Exhibit (a)(5)(F)

| | | | |

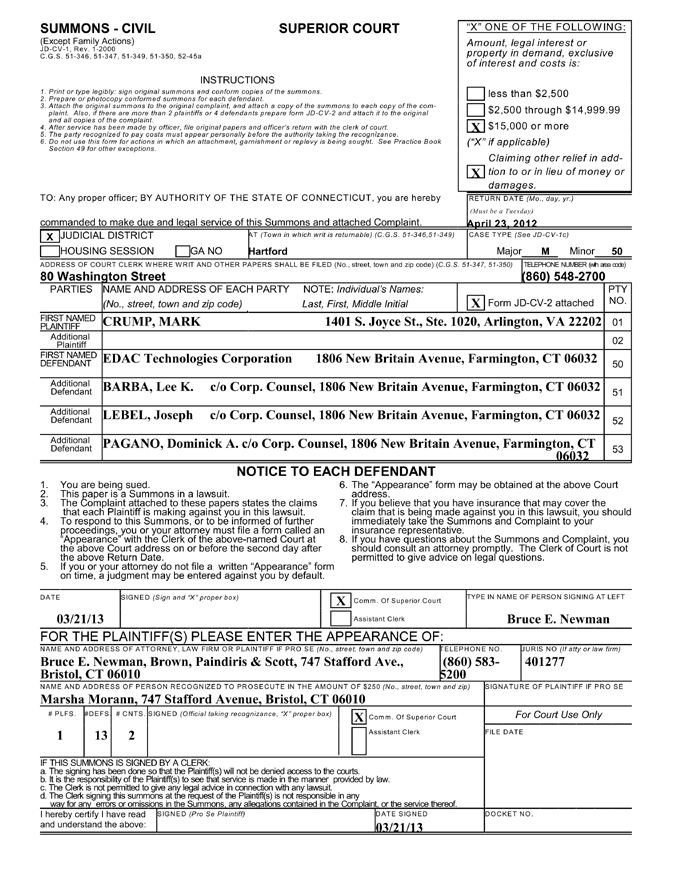

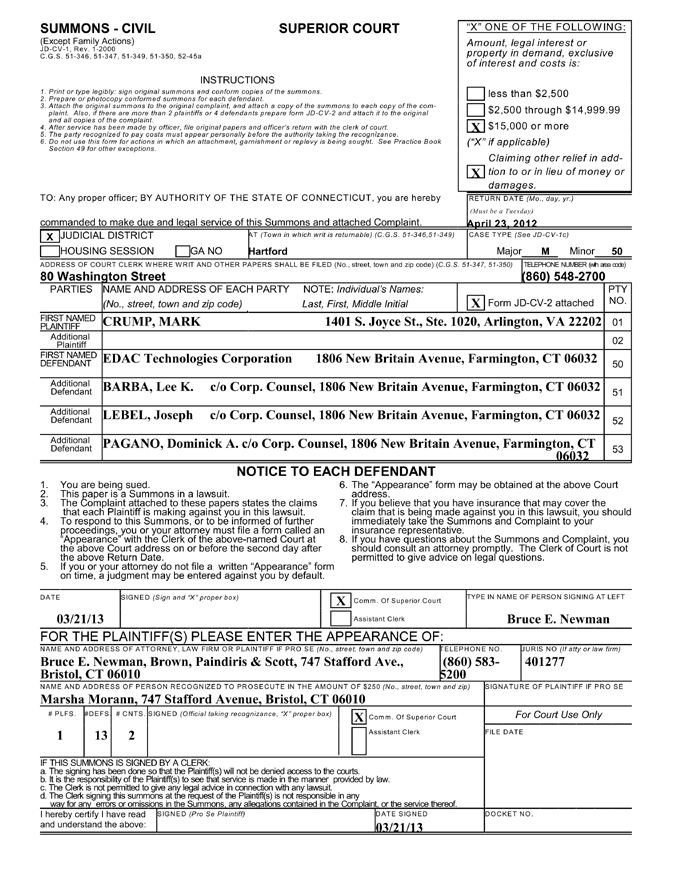

| RETURN DATE: APRIL 23, 2013 | | : SUPERIOR COURT | | |

| | |

| MARK CRUMP, On Behalf of Himself and All | | ) | | |

| Others Similarly Situated, | | ) | | |

| | ) JUDICIAL DISTRICT OF HARTFORD | | |

| Plaintiff, | | ) AT HARTFORD | | |

| | ) | | |

vs. | | ) | | |

| | ) | | |

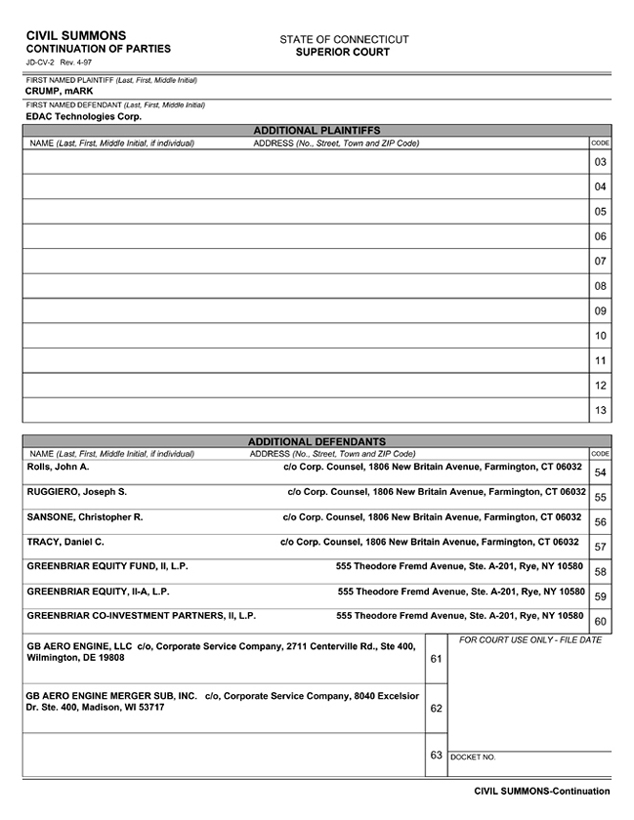

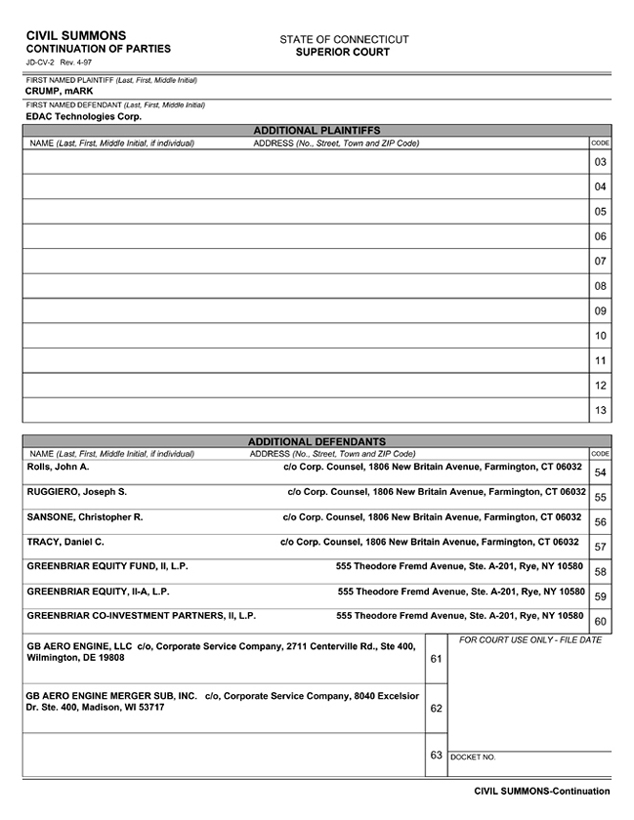

| EDAC TECHNOLOGIES CORPORATION, | | ) CLASS ACTION COMPLAINT | | |

| LEE K. BARBA, JOSEPH LEBEL, DOMINICK | | ) | | |

| A. PAGANO, JOHN A. ROLLS, JOSEPH S. | | ) | | |

| RUGGIERO, CHRISTOPHER R. SANSONE, | | ) | | |

| DANIEL C. TRACY, GREENBRIAR EQUITY | | ) | | |

| FUND II, L.P., GREENBRIAR EQUITY FUND | | ) | | |

| II-A, L.P., GREENBRIAR CO-INVESTMENT | | ) | | |

| PARTNERS II, L.P., GB AERO ENGINE LLC | | ) | | |

| and GB AERO ENGINE MERGER SUB INC., | | ) MARCH 21, 2013 | | |

| | ) | | |

| Defendants. | | | | |

CLASS ACTION COMPLAINT

Plaintiff Mark Crump (“Plaintiff”), by his attorneys, on behalf of himself and those similarly situated, files this action against defendants and alleges upon information and belief, except for those allegations that pertain to him, which are alleged upon personal knowledge, as follows:

SUMMARY OF THE ALLEGATIONS

1. Plaintiff brings this shareholder class action on behalf of himself and all other public shareholders of EDAC Technologies Corporation (“EDAC” or the “Company”), against EDAC, the Company’s Board of Directors (the “Board” or the “Individual Defendants”), GB Aero Engine LLC (“GB Aero”) and GB Aero Engine Merger Sub Inc., (the “Merger Sub”), arising out of a Acquisition in which GB Aero will acquire all of the outstanding shares of the Company’s common stock for $17.75 per share in a cash tender offer and second step merger

(the “Proposed Acquisition” or the “Merger”). The Proposed Acquisition has an aggregate equity value of approximately $104.1 million. GB Aero is owned by Greenbriar Equity Fund II, L.P., Greenbriar Equity Fund II-A, L.P. and Greenbriar Co-Investment Partners II, L.P. (collectively, the “Sponsor”) (EDAC, the Board, GB Aero, the Merger Sub and the Sponsor are hereinafter referred to as “Defendants”).

2. In connection with the signing of the definitive Agreement and Plan of Merger on March 17, 2013 (the “Merger Agreement”), Individual Defendants Lee K. Barba, Joseph P. Lebel, Dominick A. Pagano, John A. Rolls, Joseph S. Ruggiero, Christopher R. Sansone and Daniel C. Tracy together with Glen R. Purple entered into Voting and Support Agreement(s) with GB Aero (the “Voting and Support Agreements”) pursuant to which said defendants have agreed to tender all EDAC shares beneficially owned by them in the Offer and to vote such shares in support of the Merger in the event shareholder approval is required to consummate the Merger. Collectively, the parties to the Voting and Support Agreements have a beneficial ownership of 1,464,906 shares of EDAC stock, or approximately 25.3% of the currently outstanding shares of EDAC.

3. In approving the Proposed Acquisition, the Individual Defendants have breached their fiduciary duties of loyalty, good faith, due care and disclosure by,inter alia, (i) agreeing to sell EDAC without first taking steps to ensure that Plaintiff and Class members (defined below) would obtain adequate, fair and maximum consideration under the circumstances; and (ii) engineering the Proposed Acquisition to benefit themselves and/or GB Aero without regard for EDAC’s public shareholders. Accordingly, this action seeks to enjoin the Proposed Acquisition and compel the Individual Defendants to properly exercise their fiduciary duties to EDAC’s shareholders.

-2-

4. Absent judicial intervention, the merger will be consummated, resulting in irreparable injury to Plaintiff and the Class. This action seeks to enjoin the unreasonable steps taken by Defendants in entering into the Merger Agreement without attempting to maximize shareholder value in order to obtain millions of dollars in benefits for themselves. Immediate judicial intervention is warranted here to rectify existing and future irreparable harm to the Company’s shareholders. Plaintiff, on behalf of the Class, seek only to level the playing field and to ensure that if shareholders are to be ultimately stripped of their respective equity interests through the Proposed Acquisition, that the Proposed Acquisition is conducted in a manner that is not overtly improper, unfair and illegal, and that all material information concerning the Proposed Acquisition is disclosed to the EDAC’s shareholders so that they are able to make informed decisions as to whether to vote in favor or against the Proposed Acquisition or to seek appraisal of their shares.

JURISDICTION AND VENUE

5. This Court has personal jurisdiction over the Defendants inasmuch as Defendants’ principal place of business is in Connecticut, directly or by agents transact business in Connecticut, and Defendants caused tortious injury in Connecticut and elsewhere by an act or omission within or outside the State while regularly doing and/or soliciting business, and engaging in a persistent course of conduct in the State.

6. Venue is proper in this Court inasmuch as the Defendant EDAC’s principal place of business is in this Judicial District and it regularly transacts business in this county and there are multiple defendants with a merger transaction proposed involving EDAC.

-3-

PARTIES

7. Plaintiff Mark Crump is, and at all material times, was a shareholder of EDAC and resides in Arlington, Virginia.

8. Defendant EDAC is a Wisconsin corporation with its corporate headquarters located at 1806 New Britain Avenue, Farmington, CT 06032. EDAC provides design, manufacturing, and services for tooling, fixtures, molds, jet engine components, and machine spindles in the aerospace, industrial, semiconductor, and medical device markets. EDAC was founded in 1946 and is publicly traded on the Nasdaq under the symbol “EDAC.”

9. Defendant Lee K. Barba (“Barba”) has been a director of the Company since 2010.

10. Defendant Joseph P. Lebel (“Lebel”) has been a director of the Company since 2005.

11. Defendant Dominick A. Pagano (“Pagano”) has been a director of the Company since 2001. Pagano currently serves as President and Chief Executive Officer of the Company.

12. Defendant John A. Rolls (“Rolls”) has been a director of the Company since 2009.

13. Defendant Joseph S. Ruggiero (“Ruggiero”) has been a director of the Company since 2012.

14. Defendant Christopher R. Sansone (“Sansone”) has been a director of the Company since 2011.

15. Defendant Daniel C. Tracy (“Tracy”) has been a director of the Company since 1999 and currently serves as Chairman of the Board.

-4-

16. The Defendants identified in ¶¶ 9-15, above, are sometimes collectively referred to herein as the “Individual Defendants.”

17. Defendant GB Aero is a Delaware limited liability company.

18. Defendant, the Merger Sub, is a Wisconsin corporation and a wholly-owned subsidiary of GB Aero.

19. Defendant, the Sponsor, is a private equity firm with $1.5 billion of committed capital, focuses exclusively on the global transportation industry, including companies in aerospace and defense, automotive, freight and passenger transport, logistics and distribution, and related sectors. Sponsor herein refers to Greenbriar Equity Fund, II L.P., Greenbriar Equity Fund, II-A, L.P., and Greenbriar Co. Investment Partners II, L.P. (“The Sponsor.”)

THE INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

20. In any situation where the directors of a publicly traded corporation undertake a Acquisition that will result in either a change in corporate control or a break-up of the corporation’s assets, the directors have an affirmative fiduciary obligation to act in the best interests of the company’s shareholders, including the duty to obtain maximum value under the circumstances. To diligently comply with these duties, the directors may not take any action that:

| | (a) | adversely affects the value provided to the corporation’s shareholders; |

| | (b) | will discourage or inhibit alternative offers to purchase control of the corporation or its assets; |

| | (c) | contractually prohibits themselves from complying with their fiduciary duties; and/or |

| | (d) | will provide the directors, executives or other insiders with preferential treatment at the expense of, or separate from, the public shareholders, and place their own pecuniary interests above those of the interests of the company and its shareholders |

-5-

21. In accordance with their duties of loyalty and good faith, Defendants, as directors and/or officers of EDAC, are obligated to refrain from:

| | (a) | participating in any Acquisition where the directors’ or officers’ loyalties are divided; |

| | (b) | participating in any Acquisition where the directors or officers receive, or are entitled to receive, a personal financial benefit not equally shared by the public shareholders of the corporation; and/or |

| | (c) | unjustly enriching themselves at the expense or to the detriment of the public shareholders. |

22. Plaintiff allege herein that the Individual Defendants, separately and together, in connection with the Proposed Acquisition, violated, and are violating, the fiduciary duties they owe to Plaintiff and the other public shareholders of EDAC, including their duties of loyalty, good faith, candor, and due care. As a result of the Individual Defendants’ divided loyalties, Plaintiff and Class members will not receive adequate, fair or maximum value for their EDAC common stock in the Proposed Acquisition.

23. As a result of these breaches of fiduciary duty, the Company’s public shareholders will not receive adequate or fair value for their common stock in the Proposed Acquisition.

SUBSTANTIVE ALLEGATIONS

24. On March 17, 2013, EDAC filed a Form 8-K with the SEC, disclosing the Merger Agreement.

25. On March 18, 2013, EDAC issued a press release that it had agreed to be acquired by GB Aero, an entity owned by the Sponsor, in the Proposed Acquisition. The press release stated in relevant parts:

FARMINGTON, Conn., March 18, 2013 /PRNewswire/ —EDAC Technologies Corporation (NASDAQ: EDAC), a diversified designer, manufacturer and servicer of precision components for aerospace and industrial applications, today

-6-

announced it has entered into a definitive agreement to be acquired by GB Aero Engine LLC, an affiliate of Greenbriar Equity Group LLC, for $17.75 per share in cash, pursuant to a cash tender offer and second step merger, for an aggregate equity value of approximately $104.1 million. The EDAC board of directors has unanimously approved the agreement and recommended that the shareholders of EDAC accept the offer and tender their shares into the offer.

Under the terms of the agreement, EDAC shareholders will receive $17.75 in cash for each share of EDAC common stock, representing a premium of approximately 29.6% over EDAC’s average closing price during the 90 trading days ending March 15, 2013, and a 19.8% premium over EDAC’s average closing price during the 30 trading days ending March 15, 2013.

“We believe this transaction is in the best interests of the Company and our shareholders. Our agreement with Greenbriar represents an attractive valuation for our shareholders, and we look forward to closing the transaction expeditiously,” said Dominick Pagano, EDAC President and Chief Executive Officer. “We believe that Greenbriar clearly understands our markets and that this transaction will allow EDAC to continue to focus on delivering high quality products and services to our customers. We look forward to the next phase of our company following the transaction.”

Noah Roy, Managing Director of Greenbriar, said “We look forward to partnering with EDAC to continue their track record of strong growth and success serving leading aerospace and industrial customers with best-in-class precision component capabilities.”

Under the terms of the definitive merger agreement between EDAC and GB Aero Engine LLC, a wholly owned subsidiary of GB Aero Engine LLC will commence a cash tender offer to purchase all of the outstanding shares of EDAC’s common stock no later than March 26, 2013. Members of the Board and executive officers of EDAC, who own approximately 18.2 percent of the Company’s outstanding shares in the aggregate, have entered into agreements pursuant to which they will tender their shares into the offer. The closing of the tender offer is subject to customary closing conditions, including the tender of at least a majority of EDAC’s common stock and requisite regulatory approvals. If the tender offer closes, Greenbriar will acquire any EDAC shares that are not purchased in the tender offer in a second-step merger, at the same price per share paid in the tender offer. The transaction is not subject to a financing condition. EDAC expects the transaction to close in the second quarter of 2013. There can be no assurance that the tender offer will be completed, or if completed, that it will be completed in the second quarter of 2013.

The Company’s Annual Meeting of Shareholders, previously scheduled for May 1, 2013, has been postponed until further notice.

-7-

Stifel, Nicolaus & Company, Incorporated is serving as exclusive financial advisor and Robinson & Cole LLP is serving as legal counsel to EDAC Technologies Corporation. Kirkland & Ellis LLP is serving as legal counsel to Greenbriar.

26. The consideration offered in the proposed acquisition substantially undervalues the Company as EDAC has significant room for growth. Currently, industry peers such as Precision Castparts Corp. (PCP) have operating margins in the mid-20’s percentile compared to the 10.8% operating margin EDAC posted in Q3 2012. According to the January 28, 2012,Seeking Alphaarticle “Precision and EDAC Tech Offer Investors Tremendous Upside Potential,” EDAC’s operating margin “has significant room for further expansion,” and margin expansion will be a huge profit driver. For this reason,Seeking Alphabelieves EDAC to be “worth north of $20 per share.”

27. EDAC also has very real, “needle-mov(ing)” opportunities in the pipeline that defendant Pagano has stated are likely to come to fruition within the next few quarters. For example, Pagano mentioned on a recent call with Pratt & Whitney that a division of United Tech (UTX) is looking at EDAC to be a preferred domestic supply chain partner for its geared turbofan for a long-term agreement between “$50 million to several hundred million” dollars. Pagano cited with a high degree of confidence that such a deal would be struck within the next couple quarters. As the above-referencedSeeking Alphaarticle points out, a deal of this magnitude will surely add to the Company’s backlog “which has experienced the greatest growth of any commercial aerospace supplier during the past several years.” To this end, GB Aero seeks to acquire the Company before the value of the UTX agreement can be realized in EDAC’s share price.

-8-

28. Additionally, EDAC has reported strong financial and operating results throughout fiscal 2012. For example, on August 1, 2012, the Company reported Q2 2012 results wherein sales increased 21% to a record $26.5 million, net income rose 48% and the backlog at quarters end was $304.3 million. Pagano stated at the time:

Our second quarter was a very strong quarter for EDAC, with continued record sales and profitability, even before including the benefit of our acquisition of EBTEC. The diversity of the programs and customers we serve, the depth of our manufacturing capabilities, and the expanded range of products we are reliably delivering to customers have been major drivers of our sales growth over the past several quarters. Our profitability is continuing to strengthen with the further implementation of advanced manufacturing best practices company-wide combined with our increased sales level.

EBTEC is proving to be an ideal fit for our business, with the addition of its advanced welding and other high energy beam capabilities strengthening our position with our aerospace customers and increasing their confidence in our ability to further ramp-up to meet the growing demand in aerospace. EBTEC is also benefiting from the addition of our core competency in turning, which expands their portfolio of services, increases their ability to ramp-up and is adding to the confidence of their customers as well. Thus far, we have seamlessly integrated EBTEC into our operations. It was accretive to our second quarter results.

We continued to maintain a very strong level of backlog even after a quarter of record sales. Our plan is to only add to it with LTAs that fully meet our profitability objectives. A group of potential LTAs is being bid in the third and fourth quarters.

To support the ramp-up required to meet our current backlog, we recently announced the purchase of Pratt & Whitney’s world class manufacturing facility in Cheshire, Conn., where we intend to consolidate all of our Connecticut operations. The Cheshire facility will not only alleviate our current capacity constraints, but also enable us to add state-of-the-art manufacturing equipment and optimally configure the facility to deploy lean processes, cellular manufacturing and centers of excellence. We have already started to move equipment to Cheshire in line with our facility integration plan and expect to complete the plan by the end of 2013. We also are very grateful for the State of Connecticut’s support, in the form of financing incentives for this project that is essential for our Company’s continued growth.

The sales achieved in our legacy EDAC business in the 2012 second quarter were in line with our budget and our growth plan. Based on current shipment schedules, we continue to expect that legacy sales in the remaining two quarters of the year will be in line with the first quarter of 2012, as we previously forecasted. EBTEC’s monthly sales should continue at the level achieved in June and therefore will be additive to our sales each quarter. With 20% sales growth

-9-

achieved through the first half of 2012 and our positive outlook for the second half of the year, we are well on track to meet or exceed $100 million in sales for full year 2012.Our strategic initiatives in the second quarter position us for further growth in the future.

29. EDAC’s impressive second quarter ledSeeking Alpha to raise its 2012 adjusted earnings-per-share forecast to $1.05, and 2013 earnings per share forecast to $1.35 from $1.30. The August 1, 2012, article concludes that EDAC “is one of the most, if not the most, undervalued firm in the aerospace supply chain […] We think such large outsize top-line performance will be the case for the third and fourth quarters and remain confident EDAC will be well north of $100 million in sales for 2012. We were not only impressed with the firm’s top-line expansion but margin performance was nothing less than excellent […] We continue to expect the shares to nearly double from today’s levels.” Significantly, EDAC shares closed trading at $13.33 on August 1, 2012.

30. On August 21, 2012, EDAC issued a press release wherein the Company announced that it had entered into a long-term agreement for military engine components thereby growing its backlog from approximately $304.3 million to $317 million.

31. On November 1, 2012, EDAC reported Q3 2012 financial and operating results wherein sales achieved record levels for the second straight quarter, $27.5 million, and net income increased 64%. Pagano stated, in pertinent part, “For the first nine months of this year, we have realized a 22% increase in our sales and an 82% increase in our net income compared with the same period last year. Our business, backlog and opportunities remain very strong as we enter the fourth quarter. Based on our current shipment schedule, we expect fourth quarter sales to be in-line with our third quarter, which is consistent with our prior guidance. We have made important progress on several strategic fronts in 2012 and are looking forward to additional progress and growth in 2013.”

-10-

32. During Q4 2012, EDAC achieved record sales yet again, the third consecutive quarter that the Company had achieved this feat. According to the Company’s March 7, 2013, results press release, sales rose to $28.4 million for a full year total of $106.5 million, net income rose 31% and the total backlog at the end of the quarter was $304 million. Pagano confidently stated in the Company’s press released, “Based on our strong backlog and current shipment schedule, we expect first quarter 2013 sales, including EBTEC, to be in-line with 2012 fourth quarter. We are fully focused on executing our plan to achieve profitable growth in 2013 and beyond.”

33. Furthermore, in connection with the signing of the Merger Agreement, Individual Defendants Barba, Lebel, Pagano, Rolls, Ruggiero, Sansone and. Tracy together with Glen R. Purple entered into Voting and Support Agreement(s) with GB Aero pursuant to which said individuals have agreed to tender all EDAC shares beneficially owned by them in the Offer and to vote such shares in support of the Merger in the event shareholder approval is required to consummate the Merger. Collectively, the parties to the Voting and Support Agreements have a beneficial ownership of 1,464,906 shares of EDAC stock, or approximately 25.3% of the currently outstanding shares of EDAC.

34. Moreover, the Merger Agreement contains certain provisions that unduly benefit GB Aero by making an alternative transaction either prohibitively expensive or otherwise impossible. For example, the Merger Agreement contains a termination fee provision that requires EDAC to pay up to $4.5 million to GB Aero if the Merger Agreement is terminated under certain circumstances. For example, under one circumstance, EDAC must pay this termination fee even if it consummates any Takeover Proposal (as defined in the Merger Agreement)within 12 months following the termination of the Merger Agreement. This termination fee is an amount that will make the Company that much more expensive to acquire for potential purchasers.

-11-

35. In contrast, the Merger Agreement does not require GB Aero to pay a reciprocal termination fee to EDAC underany circumstances.

36. Pursuant to § 6.04, the Merger Agreement contains a “No Solicitation” provision that restricts EDAC from considering alternative acquisition proposals by,inter alia, constraining EDAC’s ability to solicit or communicate with potential acquirers or consider their proposals. Specifically, the provision prohibits the Company from directly or indirectly soliciting, initiating, proposing or inducing any alternative proposal, but permits the Board to consider a “bona fide written Takeover Proposal” if it constitutes or is reasonably calculated to lead to a “Superior Proposal” as defined in the Merger Agreement.

37. Moreover, the Agreement further reduces the possibility of a topping offer from an unsolicited purchaser. Here, Defendants agreed to provide GB Aero information in order to match any other offer, thus providing GB Aero access to the unsolicited bidder’s financial information and giving GB Aero the ability to top the superior offer. Thus, a rival bidder is not likely to emerge with the cards stacked so much in favor of GB Aero.

38. Furthermore, the Merger Agreement contemplates that only a fraction, or even none, of EDAC’s common shareholders will tender their shares in the Tender Offer. Accordingly, the Merger Agreement contains numerous provisions that permit GB Aero to acquire EDAC regardless of whether a majority of the Company’s shareholders support the deal or not.

-12-

39. For example, Section 1.04 of the Merger Agreement (“Section 1.04”) grants to Merger Sub an irrevocable option (the “Top-Up Option”), exercisable upon the terms and conditions Section 1.04, to purchase from the Company a number of newly-issued shares of Company stock equal to the lesser of (i) the number of shares of Company stock that, when added to the number of shares of Company stock held by GB Aero and Merger Sub at the time of such exercise, shall constitute one (1) share more than ninety percent (90%) of the number of shares of Company stock that would be outstanding immediately after the issuance of all shares of Company stock subject to the Top-Up Option or (ii) the total number of shares of Company stock that the Company is authorized to issue under its Charter Documents but that are not issued and outstanding (and are not subscribed for or otherwise reserved to be issued under Company Stock Plans) at the time of exercise of the Top-Up Option.

40. Given the fact that 25.3% of EDAC’s shares have already been committed in support of the Proposed Acquisition by way of the Voting and Support Agreements, Merger Sub’s exercise of the Top-Up Option virtually ensures that GB Aero will acquire control of at least 90% of the Company’s outstanding common stock without regard to whether a single shareholder tenders their shares in the Tender Offer and that the transaction will be consummated via short-form merger, without the benefit of any shareholder vote and squeeze out the Company’s common stockholders for the entirely unfair price of $17.75 per share.

41. Thus, rather than base their decision whether to tender on the financial merits of the transaction, EDAC’s public stockholders will be coerced to tender their shares in the Tender Offer because the Merger Agreement renders meaningless any ability for non-tendering stockholders to vote down the Merger and share in the future financial upside of the Company.

42. At the time that Company stockholders will be asked to either tender their shares in the Tender Offer or determine to pursue an appraisal remedy they will not have information necessary to assess the Option’s potential impact, including: (i) whether any and how many Top-

-13-

Up Shares will be issued after the close of the Tender Offer or (ii) the impact of the Top-Up Shares on the value of their shares in an appraisal action. Such lack of knowledge compels the Company’s common stockholders to tender their shares in the Tender Offer rather than consider exercising their legal right to seek an appraisal of their stock. Thus, the issuance of millions of Top-Up Shares could substantially reduce the fair value of the stockholders’ shares.

43. Accordingly, the Company’s true value is compromised by the consideration offered in the Proposed Acquisition and the Proposed Acquisition is the product of the Board’s breaches of fiduciary duty, aided and abetted by GB Aero.

CLASS REPRESENTATION ALLEGATIONS

44. Plaintiff bring this action on their own behalf and as a class action on behalf of all holders of EDAC stock who are being and will be harmed by Defendants’ actions described below (the “Class”). Excluded from the Class are defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any defendants.

45. This action is properly maintainable as a class action because,inter alia

| | (a) | The Class is so numerous that joinder of all members is impracticable. According to Yahoo! Finance, there were more than 5.32 million shares of EDAC common stock outstanding as of March 20, 2013, held by hundreds, if not thousands, of beneficial owners. |

| | (b) | There are questions of law and fact which are common to the Class including,inter alia: (i) whether the Individual Defendants have breached their fiduciary duties to Plaintiff and the Class by agreeing to the Proposed Acquisition at a price that is inadequate and is not the fair value that could be obtained under the circumstances; (ii) whether EDAC, GB Aero, and Merger Sub aided and abetted the Individual Defendants’ breaches of fiduciary duty; and (iii) whether the Class is entitled to injunctive relief and/or damages as a result of the wrongful conduct committed by defendants; |

| | (c) | Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. The claims of Plaintiff are typical of the claims of the other members of the Class and Plaintiff has the same interests as the other members of the Class. Accordingly, Plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class; |

-14-

| | (d) | The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for defendants, or adjudications with respect to individual members of the Class, which would, as a practical matter, be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests; and |

| | (e) | Defendants have acted, or refused to act, on grounds generally applicable to, and causing injury to, the Class and, therefore, preliminary and final injunctive relief on behalf of the Class as a whole is appropriate. |

CAUSES OF ACTION

COUNT I

Breach of Fiduciary Duty Against the Individual Defendants

46. Plaintiff repeats and reallege each and every allegation above contained as though fully set forth herein.

47. As alleged herein, Defendants have initiated a process to sell EDAC that undervalues the Company. Moreover, Defendants failed to sufficiently inform themselves of EDAC’s value, or disregarded the true value of the Company. Furthermore, any alternate acquirer will be faced with engaging in discussions with a management team and board that is committed to the Proposed Acquisition.

48. As such, unless the Individual Defendants’ conduct is enjoined by the Court, they will continue to breach their fiduciary duties to Plaintiff and the other members of the Class, and will further a process that inhibits the maximization of shareholder value and the disclosure of material information.

49. Plaintiff and the members of the Class have no adequate remedy at law.

-15-

COUNT II

Aiding and Abetting the Individual Defendants’ Breach of Fiduciary Duty

(Against Defendants EDAC, GB Aero, Merger Sub and the Sponsor)

50. Plaintiff repeats and realleges each and every allegation above as though fully set forth herein.

51. Defendants EDAC, GB Aero, the Merger Sub and the Sponsor knowingly assisted the Individual Defendants’ breaches of fiduciary duty in connection with the Proposed Acquisition, which, without such aid, would not have occurred.

52. As a result of this conduct, Plaintiff and the other members of the Class have been and will be damaged in that they have been and will be prevented from obtaining a fair price for their shares.

53. Plaintiff and the other members of the Class have no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands judgment against Defendants jointly and severally, and equitable and injunctive relief, in Plaintiff’s favor and in favor of the Class and against Defendants as follows:

A. Declaring that this action is properly maintainable as a class action;

B. Declaring and decreeing that the Merger Agreement was entered into in breach of the fiduciary duties of Defendants and is therefore unlawful and unenforceable;

C. Enjoining defendants, their agents, counsel, employees and all persons acting in concert with them from consummating the Proposed Acquisition, unless and until the Company adopts and implements a procedure or process to obtain the highest possible price for shareholders;

-16-

D. Directing Defendants to exercise their fiduciary duties to obtain a Acquisition which is in the best interest of EDAC shareholders until the process for the sale or proper auction of the Company is completed and the highest possible price is obtained;

E. Rescinding, to the extent already implemented, the Proposed Acquisition or any of the terms thereof and in the event the transaction is consummated prior to the entry of this court’s final judgment, rescinding it and awarding rescissory damages;

F. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and experts’ fees; and

G. Granting any other and further relief as this Court may deem just and proper.

| | | | |

| DATED: March 21, 2013 | | | | |

| | PLAINTIFF, MARK CRUMP |

| | |

| | By | | /s/ |

| | | | Bruce E. Newman |

| | | | Brown, Paindiris & Scott, LLP |

| | | | 747 Stafford Avenue |

| | | | Bristol, CT 06010 |

| | | | Tel.: (860) 583-5200 |

| | | | Fax: (860) 589-5780 |

| | | | Juris No. 401277 |

| | |

| | | | ----and---- |

| | |

| | | | BRODSKY & SMIITH, LLC |

| | | | Evan J. Smith |

| | | | Marc L. Ackerman |

| | | | Two Bala Plaza |

| | | | Suite 602 |

| | | | Bala Cynwyd, PA 19004 |

| | | | Tel. (610) 667 6200 |

| | | | Fax: (610) 667 9029 |

| | |

| | | | His Attorneys |

-17-

| | | | |

| RETURN DATE: APRIL 23, 2013 | | : SUPERIOR COURT | | |

| | |

| MARK CRUMP, On Behalf of Himself and All | | ) | | |

| Others Similarly Situated, | | ) | | |

| | ) JUDICIAL DISTRICT OF HARTFORD | | |

| Plaintiff, | | ) AT HARTFORD | | |

| | ) | | |

vs. | | ) | | |

| | ) | | |

| EDAC TECHNOLOGIES CORPORATION, | | ) CLASS ACTION COMPLAINT | | |

| LEE K. BARBA, JOSEPH LEBEL, DOMINICK | | ) | | |

| A. PAGANO, JOHN A. ROLLS, JOSEPH S. | | ) | | |

| RUGGIERO, CHRISTOPHER R. SANSONE, | | ) | | |

| DANIEL C. TRACY, GREENBRIAR EQUITY | | ) | | |

| FUND II, L.P., GREENBRIAR EQUITY FUND | | ) | | |

| II-A, L.P., GREENBRIAR CO-INVESTMENT | | ) | | |

| PARTNERS II, L.P., GB AERO ENGINE LLC | | ) | | |

| and GB AERO ENGINE MERGER SUB INC., | | ) MARCH 21, 2013 | | |

| | ) | | |

| Defendants. | | | | |

STATEMENT OF AMOUNT IN DEMAND

The amount, legal interest or property in demand is more than fifteen ($15,000.00) dollars, exclusive of interest and costs and the plaintiff also seeks equitable relief.

| | |

| PLAINTIFF, MARK CRUMP |

| |

| By | | /S/ |

| | Bruce E. Newman |

| | Brown, Paindiris & Scott, LLP |

| | 747 Stafford Avenue |

| | Bristol, CT 06010 |

| | Tel.: (860) 583-5200 |

| | Fax: (860) 589-5780 |

| | Juris No. 401277 |

| |

| | ---and--- |

-18-

|

| BRODSKY & SMIITH, LLC |

| Evan J. Smith |

| Marc L. Ackerman |

| Two Bala Plaza |

| Suite 602 |

| Bala Cynwyd, PA 19004 |

| Tel. (610) 667 6200 |

| Fax: (610) 667 9029 |

|

| His Attorneys |

-19-

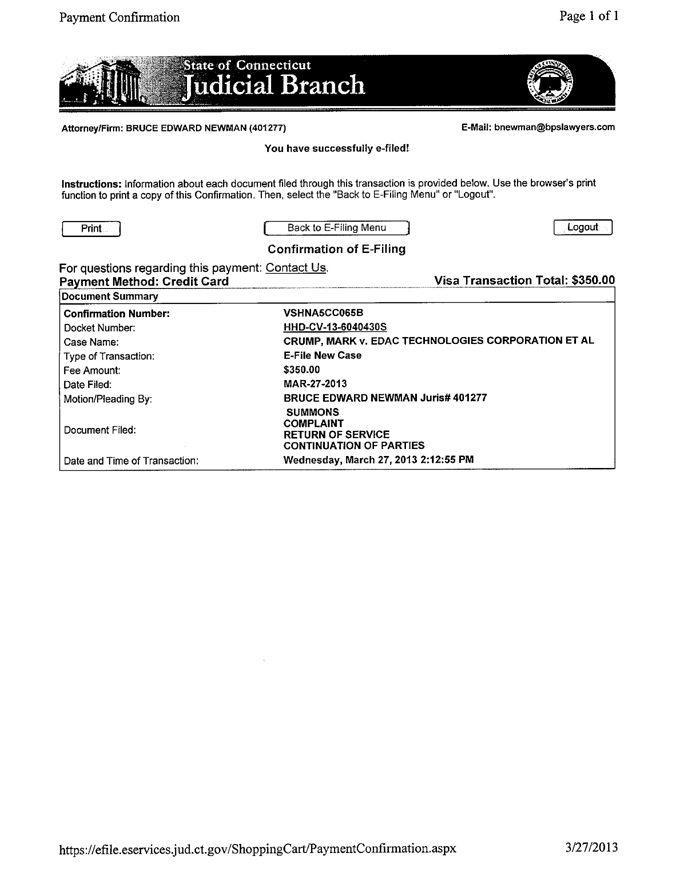

OFFICER’S RETURN TO COURT

| | | | |

| STATE OF CONNECTICUT: | | | | |

| | ss: Hartford | | March 25, 2013 |

| COUNTY OF HARTFORD : | | | | |

Then and there and by virtue hereof and by direction of the Plaintiffs attorney, I made due and legal service upon the within named defendant,GREENBRIAR EQUITY FUND, II, L.P.,by leaving two verified true and attested copies of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,at the office of the Secretary of State of Connecticut, 30 Trinity Street, Hartford, Connecticut, who is the authorized Agent for Service for the within named defendant pursuant to C.G.S, §34-381(d).

And also on the 25th day of March 2013, I made due and legal service upon the within named defendant,GREENBRIAR CO-INVESTMENT PARTNERS, II, L.P.,by leaving two verified true and attested copies of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,at the office of the Secretary of State of Connecticut, 30 Trinity Street, Hartford, Connecticut, who is the authorized Agent for Service for the within named defendant pursuant to C.G.S. §34-38 l(d).

And also on the 25th day of March 2013, I made due and legal service upon the within named defendant,GREENBRIAR EQUITY, II-A, L.P.,by leaving two verified true and attested copies of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,at the office of the Secretary of State of Connecticut, 30 Trinity Street, Hartford, Connecticut, who is the authorized Agent for Service for the within named defendant pursuant to C.G.S. §34-38 l(d).

And also on the 25th day of March 2013, I made due and legal service upon the within named defendant,GB AERO ENGINE, LLCby leaving two verified true and attested copies of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,at the office of the Secretary of State of Connecticut, 30 Trinity Street, Hartford, Connecticut, who is the authorized Agent for Service for the within named defendant pursuant to C.G.S. §34-233(c).

And also on the 25th day of March 2013, I made due and legal service upon the within named defendantEDAC TECHNOLOGIES COPORATIONby leaving a verified true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT,STATEMENTOF AMOUNT IN DEMAND,with and in the hands of DAVID OMEARA, PARALEGAL, who is authorized to accept service for R&C Service Company, Statutory Agent for Service for the within named Defendant, at 280 Trumbull Street, Hartford, Connecticut.

And also on the 25th day of March 2013, I made due and legal service upon the within named defendantLEE K. BARBAby leaving a verified true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with and in the hands of DAVID OMEARA, PARALEGAL, who is authorized to accept service for R&C Service Company, Statutory Agent for Service for the within named Defendant, at 280 Trumbull Street, Hartford, Connecticut.

And also on the 25th day of March 2013, I made due and legal service upon the within named defendantJOSEPH LEBELby leaving a verified true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with and in the hands of DAVID OMEARA, PARALEGAL, who is authorized to accept service for R&C Service Company, Statutory Agent for Service for the within named Defendant, at 280 Trumbull Street, Hartford, Connecticut.

And also on the 25th day of March 2013, I made due and legal service upon the within named defendantDOMINICK A. PAGANOby leaving a verified true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with and in the hands of DAVID OMEARA, PARALEGAL, who is authorized to accept service for R&C Service Company, Statutory Agent for Service for the within named Defendant, at 280 Trumbull Street, Hartford, Connecticut.

And also on the 25th day of March 2013, I made due and legal service upon the within named defendantJOHN A. ROLLSby leaving a verified true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT,

And also on the 26th day of March 2013, in the town of Plainville, I deposited at the Plainville Post Office via certified mail, postage paid, return receipt requested, a true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with my doings thereon endorsed, addressed to theGREENBRIAR EQUITY FUND, II, L.P.,555 Theodore Fremd Avenue, Ste. A-201, Rye, NY 10580.

SUPPLEMENTAL RETURN TO FOLLOW TRACK # 7012 0470 0000 1542 8256

And also on the 26th day of March 2013, in the town of Plainville, I deposited at the Plainville Post Office via certified mail, postage paid, return receipt requested, a true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with my doings thereon endorsed, addressed toGREENBRIAR EQUITY, II-A, L.P.,555 Theodore Fremd Avenue, Ste. A-201, Rye, NY 10580.

SUPPLEMENTAL RETURN TO FOLLOW TRACK # 7012 3050 0001 8608 7499

And also on the 26th day of March 2013, in the town of Plainville, I deposited at the Plainville Post Office via certified mail, postage paid, return receipt requested, a true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with my doings thereon endorsedGREENBRIAR CO-INVESTMENT PARTNERS, II, L.P.555 Theodore Fremd Avenue, Ste. A-201, Rye, NY 10580.

SUPPLEMENTAL RETURN TO FOLLOW TRACK # 7012 3050 0001 8608 7482

And also on the 26th day of March 2013, in the town of Plainville, I deposited at the Plainville Post Office via certified mail, postage paid, return receipt requested, a true and attested copy of the within originalWRIT SUMMONS – CIVIL, CLASS ACTION COMPLAINT, STATEMENT OF AMOUNT IN DEMAND,with my doings thereon endorsed, addressed toGB AEROENGINE, LLC, c/o Corporate Service Company, 2711 Centerville Road, Ste. 400, Wilmington, DE 19808.

SUPPLEMENTAL RETURN TO FOLLOW TRACK # 7006 0810 0001 5727 1331