UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to § 240.14a-12 | | |

TAXUS CARDIUM PHARMACEUTICALS GROUP INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

TAXUS CARDIUM PHARMACEUTICALS GROUP INC.

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

Date: Thursday, June 5, 2014

Time: 9:00 a.m., Pacific Time

Place: San Diego Marriott Del Mar

11966 El Camino Real

San Diego, California 92130

To our Stockholders:

You are cordially invited to attend the annual meeting of stockholders of Taxus Cardium Pharmaceuticals Group Inc. to consider and act upon the following matters:

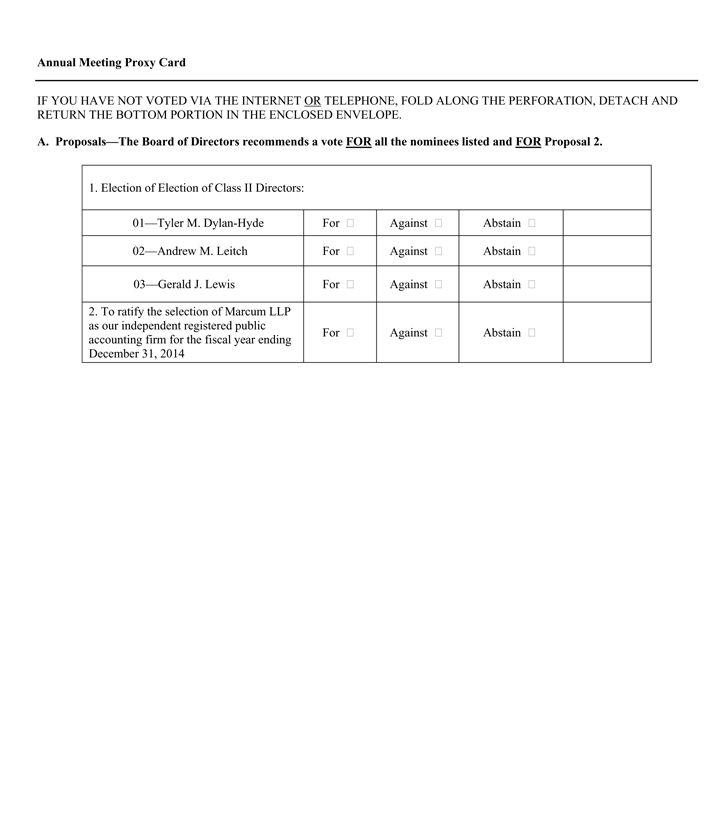

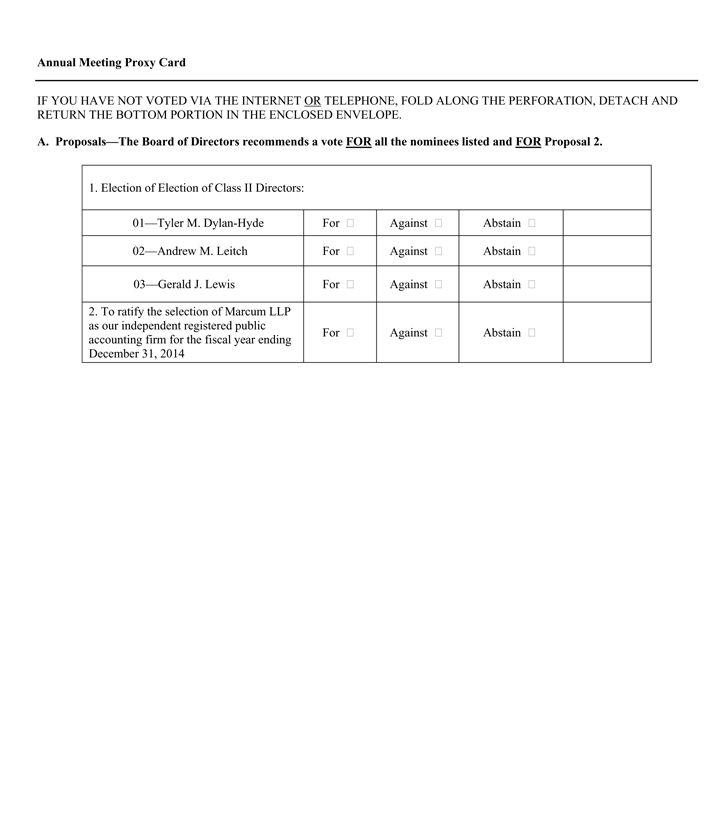

| | 1 | To elect three Class II directors, each to serve until the next annual meeting of stockholders held to elect Class II directors and until their respective successor is elected and qualified; |

| | 2 | To ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| | 3 | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

We recommend that you vote FOR Proposals 1 and 2.

The foregoing matters are more fully described in the proxy statement accompanying this notice. Stockholders of record at the close of business on April 21, 2014, the record date fixed by the Board of Directors, are entitled to notice of and to vote at the meeting and at any adjournment or postponement thereof.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 5, 2014: This notice of meeting, the proxy statement and annual report to stockholders are available on-line at www.materials.proxyvote.com/141916

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote your shares at your earliest convenience. This will help ensure the presence of a quorum at the meeting. Promptly voting your shares by telephone, by the Internet, or by signing, dating, and returning the enclosed proxy card will save us the expense and extra work of additional solicitation. A pre-addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Voting your shares now will not prevent you from attending or voting your shares at the meeting if you desire to do so.

Only stockholders and persons holding proxies from stockholders may attend the meeting. If you plan to attend, please bring a photo ID. If your shares are held in the name of a broker, trust, bank or other nominee, you will need to bring a recent brokerage statement, proxy or letter from that broker, trust, bank or other nominee that confirms you are the beneficial owner of those shares to attend the meeting.

By Order of the Board of Directors

Christopher J. Reinhard

Chairman of the Board, Chief Executive Officer and President

11750 Sorrento Valley Road Suite 250

San Diego, California 92121

(858) 436-1000

April 30, 2014

TAXUS CARDIUM PHARMACEUTICALS GROUP INC.

11750 Sorrento Valley Road, Suite 250

San Diego, California 92121

PROXY STATEMENT

We are providing this proxy statement in connection with the solicitation of proxies by the Board of Directors of Taxus Cardium Pharmaceuticals Group Inc., a Delaware corporation (the “Company,” “Cardium” or “we,” “our,” or “us”), for use at our annual meeting of stockholders to be held on Thursday, June 5, 2014, at 9:00 a.m. Pacific Time, at the San Diego Marriott Del Mar, 11966 El Camino Real, San Diego, California 92130, and at any adjournment or postponement thereof (the “Annual Meeting”). We expect to mail this proxy statement and the enclosed proxy card on or about April 30, 2013 to all stockholders entitled to vote at the Annual Meeting.

VOTING INFORMATION

Who can vote?

You may vote at the Annual Meeting if you were a stockholder of record as of the close of business on April 21, 2014. This date is known as the record date. You are entitled to one vote for each share of common stock you held on that date on each matter presented at the Annual Meeting. As of April 21, 2014, there were 9,652,710 shares of our common stock, par value $0.0001 per share, issued and outstanding.

How many votes are needed to hold the Annual Meeting?

To take any action at the Annual Meeting, a majority of our outstanding shares of common stock entitled to vote as of April 21, 2014, or 4,826,356 shares, must be represented, in person or by proxy, at the Annual Meeting. This is called a quorum.

What is a proxy?

A “proxy” allows someone else to vote your shares on your behalf. Our Board of Directors is asking you to allow the people named on the proxy card (Christopher J. Reinhard and Tyler M. Dylan-Hyde) to vote your shares at the Annual Meeting.

How do I vote by proxy?

Whether you hold shares directly as a stockholder of record or beneficially in street name, you may vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. To vote by proxy, please follow the instructions on the enclosed proxy card. You may vote by telephone, by the Internet or by mail. Shares held in street name may be voted by telephone or by the Internet only if your broker or nominee makes those methods available. Your broker or nominee will enclose instructions for voting shares held in street name by telephone or by the Internet with this proxy statement if your broker or nominee has chosen to make those methods available.

If you vote by proxy, your shares will be voted at the Annual Meeting in the manner you indicate. If you vote by mail and return a signed proxy card with no specific instructions, your shares will be voted as the Board of Directors recommends.

Can I change my vote after I submit my proxy?

Yes. You can change or revoke your proxy at any time before it is voted by submitting another proxy with a later date (via the Internet, by telephone or by mail) or attending the meeting and voting in accordance with the

1

instructions below. You also may send a written notice of revocation to Taxus Cardium Pharmaceuticals Group Inc., 11750 Sorrento Valley Road, Suite 250, San Diego, California 92130, Attention: Tyler M. Dylan-Hyde, Secretary.

Can I vote in person at the Annual Meeting instead of voting by proxy?

Yes. However, we encourage you to vote your shares at your earliest convenience to ensure that your shares are represented and to reduce any expense that the we may incur in soliciting proxies to ensure the presence of a quorum at the Annual Meeting. If you vote your shares by proxy and later decide you would like to attend the meeting and vote your shares in person, you will need to provide a written notice of revocation to the secretary of the meeting before your proxy is voted. If the holder of record of your shares is a broker, bank or other nominee and you wish to vote in person at the meeting, you must request a legal proxy from your broker, bank or other nominee that holds your shares and present that proxy and proof of identification at the Annual Meeting. If you would like to obtain directions to be able to attend the meeting and vote in person, please contact the Company at (858) 436-1000.

How are votes counted?

Except as noted, all proxies received will be counted in determining whether a quorum exists and whether we have obtained the necessary number of votes to approve each proposal. An abstention from voting will be used for the purpose of establishing a quorum, but for purposes of determining the outcome of any proposal as to which the proxy is marked “abstain,” the shares represented by such proxy will not be treated as affirmative votes. In other words, abstentions are not counted with respect to the proposal regarding the election of directors and are treated as votes cast against with respect to the other proposals. A broker non-vote will also be used for the purpose of establishing a quorum, but will not otherwise be counted in the voting process. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the Annual Meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (i) the broker has not received voting instructions from the beneficial owner and (ii) the broker lacks discretionary voting power to vote such shares.

How many votes are required to approve each proposal?

For Proposal 1, the election of the three Class II directors, a plurality of the votes is required. This means that the three candidates who receive the most votes will be elected to the three available Class II positions on the Board of Directors. Please note that a bank, broker or nominee is not permitted to vote on a discretionary basis on behalf of beneficial owners with respect to uncontested elections of directors. If you wish your shares to be voted, you must instruct your bank, broker or nominee on how to vote your shares for the election of directors.

The affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required to ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. See, however, “Proposal 2 – Effect of Ratification.”

As of April 21, 2014, our executive officers and directors held of record or beneficially owned approximately 380,758 shares, or 3.9%, of our issued and outstanding common stock. Our executive officers and directors have indicated their intention to vote FOR the election of each of the nominees for the Class II directors and FOR Proposal 2 ratifying the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014.

Who pays for this proxy solicitation?

The Company will pay the cost of soliciting proxies for the Annual Meeting, including the costs of preparing, assembling and mailing the proxy materials. We will provide copies of proxy materials to fiduciaries, custodians and brokerage houses to forward to the beneficial owners of shares held in their name. We may reimburse such fiduciaries, custodians and brokers for their costs in forwarding the proxy materials.

2

In addition to the solicitation of proxies by mail, certain of our officers and other employees may also solicit proxies personally or by telephone, facsimile, e-mail or other means. No additional compensation will be paid to these individuals for any such services.

OUR BOARD OF DIRECTORS

Board Members

Our Board of Directors is responsible for the overall management of the Company. The Board of Directors is divided into three classes, designated Class I, Class II and Class III. The Board of Directors currently includes two Class I directors, three Class II directors, and two Class III directors. The name, age and business experience of each of our directors are shown below.

CLASS I

Edward W. Gabrielson, M.D. (Age 61)

Director

Dr. Gabrielson has served as a director and a member of the Nominating Committee of the Board of Directors since January 2006. He has more than 25 years of experience as a physician and faculty member at Johns Hopkins University. Currently, Dr. Gabrielson is a Professor of Pathology and Oncology at Johns Hopkins University School of Medicine, and Professor of Environmental Health Sciences at the Johns Hopkins University Bloomberg School of Public Health. He is also an attending physician at the Johns Hopkins Hospital and Bayview Medical Center. Dr. Gabrielson received a Bachelor of Science in Biology and Chemistry from the University of Illinois and an M.D. from Northwestern University Medical School.

Lon E. Otremba (Age 57)

Director

Mr. Otremba is currently the Principal Managing Director of Otremba Management Advisory, LLC, a management advisory firm, and has served as a director and a member of the Nominating Committee of the Board of Directors since January 2006. He previously served as the Chief Executive Officer of Tylted (July 2011-March 2013), which hosts one of the Mobile Web’s largest communities of social, casual gamers. He was also Executive Chairman and a director of Professional Interactive Entertainment (July 2010-2013), a leading provider of Web-based services for video gamers worldwide. Previously he was Chairman and Chief Executive Officer (October 2006- December 2010) of Access 360 Media, a privately-held media company, where he remains a board director. Previously, Mr. Otremba was Chief Executive Officer (September 2003-August 2005) and a director (September 2003-July 2005) of Muzak, LLC; Executive Vice President (2001-2003) of Time Warner; and President and a director (1997-2000) of Mail.com (now Easy Link Services Corp.). He is also currently is a director of EEI Communications (since June 2006), a privately-held leading provider of outsourced new media, print publishing and staffing services. He is a past director of DotMenu, Inc. (2008- 2012) an interactive commerce company, which was acquired by GrubHub; Power Medical Interventions (2006 – 2009), a privately held medical technology company which was acquired by Covidien in September 2009, and Artes Medical, Inc., (from 2006 to 2008) a publicly traded medical technology company which has since filed for bankruptcy.

CLASS II

Tyler M. Dylan-Hyde, Ph.D., J.D. (Age 52)

Director, Chief Business Officer, General Counsel, Executive Vice President and Secretary

Dr. Dylan-Hyde is co-founder of Cardium and has served as a director and as the Company’s General Counsel, Executive Vice President and Secretary since its inception in December 2003, and as its Chief Business Officer

3

since May 2005. Dr. Dylan-Hyde has played a key role in the pre-clinical, clinical and commercial development of the Generx program since 1996. He was a partner in the law firm that developed the Generx intellectual property covering methods of cardiovascular gene therapy based on discoveries by researchers at the University of California, San Diego, and then joined Collateral Therapeutics in 1998. At Collateral, he further advanced the cardiovascular IP and helped lead a five year strategic partnership with Schering AG that supported the clinical development of Generx and ultimately led Schering to purchase Collateral for approximately $160 Million. After Schering was subsequently acquired by Bayer, Dr. Dylan-Hyde and Mr. Reinhard co-founded Cardium Therapeutics to re-acquire rights to the technology and advance the Generx program as a non-surgical approach to the treatment of coronary heart disease. Since August 2006, Dr. Dylan-Hyde has also served as a director and Chief Business Officer, General Counsel, Executive Vice President and Secretary of Tissue Repair Company, a wholly-owned subsidiary of Cardium. He served as a director and Chief Business Officer of Cardium’s subsidiary InnerCool Therapies Inc., from its acquisition in March 2006 until sale of the business to Royal Philips Electronics in July 2009; and its subsidiary To Go Brands, Inc. from its acquisition in September 2012 until sale of the business to Cell-Nique Corporation in November 2013. Previously, he served as the Chief Business Officer, General Counsel, Executive Vice President and Secretary of Aries Ventures Inc. from October 20, 2005 through its merger with Cardium in January 2006. Dr. Dylan-Hyde has focused on the development of innovative biologics and devices for cardiovascular and ischemic diseases for more than fifteen years. He served as General Counsel and Vice President of Collateral Therapeutics, Inc. until its 2002 acquisition by the Schering AG Group (now part of Bayer HealthCare). Dr. Dylan-Hyde played a major role in developing Collateral’s intellectual property portfolio, in furthering its business development efforts and in advancing the company toward and through its acquisition by Schering, and continued as an executive officer and later consultant until 2005. Dr. Dylan-Hyde has advised both privately-held and publicly-traded companies that are developing, partnering or commercializing technology-based products. Before joining Collateral, Dr. Dylan-Hyde was a partner of the law firm of Morrison & Foerster LLP. In his law firm practice, he focused on the development, acquisition and enforcement of intellectual property rights, as well as related business and transactional issues. He also has worked with both researchers and business management in the biotech and pharmaceutical industries. Dr. Dylan-Hyde received a B.Sc. in Molecular Biology from McGill University, Montreal, Canada, a Ph.D. in Biology from the University of California, San Diego, where he performed research at the Center for Molecular Genetics, and a J.D. from the University of California, Berkeley.

Andrew M. Leitch (Age 70)

Director

Mr. Leitch has served as a director and a member of the Audit Committee of the Board of Directors since August 2007, and was appointed Chairman of the Audit Committee and a member of the Compensation Committee in March 2011. Mr. Leitch is a financial industry veteran, having served 28 years in public accounting, including 20 years as a partner in Deloitte & Touche. He was deeply involved in international business, serving in various capacities throughout his career including Asian Regional Partner, Managing Partner of various offices in Asia, and Director of Mergers and Acquisitions for South East Asia. Mr. Leitch currently serves on the Board of Directors of two other publicly listed companies, Blackbaud, Inc. and STR Holdings, Inc. Mr. Leitch previously served as a director and the Chairman of the Audit Committee of Open Energy, Inc.(2006-2007), as a director and a member of the Audit Committee of Wireless Facilities, Inc. (2005-2006), and a director and member of the audit committee of Aldila Inc. (2004 – 2010), all publicly-traded companies at the time of service. He is also a board member of certain private and portfolio companies within leading U.S. and International private equity groups. Mr. Leitch is a Certified Public Accountant.

Gerald J. Lewis (Age 80)

Director

Justice Lewis has served as a director, a member of the Audit Committee and the Chairman of the Compensation Committee of the Board of Directors since January 2006. He served on a number of courts in the

4

California judicial system, and retired from the Court of Appeal in 1987. He has served as an arbitrator or mediator on a large number of cases and was Of Counsel to Latham & Watkins from 1987 to 1997. He has previously served as a director of several publicly-traded companies, including Henley Manufacturing, Wheelabrator Technologies, Fisher Scientific International, California Coastal Properties and General Chemical Group, and was Chairman of the Audit Committee of several of these companies. Justice Lewis was a director of Invesco Mutual Funds from 2000 until 2003, when Invesco became the AIM Mutual Funds, and thereafter served as a director of the AIM Mutual Funds from 2003 to 2006. Since August 2006, Justice Lewis has served as a director and a member of the Audit and Compensation Committees of the Tennenbaum Opportunities Fund.

CLASS III

Murray H. Hutchison (Age 75)

Director

Mr. Hutchison has served as a director, a member of the Audit and Compensation Committees and the Chairman of the Nominating Committee of the Board of Directors since January 2006. He served 27 years as Chief Executive Officer and Chairman of International Technology Corp., a large publicly-traded diversified environmental engineering and construction firm, until his retirement in 1997. Since his retirement, Mr. Hutchison has been self-employed with his business activities involving primarily the management of an investment portfolio and consulting with corporate management on strategic issues. Mr. Hutchison currently serves as a director of Cadiz, Inc. (since 1998), a publicly-traded company focused on land acquisition and water development activities, and The Olson Company (since 1996), a privately-held home builder, and has served on the Audit and Compensation Committees of several publicly-traded companies. Previously, Mr. Hutchison served as Chairman and Chief Executive Officer (1999-2000) of Sunrise Medical, a publicly-traded medical equipment manufacturer, and as a member of the Board of Management of the University of California Berkeley Haas Graduate School of Business Administration. He also has served as a trustee or member of the board of managers of various foundations. Mr. Hutchison holds a B.S. in Economics and a B.B.A. in Foreign Trade.

Christopher J. Reinhard (Age 60)

Chairman of the Board, Chief Executive Officer, President and Treasurer

Mr. Reinhard is co-founder of Cardium and has served as a director and the Chief Executive Officer, President and Treasurer of Cardium since its inception in December 2003. Mr. Reinhard has played a leadership role in the pre-clinical, clinical and commercial development of the Generx program. In 1996, he was co-founder of Collateral Therapeutics, which licensed the Generx technology covering methods of cardiovascular gene therapy based on discoveries by researchers at the University of California, San Diego. He helped lead a five year strategic partnership with Schering AG that supported the clinical development of Generx and ultimately led Schering to purchase Collateral for approximately $160 Million. After Schering was subsequently acquired by Bayer, Mr. Reinhard and Dr. Dylan-Hyde co-founded Cardium Therapeutics to re-acquire rights to the technology and advance the Generx program as a non-surgical approach to the treatment of coronary heart disease. He is also Chief Executive Officer and President of Tissue Repair Company, a wholly-owned subsidiary of Cardium, since August 2006. He served as a director and Chief Executive Officer of Cardium’s subsidiary InnerCool Therapies Inc., from its acquisition in March 2006 until sale of the business to Royal Philips Electronics in July 2009; and its subsidiary To Go Brands Inc., from its acquisition in September 2012 until sale of the business to Cell-Nique Corporation in November 2013. Previously, he served as a director and the Chief Executive Officer, President and Treasurer of Aries Ventures Inc. from October 20, 2005 through its merger with Cardium in January 2006. He also served as Chief Financial Officer of Aries Ventures Inc. from October 20, 2005 to November 16, 2005. For the past fifteen years, Mr. Reinhard has focused on the commercial development of innovative therapeutics and medical devices. Before founding Cardium, he was a co-founder of Collateral Therapeutics, Inc., a former Nasdaq listed public company, and served as a director (from 1995) and President (from 1999) of Collateral Therapeutics until the completion of its acquisition by the Schering AG Group (now part of Bayer HealthCare) in 2002. He continued as Chief Executive of Collateral Therapeutics through December 2004. Mr. Reinhard played a major role in effecting Collateral Therapeutics’ initial public

5

offering in 1998, and the sale of Collateral Therapeutics to Schering. From 2004-2008, Mr. Reinhard was Executive Chairman of Artes Medical, Inc., a publicly-traded medical technology company; and prior to co-founding Collateral Therapeutics, he was Vice President and Managing Director of the Henley Group, a publicly-traded diversified industrial and manufacturing group, and Vice President of various public and private companies created by the Henley Group through spin-out transactions, including Fisher Scientific Group, a leading international distributor of laboratory equipment and test apparatus for the scientific community, Instrumentation Laboratory and IMED Corporation, a medical device company. Mr. Reinhard received a B.S. in Finance and an M.B.A. from Babson College.

In addition to the information above regarding each director’s business experience and service on the boards of directors of other companies, our Board of Directors considered the following experience, qualifications or skills of each of our directors in concluding that each director is qualified to serve as a director. The information below is not intended to be an exhaustive list of the qualifications that the Board of Directors considered with respect to our directors.

Dr. Gabrielson was selected to serve on our Board of Directors because of his medical and general industry experience gained as a practicing physician.

Mr. Otremba we selected to serve on our Board of Directors because of his experience as a management advisor and his media industry experience.

Dr. Dylan-Hyde is a co-founder and serves as an inside director of the Company. He has legal experience as well as scientific, industry and public company experience.

Mr. Leitch served as a licensed CPA for 28 years. He was recruited to join our Board of Directors, in particular, to serve the function of audit committee chairman and financial expert. Mr. Leitch has served as audit committee chair now for three other public companies at various times prior joining the Company.

Justice Lewis was asked to serve on our Board of Directors because of his extensive service on boards of directors of public companies. His experience as a director, and his prior experience as a judge and attorney, provides valuable insight and guidance on matters related to corporate governance.

Mr. Hutchinson was invited to serve as a member of our Board of Directors because of his strong background in managing business organizations and his experience serving as a director of publicly traded companies.

Mr. Reinhard is a co-founder and serves as an inside director and the Chairman of our Board of Directors. He has significant industry experience as well as public company experience.

Board Leadership

The Chairman of our Board of Directors also serves as our Chief Executive Officer. Our Board of Directors does not have a lead independent director. Our Board of Directors has determined that its leadership structure is appropriate and effective. Our Board of Directors believes that having a single individual serve as both chairman and chief executive officer provides clear leadership, accountability and promotes strategic development and execution. Our Board of Directors also believes that there is a high degree of transparency among directors and company management. Five of the seven members of our Board of Directors are independent directors and all of those individuals serve on the committees of our Board of Directors. Our Chairman and Chief Executive Officer does not serve on any committee, which our Board of Directors believes promotes appropriate independent leadership.

Independence

Our Board of Directors, following the review and determination of the Nominating Committee, has determined that five of our seven directors are independent based on the definition of independence set forth in

6

the NYSE MKT Company Guide. The members determined to be independent are Messrs. Gabrielson, Hutchison, Leitch, Lewis, and Otremba. In addition, Messrs. Hutchison, Leitch, and Lewis also have been determined by our Board of Directors to meet the independence standards for members of an audit committee set forth in the rules promulgated under the Securities Exchange Act of 1934.

Board Role in Risk Oversight

Our Board of Directors has an oversight role in managing our risk. Our Audit Committee receives reports from senior management on areas of material risk, including operational, financial, legal and strategic risks which enable the Audit Committee to understand management’s views on risk identification, risk management and risk mitigation strategies. The Audit Committee, or if appropriate, the full Board of Directors or another committee, will periodically request that management evaluate additional potential risks, provide additional information on identified risks, or implement risk remediation procedures.

Board Meetings

Our Board of Directors held 5 meetings during the fiscal year ended December 31, 2013 and took action by written consent on one occasion. Each of the seven current directors serving in 2013 attended at least 75% of the total number of meetings of the Board of Directors and applicable committees that each director was eligible to attend.

Board Committees

Our Board of Directors has established an Audit Committee, a Compensation Committee and a Nominating Committee. The committees are comprised entirely of independent directors as defined under the rules of the NYSE MKT Company Guide. Members of the Audit Committee also must meet the independence standards for audit committee members contained in the Securities Exchange Act of 1934, as amended. The members of each of the committees of our Board of Directors are as follows:

| | | | |

Audit Committee | | Compensation Committee | | Nominating Committee |

Murray H. Hutchison* Andrew M. Leitch (Chairman)* Gerald J. Lewis | | Murray H. Hutchison Gerald J. Lewis (Chairman) Andrew M. Leitch | | Edward W. Gabrielson Murray H. Hutchison (Chairman) Lon E. Otremba |

| * | The Board of Directors has determined that Messrs. Hutchison and Leitch are each an “audit committee financial expert” as defined by applicable rules adopted by the SEC. |

During the year ended December 31, 2013, the Audit Committee held four meetings, the Compensation Committee held one meeting, and the Nominating Committee held one meeting.

Audit Committee. The Audit Committee operates under a charter, a copy of which is available in the corporate governance section of our website at www.cardiumthx.com. The general function of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and the audits of its financial statements. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the accounting, reporting and financial practices of the Company, including the integrity of its financial statements and disclosures; the surveillance of administration and financial controls and the Company’s compliance with legal and regulatory requirements; the qualification, independence and performance of the Company’s independent registered public accounting firm; and the performance of the Company’s internal audit function and control procedures. The Audit Committee has the sole authority to appoint, determine funding for, and oversee the Company’s independent registered public accounting firm.

Compensation Committee. The Compensation Committee operates under a charter, a copy of which is available in the corporate governance section of our website at www.cardiumthx.com. The primary purpose of

7

the Compensation Committee is to oversee the Company’s compensation and incentive programs for its executive officers and certain other key personnel. Among other things, the Compensation Committee recommends to the Board of Directors the amount of compensation to be paid or awarded to our executive officers and certain other personnel including salary, bonuses, other cash or stock awards under our incentive compensation plans as in effect from time to time, retirement and other compensation. In addition, the Board of Directors has delegated to the Compensation Committee the authority to administer the Company’s 2005 Equity Incentive Plan, including the authority to consider and act upon recommendations from management to grant awards under the plan to employees and consultants of the Company and its subsidiaries, not including officers and directors of the Company. The Compensation Committee may delegate its authority to subcommittees of the committee or to committees comprised of Company employees when legally permissible and when the Compensation Committee deems it appropriate or desirable to facilitate the operation or administration of the plans and programs that the committee oversees. The Compensation Committee also may engage the services of an independent compensation and benefits consulting company to conduct a survey and review of the Company’s compensation programs as compared to other similarly situated companies taking into account, among others, industry, size and location when the Compensation Committee deems appropriate. It is anticipated that the Compensation Committee will engage such independent consultants from time to time to aid the committee in its evaluation of the Company’s compensation programs for its executive officers.

Nominating Committee. The Nominating Committee operates under a charter, a copy of which is available in the corporate governance section of our website at www.cardiumthx.com. The purpose of the Nominating Committee is to assist the Board of Directors in identifying qualified individuals to become members of the Board of Directors and in determining the composition of the Board of Directors and its various committees. The Nominating Committee periodically reviews the qualifications and independence of directors, selects candidates as nominees for election as directors, recommends directors to serve on the various committees of the Board of Directors, reviews director compensation and benefits, and oversees the self-assessment process of each of the committees of the Board of Directors.

The Nominating Committee considers nominee recommendations from a variety of sources, including nominees recommended by stockholders. Persons recommended by stockholders are evaluated on the same basis as persons suggested by others. Stockholder recommendations may be made in accordance with our Stockholder Communications Policy. See “Stockholder Communications with Directors” below. The Nominating Committee has the authority to retain a search firm to assist in the process of identifying and evaluating candidates.

The Nominating Committee has not established any specific minimum requirements for potential members of our Board of Directors. Instead, the Nominating Committee’s evaluation process includes many factors and considerations including, but not limited to, a determination of whether a candidate meets the requirements of the NYSE MKT and the Securities Exchange Act of 1934, as amended, relating to independence and/or financial expertise, as applicable, and whether the candidate meets the Company’s desired qualifications in the context of the current make-up of the Board of Directors with respect to factors such as business experience, education, intelligence, leadership capabilities, integrity, competence, dedication, diversity, skills, and the overall ability to contribute in a meaningful way to the deliberations of the Board of Directors respecting the Company’s business strategies, financial and operational performance and corporate governance practices. Our Board of Directors does not have a specific policy with regard to the consideration of diversity in the identification of director nominees. The Nominating Committee will generally select those nominees whose attributes it believes would be most beneficial to the Company in light of all the circumstances.

Code of Ethics

We have adopted a Code of Ethics that applies to all of our employees and directors, including all of our officers and non-employee directors and all employees, officers and directors of our subsidiaries. The Audit Committee periodically reviews the Code of Ethics and the Company’s compliance with its Code of Ethics. Our Code of Ethics has been posted in the corporate governance section of our website at www.cardiumthx.com. Any

8

amendments to our Code of Ethics or any waivers from our Code of Ethics also will be posted on our website. Our Code of Ethics is not incorporated in, and is not a part of, this proxy statement and is not proxy-soliciting material.

Stockholder Communications with Directors

Our Board of Directors has adopted a Stockholder Communications Policy to provide a process by which our stockholders may communicate with our Board of Directors. Under the policy, stockholders may communicate with our Board of Directors as a whole, with the independent directors, with all members of a committee of our Board of Directors, or with a particular director. Stockholders wishing to communicate directly with our Board of Directors may do so by mail addressed to the Company at 11750 Sorrento Valley Road, Suite 250, San Diego, California, 92121, Attn: Corporate Secretary. The envelope should contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication.” All such letters must identify the author as a stockholder of the Company and clearly state whether the intended recipients are all members of the Board of Directors, all independent directors, all members of a committee of the Board of Directors, or certain specified individual directors.

Attendance at Annual Meetings

In recognition that it may not be possible or practicable, in light of other business commitments of the Company’s directors, to attend the Company’s annual meetings of stockholders, the members of the Board of Directors are invited, but not required, to attend each of the Company’s annual meeting of stockholders. At the Company’s last annual meeting of stockholders held on June 6, 2013 and adjourned until July 2, 2013, two members of the Board of Directors were present.

9

PROPOSAL 1

ELECTION OF CLASS II DIRECTORS

Members of each class of our Board of Directors are elected to serve for a three-year term. The three-year terms of the members of each class are staggered, so that each year the members of a different class are due to be elected at the annual meeting. The Class II directors currently are serving a term that is due to expire at the Annual Meeting. The Class III directors currently are serving a term that is due to expire at our 2015 annual meeting, and the Class I directors are serving a term that is due to expire at the 2016 annual meeting.

Nominees

At the Annual Meeting three Class II directors are to be elected, each to serve until the next annual meeting of stockholders held to elect Class II directors and until their respective successor is elected and qualified or until their respective death, resignation or removal. The Board of Directors proposes the election of the nominees named below, who are each currently are Class II members of our Board of Directors.

Vote Required and Board Recommendation

For Proposal 1, the election of the three Class II directors, a plurality of the votes is required. This means that the three candidates who receive the most votes will be elected to the three available Class II positions on the Board of Directors.

Unless authorization to do so is withheld, proxies received will be votedFOR the nominees named below. If any nominee should become unavailable for election before the Annual Meeting, the proxies will be voted for the election of such substitute nominee as the present Board of Directors may propose. The persons nominated for election have agreed to serve if elected, and the Board of Directors has no reason to believe that the nominees will be unable to serve.

Our Board of Directors proposes the election of the following nominees as Class II members of the Board of Directors:

Tyler M. Dylan-Hyde, Andrew M. Leitch, and Gerald J. Lewis

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE ELECTION OF EACH OF THE NOMINEES AS A CLASS II DIRECTOR OF THE COMPANY.

10

PROPOSAL 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our independent registered public accounting firm for the fiscal year ended December 31, 2013 was Marcum LLP. The Audit Committee of the Board of Directors has selected and approved Marcum LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2014. Representatives of Marcum LLP are not expected to be present at the Annual Meeting.

Audit Fees

The aggregate fees billed to the Company by Marcum LLP for professional services rendered for the audit of our annual financial statements, the reviews of the financial statements included in our Quarterly Reports on Form 10-Q and other services normally provided in connection with our statutory and regulatory filings during each of the last two fiscal years ended December 31, were:

| | | | |

2013 | | $ | 158,400 | |

2012 | | $ | 211,100 | |

Audit-Related Fees

There were no fees billed to the Company by Marcum LLP for assurance and related services reasonably related to the performance of the audit or review of our financial statements, and not included under “Audit Fees” above, during the fiscal years ended December 31, 2013 and December 31, 2012.

Tax Fees

There were no fees billed to the Company by Marcum LLP for professional services for tax compliance, tax advice or tax planning during the fiscal years ended December 31, 2013 and December 31, 2012.

All Other Fees

There were no other fees billed to the Company by Marcum LLP for products and services, other than those described above, provided during the fiscal years ended December 31, 2013 and December 31, 2012.

Pre-Approval Policies and Procedures

Committee Pre-Approval. Our Audit Committee has approved certain pre-approval policies and procedures which are contained in its charter. Under these policies and procedures, the Audit Committee must approve in advance all auditing services and all permissible non-audit services to be provided by our independent registered public accounting firm. If the Audit Committee approves an audit service within the scope of the engagement of our independent registered public accounting firm, such audit service will be deemed to have been pre-approved.

Pre-Approval Exceptions. Notwithstanding the Audit Committee pre-approval policies described above, pre-approval is not required for permissible non-audit services if (i) the aggregate amount of all such non-audit services provided to the Company is not more than 5% of the total amount of revenues paid by the Company to its independent registered public accounting firm during the fiscal year in which the non-audit services are provided; (ii) such services were not recognized by the Company at the time of engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Audit Committee and approved before completion of the audit by the Audit Committee or by one or more members of the Audit Committee to whom authority to grant such approvals has been delegated by the Audit Committee.

Delegation of Pre-Approval Authority. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to grant the pre-approvals of audit and permissible non-audit

11

services described above. The decision of any member of the Audit Committee to whom such authority is delegated shall be presented to the full Audit Committee at its next scheduled meeting. The Audit Committee has delegated the authority to grant the pre-approvals of audit and permissible non-audit services to the Chairman of the Audit Committee.

Effect of Ratification

Ratification by stockholders of the selection of Marcum LLP as our independent registered public accounting firm is not required by applicable law. However, as a matter of policy and sound corporate governance, we are submitting the selection to our stockholders for ratification at the Annual Meeting. If the stockholders fail to ratify the selection of Marcum LLP, the Board of Directors will reconsider the matter. Even if the selection is ratified by stockholders, the Board of Directors may select a different firm to serve as our independent registered public accounting firm at any time during the fiscal year if it believes a change would be in the best interests of the Company and its stockholders.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR THE RATIFICATION OF THE SELECTION OF MARCUM LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

12

OUR EXECUTIVE OFFICERS

The Board of Directors appoints the executive officers of the Company who are responsible for administering our day-to-day operations. The names of our current executive officers, their ages as of April 21, 2014, and their positions are shown below. Biographical summaries of each of our executive officers who are not also members of our Board of Directors are included below.

| | | | | | | | | | |

Name of Executive Officer | | Age | | | Position | | Officer

Since | |

Christopher J. Reinhard | | | 60 | | | Chairman of the Board, President, Chief Executive Officer and Treasurer | | | 2003 | |

Tyler M. Dylan-Hyde, Ph.D., J.D. | | | 52 | | | Chief Business Officer, General Counsel, Executive Vice President and Secretary | | | 2003 | |

Dennis M. Mulroy | | | 59 | | | Chief Financial Officer | | | 2005 | |

Gabor M. Rubanyi, M.D., Ph.D. | | | 67 | | | Chief Scientific Officer | | | 2006 | |

Dennis M. Mulroy (Age 59)

Chief Financial Officer

Mr. Mulroy has been the Chief Financial Officer of Cardium since November 2005. Since 2006, he has also served as a director, and as the Chief Financial Officer and Treasurer of Tissue Repair Company, a wholly-owned subsidiary of Cardium. He also served as a director and the Chief Financial Officer of InnerCool Therapies Inc., from its acquisition in March 2006 until sale of the business to Royal Philips Electronics in July 2009; and its subsidiary To Go Brands Inc., from its acquisition in September 2012 until sale of the business to Cell-Nique Corporation in November 2013. Previously, he served as the Chief Financial Officer of Aries Ventures Inc. from November 2005 through its merger with Cardium in January 2006. Before joining Cardium, Mr. Mulroy was Chief Financial Officer of Molecular Imaging Corporation, a publicly-traded diagnostic services company (January 2004 – November 2005), SeraCare Life Sciences, Inc., a publicly-traded company (November 2001 – June 2003), and Bioceutix Inc. (January 2001 – November 2001). Mr. Mulroy was also employed with Ernst & Young in San Diego, California and is a Certified Public Accountant in the State of California (inactive). He received his degree in Business Administration with an emphasis in Accounting from the University of San Diego.

Gabor M. Rubanyi, M.D., Ph.D. (Age 67)

Chief Scientific Officer

Dr. Rubanyi has been the Chief Scientific Officer of Cardium since June 2006. From November 2005 until March 2006, he provided consulting services to Cardium. In March 2006, Dr. Rubanyi became an employee and a Scientific Advisor of Cardium. Before joining Cardium in March 2006, Dr. Rubanyi was Vice President of Gene Therapy at Berlex Biosciences (a subsidiary of Berlex Laboratories, the U.S. pharmaceutical affiliate of the Schering AG Group, now Bayer Schering Pharma), and Adjunct Professor at the University of California, Davis. He initiated and played a leading role in the Angiogenic Gene Therapy for Coronary Artery Disease project at Schering/Berlex. Formerly, Dr. Rubanyi was Director of Vascular and Endothelial Research at Berlex (1992-1999), Director of the Institute of Pharmacology at Schering AG, Research Center, Berlin, Germany (1990-1992), Director of Pharmacology at Berlex Laboratories (1987-1990), and Associate Professor at the Mayo Clinic Medical School (1983-1987). Since 2006, Dr. Rubanyi has served as a director of Hybrid Systems, Ltd., a private, United Kingdom biotech company. Dr. Rubanyi is the author or co-author of 22 books and over 325 research articles, serves as an editorial board member to several biomedical journals and is the founder of the biomedical journal Endothelium. He also is a member of numerous American and international scientific societies. His pioneering work on the nature and characterization of endothelium-derived relaxing factors (nitric oxide) and contracting factors (endothelin) contributed substantially to the Company’s present knowledge about endothelial control of vascular function in health and disease, including angiogenesis.

13

STOCK HOLDINGS OF CERTAIN OWNERS AND MANAGEMENT

The following table sets forth information on the beneficial ownership of our common stock as of April 21, 2014 by (a) each director and nominee for director, (b) each of the named executive officers listed in the compensation tables included in this proxy statement, (c) all of our current directors and executive officers as a group, and (d) each person known to us who beneficially owns more than 5% of the outstanding shares of our common stock. Except as otherwise indicated, the address for each beneficial owner is 11750 Sorrento Valley Road, Suite 250, San Diego, California 92121.

| | | | | | |

Name of Beneficial Owner | | Number of Shares and Nature of

Beneficial Ownership1 | | | Percent of Common

Stock Outstanding2 |

Tyler M. Dylan-Hyde, Ph.D., J.D. Director, Chief Business Officer, Executive Vice President, General Counsel and Secretary | | | 576,050 | 3 | | 5.7% |

| | |

Edward W. Gabrielson, M.D. Director | | | 61,667 | 4 | | Less than 1% |

| | |

Murray H. Hutchison Director | | | 60,000 | 4 | | Less than 1% |

| | |

Andrew M. Leitch Director | | | 60,595 | 4 | | Less than 1% |

| | |

Gerald J. Lewis Director | | | 61,667 | 4 | | Less than 1% |

| | |

Lon E. Otremba Director | | | 61,667 | 4 | | Less than 1% |

| | |

Christopher J. Reinhard Chairman of the Board, Chief Executive Officer, President and Treasurer | | | 696,213 | 5 | | 6.8% |

| | |

Gabor M. Rubanyi, M.D., Ph.D. Chief Scientific Officer | | | 153,350 | 6 | | 1.6% |

| | |

All directors and executive officers as a group (9 persons) | | | 1,881,208 | 7 | | 16.3% |

| | |

Sabby Management Ltd | | | 816,750 | 8 | | 8.5% |

10 Mountainview Road, Suite 205 Upper Saddle River, New Jersey 07458 | | | | | | |

| 1 | A person is considered to be a beneficial owner of shares if the person, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has or shares voting or investment power over the shares, or has the right to acquire beneficial ownership of the shares at any time within 60 days (such as through the exercise of stock options, warrants or other rights). Unless otherwise indicated, voting and investment power relating to the shares shown in the table for our directors and executive officers is exercised solely by the beneficial owner or shared by the owner and the owner’s spouse. |

| 2 | The percentages shown are calculated based on the number of shares of our common stock outstanding plus, for each person or group, any shares that person or group has the right to acquire within 60 days of April 21, 2014 pursuant to options, warrants or other rights. As of April 21, 2014, there were 9,652,710 shares of our common stock outstanding. |

| 3 | Includes 448,550 shares underlying warrants exercisable within 60 days of April 21, 2014. |

| 4 | Includes 60,000 shares underlying options exercisable within 60 days of April 21, 2014. |

| 5 | Includes 548,550 shares underlying warrants exercisable within 60 days of April 21, 2014. |

| 6 | Includes 53,350 shares underlying warrants exercisable within 60 days of April 21, 2014. |

| 7 | Includes 1,430,450 shares underlying options and warrants exercisable within 60 days of April 21, 2014. |

| 8 | Based on information contained in a Schedule 13D filed with the SEC on January 8, 2014. |

14

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and any person who owns more than 10% of our common stock, to file with the SEC initial reports of ownership of our common stock within 10 days of becoming a director, executive officer or greater than 10% stockholder, and reports of changes in ownership of our common stock before the end of the second business day following the day on which a transaction resulting in a change of ownership occurs. Directors, executive officers and greater than 10% stockholders are required by SEC regulations to provide us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on our review of the copies of such reports provided to us and written representations from our directors and executive officers that no other reports were required, during the year ended December 31, 2013, all required Section 16(a) reports applicable to our directors, executive officers and greater than 10% stockholders were timely filed.

15

EXECUTIVE OFFICER COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Overview

The purpose of this “Compensation Discussion and Analysis” section is to discuss the material elements of the compensation awarded to, earned by or paid to our executive officers who are considered “named executive officers” as a result of their officer positions and the amount of compensation they earned during the year ended December 31, 2013. This discussion analyzes the information contained in the tables and related footnotes and narratives under the heading “Executive Compensation” included elsewhere in this proxy statement. In so doing, this discussion describes our compensation philosophy, policies and practices with respect to our named executive officers. Although this discussion focuses primarily on compensation awarded to, earned by and paid to our named executive officers during 2013, this discussion also describes executive compensation actions prior to 2013 and actions taken after 2013 to the extent it enhances the understanding of or gives context to our executive compensation disclosures for 2013.

As described in more detail under the heading “Corporate Governance—Compensation Committee” included elsewhere in this proxy statement, our Board of Directors has delegated to the Compensation Committee the responsibility, among other things, to determine any and all compensation payable to our executive officers, including annual salaries, incentive compensation, long-term incentive compensation and all other compensation, and to administer our equity and incentive compensation plans applicable to our executive officers. The processes and procedures the Compensation Committee use to consider and determine executive compensation are described under the heading “Corporate Governance—Compensation Committee—Processes and Procedures for Consideration and Determination of Executive Compensation” included elsewhere in this proxy statement.

Objectives of Our Executive Compensation Program

Our executive compensation program is designed to:

| | • | | attract and retain executives important to the success of our company and the creation of value for our shareholders; |

| | • | | motivate our executives to achieve our desired financial, earnings and other corporate goals and create shareholder value; and |

| | • | | reward our executives for the achievement of our desired financial, spending and other corporate goals, the creation of shareholder value in the short and long term and their contributions, in general, to the success of our company. |

Our Philosophy

Our executive compensation program and the decisions of the Compensation Committee are based on the following philosophy and principles:

| | • | | We favor linking a significant component of compensation that varies depending on the attainment of financial and spending goals and the performance of our stock price over solely fixed compensation. |

| | • | | Total compensation should generally increase with position and responsibility. A greater percentage of total compensation should be tied to corporate performance, and therefore be at risk, as position and responsibility increases. As a result, individuals, such as our named executive officers, with greater roles and responsibilities associated with achieving our desired financial and spending goals should bear a greater proportion of the risk that those objectives are not achieved than other employees and should receive a greater proportion of the reward if such goals are met or surpassed. |

16

| | • | | We seek to align the interests of our executives with the interests of our shareholders through, among other means, the use of long-term, equity-based incentive compensation. |

Determination of Amount of Executive Compensation and Use of Benchmarking

In determining the amount of compensation to pay our named executive officers, the Compensation Committee considers a variety of factors, such as the executive’s position within the Company and the level of responsibility and skills required by the executive’s position; the executive’s qualifications; the attainment of or failure to attain our financial and spending goals; individual performance of the executive; current and historical compensation levels; the executive’s length of service with our Company and other considerations the Compensation Committee deems relevant.

Our executive compensation program as a whole and each individual element of the program is designed to provide a level of compensation that is competitive for public companies that are comparable to us in terms of profitability, complexity and size in order to attract, motivate and retain executives necessary to the achievement of our desired financial and earnings goals. We generally target total compensation of our executive officers to be within the range of the aggregate compensation that similar companies pay to its executive officers. However, we do not focus on whether or not the total compensation of our executives is above or below the mean or median compensation that is paid to the executive officers of similar companies, because we recognize that trying to tie the compensation that we pay to our executives to any specific metric that is based on the compensation paid by other companies can result in volatility from year to year based on circumstances unique to those companies which may not impact us. We also recognize that those companies may have compensation philosophies that differ from ours.

Determination of Form of Executive Compensation and Total Compensation Mix

The principal elements of our executive compensation program consist of base salary, annual incentive compensation, long-term equity-based incentive compensation, and other compensation as described in more detail below under the heading “—Elements of Our Executive Compensation Program.”

We believe these elements achieve the objectives of our compensation program by providing a base salary which is adjusted to reflect individual and company performance, requiring that our financial and earnings goals be met or exceeded to earn a bonus under our annual cash incentive plan, requiring that specific company-related performance goals be met or exceeded to earn a special annual incentive bonus, and awarding stock options with an exercise price equal to the price of our common stock on the date of grant so that the options will only have value if the market price of our common stock increases over time.

In determining the form of compensation to pay our named executive officers, the Compensation Committee views these elements of our executive compensation program as related but distinct. Although the Compensation Committee reviews total compensation, it does not believe that significant compensation derived by an executive from one element of our compensation program should necessarily negate or result in a reduction in the amount of compensation the executive receives from other elements or that, on the flip side, minimal compensation derived from one element of compensation should necessarily result in an increase in the amount the executive should receive from one or more other elements of compensation.

Except as described below, the Compensation Committee has not adopted any formal or informal policies or guidelines for allocating compensation between long-term and currently paid out compensation, between cash and non-cash compensation, or among different forms of non-cash compensation. However, the Compensation Committee’s philosophy is to make a greater percentage of an executive’s compensation performance-based, and therefore at risk, as the executive’s position and responsibility increases given the influence more senior level executives generally have on company performance. It is also the Compensation Committee’s view to keep cash

17

compensation at a competitive level while providing the opportunity to be fairly rewarded through long-term equity-based incentive compensation if the Company’s stock price performs well over time. Thus, individuals with greater roles and responsibilities associated with achieving our company’s financial and earnings goals, and thus presumably increasing the total return to our shareholders, should bear a greater proportion of the risk that those goals are not achieved than other employees and should receive a greater proportion of the reward if those goals are met or surpassed.

Elements of Our Executive Compensation Program

The principal elements of our executive compensation program for 2013 consisted of:

| | • | | annual incentive compensation, in the form of payments under our annual incentive pay plan and special performance related bonus plan; |

| | • | | long-term equity-based incentive compensation; and |

| | • | | all other compensation. |

In addition, our executive compensation program also includes certain change in control arrangements and post-termination severance arrangements, which are described in more detail below under the heading “—Change in Control and Post-Termination Severance Arrangements.”

Base Salary

General. We provide a base salary for our named executive officers that is not subject to company or individual performance risk. We recognize the need for most executives to receive at least a portion of their total compensation in the form of a guaranteed base salary that is paid in cash regularly throughout the year to support a reasonable standard of living.

We initially set base salaries for our executives at a level that we believe enables us to hire and retain them in a competitive environment and to reward satisfactory individual performance and a satisfactory level of contribution to our overall business objectives.

The Compensation Committee’s determination regarding the base salaries of our named executive officers are based on a number of factors, including: the executive’s level of responsibility, prior experience, base salary for the prior year, base salary and other compensation data for similarly situated executives from some of our peer group companies, the skills required by the position, length of service with our company (or predecessors), past individual performance, company performance and other considerations the Compensation Committee deems relevant. The Compensation Committee also recognizes that in addition to the typical responsibilities and duties held by our executives by virtue of their positions, they often have additional responsibilities and perform additional duties that typically would be delegated to others in most organizations with additional personnel and resources.

Analysis. The2013 Radford Global Life Sciences Survey for U.S. Executive Headcount Data for Companies Under 50 Employees (the “Radford Survey”), a primary benchmarking information source, supports the Company’s current practice of establishing base salaries targeted for approximately 50th percentile based on data from the Radford Survey, adjusted for such factors as years of service, specialized skills applicable to our technologies and businesses as well as competitive factors.

Approved annualized base salary rates for 2012, 2013 and 2014 for our chief executive officer and our two highest paid named executive officers are as follows – it being noted that while the base salary rates for Mr. Reinhard and Dr. Dylan-Hyde in effect since 2012 and approved by stockholders at the Annual Meeting of

18

Stockholders in 2013 remain unchanged, Mr. Reinhard and Dr. Dylan-Hyde voluntarily elected to take only 75% of their base salary during the 4th Quarter of 2013 and continuing in 2014, as shown below.

Annualized Base Salaries Approved by Stockholders:

| | | | | | | | | | | | | | | | | | | | |

Name | | 2012 | | | 2013 | | | % Change

From 2012 | | | 2014 | | | % Change

From 2013 | |

Christopher J. Reinhard | | $ | 385,875 | | | $ | 385,875 | 1 | | | 0.0 | % | | $ | 385,875 | 2 | | | 0.0 | % |

Tyler Dylan-Hyde | | | 358,313 | | | | 358,313 | 3 | | | 0.0 | % | | | 358,313 | 4 | | | 0.0 | % |

Gabor Rubanyi | | | 330,750 | | | | 244,281 | 5 | | | 0.0 | % | | | 36,000 | 5 | | | 0.0 | % |

Notes:

| 1) | Mr. Reinhard voluntarily elected to take only 75% of his base salary during the 4th Quarter of 2013. |

| 2) | Mr. Reinhard is voluntarily electing to take only 75% of his base salary in 2014. |

| 3) | Dr. Dylan-Hyde voluntarily elected to take only 75% of his base salary during the 4th Quarter of 2013. |

| 4) | Dr. Dylan-Hyde is voluntarily electing to take only 75% of his base salary in 2014. |

| 5) | Dr. Rubanyi’s salary has been adjusted as programs have advanced in connection with Generx. |

While the base salary rates for Mr. Reinhard and Mr. Dylan-Hyde in effect since 2012 and approved by stockholders at the Annual Meeting of Stockholders in 2013 remain unchanged, Mr. Reinhard and Mr. Dylan-Hyde voluntarily elected to take only 75% of their base salary during the 4th Quarter of 2013, and are continuing to take reduced salaries in 2014, with the reduced actual rates being as shown below.

Adjusted Salaries Reflecting Voluntary Reductions:

| | | | | | | | | | | | | | | | | | | | |

Name | | 2012 | | | 2013 | | | % Change

From 2012 | | | 2014 | | | % Change

From 2013 | |

Christopher J. Reinhard | | $ | 385,875 | | | $ | 332,817 | | | | (-13.7 | )% | | $ | 289,406 | | | | (-13.0 | )% |

Tyler Dylan-Hyde | | | 358,313 | | | | 309,045 | | | | (-13.7 | )% | | | 268,735 | | | | (-13.0 | )% |

Gabor Rubanyi | | | 330,750 | | | | 244,281 | | | | (-26.1 | )% | | | 36,000 | | | | (-85.3 | )% |

We have historically granted our executive officers an occasional mid-single digit percentage increase in their base salary, although the percentage may be higher or lower if the responsibilities of the executive increased or decreased during the year. For 2012, 2013 and 2014, none of our executive officers was granted an increase to their base salary.

For 2013, base salaries accounted for approximately 100% of total compensation for our Chairman, President and Chief Executive Officer and for the other named executive officers.

Annual Incentive Compensation

General. In addition to base compensation, we provide our named executive officers the opportunity for annual incentive compensation, which is designed to provide a direct financial incentive to our executives to achieve annual financial, earnings and other goals of our Company. We provide our named executive officers a direct financial incentive to achieve our annual goals. In addition, there is possible performance related bonus for our named executive officers to further motivate them to achieve other company-related performance goals. We believe that the combination of our Incentive Pay Plan, which rewards our executives for achieving and exceeding annual financial goals, and the special performance related bonus, which rewards our executives for successfully executing initiatives that we believe will have a positive long-term impact, provides appropriate monetary incentives for our executives to help our Company achieve both near term and long term success.

19

Analysis. The annual incentive compensation awards for our named executive officers for 2013 are summarized below.

Payouts made to our named executive officers were as follows:

| | | | |

| | | Incentive Pay Payouts

for 2013 Performance | |

| | | $ Amount | |

Christopher J Reinhard | | $ | 0 | |

Tyler Dylan-Hyde | | $ | 0 | |

Gabor Rubanyi | | $ | 0 | |

Long-Term Equity-Based Incentive Compensation

General. Although we do not have any stock retention or ownership guidelines, our Board encourages our named executive officers to have a financial stake in our company in order to align the interests of our shareholders and management. We therefore provide long-term equity-based incentive compensation to our named executive officers, as well as to all of our employees. This compensation has historically been paid in the form of founder’s stock grants and or stock options. We believe that equity incentive compensation is an important part of our overall compensation program. In particular, we believe that equity-based compensation, such as stock options, aligns the interests of our executives and other employees with shareholder interests and long-term value creation and enables these individuals to achieve meaningful equity ownership in our Company. Through the grant of stock options, we seek to align the long-term interests of our executives and other employees with the long-term interests of our shareholders by creating a strong and direct linkage between compensation and long-term shareholder return. When our executives deliver positive returns to our shareholders, in the form of increases in our stock price or otherwise, stock options allow our executives and employees to share in this positive return. We believe stock options or other equity-based compensation also may enable us to attract, retain and motivate executives and other employees by maintaining competitive levels of total compensation. Unless our stock price increases after stock option grants are made, the stock options deliver no value to the option holders. A stock option becomes valuable only if our common stock price increases above the option exercise price and the holder of the option remains employed during the period required for the option to “vest.” This provides an incentive for an option holder to remain employed by us.

All of the stock options held by our executives and other employees have been granted under the 2005 Equity Incentive Plan. The plan was been approved by our shareholders. Under the 2005 plan, we have the ability to grant stock options to directors, officers, employees, and outside consultants. To date, only incentive and non-statutory stock options have been granted.

The Compensation Committee has retained all authority to grant options to eligible recipients, and none of its authority may be delegated to our management in the form of “mass” or “block” grants to be allocated among employees by our management. Grants to be made in connection with new hires and performance will be recommended by our Chairman, President and Chief Executive Officer and will be considered and acted upon by the Compensation Committee at the next Compensation Committee meeting or by unanimous written consent resolutions or, in the case of executive officers, as part of their compensation package at the time of hire or promotion. Current executive officers and other employees are eligible for option grants thereafter on a periodic basis. We do not have, nor have we ever had, a program, plan or practice to time stock option grants to executives in coordination with the release of material nonpublic information.

The plan also sets forth the general terms and conditions of our stock option grants. For example, we generally grant “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, in order to provide our executives and other employees the additional tax benefit associated with incentive stock options, which we believe at this time outweighs our interest in obtaining the tax deduction

20

which would be available if we granted non-statutory stock options which were later exercised by the optionees. The stock options granted to our employees typically vest or become exercisable over a period of four years from the date of grant, with one-fourth of the underlying shares vesting on the first anniversary of the date of grant and the remaining vesting monthly over the next three years. Stock options typically remain exercisable for a period of seven years from the date of grant, so long as the optionee continues to be employed by us.

It is our policy to set the per share exercise price of all stock options granted under the 2005 plan at an amount equal to the fair market value of a share of our common stock on the date of grant. For purposes of the 2005 plan, the fair market value of our common stock is the closing sales price as reported by OTC QB or exchange on which our stock is traded.

We review the long-term equity-based incentives for our named executive officers and employees, on an individual basis and on an aggregate basis. The Compensation Committee’s determinations regarding the number of stock options to grant our named executive officers are based on a number of factors, including: the executive’s position within the company and the level of responsibility, skills and experiences required by the executive’s position; the attainment of or failure to attain company objectives and the difficulty in achieving desired company objectives; individual performance of the executive; the executive’s length of service to our company; the executive’s percentage ownership of our common equity outstanding, including stock options; and competitive compensation data, including outstanding options held by an executive as a percentage of our common equity outstanding.

Analysis. While our 2005 plan allows us to grant stock options to all of our employees, including each of our named executive officers, Mr. Reinhard, Dr. Dylan-Hyde, Dr. Rubanyi have refrained from participating in the stock option plan. No stock options were awarded to our named executive officers in 2013.

During 2013, we experienced significant cash constraints. In 2014, after the period covered by this Summary Compensation Table below, partial consideration of the voluntary salary reductions from Mr. Reinhard’s and Dr. Dylan-Hyde’s stockholder-approved salaries, which reductions significantly reduced their salaries in 2013 and 2014, as noted above, the Compensation Committee of the Board of Directors recommended to the full Board of Directors that it award warrants to Mr. Reinhard and Dr. Dylan-Hyde as partial compensation and to serve as an equity incentive. The Board of Directors agreed with the recommendations of the Compensation Committee, and the warrants awarded comprised 548,550 shares for Mr. Reinhard and 448,550 shares for Dr. Dylan-Hyde, subject to certain adjustments and exercisable over a ten year period at $0.80 per share, which was approximately 57% above the closing price of the Company’s common stock on their issue date, February 28, 2014. The Company’s Chief Scientific Officer Dr. Gabor Rubanyi, its Chief Financial Officer Mr. Dennis Mulroy, and its Chief Medical Advisor Dr. Robert Engler, were awarded similar warrants in the amount of 50,000 shares, each at approximately 57% above the closing price on their issue date.

All Other Compensation

General. It is generally our policy not to extend significant perquisites to our executives that are not available to our employees, our executives only receive benefits, which are also received by our other employees, which include health, dental and life insurance benefits. We do not provide pension arrangements or post-retirement health coverage for our executives or employees. We also do not provide any nonqualified defined contribution or other deferred compensation plans or any matching of contributions to a 401(k) plan.

All of our employees, including our named executive officers, are employed at will and do not have employment agreements. We have, however, entered into written severance agreements with all of our named executive officers, which provide for certain cash and other benefits upon the termination of the executive’s employment with us under certain circumstances, as described below.

Change in Control and Post-Termination Severance Arrangements

In July 2010, the Board of Directors adopted a Change in Control Severance Plan that provides severance benefits to certain members of management and employees of the Company. The Company has entered into a

21