EDAC TECHNOLOGIES CORPORATION

1806 NEW BRITAIN AVENUE

FARMINGTON, CONNECTICUT 06032

(860) 677-2603

Notice of 2012 Annual Meeting of Shareholders

to be held on Wednesday, April 25, 2012

The 2012 Annual Meeting of Shareholders of EDAC Technologies Corporation, a Wisconsin corporation (the “Company”), will be held at the offices of the Company at 275 Richard Street, Newington, Connecticut 06111, on Wednesday, April 25, 2012, at 9:30 a.m. local time, to consider and act upon the following matters:

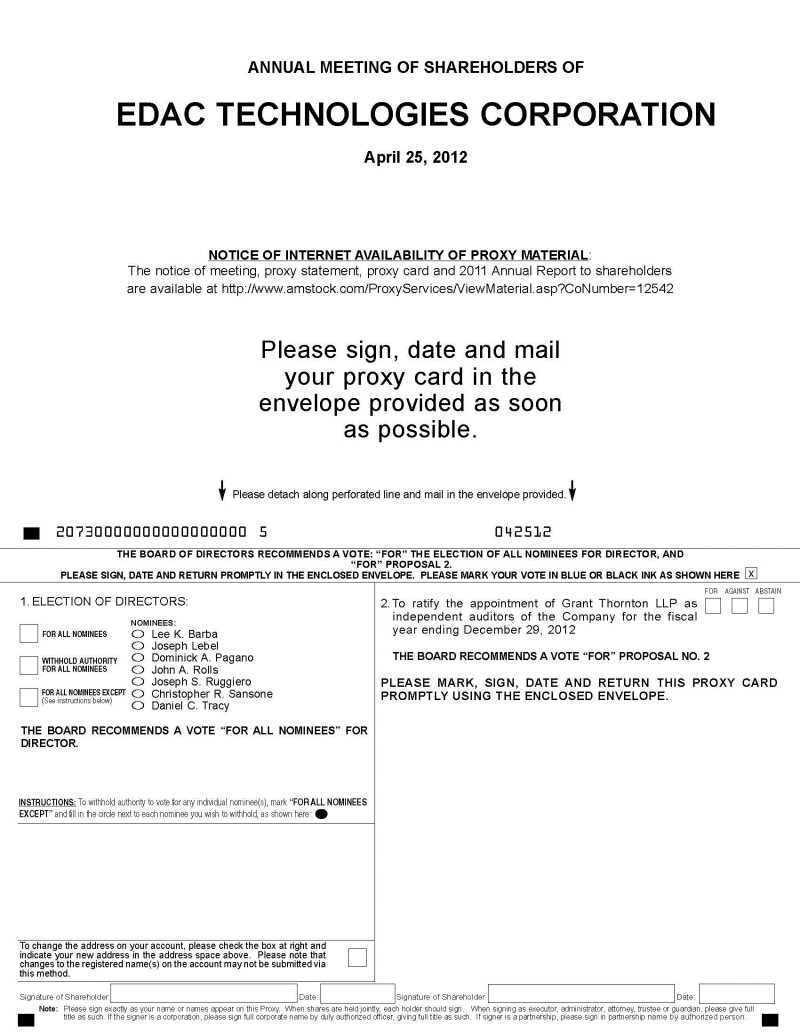

1. To elect seven directors to serve until the next Annual Meeting of Shareholders;

2. To ratify the appointment of Grant Thornton LLP as independent auditors of the Company for the fiscal year ending December 29, 2012; and

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

By Order of the Board of Directors

/s/Glenn L. Purple

Glenn L. Purple, Secretary

Farmington, Connecticut

March 20, 2012

Shareholders of record at the close of business on March 1, 2012 are entitled to notice of, and to vote at, the meeting or any adjournment thereof.

Your vote is important. Whether or not you expect to attend the meeting, please complete, sign and date the enclosed proxy card and return it promptly in the enclosed envelope in order to ensure representation of your shares at the meeting. No postage need be affixed if the proxy card is mailed in the United States. To obtain directions to attend the meeting and vote in person, please call the Company at (860) 678-8140.

A copy of the Company’s 2011 Annual Report to Shareholders and a Proxy Statement also accompany this Notice.

Important Notice Regarding the Availability of Proxy Materials for the 2012 Annual Meeting of Shareholders to be held on April 25, 2012:

A copy of the Company’s 2011 Annual Report to Shareholders and the Proxy Statement for the 2012 Annual Meeting of Shareholders are also available at the following website: http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=12542

EDAC TECHNOLOGIES CORPORATION

1806 NEW BRITAIN AVENUE

FARMINGTON, CONNECTICUT 06032

Proxy Statement for the 2012 Annual Meeting of Shareholders

to be held on Wednesday, April 25, 2012

SOLICITATION AND VOTING

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of EDAC Technologies Corporation ("EDAC" or the "Company") of proxies, in the accompanying form, to be used at the 2012 Annual Meeting of Shareholders of the Company to be held at the offices of the Company, 275 Richard Street, Newington, Connecticut 06111, on Wednesday, April 25, 2012, at 9:30 a.m. local time, and any adjournments thereof.

The Company’s Annual Report for the fiscal year ended December 31, 2011 is being mailed to shareholders, along with these proxy materials, on or about March 20, 2012.

At the close of business on March 1, 2012, the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting, there were 5,077,368 shares of common stock, par value $.0025 per share (“Common Stock”), outstanding and entitled to vote, constituting all of the outstanding voting stock of the Company. Holders of Common Stock are entitled to one vote per share.

The holders of a majority of the number of shares of Common Stock issued, outstanding and entitled to vote at the Annual Meeting shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares that abstain or otherwise do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

Assuming a quorum is present, the affirmative vote of the holders of a plurality of the votes cast by the shareholders entitled to vote at the Annual Meeting is required for the election of directors, meaning the seven directors receiving the most votes will be elected. All other matters which are properly brought before the meeting will be approved upon the affirmative vote of a majority of the shares of Common Stock represented and voting on the matter. Shares that abstain from voting as to a particular matter, and shares held in “street name” by a broker or nominee that indicates on a proxy that it does not have discretionary authority to vote as to a particular matter, will not be voted in favor of such matter, and also will not be counted as shares voting on such matter. Accordingly, abstentions and broker non-votes will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the votes cast or the shares voting on that matter.

Please note that the rules regarding how brokers may vote your shares have changed. Brokers may no longer vote your shares on the election of directors in the absence of your specific instructions as to how to vote, so we encourage you to provide instructions to your broker regarding the voting of your shares. New York Stock Exchange (“NYSE”) rules prohibit brokers from voting on the election of directors without receiving instructions from the beneficial owner of the shares. In the absence of instructions, shares subject to such broker non-votes will not be counted as voted or as present or represented on the proposal regarding the election of directors.

Although not required by law, the Company is seeking shareholder approval to ratify the appointment of Grant Thornton LLP as the Company’s independent auditors for the 2012 fiscal year. If shareholders do not ratify such appointment, the Company may reevaluate its appointment.

All shares of Common Stock represented by properly executed proxies that are received in time for the Annual Meeting and which have not been revoked will be voted in accordance with the instructions indicated in such proxies. If no such instructions are indicated, such shares of Common Stock will be voted "FOR" each nominee for election to the Board of Directors, and “FOR” the ratification of the appointment of Grant Thornton LLP as independent auditors of the Company. In addition, the persons designated in such proxies will have the discretion to vote on matters incident to the conduct of the Annual Meeting. If the Company proposes to adjourn the Annual Meeting, the persons named in the enclosed proxy card will vote all shares of Common Stock for which they have authority in favor of such adjournment.

The grant of a proxy on the enclosed proxy card does not preclude a shareholder from voting in person at the Annual Meeting. A shareholder may revoke a proxy at any time prior to its exercise by delivering to the Secretary of the Company, prior to the Annual Meeting, a written notice of revocation bearing a later date and time than the proxy, delivering to the Secretary of the Company a duly executed proxy bearing a later date and time than the revoked proxy, or attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not in and of itself constitute the revocation of a proxy.

Voting questions

What am I voting on?

There are two proposals scheduled to be voted on at the meeting:

| · | The election of seven directors; and |

| · | The ratification of the appointment of Grant Thornton LLP as the Company’s Independent Auditors for 2012. |

Who is entitled to vote?

You are entitled to vote or direct the voting of your EDAC Common Stock at the Annual Meeting if you were a shareholder at the end of the day on March 1, 2012, the record date. You may own EDAC Common Stock either (1) directly in your name as a shareholder of record or (2) indirectly through a broker, bank or other nominee as a beneficial owner. A shareholder of record is a person or entity that holds shares on the record date which are registered in such shareholder’s name on the records of American Stock Transfer & Trust Company, EDAC’s stock transfer agent. A beneficial owner is a person or entity that holds shares on the record date through a broker, bank or other nominee. Beneficial owners are generally entitled to provide voting instructions to the shareholder of record of those shares.

How can shareholders vote?

Shareholders of record can vote in person by attending the Annual Meeting or can vote by proxy. We send proxy cards to all shareholders of record to enable them to direct the voting of their shares. Brokers, banks and nominees typically offer telephonic or electronic means by which beneficial owners can submit voting instructions, in addition to the traditionally mailed voting instruction cards. You are welcome to attend the Annual Meeting and vote in person, however, if you are a beneficial owner, you will need to contact the broker, bank or other nominee through

which you indirectly own the shares, to obtain a “legal proxy” to permit you to vote by written ballot at the Annual Meeting.

How does the Board of Directors recommend shareholders vote on the matters to be considered at the meeting?

The Board recommends a vote:

FOR each of its nominees for election as director, and

FOR the appointment of Grant Thornton LLP as Independent Auditors.

What does it mean if I receive more than one proxy card?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card.

Could other matters be decided at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement.

If other matters are properly presented at the Annual Meeting for consideration, the persons named in your proxy card, if you are a shareholder of record, will have the discretion to vote on those matters for you.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

Nominees

The Company's By-Laws provide for at least five and no more than nine directors to be elected at each Annual Meeting of Shareholders. Each director holds office until the next succeeding Annual Meeting and until his or her successor is duly elected. In accordance with the By-Laws, the Board of Directors has set the number of directors at seven, effective as of April 25, 2012, the date of the Annual Meeting of Shareholders. Proxies may not be voted for more than seven directors. The persons named in the enclosed proxy will vote to elect each of Lee K. Barba, Joseph Lebel, Dominick A. Pagano, John A. Rolls, Joseph S. Ruggiero, Christopher R. Sansone, and Daniel C. Tracy as directors, unless authority to vote for the election of the nominees is withheld by marking the proxy to that effect. Each of the nominees is currently a

director of the Company, except for Mr. Ruggiero. Each of the nominees has indicated his willingness to serve, if elected, but if any of such persons should be unable or unwilling to stand for election, proxies may be voted for a substitute nominee designated by the Board of Directors.

The Governance and Nominating Committee seeks directors with established strong professional reputations and experience in areas relevant to the strategy and operations of the Company’s businesses. Each of the nominees for election as a director holds or has held executive, management or professional positions in such organizations and has operating or professional experience that meets this objective. In these positions, they have also gained experience in core management skills, such as strategic and financial planning, public company financial reporting, compliance, risk management and leadership development. Each of our current directors has previous experience serving on boards of directors and board committees of either our Company or other public companies and has an understanding of corporate governance practices and trends.

The Governance and Nominating Committee also believes that each of the nominees has other key attributes that are important to an effective board: integrity, candor, analytical skills, the willingness to engage management and each other in a constructive and collaborative fashion, and the ability and commitment to devote significant time and energy to service on the Board and its committees. The Governance and Nominating Committee takes into account diversity considerations in determining the Company’s nominees and believes that, as a group, the nominees bring a diverse range of perspectives to the Board’s deliberations. Each of the nominees, other than Mr. Pagano, is also independent of the Company and management.

In addition to the above qualifications and the criteria set forth below in this Proxy Statement under the heading “Director Nominations”, the Governance and Nominating Committee also considered the specific experience described in the biographical details that follow in determining to nominate the individuals set forth below for election as directors.

| Name | | Age | | | Director Since | | Principal Occupation |

| Lee K. Barba (1) | | 61 | | | 2010 | | CEO of Maitoya Farm Inc. (a private investment and consulting firm) |

| Joseph Lebel (2) | | 81 | | | 2005 | | Retired Quality Control Manager for the Company |

| Dominick A. Pagano (3) | | 68 | | | 2001 | | President and Chief Executive Officer of the Company |

| John A. Rolls (4) | | 70 | | | 2009 | | Managing Partner of Core Capital Partners LLP (a private investment partnership) |

| Joseph S. Ruggiero (5) | | 61 | | | n/a | | Retired Supply Chain and Contracts Manager for Pratt & Whitney Aircraft |

| Christopher R. Sansone (6) | | 37 | | | 2011 | | Managing Member of Sansone Capital Management, LLC (a private portfolio management company) and analyst for Robotti & Company LLC (a diversified financial services boutique) |

Name | | Age | | | Director Since | | Principal Occupation |

| Daniel C. Tracy (7) | | 71 | | | 1999 | | Chairman of the Board of the Company and Business Consultant |

| (1) | Mr. Barba was Chairman and Chief Executive Officer of thinkorswim Group Inc., a leading online brokerage and investor education firm which he built through acquisitions from 2000 until its sale to TD Ameritrade in 2009. Prior to that, he was President of Coral Energy L.P., a joint venture of Shell Oil Company focused on deregulated energy markets and spent over 22 years on Wall Street as an investment banker at Paine Webber, Lehman Brothers and Bankers Trust. Mr. Barba was appointed a director of the Company effective January 7, 2010. |

Mr. Barba’s qualifications for election to EDAC’s Board include his ability to bring to the Board his experience as a CEO of a large public company and his experience on Wall Street in investment banking.

| (2) | Mr. Lebel was the Quality Control Manager for the Company from 1961 until he retired in 1995. He was a director of the Company from 2001 to 2002. |

Mr. Lebel’s qualifications for election to EDAC’s Board include his ability to bring to the Board his long experience in Aerospace quality control.

| (3) | Mr. Pagano became President and Chief Executive Officer of the Company in February 2003. Until March 2007, Mr. Pagano also owned and operated Dapco Industries, Inc., a manufacturer of ultrasonic inspection equipment for the steel and railroad industries, which he founded in 1972, serving as its President and Chief Executive Officer. In March 2007, Mr. Pagano sold Dapco Industries, Inc. and, in March 2009, concluded a two year contract serving on a part time basis as its President. Mr. Pagano served as Chairman of the Board of Directors of American Environmental Technologies, Inc. from 1988 until 1999. Mr. Pagano has been a director of the Company since July 2001, but he did not serve as a director from April 2002 to October 2002. |

Mr. Pagano’s qualifications for election to EDAC’s Board include his demonstrated leadership skills and extensive operating experience. He is highly experienced at driving operational excellence.

| (4) | Mr. Rolls is Managing Partner of Core Capital Partners LLP, a private investment partnership, a position he has held since 2006. From 1996 until 2006 he served as President and Chief Executive Officer of Thermion Systems International; previously, he was President and Chief Executive Officer of Deutsche Bank North America; Executive Vice President and Chief Financial Officer of United Technologies; Senior Vice President and Chief Financial Officer of RCA; and Treasurer of Monsanto Company. Mr. Rolls is a director of FuelCell Energy, Inc. and International Executive Service Corporation. |

Mr. Rolls’ qualifications for election to EDAC’s Board include his ability to bring to the Board his experience as CEO for a large public company and his experience as CFO of United Technologies Corporation.

| (5) | Mr. Ruggiero was employed by Pratt & Whitney Aircraft, a division of United Technologies Corporation, from 1973 until his retirement in 2010, serving as Supply Chain and Contracts Manager since 1990. The Board of Directors has determined that Mr. Ruggiero, a nominee for director who has not previously served as a director of the Company, meets the qualifications for an independent director, as such term is defined in Rule 5605 of the NASDAQ Marketplace Rules. |

Mr. Ruggiero’s qualifications for election to EDAC’s Board include his ability to bring to the Board his extensive experience in managing the procurement of jet engines parts as well as expertise in Strategic Source Planning for one of the world’s largest jet engines manufacturers.

| (6) | Mr. Sansone is the founder and managing member of Sansone Capital Management, LLC, formed in July 2007. Mr. Sansone has been an analyst for Robotti & Company LLC, a New York City based diversified financial services boutique since September 2003 except for the period of time from June 2009 to September 2009 when Mr. Sansone joined a newly formed private equity group called Seaward Partners, which focuses on acquiring small public and private companies. While at Robotti & Company, he has advised the firm’s institutional clients on small cap investment opportunities. Mr. Sansone is a graduate of Pace University. |

Mr. Sansone’s qualifications for election to EDAC’s Board include his ability to bring to the Board his experience and perspective as an analyst and as a managing partner of an investment partnership.

| (7) | Mr. Tracy was employed by Arthur Andersen LLP from 1963 until his retirement in 1998, serving since 1975 as a partner. |

Mr. Tracy’s qualifications for election to EDAC’s Board include his ability to bring to the Board his extensive financial and accounting experience acquired through oversight of Arthur Andersen’s audits of public companies. Mr. Tracy qualifies as an audit committee financial expert.

The Board of Directors recommends that shareholders vote FOR all of the nominees for director.

Board Leadership Structure and Risk Oversight

Mr. Tracy, an independent director, currently serves as Chairman of the Board of Directors. Mr. Pagano, a management director, currently serves as President and Chief Executive Officer of the Company. The Company believes it is the Chairman’s responsibility to lead the Board of Directors and the President and Chief Executive Officer’s responsibility to lead

the day-to-day operations of the Company. As directors continue to have more oversight responsibility than ever before, we believe it is beneficial to have an independent Chairman who is responsible for leading the Board, which allows the President and Chief Executive Officer to focus on running the Company. This separation of responsibilities ensures that there is no duplication of effort between the Chairman and the President and Chief Executive Officer. We believe this separation of leadership provides strong leadership for our Board, while also positioning our President and Chief Executive Officer as the leader of the Company in the eyes of our customers, employees and shareholders.

Our Board of Directors currently has five independent directors and only one non-independent director, the President and Chief Executive Officer.

The Company has three board committees comprised solely of independent directors, each with a different independent director serving as chair. We believe that the number of independent, experienced directors that make up our Board, along with the independent oversight of the Board by the non-management Chairman, benefits the Company and our shareholders.

The Audit and Finance Committee is primarily responsible for overseeing the Company’s risk management process on behalf of the full Board of Directors. The Audit and Finance Committee periodically meets with the Company’s management to review the Company’s risk exposure and the steps management has taken to monitor and control such exposure. The Committee reports regularly to the full Board of Directors, which also considers the Company’s risk profile. While the Audit and Finance Committee and the full Board of Directors oversee the Company’s risk management, the Company’s management is responsible for the day-to-day risk management process. The Company believes that this division of responsibilities is the most effective approach for addressing risks that may face the Company.

Board and Committee Meetings and Related Matters

The Company has an Audit and Finance Committee, a Compensation Committee and a Governance and Nominating Committee of the Board of Directors.

On July 26, 2011, the Audit Committee and the Finance Committee combined into one committee, the Audit and Finance Committee, herein referred to as the “Audit Committee”. From July 26, 2011, and for the remainder of the year, the Audit Committee was composed of Messrs. Rolls, Sansone and Tracy and held two meetings. For the portion of the year prior to July 26, 2011, the Audit Committee held two meetings and was composed of Messrs. Lebel, Tracy and until his death in May 2011, former director of the Company, Ross Towne. For the portion of the year prior to July 26, 2011, the Finance Committee was composed of Messrs. Barba, Lebel and Rolls and, effective April 27, 2011, Mr. Sansone. The Audit Committee meets annually to consider the report and recommendation of the Company’s independent auditors and is available for additional meetings upon request of such auditors. The Audit Committee’s functions also include the engagement and retention of such auditors, adoption of accounting methods and procedures, public disclosures required for compliance with securities laws and other matters relating to the Company’s financial accounting and reporting. The Audit Committee is also primarily responsible for advising management on strategic opportunities, investor relations and the Company’s capital needs. For additional information regarding the Audit Committee, see the “Report of the Audit Committee” below.

From July 26, 2011, and for the remainder of the year, the Compensation Committee was composed of Messrs. Barba, Lebel and Rolls. For the portion of the year prior to July 26, 2011, the committee was composed of Messrs. Barba, Rolls and until his death in May 2011, Mr. Towne. The Compensation Committee sets the compensation for the executive officers of the Company and establishes compensation policies for the Company’s Chief Executive Officer and other executive officers. The Compensation Committee is primarily responsible for the administration of the Company’s stock option plans, under which option grants may be made to employees, officers, directors and consultants. The Compensation Committee convened four times in fiscal year 2011 .

From July 26, 2011, and for the remainder of the year, the Governance and Nominating Committee was composed of Messrs. Barba, Lebel and Sansone. For the portion of the year prior to July 26, 2011, the committee was composed of Messrs. Barba, Lebel, Rolls and Towne (until Mr. Towne’s death in May 2011) and effective April 27, 2011, Mr. Sansone. The Governance and Nominating Committee held one meeting during 2011.

The Board of Directors held six meetings during 2011, of which one was telephonic. In 2011, no director attended fewer than 75% of the total number of meetings of the Board of Directors and each Committee on which he served.

The Board of Directors has determined that the following members of the Board are independent directors, as such term is defined in Rule 5605 of the NASDAQ Marketplace Rules: Lee K. Barba, Joseph Lebel, John A. Rolls, Christopher R. Sansone and Daniel C. Tracy.

Director Nominations

From July 26, 2011, and for the remainder of the year, the Governance and Nominating Committee was composed of Messrs. Barba, Lebel and Sansone. For the portion of the year prior to July 26, the committee was composed of Messrs. Barba, Lebel, Rolls and Towne (until Mr. Towne’s death in May 2011) and effective April 27, 2011, Mr. Sansone. All of the committee members were independent directors. The duties and responsibilities of the Governance and Nominating Committee are set forth in a written Nominating Committee Charter. A copy of the charter is available on the Company’s website: www.edactechnologies.com. Nominations of candidates for election as directors may be made by the Governance and Nominating Committee or by shareholders. The Governance and Nominating Committee will consider director candidates recommended by shareholders.

The general criteria that the Governance and Nominating Committee uses to select nominees, whether such nominees are recommended by the Governance and Nominating Committee or by a shareholder, are: such individual’s reputation for integrity, honesty and adherence to high ethical standards; their demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company; their willingness and ability to contribute positively to the decision-making process of the Company; their commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board and its committees; their ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include shareholders, employees, customers, governmental units, creditors and the general public, and to

act in the interests of all shareholders; and no nominee should have, or appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s shareholders and to fulfill the responsibilities of a director. While the Nominating Committee Charter does not expressly contain diversity standards, as a matter of practice, the Governance and Nominating Committee considers diversity in the context of the Board as a whole and takes into account the personal characteristics (gender, ethnicity, age) and experience (industry, professional, public service) of current and prospective directors to facilitate Board deliberations that reflect a broad range of perspectives.

A shareholder may nominate one or more persons for election as a director at a meeting of shareholders only if such shareholder has given timely notice in proper written form of his or her intent to make such nomination or nominations. To be timely, such shareholder’s notice must be delivered to or mailed to and received by the Secretary of the Company at the principal executive offices of the Company not later than the close of business on the later of (i) the 60th calendar day prior to the date of such meeting or (ii) the 10th calendar day following the day on which public announcement is first made of the date of such meeting. In no event shall the public announcement of an adjournment of a meeting commence a new time period for the giving of a shareholder’s notice described above. To be in proper form, a shareholder’s notice to the Secretary shall set forth:

| · | the name and address of the shareholder who intends to make the nomination and the name and address of the person or persons to be nominated; |

| · | a representation that the shareholder is a holder of record of stock of the Company entitled to vote at such meeting, that the shareholder will continue to be a holder of record of stock of the Company as of the date of such meeting and, if applicable, that the shareholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

| · | if applicable, a description of all arrangements or understandings between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder; |

| · | such other information regarding each nominee to be proposed by such shareholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission had the nominee been nominated, or intended to be nominated, by the Board of Directors; and |

| · | the consent of each nominee to serve as director of the Company if so elected. |

The Chairman of the meeting shall refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

Director Attendance at the Annual Meeting

Although the Company does not have a formal policy with respect to director attendance at annual meetings, the Company strongly encourages directors to attend the annual meeting. All

of our directors who were directors in 2011 attended last year’s annual meeting, and we expect that all of our directors will attend this year’s annual meeting.

Shareholder Communications with the Board of Directors

The Board will give appropriate attention to written communications on issues that are submitted by shareholders and other interested parties. Absent unusual circumstances, the Chairman of the Board of Directors will, with the assistance of the Company’s outside legal counsel, (1) be primarily responsible for monitoring communications from shareholders and other interested parties and (2) provide copies or summaries of such communications to the other directors as he considers appropriate.

Shareholders and other interested parties who wish to send communications to the Board should address such communications to Daniel C. Tracy, Chairman of the Board, EDAC Technologies Corporation, 1806 New Britain Ave., Farmington, CT 06032.

Fees of Independent Auditors

The following is a summary of the fees billed by the Company’s principal accountant for professional services rendered for the fiscal years ended December 31, 2011 and January 1, 2011.

| Fee Category | | Fiscal 2011 fees | | | Fiscal 2010 fees | |

| | | | | | | |

| Audit Fees | | $ | 122,450 | | | $ | 124,000 | |

| Audit-related fees | | | - | | | | - | |

| Tax Fees | | | - | | | | - | |

| All Other Fees | | | 18,500 | | | | 18,000 | |

| Total Fees | | $ | 140,950 | | | $ | 142,000 | |

Audit Fees. Services consist of the audit of the Company’s annual financial statements and review of financial statements included in the Company’s quarterly reports on Form 10-Q.

Audit-Related Fees. Services consist of that which are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements, but are not reported under “Audit Fees.” No such fees were incurred during the past two years.

Tax Fees. Services consist of tax return preparation and tax advice for federal and state taxes. Services for fiscal 2011 and fiscal 2010 were provided by accountants other than the Company’s principal accountant.

All Other Fees. Services consisted of audits of the Company’s employee benefit plans.

The Audit Committee of the Board of Directors of the Company considered that the provision of the services and the payment of the fees described above are compatible with maintaining the independence of Grant Thornton LLP and the Company’s former principal accountant, CCR LLP.

The Audit Committee’s policy is to pre-approve all audit services, audit related services, tax services and other services. The Audit Committee may also pre-approve particular services on a case-by case basis.

The Audit Committee approved all services and fees billed by the Company’s principal accountant for the fiscal years ended December 31, 2011 and January 1, 2011

Report of the Audit Committee

The Audit Committee is currently composed of three members of the Company’s Board of Directors, namely Messrs. Rolls, Sansone and Tracy. Each member of the Audit Committee is independent, as defined in Rule 5605 of the NASDAQ Marketplace Rules. The Board has identified Mr. Daniel Tracy as the “Audit Committee Financial Expert” as defined by the rules of the Securities and Exchange Commission (the “Commission”). The duties and responsibilities of the Audit Committee are set forth in a written Audit Committee Charter. A copy of the charter is available on the Company’s website: www.edactechnologies.com.

The Audit Committee has:

| · | reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 2011, with the Company’s management and with the Company’s independent auditors; |

| · | discussed with the Company’s independent auditors the matters required to be discussed by Statement on Accounting Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and |

| · | received and discussed with the Company’s independent auditors the written disclosures and the letter from the Company’s independent auditors required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and discussed with the independent auditors the matters disclosed in the letter and their independence from the Company. |

Based on such review and discussions with management and the independent auditors, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, for filing with the Commission.

AUDIT COMMITTEE:

John A. Rolls, Chairman

Christopher R. Sansone

Daniel C. Tracy

Compensation of Directors

In 2011, the Company paid directors of the Company a retainer of $4,000 each fiscal quarter and $1,500 for each non-telephonic Board of Directors or committee meeting attended. The Chairman of the Board of Directors was paid an additional retainer of $2,000 each fiscal quarter and an additional $500 per non-telephonic meeting attended. Each director who serves as Chairman of a committee was paid an additional $500 for each non-telephonic meeting chaired by such director. In addition, each director who participates in a telephonic Board of Directors or committee meeting at which a substantive resolution is considered is paid $500.

In 2009, the Compensation Committee recommended, and the Board of Directors approved, a Director Stock Option Program (“Program”) whereby each Director can make an annual election to receive compensation in the form of stock options in lieu of cash payment. The Program was adopted pursuant to the EDAC Technologies Corporation 2008 Equity Incentive Plan. The number of common stock shares represented by each option will be determined on the first day of each fiscal quarter based on meeting attendance fees earned in the preceding fiscal quarter but not paid in the form of cash, plus the retainer for the current fiscal quarter. Options issued under the Program are exercisable for a period of five years and vest immediately upon grant. Shares of the Company’s common stock acquired upon exercise of the options must be held by the Director for a minimum period of three years from the date of granting the option. The Program was effective with the commencement of fiscal year 2010.

Each new director of the Company is granted a stock option to purchase 10,000 shares of Common Stock on the day of such director’s initial election to the Board of Directors. The exercise price of such options is equal to the fair market value of the Company’s Common Stock on the date of grant.

2011 Director Compensation Table

The following table sets forth the compensation of the Company’s independent directors for the fiscal year 2011:

Name | | Fees Earned or paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($)(1) (2) | | | Total ($) | |

| Lee K. Barba | | | 36,000 | | | | 13,150 | | | | 6,125 | | | | 55,275 | |

| Joseph Lebel | | | 34,500 | | | | 13,150 | | | | 6,125 | | | | 53,775 | |

| John A. Rolls | | | - | | | | 13,150 | | | | 44,625 | | | | 57,775 | |

| Christopher R. Sansone (3) | | | 19,857 | | | | - | | | | 20,500 | | | | 40,357 | |

| Ross Towne (4) | | | 21,000 | | | | - | | | | - | | | | 21,000 | |

| Daniel C. Tracy | | | 42,000 | | | | 13,150 | | | | 6,125 | | | | 61,275 | |

| (1) | Amounts reflect the aggregate grant date fair value calculated in accordance with FASB ASC Topic 718 with respect to stock options. The assumptions made in the valuation of these awards are set forth in Note C Common Stock and Stock Options to the Consolidated Financial Statements in Exhibit 13 to the Company’s 2011 Annual Report on Form 10-K. |

| (2) | The aggregate number of option awards outstanding at December 31, 2011 by director were: Mr. Barba 12,500; Mr. Lebel 37,500; Mr. Rolls 56,620; Mr. Sansone 10,000 and Mr. Tracy 45,000. |

| (3) | Mr. Sansone was elected Director of the Company effective April 27, 2011. An option for 10,000 shares was granted to Mr. Sansone upon his election in accordance with Company policy. |

| (4) | Mr. Towne was a Director of the Company until his death on May 29, 2011. |

Executive Officers

The following table sets forth the name, age and positions and offices held by each executive officer of the Company during fiscal year 2011:

| Name | | Age | | Office |

| Dominick A. Pagano | | 68 | | President and Chief Executive Officer; Director |

| | | | | |

| Glenn L. Purple | | 56 | | Vice President – Finance, Chief Financial Officer and Secretary |

Mr. Pagano became President and Chief Executive Officer of the Company in February 2003. Mr. Pagano has been a director of the Company since July 2001, but he did not serve as a director from April 2002 to October 2002. Until March 2007, Mr. Pagano also owned and operated Dapco Industries, Inc. a company that he founded in 1972, serving as its President and Chief Executive Officer. In March 2007, Mr. Pagano sold Dapco Industries, Inc. and in March 2009, concluded a two year contract serving on a part time basis as its President.

Mr. Purple joined the Company in February 1982 as Controller. He served as Controller until November 2002, when he was appointed Vice President – Finance, Chief Financial Officer and Secretary of the Company. Mr. Purple also served as Vice President – Finance and Chief Financial Officer of the Company from 1989 through 1996.

Officers are elected annually by, and serve at the discretion of, the Board of Directors.

Compensation Discussion and Analysis

Design and Objectives:

The Compensation Committee is responsible for the design and administration of the Company’s executive and management compensation programs. The programs consist of: (i) base compensation in the form of a base salary plus typical employee fringe benefits, (ii) short-

term incentives in the form of cash bonuses and (iii) long-term incentives in the form of stock options. These incentive programs are designed to align executive compensation with shareholder value. The overall goals of the compensation programs are to:

| · | Ensure that the Company is able to attract, retain and motivate outstanding employees; |

| · | Ensure that pay levels remain competitive; |

| · | Encourage business development consistent with the business cycle of the Company; |

| · | Promote the achievement of financial objectives specified by the Company; |

| · | Recognize and reward employees for the Company’s performance and the achievement of individual goals and objectives. |

Elements of Compensation:

The Compensation Committee believes that each element of the compensation programs is essential to the achievement of short-term and long-term objectives of the Company. The following is a discussion of each of those elements.

Base Compensation:

Base compensation is a critical element of executive compensation because it provides executives with a consistent base level of income. During fiscal year 2011, base annual salaries for our executive officers were set at levels that the Compensation Committee believes, based on input from an independent human resources consulting firm, are fair and competitive. We intend to evaluate our executive officers’ base annual salaries periodically relative to local competitive situations for similar companies in the same or similar industries in order to continue to attract and retain qualified executive officers. In addition to compensation market data, the Compensation Committee also considers each individual executive’s position scope and accountability, experience level and overall performance when determining base salary. To the extent they are eligible, executive officers of the Company are also able to participate in all benefit programs that the Company makes available to its employees, including, but not limited to, health and dental insurance.

Short-Term Incentives:

Executive officers can also earn short-term incentives in the form of an annual cash bonus based on the Company’s achievement of predetermined objective financial and other criteria established annually by the Compensation Committee. The Company’s short-term incentives are designed to produce compensation that the Compensation Committee believes is fair and competitive for executive officers. Short-term incentives are a key component of the total compensation offering and are designed to reward executives for achieving annual financial and other performance goals. We have used cash as the payment form to enhance the total cash opportunity for our executives which we believe strengthens our ability to attract and retain talented leaders.

The target incentive bonuses for the executive officers of the Company have been established as a percentage of their base salary. The specific financial objectives established by the Compensation Committee to determine bonus compensation for fiscal year 2011 were based

on the Company’s sales and operating income, and the achievement of certain personal performance objectives, as detailed in the chart below:

| | | | | | Financial Objectives for Target Incentive Bonus (total 100%) | |

| Position | | Target Incentive Bonus (Percentage of Base Salary) | | | Company Sales | | | Company Net income Before Tax | |

| Chief Executive Officer | | | 50 | % | | | 25 | % | | | 75 | % |

| Chief Financial Officer | | | 30 | % | | | 25 | % | | | 75 | % |

In connection with determining the annual bonuses for the executives, each element of the compensation programs is considered individually. For example, if corporate sales objectives and individual performance objectives are achieved, but corporate operating income falls short of the target objectives, then only a portion of the target incentive compensation would be awarded to the executive officer.

The chart below details results as certified by the Compensation Committee compared to the financial objectives:

(Dollars in Thousands)

| | | Threshold | | | Target | | | 2011 results | |

| Sales | | $ | 72,498 | | | $ | 85,292 | | | $ | 86,633 | |

| Net Income Before Tax | | $ | 3,516 | | | $ | 4,136 | | | $ | 5,379 | |

The threshold amount must be met before any bonus is paid. Meeting Target will pay out 80% of the bonus. Meeting 110% of target will pay out 105% of Target Incentive Bonus amount and additional increments of 5% of the Target Incentive Bonus will be paid for each 5% of additional increment to the Target. Additionally, the Compensation Committee may award up to 10% of base salary as additional bonus for exceptional performance.

Long-Term Incentives:

Long-term incentives are awarded to executives in the form of stock options and restricted stock at the periodic and subjective discretion of the Compensation Committee, and as approved by the Board of Directors. The Board of Directors believes the awarding of such incentives will retain experienced and capable executive management focused on the longer term benefit of the shareholders. In particular, equity-based awards are intended to motivate our executive officers to improve the long-term performance of our common stock, and we therefore believe that equity-based compensation helps create a vital long-term partnership between our executive officers and shareholders.

There is no direct or indirect relationship as to the allocation of short-term and long-term compensation programs of the Company. The awarding of short-term and long-term incentives and compensation to executive officers are based primarily on financial results and achievement of personal goals and objectives.

Incentives are based primarily on historical results; therefore, the Compensation Committee has determined that there is no need to implement a plan to adjust or recover incentives previously granted executive officers. To the extent the incentive programs focus on future events, the value of long-term incentives (stock options and restricted stock) will be reflected in the market value of such options and stock.

Overview of the Activities of the Compensation Committee:

During 2008 the Board of Directors authorized the Compensation Committee to engage the services of Overton Consulting, Inc., an independent compensation consulting firm, to review and evaluate the various compensation programs and compensation levels of the Company’s management and proposed employment agreements of executive officers. The scope of the resulting review included cash compensation plans and short-term and long-term incentive programs of the Board of Directors, executive officers and division managers of the Company.

As a result of the review and evaluation, certain salaries were adjusted to bring them within the competitive level of similar positions within the local market. Furthermore, in 2009 the Company extended the employment agreement with Mr. Pagano through fiscal year 2013 and in 2011, extended the employment agreement with Mr. Purple through fiscal year 2012. The Compensation Committee believes these agreements, which are aligned with the fiscal year of the Company, (i) incorporate terms and conditions commensurate with the local market and industry and companies of a similar size and (ii) provide competitive compensation with similar positions in the local market. These employment agreements are further described elsewhere in this Proxy Statement under the heading “Employment Agreements”. The Chief Executive Officer’s employment agreement provides for (among other things), certain severance payments (including typical employee fringe benefits) in the event of a change of control which is defined in the agreement as previously filed with the Securities and Exchange Commission.

The Compensation Committee convened four times in fiscal year 2011 . The executive officers of the Company do not play a role in determining the amount or form of executive and director compensation. The duties and responsibilities of the Compensation Committee are set forth in a written Compensation Committee Charter. The Compensation Committee Charter is consistent with the design and objectives of the Company’s compensation programs and elements of compensation described above. A copy of the charter is available on the Company’s website: www.edactechnologies.com.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the foregoing Compensation Discussion and Analysis with the management of the Company. Based on this review and discussion, we recommended to the Board of Directors that the Compensation Discussion and Analysis be included in the Company’s Proxy Statement for the 2012 Annual Meeting.

COMPENSATION COMMITTEE:

Lee K. Barba, Chairman

Joseph Lebel

John A. Rolls

Executive Compensation

Summary Compensation Information

The following table sets forth certain information concerning compensation of the Company’s Principal Executive Officer, Principal Financial Officer and other executive officers of the Company who served during 2011 (collectively, the “Named Executive Officers”).

2011 Summary Compensation Table

| | | | | | | | | | | | Change in Pension Value | | | | | | | |

| | | | | | | | | | | | | | | | | | And | | | | | | | |

Name and Principal Position | | Year | | | Salary ($) | | | Bonus ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(2) | | | Nonqualified Deferred Compensation Earnings ($) (3) | | | All Other Compen- sation ($) | | | Total ($) | |

Dominick A. Pagano President and Chief Executive Officer | | 2011 2010 | | | | 360,000 360,000 | | | | 236,577 55,800 | | | | 78,900 -- | | | | 36,750 -- | | | | -- -- | | | | 4,757 16,757 | | | | 716,984 432,557 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Glenn L. Purple Vice President and Chief Financial Officer | | 2011 2010 | | | | 171,150 171,150 | | | | 58,405 7,958 | | | | -- -- | | | | 12,250 -- | | | | 11,898 8,570 | | | | -- -- | | | | 253,703 187,678 | |

| (1) | Amounts reflect the aggregate grant date fair value calculated in accordance with FASB ASC Topic 718 with respect to awards of stock. |

| (2) | Amounts reflect the grant date fair value calculated in accordance with FASB ASC Topic 718 with respect to stock options. The assumptions made in the valuation of these awards are set forth in Note C Common Stock and Stock Options to the Consolidated Financial Statements in Exhibit 13 to the Company’s 2011 Annual Report on Form 10-K. |

| (3) | Amount represents the change in the actuarial present value of the accumulated benefit under the Company’s defined benefit plan. This plan was frozen with respect to all future benefits as of April 1, 1993. |

Option Grants

The following table provides certain information regarding stock options granted to the Named Executive Officers in 2011.

2011 Grants of Plan-Based Awards

| | | | | All Other Stock Awards: Number of Shares of Stock or Units (1) | | | All Other Option Awards: Number of Securities Underlying Options | | | Exercise or Base Price of Option Awards | | | Of Stock and Option Awards (3) | |

| | | | | | | | | | | | | | |

| Dominick A. Pagano | | 8/9/11 | | | | | | 15,000 | | | | 5.786 | | | $ | 36,750 | |

| | | 8/9/11 | | | 15,000 | | | | 15,000 | | | | - | | | $ | 78,900 | |

| Glenn L. Purple | | 8/9/11 | | | | | | | 5,000 | | | | 5.26 | | | $ | 12,250 | |

| (1) | Stock award vests 1/3 after 1 year, 2/3 after 2 years and is fully vested after 3 years. |

| (2) | Stock options with an exercise price equal to the closing price of the Company’s common stock on the date of grant and a five year term. Options are exercisable 1/3 after 1 year, 2/3 after 2 years and are fully exercisable after 3 years. For Mr. Pagano, the option is exerciseable provided that the share price must be at least $8 per share at the time of exercise. |

| | (3) | Reflects aggregate grant date fair value of stock options calculated in accordance with FASB ASC Topic 718. |

Fiscal Year-End Option Values

The following table provides certain information regarding options held by the Named Executive Officers as of December 31, 2011.

Outstanding Equity Awards at Fiscal Year-End

| | | | | | | |

| | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | | | | | | | Number of shares or units of stock that have not yet vested (#) | | | Market value of shares or units of stock that have not vested ($) | |

| Dominick A. Pagano | | | - | | | | - | | | | - | | | | - | | | | 15,000 | (1) | | | 165,750 | |

| | | | - | | | | 15,000 | (1)(2) | | | 5.786 | | | 8/8/16 | | | | | | | | | |

| | | | 136,000 | | | | 68,000 | (3) | | | 3.64 | | | 11/29/14 | | | | | | | | | |

| | | | 30,667 | | | | 15,333 | (3) | | | 4.00 | | | 11/29/14 | | | | | | | | | |

| | | | 50,000 | | | | | - | | | 2.31 | | | 12/1/13 | | | | | | | | | |

| | | | 100,000 | | | | - | | | | 9.28 | | | 12/02/12 | | | | | | | | | |

| | | | 16,667 | | | | - | | | | 2.90 | | | 12/04/16 | | | | | | | | | |

| Glenn L. Purple | | | - | | | | 5,000 | (1) | | | 5.26 | | | 8/8/16 | | | | | | | | | |

| | | | 3,333 | | | | 1,667 | (3) | | | 3.64 | | | 11/29/14 | | | | | | | | | |

| | | | 7,500 | | | | | - | | | 2.10 | | | 12/1/13 | | | | | | | | | |

| | | | 7,500 | | | | | - | | | 9.28 | | | 12/02/12 | | | | | | | | | |

| | | Option Awards | | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price($) | | | Option Expiration Date | | | Number of shares or units of stock that have not yet vested (#) | | | Market value of shares or units of stock that have not vested ($) | |

| | | | 7,500 | | | | - | | | | 2.90 | | | 12/04/16 | | | | - | | | | - | |

| | | | 10,000 | | | | - | | | | 3.70 | | | 12/30/15 | | | | | | | | | |

| | | | 5,000 | | | | - | | | | 1.67 | | | 12/6/14 | | | | | | | | | |

| | | | 2,500 | | | | - | | | | 1.10 | | | 1/5/14 | | | | | | | | | |

| | | | 5,000 | | | | - | | | | 0.51 | | | 12/2/12 | | | | | | | | | |

| (1) | Scheduled to vest 1/3 on August 9, 2012, 1/3 on August 9, 2013 and 1/3 on August 9, 2014. |

| (2) | Exerciseable provided that the share price must be at least $8 per share at the time of exercise. |

| | (3) | Scheduled to vest on November 30, 2012. |

Pension Plan

The following table provides certain information regarding the pension plan benefits accumulated by the Named Executive Officers and the present value of such accumulated benefits as of December 31, 2011.

Pension Benefits

Name | | Plan Name | | | Number of Years Credited Service # | | | Present Value of Accumulated Benefits (2) $ | |

| Glenn L. Purple | | | (1 | ) | | | 11 | | | | 63,967 | |

| (1) | Plan name is EDAC Technologies Corporation Gros-Ite Division Employees’ Pension Plan. |

| (2) | The Present Value of Accumulated Benefits is calculated using a discount rate of 4.50%. Reference Note F to the Consolidated Financial Statements on pages 27 through 30 of the Company’s 2011 Annual Report to Shareholders. |

The plan provides for benefits based on years of service and compensation during the last five years of employment prior to April 1, 1993. The normal retirement benefit payable monthly at age 65 is calculated as one-twelfth of the sum of 1.5% of final average compensation less .45% of the offset allowance multiplied by the years of credited service to a maximum of 30 years. The offset allowance is the lesser of $10,000 per year or the final average compensation. Final average compensation used in the formula includes an employee’s salary, or if paid hourly, his hourly rate of pay multiplied by 2,080. In March 1993, the Board of Directors approved a curtailment to the plan which resulted in the freezing of all future benefits under the plan as of April 1, 1993.

Potential Payments Upon Termination

Regarding Mr. Pagano:

Under Mr. Pagano’s employment agreement, described below, if the Company terminates Mr. Pagano’s employment for any reason other than cause or elects not to extend the then current term of employment, or if Mr. Pagano terminates his employment for “good reason”, Mr. Pagano is entitled to receive all accrued amounts owing to Mr. Pagano but not yet paid as of the date of termination, and all then outstanding stock options held by Mr. Pagano that were granted to him but not yet vested shall become fully vested as of the date of termination. In addition, Mr. Pagano is entitled to receive certain severance benefits, as summarized below, for a severance period equal to the longer of (x) 24 months from the date of termination and (y) the period of time remaining in the then current term of employment (assuming no such termination had occurred, prorated for any partial year).

Specifically, Mr. Pagano is entitled to receive the following severance benefits during the severance period: (i) Mr. Pagano’s base salary for the year in which such termination occurs, to be paid in annualized monthly installments over the severance period, (ii) Mr. Pagano’s target bonus in effect for the year in which such termination occurs, or the actual bonus earned by Mr. Pagano in the year immediately preceding such termination, whichever amount is greater, to be paid at the time when the Company customarily pays such amounts for each year during the severance period, and (iii) the other fringe benefits that were provided to Mr. Pagano while employed by the Company including health and dental insurance, to the extent such benefits can be provided by the Company to non-employees, or to the extent such benefits cannot be provided to non-employees, the cash equivalent thereof. The payment of these severance benefits is contingent upon Mr. Pagano executing a release, which shall release the Company of and from any and all claims and liabilities Mr. Pagano has or may have against the Company. The employment agreement includes provisions that require the Company to delay any severance payments due to Mr. Pagano in order to meet the requirements of Section 409A of the Internal Revenue Code of 1986, as amended. The employment agreement also includes provisions that require the Company to reduce any severance payments due to Mr. Pagano as a result of a “change of control” of the Company, to ensure that such payments do not exceed the limits set forth in Section 280G of the Internal Revenue Code of 1986, as amended.

Mr. Pagano can terminate his employment for “good reason” if any of the following occurs during the term of his employment: (i) a material reduction in Mr. Pagano’s authority or duties, or a reduction in Mr. Pagano’s compensation, in each such case without the prior written consent of Mr. Pagano, (ii) a material breach by the Company of the terms of the agreement, which breach, if capable of being remedied, (A) the Company has not taken appropriate action to remedy within 10 business days following written notice from Mr. Pagano to the Company notifying it of such breach, and (B) is not remedied by the Company within 30 days following such written notice, (iii) the relocation of Mr. Pagano’s place of work more than 30 miles from the Company’s current facilities in Farmington, Connecticut, or (iv) a “change of control” of the Company.

Under Mr. Pagano’s employment agreement, a “change of control” means: (i) the acquisition by an individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) (a “Person”) of beneficial ownership of any capital stock of the Company if, after such acquisition, such Person beneficially owns (within the meaning of Rule 13d-3 promulgated under the Exchange Act) 40% or more of the then-outstanding shares of common stock of the Company or the combined voting power of the then-outstanding securities of the Company entitled to vote generally in the election of directors; (ii) such time as the Continuing Directors (as defined below) do not constitute two-thirds of the Board (or, if applicable, the Board of Directors of a successor corporation to the Company), where the term “Continuing Director” means at any date a member of the Board (A) who was a member of the Board on the date of the execution of the new agreement or (B) who was nominated or elected subsequent to such date by at least two-thirds of the directors who were Continuing Directors at the time of such nomination or election or whose election to the Board was recommended or endorsed by at least two-thirds of the directors who were Continuing Directors at the time of such nomination or election; provided, however, that there is excluded from clause (B) any individual whose initial assumption of office occurred as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents, by or on behalf of a person other than the Board; or (iii) the consummation of a merger, consolidation, reorganization, recapitalization or statutory share exchange involving the Company or a sale or other disposition of all or substantially all of the assets of the Company, unless the owners of the capital stock of the Company before such transaction continue to own more than 50% of the capital stock of the acquiring or succeeding entity in substantially the same proportions immediately following such a transaction.

Regarding Mr. Purple:

Under Mr. Purple’s employment agreement, described below, if the Company terminates Mr. Purple’s employment for any reason other than cause, or if Mr. Purple terminates his employment for “good reason”, Mr. Purple is entitled to receive the following for the 12 month period following the date of his termination: (i) Mr. Purple’s salary as in effect on the date of his termination and the amount of the annual bonus paid to him for the fiscal year immediately preceding the date of termination (payable in annualized monthly installments), (ii) any incentive compensation earned by Mr. Purple through the date of his termination (payable to him at the customary time), and (iii) the other fringe benefits that were provided to Mr. Purple while employed by the Company including health and dental insurance, to the extent such benefits can be provided by the Company to non-employees, or to the extent such benefits cannot be provided to non-employees, then the cash equivalent thereof. The payment of these amounts is contingent upon Mr. Purple executing a release in a form reasonably acceptable to the Company.

Mr. Purple can terminate his employment for “good reason” if any of the following occurs during the term of his employment, (i) a material reduction in Mr. Purple’s authority, duties or compensation without the prior written consent of Mr. Purple, (ii) a material breach by the Company of the terms of the agreement, which breach, if capable of being remedied, (A) the Company has not taken appropriate action to remedy within 10 business days following written notice from Mr. Purple to the Company notifying it of such breach, and (B) is not remedied by the Company within 30 days following such written notice, or (iii) the relocation of Mr. Purple’s

place of work more than 30 miles from the Company’s current facilities in Farmington, Connecticut.

Employment Agreements

Amended and Restated Employment Agreement – between the Company and Dominick A. Pagano.

On January 14, 2010, the Company entered into an Amended and Restated Employment Agreement with its current President and Chief Executive Officer, Dominick A. Pagano, which replaced his employment agreement dated as of February 12, 2007. Under the agreement, the initial three-year term commenced on the first day of the Company’s 2010 fiscal year and continues until the last day of the Company’s 2012 fiscal year, and automatically extends for successive periods of 12 months (equal to the Company’s next fiscal year period) unless the Company elects to not extend the Agreement by providing notice to Mr. Pagano at least 90 days prior to the end of the then current term. Mr. Pagano’s annual base salary for the Company’s 2011 fiscal year was $360,000 and is subject to annual review and adjustment thereafter, and his annual base salary is currently $400,000 for the Company’s 2012 fiscal year. Mr. Pagano shall be eligible to receive a performance based annual bonus of at least 50% of his base salary, in accordance with the Company’s Management Incentive Bonus Plan and established performance goals. To the extent he is eligible, Mr. Pagano is entitled to participate in all other benefit programs that the Company establishes and makes available to its employees. Under the new agreement, the Company may terminate Mr. Pagano’s employment for cause (as defined in the agreement) or at the end of the then current term of employment upon 90 days prior notice. Mr. Pagano may terminate his employment with the Company for “good reason”.

Under Mr. Pagano’s employment agreement, if the Company terminates Mr. Pagano’s employment for any reason other than cause or elects not to extend the then current term of employment, or if Mr. Pagano terminates his employment for “good reason”, Mr. Pagano is entitled to receive all accrued amounts owing to Mr. Pagano but not yet paid as of the date of termination, and all then outstanding stock options held by Mr. Pagano that were granted to him but not yet vested shall become fully vested as of the date of termination. In addition, Mr. Pagano is entitled to receive certain severance payments as previously summarized above in this Proxy Statement under the section heading “Potential Payments Upon Termination”.

While Mr. Pagano is employed by the Company, and if the Company terminates his employment for cause, for a period of one year following such termination, Mr. Pagano cannot directly or indirectly: (a) engage in any business or enterprise (whether as owner, partner, officer, director, employee, consultant, investor, lender or otherwise, except as the holder of not more than 1% of the outstanding stock of a publicly-held company) that is competitive with the Company’s business as conducted as of the termination date, including but not limited to any business or enterprise that develops, manufactures, markets, or sells any product or service that competes with any product or service developed, manufactured, marketed, sold or provided, or planned to be developed, manufactured, marketed, sold or provided, by the Company or any of its subsidiaries while Mr. Pagano was employed by the Company; or (b) either alone or in association with others (i) solicit, or permit any organization directly or indirectly controlled by Mr. Pagano to solicit, any employee of the Company to leave the employ of the Company, or

(ii) solicit for employment, hire or engage as an independent contractor, or permit any organization directly or indirectly controlled by Mr. Pagano to solicit for employment, hire or engage as an independent contractor, any person who was employed by the Company at any time during the twelve-month period preceding the date of termination of Mr. Pagano’s employment with the Company.

Employment Agreement – between the Company and Glenn L. Purple.

The Company extended the Employment Agreement initially entered into on February 12, 2007 with its current Vice President – Finance, Chief Financial Officer, and Secretary, Glenn L. Purple, the term of which expired on December 31, 2011. Under the agreement, Mr. Purple’s current term of employment will expire on December 31, 2012, but the term of employment automatically extends for successive periods of 12 months (equal to the Company’s next fiscal year period) unless either party gives the other 90 days advance written notice to the contrary. Mr. Purple’s annual base salary for the Company’s 2011 fiscal year was $171,150, subject to adjustment thereafter, and his annual base salary is currently $179,708 for the Company’s 2012 fiscal year. To the extent he is eligible, Mr. Purple is entitled to participate in all bonus and benefit programs that the Company establishes and makes available to its employees. Under the agreement, the Company may terminate Mr. Purple’s employment for cause (as defined in the agreement), or upon not less than 90 days’ prior written notice to Mr. Purple. Mr. Purple may terminate his employment with the Company for “good reason” or upon 90 days’ advance written notice to the Company.

The agreement provides that if Mr. Purple’s employment terminates because of death or disability, or if the Company terminates Mr. Purple’s employment for cause or Mr. Purple terminates his employment (without “good reason”) upon 90 days’ advance written notice to the Company, Mr. Purple is entitled to the compensation, bonus and benefits otherwise payable to him under the agreement through the last day of his actual employment by the Company.

While Mr. Purple is employed by the Company, and if the Company terminates his employment for cause, for a period of one year following such termination, Mr. Purple cannot directly or indirectly: (a) engage in any business or enterprise (whether as owner, partner, officer, director, employee, consultant, investor, lender or otherwise, except as the holder of not more than 1% of the outstanding stock of a publicly-held company) that is competitive with the Company’s business as conducted as of the termination date, including but not limited to any business or enterprise that develops, manufactures, markets, or sells any product or service that competes with any product or service developed, manufactured, marketed, sold or provided, or planned to be developed, manufactured, marketed, sold or provided, by the Company or any of its subsidiaries while Mr. Purple was employed by the Company; or (b) either alone or in association with others (i) solicit, or permit any organization directly or indirectly controlled by Mr. Purple to solicit, any employee of the Company to leave the employ of the Company, or (ii) solicit for employment, hire or engage as an independent contractor, or permit any organization directly or indirectly controlled by Mr. Purple to solicit for employment, hire or engage as an independent contractor, any person who was employed by the Company at any time during the twelve-month period preceding the date of termination of Mr. Purple’s employment with the Company.

Review and Approval of Transactions with Related Persons

The Board of Directors reviews on a case-by-case basis any direct or indirect transactions between the Company and its executive officers, directors or stockholders holding 5% or more of its voting securities, and any other transactions required to be disclosed as related person transactions by Item 404 of Regulation S-K under the Exchange Act. The Board of Directors has adopted a written Related Person Transaction Policy for the review, approval or ratification of transactions with related persons. Pursuant to this policy, all related person transactions or series of similar transactions required to be disclosed by the SEC rules are prohibited unless approved or ratified by the Board of Directors. In general, the Board of Directors will consider all relevant facts and circumstances when reviewing any potential related person transaction, including, for example, the commercial reasonableness of its terms; the benefit to the Company; the opportunity costs of alternate transactions; and the materiality and character of the related person’s interest, and the actual or apparent conflict of interest of the related person.

If the potential transaction were to involve a Board member, he or she must be available to answer questions, but would neither participate in any discussion nor vote to either approve or disapprove the transaction.

The Board will not approve or ratify a related person transaction unless it shall have determined that, upon consideration of all relevant information, the transaction is in, or not inconsistent with, the best interests of the Company and its shareholders. If the Board determines not to approve or ratify a related person transaction (whether such transaction is being reviewed for the first time or has previously been approved and is being reviewed), the transaction will not be entered into or continued, as the Board shall direct.

The Company has advised its directors and executive officers that they are required to promptly notify the Corporate Secretary of the Company of any proposed related person transaction in which such director or executive officer may be directly or indirectly involved as soon he or she becomes aware of a possible transaction. The Corporate Secretary of the Company is responsible for taking all reasonable steps to ensure that all related person transactions be presented to the Board of Directors for review and discussion, and if appropriate, pre-approval or ratification by the Board of Directors.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists solely of independent directors. During the fiscal year ended December 31, 2011, the following board members served on the Compensation Committee: From July 26, 2011, and for the remainder of the year, the Compensation Committee was composed of Messrs. Barba, Lebel, and Rolls. For the portion of the year prior to July 26, 2011, the committee was composed of, Messrs. Lebel, Rolls and Towne (until Mr. Towne’s death in May 2011). No member of the Compensation Committee was at any time during fiscal year 2011 an officer or employee of the Company or any subsidiary of the Company, or formerly an officer of the Company or any subsidiary of the Company, nor has any member of the Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Exchange Act.

PROPOSAL NO. 2 – RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

On November 30, 2011, the Audit Committee approved the engagement of Grant Thornton LLP as the Company’s new independent registered public accounting firm. CCR LLP (“CCR”), the Company’s former independent registered public accounting firm, resigned as the Company’s independent registered public accounting firm simultaneous with the engagement of Grant Thornton LLP by the Company. This change was a result of Grant Thornton LLP’s acquisition of CCR on December 1, 2011.

CCR’s reports on the Company’s consolidated financial statements for the two years ended January 1, 2011 and January 2, 2010 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s fiscal years ended January 1, 2011 and January 2, 2010, and through November 30, 2011, there were no disagreements between the Company and CCR on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of CCR, would have caused CCR to make reference to the matter in their report. None of the “reportable events” described in Item 304(a)(1)(v) of Regulation S-K of the SEC’s rules and regulations have occurred during the fiscal years ended January 1, 2011 and January 2, 2010, and through December 1, 2011.

During the fiscal years ended January 1, 2011 and January 2, 2010 and through November 30, 2011, neither the Company nor anyone acting on its behalf consulted Grant Thornton LLP regarding (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and Grant Thornton LLP did not provide either a written report or oral advice to the Company that was an important factor considered by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, (2) any matter that was either the subject of a disagreement with CCR, which, if not resolved to the satisfaction of CCR, would have caused CCR to make reference to the matter in their report, or a “reportable event” as described in Item 304(a)(1)(v) of Regulation S-K of the SEC’s rules and regulations.

CCR furnished the Company a letter addressed to the Commission stating that CCR agreed with the above statements.

The Audit Committee of the Board of Directors has appointed Grant Thornton LLP as the Company’s independent auditors for the 2012 fiscal year. Although this appointment is not required to be submitted to a vote of shareholders, the Company believes it appropriate as a matter of policy to request that the shareholders ratify the appointment. The Board of Directors recommends that all shareholders vote “FOR” the ratification of the appointment of Grant Thornton LLP as the Company’s independent auditors. If shareholder ratification is not received, the Audit Committee of the Board of Directors may reconsider the appointment of Grant Thornton LLP.

It is expected that a representative of Grant Thornton LLP will be present at the Annual Meeting and will have the opportunity to make a statement if he or she desires to do so and will also be available to respond to appropriate questions.

SECURITY OWNERSHIP

The following table sets forth information regarding the beneficial ownership of shares of Common Stock as of March 2, 2012 by (i) each director, nominee for director and Named Executive Officer, (ii) each person or entity known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock and (iii) all directors and executive officers as a group.

The Company has determined beneficial ownership in accordance with the rules of the Commission. Unless otherwise indicated, the persons included in the table have sole voting and investment power with respect to all shares beneficially owned, except to the extent authority is shared with spouses under applicable law. Shares of Common Stock subject to options that are either currently exercisable or exercisable within 60 days of March 2, 2012 are deemed to be outstanding and to be beneficially owned by the option holder for the purpose of computing the percentage ownership of the option holder. However, these shares are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| Name | | Number of Shares Beneficially Owned | | | Percent of Class(11) | |

| Lee K. Barba (1) | | | 35,500 | | | | * | |

| Joseph P. Lebel (2) | | | 181,224 | | | | 3.5 | |

| Dominick A. Pagano (3) | | | 827,085 | | | | 15.3 | |