Exhibit (a)(5)(C)

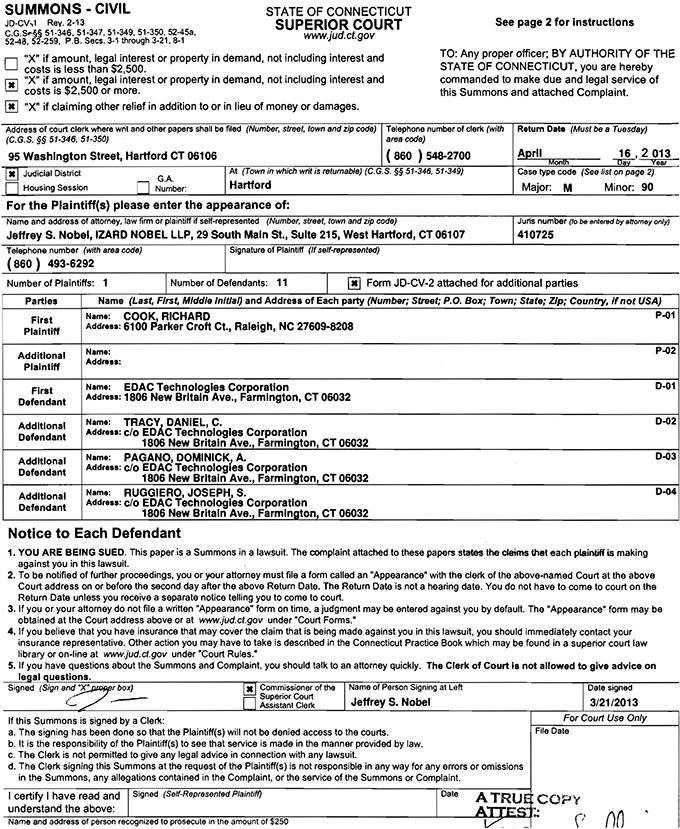

SUMMONS - CIVILSTATE OF CONNECTICUTjd-cw Rev. 2-13SUPERIOR COURTSee Pa9e 2 for instructionsC.G.S^ 51-346, 51-347. 51-349. 51-350, 5Z-5a.wwwiudctaav52-»f;52-259. P.8. Sees. 3-1 through 3-21. 8-1WWW.jua.Ct.govi-i “X” if amount, legai interest or property in demand, not including interest andT0: AnV Pr°Per officer: BY AUTHORITY OF THE<—’ costs is less than $2,500.STATE OF CONNECTICUT, you are herebyr=1 “X” if amount, legal interest or property in demand, not including interest andcommanded to make due and legal service ofi—1 costs is $2,500 or more.this Summons and attached Complaint. \*\ “X” if claiming other relief in addition to or in lieu of money or damages.Address of court clerk where writ and other papers shall be filed (Number, street, town and zip code) Telephone number of clerk (with Return Date (Must baa Tuesday) {C.G.S. §§ 51-346, 51-350)area code;95 Washington Street, Hartford CT 06106{860 ) 548-2700APr”„IS 2013_^~I ‘;MomtiT3avYaar\H\ Judicial District77I At (Town in which writ is returnable) fC G.S. §§ 51-346. 51-349}Case type code (See list on page 2}| | Housing session^] Number:HartfordMajor: MMinor: 90For the Plaintiff(s) please enter the appearance of:Name and address of attorney, law firm or plaintiff if self-represented (Number, streat, town and zip coda)Juris number (to t salami by sacmey only)Jeffrey S. Nobel, IZARD NOBEL LLP, 29 South Main St., Suite 215, West Hartford, CT 06107410725Telephone number (with area code)Signature of Plaintiff (it sett-represented) ( 860 ) 493-6292Number of Plaintiffs: 1Number of Defendants: 11[«] Form JD-CV-2 attached for additional partiesPartiesName (Last First, Middle Initial) and Address of Each party (Number; Streat; P.O. Box; Town; State; Zip; Country, if not USA)IT~IName: COOK, RICHARD^Ol”Plaintiff Add™”: 6100 Parker Croft Ct., Raleigh, NC 27609-8208Additional H”””p-°2Plainttff *«<»re«:First Nama: EDAC Technologies CorporationD-01Defendant Add™..: 1806 New Britain Ave., Farmlngton, CT 06032Additional Nam8: TRACY. DANIEL, C.CM>2nofendant Addr«»: c/o EDAC Technologies Corporation°»Mngaro1806 New Britain Ave., Farmington, CT 06032Additional Nam”; PAGANO, DOMINICK, A.D-03nofnnHant Add«m: c/o EDAC Technologies CorporationuMonaara1806 New Britain Ave., Farmington, CT 06032Additional Nam”; RUGGIERO, JOSEPH, S.D-04n*tanrtan+ Add™..: c/o EDAC Technologies Corporationueienoam |1806 New Britain Ave.. Farmlngton. CT 06032Notice to Each DefendantYOU ARE BEING SUED. This paper is a Summons in a lawsuit. The complaint attached to these papers states the cfatms that each plaintiff is making against you in this lawsuit.To be notified of further proceedings, you or your attorney must file a form called an “Appearance* with the clerk of the above-named Court at the above Court address on or before trie second day after the above Return Date. The Return Date is not a hearing date. You do not have to come to court on the Return Date unless you receive a separate notice telling you to come to court.If you or your attorney do not file a written “Appearance” form on time, a judgment may be entered against you by default. The “Appearance” form may be obtained at the Court address above or at wmv.jud.ct.gov under “Court Forms.”If you believe that you have insurance that may cover the claim that is being made against you in this lawsuit, you should immediately contact your insurance representative. Other action you may have to take is described in the Connecticut Practice Book which may be found in a superior court law library or on-line al wwwjud.cJ.gov under “Court Rules.”if you have questions about the Summons and Complaint, you should talk to an attorney quickly. Th* Clerk of Court is not allowed to give advice on legal questions.^Signed (Sign and “X^juoflpr box)| k | Commissioner of the Name of Person Signing at LeftDate signed^^/~D Ijgi oS I -Jeffrey S. Nobel| 3/21/2013If this Summons is signed by a Clerk:For Court Use Onlya.The signing has been done so that the Plaintiffs) will not be denied access to the courts.Fil9 Daleb.It is the responsibility of the Plaintiffs) to see that service is made in the manner provided by law.c.The Clerk is not permitted to give any !ega! advice in connection with any lawsuit.d.The Clerk signing this Summons at (he request of the Platntifl(s) is not responsible in any way for any errors or omissions

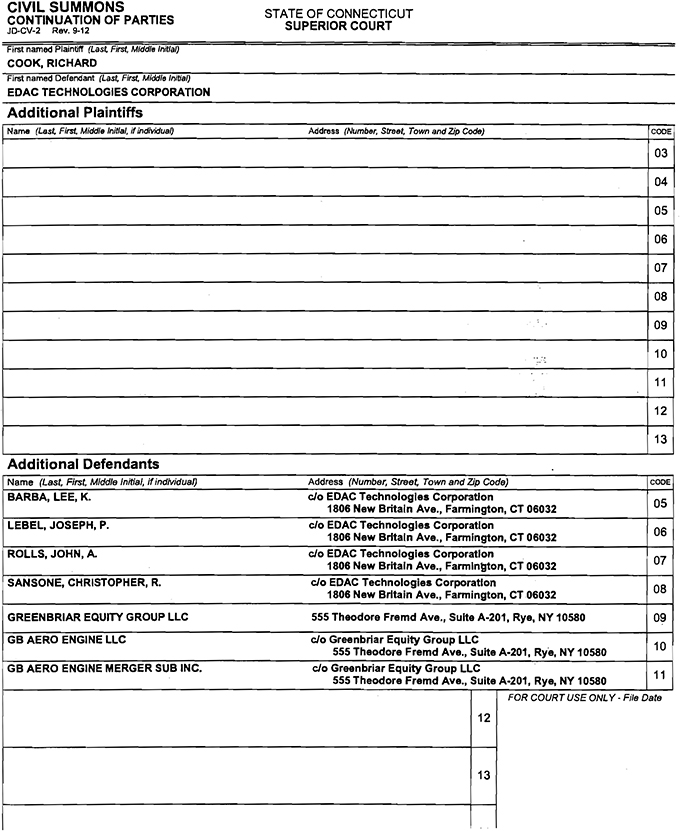

CIVIL SUMMONSstatf of rnuNFrnruTCONTINUATION OF PARTIESSUPERIOR COURTJD-CV-2 Rev. 9-12SUPERIOR COURTFirst named Plaintiff fLasl Fint, Middle Initial)COOK, RICHARDFirst namad Defendant ftast First, Middle fnffia/;””~EDAC TECHNOLOGIES CORPORATIONAdditional Plaintiffs| Nam« (Last. Fiftf, Middle Initfal, ifindMdue!}Address fAtombar. Slreet, TownandZip Code)CODE0304 ^1 06 07 08 03 10 11 12 13Additional DefendantsName (Last, First, Mlddta Initial, if individual} Address (Numbsr, Street Town and Zip Code) |cQOE BARBA, LEE, K. c/o EDAC Technologies Corporation 1806 New Britain Ave., Farmington, CT 06032”^LEBEL, JOSEPH, P.c/o EDAC Technologies CorporationIT1806 New Britain Ave., Farmington, CT 06032Ut>ROLLS, JOHN, A c/o EDAC Technologies CorporationI _7 1806 New Britain Ave., Farmington. CT 06032[ u/’ SANSONE, CHRISTOPHER, R. c/o EDAC Technologies Corporation~I1806 New Britain Ave., Farmington, CT 06032 UBGREENBRIAR EQUITY GROUP LLC555 Theodore Fremd Ave., Suite A-201, Rye, NY 1058003GB AERO ENGINE LLC c/o Greentmar Equity Group LLC~ 555 Theodore Fremd Ave., Suite A-201. Rye. NY 10580 1UGB AERO ENGINE MERGER SUB INC. c/o Green briar Equity Group LLC~ 555 Theodore Fremd Ave.. Suite A-201, Rye, NY 10580 | n ^j I FOR COURT USE ONLY-File Date

Return Date: April 16, 2013

| | |

| RICHARD COOK, Individually and on behalf of all others similarly situated, | | SUPERIOR COURT |

| | |

| | | JUDICIAL DISTRICT OF HARTFORD |

| | |

| Plaintiff, | | |

| | |

| v. | | |

| | |

| EDAC TECHNOLOGIES CORPORATION, DANIEL C. TRACY, DOMINICK A. PAGANO, JOSEPH S. RUGGIERO, LEE K. BARBA, JOSEPH P. LEBEL, JOHN A. ROLLS, CHRISTOPHER R. SANSONE, GREENBRIAR EQUITY GROUP LLC, GB AERO ENGINE LLC, and GB AERO ENGINE MERGER SUB INC., | | |

| | |

| Defendants. | | |

CLASS ACTION COMPLAINT

Plaintiff, by and through his attorneys, alleges upon personal knowledge as to himself, and upon information and belief, including the investigation of counsel and publicly available information, as to all other matters.

SUMMARY OF THE ACTION

1. This is a class action brought by Plaintiff on behalf of holders of the common stock of EDAC Technologies Corporation (“EDAC” or “Company”) to enjoin the acquisition of the publicly owned shares of EDAC by GB Aero Engine LLC (“GB Aero”) and GB Aero Engine Merger Sub Inc. (“Merger Sub”). GB Aero and Merger Sub are affiliates of private equity firm Greenbriar Equity Group LLC (“Greenbriar Equity”) (collectively “Greenbriar”).

2. On March 18, 2013, EDAC announced that it had entered into a definitive merger agreement under which Greenbriar will acquire the stock of EDAC for a total equity value of approximately $104.1 million (“Proposed Transaction”). Under the terms of the agreement (“Merger Agreement”), EDAC shareholders will receive $17.75 in cash for each share of EDAC they own.

3. In approving the Proposed Transaction, the Individual Defendants have violated certain securities laws and breached their fiduciary duties by, among other things, agreeing to sell to Greenbriar without obtaining adequate, fair and maximum consideration under the circumstances.

4. In addition, the Proposed Transaction consideration fails to adequately compensate EDAC’s shareholders for the significant synergies created by the merger. Thus, the Board failed to secure a fair price for the Company, either for the intrinsic value of its assets or the value of the Company’s assets to Greenbriar.

5. In pursuing the unlawful plan to facilitate the acquisition of EDAC by Greenbriar, for inadequate consideration and through a flawed process, each of the defendants violated applicable law by directly breaching and/or aiding the other defendants’ breaches of their fiduciary duties of loyalty, due care, independence, good faith and fair dealing.

6. For these reasons and as set forth in detail herein, Plaintiff seeks to enjoin Defendants from taking any steps to consummate the Proposed Transaction or, in the event the Proposed Transaction is consummated, recover damages resulting from the Individual Defendants’ (as defined herein) violations of their fiduciary duties of loyalty, good faith, due care, and full and fair disclosure.

PARTIES

7. Plaintiff was, and at all relevant times is, a continuous stockholder of Defendant EDAC.

8. Defendant EDAC is a corporation organized and existing under the laws of the State of Wisconsin with its principal executive offices located at 1806 New Britain Avenue, Farmington, Connecticut 06032.

9. Defendant Daniel C. Tracy has served as Chairman of the Board of Directors of the Company.

10. Defendant Dominick A. Pagano has served as President, CEO, and director of the Company.

11. Defendant Joseph S. Ruggiero has served as a director of the Company.

12. Defendant Lee K. Barba has served as a director of the Company.

13. Defendant Joseph P. Lebel has served as a director of the Company.

14. Defendant John A. Rolls has served as a director of the Company.

15. Defendant Christopher R. Sansone has served as a director of the Company.

16. Defendants Tracy, Pagano, Ruggiero, Barba, Lebel, Rolls, and Sansone are collectively referred to herein as the “Board” or the “Individual Defendants.”

17. Defendant Greenbriar Equity is a private equity firm that focuses on the global transportation industry, including companies in aerospace and defense, automotive, freight and passenger transport, logistics and distribution, and related sectors. Greenbriar Equity is located at 555 Theodore Fremd Avenue, Suite A-201, Rye, NY 10580.

18. Defendant GB Aero is an affiliate of Greenbriar Equity. GB Aero is located at c/o Greenbriar Equity, 555 Theodore Fremd Avenue, Suite A-201, Rye, NY 10580.

19. Defendant Merger Sub is a Wisconsin corporation and a wholly-owned subsidiary of GB Aero. Merger Sub is located at c/o Greenbriar Equity, 555 Theodore Fremd Avenue, Suite A-201, Rye, NY 10580.

20. Collectively, EDAC, the Individual Defendants, Greenbriar Equity, GB Aero, and Merger Sub are referred to herein as the “Defendants.”

FURTHER SUBSTANTIVE ALLEGATIONS

I.Background

21. EDAC provides design, manufacture and service meeting the precision requirements for customers in the tooling, fixtures, molds, jet engine components and machine spindles. The Company’s wholly owned subsidiaries include Gros-Ite Industries and Apex Machine Tool Company, Inc. EDAC AERO produces low pressure turbine cases, hubs, rings, disks and other complex, close tolerance components for aircraft engine and ground turbine manufacturers. Apex Machine Tool designs and manufactures fixtures, precision gauges, close tolerance plastic injection molds and precision component molds for composite parts and specialized machinery. In April 2012, it purchased an 181,000 square foot manufacturing facility in Plainville, Conn. In June 2012, the Company acquired EBTEC Corporation. In October 2012, it acquired certain assets of Smith-Renaud, Inc.

22. EDAC’s financial performance has improved. On November 1, 2012 the Company issued a press release (“November 1st Press Release”) announcing financial results for its third quarter 2012, which touted a record in sales and a net income rise. Sales for the third quarter of fiscal 2012 were $27.5 million, a record for EDAC and an increase of 26% from the third quarter of fiscal 2011. Gross profit for the third quarter of 2012 increased 50% from the third quarter of 2011 to $5.8 million, and represented 21.2% of third quarter 2012 sales versus

17.8% of sales in the third quarter of 2011. Operating income increased 69%, to $3.0 million, compared with the third quarter of last year, yielding an operating margin of 10.8% of sales compared with 8.1% in the third quarter of 2011. Net income for the third quarter of 2012 increased 64% to $1.7 million, or $0.29 per diluted share, compared with $1.0 million, or $0.19 per diluted share, reported for the third quarter of 2011.

23. EDAC has two business segments: the Aerospace Segment, which consists of its EDAC AERO and EBTEC product lines; and the Industrial Segment, which includes the APEX Machine Tool and EDAC Machinery product lines. Aerospace Segment sales for the third quarter of 2012 were $19.2 million, an increase of 30% from the third quarter of 2011. This included the sales of EBTEC as well as a 9% increase in the sales of the Company’s legacy EDAC AERO business. Aerospace Segment operating income increased 81% from the third quarter of 2011 to $1.9 million and represented 9.7% of Aerospace Segment sales versus 7.0% of sales in the third quarter of 2011. Industrial Segment sales for the third quarter of 2012 increased 17% to $8.3 million compared with the third quarter of 2011. A 24% increase in the sales of Apex Machine Tool more than offset 2% lower sales for EDAC Machinery in comparison to the third quarter of 2011. Industrial Segment operating income increased 51% to $1.1 million, compared with the third quarter of 2011, and represented 13.5% of Industrial Segment sales versus 10.4% of segment sales in the 2011 third quarter.

24. In connection with the November 1st Press Release, Defendant Pagano stated: “We continued to achieve record sales and profits in the third quarter as we made further progress in executing our plan for growth. Third quarter results benefited from the diversity of our business with prime and top-tier aerospace customers, the transition of our industrial business to more full-scale programs and complex parts, and the broadening of our capabilities through selective acquisitions.”

II.The Proposed Transaction

25. On March 18, 2013, EDAC issued a press release announcing the Proposed Transaction:

FARMINGTON, Conn., March 18, 2013 /PRNewswire/ — EDAC Technologies Corporation (NASDAQ: EDAC), a diversified designer, manufacturer and servicer of precision components for aerospace and industrial applications, today announced it has entered into a definitive agreement to be acquired by GB Aero Engine LLC, an affiliate of Greenbriar Equity Group LLC, for $17.75 per share in cash, pursuant to a cash tender offer and second step merger, for an aggregate equity value of approximately $104.1 million. The EDAC board of directors has unanimously approved the agreement and recommended that the shareholders of EDAC accept the offer and tender their shares into the offer.

Under the terms of the agreement, EDAC shareholders will receive $17.75 in cash for each share of EDAC common stock, representing a premium of approximately 29.6% over EDAC’s average closing price during the 90 trading days ending March 15, 2013, and a 19.8% premium over EDAC’s average closing price during the 30 trading days ending March 15, 2013.

“We believe this transaction is in the best interests of the Company and our shareholders. Our agreement with Greenbriar represents an attractive valuation for our shareholders, and we look forward to closing the transaction expeditiously,” said Dominick Pagano, EDAC President and Chief Executive Officer. “We believe that Greenbriar clearly understands our markets and that this transaction will allow EDAC to continue to focus on delivering high quality products and services to our customers. We look forward to the next phase of our company following the transaction.”

Noah Roy, Managing Director of Greenbriar, said “We look forward to partnering with EDAC to continue their track record of strong growth and success serving leading aerospace and industrial customers with best-in-class precision component capabilities.”

Under the terms of the definitive merger agreement between EDAC and GB Aero Engine LLC, a wholly owned subsidiary of GB Aero Engine LLC will commence a cash tender offer to purchase all of the outstanding shares of EDAC’s common stock no later than March 26, 2013. Members of the Board and executive officers of EDAC, who own approximately 18.2 percent of the Company’s outstanding shares in the aggregate, have

entered into agreements pursuant to which they will tender their shares into the offer. The closing of the tender offer is subject to customary closing conditions, including the tender of at least a majority of EDAC’s common stock and requisite regulatory approvals. If the tender offer closes, Greenbriar will acquire any EDAC shares that are not purchased in the tender offer in a second-step merger, at the same price per share paid in the tender offer. The transaction is not subject to a financing condition. EDAC expects the transaction to close in the second quarter of 2013. There can be no assurance that the tender offer will be completed, or if completed, that it will be completed in the second quarter of 2013.

The Company’s Annual Meeting of Shareholders, previously scheduled for May 1, 2013, has been postponed until further notice.

Stifel, Nicolaus & Company, Incorporated is serving as exclusive financial advisor and Robinson & Cole LLP is serving as legal counsel to EDAC Technologies Corporation. Kirkland & Ellis LLP is serving as legal counsel to Greenbriar.

III.The Unfair Price

26. As discussed herein, the $17.75 per share consideration offered in the Proposed Transaction is inadequate. EDAC, if properly exposed to the market for corporate control, would bring a price materially in excess of the amount offered in the Proposed Transaction. The Board should have leveraged EDAC’s position to extract a greater premium and a favorable merger agreement. Instead, the Board agreed to hastily lock-up a deal with Greenbriar before fulfilling its fiduciary duties to maximize shareholder value. The decision to enter into the Proposed Transaction for the stated consideration is curious given EDAC’s appreciating stock price and strong financial performance over the last year that includes record revenue growth.

27. Despite the significant benefits and synergies inherent in the Proposed Transaction for Greenbriar, however, the Board failed to secure a fair price for the Company, either for the intrinsic value of its assets or the value of the Company’s assets to Greenbriar.

28. As these indicators make clear, EDAC, if properly exposed to the market for corporate control, would bring a price materially in excess of the amount offered in the Proposed Transaction.

IV.The Preclusive Deal Protection Devices

29. The Proposed Transaction is also unfair because, as part of the Merger Agreement, the Individual Defendants agreed to certain onerous and preclusive deal protection devices that operate conjunctively to make the Proposed Transaction afait accompli and ensure that no competing offers will emerge for the Company.

30. Sections 8.06 of the Merger Agreement contains the termination and expenses provisions. Section 8.06 provides that under specified circumstances, EDAC must pay a steep $4,500.000.00 termination fee that will all but ensure that no competing offer will be forthcoming. In addition to the termination fee, section 8.06 provides that if the Company terminates the Proposed Transaction, it must bear all out-of-pocket costs and expenses incurred by Greenbriar and its representatives of up to $2,750,000.00.

31. The Merger Agreement also contains a strict “no shop” provision prohibiting the members of EDAC’s Board from taking any affirmative action to comply with their fiduciary duties to maximize shareholder value, including soliciting alternative acquisition proposals or business combinations.

32. Specifically, Section 6.04 of the Merger Agreement prohibits the Company and its agents from soliciting additional bids for the Company (“No Solicitation Provision”). The No Solicitation Provision precludes the Company from: (i) participating in any negotiations regarding, or furnish to any person any material nonpublic information with respect to, any Competing Proposal; (ii) engaging in discussions with any person with respect to any Competing Proposal; (iii) approving or recommending any Competing Proposal; (iv) withdrawing, amending, or modifying in a manner adverse to the Company’s Board’s recommendation; (v)

entering into any letter of intent, memorandum of understanding or similar document or any agreement, document or commitment providing for any Competing Proposal. The Company may furnish nonpublic information and participate in negotiations or discussions if the Board concludes in good faith that a Competing Proposal is likely to result in a Superior Proposal.

33. This high termination fee coupled with the No Solicitation Provision will all but ensure that no competing offer will be forthcoming.

34. Pursuant to Section 6.04 of the Merger Agreement, should an unsolicited bidder arrive on the scene, the Company must notify Greenbriar of the bidder’s offer within twenty-four hours, including the identity of the bidder, and all relevant details of those inquiries or proposals. Thereafter, should the Board determine that the unsolicited offer is superior, Greenbriar is granted time to amend the terms of the Merger Agreement. Greenbriar would then be able to match the unsolicited offer because it is granted unfettered access to the unsolicited offer, in its entirety, eliminating leverage that the Company has in receiving the unsolicited offer.

35. In other words, the Merger Agreement gives Greenbriar access to any rival bidder’s information and allows Greenbriar a free right to top any superior offer. Accordingly, no rival bidder is likely to emerge because the Merger Agreement unfairly assures that any “auction” will favor Greenbriar and piggy-back upon the due diligence of the second bidder.

36. Ultimately, these preclusive deal protection provisions improperly restrain the Company’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all or a significant interest in the Company. The circumstances under which the Board may respond to an unsolicited written bona fide proposal for an alternative acquisition that constitutes or would reasonable constitute a superior proposal are too narrowly circumscribed to provide an effective “fiduciary out” under the circumstances.

INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

37. By reason of the Individual Defendants’ positions with the Company as officers and/or directors, said individuals are in a fiduciary relationship with Plaintiff and the other shareholders of EDAC and owe Plaintiff and the other members of the Class (defined herein) the duties of good faith, fair dealing, loyalty and full and candid disclosure.

38. By virtue of their positions as directors and/or officers of EDAC, the Individual Defendants, at all relevant times, had the power to control and influence, and did control and influence and cause EDAC to engage in the practices complained of herein.

39. Each of the Individual Defendants is required to act in good faith, in the best interests of the Company’s shareholders and with such care, including reasonable inquiry, as would be expected of an ordinarily prudent person. In a situation where the directors of a publicly traded company undertake a transaction that may result in a change in corporate control, the directors must take all steps reasonably required to maximize the value shareholders will receive rather than use a change of control to benefit themselves, and to disclose all material information concerning the proposed change of control to enable the shareholders to make an informed voting decision. To diligently comply with this duty, the directors of a corporation may not take any action that:

| | a. | adversely affects the value provided to the corporation’s shareholders; |

| | b. | contractually prohibits them from complying with or carrying out their fiduciary duties; |

| | c. | discourages or inhibits alternative offers to purchase control of the corporation or its assets; |

| | d. | will otherwise adversely affect their duty to search for and secure the best value reasonably available under the circumstances for the corporation’s shareholders; or |

| | e. | will provide the directors and/or officers with preferential treatment at the expense of, or separate from, the public shareholders. |

40. In accordance with their duties of loyalty and good faith, the Individual Defendants as directors and/or officers of EDAC, are obligated to refrain from:

| | a. | participating in any transaction where the directors’ or officers’ loyalties are divided; |

| | b. | participating in any transaction where the directors or officers are entitled to receive a personal financial benefit not equally shared by the public shareholders of the corporation; and/or |

| | c. | unjustly enriching themselves at the expense or to the detriment of the public shareholders. |

41. Plaintiff alleges herein that the Individual Defendants, separately and together, in connection with the Proposed Transaction, violated, and are violating, the fiduciary duties they owe to Plaintiff and the other shareholders of EDAC, including their duties of loyalty, good faith, candor, and due care. As a result of the Individual Defendants’ divided loyalties, Plaintiff and Class members will not receive adequate, fair, or maximum value for their EDAC common stock in the Proposed Transaction.

42. As a result of these breaches of fiduciary duty, the Company’s public shareholders will not receive adequate or fair value for their common stock in the Proposed Transaction.

CLASS ACTION ALLEGATIONS

43. Plaintiff brings this action on his own behalf and as a class action on behalf of all holders of EDAC common stock who are being and will be harmed by Defendants’ actions described below (“Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation or other entity related to or affiliated with any of the Defendants.

44. This action is properly maintainable as a class action because:

a. The Class is so numerous that joinder of all members is impracticable. As of March 19, 2013, there were 5.32 million shares of EDAC common stock issued and outstanding. The actual number of public shareholders of EDAC will be ascertained through discovery.

b. There are questions of law and fact that are common to the Class, including:

| | i) | whether the Individual Defendants have breached their fiduciary duties with respect to Plaintiff and the other members of the Class in connection with the Proposed Transaction; |

| | ii) | whether the Individual Defendants have breached their fiduciary duty to obtain the best price available for the benefit of Plaintiff and the other members of the Class in connection with the Proposed Transaction; and |

| | iii) | whether Plaintiff and the other members of the Class would suffer irreparable injury were the Proposed Transaction complained of herein consummated. |

c. Plaintiff is an adequate representative of the Class, and has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class.

d. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class.

e. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class which would establish incompatible standards of conduct for the party opposing the Class.

f. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole.

FIRST CAUSE OF ACTION

(Breach of Fiduciary Duty Against the Individual Defendants)

45. Plaintiff repeats and realleges each allegation set forth herein.

46. The Individual Defendants have violated fiduciary duties owed to public shareholders of EDAC.

47. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants have failed to obtain for EDAC’s public shareholders the highest value available for EDAC in the marketplace.

48. As demonstrated by the allegations above, the Individual Defendants breached their fiduciary duties owed to EDAC’s shareholders because they failed to take steps to maximize the value of EDAC to its public shareholders in a change of control transaction.

49. As a result of the actions of Defendants, Plaintiff and the Class will suffer irreparable injury in that they have not and will not receive the highest available value for their equity interest in EDAC. Unless the Individual Defendants are enjoined by the Court, they will continue to breach their fiduciary duties owed to Plaintiff and to the Class members, all to the irreparable harm of the Class members.

50. Plaintiff and the Class members have no adequate remedy at law. Only through the exercise of this Court’s equitable powers can Plaintiff and the Class be fully protected from immediate and irreparable injury, which the Individual Defendants’ actions threaten to inflict.

SECOND CAUSE OF ACTION

(Aiding and Abetting the Board’s Breaches of Fiduciary Duty

against Greenbriar Equity, GB Aero and Merger Sub)

51. Plaintiff incorporates each and every allegation set forth above as if folly set forth herein.

52. Greenbriar Equity, GB Aero and Merger Sub have acted and are acting with knowledge of, or with reckless disregard to, the fact that Individual Defendants are in breach of their fiduciary duties to the Company’s public shareholders, and have participated in such breaches of fiduciary duties.

53. Greenbriar Equity, GB Aero and Merger Sub knowingly aided and abetted the Individual Defendants’ wrongdoing alleged herein. In so doing, Greenbriar Equity, GB Aero and Merger Sub rendered substantial assistance in order to effectuate the Individual Defendants’ plan to consummate the Proposed Transaction in breach of their fiduciary duties.

54. Greenbriar Equity, GB Aero and Merger Sub should take whatever action is necessary to halt the shareholder vote on the Proposed Transaction.

55. Plaintiff has no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE,Plaintiff demands relief in his favor and in favor of the Class and against Defendants as follows:

A. Declaring that this action is properly maintainable as a Class action and certifying Plaintiff as Class representative;

B. Enjoining Defendants, their agents, counsel, employees and all persons acting in concert with them from consummating the Proposed Transaction, unless and until the Company adopts and implements a procedure or process to obtain a merger agreement providing the best available terms for shareholders;

C. Rescinding, to the extent already implemented, the Proposed Transaction or any of the terms thereof, or granting Plaintiff and the Class rescissory damages;

D. Directing the Individual Defendants to account to Plaintiff and the Class for all damages suffered as a result of the wrongdoing;

E. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorney’s and experts’ fees; and

F. Granting such other and further equitable relief as this Court may deem just and proper.

JURY TRIAL DEMANDED

Plaintiff and the Class demand a trial by jury as to all issues so triable.

Dated: March 20, 2013

| | |

| | Respectfully Submitted, |

| |

| BY: | | /s/ Jeffrey S. Nobel |

| | Jeffrey S. Nobel IZARD NOBEL LLP Juris No. 410725 29 South Main Street, Suite 215 West Hartford, CT 06107 Tel: 860-493-6292 Fax: 860-493-6290 |

| |

| | BROWER PIVEN |

| | A Professional Corporation David A.P. Brower Brian C. Kerr 475 Park Avenue South, 33rd Floor New York, NY 10016 Tel: 212-501-9000 Fax: 212-501-0300 |

| |

| | Attorneys for Plaintiff |

APPEARANCE

Jeffrey S. Nobel of the law firm Nobel Izard LLP appears for the Plaintiff

| | | | | | |

| | | | A TRUE COPY ATTEST: |

| | | |

| /s/ Jeffrey S. Nobel | | | | | | /s/ Kevin Sullivan |

| Jeffrey S. Nobel (Juris No. 04855) | | | | | | KEVIN SULLIVAN |

| IZARD NOBEL LLP (Juris No. 410725) | | | | | | STATE MARSHALL, HARTFORD COUNTY |

Return Date: April 16, 2013

| | |

RICHARD COOK, Individually and on behalf of all others similarly situated, | | SUPERIOR COURT |

Plaintiff, | | JUDICIAL DISTRICT OF HARTFORD |

| | |

v. | | |

| | |

| EDAC TECHNOLOGIES CORPORATION, | | |

| DANIEL C. TRACY, DOMINICK A. PAGANO, | | |

| JOSEPH S. RUGGIERO, LEE K. BARBA, | | |

| JOSEPH P. LEBEL, JOHN A. ROLLS, | | |

| CHRISTOPHER R. SANSONE, GREENBRIAR | | |

EQUITY GROUP LLC, GB AERO ENGINE LLC, and GB AERO ENGINE MERGER SUB INC., | | |

| | |

| Defendants. | | |

STATEMENT OF AMOUNT IN DEMAND

The amount, legal interest or property in demand is in excess of FIFTEEN THOUSAND DOLLARS ($15,000) exclusive of interest and costs.

Respectfully Submitted,

| | | | |

| | |

| | BY: | | /s/ Jeffrey S. Nobel |

| | | | Jeffrey S. Nobel |

| | | | IZARD NOBEL LLP Juris No. 410725 |

| | | | 29 South Main Street, Suite 215 |

| | | | West Hartford, CT 06107 |

| | | | Tel: 860-493-6292 |

| | | | Fax: 860-493-6290 |

| | |

| | | | BROWER PIVEN |

| | | | A Professional Corporation |

| | | | David A.P. Brower |

| | | | Brian C. Kerr |

| | | | 475 Park Avenue South, 33rd Floor |

| | | | New York, NY 10016 |

| A TRUE COPY ATTEST: | | | | Tel: 212-501-9000 |

/s/ Kevin Sullivan | | | | Fax: 212-501-0300 |

KEVIN SULLIVAN STATE MARSHALL, HARTFORD COUNTY | | | | Attorneys for Plaintiff |