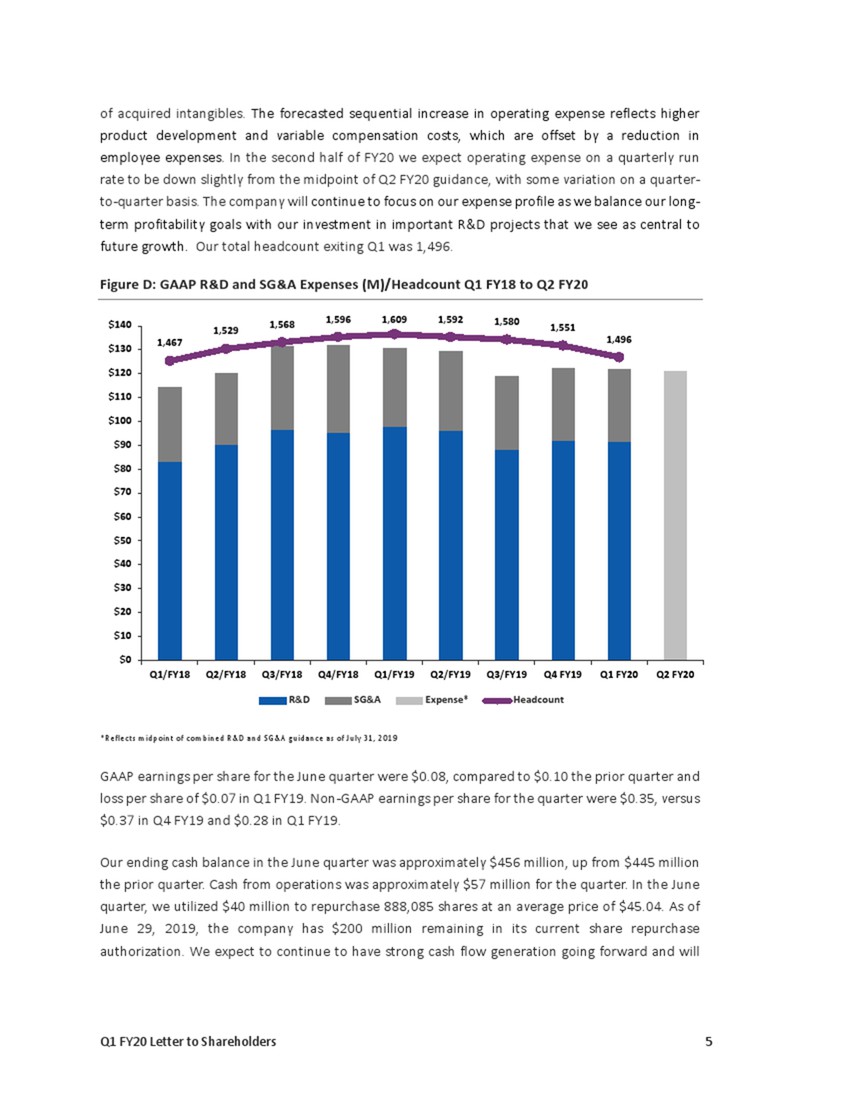

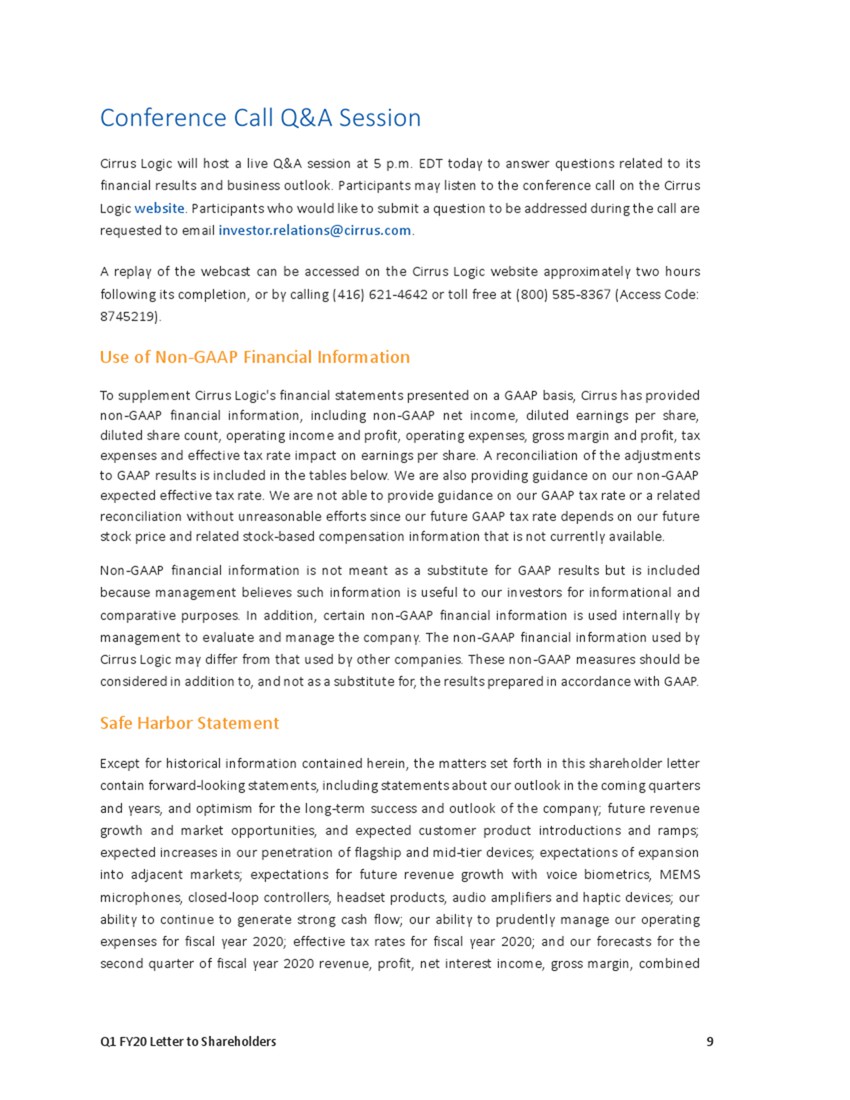

of acquired intangibles. The forecasted sequential increase in operating expense reflects higher product development and variable compensation costs, which are offset by a reduction in employee expenses. In the second half of FY20 we expect operating expense on a quarterly run rate to be down slightly from the midpoint of Q2 FY20 guidance, with some variation on a quarter- to-quarter basis. The company will continue to focus on our expense profile as we balance our long- term profitability goals with our investment in important R&D projects that we see as central to future growth. Our total headcount exiting Q1 was 1,496. Figure D: GAAP R&D and SG&A Expenses(M)/HeadcountQ1FY18toQ2FY201,596 1,609 1,592 1,580 1,529 1,568 1,551 1,467 1,496 $140 $130 $120 $110 $100 $90 $80 $70 $60 $50 $40 $30 $20 $10

$0 Q1/FY18 Q2/FY18 Q3/FY18 Q4/FY18 Q1/FY19 Q2/FY19 Q3/FY19 Q4 FY19 Q1 FY20 Q2 FY20 R&D SG&A Expense* Headcount *Reflects midpoint of combined R&D and SG&A guidance as of July 31, 2019 GAAP earnings per share for the June quarter were $0.08, compared to $0.10 the prior quarter and loss per share of $0.07 in Q1 FY19. Non-GAAP earnings per share for the quarter were $0.35, versus $0.37 in Q4 FY19 and $0.28 in Q1 FY19. Our ending cash balance in the June quarter was approximately $456 million, up from $445 million the prior quarter. Cash from operations was approximately $57 million for the quarter. In the June quarter, we utilized $40 million to repurchase 888,085 shares at an average price of $45.04. As of June 29, 2019, the company has $200 million remaining in its current share repurchase authorization. We expect to continue to have strong cash flow generation going forward and will 5

evaluate potential uses of this cash, including acquisitions and the repurchase of shares on an opportunistic basis. Net interest income is currently expected to be roughly $2.5 million in Q2 FY20. Taxes and Inventory For the June quarter, we realized GAAP tax expense of $1.4 million on GAAP pre-tax income of $6 million, resulting in an effective tax rate of approximately 24 percent. Non-GAAP tax expense for the quarter was $4.2 million on non-GAAP pre-tax income of $25 million, resulting in an effective tax rate of approximately 17 percent. Non-GAAP tax expense for the quarter includes the effect of higher non-GAAP income in various jurisdictions. We expect that our worldwide non-GAAP effective tax rate in FY20 will range from 15 percent to 17 percent. Q1 inventory was $146.3 million, down from $164.7 million in Q4 FY19. Inventory in Q2 FY20 is expected to be relatively flat from the prior quarter, as new product ramps are offset by continued sell-through of products built earlier in the calendar year. Company Strategy Cirrus Logic experienced strong customer engagements in the June quarter. We are now shipping in seven of the top 10 smartphone OEMs and anticipate more devices utilizing our components to come to market over the next 12 months. We recently began ramping production for customers who we expect to introduce devices in the coming quarters, including a new smart codec delivering enhanced performance and mixed-signal capabilities and lower-power data conversion. Looking ahead, we believe we are positioned for future growth as the value placed on audio and voice continues to expand and demand for our low-power expertise in new mixed-signal domains beyond our traditional markets is increasing. Design momentum in our boosted amplifier product line has remained strong and sales of amplifiers contributed to a second customer generating 10 percent of revenue in Q1 FY20. The company remains engaged with new and existing Android customers and we anticipate that additional amplifier wins will further increase our penetration of flagship and mid-tier devices. Demand for high-voltage boosted amplifiers is being driven by consumer desire for better and louder audio and industrial design trends that require greater output from smaller devices. We are investing in broadening our line of 55-nanometer high-voltage boosted amplifier solutions with integrated signal processing capabilities, which enable micro speakers to be driven harder while monitoring the speaker sub-systems to ensure they are protected and perform reliably. With best- in-class products and a solid design funnel, we expect revenue from boosted amplifiers to continue to increase in FY20.

Although still in the early stages of broad-market adoption, demand for sophisticated haptic solutions is gaining momentum. Several factors are driving interest in compelling haptic solutions. First, smartphone OEMs continue to pursue maximizing screen size, which reduces the space available for mechanical buttons. Secondly, these display-dominated devices are incorporating more gesture-based navigation features into the user experience. Finally, as OEMs prioritize device reliability and waterproofing, the need for virtual buttons is increasing. Since introducing our first general market haptics product nearly a year ago, we have penetrated additional Android flagship smartphones and expect multiple models with new and existing customers to come to market during the next three to 12 months. To capitalize on what we believe is a substantial market opportunity we are developing the next-generation of products designed to deliver improved performance and an expanded feature set, while reducing the overall system area and total bill of materials of a haptics subsystem. With significant ongoing customer activity, we look forward to further sales in this product line. Cirrus Logic has been successful with many of the leading headset OEMs, including designs wins in some of the highest volume wired and wireless digital headsets shipping today. Our strategy is to target opportunities where we can leverage our expertise in low-power signal processing to support customers who value differentiation and performance. This approach is fueling design momentum, particularly in the fast growing truly wireless earbud segment of the headset market, where customers prioritize size, power consumption and smart features. We note, despite frequent speculation concerning our continuously adaptive ANC components, the use of this high- performance technology in truly wireless earbuds is limited by battery size. Nonetheless, we see strong customer interest across our portfolio of digital headset components. Last quarter we began shipping a smart codec to a leading Android OEM for truly wireless earbuds that were launched alongside a flagship smartphone and we expect additional earbuds using Cirrus Logic technology to come to market later this year. We are investing in several strategic technologies that leverage the company’s capabilities in low- power, high-performance signal processing that we believe provide longer-term opportunities for growth. Interest in our 28-nanometer voice biometrics solution remains strong and our teams are actively engaged with key customers for evaluation and initial design-in. We are delighted that during the June quarter our solution has become the first voice biometrics product certified by the FIDO Alliance, the leading standards organization driving the adoption of biometric user authentication. Our MEMS microphone team continued working with a lead customer, executing on the product roadmap and strengthening the Taiwan supply chain. Beyond the audio domain, Cirrus Logic is investing in the development and productization of new closed-loop controller products targeting adjacent market opportunities where we have seen significant customer interest. While these technologies are still in the design phase, we believe they have the potential to meaningfully expand our market opportunities and contribute to future revenue.

As Cirrus Logic has evolved, we continue to focus on developing our leadership teams. Over the past year we have enhanced our corporate organizational structure to better address the opportunities we see ahead of us. John Forsyth was appointed chief strategy officer, with the responsibility of driving the company’s investment in new technologies, products and markets. We combined our hardware and software engineering teams under Jeff Baumgartner, vice president of Research and Development, bringing together our hardware, software and algorithm experts on one team and enabling us to optimize our mixed-signal processing solutions across the software- silicon boundary. As vice president of Mixed Signal Products, Carl Alberty has oversight of our largest customer engagements and responsibility for maximizing our growth in haptics, audio and other product areas. More recently, Justin Dougherty became vice president of Engineering Operations, where he is overseeing the company’s product and test engineering, validation, quality, silicon technology and assembly technology organizations. All of these individuals have played key roles in the company’s successes to date, and we are looking forward to their expanded leadership roles. Summary and Guidance For the September quarter we expect the following results: Revenue to range between $300 million and $340 million; GAAP gross margin to be between 51 percent and 53 percent; and Combined GAAP R&D and SG&A expenses to range between $118 million and $124 million, including approximately $13 million in stock-based compensation expense and $7 million in amortization of acquired intangibles; In summary, in the June quarter, Cirrus Logic continued to broaden our penetration of flagship and mid-tier smartphones, while executing on new product development and strategic initiatives that we believe are critical for long-term growth. With a differentiated product portfolio, commitment to design and supply chain excellence, and increasing demand for innovation in the markets we target, we are optimistic about our future. Sincerely, Jason Rhode President and Chief Executive Officer Thurman Case Chief Financial Officer

Conference Call Q&A Session Cirrus Logic will host a live Q&A session at 5 p.m. EDT today to answer questions related to its financial results and business outlook. Participants may listen to the conference call on the Cirrus Logic website. Participants who would like to submit a question to be addressed during the call are requested to email investor.relations@cirrus.com. A replay of the webcast can be accessed on the Cirrus Logic website approximately two hours following its completion, or by calling (416) 621-4642 or toll free at (800) 585-8367 (Access Code: 8745219). Use of Non-GAAP Financial Information To supplement Cirrus Logic's financial statements presented on a GAAP basis, Cirrus has provided non-GAAP financial information, including non-GAAP net income, diluted earnings per share, diluted share count, operating income and profit, operating expenses, gross margin and profit, tax expenses and effective tax rate impact on earnings per share. A reconciliation of the adjustments to GAAP results is included in the tables below. We are also providing guidance on our non-GAAP expected effective tax rate. We are not able to provide guidance on our GAAP tax rate or a related reconciliation without unreasonable efforts since our future GAAP tax rate depends on our future stock price and related stock-based compensation information that is not currently available. Non-GAAP financial information is not meant as a substitute for GAAP results but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. The non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non-GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. Safe Harbor Statement Except for historical information contained herein, the matters set forth in this shareholder letter contain forward-looking statements, including statements about our outlook in the coming quarters and years, and optimism for the long-term success and outlook of the company; future revenue growth and market opportunities, and expected customer product introductions and ramps; expected increases in our penetration of flagship and mid-tier devices; expectations of expansion into adjacent markets; expectations for future revenue growth with voice biometrics, MEMS microphones, closed-loop controllers, headset products, audio amplifiers and haptic devices; our ability to continue to generate strong cash flow; our ability to prudently manage our operating expenses for fiscal year 2020; effective tax rates for fiscal year 2020; and our forecasts for the second quarter of fiscal year 2020 revenue, profit, net interest income, gross margin, combined

research and development and selling, general and administrative expense levels, stock-based compensation expense, amortization of acquired intangibles and inventory levels. In some cases, forward-looking statements are identified by words such as “emerge,” “expect,” “anticipate,” “foresee,” “target,” “project,” “believe,” “goals,” “opportunity,” “estimates,” “intend,” “will,” and variations of these types of words and similar expressions. In addition, any statements that refer to our plans, expectations, strategies or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and assumptions and are subject to certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, but are not limited to, the following: the level and timing of orders and shipments during the second quarter of fiscal year 2020, customer cancellations of orders, or the failure to place orders consistent with forecasts; changes with respect to our current expectations of future smartphone unit volumes; any delays in the timing and/or success of customers’ new product ramps; failure to win new designs or additional content as expected at Android customers; any changes in U.S. trade policy, including potential adoption and expansion of trade restrictions, higher tariffs, or cross border taxation by the U.S. government involving other countries, particularly China, that might impact overall customer demand for our products or affect our ability to manufacture and/or sell our products overseas; and the risk factors listed in our Form 10-K for the year ended March 30, 2019 and in our other filings with the Securities and Exchange Commission, which are available at www.sec.gov. The foregoing information concerning our business outlook represents our outlook as of the date of this news release, and we undertake no obligation to update or revise any forward- looking statements, whether as a result of new developments or otherwise.Cirrus Logic, Cirrus, and the Cirrus Logic logo are registered trademarks of Cirrus Logic, Inc. All other company or product names noted herein may be trademarks of their respective holders.Summary of Financial Data Below:

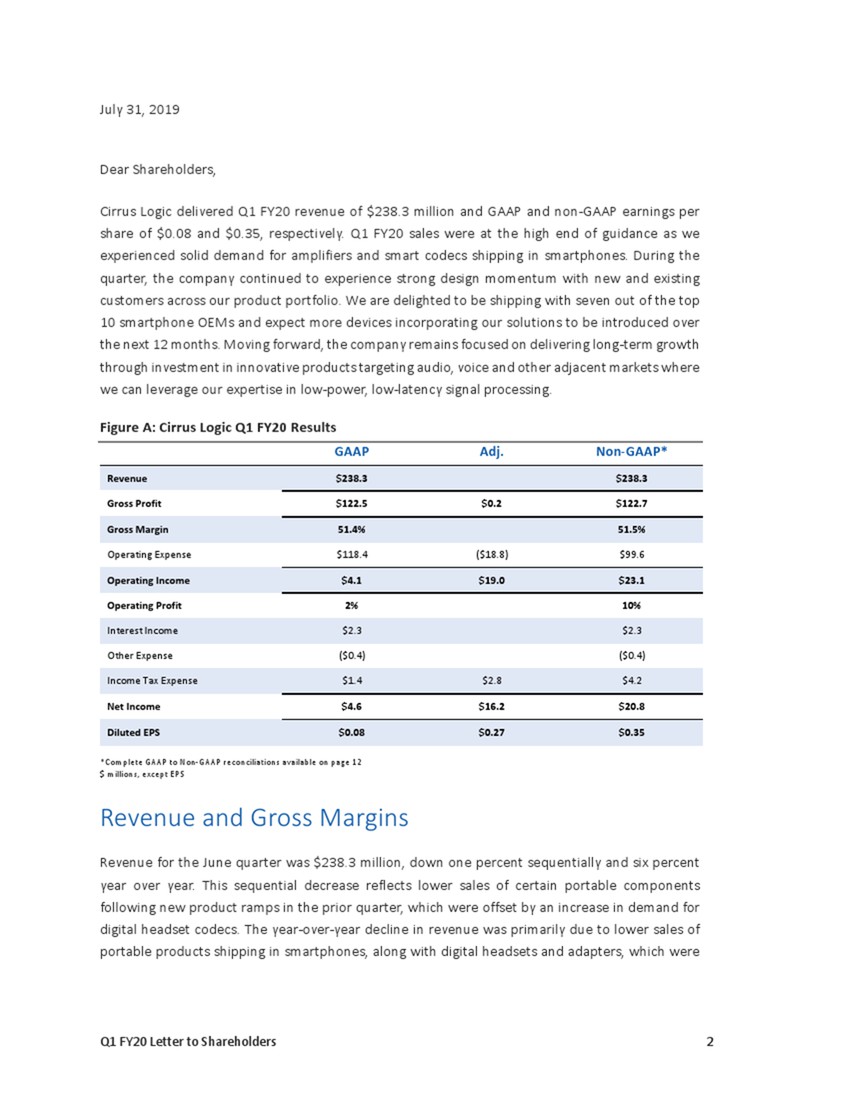

CONSOLIDATED CONDENSED STATEMENT OF OPERATIONS (unaudited) (in thousands, except per share data) Three Months Ended Jun. 29, Mar. 30, Jun. 30, 2019 2019 2018 Q1'20 Q4'19 Q1'19 Portable products $ 202,938 $ 207,099 $ 212,260 Non-portable and other products 35, 315 33, 342 42, 223 Net sales 238, 253 240, 441 254, 483 Cost of sales 115, 759 115, 802 129, 924 Gross profit 122,494 124,639 124,559 Gross margin 51.4% 51.8% 48.9% Research and development 88,830 92,251 97,932 Selling, general and administrative 29,520 30,194 32,784 Gain on sale of assets - (4, 913) - Total operating expenses 118, 350 117, 532 130, 716 Income (loss) from operations 4,144 7,107 (6,157) Interest income 2,285 2,248 1,447 Other (expense) income (378) (150) 210 Income (loss) before income taxes 6,051 9,205 (4,500) Provision (benefit) for income taxes 1, 433 3, 048 (228) Net income (loss) $ 4, 618 $ 6, 157 $ (4, 272) Basic earnings (loss) per share: $ 0.08 $ 0.10 $ (0.07) Diluted earnings (loss) per share: $ 0.08 $ 0.10 $ (0.07) Weighted average number of shares: Basic 58,540 59,031 61,462 Diluted 60,258 60,199 61,462 Prepared in accordance with Generally Accepted Accounting Principles

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL INFORMATION (unaudited, in thousands, except per share data) (not prepared in accordance with GAAP) Non-GAAP financial information is not meant as a substitute for GAAP results, but is included because management believes such information is useful to our investors for informational and comparative purposes. In addition, certain non-GAAP financial information is used internally by management to evaluate and manage the company. As a note, the non-GAAP financial information used by Cirrus Logic may differ from that used by other companies. These non- GAAP measures should be considered in addition to, and not as a substitute for, the results prepared in accordance with GAAP. Three Months Ended Jun. 29, Mar. 30, Jun. 30, 2019 2019 2018 Net Income (Loss) Reconciliation Q1'20 Q4'19 Q1'19 GAAP Net Income (Loss) $ 4,618 $ 6,157 $ (4,272) Amortization of acquisition intangibles 7,228 7,228 13,266 Stock-based compensation expense 11,786 12,583 12,794 Gain on asset sale - (4,913) - Adjustment to income taxes (2,803) 1,202 (3,926) Non-GAAP Net Income $ 20,829 $ 22,257 $ 17,862 Earnings (Loss) Per Share Reconciliation GAAP Diluted earnings (loss) per share $ 0.08 $ 0.10 $ (0.07) Effect of Amortization of acquisition intangibles 0.12 0.12 0.21 Effect of Stock-based compensation expense 0.20 0.21 0.20 Effect of Gain on asset sale - (0.08) - Effect of Adjustment to income taxes (0.05) 0.02 (0.06) Non-GAAP Diluted earnings per share $ 0.35 $ 0.37 $ 0.28 Diluted Shares Reconciliation GAAP Diluted shares 60,258 60,199 61,462 Effect of weighted dilutive shares - - 1,723 Non-GAAP Diluted shares 60,258 60,199 63,185 Operating Income (Loss) Reconciliation GAAP Operating Income (Loss) $ 4,144 $ 7,107 $ (6,157) GAAP Operating Profit (Loss) 2% 3% -2% Amortization of acquisition intangibles 7,228 7,228 13,266 Stock-based compensation expense - COGS 241 288 199 Stock-based compensation expense - R&D 7,240 8,270 7,250 Stock-based compensation expense - SG&A 4,305 4,025 5,345 Gain on asset sale - (4,913) - Non-GAAP Operating Income $ 23,158 $ 22,005 $ 19,903 Non-GAAP Operating Profit 10% 9% 8% Operating Expense Reconciliation GAAP Operating Expenses $ 118,350 $ 117,532 $ 130,716 Amortization of acquisition intangibles (7,228) (7,228) (13,266) Stock-based compensation expense - R&D (7,240) (8,270) (7,250) Stock-based compensation expense - SG&A (4,305) (4,025) (5,345) Gain on asset sale - 4,913 - Non-GAAP Operating Expenses $ 99,577 $ 102,922 $ 104,855 Gross Margin/Profit Reconciliation GAAP Gross Profit $ 122,494 $ 124,639 $ 124,559 GAAP Gross Margin 51.4% 51.8% 48.9% Stock-based compensation expense - COGS 241 288 199 Non-GAAP Gross Profit $ 122,735 $ 124,927 $ 124,758 Non-GAAP Gross Margin 51.5% 52.0% 49.0% Effective Tax Rate Reconciliation GAAP Tax Expense (Benefit) $ 1,433 $ 3,048 $ (228) GAAP Effective Tax Rate 23.7% 33.1% 5.1% Adjustments to income taxes 2,803 (1,202) 3,926 Non-GAAP Tax Expense $ 4,236 $ 1,846 $ 3,698

Non-GAAP Effective Tax Rate 16.9% 7.7% 17.2% Tax Impact to EPS Reconciliation GAAP Tax Expense $ 0.02 $ 0.05 $ -

CONSOLIDATED CONDENSED BALANCE SHEET unaudited; in thousands Jun. 29, Mar. 30, Jun. 30, 2019 2019 2018 ASSETS Current assets Cash and cash equivalents $ 198,077 $ 216,172 $ 186,459 Marketable securities 52,350 70,183 39,877 Accounts receivable, net 111,497 120,656 126,604 Inventories 146,317 164,733 173,063 Other current assets 55,834 53,239 49,118 Total current Assets 564,075 624,983 575,121 Long-term marketable securities 205,079 158,968 159,334 Right-of-use lease assets 146,035 - - Property and equipment, net 182,042 186,185 195,804 Intangibles, net 62,496 67,847 99,366 Goodwill 286,370 286,241 287,042 Deferred tax asset 9,394 8,727 15,985 Other assets 14,625 19,689 34,151 Total assets $ 1,470,116 $ 1,352,640 $ 1,366,803 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Accounts payable $ 60,408 $ 48,398 $ 53,655 Accrued salaries and benefits 23,416 29,289 22,924 Other accrued liabilities 47,382 37,853 42,065 Total current liabilities 131,206 115,540 118,644 Non-current lease liability 137,180 - - Non-current income taxes 79,484 78,309 94,612 Other long-term liabilities 4,996 18,551 26,451 Stockholders' equity: Capital stock 1,375,777 1,363,736 1,325,287 Accumulated deficit (258,899) (222,430) (184,673) Accumulated other comprehensive income (loss) 372 (1,066) (13,518) Total stockholders' equity 1,117,250 1,140,240 1,127,096 Total liabilities and stockholders' equity $ 1,470,116 $ 1,352,640 $ 1,366,803 Prepared in accordance with Generally Accepted Accounting Principles