, Ontario, Canada” dated effective June 30, 2021, by A. Mainville, E. Lachapelle, and D. Felsher; and

•a report relating to the Escobal mine entitled “Escobal Mine Guatemala: NI 43-101 Feasibility Study, Southeastern Guatemala” dated effective November 5, 2014, by M3 Engineering & Technology Corp., with authors C. Huss, T. Drielick, D. Roth, P. Tietz, M. Blattman, and J. Caldwell.

Each of Martin Wafforn, P. Eng., Christopher Emerson, FAusIMM, Americo Delgado, P.Eng., Alain Mainville, P.Geo., Eric Lachapelle, P.Eng., Dave Felsher, P.Eng., Conrad Huss, P.Eng., Thomas Drielick, P.Eng., Daniel Roth, P.Eng., Paul Tietz, C.P.G., Matthew Blattman, P.Eng., and Jack Caldwell, P.Eng. is or was, in relation to the Technical Reports, a “Qualified Person” as defined in NI 43-101. A “Qualified Person” means an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience, or engineering, relating to mineral exploration or mining, with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice, has experience relevant to the subject matter of the mineral project, and is a member in good standing of a professional association.

Mineral reserve and mineral resource estimates in this AIF relating to the La Colorada, Dolores, Huaron, Shahuindo, and Escobal mines have been prepared by, or under the supervision of, Christopher Emerson and Martin Wafforn. Mineral reserve and mineral resource estimates in this AIF relating to the Timmins West and Bell Creek mines have been prepared by, or under the supervision of, Alain Mainville and Eric Lachapelle.

Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources

Unless otherwise indicated, all reserve and resource estimates included in this AIF and the documents incorporated by reference herein have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this AIF and the documents incorporated by reference herein use the terms “measured resources,” “indicated resources” and “inferred resources” as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property disclosure requirements in the United States (the “U.S. Rules”) are governed by subpart 1300 of Regulation S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) which differ from the CIM Standards. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system (the “MJDS”), Pan American is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. If Pan American ceases to be a foreign private issuer or loses its eligibility to file its annual report on Form 40-F pursuant to the MJDS, then Pan American will be subject to the U.S. Rules, which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the new U.S. Rules, the SEC recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources.” In addition, the definitions of “proven mineral reserves” and “probable mineral reserves” under the U.S. Rules are now “substantially similar” to the corresponding standards under NI 43-101. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Pan American reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar” to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Pan American may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Pan American prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.

CORPORATE STRUCTURE

Incorporation

Pan American is the continuing corporation of Pan American Energy Corporation, which was incorporated under the Company Act (British Columbia) on March 7, 1979. Pan American underwent two name changes, the last occurring on April 11, 1995, when the present name of Pan American Silver Corp. was adopted. Amendments to the constating documents of Pan American to that date had been limited to name changes and capital alterations. In May 2006, we amended our memorandum and articles in connection with Pan American’s required transition under the Business Corporations Act (British Columbia), and in January 2019, we obtained shareholder approval to increase our authorized share capital from 200,000,000 to 400,000,000 common shares without par value (“Common Shares”).

Pan American’s head office is situated at 1440 - 625 Howe Street, Vancouver, British Columbia, Canada, V6C 2T6 and our registered and records offices are situated at 1200 Waterfront Centre, 200 Burrard Street, Vancouver, British Columbia, Canada, V7X 1T2. Our website is www.panamericansilver.com.

Capital Structure

Pan American’s authorized share capital consists of 400,000,000 Common Shares and there were 210,680,834 Common Shares issued and outstanding as at December 31, 2022. The holders of Common Shares are entitled to: (i) one vote per Common Share at all meetings of shareholders; (ii) receive dividends as and when declared by the directors of Pan American; and (iii) receive a pro rata share of the assets of Pan American available for distribution to the shareholders in the event of the liquidation, dissolution or winding-up of Pan American. There are no pre-emptive, conversion or redemption rights attached to the Common Shares.

In connection with Pan American’s acquisition (the “Tahoe Acquisition”) of Tahoe, Pan American issued 313,887,490 contingent value rights (each, a “CVR”) to Tahoe shareholders. Each CVR has a term of ten years and is exchangeable for 0.0497 of a Common Share upon first commercial shipment of concentrate following restart of operations at the Escobal mine. The CVRs are not entitled to any voting or dividend rights, and the CVRs do not represent any equity or ownership interest in Pan American or any of its affiliates.

In connection with Pan American’s proposed acquisition of all of the issued and outstanding common shares in the authorized share capital of Yamana (the “Yamana Shares”) following the sale by Yamana of its Canadian assets, including certain subsidiaries and partnerships which hold Yamana’s interests in the Canadian Malartic mine, to Agnico Eagle Mines Limited (“Agnico Eagle”), by way of a plan of arrangement (the “Arrangement”) under the Canada Business Corporations Act (the “CBCA”), our shareholders approved the issuance of up to 156,923,287 Common Shares to the shareholders of Yamana as part of the consideration payable under the Arrangement.

More details about the Arrangement can be found below under the heading, “Business of Pan American”.

Subsidiaries

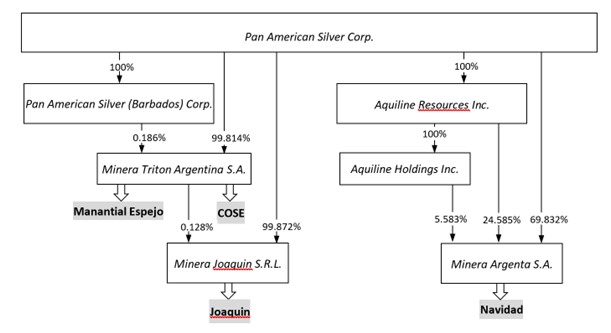

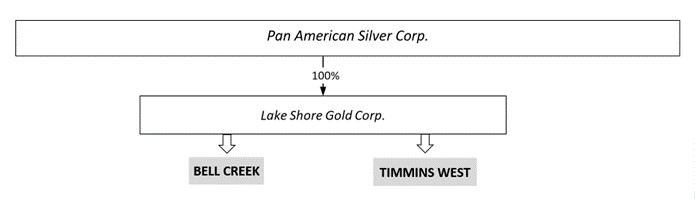

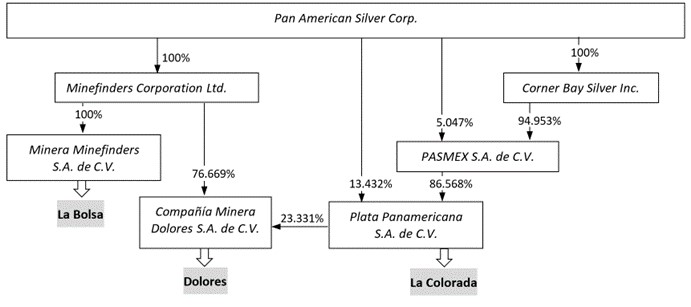

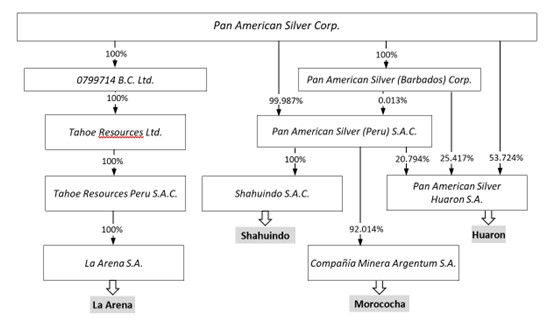

A significant portion of our business is carried on through various subsidiaries. The table below lists our significant subsidiaries and their jurisdiction of organization, and the chart following shows the structure of our organization as it relates to the countries of our mines. Not all of our operating mines are material properties for the purposes of NI 43-101. This information is provided as at December 31, 2022.

| | | | | |

| Name of Subsidiary | Jurisdiction |

| Tahoe Resources Ltd. | Alberta |

| 0799714 B.C. Ltd. | British Columbia |

| Corner Bay Silver Inc. (“Corner Bay”) | Canada |

| Lake Shore Gold Corp. (“Lake Shore”) | Canada |

| Aquiline Resources Inc. (“Aquiline”) | Ontario |

| | | | | |

| Name of Subsidiary | Jurisdiction |

| Minefinders Corporation Ltd. (“Minefinders”) | Ontario |

| Pan American Silver (Barbados) Corp. | Barbados |

| Aquiline Holdings Inc. | Barbados |

| PASCAP Insurance (Barbados) Ltd. | Barbados |

| Escobal Resources Holdings Ltd. | Barbados |

| Minera Triton Argentina S.A. | Argentina |

| Minera Argenta S.A. | Argentina |

| Minera Joaquín S.R.L. | Argentina |

| Pan American Silver (Bolivia) S.A. (“PASB”) | Bolivia |

| Pan American Silver Guatemala, S.A. (“PASG”), formerly Minera San Rafael S.A. | Guatemala |

| PASMEX, S.A. de C.V. | Mexico |

| Plata Panamericana S.A. de C.V. (“Plata Panamericana”) | Mexico |

| Compañía Minera Dolores, S.A. de C.V. (“CMD”) | Mexico |

| Minera Minefinders S.A. de C.V. | Mexico |

| Pan American (Netherlands) B.V. | Netherlands |

| Pan American Silver (Peru) S.A.C. | Peru |

| Pan American Silver Huaron S.A. (“PAS Huaron”) | Peru |

| Compañía Minera Argentum S.A. (“Argentum”) | Peru |

| Tahoe Resources Peru S.A.C. | Peru |

| Shahuindo S.A.C. | Peru |

| La Arena S.A. | Peru |

Corporate Organization by Material Mineral Property Location

The following charts depict the corporate organizational structure of our significant subsidiaries as they relate to the country of our material mineral properties as at December 31, 2022 and identify the main property asset interests (including non-material properties, as applicable) held by the respective entities1.

Argentina Properties

Bolivia Properties

Canada Properties

Mexico Properties

Guatemala Properties

Peru Properties

Note:

1. In some jurisdictions in which we operate, laws require that a company operating mineral properties must have more than one shareholder. For those jurisdictions, a nominal interest may be held by an individual or other affiliated entity and this may not be represented on the charts. Percentages shown indicate ownership of common shares and other voting interests and do not include holdings of investment shares in Peru or other non-voting shares. Percentages are rounded (in most cases, to a maximum of three decimal places). Minority interests of less than 0.0005% are therefore not shown.

GENERAL DEVELOPMENT OF THE BUSINESS

Business of Pan American

We are principally engaged in the operation and development of, and exploration for, silver and gold producing properties and assets. Our principal products are silver and gold, although we also produce and sell zinc, lead, and copper. As at December 31, 2022, we operated mines and developed mining projects in Mexico, Peru, Canada, Argentina and Bolivia, and had control over non-producing silver assets in each of those jurisdictions, in addition to Guatemala and the United States.

With the completion of the Tahoe Acquisition in February 2019, we acquired four operating mines in Peru and Canada, as well as the Escobal mining property and facilities in Guatemala. The Escobal mine is currently not operating primarily as a result of the suspension of its mining license in July 2017, pending, among other things, the successful completion of an ILO 169 consultation process with Xinka communities which is currently underway and which is being led by Guatemala’s Ministry of Energy and Mines. In addition to supporting the consultation process, we believe that it is important to engage with local communities and the Xinka people in an effort to build long-lasting, trusting relationships for the benefit of all stakeholders.

Pan American, Agnico Eagle and Yamana entered into an arrangement agreement dated November 4, 2022 (the “Arrangement Agreement”), in connection with the proposed Arrangement pursuant to which Pan American will acquire all of the issued and outstanding Yamana Shares following the sale by Yamana of its Canadian assets to Agnico Eagle. Pursuant to the Arrangement, the Yamana shareholders will receive for each Yamana Share: (i) 0.1598 of a Common Share to be issued by Pan American; (ii) 0.0376 of a common share in the authorized share capital of Agnico Eagle (an “Agnico Share”) to be issued by Agnico Eagle; and (iii) $1.0406 in cash to be paid by Agnico Eagle. The aggregate consideration represents a value of approximately $4.8 billion or $5.02 per Yamana Share, based on the closing price of our Common Shares and the Agnico Shares on November 3, 2022, the day prior to the announcement of the proposed Arrangement. Both Yamana and Pan American received shareholder approvals related to the Arrangement in their respective special meetings of shareholders held on January 31, 2023, and the final court order in respect of the Arrangement was granted by the Ontario Superior Court of Justice on February 6, 2023. The Arrangement is expected to be completed within the first quarter of 2023, subject to approval from the Mexican Federal Economic Competition Commission and satisfaction or waiver of certain other closing conditions.

Yamana is a leading Canadian-based precious metals producer with significant gold and silver production, development stage properties, exploration properties, and land positions throughout the Americas, including Canada, Brazil, Chile and Argentina. The Arrangement, if completed, will result in a transformational growth in scale for Pan American, adding Yamana’s four producing mines from Latin America – the Jacobina mining complex in Brazil, the El Peñón and Minera Florida mines in Chile, and the Cerro Moro mine in Argentina – plus two development projects in Argentina, to Pan American’s existing portfolio of eight producing mines and other non-operating and development projects in the Americas.

The following map depicts the location of our operating mines and certain of our exploration and non-operating projects as at December 31, 2022.

Corporate Strategy and Objectives

Corporate Strategy and ObjectivesOur mission is to be the world’s premier silver producer with a reputation for excellence in discovery, engineering, innovation and sustainable development. We will continue to strengthen our position as one of the world’s leading primary silver mining companies by acquiring or discovering silver resources that have the potential to be developed economically and to add meaningfully to our production profile while, ideally, lowering consolidated unit costs of production.

The key objectives of our strategy are to:

| | | | | |

| Strategy Objective | Implementation |

| Increase production | Our long-term growth over the years has been accomplished through a combination of acquisition, exploration, development and expansion efforts. The Tahoe Acquisition in February 2019 contributed significantly to our production, particularly gold, and we anticipate meaningful impacts to our future production profile if the Arrangement with Yamana completes. In 2022, we produced 18.5 million ounces of silver, which was slightly less than the 19.2 million ounces produced in 2021. Gold production was 552,500 ounces, slightly less than the 579,300 ounces produced in 2021. |

| Increase mineral reserves and mineral resources | Historically, we have achieved increases in our mineral reserves and mineral resources through exploration and acquisitions. Pan American invests in mine and near-mine exploration programs throughout the silver and gold price cycles and to replace and add to our mineral reserves and mineral resources. However, much like production, our ability to conduct exploration between 2020 and 2022 was hampered by COVID-19. Effective June 30, 2022, our proven and probable silver and gold mineral reserves were approximately 514.9 million ounces and 3.6 million ounces, respectively, which was less than the 529 million ounces of silver and 4.2 million ounces of gold as at June 30, 2021. Similarly, our measured and indicated mineral resources (excluding mineral reserves) were approximately 933.0 million ounces of silver and 8.1 million ounces of gold effective the end of June 2022, which represents an increase of approximately 115 million ounces of silver and a decrease of 0.2 million ounces of gold compared to our June 30, 2021, estimates. Please refer to the complete mineral resource and mineral reserve information for each of our material properties under the heading “Mineral Reserve and Mineral Resource Estimate Information” contained in this AIF, and to the “Reserves & Resources” page of our website at www.panamericansilver.com for additional information. |

| Continue to be a “Low Cost Producer” | In 2019, with the Tahoe Acquisition, we began reporting Cash Costs1 and AISC1 on both a Silver Segment and Gold Segment basis in order to better reflect our assets’ production profiles. For 2022, Silver Segment Cash Costs and AISC were $12.72 and $16.56 per silver ounce sold, respectively, and Gold Segment Cash Costs and AISC in 2022 were $1,113 and $1,459 per gold ounce sold which excludes $98.9 million of net realizable value (“NRV”) adjustments related to the impairment of Dolores in Q2 2022, respectively. |

| | | | | |

| Acquire additional silver properties | We actively investigate and evaluate strategic opportunities to acquire promising silver production, development and exploration properties primarily in those jurisdictions where we are presently active. In November 2022, we announced the proposed Arrangement between Pan American, Agnico Eagle and Yamana. Yamana is a Canadian-based precious metals producer with significant gold and silver production, development stage properties, exploration properties, and land positions throughout the Americas, including Brazil, Chile and Argentina. The proposed acquisition of Yamana is consistent with Pan American’s vision to be the world’s premier silver mining company. In February 2019, we acquired all of the issued and outstanding shares of Tahoe pursuant to the Tahoe Acquisition. Among other assets, Tahoe owned two mines in each of Peru and Canada, as well as the Escobal mine in Guatemala. Operations at the Escobal mine are currently suspended pending the completion of an ILO 169 consultation process and further engagement with local communities and Indigenous peoples, as well as the renewal of certain other permits. In addition to the Arrangement with Yamana and the Tahoe Acquisition, we acquired the Dolores mine and the La Bolsa property by virtue of acquiring Minefinders in 2012, and the Navidad property pursuant to our acquisition of Aquiline in 2010. Please refer to the section of this AIF entitled “Risks Related to Our Business” starting on page 60 for more information about the risks relating to our business and our mining properties, particularly with respect to the Escobal mine, and to our website at www.panamericansilver.com for additional information. |

| Maintain strong financial performance from mining operations | In an effort to ensure we continue to have a strong and prosperous business, financial performance is monitored against targets for operating earnings and cash flow from operations, as well as against operating measures such as production and cash costs. |

| Continue to be a responsible company, committed to sustainable development | We are committed to operating our business in accordance with the highest standards of governance and ethics, and the principles of sustainable development. We also place a high priority and particular emphasis on the health and safety of our personnel. We have operations in a number of countries and across diverse cultures that have the potential to both positively and negatively impact their host communities and nearby populations. Our goal is to minimize the negative impacts and maximize the benefits garnered to local populations, while at the same time achieving success from a business perspective. We conscientiously strive to operate within a framework of moral principles and values and to engage and interact regularly, and in an open and honest way, with governments, shareholders, employees and other stakeholders. We have adopted board-level corporate policies that formalize how we must conduct our business and interact with stakeholders and others. These policies include our: Global Code of Ethical Conduct, Global Anti-Corruption Policy, Environmental Policy, Social Sustainability Policy, Global Human Rights Policy, and Health and Safety Policy. We have also adopted a Supplier Code of Conduct setting out the expectations we have of our suppliers. We are implementing the Towards Sustainable Mining (“TSM”) protocols and frameworks of the Mining Association of Canada (“MAC”), a world-class management standard designed to enhance our community engagement processes, drive industry-leading environmental practices and reinforce our commitment to the safety and health of our employees and surrounding communities. By implementing TSM at our operations within and outside of Canada, we are voluntarily exceeding MAC’s membership requirements and setting a consistently high performance standard across all of our operating jurisdictions. As part of our commitment to driving global sustainable development and contributing to the United Nations Sustainable Development Goals, we became signatories of the United Nations Global Compact in 2020 and we formed a high-level and multidisciplinary group to guide the implementation and communication of our progress in the 10 principles established in the UN Global Compact. We are aware that our business is in many ways dependent on various stakeholders, and we view establishing relationships of mutual trust and respect as important. By building such relationships and conducting ourselves in a transparent manner, we can further the exchange of information, address specific concerns of stakeholders and work cooperatively and effectively towards achieving mutual goals. We report annually on our sustainability performance in accordance with the Global Reporting Initiative Standards and have begun to align our reporting with the Sustainability Accounting Standards Board (“SASB”) and Taskforce on Climate-related Financial Disclosures (“TCFD”) reporting frameworks. Our current TCFD disclosure for the year-ended 2021 has been incorporated into our 2021 Sustainability Report and is available on Pan American’s website at www.panamericansilver.com, and future reports will similarly be posted to our website. |

Note:

1 Cash Costs and AISC are non-GAAP measures and do not have standardized meanings prescribed by IFRS. For additional information, please see “Non-GAAP Measures” on page 2 of this AIF.

Key Developments Over the Last Three Financial Years

| | | | | |

| Year | Key Developments |

| 2022 | •Announced the proposed Arrangement between Pan American, Yamana and Agnico Eagle, which is expected to be transformative for Pan American in terms of scale, provide meaningful increases in our production of gold and silver, increase our financial flexibility, and enhance our ability to advance internal growth projects, such as the La Colorada Skarn project. •Produced 18.5 million ounces of silver and 552,500 ounces of gold. Despite ventilation issues at the La Colorada mine, it continued to lead our silver production with 5.9 million ounces of silver produced in 2022. Huaron and Manantial Espejo followed with 3.7 million and 3.5 million ounces respectively. Shahuindo led gold production with 151,400 ounces of gold produced, followed closely by the Dolores mine and the Timmins West and Bell Creek mines (combined) with 136,900 and 134,600 ounces of gold produced, respectively. •We successfully completed 77,745 metres of underground and surface drilling on the La Colorada Skarn project during 2022, discovering and extending the high-grade silver mineralization zone located to the west of the main skarn resource. •We released an updated mineral resource estimate on the La Colorada Skarn project in September 2022 assuming a sub level caving underground mining method and reported an indicated mineral resource of 95.9 million tonnes with grades averaging 31 grams per tonne (“g/t”) silver, 1.28% lead and 2.77% zinc containing 94.4 million ounces of silver, 1.2 million tonnes of lead and 2.7 million tonnes of zinc, and an inferred mineral resource estimate of 147.8 million tonnes with grades averaging 28 g/t silver, 1.04% lead and 2.29% zinc and containing 132.9 million ounces of silver, 1.5 million tonnes of lead, and 3.4 million tonnes of zinc, using a cut-off value of $45 per tonne after accounting for transportation, smelting and refining costs. •Completed 25,000 meters of drilling at Huaron in 2022 and added 7.0 million ounces of silver mineral reserve in the updated mineral resource and reserve statement in August 2022. Successful exploration drilling to the southeastern portion of the deposit at shallower depths has identified new structures. •The La Colorada mine had a very successful year for exploration with almost a 50% increase in the inferred mineral resource for silver ounces while replacing 108% of the mined production with new mineral reserves. The increase in inferred mineral resources came from the Candelaria mine and the discovery of new veins as well as along strike and down dip projection of the known veins and mineralisation. •The pre-consultation phase of the ILO 169 consultation process relating to the Escobal mine in Guatemala was concluded and the process advanced to the consultation phase. •We placed the Morococha operation on care and maintenance and began to explore strategic alternatives for the asset. •As part of our continued commitment to ESG practices and responsibilities, in May 2022 we released our 2030 greenhouse gas emissions reduction goal to reduce our emissions by 30% from the 2019 baseline by 2030. |

| 2021 | •COVID-19 continued to have a significant impact on our mining activities. Most notably, the production rates of our operations and progress on capital projects was affected by the pandemic. The pandemic continued to cause difficulties and hardship in the communities in which we operate. •Produced 19.2 million ounces of silver and 579,300 ounces of gold. The La Colorada mine continued to lead our silver production with 5.2 million ounces of silver produced in 2021. Huaron and Manantial Espejo followed with 3.5 million and 3.2 million ounces respectively. Dolores led gold production with 160,100 ounces of gold produced, followed closely by the Shahuindo mine and the Timmins West and Bell Creek mines (combined) with 134,000 and 133,800 ounces of gold produced, respectively. •At the La Colorada mine, we successfully cleared a blockage that formed during the commissioning of a primary ventilation raise. This relieved the ventilation-driven constraints that have impacted operations since late 2019 and mine development, mining rates and throughput rates have increased as a result. Multi-year ventilation infrastructure projects are being undertaken in parallel to upgrading and expanding existing underground mine ventilation infrastructure to further improve overall mine ventilation performance and ensure the long-term reliability of this critical infrastructure. •We successfully completed 72,500 metres of underground and surface drilling on the La Colorada skarn increasing the footprint of the mineralisation from 500 metres x 600 metres to 1,400 meters x 650 metres. •As part of our commitment to ESG practices and responsibilities, in August 2021 we amended and extended our $500 million corporate credit facility into a sustainability-linked revolving credit facility (the “Facility”). The 4-year Facility features a pricing mechanism that allows for adjustments on drawn and undrawn balances based on third-party sustainability performance ratings, which aligns our ESG performance to our cost of capital. |

| 2020 | •COVID-19 had a significant impact on the world for much of the year and took a toll on human life and well-being. This included the areas where we work, and the effects were felt by local communities and members of our workforce and their families. Most of our mines were also transitioned to care and maintenance for an average of two months during the year as a result of government restrictions and the implementation of protocols to keep our workforce safe and reduce the spread of the virus. Our Huaron and Morococha operations were suspended for approximately three additional months due to COVID-19. The Timmins operations in Canada remained in operation throughout 2020, operating at reduced rates to accommodate COVID-19 protocols. •Produced 17.3 million ounces of silver and 522,400 ounces of gold. Despite the production disruptions due to COVID-19, the La Colorada mine continued to lead our silver production with 5.0 million ounces of silver produced in 2020, with our Dolores mine producing approximately 3.8 million ounces. Timmins West and Bell Creek (combined) led in gold production, producing nearly 150,000 ounces of gold, followed closely by the Shahuindo mine which produced over 140,000 ounces. Our La Arena and Dolores mines each produced about 100,000 ounces of gold during 2020. •We repaid $275.0 million on the Facility and distributed approximately $46.2 million in dividends to shareholders during the year. |

| | | | | |

|

|

| •Continued exploration of the La Colorada skarn discovery and reported an inferred mineral resource estimate of 100.4 million tonnes with grades averaging 44 g/t silver, 0.20% copper, 1.77% lead and 4.29% zinc, and containing 141.0 million ounces of silver, 4.3 million tonnes of zinc, 1.8 million tonnes of lead, and 199 thousand tonnes of copper using a cut-off value of $60 per tonne after accounting for transportation, smelting and refining costs. •As part of our commitment to driving global sustainable development and contributing to the United Nations Sustainable Development Goals, we became signatories to the United Nations Global Compact in July 2020. We also made advances on our commitment to inclusion and diversity. |

Outlook for 2023

Pan American, Agnico Eagle and Yamana entered into the Arrangement Agreement in November 2022 in connection with the proposed Arrangement pursuant to which Pan American will acquire all of the issued and outstanding Yamana Shares following the sale by Yamana of its Canadian assets to Agnico Eagle as previously described. Both Yamana and Pan American received shareholder approvals related to the Arrangement in their respective special meetings of shareholders held on January 31, 2023, and the final court order in respect of the Arrangement was granted by the Ontario Superior Court of Justice on February 6, 2023. The Arrangement is expected to be completed within the first quarter of 2023, subject to approval from the Mexican Federal Economic Competition Commission and satisfaction or waiver of certain other closing conditions.

We plan to provide our 2023 operating outlook and guidance following the completion of the Arrangement, which would be inclusive of the Latin American assets that are expected to be acquired through the Arrangement, as well as a consolidated forecast for annual general and administrative, exploration and project development costs.

NARRATIVE DESCRIPTION OF THE BUSINESS

Principal Products and Operations

Our principal products and sources of sales are silver and gold doré and silver bearing zinc, lead, and copper concentrates. In 2022, the La Colorada, Dolores, Huaron, Morococha, Shahuindo, La Arena, Timmins West, Bell Creek, Manantial Espejo and San Vicente mines accounted for all of our production of concentrates and doré.

Consolidated production for the year ended December 31, 2022, was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| La Colorada | Huaron | Morococha1 | San Vicente2 | Manantial Espejo3 | Dolores | Shahuindo | La Arena | Timmins4 | Total5 |

Tonnes Milled6 | 641,100 | 938,400 | 100,500 | 346,000 | 642,600 | 7,956,600 | 13,754,800 | 11,486,100 | 1,694,300 | 37,560,500 |

| Grade |

|

|

|

|

|

|

|

|

|

|

| Silver - g/t | 316 | 146 | 112 | 250 | 195 | 18 | 6 | 1 | |

|

| Gold - g/t | 0.26 | 0.24 | 0.21 |

| 1.47 | 0.64 | 0.50 | 0.33 | 2.60 |

|

| Zinc % | 1.85 | 2.25 | 3.12 | 3.29 |

|

|

|

|

|

|

| Lead % | 1.05 | 1.52 | 0.96 | 0.30 |

|

|

|

|

|

|

| Copper % |

| 0.63 | 0.60 | 0.18 |

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

|

|

|

Ounces Silver6 | 5,927,200 | 3,659,700 | 324,300 | 2,525,600 | 3,462,800 | 2,242,000 | 260,300 | 37,600 | 15,300 | 18,454,800 |

Ounces Gold6 | 3,300 | 900 | 100 | 100 | 26,600 | 136,900 | 151,400 | 98,500 | 134,600 | 552,500 |

Tonnes Zinc7 | 10,020 | 16,430 | 2,670 | 9,510 |

|

|

|

| | 38,620 |

Tonnes Lead7 | 5,650 | 11,440 | 730 | 890 |

|

|

|

| | 18,710 |

Tonnes Copper7 | 10 | 4,300 | 470 | 480 |

|

|

|

| | 5,270 |

___________

Notes:

1 Morococha data represents our 92.3% interest in mine production based on ownership of the operating entity. Morococha was placed on care and maintenance in February 2022.

2 San Vicente data represents our 95% interest in mine production based on ownership of the operating entity.

3 Manantial Espejo data includes production from the COSE and Joaquin mines.

4 Timmins refers to the Timmins West and Bell Creek mines.

5 Totals may not add due to rounding.

6 Rounded to the nearest hundred.

7 Rounded to the nearest ten.

Our approximate revenue by product category for the financial years ended December 31, 2022 and December 31, 2021 was as follows:

| | | | | | | | |

| Product Revenue | 2022 | 2021 |

| ($000’s) | ($000’s) |

| Silver and Gold Doré | 1,106,793 | 1,177,388 |

| Zinc Concentrate | 98,341 | 119,059 |

| Lead Concentrate | 167,673 | 145,524 |

| Copper Concentrate | 65,096 | 133,025 |

| Silver Concentrate | 56,815 | 57,754 |

| Total | 1,494,718 | 1,632,750 |

Additional segmented information is set forth in Note 28 to Pan American’s Audited Consolidated Financial Statements for the year ended December 31, 2022, and further information on individual mine performance and other metrics is presented in the 2022 MD&A under the heading “Individual Mine Performance”.

Silver and Gold Doré

Our principal buyers of silver and gold doré produced from our La Colorada, Dolores, Manantial Espejo, Shahuindo, La Arena and Timmins mines, once refined, are international bullion banks and traders, except for the gold produced from La Colorada, which is sold to Maverix Metals Inc. (“Maverix”) pursuant to the Maverix Gold Stream (as defined below) discussed on page 25 herein. Silver and gold doré is delivered to refineries in Canada, Mexico, Germany, Switzerland, and the United States, and subsequently transferred to the accounts of our buyers. Zinc, Lead, Copper and Silver Concentrates

The majority of our concentrate production is sold to international concentrate traders and smelters. Concentrate production from the La Colorada mine is delivered to the buyers at various ports and smelting facilities in Mexico. Concentrate production from the Huaron mine is delivered to the buyers at the port of Callao, Peru, with the exception of a portion of the zinc concentrate which is delivered to the Cajamarquilla smelting facility in Peru. Concentrate production from the San Vicente mine is delivered to the buyers at ports in Chile and Peru. From these ports, the concentrates are shipped by the buyers to various international locations.

Employees and Contractors

At the end of 2022, we had approximately 6,200 employees and about 6,820 contractors. The majority of those employees and contractors were working at our operations in South and Central America, Mexico and Canada. Our Peruvian operations had the largest workforce with approximately 7,210 employees and contractors as of December 31, 2022, while our Mexican operations had approximately 3,440 total employees and contractors. Our Argentina and Bolivia operations had approximately 510 and 640 employees and contractors, respectively, and there were approximately 280 employees and contractors in Guatemala. In Canada, our operations had about 860 employees and contractors, and approximately 70 employees worked for Pan American’s head office in Vancouver, British Columbia at year-end.

Protecting the health, safety and wellbeing of our employees, contractors, suppliers, and community partners where we operate is always a priority for us. However, we are deeply saddened to report that there were three fatal accidents at our operations in 2022. We have conducted full accident investigations with assistance from our local safety committees and relevant authorities and seek to use these accidents as learning tools to prevent recurrences in accordance with our commitment to improving safety performance.

We are advancing several additional safety initiatives, including working with a third-party consultant to incorporate the ‘do safety differently’ concept, the expansion of our training and the technical abilities of our workforce, focussing on the development of leadership skills, and raising even greater awareness and prioritization of safety. In 2022, Pan American joined the Mining Safety Roundtable, a group of participant companies that are committed to eliminating fatalities and major incidents by sharing strategies and best practices to address mining industry hazards and risks. Please refer to the Sustainability page of our website at www.panamericansilver.com for further information on our health and safety programs.

Research and Development

While we conduct feasibility work and operational enhancement evaluations in order to improve production processes and exploration and mining operations, we do not, in the normal course, embark on any research and development activities in relation to products or services. Costs associated with this work would usually be expensed as incurred. As such, we did not incur any significant research and development costs during 2020, 2021 or 2022.

Working Capital and Liquidity Position

As at December 31, 2022, we had cash and cash equivalents and short-term investment balances of $142.3 million and working capital of $423.5 million. The Company also maintained a long-term investment in Maverix which was sold in January 2023 for $105.3 million net of transaction costs. Total debt of $226.8 million included $66.8 million related to lease liabilities and construction loans and $160.0 million related to the Facility to fund transaction costs related to the Arrangement with Yamana.

On April 15, 2015, we entered into the Facility, a $300 million senior secured revolving line of credit available for general corporate purposes, including acquisitions, and originally had a four-year term. In 2016, we amended the Facility to extend the term by an additional year. On February 1, 2019, the Facility was increased by $200 million to $500 million, and further extended to mature on February 1, 2023. In August 2021, the term of the Facility was again extended to mature on August 8, 2025, and a sustainability-linked pricing adjustment feature was added. The borrowing costs under the Facility are based on our leverage ratio subject to pricing adjustments based on sustainability performance ratings and scores at either (i) LIBOR plus 1.825% to 2.80% or; (ii) The Bank of Nova Scotia's Base Rate on U.S. dollar denominated commercial loans plus 0.825% to 1.80%. Undrawn amounts under the Facility are subject to a stand-by fee of 0.41% to 0.63% per annum, dependent on our leverage ratio and subject pricing adjustments based on sustainability performance ratings and scores. The outstanding balance on the Facility was $160.0 million as at December 31, 2022, which is primarily related to the funding of $150 million towards the termination fee payable by Yamana to Gold Fields Limited (“Gold Fields”) in connection with the proposed transaction between Yamana and Gold Fields that was terminated as a result of the Arrangement constituting a superior proposal by Pan American and Agnico.

If the Arrangement with Yamana closes, Pan American would assume Yamana’s obligations with respect to the Senior Notes. The Senior Notes contain certain change of control provisions, the triggering of which would result in a mandatory repurchase of the Senior Notes in accordance with their terms. We do not currently expect that the change of control provisions would be triggered. However, to support the potential financial requirements and to provide financial flexibility and liquidity in connection with the Arrangement, we have obtained a commitment from a Canadian chartered bank to underwrite an amendment to the Facility to increase it to $750 million following closing of the Arrangement as well as to include an additional term loan of up to $500 million to be available for a limited period of time in connection with the Arrangement.

Our financial position as at December 31, 2022, and the operating cash flows that are expected over the next twelve months lead management to believe that our liquid assets and available credit from the Facility are sufficient to satisfy our 2023 working capital requirements, fund currently planned capital expenditures (including both sustaining and project capital) for existing operations, and to discharge liabilities as they come due. We also remain well positioned to take advantage of further strategic opportunities as they are identified and become available.

Environment, Social and Governance

Safe production, the environmentally sound development and operation of assets, and fostering positive long-term relationships with employees, shareholders, communities, and local governments are fundamental to our strategy.

We have implemented a number of policies relating to the environment and sustainability, including an Environmental Policy, a Social Sustainability Policy, a Health and Safety Policy, and an Inclusion and Diversity Policy in which we accept our corporate responsibility to practice environmental stewardship, community engagement and development, and provide a safe, healthy, respectful and open and inclusive workplace for our employees. We also joined the BlackNorth Initiative in June 2020 as part of our commitment to inclusion and diversity and to support the fight against racism. Our Global Code of Ethical Conduct, Global Anti-corruption Policy, and Supplier Code of Conduct, which are available on our website at www.panamericansilver.com, further formalize our commitment to operating ethically. Our directors, officers, executives, and senior management provide annual certifications in connection with the Global Code of Ethical Conduct and Global Anti-corruption Policy, and we provide related training across our organization. We comply with relevant industry standards, legislation and regulations in the countries where we carry on business.

Through our membership in the Mining Association of Canada, we continued to implement the TSM performance system, a world class management standard designed to help mining companies responsibly drive sustainability performance and manage risk. In 2022, we achieved or maintained Level A or higher for all TSM protocols at all operations, except for the Safety protocol at Huaron, Dolores and La Arena where we had fatal accidents.

During 2022, reviews of the environmental and social performance of our operations were led by our Senior Vice President of Corporate Affairs and Sustainability, our Vice President, Social Sustainability, Inclusion and Diversity, and our Vice President, Environment, and our reviews of our tailings facilities were led by our Vice President, Mineral Processing, Tailings and Dams. The reviews typically include in-person inspections of our mine sites and surrounding areas with key operations and corporate team personnel, reviews of monitoring programs and operating procedures, and evaluation of the principal environmental and social issues related to each of these operations. In addition to periodic reviews, detailed environmental audits and sustainability audits are conducted at each operation approximately once every two years.

We conduct environmental audits to assess the mines’ facilities, operating procedures and control systems to ensure that procedures comply with regulations, are consistent with our corporate standards, and that potential risks are being managed. The ability to complete the environmental audit program was partially affected by pandemic-related travel restrictions in 2022; however the Huaron, La Arena, Shahuindo and La Colorada mine audits were completed. In intervening years between audits, the implementation of the corrective actions required by each audit is monitored and confirmed. The Timmins, Dolores, Escobal, San Vicente and Manantial Espejo mines’ corrective actions were found to be satisfactory in 2022.

We continuously work to ensure that all tailings storage facilities, dams, heap leach pads, and waste stockpiles are robustly designed, built, operated, maintained and closed in accordance with our internal standards, the TSM Tailings Management protocol, the Canadian Dam Association guidelines, and known global best practices in order to prevent any incidents or failures. Our tailings storage facilities and water dams are subject to routine inspections, audits, geotechnical and environmental monitoring, annual reviews, and independent reviews to continually improve systems and methods in order to minimize potential harm associated with these long-term facilities. During 2022, tailings management audits and follow-up reviews were undertaken at the Huaron and Timmins mines. Dam safety reviews, or annual inspections in the case of heap leach facilities, were conducted in 2022 by the respective third-party engineers of record on all tailings storage facilities and heap leach pads. In addition, all operating tailings storage facilities have independent reviews conducted by third parties approximately every five years. In 2022, an independent review was carried out at Dolores, which is a heap leach operation. The TSM Tailings Management protocols do not apply directly to heap leach operations or water reservoirs, however, we have adapted these protocols as best practices to heap leach operations. All tailings storage facilities and heap leach pads are in satisfactory condition and monitoring results are normal.

Our Timmins, Dolores, La Colorada, Escobal, La Arena, Shahuindo, Huaron and Manantial Espejo mines were all inspected by government agencies in 2022 and no material environmental issues were recorded.

In the financial year ended December 31, 2022, our environmental expenditures for concurrent reclamation were approximately $4.2 million. The closure and decommissioning liabilities for all sites other than Timmins West, Bell Creek, and Alamo Dorado were prepared using the standard reclamation cost estimator (“SRCE”) methodology developed in the State of Nevada, USA, using quantity estimates and cost data obtained at each mine site. Estimates for Timmins West, Bell Creek and Alamo Dorado were developed by each site using direct estimation with site-specific closure plans, engineering estimates, local rates and contractor quotes. We currently estimate the aggregate present value of expenditures required for future closure and decommissioning costs in respect of the Huaron, Morococha, Shahuindo, La Arena, Alamo Dorado, La Colorada, Dolores, Timmins West, Bell Creek, Manantial Espejo, San Vicente, and Escobal mines, along with our development properties, to be approximately $296.2 million.

We have adopted formal policies, procedures, and industry best practices to manage our impacts and contribute to the social and economic development of local communities. Our social management framework provides a consistent methodology for measuring and tracking social impacts and sustainability performance across our mines, while offering the flexibility needed to tailor our approach to the circumstances of each operation. Our sustainability audits cover human rights, labour, security and social practices. The sustainability audit framework is based on the ISO 26000 guidance standard on social responsibility and is regularly updated to reflect international best practice and standards, such as the TSM Aboriginal and Community Outreach Protocol, the United Nations Guiding Principles on Business and Human Right, UNICEF Canada’s Child Rights and Security Checklist, the Voluntary Principles on Security and Human Rights, and the International Labour Organisation’s

Guide for Enterprise Diagnostics. During 2021, we conducted sustainability audits at the San Vicente, Huaron, Morococha, Shahuindo, La Arena, La Colorada and Dolores mines and in 2022, we conducted sustainability audits at Manantial Espejo and the Timmins West and Bell Creek mines. The key observations and recommendations from the reviews are reported monthly to senior management and quarterly to Pan American’s board of directors (the “Board of Directors”) and its committees, and summary results are presented annually in our Sustainability Reports. In 2021, we established the Communities and Sustainable Development Committee (“CSD Committee”) of the Board of Directors in order to increase our focus on ESG matters. Together, the CSD Committee and the Health, Safety, and Environment Committee oversee our ESG strategy.

In 2019, we adopted a new human rights policy that is based on the three pillars of the United Nations Guiding Principles on Business and Human Rights, as well as the Voluntary Principles on Security and Human Rights and the OECD Guidelines for Multinational Enterprises. This policy consolidates several of our existing objectives in the areas of environment, labour, diversity and social responsibility. It formalizes our approach to fostering a positive human rights culture throughout our organization and our work to prevent, minimize or mitigate adverse impacts from our activities on our employees, communities, and other external stakeholders, including discrimination and harassment. In 2022, all of our operations met the internal audit requirements of the Voluntary Principles on Security and Human Rights and the UNICEF Child Rights and Security Checklist, with three of our Peruvian sites being externally assessed as part of our ongoing external assessment process. In 2022, we also conducted a human rights impact assessment and due diligence process relating to the Escobal mine. During the year, we achieved signatory status with the Voluntary Principles on Security and Human Rights Institute, which has helped us improve our approach to maintaining the safety and security of our operations within an operating framework that supports and respects human rights and fundamental freedoms. We also became observers of the International Code of Conduct Association (“ICoCA”) for Security Providers. Our Latin America security providers are required to be members of the ICoCA for Security Providers and work towards certification if the mining operation has at least three years of life remaining. The Code of Conduct provides a framework for our security providers to improve their services with focus on human rights and humanitarian law. We received external limited assurance from Apex Companies LLC for our compliance with the World Gold Council Conflict Free Standard. This Standard provides us with an approach for identifying and minimizing the risk that our gold production could cause, contribute to, or support unlawful armed conflict. In 2022, we completed the second module of our Building Respect together program (“awareness” module) and covered all of our contractors and employees. We also trained key supervisors and managers in harassment prevention.

We also recognize and respect the rights, cultures, heritage, and interests of Indigenous peoples. We are committed to building and maintaining positive relationships with Indigenous peoples in the regions where we operate through on-going engagement, and identification of mutually beneficial opportunities.

As part of our commitment to driving global sustainable development and contributing to the United Nations Sustainable Development Goals, in 2020, we became signatories to the United Nations Global Compact and established a working group to lead the implementation and develop our first Communications of Progress report, a membership requirement.