Exhibit 99.2

July 23, 2014 Letter to Shareholders Q1 FY15 CIRRUS LOGIC, INC.

Dear Shareholders, Our financial results for the June quarter were at the high end of guidance as we delivered GAAP EPS of $0.16 and non-GAAP EPS of $0.37 on revenue of $152.6 million. Sales of our portable audio products accelerated in Q1, as we continued to experience robust demand for higher performance audio solutions across our customer base. Sales in our energy division remained relatively unchanged from the prior quarter. In the June quarter, we began sampling several new audio products in advanced geometries and are encouraged by the initial feedback from key customers. Cirrus Logic announced its intention on April 29, 2014 to acquire Wolfson Microelectronics for an enterprise value of approximately $467 million. This acquisition augments the company’s core audio signal processing product portfolio, provides differentiated software capabilities, particularly in the Android ecosystem, and adds new product categories such as MEMS microphones. With a diverse customer base and an end-to-end audio solution consisting of a broad selection of custom-and general-market products, the combination of the two companies reinforces Cirrus Logic’s position as a market leader. The additional resources will enable the company to better address the substantial opportunities driving future revenue growth in the portable audio market. During the quarter, we made progress toward meeting the necessary UK regulatory approvals for the acquisition of Wolfson and expect to complete the transaction during our second fiscal quarter. As we do not have an exact close date, please note that all forecasts that we are providing for the second quarter do not include any potential contribution or expenses associated with the Wolfson acquisition.

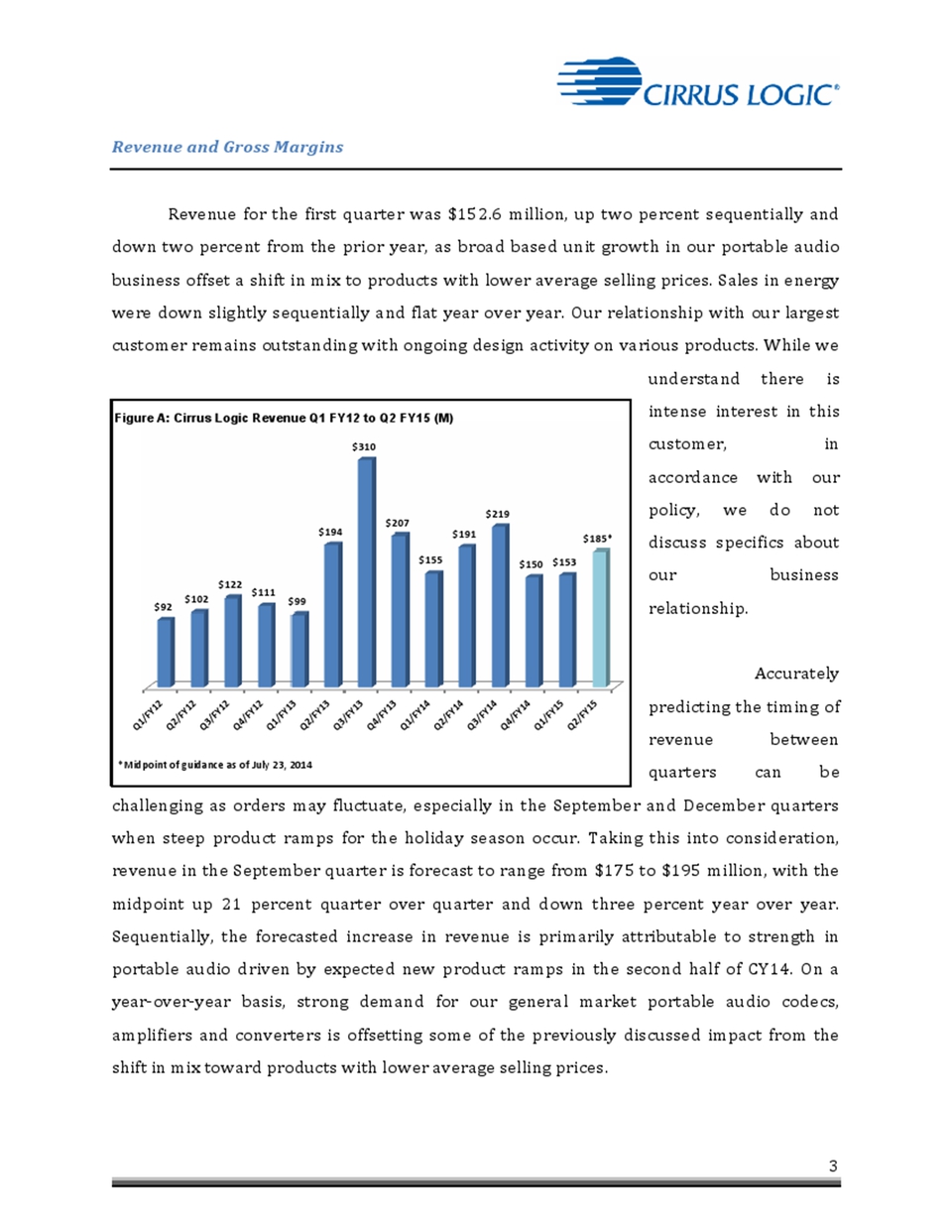

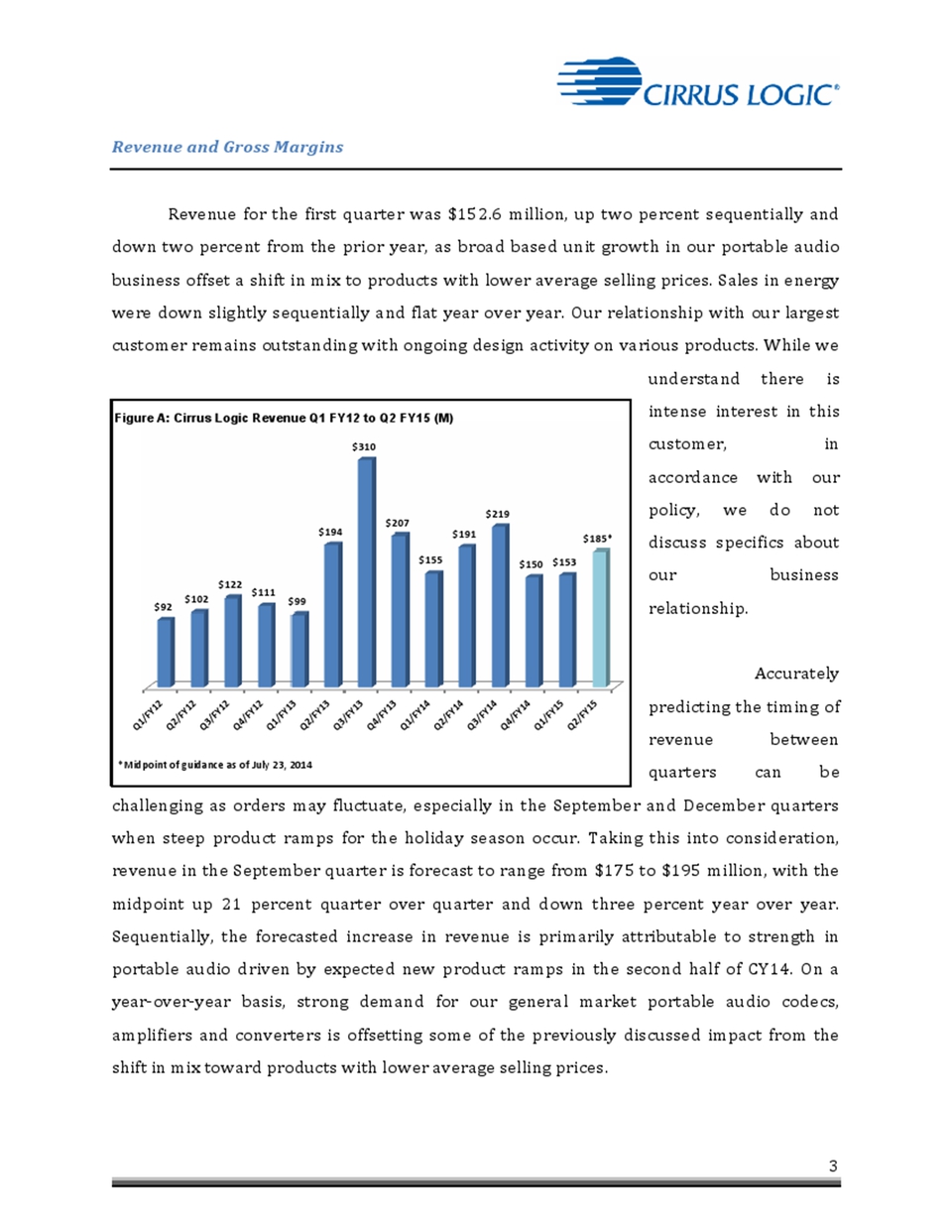

Revenue and Gross Margins Revenue for the first quarter was $152.6 million, up two percent sequentially and down two percent from the prior year, as broad based unit growth in our portable audio business offset a shift in mix to products with lower average selling prices. Sales in energy were down slightly sequentially and flat year over year. Our relationship with our largest customer remains outstanding with ongoing design activity on various products. While we understand there is intense interest in this customer, in accordance with our policy, we do not discuss specifics about our business relationship. Accurately predicting the timing of revenue between quarters can be challenging as orders may fluctuate, especially in the September and December quarters when steep product ramps for the holiday season occur. Taking this into consideration, revenue in the September quarter is forecast to range from $175 to $195 million, with the midpoint up 21 percent quarter over quarter and down three percent year over year. Sequentially, the forecasted increase in revenue is primarily attributable to strength in portable audio driven by expected new product ramps in the second half of CY14. On a year-over-year basis, strong demand for our general market portable audio codecs, amplifiers and converters is offsetting some of the previously discussed impact from the shift in mix toward products with lower average selling prices. Figure A: Cirrus Logic Revenue Q1 FY12 to Q2 FY15 (M) *Midpoint)of)guidance)as)of)July)23,)2014) Q1/FY12' Q2/FY12' Q3/FY12' Q4/FY12' Q1/FY13' Q2/FY13' Q3/FY13' Q4/FY13' Q1/FY14' Q2/FY14' Q3/FY14' Q4/FY14' Q1/FY15' Q2/FY15' $92'' $102'' $122'' $111'' $99'' $194'' $310'' $207'' $155'' $191'' $219'' $150'' $153'' $185*''

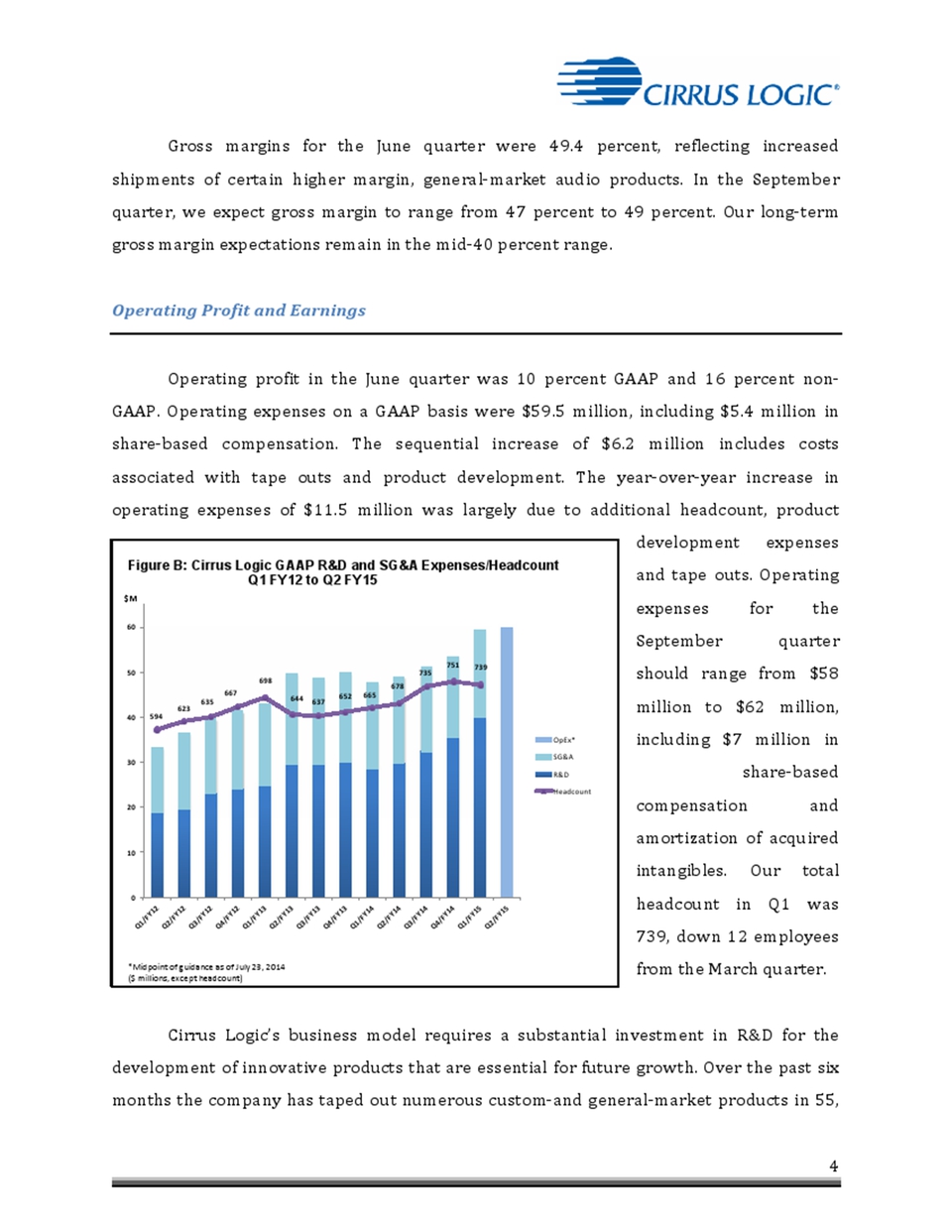

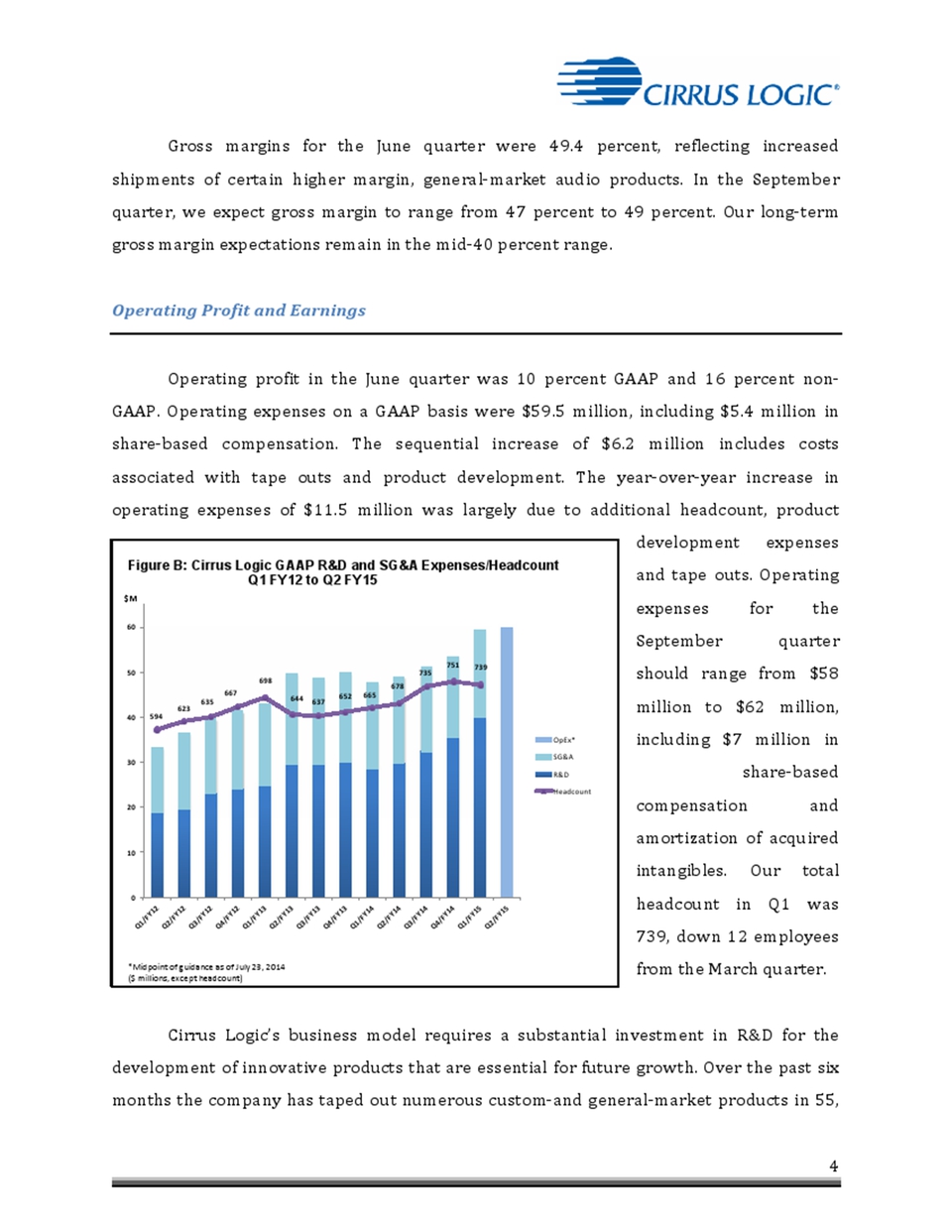

Gross margins for the June quarter were 49.4 percent, reflecting increased shipments of certain higher margin, general-market audio products. In the September quarter, we expect gross margin to range from 47 percent to 49 percent. Our long-term gross margin expectations remain in the mid-40 percent range. Operating Profit and Earnings Operating profit in the June quarter was 10 percent GAAP and 16 percent non-GAAP. Operating expenses on a GAAP basis were $59.5 million, including $5.4 million in share-based compensation. The sequential increase of $6.2 million includes costs associated with tape outs and product development. The year-over-year increase in operating expenses of $11.5 million was largely due to additional headcount, product development expenses and tape outs. Operating expenses for the September quarter should range from $58 million to $62 million, including $7 million in share-based compensation and amortization of acquired intangibles. Our total headcount in Q1 was 739, down 12 employees from the March quarter. Cirrus Logic’s business model requires a substantial investment in R&D for the development of innovative products that are essential for future growth. Over the past six months the company has taped out numerous custom-and general-market products in 55, 65, and 180 nanometers designed for the rapidly growing audio and voice markets. We expect development activity to accelerate in the September quarter as we continue to tape out new mixed-signal products in advanced geometries. Figure B: Cirrus Logic GAAP R&D and SG&A Expenses/Headcount Q1 FY12 to Q2 FY15 *Midpoint of guidance as of July 23, 2014 ($ millions, except headcount) 594 623 635 667 698 644 637 652 665 678 735 751 739 0 10 20 30 40 50 60 Q1/FY12 Q2/FY12 Q3/FY12 Q4/FY12 Q1/FY13 Q2/FY13 Q3/FY13 Q4/FY13 Q1/FY14 Q2/FY14 Q3/FY14 Q4/FY14 Q1/FY15 Q2/FY15 OpEx*SG&A R&D Headcount $M

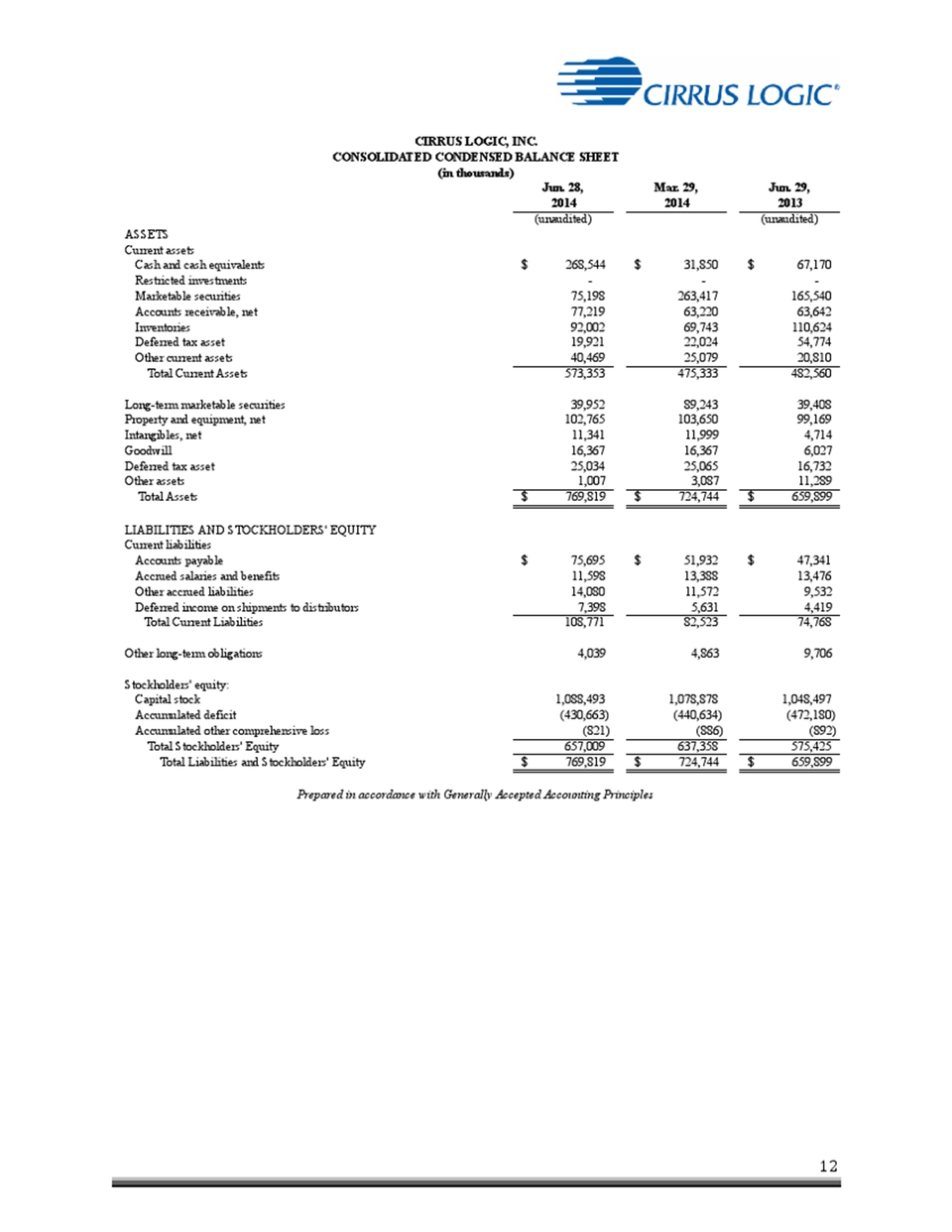

The ending cash balance in the June quarter was $383.7 million, relatively flat from the prior quarter, due in part to expenditures associated with the Wolfson acquisition. This transaction will be financed through a combination of existing cash on the balance sheet and $225 million in debt funding. Cash from operations in Q1 was $13 million. Taxes and Inventory Our GAAP tax expense during the quarter was $5.7 million, which included $5.2 million of non-cash expense associated with our deferred tax asset and other tax credits. We have approximately $48.9 million remaining of deferred tax assets and other tax credits. We continue to actively evaluate various long-term operating structures that could result in a reduction of our overall corporate tax rate, including opportunities associated with the acquisition of Wolfson. At this time, we expect our effective quarterly cash tax rate to be less than four percent in Q2 and we expect it to remain at that rate until we have depleted our remaining deferred tax assets and other tax credits. Q1 inventory was $92 million, up from $69.7 million from the prior quarter, as we expect increased product demand in the back half of the calendar year. We also expect inventory growth in the September quarter to support customer demand. Company Strategy Recently, we have seen a significant transformation in the audio market as a wide range of OEMs developing mobile consumer products have begun to view audio and voice as a way to deliver highly differentiated consumer experiences, driving a substantial increase in customers looking for devices with higher performance, more features and more processing power. There is also growing consumer demand in emerging markets for smartphones that deliver high fidelity audio playback experiences that rival high-end consumer audio/video equipment. Our broad portfolio of high performance audio converters provide OEMs addressing these markets the ability to deliver a best in class user experience, thus driving additional demand for these products.

With a robust long-term roadmap, Cirrus Logic is focused on strengthening our leadership position in audio, organically and through the acquisition of Wolfson. Our engineers are developing an innovative portfolio of custom-and general-market products targeting audio and voice applications that fuse our expertise in complex analog and mixed-signal processing with our SoundClear® embedded software suite. We are excited to be sampling several of our new, advanced geometry, high-performance products and are actively engaged with customers on future designs. Further, the desire for innovation in mobile accessories is expanding as new intelligent products emerge and OEMs participate in and fuel the development of this ecosystem. With an extensive range of advanced codecs, DSPs and amplifiers, coupled with our SoundClear® noise suppression and echo cancellation software, Cirrus Logic is well positioned to capitalize on this emerging market. In the June quarter, we gained momentum in our portable audio business. We are now shipping general market products into multiple mobile handsets on seven unique customer platforms. During the quarter, we ramped shipments of our boosted amplifier with speaker protection and sound quality enhancement software to support the product launch of a recently added top tier smartphone customer. Reviews of the smartphone have been positive, contributing to increased interest for this product. Although the amplifier market is highly competitive, we are encouraged by our success with these products and expect to see year-over-year unit growth in FY15. As the portable market evolves we believe the requirements for advanced processing functionality in amplifiers will increase considerably, enhancing Cirrus Logic’s competitive advantage given our expertise in sophisticated analog and mixed signal processing. Cirrus Logic introduced its first amplifier for the portable market several years ago, and while we do not expect to win every socket in the business, we are extremely pleased to have built a highly profitable and growing business in a few short years.

As we highlighted in the March quarter, a wide range of opportunities in audio and voice applications have emerged that we believe will fuel future revenue growth and diversification. As such, over the past few quarters we have increased the percentage of company resources dedicated to audio. We expect this focus to accelerate following the close of the Wolfson acquisition. While the company is expanding its developments in audio, we will continue to support retrofit LED lighting with existing products as our team explores alternative markets where customers are willing to pay a premium for higher performance products. With a strong intellectual property portfolio and differentiating technology in the LED lighting market we are evaluating various options to best capitalize on our investment. Summary and Guidance For the September quarter, excluding any potential financial contributions or expenses associated with the Wolfson acquisition, we expect the following results: Revenue to range between $175 million and $195 million; Gross margin to be between 47 percent and 49 percent; and Combined R&D and SG&A expenses to range between $58 million and $62 million, including approximately $7 million in share-based compensation expense and amortization of acquired intangibles. In summary, we are pleased with our progress in Q1 as we delivered strong financial results and gained momentum across our portable audio products. We believe the portable audio market is in the initial stages of the next wave of growth, driven by the desire to differentiate products through the audio and voice experience. With a strong pipeline of compelling products and the pending acquisition of Wolfson, we are strengthening the company’s position as a market leader in audio with a comprehensive custom-and general-market product portfolio, differentiated software capabilities and a top-tier customer base.

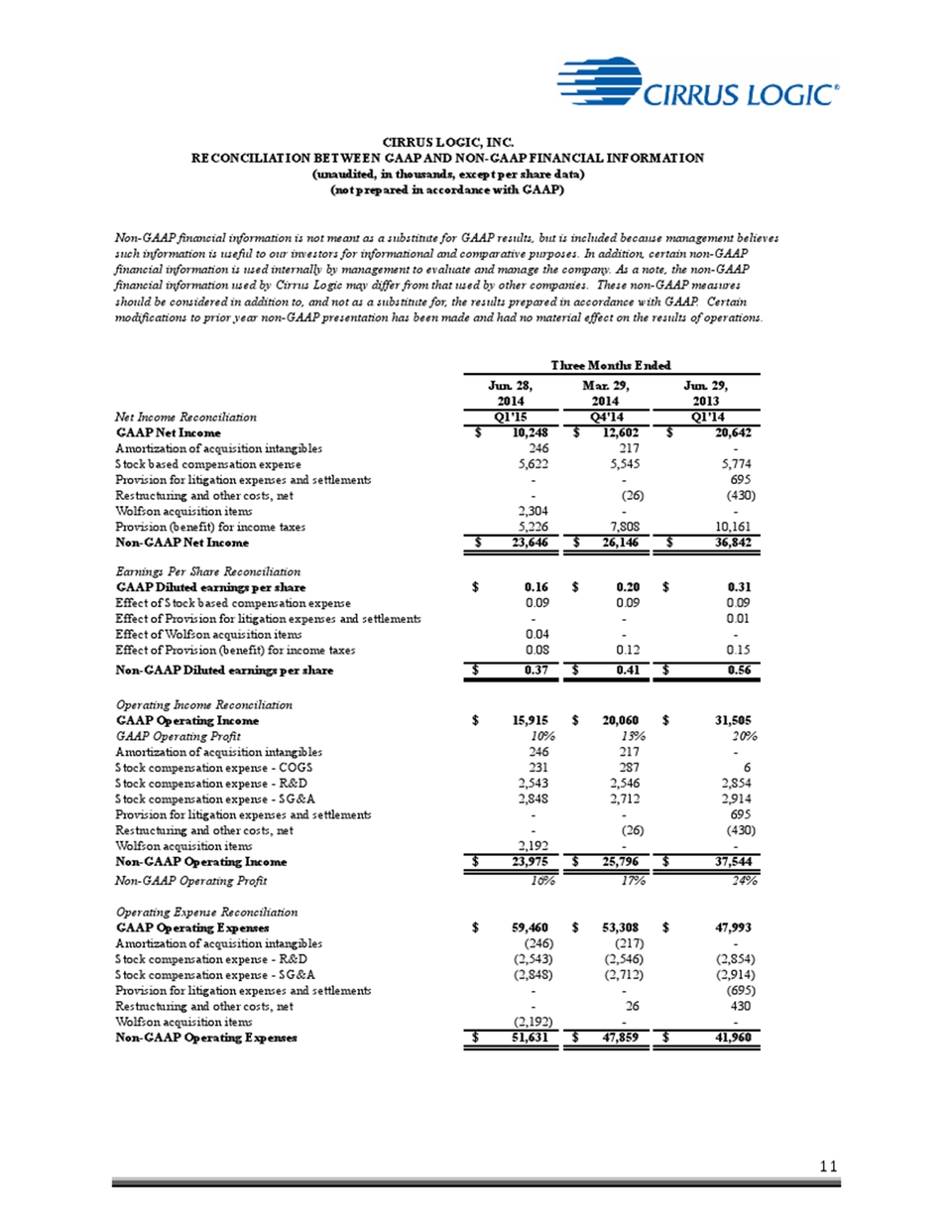

Sincerely, Jason Rhode Thurman Case President and Chief Executive Officer Chief Financial Officer Conference Call Q&A Session Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website. Participants who would like to submit a question to be addressed during the call are requested to email investor.relations@cirrus.com. A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion, or by calling (404) 537-3406, or toll-free at (855) 859-2056 (Access Code: 66089509). Use of Non-GAAP Financial Information This shareholder letter and its attachments include references to non-GAAP financial information, including operating expenses, net income, operating profit and diluted earnings per share. A reconciliation of the adjustments to GAAP results is included in the tables below. Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP.

Safe Harbor Statement Except for historical information contained herein, the matters set forth in this news release contain forward-looking statements, including our future growth expectations and our estimates of second quarter fiscal year 2015 revenue, gross margin, combined research and development and selling, general and administrative expense levels, share-based compensation expense and amortization of acquired intangibles. In some cases, forward-looking statements are identified by words such as “expect,” “anticipate,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, but are not limited to, the level of orders and shipments during the second quarter fiscal year 2015, as well as customer cancellations of orders, or the failure to place orders consistent with forecasts; and the risk factors listed in our Form 10-K for the year ended March 29, 2014, and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new developments or otherwise. Cirrus Logic, Cirrus and SoundClear are registered trademarks of Cirrus Logic, Inc. All other product names noted herein may be trademarks of their respective holders. Summary financial data follows:

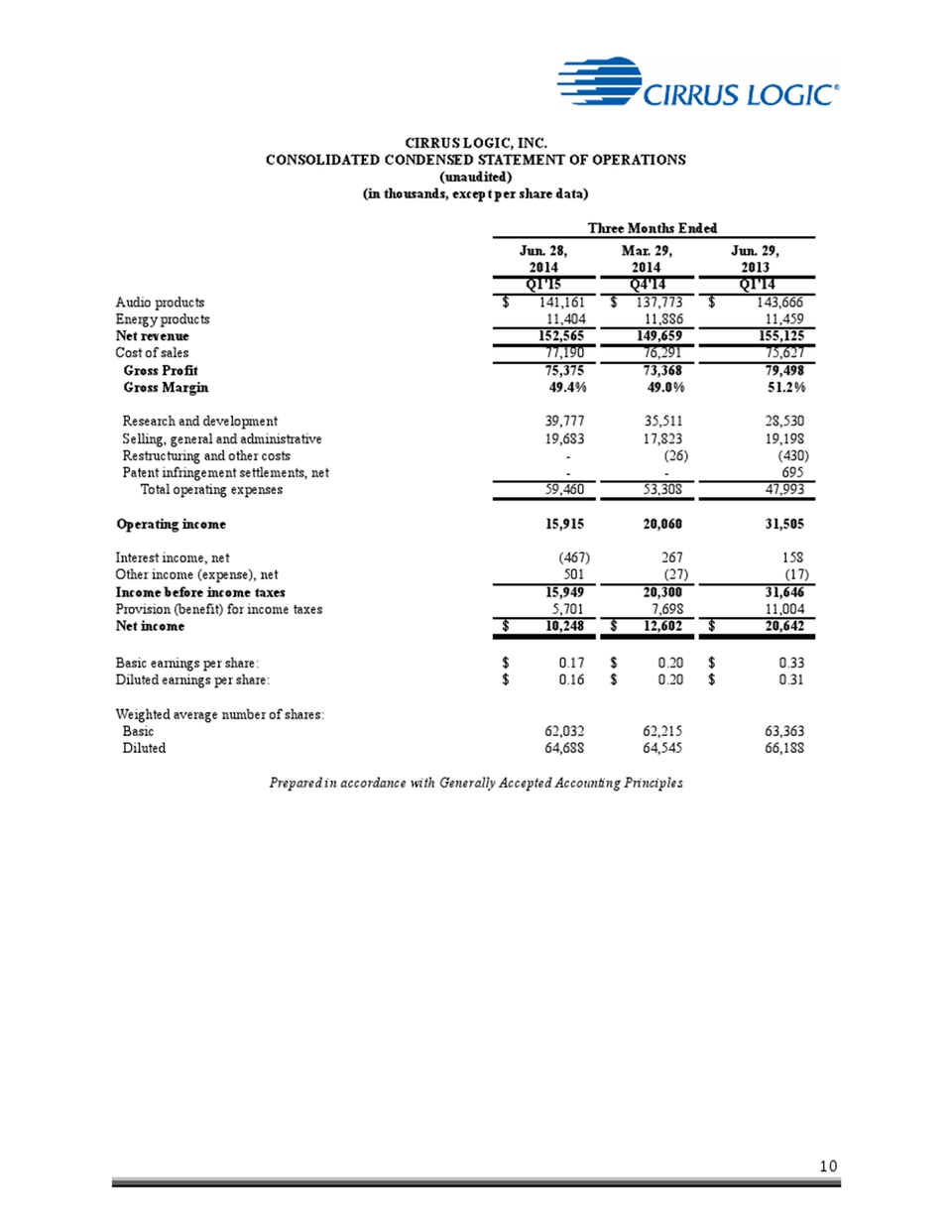

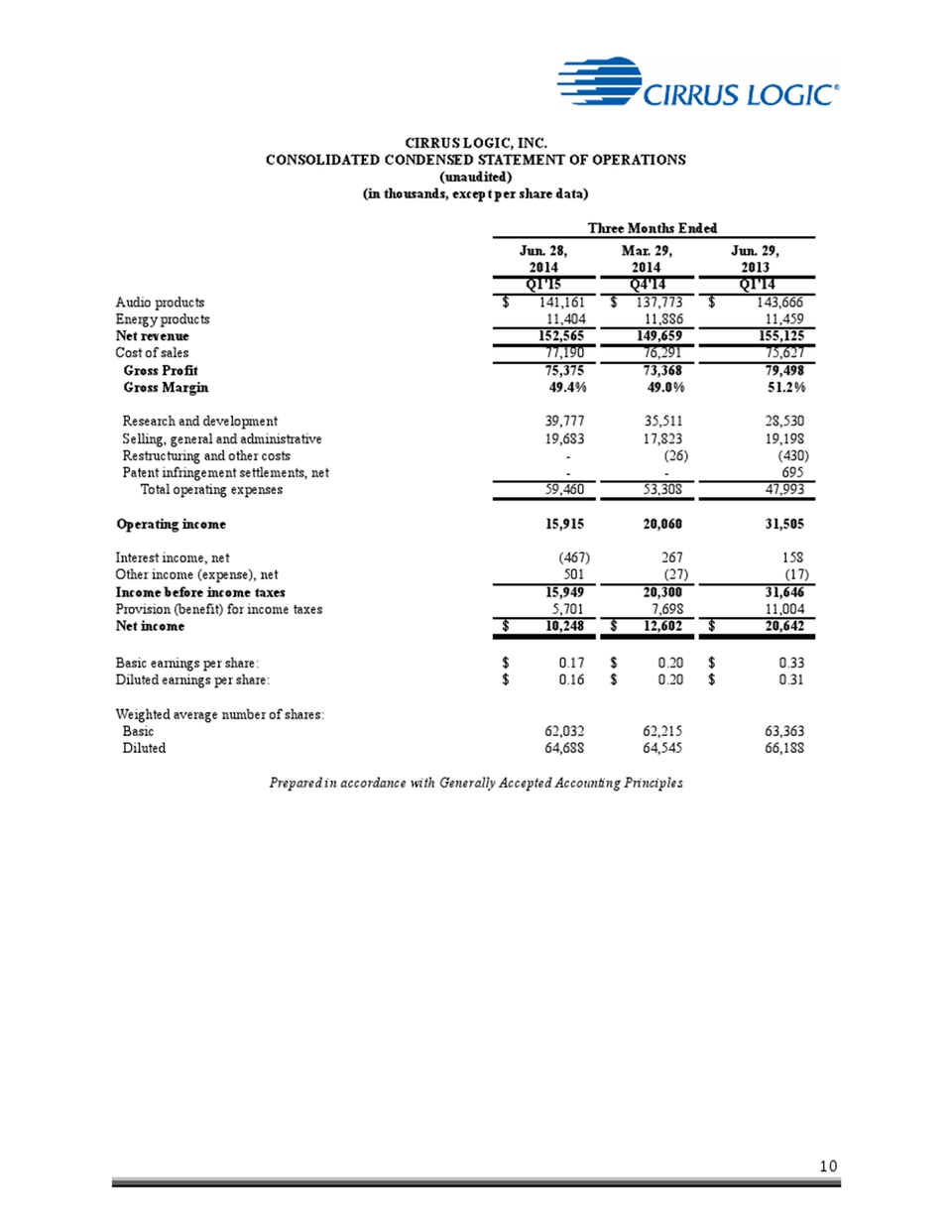

Jun. 28, Mar. 29, Jun. 29, 2014 2014 2013 Q1'15 Q4'14 Q1'14 Audio products 141,161 $ 137,773 $ 143,666 $ Energy products 11,404 11,886 11,459 CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in thousands, except per share data) Three Months Ended Net revenue 152,565 149,659 155,125 Cost of sales 77,190 76,291 75,627 Gross Profit 75,375 73,368 79,498 Gross Margin 49.4% 49.0% 51.2% Research and development 39,777 35,511 28,530 Selling, general and administrative 19,683 17,823 19,198 Restructuring and other costs - (26) (430) Patent infringement settlements, net - - 695 Total operating expenses 59,460 53,308 47,993 Operating income 15,915 20,060 31,505 Interest income, net (467) 267 158 Other income (expense), net 501 (27) (17) Income before income taxes 15,949 20,300 31,646 Provision (benefit) for income taxes 5,701 7,698 11,004 Net income 10,248 $ 12,602 $ 20,642 $ Basic earnings per share: 0.17 $ 0.20 $ 0.33 $ Diluted earnings per share: 0.16 $ 0.20 $ 0.31 $ Weighted average number of shares: Basic 62,032 62,215 63,363 Diluted 64,688 64,545 66,188 See notes to Consolidated Condensed Statement of Operations Prepared in accordance with Generally Accepted Accounting Principles

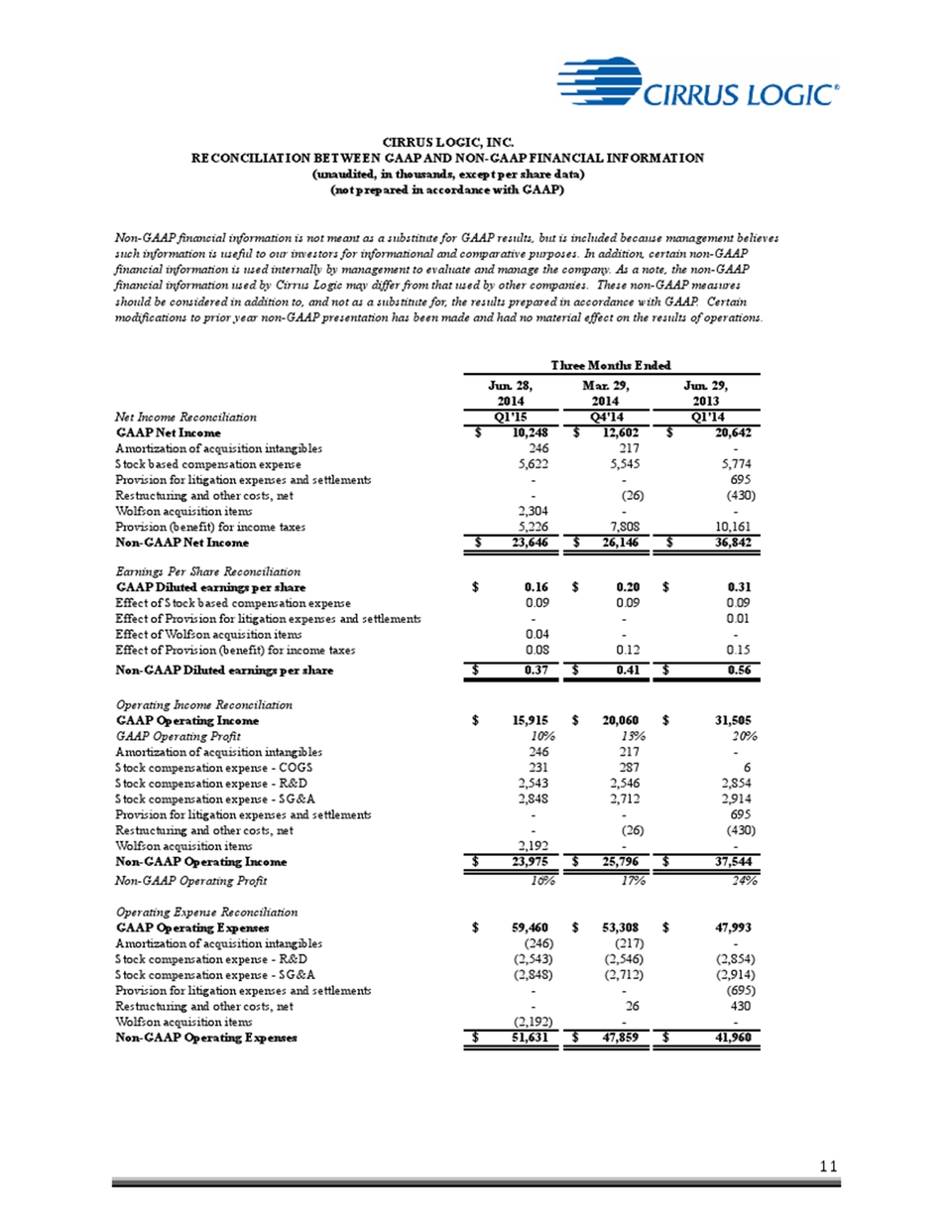

Jun. 28, Mar. 29, Jun. 29, 2014 2014 2013 Net Income Reconciliation Q1'15 Q4'14 Q1'14 GAAP Net Income 10,248 $ 12,602 $ 20,642 $ Amortization of acquisition intangibles 246 217 - Stock based compensation expense 5,622 5,545 5,774 Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. Certain modifications to prior year non-GAAP presentation have been made and had no material effect on the results of operations. Three Months Ended (not prepared in accordance with GAAP) CIRRUS LOGIC, INC. RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION (unaudited, in thousands, except per share data) Provision for litigation expenses and settlements - - 695 Restructuring and other costs, net - (26) (430) Wolfson acquisition items 2,304 - - Provision (benefit) for income taxes 5,226 7,808 10,161 Non-GAAP Net Income 23,646 $ 26,146 $ 36,842 $ Earnings Per Share Reconciliation GAAP Diluted earnings per share 0.16 $ 0.20 $ 0.31 $ Effect of Stock based compensation expense 0.09 0.09 0.09 Effect of Provision for litigation expenses and settlements - - 0.01 Effect of Wolfson acquisition items 0.04 - - Effect of Provision (benefit) for income taxes 0.08 0.12 0.15 Non-GAAP Diluted earnings per share 0.37 $ 0.41 $ 0.56 $ Operating Income Reconciliation GAAP Operating Income 15,915 $ 20,060 $ 31,505 $ GAAP Operating Profit 10% 13% 20% Amortization of acquisition intangibles 246 217 - Stock compensation expense - COGS 231 287 6 Stock compensation expense - R&D 2,543 2,546 2,854 Stock compensation expense - SG&A 2,848 2,712 2,914 Provision for litigation expenses and settlements - - 695 Restructuring and other costs, net - (26) (430) Wolfson acquisition items 2,192 - - Non-GAAP Operating Income 23,975 $ 25,796 $ 37,544 $ Non-GAAP Operating Profit 16% 17% 24% Operating Expense Reconciliation GAAP Operating Expenses 59,460 $ 53,308 $ 47,993 $ Amortization of acquisition intangibles (246) (217) - Stock compensation expense - R&D (2,543) (2,546) (2,854) Stock compensation expense - SG&A (2,848) (2,712) (2,914) Provision for litigation expenses and settlements - - (695) Restructuring and other costs, net - 26 430 Wolfson acquisition items (2,192) - -Non-GAAP Operating Expenses 51,631 $ 47,859 $ 41,960 $

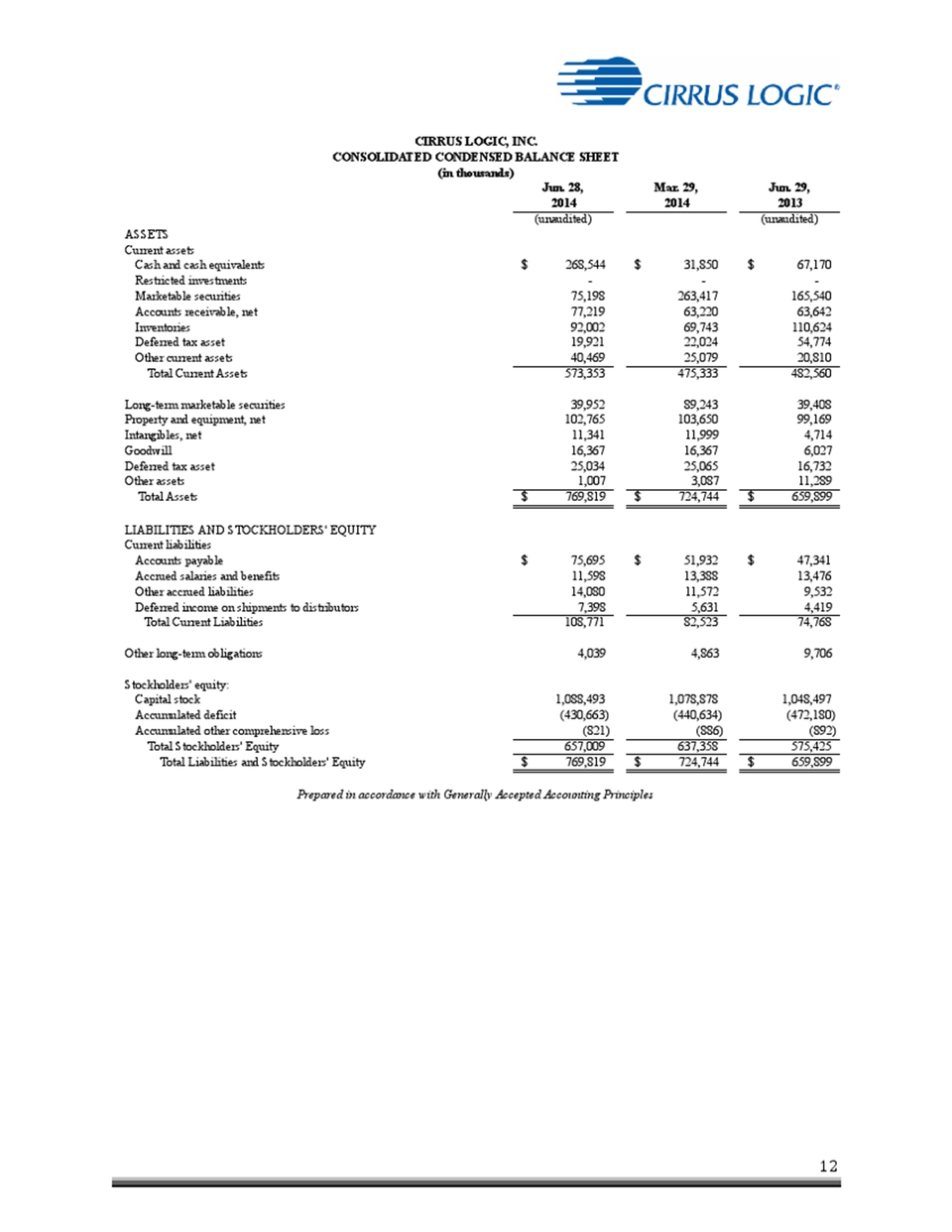

CIRRUS LOGIC, INC. CONSOLIDATED CONDENSED BALANCE SHEET Jun. 28, Mar. 29, Jun. 29, 2014 2014 2013 (unaudited) (unaudited) ASSETS Current assets Cash and cash equivalents 268,544 $ 31,850 $ 67,170 $ Restricted investments - - - Marketable securities 75,198 263,417 165,540 Accounts receivable, net 77,219 63,220 63,642 Inventories 92,002 69,743 110,624 Deferred tax asset 19,921 22,024 54,774 Other current assets 40,469 25,079 20,810 Total Current Assets 573,353 475,333 482,560 Long-term marketable securities 39,952 89,243 39,408 Property and equipment, net 102,765 103,650 99,169 Intangibles, net 11,341 11,999 4,714 Goodwill 16,367 16,367 6,027 (in thousands) Deferred tax asset 25,034 25,065 16,732 Other assets 1,007 3,087 11,289 Total Assets 769,819 $ 724,744 $ 659,899 $ LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable 75,695 $ 51,932 $ 47,341 $ Accrued salaries and benefits 11,598 13,388 13,476 Other accrued liabilities 14,080 11,572 9,532 Deferred income on shipments to distributors 7,398 5,631 4,419 Total Current Liabilities 108,771 82,523 74,768 Other long-term obligations 4,039 4,863 9,706 Stockholders' equity: Capital stock 1,088,493 1,078,878 1,048,497 Accumulated deficit (430,663) (440,634) (472,180) Accumulated other comprehensive loss (821) (886) (892) Total Stockholders' Equity 657,009 637,358 575,425 Total Liabilities and Stockholders' Equity 769,819 $ 724,744 $ 659,899 $ Prepared in accordance with Generally Accepted Accounting Principles